Forties - Grangemouth: the failure of a complex tightly coupled system

Posted by Euan Mearns on April 27, 2008 - 8:00pm in The Oil Drum: Europe

The sequence of events (covered here on The Oil Drum previously) that led to the Forties Pipeline closure on 27 April 2008 began in 2005 when BP, currently the UK's largest company, sold Innovene, their Grangemouth refinery subsidiary to Ineos. Ineos is privately owned petrochemicals company that has grown from nothing since its formation in 1998, fueled by debt reported to be €9 billion.

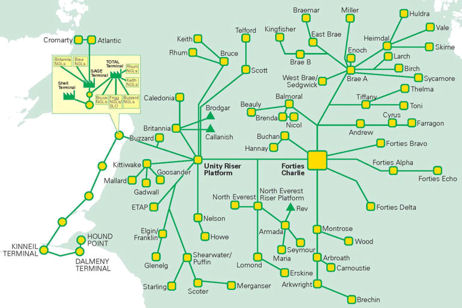

BP, once 50% owned by the UK government, used to own and operate the Forties Field, the Forties Pipeline system and the Grangemouth oil refinery. This is a tightly coupled complex system where oil from the North Sea flows by pipeline to Kinneil terminal where it is either diverted to Grangemouth to be refined and then combusted by energy hungry consumers or it is diverted to Hound Point for export by tanker (see map below the fold). The failure of any vital part of this complex system may close the whole system down. This system is now fragmented and its failure has just happened.

Failure by BP to recognise the dependency of the Forties Pipeline upon vital services provided by Grangemouth, and to provide contingency back up for their loss, is the principal cause for over 40% of UK North Sea oil and gas production now being shutdown.

Incident prone BP are of course not the only stake holder to shoulder responsibility and below the fold I explore the responsibilities of the Grangemouth Workers, Ineos, The Banks, Government and The Media in contributing to this debacle.

Grangemouth oil refinery lies close to the Kinneil terminal and is an integral part of this massive oil and gas production and transportation system.

Ineos

Ineos have grown from nothing in 1998 to become the World's third largest chemicals company today. How was this achieved? Through innovation, research, engineering, creativity and hard work? No, it was achieved by buying assets no longer required by leading companies with borrowed money and..

• Leveraging existing resources to expand sales

• Achievement of cost savings

Why is it that world beating chemicals companies such as BP, BASF, Dow Chemicals, ICI and EVC have chosen to sell their assets to Ineos rather than leverage sales and cut costs themselves? Publicly listed companies are of course answerable to their many shareholders which provides one check and balance in our system of industrial regulation. The objective of making money rightly lies at the heart of most companies - but not at any cost. Ineos is answerable principally to their billionaire owner, Jim Ratcliffe. The safety net of broad public ownership has, in this case, gone.

At a time when refinery feed stock costs are escalating (oil and natural gas), energy costs are escalating, interest costs are rising, banks are deleveraging their risk and requiring higher security cover, it is relevant to enquire how resilient Ineos is? And is it in the national interest to place a lynchpin of UK oil and natural gas production (the power supply for the Forties Pipeline system) in the hands of a company such as this one?

Are Ineos to blame for not settling this dispute with the Grangemouth workforce? The honest answer is I don't know. If the company is making massive profits to line the pockets of one majority shareholder then the move to reduce worker's remuneration must be seen as feudal and inexcusable. If on the other hand Ineos are facing troubled waters and the move to revise workers pension rights is designed to protect the company then that would be a different situation altogether. Only time will tell.

BP

The dream that was BP, created by Lord John Browne, has turned into a nightmare. The Thunderhorse platform nearly sank, Alaskan pipeline leaks, Texas Refinery explosion and now the closure of the Forties Pipeline system - when will the series of high profile incidents end?

BP seem to lack the management skills to run large complex projects reliably, all the time. When they sold the Grangemouth refinery to Ineos they must have known that they were also selling services vital to their highly profitable Forties Pipeline system and in so doing they were relinquishing control over this prime asset, vital to their own, their shareholders' and to the nation's best interests. One must presume therefore that the risk of losing the pipeline to an incident at Grangemouth was evaluated by BP management and was regarded as a risk worth taking.

I would argue that a large public company like BP should have identified this risk and set in place contingencies to mitigate it - such as retaining part ownership of the power plant or building a back up system.

Of course the cost of doing so may have been too high and running the risk of Grangemouth failure chosen as the better option. It will be interesting to see if third parties who pay handsomely to use the Forties Pipeline system take any action against BP for their losses. This is not in my opinion Force Majeure but force avoidable.

The Scottish Government

Energy policy is not a devolved power to the Scottish Parliament which must therefore by held largely blameless in the current dispute. By Friday, First Minister Alex Salmond was making the right noises about workers and management getting together but by this time they were all likely down the pub and this intervention was rather late.

The UK Government

Last week the UK Government, led by Prime Minister Gordon Brown, was pre-occupied with un-muddling a tax muddle of their own creation and with preserving their own fragile popularity while a crisis to the nations energy supplies was unfolding. Gordon Brown has for too many years seen the North Sea as a source of tax revenues for his profligate spending and lacks understanding of the vital roll North Sea oil and gas has played in providing energy and energy security to the United Kingdom.

The Government's understanding and approach to energy issues is utterly shambolic and this ignorance and indifference has contributed significantly to the current crisis. The government should be well-advised on the interconnectivity and interdependence of strategic resources within the UK and should be prepared to speak out and act when the nations vital interests are threatened.

It is Gordon Brown's government that has presided over and encouraged the debt binge that threatens to topple our financial institutions, which has made possible the sale of strategic assets to private equity venture capitalists and banks whose sole interest is to line their own pockets with little regard for public service and national interest.

