Financial Forecast for 2009, Considering Resource Limitations

Posted by Gail the Actuary on January 6, 2009 - 11:10am

In this post, I consider some major issues contributing to our current financial problems, before making a financial forecast for 2009. These are

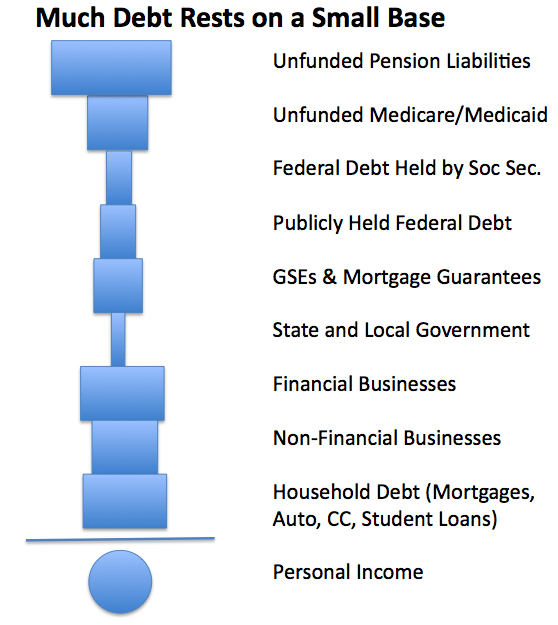

1. Why so many asset classes are so highly correlated in times of distress. This chart gives my interpretation of part of the problem.

2. Why growth is essential for keeping the current debt-based financial system operating.

3. Where we are now, and the role reduced resources (including peak oil) are likely to play as we go forward.

4. My forecast for 2009.

1. Why so many asset classes are highly correlated in times of distress.

We keep hearing about plans to stimulate the "consumer" to buy more. Until I stopped to think about it, it wasn't obvious to me that the consumer (or perhaps I should say, ordinary citizen), and his ability to purchase goods and services are key to keeping the whole system going. These connections include:

1. Adequate income is needed for a citizen to repay the debt he already has.

2. Some of the "higher level" debt in the tower in Figure 1 is simply debt from one of the lower levels, recycled on someone else's balance sheet.

3. Revenues from ordinary citizens support the businesses and governments that have loans higher up on the "tower", and are critical to these organizations' ability to repay their own debt.

It is only when the system is under stress, and shortfalls in income of the ordinary citizen start shaking the system, that these connections becomes clearer. Let's look at the debt shown in Figure 1 by layer, starting from the bottom:

Layer 1. Household Debt (Mortgages, auto loans, credit card debt, student loans). Adequate income is needed for citizens to repay these loans. Also, if ordinary citizens have adequate incomes, this helps to keep demand for houses up, which in turn helps to keep the prices for houses up. These higher prices allow citizens to borrow more against their homes, and use this revenue to purchase even more, helping prop up businesses from which they buy goods and services. If the prices of homes drop because of inadequate demand, huge problems develop, as we are now acutely aware.

Layer 2. Debt of Non-Financial Businesses. This would include loans for companies like GM and Ford and mortgage loans for restaurants. It might include debt for casinos, and debt for church buildings. All of these businesses are directly or indirectly dependent on wage-earners having enough money to buy their products, or contribute their Sunday offerings, in order that they can repay their loans. Even if a business only sells its service to other businesses, it is a part of a chain of businesses that at its base is dependent on customers buying its goods and services.

Layer 3. Debt of Financial Businesses. To a significant extent, this is just recycled debt from the first two layers. What happens is that an individual or business borrows from a financial institution, for example a commercial mortgage or credit card debt. The financial institution repackages the debt (sometimes first slicing and dicing it) and lays it off again. If one of the first two layers defaults, then the third layer is likely to default as well.

Layer 4. Debt of State and Local governments. In a way, these governments are service providers. They collect money from their citizens one way or another (property tax, sales tax, tolls on roads, lottery tickets) to pay for the services they provide. If citizens are laid off, or are working for lower paid jobs, they will pay lower taxes to the state. Also, if the citizens don't bid up the prices of houses, it is difficult to collect as high property taxes on them. Some of a state's services, like unemployment compensation and health services for the poor, may increase in bad times.

Layer 5. Government Guaranteed Mortgages. This is just a recycled version of part of the mortgages in Layer 1, including those held by Fannie and Freddie, and those indirectly guaranteed by Fannie and Freddie. If the Layer 1 mortgages default (or are reduced because of "cram down" provisions), Layer 5 mortgages will almost certainly have problems as well.

Layers 6 and 7. Different Versions of Federal Debt. The Federal Government obtains most of its revenues from taxes of individuals. If citizens are earning less money, it is difficult to continue collecting as much taxes. Some of the taxes come from businesses, but to earn money to pay taxes, businesses have to sell some goods or services to the public. If citizens are short of funds to buy goods and services, the profits of businesses will be lower, and the revenues from taxes on these businesses is likely to be lower as well.

Layer 8. Unfunded Medicare / Medicaid. These are promises made to individuals that will eventually have to be paid for by someone. Ultimately, the funding for these will have to come from taxpayers, which for the most part are ordinary citizens.

Layer 9. Unfunded Pension Plan Amounts. Pensions are funded by a combination of investments in bonds, stocks and other securities. To the extent that these securities have performed poorly, there will be a shortfall in funding. The events of the last year will cause many pension plans to be in poor shape, because they hold debt shown in the tower in Figure 1 and some of it is defaulting. If additional contributions from the organization setting up the pension plan become necessary, these funds will ultimately have to come from a taxpayer (if it is a local government) or a purchaser of goods or services (if it is a business).

The above list relates only to debt and promises to pay, but other financial assets are affected as well. The value of stocks is likely to decrease if people aren't buying a company's goods and services because of inadequate income. Insurance companies will have financial difficulties, because they tend to hold many bonds which decline in value as defaults increase. Hedge funds hold a mixture of asset types, but are also likely to be affected. Derivatives vary in what they cover, but some of these will also be affected by debt defaults related to inadequate consumer income. While this list is not exhaustive, it gives an idea why inadequate income by the ordinary consumer is likely to ripple though the system in many ways.

I would note too that there are a lot of feedback loops in the tower. When things are very good, the feedback loops tend to make things look very, very good (higher wages-> higher spending -> profitable businesses -> more hiring -> rising home prices -> less need for government programs). These same feedback loops work the opposite direction when things are bad (layoffs, for example), making a bad economic scenario truly terrible. The huge tower is also expensive to maintain, and takes resources from productive uses, like building infrastructure and new factories. As more and more layers are added to the tower (like TARP), the tower becomes more and more unstable, and more and more likely to have big reactions to small events.

2. Why growth is essential to keeping the current debt-based financial system operating.

Perhaps the easiest way to see that growth is essential to repayment of debt is to think about the government's borrowing to bail the United States out of our current financial predicament. As with the vast majority of debt, the debt is not really for an investment that will add value in any real sense (more goods and services manufactured). Instead, it represents time-shifting of payments to the future, with an interest charge for this time shifting. In the case of the government spending, it is not even clear that all of the spending will be particularly beneficial. When previous stimulus checks were sent, some of the money was spent on goods imported from China, helping the Chinese economy. Also, some of the additional borrowing ended up in the pockets of high-paid financial executives who likely will not spend it on another car or house, since they already have more money than they are able to spend.

Think about the additional debt from the perspective of a typical wage-earner. Suppose the typical wage-earner's income is 100 units in 2007, 105 in 2008, 110 in 2009, 115 in 2010, 120 in 2011, and so on. If the government spends the equivalent of 10 units on the bailout (the wage-earner's share of the total), and gives the wage earner 3 units of it back as a stimulus check in 2009, the wage-earner's 2009 income will equal 110 + 3 = 113 with the stimulus check. It should not be too onerous a task to pay the 10 units back through higher future taxes, since the wage-earner's income will be higher in future years, and he can use part of that increased income to pay the 10 back. With interest, the total amount to be re-paid may amount to 11 or 12 or 13, but even this may not be too onerous, because of rising income. Additionally, there may be the possibility of "rolling the debt forward", and not really repaying it, saving it for society's grandchildren, since it looks like the future is getting better and better.

