The Round-Up: September 11th 2007

Posted by Stoneleigh on September 11, 2007 - 3:53am in The Oil Drum: Canada

In her new book The Shock Doctrine: The Rise of Disaster Capitalism, Canadian writer Naomi Klein uses the example of public sector dismantling in both New Orleans and Iraq as an illustration of Milton Friedman's idea that crisis presents an opportunity to push a pre-existing agenda and achieve sweeping change. This is both an important point and a timely warning, as the developing international credit crunch is arguably approaching a critical phase. The inability to roll over short term commercial paper, often backed by dubious loans, is presenting an enormous challenge to a banking system short of cash. The coming economic upheaval could be sufficient to precipitate far-reaching socio-political changes on a global scale.

On the energy front, CIBC World Markets claims that Canada has 50-70% of the investable oil reserves in the world, for oil majors increasingly shut out of producing regions. However, those reserves suffer from a shortage of pipeline capacity for both inputs and output. Saskatchewan decides against 'clean coal' on cost grounds, but continues to maintain a low royalty, low tax regime for natural resources. In the meantime, the Canadian wind industry is being consolidated in fewer and fewer hands, and there is strong resistance to uranium mining in rural Ontario.

As for environmental news, Holland is developing a 200 year plan for climate change, but with the assumption that sea-levels will rise very little despite evidence of rapid change in Greenland's icesheets. There is considerable concern over the potential for warming to activate microbial oxidation of the organic matter of the arctic tundra, which could ignite a devastating spiral of positive feedback.

Naomi Klein: The Shock Doctrine

In one of his most influential essays, Friedman articulated contemporary capitalism's core tactical nostrum, what I have come to understand as "the shock doctrine". He observed that "only a crisis - actual or perceived - produces real change". When that crisis occurs, the actions taken depend on the ideas that are lying around. Some people stockpile canned goods and water in preparation for major disasters; Friedmanites stockpile free-market ideas. And once a crisis has struck, the University of Chicago professor was convinced that it was crucial to act swiftly, to impose rapid and irreversible change before the crisis-racked society slipped back into the "tyranny of the status quo". A variation on Machiavelli's advice that "injuries" should be inflicted "all at once", this is one of Friedman's most lasting legacies....

....I started researching the free market's dependence on the power of shock four years ago, during the early days of the occupation of Iraq. I reported from Baghdad on Washington's failed attempts to follow "shock and awe" with shock therapy - mass privatisation, complete free trade, a 15% flat tax, a dramatically downsized government. Afterwards I travelled to Sri Lanka, several months after the devastating 2004 tsunami, and witnessed another version of the same manoeuvre: foreign investors and international lenders had teamed up to use the atmosphere of panic to hand the entire beautiful coastline over to entrepreneurs who quickly built large resorts, blocking hundreds of thousands of fishing people from rebuilding their villages. By the time Hurricane Katrina hit New Orleans, it was clear that this was now the preferred method of advancing corporate goals: using moments of collective trauma to engage in radical social and economic engineering.

US Federal Reserve data show that the outstanding stock of US commercial paper has fallen by US$255 billion or 11% over the past three weeks, a sign that many borrowers have been unable to roll over huge amounts of short-term debt at maturity. Asset-backed commercial paper (ABCP), which accounted for half the commercial-paper (CP) market, tumbled $59.4 billion to $998 billion in the last week of August, the lowest since December. Total short-term debt maturing in 270 days or less fell $62.8 billion to a seasonally adjusted $1.98 trillion. The yield on the highest-rated asset-backed paper due by August 30 rose 0.11 percentage point to a six-year high of 6.15%.

Some analysts are comparing the current collapse of the CP market to the sudden drain on liquidity that occurred at the onset of the 2001 dotcom bust. Others are comparing the current crisis to the 1907 crash, when large trusts did not have access to a lender of last resort, as the Fed had not yet been established. Still others are comparing the current crisis to the 1929 crash, when the Fed delayed needed intervention.

Today, key market participants who dominate the credit market with unprecedented high levels of securitized debt operate beyond the purview of the Fed in the non-bank financial system, and these market participants do not have direct access to a lender of last resort when a liquidity crisis develops except through the narrow window of the banking system.

Worst crisis for 20 years, say banks

Leading bankers are warning of the worst crisis in the money markets for 20 years, which will come to a head this week when $113 billion (£57 billion) of commercial paper – market IOUs – comes up for refinancing.

This huge refinancing, mainly through London, exceeds the $100 billion that became due in mid-August, and which sparked the most serious phase in the money-market crisis, which has seen banks scrambling for funds and market interest rates rising sharply. "This is a serious pressure point," said one leading banker.

Another senior executive of one of Britain's top five retail banks said: "These are the worst conditions I have seen in money markets for 20 years".

UK: Banks face 10-day debt timebomb

Britain's biggest banks could be forced to cough up as much as £70bn over the next 10 days, as the credit crisis that has seized the global financial system sparks a fresh wave of chaos.

Almost 20 per cent of the short-term money market loans issued by European banks are due to mature between September 11 and September 19. Senior bankers fear that they will have to refinance almost all of these debts with funds from their own coffers, putting a further strain on bank balance sheets.

Tens of billions of pounds of these commercial paper loans have already built up in the financial system, because fear-ridden investors no longer want to buy them. Roughly £23bn of these loans expire on September 17 alone. Fears of this impending call on bank credit lines are the true reason that lending between banks has ground to a halt, according to senior money market sources.

Banks have been stockpiling cash in preparation for this "double rollover" week, which sees quarterly loans expire alongside shorter term debts - exacerbating a problem that lies at the heart of the credit crisis.

Britain's Coming Credit Crisis

Could any country be more exposed to the current credit crunch than the U.S.? You bet, and that place is Britain. Unlike most of its European neighbors, Britain shares many of America's financial traits-and problems. Access to cheap credit has fueled a decade of unprecedented growth, with home prices tripling over the past decade, a faster rise than in the U.S. Consumer spending has skyrocketed, now making up roughly two-thirds of the country's total outlays. And the overall economy in Britain is more dependent on financial services than it is in the States....

....As in the U.S., consumers are another key driver of the economy-and today they're among the most indebted in the world. British consumers owe $2.7 trillion on credit cards, mortgages, and other consumer loans-or more than the country's entire economic output. Household debt as a percentage of gross disposable income is 166%, compared with 127% in the U.S. So it's hardly surprising that in the past year, British banks have had to write off $18 billion in bad debts, mostly consumer borrowing.

On Thursday afternoon, GMT, Citi released its latest figures for the seven SIVs it operates. Together, those seven SIVs corner 25 per cent of the SIV world - with just over $100bn in assets under management.

According to the WSJ:

The problem facing SIVs isn't the assets they own, which can include securities underpinned by U.S. subprime loans — often mortgages to home buyers with sketchy credit histories. Rather, they can't raise money because investor demand for commercial paper sold by SIVs is minimal.That means banks such as Citigroup are facing questions as to whether they will step in to provide financial support for the SIVs.

The banks woes have been exacerbated by the flight of investors from money market funds, many of which are backed by Mortgage-backed Securities (MBS). Wary investors are running for the safety of US Treasuries even though yields that have declined at a record pace. This is causing problems in the Commercial Paper market as well as for the lesser-know SIVs and "conduits". These abstruse-sounding investment vehicles are the essential plumbing that maintains normalcy in the markets. Commercial paper is a $2.2 trillion market. When it shrinks by more than $200 billion ---as it has in the last 3 weeks--the effects can be felt through the entire system.

