Three Nails in the Coffin of Peak Oil

Posted by Euan Mearns on August 13, 2013 - 5:06am

This post is based on a talk I gave as an "undistinguished speaker" to the American Association of Petroleum Geologists (AAPG) oil finders lunch in Aberdeen a few weeks ago. This will be one of my last posts on The Oil Drum. There should be enough controversy below the fold to keep a hoard of Oil Drummers satiated for weeks;-)

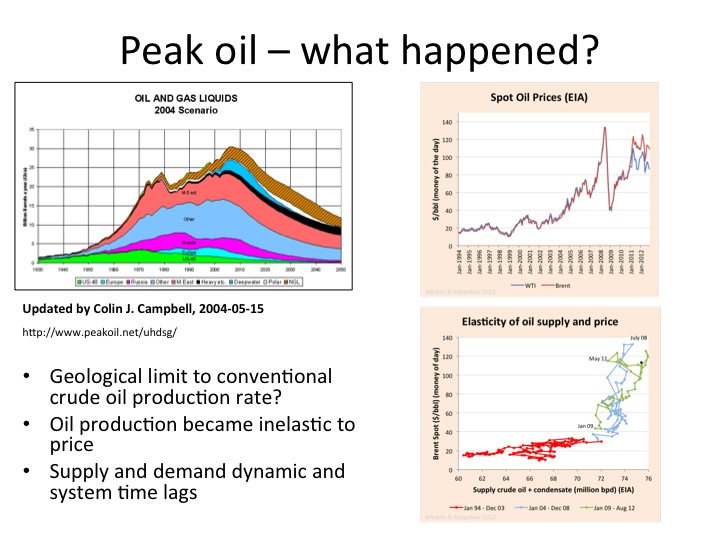

Peak oil - what happened? Before answering "what happened" it is perhaps best to try and define what peak oil actually means. In its simplest formulation, "the theory" is that owing to geological constraints on flow rates from natural finite reservoirs, global oil production will one day reach a maximum point and thereafter inexorably decline. An extension to the theory is to contemplate the possible consequences of peak oil for society. The argument goes that since oil is the pinnacle fuel in terms of energy content, transportability and storability, crucial to the smooth running of modern transport systems, that a decline in crude oil availability may lead to social disruption. The chart top left, shows a typical peak oil profile from Colin Campbell, one of the key Peak Oil analysts of recent decades.

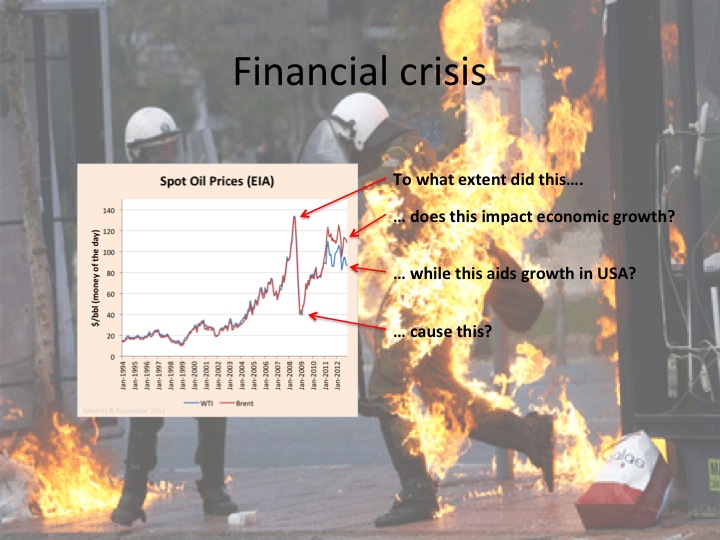

The chart top right shows the oil price for Brent and WTI. The phenomenal rise in price from 1999 to 2008 bore witness to growing scarcity, where demand growth outstripped supply growth. The chart bottom right is a cross plot of the monthly production and price data and shows how supply became inelastic to price from January 2004. Many "peak oilers" were convinced that the time had come.

(Click on slides to get a larger version that will open in a new window)

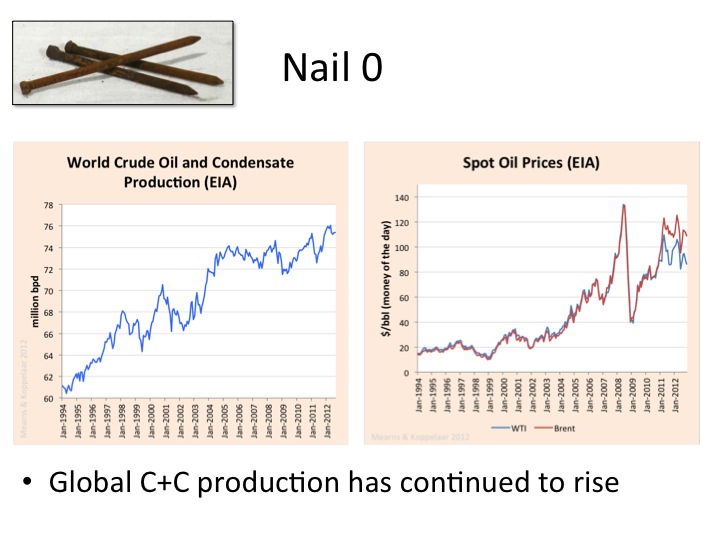

Nail 0 When I submitted the title to the AAPG many months ago I thought there were three main nails in the theory of Peak Oil, but when I came to write my talk I discovered there were four, hence the introduction of Nail 0. For the time being at least, it is an undeniable fact that oil production has continued to rise. Note that in this case, C+C includes conventional crude oil, condensate, shale oil and tar sands production but excludes biofuel and natural gas liquids. All scientists should update their views and theories when new facts come to light.

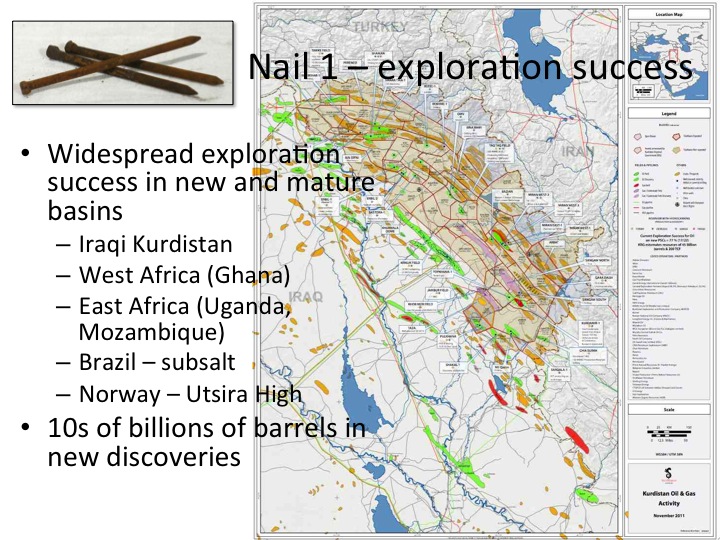

Nail 1 The first big nail is the ongoing exploration success of the international oil industry. Higher price has encouraged a resurgence in exploration activity that has resulted in tens of billions of barrels being found. Land locked Iraqi Kurdistan alone may hold >40 billion barrels in new reserves. We will of course one day run out of planet to explore but that day does not seem to have arrived yet.

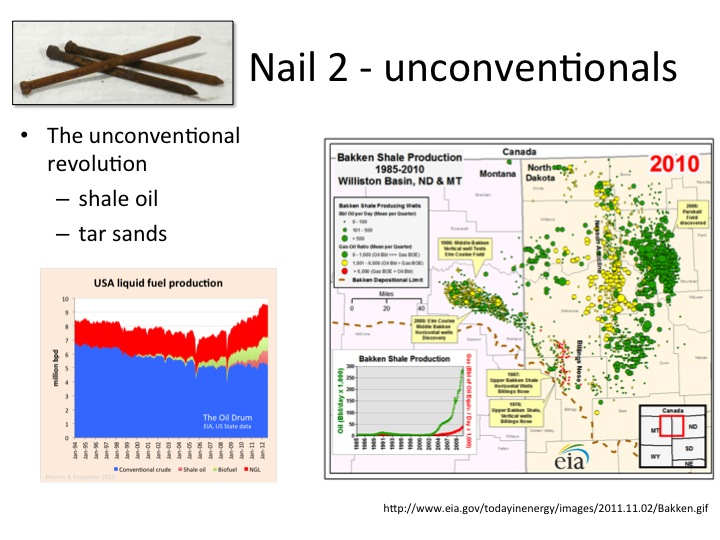

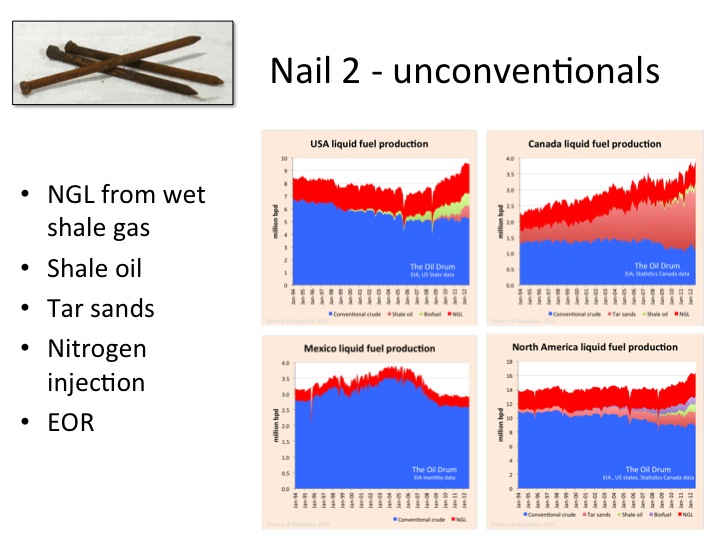

Nail 2 The second big nail has been the expansion of unconventional oil and gas production, especially shale oil and shale gas in North America. Several years ago when I first engaged with this debate no one ever mentioned shale oil as a massive new resource just begging to be exploited. Shale, together with tar sands, biofuels and enhanced oil recovery has transformed the fortunes of US and N American liquid fuel production.