Whilst other European countries make strides towards energy security and energy independence, the slide in North Sea production pushes the UK ever closer to the brink of energy poverty and electricity blackouts.

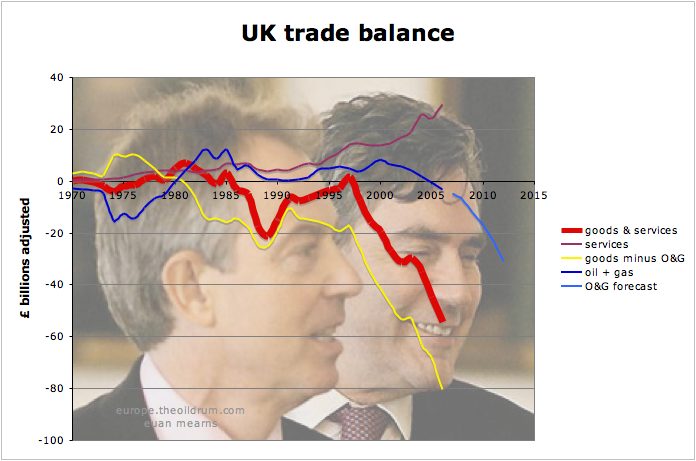

Leader Tony Blair and Follower Gordon Brown have presided over an unprecedented plunge of UK trade into the red. This is about to get much, much worse as North Sea oil and gas production declines and we are forced to import ever larger amounts of oil and gas from overseas using a currency in free fall (see below). This forecast is 9 months old and is based on what is turning out to be over conservative estimates of oil and natural gas price inflation. You can maybe run an economy on debt for a while and garner popularity as a result - but it is not sustainable and is down right irresponsible.

The plunging Pound against the Norwegian Krone (courtesy of Yahoo Finance). As the UK imports ever increasing amounts of gas from Norway and has little to offer of value in return, the currency takes up the slack in a nose dive towards the North Sea. Savvy investors will have seen this coming, little comfort though for the poor and elderly families in the UK who will shortly be unable to afford to heat their homes.

The Striking Workers

Since Margaret Thatchers felling of the UK coal mining industry and with it trade union power back in 1985, strikes and industrial unrest that once plagued the UK economy have become a rarity.

A two day strike over the protection of workers pensions does not seem unreasonable action to take. However, the workers should focus on venting their ire against their employer and doing what they can to ensure that undue hardship does not spill over to the Scottish People and other oil companies that have this nations best interests at heart.

Forcing closure of the Forties Pipeline and over 40% of UK oil and gas production is disproportionate to the pensions grievance, in my opinion, and so I would urge that if further industrial action is taken that a way is found to keep the power plant and pipeline open. Doing so will be a sign of moral strength.

By all means do all you can to damage the financial viability and reputation of your employer upon which your livelihood depends but try not to let this spill over into the wider community.

Pensions in an a fossil fuel energy declining world

The Grangemouth workers cannot be blamed for not understanding the energy decline crisis that confronts the OECD. Throughout the 20th Century, abundant and cheap supplies of fossil fuels (oil, natural gas and coal) powered industrial growth and economic growth upon which the current pensions system is based. Workers rightly believe that it was by the sweat and grease of their own elbows that created the wealth that allowed them to retire and enjoy their twilight years. In fact behind these workers elbows was a legion of fossil fuel slaves that amplified their endeavours creating the vast surpluses of the 20th Century (for some).

These fossil fuel resources whilst not yet exhausted are getting mighty tired, manifest by escalating oil, natural gas and coal prices around the world. The bottom line is that economic growth as we have known it will likely halt with peak oil and declining energy from fossil fuels. While this may spell The End Of The World As We Know It (TEOTWAKI) it does not have to spell total disaster for industrial civilisation.

Acceptance and understanding of the problem can allow industrialised economies to plan alternative energy supplies and to maximise the use of those we already have. But no matter which way you slice this cake, the 20th century energy Party is well and truly Over.

And so a message to the Grangemouth workers. The UK is running out of oil and the world will soon face oil production decline. Your plant will one day, in the not too distant future, be forced to close owing to a lack of feedstock (think about why BP sold it in the first place). Think about that and your future pension.

The Media

The BBC and ITN news in the UK were all but mute on this dispute until Friday. The story was covered by regional / Scottish news networks but only broke onto the main news once the strike and its consequences became apparent on Friday. Of course now it is main headlines over every news bulletin, newspaper and internet site. But there is a place for the mainstream media to bring these issues of vital national interest into the public and political eye before the wave breaks. On The Oil Drum we were discussing the potential disruption that might be caused by closure of the Forties Pipeline on Tuesday. Producers at the BBC need to ask themselves if they had prime time aired these concerns on Tuesday might this have cystalised public and political opinion and averted the closure of our energy life line?

Of course we cannot blame the main stream media for their ignorance. But misplaced priority in popular appeal will in fact fail the population badly one of these days.

So who is most to blame for the Forties - Grangemouth debacle?

Thanks to all who participated in our poll with results shown below after 502 votes had been counted (I considered withholding publication of these results but PG insisted the truth must be known).

In broad terms I agree with this result which is that in such circumstances a combination of factors are to blame for the complex system failure that we now witness. In detail, however, I beg to differ with the views expressed by the TOD readership - and not for the first time.

Top of my list of culpability is BP. They alone have responsibility for ensuring the operational integrity of the Forties Pipeline system and have failed the British people, their shareholders and the Government. New CEO Tony Hayward needs to get this house in order - fast.