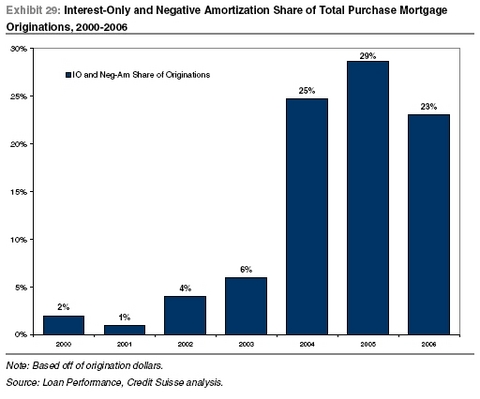

The credit crunch has spread across the whole gamut of commercial paper and low-grade debt. Banks are hoarding cash and refusing loans to even credit-worthy applicants. The collapse in subprime loans is just part of the story. More than 50% of all mortgages in the last two years have been unconventional loans—no down payment, no verification of income "no doc", interest-only, negative amortization, piggyback, 2-28s, teaser rates, adjustable rate mortgages "ARMs". All of these reflect the shoddy lending standards of the past few years and all are contributing to the unprecedented rate of defaults. Now the banks are holding $300 billion of these "unmarketable" mortgage-backed CDOs and another $200 billion in equally-suspect CLOs. (Collateralized loan obligations; the CDOs corporate-twin).

Even more worrisome, the large investment banks have myriad "off-book" operations which are in distress. This has forced the banks to circle the wagons and reduce their issuance of loans which is accelerating the downturn in housing. Typically, housing bubbles unwind very slowly over a 5 to 10 year period. That won't be the case this time. The surge in inventory, the financial distress of many homeowners and the complete breakdown in loan-origination (due to the growing credit crunch) ensures that the housing market will crash-land sometime in late 2008 or early 2009. The banks are expected to write-off a considerable portion of their CDO-debt at the end of the 3rd Quarter rather than keep the losses on their books. This will further hasten the decline in housing prices.

Subprime crisis tests hedge funds

You could say that this summer's credit crunch was a chance to see the hedge fund emperors without their clothes.

As banks around the world tightened access to money, on concern that borrowers' collateral was impaired by exposure to subprime loans, some of the highest-profile upsets were reported in the $1.7 trillion hedge fund industry. As these secretive and unregulated funds scrambled to raise cash and dump tradable assets, tales of double-digit losses, implosions and bankruptcies replaced Paris Hilton in the headlines.

The crunch, which is still working its way out of the world's financial system, raised big questions about the viability of some hedge fund strategies in the absence of easy money, which had encouraged fund managers to take on increasing levels of leverage and risk.

Global Growth Threatened as U.S. Contagion Spreads

This time, when the U.S. sneezes, the rest of the world may well catch a cold.

Global economic growth looks likely to slow markedly in the months ahead as further weakness in the U.S. infects Asia and Europe. That would represent a shift from the last 18 months, when the world economy proved immune to a U.S. slowdown and grew at an annual clip of more than 5 percent.

What's different now is the U.S. slump is starting to spread from the domestic housing market to consumers who buy imports from companies such as Toyota Motor Corp. And the sudden increase in borrowing costs that followed the collapse of the subprime-mortgage market is now showing up overseas, raising the price tag on credit worldwide.

The problems in the housing market were supposed to stay there. Perhaps they would be a nightmare for some homeowners, but not for theeconomy in general.

Or at least that's what most of Wall Street was espousing until July. Yet, in the last eight weeks, it has become clear that their analysis was wrong.

Fear has brought to an end the easy-money conditions that homeowners and businesses have enjoyed for the last few years. Temporarily, at least, there is a credit crunch. Banks and other lenders are reluctant to make loans, and homeowners and businesses that want, or need, to borrow may have to pay a dear price to get money.

Washington Mutual Sees Housing `Near-Perfect Storm'

Washington Mutual Inc., the largest U.S. thrift, said that conditions in the housing market are creating a `near-perfect storm' and may force the company to set aside more money to cover bad loans.

Chief Executive Officer Kerry Killinger told the Lehman Brothers Holdings Inc. financial services conference today the bank may have to increase its loan-loss provision by $500 million. Previously the bank forecast provisions of $1.5 billion to $1.7 billion for the full year.

``The combination of rising delinquencies, higher foreclosures, more housing inventories, increasing interest rates on many mortgages and greatly reduced availability of mortgages due to limited liquidity is creating what we call a near-perfect storm for housing,'' he said.

August Home Sales Take a Major Plunge

The expanding mortgage crisis and credit crunch slammed the Los Angeles housing market in August, with home sales plunging 50 percent from the same month last year and 25 percent from July.

Sales of new and existing homes in Los Angeles County slid to 4,107 units in August, just under half the 8,246 units that sold in August 2006 and well below July's 5,458 units, according to figures compiled for the Business Journal by Melville, N.Y.-based HomeData Corp.

The pain was widespread, as only a handful of the county's nearly 300 ZIP codes managed to eke out any sales gains. August's plunge was even more dramatic considering that the month is traditionally one of the more robust for home sales.

More US subprime borrowers hit

More than one in seven US homebuyers with subprime loans failed to keep up with mortgage payments in the second quarter, in a sign of growing distress in the housing market.

More than 619,000 homeowners – or 1.4 per cent of all those with mortgages – face the prospect of repossession, up from 1.28 per cent in the first quarter, according to estimates by the Mortgage Bankers' Association. Total delinquencies rose to their highest level since 2002 – by 0.28 percentage points to 5.12 per cent of all mortgages. The data indicates an acceleration in the troubles in US mortgage markets, and covers the period before last month's credit squeeze raised the cost of borrowing.

Negative Amortization and Interest Only: The Next Mortgage Bomb?

It's already an accepted fact that people who bought homes with zero money down and are now in a negative equity situation are quite likely to go into foreclosure, however, how about people who never paid down a lick of principle over the time they owned the home and/or are now dealing negative amortization to the tune of 10-20%? It's quite possible that there are home owners out there who on top of 20% worth of negative amortization from their mortgage loan, are dealing with depreciation in the area of 10, 20, even 30%. Even if you can afford to make the payments, facing down the barrel of owning 30-50% more on your home than it's worth is a horrific situation for a home owner to be in. Considering how many new home owners are in this situation, what will this do to new home buyer psychology long-term? Americans aren't used to hearing (and have a hard time dealing with) financial horror stories from home ownership.

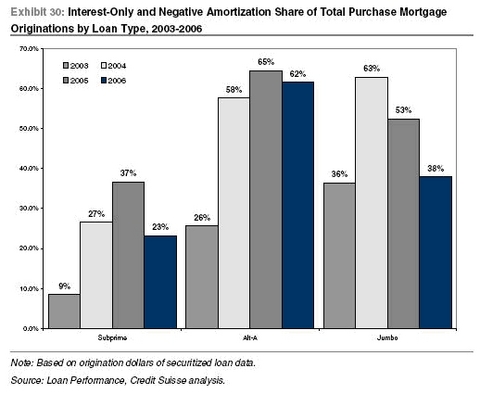

The thing that jumps out at me is the fact that for three years straight, nearly 60% of negative amortization and interest only mortgages were in the alt-a space, where it’s now pretty much accepted that the borrowers often lied about their potential income. The implication here is pretty clear: borrowers lied about their income to borrow more money, than took the loan with a minimum payment to make-up for the fact that it was more mortgage than they could afford and at some point, these loans will recast as fixed rate mortgages with the full payment, once the maximum negative amortization amount is reached.

Moody's Warns Housing Slump Will Persist

Credit rating agency Moody's Investors Service said Monday it expects the housing-market slump to last at least until 2009, likely precipitating numerous ratings downgrades at publicly traded homebuilders.

"Our current thinking is that the downturn, currently two years in the making, will last until 2009, with any sector recovery likely to be sluggish for some time after that," said Joseph Snider, senior credit officer at Moody's.

The agency predicts an increase in the number of downgrades and changes in ratings outlooks over that period, after already cutting nearly all of the public builders in recent weeks.

"Many of these companies may see further downgrades, with multiple-notch downgrades possible for homebuilders," Moody's said.

