Energy Products: Return on Investment Is Already Too Low

Posted by Gail the Actuary on August 1, 2013 - 4:14am

My major point when I gave my talk at the Fifth Biophysical Economics Conference at the University of Vermont was that our economy’s overall energy return on investment is already too low to maintain the economic system we are accustomed to. That is why the US economy, and the economies of other developed nations, are showing signs of heading toward financial collapse. Both a PDF of my presentation and a podcast of the talk are available on Our Finite World, on a new page called Presentations/Podcasts.

My analysis is with respect to the feasibility of keeping our current economic system operating. It seems to me that the problems we are experiencing today–governments with inadequate funding, low economic growth, a financial system that cannot operate with “normal” interest rates, and stagnant to falling wages–are precisely the kinds of effects we might expect, if energy sources are providing an inadequate energy return for today’s economy.

Commenters frequently remark that such-and-such an energy source has an Energy Return on Energy Invested (EROI) ratio of greater than 5:1, so must be a helpful addition to our current energy supply. My finding that the overall energy return is already too low seems to run counter to this belief. In this post, I will try to explain why this difference occurs. Part of the difference is that I am looking at what our current economy requires, not some theoretical low-level economy. Also, I don’t think that it is really feasible to create a new economic system, based on lower EROI resources, because today’s renewables are fossil-fuel based, and initially tend to add to fossil fuel use.

Adequate Return for All Elements Required for Energy Investment

In order to extract oil or create biofuels, or to make any other type of energy investment, at least four distinct elements described in Figure 1: (1) adequate payback on energy invested, (2) sufficient wages for humans, (3) sufficient credit availability and (4) sufficient funds for government services. If any of these is lacking, the whole system has a tendency to seize up.

EROI analyses tend to look primarily at the first item on the list, comparing “energy available to society” as the result of a given process to “energy required for extraction” (all in units of energy). While this comparison can be helpful for some purposes, it seems to me that we should also be looking at whether the dollars collected at the end-product level are sufficient to provide an adequate financial return to meet the financial needs of all four areas simultaneously.

My list of the four distinct elements necessary to enable energy extraction and to keep the economy functioning is really an abbreviated list. Clearly one needs other items, such as profits for businesses. In a sense, the whole world economy is an energy delivery system. This is why it is important to understand what the system needs to function properly.

What Happens as Oil Prices Rise

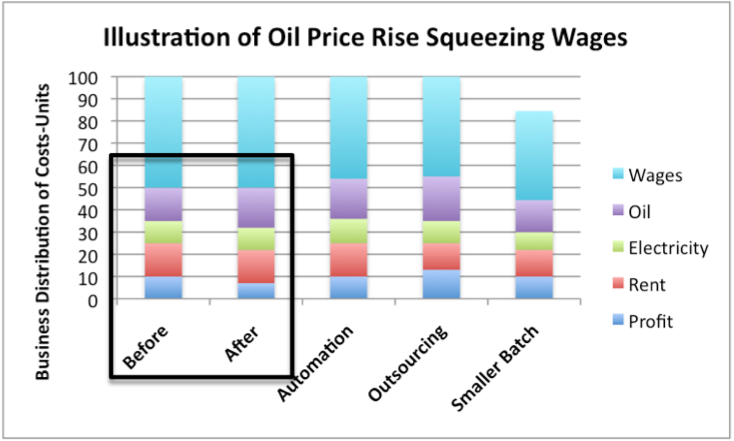

When oil prices rise, wages for humans seem to fall, or at least stagnate (Figure 2, below). The comparison shown uses US per capita wages, so takes into account changes in the proportion of people with jobs as well as the level of wages.

In fact, if we analyze Figure 2, we see that virtually all of the rise in US wages came in periods when oil prices were below $30 per barrel, in inflation-adjusted terms. The reason why the drop in wages happens at higher per-barrel levels is related to the drop in corporate profits that can be expected if oil prices rise, and businesses fail to respond. Let me explain this further with Figure 3, below.

Figure 3 is a bit complicated. What happens initially when oil prices rise, is illustrated in the black box at the left. What happens is that the business’ profits fall, because oil is used as one of the inputs used in manufacturing and transportation. If the cost of oil rises and the sales price of the product remains unchanged, the company’s profits are likely to fall. Additionally, there may be some reduction in demand for the product, because the discretionary income of consumers is reduced because of rising oil prices. Clearly, the business will want to fix its business model, so that it can again make an adequate profit.

There are three ways that a business can bring its profits back to a satisfactory level, illustrated in the last three columns of Figure 3. They are

- Automation. Human energy is the most expensive type of energy a business can employ, because wages to paid to humans to do a given process (such as putting a label on a jar) are far higher than the cost of an electricity-based process to perform the same procedure. Thus, if a firm can substitute electrical or oil energy for human energy, its cost of production will be lower, and profits can be improved. Of course, workers will be laid off in the process, reducing total wages paid.

- Outsourcing to a Country with Lower Costs. If part of the production cost can be moved to a country where wage costs are lower, this will reduce the cost of manufacturing the product, and allow the business to offset (partially or fully) the impact of rising oil prices. Of course, this will again lead to less US employment of workers.

- Make a Smaller Batch. If neither of the above options work, another possibility is to cut back production across the board. Even if oil prices rise, there are still some consumers who can afford the higher prices. If a business can cut back in the size of its operations (for example, close unprofitable branches or fly fewer airplanes), it can cut back on outgo of many types: rent, energy products used, and wages. With reduced output, the company may be able to make an adequate profit by selling only to those who can afford the higher price.

In all three instances, an attempt to fix corporate profits leads to a squeeze on human wages–the highest cost source of energy services that there is. This seems to be Nature’s attempt way of rebalancing the system, toward lower-cost energy sources.

If we look at the other elements shown in Figure 1, we see that they have been under pressure recently as well. The availability of credit to fund new energy investment is enabled by profits that are sufficiently high that they can withstand interest charges incurred in the payback of debt. Debt use is also enabled by growth, since if profits will be higher in the future, it makes sense to delay funding until the future. In recent years, central governments have seen a need to put interest rates at artificially low levels, in order to encourage borrowing. To me, this is a sign that the credit portion of the system is also under pressure.

Government’s ability to fund its own needs has been under severe stress as well. Part of the problem comes from the inability of workers to pay adequate taxes, because their wages are lower. Part of the problem comes from a need for governments to pay out more in benefits, such as disability income, unemployment, and food stamps. The part that gets most stressed is the debt portion of government funding. This really represents the intersection of two different areas mentioned in Figure 1: (3) Adequacy of credit availability and (4) Funding for government services.

The constellation of energy problems we are now experiencing seems to me to be precisely what might be expected, if energy return is now, on average, already too low.

The Role of Energy Extraction in this Squeeze

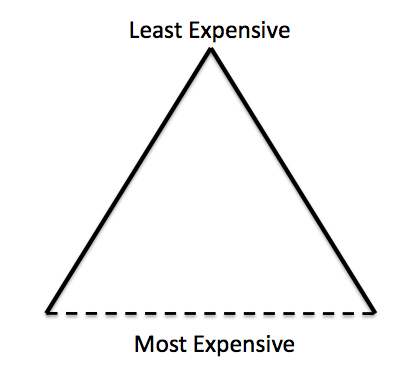

When any energy producer decides to produce energy of a given type (say oil or uranium), the energy producer will look for the resource that can be extracted at lowest cost to the producer.

Initially, production starts where costs are most affordable–not much energy is required for extraction; governments involved do not require too high taxes; and the cost of human labor is not too high. The producer may need debt financing, and this must also be available, at an affordable cost.

For example, easy-to-extract oil located in the US that could be extracted very simply in the early days of extraction (say before 1900), was very inexpensive to extract, and would be near the top of the triangle. Tight oil from the Bakken and bitumen from Canada would be examples of higher cost types of oil, located lower in the triangle.

