Drumbeat: June 19, 2010

Posted by Leanan on June 19, 2010 - 10:29am

The man who’s tutoring Bill Gates …

Prof. Smil is an expert on the history of technological innovation. He points out that the U.S. energy industry – which includes production, processing, transportation and distribution, coal and uranium mines, oil and gas fields, pipelines, refineries, fossil-fuel fired, nuclear, and hydroelectric power plants, tanker terminals, uranium enrichment facilities, and transmission and distribution lines – constitutes the world’s most massive, most indispensable, most expensive and most inertial infrastructure. Its principal features change on a time scale measured in decades, not years. That’s why “we’re going to be a fossil-fuel society for decades to come.”A lot of us don’t want to hear that. Yet the facts don’t care whether we like them. Prof. Smil methodically sets out to show that the facts do not support either the romantics, who think we’ll be saved by wind turbines, or the techno-optimists, who think that electric cars are right around the corner. Along the way he demolishes peak oil theory, biomass for fuel, carbon sequestration, and various other energy myths. He believes that weaning ourselves away from fossil fuels would be a good thing. But we need to understand that the transition from fossil fuels will be complex, protracted and nonlinear, and will require enormous investments. “Wishful thinking,” he writes, “is no substitute for recognizing the extraordinary difficulty of the task.”

IEA chief sees possible slide in global oil output

TOKYO (Agencies): Global oil output could slide by up to 900,000 barrels a day from projected levels for 2015 if oil producing countries follow the US lead and impose moratoriums on development of new offshore oil reserves, International Energy Agency executive director Nobuo Tanaka said Friday.

Why the oil minister doesn't feel too well right now

WHO would swap places with Resources Minister Martin Ferguson? There he is with the world's leading resource companies fuming over a mining tax, the spectre of BP's monstrous US oil spill on the nightly news, and he's just signed off new drilling leases in Australian waters that allows for wells twice as deep as the fatal rig that has ruined the Gulf of Mexico.No wonder the Greens have popped up with a call to halt all oil drilling in Australian waters.

Markey Will Demand Oil Companies Rewrite Spill-Response Plans

(Bloomberg) -- U.S. Representative Edward Markey will ask oil-company executives to revamp the spill-response plans lawmakers this week said were duplications and inadequate to deal with an environmental disaster.

Analysis: Interior Faces Challenges in Monitoring O&G Production

The Deepwater Horizon tragedy in the Gulf of Mexico has sparked national attention to the manner in which oil and gas exploration and production operations on federal onshore and offshore leases are conducted.

Lisa Margonelli: Question for BP: How Close Are We to the Unthinkable?

The most important question (and one Tony CAN answer) was only hinted at by Rep. Scalise when he asked if the casing around the well was cracking. Hayward's response was a variant of "I don't know" because, he said, they can't see into the well. Scalise dropped the line of questioning without asking Hayward to offer his best explanation for the increasing flow rate of the well.Why is the integrity of the casing or the ground around the well hole important? Because it says everything about whether the flow rate of this spill will increase, whether there are more disasters yet to come, and how long it could take to stop flow from this well with the relief wells. The question I'd like to ask Tony Hayward is this: To the best of your knowledge are we near the end of this spill? In the middle? Or perhaps, only at the very beginning?

Signs of Hope as BP Captures Record Oil Amounts

Good days are relative for BP, the company responsible for stopping the largest offshore oil spill in the nation’s history. But the last two days brought moderate signs of progress in the company’s struggle to contain the catastrophe flowing from the floor of the Gulf of Mexico.

BP's oil-capture systems shut Friday, to restart Saturday

(Reuters) - BP Plc said its oil-capture systems at the gushing leak in the Gulf of Mexico shut down Friday night because of a problem and a restart was expected on Saturday after a lightning storm passes.

Saudis can help fix BP oil leak: former Aramco engineer

The latest suggestion comes from Nick Pozzi, a former pipeline engineering and operations manager for Saudi Aramco, is seek help from Saudi Arabia.Pozzi says the oil-rich nation contained a similar oil leak in the Persian Gulf in 1993 using super tankers, after an accident spilled millions of litres of crude oil.

BP's relief wells seen as best Gulf leak solution

HOUSTON (Reuters) - A pair of relief wells snaking their way beneath the Gulf of Mexico are energy giant BP Plc.'s (BP.L: Quote) (BP.N: Quote) last and best hope for choking off its blown-out Macondo well in the near-term.But after drilling through more than 10,000 feet (3,050 metres) of rock layers a mile (1.6 km) beneath the ocean surface, BP engineers in coming weeks face the most challenging part of the drilling assignment: hitting a target that is the size of a large dinner plate with the drill bit.

Lukoil Chief Denies Eyeing BP Assets

ST PETERSBURG, Russia (Reuters) - LUKOIL, Russia's second-largest oil producer, said it was not interested in snapping up anything from the $10 billion asset sale with which BP hopes to help pay for its oil spill in the Gulf of Mexico. "We are not wolves, we do not eat the weak," LUKOIL head Vagit Alekperov told Reuters on Friday when asked whether Russia's largest non-state oil firm was interested in BP's assets.

BP CEO the ghost at the feast as Russia fetes big oil

Russia (Reuters) - The leaders of the global oil industry gathered as usual at Russia's top annual business forum this week but there was one ghost at the party.BP chief executive Tony Hayward, normally a regular, was conspicuous by his absence this year and his company's woes were a constant topic of discussion among those who did come.

As a foreign company, BP may suffer harsher treatment at the hands of consumers and lawmakers.

The BP spill is a failure not just of technology but ideology. That oil flows into the ocean from the deregulatory tide of the last 30 years. President Obama is right to compare the fiasco to 9/11. If he can frame the message more memorably than he did in his Oval Office address, Obama may yet use the largest environmental disaster in U.S. history to speed the transition to a green economy, just as George W. Bush used terrorism to refashion foreign policy. To do so, “deregulation”—once a Reaganite call to arms—must be transformed into an epithet. If the president can’t put the antigovernment, Tea Party types in their place now, when will he? The legacy of the American progressive tradition is on the line.

"The Daily Show" news staff outdid itself Wednesday. While often specializing in skewering the news and the TV personalities who deliver it, Jon Stewart’s team showed what national news ought to be presenting.On the day after President Barack Obama’s prime-time address pitching a renewed emphasis on developing alternative fuel sources to wean our country off its oil dependence, "The Daily Show" presented a well-researched documentary of sorts in a segment titled “America is an unstoppable oil-dependency breaking machine – unfortunately, the machine runs on oil” (Click here to watch).

Eight More Deep Thoughts from Rep. Joe Barton

In his 26 years in office, energy issues have defined Congressman Joe Barton's career. They've also defined his gaffes, as was evident Thursday when the Fort-Worth area Republican alienated even the members of his own caucus by apologizing to BP CEO Tony Hayward for what he initially called a White House $20 billion "shakedown," only to turn around later in the day and issue an apology for the impolitic apology. Here are eight of Barton's other not-so-finest moments in the limelight.

Russia calls for reduction of rates for oil transit through Ukraine by 30 prc

ST. PETERSBURG (Itar-Tass) -- Russia believes it necessary to reduce transit rates for oil transported through Ukraine by 30 percent.Ukraine has rates the transit rate by 30 percent on the average since the beginning of the year, Deputy Energy Minister Sergei Kudryashov said on Saturday.