Suppose on the other hand that the typical wage-earner's income is 100 in 2007, 98 in 2008, 96 in 2009, 94 in 2010, 92 in 2011, and so on. If the government spends the equivalent of 10 units on a bailout, and gives the wage-earner 3 units of it back as a stimulus check in 2009, the 3 units added to the 96 units will bring the wage-earner almost back up to where he was in 2007, (since 96 +3 = 99). The difficulty comes in paying back the 10 (or 11 or 12 or 13) units, because these will need to be subtracted from the wage-earner's lower future income, putting him in progressively worse financial shape. Also, the possibility of "rolling the debt forward" is likely to go away, since those buying government bonds will figure out that in 2020, when the typical wage-earner's income is down to 74, the chance of the wage-earner using part of that income to repay the debt from 2009 is pretty poor.

Because of these issues, the amount of debt a declining economy can support is much lower than the amount a rising economy can support. It seems to me that if there is no interest to pay, time shifting works well in a flat economy (as in 5,000 year ago). If there is interest to pay, time-shifting works as long as the growth rate is equal to the "real" interest rate. If there is a long-term decline in the economy, (something never really experienced in the past), time shifting generally doesn't work well.

If an investment truly generates a return rather than simply time-shifts (a factory rather than a mortgage), it may be possible to use debt in a period of economic decline, but interest rates will need to be much higher (quite possibly 15%+) because of a much higher risk of default. Such high interest rates are likely to make most potential investments no longer profitable. As a result, I would expect that the total amount of debt in a declining economy would be much less than today--probably less than 10% of the current total debt load.

3. Where we are now, and the role reduced resources (including peak oil) are likely to play as we go forward.

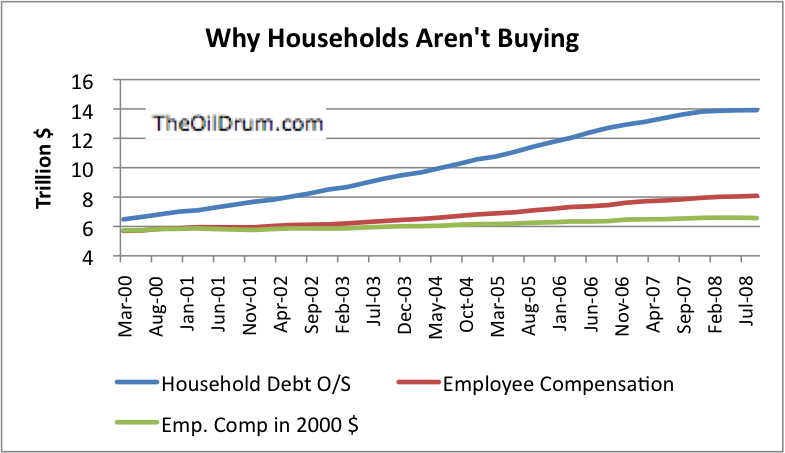

This graph gives an indication as to the problem. Employee compensation has been fairly flat since 2000. The situation for many employees is likely quite a bit worse than what the graph would suggest when one considers that (1) the wages I show in 2000 $ are adjusted using the US GNP deflator, and the actual inflation rate is likely higher, so the trend in wages in 2000 $ is likely lower than that shown; (2) the increase shown includes population growth of about 1% per year rather than being on a per capita basis; and (3) pay changes have not been the same for all employees. In general, higher paid employees have tended to fare better than the rank and file (rising Gini Coefficient). Now that major layoffs are starting, the situation is worse than shown on the graph. Taxation policies have tended to reinforce the trend toward lower spendable income for the middle and lower classes, with most tax cuts since 2000 favoring the wealthy.

The reason the economy appeared to do quite well between 2000 and 2007 was the increase in household debt. With greater debt, families were able to buy more from business, keeping businesses profits high. Prices of houses also rose. The higher home prices allowed people to remove more equity from their houses, and use this equity to spend even more. In addition, the stock market was rising in 2002 to 2007, also contributing to the feeling of wealth.

The amount of additional spendable income available from (1) the increasing debt and (2) the money people could take out from the equity on their homes was truly phenomenal. Figure 2 indicates additional debt amounted to about $1 trillion a year. Also, as the value of homes inflated, people were able to refinance loans and use the additional cash to for buying other goods. The amount of home inflation was of the order of magnitude of $1 trillion a year, and this was available to homeowners to extract, theoretically making a total of up to $2 trillion a year. Funds available in these two ways (higher debt and equity extraction) were generally not subject to income tax, so the impact was even greater than if they had been added to wages. Employee compensation during this period was only $6 to $8 trillion a year, so the impact was very large.

Figure 2 shows that there was a sharp change, starting in late 2007. The total amount of household debt flattened, cutting out the less credit-worthy from buying more goods. Other factors not shown on the graph also had an effect. The prices of food and energy products rose, putting a strain on the finances of families, and causing debt defaults. In addition, homeowners were forced to stop padding their spending by taking more equity out from the value of their homes, because by then the value of their homes was falling, rather than rising. All of these factors provided a sharp contrast to the very favorable dynamic that existed when household debt was rising rapidly.

I expect that Greenspan and other financial leaders engineered much of the debt-driven growth in the 2000 to 2007 period when they realized that underlying growth rate was very low. Now we are hitting the "no free lunch" time. The attempt to pump up growth in the 2000 to 2007 period using additional debt could only produce a temporary fix, and that fix is falling apart. The fact that wages weren't really growing much in "real" terms suggests that there was an underlying problem that more and more debt could only temporarily disguise, but could not really fix.

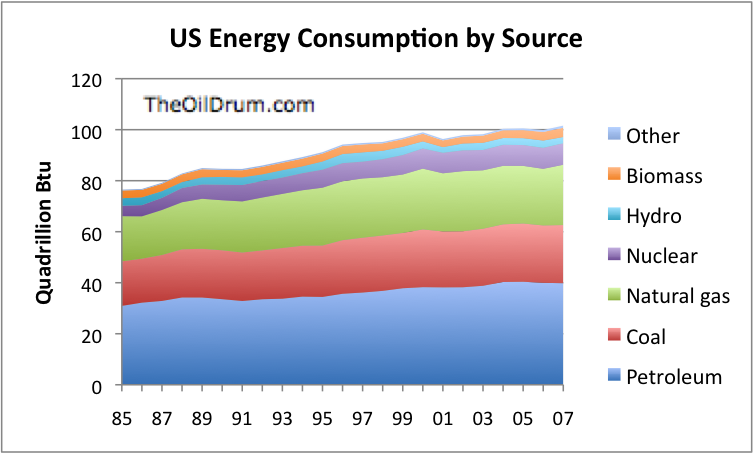

A big piece of the problem is that energy consumption in the US has not been growing very rapidly since 2000, and we know from the work of Robert Ayres and Benjamin Warr that there is a close tie between energy use, increase in energy efficiency, and economic growth.

Between 1985 and 2000, US energy consumption (all fuels combined) grew by an average of 1.7% per year; between 2000 and 2007, US energy consumption grew by an average of 0.4% per year. On a per capita basis, energy consumption was actually declining between 2000 and 2007. Energy consumption through September 2008 is down about 2% from 2007 (about 3% on a per capita basis).

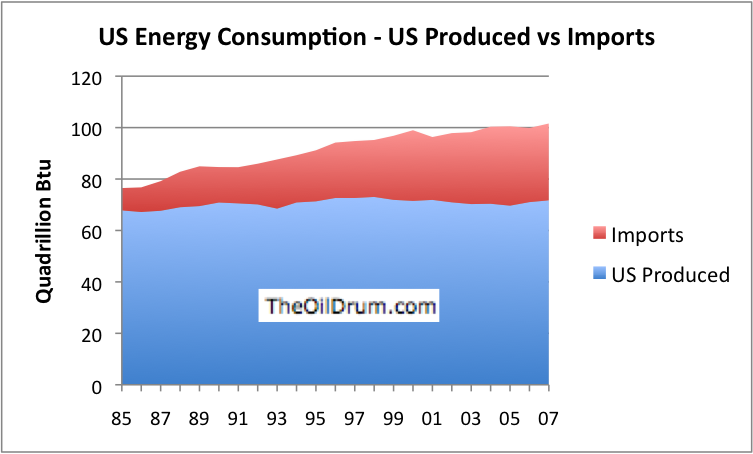

Another part of the problem is that a larger and larger share of US energy consumption has been coming from imports (Figure 4), and the US has been becoming less and less able to pay for these imports, as evidenced by its ballooning balance of payment deficit. If the US had been able to import energy, use the energy to produce products that were worth a great deal more, and export those products, the US would not have had this problem.