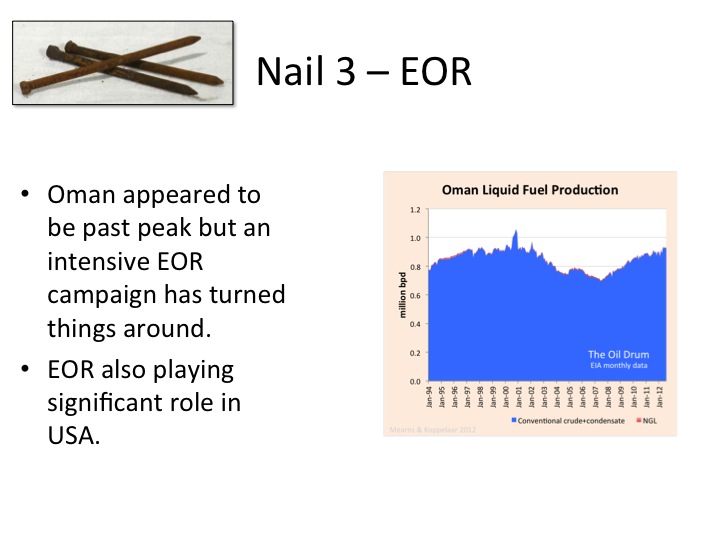

Nail 3 The third and final big nail may not seem significant but it is symbolic of what can be achieved with technology and the desire to succeed. Oil production in Oman had been in decline since the year 2000 to the disappointment of the Omani people and Shell Oil that operates much of the production in that country through a joint venture with the Omani government called Petroleum Development Oman (PDO). Oman would have been a classic case of a country peaking. But the fortunes were reversed by rolling out an array of enhanced oil recovery strategies. Increasing recovery factors across the globe will add billions more to reserves.

Points At this point many readers may think I have lost the plot, and indeed by the end of the post may still think so. It is important to set the preceding observations in context.

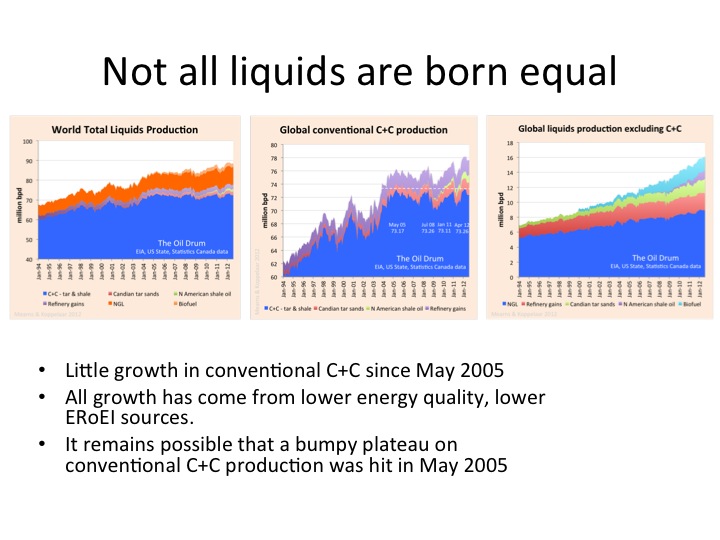

Not all liquids are born equal A careful dissection of global liquids production data shows that conventional crude oil + condensate has been on a bumpy plateau, just over 73 mmbpd, since 2005 - that is for 8 years. Despite record high oil prices, the international oil industry has not been able to grow production of this most lucrative resource that flows freely from the ground. Something is up! All of the meagre growth in liquids production has come from liquids that are very difficult to get, i.e. shale oil and syn crude form tar sand, or from inferior liquids that condense from natural gas production (NGL). Note that in this case conventional C+C excludes shale oil and tar sands. It remains a debatable point whether or not shale oil should be classified as conventional or unconventional oil.

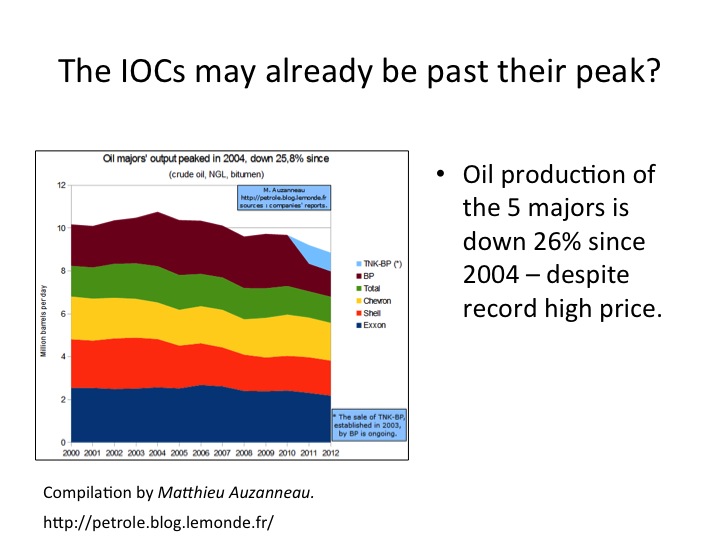

The IOCs may already be past their peak If the world is awash with oil as many reporters now claim, it is curious that this oil seems out of reach of the biggest independent oil companies in the world. Some of the new supplies may of course be in the hands of the second tier independents but most of it lies in the hands of national governments out side of the OECD. This presents very serious threats to energy security and on-going trade imbalances that lie at the heart of on-going financial system stress.

Thanks to Matthieu Auzanneau for the splendid chart.

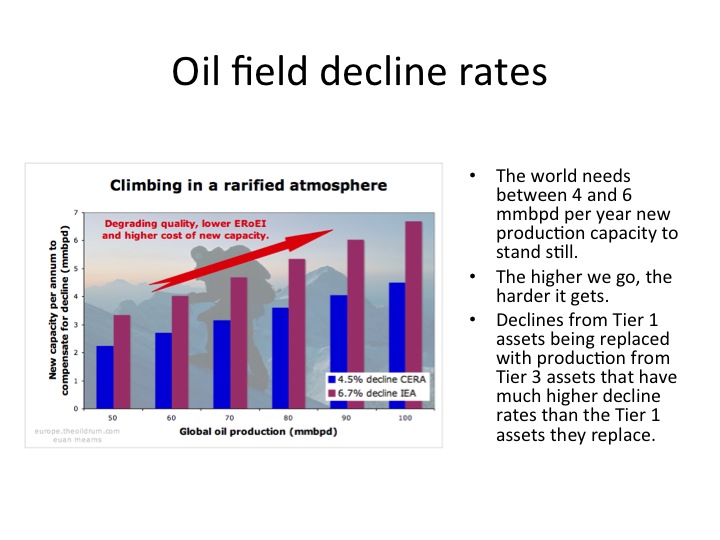

Oil field decline rates In the context of oil production, decline rate refers to the fall in annual production that invariably takes place owing to pressure depletion of the reservoir, the production of oil and the ingress of water or gas into the formerly oil bearing strata. Companies are continually battling decline with strategies like injecting water for pressure support, drilling new infill wells, doing well work overs etc. and the combined effect is to reduce declines from headline numbers that may be much greater than 10% to more manageable numbers in the range 4 to 7%. Therefore, absent new field developments, global oil production would decline every year by about 4.5% according to CERA or 6.7% according to the IEA. Given crude + condensate production of around 73 mmbpd, this means that new fields amounting to between 3.3 and 4.9 mmbpd are required every year to just maintain global production at 73 mmbpd. This is a mammoth task, finding and developing fields equivalent to a province like the North Sea, every year. The industry has been working flat out to achieve and maintain this. Tier one supergiants are being replaced with tier three assets like shale oil, that by comparison require enormous effort to develop and decline much more rapidly.

The world has changed The world changed in August 2008 with the onset of the financial crisis. This together with a range of other events, that all impinge on the global energy picture, has tended to take the media and public eye away from the energy crisis that was prominent before August 2008.

Financial crisis Eight years ago I would use images from movies to depict social unrest; now there is no shortage from the real world. There should be no doubt that the crash in oil price in 2008 was brought about by the financial crisis. The role of high oil and energy prices in triggering the financial crisis, however, remains less certain and mainly out of the public and political eye. The sharp recovery in oil prices following the crash is part of the new energy reality. Marginal supply is now much more expensive than in the past and to maintain supplies at current levels, a high price must be paid.

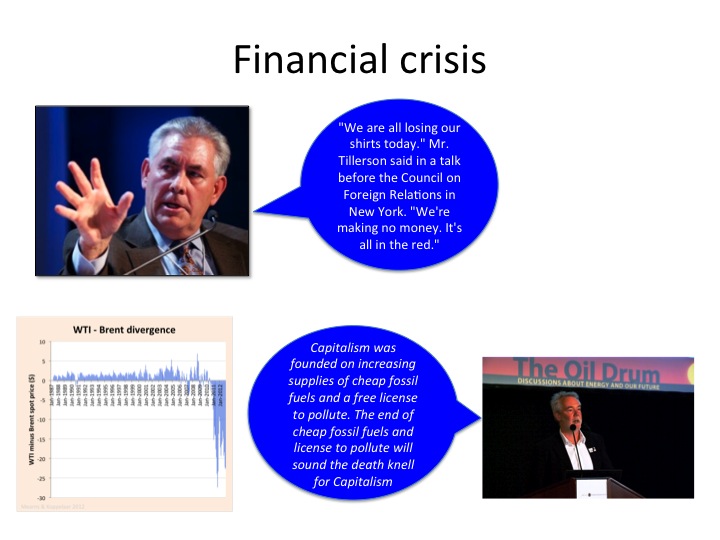

Financial crisis At a speech I made in Vienna last year I made the assertion that Capitalism was founded on growing supplies of cheap fossil fuels. The financial crisis bares many of the hallmarks to be expected with the end of cheap fossil fuels, and the end of capitalism, the loss of ability to pay rent on savings being one of them. The shale revolution is perhaps the best example of the end of capitalism as oil companies struggle to bring a vast but expensive resource to market and in so doing dump the price below which the resource can be produced. Rex Tillerson, CEO of ExxonMobil kindly affirmed the assertions made by Arthur Berman and others that the US gas industry is losing its shirt on shale. US natural gas prices seem to have bottomed, but are still below the price needed to turn a profit. US shale gas is expensive, and it is curious for me to observe that companies now seek to make it even more expensive by liquefying it and sending it half way around the world. This is curious behaviour for capitalists operating in a broken market.