Second on my list is the UK government for portraying either ignorance or indifference towards UK energy matters that with every day that passes threatens to sink this country into energy poverty and hardship. I expect to hear news of the creation of a new Department of Energy with a Secretary of State before the year is out. Former energy secretary Brian Wilson springs to mind as an imminently well qualified person to fulfill such a role.

Third equal goes to Ineos and the workers. Ineos and the demise of pensions are creations of the system built by Gordon Brown. Ineos and their employees are embarking upon a course of mutually assured self destruction.

The Scottish Government, with no real power in this domain, get off lightly as all powerless systems do. But a question for Ice Cold Alex - are you sure you are receiving sound advice on Scottish Energy Matters?

In tryng to make sense of this complex matter here are a few questions to answer and to start drawing dots to make a picture:

• Why did BP sell the Forties oil field?

• Why did BP sell Grangemouth refinery?

• Why did BP not ensure that they retain operational control over the Forties pipeline system?

• Why were banks so keen to lend such large amounts of money to buy assets that world beating companies no longer required?

• Why is the Ineos pension fund under strain?

Diligent analysts will find that the answer takes them down the path to the Olduvai Gorge.

This is the new world order, now that maximizing profit is the number one goal, and no one cares a whole lot about details like reliability. We have broken off parts of pieces of big companies, and sold the pieces (with lots of leverage) to much less financially strong companies. I understand that this has also happened to quite a few electric utilities in the United States - another place where we really need reliability. We have created a much more complex system, with less reliable parts, and a greater chance of system failure.

The new world order looks a lot like the 19th century. Gilded and greedy. Complete with addictions to gambling and the likely return of smoke filled rooms. The systems and infrastructure of the 20th results, as much, in progress as the availability of energy. What we have witnesses is the concentration of power into the hands of a short-sighted, greedy, and unreliable few. I sincerely hope things change as we enter the peak oil crisis. Otherwise, I'm afraid anarchy is likely to follow.

Robert, I'm afraid that concentration of power into fewer hands--particularly as it concerns grid power--is exactly what we should expect in the US.

When Congress passed the Energy Policy Act of 2005, they repealed the Public Utility Holding Company Act (PUHCA) of 1935, after intensive lobbying by utilities & their owners. This opened the floodgates once again to the possibility of having a small number of utility holding companies in control of vast portions of the grid. As individual utilities and providers now sell off the unwanted parts of their businesses, it will be possible for evil-minded opportunists to buy up key parts of the infrastructure and hold everyone else hostage.

There is some fascinating reading to be had on PUHCA...how it came to be and the danger of its repeal:

PUHCA for Dummies

The PUHCA Primer

It's 11:55pm. Do you know where your Grid is?

ChrisN--

Thanks! Very interesting.

Chris - I've not read your links. But I'm told by capitalist b*sta*srd that larger units are required to muster the scale of investment required in power systems.

Thoughts?

Yooooon, that may be true in some cases, but I wouldn't make a blanket statement like that. The holding companies that PUCHA sought to limit are very large, owning many companies and facilities. That's a different sort of animal.

I don't buy that argument for another reason: I think we should be focusing on massively distributed, renewable production of grid power, not giant facilities in the hundreds of megawatts. In which case micro-financing is what we need. (Although long-distance grid building & operation would certainly require a larger company and more capital.)

Nothing new about it Gail, people are intrinsically greedy, here are just a few of the well known bubbles where people were looking to make "easy money":

1634 Tulip craze when one tulip was "worth" more than a house.

1711 South sea bubble, including promises to reclaim sunshine from vegetables.

1719 Mississippi Company.

1926 Florida real estate.

1929 Great depression.

1987 19 October largest crash in a single day.

1990 Japanese land and stock.

2001 Dot-com.

2006 Chinese stocks.

on-going somewhere near you, various property bubbles.

Many get-rich-quick schemes every week, Nigerian 419 - someone you have never met wants your help in illegally transferring millions of dollars...

When people are more interested in celebrities and an easy life what do you expect?

Now if i was in charge...

Why did BP sell the Forties oil field?

Production falling.

Why did BP sell Grangemouth refinery?

No oil, no refinery needed.

Why did BP not ensure that they retain operational control over the Forties pipeline system?

Wealth losing proposition from here on out.

Why were banks so keen to lend such large amounts of money to buy assets that world beating companies no longer required?

A Sovereign wealth fund and/or hedge fund/Synthetic Investment

Vehicle to leverage out debt as far as possible into the future

while taking all/as much "real" wealth out ASAP.

Why is the Ineos pension fund under strain?

Because all wealth is being drained into the Queen's Offshore Tax Havens and other Top .01% positions. Pensions are being underfunded across the board.

G7 countries are looking to crush labor across the board.

This is only the start.

Clive Maund almost gets it (MI-6?):

http://www.safehaven.com/article-10087.htm

"As we entered this unique century, the greatest economic and military power in the world, the United States, still basking in the glory of facing down and defeating the Soviet Union, had the choice of getting together with the other nations of the world and arriving at a common and equitable agreement regarding how to apportion and parcel out the world's dwindling fossil fuel energy supplies in the coming decades. Instead of taking this enlightened route it has decided instead to adopt the primitive "me first" approach and has embarked on an old-fashioned campaign of colonial conquest, with a few sycophants in tow such as Britain hoping to get "a piece of the action". This is, of course, very bad news for the planet, not just because of the colonial powers' plans to make off with most of the pie, but because of the vast misuse of resources required to secure a disproportionate share of the pie in the first place, which has involved considerable death and destruction, including a lot of Iraqi civilians and US servicemen."