Unexpected Loss of Jobs Raises Risk of Recession

The unexpected weakness in employment changed the terms of the debate over the health of the economy. Before the report was released, most economists were predicting that the economy had added about 100,000 jobs in August and that growth had slowed but continued.

But now, the odds of a recession in the next year have risen, to 25 to 50 percent, economists interviewed yesterday said. A recession is typically defined as an extended period in which the economy shrinks, leading to a rise in unemployment and a drop in consumer spending and business investment.

"People need to start thinking about the housing market not just as some ring-fence problem which is off on its own," said Nigel Gault, chief United States economist at Global Insight, an economic research firm in Lexington, Mass. "They need to start worrying about the health of the broader economy."

Countrywide Job Cuts May Lead to 20% Contraction in Industry

The worst U.S. housing slump in 16 years may lead mortgage companies to eliminate almost 100,000 jobs, more than double the number already cut this year.

As many as 20 percent of the nation's real estate loan officers and mortgage brokers will be fired, according to Josh Rosner, managing director at the New York investment research firm Graham Fisher & Co. That's in addition to the 10 percent reduction from December to July that thinned their ranks to 450,000 as investors stopped buying mortgages and lenders curtailed financing to avoid rising subprime defaults.

``Originations are going to decline dramatically,'' Rosner said. ``We are just at the front-end of seeing the large banks and investment banks start to cut their capacity.''

Bond Fund Investors May Be in for Shock

Could the housing market's woes spread to bonds held in mutual funds by millions of ordinary investors?

Some experts -- and hedge fund investors who have made big bets that the mortgage crisis will worsen -- are saying that's exactly what will happen. Some bond funds that invest in riskier short-term debt already have been whacked by soaring default rates on bonds backed by subprime loans made to borrowers with weak credit.

Critics charge that Standard & Poor's, Moody's Investors Service and Fitch Ratings routinely give triple-A ratings -- the safest rating there is -- to far too many mortgage-backed bonds backed by subprime home loans.

''The rating agencies just completely missed the boat in their methodology for rating these things,'' said Janet Tavakoli, president

of Tavakoli Structured Finance, a Chicago consulting firm.About 80 percent of debt in bonds backed by subprime loans is rated triple-A, the same rating on virtually risk-free U.S. Treasury bonds, experts say.

If that seems shocking, there are bonds backed by delinquent credit card accounts -- one of the riskiest forms of debt -- in which up to 40 percent of the accounts in the security are rated triple-A, says Drexel University finance professor Joseph Mason.

In the beginning, the ratings business was that simple, as outfits like CBRS gave grades – backed up with written explanations – that the markets could accept or reject. But as the financial world grew exponentially through the 1980s and '90s, the raters were asked to be tutors as well, guiding securities issuers as well as investors in a risky game itself that may have been at the root of this summer's market turmoil, which damaged investment portfolios around the world.

For Mr. Neysmith, who retired five years ago, there's a simple analogy:Pretend you're a park ranger, and a camper wants to cross a big lake. He tells you he's got a canoe, a paddle and a lifejacket, and asks what his chances are of crossing safely. You ask him what his canoeing experience is, and conclude that his chances are decent.

But then the camper asks what he would have to do for you to conclude that his chances were excellent. And so you tell him that he needs to add a flotation device, heavy weather gear and an extra set of paddles, just in case one falls out. And you say that if he does all that, you'll give him a 100 per cent chance of success.

"In other words, the rating agencies became part of the advice," Mr. Neysmith says. "It's conjecture, but maybe rating agencies shouldn't be too close to the market. Maybe they should really stand back."

That perceived conflict is part of what has North America's rating agencies – once a revered source of judgment – under a cloud. Officials in the United States and Europe are calling for new scrutiny and tougher rules for credit-rating agencies. The Securities and Exchange Commission confirmed yesterday that it has begun a review of credit-rating agency policies and procedures, focusing on their role in the subprime debacle. The review will include looking at conflicts of interest and the meanings of ratings.

Treasury Yields Near 19-Month Low on Growth Outlook

U.S. 10-year Treasury yields were near the lowest in 19 months after a report showing Japan's economy contracted at almost twice the pace forecast by analysts in the second quarter, stoking concern global growth is slowing.

The world's second-biggest economy shrank at a 1.2 percent annual rate in the three months ended June 30 as business spending slumped, the Cabinet Office said in Tokyo today. U.S. two-year note yields had their second-largest drop in three years on Sept. 7 as an unexpected decline in employment fueled speculation the Federal Reserve will cut its key rate to as low as 4.25 percent by year-end.

Wall Street Credit Costs Soar on Spread to U.S. Rates

Wall Street is getting no benefit from the biggest bond market rally in five years.

Lehman Brothers Holdings Inc. faces higher borrowing costs today than it did in June, even after the steepest quarterly drop in U.S. Treasury yields since 2002 pushed interest rates down for everyone from Procter & Gamble Co. to AT&T Inc. Investors are so leery of Bear Stearns Cos. that its 10-year bonds trade at a discount to Colombia, the South American nation that's barely investment grade. Goldman Sachs Group Inc. is being punished with a higher yield than Caterpillar Inc., the heavy-equipment maker.

Bond buyers view the nation's largest securities firms as no safer than taking a flier on subprime mortgages. That's a nightmare scenario for the industry's chief executive officers, who relied on cheap financing for leveraged buyouts, real estate lending and proprietary trading to produce record profits -- and paychecks of $40 million or more for themselves.

Feds start bailing as housing takes on more water

Pending home sales plunge to 9/11 levels

This week, we got one of the worst housing reports in a long, long time. The National Association of Realtors reported that pending home sales plunged 12.2% between June and July. That's the worst one-month fall on record!

The index, which tracks contracts to buy existing homes, stood at 89.9, the lowest since September 2001. That's right — the same month we suffered the 9/11 terrorist attacks....

....Bernanke acknowledged that the housing market is in awful shape, dropping the tiresome "well-contained" claptrap we've been subjected

to.He did something else, too — he tacitly promised to try to backstop the mortgage market and economy by saying:

"The Committee continues to monitor the situation and will act as needed to limit the adverse effects on the broader economy that may arise from the disruptions in financial markets."

This increases the chance the Fed will cut its benchmark federal funds rate as soon as September 18, when it next meets to discuss monetary policy. The funds rate is currently 5.25%.

Five Key Questions for Bernanke

The chairman of the Federal Reserve is like a golfer trying to line up a tee shot while thousands of spectators shout advice. The higher the stakes, the louder the buzz from the gallery, and the stakes are superhigh after the government's surprising report on Sept. 7 that employment shrank in August.

NAR Admits to Initiating Bush's Mortgage Bailout Plan

In a press release last week, the president of the National Association of Realtors applauded Bush's FHA mortgage bailout proposal, and admitted that the Association has been pushing for the bailout since early 2007. If the NAR continues to have their way, taxpayers will be forced to clean up the mess the realtors helped to create.

Now that home mortgage defaults are spreading like wildfire from coast to coast, there is a growing sense of certainty that the government will attempt to bail out homeowners and lenders. The ideas put forward last week by President Bush may be the camel's nose pushing under the bottom of the tent. However, just as some things are too big to fail, this problem is far too big to fix....

....Even without the incentives of a government bailout luring more people into default, policy makers simply have no idea as to the scope of the problem. Before this home mortgage correction runs its course, nearly every homeowner in the country who had availed themselves of an adjustable rate mortgage or a home equity loan will be in need of a bailout. Even a sizable percentage of those with traditional fixed rate mortgages will find themselves in danger. With millions, or perhaps tens of millions, of home owners on the rocks, there is simply no way the government can structure a bailout without bankrupting the country or destroying the currency.

Canada avoids U.S. economic woes ... for now

North America is becoming a tale of two economies - sinking housing and shrinking job markets south of the border but boom times for both here.

However, there's fear Canada's economy cannot remain immune to what's happening in its largest export market, the United States.