It appears to me that the US is rapidly reaching "peak energy", whether or not the world is reaching peak energy. What drives this peak is the economics of the situation--we are not producing enough goods and services with the fuels that we are importing to justify their continued importation. Also, even US produced natural gas from unconventional sources is becoming too expensive for the economy to afford. We have been in a type of overshoot in terms of buying more energy products than we really had funds for. The spike in prices for oil this summer helped force the issue. With the higher prices of oil and food, some people at the margin could no longer pay their mortgages, and the situation began to unwind.

Now with the lower prices of energy products, world oil production is starting to drop back. Demand is dropping off, because consumers are not able to borrow as much, and thus cannot buy as many goods and services requiring oil to produce. It is likely that US oil use will drop in years ahead, because of these factors. US natural gas production will also decline, because most of the new sources of natural gas are high priced sources (low Energy Return on Energy Invested sources), and consumers cannot afford the high cost of energy from these sources.

When the US faced a situation with declining energy availability in the 1970s, it was able to make changes to improve energy efficiency and to shift production of heavy goods offshore, and thus mitigate the impact of the decline in energy on economic growth. It seems unlikely that we will be able to do as much this time around. For one thing, the easy solutions have already been implemented. For another, US energy efficiency gains have only been about 2% per year in recent years. It will take capital (which is difficult to obtain now) to even maintain this kind of efficiency growth. Also, oil and gas are becoming more and more difficult to produce, meaning that a greater share of the oil and gas that is produced will need to be used in production of these fuels, leaving less for other uses.

The US economy has barely been growing between 2000 and 2008, apart from debt-induced growth; it has not been growing enough to produce much gain in the compensation of employees. If energy consumption declines from the level it is at today, it is likely that real growth will be even lower than it is today. Based of the discussion in (2) regarding how essential growth is for the repayment of debt, this suggests that it will be extremely difficult to pay back all of the debt that is currently outstanding. The existence of the close inter-relationship between all of the types of debt shown in Figure 1 suggests that there may be defaults on many of these types of debt simultaneously, and the same factors that caused debt defaults may affect other classes of assets as well.

4. My forecast for 2009.

It looks to me as though that we are due for a debt unwind, and with it a rapid decline in the US standard of living. Exactly what form it will take, and what the timing will be (for example, sudden one month from now or sudden three years from now, or gradual over a longer period), isn't certain. I would expect that many (or most) other economies in the world will be dragged along in this debt unwind and will experience a decline in their standards of living.

As I note in the Section 1 discussing why so many asset classes are correlated in time of stress, the tower of debt (Figure 1) has many feedback loops, and tends to magnify the economy's reaction to events, both favorable and unfavorable. When consumer debt is rising it tends to make the economy look very, very good. When there are layoffs, the interrelationships tend to magnify the impact, making the economic impact much worse. One wonders whether there are tipping points, beyond which it is not really possible for the system to recover--particularly now that the US seems to be at the point of "peak energy" (Section 3), energy is required for growth (Section 3), and growth is required to allow debt to continue (Section 2).

The tower of debt is in some ways deceptive. It can make the economy look mostly OK to the casual observer, until all too quickly, things start to fall apart.

So far, the "fixes" that the US government has been attempting seem mostly counterproductive. Putting government guarantees behind more and more debt (thus stacking Figure 1 higher and higher, with a new TARP layer) just increases the likelihood that the US government will be drawn into the downward spiral. The financial services layer will be less and less needed in years ahead, as our need for debt-based products declines. Bailing it out does not help get additional income to ordinary workers (although it may temporarily protect them from losing their bank account balances).

I expect that essentially all aspects of finances will be affected by the unwind of debt. A huge amount of debt will be defaulted on (or will be forgiven, so that an actual default does not need to occur). Regardless of whether the non-payment occurs because of default or forgiveness, the effect on financial institutions will be the same. Financial institutions such as banks, insurance companies, pension funds, and many hedge funds will find themselves in poor financial condition, because they were depending on the proceeds of this debt repayment to fund what they have promised--bank account balances; insurance policies; pension payments; or hedge fund returns. Institutions guaranteeing debt, such as monoline bond insurers will be particularly hard hit. The FDIC will likely be called on to rescue many failed banks, and will need to find funds from some source (printed money?) to do this.

As the year goes on, I expect each evaluation of where we are to be worse. Banks will report operating losses each quarter. Fannie and Freddie will need more funds than originally thought. TARP will need more funds than original planned. More and more businesses will enter bankruptcy, and more and more governments (states, cities, counties, and countries around the world) will find themselves unable to meet their obligations. There are a huge number of inter-relationships, and the bankruptcies and losses in one area will tend to cause more bankruptcies and losses in other areas, and act to destabilize the debt tower.

Debt of all forms will be very difficult to obtain, except through government sources. The interest rate the US government is currently paying is very low, mainly because of a "flight to quality". If the US government keeps issuing more and more debt, it seems likely that at some point this will change, because buyers will figure out that even if the US is the best of a bad lot, its risk of failure is significantly greater than 0%.

I do not expect a steep rise in the price of oil and natural gas in the next year, because the decline in demand is likely to outpace the decline in production in the short-term. If we look back at Figure 2, I expect that funds available to ordinary citizens will continue to decline in 2009, even considering any stimulus plan. This will happen because employee compensation will decline due to layoffs. Household debt outstanding will also decline (rather than just stay flat, as it has in the past year), because of the poor financial condition of lending institutions, and because with the poor economy, the risk of borrower default will be quite high, discouraging lending. A $300 billion stimulus program will be tiny in comparison to the boost the economy got in the past from increasing debt and greater refinancing (up to $2 trillion per year), as the prices of homes increased. With lower incomes, lower (actually net negative) cash flow from borrowing, and only a modest boost from a stimulus program, citizens will have less and less to spend on goods and services.

I think there is a distinct possibility that this could all end very badly. One possibility is that there will be more and more defaults, and the US government will not be able to prop up all of the institutions and will eventually default on its debt. While this seems to be the direction things are headed at the current time, the much more usual outcome is hyperinflation, caused by printing more and more money, wiping out the value of people's savings and pensions. Situations such as these are often accompanied by a new government (including a new constitution), and may even include different country boundaries (for example, Soviet Union after its fall).

Many people have started making preparation for the time when food needs to be produced locally and electricity is often not available. I would not discourage such preparations. While we do not know that the economy will collapse completely, I think such preparations are prudent, in the face of rising risk. Preparation for a major change takes many years, so starting earlier rather than later makes sense. Also, with the tower of debt (Figure 1) and the many feedback loops, the downward spiral can happen more quickly than our prior experience suggests is possible.

To solve our current financial problems, I expect that the United States (and other countries) will ultimately need a new financial system that is much less debt based. Such a system might start simply as ration coupons for food and energy products, and gradually be expanded to replace our current monetary system. Debt forgiveness and derivative write downs will also probably need to be part of the solution, but with the caveat that debt forgiveness and derivative write downs can be expected to have just as adverse an effect on the balance sheets of financial institutions as outright defaults. In conclusion, 2009 looks like to be a very challenging year for the new administration and for the world as a whole.

Last year's forecast: Peak Oil and the Financial Markets: A Forecast for 2008

Thanks, Gail. I'd been waiting impatiently to view your prognostications for the year.

This year's assessment is at least as dire as yours from last year, but perhaps not as detailed.