As the least expensive energy is extracted, later producers wishing to extract energy must often settle for higher cost extraction. In some cases, technology advancements can help bring costs back down again. In others, such as recent oil extraction, the higher costs are firmly in place. Higher sales prices available in the market place enable production “lower in the triangle.” The catch is that these higher oil prices lead to stresses in other systems: human employment, government funding, and ability for credit markets to work normally.

What Is Happening on an Overall Basis

Man has used external energy for a very long time, to raise his standard of living. Man started over 1,000,000 years ago with the burning of biomass, to keep himself warm, to cook food, and for use in hunting. Gradually, man added other sources of energy. All of these sources of energy allowed man to accomplish more in a given day. As a result of these greater accomplishments, man’s standard of living rose–he could have clothes, food which had been cooked, sharper tools, and heat when it was cold.

Over time, man added additional sources of energy, eventually including coal and oil. These additional sources of energy allowed man to leverage his own limited ability to do work, using his own energy. Goods created using external energy tended to be less expensive than those made with only human energy, allowing prices to drop, and wages to go farther. Food became more available and cheaper, allowing population to rise. Money was also available for public health, allowing more babies to live to maturity.

What happened in the early 2000s was a sharp “bend” in the system. Instead of goods becoming increasingly inexpensive, they started becoming relatively more expensive relative to the earnings of the common man. For example, the price of metals, used in many kinds of goods started becoming more expensive.

There seem to be two reasons for this: (1) In the early 2000s, oil prices started rising (Figure 2, above), and these higher prices started exerting an upward force on the price of goods. At the same time, (2) globalization took off, providing downward pressure on wages. The result was that suddenly, workers found it harder to keep a job, and even when they were working, wages were stagnant.

It seems to me that prior to the early 2000s, part of what buoyed up the system was the large difference between:

A. The cost of extracting a barrel of oil

B. The value of that barrel of oil to society as a whole, in terms of additional human productivity, and hence additional goods and services that barrel of oil could provide.

As oil prices rose, this difference started disappearing, and its benefit to the world economy started going away. The government became increasingly stressed, trying to provide for the many people without jobs while tax revenue lagged. Slower economic growth made the debt system increasingly fragile. The economy was gradually transformed from one which provided perpetual growth, to one where citizens were becoming poorer and poorer. This pushed the economy in the direction of collapse. Research documented in the book Secular Cycles by Turchin and Nefedov shows that in past collapses, the inability of governments to collect sufficient taxes from populations that were becoming increasingly poor (due to more population relative to resources) was a primary contributing factor in these collapses. The problems that the US and other developed countries are having in collecting enough taxes to balance their budgets, without continuing to add debt, are documentation that this issue is again a problem today. Greece and Spain are having particular problems in this regard.

A More Complete List of Inputs that Need Adequate Returns

My original list was

- Energy counted in EROI calculation–mostly fossil fuels, sometimes biomass used as a fuel

- Human labor

- Credit system

- Cost of government

To this we probably need to add:

- Profits for corporations involved in these processes

- Rent for land used in the process – this cost would be highest in biofuel operations.

- Costs to prevent pollution, and mitigate its effects – not charged currently, except as mandated by law

- Compensation for mineral depletion and degradation of soil. Degradation of soil would likely be an issue for biofuels.

- Energy not counted in EROI calculations. This is mostly “free energy” such as solar, wind, and wave energy, but can include energy which is of limited quantity, such as biomass energy.

Given the diversity of items in this list, it is not clear that simply keeping EROI above some specified target such as 5:1 is likely to provide enough “margin” to cover the financial return needed to properly fund all of these elements. Also, because the need for government services tends to increase over time as the system gets more stressed, if there is an EROI threshold, it needs to increase over time.

It might also be noted that the amounts paid for government services are surprisingly high for fossil fuels. Barry Rodgers gave some figures regarding “government take” (including lease fees as well as other taxes and fees) in the May 2013 Oil and Gas Journal. According to his figures, the average government take associated with an $80 barrel of US tight oil is $33.29 per barrel. This compares to capital expenditures of $22.60 a barrel, and operating expenditures of $7.50 a barrel. If we are to leave fossil fuels, we would need to get along without the government services funded by these fees, or we would need to find a different source of government funding.

Source of the EROI 5:1 Threshold

To my knowledge, no one has directly proven that a 5:1 threshold is sufficient for an energy source to be helpful to an economy. The study that is often referred to is the 2009 paper, What is the Minimum EROI that a Sustainable Society Must Have? (Free for download), by Charles A. S. Hall, Steven Balogh, and David Murphy. This paper analyzes how much energy needs to provided by oil and coal, if the energy provided by those fuels is to be sufficient to pay not just for the energy used in its own extraction, but also for the energy required for pipeline and truck or train transportation to its destination of use. The conclusion of that paper was that in order to include these energy transportation costs for oil or coal, an EROI of at least 3:1 was needed.

Clearly this figure is not high enough to cover all costs of using the fuels, including the energy costs to build devices that actually use the fuels, such as private passenger cars, electrical power plants and transmission lines, and devices to use electricity, such as refrigerators. The ratio required would probably need to be higher for harder-to-transport fuels, such as natural gas and ethanol. The ratio would also need to include the energy cost of schools, if there are to be engineers to design all of these devices, and factory workers who can read basic instructions. If the cost of government in general were added, the cost would be higher yet. One could theoretically add other systems as well, such as the cost of maintaining the financial system.

The way I understood the 5:1 ratio was that it was more or less a lower bound, below which even looking at an energy product did not make sense. Given the diversity of what is needed to support the current economy, the small increment between 3 and 5 is probably not enough–the minimum ratio probably needs to be much higher. The ratio also seems to need to change for different fuels, with many quite a bit higher.

The Add-On Problem for Fossil Fuel Based Renewables

With renewables made using fossil fuels, such as hydroelectric, wind turbines, solar PV, and ethanol, the only way anyone can calculate EROI factors is as add-ons to our current fossil fuel system. These renewables depend on the fossil fuel system for their initial manufacture, for their maintenance, and for the upkeep of all the systems that allow the economy to function. There is no way that these fuels can power the whole system, based on what we know today, within the next hundred years. Thus, any EROI factor is misleading if viewed as the possibility what might happen if these fuels were to attempt to operate on a stand-alone basis. The system simply wouldn’t work–it would collapse.

A related issue is the front-ended nature of the fossil fuels used in creating most of today’s renewables. People today think of “financing” any new investment, with easy payments over a period of years. The catch (as Tom Murphy pointed out in his BPE talk) is that Nature Doesn’t Do Financing. Nature demands up-front payment in terms of any fossil fuels used. Thus, if we build a huge new hydroelectric dam, such as the Three Gorges Dam in China, the fossil fuels required to make the concrete and to move huge amounts of soil come at the beginning of the project. This is also true if we make a huge number of solar panels. The saving we get are all only theoretical, and will take place only if we are actually able reduce the use of other fossil fuel energy sources in the future, because of the energy from the PV panels or other new renewable.

In nearly all cases, adding renewables requires increasing fossil fuel use for this reason. We could, in theory, reduce fossil fuel use elsewhere, to try to cover the greater fossil fuel use to add renewables, but this would mean cutting industries and jobs currently using the fuel, something that many find objectionable. Several readers have suggested that we could greatly ramp-up solar PV. Yes, we could, but we would have to greatly ramp up fossil fuel usage (mostly coal in China, if current manufacturing approaches are used) to create these panels. Any future savings would be theoretical, depending on how long we keep the new system operating, and how much fossil fuel energy consumption is actually reduced as a result of the new panels.

Conclusions

At this point, the foregoing analysis suggests that products created using today’s oil and other energy products are not producing an adequate financial return to cover wages, interest expense, and necessary taxes. If EROI plays a major role in determining financial returns, EROI on average is already too low for many developed economies.

