Horizontal Wells and Gas Shales

Posted by Heading Out on November 15, 2009 - 11:06am

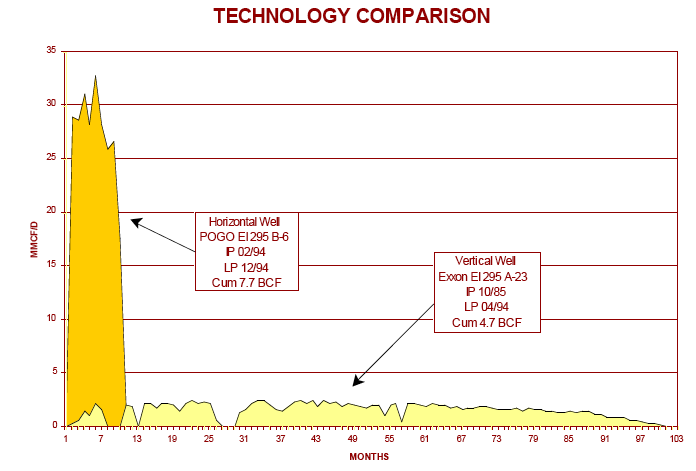

This post is one of my series of tech talks, describing some of the ways in which fossil fuels are produced. In the current part of the series we are focusing a little more on the procedures that are being used to recover natural gas from formations such as the Barnett, Fayetteville, Marcellus, Haynesville and Woodford shales. In this particular post I am going to concentrate more on the benefits of horizontal drilling through these shale reservoirs, rather than using the more conventional vertical wells that were used historically. This, and the next three posts in the series are likely to be a bit more technically dense than earlier posts, but I am trying to illustrate some of the problems of production, and some of the gains that technology is bringing to help solve some of them. And while the reason for the horizontal wells can be simplified in this graph from Chris McGill, there are a lot of other things that have to be considered in deciding whether or not the horizontal well is going to be worth developing.

Notice the gain in production, but much shorter life of the horizontal well.

To begin with it’s probably best to start with rock pressure. And to explain this I am going to do some simplification, so, as I ask in most of these “tech talks”, to those who do know better please understand that this is trying to explain concepts, but also please do comment on where I may either accidentally or by error, get something wrong. I am also going to repeat some information from earlier posts, since some of you may not have read them.

As we go deeper into the earth, the weight of the ground above us will also increase. For a very simple measure (and to make the illustrations easier to follow) we can assume that this is around a 1 pound per square inch (psi) increase for every foot deeper we go. So if we were, for example, 10,000 ft down then the pressure in the rock due to that weight would, undisturbed, be around 10,000 psi. (This is about 7 times the pressure that you see coming out of a car wash pressure washer for example).

When a oilwell is drilled vertically down into that rock it does not see this pressure, but it does see a part of it. The reason is that the rock on either side of the hole can now expand into the hole, and we’d rather it didn’t. (It’s somewhat as though you step on a rubber eraser – the eraser will bulge out laterally as it compresses vertically under your weight.) The resistant pressure in the horizontal direction can be calculated as a function of the vertical pressure through a ratio known as Poisson’s Ratio. Sufficient for our discussion to say that it can have a value of about 0.3. So that if we are 10,000 ft down, then the vertical pressure on the rock will be around 10,000 psi, and the horizontal pressure will be around 3,000 psi. If the well is vertical then the casing for the well may not have to resist pressures of more than the 3,000 psi level.