Do you have a sense of timing or sequencing? Will commercial real estate collapse before bonds go?

Where will unemployment end up? Will we get off with "just" 11 percent? Or will it go to 25%?

To me it feels like we're sandbagging against a growing surge. Each new bailout provides a new supply of bags, but the baggers are getting tired yet the flood is rising. Before too long a levee here or there will be allowed to fail, in order to relieve some pressure and permit focus on another area, but even then the water will keep rising.

Perhaps all that bailouts will due is slow the faults, so that people have a bit more time to adjust. Some items like debt can be addressed to a degree through financial discipline. Unfortunately, job losses are hard to evade, and home value losses will accrue to somebody's balance sheet -- I may sell mine in time, but the poor sucker who buys it will then eat the drop.

Regarding where we are going, I think we tend to be very tied to our past experience. We tend to think that if unemployment only went to 11% in a past recession, that is as high as is it will go. I expect what we are doing is moving on a continuum from 100% (or 94%) of us being employed in today's types of institutions, to 100% working at self-sustaining occupations which may not even be counted in today's estimates of what the economy looks like. We could very well end up with 25% of the people losing their jobs in today's economy, in 2009 or 2010. Some of them may figure out a way to do something that doesn't fit in today's economy. Some may grow more o their own food; some may (illegally) work on dismantling buildings that are no longer being used, and selling the scrap for other uses. In the years ahead, I don't see the traditional unemployment rate as going back down, just more jobs moving to the currently uncounted sector.

Regarding what happens first, the problem is that everything is so interconnected that what happens first is almost irrelevant. Perhaps commercial real estate collapses three to six months before bonds, or perhaps it works the other way around. Everything is so inter-connected that each decline helps bring on another decline. If you are thinking that you can put your money in one area, then quickly move it to another, I doubt that you will really be able to accomplish what you plan.

Thanks for the reply.

I wonder if the unemployment rate will also degrade in meaning as the underemployed will grow -- an unemployed banker working as a grocery stocker is "employed" officially, but perhaps not in his view.

I wonder if the collapse of the two-earner family may occur as well, as the combination of lower wages and harder work may well push second-earners back home to help save money (clipping coupons, cooking from scratch, avoiding childcare bills, etc.). A single-wage-earner may travel to find work as well, and send money home to the "wife and kids". I can't see a lot of companies paying relo in a worker-abundant market, and moving a household may be an expensive risk just to follow work, but commuting for contract work, seasonal farm work, hurricane repair, etc. might make good sense for some.

"Betting the farm" on timing or even deflation/inflation seems like an unacceptable risk to me (see other comments in this thread). I'm going to sock away cash to the extent possible, and consolidate real-estate (fewer properties with few/no loans rather than more properties with several loans). It's a deflationary strategy, really, but "safe". Beyond that I just want to stay employed -- that seems like the most important "protection" you can have whether markets are deflationary or inflationary.

Highly unlikely any ex- bank worker will get a job as a shelf stocker, as the retail sector will be forever shrinking too. Those people I saw in their last days at Woolworths will never have a job again, I reckon (though I could not bring myself to tell them).

And not just the collapse of two-earner families. The sums will cease to add up. All sorts of households will go bust, start to starve and become ill, and resort to suicide if not dead by other means first. "Wealthy" people will not be exempt from this, as their wealth is a mere figment of imaginations of varying enthusiasm.

The big question is what do I do with my limited retirement funds? So far i am paralyzed with indecision.

Can't TOD produce some articles on this subject?

I think the point is that almost any paper investment will not work, and you cannot expect government or insurance to provide very much. I expect most of us will end up working as long as we are able. If we can team up with children or other younger relatives, that could be helpful.

There might be some things that one can buy that will be helpful for barter. Some argue that physical gold and silver will be helpful. Small, useful objects would seem to be even better (bottles of liquor; medicine; canned food).

Buying land, tools and seed theoretically might work, if we can also learn the necessary skills, can deal with all of the needed inputs (water and compost particularly, also ways of repelling insects and animals), and keep others from stealing what we produce and the government from reneging on our ability to keep the land.

We have started the Campfire series of posts (Wed evenings and Saturdays), dealing with some of the practical aspects of what may be ahead.

I am assuming that at some point in the next decade, the US government will realize that it cannot possibly make good on Social Security as presently configured. What I expect to see happen is that everyone will just get a minimum amount each month, regardless of prior earnings and contributions. This minimum will be pretty low, and become ever-lower in terms of real purchasing power. Someday it might go away completely.

I also expect that the federal or state governments will increasingly rely on institutionalized programs to deliver food and shelter to those who are unable to live on whatever money they have. The feeling will be that living on one's own in one's own home is a luxury, not a right, and if one doesn't have enough money to afford it, then it is not an increasingly impoverished society's obligation to provide it.

Thus, for those of us approaching retirement, I suggest the following:

1) You MUST liquidate all debts, and own your home free and clear. Don't even THINK of retiring unless and until you are at this point.

2) Try to set yourself up to raise as much of your own food as possible, make your home as energy efficient as possible, and invest in renewable energy if possible. You want to minimize your dependence upon and vulnerability to food and energy supplies.

3) Be prepared to do SOMETHING to bring in some money (or bartered goods) for as long as possible. This might be something different than you are doing now. Forget about "retirement" from all work; at best you might be able to shift to a different and less physically demanding type of work.

4) Reconfiguring one's home so that one can take in a renter is a good idea. Not only will this bring in enough money to help cover property taxes, there are also advantages in having more hands around the house as one gets older.

5) As far as your finances are concerned, don't put all your eggs in one basket, and live below your means. You need multiple retirement income assets, and need to assume that some will lose value or might go away entirely. You need to live on less than what your retirement assets could provide initially, because you might have less in the future.

Are you referring to all debts, or just the secured ones? Credit cards, not being secured, don't provide a creditor much remedy to get their money back. Not being an expert in Cred Rem, (never took the course in law school, not my interest then, wish I had now) it appears it would be difficult to go after real property to satisfy a credit card debt. I'm guessing a lot of this debt will go up in smoke.

I personally have followed this, but I am not as certain that liquidating all debts is necessarily helpful. If the US government has huge debts, it will work as hard as it can at inflating those away (pay them back, but in dollars that aren't worth much). Also, if we go to a new monetary system (similar to rationing coupons), who owes what in the old monetary system may not make all that much difference.

I come at this from a different direction. I assume that as one enters what we presently know as "retirement age", one's ability to adjust to changing circumstances becomes increasingly constrained. For example, it is fine to say that one simply will not retire and just keep working. Unforunately, your body just might not cooperate with that plan, and employers might not be very keen on it either. Thus, I am suggesting that one forgo the temptation to game the system, and just try to minimize one's vulnerabilities.

That probably is the smart choice, and the one I'm taking. However in a situation in which one has to make the choice between paying off unsecured debt, especially if it was made for an emergency such as unforeseen medical bills, versus paying day to day bills or keeping some cash stashed in a secure place to give one some flexibility, I'd go for the latter, and consider bankruptcy as an option. What good is being debt free if the credit market has collapsed and you have no cash or assets to help you through?

The ideal would be to pay off the credit cards AND have cash, but if the former is isn't possible in a reasonable time frame I'd rather have cash on hand, too. Thus I'm "hoarding" cash right now and will get back to paying down the credit cards once I've reached a certain level of cash.

The cash hoarding would go quicker except that I'm also making other preparations i.e. building my personal library, stocking the disaster kit (which got up there in $$'s once I was done), etc.

WNC, realistically, I think that the longer term future of baby boomers is something like what happened in Russia - they now will need to rely on their children or other family members, or on non-family relationships that trade long-term support for home and land. I don't think that most older people will be physically or economically able to go it alone - Orlov observed that this was particularly tough on the grandparents who had been able to help their children and now depended on them. Elder work is often likely to be child care so that the adult children can bring in income - I expect to see a lot of older folks lose jobs and never be able to find them again. Cottage industries are good too.

I agree strongly about paying off the house - because boomers have a disproportionate portion of wealth, and frankly, there's a good chance their kids and grandkids are going to be living in it with them. The family home and its capacity to produce food and cottage industry will probably matter a lot more than it has.