It is convenient to think that an economy can keep adding lower and lower EROI resources, but at some point, a “stop” signal starts appearing. I would argue that the issues we are seeing in many sectors of the economy are clear indicators that such a threshold is already being reached. An economy in which the wages of the common worker are buying less and less is an economy in trouble. I talk in another post (Energy and the Economy–Basic Principles and Feedback Loops) about the fact that economic growth seems to be the result of one set of feedbacks. As the price of oil rises and related changes take place, these feedbacks change from economic growth to economic contraction. It is these feedbacks that we are already having problems with.

One can argue that EROI has nothing to do with these issues. But if this is the case, what is the point it analyzing it in the first place? We clearly need to understand when an economy is giving us “stop” signals with respect to increasingly low quality energy inputs. If EROI is not helpful in this regard, perhaps we need to be looking at other indicators.

Originally posted at OurFiniteWorld.com.

Hi Gail, just curious, are you suggesting that this is the end of all economic systems, FULL STOP?

People will always be trading goods and services, and converting the "cost" of goods to a common denominator--whether it is bushels of wheat or US dollars. People did this 5,000 years ago, with accounts kept on tablets of clay.

What will change is the proportion of goods coming available from "promises" in advance--I will work for 40 years, and you will promise to pay me a pension when I turn 65. These promises just don't work. Or I will make you a loan of $100,000, and you will pay it back in 10 years. If things are going downhill quickly, a high interest rate is needed to make such a loan viable.

Another thing that will change is the extent of International trade. There will be an increasing number of local currencies, that are not really convertible internationally, because things are changing quickly. (These will include countries like Syria and Egypt, with internal conflict situations, or Greece and Spain with changing financial situations.) Countries will tend to set up bilateral trade agreements with trusted friends, rather than "just anyone".

What will change is the ability of any kind of currency to "hold value" over time. Even if I own gold, it will buy fewer and fewer bushels of wheat, because society's ability to grow bushels of wheat is declining over time. Money of any kind that is saved for the future will be worth less and less over time.

So I guess it is a matter of definition. New systems will be much different, and much more limited.

A lot of small currencies will decrease the need to move. Currency value will be adjusted so that it is cheaper to manufacture goods in a country with demand for imported goods.

First order of business for any successor to TOD:

Stop focusing on absolute EROI and start talking about RATE of energy return. I find this entire blog to be of very little practical use because it discusses absolute returns and not rate of return.

RATE of return is what matters, along with resource limitations and production constraints.

An oil sands operation could have an EROI of 1:1.1 - but it wouldn't matter if it was making that return on a daily basis. It would be returning 3,750% of the initial energy invested every year.

A solar PV installation might have an absolute EROI of 10:1. But if that 10 fold return happens over the course of 100 years then it is only returning 10% per year.

As someone who has made my share of pitches for project investment, I can promise that no financial investor would give you the time of day if you told him the absolute return without knowing the rate return (i.e. IRR). The principles are exactly the same here, and we need to start talking the right language if we are going to start understanding these issues properly.

Sorry Gail, other than that, thank you very much for your effort with TOD over the years. #legend.

The fact that EROI ignores timing is a major deficiency of this measure in my view. Early oil was pulled out, almost as investment was made. Intermittent renewables usually require huge up-front investments, which as you point out, is very different. This is an apples to oranges comparison.

There are major differences in types of energy as well. Intermittent electricity is not equivalent to "dispatchable" electricity, which is not equivalent to coal energy. These differences, plus "boundary issues" make comparisons from one type of energy to another very difficult.

Thanks, and thanks for not taking it personally! I agree with you on the other 2 points as well but I tend to see them as rather fudgy problems that can always be improved upon but never perfectly solved, whereas rate versus absolute returns is a relatively easy problem to solve and absolutely fundamental to understanding how useful energy can flow to society.

Cheers

Ben

It is easy not to take it personally, because EROI is not my subject. I got drawn into it because others are using the measure.

"Intermittent renewables usually require huge up-front investments..."

I agree this is necessary if one is to maintain one's current economic level. In my case, I intentionally crashed my personal energy economy and created a new base to work from. The modular nature of PV allowed me to build up a new energy economic system over time (new growth along a different path) while making more investments in types of efficiency that don't sacrifice resilience, both in infrastructure and in our behavior. Why I agree this is unlikely to work at scale:

1. I couldn't have done this without the macro, mostly fossil fuel based economy. My choices would have been much more primitive. Our current economy spawned the choices available.

2. I began planning and implementation ahead of the affective decline curve. I chose to divest in previous investments; emphasis on choice.

3. I had the willingness to reset my expectations.

4. The only people I had to convince were my immediate family (tribe) who were fully on board with the idea that I could, and would, accomplish my objectives; unity of purpose. They, too, gained a willingness to invest, and had time to reset their own expectations. They became convinced that the path I set was beneficial, if not necessary (over time).

5. I took care to convert surpluses into lasting investments, limiting waste.

6. This simply doesn't work at scale. Too many widely varying objectives; too many well-established competing investments limit the efficiency of process; our collective decision-making processes are inefficient and dysfunctional (political stalemate). Far too much denial and delusion begets inefficiencies that hinder affordability. Our current economies are largely waste-based. We are in the habit of squandering surplus. We, collectively, are too busy infighting to see who/what the real enemy is. Too late - the enemy is at our door.

This process will continue to be forced and chaotic with high levels of resentment, resistance and conflict. Too bad for those unwilling or unable to see this coming, many (most?) with few choices. Great opportunity for those who would exploit increasing vulnerabilities. In this age of triage, divisions, rather than unity will become the norm. The inevitable simplification from our hyper-complex state will be messy indeed.

I sometimes talk about solutions for a small percentage of people who are able and willing to do a lot of up-front preparations vs solutions for society as a whole. Solar PV may be at least temporary (as long as the panels last, and the things they run last) solution for some small percentage of the population. They really are not a solution for society as a whole, for the reasons you mention. Once the panels cease to work, or the things that they run cease to work, there may be a need to downshift further.

"They really are not a solution for society as a whole..."

...because, IMO, there aren't any. It's the nature of predicaments, and I'm largely in agreement with Orlov as he lays it out in his "Five Stages of Collapse", discussed here recently. Societies collapse and reform; a long, usually messy process. It comes down to buying time, creating buffers, especially in regard to basic necessities; slowing the process locally so that one's group has the oportunity (perhaps just a chance) to adapt rather than panic and react. Education, hope, and a proactive, early response is the best I could come up with under the circumstances.

I think many central bankers are aware of the direction that our society is headed in, and their response is to also buy time at a macro level. EOR in oil extraction is having the same effect, though, IMO, there's a much more costly downside to centralised, top-down responses; makes matters worse. Our resources should be applied to enabling less centralised adaptations, which would, of course, require an acceptance that BAU and growth are no longer supportable. This won't happen, as that would stampede the herd. Meanwhile, society cooks away in its own detritus, suffering the consequences and latching on to whatever false hopes come along. Hard to watch, even from the cheap seats.

Rocks and hard places...

Gail,

You're obviously an intelligent person who is very knowledgeable, but you're really doing a disservice by repeatedly talking down renewables. I don't mean to suggest renewables will be able to compensate for the decline in fossil fuels entirely, or that Humanity doesn't face daunting challenges, but by repeatedly slamming renewables you're just helping to perpetuate the current fossil fuel dominated system.

Gail, if Wind Power is such an inadequate energy source, why do I pay 9 cents per KWh for Wind Power that covers over 80% of my electricity consumption?

Again, I don't want people to take away the idea renewables will allow for the continuation of business as usual (BAU), but adding to the negativity regarding renewables is really counter-productive.