Complete control of the Mid-East, which the United States and the major oil companies are now close to having achieved, of course confers massive power over the rest of world, in particular over rising economic powers such as China and India and the immense leverage that this will in time afford can be used to steer these countries in whatever direction is desired. The US is believed to be involved in a strategic race against time to corner the bulk of the world's remaining oil reserves, the control of which can then be used to dissuade countries like China from resorting to the wholesale dumping of dollars or US Treasuries, along the lines of "Try it and we'll cut off your oil supply", which one would expect to be couched in more diplomatic language. Because of its gargantuan levels of debt the US is acutely vulnerable now, but with time it plans to tip the scales back in its favor partly by sales of its recently acquired plunder."

Britain, as the 1st officer of the US in its wars of acquisition, will enjoy a privileged place at the table in an increasingly resource starved world. Israel will look on with quiet satisfaction at all of this."

The worker in all of this will be crushed.

There is no polite way to get the attention of the Queen and her minions.

Note that the workers here aren't demanding anything more, they're striking to keep what they have. That's where we are.

TPTB have to start taking away to keep increasing their wealth.

Good luck to us all.

James

PS-"A two day strike over the protection of workers pensions does not seem unreasonable action to take."

Watch law enforcement/military. Whose side they come in on.

Like during Thatcher's Coal Strike, I don't think it'll

be on labor's side.

It's greed and stupidity that will kill us.

Dont forget: When BP Sold the Grangemouth Plant (Assets) it also sold on the Grangemouth Workers Pensions (Liabilities).

Sold in 2003, BP must know that carrying 1200 current workers and quite possibly a lot more current pensioners into 2013, 2023, 2033 when UKOil tapers to zero and would appear to have been a shrewd move on BP's part.

Its just that nobody gamed a strike and identified a single point failure in the Forties Pipeline.

Sometimes you can be too clever by 'alf...

The economic pie has expanded significantly over the course of the energy age. The average person has enjoyed an increase in his standard of living, but the privileged few at the top and in power have taken a disproportionately large shares of the expanding pie. This has been accomplished by destruction of free markets through imposition of laws to rig the economy in favor of the few; call it slavery, socialism, economic fascism, or corporatism as you prefer.

There is an underlying, yet still invisible point which might be called the revolution point or break point. It occurs when the economic pie begins to shrink (in this case from lack of energy supplies) and the average person begins to suffer intolerably. This suffering is inflamed by a continuation of the rigged economic system as those in power seek to continue their plunder of the shrinking pie.

I think that this incident is a reflection (reachback) of the approaching revolution point; the future is in a little way revealing itself to us. The average man has tolerated the current inequitable system because the pain of fighting against it (other than the ineffective within the system approach) would be greater than the pain of accepting it. Strikes are mostly a "within the system" protest. I imagine that over then next decade or two there will be an escalation and we will see more strikes, riots, local insurrections, repression, anti-government terrorism, sabotage, and eventually open civil war.

I doubt that out of the goodness of heart will those in power release their stranglehold on the masses, so I am fairly certain that we face a violent future; and, even in a free society economic suffering of great magnitude would be disruptive.

I also point out that once the rate of growth goes negative, as Albert Bartlett illuminated the mathematical basis to understand, we are looking at halving periods instead of doubling periods. If the rate of growth goes to -3.5% it will only take 20 years for the economic pie to be cut in half. Consider that in absolute terms, rather than percentage terms, the first halving period will be the greatest of all to come, just as the last doubling period on the way up was in absolute terms the greatest expansion period. As we linger on this plateau at the top of the energy age, the magnitude of what we face is almost too difficult for my mind to grasp.

"TPTB have to start taking away to keep increasing their wealth."

Take it one step further, They are STEALING the future.

Any real profit that might have come from real production over the next 20 to 30 years has been cashed in and pocketed.

What should the UK energy policy be?

This action may be a good wakeup call to the UK. I can only hope that the press talks about the UK's energy dependence, and the reality of the situation - continued depletion of the North Sea, and situations like this (hoarding and other supply issues) happening without a strike.

Mini crisis's like this that really have little effect in the grand scheme of things, and allow people to understand the seriousness of the near future's energy issues can be used to the nation's advantage helping advance beneficial reforms. .

Obviously the system shutting down is disruptive, but it's not like the oil and gas had to be poured into the sea - it can and will be sold.

I only hope this doesn't muddle Peak Oil issues with the addition of Labour Unions (on top of Nationalist Oil Companies, rebels, and speculators).

"What should the UK energy policy be?"

Leave grangemouth shut down and learn to make do with less oil.

There it is kiddies. The failure of a tightly linked complex dynamical system.

Welcome to Chaos.

I've been waiting for this for decades.

We should throw a party.

I'm not so sure I would characterise this as a complex system.

Sure there is a direct closely coupled linkage between the rigs in the North Sea and the delivery of petrol to forecourts. But that is no different to most of the oil/petrol system throughout the world. If one part breaks down the entire chain is affected, with stoppages rippling through the entirity.

That's not complex though - its pretty damn simple.

You can calculate the probabilities of occurrence, the failure modes, and optimise the system for overall profitability. I'll guess that BP have done this, and after all, a two day stoppage ISN'T enough to stop supply at the forecourts and ISN'T going to make much difference at the rigs either.

Complex is when its gets too difficult to understand and predict linkages - but the entirety still displays emergent modalities which are not random. The oil market as a whole displays this characteristic (eg OPEC but still with price falls) and one of the major factors for the next few years is that the emergent behaviours for a plateau-to-post peak world are different to those up till now (eg rationland, bottom up collapse, supply to friends, credit bombs).