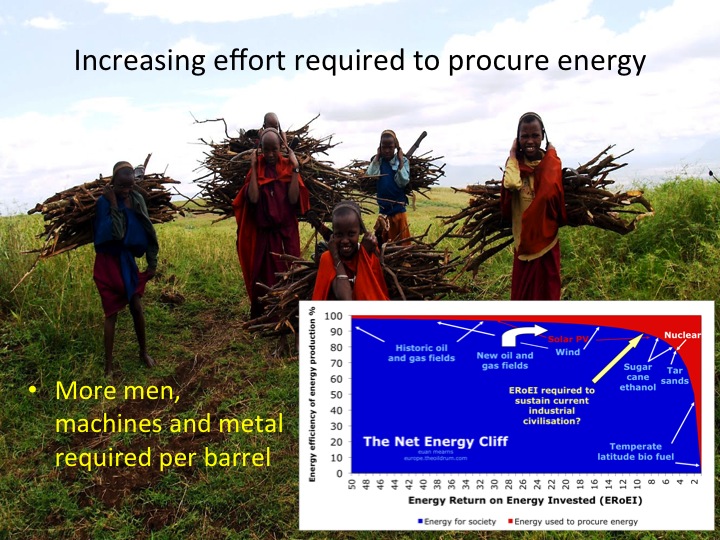

Increasing effort required to procure energy I first produced this chart many years ago now, inspired by Nate Hagens and many others. I have grown to realise that low ERoEI energy sources are in fact energy conversions. When we use natural gas to make biofuel or to help procure syn crude from tar sands we are electing to convert "cheap" natural gas into these more prized liquids. ERoEI of the global energy mix will undoubtedly be falling, but on average still so high so as to not be a problem for now. Likely not a problem for many decades to come.

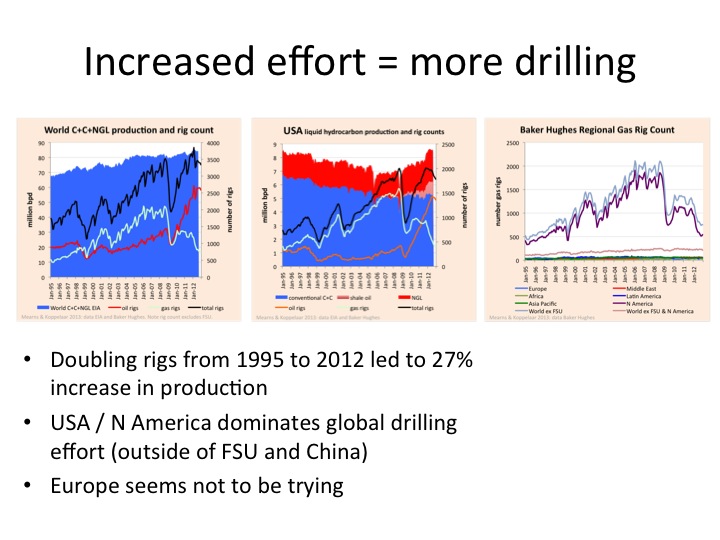

Increased effort = more drilling When it comes to N American oil and gas, increased effort simply means drilling more wells, more expensive wells, less productive wells. High resolution versions of the charts are given below. In this post I was astonished to see how the USA drilling statistics dwarf the rest of the world. Whilst Europe appears not to be trying, on reflection I am not convinced that covering our remaining countryside with drilling pads and service roads is a wise route to follow. North America has wide open spaces better suited to this type of resource exploitation than the densely populated rural landscape of Europe.

Global

US

Regional gas

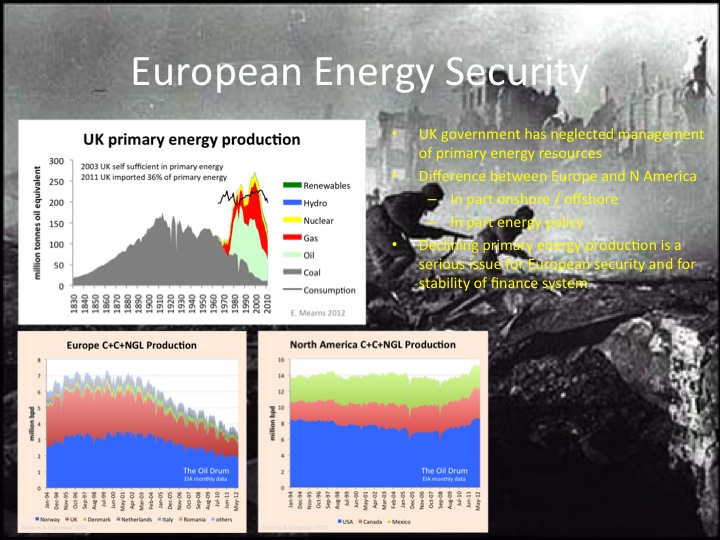

European energy security

Energy security has been a long-running and serious issue for Europe, one of the key factors leading to the expeditionary exploits of Germany in WWII. And yet, as discussed below, European energy policy is currently driven by a unilateral desire to reduce CO2 emissions which so far has achieved virtually nothing.

I sent the chart on UK primary energy to The UK Department of Energy and Climate Change (DECC) many years ago, asking, if confronted with nothing but this data, what should the UK do? It was and still is clear to me that we must do all we can to reduce our energy consumption (without harming the economy and the populace) whilst doing all we can to boost primary energy production. DECC did reply but did not give the glaringly simple answer I expected to get. In the interim, the government has implemented a totally botched tax raid on UK oil and gas production. And it continues to pursue (interminably) with its £1 billion carbon capture and storage competition that seems designed to give Britain the most expensive electricity on the planet. It should be blindingly obvious that if CO2 can be captured at power stations it should be used to enhance oil recovery from the North Sea. What has made our policy makers so blatantly dumb?

To be fair, the UK does have a raft of sensible measures such as progressive taxation on motor vehicles linked to energy efficiency (or is it linked to emissions?), tax breaks for home solar installations (though I'm still not convinced that solar is a great idea for a country where it is dark for most of the winter when demand is at a peak) and is rolling out smart meters at a snail's pace. We are still taking two small steps forward for every three large steps back.

European oil and gas production is in free fall, in sharp contrast to North America. We are becoming increasingly dependent upon Russia, Africa and The Middle East for our energy supplies with every day that passes. Covering Britain with wind turbines seems increasingly to me like a bad idea. There is, of course, interminable chatter about fracking in the UK and elsewhere in Europe. This excerpt from an email from Arthur Berman I believe places the great fracking hope in context:

So, most-likely reserves suggest that all of the Wrexham, Blackpool, Nottingham and Scarborough shale reserves may amount to a Barnett Shale-sized accumulation. Not nothing, but on balance, not terribly impressive for an entire country. I'm sure the Brits will love the 30,000 wells necessary to develop 43 Tcf!

Drill baby drill This final slide depicts the very different attitudes to energy policy on either side of the Atlantic pond. The USA, still dominated by free market policies, private ownership of mineral rights and the fossil fuel industries, has pursued a very different course to Europe that is pre-occupied with unilateral emissions reduction policies. So far, this unilateral EU action has achieved essentially zero on the emissions front, any savings made in Europe being wiped out by increased emissions else where. Europeans are being saddled with expensive and less reliable electricity supplies and increasingly loss making energy industries. Only time will tell if the European strategy bears fruit in the long run. The need to increase indigenous primary energy production in Europe does make expansion of renewable energy a sensible option, but I can't help feeling that 100 GW of new nuclear capacity may better serve the people of Europe.

The future When I first came to The Oil Drum over seven years ago I was looking for information to explain the steadily rising oil price. It has been some ride. In the vastly complex system that is industrial society it is impossible to make predictions about the future, but here, in any case, is my wag. $100+ oil has opened the door to exploitation of more expensive resources and reserves. Society is adapting to the new reality of higher energy prices. Some are becoming more energy efficient, some have installed renewable energy devices at home, some will forgo an expensive vacation they can no longer afford and some have been squeezed out of the labour market, perhaps forever, and will live out their lives on dwindling State handouts, in poverty. The new higher oil / energy prices are here to stay but I believe they will stay range-bound in $100 to $150 / bbl bracket, perhaps for decades as we munch our way through the $125±25 slab of resource. The tremendous uplift in price from 2002 to 2008 may have been a generational one-off investment opportunity where some made billions whilst society lost its shirt. The energy industries are still under-dimensioned for the new reality of harder to get at energy but scarcity of women and machines will gradually ease as the industry continues to upscale.

As for me, I may start my own blog on energy, climate, and policy - that will not be suitable reading for many existing TODers. For the 7+ years I have been involved with The Oil Drum I have not worked and so any new venture will need to be fully funded, somehow.

"perhaps for decades as we munch our way through the $125±25 slab of resource"

it this slab thats suprised some and lead to conclusions that a peak in resource , in this case oil, cannot happen.

Sadly in the minutae of everyday expirence this may look that way , but lets face it , if there was plentiful light sweet crude we wouldnt be even looking in the direction of these plays

still have fun ! there was apparently some good dancing on the Titanic before it sunk....