Now, if instead of just drilling the well vertically I turned and drilled it out horizontally through the rock, then the hole would now have the 10,000 psi squeezing down vertically, and the 3,000 psi coming in from the side. So the first thought that we have is that the casing (the lining that we put into the hole to make sure that it stays open) has to be a bit stronger. Life gets, however, a bit more complicated than that. When you put a hole into ground that is under pressure, the first response of the rock is to try and move the weight of the rock over the hole onto the rock on the sides of the hole. This roughly doubles the pressure that is on that thin layer. Before the hole was put there that particular rock was held in place by the rock around it, and collectively the mass could carry the original pressure. But now there is no rock where the hole is, and thus the confining pressure on the rock there is less. (In technical terms you have shifted the load from a triaxial confinement under 10,000 psi to a uniaxial load of 20,000 psi, if there were no pressure within the well.) The result can be that the rock on the sides of the hole crushes under the load. This then puts crushed rock or sand into the hole, and that interferes with lots of things. Now you can possibly stop that by keeping the pressure high in the liquid that you are using inside the hole to get the drilled rock out (the drilling mud), but if you keep that pressure too high, then the oil/gas won’t flow to the well and so you have to drop it down to a certain level by choking the flow out of the well when, after completing the hole, you go back to start production.

Life also gets a bit more complicated in reality, since the presence of the fluid in the rock tends to even out the pressure within it. So that while, relatively close to the surface, and in a dry rock the ratios may be as I gave them earlier, with a fluid saturated rock, and in an over-pressured region, the horizontal pressure can be as high as 80% or more of the vertical value. The values generally get closer to 100% as the wells go even deeper, but that is another story.

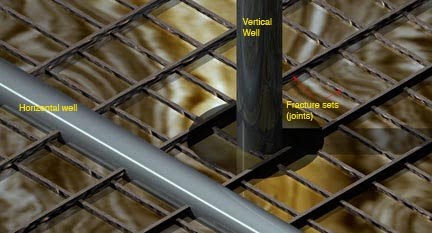

So rock pressure is the first problem that you have to deal with. But why do we drill the horizontal holes in the first place? Why can’t we just use the old vertical ones. Well, the reason is that the old ones didn’t work very well. And to explain that I am gong to try and re-explain an article from Penn State. (then I’ll give the relevant quote).

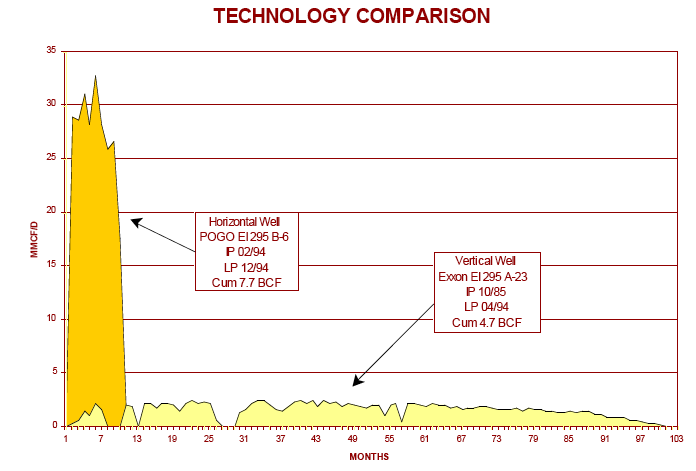

Shale is a very fine grained rock, and though gas can gather in the small pores of its structure, if the gas is to flow to a well, then it has to migrate through passages that are very narrow, and thus very resistive to that flow. However, as the shale has been formed under geological pressure and over time, the pressures not only compressed it from mud into shale, but they also caused it to fracture. In the Marcellus shale, for example, the cracks that occurred in the shale are roughly vertical, and form two sets that are perpendicular to one another.

The first advantage that a horizontal well has, over a vertical one, is that the well can penetrate a long way through the rock that carries the oil or gas (OG). The amount of OG that comes from the rock is, in part, a function of how long the length of well is in the rock that carries it. So that while a vertical well might produce say 800 bd from a well that goes straight through a 200 ft thick layer of oil-bearing rock, when the well is drilled so that it goes out he equivalent of 4 miles horizontally through the oil-bearing rock, then the production per day may go up to 10,000 barrels. It is not always that easy to find reservoir data from two adjacent wells, one vertical and one horizontal, but I found a paper on Natural Gas by Chris McGill, in 2006 from which I took the following graph. (For those who want to see what projections on NG were just those few short years ago – the paper is worth a cautionary read.)