Mortgages with 40-year amortizations are shaking up the market. Some say they are the only way to afford today's home prices. Ron Cirotto, of www.amortization.com, calls that "bullshit." "There are a lot of people buying a house who shouldn't be buying the house they're buying."

Do not pay until 2047. It has a nice ring to it for Canadians seduced into home ownership but unable to afford the price tag that comes with buying property. No money for a down payment? Little cash to make monthly payments? No worries. The Canadian real estate industry has come up with the perfect product -- the 40-year amortization. Instead of planning to pay off their mortgage in 25 years, Canadians are now turning to products that give them at least an extra decade to pay their debt -- subject to massive interest payments over the course of a loan.

Americans living beyond their means

Prior to the recent, unprecedented string of deficits, Kasriel says there have been only seven other years American households have been so upside-down in their finances since 1929. Two of those were during the Great Depression. Three more were just after the end of World War II. Another was in 1955, then again in 1999. That leads to an obvious question: If they can't afford it, how are people continuing to spend as Thursday's report of retail sales suggested they are continuing to do as if all is well?

The answer, which has become all too obvious in recent weeks and months, Kasriel says: They appear, in large part, to be borrowing against their homes, which will become less available as a piggy bank going forward. "Households are going into debt like never before," he says. They also have been net sellers of stocks. All of this means, Kasriel says, that there will be less cash for things we like to buy.

Sun is setting on Spanish property boom

During the last decade vast swathes of the Spanish coastline have been developed in a construction boom that has made the nation one of the fastest growing economies in Europe. Spanish house prices have risen by more than 200 per cent in that period, encouraging many overseas investors - a large number of them British - to purchase property with the promise of short-term financial rewards.

But in the second quarter of this year the rise in house prices dipped below the rate of inflation for the first time in 10 years. Analysts believe that because of low interest rates and poor regulations speculators have saturated the market.

Last year more than 800,000 homes were built in Spain, more than in Britain, France and Germany combined. The result is a long anticipated downturn in the market with the worst hit areas in the big cities and on the Costa Blanca and Costa del Sol, where more than 250,000 homes are British-owned. At the height of the construction boom in 2005 there were 7,000 estate agents on the Costa Blanca but 300 have closed this year, according to Enrique Llopis, honorary president of Alicante's College of Real Estate Agents. "It is a symptom of the property bubble bursting," he said yesterday.

What is the financial status of a home? Many people say they “invest” in their homes. But a home is not an investment. It is an item that loses value through deterioration even if no one lives in it. A home is expensive to finance, expensive to maintain and expensive to buy or sell. Ironically, it is also very costly to realize the loss of value on a home.

If there is a possible benefit to the slump, it may be that we'll emerge with a different understanding of the value of our homes, regarding them less as investments (perhaps burying the presumption, at least until the next boom, that they're as reliable as stocks and bonds) and more as something all too ordinary. That is, as places to live.

I say this in part because I tend to believe that houses are immensely valuable for their intangible benefits (a sense of place, community and stability), while being much more complex investments than we acknowledge. When we calculate appreciation, for instance, we almost always discount the steady and substantial costs of upkeep and improvements, especially on older houses. We assume large income tax benefits, even when they are eroded by property taxes. We forget that inflation matters (the $425,000 we paid for our house, for example, would be about $500,000 today). Finally, we overlook the historical data, which suggest that trends in housing prices have been mostly unremarkable over the 20th century. Robert Shiller, the Yale economist, who has been one of the most astute longtime observers of the housing market, concluded in 2005 that during the past hundred years, prices have mostly been flat or declined, with just a few exceptions.

To me, there seems to be an obvious correlation between the current failures in the financial markets -- in particular the credit sector -- and the gross failure of leadership across the board in American life. Ultimately, credit depends on legitimacy, and so does authority. They are tied together. For years, both have been immersed in fantasy rather than reality.

How does one otherwise account for the remarkable disappearance of standards in lending among the human beings who lead banking institutions? All the banking executives didn't wake up one morning missing sixty IQ points. And yet neither can one say that they all woke up one morning with evil intentions to work wickedness in the world. They simply became subsumed in a fantasy that there was no material difference between borrowers with a proven ability to pay back loans and borrowers with no record of credit-worthiness. And they got rid of the problems that might have ensued by selling off wholesale bundles of good-and-bad loans to willing buyers (other banking executives) further down the line, who in turn sold certificates representing these bundles to willing executives in pension groups and money markets. It became normal. It was justified at the tip-top of American leadership by the Explainer-in-Chief saying that it was a good thing for as many Americans as possible to own their own house.

Greenspan Warns "Market Identical to 1837"

According to the Wall Street Journal, Former Federal Reserve Chairman Alan Greenspan said the current market turmoil is in many ways "identical" to 1987 and 1998.

"The behavior in what we are observing in the last seven weeks is identical in many respects to what we saw in 1998, what we saw in the stock-market crash of 1987, Greenspan said.

"I suspect [it is similar to] what we saw in the land-boom collapse of 1837 and certainly [the bank panic of] 1907," Mr. Greenspan told a group of academic economists in Washington, D.C. last night. But that's not all, Mr. Greenspan also said there were still other signs that this market resembles similar markets in 1834, 1858, 1974, definitely 1983, a little bit 1984, not so much 1985 and 1986, but kind of 1989, and from certain angles 1991 and 1992, although 1994 is in no way like today unless you turn the chart sideways.

Greenspan then took out his wallet and removed from it a small piece of a Dow Jones Industrial Average chart from 1977 that he says looks exactly like the Shroud of Turin.

CIBC World Markets Examines Future Of Canadian Oil Sands

Jeff Rubin and Peter Buchanan from CIBC World Markets stated that what also makes the Canadian oil sands attractive is not simply their geological assets but their regulatory environment in Canada.

They noted that in most places in the world these days, there is a growing political consensus that oil and gas assets should be owned and operated by the state. Depending on one's view of the investment climate in Kazakhstan and Nigeria, the economist noted, Canada represents anywhere from 50-70% of the investable oil reserves in the world.

For most multinational oil firms, the world is rapidly shrinking, according to Rubin and Buchanan. Increasingly, they are shut out of the backyards of all the state-owned oil patches and then have to bid against those state firms in places still open for investment. Canada remains one of those few places, they said, where governments have been content to take their share of economic rents through royalties and not be concerned about the ownership per se.

Petro-Canada Bets Big on Oil Sands

Long-suffering Petro-Canada (PCZ) investors may think their luck has turned this past year as the company starts to shake off a reputation for operational unreliability and its share price has risen. But its biggest challenge yet lies ahead: a massive C$26.2 billion oil sands project that has some analysts wondering whether it might halt the stock's upward march.

Canada's fourth-largest oil and gas producer has set itself an aggressive schedule for bringing 280,000 barrels a day of synthetic crude onstream by 2014. Meanwhile, other oil sands projects are struggling increasingly with scarce labor and materials, sending budgets spiraling upward.

So the question is, can Petro-Canada pull it off?

More refining needed to process Alta. output

U.S. refineries must be expanded to handle a rising tide of crude-oil imports from Alberta's tar sands, the world's second-biggest oil deposit, says John Hofmeister, Royal Dutch Shell PLC's U.S. chair.

Shell, Saudi Aramco, ConocoPhillips, BP PLC and Marathon Oil Corp. plan to spend a combined $15 billion (U.S.) to expand refineries from Michigan to Texas to process more low-grade oil from the tar sands.

Oil sands facing capacity squeeze

A lack of pipeline capacity to take Canadian crude to refineries in the United States between now and 2009 will increase competition for producers to get their output to market, according to a new report from energy industry consultancy Purvin & Gertz.

And the constraints could result in apportionment, an unpromising scenario where there's not enough infrastructure in place to take all production to market, creating both lower prices and higher price volatility.