Your answers to 1, 2, and 3 are the same. Increase short term profits from the cash cow, and make any reliability concerns somebody else's problem, including any investment in backup. If their customers complain claim force majeure and blame Ineos.

The answer to 4 is that the banks made a shitpile of money on their cut of deals like that. And no matter what happens they get to keep the fees.

I'm not sure we know positively yet that the fund is under stress.

for those new to the industry, force majeure is:

Yes - I should have phrased that "is the Ineos Pension fund under strain?" - but given they want to revise the terms and the overall economic circumstance I suspect they likely have a problem.

Because BP knew that

Yes, think about the future pensions. The sale was likely fraudulent - intended to dump the future costs. That's the sort of thing all these divestitures are about. Ineos and BP better hope the workers don't get even more uppity. I wonder how far we are from these workers - who will understand they have been cheated with no hope of regaining lost promises - start taking revenge and begin destroying the plants. From when airline workers, auto industry workers - anyone who has been ripped off by the finance industry - start taking revenge. As long as they keep getting their long-promised share they will stay quiet and settle for the two-tier system, but when they lose their privilege, all hell will break loose.

cfm in Gray, ME

Lets hope we find out the truth about the financial state of the pension fund.

Thats whats important here.

From the scotsman newspaper yesterday

"...he union Unite claims the company is not under financial pressure to reduce pensions costs, because the scheme has a surplus of £24m. Its assets are valued at £249m, covering £225m liabilities...."

IMVHO it is perfectly reasonable for the company to stop the final salary pension for new employees, after all nobody is forced to take a job there. Prospective employees can make up their mind based on the total salary package. It is unrealistic for a private company to be able to guarantee a pension based on the financial conditions 20, 30 or 40 years in the future.

Unrealisitic, yes - since long-term savings depend on impossible long-term exceptional exponential economic growth such as we have seen in the second half of the 20th century. The problem is, in the UK anyway, this promise of guarantee by the employing company has been made - the pension payments are part of the pay for doing the job but deferred for a rapidly increasing number of years.

Pensions such as final salary schemes are a new and largely untried idea - employees naively believe the company's/government's promises.

So, if you are intending to retire on a pension for a long period of time, watch and learn.

Even with cheap energy, long term savings of just 5% or so of your salary (whether final salary pension or some other scheme, the money ultimately comes from the employer) WILL NOT reasonably fund a retirement that lasts half as long as your working life! These schemes were set up assuming people would retire for just two or three years on average - it turns out that, at the moment, this is an unrealistic assumption.

Once we get peak oil or peak energy the world economy will almost certainly have to contract - that means interest payments (and anything depending on large amounts of interest, such as pensions) will not be affordable - this is why many religions ban interest on loans.

In a final salary scheme the employer takes the risk of failure, in other schemes the pensioner takes the risk. The important thing is, if the employer, the government or you can't afford the pension payments then they can't and won't be made, despite the promises - in the medium term there is a VERY HIGH risk of failure and the buck always stops with you, not the company (despite their promises).

It's this sort of thing which belongs more in the comment section than a TOD article. Opinions and grizzling we can manage ourselves, we come here for facts, bombproof reasoning and reasonable surmise.

If a strike can have effects on the wider community, the strikers have a stronger motivation to do it. If only its money is on the line, a company might wait out the strikers over months; if the wider community is harmed, they'll put pressure on the company to resolve the strike issue quickly.

So we can have a small effect over a long time, or a big effect over a short time. That's the way strikes work.

I am astounded that anyone can think doing "all you can to damage the financial viability and reputation of your employer" is in the long term interest of the employees.

Like Kiashu I do not appreciate this sort of comment in the main body of a TOD article. There is a lot of spin and many rumours and claims going on around this dispute so let's try and have the facts in the main body and leave the opinions to the comments.

I am astounded that anyone can believe such a statement as "By all means do all you can to damage the financial viability and reputation of your employer upon which your livelihood depends" can be interpreted as being anything other than ironic sarcasm and a joke.

It was certainly irony. But I do fail to see how the worker's position may now be strengthened as a result of this action.

This from a friend today:

If Ineos are in trouble and need to raise a bit of cash to reduce debt, selling a bit of prime real estate just outside of Edinburgh might just do the trick. This is a well established pattern in UK business evolution in recent years.

Euan, apologies, i failed to spot the irony.

It wasn't irony, it was sarcasm, as your comment makes clear here.

The company isn't going to collapse simply because of a strike of a few days. It'd take months to really hurt them.

What this does is create public and political pressure on the company to settle the issue quickly. If a strike didn't inconvenience anyone there'd be no point in doing it.

If you hate unions and don't believe in the right to withhold labour, fair enough. But keep unsubstantiated opinion and hearsay like this "friend of a friend said -" stuff for the comments section.

Several points of reflection come about:

First of all, the present situation is a good example of unbundling schemes going wrong. State Companies (or state dimension private companies) that once had geographic bound monopolies are sliced and diced to private firms. And only when the damage is done someone realizes that the business isn't profitable.

But of course it isn't. It can't be, petrol and diesel are not differentiable products and so these markets like Refining will always tend to profitless perfect concurrency. Electricity also isn't differentiable.

I find every stakeholder in this plot accountable, they all lack the capacity to think and plan in the long term. BP never thought of the dependencies that make the Pipeline run, Ineos was made buying dying businesses, the workers don't understand the North Sea decline, governments just watched the crisis unfold and of course none of this is interesting enough for the media.

It is a much broader failure, it is an extensive social fabric laid down in ways that do not cope with long term change, predicting the short term future by projecting the past.