Forbin

"... there was apparently some good dancing on the Titanic before it sunk..."

Suppose the Titanic had sunk much more slowly than it did? Would the Carpathia have gotten there in time to save all the passengers? Will some energy Carpathia come along as our oil-based systems struggle to remain afloat, or will we be disappointed as just a few dingies show up, far too small to rescue all the passengers? It seems to me that, as this drama unfolds, other storms are brewing just over the horizon that may make any rescue for all problematic. Meanwhile, the crew is desperately bailing for their grog, attempting to keep the gunwales above water, and little headway is possible.

What does this mean for a complex, growth-based global economy?

Pi, below:

Years ago, as I saw that our Titanic was doomed, I had no idea how our hyper-complex system of arrangements would fall apart, only that they were becoming more brittle over time. I decided that I wasn't going to be dragged into a more resource-constrained future kicking and screaming like so many are doing now. The fact that we are, and have been, in overshoot (The Titanic has far too many passengers, indeed is NOT unsinkable, and there aren't nearly enough lifeboats...) often gets lost as we focus on the current predicament du jour.

I don't know if "I can live with these changes". It's not really the point. If I can lighten the load and, perhaps, save a few souls in the process, it beats the crap out of partying on deck, allthewhile insisting that our ship is unsinkable. I never could dance so well anyway; usually didn't like their music.

The advice to "have fun" reminded me of a quote I read in an excellent TOD article called "The Seneca Effect" (about why the decline is faster than the way up) in human civilizations. I will quote the very last paragraph:

I don't know what Seneca would say if he could see this planet-wide effort we are making in order to put into practice the idea that he expressed in his letter to his friend, Lucilius. I can only imagine that he would take it with some stoicism. Or, maybe, he would comment with what he said in his "De Providentia" "Let Nature deal with matter, which is her own, as she pleases; let us be cheerful and brave in the face of everything, reflecting that it is nothing of our own that perishes."

(Ugo Bardi, thank you for bringing this quote before us and for an excellent article.)

"Cheerful and brave"----in other words, "have fun"?!?

I will miss, miss, miss TOD!!

Your text seems to suggest that this is less of a "nail in the coffin" situation (which implies the whole issue is dead and buried) and more of a "the expected arrival to rich western industrialised countries of peak oil's more disruptive aspects has been delayed for an indeterminable period, but not indefinitely"

I never bought that upsurge in oil prices a few years ago had any major causal relationship to the major financial upheaval immediately thereafter. However the financial upheaval has given producers time they might not otherwise have had to build capacity and also cheap money with which to finance it. If money printing hurts savers but finances energy projects then it amounts to burning capital for oil, sort of like burning your chairs for heat.

If I understand the point of the article, which appears to be some sort of rationalization, I can offer this:

I don't think it is a failure of peak oil theory as much as it is a failure of "Peak Oil theory", which is the old-fashioned heuristics epitomized by poor approximations such as Hubbert Linearization (HL). This forced many into a trick-box in which they could not explicate themselves. What we observe is that few of the depletion curves seem to fit HL any longer, and so the old heuristics are failing. The final stake in the coffin was the adoption of multi-Hubbert peak analysis, which adds nothing at all to a deeper understanding, other than to say one can fit any profile given enough parameters.

The way to keep going is to adopt the more modern approaches to analysis, as illustrated by the shock model convolution techniques that are being used on Bakken oil, for example. But The Oil Drum shot its wad, so to speak, on loyalty to the Hubbert logistic and that is why "Peak oil theory" is going away, but the general idea of oil depletion is here to stay.

Eaun said his post should stir up some controversy, so this is is offered as my own perhaps controversial opinion to stir the pot.

Your point (which you already made years ago) always sounded very sensible to me.

Indeed. Hubbert's calculations were always nothing but a 'back of the envelope' estimation of peak oil. He had very little data to work with and he relied upon the central limit theorem to have various things cancel each other out. Just as Darwin's work was revolutionary and set us on the right path, the early work of Darwin and Hubbert is crude, has flaws, and is outright dead wrong in parts. So when you see people refuting Hubbert it is just as silly and pointless as the creationists that refute parts of Darwin's work.

According to the late L. F. Buz Ivanhoe, Hubbert said very little about the details of the decline side of the curve. His prediction was for the lower 48 and did not include Alaska or deep offshore. Hubbert was aware that he did not have sufficient information to make valid predictions about world production. He did make sample projections using various estimates of world oil endowments.

http://hubbert.mines.edu/news/Ivanhoe_97-1.pdf

I don't think it was Hubbert's fault, but the discovery of the quirky Hubbert Linearization which was named after him. This heuristic would only work in a very narrow class of profiles and that profile had to be precisely in the form of a logistic curve. If the oil production profile was not logistic, the line was not straight and then it was impossible to get a URR.

What is really amazing with the more appropriate mathematical models, is how well we can track the production profile of a region such as Bakken. Look at what Rune and DCoyne are doing in tracking that production. The projections actually start to make some sense in physical terms, not just as a heuristic approximating a bell curve.

Web, I think this is a little unfair. The very first comments I posted on this site were to Stuart Staniford questioning the veracity of HL. You may recall back then I was posting as "Cry Wolf". And later I wrote this post The Amazing Power of King Hubbert(...?), again questioning the simplistic logistic approach. Robert Rapier did much the same, but alas, in this world of unmoderated comments, those who may have won the argument on the day lost the war to those who had more stamina.

I've told you before, I'm crap at maths, and never fully grasped your shock model - forgive me! But please, post a 500 word summary here + charts or submit a farewell post to TOD - focussing on a layman's explanation.

I love this post... like the old days. Euan flings in another class trolling! ;-)

I think your predictions are in the ball park. Maybe a bit shorter in timescale than we may imagine because I get the feeling stuff is going to happen that is off the fairway when it comes to prediction. I think history calls them events.

Social unrest arising out of these crunch times is the joker in the pack.

+1 on the shock model for dummies post from WHT

Euan, So you were also questioning Stuart Staniford in the early days of TOD?

I debated Stuart for pushing his fits to the Hubbert logistic, and I recall that he didn't appreciate that too much. I do remember Robert Rapier debunking HL with a top-level post or two. The killer argument against it was that it could not describe a plateau in production or a fat tail, which Robert noticed as well.

Thanks for the offer, I would like to post a short piece. The big issue in modeling has always been the lack of a comprehensive data set to draw from, even now with Bakken.

WHT if you do post something just pretend for moment we don't know anything about shock modeling and statistical modeling in general.

Ah, I made that request of WHT about...5 years ago? Dude, get a ghost writer! Amusing that Euan never figured out the Shock Model either. There were other models, too. Remember loglets?

I see that Sam will have an article here examining how the various forecasts of the past have played out so we can see how well they've worked, setting aside the matter of how they actually function. There have been so many papers over the years, that one out of Kuwait for instance.

Web:

Just to say thank you. You were one of the first to help get through my thick skull that there would be an extended plateau, and a 'fat tail.' At the time I didn't know what that meant.

TOD has been very helpful to me, in establishing a better train of logic in order to sort out, at least to me, probabilities for the future.

Sure will miss having easy access. Peak Oil is difficult to get around, at least for me. I will be surfing the various blogs and sites, so may still see you from time to time. At least I hope so.

Best always,

Craig

The problem with HL is that individual wells go through their growth / peak / decline phases over a constant economic environment, according to "peak oil theory". But when the whole world peaks, we get very disruptive economic effects from oil shortages that create feedback loops that change the environment in which future oil extraction occurs. Unfortunately, TOD never really delved into too much detail about those financial feedback loops, not to any significant extent at least. Gail has provided some analysis to this effect but I don't think it went into enough detail about how the monetary / financial system works and how this all relates to the real economy of resources that the financial system is supposed to represent, and which funds further resource extraction activities. Has there EVER been ANY post on here even MENTIONING how interest rates have gone from 17% in 1982 to basically 0% in 2012? How can anyone seriously attempt to analyse anything in the economy, especially something as fundamental as oil production, without incorporating an analysis of historical interest rates and monetary policy as the central theme? It just boggles me.

This is why the continuing plateau of oil production has dumbfounded peak oil "theorists" who used to be crash and burn doomers, as much as central economists are dumbfounded to explain why dropping interest rates and printing $2 trillion a year isn't kickstarting the economy like it always used to. Peak Oil is AN INTERPLAY OF GEOLOGICAL, FINANCIAL, ECONOMIC, POLITICAL, and TECHNOLOGICAL factors. This site has almost entirely (with the exception of some work from Gail) focused on geology and technology. No wonder the doomers failed in their predictions (well they didn't really fail, they were just about 8 years too early). Why did this site only post articles from technical junkies (not that there's anything wrong with being a techno-junkie, I am one myself...)? Where were the economist and financial types to explain the other side of the Peak Oil story? Finance and oil extraction are intimately related and you cannot understand one with out the other. So how can TOD call itself a peak oil site, when it really only ever analysed half of the factors involved in the phenomenon of peak oil?

I still cannot believe TOD is shutting down when we're only months, possibly weeks (and I'll hedge my bets, maybe up to a year) from total financial collapse. This decision will be seen as a monumental and short sighted blunder. I suggest the keepers of the archives have their computers set to re-activate because they are going to have to do that pretty soon if they stay true to their words of bringing TOD back if things significantly change. I can assure everyone that we will not have to wait "decades" for PO to be evident.