If renewables could really replace oil, they would be producing enough profit that they could be paying high taxes like the oil and gas industry has been over the years, and still does now. The fact that wind energy still needs subsidies (and this is without considering the amount of grid upgrades needed) is verification that wind energy is a real problem for replacing oil. The fact that wind energy still needs subsidies means it isn't even very good for extending electricity--although if wind energy it is onshore, near where the wind energy is to be used, and the total penetration of the grid is kept low, it may be a passable "extender" for other electricity.

How long wind energy lasts is really a function of how long we can keep the electric grid working. It also depends on how long we can keep the wind turbines repaired. How long they can be used is the lower of these two lengths of time. All of the EROI studies that have been done assume that they will last their full planned working life, so are biased on the high side. The front-ended nature of the investment also makes comparability with other EROIs very "iffy."

I don't know how you get the wind rate you get for 80% of your electricity consumption, but I would be willing to bet that (1) it doesn't come from a grid system that in fact is generated 80% by wind and (2) the 9 cents per KWh rate reflects more than one kind of subsidy.

You clearly have some axe to grind because no where did I say renewables would "replace oil." This is an apples to oranges comparison in the first place. As for Wind Energy "needing" subsidies, if I correctly recall the Oil and Gas Industry, in which you put so much faith in, receives considerable federal tax relief.

I'm going to ignore your last paragraph.

I'm going to ignore your last paragraph.

Why?

Remarkable post Gail. I have not read this slant on EROEI before and wonder if this is original with you? I will need to mull it over at any rate and read the comments to see if I can understand it better and possibly refute some points. If I can't, then you have really drawn attention to a looming very serious problem. I also guess I don't understand the IRR comment including the (on the surface) absurd comment that an EROEI of 1.1 could return 3750% depending upon the rate of return. The math is unexplained and I suspect doesn't reflect a real world rate of return of the fossil based industry. People are going to be upset with their renewable strategies being minimized, probably because that was their last best hope. You pointed out some obvious oft repeated points about renewables needing subsidy (hidden or otherwise) from fossil fuels to exist,but even these comments upset folks. Too bad. What I would like to see emphasized is that solar and wind have a great future as well as a great past, and essential applicability going forward, but not for generating electricity but for doing work directly, grinding grain, pumping water and the like. Wind and water are extremely efficient driving dynamo generators yielding over 90% efficiency but once they jump on the grid you face line losses depending upon the distance from the source. Solar electricity generation is very inefficient and faces long term issues you covered. Solar is very diffuse but it works fabulously well for heating structures, water, and for drying. The final point of emphasis is the low efficiency of fossil fuels especially in transportation engines which perform in the 30% range. Burning coal is better in the best combined cycle plants, approaching 40%. Gas plants almost 50% better and not spewing heavy metals and leaving contaminated waste.If this isn't a reason to end coal powered generation, I don't know what is. I am from Wyoming and could get shot for that comment. Gail, you are so polite upsetting people's applecarts. Yesterday, I was on a long hike with some very fine, intelligent and oh so wealthy folks high above Jackson Hole. I tried to point out the risks of living in a remote mountain town devoid of resources, unable to feed itself and at the tail end of supply chains. I don't think I persuaded anyone. Once they have wrapped themselves in their Lexus Suv on their way to their Gulfstream where Ben Bernanke and his financial cronies are climbing off theirs, they just don't perceive the risk to continuing their energy extravagant lifestyles.The Bourbons didn't see the risk either.

In conclusion, it is going to be painful to lose posts and comments such as yours with such a high level of value as we put TOD to bed. Thank you again , Gail.

"The math is unexplained"

Try this:

In this example The EROI is 1:1.1 because every time you put 1 unit of energy you get 1.1 units back. That is how EROI is measured. In this example the length of time of this cycle is 1 day.*

At the start of the year the oil sands company (SandTarInc)has 100 units of energy. This is the "energy investment" that the company uses to start up the operation for the whole year. This energy was lent to it by "society" and "society" had to forego some quality of life in order to give it to SandTarInc so they could start up the tar sands mining operation.

Importantly, all future energy required to keep the operation running will be taken from energy-flow that is generated as they goes along. Although all of the energy ever spent is acouunted for in the EROI accounts (to give us our 1:1.1m ratio) - only the first 100 units was ever put at risk and temporarily foregone by "society" the rest of it was just re-invested over and over again.

SandTarInc uses all 100 units on the first day, and at the end of the day it has produced 110 units of energy. It gives 10 units of energy back to "society" which has been waiting all day to have it's hot bath, and keeps 100 units back so it can operate again the next day.

The next day it again uses the entire 100 units that it saved from the last day but again produces 110 units. Again it gives 10 units back to society for its hot bath, and keeps 100 units back for the next day's operations.

He does this every day of the year except on December 31st when the CEO decides to quit to become a blogger about peak oil and the company folds. On this day it does not need to keep 100 units back for the next day so it gives that back to "society" as well.

So, "society" invested 100 units of its precious energy in SandTarInc at 12:01 on January 1st. It was then repaid 10 units of energy every day of the year. Therefore, over the course of the year received:

365 * 10 units = 3,650 units.

On the last day "society" was also given back an additional 100 units as it wasn't needed any more.

3,650 + 100 = 3,750

So, "society" invested 100 unit in OilTarInc and after one year had been given back 3,750 units, so after one year, its annual return was:

3,750 / 100 * 100(%) = 3,750%

And that's why the annual "internal" rate of return was 3,750% when the EROI was only 1:1.1

I hope that isn't patronising but you did say you didn't understand the maths. I had previously assumed it was obvious.

*Note: this is an oversimplified example that assumes 100% operational energy costs and 0% capital costs, but in a surface mining oil sands operation this is not such a terrible approximation - the vast majority of the energy costs are "variable" cost used throughout the life of the operation to power the machines that extract and transport the sands and then separate the bitumen from the sand. Relative to that the energy sunk in capital machinery is tiny over the lifetime of the operation.

The math is technically correct. However in the real world such examples might be phony due to unaccounted monetary and energetic costs.

EROEI accounts for the energetic costs - that's the point. The monetary costs - I think that's why he picked out the examples he did. If a project doesn't make a monetary return on a scale we believe is appropriate we scoff at it, although it might be entirely suitable on an energy basis.

The biggest fault, by far, has been the lack of taking externalities into account. Pollution, displacement, etc. With biofuels it comes as soil mining and displacing of fields that could be used for food. There may also be pesticide pollution involved. Tar sands use a lot of water, fracking pollutes the water table.

Does ERORI account for the massive amounts of energy from nuclear radiation and gravitational collapse that originally allowed for the epithermal concentration of minerals? Does it account for the energy used to mine minerals essential to the energy industry or the energy consumed by workers (and their families) that commute to coal mines, stripper wells and wind farms?

Does EROEI account for Kim Kardishian ?

Without her to "entertain us", perhaps the workers and their spouses might not be motivated enough to not call in sick one day ?

The boundaries can be very wide in accounting for EROEI. Kim apparently (empirical evidence) performs some function in our overall economy. In theory, I personally cannot describe exactly what, but there is ample empirical evidence that she has some very indirect effect on EROEI.

Alan

The EROI is calculated daily, but the IRR was calculated annually? No wonder the IRR looks so good compared to the EROI.

I guess I am thinking that a 10% interest on my savings ( EROI 1.1 for every 1 I had the day before) , as a daily rate of return, would make me a rich man pretty fast, but on an annual basis, its less than a wash with inflation.

They burned up an enormous amount of energy to extract that 3,750 units which means society probably had to pay for that in other ways, i.e. heat pollution, greenhouse gas emissions, whatever.

Its not a pretty picture however you want to look at it. But if its all you have...

Hi Hardhat

You are right - the EROI in the first example is terrible, a horrible amount of energy has to be invested in order to keep supplying some net energy.

But as far as society is concerned it really doesn't matter. The net energy produced each year is still huge relative to the initial investment in energy. We are rich!! (in that example anyway, and at least until the tar-sands run out or the planet over-heats).