Consequently, producers could delay some oil sands projects to try to ensure they don't have to discount their future output to guarantee it gets to market, said Tom Wise, executive vice-president at Purvin & Gertz. "We do see growth in Canadian production, but the pipelines are full and we could see apportionment," he said in an interview.

Exxon hasn't shelved Mackenzie pipeline

The Mackenzie natural gas pipeline is "very actively progressing," though a $16.2-billion cost estimate remains loose and may yet be adjusted higher or lower, the chairman and CEO of Exxon

Mobil Corp. said on Friday. The project "has not been put on the shelf," Rex Tillerson told reporters after speaking about the challenge of global energy security at the Spruce Meadows round table, a blue chip gathering of international business leaders near Calgary.

Wood wedges stabilize Alaska pipeline

Alyeska Pipeline Service Co. is taking steps to address potentially dangerous vibrations in a newly rebuilt pump station of the trans-Alaska pipeline.

As a temporary measure, workers have wedged blocks of wood underneath shaky piping at the pump station to add stiffness.

Though wood supports might seem like a crude technique for the pipeline, which this year has carried an average of 761,226 barrels per day, a spokesman for the company said cribbing is common in the industry. Alyeska spokesman Mike Heatwole also said the piping is safe to operate even without the cribbing.

The vibration is one of the nagging problems that have plagued Alyeska's campaign to rebuild four key pump stations along the 800-mile pipeline, which began moving Prudhoe Bay oil 30 years ago.

Alyeska began its overhaul in 2004 with the goal of finishing in two years on a $250 million budget. The project remains incomplete and costs have risen to more than $400 million.

Chuck Hamel, a Virginia resident and longtime Alyeska critic, last month exposed problems with power failures, welding records and other issues in a letter to congressmen.

Hamel said the pipeline modernization project "is in total disarray."

French oil giant Total reins in Canadian plans

Total SA, which as recently as two years ago was in hot pursuit of a third acquisition in Canada as a way to bulk up its presence in the Alberta oilsands, is likely content, given pressures on the growing industry, to spend the next few years focused on developing its two main assets in the province.

Federal Government Dodging Responsibility for Environmental Impacts of Oil Sands

Recommendations regarding greenhouse gas pollution and global warming, air pollution, the Athabasca River and its fishery, environmental assessment, and First Nations consultation and

accommodation are included in the petition."We don't hear from the federal government about the oil sands except when we learn about loopholes in their proposed environmental regulations," said Dan Woynillowicz, a Senior Policy Analyst with the Pembina Institute. "To date, the federal government has failed to require the oil sands sector to take responsibility for its environmental impacts. This is holding Canada back from having effective climate change and air quality regulations that live up to Canadians' expectations."

Last year, enough natural gas to supply 27% of U.S. needs was burned off as waste around the world, according to a new report by the World Bank. Flared natural gas is a by-product of petroleum production and is not generally considered worth capture and sale, the bank adds.

However, the bank estimates the gas could be worth as much as $40 billion if sold on the U.S. market, where natural gas demand is high because of its use as a chemical feedstock and fuel.

Global gas flaring releases about 400 million tons of carbon dioxide to the atmosphere each year, and the practice has remained mostly stable at 150 billion to 170 billion m3 annually over the past 12 years, according to the World Bank report. To generate the data, the World Bank collaborated with the U.S. National Oceanic & Atmospheric Administration to pinpoint the extent of flaring through close examination of satellite imagery gathered from 400 miles above ground.

Greenpeace backs Algonquin uranium protest

David Martin, one of 19 people aboard the green ship draped with a yellow banner reading "No coal. No nuclear," said even uranium exploration, not just mining, risks environmental contamination.

Martin added that more than 20 years ago, he helped monitor environmental problems that resulted from uranium mining in Elliot Lake, Ont., and helped clean up the contaminated tailings there. "So when I heard about the situation at Sharbot Lake, I thought, 'My God, they're doing it again. How can they be so stupid?" he said. "The solution here is just don't enter into this madness. Stop it before it goes any further."

That's a message the Ardoch and Shabot Obaadjiwan Algonquin First Nations are also trying to send through their occupation of an area near Sharbot Lake, about 60 kilometres north of Kingston, which began in late June.

No nuclear nirvana for power producers

Budget overruns, high operational costs cast doubt on atomic option for a power-hungry world

Martin Landtman hunches forward in his shirtsleeves as a June storm on Finland's Baltic coast drenches the construction site of the world's most powerful nuclear reactor. As project manager for TVO, the joint venture buying the plant, Landtman has weathered far worse annoyances than rain.

Flawed welds for the reactor's steel liner, unusable water-coolant pipes and suspect concrete in the foundation already have pushed back the delivery date of the Olkiluoto-3 unit by at least two years.

"Substantial delays, I think you can use that word, yes," the 54-year-old Landtman says.

Olkiluoto-3, the first nuclear plant ordered in Western Europe since the 1986 Chernobyl disaster, is also more than 25 per cent over its three-billion-euro ($4-billion US) budget.

If Finland's experience is any guide, the "nuclear renaissance" touted by the global atomic power industry as an economically viable alternative to coal and natural gas may not offer much progress from a generation ago, when schedule and budgetary overruns for new reactors cost investors billions of dollars.

The U.K.'s Sizewell-B plant, which took nearly 15 years from the application to completion, opened in 1995 and cost about 2.5 billion pounds ($5.1 billion), up from a 1987 estimate of 1.7 billion pounds.

Proponents of nuclear power argue that the higher cost to build is balanced by lower fuel costs. Still, after accounting for costs from construction and fuel to maintenance, electricity from a new U.S. nuclear plant in 2015 would be 15 per cent more expensive over the reactor's life than natural gas and 13 per cent more than coal, according to 2007 estimates by the U.S. Energy Information Administration.

"The nuclear industry has put forward very optimistic construction cost estimates, but there is no experience that comes even close to backing them up," says Paul Joskow, director of the Center for Energy and Environmental Policy Research at Massachusetts Institute of Technology in Cambridge.

UK: New nuclear row as green groups pull out

Britain's leading environmental groups are poised to formally withdraw from a government consultation today that will determine whether ministers will be able to push ahead with plans to build a new generation of nuclear power stations. The coalition which was asked to provide evidence to inform the debate believes the government has failed to fairly reflect the arguments for presentations that will be given to more than 1,100 members of the public that are due to start tomorrow.

The process was forced upon the government by the high court, which ruled in February that a previous consultation was "seriously flawed" and "manifestly inadequate and unfair". At least six groups, including Greenpeace, Friends of the Earth, WWF and Green Alliance, claim the government is distorting the evidence and say they are considering whether to take the case to court again.

The accusations are damaging because the government is bound by its own guidelines to keep an open mind on new nuclear power stations until after the "fullest public consultation". If the government is forced into a third consultation it could delay major energy decisions being made for at least a year.

Flurry of deals carves up a Canadian industry

Canada's nascent wind power business has caught the attention of foreign players, who have been steadily buying up domestic companies as the industry consolidates into fewer and fewer hands. While more buyouts are expected, wind energy executives say there is still room for small independent wind developers in an industry that is finding its feet in a burgeoning market for alternative energy sources.

SaskPower shelves clean-coal project

It was supposed to herald the era of "clean coal," but Saskatchewan now says a proposed coal-fired power plant that would capture and store carbon dioxide is simply too expensive.

Instead, the province will spend $525-million to build natural gas power plants.

In a decision that is a blow to the coal industry, the government-owned utility, SaskPower, said the proposed 450-megawatt coal plant is too expensive, but insisted it is not abandoning the

technology."We remain fully committed to exploring clean coal as a supply option in the longer term," SaskPower president Pat Youzwa said yesterday.

Saskatchewan Resources and Royalties

Who benefits from low royalties and taxes?