No documents on Russian gas transit debts received from Belarus - Zubkov

ST. PETERSBURG (Itar-Tass) -- Belarus’ government has provided no documents to prove Russia’s debts for gas transit via its territory, Viktor Zubkov, the Russian First Deputy Prime Minister and chairman of the board of directors of national gas utility Gazprom, told journalists on Saturday.

Belarus gas talks failed - Ifax quotes Gazprom CEO

Alexei Miller also confirmed that if Gazprom fails to pay the debt for gas deliveries Gazprom will cut supplies to Belarus starting from Monday.

Eni, Gazprom Sign Memorandum for Edf Joining South Stream

(Bloomberg) -- Eni SpA and Gazprom OAO agreed today in Saint Petersburg to sell a stake to Electricite de France SA, allowing the French company to enter the South Stream project, Eni said in an e-mailed statement.

Iraq police shoot dead protester over power cuts

BAGHDAD (AP) -- A protest over electricity shortages in Iraq's southern port city of Basra turned deadly on Saturday with troops fatally shooting one demonstrator, police officials said, underscoring rising tension over the country's lack of basic services.

China to double natural gas weighting in total energy basket over 5 years

BEIJING (Xinhua) -- China will endeavor to double the weighting of natural gas in its total energy consumption basket over the next five years to reduce its reliance on coal, a senior official with the National Energy Administration (NEA) said Saturday."Natural gas accounts for only 4 percent of energy in China now. The country will raise that to 8 percent during the 12th Five-Year Period (2011-2015)," Wu Yin, deputy head of the NEA, said at an energy forum in Beijing.

Oil extraction hits snag over tax wrangles

A PLAN to start extracting and refining Uganda’s oil has hit a snag due to tax disagreements between an exploration company and the Government.Heritage Oil and Gas Company Ltd has to sell its interests to a richer company that has the resources to extract and refine the oil, but does not want to pay taxes on the sale.

Petrobras Sale Should Match Oil-Reserve Swap, Official Says

(Bloomberg) -- Brazilian Energy Ministry official Marco Antonio Almeida said it is “indispensable” that Petroleo Brasileiro SA offers new shares at the same time as the government swaps oil for the state-controlled company’s stock.“Things will have to match somehow, this marriage looks indispensable to me,” Almeida, the ministry’s secretary for Oil, Gas and Renewable Fuels, said yesterday in an interview in Brasilia. “Either the capital increase happens a bit later or we succeed in accelerating the oil pricing process,” he said.

Beginning in 1975, the first step in transition from the consumer/industrial economy to a knowledge/service economy was taken. It was innocent enough—the oil embargo made the manufacture of cheap goods questionable. Seeking a way to return to maximize profits that were being hit by rising oil prices, outsourcing to third-world countries with low-wage employment enabled U.S. corporations to compensate for rising oil prices and continue to rake in large profits. It’s taken 35 years, but the US is clearly no longer an industrial producer. Where once companies like GM, US Steel and Motorola electronics manufacturing and other production businesses dominated the business sector, today they’ve been replaced by finance/banking, insurance, and medical care as the largest, most successful businesses. We make nothing and those countries that do, India, China and Indonesia are already beginning to see the reality that they too will no longer be able to fuel their economy on cheap goods production. The ‘learning curve’ for them will be very short. We produced for 150 years…they for perhaps 50.

Complacency, human nature and the Gulf leak

First, the science that I’ve read suggests there is a layer of oil located deep below the surface that covers a huge area of the globe. If it can be recovered, then this oil could keep the world going for many years — contrary to the central claim of “peak oil” theorists, who believe we’re already seeing the effects of the world “running out” of available oil.And that oil is under tremendous pressure. So, this seems to be an area where humanity never has been before and that we really don’t understand that well. You could even describe it as a place where we may not belong.

The End Is Near! Rent 'The Book of Eli'

"We threw away things people kill each other for now." That's how Eli (recent Tony winner Denzel Washington) describes the world before it was flattened by "the flash" in the Christian fable The Book of Eli, new to DVD and Blu-ray this week. Since the world ended, or very nearly did, everything is at a premium. The thirsty must barter for a full canteen; even an iPod charge costs a pocketful of trinkets.

CARBON SHIFT: How Peak Oil and the Climate Crisis Will Change Canada Edited by Thomas Homer-Dixon, Vintage Canada, 230 pages, $22Homer-Dixon, a leading member of Canada’s small band of public intellectuals, has assembled a collection of six essays by the influential likes of former CIBC world markets chief economist Jeff Rubin and Globe and Mail columnist Jeffrey Simpson to address the challenge of shifting to a clean, low-carbon energy. Especially timely as the oil continues to gush in the Gulf of Mexico.

New Point of Inquiry: Bill McKibben on Our Strange New Eaarth

Global warming, we’re often told, is an issue we must address for the sake of our grandchildren. We need to cut carbon because of our moral obligation to future generations.But according to Bill McKibben, that’s a 1980s view. As McKibben writes in his new book Eaarth: Making Life on a Tough New Planet, the increasingly open secret is that global warming happened already. We’ve passed the threshold, and the planet isn’t at all the same. It’s less climatically stable. Its weather is haywire. It has less ice, more drought, higher seas, heavier storms. It even appears different from space.

And that’s just the beginning of the earth-shattering changes in store—a small sampling of what it’s like to trade a familiar planet (Earth) for one that’s new and strange (Eaarth). We’ll survive on this sci-fi world, this terra incognita—but we may not like it very much. And we may have to change some fundamental habits along the way.

Eaarth, argues McKibben, is our greatest failure.

Now we're reaching "peak water"

THE planet is far from running out of water, but many countries are beginning to exhaust the local supplies they need to maintain agricultural productivity and ecosystem health.Welcome to the age of “peak water”.

The dilemma on your dinner plate

Fifteen hundred miles — that’s what the average American meal has traveled to reach your plate, according to a Natural Resources Defense Council study. It’s the equivalent of your lunch road-tripping from Las Vegas to Columbia. That doesn’t even account for the ingredients from five foreign countries in the standard meal.“The entire industrial food system essentially ensures that your food is marinated in crude oil before you eat it,” said author Bill McKibben in the foreword to "Diet for a Hot Planet" by Anna Lappè.

Energy Dept. prioritizes building energy efficiency, hands out $76M

The U.S. Department of Energy is leading a sea change in the way industry, investors and consumers are approaching the energy crisis: turning away from the hype surrounding solar, wind and other renewable generation technology, to focus more on energy efficiency.

Greening the backyard BBQ: Less meat could mean more water and fuel

It's summertime and the grilling is easy. But before stocking up on steaks, burgers and other traditional carnivorous fare, consider trying meat-free alternatives.Exploring a vegetarian diet isn’t just about making healthier lifestyle choices. A UN report released earlier this month called for a global shift toward a vegan diet, citing the disproportionate amount of resources required to produce meat.

Net Benefits of Biomass Power Under Scrutiny

Power generated by burning wood, plants and other organic material, which makes up 50 percent of all renewable energy produced in the United States, according to federal statistics, is facing increased scrutiny and opposition.That, critics say, is because it is not as climate-friendly as once thought, and the pollution it causes in the short run may outweigh its long-term benefits.