My point is that if you just focus on energy returns, and don't worry about environmental impacts or any constraints or limitations on the resource (which are not captured by EROI either) then some energy production operations will provide easily enough annual net energy returns on investment - despite having a very low absolute EROI - to keep society chugging along very happily. Meanwhile other types of primary energy production ("capital intensive" ones) might have quite a good EROI, but actually supply from those sources might not keep up with demand, giving us a big problem. Rate of net energy return (or Energy IRR) is much more important for society to know than absolute returns on energy.

Actually having looked at recent energy costs for solar PV, I am already getting more and more comfortable about energy returns. Without having applied enough academic rigour to strongly stand behind this, my own desktop-research is showing an Energy IRR of about 20% for good PV, supplied to a near-by grid with demand matching supply profile. That is very encouraging as it shows that PV - the least constrained of all energy resources and one with huge potential for further efficiency/cost-reduction gains - is already well ahead of the kind of growth levels that make society function well (which it has to be to drive available wealth, but growth is exponential so any difference at all will scale quickly).

Unfortunately I suspect that the amount of PV that can be supplied in this 20% scenario is relatively limited - the next stage would be to add bigger and bigger transmission lines and more and more overnight storage plus new electric vehicles - and that would incrementally take that E-IRR down to a much less comfortable level and eventually negative. The challenge for society is to keep improving the technology at a rate that is faster than the rate at which we will have to move to add capacity in the less atractive locations. I am quite optimistic about that, and I think we have quite a good timeframe to achieve it especially relative to what has been achieved already in the last 8 years alone.

I would guess that a 100% renewable grid would be roughly very, very roughly 30% solar, 50% wind, and 20% other. Solar doesn't really need to provide anything like 100%.

Wind is around 50:1...

It very much depends upon the location. Solar in Iceland - not. In Saudi Arabia, potentially quite a bit.

Hydro and geothermal take as large a % as the local resource allows. HV DC (to trade renewables) and pumped storage will have to figure in most renewable grids.

Brazil could be 85% hydro, 18% solar and 2% wind for example. Iceland is about 70% hydro, 30% geothermal. etc.

Alan

Math was obvious to me.

I also think Hoover is onto something important. EROI has to add up in the positive to even have a chance for an energy source to be viable. But the rate of return is also very important, economically and otherwise. Perhaps more so than total EROI.

Looking at nature, haven't you wondered how it functions at such a low EROI? Plants and things are perhaps 2% efficient in converting solar to energy. Yet nearly all life is built upon this base of photosynthesis. Some of that is possible due to the rate and not just the total return. A small EROI per batch can be a large resource indeed if the batches are turned very quickly. Just like in Hoover's example.

That immediately points to one of the reasons solar hasn't taken off I think. The rate of turnover and payback is too slow and drawn out. Even though the total EROI is not too bad it just doesn't quite add up in the sense of rates of energy and rates of investment. It also points to maybe a different strategy for replacing fossil fuels. Things that can turn over quickly are more valuable to the flow of energy. It is the total flow our culture and economy are built upon. Yes, fossil fuels once had an EROI approaching 100, but they also had a very high rate of energy flow. Drilling wells didn't take long. Now with offshore deepwater oil drilling even if the EROI is positive look at the lag in flow how it impacts the rate at which energy is available.

Energy return rates on energy invested is a much more meaningful measure to our energy needs. Economies, civilizations, life itself are about energy flow rates. Feedbacks are about flow rates not total amounts. Money in terms of wealth is about money flowing in faster than it goes out more than about totals.

Slowly. Very, very, slowly. And that's the problem. Nobody is saying that humans can not function at those energy rates. We did for million years, after all. It's just that those energy rates are too slow for our current civilization and our current population numbers.

Well, plants are pretty inefficient: overall, well below 1%. PV does a lot better. And, of course, wind is still at 50:1 EROEI.

The sun drops 100,000TW continuously on the earth - we're surrounded by vast, high quality energy - it's just a matter of figuring out how to capture it. And, we've now done that.

Yes, but why are plants so slow? Because they depend on the cycle of water, nitrogen, phosphorus, etc... And they had billions of years to optimize those processes to run for another billions of years. We may have figured out how to outsmart them, but we did it by depending on external sources for metals and raw materials, sources that are just as limited as fossil fuels. The plants' solutions may be very slow, but they are infinitely scalable. Ours aren't.

Plants have grown just as far as they can.

No question humans have limits too, but we haven't really come to those imposed by energy supply. Pollution, on the other hand...

We need to eliminate FFs ASAP.

Perhaps not...

Part of they dynamic here is that electricity demand is pretty flat, so new capacity isn't really needed. But...consumers still want solar, so they'll keep installing, and taking market share away from FFs.

I disagree with a number of your conclusions and the points made by Gail.

Renewables are viable sources for a high fraction of the electrical grid.

Unfortunately, I will be busy for a couple of days to properly refute her points.

See

http://www.theoildrum.com/node/10052/972684

on this post.

Alan

On EROEI boundary conditions:

http://connectrandomdots.blogspot.com/2012/07/test-post.html

and analysis:

http://connectrandomdots.blogspot.com/2012/12/scope-of-analysis.html

Rgds

WP

Gail, do you really feel that renewables are subsidized more heavily than fossil fuels??

What about the $2T oil war recently fought by the US to ensure the stability of oil supplies? That investment would have bought a lot EVs.

What about mountain top removal, coal ash, mercury, and CO2?

What about the vast subsidies to fossil fuel provided by governments around the world? $.10 per liter for gas in Venezuela, or Saudi Arabia isn't a subsidy?

Do you really see the oil industry as generating a lot of taxes? Remember, fuel taxes don't go into the general fund, they simply pay for road maintenance. Further, both the Federal and local governments subsidize road consruction and maintenance heavily.

Finally, do you really not believe in Climate Change, and the cost of all that CO2 pouring into the atmosphere?

Why, oh why, do you defend fossil fuels so much?

To use wood as a heat source money need to be invested in a heating system and maybe also some forest.

An intersting thing with forests are even though it takes 70 to 80 years for the trees to grow large some large trees could be harvested every year provided that there are trees in all ages available. It is also possible to deplete the forest totally so no large trees could be harvested for 70 to 80 years.

Peat (turf) are continuosly replenished so even if takes thousands of years for a thick layer to develop some could be harvested every year but it could also be totally depleted so that it will take thousands or at least hundreds of years before any ny peat (turf) could be harvested.

I never heard any numbers of how fast other fossil fuels buried deeper in the earth like: natural gas, oil and coal replenish. Under the right conditions I guess it would possible to build a trap of silt or clay above peat (turf) so an oil accumulation is formed over time but in such case the peat (turf) can't be used today.

Historically, there has been a lot of problem with deforestation, apparently even as far back as 4,000BCE, according to Sing Chew, "The Recurring Dark Ages". It is very tempting to cut down too many trees. For one thing, this can provide more arable land, at least until erosion depletes soil level. Even more importantly, forests can be used for heating homes and for making charcoal, to be used in making metals and glass. It is this use that tends to quickly lead to deforestation.

Peat in remade at a very slow rate. According to Wikipedia, "Peat usually accumulates slowly, at the rate of about a millimetre per year."

Wikipedia also says, ". . . peat is not generally regarded as a renewable source of energy, due to its extraction rate in industrialized countries far exceeding its slow regrowth rate of 1mm per year,[6] and as it is also reported that peat regrowth takes place only in 30-40% of peatlands." I don't think we should count on much from peat.

It comes down to population and extraction rate. Avoiding overshoot is the key, something we'll come to terms with soon enough.

There's plenty of free energy if one just learns to utilize it. Passive solar/passive cooling are grossly under-utilized, and much higher levels of insulation and better construction techniques are examples of where efficiency and resilience coexist nicely. Many of our structures are much too big. Simply wearing the right clothing for the seasons and letting our bodies adapt to seasonal changes can reduce the need for external energy sources.