In the area of business economics and political economy, one of the major topics over the past few years has been the dramatic rise in the price of most natural resource commodities, the profits being made by the large trans-national corporations and the efforts by resource producing countries to capture the surplus or excess profits created in these industries. Across North America there has been widespread criticism of the oil corporations for the high price of gasoline. But there has been absolutely no debate on this issue in Saskatchewan. The major political parties, the business community and the mass media are not interested. Why is this the case?

It is not that the issue is foreign to Canada. In Newfoundland the major political issue over the past two years has been the effort by Danny Williams’ Progressive Conservative government to get a greater share of the value of oil from offshore extraction. In Alberta the Tory government created a special commission to look into the royalties and taxes being paid by the large corporations extracting bitumen from the tar sands. This commission has held hearings across the province, with the general public demanding higher royalties and taxes and the oil and gas industry and the business community in general supporting the status quo.

Is this the year for cellulosic ethanol?

Three new U.S. DOE-funded research centers will house

multidisciplinary teams of scientists from across the country with

the aim of coordinating the basic research needed to accelerate the

promise of cellulosic ethanol as a renewable, sustainable, secure and

cost-competitive biofuel.

Developing countries face serious social unrest as they struggle to cope with soaring food prices, inflation that shows no signs of abating, the United Nations’ top agriculture official has warned. Jacques Diouf, director-general of the UN’s Food and Agriculture Organisation, said surging prices for basic food imports such as wheat, corn and milk had the “potential for social tension, leading to social reactions and eventually even political problems”.

Mr Diouf said food prices would continue to increase because of a mix of strong demand from developing countries; a rising global population, more frequent floods and droughts caused by climate change; and the biofuel industry’s appetite for grains.

Treasure in the trees

Experts say it's time to consider privatizing our forests

Reid Carter has a simple suggestion for Canada's provincial governments that, if adopted, could put tens of billions of dollars into their coffers, attract hundreds of millions of dollars of new investment to one of the nation's largest and most beleaguered industries, shore up Canada's public pension plans, and maybe even end our most chronic bilateral trade dispute.

If that sounds like an irresistible pitch, think again. Mr. Carter, a managing partner with Brookfield Asset Management Inc. in Vancouver, has spent four years crossing Canada, talking up bureaucrats and cabinet ministers about a proposal that sounds too good to be true, but isn't. Privately, many tell him it's a great idea. Publicly, nobody will touch it with a hundred-foot tree trunk.

Why not? Because it would involve doing what many Canadians would consider unthinkable: privatizing the forests. Fully 93% of Canada's 402-million hectares of forest is owned by government -- mostly the provinces -- and Brookfield owns a portion of the rest, in British Columbia and the Maritimes.

If Mr.Carter had his wish, Brookfield would own a lot more. He's not alone. "There's a significant institutional interest among investors in Canada and globally" in Canadian timberland, he says. In B.C. alone, it is estimated the province's roughly 22 million hectares of timber harvest area would be worth an average of US$1,000 per acre -- US$22-billion in total -- if sold, enough to reduce the provincial debt by 60% and save $1.44-billion in annual interest costs. That is more than its annual revenue from forestry fees and taxes.

Such compelling calculations don't change the fact that in most legislatures, the idea of selling the forests is considered as politically astute as advising peasants to eat cake on the eve of the French Revolution.

Seeds of a super forest

Planting a million clones

In a non-descript office building on the outskirts of the British Columbia capital, Tom Urban waves away a thick cloud of white fog lingering on top of an open cryo-tank. Inside, frozen to -196 degrees Celsius, are stacks of tiny vials. Each is neatly arranged in a plastic tray and carefully numbered and catalogued. Each contains the seed material of a single tree. The two dozen similar tanks in this room together contain thousands and thousands of unique genetic signatures. Most are for loblolly pine, the fast-growing conifer that dominates the southeastern U.S., where Mr. Urban's company, Cellfor Inc., does most of its business.

Somewhere in the room are vials containing the genetics of lodgepole pine, the tree that covers the ridges and valleys of B.C.'s lumber-rich interior, which happens to be in Mr. Urban's backyard. But rather than germinating that material into a Canadian super-forest -- one that is faster-growing, more disease-resistant and more valuable -- Mr. Urban, who is the company's president and CEO, has no immediate plans to move the lodgepole genetics out of the cryo-tanks. There is simply no market for it.

The problem? The companies that plant Canada's publicly owned forests have little incentive to pay the premium for Cellfor's seedlings -- a fact that, critics say, could jeopardize Canada's future as a forest leader as other parts of the world rapidly embrace high-tech genetics and plant increasingly profitable trees.

Netherlands has 200-year global warming plan

With two-thirds of the Dutch population living below sea level, the country's government sees the risk of rising seas caused by global warming as a matter of life and death. So it's taking a long term view of the problem - a two hundred-year view, to be exact. The Cabinet announced plans on Friday for a new commission to begin preparing water defences through the year 2200.

"We want to make sure that there's still a Netherlands a century from now," Tineke Huizinga, the country's top water official, told state broadcaster NOS. "We don't want to just let the water flow and all have to move to Germany."

"We agree that in this light, we have to reckon with extreme scenarios ... it's important to understand what level of (flooding) risk is acceptable."

The Netherlands' political history and even its name, which means the "lowlands," have been shaped by its location at the delta created by the Rhine and other major European rivers. The country is in a constant state of constructing and reconstructing its sea and river dikes, and evaluating and re-evaluating the their safety.

In December, the government approved a $20-billion increase in spending on water defences and water quality improvements over the next 20 years. That was on top of $4,1-billion in extra projects already in the works this decade against the threat from river floods, as Dutch climate models predict global warming will lead to more abrupt showers in the Rhine catchment area, whose water ultimately funnels through the Netherlands on its way out to the sea. The country also spends $680-million annually on maintaining its intricate existing system of sea and river dikes that have been built and improved for a millennium.

"I don't want to scare people. Our safety is guaranteed for the coming 50 years, insofar as it can ever be ... we spend a lot of money to make sure everything is really in order," Huizinga said. "But we know that the sea levels are rising, and that's going to demand other solutions."

Dutch policymakers are counting on a rise in sea level of around 80 centimetres in the coming century regardless of the ongoing scientific debate on the causes and likely impact of global warming.

Greenland ice melt shocks scientists

The vast ice sheet that coats Greenland up to 2 miles thick is reacting to global warming far faster than scientists thought it would. It makes some of them wonder whether they've underestimated the speed of changes a warmer climate brings.

A few decades ago, Greenland's glaciers had little bearing on Oregon. Now they're melting and sliding into the ocean quickly enough to measurably -- though slightly -- raise the sea level on the coast of Oregon and around the world.

It is the acceleration that stuns scientists. Greenland's glaciers are adding up to 58 trillion gallons of water a year to the oceans, more than twice as much as a decade ago and enough to supply more than 250 cities the size of Los Angeles, NASA research shows.

That's particularly unsettling because elaborate climate models that scientists use to estimate the effects of global warming did not foresee it. Scientists themselves never imagined Greenland's ice, which holds enough water to raise sea levels 23 feet and sits in position to influence Northwest weather, would move so quickly.

"The overriding mind-set was that it would take many centuries to change in any significant way," said Robert Bindschadler, a leading ice researcher and chief scientist at NASA's Hydrospheric and Biospheric Sciences Laboratory. "The whole community was astonished at how rapidly these really large glaciers are accelerating."

So much ice is disappearing so rapidly that the earth beneath Greenland is rising -- bouncing back like a bathroom scale when you step off it. Researchers helicoptering around Greenland are now dotting its coast with global positioning units to track that rise.

Two-thirds of the world's polar bears will be killed off by 2050 and the entire population gone from Alaska because of thinning sea ice from global warming in the Arctic, government scientists forecast Friday.

Only in the northern Canadian Arctic islands and the west coast of Greenland are any of the world's 16,000 polar bears expected to survive through the end of the century, said the U.S. Geological Survey, which is the scientific arm of the Interior Department.

