Peak Oil Overview - March 2008 (Pdf and Powerpoint available)

Posted by Gail the Actuary on March 13, 2008 - 10:57am

Preliminary data regarding oil production through December 2007 is now available from the US Energy Information Administration, so it is a good time to put together an updated summary of where we are now with respect to peak oil. The major themes of this presentation are

• The US oil story

• The world oil story

• Five myths

I have put this summary together in the format of a PowerPoint presentation plus notes. In this format, it is a multi-purpose document. You can

1. Read the post yourself, with or without my comments.

2. Use the presentation (PDF) as a handout, to give to one or two of your friends. My comments are intended to give you some more background, so you can better explain the presentation and answer questions.

3. Use the presentation for a group, using the PowerPoint format.

The PDF version of this presentation is available here. The PowerPoint version is available here.

Peak Oil Overview - March '08 Gail Tverberg

TheOilDrum.com

Outline

• The US oil story

• The world oil story

• Five myths

2

The US Oil Story 3

The US Oil Story

4

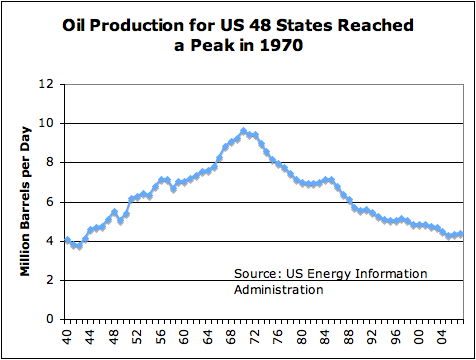

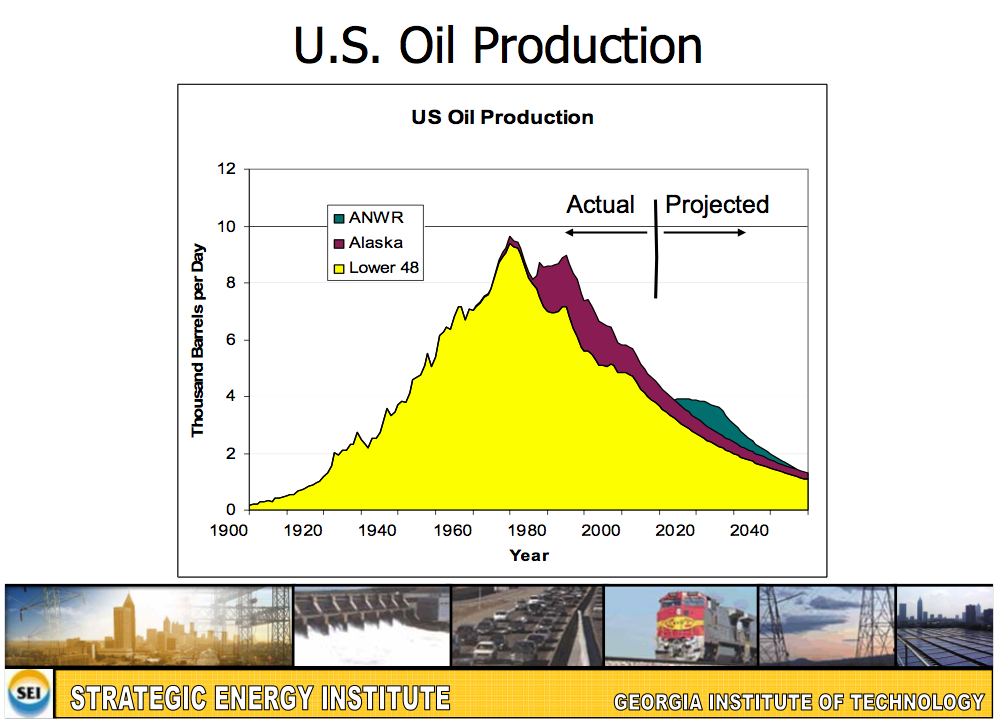

Comments: US oil production has been declining since 1970, in spite of technology advances and new drilling in the Gulf of Mexico. The recent dip and uptick reflects lower production in 2005 due to hurricane damage, followed by a bounce back in 2006 and 2007, as the damage was repaired.

US Peak in 1970 • US had been world's largest producer

• Peak came as a surprise to most

---Had been predicted by Hubbert in 1956• Precipitated a rush to find oil elsewhere

---Ramp up Saudi and Mexico production

---New production in Alaska and North Sea5

Comments: We were fortunate in 1970 to find other places in the world where oil was available, but had not yet been developed. There are still a few such sites available (for example, some US sites that have been placed off-limits for development), but they are much smaller in relationship to what was available in 1970.

M. King Hubbert had predicted in 1956 that the US production of oil would peak in 1970, but few believed him.

On page 22 of the same report, he predicts that world oil production will peak "about 2000". His prediction was made in 1956. As such, it did not reflect significant changes in the 1970s, including the significant recession of the 1973-1975 period, the switch to nuclear and natural gas instead of petroleum for electricity generation, and mileage improvements for cars. If these had been reflected, the predicted peak would have been several years later.

Saudi increases were quickest • Saudi oil company was run by Americans

---Able to ramp up quickly• OPEC embargo in 1973, however

---Oil shortages

---Huge oil price run-ups

---Lead to major recession 1973 - 756

Comments:

According to Wikipedia, Arabian American Oil Company (Aramco) was jointly owned by four US oil companies in 1970. In 1973, the Saudi Arabian government acquired 25% of the company. The percentage ownership was increased to 60% in 1974, and 100% in 1980.

OPEC began operation in 1965, but did not have pricing leverage until the United States could no longer produce the vast majority of its own oil, because of its decline in production. In Octover 1973, OPEC initiated an oil embargo against countries that supported Israel in the Yom Kippur War, particularly targeting the United States and Netherlands. The embargo lasted only a few months, until March 1974.

During this time, there was a sharp rise in oil prices, and a sharp drop in the stock market. In the United States, gasoline was rationed with people able to buy on odd or even days, depending on the last digit in their license plate number. According to Wikipedia, oil consumption in the United States dropped by 6.1% during this period.

The 1973-75 recession was the most severe recession since World War II. Merrill Lynch says it believes the current recession will be similar to that recession.

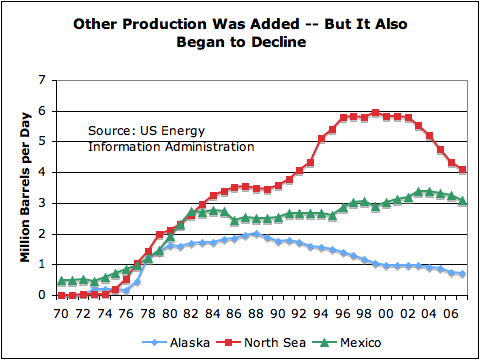

Other oil online by late 1970s

7

Comments: Even when an oil company wants to start new production quickly, it is difficult to do so. The ramp up in Alaska oil production had to wait until the Trans-Alaskan Pipeline System was completed in 1977.

It was known that oil was available in the North Sea prior to the oil embargo. It was not until the price run-up related to the embargo that it was economically feasible to drill there, however.

Production in all three of the areas shown is now declining. Alaskan production reached its peak in 1988; the North Sea peaked in 1999; and Mexico peaked in 2004. The shapes of the production curves vary for the different locations, depending on where the oil was located, and how it was produced.

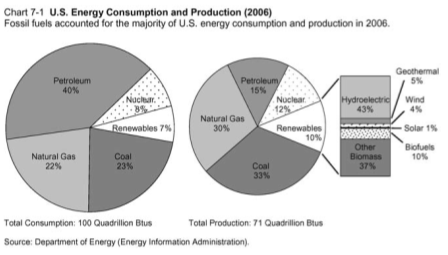

Now the US is a major importer of oil

and a tiny user of newer renewables

8

Comments: This figure is from Page 166 of the 2008 Economic Report of the President. The data shown are 2006 figures. Percentages for the newer renewables would be slightly higher for 2007.

The graphs are not as clear as I would like. The larger circle on the left represents consumption. It totals 100 quadrillion Btus. The smaller circle represents production. It totals 71 quadrillion Btus. Renewables are in the section pulled out. In total, renewables amount to 10% of production or 7% of consumption. The vast majority of renewables are hydroelectric and "other biomass" (wood used to heat homes and fuel some electric generating plants).

Reading Slide 8 • About two thirds of oil is imported

• Biofuels make up about 1.0% of energy production - a little less of use

• Wind comprises 0.4% of energy production

• Solar comprises 0.1% of energy production

9

Comments: We use a huge amount of oil and other fossil fuels. Even with big ramp up in alternatives, they are still tiny. If a cutback is made in fossil fuels, either because of shortages or because of a desire to reduce carbon dioxide, it seems clear that at least part of the response will have to be reduce total energy usage.