The opposition to biomass power threatens its viability as a renewable energy source when the country is looking to diversify its energy portfolio, urged on by President Obama in an address to the nation Tuesday. It also underscores the difficult and complex choices state and local governments face in pursuing clean-energy goals.

Oil, gasoline higher heading into the weekend

The American Petroleum Institute said Friday that gasoline deliveries fell 0.4 percent in May to 9.05 million barrels per day, the lowest May level in seven years. That compared with year-over-year increases in March and April.API Chief Economist John Felmy said the decline shows that demand is more sensitive to higher prices and the pace of the economic recovery than other oil products, like diesel, heating oil and jet fuel.

HOUSTON — The number of rigs actively exploring for oil and natural gas in the U.S. increased by 12 this week to 1,539.Baker Hughes Inc. said Friday that 953 rigs were exploring for natural gas and 574 for oil. Twelve were listed as miscellaneous. A year ago this week, the rig count stood at 899.

APEC to Study IEA Oil-Supply Disruption Safeguards

(Bloomberg) -- Asia-Pacific countries will study safeguards used by International Energy Agency members to protect against energy supply disruptions and oil price swings.Asia-Pacific Economic Cooperation energy ministers meeting in central Japan agreed to participate in a one-week session organized by the IEA this fall, Mitsuo Matsumoto, a director for natural resources at Japan’s trade ministry, told reporters today in Fukui city.

Gazprom 2010 output may be hit if Europe demand falls

ST PETERSBURG, Russia (Reuters) - Russia could produce less gas than expected this year if European demand falls, energy officials said on Friday, but maintained that the spot market and shale gas do not pose long-term threats.Russia's biggest short-term concern is falling demand in Europe, its biggest export market, due to the economic downturn. While demand grew steadily in the first four months of the year, it fell sharply in May, especially in south-west Europe.

Total, Chevron Found Guilty in U.K. Buncefield Fuel Depot Fire

(Bloomberg) -- A U.K. court has found Total SA and Chevron Corp. guilty of failing to prevent the Buncefield fire in a fuel depot in north London in 2005, according to the Health and Safety Executive.“When the largest fire in peacetime Europe tore through the Buncefield site on that Sunday morning in December 2005, these companies had failed to protect workers, members of the public and the environment,” the HSE said today in an e-mailed statement.

Chevron vows to pay for Salt Lake City oil spill

SALT LAKE CITY – Salt Lake City attorneys expect Chevron Corp. will quickly agree to a financial settlement related to last weekend's pipeline spill that dumped 33,000 gallons of crude oil into city waterways, a spokeswoman for Mayor Ralph Becker said Friday.Becker has vowed to make Chevron pay for the cleanup, and the company has repeatedly pledged to cover the city's expenses, as well as damage or reimbursement claims from others.

Where Gulf Spill Might Place on the Roll of Disasters

From the Oval Office the other night, President Obama called the oil leak in the Gulf of Mexico “the worst environmental disaster America has ever faced.” Senior people in the government have echoed that language.The motive seems clear. The words signal sympathy for the people of the Gulf Coast, an acknowledgment of the magnitude of their struggle. And if this is really the worst environmental disaster, the wording seems to suggest, maybe people need to cut the government some slack for failing to get it under control right away.

But is the description accurate?

BP Partners Anadarko, Mitsui Should Share Oil Woes, Markey Says

(Bloomberg) -- Anadarko Petroleum Corp. and Mitsui & Co. should pay into a multibillion dollar fund for claims tied to the leaking Gulf of Mexico oil well the companies co-own with BP Plc, U.S. Representative Edward Markey said.“They cannot escape responsibility,” Markey, a Massachusetts Democrat, said yesterday on Bloomberg Television’s “Political Capital With Al Hunt,” being broadcast this weekend. Both companies should be “contributing to any fund that is constructed for any part of the reconstruction.”

Anadarko Says BP Should Pay After Being Reckless

(Bloomberg) -- Anadarko Petroleum Corp., the Texas oil company that owns 25 percent of the damaged well pouring crude into the Gulf of Mexico, said BP Plc, the project’s operator, should pay the costs from the spill because it acted recklessly and unsafely at the drilling site.BP didn’t monitor or react to warning signs as the Macondo well was drilled, Chief Executive Officer Jim Hackett said yesterday in a statement. BP is responsible for damages under such conditions, Anadarko said.

Goldman-Backed Cobalt a Target After BP Oil Spill

(Bloomberg) -- Five years ago, investors including Goldman Sachs Group Inc. and Carlyle Group put up $500 million in seed money to hunt for oil in the deep waters of the Gulf of Mexico and elsewhere.After the BP Plc oil spill, smaller Gulf operators such as the Goldman startup, Cobalt International Energy Inc., may be swept up in a wave of consolidation as the regulatory landscape tilts in favor of larger firms, said William Herbert, an analyst at Houston-based Simmons & Co.

Amid the Gulf crisis, Wall Street touted BP stock

(Reuters) - As early word of BP's Deepwater Horizon blowout began spreading, investors panicked. After closing above $60 before the April 20 disaster, the energy giant's shares plunged almost 20 percent in New York, to below $50, in just two weeks.It is not hard to understand why. Even then, the out-of-control oil spill in the midst of rich fishing grounds and nearby resort beaches raised the specter of horrific damages and untold potential liabilities.

Yet, nearly to a person, the dozens of securities analysts who followed the British oil giant were unfazed. As BP shares continued to drop, most were screaming the same message: buy, baby, buy.

For proud BP employees, an awkward new reality

HOUSTON — The green-and-yellow logo that BP employees normally wear with pride is meant to evoke an environmentally friendly sunflower. These days, it feels more like a bull's-eye.

BP Team Will Tie $20 Billion of U.S. Assets to Fund

(Bloomberg) -- BP Plc has appointed an internal team to review BP’s U.S. portfolio and select $20 billion in assets that will be used to guarantee a fund it will set up to pay oil spill claims, Robert Dudley, BP managing director, said in an interview at BP’s Washington office.

BP escrow account will pay claims fast: Feinberg

Mississippi (Reuters) - A $20 billion fund set up by energy giant BP Plc to compensate financial losses due to a big oil spill in the Gulf of Mexico will pay legitimate claims fast, the fund's independent administrator said on Friday.

Embattled BP asks 7 banks for $1 billion each - bankers

(Reuters) - BP Plc , battling to plug a gushing oil well under the Gulf of Mexico, is seeking loans of $1 billion (676 million pounds) from each of seven banks to raise up to $7 billion, banking sources told Thomson Reuters LPC on Friday.

BP’s $20 Billion Fund May Not Stop Spill Lawsuits, Judge Says

(Bloomberg) -- BP Plc’s $20 billion oil spill fund, established at the request of U.S. President Barack Obama, may not stop more than 230 lawsuits filed by people and businesses harmed by the worst environmental disaster in U.S. history, a judge said.

Bumbling Carter was right all along

When Barack Obama looked into a television camera this week and said the United States urgently needed to break its addiction to oil, he was sitting at the same desk in the same office where Jimmy Carter said the same thing 31 years ago. For conservatives who think Jimmy Carter was a terrible president, the parallel was ominous."It's the second term of Jimmy Carter! Same speech!" bellowed the inexplicably popular radio host Rush Limbaugh. "Everything he said, Obama repeated last night!"