We are very close to PO, and it will be a shark fin, not a bell shaped peak. The West is now officially almost out of gold. The Dollar / Pound / Euro Ponzi scheme is basically finished. Gold has been in backwardation for an unprecedented month now, well beyond anytime in history, ever. This means that people are afraid to lend their gold out for leasing FOR JUST A MONTH, out of fear of not getting it back. This means that there is essentially no more gold left for Asia to scoop up. This means that China will soon start dumping Treasuries (virtually all of America's deficit is currently being funded by the Fed's debt monetization anyways, instead of China buying it like it used to; all that's left now is for the world to shift away from using dollars for international settlements and that will be the end). Even with $1 trillion a year of freshly printed confetti, the 10 year Treasury yield has risen 1% over the last few months. This is a VERY clear warning that we are on the brink. When this financial shift happens (we haven't had one for 30 years), the US is going to lose its trade deficit and the world of oil production will then tell a very different story ... virtually overnight.

Rune Likvern touched on the subject a couple of days ago. http://www.theoildrum.com/node/10139

If you can fund investments out of cash flow and not take on debt, as oil companies could in the past, interest rates are not so important, so maybe that's why they weren't mentioned in the past.

It could be that in the current low interest rate environment, oil companies have taken on cheap debt to increase profitability via leverage, rather than taking on debt because of a lack of adequate cash flow as Rune states.

For whatever reason, debt is now a part of the oil equation, and the ability of oil companies to service that debt going forward if interest rates rise must be considered.

Personally, I can predict interest rates with the same accuracy I can predict the oil price, i.e. not reliably.

Yes, it's good to incorporate interest rates on the micro scale but what about the macro scale? We need to bring all of this together in the long term trends analysis or it's nowhere near as useful as it could be for predicting the future. Debt isn't just debt, but all money is debt too, and lots of different kinds of debt. Where is the wider perspective bringing together debt, money (same thing), and the energy (i.e. fossil fuels ) that gives the whole system life? How about an analysis of the global monetary system over the last 50 years, a discussion of M2, M3, Federal Reserve holdings, etc. etc.? I find that here, "a dollar is a dollar" as far as oil market analysis goes, when a dollar is definitely not just a dollar, there are many different kind of dollars out there and they all are affected by money velocity in different ways, and of course it's all driven by energy. It's not very meaningful to just say that oil price spiked in dollars in 2007 and analyse the trends over the years surrounding that event using a two dimensional chart, because the proportions from different kinds of dollars in the system were shifting greatly over that period. How is it that M2 has quadrupled since 2008 (meaning 3 x more dollars were printed in the last 5 years than all of previous human history), yet prices haven't quadrupled, they've only maybe at most doubled? It's because of different types of dollars being created, and those dollars going to different places and doing different things, and having different impacts on the greater economy.

What about that age-old question that hardly anyone seems to be able to answer (or even think about asking): "What is money?" Well, it's fundamentally just a claim on energy. Since oil is the most important of our energy sources, then how specifically does money's claim on oil work? This question should be fundamental to TOD's focus.

Johnny Mandel, Suicide is Painless

The "nails in the coffin" title is misleading because your article goes on, actually, to prove peak oil has occurred with the bumpy plateau for C+C that started in 2005. All of the finncial problems and other issues you mention seem only to underpin the basic logic of the peak oil theory.

The idea that there would be a rapid peak and then gas lines and economic collapse following within months of each other (it may be what you mean by "peak oil") was never the mainstream view of the issue. And most who had studied and observed PO saw complex interactions, with governments, especially, involved as support.

Possibly the underlying human logic all along during the heavy growth years was (secretly, but for us all) "let the collapse be widespread and humongous and slow enough that I, personally, won't be badly affected". The personal bargaining went something like: "OK, the average lifespan may decline by 5 years. I may be able to afford fewer things. I will just rent an apartment.I will have one cat instead of three cats...I can live with these changes."

System-wide, global-wide slow collapse may have been the goal from the start for several reasons. 1) It would just be judged as general economic malaise by most, not a consequences of choosing energy sources without regard for the future in a blind and passionate way (i.e. sparing leaders embarrassment)

2) The consequeces (closed shops, empty buildings, etc.) would appear slowly, way after the initial builders and owners had died of natural old age, again, sparing everyone embarrsassment.

People don't like to be shown the consequences of their mistakes. People have enough embarrassing things to deal with, like mortality, thinning hair, or not scoring as high on math tests as their friends. Life is full of embarrassing mistakes. Adding "paving over the planet" to the list would just be cruel and vindictive. People were out to use oil to enjoy themsleves and make life better, to improve access to health care and education and goods and services.

Peak oil doesn't make sense as a short-term phenomenon, which may have been an initial image it had, rather like Y2K, or a Hollywood disaster movie. It only makes sense as a slow, progressive series of smaller events and battles occurring all over the globe. All of these events and battles together constitute PO.

You did not put a nail in the PO coffin in this article. Quite the reverse, I think.

If many readers reach this conclusion I will be quite satisfied;-) However, the acute problem of 2002 - 2008 appears to have turned into a cancer that may fester for years / decades. The patient is sick but doesn't know what is wrong. Maybe human ingenuity will find a cure, maybe not.

Euan,

Count me as one who saw your intent. I hope and believe there are many more like me. Regardless of the details of arguments presented in the past, the problem protended by peak oil has become real, thus the details of those old arguments are moot (which is legalese for 'who cares anymore').

Thankyou

I take this article to say that only 4 nails won't hold the coffin lid on for long.

Great! Now that TOD is shutting down and the final nails have been driven into the coffin of 'Peak Oil' we can all relax. Thank god for all the 'OIL' reserves in the tar sands and shales, let the kerogen flow. I'm sure if I join the right online blog I can also find confirmation that climate change is just one big hoax. Nothing more to worry about! So next I will be registering as a Republican, starting an MLM online business so I can milk those that don't understand the exponential function and will be looking for a new SUV! While I'm at it, maybe I'll get a big speedboat to tow behind it. Sailboats, kayaks, bicycles and solar panels are for those deeply misguided individuals who made the wrong bet that BAU could not continue forever and ever... of course it can. Amen!

Cheers!

Fred

P.S. Thanks, Euan, for letting us know that Peak Oil is really dead!

:-) "let the kerogen flow....."

things are going to have to get really hot for that to happen !

Peak Kerogen anyone ?

forbin

Hi Euan,

Long time, no see! I haven't said anything here at TOD for years.

Congratulations to you for writing this post. You've got balls, which is pretty rare in this world.

By far the most important thing you said is this --

All scientists should update their views and theories when new facts come to light.

And I might add, all non-scientists should do the same. Unfortunately, humans by and large are not capable of updating their belief systems, which are founded on other, more fundamental factors (e.g. social instincts like group membership & cohesion, etc.)

The other things you wrote -- the actual data and their reasonable interpretation -- are only footnotes to that one important statement.

My experience with humans is that they believe some story and then they stick with that story, no matter what. Thus, generally speaking, people learn nothing.

-- Dave Cohen

Hi Dave, good to hear from you and trust you are well. Global "oil" production will of course reach a peak one day and then decline, but I suspect we may see a "bumpy plateau" for some years accompanied by lots of adaptation on all scales. Individuals may of course adapt to a "new" lower norm. I was talking to a chap from CERA a couple of months ago and I think we agreed there was significant convergence of our views - it has to be a good thing when "the establishment" view converges with that of the fringe. He sees a bumpy plateau at a level higher than today whilst I think we will struggle to grow conventional C+C from current 73 mmbpd plateau.

In a comment I left on Phil Harts post a couple of days ago I pointed out that in any polarised controversy the reality often lies somewhere in the middle ground. I think The Oil Drum has played an important role defining one of these poles.

Cry Wolf ;-)

Euan,

Well, I consider shale oil to be C+C, and these definitions are important because they define how we see things. And remarkably, that Bakken/Eagle Ford oil is high quality stuff, even if it only trickles out of the ground, depletes fast, and you've got to drill your brains out to get it.

But, anyway, I'm glad to say hello to you today.

Check out some of the additional comments below -- some of those people have no idea who we are!

But then again, memory and history is not a human strong point either (sigh).

best,

-- Dave

Dave

We do know who you are. Just because everyone doe not agree.....

Paulo

I think many don't see the forest for the trees. (Global) peaking - which started in 2005 - is a complex process which continues to do its damage.

Nail 0

Look under the crude oil curve

Except for US shale oil, the rest of the world is at peak.

Nail 1

Iraq

The Iraq war was a peak oil war

16/3/2013

Iraq war and its aftermath failed to stop the beginning of peak oil in 2005

http://crudeoilpeak.info/iraq-war-and-its-aftermath-failed-to-stop-the-b...

Result:

9/8/2013

Iraq crude oil exports stall amid pipeline attacks

http://crudeoilpeak.info/iraq-crude-oil-exports-stall-amid-pipeline-attacks

Oil wars are one of the many feed-back loops of peak oil, discussed at nauseam in the oildrum

Nail 2

So when will US shale oil peak? 2017? 2020?

http://www.postcarbon.org/article/1816957-whither-shale-oil-interview-wi...

Nail 3

Oman shows an increase of just 200 kb/d. Where is your number crunching for all the other EOR schemes?

Not all liquids are equal

The graph labelled "Global conventional C&C production" contains unconventional oil

Not to mention that country or regional oil peaks can still bring down much larger supply systems, again feed-back loops. Just turn on your TV and look at what's happening in Egypt

6/7/2013

Egypt's future crude oil import requirements for 3 population scenarios

http://crudeoilpeak.info/egypts-future-crude-oil-import-requirements-for...

4/7/2013

2/3 of Egypt's oil is gone 20 years after its peak

http://crudeoilpeak.info/23-of-egypt%e2%80%99s-oil-is-gone-20-years-afte...

And what is the consequence of Iran's 2nd peak?

http://crudeoilpeak.info/iran-peak

Euan, the nails hit your foot.

"All scientists should update their views and theories when new facts come to light."

Who said: "The first duty of the true scientist is to prove himself wrong"

I would enjoy some discussion of the article that appeared in the Oil and Gas J. 08/12/2013 and began “The Spraberry Wolfcamp could possibly become the largest oil and gas discovery in the world,” said Pioneer Natural Resources Co. Chief Executive Officer Scott Sheffield while speaking Aug. 12 at the..." and compared this play to Ghawar. I posted a link to this article on the latest Tech Talk/

The material I have been able to read to date looks just like the Bakken spin before they began drilling there. It is a way to get investors excited about something that will play out the same way. Not that this means there won't be significant recovery from Spraberry. It is just that it is another shale play, requiring many horizontals, and playing out quickly with high depletion rates. In other words, more of the same.