The World Oil Story 10

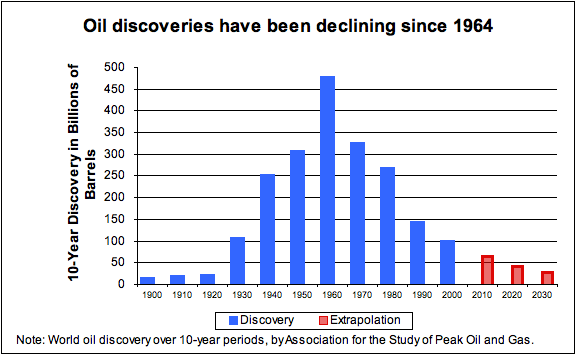

World Oil: Discoveries follow same pattern as US production

11

Comments: The discovery information is based on backdated information - what we now think old discoveries were worth. Some of the big oil fields in the Middle East were discovered about 1960. We are still discovering new fields, but they tend to be smaller and more difficult to extract. The discovery information includes only liquid oil, not oil in the form of tar or other solids.

The combination of discoveries which peaked many years ago, and oil extraction which tends to peak in individual areas, leads one to believe the eventually world oil production will peak. There will still be oil in the ground, but it will be difficult to extract. Eventually, we simply won't be able to keep extracting as much as we would like:

• As oil fields get older, the percentage of water extracted with the oil tends to increase. In some cases the water percentage exceeds 99%. Once an oil field's water production exceeds the installed water handling capability, production will need to be reduced. When the cost of additional water handling capability exceeds the cost of oil extracted, it stops making economic sense to extract the oil.

• Some of the oil will be mixed with toxic chemicals like poisonous hydrogen sulfide gas. Special techniques will be required to safely extract this oil. This process will be expensive and time consuming. A giant oil field discovered in Kazakhstan in 2000 has this problem and isn't expected to come on line until at least 2011.

• Some of the oil is found extremely deep beneath the sea. Special techniques need to be developed to deal with the high pressures and the temperature differentials encountered when drilling in these locations. Developing these new techniques takes time and is expensive. At some point, we will reach our limit on deep sea drilling.

• Some of the oil is very viscous, akin to tar. It can only be extracted by digging. Production requires inputs of fresh water and natural gas. Once limits on either of these are reached, production must stop. In some cases nuclear may be substituted for the natural gas, but this takes time, money, and agreement of the local population.

World oil production has stalled

12

Comments: Oil production on an "all liquids" basis was flat for the years 2005, 2006, and 2007. On an energy available basis, production actually declined. There are several reasons for this:

• The "All Liquids" summary includes lower energy products like ethanol and natural gas liquids. These have been growing, while crude oil production has tended to slightly decline since 2005.

• The oil produced requires more and more energy in extraction, because it is mixed with more and more water, and is found in deeper and deeper locations. More energy is required for extraction, leaving less for end users.

• If we look at oil available for imports, this has been declining since 2005. Part of the reason is the greater amount of oil used in extraction; part of the reason is that the standard of living in oil exporting nations is rising, so these nations are using more of the oil themselves, leaving less to export.

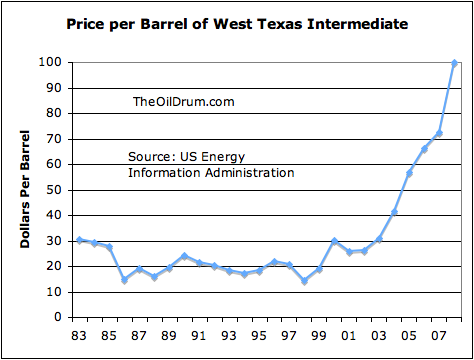

And prices are spiking

13

Comment: The fact that oil prices have been spiking since 2005 should come as no surprise. I show an estimated partial 2008 price on this graph, too, since we know the price spike has continued into 2008.

Given the shrinking supply and rising demand, the rise in prices was close to inevitable. Some of the poorer countries are being priced out of the market, and the use of coal is rising, particularly in China.

The higher prices have stimulated work on fields that were known, but not fully developed. Recent data compiled on oil megaprojects indicates that oil companies are now making a concerted effort to develop sites that may be available but have not yet been developed. Many of these projects are expected to begin production in 2008 and 2009.

It might be noted that in the 2000 to 2002 period, production stalled and even dropped a bit. Prices did not rise during this time period. They actually fell a bit. The reason for the decline during this period was lack of demand, due to recession. Now, many potential buyers are asking for more, but price does not seem to rise accordingly.

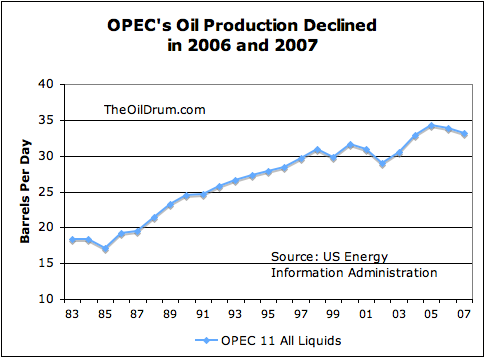

OPEC, particularly Saudi Arabia, has had

reduced oil production recently

14

Comment: The oil production of Saudi Arabia and OPEC has been sufficiently variable over time that it is difficult to make predictions, simply based on trends. OPEC's production, and in particular Saudi Arabia's production, is down in both 2006 and 2007. It is hard to know exactly what this means.

According to the US Energy Information Administration, Saudi Arabia's highest oil production was in 1980, when it produced 9.9 million barrels a day. Its recent peak was in 2005, when it produced 9.6 million barrels a day. In 2006, Saudi production dropped to an average of 9.2 million barrels a day. In 2007, production from February to August was only 8.6 million barrels a day.

When OPEC agreed to raise quotas near the end of 2007, Saudi Arabia did in fact raise its production. Its highest single month of production in 2007 was 9.1 million barrels a day, in December 2007. This represented a 500,000 barrel a day increase over its earlier low production of 8.6 million barrels a day, but still left production below both the 2006 average of 9.2 million barrels a day and the 2005 average of 9.6 million barrels a day.

One question too is whether this increase will continue, or if it is just temporary. It is sometimes possible to squeeze out a little extra production for a while, but then production drops back to a more normal level. Saudi Arabia originally planned to have an upgraded field (Khursaniyah) on line by late 2007, which was expected to produce an extra 500,000 barrels a day of oil. It may have thought it could make a spurt of extra production until this field came on line. Now the Khursaniyah field upgrade has been delayed until late 2008. Will Saudi Arabia be able to continue the increase, without the assistance of the Khursaniyah field?

Another question is why OPEC refused to raise its quota further on March 5, 2008. Is Saudi Arabia now really at the peak of what it can produce? It claims to have more production available in reserve. We know that Saudi Arabia has some poor quality oil off-line because the oil requires special processing which is not yet available in any refinery. Is this the only Saudi production off-line? Are other OPEC countries also unable to produce more?

OPEC's true reserves are unknown • Published reserves are unaudited

• Last Saudi reserve while US involved was 110 Gb in 1979 (perhaps 168 at "expected")

---Production to date 81 Gb, implying 29 to 87 Gb remaining; Saudi claims 264 Gb remaining• Kuwait published 96.5 Gb - Audit 24Gb

• GW Bush says regarding asking Saudi Arabia for more oil

---"It is hard to ask them to do something they may not be able to do."15

Comment: If one analyzes the reserves for OPEC countries, one very quickly comes to the conclusion that the published numbers are unreasonably high.

This is the story: In the early 1980s, OPEC oil countries were all vying for high quotas. To get those high quotas, they believed that publishing high reserves would be helpful. One by one, OPEC oil countries raised their reserve estimates, in an attempt to make it look like they had more oil, so deserved higher quotas. To further this illusion, they kept the reserve numbers at the new high level, even when oil had been pumped out, and no new oil had been found.

The practice has continued for years. OPEC leaders found that by overstating their reserves, they gained new respect, both within their own countries and abroad. They also found that the practice was very easy to do, since no one is auditing the reserve numbers they provide.