I believe this is just the first of a succession of similar crisis. This strike will unlike do any good for the pension scheme; it is over, it was something that worked in the past but can't possibly work in the same way in the future. The clash between owner and workers will exacerbate until some retrocession takes place like Grangemouth coming back to BP's hands or even being nationalized.

Projecting short term trends into the future is fraught with danger. We are all prone to it. And it requires deep and broad understanding to be able to forecast a future that does not follow the current trend. Especially if that future is much less favorable than we otherwise expect.

I guess this lies at the very heart of our problem.

I don't think tight coupling here is necessarily the only reason for system failures like this, BUT when it is combined with increasing complexity, distributed responsibility, very tight margins of operation, and almost zero buffer/overstock capacity... well, this is what happens in systems.

We have become so optimized, so lean, so JOT/JIT, so zero-inventory that even small perturbations can easily cascade down the chain.

And it doesn't help, if one or several of the value chain actors start rigging the system in zero-sum fashion causing significant losses to other parties.

This can only result in loss of confidence, trust and visibility down the chain. This is utter poison for any multi-component value chain/network.

And it wouldn't be any more 'better' if the system was loosely coupled, because every actor, every component in the chain, is becoming equally tight/zero-inventory/JIT/lean.

It doesn't really help to change one piece of the value chain to another, when all parts 'malfunction' the same way from the overall total system perspective.

There is very little margin for error.

And don't for a minute think it's going to get any better, before it gets worse.

Once the European electricity market de-regulation finally heats up, peculators will come in like vultures 'Enron-style' and try to leverage profits with very little regard to how it affects prices, stability, overall reliability or systemic risk.

But like the Americans say: "Don't hate the player, hate the game."

We get what we deserve :)

One of the first acts of Gordon Brown as Chancellor was an attack on pensions by removing the tax relief despite being warned by officials that he risked long term damage to the UK's occupational pensions industry when he pressed ahead with a £5bn a year cut in tax relief in his first budget in 1997.

This made funding pensions even harder and is one of the major reasons for the decline in final salary pensions in the UK.

Yes agreed - and has anyone calculated the cumulative cost of this dawn raid? 1997 was of course a dot com bubble year - raiding profits of companies that had never made one.

But the real issue in pensions and financial services is an army of idiots doing analysis, providing advice, administering complex regulations etc that adds no real value and in a bear market will amplify the losses for those invested in the wrong sectors.

Euan, a year ago the times newspaper said "... Since the tax rise, which analysts say cost the industry up to £100 billion, private and company pensions have faced increasing financial difficulties..."

http://www.timesonline.co.uk/tol/news/politics/article1599964.ece

So i guess it would be another 10 billion by now making £110 billion. Of course we all know that the £110 billion has been well spent don't we :-(

Now imagine what could have been achieved with £110 billion, how many buildings insulated, how many wind farms... Any more room in Norway?

• Why did BP sell the Forties oil field?

They calculated that their profits would increase by so doing.

• Why did BP sell Grangemouth refinery?

They calculated that their profits would increase by so doing.

• Why did BP not ensure that they retain operational control over the Forties pipeline system?

They calculated that their profits on balance would not be affected or would increase by so doing.

• Why were banks so keen to lend such large amounts of money to buy assets that world beating companies no longer required?

They calculated that their profits would increase by so doing.

• Why is the Ineos pension fund under strain?

Not very clued up on that one?

A few things:

• Instead of sourcing apples from our indigenous orchards, we source them from halfway around the world.

• Instead of delivering milk bottles to homes, then returning, and refilling as we used to, we now use plastic ones which are then discarded into landfill.

• In the 1970s, drinks manufactures (Coke, Fanta, Lucozade, 7Up etc) offered refunds on their bottles so that kids like me scavenged them all off the beach and returned to the shops for extra pocket money. They were then returned to the bottler for refilling. Now these are plastic and when used are buried in landfill.

• Instead of pubs returning their empties for refill to the bottlers as of old, they're smashed up, melted down and remade into identical bottles and then filled and sent to the pubs.

• Instead of appliances which can be repaired, it's cheaper to bury said item in landfill and buy a new one.

• Instead of replacing a car headlamp bulb you now replace the entire sealed unit headlamp. The old headlamp assembly being buried in landfill.

• The Hoverspeed Dover-Calais hovercraft was not withdrawn from service because it was losing money, but because it was not making enough profit.

It seems Euan, that you are trying to answer these questions using good old common sense which in our insane world is unlikely to give you the answers you seek. Much business activity flies in the face of any reason, unless you look at profit maximisation and that will answer pretty much all your questions IMHO.

Kiltedgreen,

I agree with you that our disposable age sounds crazy, but in an age of cheap resources and expensive human labour your examples make economic sense, e.g. it is quicker, cheaper and more reliable to supply a sealed unit headlamp rather than fitting several parts into the car on the assembly ramp. In a future of scarce resources and cheap labour this will not occur.

For a private company, it exists to maximise the returns for the owners (shareholders) and nothing else. Other requirements are mandated by the people through laws and taxes and businesses should of course comply. It is not the responsibility of the oil companies to invest in other technologies such as pv or wind...

For example, if the people care enough about the environment they will lobby for laws to reduce CO2 emissions, if they don't they will continue to buy gas guzzlers and demand the lowest costs for fuel & power regardless of the consequences. Oh hey, we the people have the same "attitude" just expressed in a slightly different way.

Thanks tony.