This is not something that will drive down the price of oil. Though it could prolong what Euan anticipates to be a long plateau.

Craig

As you noted, an article comparing the Bakken to Ghawar:

Is Bakken set to rival Saudi supergiant Ghawar oilfield?

http://business.financialpost.com/2012/11/12/is-bakken-set-to-rival-saud...

Humans are not 'rational'.

"Humans are not 'rational'."

Sure we are. We're so good at being rational, we rationalise our rationality :-0

"I think. Therefore, I think I think..."

Good one.

I've heard a similar statement:

I think, therefore I am, I think...

However, I view self awareness as an artifact of the monitoring routines that are genetically programmed into our neural network, that provide a narrative to the decisions our unconscious brain makes, enabling us to build an internal model of our world view. So...

I know for certain that "I" doesn't exist

You're definitely right buddy. We have the same exact point of view. Self awareness is something you know you possess and might be common as well to how others see you as an individual. You got my back on that!

buy twitter follower

Peak oil is just fine. As with this article, people simply changed the discussion by changing definitions. If you'll notice, production rates are ignored as the author rattles on with talk of "massive" reserves. Wonderful adjective but leads the discussion far, far from the concept of production and, certainly, is based on the assumption that technology will save us. Bit of faith based thinking there. The faith, of course, is the technology will arrive on time, in sufficient quantities to save us and cheap enough that we aren't all huddled in a shack trying to stay warm. Adding in the kitchen sink of carbon based energy is a clever one. The discussion started with oil and now includes gas, coal, etc. The addition of "changes in human behavior" is a very good one. Won't happen of course but makes nice words which certainly appeals to many right now. And increased efficiency is another one. With the population increasing at light speed, efficiency is already far behind. There's more, of course, but useless.

Actually, if one sits down with a hand held computer and takes a serious look at the increases in production versus global consumption, the increases are a pittance. But if one jiggers the figures enough, a very sensible sounding argument can be made. We're in a lull that will not last. Bit of rest before the next battle.

For me, the article is simply one more in the frantic "all is well" hype I see everyday.

Peak oil is dead? Oh thank God! We're saved!

"...some have been squeezed out of the labour market, perhaps forever, and will live out their lives on dwindling State handouts, in poverty. The new higher oil / energy prices are here to stay but I believe they will stay range-bound in $100 to $150 / bbl bracket, perhaps for decades as we munch our way through the $125±25 slab of resource."

Wait... what? Are you fricken joking? What sort of twisted psychotic sadist-pervert would write pages of text claiming peak oil was dead and then basically say "not really"? It's not fricken April Fool's Day you know.

I may not have the fancy math to support my observations, but it should be apparent that we (especially the USA) are now currently (and finally) converting

--remaining stored solar energy (hydrocarbon petrochemicals) and extracted concentrated minerals,

--an entropic industrial infrastructure,

--and the ability to maintain the above,

for a little wisp of energy in hopes of continuing our consumptive growth-based consumer economy. I believe don't believe Euan psychotic, just socratic.

I suppose these new discoveries around the world are not so costly. I look at the Bakken statistics, though, and wonder if shale oil is in Stage 4 cancer. I mean $1,000,000,000 in new wells in a month for 1.3 million barrels? I'll keep looking at the data.

The comments crack me up. Good job and good luck, EM.

Ninety-one percent certain that this prediction will be wrong. It will be below $60 in the next few years as governments continue austerity measures and the money supply deflates OR it could be above $300 if Saudi Arabia has a revolution OR ...

Prediction is very difficult, especially if it's about the future;-) Niels Bohr

I thought that quote was from Yogi Berra. Oh well, I guess great minds think alike.

Thanks Euan, for this post and for all of your posts, many of which have been particularly memorable for me.

Almost the entire post is objective, empirical, well-argued and well supported. Most of these points are very hard to dispute, but...

...personally I was a little disappointed to see this comment:

"Capitalism was founded on growing supplies of cheap fossil fuels."

It's at this point that objectivity and empiricism have given way to outright proclamation.

Forgive me for starting with an absurdly literal objection, but most people consider capitalism was founded in Britain during the industrial revolution. As a fellow Brit you surely know that the major sources of power during the British industrial revolution were water, wind and muscle. The Watt engine was not invented until 1775, and steam engines did not really take off until the second decade of the 1800s.

More germanely, there is no reason given why capitalism should require fossil fuels to operate. Arguably capitalism does require growth, and ultimately that growth must be fuelled, but it could just as well come from nuclear power or renewables. Since energy has been used inefficiently there is actually a period where economic growth without growth in primary energy consumption is possible (by efficiency gains), although obviously this is limited.

You say that financial losses in shale gas prove that capitalism is unsustainable, but I find there to be no plausible link. Was the dot-com bust the end of capitalism? Was the South Sea Bubble? Capitalism admits failure - particularly of judgement. It always has, this is no different.

The bigger challenge to growth, and therefore capitalism, will come later this century when the global population will (inevitably now) peak. I would be much more interested in seeing arguments developed around that.

Personally I am satisfied that existing renewable energy technology can already achieve an annual rate of energy return of 20%(for PV) and upwards and still has huge potential for further gains. Considering this, limits to growth should not come from energy returns. I don't want to rehearse the arguments about storage and transmission yet again, I have never fully subscribed to those issues as show stoppers (except that the current high use of personal vehicles won't be able to continue indefinitely unless vehicle battery technology improves dramatically) load profiles can be managed by a combination of demand management and using biomass and reservoir hydro for load following.

None of this is to deny the drama or import of the transition that we as society now have to make as, for the first time, we are forced to confront the reality of slowly leaving fossil fuels behind us. But to stand here now and condemn elements of our functional society to failure is not only unnecessarily defeatist, but it pollutes the real message (the objective, empirical one) which you yourself have made so well - that the transition MUST soon begin, whether we like it or not.

Hoover and WHT - I gotta walk my dogs, I'll get back to you later.

Hi Hoover, my dogs are now exhausted;-)

From your comment I realise I must have expressed my point poorly. It is of course possible to run a capitalist economy on water wheels and slave labour, still component parts of today's system and so my expression is proven to be false:-( And so the point I was trying to make, albeit poorly, was that we have reached, or about reached, a pinnacle in the per capita FF slave labour output of our current capitalist cycle and that trying to replace the pinnacle FFs with the lesser substitutes on offer is causing distress to the system.

It may well have marked the beginning of the end of the current capitalist super-cycle as .com bubble was replaced by credit expansion bubble was replaced by QE bubble to be replaced by what? I don't want to venture too far into the economic argument, Nate, I believe will do that before the end of September. But my simplistic wag is that savings are the net energy surplus, which have been leveraged through the finance system, and are now being crushed as the lever pushes the other way (stock PEs going from 25 to 5). There is going to be a fight between public (i.e. market) ownership and state ownership of key industries. Most UK banking is already owned by the State - the British state or some foreign sovereign wealth fund, and at some point other key industries will go the same way as their capital fails. I, for example, as a capitalist would argue that the UK government should fund the rebuilding of our energy infrastructure with a view to selling back to the people at the right time. The value of money used to do this will be re-jigged many times in the process, but if at the end of the day we have reliable heat, light and a stable society, we will have done well.

I will miss The Oil Drum since exchanges such as this and the many other stimulating comments on this thread taught me an awful lot over the years.

Cry Wolf

Thanks for the reply. One of the real strengths of TOD in my opinion has been that the authors have always actively engaged in the discussion following the initial article. So many of those blogging about the demise of peak oil on big media websites never deign to reply to the comments, who knows if they even read them?

The discussion about capitalism is an interesting one in its own right; but I just don't see it as a black and white issue, unlike peak oil. Whether or not free markets, free enterprise and democracy survive peak oil is something that I like to believe remains within our own hands to determine, but peak oil does not. We have to transition away from fossil fuels, we have no influence in that matter, only on whether the transition is successful or not.

Regards, Ben

In graduate school in 1969, I went to a lecture by my supervisor on the limits to growth. Anticipating quite a bit of discussion here, he was, he said in despair for our future. The fog of his despair condensed around three dependent nuclei: population growth, rising pollution, and the consumption of resources. Winding up his rapt audience as his talk ended, he said: “This is our last chance to play this game.” It was 1969, and we had only a few years to act.

Maybe he was right. Regardless, our association left me with an abiding interest in the consumption of energy, the transformation of stored sunlight into a growing entropic cascade. A bit like the Oil Drum then.

I see I signed up almost eight years ago. I haven’t posted much, because those whose words I’ve wanted to read know so much more than me. Like other commenters here, I will really miss this site. Thanks for the memories.

Bob

Decades? A mix of conventional and non-conventional will last that long in that price bracket? I liken peak oil to a fast spinning well oiled wheel. As we work our way through the light sweet crude to the tar sands the oil being applied to the wheel is getting thicker, gumming up the economy slowing the wheel. At some point the flow thickens enough to cause the wheel to begin heating up and once it starts smoking it's not long until it ceases up like our economy will. Decades for that to happen? I think it will more likely be in the 2015-2020 time period.

I see PO as being like an east Yorkshire caravan park, right on the coast.

When it was first built, the sea was at least 100 metres away from the caravans nearest the sea.

If you imagine that each of those caravans contains an aspect of our modern lives, then it's easy to see how some things are impacted more than others.

Over the years coastal erosion has gradually eroded away the sand until the caravans started toppling into the sea. The ones that contain supersonic passenger flight, "too cheap to meter", "don't care about fuel consumption" and "don't need insulation", have gone over the edge.