USGS projects that polar bears during the next half-century will disappear along the north coasts of Alaska and Russia and lose 42 percent of the Arctic range they need to live in during summer in the Polar Basin when they hunt and breed. A polar bear's life usually lasts about 30 years.

"Projected changes in future sea ice conditions, if realized, will result in loss of approximately two-thirds of the world's current polar bear population by the mid 21st century," the report says.

Natural 'feedbacks': Scientists test 'the gorilla at the door'

The high Arctic tundra now appears to hold much more carbon that scientists thought

The big wild-cards as the climate changes are what scientists call "feedbacks" -- natural mechanisms that, as the climate warms, make it warm ever faster.

One example is the barren tundra that covers vast stretches of the Arctic. Rising temperatures melt the frozen ground, stirring microbes that convert underground carbon into added greenhouse gases, which in turn heat up the atmosphere even faster.

It's "the gorilla at the door, because just the smallest change in temperature could lead to oxidation of these massive stores of carbon," said Jeffrey Welker, a professor of biology at the University of Alaska in Anchorage. On Greenland's northwest fringe, down the road from an air base that's the northernmost U.S. defense installation, Welker's science team is testing that point.

The reaction to rising temperatures is an especially important question here, because tundra in such high Arctic regions -- north of 70 degrees latitude -- has long been considered too cold and too poor in carbon to be a big player, compared with lower latitude tundra such as Alaska's.

But as in many other cases involving the effects of global warming, the natural world is reacting in surprising ways. The high Arctic tundra now appears to hold much more carbon that scientists thought, and can churn it out rapidly. That happens even faster when extra precipitation dampens the ground, which is also likely because global warming helps the air hold more water -- fueling storms.

"These carbon pools are much greater than we thought, and can be almost spontaneously released," Welker said. "Our longstanding dogma, our longstanding perspective is changing now."

Climate change will harm life on the deep ocean floor

A study of the most remote forms of life on Earth has found that their splendid isolation on the deep seabed will not protect them from environmental catastrophes on the surface.

Scientists used to believe that a global disaster that wiped out most of the life on Earth would not touch the unusual organisms that live around the mineral-rich vents on the sea floor. But research by a team of British scientists has found that even these deep-sea creatures which live in total darkness and survive on the chemical energy oozing from mineral vents on the seabed are not immune from the seasonal changes above.

"The marine ecosystem may be even more interconnected than we previously realised and in fact there may be nowhere for life to hide from global catastrophes," said Jon Copley of Southampton University. "I used to think that life on the deep ocean-floor environment is pretty much quarantined from what happens in the sunlit world up here thanks to their chemical energy supply," Dr Copley will tell the British Association's Science Festival today.

A study of a species of tiny shrimp living around deep-sea vents has found that they produce microscopic larvae as part of their lifecycle and that when these larvae migrate they have to rely on food coming down from the sunlit waters above. So the animals living on the deep seabed have to time the hatching of their eggs to coincide with spring blooms of microscopic plant life growing at the surface a link that has been overlooked.

Australia: Parched summer on way

Up to two million Australians in the lower Murray-Darling catchment are facing the worst summer of water restrictions and shortages in 70 years.

The warning by the head of the Murray-Darling Basin Commission, Wendy Craik, was just one of several issued yesterday by some of Australia's top experts on drought and climate change. Some predicted that Australia may never fully recover from the current dry. Water Services Association of Australia executive director Ross Young said the outlook for capital cities apart from Sydney, Hobart and Darwin, was "not looking good".

"It is going to take a concerted effort to make sure we implement appropriate restrictions and water conservation measures to get through this summer and the next one," he said. "Around Australia, Brisbane, of all the capitals, is the one that really does have its back to the wall."

The nation's biggest river system is holding 1700 gigalitres less water in storage this year than at the same time last year, the worst on record. For the towns, communities and farmers of the nation's food bowl, she warned of "significant challenges" ahead. "We're facing a spring and summer on the Murray like no other," she said.

British seas 'a wasteland compared with 100 years ago'

The Unnatural History of the Sea

The seas around Britain are a wasteland compared with 100 years ago and at least a third of the sea must be closed to fishing if the profusion of fish we had then is to return, according to a new book."We have an ecosystem that has turned from the big turbot and halibut and the shoals of herring and cod of the 1880s, into prawns, scallops and mud," says the author, Callum Roberts, Professor of Marine Conservation at York University.

His book tells the story of the profusion of fish and marine mammals that were in the sea in previous centuries - North Sea cod, he calculates, is now just two per cent of its former, pre-industrial profusion of two million tons. And he argues that over-fishing is not just a modern phenomenon. It had its roots in the dawn of fishing in Europe for freshwater fish.

As towns, deep ploughing, mill dams and weirs began to alter and pollute the rivers and stop migrations of fish such as salmon, fishermen were driven to sea, and ever outwards in pursuit of fish.

The Vikings brought the ships that made deep-water fishing for herring and cod possible and by the middle 1400s, British fishermen were fishing in Icelandic waters for large cod. Researchers can trace the chemical signature of the cod's origin in the bones found in medieval middens.

"What we can see from this is the roots of today's inability to solve the fishing problem. The solution was always to fish somewhere else or for something else. We're coming to the end of that option because we now fish everywhere across the oceans, down to 2000 metres depth. We've run through the suite of species, too."

Debilitating tropical mosquito virus arrives in Europe

A debilitating tropical virus carried by mosquitoes has become established in Europe for the first time. The Ministry of Health in Italy has confirmed about 160 cases of chikungunya in the Ravenna region in northern Italy.

Travellers have been advised to protect themselves against mosquito bites. The European Centre for Disease Control urged pregnant women and those with chronic illnesses to seek medical advice before visiting the area. The villages of Castiglione di Ravenna and Castiglione di Cervia havereported most of the cases.

The main symptoms of the patients were high fever and joint pain, as well as headache, muscle pain, rash and less frequently gastrointestinal symptoms. One death was reported in a 83-year old individual with underlying medical conditions.

Professor Antoine Flahault, who coordinates French research on chikungunya, said the Italian outbreak was a "world first" outside the tropics.

Amazon Rainforest may go extinct by 2080 if deforestation keeps on

The Amazon Rainforest may go extinct by 2080 if the deforestation rates do not change, Brazilian environmentalist PhilipMartin Fearnside said. In his words, Brazil is one of the countries most affected by the global warming, and it must become a leader in the campaign against deforestation.

The country is already taking measures to contain the deforestation of the Amazon Rainforest. Environment Minister Marina Silva said in late August that they will reduce the deforestation to 9,600 square kilometers from August 2007 through July 2008 as against 14,000 square kilometers in August 2006 July 2007.

The annual rate of deforestation in the Amazon region has continued to increase from 1990 to 2003 because of factors at local, national, andinternational levels.

In 1996, the Amazon was reported to have shown a 34% increase in deforestation since 1992. The mean annual deforestation rate from 2000 to 2005 (22,392 km per year) was 18% higher than in the previous five years (19,018 km per year).

According to INPE (the National Institute of Space Research), the original Amazon rainforest biome in Brazil of 4,100,000 km was reducedto 3,403,000 km by 2005 representing a loss of 17.1%.

England's countryside 'set to vanish in decades'

The English countryside is set to vanish by the end of the century under a mass of brick and tarmac, campaigners warn.

The ever-growing need for more homes, more airport runaways, more motorways and more power stations, will see bulldozers tear up the green belt as space becomes scarcer, it is claimed.

Fifty per cent of the land in England already suffers from noise disturbance, ruined views and, at night, light pollution, maps published today by the Campaign to Protect Rural England (CPRE) show.

The South-east is all but disappearing under development, with 70 per cent of the region affected and the remaining 30 per cent set to be blighted in just 45 years under current rates of growth, the CPRE

said.