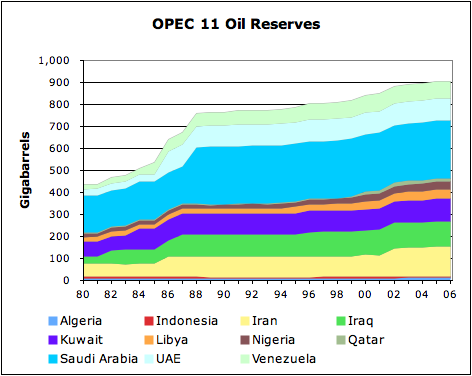

A graph of OPEC oil reserves over time is as follows:

There are many other ways this problem can be seen. For example, OPEC's oil production is unreasonably low in relationship to its reserves, unless the countries are inept at production or are misstating their reserve amounts. I discuss this issue further in my post The Disconnect Between Oil Reserves and Production. "Ace" has calculated some much lower reserve estimates, based on industry estimated recovery percentages.

Another insight can be gained by looking at Saudi oil reserves, when Americans were involved in setting reserves. According to Matt Simmons' "Twilight in the Desert", Saudi oil reserves were 110 Gigabarrels (Gb or billion barrels in US terminology) in 1979, back when Americans were still partial owners of Aramco. If we subtract the 81 Gb pumped out since then, this suggests remaining reserves of 29 Gb.

If is possible (even likely) that the 1979 American estimate was low. If, instead, we use the Saudi published estimate of 168 Gb in 1980, and subtract from it production of 81 Gb to date, we get an estimate of 87 Gb. This is less than a third of the 264.3 Gb that Saudi Arabia is currently reporting as reserves!

Kuwait is another country where we have an alternate estimate of the proven reserves available. An analysis by the Kuwait Oil Company as of December 31, 2001, showed proven reserves for the country of 24 Gb. Their published reserves were 96.5 as of December 31, 2001, moving up to 101.5 as of December 31, 2006!

President George W. Bush seems to be aware of Saudi Arabia's production/reserve problems. In an interview on ABC's Nightline, when asked why he didn't pressure the king for more oil, George Bush said

If they don't have a lot of additional oil to put on the market, it is hard to ask somebody to do something they may not be able to do.

Somehow, US textbooks and newspapers have not figured out the problem with OPEC reserves. They continue to quote huge "proven reserves" for most of the OPEC countries. The word proven adds credibility to the numbers, suggesting that somehow, the reserves have been proven to some authority, when nothing could be further from the truth.

The United States Geological Service (USGS) has added further to the confusion. It has taken the absurd reserves published by OPEC, and made calculations based on US development patterns suggesting that OPEC reserves may, in fact, be low. USGS publishes its even higher estimates, confusing the situation further.

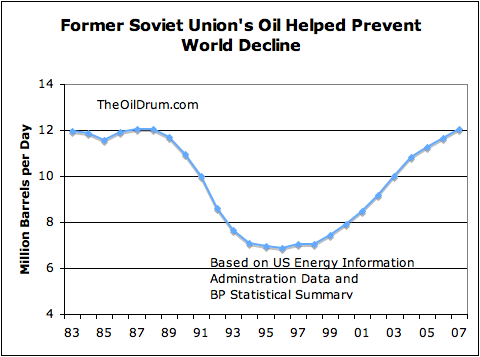

Fortunately, FSU production has increased recently

16

Comment: The Former Soviet Union saw a sharp decline in oil production in the late 1980s and early 1990s. With the adoption of modern extraction methods, they have been able to increase production again. There have even been some more recent discoveries brought on line.

Production going forward is uncertain • OPEC refuses to increase quotas

• Numerous reports say Russian production is likely to begin decreasing soon

• Little hope for US, North Sea, Mexico

• Canadian oil sands contribution is very small

• Recent discoveries have been small, relative to what is needed

• New production techniques can lead to sudden drop-offs

---Followed by small dribble for years from EOR17

Comments:We have problems almost everywhere we look. OPEC doesn't look like it is willing/able to increase production; Russia, which is the biggest part of the Former Soviet Union, looks like it is about to begin to decline; and there are a huge number of countries already post-peak, like the United States, Mexico, and the countries that make up North Sea production.

Even Canada, apart from the oil sands, is post peak. Canada depends on imports--heavily from Saudi Arabia--for its oil. While Canada has been exporting oil from the oil sands to the US, there are really two issues involved:

(1) The amount of oil from the oil sands is not likely to ramp up quickly.

(2) Canada is likely to need the oil itself, as its other production declines. This is especially the case if Saudi oil which it imports continues to decline. Under NAFTA, Canada is obligated to export a proportional share of its oil to the US, but this may be subject to renegotiation in the next few years.

There are really a couple of issues with newer technologies that are being used. One is that fancier and fancier extraction tools (such as horizontal wells and maximum reservoir contact wells) have been developed. These are able to suck out a greater percentage of the available oil, before production suddenly "hits a wall" when the layer of oil has been extracted, and the remaining oil is mixed with a huge amount of water and under little pressure. If this should happen on an enormous field like Ghawar in Saudi Arabia, we could very quickly see production drop by 2 million barrels a day, or more.

In recent years, quite a few "enhanced oil recovery" methods have been developed. Much of the impact of these methods is already reflected in the production data graphed. In some cases, like Mexico, it has permitted production to continue longer before the inevitable drop in oil production came. In others, it helps wells to continue to produce at a very low level after the vast majority of production is completed. It is doubtful that oil production will ever stop - a dribble that is nearly all water will continue indefinitely.

Projections of Future Production Vary Widely

18

Comment: The highest estimate in slide 18 is from the US Energy Information Administration. It is based solely on demand, under the assumption that OPEC can always provide additional oil if needed.

The next highest forecast is from the newsletter of the Association for the Study Peak Oil and Gas-Ireland, prepared by Colin Campbell. A link to it can be found here. It assumes that production will rise from its current level of 85 million barrels a day to a peak of 88 million barrels a day in 2010. After that, production will decline.

The next highest forecast is that of "Ace" of The Oil Drum staff. A link to his forecast can be found here. In this forecast, Ace considers the various Megaprojects, and when they are expected to go on line. He also considers expected decline rates on existing fields. He believes that we are on a plateau now that may last a few years. After that production will decline.

The remaining estimate is by Matt Simmons. In this interview, he mentions that he expects crude oil (not "total liquids") to drop to 65 million barrels a day by 2013. I have attempted to translate this comment into an equivalent projection, on a total liquids basis. It ends up being just a bit below Ace's projection.

World "All Liquids" Forecasts • "All Liquids" - Includes biofuels and "coal to liquid" fuels

• US EIA forecast - Based solely on demand

• ASPO Newsletter - Assoc. for the Study of Peak Oil and Gas Ireland, March '08

• "Ace"- Tony Eriksen, on The Oil Drum

• Simmons - Matt Simmons, recent interview on evworld.com

19

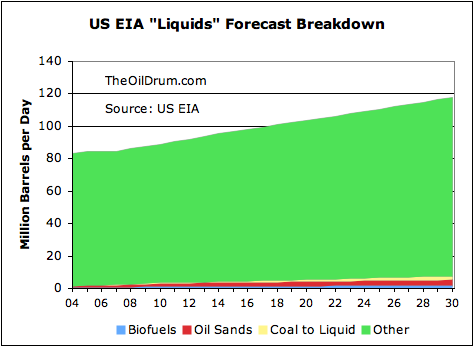

EIA expects biofuels, CTL,

and oil sands to remain small

20

Comment: The US Energy Information Administration's current projections suggest that it does not expect any of these fuels to grow to be significant between now and 2030.

Five Myths 21

Myth #1: OPEC could produce more if it used current techniques • International oil companies use same service companies US companies do

• Most are using up-to-date techniques

• Expenditures often are high

• Problem is very old fields

• Overstated reserves raise expectations

22

Comment: It is easy to see how this myth might arise, if people believe published reserves.

Myth #2: Drilling in Arctic National Wildlife Refuge will save us 23

Comment: This slide is from a presentation of Dr. Sam Shelton of Georgia Tech. The oil from ANWR is expected to provide only a small upward "bump" to US production.

Quite a few of the other much-hyped solutions are expected to provide equivalently little benefit. We will likely need to reduce consumption to better match supply.

It might be noted that the Y scale on this graph should say million barrels a day, not thousand barrels a day. Since I did not make the graph, I can't fix it.

Myth #3: A small downturn can easily be made up with energy efficiency • The quickest impacts are financial

---Recession or depression

---Serious recession in 1973 - 75• Use of biofuels raises food prices

---Further increases recession risk• Don't need peak for recession

---Only need supply/demand shortfall

---Likely what we are experiencing now24

Comment: The connection between oil supply and the economy is not well understood by most. A shortage of oil very quickly leads to an increase in prices, and a cutback in the demand for other goods and services. The combination of these events tends to cause a recession. Cutting back on usage tends not to be sufficient to prevent the problem, because there are so many other users around the world, including in China and the developing world. They are likely to cause an increasing demand for oil, even if we try to cut back.