It is interesting to note (vide the recent controversy over Arthur Berman’s opinions on horizontal well life stability of production), that the horizontal well here had an operational lifetime of only a year, as opposed to the ten years of the conventional well.

The second advantage relates to the way in which the fractures lie in the rock. Because they are vertical, a vertical well won’t hit very many of them, and so since these fractures provide an easy flow of OG to the well, rather than the difficult path through just the rock, then the well will not show very much production. (And this was the case with many of these shales when they were tested earlier.)

However if the well is horizontal (see figure) then the well will intersect many of these fractures and in drawing the fluid from them will also provide an easy path for fluid to ease out of the rock into the fracture paths, so that the entire rock can be more easily drained.

Now in the picture I have shown one set of joints as being bigger than the other. And that is usually the case, because the horizontal pressure, that earlier I had suggested was the same in each direction, actually usually isn’t. The strongest horizontal pressure will tend to close up those fractures that run perpendicular to it, and tend to open the ones that run parallel with it. Thus it helps to know at the level of the shale, what the pressures in the different directions are (the engineers among us generally refer to them as stresses rather than pressures). The best direction to drill is then perpendicular to the maximum horizontal pressure, if we want to take the best advantage of the fractures in the rock. The only problem with this is that it also increases the pressures on the sides of the borehole, so that if we go that way, and the rock is not that strong, then we may be making the borehole stability worse.

But even with a horizontal well the production may not be that great, because the fractures are still relatively narrow, and so flow won’t be that fast. And so there is another tool that can be used, and that is to deliberately put a crack into the rock on the side of the borehole. On a very small scale, if you look at the picture, you can see a shaded zone around the vertical well. If I could make a crack out from the well at that level and grow it out just a short way you can see that it already intersects two of the better joint sets, whereas at the beginning the well didn’t reach any. And if we could do this from the horizontal well and grow that crack out a goodly distance horizontally, then it would intersect a lot of the vertical fractures and production would become high and useful.

There are, however, three snags to forming and growing that crack, all solvable, but all costing additional money. The first is that if we just grow the crack out and then let the weight of the overlying rock close it up again, then we haven’t made a whole lot of difference. So we have to prop the crack open. For this we need to inject relatively fine grained particles (let’s call it sand, though the technical term is proppant) into the crack in enough quantity that it will fill up the crack and hold it open so that it gives an easy path through the rock to the well for the OG. (We won’t go into what a mess pumping sand at more than 10,000 psi makes of the pump – Halliburton gets paid very nicely to fix those problems.)

The second snag is that trying to push sand into a thin crack and get it to go very far can be an exercise in futility. Among other things if you are using plain water the sand tends to settle to the bottom rather fast, and if it fills the crack near the well, it then acts as a filter to stop sand going back further into the slot. So now we change the chemistry of the water by adding what are usually known as long-chain polymers. These chemicals thicken the water so that it will (at relatively low chemical percentages) suspend the sand in the fluid. Because these molecules are also slippery (in another variety they are added to the water in crowd control water cannons to produce what is known as Banana Water – since it makes the street too slippery to stand on) they also reduce the friction between the fluid flow and the walls of the crack, and this also helps carry the sand further back into the crack, and gives the slickwater title to the hydrofrac.

The third snag is a bit more technical. You remember that earlier on I talked about the pressure about the hole causing the sides of the horizontal well to crush. Well, at the top and bottom of the well instead of the rock seeing this additional crushing pressure, the shifting of the vertical load to the walls of the hole, can mean that the rock will go into tension, where it is much weaker. As a result cracks can appear in the top and bottom of the horizontal hole. Why is this a problem? Because the easy way to cause a fracture to grow is to fill the well with liquid and increase the pressure of the liquid until the rock breaks. (Hence hydraulic fracture or hydrofrac.) But if there is a crack there already then just increasing the pressure in the hole causes that crack to grow and it may not be in the direction we want. And so it is time to call in the engineers (who also don’t come cheap) to do the interesting things that cause the crack to grow in the right direction.

The benefits to all this for the Marcellus has been described by Engelder.