Isn't the problem more that we do not, conventionally, include all energy inputs when calculating EROEI. That is at least in part because they are so difficult to quantify. For instance, oil includes cost of producing pipes, cost of rigs, transportation of labor daily to and from rigs, storage facility manufacture, and later demolition, etc., etc. ad nauseam. Consequently, the input value is almost certain to be in error.

Then there are inputs later on in the cycle. Deliver vehicles (pipelines, railroads, rolling stock,) roads, more pipe manufacture, ships, disposal and clean up, and so forth.

Then there is the time value of money if there is a long time involved between start and delivery (by burning, or transforming into useful things).

I think it is more difficult to quantify the input than the output by far. The energy value of an oil or any hydrocarbon product can be measured easily in caloric terms.

Add to that the fact that some products are valuable not as energy delivery, but rather in some other sense, and can be used to create profit, even if at a net energy loss. Oil and gas would be extracted at negative EROEI for use in production of certain pharmaceuticals, and gas for use in production of plastics, as a few easy examples.

What we are left with is some generalities, and a "feeling" that at some point our economy will no longer be able to sustain if EROEI is too low.

Craig

The EROEI calculations have been "sold" as a way of telling whether an energy product is "working" in terms of providing adequate energy for investment. Yet our economy is now presenting the classic symptoms of not enough net energy, and EROEI doesn't have a way of really showing this. EROEI values have generally been moving down over time. They also vary greatly around the world--something I doubt academic studies have been able to investigate in any meaningful way. The high EROEI values of the past have subsidized our economy, but there is no from the EROEI values of knowing when this subsidy is now inadequate.

Hoover: "An oil sands operation could have an EROI of 1:1.1 - but it wouldn't matter if it was making that return on a daily basis. It would be returning 3,750% of the initial energy invested every year.

A solar PV installation might have an absolute EROI of 10:1. But if that 10 fold return happens over the course of 100 years then it is only returning 10% per year."

I think you are looking at it wrong. EROEI is supposed to measure the TOTAL investment and TOTAL return over the entire lifecycle of a resource. Of course, that means that it is a very abstract measure, and a very hard (or nearly impossible) to calculate properly. Nevertheless, when you calculate the totals, then your examples are not correct, the first one would have a much higher EROEI and the second one much lower.

Hi Strummer, I hear what you are saying but I am already doing that. Obviously I have over-simplified in both cases and just used illustrative numbers, but that is just to demonstrate a point about rate of return versus absolute return it's not supposed to be a comment about either technology.

The PV example already uses the full lifetime of the PV panel - it has to because it is 100% upfront Capital investment and 0% ongoing operational investment. The tar sands example was the exact other way around 0% capital and 100% operational cost. Because it was 100% operational costs and the operational cycle in my example was 1 day, I just worked on that basis, but if the resource lasted 100 days (or years) both the inputs and the returns would be multiplied by 100 and you would still get the same EROI.

Of course in real life there will always be some capital investment so you will always have to work on the basis of the full lifetime of the investment (and likewise there will always be some ongoing operational costs as well). But none of that changes the point that EROI does not account for time and hence tells us next to no useful information about how free energy will flow to society or how that energy could be re-invested to make sure that even more free energy flows at some point in the future when we might need it.

Let's take it to the far extreme:

I find a resource into which, when I put 1 joule of energy it will pay me back 1.01 joule after 1 second. It doesn't matter how may joules I put in, I always get 1% more back in return, so it has an EROI of 1:0.01. If it was a limitless resource and I started the day with enough energy to power an LED lightbulb for 1 second, and kept on reinvesting my 1% gains every second, by the end of the day I would be producing - with my energy source EROI of 1% - far far more energy every minute than the entire human race could possibly consume in its history before our Sun goes super nova.

But if I had an energy source of EROI 1:1,000,000 that had a 100 year production cycle with all of the energy returns being generated in one go at the end... well it might have been some use to my grandkids, but they were never born because my own kids and I starved to death first.

They are stupid examples, that obviously don't exist, I am just trying to point out that to measure energy returns without knowing the rate of return is of purely academic interest and of no use to society.

This is a very good point, but more importantly: no financial investor would give you the time of day if you told him either the EROEI *or* the energy rate of return, without knowing the financial IRR.

EROEI is really only useful for analysis of unusual cases, like biofuels, where subsidies are large or the business case is still very theoretical. In the case of almost everything else, like PV and wind, the EROEI is "good enough", and the financial case (combined, of course, with all of the other important factors, like internalization of pollution and security) is the most important thing.

So, for instance, PV is now nearing and surpassing grid parity in many places, as the Germans, good engineers that they are, knew that it would.

"An oil sands operation could have an EROI of 1:1.1 - but it wouldn't matter if it was making that return on a daily basis. It would be returning 3,750% of the initial energy invested every year."

I point that out every time I talk about EROI, and I used an example like the one you did above. The other major caveat is that unless you are talking about fungible energy inputs you could have a situation with a poor EROI and great economics. The EROI in that case just means you are accelerating the depletion of the input energy, even though it may be cheap input energy.

Fungibility of energy inputs and outputs is such a basic problem.

What if the inputs are cheap natural gas, and the outputs are peak electricity, which is worth 3-10x as much per joule (to the grid and it's consumers) as the NG?

Or cheap NG, vs expensive liquid fuel?

Surely EROI (or E-IRR!) is only applicable to situations where primary energy is being produced?

As a power station developer I can honestly say that of the couple dozen or so projects I have worked on over the years not a single one of them had an EROI above 1:1 or a positive E-IRR.

At this point this is where the good old financial returns help us out - and as you said earlier Nick, we can never forget about those.

For energy accounting purposes though, I think some simple principles can give us a good idea:

gas to power: based on the efficiency of a good CCGT

gas to liquids: volume weighted average of (a) efficiency of a GTL plant and (b) small scale liquefaction plant (volume weighting of LNG to depend on amount of LNG used in transport in that country, changing over time)

power to liquids: arbitrage through gas

liquids to other liquids: crack efficiencies

anytime power to peak power: pumped storage efficiency

etc etc etc

I think some simple principles can give us a good idea

I take it you mean that these are good benchmarks for comparison & evaluation of a proposed project?

One quibble: for "anytime power to peak power": efficiency may be only a secondary criterion. In particular, if we're shifting surplus wind power from one part of the year to another, capital cost will be the overriding factor, not efficiency. So, a plant that uses surplus wind power to create hydrogen or methane (to be stored underground, or in the NG pipeline network) needs to have capex costs that are much, much lower than pumped storage, and can handle relatively low input./output efficiency.

Surely EROI (or E-IRR!) is only applicable to situations where primary energy is being produced?

Well, both wind and PV produce electricity, which is 3x as valuable as FF primary energy, joule for joule. If PV has a EROEI of 10, but uses NG to heat it's polysilicon, and outputs peak electricity, it's EROEI is arguable 3-10x higher, as a practical matter.

Most rate of energy return issues can be analyzed into resource cost issues. For example bio-energy crops require a growing season, so there appears to a time issue involved. But if we had enough fallow land available we could get very high yearly return rates. The fundamental economic issue is the opportunity cost of land use and not the rate at which crops can be produced. Of course energy balance matters since you need to know how much useful energy was produced for a given resource input.

Similarly how fast we can extract oil from the Canadian tar sands depends on how much capital and labor we are willing to invest. Again the basic issue is the opportunity cost of investing such resources rather than a time issue per se.

The use of EROEI as an economic parameter can charitably be interpreted as an attempt to make the input energy serve as a marker for the total resource opportunity cost of producing energy. But the idea that dealing with dimensionless energy ratios frees us from the complex process by which value is placed on various production resources is pseudo-intellectual delusion.

it's most useful for unusual situations, where EROEI is very low, or negative.