Myth #4: Canadian oil sands will save us • Hard to see this with current technology

---Technology known since 1920s

---Production slow and expensive• Requires huge amount of natural gas

---In limited supply• Most optimistic forecasts equal 5% of current world oil by 2030

---Even this exceeds available natural gas

25

Comment: There has been commercial development of the Canadian Oil Sands since 1967. Huge amounts have been spent, and there has been great damage to the environment. Even with this, production has remained small--only a little over 1% of world supply. Natural gas limitations suggest that we will never be able to greatly ramp up production.

It might be noted that a similar argument can be made as to why oil shale will not save us from peak oil. At this point, we don't even have an economic method of extracting oil shale. From what we know, extraction will require a large amount of water and considerable electricity. Finding adequate water for extraction is likely to be a problem. It is not clear that we will have extra electricity to spare either, for this large a project. Extraction is likely to be slow and expensive, since it will require moving large amounts of dirt around, plus heating and perhaps chilling the dirt. If we are able to extract oil shale, it will likely be in small quantities.

Myth #5: Biofuels will save us • Corn-based ethanol has many problems

---Raises food prices, not scalable, CO2 issues, depletes water supply• Cellulosic ethanol theoretically is better

---Still does not scale to more than 20% of need

---Competes with biomass for electric, home heat• Biofuel from algae might work

---Not perfected yet

26

Comment: Every study that has been done recently with respect to corn ethanol seems to come out with worse indications. Corn ethanol has virtually no benefits over petroleum. It uses huge amounts of fossil fuels as inputs, so it has most of the drawbacks of fossil fuels. It also has its own drawbacks, including raising prices, damage to the environment, high water usage, and possible CO2 and other global warming gas increases because of land use changes and nitrogen fertilizer use.

At this point, there aren't good alternatives to gasoline commercially available, however. Since there is great political appeal to growing our own fuel, corn ethanol is supported by most politicians, even if any reasonable analysis would say its benefit is very limited.

Longer term cellulosic ethanol may be a better solution, but at this time it is not commercially available. Even if we use wood and switchgrass as inputs, cellulosic ethanol will be difficult to scale up to provide more than a small share of the needed fuel.

Biofuel from algae looks to some like it might work. At this point, we do not have a commercial way of doing this and the cost would be extremely high.

Hi, Gail. This is very good...well done.

In my presentations I handle the myth that any new technology or combination of technologies can make up for the decline in energy from oil. I do that by pointing out that we can never transition more than a fraction of our existing infrastructure because of the size of it — even with extremely generous (i.e. high) market penetration rates. I find that if I don't handle the general case in that way, someone always comes up to me with the "technology du jour" and misses the point that we are in for an unavoidable energy descent. Last night it was the recent breakthrough of creating synthetic gasoline that is chemically identical to that derived from oil that someone got hung up on at an event I attended (I wasn't speaking).

My goal is to leave people boxed in — to exhaust their "how abouts", "ya, buts" and "what ifs." If I don't move them past that stage, they won't start to look seriously at how they are going to deal with our inevitable future.

The relevant conversation starts on page 33 of my presentation here:

www.savinggreenbygoinggreen.com/downloads/SunSpeechWithSlides.pdf

Also, I believe one can make a stronger argument for peak economy coinciding with peak oil and the likely impacts of that. See my piece Estimating the Economic Impacts of Peak Oil, which uses the latest Hirsch Report in Energy Policy to make the case:

www.inspiringgreenleadership.com/blog/aangel/estimating-economic-impacts...

-André

www.InspiringGreenLeadership.com

This may sound a bit crazy for a primer. But I think adding in a little bit about error in measurement would be invaluable. For example our world production number have a +/- 1mbd error with unknown but potentially large systematic errors i.e a country reports or does not report a oil source that another country includes.

I would not go into to much detail but the average joe would claim peak oil is a hoax if they read a number that we produced one more cup of oil over a certain date.

I notice a lot of avid Oildrum readers fall prey to reading to much into the numbers so I think this might be a big issue for the public at large.

It is really easy to increase complexity in the whole subject. It doesn't seem to me that saying that we don't really know what the numbers are helps a beginner understand the situation that much better.

Gail,

Great work as usual.

Question: I believe you were working on a book on Peak Oil.

Have you finished that? If so, I'd like to buy one (I assume it will be available on Amazon, true?).

I probably should be, but there are several issues involved. One is that it takes a long time to get a book published, unless one self-publishes, and the field is changing rapidly. Another is that if one wants to put together a really good book, one has to devote a lot of time to it, and this would take away from my time writing on the web.

I have thought about having someone put together a compilation of some of my web posts and publish it. I could even write a few more posts to fill in the blanks.

One minor issue is that if one wants to keep publishing costs reasonable, one needs to only use black and white illustrations. On the web, color works better. With this particular post, I tried to make illustrations that would print out reasonably well in black and white. If one wants a book that would meet the standards of most "regular" publishers, all of the graphs would have to be reset in a manner that would make them look sort of OK in black and white.

A person can get to my Oil Drum posts on this link:

http://www.theoildrum.com/user/Gail+the+Actuary/stories

In November 2007, I put together a PDF of some of my posts. It is about 110 pages long. In some ways, it is a substitute for a book. It can be found here:

http://gailtheactuary.files.wordpress.com/2008/01/introduction-to-peak-o...

Quite a few of my earlier posts can also be found, in written out form, on that site. I have not been adding ones recently, because the Word Press site and The Oil Drum use different forms of HTML, and making the translation takes time.

Gail,

I want to complement you on your clear, uncluttered graphs. I think color is highly overrated. Especially on a low resolution medium like computer screen. Please don't make extra work for yourself. Timely access to clear information on an uncluttered display with evenly spaced grid lines is my strong preference.

Thanks.

Hi, memmel. Pleased to meet you.

I too think that reading too much into the numbers is a trap.

To handle that, I go the other direction than you are suggesting...I keep bringing the audience back to the big picture so that they don't get hung up on the numbers, margins of error, etc. etc. When making a public presentation, audience members with an analytical bent to them can derail a conversation with their questions if they are overly indulged. I redirect the conversation quickly away from the specific objection and point out its irrelevance in the bigger picture so that I can keep the other members of the audience focussed on the important bit: the inescapable nature of Energy Descent and how they are going to respond.

-André

Yes I agree either way the point is that detractors of peak oil often use "numbers" so no matter how you deal with it its not a numbers game. At best if your lucky and eventually get good real numbers it will help you decide the best approach to mitigating peak oil. Other than that the number don't matter.

lol you mean so they don't get hung up on the facts ...?

See the next sentence to see what I mean.

Andre,

I found your presentation interesting but not persuasive.

You mention a show-stopper: scale.

I'll come back with a single line reply: different peaks.

Peak oil is here about now, and will indeed have severe consequences.

However, although it may be in fairly short supply, peak gas is not here yet, and peak coal even on Dr Rutledge's estimates is come time away.

You then give the scale of substitution we need and declare it not possible:

To use the most developed of the alternatives, you mention that it would take 52 nuclear plants worldwide per year, presumably of 1 GW for a total of 52GW.

At the peak of the seventies build around 18 a year were built.

Present reactors are often of around 1.5GW, so we would need around 35 a year.

China alone plans to have the capacity to build 10 a year plus some pebble-bed reactors by 2020, and are ahead of plan.

So what is not do-able?

None of that is to detract from other sources of energy, as wind-power alone will make quite a contribution.

The second strand of your argument is that this is electricity, not liquid fuel.

This is a very valid concern, and will cause great difficulties.

However, oil supplies are not going to stop dead, but will certainly need to be used more wisely.

Natural gas, sometimes liquified can also be used for many of the things oil is, and coal can be liquified as you say, and by your own argument we appear to have at least some leeway in greenhouse gas emissions.

Of course, batteries and other storage mechanisms are the real long-term answer, but it is the fact that NG and coal are not peaking at the same time as oil that may allow us to bridge the gap.

Providing all the power a technological society needs seems eminently do-able.

Hi, DaveMart. That is a valid point of view that you are advocating. I'm choosing to disseminate the point of view I outline in my presentation.

Best,

Andre'

Actually Andre, you seek to present your case rather more strongly than you indicate:

Since there are other points of view which you characterise as valid, how and in what way is this a myth?

If you wished to make the rather weaker presentation that you thought it unlikely that we could ramp up in time due to crises points, well and good, although similar difficulties might also be encountered in the options you favour, but to seek to characterise the rather modest target of about doubling the yearly number of units of a non-fossil fuel alternative as a myth is surely a misrepresentation, and profoundly misleading to your audience.