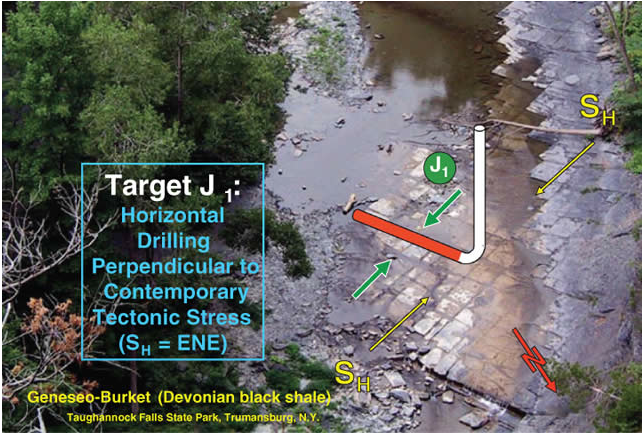

"Conservatively, we generally only consider 10 percent of gas in place as a potential resource," said Engelder. "The key, of course, is that the Marcellus is more easily produced by horizontal drilling across fractures, and until recently, gas production companies seemed unaware of the presence of the natural fractures necessary for magnifying the success of horizontal drilling in the Marcellus." The U.S. currently produces roughly 30 trillion cubic feet of gas a year, and these numbers are dropping. According to Engelder, the technology exists to recover 50 trillion cubic feet of gas from the Marcellus, thus keeping the U.S. production up. If this recovery is realized, the Marcellus reservoir would be considered a Super Giant gas field. . . . . These fractures, referred to as J1 fractures by Engelder and Lash, run as slices from the northeast to the southwest in the Marcellus shale and are fairly close together. While a vertical well may cross one of these fractures and other less productive fractures, a horizontally drilled well aimed to the north northwest will cross a series of very productive J1 fractures.

The article illustrates that concept with a representation of the horizontal well drilled perpendicular to the joints at an outcrop.

The upfront money may give some pause to prospectors. A typical well that drills straight down to a depth of about 2,000 to 3,000 feet costs roughly $800,000.

But in the Marcellus Shale, Range and other companies hope a different kind of drilling might yield better results — one in which a well is dug straight down to depths of about 6,000 feet or more, before making a right angle to drill horizontally into the shale. That kind of well could cost a company $3 million to build, not counting the cost of leasing the land, Engelder said.

The company, in a December financial report, estimated that two horizontal wells are producing roughly 4.6 million cubic feet of gas per day. Tests on an additional three recently completed horizontal wells showed potential for a total of 12.7 million cubic feet of gas per day. Industry experts call those results promising.

The benefits have also been projected here. And while they may be considerable, it is only after the wells are in production, and not only initial flows, but also well lifetimes are established, that the true benefit will become apparent.

But until some solid, repeatable well data emerges, the Haynesville will remain more diamond in the rough than diamond ring. As BMO Capital Markets analyst Dan McSpirit rightly noted in a report last week: "The proof (of Haynesville economics) is in how the wells get drilled and the rates of return such operations yield." He added, "These are early innings. Lasting value creation should be revealed later in the game."

The costs and estimates of production came from the time that the original post on this topic was written, and costs (as you may have noted from the comments and from other references I have made) can now get as high as $8 million for a horizontal well. But I will come back and write more about penetrations and hydraulic fracture in the next post.

How long have they been experimenting with proppants? I'm always curious about the curve of technological advancement in drilling - its Moore's Law if you will. Well, maybe there's an aspect of the field that has advanced in some quantifiable fashion - cost per foot, say. And you have the big agencies and cornucopian pundits promising never ending advances in technological development, which have certainly happened, but will this really continue forever?

probably as long as there has been proppants. much of the early research was oriented toward selecting the optimum propant size.

exxon, halliburton, and others were doing research on bauxite propants in the mid to late 70's that i know of. resin coated propants were introduced sometime in the 80's and more recently, ceramic propants are in vogue.

strength of the propants is a concern, but making a stronger propant doesnt solve the problem altogether. with high closure stress, the propant imbeds in the (shale). the modern ceramic propants address this(imbeding) to an extent by using spherical ceramic beads.