The Great American Media Mind Warp

All Americans, regardless of caste, live in a culture woven of self-referential illusions. Like a holographic simulation, each part refers exclusively back to the whole, and the whole refers exclusively back to the parts. All else is excluded by this simulated reality. Consequently, social realism in this country is a television commercial for America, a simulated republic of eagles and big box stores, a good place to live so long as we never stray outside the hologram. The corporate simulacrum of life has penetrated us so deeply it now dominates the mind's interior landscape with its celebrities and commercial images. Within the hologram sparkles the culture-generating industry, spinning out our unreality like cotton candy.

A six part series on YouTube

http://www.youtube.com/watch?v=Ka3Pb_StJn4&mode=related&search=

The Shock Doctrine: The Rise of Disaster Capitalism, Naomi Klein

A bit of information for all you Canadian Snowbirds that plan to visit Florida this winter...

Subprime meltdown finally affects beer drinkers

By The Mogambo Guru

http://www.atimes.com/atimes/Global_Economy/II12Dj01.html

'If you are one of the nervous people who have spent a lot of time tracking me down to get information about your investment in the Mogambo Super-Secret Hedge Fund (MS-SHF), you are wasting your time trying to get your money back ... or what's left of your money back ... or even finding out if there is even any money to get back.'...snip...

'Most investors were happy with hearing that uplifting message (as it is nice to know that you are at least "average"!) until George Ure of UrbanSurvival.com revealed that "The data seems to suggest that out of about 10,000 hedge funds operating worldwide, some 30% of firms reportedly have losses of 40% in their portfolios." Yow! A 40% loss!'...snip...

'He relates, "In 1983, the Bureau of Labor Statistics [BLS] was faced with an awkward dilemma. If it continued to include the cost of housing in the Consumer Price Index, the CPI would reflect an inflation rate of 15%, thereby making the country's economy look like a banana republic. Worse, since investors and bond traders have historically demanded a 2% real return after inflation, that would mean that bond and money market yields could climb as high as 17%."'...snip...

'Putting it all together, he concludes, "The present subprime credit crisis can be directly traced back to the BLS decision to exclude the price of housing from the CPI. It is now clear that the 'benign' inflation figures reported over the last 10 years" were, (using my awesome editorial powers to insert my own words for special emphasis), "A big stinking load of lying crap by the corrupt Federal Reserve and the despicable government (except Ron Paul)." 1'

'I think that there is a link between this inflationary monetary nonsense and the bad economic news that, as columnist Ernest Hooper reports in the St Petersburg Times, a restaurant owner friend of his is saying that around this part of Florida the usually slow summer business season, "is so bad this year that even beer distributors are noticing a difference".'...snip...

Stoneleigh--

As always, thank you for putting together an incredible amount of information on financial issues.

Do you have any idea on how many re-finances, including ARMs, are recourse loans? In a purchase money security interest, where you get an initial mortgage to buy a house, the loan is normally non-recourse, i.e. if the buyer can't repay, he can just walk and the lender must look to the security (the house) to recoup his losses). However, I had understood many (if not most) re-fi's were recourse, i.e. the lender can get a judgement againt the homeowner for any shortfall between the loan amount and what the lender realizes from the foreclosure sale of the asset. And judgements are often good for 10 years and can be renewed for another ten, so the judgement follows the homeowner for a long time and threatens any later-acquired assets.

When re-fi's are for 100% of equity, I would think recourse loans are the only way a lender would lend, but if the lender is simply intending to sell off the loan as quickly as possible, maybe having recourse to the borrower became less important. At any rate, if a high percentage of these re-fi's are recourse, I would think any recovery from the coming crash would be even slower.

Rick

Rick,

A very good question. Though not exactly our forté.

I put it to Tanta at Calculated Risk, who has an amazing depth of knowledge in these matters, and she was gracious enough to reply within the hour. I'll quote her entire response here, and thank her very kindly.

Hi Tanta--

Thank you for an excellent and thorough response. I agree that non-judicial foreclosure is faster and more common and that judicial foreclosure makes no sense with sub-prime borrowers since they have no assets to pursue. However, as foreclosures spread to A borrowers and as collateral values plummet, it will be interesting to see if lenders resort to judicial foreclosures more often to try to lessen their losses.

Rick

Hi Tanta--

One more thought on the issue of deficiencies between loan amount and realized sale price on non-judicial foreclosure: to the extent the foreclosing lender choses methods that do not allow it to pursue the homeowner for any deficiencies, the difference may constitute 'debt forgiveness' in the eyes of the IRS and become taxable income to the foreclosed homeowner. Granted, it is better to owe 20-25% of the debt amount than 100%, but this will effectively be new money owed the IRS which is just tacked onto the tax bill.

Thanks Stoneleigh for the massive meal,

Here is a slight bit more, though I hope not like that after dinner mint in the Monty Python sketch of Mr Creosote,

http://www.minyanville.com/articles/MA-Bernanke-economy-Fed-Mishkin-cons...

---------

Souperman2, that video looks interesting, privatizing Yaks eh? Hmmm sounds a bit like a guy that privatizes wallets in dark alleys.

Normally I enjoy reading Kunstler but his latest is a bit disappointing.

What he calls "a gross failure of leadership across the board in American life" unduly softens criticism due to PC.

What we have is a culture of gross fraud across all levels of society, and it is so extreme that the intent seems to be to force the few honest individuals left into it as a survival reflex.

Even the biggest idiots in the world can't fu*( things up this bad if they are reasonably honest.

Maybe I'm just getting bored waiting for the Potemkin village to collapse, just like watching a kitty walking around a plate of hot milk while pushing the turds under the carpet.

Bored? yes! Life's wishes meaningless. There can be only waiting, eyes transfixed on a village that doesn't exist.

Other than that, not too bad a day:)

Darn it Musashi, now you've got me thinking and I really am too busy presently for depressing things like thinking. Anyway what I am thinking is, that with the 'news of the day', about energy and resource depletion and global warming and war and everything, how is all this is effecting us as 'just people' and as a result the running of the machine.

An army can have the greatest resources, the best trained soldiers, great food (I can attest for that, at least in the Canadian Army while I was there, no stinting in quantity or quality ). Anyway they can have all this stuff and still lose if they feel from the start of battle they are destined or deserve to lose.

Short term seems to be trumping long term thinking and planning yet real awareness of the implications of the heavy problems of the day are still IMO 90% below the surface.

So Scotty, er I mean Musashi, with what enthusiasm are the boiler rooms of the nation being manned? And how long will the lights stay on?

It isn't depression, it truly is boredom. I think. LOL.

Everyone has a different nature, I'm not much of a strategist but a good tactician, the best laid plans of men and mice do not survive first contact, so I don't see a clear line of action with this slow decline, but I'm convinced that the track comes to me once the fur starts flying.

As far as the mood in the boiler rooms it seems to be quite bleak, I talk to the ex and the daughters almost every day and they don't seem to be happy campers despite being in upper income brackets. Most of the tribe that has jobs is also rumbling. It seems incomprehensible that they would stay in a game that is rigged for them to lose, but all one can do is mention it from time to time. They are not ready to live in the woods yet.

I'm fine with my very low target cross section and watch from the sidelines.

Didn't mean to imply you musashi, but as I wrote I did get the thought that the mood of the people is going to affect what is going down, just like the mood in the simpler system the stock market affects prices.

The community here that my family of 3 moved into about 8 years ago is mostly what I guess is working class, a lot descended from English miners that worked coal mines here till about 1950. The attitude towards PO is non existent and GW is just 'funny weather', so there is mainly an upbeat attitude in the older inhabitants. Not so in the youth who seem to know whats up but just don't feel any point in talking or doing anything about it. Quite a few just drifting from day to day, not bad kids just no thinking of a bright future. You know a What's the point attitude, not a healthy boredom which can stimulate one into action:)

These round-ups are amazing.

I'm not a frequent contributor (mostly a lurker) but I wanted to stop in and say thank you for all the hard work!

Don't think it's not appreciated by the silent lurkers around here.

.

You're very welcome :)