Hi, DaveMart.

I understand that you don't agree with my line of thinking; let's agree to disagree on this because I'm not interested in exploring this with you. I'm very familiar with your writing from other posts and I think I have a good idea of what your opinion is. It is a valid opinion, I do not share it and I believe the points I raise stand on their own merits.

Best,

Andre'

Up to you, Andre, but to miss-state is to mislead, and it seems that you are prepared intentionally to present a case you cannot substantiate, which I would certainly not do.

You have actually made no attempt to demonstrate that your points stand on their merits - presumably you rely on your audience not being aware that the figures you give are not so very big or out of line with past practise at all, which since your argument is about scale will hardly do.

Unless of course you want to present your case as a myth.

Dave, I suspect that Andre wishes to encourage powerdown and a more "green", less energy intensive society for its own sake, and if advancing that goal requires intentionally misleading his audience about the scalability of non-oil sources of energy, he's more than happy to do that.

I certainly hope that you are wrong, and that upon reflection Andre will wish to give a more balanced presentation, and let the merits of his own case be only such as can be shown to be genuine - I would certainly wish to do that for any argument I wished to present, as is only fair to the audience.

People who seek to mislead usually do so because they are aware that their case is weak.

This seems quite rude Dave. Because Andre disagrees with you does not make him misleading. Perhaps he does not believe that nuclear power will scale rapidly enough to make up for falling supply. Or that promised technical advances will arrive on time.

The Hirsch report makes clear a 20 year head start is needed to avert economic difficulties. If peak oil is in 2010 then we don't have 20 more years.

Then why don't you put together your own presentation and offer it up.

It certainly is in no way intended to be rude.

I think if you re-read the argumentation in this thread you will see why this is phrased that way.

He may be correct that 52 nuclear plants or the equivalent in other power sources may not be possible to be built.

Alternatively, he may be correct that even if this can be done then as they would be producing electric, not liquids then it would still not be viable.

The point I brought up was that Andre presenting the possibility of such a build as a, in his words, 'myth', when in fact it is well within the same kind of order of build as that which has already been done in the past, which his audience may not be aware of.

And so, without in any way meaning this personally, I stand by my statement that this is grossly missleading.

He states clearly in his presentation that the problem is one of scale - please check back to it.

Had he presented the actual historic scale comparisons fairly his argument would not look very impressive.

DaveMart:

"The point I brought up was that Andre presenting the possibility of such a build as a, in his words, 'myth', when in fact it is well within the same kind of order of build as that which has already been done in the past, which his audience may not be aware of."

I would question your assertion that, because we once were able to build 18 nuclear power plants a year (back in the 70's when concrete and steel were much, much cheaper) that it is "well within" feasible limits to build 56 per year over the next decade or two.

I do not know your age or location, but I was college-aged and living in the heart of Commonwealth Edison territory (northern Illinois, USA) during their monumental nuclear build-out. I grew up about 10 miles from one of their plants, and within 50 miles of several more. It was fascinating, and horrifying, to watch the kinds of hiring practices they had to engage in to get enough workers to build their plants. Buying of union cards by unqualified workers was commonplace. Reports (from friends and neighbors who worked there) of on-the-job alcohol and drug-abuse were the norm. Short-cuts to keep on schedule were demanded, like the day my neighbor saw a 55-gallon drum slip and fall into a concrete pour of the containment vessel. He was told by his supervisor to "let it be, we have to stay on schedule". Perhaps you never read of the scandals regarding falsified QC x-ray records of welds...

My point is that it was very difficult then to get enough qualified workers to meet schedules in a safe and proper manner. I'd ask where you get the optimism to think we could do any better at 4 times the rate of construction.

That's always been my big concern with nuclear power plants: the need to execute to near-perfect standards (do you want a half-assed nuke near your house?) butting into the pressure to keep to tight schedules and avoid delays in getting them into the rate-base seems like a Really Bad Way to power our society. Well, that plus the market-distortions induced by the infamous Price-Anderson Act, of course :-)

Larry

Andre may be correct, my concern was solely that I felt that he is overstating his case - but I would point out that at the same time as the maximum nuclear build was taking place plenty of other sorts of plants were being built.

In an effort to avoid over-stating my own case I also gave the present Chinese coal build as the lowest I could reference, around the 52GW needed power per annum.

I have since checked more carefully and it last year it was around 90GW, admittedly that is a different technology but it perhaps goes to show that the size of the build needed is not unreasonable per se, especially considering we are talking about what is possible by the whole world, not just China.

To re-iterate, my comment is not about nuclear per se, but just to assess whether builds on the scale that Andre is talking about are as 'mythical' as he asserts.

Wind power, and perhaps solar and geothermal will take a fair chunk out of the needed build anyway, as will nuclear build in China, where regardless of what you or I think of safety they intend a build of around 10 reactors a year by 2020, and they are ahead of schedule - at 1.5GW a reactor that is over 25% of the specified build.

It is clear that he has greatly over-stated his case on the impossibility of a build on the scale needed.

For people who are following along, I'm going to point out that DaveMart is saying that it is within the realm of possibility that we (i.e. humanity) can build 52 nuclear reactors each year for 50 consecutive years for a total of 2600 nuclear power plants — all while we are experiencing Energy Descent.

For people who are REALLY following, I am talking not just about nuclear, I used the nuclear figure as it is convenient as it was given in the link in 1GW stations, so we actually need according to the presentation 52 GW of energy a year.

For reference last year China alone built around 90GW of all sources.

20GW of wind-power was built - the reason I did not use this is that you have to allow for capacity, so at, say, 25% that comes to 5GW of wind power last year in actual terms.

Nuclear reactors are now often around 1.5 GW, so you would only need 35 of them, even assuming no help at all from other sources.

At the height of the last nuclear build we were building around 18 nuclear reactors a year, so we would need about double that - minus help from other sources - and at the time they were simultaneously building plenty of other gas and coal stations and so on.

China alone plans to be building 10 nuclear reactors a year by 2020 - and they are ahead of schedule.

If the argument was that it will be difficult, especially in a world short of oil, that is fine, but to say that it is 'mythical' and it does not 'scale' clearly implies that we are attempting something way beyond anything which has been done before, which is clearly and simply untrue.

The presentation for that reason is tendentious and highly misleading.

I have over-stated things myself on occasion, we all do, it is human nature, but I always amend when this is pointed out, and present my case more conservatively.

I think Aangel has let his enthusiasm run away with him, to the extent of making unfair arguments without proper balance - trust your audience, and let them decide.

Hi, DaveMart.

I suggest that you're still not thinking through this.

Using an average build time of eight years, what makes it especially mythical is this:

Year 1: 52 starts

Year 2: 52 starts, 52 in progress = 104

Year 3: 52 starts, 104 in progress = 156

Year 4: 52 starts, 156 in progress = 208

Year 5: 52 starts, 208 in progress = 260

Year 6: 52 starts, 260 in progress = 312

Year 7: 52 starts, 312 in progress = 364

Year 8: 52 starts, 364 in progress = 416

Year 9: 52 starts, 52 completions, 416 in progress

The world would have to be building 416 nuclear power plants each year for decades if we were to go all nuclear and wanted to replace oil only through that means.

You are welcome to play with the numbers all you want (35 power plants per year instead of 52, etc.), you can throw in a few million wind turbines, perhaps a few tens of millions solar panels and I assert that any plan that you can come up with that would replace oil -- while oil itself is depleting -- will be mythical.

That's what I mean about not letting public discussions devolve into a battle of numbers. (Here is fine obviously.) There is no set of numbers grounded in reality that will have us avoid Energy Descent.

Hi Aangel,

I would like to emphasise that I simply feel that you have let your enthusiasm get the better of you, and no personal disrespect is intended.

The basic point is that you can fairly make the point that it will be a lot more difficult to carry out builds post peak oil, but as against that you have to take into account that they would be prioritising building power units much more than we had to in the past, when they did not really absorb a very substantial proportion of our efforts.

The build required, even on your terms, and I note that Nick, who is pretty well versed it seems in many engineering issues, has cast grave doubts on those, is really very modest compared to many past engineering efforts.

What you are essentially doing is just casting numbers in a fashion which says-'Wow! That's a big number!'

It is just as easy, in fact easier, to cast them in a light which would show them as being very small, for instance on the same numbers we could say:

'All we have to do, is for the whole world together to build around half of China's build for power, but move it across to other proven technologies like wind and nuclear - not to mention coming technologies like solar energy'

It really doesn't sound so daunting shown that way, does it?