This time last week I wasn’t convinced that we face “an irrecoverable fall in global oil supply by 2015 at the latest”, which is the view of the UK’s Industry Taskforce on Peak Oil and Energy Security. So have I changed my mind?Well, not on that precise point. But, at the risk of stating the obvious, peak oil is not the issue. The real danger is the “oil crunch” that could well happen even if the world’s oil supplies plateau in the next few years rather than fall off dramatically.

Stuart Staniford: Technology Adoption in Hard Times

I have added the purple rectangle for the great depression, and red rectangle for WWII. As you can see, whether the technology adoption was slowed or partially reversed very much depends on the individual technology. Automobiles and telephones took a big hit - actually going backward for a number of years. However, the progress of electricity is only moderately affected, and the progress of radio barely deviates at all from its rapid increase. Refrigerators started only in the late 1920s and spread very rapidly all through the depression.I think the point is that for industrial societies, even when under a great deal of stress, they have some resources and some choices. Thus, those things that they see as the highest priorities may continue to move forward.

Among those who understand Peak Oil and the fragility of global supply chains, it is widely assumed cities will quickly become hellholes of squalor and extreme violence once liquid fuels are no longer cheap and abundant. Perhaps, but history suggests cities are highly resilient adaptations.What never ceases to amaze me is how few people who expect cities to implode have any grasp of the size and scale of cities which thrived for hundreds of years without any fossil fuels.

Peak oil crisis looms, Montrose told

"For a moment, put aside thoughts of the British Petroleum oil leak that's clogging the Gulf of Mexico. The greater crisis is peak oil, those attending the Colorado Renewable Energy Expo's pre-conference were told Friday."Peak oil" refers to the point in time when demand for the fossil fuel will exceed the supply of what is left in the ground, factoring in who wants the oil, and how easy and cost-effective it is to obtain. Global political realities (called geo-politics in energy circles) also affect oil supply.

Fuel Maker for Reactors Has China as Investor

HONG KONG — A company here that is partly owned by the Chinese government has quietly purchased a 5.1 percent stake in the only American-owned provider of enriched uranium for use in civilian nuclear reactors.

The Best Peak Oil Investments: GPS Navigation Stocks

If you believe that much of our response to peak oil will be last-minute and on a budget, you may have little trouble imagining growing numbers of people buying increasingly cheap and functional navigation devices or software for their smart phones in order to save gas by avoiding traffic and wrong turns. As I argued in "The Methadone Economy," my vision of a likely peak oil future, the less prepared we are for peak oil, the more prevalent such bottom-up, quick to implement solutions will become.

The Fortwo “Smart” Car – Is It Really So Smart?

ince it came out, the Fortwo Smart “microcar” has made a bit of a splash in a world of peak oil and increasing environmental concerns. This tiny vehicle, which holds only two occupants (hence its name), traces its origins back to the 1980s, but the first ones did not roll off the assembly line until 1998. For several years, the car was available only in Europe (where motorists have long paid 3-4 times as much for motor fuel as Americans), and was not legally available in the U.S. until 2008.Today, the Smart Fortwo has gained a reputation as being the most fuel-efficient vehicle on the road. But is it, really? And what about the trade-off in terms of storage capacity and safety?

China’s Tianjin May Be First APEC Low-Carbon City

(Bloomberg) -- Asia-Pacific nations will establish as many as 20 low-carbon model cities to test new technology including smart grids and renewable-power generation as part of efforts to reduce pollution and dependence on crude oil.Tianjin, northeastern China, may be the first city picked for the project, Japan’s trade minister, Masayuki Naoshima, said today after a meeting of Asia-Pacific Economic Cooperation energy ministers in the western Japanese town of Fukui. The cities will be chosen within three years, he said.

Major climate decisions may come from ozone treaty

Governments moved closer Friday to curbing the use of chemicals commonly used as coolants in refrigerators, air conditioners, hair spray and other household items in what some say would be among their biggest climate decisions ever.

Large oil spills are old news in the Niger Delta

Friday night failures:

Nevada Security Bank closes, deposits to Umpqua

Kinda curious that the '08 Tennessee coal ash spill doesn't even register on articles like that NYT one about the worst USA environmental disasters...

That whole article was pedantic and contrarian. If they wanted to give a perspective of bad environmental disasters, that would have been fine, but chiding the President for the pretty obvious statement that this is the worst environmental disaster in our history just shows the commentators bias. He definitely has to prove something if he want to minimize the nature of this disaster.

If you look at the current effects to fishing, coastlines, wildlife and tourism, this is the worst environmental disaster in US history. You can easily make arguments about more localized accidents having a more intense effect, but this is already dramatically affecting food production and tourism across a very broad area. This is introducing poisons into the ecosystem that will last for years, if not decades. It is shutting down industry, destroying food production, and killing broad populations of animals.

The only thing that comes close is the dustbowl, but it was a much simpler recovery without residual toxins.

There may be worse accidents in other parts of the world, but that hardly minimizes this one.

More Climate News:

June has been hot here (Atlanta area), and the long range forecast is for continued high temperatures. I understood this long range forecast is related to high ocean temperatures, so I would wonder if June might not be up there in terms of high temperatures again.

Having lived in and around this house for over 30 years, I know a bit about the hot temps we have had in the past. Back in the summer of 1980 our home AC unit went out, temps in the house got up to 120 degrees while they were trying to fix the thing. Outside there was over 20 days straight of 100+ days. It was the hottest on record back then.

We'd barely been in the house 3 years, so this month when the AC failed again it was a reminder of those days back when.

Last year we had the record rainest year, over 80 inches normally around 45 to 50. This week we are scheduled to have high 90's all week and dry.

The afternoon heating thundershowers might or might not show up, we have had them off and on since the first of may.

About normal for here, hot humid and hard on the crops.

The amaranth I grew took the brunt of insect damage that the other plants nearby did not get. It is supposed to be a drought tolerant plant. It is starting to get seed heads on it right now. And the first Tomatoes are being eaten this week. But the last rain storm has almost been spent on the garden from my water catchment system, likely not to get another rain till after I am back using city water. More storage capacity when money is available is planned.

Charles,

BioWebScape designs for a better fed and housed world.

Hugs from a cool arkansas house.

Both ocean and global surface temps are at record levels. OTOH, the El Nino has collapsed and forcasts are for La Nina to fire up shortly. La Nina's tend to be a bit cooler than normal global temp wise, so maybe you'll get some relief. I recommend becoming a regular reader of Jeff Masters weather blog.

With so much of the world above normal, here in California, we've had the opposite. Today I had a high of 74F (normal would be 90).

We are definitely noticing it here in Chicago. Increased temperatures, combined with more moisture in the air, are creating air disturbances which manifest as strong, fast-moving thunderstorms.

See my note below on the hurricane-force winds we experienced yesterday.

It is definitely getting worse every year. We recently had major sewer work done in this neighborhood - the sewers have been unable to handle the sudden deluges of water, resulting in street and basement flooding.

Last year, the river topped its banks, putting some streets under water, at one point. People a mile from my house were being evacuated by boat.

Edit : Anyone who has lived in a tropical/sub-tropical area with summer rainfall would recognize the scenario - around 4pm the sky gets very dark, the wind whips up, thunder, lightning, and a torrent of rain, which is quickly over, and then the sun comes out.