But if I had to add a number to that list, it would be "begin to get along with your family." Right now with one exception, our parents are all comparatively more affluent than we are - but they rely on invested funds, not on earned income, and I have long term concerns about what they will live on. I'm not a totally atypical case - my husband and I between us, in our mid-thirties have 7 parents - divorce and remarriage on both sides. For my husband's four parents, he is an only child. Our personal nightmare ;-) is the arrival of previously divorced exes, all in crisis.

Sharon

Should we see a collapse of biblical proportions, on the order of something between the Dark Ages (though a bit of a misnomer) and the Stone Age, I wonder if the practice of discarding the infirm and unproductive might begin to arise? Seems euthanasia and suicide might become more accepted options for the formerly-affluent current generations unable to cope well with the reduced standard of living.

Caveat: unlike many, I see the only things preventing everyone being well-fed are ignorance of farming methods, politics and Big Money. It is, in my opinion, absurdly easy to feed all 6.7 persons currently alive. However, people (in the sense of the entirety of humanity, are selfish and stupid, so...) Thatis to say, I am not advocating the above measures in any way, shape, or form.

Cheers

I agree. I consider myself a techno-cornucopian, and a political doomer.

We could solve these problems, but we won't.

That's really the most frustrating part of all of this. It doesn't have to be this way, but it will.

You and I might disagree on the level of mitigation possible but more and more I think it's moot.

Politics are barrier 1

Disaster capitalists are barrier 2

Foreign bad actors are barrier 3

Mix this all in with a healthy dose of denial, BAU and a credit crisis and I think we're toast.

Gail, I'm thinking you are considering this from the individual's point of view. Consider the point of view of the economy as a whole - another way of looking at the same picture:

Every dollar is a claim on future resources. In a world of limits, those dollars have to be generated by grinding up a smaller and smaller resource base even while carrying a larger and larger overhead. 2007 showed some sort of limits beginning to shut down consumption. Imagine the Easter Islanders taking out a loan to increase the production of bigger stone heads. Of course, all the masons and woodcutters need work, right? And consider, that is precisely the solution offered by the economic stimulus packages. We're dumping our children into a world where they will have less of everything and have to grind up more of those resources to make the payments.

An intuitive argument, I'll admit. One I used in a letter to editor today about Maine's budget mess.

It's time to "pay it forward".

cfm in Gray, ME

I am afraid our financial people (and I am one of them) are the ones that the government seems to think it needs to bail out. Most of the "products" that we make are about as useful long-term as bigger stone heads. They only work in a growing economy.

What's ahead doesn't look good.

Very interesting piece.

The people in charge are basically doing what they say they are going to do. That is, the expressed jobs of the Fed and the Treasury are basically to protect the financial system and growth. From their respective Mission Statements (emphasis added)...

Fed Mission (http://www.federalreserve.gov/aboutthefed/mission.htm):

Treasury Mission(http://www.ustreas.gov/education/duties/)

The people controlling the "fixes" are not trying to fix what is really broken, they are trying to preserve it! Neither the Fed or the Treasury is the least bit interested in examining the possibility that the fundamental economic structure is flawed. And, frankly, given their mission, that is not their job. Their job is not to figure out an economy that works, but to protect the one we have. If we are looking for "fixes" we will need to look elsewhere.

Brian

I wouldn't expect to find "find new sources of cheap plentiful energy" in there but that would probably achieve some of their job for them too...

Nick.

New sources of cheap plentiful energy is fast neutron breeder nuclear power plants. Such reactors designed to breed fuel by producing more fissile material than it consumes.

How about building some giant 100 GWt plants on ocean floor (or shelf) for security reasons?

Russia planned start to build commercial prototype 1.8 GWt (BN1800) fast neutron breeder nuclear power plant near Zarechny, Sverdlovsk Oblast in 2012. One prototype 0.8 GWt (BN800) already in building phase and get operation in 2012.

Good points, Brian. These are among the reasons I found this paragraph in the otherwise-awesome (as usual) post by Gail to be rather naive:

"So far, the "fixes" that the US government has been attempting seem mostly counterproductive. Putting government guarantees behind more and more debt (thus stacking Figure 1 higher and higher, with a new TARP layer) just increases the likelihood that the US government will be drawn into the downward spiral. The financial services layer will be less and less needed in years ahead, as our need for debt-based products declines. Bailing it out does not help get additional income to ordinary workers (although it may temporarily protect them from losing their bank account balances)."

The fixes are counterproductive only if you think the real underlying goal was to help anyone other than bankers, hedge fund managers and other types. Paulson is saving his own kind, the rest of us be damned. In spite of some rhetoric to the contrary, the "ordinary worker" is not represented at all well in our system--there is no labor or workers party, and organized labor is notoriously weak.

I have no great faith that the new administration will do much better--Paulson is being replaced by his partner in crime. Perhaps that will depend on the rapidly changing circumstances so eloquently described by Gail, as well as how much pressure is exerted by the likes of those on this board.

I keep seeing complaints that even organized labor appears to act in the interests of the union management rather than the rank and file, so it's possible that the only voice of the people at the bottom is their votes (often wildly at odds with the leadership) and their spending.

"even organized labor appears to act in the interests of the union management rather than the rank and file"

Yes, all too true all too often. Yet another measure of how dis-empowered workers in the US are.

Sadly, no. The people don't seem to have much control over who the choices are to vote for. There are few Mr. Smiths in Washington. I know of only two: Paul and Kucinich.

So, the power of the people is in their protests: their arms, hands, legs, feet and voices.

There is precious little "people power" evident at this time. Koreans have my respect for forcing their gov't to reconsider the trade agreement with the US (though I disagreed with their reasoning as being irrelevant and a bit childish). The Greeks, too, though I know next to nothing of their reasons for protesting. What I admire is that they will act at all.

Cheers

"There are few Mr. Smiths in Washington. I know of only two: Paul and Kucinich."

For a split second when I first saw this I thought you meant Paul Wellstone prompting a wistful smile-- happy to remember him; sad that he is gone.

The libertarianism of Ron Paul is so naive that I don't often think of him as similar to Dennis K., but I guess they are similar in the depth of their analysis of the problems, especially compared to everyone else.

I dont think they are looking ahead that far. Maybe their only plan is to keep those workers in jobs for as long as possible even if its only for another couple of years?

I keep seeing these very pessimistic reports about the future of the car industry, worldwide, in the MSM.

Dammit, that's the same metaphor I was writing into a piece yesterday.

I swear you're reading my mind and stealing my ideas! Now where did I put that tinfoil hat...

I like that bit in the letter about needing to dampen business activity. Isn't everybody trying to keep it going.

Yes, even around here on TOD, many are trying to think of what we need to do to get back "up to speed". This crash is framed as something that needs to be fixed. Seems to me it would be better to direct it. Business activity - the realm of retail and consumption needs to be reduced. We need more stay-at-home moms and dads out of the money economy repairing stuff, gardening, ditching the second car and so forth. Remember that the sources of our problems are our own successes.

It's going to be "fun" tussling over the cuts in the state budget - already about 20% and sure to grow. A bunch of us are going to put Peak Oil, resource depletion and borrowing front-and-center in every committee.

cfm in Gray, ME

I think you are correct. Of course, at The Oil Drum, we have quite a few different writers, each with different perspectives. I hadn't really thought about directing the crash.

Alcoa is laying of 13% of world workers, and Big 3 factories are sitting idle while we sit here with a looming energy crisis and no wind turbines or solar panels.

Seems to me that directing the crash and then softening the landing such that we have a path out would make a lot of sense. Ramping proven, EROEI-positive alt energy production will be a necessity to maintain viability on the world commerce stage after the dollar plummets.

We at TOD have long been in the position of watching and predicting situations over which we have no control, like geology and world markets. We could potentially impact behavior in at least some countries, and add tremendous value. It's a great paradigm shift, and for me, an epiphany.

Aluminum production is, of course, enormously energy intensive.