The same thing applies to your 464 in progress numbers.

For a start, you have used build times which have some relevance to the west, as long as they are not in series production, but include lead-in times and preparatory work, when much of the build will happen in places like China, where periods like 4-5 years are more appropriate.

Secondly, you have assumed that the whole build is nuclear, when even at the moment around 10% of the build is wind power, where a time of two years or less is more appropriate.

Even using your figure of 464 under construction, with a population of 6.5 billion that would mean that one reactor would be under construction for every 13 or 14 million people on the earth - it doesn't sound so huge then, does it?

So there are plenty of numbers grounded in reality which would allow us to avoid energy descent.

The biggest obstacles are faulty risk assessment when the main problems are the lights going out and global warming, and even more importantly the fear held by many in the financial community that prices will suddenly drop for fossil fuels, as they did before at the end of the seventies, leaving them high and dry with expensive investments.

Your argument that the scale is too great simply does not hold water, and is well within previous construction experience.

Other arguments such as Gail or Leanan might argue (without putting words into their mouths) that financial breakdown and so on would prohibit it have much more substance, as does to some degree your own argument that shortages of fossil fuels will cause severe difficulties.

I look forward to seeing your comprehensive plan to address Energy Descent, then. Please submit it to the editors here and we can all study it.

Best,

André

This is to switch the grounds of the argument.

You have made specific statements that the needed build is 'mythical' and out of scale.

Myself and others have clearly shown that it is neither.

I have even suggested other lines of argument which are more soundly based.

All that I am asking is that you present your ideas fairly, and without unduly distorting reality to suit your case.

I find your case itself perfectly arguable, if perhaps somewhat unrealistic in it's assumption that we can cope by reducing consumption and switching to a new paradigm or whatever was the somewhat hazy end point, but dislike any misrepresentation at all as smacking of propaganda, and feel that we owe our audience the most moderate and conservative presentation of our case possible.

If you overstate and someone finds out about it they are very likely to dismiss your whole argument out of hand.

There is nothing wrong in saying that in your judgement such a build would not be possible, you know.

But of course the real problem is that you have overstated your case to yourself, as is clear from your statement that you would seek to drive interlocutor's from point to point, until there was no escape from your remorseless logic.

That is a problem when your case is based on assumption, not logic.

I don't know and neither do you for sure what is going to happen, nor are all the parameters which will influence it quite clear, and you are fooling yourself if you imagine that you have total insight.

Aangel, come back down to earth.

And it gets worse. All those "in progress" nuclear plants (or any other alternative power source) are pulling energy out of the economy. Build too fast and you don't have a power source, you have a power sink. Nuclear is estimated at a maximum build of 10% to just break even. To be a source of power, the growth rate would need to be lower. To supply anywhere near the percentage of power we get from oil, the growth rate would have to be a very low 1-3%.

Pearce, J.M. (2008)

‘Thermodynamic limitations to nuclear energy deployment as a greenhouse gas

mitigation technology’, Int. J. Nuclear Governance, Economy and Ecology,

Vol. 2, No. 1, pp.113–130.

Based on build time, wind is slightly better (very simple tech). Based on EROI, solar PV is far worse.

"All those "in progress" nuclear plants (or any other alternative power source) are pulling energy out of the economy. Build too fast and you don't have a power source, you have a power sink. "

You seem to be assuming a very low E-ROI. Everything I've seen has shown an E-ROI of 20-50 for wind, solar, nuclear. What numbers are you using?

I have been reading one paper after another on nuclear power and the EROI values are all over the map. Some are clearly biased low (they include things like interest which are not part of the construction cost) and some are biased high (they leave out steps of the fuel cycle). I recommend you read the paper itself, because he does a literature review and he uses a range of values for both the US and Europe.

Second, an EROI of 5:1 means that an energy source is consuming 20% of the energy it is generating. It does not take much growth in a capital intensive energy source to reach 20% even if the source initially has a 20:1 EROI (5% energy consumed in production).

Hall states that 5:1 is roughly the lowest that civilization can tolerate and this puts a cap on the investment rate.

Energy return of a fuel source is only the first steps in using a fuel, and margin must be left for all further steps. It could well be the margin that must be maintained is higher, like 10:1. I have some thoughts for how it could be calculated, but I have not done the math yet.

I don't really trust EROI calculations too much, it is too difficult to distinguish 2nd and 3rd order derivatives.

Fortunately, I don't really think it needs worrying about too much, as money is fungible and does a better job in the real world of showing costs, as no-one forgets to charge for their work.

In that connection it should be noted that fuel costs a small fraction of the power costs from a nuclear reactor, so providing no-one is giving away their services for free there would seem to be plenty of leeway.

So the worry would seem to be somewhere in the future, rather than in the present.

Should we be worried about that?

Not really, as we already have lots of ways to greatly increase the EROI of nuclear energy, which I won't insult your obviously considerable knowledge by belabouring, but include the obvious breeder reactors, the research at Idaho directed to raising fuel burn from 9% to 14%, annular fuel, re-processing, molten salt reactors which would increase fuel burn to around 50% from 1%, better conversion of the energy to electricity via thermionics,extracting uranium from seawater, or even the very low tech method of siting a buried reactor close enough to a town to pump the cooling water there and use it for heating, which if money is really tight and building a lot of reactors expensive in a constrained fossil fuel environment might be a preferred option.

You could also use a CANDU reactor or others to burn thorium.

Just like Hubbert, who felt that the answer to peak oil was to move on to nuclear generation, and that that power source is effectively unlimited, I don't think we need fear 'peak uranium'

" It does not take much growth in a capital intensive energy source to reach 20% even if the source initially has a 20:1 EROI (5% energy consumed in production). "

Well, it would take quadrupling the energy input. That's a pretty big change.

I've seen a lot of controversy over nuclear and solar PV (although I know enough about PV to confident that PV's E-ROI is high), but I haven't seen any suggestion that wind's E-ROI is not high enough. Have you?

It sounds an incredible stretch to me to worry about the EROEI of PV, but presumably solar thermal is safe just like wind from even the most fevered EROEI critique Nick, as it uses very similar materials to wind energy?

I would make a wild guess that CSP's E-ROI is roughly half of wind's, as wind costs about half as much per KWH, and they're roughly similar manufactured goods. OTOH, wind's E-ROI is pretty high, so I agree that CSP should be in good shape.

Yes, quadruple is a large change, but most assume that reinvestment can reach 100% It is a mistake to imagine energy source growth so fast it creates energy sinks and that society can survive in that fashion.

As for wind, I thought the TOD summery of wind EROI was quite good. Although no accounting was made for new transmission systems or load leveling costs.

I am not against any of these energy sources. I am in favor of finding the limits to how fast they can scale.

" most assume that reinvestment can reach 100%"

I'm not sure what you mean.

"It is a mistake to imagine energy source growth so fast it creates energy sinks and that society can survive in that fashion. "

I don't think anyone is proposing that.

Perhaps you're assuming that new forms of generation have to be powered by themselves. I can't see any reason to apply such a limit, when we don't apply that logic to existing infrastructure. We just ask: "how much is needed, and what forms of generation can provide it?"

Right now, for instance, electrical demand is growing at about 1.5% per year in the US, or about 7GW per year. In the past such new capacity would have come from fossil fuels as a normal part of reinvestment. That suggests a need for perhaps new capacity of about 15GW of wind, 4GW of solar, and 2GW of nuclear. At 30%, 20% and 90% capacity factors, respectively, that gives us our 7GW of average output, and at 15%, 75% and 95% peak capacity factors, respectively, that gives us our 7GW of peak output.

Pearce has placed his paper behind an internet wall, so we only judge it by what he tells us, and what he tells us sounds a lot like the often refuted "storm-smith" arguments. But in this case, I will simply refer to "storm-smith" who were unable, despite a who lot of fudging, to show that the Energy input for nuclear power came anywhere close to its outputs. You are not engaged in a serious argument, if you insist on using the title of an inaccessible paper, and saying the author argued such and such, if no one can read the paper. This is a black box approach to debate, and it is used by people who have contempt for rationality.

Hi Charles,

It has been my experience that State Universities are quite welcoming to the general public. There you may read the article in full.

My preference is to rely on peer reviewed literature where available. You are welcome to a different view.

JonFreise, we are talking about a highly obscure journal. What are the chances of finding it in the library of a second or third class university? No one seems to have actually read ‘Thermodynamic limitations to nuclear energy deployment as a greenhouse gas mitigation technology’. Basically we have a bunch of second hand reports that may or may not have originated from Pearce himself. We have no idea about what Pearce's sources are, what are the on which he based his analysis, or what conceptual tools he used. To argue that Pearce conclusions must be true on the basis of his unknown argument, is highly irrational. Nor is it rational to send me rummaging through university libraries, for a journal that may not even be in their holdings. If you know what Pearce actually argued, set it out. It is incumbent on you and Mr. Pearce to set out the case that he makes.