Tropical Chicago, anyone ??

Yep, here in the tropics the rainy season has kicked in, the weed growing season is starting. The temperatures have been over average as well. Haven't tracked it but it is over right now. I've also noticed a lot of 'this day is the hottest, for this day/month, since 1998'.

NAOM

Willamette Valley Oregon is in the middle of a cool anomaly and we are having the coolest, wettest June I can remember. I recently saw a temperature anomaly map of the US and, sure enough, most of the country is glowing red while there is a blue area where I live. Global weirding for sure.

No complaints from this fellow denizen of the WV. Maybe it will gloom some of these Californiacators to go back to their blistering homeland. Bill Hicks on LA weather: "'Hot and sunny, hot and sunny, ain't this great?' 'What, are you a lizard?'"

Long term forecast is for more intense precipitation in the winter and scorching summers. 2 out of 3 ain't bad? The rainfall here is actually tepid compared to Chicago, for instance.

Behind the WSJ paywall, but viewable through Google:

Mexico's Pemex Produces Less Crude In First Half Of June

It is starting to drop again ... 2% month-on-month, seems quite alot.

Net Exports to the US were only -.15% average Nov-March, better than Angola, Algeria, Iraq, Kuwait, Brazil.

Not only was Cantarell resuming its fall, KMZ fell and so did Chicontepec.

Some structural reason why production should be generally down maybe? The only thing I can find is the drug gangs are kidnapping Pemex staff and generally more theft from pipelines. Maybe we are seeing the second phase of decline in Mexico, as reduced earning feeds through into more lawlessness and that feeds back into less production in a positive loop.

If it's not changed in short order then Mexico will indeed hit its zero exports point in the year or so envisaged earlier.

And frankly, a Mexico with no earnings from oil is going to be a bigger threat to the US than a spill - there's no relief well that will fix that problem.

And there is nothing short of mass deportation that will stem the rising tide of illegal immigrants to the U.S. As Mexico declines, we can expect ever greater floods of desperate families fleeing a no-job situation in Mexico--not mention other parts of Central and South America.

Cantarell's 2009 average of 638.7 kb/d was 30.09% of its 2004 peak; by contrast Forties, another supergiant offshore field, was at 74.92% 5 years after its 1980 peak. If Cantarell now follows a Forties type production decline in 5 years it would be at ca. 350 kb/d, leaving Mexican net exports at perhaps 650 kb/d.

The decline in Cantarell has been interesting to watch. I gave a copy of its depletion curve to FOX news commentator, Glenn Beck, last fall and suggested that they need to be covering this stuff. He had previously interviewed Boone Pickens on oil depletion and was familiar with the topic.

If a Fox News right-wing partisan hack like Beck even *covered* Peak Oil, my guess is he'd try to discredit it as yet another "Liberal Myth" like AGW or overpopulation. If things get to the point where even Faux News "journalists" have to acknowledge that there's a problem, then they will try to blame it all on environmentalists and those "socialist" Democrats --especially that secret Muslim with no birth certificate sitting in the White House.

Peak Oil and economic contraction simply does not fit in with the right-wing narrative of Happy Motoring, NASCAR, cheap beer, unlimited junk food and refusing to change "Our Way of Life" 'cuz if that happens, the terr'ists win. The oil companies are the guys wearing the white hats, didn't Rep. Barton make that crystal clear?

Good points. You might find this interview with Boone Pickens to be interesting. http://www.glennbeck.com/content/articles/article/198/10382/

Because Mr. Beck, you are the one we've all been waiting for to get into the lab and personally get it done.

I just wanted to say, congratulations, Dr. Hagens!

(just saw the news in another forum)

We should have mentioned that. Nate finished his Ph. D. earlier this week.

I understand he will be back to writing more posts, once he finishes up a few tail ends.

No more Mr doom...now its Dr Doom

No hurricanes in Illinois ? (for FMagyar;))

Fast-moving storms, organized as a "bow echo" on radar, swept through Chicago yesterday afternoon, with hurricane-force winds clocking upwards of 70 mph...

http://rightnreal.com/news/chicago-weather-conditions-forecast-a-severe-...

When you get sustained winds upwards of 150 mph then I'll pay attention, I've had pool parties with 70 mph winds and people go surfing ;^)

Yeesh ;)

Do you harness your guests to the deck ?

Nah, they're on their own...

Caption : "Did you want salt with your margarita ?"

Looks like a type of "wind-sock" they might use in Florida...

FM do you have any idea how fast a wind that is going 70 mph feels like? I think not. If you did you wouldn't be claiming pool parties in them. I sailed in wind gusts up to 60 mph and the other two sailboats we saw ended up on the rocks. We were sailing with only a storm jib, no mainsail and we were booking. I was in my twenties so I took the tiller cause my Father, who was in his early 50's didn't have the strength to control the boat with the tiller. When we got to shore I collapsed on the dock from exhaustion. That was just in gusts up to 60 pmh. Sustained winds of 70 mph and we would have been toast. When I tried to go to sleep, besides feeling like we were still rocking and rolling, the mental echo of the wind was still rumbling away.

Good luck with those pool parties in sustained winds of 70 mph. Your comment reminds me of when Reagen said people should wear sunglasses if they are worried about excessive UV rays due to ozone depletion. Now the comment is let me know when its 150 mph. Yeah, right.

By the time the weather gets so bad due to GW that people finally say, oh boy, what can we do to stop this, it will be too late. It might already be too late.

Perhaps FM was simply exaggerating in jest...?

A little levity to leaven the bad news all around us?

PE

Sorry to confuse everyone - we were just riffing on a humorous post from a day or two back...

It is pretty serious to get that kind of weather in the city. Very disruptive - windows blown out, trees down, power outages.

Although a good laugh really helps, at times ...

Actually I do! I live in South Florida and have been through a few hurricanes. I also sail and while I know I can walk in a 70 mph gust I'm also well aware that that same gust can easily topple a sailboat or put it on the rocks. Of course if the wind is blowing at 70 plus mph chances are you don't want to be outside mainly because of all the projectiles flying around.

I wasn't seriously suggesting something as stupid as having a pool party in a cat one hurricane though I know of people who do plan to have hurricane parties, they are usually young male tourists well lubricated with copious quantities of alcohol. Some of them end up as statistics during the hurricane season.

As for me I plan to be working on my hurricane shutters tomorrow to make sure everything is ready!

I won't be having any pool parties though, were expecting thunderstorms...

Uh, a lot like sticking your hand or head out of a car doing 70?

My sailboat, an Ensign, was knocked down in Raccoon Strait, which is part of San Francisco Bay. The nearby Mt. Tamalpais weather station clocked the gust at 107 statute miles per hour. No damage, nobody hurt, but we did have to bail out a couple of hundred gallons of salt water.

Fortunately, I saw the gust coming and get go the main and jib sheets.

More recently I was out in a Lido 14 on Lake Harriet in winds clocked at the nearby airport as 77 miles per hour. Once again, saw it coming (I was reefed.) and luffed on a beam reach to get back to the dock just as the thunderstorm hit. We got off that boat in a hurry, due to the nearby lightning and our aluminum mast reaching up for it. Every other sailboat on the lake capsized; there were about a dozen of them.