A classic example is Soviet toilet paper: if you subsidize it too much, the toilet paper makers start buying it from the stores, and using it to make new toilet paper, because it's cheaper than the normal wood feedstock!

I think high EROEI is necessary based on a couple of informal questions

1) what distinguishes us from hunter gatherers?

2) why can't we shake off coal?

We are different to Neolithic people because we have cars, computers, electric toothbrushes, air conditioning and effective medicine. These and a myriad other things make up the obligatory energy load for modern society. There's no EROEI for Medicare but the system needs high EROEI to pay for it. We used to get by burning wood grown in realtime then we changed to accumulated fossil fuels like coal, oil and gas. Now some think we can go back to realtime energy fluxes. Maybe not.

The coal and gas fudge. We look at PV and wind turbines and think ain't they sweet but without the despised fossil fuels we wouldn't have the necessary steel, silicon and cement nor most backup power. As Gail says things will be tough without fossil fuels unless wind and solar get to run their own mines, furnaces and factories.

Germany has an aggressive renewables program but is building new coal plants. Same goes for China who are now starting to publicly worry about extreme weather. There was an excellent show 'Ten Bucks A Litre' on Australian TV tonight hosted by businessman Dick Smith. He flew his own exec jet, helicopter, prop plane and ultralight to various energy installations. He covered nukes, wind farms, off grid PV, EVs, conventional and coal seam and shale gas, solar thermal and efficiency. There waiting on the coastline were all the coal ships going to China, India and elsewhere. For now some are saying we don't need no coal others can burn it for us. Maybe all the low EROEI stuff is a big delusion for domestic consumption so long as we can import manufactured goods made with coal.

I think trying to discourage coal usage internally while allowing importation of goods made with coal from the rest of the world is counterproductive. What happens is we send manufacture of goods overseas, where they are made with coal. Sending manufacturing of goods overseas has a multiplier effect, because those countries suddenly need all of the services, roads, and new homes that go with new prosperity. These are all created using coal. At the same time, the US and other developed goods get the "reverse multiplier" effect of losing the jobs that would have gone with manufacturing if it had stayed here. Think of Detroit, with its lower population, and less need for school teachers, police (?), grocery stores, and many other things.

Most of the time humans and pre-humans have lived on earth, we were hunter-gatherers. Even then, we did not live very sustainably, because we killed off the large animals and not-so-smart animals, such as the auk, as soon as we moved to new territory. We also burned down woods, in attempts to force animals out to where we could reach them. Even back then, we had a problem with rising population, so there was no doubt fighting among groups. I think the main thing that distinguishes us from hunter gatherers is that there are more of us now, so we have a need to use more resources than what can be obtained from simple hunting and gathering.

We can't shake off coal because in any economic contest, "cheap wins." Coal comes out at the bottom, or near the bottom, in almost any cost comparison.

Well perhaps what we need is a 'coal tax' put on imports from any nation that uses more than X amount of coal per capita. I agree eliminating CO2 output here only to have it increased overseas does not solve anything.

And if you look at the pollution in some coal-heavy areas, you'd think that they also realize that they need to reduce coal usage as well.

I don't know whether we can get off coal, but accepting Gail's thesis, it doesn't sound like we get off fossil fuels in general until we become unable to extract them. But since, apparently, renewables are dependent upon fossil fuels, we eventually end up in a hunter, gatherer situation assuming there is anything left to hunt and gather.

There is still a bit of an unknown for me as I see the production of solar, for example, becoming increasingly efficient. Will there ever come a day where solar electricity can be produced without any or significant fossil fuel input. I know this is a trivial example but I see some of the ff input being reduced locally by the fact that a local PV installer brings their panels and tools to the site via a bike hauler. Trivial but maybe it is the beginning to breaking down the whole process and trying to attack each step by figuring out a way to reduce or eliminate ff input.

Well, at least the bears and the ground squirrels here locally have figured out a way to deal with seasonal heat and cold with respect to their housing needs. But with 7 billion people and counting I think we will be overrun with global warming before we make a dent in this problem.

"Will there ever come a day where solar electricity can be produced without any or significant fossil fuel input."?

Latching onto the idea that fossil fuels are a direct requirement for the production of solar panels misses a broader point, one I think Gail makes and many are missing:

Can the complex systems of exchange, manufacturing, marketing, etc., required to produce and deploy PV at scale continue to function as they are? It's a hyper-complex system that requires many inputs, mostly subsidized by fossil fuels. Many things have to go right. The big question is; can a broader economy dependent on fossil fuels and many other inputs (mostly dependent on fossil fuels to be brought to market economically) continue to function at a level that allows things like PV panels to be produced and deployed,, and will we be able to afford such without the fossil fuel energy subsidy? With so many things pointing in the wrong direction, I have serious doubts. I think we'll be too busy feeding ourselves and trying to not kill each other; all competing for a declining, more expensive energy base.

The availability of fossil fuels is not an "On/Off" switch but a complex progression that varies by fuel type, fuel demand and likely locality (see LNG trade by tanker vs. US NG prices and availability).

I can see a European nation where people move with their feet, bicycles, trams and trains but ambulances, garbage trucks and fire engines move with ICEs - powered with either FF or renewables. Almost all cars are EVs and 18% of the population owns one. (18 cars per 100 population). Goods move mainly with electrified trains, ICE barges & coastal ships, EV delivery trucks with some ICE trucks for longer distances. Farms use ICE tractors and farm equipment. ICE is powered by a combination of FF and bio-fuels.

Only 1% of the population flies in any given year, using FF. Sort of like 1965 in that way. Trips up to 800 km (500 miles) are routinely made with high speed, or just fast (150 kph or so), trains. Some trips longer than 800 km are also made by train, usually with a change of trains in a major city.

Per capita electrical demand is down by half (say 1/4th of current US electrical demand) and the capitas are down too, perhaps -10% from the peak population.

Electrical production is mostly renewables (hydro being a good part) with lots of pumped storage, perhaps some nuclear and the balance coal to fill the gaps. HV DC to transmit surplus renewables and import hydro & other renewables as needed.

Such a nation could produce solar PV when electricity is cheap i.e. when renewables are in surplus. They could also use electric arc furnaces to recycle steel - again when renewables are in surplus. Steel that could be used for wind turbines and their towers. This is exactly the sort of scheduled demand needed for a high renewable grid, EV charging is another.

And this is clearly the trend for France and Denmark 2040+.

And it could be the United States as well. The French effort could be duplicated with a quarter of our subsidy for cheap gasoline and diesel - about $25 billion/year (adjusting for population and currency).

Both nations are net food exporters BTW.

Best Hopes for Those That Prepare,

Alan

For Denmark, hydro and pumped storage are in Norway. Today, four HV DC lines are in operation between Norway and Denmark. The basic trade is Danish wind (when in surplus) for Norwegian hydro (as needed). Somewhat similar trade between France (excess nuke power late at night) and Switzerland.

Actually, I think the limiting factor on fossil fuels will be sales price dropping too low, to keep up production. This limit will be reached because debt for goods like cars and homes doesn't keep growing, and because wages don't rise by much, so consumers cannot afford cars and new homes. Unwinding quantitative easing can also expected to have a downward impact on commodity prices, including those for energy products. So we indeed will get off fossil fuels, quite possibly in the very near future, because of prices too low to sustain production. This will not be a nice way of doing it, however.

I need to comment on the rigor of this post. Analysis is not a proof-by-picture process. The association of oil price and wages in fig 2 is suspect. Such a claim would produce...eyeballing the picture.... a poor correlation. However, that is my point. The sweeping claims of this post are not convincing when built on poor analysis. Fig 2 and subsequent claims is a classic case of cherry picking. Shame on ToD for posting this. The quality used to be higher.

Rigor? Hell the Term EROI was used, what more do you want? Running with the Red Queen? BAU? Oldivi?