So far you appear to be arguing out of ignorance.

JonFreise, we are talking about a highly obscure journal. What are the chances of finding it in the library of a second or third class university? No one seems to have actually read ‘Thermodynamic limitations to nuclear energy deployment as a greenhouse gas mitigation technology’. Basically we have a bunch of second hand reports that may or may not have originated from Pearce himself. We have no idea about what Pearce's sources are, what are the on which he based his analysis, or what conceptual tools he used. To argue that Pearce conclusions must be true on the basis of his unknown argument, is highly irrational. Nor is it rational to send me rummaging through university libraries, for a journal that may not even be in their holdings. If you know what Pearce actually argued, set it out. It is incumbent on you and Mr. Pearce to set out the case that he makes.

So far you appear to be arguing out of ignorance.

The solution is quite simple, and I am sure that the Chinese already have a plan to do this. Build a very large factory. Im part of the factory build barges on an assembly line. Once the barges are complete float them over to another assembly line where you start ass4embling a reactr ib top of the barge, You move the barges down the assembly line as the reactor is assembled part by part. Once the reactor is finished it is floated out of the factory, and a tug boat pushes the barge to its final destination where it is moored and attached to the local grid. If the United States built 2750 Liberty Ships during world War II, The United States or China can build 52 reactors a year.

http://en.wikipedia.org/wiki/Liberty_ship

Picturing this requires vision. Vision is something that is in exceedingly small supply on The Oil Drum.

You mean Homer Simpson needs re-training? ;-)

Here, he is saying Andre is misleading when Dave has spammed this board with so many exaggerations about nuclear power he was finally asked to stop turning every thread into a campaign for nuclear power. All while refusing to consider the limitations others brought up with regard to financing and TIME. He blithely ignores the economic downturn and the fact that the preponderance of evidence suggests a near-term Peak.

But he's not misleading anyone.

The goose and the gander.

Cheers

I have already had enough samples of your idea of 'debate' ccpo. I really can't be bothered reading any more.

Enjoy your prejudices.

My post has nothing at all to do with the desirability or otherwise of using nuclear power.

It was convenient to use the numbers from nuclear power stations for illustrative purposes for two reasons, it comes in 1 GW lumps and considerations of availability are not so difficult to work out as wind or solar, and secondly it is a more mature technology and so it was also easier to illustrate that the rate of build needed was perhaps not so greatly ahead of what we had previously done that Andre's assertion that it was 'mythical' appeared unsustainable.

Both wind and solar might well be preferred alternatives in many parts of the States, and certainly there are good possibilities to greatly reduce solar costs in particular, in which case once again the build would appear very do-able.

It is becoming very irritating Dave to have to wade through your inane arguments about academic minutiae regarding the absolute accuracy of someones genuine attempt to advance teh general awareness of peak oil. Not all of us are university educated gits, some of actually have to work for a living, producing all the stuff like oh...food for example nd computers and keep the internet running. The question is not if we need 35 or 2 nuclear reactors, the question is how do safely power down our societies and somehow make the transition to a low energy sustainable futre without anihiliating ourselves, or destrying the life support system that is planet Earth. Your constant nitpicking and criticisms are irritating and detract from the useful debates that concentrate on proposed solutions and merits and drawbacks.

This assumes that your thesis is correct, and have identified the question correctly.

Conservation is indeed the first priority in my opinion too, but perhaps such a large power-down as you seem to be saying is needed can be avoided.

It remains possible that you are wrong, and so it is worth checking that we are assessing issues correctly.

I cannot see the utility of miss-stating issues, and would be equally concerned if a position that I supported were so miss-stated.

It is not nit-picking when it seems that whole chunks in the chain of reason presented are unsubstantiated or poorly stated - the whole shebang may be wrong.

In fact, on occasions when I have over-stated my case, which happens to all of us, I have withdrawn and tried to be more accurate in a re-formulation.

A lot of dumb decisions are made by people making what according to you are 'genuine attempts' to do this and that - I prefer that the genuiness is expressed through a devotion to accuracy in as far as is humanly possible.

BTW, your 'mythical' number of nuclear plants that you say the whole world can't build, around 52 a year, is about the same as the number of coal plants China alone is building every year.

If it is all a question of scale, you have got your scales wrong, and if you are aware of that and are still using it in your presentations are grossly misleading your audience.

Please don't compare building coal power plants with building nuclear power plants. If you do, you'll look silly.

Of course nuclear plants are more complex and expensive than coal, but we are talking about scale, and the world is also a great deal bigger than China, which anyway plans to build at least 10 nuclear plants a year by 2020 in addition to wind and coal plants.

Therefore the analogy I used helped to give a reference scale - a candid mind would also see that I had already offered others.

No, you are talking about coal plants and nuclear plants. They aren't the same in any way, shape or form. not in cost, not in structure, not in public perception.

You keep saying something like France built N plants in X years. Somehow that N (12? 17? Don't remember) magically becomes 52!

Get off it, Dave. You're repeating yourself, insulting people for no reason other than your love of your agenda and then acting like the school yard bully and blaming the guy you first attacked.

Yawn

Cheers

The biggest thing Dave is failing to acknowledge is that the world, as a whole, is at the limits of its ability to produce large things like power plants. There just isn't enough spare concrete and steel production to be turned towards building 52 nuclear reactors a year. There certainly aren't enough trained engineers to work on the projects, and I don't want wet behind the ears college grads doing design work that the whole world's life depends upon.

Even if, somehow, we are able to avert the immediate disaster of our primary transportation fuel declining in production, it doesn't remove the overall problem. Our world is finite. We cannot continue to expand and expect it to support that expansion forever. Unfortunately, there's a lot of inertia in the growth of the past 200 years, and when it reaches hard limits the impact is goign to spectacular.

Huh? Although the technologies are radically different, the concrete and steel and so on for a large coal plant aren't THAT far out of line with that needed to build a nuclear plant, and China alone managed to build 90GW of the things last year.

Wind power takes far more of both, but in any case I was not seeking to argue the case for nuclear power, just that a build of the size Andre specifies is by no means 'mythical'.

Now it will be a lot tougher with limited oil, but the case that it is entirely impossible needs to be argued, not assumed.

As for the second point, that the world is finite, sure it is, but the question is when we actually hit the buffers.

In that context it is perhaps worth noting that Hubbert himself, on whom so much of the intellectual foundation of this site is built, felt that although resources of fossil fuels and more particularly oil were so limited that we would have to move on, the resources of uranium and thorium are so great that we could securely base an industrial economy on them, without worrying about a Hubbert's peak.

It seems strange that so many disregard this element of his thinking.

I agree that going forward we are going to have more problems than we have in the past.

I also agree that we are reaching limits.

It is hard for me to imagine us building 52 nuclear plants, but I wouldn't rule out entirely the possibility of some source of energy/electricity that might be available on a widespread basis.

I seriously doubt all of this would keep us close to where we are now. Electricity is not a liquid fuel. It doesn't keep the roads paved. It doesn't make plastics. It doesn't maintain the electric grid.

I expect the world will change dramatically, if for no other reason than the fact that any change has a long lead time. Building 52 nuclear plants would take at least 8 years (including finding sites for the plants, finding people, finding materials, etc.) even if it were done on an expedited basis. If the finances of banks and the federal government are in disarray because of peak oil related issues, I would expect it to take much longer than 8 years.

"It is hard for me to imagine us building 52 nuclear plants,"

It's important to realize that we don't need to build that much - maybe 10, and that's if we did only nuclear.

First, the calculations are incorrect. It assumes that oil BTU's and electrical BTU's are equivalent, and they're not. One electrical BTU can propel a vehicle 4 times as far as an oil BTU. Thus, for vehicle fuels (which are 70% of the problem), the numbers are 4 times too high. For the remainder, that ratio varies between 2 (efficient thermal electrical generation) and 4 (residential heat pumps), and is perhaps an average of 3. 1/4 of 70% is 17.5%, and 1/3 of 30% is 10%, for a total of 27.5% of what the chart presents.

2nd, we already have much of the electrical infrastructure in place: more than 4/5 of the capacity needed to replace US cars with EV's already exists. That reduces the new construction needed by another 80%, reducing our need from 27.5% to 5.5%! Now, that's transportation, which is only 70% of oil consumption, but you get the idea...