Fred, when Hurricane Ivan came up into Alabama that was a fun time, I remember going outside to see the high winds. Then again I like watching tornados, been near a few of them in my time being a storm buff. Not something you do in a light hearted way mind you. Fun to joke about when you are safe again.

Charles,

Hugs from a stormy arkansas,

BioWebScape designs for a better fed and housed world.

I think it is all compared to what is normal for the location. If an area gets strong winds with reasonable frequency, then either the building standards have kept up, or the weak building get knocked down/eliminated. I once lived in Boulder Colorado, we would frequently get Chinooks of 100 to 150mph. Sometimes two or three times a week. One reason why the damages weren't very great, lower air pressure/air denisity, and always dry air. Also every Chinook always came from the same direction and was the same temperature, low 50's. Where I live in California 15-30 mph is very very common, but 50mph and above is exceedingly rare. Perhaps thats why we have wind farms nearby.

In a closed thread somebody said:

Has anyone talked about how the North Sea Piper Alpha disaster compares to this one? 167 people died while the operating company was Occidental.

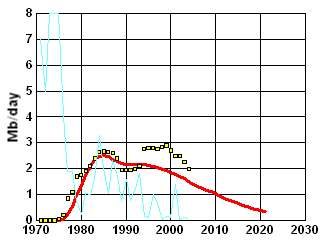

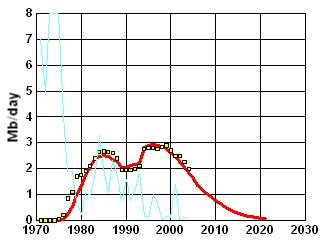

The UK North Sea production shows a unique double peak. The first peak appears to start declining right before the explosion but I it appears to subtly exaggerate the effect when analyzed via the Oil Shock model.

http://mobjectivist.blogspot.com/2005/10/uk-north-sea-simulation.html

At the time I said this: "I placed one regular shock causing a dip of 10% to the extraction rate in 1988; this corresponded to the devastating offshore fire on the Piper Alpha platform. After settling back to 10% extraction rate, I placed a fairly significant linearly increasing reverse shock starting in 1994."

On my blog site, the images had disappeared from the free image hosting site, so here are total North Sea production levels reproduced with the Oil Shock model profiles overlaid. I didn't have a discovery model at the time I did this curve so the discovery input stops at around 2004 and the extrapolated curve beyond 2004 is somewhat pessimistic.

unshocked (blue curve is discovery data)

shocked

The current production level for UK appears 1/2 the value of the peak in 1999.

We may see a similar subtle behavior in the USA due to the Gulf Oil production.

edit: Here is a spreadsheet of current UK data

https://spreadsheets.google.com/pub?key=0AuycoDmNCe6wdDJWNGgwUVhKRWpyY1U...

Piper had two direct impacts - first the closure of the Piper production hub, but second, government legislation led to many more fields being closed for installation of subsea safety valves on production lines. (check for example the Brent field data).

The twin peaks are also complicated by fact of low oil price and recession in industry leading to several big new field developments (Miller, Nelson, Scott) being delayed - it was these fields coming on in the 1990s that led to second peak.

I think you are right that US production may take hits from new regulation adding costs, delaying projects and keeping many off shore areas closed to exploration.

Sounds like Prof. Smil is a bright guy - he's figured out some of it anyway. Apparently he does not want to think about what all of the things he does understand lead to - chaotic and uncontrolled collapse. And peak oil is not a theory, it's just a description of reality.

Like most everyone he is really bright on some subjects and really stupid on some other subjects. He is not only a peak oil denier but, like Michael Lynch, continually bad mouths peak oil people such as Duncan, Deffeyes, Campbell, Ivanhoe and Laherrere.

Peak Oil: A Catastrophist Cult and Complex Realities By Vaclav Smil

Ron P.

Yeah, I was being a bit sarcastic. It's really irritating to read things like "Along the way he demolishes peak oil theory". Sure - what part about a maximum in the rate of oil extraction is a "theory", and just how did he demolish it? That's like me saying that my beer bottle will soon be empty* is a "theory" - maybe if it was my sixth beer that would make some sense.

The guy's either in denial or being intentionally misleading.

* I realize peak oil is not about running out, just a maximum rate.

Yeah, we all knew that. Smil happens to be featured on the TOD "Guide to Cornucopians" page.

http://www.theoildrum.com/story/2006/8/27/9544/28473

From today's article

I think the problem is that perhaps Smil cannot separate the rather dry oil depletion analysis from the repercussions of "Peak Oil". I have his book, pretentiously named "Oil" (in less than 200 pages, no leess), and his chapter "How Long Will it Last" really beats up on all the depletion analysts, and he can't resist mixing it up with Olduvai theory, which has nothing to do with it.

That is why I like to concentrate on the process of oil depletion itself and not get caught in the doom-mongering aspects. Unfortunately, Smil himself gets caught up in this doomerism in other areas.

I think Bill Gates picked the wrong man for a tutor.

At least he's not as bad as that Ralph Kingsbury chap. Then again what can one expect when an economist claims to have read some science

RALPH KINGSBURY: Complacency, human nature and the Gulf leak | Grand Forks Herald | Grand Forks, North Dakota

Hmm, is there a language barrier at work here or something? I'm reading the above using the voice of one of the characters from that movie Fargo to test my theory, yah hay.

Do economists write columns for the "Grand Forks Herald"? I doubt that. The guy looks like a business journal, with maybe a B.S. in Marketing.

Do you have any evidence that Ralph Kingsbury is actually an economist? Ph.D.? From what university, I wonder. May be a mail order degree.

While Smil may claim to be a peak oil denier, I don't think he really is. If you look at Figure 4.15 in his 2005 book "Energy at the Crossroads" he offers graphs of "plausible oil futures" which essentially peak at various times. Here is a quote from Chapter 4 "There is nothing inevitable about any particular estimate of an imminent peak of global oil extraction: this event may, indeed, happen during the first decade of the new century, but it may come at any time from a few years to a few decades in the future."

These same curves appear in his work 2008 "Oil" in Figure 27.

There is a lot more on this in Chapter 4 if you want to follow it. Kind of reminds me of when people say there is no peak .... just an "undulating plateau." Hello, what do you think that will look like in the rear view mirror 100 years hence?

His books are very interesting and I am reading his newest work, "Energy Transitions."

I'm perusing his Global Catastrophe book. He refers to Deffeyes's Thanksgiving Day 2005 prediction as "ridiculously specific." A sense of humour isn't critical to doing analysis, but.

Then he suggests that reserves figures could be underestimated as well as overestimated. That's old news, and specific to the US or certain overseas holdings, including Aramco, corporate undereporting being the ostensible justification for the late 80s revisions, at least in KSA, which begs the question of why the other OPEC members revised upward in lockstep.

Do agree with him that we need to analyze the curve for demand just as much as that for supply. The unswaying linear demand increase through time leading to skyrocketing prices is "ridiculously simplistic."

Then he is a classic pundit in that even though he agrees with everyone else, they are all incorrect because only he can be right. Reading his chapter "How Long Will it Last", he does ridicule Campbell and others for being wrong on their peak date estimates.

After reading his article in the January / February edition of World Watch, Smil is not a peak oil denier. He claims the URR is higher than 1.8 Tb citing a USGS estimate of 3 Tb and asserts that the peak is highly likely to occur before 2026.