Perhaps one of the brainiacs (and I mean this in the most respectful, awe-struck sense) could do an analysis of the most energy intense industries. A separate and more political analysis would be to balance energy intensity with necessity/desirability.

As we are seeing with the recent low prices for oil, the market does not give consistent indications of the direction we should be heading, so depending solely on "market forces' (much less the "magic of the market," a term you don't here very much these days) does not seem a very prudent course to say the least.

Energy intensity is one thing, but I doubt that Iceland's hydropower is going to be good for much else. Once such investments are made they're probably going to run unless the price of product heads down toward the cost of ore.

I'd bet that the sudden crash in prices due to the abundance of scrap aluminum has more to do with this. Of course, being able to buy aluminum at 40¢/lb should be a boon for somebody... which is a point I touch on in the piece I'm writing.

"Every dollar is a claim on future resources"

Chris Martenson gives it a personal touch: "Debt is a claim on future human labour".

http://www.chrismartenson.com/crashcourse/chapter-12-debt

Regards, Matt B

Still a concerned dad in Australia

PS. Just out of curiosity (it's probably been done to death), what do TODers think of Chris' "Crash Course"? I ended up downloading the whole thing and handing out a few DVD copies to family and friends.

Waste of time?

To paraphrase Kramer: No, no, no, no. (Irony intended)

The point may fall on deaf ears, but the point must be made. The more people that understand means that fewer people will suffer, or suffer less.

Rather than be the clarion call, make sure that those close to you are prepared, after that you can walk around with a sandwich board.

I find no flaw in Martenson's presentation, although I wish that someone here would point out the errors. :-)

Best wishes to you and your offspring, for a better and simpler life. It will be simpler, it's up to you to make it better.

Thanks pragma; a simpler life would suit just fine - a great sunset beats a TV screen anyday.

But what errors? I thought the exponential math could have been explained a little better; more Al Bartlett(erish) - perhaps use China's recent growth as an example (seven years at ten percent/the doubling factor). And the surplus arguement for *either* growth OR prosperity seemed overly-simple.

And perhaps the "solutions" chapter...

But otherwise, what errors?

Regards, Matt B

He also ignores climate change. Big error. You simply cannot come to a rational conclusion about the future without factoring that in. Absolutely impossible.

Thus, his future projections will always be flawed. I got the impression from the many denialists posting there that he is a denier.

He doesn't say anything anybody else isn't saying. He's just made it into a nice presentation. Until he adds in proper climate info, he's not saying anything of great use.Financial advice and survival advice can be found anywhere. Even at this late date not many are putting it all together in one place.

Cheers

Climate change is a result of the overuse of resource "sinks". I don't consider it a flaw in Crash Course logic, only something he doesn't explicitly discuss much as its own entity. Environmental toxicity - a huge sleeper - would be in the same category. I do find the Crash Course a good, accessible economic primer and recommend it to many.

cfm, sunk in Gray, ME

The Martenson course is great except the last chapter where he fights very shy of drawing the full clear implications of the preceding 19 chapters. He just leaves it as a choice depending on the "beliefs" of the reader.

He bypasses nuke energy, because as he said to me he just didn't have room.

Resource depletion and environmental degradation do not equal climate change.

He explicitly avoided climate change. Why? Again, my suspicion is he is a denialist. Again, some of the things he recommends make no sense in a climate changed world. A nice presentation, but let me ask you, did you actually learn anything?

So, another tool in the belt, but not the Swiss Army Knife for the Perfect Storm that we really need.

And, yes, I have an inherent disrespect for denialist (as opposed to true sceptics.) I consider them suigenocidal. (<-- My new term.)

Cheers

As 2008 slinks off to the history books, my impression from MS media, government and even my immediate circle remains...

Perhaps 1pc understand resource depletion (or limits to growth);

Perhaps 10pc believe man's contributing to GCC;

Nearly all believe 2009 will be a substantantial challenge to their financial positions (or folk in their own circles).

If I, very much a fellow Joe Average, can pop something in their lap that encourages them to think about the immediate future (in some way) and perhaps learn a few "big picture" basics, that's a good start right?

Regards, Matt B

Paying the bills from April onwards (when my contracts run out - where I've been the past couple of months, attempting to write up more) is foremost in my mind. Doesn't mean I'm a denier of other things, but in a big city, there's priorities.

Further, it's taken up to now to get my (very much smarter) wife onboard with me - well, at least to begin "window shopping for life jackets".

As I said, another tool in the belt.

Cheers

best on the web.

Agree. The download and transfer to DVD is disappointing (PAL version anyway). "Looks" unprofessional, and I said so on the site's feedback...

Regards, Matt B

Looks like the "Club of Rome" 1972's "Limits to Growth" can be applied to more than just population.

There are lots of systems which operate on this kind of positive feedback and suffer disastrous crashes by over committing during "the good times" without ever worrying about having something in reserve when circumstances change, as they always do.

Are we doomed to just being lemmings trapped in a series of boom/bust cycles?

No, one cycle - bust.

Denninger says yes. He calls it "The Price of Capitalism."

"Capitalism" as we would recognize it has only been around for a few hundred years. Human civilization got along without it for thousands of years before that. Of course, there was hardly any economic growth.

If our future is one devoid of economic growth (as I believe it must be if "sustainability" means anything at all), then it sure would be good if that future continued to be civilized. I am not at all sure that anything we would recognize as "capitalism" is really needed at all in such a future; indeed, trying to continue the capitalist paradigm might very will cause more harm than good, and prevent us from estabilshing and maintaining the steady-state economy that is needed for the survival of human civilization.

What am I suggesting instead? I don't know. I do know that capitalism is just one of many possible economic arrangements. Some perform better than others, depending on the circumstances. When the circumstances change (as ours certainly will), then the list of what performs the best changes too.

I don't have an answer, but maybe in light of the post(s) above about directing the crash perhaps Gail or others more in the know than certainly me could comment on what other economic "systems" would be best for an economy in need of sustainablility.

And then how we might transition from this form of capitalism to the more optimal system.

Pete

I am definitely not a student of forms of economic systems.

I know that in the insurance world, the old form of business ownership was the mutual company. A mutual insurance company is owned by its policyholders. In recent years, there has been a trend toward demutualization. I believe State Farm is still a mutual insurance company. Another old form of insurance ownership was Lloyds of London, in which a number of wealthy individuals pooled their wealth to form the insuring organization. There are a number of variations on these forms of ownership.

Among insurance consulting firms, the traditional form of ownership has been ownership by the principals, or by all employees.

If the economy is moving toward more local companies, and difficulty raising capital, it seems like the most probable outcome is more companies owned by individuals, or groups of individuals, in an area. If the goal of the these companies is to produce products used mostly in the area, and to provide jobs to people in the area, this could work out well. When there is a close tie to a particular area, a company is likely to have more concern for not over-using the resources of the area, not polluting the area, and taking care of the people in the area.

The larger issue is what constitutes a social system that benefits the members of society in meaningful ways, not just material goods, but life satisfaction. This would include economics, social norms and mores, and all governance mechanisms.

For several years now I have been researching the mental and neurological basis of wisdom. It is not just more intelligence, but rather a higher form of moral/ethical judgment backed up by strategic and systemic thinking covering much longer time frames and many more 'members' of the we-group. Wisdom is what is sorely lacking in our current systems and there is an evolutionary explanation for this. Sapience, the mind/brain basis for wisdom is not fully developed in the average human being. We still, at best, possess tribal-level sapience but are trying to make judgments about a globalized world of nearly 7 billion people. A successful form of social structure and function should, I think, be based on a more sapient approach. It turns out that nature provides many elegant models of governance and organization that, if we were wise enough to pay attention, would provide us with something I call sapient governance.

Starting last July 20 I began posting a series of blogs (actually pointers to essays maintained at my university server) about what form sapient governance might take. Governance, in this context, includes things like markets with levels of coordination control (regulation in today's jargon) up through strategic management of Earth's resources for the benefit of the whole planet, not just mankind.

You can find the blogs at: Question Everything (July). Scroll down to July 20 to start.