If you were in one of those nearest the sea, the affects would have been devestating while those furtherest away were totally unaware of the coastal disaster, these aspects of living have gone. The next to go will probably be "long distance lone commute in a low mpg car to a poorly paid job" and the like.

The current boost in production could be likened to a temporary sea wall being erected to delay the next phase of the erosion.

China could be said to have the same park but still a 100 metres or so from the sea, but their time will come.

Peak oil is simply a logical outcome of extracting a finite resource. It will therefore prove to be impossible to put a final nail in the peak oil coffin. No matter how hard anybody treis debunk (or redefine) peak oil, it will always resurrect itself.

As far as I can tell in my life, we are definitely at Peak Oil. This is what it is, a fine line in balance of production costs with what people can afford to pay....the undulating plateau often mentioned since 2005. I really don't think too many, (but correct me if I am wrong), expected that a certain date would arrive, then kaboom 3 and 4% decline right away until we are ensconced in some kind of Clan of the Cave Bear lifestyle.

The picture is muddled with economic decline, globilization, crooks in finance, inept Govt, and high prices of FF. Add to that renewables, unconventionals, changing demand regime, (Chindia), and improved efficiencies and conservation. Throw in some sanctions, Arab Springs, ME revolutions, and generally speeding up mahem based on instant communication.

There are many scientists, mathematicians, and engineers on this site trying to reduce this messy transition to a graph and numbers format. Yes, this can be done. Euan may be right with his new way of crunching events. WHT has certainly narrowed down and corrected many problems with past attempts to graph data and extrapolate the future on a foundation of error.

But I submit this Plateau, or Peak Oil manifestation is also a story of biology and sociology. Our socities are dynamic beings with a greater sum than that of explaining data and consumption/extraction rates. We are at PO now, and our lives have changed, are changing, and will be forever different because of it. Euan's explanation does not convince me that "oops, we were wrong, the numbers were off", because the cause and effect and dynamic relationships are impossible to narrow and quantify with numbers.

Oil at close to maximum production (not Peak, you readers because the numbers say so), coupled with population increases, and all of the above mentioned (and more) messy relationships paint a more human story that what can be passed about on in energy forums.

JHK talks about the end of suburbia and a future Long Emergency, and Jeff Rubin wrote about how his fly-in-fishing experience in Yukon would be a thing of the past because of Peak Oil, and they were right in many ways. I use those two examples because they are dear to my heart. I worked for many years flying out of Watson Lake, YT. (Rubin's fishing area). My company had 5 aircraft, and the competition had 7. That was in 1981. Missing it, in 1990 I decided to return. The competition was gone, and we were down to 3 aircraft and two pilots. By 2000 there were no more commercial aircraft operating out of the base except for one guide outfitter. I worked for years out of Campbell River BC. It used to be the busiest seaplane base in the world with 30-40 full-time operating aircraft. You could do all the work now with three in today's market. Living in Suburbia and the cost of commuting was never even a consideration until about 10 years ago. We all know what it is like now and can probably imagine what will unfold over time. A well paid workingman can no longer afford to run a pick-up truck around here. They still try, but the results are they are broke mindlessly adapting to Peak Oil with an out of date paradigm. It is gone. Kaput. These examples are a few events that I have experienced as a result of increasing ff energy costs. All of you will have your own stories, but in my case what was once a career of my dreams is simply no more. I had to move on.

People who once had lots and took it for granted are becoming poorer every year. Certainly, the system has been rigged for the few at the top, but it is wrong to discount the huge increase in costs of our energy sources that made our lives so easy. This is Peak Oil. The resources are now expensive and have to be shared with more people. The data is an unbelieveable compilation of observation, but it is missing the story. To back off from the obvious conclusion of what has happened to our lives because the energy to live them has become more dear is to trip over the details. To paraphrase my favourite exclamation made by Todd, "I get so pissed off with those writing to TOD about how many joules can fit on the head of a pin"!! Arguing about the timing of PO is simply that.

There might not be an exact unfolding of JHK's Long Emergency as he envisioned it. However, compounding growth has waned and might never return, (probably never return). If this is not a result of waning/expensive energy supplies, then what is it?

I submit to this forum that we will never return to the increasing riches of the past, and that year after year people will learn to do more with less simply because of the energy constraints inherent in all things and manner of production. For those who do not accept this reality and its cause will be become increasingly bitter. If our leaders and leading researchers/writers continue to obfuscate and fail to lead society forward with a vision of adaptation and change, then social upheavel and increasing violence will surely occur. Why wouldn't it? It always has in the past. Sorry, this is Peak Oil. It may unfold more slowly than once thought, but to call it something else and not face it head on with personal and group adaptations will make it worse in both short and long term.

Paulo

WEDNESDAY, DECEMBER 07, 2011

What Peak Oil Looks Like

Thanks. Arcdruid, who you linked, has said it best.

As far a the Oil Drum goes, I think it has been a victim of its own success. People collected data and analyzed them carefully. They described situations, projects, and operations. They made predictions. The predictions proved true. This was all done years ago. It is hard to just keep repeating oneself--few writers of integrity can manage it.

The current thrashings of the oil industry are of interest but are no longer strategic. The oil and oil-like substances that are currently produced--in whatever quantity--are too expensive in real and nominal terms to maintain our civilization. This, too, was predicted. This is the essential meaning of decline. That these expensive flows are themselves fated to max out and decline is just another nail in a somewhat different coffin than the "coffin of peak oil." The issues that matter now--what happens when a civilization resolutely ignores all warnings of ongoing failure--are issues for historians, sociologists, and, perhaps, systems theorists, but not ones for which engineers and technical people are at their best.

The idea that we might organize our lives in less energy-intensive ways is one that has been presented decades ago, but has never, ever gotten much traction. Most of us are so unaware of the thoughts underlying our everyday lives that deliberate change is pretty well impossible. Most of us our waiting--in various degrees of ignorance or panic--for physical circumstances to grind us down. Those who survive the grinding will perforce have minds oriented to surviving on less, less of everything, including on less energy. The thoughts that go with those minds will not be thoughts we can perceive--let alone entertain--now.

--Gaianne

The impact of what has happened the last decade is very unevenly spread and the causes of what has happened are not clearly defined. Oil and energy consumption is markedly down in the European periphery. Faced with inelastic supply and growing competition for supplies, European oil consumption had to fall but the fall has been very unevenly spread. Its just that the decline of the periphery is understood to be caused by the € zone crisis. I don't believe the Euro periphery will ever regain its share of global oil supplies and may therefore be doomed to wither. Replacing oil with renewables in these bankrupt countries is also proving to be hard if not impossible. But most Europeans are unaffected by the peripheral trauma, for so long as they hold the € together.

Similarly the chaos in the Arab world is attributed to bad leadership and not to declining oil revenues, rising food prices and falling food subsidies. It is being proven, I believe, that democracy cannot fix this problem.

I don't think one can conclude anything about 'democracy' specifically in all of this. We've got so many of the major democracies being tampered with and interbred into monied interests, at which point, what could the minor democratic states hope to do?

This problem of declining living standards being laid at the feet of failing democratic institutions to deal with is a recipe for a dystopian catastrophe. You are seeing the rise of some right headbanger ideas in the political space. My concern is the lack of understanding is going to translate into some right horribleness.

The whole resource constraint argument needs to be attached to some sort of coherent political-economic solution and in short order. Failing states on the periphery of a larger stagnating one is not a go getting 21st century model for geopolitical success.

You will never combine resource constraints with a economic-political solution, because there is no happy ending. The lack of happy ending is exactly why this has not occurred. There are plenty of unicorn ideas out there, but yet here we are.

Never seems to be a famous last word type of thinking when applied to human behaviour. Of all the variables behaviour change and social organisation seems to be an area either ignored or has unexplored potential. unlike the reality of physical limits to resources.

Stable adaptations of the social order in the face of resource constraints in the last century have precedents.

Very well said!

I've been trying to keep this group abreast of some of the stories from my neck of the woods, a small tropical island that, has to import all of it's fossil fuel energy and as a result probably started feeling effects similar to those forecast for Peak Oil beginning with the 73 oil crisis and after that, every time the price of oil spiked. The whole world economy is structurally dependent on oil and most small island states even more so. We are stuck in a rut and the radical thinking required to cure our structural dependency is not finding favour with the opinion leaders in the media.

edit: Some of the stories I could link to don't even make it. The connections to Peak Oil are far too tenuous. Yet still, having been a member here for the past five plus years, I look at every story for a Peak Oil angle and invariably, there is one to be found.

I have tried and will keep trying to tell the other side of the story through any comments I can get past the mods in the local rags but, after August 31, I will just have to do so without the help of any fresh input from TOD. I will continue to speak loud and speak often, in the hope that I can get more people to start thinking about a different kind of future. It's really hard when it seems you can't get through to your closest friends and family but, the best I can hope to do, is to lead by example.

Alan from the islands

The whole world economy is structurally dependent on oil and most small island states even more so.

That dependency is temporary. Many small island states are even better situated than average to get rid of their oil consumption, given their very high quality solar and wind resources.

Tell that to the politicians, business leaders and opinion leaders around here.

If they agree with you, they certainly aren't making it known. The other thing is that transport can't be easily changed to run on solar and wind. The railway network on my island, the first one in this hemisphere outside of North America, has slowly deteriorated to the point where, only the lines from the alumina plants and the sea port that handles their inputs and their product, remain in service.

AFAIK the local minister (secretary) responsible for transport, is not on board with a near term peak, assuming he is Peak Oil aware. As long as that remains the case, the government will continue make long term investments in oil dependent transport infrastructure rather than try to wean the transport sector off it's almost total dependence on oil.

Alan from the islands

If they agree with you, they certainly aren't making it known.

That's a tragedy. You'd think they'd have gotten the idea that $100 oil is here to stay. That price level should be more than high enough to push generation away from oil, ASAP.

transport can't be easily changed to run on solar and wind.

Converting personal transport away from oil doesn't really depend on infrastructure. How are hybrids selling in your area? They're the first step in that direction...