Since he does not mention Export Land Model nor ERoEI, he appears under-informed on the subject of peak oil. He is also contradictory on society's ability to convert acknowledging that energy transitions take decades but arguing that photovoltaic panels, wind turbines, nuclear and natural gas will rush to the rescue. In the article, The Man Who’s Tutoring Bill Gates, Margaret Wente may be mischaracterizing his positions. He certainly did not demolish peak oil in the 2006 article, but rather acknowledged it at a later date. She claims that he states that wind power will not be enough contradicting his position in the 2006 article.

Smil's position seems to be rooted in the idea that peak oil will occur nearer to 2025 than 2005 giving humans more time to adapt.

He may be changing his stripes then. If you read his book "Oil", you will see all the conventional talking points laid out. "They have been wrong so many times before, blah blah, blah".

I have done the modeling and even if you put URR at 3 trillion you still get much closer to 2005 than 2025 for peak. Easily explainable because no one accounts for the possibility of fat-tails, in which case you can have a peak early on but still have room left in the tail to pick up the extra URR. People are so used to looking at the symmetric Hubbert logistic curve that they can't think straight.

This is an example of a URR of 2.8 trillion that I key-posted on TOD in 2007. Notice that the peak still occurred before 2010, even for a 2.8 trillion URR.

http://www.theoildrum.com/node/3287

It all has to do with what quantity is in the tail.

For now, Smil is just a pundit and doesn't do any deep thinking about the subject matter.

You may not like or agree with Smil's commentary but I don't know how you can say he not a deep thinker on energy including oil. How many pundit's do you know that have a publication list like this? http://www.vaclavsmil.com/publications/

Deep thinker? My impression is that someone who cranks out that much stuff couldn't possibly be giving the subject matter the analysis it deserves.

Read some of Smil's books and think again. I would recommend starting with "the Earth's Biosphere."

It also has to do with backdating the discovery curve as new technology and higher prices allow a higher rate of production and greater URR from the old oil wells.

And that is partly how you get the tail.

I don't think this was ever the case. If you read his recent work "Energy Transitions" he makes a clear case on the very long time (generations) it will take to make the transition to solar PV, wind etc. He has a very good feel for the scale problem. I have read more than a half dozen of his books and he has always been clear on the scale of our energy shortfall as we wean ourselves off of FF.

Prof Smil's quote seems very naive: “Wishful thinking,” he writes, “is no substitute for recognizing the extraordinary difficulty of the task.”

What's so difficult about putting a solar panel on every sunny-climate roof, or putting wind turbines in every wind corridor? Yes, the grid needs upgrades to move that power to where it's needed. But that cost should be very minimal compared to wasteful spending on bank bailouts and military expeditions.

The main impediment is not cost, technology or inertia. The main impediment is the political power of the industries that stand to lose.

Two disconnected thoughts:

A. Yesterday, while watching a couple hours of the US open, I was struck by the beautiful shots of the Pacific coast. And one shot of the exquisite, clean, and serene ocean waves off the CA coast was instantly contrasted by my mind - with the ugliness of the fouled, polluted gulf. I'd love to see contrasting shots, like a split screen, available all over - just to force people to see and contemplate.

B. Having written (A) I now see it actually does connect to my second point: Although I was opposed to the concept of "preemptive strike" as set-forth by the previous administration in terms of foreign policy, it seems to me that an overall energy policy, related to pre-emption" is now needed - and to call it "preemption". We simply can't wait for another crisis. IMVHO If such a thing can be "decreed" in terms of foreign policy, why can it not also be "decreed" in terms of energy policy?

I think someone is working on a response to that post.

I don't think anyone on staff believes it's accurate.

What I'd like to see is people start connecting the dots that their lifestyles are as much to blame as BP.

I've tried to get people to connect the dots locally. All I get is pushback and resentment with some hoping we can get to all out drilling as soon as possible. And this is in northern california along the stunning pacific coast. Lots of great Pelicans here.

No hope whatsoever.

Last Thursday, Digby on her blogspot Hullabaloo, cited an Oil Drum story that posited an ongoing break-up of the seafloor at the Deep Horizon disaster, that might empty the reservoir into the waters of the Gulf. (I summararize baldly, the details may differ.)

I've been looking on The Drum Beat for more comment on the accuracy or pertinence of this item, but 400-comment strings are hard to skim. Can someone tell me what's become of this speculation?

I certainly won't comment on the accuracy of that post Mudduck. I believe it's being questioned. But some level of seafloor damage is a concern that numerous people have expressed.

This is an interesting story of an out-of-control well in the early California oil fields that developed a crater around the well that swallowed the rig and equipment. http://web.archive.org/web/20061019100520/http://www.sjgs.com/lakeview.html

Thanks to Navigator for the additional context.

A possibly related story is up at Pam's House Blend website:

"Worst case scenario unfolding in Gulf: Oil leaking from seabed, methane building up."

I don't want to be a disaster-junkie. Seeing these stories on more general websites gives me concern for the sort of information being hawked. I know that the methane and leak angles are being discussed on the Oil Drum, but I'd like to know what to make of these particular outcries. The commenters at the Digby post were respectful, but none had the cred of Oil Drum regulars. Hence, this request for advice on these postings.

mudduck: some related TOD discussion I found: start at this post. The post that refers back to is here.

Alluvial,

Thanks for the link to Digby's original citing, and for the follow-up discussion. I suppose that's all that's to be said at this time.

I seem to remember a few comments noting that Matt Simmons seemed to have gone off the deep end and was saying stuff like that. So I think a few comments might have linked to what the crazies are saying. BUt I doubt you could find 1% of our posters here to agree with that argument.

Now, it is possible that the integrity of the deepwaterhorizon well might be failing, and that could potentially make the leak worse, i.e. reduce the resistance to flow yet further, but does anyone here think a million barrels a day is possible?

I've been reading through a couple Time articles on energy from May of 1973 and April, 1977. Much of what had been written then on the Remmington Rand reads like it could have been banged out at the local WiFi hotspot.

From May 7th, 1973:

Environment: The Energy Crisis: Time for Action

See: http://www.time.com/time/magazine/article/0,9171,907177,00.html#ixzz0rJq...

And from April 4th, 1977:

POLICY: SUPERBRAIN'S SUPERPROBLEM

See: http://www.time.com/time/magazine/article/0,9171,947870-2,00.html#ixzz0r...

It seems there's nothing new under the sun.

Cheers,

Paul

Hey Paul,

As you suggested, I did go the North Vancouver library last weekend and borrowed a Kill-a-Watt meter. I hooked up this device to my apartment fridge for a week. Here are the results:

Total hours: 161

Total energy used: 9.25 kWh

Energy/day: 1.38 kWh/day

Any idea how this "old" fridge compares to a new energy-efficient one?

Hi Frugal,

At roughly 500 kWh/year, your old refrigerator is performing rather well. A new energy efficient 15 cubic foot refrigerator will get you into the 350 kWh/year range for a 30 per cent reduction. In this case, I wouldn't bother to replace it until it dies.

See: http://www.energystar.gov/index.cfm?fuseaction=refrig.search_refrigerators

Cheers,

Paul

You can always try adding a bit more insulation round your old fridge (particularly between the back and the hot condenser pipework - though do this carefully because it means unfixing it from the fridge bodywork and refixing it on top of the new insulation). It not only saves energy but it also means that the compressor doesn't run for so long and shouldn't wear so quickly. I did this about 15 years ago to mine and it's still running at about the 350 kWh/yr level.