I have been thinking for some time that the systems we have created would have to come to an end eventually. Now it looks to be sooner rather than later. What do we do to pick up the pieces? How do we reorganize for a new reality after the energy bank is empty? What path should humanity pursue to capitalize on its accumulated knowledge base and secure a place for the genus Homo in the future of evolution?

I have no thought that our current systems will be saved. Indeed they need to be radically altered, many scrapped, if there is to be a viable future for human kind. But how we go about 'directing' this process will determine success or failure. Success means Homo is still in the evolution game. Failure means extinction of the only abstract symbol manipulating genus to have evolved on the planet.

Question Everything

George

PS. my current blog is along the same lines as Gail's post.

THANK YOU George - and Gail.

Pete

Great Post.

I do disagree with some of your points though. You mention that by stimulating manufacturing and services today that we're pushing the payments into the future.

Keep in mind that the financial economy and the real economy are two different beasts. There's a limited amount of production, so there's a limited amount that can ever be "paid back." Unless you're talking about more "dollars" being paid back. In that case, the government can just print more money and inflate. That's how they are going to get out of this. Inflation solves all of the problems. Social Security will stay solvent. It's just that your $1500/month social security check might be enough for a car payment, or for some food. Inflation is going to hurt those on fixed incomes because they aren't "contributing" to society anymore. It's not going to be the end of the world. Four or five seniors will be able to pool their retirement savings and social security. Doing that, they should be able to live a fairly comfortable communal lifestyle.

Personal income has to at least come close to keeping pace with inflation, otherwise, people won't come to work. They might show up, but they won't be very productive or happy. How will companies be able to increase the wages of employees? Expect some sort of massive tax break on payroll taxes, or some other type of incentive to encourage massive increases in the pay of the average worker. The net result is a type of "reset" of the system. Production and consumption is re-established. The liabilities are a lot easier to handle for the government and for individuals. The "only" people who end up getting screwed over are those who aren't working, who are looking to retire.

Along the way, we're going to end up with bubbles. My hope is that the bubbles this time go into productive things. With the housing bubble, we're left with a bunch of poorly built and overly large homes a great distance from population centers. If the next bubble ends up being alternative energy, rail, or conservation, we're actually left with something Useful after the bubble breaks.

I don't quite understand what you are saying, and I don't think you quite understand what I am saying.

If future resources aren't there, they just aren't there. Printing more money won't change the situation--the new money that is printed just becomes worth less. If there aren't enough resources to raise personal income, it can't rise in a real sense, no matter how much money the government may try to print, or how unhappy or unproductive workers might become. If you have a "pie" of resources, you can cut the slices thinner, but you can't make more resources. The printed money that the government makes will become worth less and worth less, until it finally becomes worthless.

This is a link to my post The Expected Economic Impact of an Energy Downturn. It explains some of the same issues differently.

Actually, I think we're in agreement regarding the ultimate outcome, but differ on the way it's going to play out. I did seem to be a bit cornucopian in my reply, but that's not the case at all.

Printing money does change the situation regarding the debt pyramid. If the economy does inflate, you're not going to see the collapse of the pyramid for a little bit longer. There is a possibility through inflation of keeping the financial system intact while also bringing our standard of living way down. Imagine that the price of goods quadruples. Now, imagine that person income doubles. I know this is a simple example, but you have a situation where our standard of living is going to be lower, but our debt burden is also going to be a lot lower.

In these situations, the people who are going to be hurt the most are the elderly, and people who have their money in "safe" investments like Annuities, etc. If you can somehow stabilize the money supply, you have a chance of at least holding things together after you inflate. If you don't (Which I suspect we won't be able to) you're going to end up at a hyperinflationary collapse at some point due to diminishing resources.

"That's how they are going to get out of this. Inflation solves all of the problems......"

Now consider this: US imports 70% of oil and petroleum products. As the value of the dollar decends the oil exporting countries will curtail production to keep the price of oil (in dollars) rising. How do we get by on oil that is say $1000 per barrel and gas is $40 per gallon when average wages are $1000 per week?

If the US dollar falls to 10% of value from start of year to end of year, expect oil to rise by at least 10 or 20 times (Canadian nat gas will rise similarily) keeping the average working person in the "poor house". Inflation solves nothing for things we must import like energy.

This is the reason that I've LONG said that energy conservation and alternative generation is a strategic imperative for our country. If we could break-even on energy (no massive imports) we can ship grain to get goods, and inflation of the dollar will help us export some goods as well and thereby rebuild a manufacturing base.

I think you are correct that with today's oil in the picture, the picture is dire with inflation or deflation either one. It's also dire for the holders of our debt either way.

This is why I am not expecting inflation for quite some time. It's not just the money supply, it's the velocity of money. People have to spend it. I don't see how they do that without wages rising, and I don't see wages rising any time soon.

Two possibilities. First, a massive tax cut or other stimulus to corporations in order to encourage them to raise incomes. The second is a possible "Debit Card" idea that's being floated by the FED. Basically, everyone gets a debit card. The Fed can put "money" on this card instantly. The "money" must be spent on goods or services. The balance declines as time passes.

It's the wet dream of a central banker. In their mind, recessions would be a thing of the past!

I don't wear a tinfoil hat, but that's just scary!

I would be tempted to cash that card out, like the food stamp people do.

There will be a huge black-market business there, at $.50 on the dollar.

This isn't just a temporary Debit card. This is a permanent card that may have more value added to it in the future. I don't know if people would want to part with that. Even if you people "trade" the use of the card for $.50 on the dollar, the card still can only be used for goods and services. Thus, at some point, the card has to be used to "stimulate" the economy.

That still wouldn't stop you from replacing your cash expenditures with the card. It wouldn't even stop you from buying services (e.g. welding) to make capital investments in your own productivity that you can use outside the formal economy. That would make you better off while cutting out both the fat cats at the top and the government.

The more I see this, the more I see pressures growing to satisfy the urges of the Hippie-era anarchists: smashing the state!

It seems like it would be very easy to use the Debit Card to buy your usual groceries and gasoline, and leave your other funds wherever there are. How in the world could they make a person actually increase their total spending because of it?

Very few people think that way. Sure, with any stimulus, some people "save" the money. Most people view it as a Bonus. Heck, even if people do use the money they "save" to pay down their debt, that reduction in debt is going to have a psychological impact on how they spend in the future.

With it being a debit card, they can set it up so Gas or Grocery purchases would be rejected. The possibilities are limitless.

The biggest benefit isn't being able to control where the money's spent, it's the fact that the Fed can Instantly give money to the people. It's the closest thing to Ben's Helicopter you can get. The checks work well, but they take months to print and distribute. This would be instant.

Money stuffed under a matress has a particularly low velocity rate.

Because everybody is having a hard time figuring out if/when the deflation switches to inflation, I would imagine it won't happen over night. You could probably get away with keeping the money in the mattress until the TODers start to say go, then spend it on the proverbial "shovel".

Great insight!

Question: With all this talk of dept forgiveness, am I doing the correct thing by paying off my mortgage?

I assume that I am not inline to be "forgiven".

I would continue to make your normal payment, but I wouldn't be putting any extra money towards it. If we end up inflating (Which is looking more and more likely to be the result of the trillions of dollars being pumped into the system) it's going to be a lot easier to pay off your mortgage.

The Fed is working on getting rates down to 4.5% if you can refinance at something like that, inflation doesn't have to go very high before you end up with a Negative Real interest rate.

If I had extra income for a mortgage, I would be putting into a CD or other "safe" account paying interest. This gives you some time to see what happens. If your mortgage is 6% and you're putting your money in a 5% cd, you aren't losing much by holding off on the payment. If you can get a 4.5% mortgage, and a CD at 5%, you're making money by not paying extra!

If we end up deflating, the money might be needed for other things, if we inflate, you can use that money to buy toys!

My situation is as follows:

I work for an oil services company in Houston. Because they had a good year in 2008, I will get a bonus. This year, I will run the risk of being laid-off.

My mortgage is set at 5.25% and my CDs are running at 2.9%. Between the CDs coming to maturity and the before mentioned BONUS, I could blow it all and wipe out my mortgage.