"Shame on ToD for posting this."

Shame on you for not being more specific in your counter-points. Pot calls kettle black.

What is not specific about my claiming that Fig 2 should be a regression analysis to have any merit?

Specifically: a lagged regression model comparing change of wage with oil price.

It's not hard. A one-liner in any stat language given the dataset.

If it's not hard, perhaps you can offer a more accurate analysis; fill the void you have created. Criticism is not a solution.

It is called peer review. Something the editors should have done.

What I am saying is that the absolute level of oil price is important, relative to the change in wages. This is different from what you are trying to test. The reason is the one I gave--When oil prices are low, there is a large difference between:

A. The cost of extracting a barrel of oil

B. The value of that barrel of oil to society as a whole, in terms of additional human productivity, and hence additional goods and services that barrel of oil could provide.

This difference can, over time, feed into wages, because it looks like increased efficiency for humans, together with increased profits for a company. When oil prices are high, this difference disappears, and this difference can no longer act to support wages.

If that is what you are arguing then the figure should be plotted as the relationship between those variables over the entire dataset. Otherwise, you are hand-picking data to support your argument and providing no statistical evidence of its likelihood. Plot: X-axis = absolute price of oil and Y-axis = change in wages (i.e., wage(t)-wage(t-1)). Perform regression (I would suggest at least a lag of 1-year) and post the r^2 values at least. I'm not saying you're wrong, I'm saying that Figure 2 is not evidence to support your argument; therefore, you have no argument.

Edit: As I posted below, if you post the raw data I will do the plot. I will plot: panel(a) the raw data as a time-series to recreate your figure (so everybody sees that it is the same dataset) and panel(b) the regression described above. I will even search over all possible lags to find the highest r^2 value to best support your claim. However, I am not satisfied with the evidence provided and it is below the lowest level I have yet seen on this site.

I attached he dataset, which can be found at this link.

I converted Gail's Excel file to csv format, removed header information, and rescaled wages to match her figure exactly, Panel (a). Panel (b) depicts the relative wage dependent on oil price. Note, r^2 of 0.086 means that only 8.6% of the variance is explained by the model http://en.wikipedia.org/wiki/Coefficient_of_determination. Panel (c) depicts r^2 values over various lagged regression models. The best explanation is a 7 year wage lag (r^2=.33 is still pretty weak evidence but moving in the right direction).

Here is the link to the figure.

http://i.imgur.com/W5rENe3.png

Here is the source code Matlab version: 8.0.0.783 (R2012b)

%========================================

% Source: test_oil_wage.m

% Author: bristlecone

% Date: Aug 1, 2013

%

% Purpose: Validate/refute hypothesis of the

% relationship between abs oil price and

% relative wage

%========================================

clear all; close all;

%Format wages into figure units

data = importdata('oil_wage.csv',',');

data_v2 = data;

data_v2(:,3) = data(:,3)*120/25;

figure(1)

subplot(1,3,1);

plot(data_v2(:,1),data_v2(:,2));

hold on;

plot(data_v2(:,1),data_v2(:,3),'r');

hold off;

%set(gca,'XTickLabel',data_v2(:,1));

title('Per capita non-gov wages compared to oil prices');

Nyears = 30;

r2vec = zeros(1,Nyears);

for(i =1:Nyears)

lag = i;

regressX = data_v2((lag+1):end,2);

regressY = data_v2((lag+1):end,3)-data_v2(1:(end-lag),3);

%Perform Regression

p = polyfit(regressX,regressY,1);

%Compute r-squared

f = polyval(p,regressX);

yfit = p(1)*regressX+p(2);

yresid = regressY-yfit;

SSresid = sum(yresid.^2);

SStotal = (length(regressY)-1)*var(regressY);

r2 = 1-SSresid/SStotal;

r2vec(i) = r2;

if(lag==1)

subplot(1,3,2)

[ysort isort] = sort(regressX);

scatter(regressX(isort),regressY(isort));

hold on;

plot(regressX(isort),yfit(isort),'r-');

hold off;

r2string = ['r^2=',num2str(r2)];

text(80,4,r2string);

xlabel('Absolute oil price(year=t)');

ylabel('Change of wage: wage(year=t)-wage(year=t-1)');

end

end

subplot(1,3,3);

plot(1:30,r2vec);

xlabel('Wage lag');

ylabel('r^2 of model fit');

I would observe that any mathematical model you put together has a number of built in assumptions. If a particular model doesn't fit, all that proves is that the particular model isn't right.

The way I look at things is to see what patterns I would expect to observe, based on the underlying interactions of the data. I want to understand how the system works first. Then I look at the data, to see whether it in fact fits the general shape I would expect. When I do the analysis this way, the data "makes sense." In general, growth in wages takes places when oil prices are low, but not otherwise.

Economics has developed an addiction to fancy models and expected changes in one variable based on small changes in other variables. These models may have nothing at all to do with underlying reality. The economy doesn't necessarily work in the way the model assumes. If a person can put together a sufficiently complex model that it somehow agrees with reality, there is a remote chance that it will have predictive power. But if it really doesn't incorporate the actual dynamics of how the "system works," the likelihood of this is very low. Starting from the assumption that year to year fluctuations changes are meaningful indicators of long term trends handicaps a person significantly in understanding the real interactions.

In my view, the best model is the simplest one. In fact, I talk about some indications of simple models in Energy and the Economy-Basic Principles and Feedback Loops.

"However, I am not satisfied with the evidence provided and it is below the lowest level I have yet seen on this site."

Jeez, you are a bristly cone. Casting stones such as the above isn't improving the conversation nor the data. Best hopes for more constructive responses on all levels.

bristlecone you're detonating, which just comes across as arrogant since you are in this case merely a couch potato passing judgment on someone's else's effort. Why don't you contribute what you think would be a better fig. 2. Gail's given you the data link and you are apparently clear on what it should include. Have it done and posted by 5:00pm ET.

Yair . . . I am an old uneducated bushman and I tend to look at things through different eyes.

It won't happen but it is possible for humankind to live happy fulfilling lives without laying waste to all the wonder and beauty of this planet.

You have to get back to the basics. We need food, fresh water, a comfortable place to live and raise kids and creative things like art and storytelling and music to occupy our minds.

From what I have seen of the Pacific Islands, PNG and our own aboriginal cultures it seems to me populations were kept in check by the availability of local recourses and for the most part the people lived as described above.

Just as much pleasure can be obtained by gliding down a creek in a tin canoe as doing the same with a jetski . . . you just need the right mindset.

I too watched that Dick Smith program and found it quite disturbing to actually see the extent of the bull-shit going on to sustain an unsustainable way of life.

Cheers.

A good example of what Gail writes about how companies try to survive:

THis really should be a comment in response to Bristlecone's post above. It is an example of why what I am saying is true about the connection of salaries with high energy costs. High cost feed through to lower worker wages.

Gail, thanks for this interesting posting. However I think that this might be a typical case where the rule applies that

correlation does not necessarily mean causation:It is true that wages went down when the oil prices were high - and the same is also true for many other industrialised countries. And I also can imagine that the oil price played some role But at least for the period after 2000 there were also other important factors that "helped" to bring wages down in these countries:

- I think that after the breakdown of the communist block there was a general shift in mentality to think that the western, capitalist system has shown to be superior - so the world would become even better the more capitalistic it gets. Thus, in many countries there was a strong tendency towards fixing or lowering wages (especially those of low-payed employees).

(Curiosly, as TOD readers know, the oil price also was one cause for the breakdown of the Soviet Union, which had problems with too little oil export revenues when the oil price was low.)

- Furthermore western enterprises felt challenged by the growing competition from China (especially in the area of low qualified jobs), which even more lead to bringing wages down to levels deemed "competitive" with China.

So, the oil price may have had its effect, but it is probably not the only cause. And it is probably almost impossible to disentangle this mess of causalities and effects.