As for freight: it's sad to hear that rail has deteriorated. Is that simply a matter of public policy, or do trucks have a relative advantage over rail on islands, do you think?

That's a tragedy.

Notice I said if they agree with you. The real tragedy is that, I doubt that they agree with you. Most people have been delighted by the performance of their liquid energy slaves and would really like things to continue they way they've "always" been. I suppose the hope is that all this nonsense will stop and fuel prices will return to normal!

How are hybrids selling in your area?

Not that well. It seems to me that most people still think a real car has to have a ICE of some sort. These hybrids (or hybreds as some peole call them) are thought of sort of like spacecraft, science fiction in the flesh. Heaven forbid it should ever need repairs! Where are you gonna find an alien to fix that? I have seen one Nissan Leaf,despite the fact that the local Nissan dealer has no plans to sell or support them.

On the other hand an awful lot of US style (full size) pickup trucks seem to have "For Sale" signs on them. Tiny cars, think Honda Fit, Toyota Yaris, Suzuki Swift (Geo Metro) seem to be all the rage, that is, making up an increasing proportion of the cars on the roads. Adjusting to higher fuel prices but, sill dependent on oil.

Is that simply a matter of public policy, or do trucks have a relative advantage over rail on islands, do you think?

The rail network did not real cover the island all that well and being a fairly hilly island, did not access some of the more hilly inland areas. Even in my old home town, the journey from the capital city to my town was frequently held up by the on last very steep hill. If it was raining the locomotives would often skid going up the steeper parts of the grade and if there was anything wrong with the locomotive, it would usually show up on that last hill. Trucks can go into almost every nook and cranny and while fuel was relatively inexpensive well, you know the rest. As a result, the value proposition of railway transport was eroded by trucking and the railway did not adapt to handled containerised freight in time to stay alive. The bauxite/alumina industry knows full well, the advantage of rail transport over road transport and has kept the parts of the network that they use alive.

Alan from the islands

People take a long time to adopt new ideas.

Reminds me of a company that spent billions in the US a few years ago to offer online food shopping and delivery - Webvan. It was a great idea, but people took too long to get used to such a novel idea, and they went bankrupt before they could generate enough cash to pay for the expensive automated warehouses.

That's just the way it is - it takes time to absorb new things...

Very well put, Paulo.

It irks me to no end that the bones of several viable adaptation measures are already in place, but they remain invisible to all. In our backyard (south coast of BC) one is staring at us right in the face: the disused E&N Railway on Vancouver Island. The land is there, and consists of about 250 km of rail bed in a right-of-way averaging 30m wide joining all the major towns from Victoria to Courtney, with branch lines to Cowichan Lake and Port Alberni. It doesn't take a nuclear physisist to see the potential of a 21st Century electrified passenger and freight rail service incrementally outcompeting the Island Highway as time goes by, especially if extended to Campbell River.

My guess is it would be hugely successful financially if linked directly to the critical mass of a decent passenger ferry service to the Mainland, specifically to the Waterfront Station in the downtown Vancouver harbour. A passenger ferry service would not assume the energy and cost penalty of moving thousands of tonnes of trucks, buses and cars, just a few thousand kg of human flesh. Commercial trucking ferries need not provide the same services, staffing and frequencies as currently offered on the BC Ferries main routes that cater mostly to the private car ... they're not called floating traffic jams for nothing. BC Ferries currently burns B5 biodiesel (5% lower grade canola oil) in a lot of its ships, and that could be pushed to B20 without penalty. New, lighter ferries could be made from BC smelted aluminum that uses mostly hydro power for the smelting process, and burn BC CNG -- if that resource isn't devoted entirely to export -- or B100 biodiesel (this, admittedly, will be a challenge because it doesn't store well in varying temps and being organic, tends to grow algae and fungus). If tied to certain urban land use measures and sound planning and urban design, and also with new energy efficiency provisions in the National and BC Building Codes, a ferry-linked commuter rail line could result in very pleasant pearl-necklace of human-scaled communities linked by clean, efficient and affordable transport alternatives to liquid fossil-fueled private vehicles and the whims of asphalt politics.

The essential railway components exist: Land already zoned for this industrial purpose; relatively clean hydro power -- and much potential with baseload geothermal and intermittent tidal and wind to power new industries along the line; local knowledge and expertise in design and engineering; a significant chunk of the populace already motivated to accept well-thought out ideas; a triple A financing rating for public agencies willing to take on the challenge (and accept the returns); a Canadian-owned transport company highly rated for its railway projects worldwide, and who would probably jump at the opportunity to provide deep bulk order discounts on livery just to kickstart a major expansion of rail in Canada. The only thing lacking seems to be leadership. Our new premier appears to be rooked by the hype dished out on LNG in northeast BC and is willing to gamble our future on a 'gold rush' rather than sound long term planning. Our prime minister is too busy working to secure his sseven-figure post-politics seat at the Suncor board table to bother.

A number of the old Interurban streetcar lines that wove through the Fraser Valley a century ago are still there in legal easements, and the old BC Rail route from Vancouver to Prince George via Whistler, Pemberton and the upper Fraser River watershed could also be electrified and provide a committed passenger service.

The E&N land grant basically removed 80 square km of land from First Nations traditional territory and handed it over to lumber and coal barons in return for building a railway and opening up the Island to resource extraction. The RR operation is still partially intact, though lack of maintenance and demand has resulted in the decline and elimination of the diesel dayliner service between Victoria and Courtney. The land grant area has been largely logged over, in many areas twice, and the coal mines of Nanaimo were well-serviced by the RR and a rail barge service that still operates today in Nanaimo harbour, mostly with lumber products from Port Alberni. The logging companies that eventually bought the land from the the original grantees (Dunsmuir was the big guy back then) are now selling off big chunks in the form of unsustainable rural residential subdivisions, and they're making a killing on the radical land lift from a change in zoning from an old forestry tenure to residential on top of the minute fraction of taxes they paid for decades as lumber operations. Take a flyover on Google Earth near Duncan, Ladysmith, Nanaimo and Sooke and you'll see a patchwork of old and new clearcuts -- some obviously not done well (within 30m of the river banks, on mountainsides too steep to hold the soil once logged). In my opinion, there is a better way to practice land use planning for a sustainable Island economy near towns serviced by and Island-wide rail operation , one that could bring justice through the full economic participation/inclusion of First Nations who were never compensated, let alone protected with legal representation, when 800,000 hectares of their land was confiscated in the 1860s.

This is a current research project, and it has shown me that there is much potential for a better future, or should I say a more stable future, considering it will be more localized and have troubling financial peaks and valleys for individuals, families and businesses. Not planning for diminishing fossil fuels will result in these same people getting stuck on the highway to nowhere.

Salish,

I grew up to the sound of the 11:00 freight rumbling through the Cowichan Valley. Logs were hauled from lake Cowichan daily. There is a move afoot to bring the En back online, a good thing because it will still preserve the rail bed from destruction or further giveaway.

I don't know offhand the exact land grant size for the EN, but following is a synopsis. CP had the land up Island for most of my life through Pacific Logging. I believe it is now mostly owned by Timberwest as it was parcelled off over the years to many forest companies.

Read it and weep. Govt larceny and under the table dealing has been a hallmark of British Columbia history. This might be interesting to others as a picture of insider oligarchs running Govt. for themselves.

Paulo

"The controversy surrounding the E&N land grant still haunts decision making today. In late October, the Hul’qumi’num Treaty Group, representing six Coast Salish First Nations, asked the Inter-American Commission on Human Rights in Washington to hear its complaint that 300,000 hectares of land converted to private property in the E&N land grant was “an act of egregious piracy.”

In the 1870s as part of its commitment to “connect the seaboard of BC with the railway system of Canada,” Canada agreed to contribute $100,000 annually towards the construction of a railway. BC later agreed to grant about two million acres plus $750,000 to the company that constructed a railroad on Vancouver Island.

Only a select few well-connected people reaped the bulk of the windfall. The man behind the E&N deal was coal baron Robert Dunsmuir. Dunsmuir was both the richest man in BC and, with a seat in the provincial legislature, influential in political circles.

Dunsmuir had little interest in railroads; what he wanted was the land, and with it control of the great reserves of coal and other minerals. He used his economic and political influence to secure the contract to build the railway.

The Esquimalt & Nanaimo Railway Company immediately began subdividing the grant into parcels and selling it off, making Dunsmuir and his colleagues millions. In 1905, the Canadian Pacific Railway Company (CPR) paid just over $1 million for the E&N and $1.25 million for the remaining 566,580 hectares of land not yet sold. In 1910, Dunsmuir sold his coal mining interests in the granted lands for $11 million."

The E&N Railway line on Vancouver has always struck me as a good candidate for conversion to light rail, running as it does through the suburbs of Victoria (metro pop. 360,000). If you want to see examples of LRT built in freight railway ROW's, you can go to Calgary or Edmonton. Neither Calgary nor Edmonton had a lot more people than Victoria does now when they started building their LRT systems. Nowadays, of course, they're MUCH bigger (1.2 million or so). LRT works really well when you get to that size. It would have worked back then in Vancouver, given the number of unused and underused RR ROW's weaving around the city and its suburbs, but instead Vancouver decided to concentrate on high-profile and high-priced solutions like the SkyTrain, which achieved much the same results as LRT in Vancouver for several times as much money as Calgary, and is unaffordable in the far flung suburbs whereas Calgary built LRT to its distant suburbs right from the start.

The main constraint on rail is that even light rail, although cheap by rapid transit standards, is not dirt cheap. Even with an existing ROW, a basic system might cost $10 million per kilometre. 250 km might cost $2.5 billion. That would be much cheaper than freeways and have a lot more commuter capacity, however. Governments unfortunately get obsessed with the low incremental costs of building roads, and by the time the costs of keeping the roads from gridlocking start to rise into the tens of billions, they're too committed to back away from the concept of solving traffic congestion by building more freeways.