We have plenty of steel and concrete to build nuclear reactors. They use much less steel and concrete than underground coal mines, after all. We aren't building a million extra houses every year and that's a lot of concrete and steel.

Building 52 nuclear plants would take at least 8 years (including finding sites for the plants, finding people, finding materials, etc.) even if it were done on an expedited basis. If the finances of banks and the federal government are in disarray because of peak oil related issues, I would expect it to take much longer than 8 years. - Gail the Actuary

Gail you assume business as usual. If you want to build a lot of Nuclear plants quickly, first you build a factory, than you build the plants on an assembly line, just like Henry Ford built cars. Before Henry Ford the auto manufacturers built car kits. When someone bought a car, the manufacturers shipped a kit by rail along with a team to assemble it. The cars were assembled at the home of the purchaser. The building method was expensive and time consuming. The workers were not very productive, but were highly skilled and highly paid. Ford used low skilled workers, who only knew how to attach one part to a car as it came down the assembly line. Why should we build reactors the way people built cars before Henry Ford?

Absolutely. His messianic belief in nuclear is astounding. A useful expense of his time and energy would be in defining where nuclear is THE answer and advocating for that. I am quite certain such places exist. This, "Nuclear can save us!" bit is OLD, BORING and highly, highly unlikely.

One more time: near-term peak *alone* destroys the fantasy of an Earth-saving nuclear build-out.

Cheers

I want more nuclear power since it can create lots of prosperity post peak oil for Sweden, Finland, Denmark and so on. There will probaly not be powerplants built everywhere but keeping the light on for myself, my neighbours, the nearest countries and exporting products across Europe and globally is a good thing. I wish that everybody who can invest in long term power sources and productive enterprizes do so.

What parts of the US are investing and will continue to be prosperous for decades and manny generations?

Yesterday I read a new open paper for planned nordic grid investments and one of the serious planning scenarios is to prepair for the grid parts needed around 2020 if global warming accelerates to utilize likely additional hydro power and power industry north of the arctic circle. And I know that this is not wishfull thinking since previous plans have been followed thru and since the investments are productive they are financed by their utility and not debt.

I think the early post peak times locally will be a time of economical growth and change if people react in a good way.

The global production in nuclear power plants peaked in 1984 with 29 reactor completions in that year. 27 in 1985. 22 in 1986. 20 in 1983.

Ultracapacitors combined with batteries look good for electric and hybrid cars. But those will take a long time to transition for new cars built. 60 million new cars and trucks each year and only 1 million or so hybrids and electric.

So there needs to be a program to address the efficiency and convert the 800 million cars and trucks already on the road.

Some big things like after market aerodynamic improvements to trucks and cars. Less than $1000 could provide 25% better highway mileage. Ultracapacitors can extend battery life and performance.

China has 60 million electric bicycles and scooters. Those are $200-300 devices that can enhance the convenience of mass transit. 20-30 million are being added every year and increasing. Electric bikes and scooters are an easier technology to enable. Electric bikes and scooters can achieve highway speeds but most are at city speeds of 40mph or for safety reason 25mph. Within 5 years, China could have converted most regular bike riders to electrics. 400 million electric bike riders.

The Aptera 300 mpg car is basically a three wheel scooter with a shell that can safely transport 2 people and a child and some groceries.

For regular oil, Bakken exploited with Stackfrac horizontal drilling ($1.7 million per well, many with payback in 11 months or less, light oil),

http://nextbigfuture.com/2008/02/multi-stage-fracturing-of-horizontal_29...

Thai/Capri drilling, tech for better oilsand recovery.

http://www.wcpipeline.com/article_1993.php

I agree that the economic impact is probably larger than I say in this post. A lot of people don't seem to get the connection at all, and I felt this is where I needed to start from. I need to do more writing about this subject, but I didn't think this introductory post was the place to do it. One issue is that the presentation/post is getting long; partly, I do not want to demolish all hope in possibly a person's first introduction to peak oil. Peak oil is hard enough to take on its own.

You do a good job of covering a lot of areas in your presentation. With respect to saying that nothing will work to avoid an energy descent, I think that the probability is 99% in favor of what you are saying. At the same time, I don't want to overstate the case, and I don't think an initial presentation is necessarily the place to completely box people in. It seems like as one learns more and more, the situation looks bleaker and bleaker.

Hi, Gail. Yes, it can be quite a shock to the mental system. When I give a talk, I come from the place that, rightly or wrongly, I'm the best person to introduce the topic AND give them openings for personal action. If the person learns of peak oil on the web often they get the importance of peak oil but there is no one beside them saying, "Ok, this does not mean we're all going to die. It does mean that we are going to live very differently, though, and if you take concrete steps now you'll be better off." My goal is to deliver both messages while I have their attention. After they leave my audience, I don't usually have a second chance to move them to a better line of thinking. Once they go out the door, my opportunity to impact them is over.

To be able to include the second part of the conversation in a limited amount of time I must box them in with respect to the first part or they won't be with me as I start to discuss what's still possible in the face of peak oil.

As for the 99% probability, you are technically correct but it makes no difference in the real world (I don't think you honestly believe the 1% chance of us avoiding Energy Descent will come true) and including the 1%, to my thinking, just dilutes the message and takes away valuable time.

I say box them in and get them to deal with it: some people are fragile, that's true, but the other 95% of the audience can be related to like they are powerful, competent adults who want the full story the first time. I'm not oblivious to the other 5% but time is short and I believe I can do the most good in the least time with my approach.

-André

This is an excellent point: "We can never transition more than a fraction of our existing infrastructure because of the size of it — even with extremely generous (i.e. high) market penetration rates. I find that if I don't handle the general case in that way, someone always comes up to me with the "technology du jour" and misses the point that we are in for an unavoidable energy descent." In addition, using oil to get electric power will accelerate oil depletion. The development of solar hardware uses much energy and yields only electric power that will not be useful for planting, harvesting, transporting, and heating. See pages 16 to 28 of the report below for a review of the literature that documents the lack of capacity for the so called alternatives to oil. Also, oil depletion means a collapse of the global economy and the systems that support life in the U.S., as discussed on pages 28 to 40: http://www.peakoilassociates.com/PeakOilAnalysisOctober6-2007.pdf

"In my presentations I handle the myth that any new technology or combination of technologies can make up for the decline in energy from oil. I do that by pointing out that we can never transition more than a fraction of our existing infrastructure because of the size of it"

This is unrealistic to the point of being dishonest.

I can think of 4 reasons why off the top of my head, and any one of the first 3 is adequate to refute this idea.

First, the chart you include in your presentation is incorrect. It assumes that oil BTU's and electrical BTU's are equivalent, and they're not. One electrical BTU can propel a vehicle 4 times as far as an oil BTU. Thus, for vehicle fuels (which are 70% of the problem), the numbers are 4 times too high. For the remainder, that ratio varies between 2 (efficient thermal electrical generation) and 4 (residential heat pumps), and is perhaps an average of 3. 1/4 of 70% is 17.5%, and 1/3 of 30% is 10%, for a total of 27.5% of what the chart presents.

2nd, we already have much of the electrical infrastructure in place: more than 4/5 of the capacity needed to replace US cars with EV's already exists. That reduces the new construction needed by another 80%, reducing our need from 27.5% to 5.5%!!

3rd, you say that the original projected level of investment over 50 years (2% per year) is impossible, and give no evidence at all. In fact, it's clearly wrong: most existing energy infrastructure has a lifetime of less than 50 years (light vehicles are 10-20 years), and the average is well below 50 years. Our energy infrastructure is replaced at well above a rate of 2% per year even now. This won't be significantly harder to do with non-oil infrastructure (coal/wind/solar/nuclear/PHEV/EV's, etc) - yes, wind/solar/nuclear are capital intensive, but they don't use fuel (except for uranium, which is cheap, and coal, which isn't that capital intensive), so they pay for themselves very quickly. Such a level of manufacturing and construction is a small % of our manufacturing and construction capability.

4th, even after 50 years we'll still have at least 30% of our current liquid fuels production, should we need it. Oil will still be around at least 20% of our current production (unless we've been smart enough to phase it out, as we probably will for everything but a minority of aviation needs), and other liquid fuels will be possible - heck, even now we produce more than 5% of US liquid fuels with ethanol (yes, it's low E-ROI, but we have plenty of coal for the energy input, if needed; and yes, it's low BTU/gallon, but appropriate compression ratios can solve almost all of that problem). CTL is available, if we're willing to put up with the pollution (which we would, before allowing an olduvai).

To scare people like that is just irresponsible, and probably ineffective, as it will reduce your credibility: some will go into denial, and some will recognize that you're misleading them.

Thanks for your comment, Nick.