My question regarding horizontal wells and hydrofracing would be, how much is the total production over the lifetime of the well inceased? In the endcase, where only the time span is changed, but the total volume is the same, then all you've done is move production forward in time. But if OG that has no flow pathway to your well in the vertical well, is now available, then your expensive unconventional techniques, have brought increased lifetime volumes, as well as quicker access to the OG. So typically how do these different factors pan out?

it would be helpful if we had more information on the graph comparing a hz well with a vertical well. the hz well appears to have suffered an untimely death for a reason not related to basic wellbore geometry.

the production profile of the hz well doesnt look at all typical of a shale gas well. it appears the well either watered out, or was abandoned because of a mechanical failure. unless the well was replaced with another well, i would guess the former(watered out).

I agree that this comparison does not seem typical. In fact, it may be an outlier. A comparison from the Barnett may yield more reliable data, and even there you have to take into account whether you are looking at core data or the entire play. Arthur Berman's article may be the best study yet.

I would like to note that early on in Barnett development it was common knowledge to drill counter-regional to natural fractures. I believe that the preferred wellbore orientation was NW to SE... But I don't even recall for sure anymore because everyone has long since abandoned that idea as antiquated. In lower tier production zones it could certainly be helpful, but when you get into the tenderloin it doesn't even seem to be a factor.

The Marcellus shale occurs from NY to WV. Part of the play is wet gas, but most of the play is dry gas.

Currently there is no shortage of natural gas. Although the price of natural gas is low, some operators had wet gas and were able to recover the NGL's and make a profit from them. Some LNG operations were in danger of going under if it were not for the condensates and liquids they recovered from the gas before shipping it.

Thanks again HO for your time & effort to bring the many of us not so tech oriented up to speed. One question I have is, how do the engineers "know" which direction the natural fractures are oriented?

Also, as to the "banana water" you mentioned (for crowd control), If one thinks it's slippery on a street, imagine what it's like on a rolling deck offshore. I myself have busted my arse when a bag of "gel" (that's what we know it as) was accidently ruptured and exposed to water on deck. Slickern goose s*@T!

boot -- Usually it's the geologists that come up with the orientation. It might be as simple as just following the trend established by others: i.e. always drill NW to SE. This can develop by nothing more then trial and eror. But sometimes, in some trends, the fractures don't follow a regional trend. Local structural changes can establish a uniques set of fractures. Sometimes seismic can help ID such orientations.

Rockman

Thanks for the info.

There have been environmental concerns voiced about the hydrofracking. Reading this I didn't see anything that seemed as if it would affect ground water.

What have been the environmental concerns and do they have any merit?

I am going to write about this a bit more next week, and will list the chemicals in a typical frac job in that post.

There are concerns, and this is particularly true in the Marcellus which underlies the aquifer from which New York gets its water. Despite the vertical distance between the Marcellus and that aquifer (several thousand feet) the emotional appeal about threatening what you drink has led to some efforts by legislators to tighten up the monitoring of the operations. The concerns were not alleviated by a couple of surface spills of fluid that happened around a couple of the wells.

Is the tightened monitoring funded by the resource extraction/delivery system or directly from public funds? The public will pay the bill regardless but there must be advantages and disadvantages related to either source. A more general question, is there even a decent cost benefit analysis system in place for determining where it is most effective to acquire funds for necessary monitoring?

Porsena has added a comment to the post that will appear here next Sunday in which he cites a draft EIS from the Department of Environmental Conservation in New York, and it takes you to an SGEIS document that discusses this in considerable detail.

Not difficult to fund Luke. Just do like we do in TX and La: oil and gas permit fees and taxes fund such operations. We even fund environmental clean ups via bonding and insurance when the offending operator goes belly up. The problem sounds like the local politicians are winging it instead of researching how the other oil patch states solved these problems.