Well, as I see it, it doesn't just "sound crazy" it is crazy. I realise the reasons why it's done - ££££s - and the legal requirement to maximise shareholder returns. The thing is that looked at with a sane working brain, even without scarce resources and cheap labour I still believe it's mad. Just as it makes economic sense to export X,000 tons of chocolate waffles to Germany in a year and import near as dammit the same amount from them. If it didn't make 'economic sense' it wouldn't happen. It will just become more and more obvious that it's mad to more and more people and things get tighter! I suppose what I mean is that even even we had vast as yet untapped resources and endless cheap labour - it just feels so wrong.

I think the key issue here lies in Luis' post up thread and how I responded. In short, it lies in short termism, projecting short term trends into the future, discounting the future, etc - this is Nate's territory.

I agree with everything you say in your second part. In Norway they have a state liquor firm. And one advantage of that is they have standard wine and other drinks bottles. All bottles have a deposit and are recycled intact. Its been that way for 30 years. Its a different economic model that works better than ours. Tomra - the company that makes the bottle returning receipt issuing machine makes a fortune - at least they used to.

The litter and waste and ignorance and hypocrisy in this country makes me sick.

"Of course we cannot blame the main stream media for their ignorance."

Why not, Euan? Discovering and disseminating vital truths is what they purport -- and fail so chronically -- to do. But then, despite all their self-congratulatory blether, that's not what they're really here to do, so no surprises that they don't do it. Not to go on at length about this, can I just recommend for those who want an unparalleled (IMO) insight into media function in Western 'democracies' study in depth of Herman and Chomsky's 'Manufacturing Consent'; twenty years old, and as sharply pertinent as ever to the real world behind the Permanent Bullsith Blizzard. If you haven't already, get your ideas straight about what media in Western 'democracies' are really for.

I too come to TOD for the density of facts and professionally-competent insight. It seems to me to be one of the best places on the net for that. Because I can't match the excellent technical skills and knowledge of many contributors, I'm content -- indeed obliged -- just to read silently and keep my lip buttoned, mostly.

But it does seem to me that low political savvy is more patchy at TOD, sometimes. One of the background understandings that still appears a little light amongst seasoned TODers is the crucial real position of the US in all this.

As mentioned again in this comment thread, the attempt by USukisoz, with a few smaller hangers-on, to grab decisive control of the Caspian-Hormuz sweetoil corridor, and so to grab the world by the balls, seems well enough understood by TODers. (What awake grown-up who's paying attention doesn't understand that?) But the chance of the malign axis actually pulling off its huge crime against humanity 'successfully' -- from the viewpoint of the criminals in charge -- still seems to me to be greatly over-estimated. My guestimate, for what it's worth, is that the aggressions in SW Asia are failing, will fail totally, and in the process will precipitate the US into its turn to go down the black hole that swallowed the SU. (They were always going to do that, both of them. I don't believe any other outcome was ever likely. It's just that the SU went first, and -- as history may well show -- had a much lighter landing than the US)

Here in the execrable fake 'democracy' of Britain we suffer successive governments of breathtaking incompetence in anything except faithful service to their true masters, who I suppose can be described in a few words as the deeply-criminal, special-interest-minority WealthPowerStatus-mafias whom we silly commoners allow to control such a disproportionate share of wealth in the world. Because of this, our public services and our public properties have been looted, vandalised, smashed into thievable bits, and largely sold -- or more nearly, given at silly token prices -- by successive gangs of expendable pocket-politicians of one wing or other of the single bigbiz party to their real WPS-mafia owners. (Always without anything remotely like popular mandate, natch) And still, whilst we geese watch confusedly, these gangsters continue to suck out and salt away the last dregs of loot that they can get out out of our commonwealths before widespread collapse changes the game drastically.

The all-important perception-managing hacks of the corporate media, who keep us common shlubs (and themselves, mostly) confused, distracted and supremely ill-informed, are a key part of this mafia racket.

I haven't been a red revolutionary since my distant teens (to much blood, anguish and destruction for too little real result). But soberly, I suspect that nothing less is going to alter this lamentable situation, here and globally, and give us some chance of weathering the synergising crises of the global perfect storm. But for any kind of revolution, whether violent or velvet, it's necessary for enough people to wake up from the continuous sleepwalking state in which the Pampered Twenty Percent of the world's humans live currently. TODers know that a very rude awakening is imminent now, as bread, circuses and continuous bauble-dreaming all evaporate. So, any chance of a TOD-vote about when widespread civil disturbances, including the recent sleepwalkers of the over-rich countries, will begin? Who of us a year ago would have voted confidently for widespread, government-panicking food-riots in the Spring of '08?

I quite agree that we are [generally] all played for saps by the politico/media machine. But why do you romantically believe a popular revolt would change things? The media circus works [for its masters] because the concensus view is the average [mean, not usually median or mode]opinion. And the 'mean' public opinion reflects the media message...

Who is to blame?

The British government, for bloody-minded refusal to shoulder their responsibility for strategic thinking.

To put a name on it : the emetic Tony Bleeeeagh.

The hapless Golden Brown (reminds me of the Stranglers song : never a frown, Gordon Brown) turns out to be nothing but a talentless understudy. I once hoped for better things from him.

The failure of the remnants of the North Sea bonanza is something of a sideshow. As a sunset industry, I don't think it's such a big deal to have privatized it. It is not an ongoing strategic asset like, say, the railways or the water industry.

The failure to take any steps, or even plan coherently, for the UK's energy security and trade balance are the big picture. If they manage to bring enough nuclear electricity on line quickly enough, then collapse can be avoided. Even then, one assumes that the trade balance will suffer, since the profits will largely be shipped back to France (EDF and associates). This is logical enough : the UK no longer controls the nuclear technology they need.

Just as the UK's "independent nuclear deterrent" depends on Uncle Sam, the UK's "energy independence" will be in French hands. Count on future UK governments being strikingly more pro-European.