I might commit suicide, though, if Obama comes out in September to say that all mortgages are being "Forgiven".

I'm pretty sure the new administration is not going to suddenly 'forgive all debts.'

They might try to coerce some more favorable rates from the lenders for the people who become unemployed during this recession (nobody profits during a depression.)

Still wouldn't do me any good.

I've been laid off since 2007 but I'd already paid off my mortgage, so between unemployment and some cash on hand, I'm hanging on.

I'm back in college (bye bye IT, you were fun while you lasted. Hello communications degree and blogging & podcasting)

Lots of very wrong advice hereabouts, IMHO, in regards to inflation and home ownership.

If you own a house outright, and the inflation genie comes to call in a big way, which it will, what needs to be done is this.

1. Unless you are on a farm, or have a few acres in a good safe area and have a small super insulated place, borrow as much as you can against your house or condo. The rate is not important anymore. 30 year fixed...it will never be worth more than it is today....open your eyes and ears to what is going on. If you live in an area that drops out, a subdivision that is unsustainable and unprotectable, or you live in a condo in the city, you will be able to walk away and have something to keep you going for quite a while. You will not be getting a Bailout..sorry to disappoint. Most people will not be able to get out of the cities with more than the shirt on their back. Be different. Think you can eat your drywall???

2. Take all the cash except for 2 years worth of payments,and turn it into solid tangible goods. Minimum 1 year food and water. Preferably more. Silver coin, some gold coin and a few other hard metals of value. Buy as much tradeable supply as possible, be it ammo, guns, farm tools, livestock that can be boarded at remote farm, seed ,booze, meds, etc. Find a safe place out of any large city to keep most of it. Friend or family, even locked storage will work. Buy the most fuel effecient ICE small car you can find. Honda FIT or VW Rabbit TDI. Pay cash for it. Do not buy a Hybrid. Buy a small quality trailer to pull with it and learn how to use it. Buy a few years worth of spare parts, tires, oil and filters. Gas WILL be available on and off for a few years, but buy a few good bikes with spare parts. . Easy to trade as well. Quality counts much more than quantity in all your tangibles.

3. Get clear of all of your financial assets, except for 2 years worth of living cash, to be kept in a very short term, easy to get at, interest bearing checking account. Everything else, out of the U.S. financial system. Completely out. Completely. Make sure your Passport is valid.

Two years out is about all most of the better Crystal Ball Rubbers can project to be safe, aside from a Nuke event. You will never, I repeat, never beat hyperinflation on the wage/income side. Never. If you think you can force your boss to give you a 25/30% raise every year, for the next 5 years, without a gun to his head, you are truly wacked and should put a gun to yours.

What you need, to be prepared for uncertain times, is just that. TIME. Time to roll with the punches and be able to make decisions based on changes as they happen. Not decisions based on fear. Not some pie in the sky, wish upon a star, techno fix. It ain't coming...And believe me, your government is not going to come to save you either. I am a certified Disaster Management Planner with FEMA...You must, plan for your own, and your families survival.

Um......thanks?

"I am a certified Disaster Management Planner with FEMA"

Given your background, I am curious about your take on my Scenario 2020 piece, which was on this forum yesterday?

Some here feel I am a bit blunt with a comment or two, but IMHO, the time for polite discourse has come to an end. My opinion is not for everyone. It works for me. Some still think they will be able to buy their way out of what is coming. I find it hard to believe anyone will be prosecuted for defaulting on a home loan in the near or distant future.

Your "Scenario 2020" is a VERY good exercise for thought. The reality as usual, sometimes comes out different. Try a rebuild to stability, without ANY Grid Electricity and see where you go.

Your 3 days to breakdown is right on the money. Way too clean though. I was in LA during the R.King riots, and that was just a small disturbance. Multiply it by a factor of 10,000, spread to every medium and large city and think about the dirt that rises to the surface of what we call civilization. The looting will be far, far worse than you can imagine.

In any community, Security will be the numero uno...that needs to be the priority before any food and water. Dead people don't eat much. The Fed will circle the wagons. The first thing they sent to NOLA was the Military....

Racking up credit card debt will work if:

1) you don't plan to need credit going forward

2) you are OK with walking away debts you agreed to pay, knowing full well you would not

3) the rules never change to where they come get you or your stuff because of the debts

Even if you bet on inflation and you keep your job you won't be able to pay off the debt, as the interest rates will rocket.

Other than that, I can't fault your preps. I've done most of them, and since I still have a mortgage I've even got part of your first point (though I wish I didn't). I'm still putting back more each month. Still gotta get a trailer (but I have some I can borrow now).

I'm a guy who is happiest owing no man anything but goodwill. I'll be happier when the mortgage is gone. Please, God, just one more bubble or 2 more years.......

You know, there is no consensus about ... 'inflation' or 'deflation'. Back and forth. Left and right. I've commented on this subject before, I suppose I will comment on it again, later.

The inflationists remark upon the ability of the government to create money from nothing and, of course, this is blatantly inflationary. Throw the bums out!

NOT SO FAST! The Keynesians are misinterpreted as to favor inflation in difficult circumstances such as ours. As a matter of fact, he became noteworthy as an advisor to President Roosevelt during the Great Depression. We are all Keynesians, now! We've been Keynesians for the past twenty- five years! Of course, most mainstream economists believe that sufficient 'inflation' (stimulus) will cause consumers to start buying, since if prices go up, waiting will only cause prices to rise out of reach. If a consumer cannot pay because of the loss of a job or an arm or leg someone will provide credit. According to the 'inflation plan', there will be a short recession and then we will all live happily ever after, with the Fed mopping up excess liquidity and the various 'toxic' assets bought by the taxpayers sold into an eager market at a fat profit.

It was Keynes who also said, "Deficits don't matter." When some dude with a reputation comes along and sez there really is a Santa Claus, who is going to argue?

The deflationists point out that the nature of inflation (as well as deflation) requires large public participation. In order for there to be inflation, not just rising prices for some items, both prices and wages must increase. Inflation only 'works' when there is an 'inflationary spiral' where wages endlessly pursue endlessly rising prices. This obviously isn't happening. When prices rise and the means to pay them disappears, this is deflation, since nobody buys the items or sevices and the companies with the high prices eventually go out of business. Today, people are losing their jobs left and right. Those who have jobs are earning less, since the hammer of doom hangs low over them; they might be fired next week or tomorrow ... or who knows when? Those who are more secure are paying off debts and retrenching. Not for them is the new car or home furnishings. The urge - and the means - to spend is kaput. Hardly inflationary.

Plus, persons overseas aren't buying American goods, either. Look at the Baltic Dry Goods price index:

http://www.investmenttools.com/futures/bdi_baltic_dry_index.htm

The bottom has dropped out of overseas shipping. Nobody is hiring ships or crews because nobody is shipping goods! Even at depressed prices, American commodities, airplanes and defense items are still too expensive for foreign customers, one reason is because investors are selling assets in these countries - particularly developing countries - and buying dollars or Treasury securities. This makes the dollar stronger and ... the strong dollar makes American goods even more expensive, but ... without rising wages or earnings overseas, nobody can afford to buy goods there, either.

Right now, we are in deflation. There is a consensus about that. Deflation scares the crap out of people, there is no hedge against deflation. All assets lose value and in a debt- driven deflation like ours, the means to support prices evaporates. We are truly doomed, indeed.

So ... what about all that cash the Fed is merrily printing away? There are trillions of dollars ... somewhere. Where are they?

Here's a remark by Martin Weiss:

Mike Shedlock has said the same thing ... and both point out that the notational trillions are worthless against the loss of asset value if the money isn't "lent or spent", that is, gotten into the pockets of wage earners, first. This leads right back to a lack of public participation. The stimulus and liquidity presupposes that dollars will fall into the hands of the public, like manna from heaven. If this were so; if the public had funds and these funds were earned - not borrowed - there would be no crisis! Of course, with less - or no - public participation, there is less credit created - less 'checkbook credit' - and the spiral of deflation accelerates.

What is the best way to cope? If there are no hedges, what about holding Treasuries? What is one to do?