I believe that is also the case up here but then a close connection between the source of funding for the oversight agency and the entities overseen has caused some commotion from time to time. A quarter million gallons spilt on the frozen tundra back in 2006 highlighted how little the state had done to verify BP's reports on pipe condition for the best part of the decade preceding the spills.

Fortunately the spills occured in winter, admittedly good odds for that on the slope, which kept them fairly well contained on top of a couple acres thus facilitating complete cleanup. Now of course the state is sueing BP for the revenue it lost due to the shut down of the corroded feeder lines that it had allowed BP to BS about for years. Well at least AK and the oil companies do put a heck of lot of lawyer's kids through law school.

Nice piece. I was just at PSU, they have an excellent rock mechanics program there. The key is water and water disposal.

Here in the Pittsburgh region there are two 3D seismic polygons that have been collected. The data from the central-northern PA region is fantastic. Unbelievable quality, it was highlighted at the recent SEG.

The bottom line is that energy will drive us to produce shale gas, there is no other option. The key is the hydrogeophysics.

Thanks again for this article.

I have done some analysis of the value of the horizontal vs vertical wells. I was able to extract the production volume by approximating the area under the graph of the two wells using Photoshop:

* Vertical Well (Yellow): 3547 MMFC

* Horizontal Well (Orange): 6097 MMFC

* Horizontal to Vertical Well total production gain: +72%

I then calculated the future value after 100 months (ie. at the end of the vertical well's life) using the time value of money principle (at 5% interest rates and $8 per MCF):

* Total value of horizontal well at 100 months: $70,913,392

* Total value of vertical well at 100 months: $28,376,000

* Horizontal to Vertical well gain: +150%

So in conclusion, if the cost of the horizontal well is less than 150% of the vertical well (in the above example), then it becomes economical to use horizontal wells.

I am fairly new to all this and would like to here your feedback if you can detect any flaws in my logic. More details of my analysis can be found here: http://www.graemeklass.com/economics/horizontal-vs-vertical-wells/

I think you're on a good track grae but a few questions: how are you using that "5% interest"? To do the type of comparison you're attempting we use a discount rate (usually 10 to 15%) to calculate a net present value...NPV. It is essentially a negative interest rate. A dollar produced next year has a NPV of $0.90 ($1 x 0.9). A dollar produced the second year = $.80 ($1 X 0.8). As you can see by the time you get to year 7 or 8 the future revenue stream has almost no NPV.

Beyond NPV the payout period (time to recover investment from net revenue stream) is a critical component of the decision process. When PO gets much beyond a couple of years a project becomes much less appealing. The longer payout obviously equates to a lower rate of return.

The other big factor in doing NPV is the oil/NG price inflation factor. If it's high enough in can neutralize the effect of the discount rate. There's no good answer to what price inflation rate to use. But we tend to stay conservative... usually just a few per cent and often after the first couple of years being flat.

Well costs: can vary a good bit. A horizontal might cost as little as 150% of a vert well but can also run 2 or 3 times more.

Thanks Rockman. I have used 5% because that seems to be the historical interest rate. In my business plans, I normally compare the ROI compared to this rate (eg. compared to sticking it in a bank). I find it interesting that the industry uses 10 - 15%, this is seems unusually high, perhaps the industry likes to compare returns based on long terms stock market returns?

Yes, price inflation can reduce the impact of the discount rate, but pricing oil/natural gas so many years out is pretty difficult.

Re: costs. I did some quick calcs for discount rates:

10%: horizontal needs to be less than 3.62 times the vertical

15%: horizontal needs to be less than 5.25 times the vertical

grae -- We use the higher discount rate more as a "hair cut" as we call it. It allows us to add another risk factor. Actually more of a fudge factor. We also give the targeted reserves a hair cut also...maybe only use 50% to 80% of the proposed volume. Same thing with keeping the oil/NG inflation factor conservative. We'll even normally use a contingency factor in the well cost: if the estimated well cost is $2 million we would use $2.2 million as an estimate. Lots of fudge factors. And then when oil sells for $38/bbl instead of the $70/bbl you used in your economic analysis all the fudge factors don't come close to saving your butt.