"The British government, for bloody-minded refusal to shoulder their responsibility for strategic thinking."

See Council on Foreign Relations and Sykes Pinchot Agreement

for details on British Gov't strategic thinking.

World History/Causes and course of the First World War - Wikibooks ...

This telegram was provided to the United States by Great Britain and there has been some speculation on whether it was forged by Great Britain in order to ...

Empires don't just magically spring up by accident.

The UK has a choice to side with the US or Russia/China.

This is such short-term thinking.

On a geopolitical level, who the UK sides with doesn't change anything much. Currently a useful military sidekick to the USA, I suppose one can imagine the possibility, in theory, of the UK switching sides to become a mercenary for "Russia/China".

But it's not going to happen, not in the next hundred years anyway.

On the other hand, it's too early to write off Europe. If the UK (not the Brown government, but the next one) becomes a little bit more reality-based, a complete turn-around of their traditional spoiler role in the EU is imaginable. Europe is the world's most sustainable continent : industrially mature, self-nourishing, ecologically conscious and not all that far from sustainability. The UK's long-term interests are -- self-evidently -- in tight integration in a strong Europe.

Having waited too long, however, they now have a pretty weak case for inclusion in such a Europe -- frankly, what do they bring to the table? Creative financial engineering?

Let's hope the EU doesn't bear a grudge.

The EU needs Russia and Russia needs the EU. Europe needs to wake up to that fact and make sure it creates a symbiotic relationship with Russia. Breaking its ties with the Anglo-Saxon countries and China if necessary.

The UK will have little choice but integrate more tightly with the rest of Europe and Russia as it cannot survive by itself and the US is unlikely to support it with fuel, food, etc. Britain's attempted colonial revival will also likely fail with nasty side effects (ie. the disintegration of the Union).

I think we're talking about years here, not necessarily decades.

That's Sykes Picot Agreement - responsible for much of the conflict in the Modern Middle East

http://en.wikipedia.org/wiki/Sykes-Picot_Agreement

Maybe it IS strategic thinking: at least in EDF's hands it will be competently run! ;-)

I agree entirely that Gordon just ain't up to the job.

My rational mind knows that there is almost certainly no connection between this and the 5-hour power cut I experienced in my Edinburgh tenement block last night (it was much too localised), but boy did it freak me out. How's that for a coincidence - the first major power outage I've ever experienced in 15 years of living in Edinburgh, and it's on the day they shut down the Forties pipeline. What are the odds?

Is this a taste of the future?

This from the Scottish Daily Record.

Crisis Threat To 100 Construction Jobs

A wind-farm construction project brought to a standstill because of a lack of fossil fuel. I hope the powers that be are taking note...

In current transient circumstances not big news but a wonderful metaphor the future.

This is just the beginning.

As energy prices rise and the economy falters, anyone with any influence will attempt to engineer pay rises etc in order to maintain their standard of living.

A refinery here, a teachers strike there ... on top of a meta-stable energy-deficient system ... could well lead to all sorts of complex failures.

At the very best, those with control of the oil, gas, water or other key systems will be Kings Of The Castle. Those without influence will be hungry, cold and maybe unemployed.

At the worst, we might see earlier than expected infrastructure failures caused by multiple interacting selfish (?) and short sighted actions.

As oil and natural gas decline we will need to husband all aspects of our infrastructure in order to avoid sliding into The Abyss.

Sadly I anticipate many further petty strikes, together with copper cable thefts and other scavenging by the new poor, to bring our infrastructure to an ignominious halt, possibly quite rapidly.

This Grangemouth affair has been an eye-opener for me: I now realise that I cannot trust The System to be there for me & my family 'forever'. One day the lights will NOT come on when I flick the switch. One day the petrol station will be out of fuel ... and will stay out of fuel for days or even weeks.

I hate to sound like a nutty US survivalist .. but it does suddenly seem wise to install solar electricity, stockpile some fuel and maybe buy a generator as a matter of (almost) urgency.

Its hard to put into words, so forgive me if I make a mess of it, but I think the situation is as follows:

The only thing that has perceived value is money or activities that make money. Suppose a community has a farm that is loosing money but never the less, for the time being at least, the farm feeds the community. The community has a local bank that is making money. The the bank pulls the plug and the farmer decides he can go on no longer and sells his land to a local devloper who is able build houses on the land. The farmer has made a quick fortune and paid of his debts to the bank, and does not care that he no longer produces food. The developer will make a fortune building houses, the food will come from "some one else", the community now has a profitable bank and a profitable constuction site and is relieved of its loss making food supply. The irony is Food has no value if it can't be produced at a profit! The same goes for oil supply and infrastructure of the uk. If the farmer had any sense he would have sold while he was still making a profit and let the next person suffer the loss.

I suspect Ratcliffe has no liabilities. The money the banks has chosen to lend him will be from our pension funds etc. The loosers are the workers who built the infrastructure in the first place. The only way to have avoided such a mass asset stripping exercise would be for the workers to own the company shares and have hung on to them. I suspect most workers would sooner sell shares for a quick lump sum as did most who got shares when the building societies were turned into banks

The problem; human greed and complete inability to see further than our next meal (especially politicians). We are all guilty to some extent (wanting more "highly vauable" money for "less valuable" hard work).

Sorry I'm a doomer!

Say the pipeline was restarted. there were half a dozen articles on the shutdown. Should there not be an article about the restart ?

Of course it is visible in terms of the price drop per barrel of oil

http://www.bloomberg.com/apps/news?pid=20601086&sid=aRoaiNYSN6kY&refer=l...