BobE

Paul,

This is actually a big problem in making the PO/Limits-to-Growth case...lots of folks point to Malthus and The Club of Rome etc. and claim that people who make predictions about such issues are nothing more than Chicken Littles/Boys who Cry Wolf...nothing to see here...

'we have been running out of resources 30 years from now and always will be'

Even further, there are are plenty of folks who accuse certain people who are advocating changing our energy mix of seeking to ramrod such changes to make their own personal fortunes...

Perhaps attitudes are slowly changing, but likely too littel, too late...especially since every time the economy takes a dead cat bounce most folks revert to the 'let the good times roll' mentality...

Sorry to be such a downer... :(

Not at all. I very much believe in preparing for the worst (if, indeed, we could ever possibly determine such in advance) and hoping for the best. There is, admittedly, the fatigue factor that has left me somewhat numb/jaded.

Cheers,

Paul

Glad you've discovered the joy of trawling through the mistakes of the past, Paul. Try a Google News Archive search, with only free articles for hits; you'll get all kinds of papers in the results. NYT is good as they provide web page results instead of the hand scanned newspapers most rags have.

There have been bad calls on either side of the table, or both sides of the coin, or whatever. One article I dug up from the mid-60s promised that oil field recovery factor would be around 60% within a decade - courtesy of EOR, specifically CO2 injection. It's still stuck in the mid 30s.

Carter also warned, in the MEOW speech I think, that we would need to bring on a new Texas's worth of production every year soon, which no doubt sounded alarming at the time; after reading that I didn't really raise an eyebrow any more at dire warnings that we will need to bring on a Saudi Arabia every other year soon. You could have made a similar statement in 1995; how relevant is this, have all bits of fruit been plucked from low hanging branches, is there some other source of food handy? We're bringing on an Iran every year now, seemingly without any ill effect besides, oh, price shocks, catalysts to massive recessions, shortages in the developing world here and there.

This all spurs me on to attempting to get a handle on what is really unfolding. Could be Doom, could be 1986 redux. Longer term I'm much less sanguine, but whether things will go completely sideways within a decade is much up in the air.

Hi Kevin,

I use Google News Archive a fair amount; it's a great service. Occasionally, there is something of interest on Youtube as well (e.g., http://www.youtube.com/watch?v=G9aygUVTEFU).

For the record, I have no clue as to how our collective future will ultimately play out. We'll just have to see how each new day unfolds.

Cheers,

Paul

The thing that tends to be missed is that the doomers can only ever be right once. After that point you usually aren't around to admit it, so the only evidence point you will ever find are from times they were too pessimistic.

Consider the doom/survival prediction to be Russian Roulette played for even higher stakes than normal.

GOM Oil spill has moved the debate over energy to the water-cooler.

For regulars on TOD the GOM oil spill (for better or worse) has moved the energy debate front and center. I can hardly turn on the news (yes I own a TV and I'm keeping it) without being subjected to the right and left tug of war over how we're going to adjust to energy use in the U.S. after 4/20.

The link is attached to a PBS debate between Kenneth Green of the American Enterprise Institute (AEI) and Daniel Weiss from the Center for American Progress (CAP).

The following are a short list of talking points from that debate:

Kenneth Green of AEI had a different take on current events:

The impression is that the right seems to be better at formulating talking points and winning debates. Kenneth Green of the AEI certainly came across as the voice of reason in this particular round. Is the right right?

Joe

Joe,

Sure, Mr. Green's arguments seem to hold sway for people whose 'give a crap' time horizon is fairly short...say several years to maybe a couple of decades...

But, his arguments are not logical over the longer term...but how many people really think seriously in time horizons longer than 5-10 years?

The other huge factor is the 'Boy who cried wolf' issue...see my comment above about predictions made 40 years ago and even longer (Rickover, 1950s, 1766 – 1834)

My initial responses to his four points:

1. There is no and hasn't been a completely 'free market'...the U.S. and most countries have a 'Mixed Economy', which is a combination of private entities and government rules and enterprises. The private sector historically does not include all costs in determining a good or service's 'true price'...the missing factors which can be ignored are called 'externalities...things such as pollution and impending resource constraints are too vague or far-off for many people to worry about, and/or the effects are too diffuse and non-obvious to quantify without significant extra effort...Some level of societal group long-term planning using the scientific method is necessary for truly long-term sustainability...the free market discounts the future too heavily to care about anything but the short term.

2. By what criteria (including over what time/planning horizon) are wind, solar, etc. to be judged as 'failed technologies'? Mr. Green also conveniently fails to mention past, present, and future subsidies to entrenched technologies. He also fails to acknowledge any externalities and their longer-term cumulative negative effects.

3. An appeal to BAU for BAU's sake...if we were to develop new, different technologies (including efficiency) and adopt different paradigms (level population, being less extravagant and wasteful) then we would generate competitive/comparative advantages that way...and besides, what is wrong with us simply getting our own house in order without playing the great globalization game?

4. Another appeal to BAU without any other rationale (We're here because, we're here because, we are hear because we're here....[sing to Auld Lang Syne]. Notice that he frames his statement in a time horizon of 'a few years'...lack of worrying about anything beyond five years hence is a call for inaction. Mr. Green puts off any thought of a time when these constructs must be affected by resource depletion...kicking the can down the road...

Other have written treatises on blogs and indeed whole books doing a much better job than my simple quick responses...the bottom line is that Mr. Green's words make people comfortable because they demand no sacrifice, change, or even thought...just 'stay the course'.

Thank goodness we ignored all those alternative energy advocates 40 years ago. That is why are energy and oil independent. Otherwise, we would be drilling in very deep waters off the Gulf.

re. ‘the future of cities‘ > the past of cities:

A ride down San Francisco's Market Street, Sept. 1905.

http://www.howtobearetronaut.com/2010/04/a-ride-down-san-franciscos-mark...

It is jerky and irritating in spots, don't be put off by the beginning, which is bad. It is fascinating, as the pre-history of film, and as a snapshot of SF so long ago.

The site has other pictures, vids. etc. The current entry is the Roman Road Map.

http://www.howtobearetronaut.com/

“we’re going to be a fossil-fuel society for decades to come.”

Anyone who knows logistics and has run the numbers could have told you this. I have been saying it for years.

If you by "be a fossil-fuel society" mean "we will kill each other over fossil fuels" then yes, we're going to be. :P

Wind etc. will be failed technologies until they produce energy at current market rates. And until there is sufficient low cost storage (think days or weeks of storage) to even out the peaks and valleys without requiring fossil fuel plants as backup.

Lots of money going into AE production. Hardly any going into storage which would make AE viable.

Also capital costs need to decline by at least 70% for AE. Why? Well if you consider the intermittent nature of AE the real cost of a $1 a peak watt (currently) is really $3 a watt plus $1 a watt for the backup generation. The electrical industry likes to pay about $1 a watt for generation capacity.

I swear. (I'm a sailor) Can't anyone run the numbers?

The current rush to AE is just a subsidy capture mechanism. Way cool huh?

Idiot. Of course it can't compete with oil right now. Oil has the benefit of millions of millions of years of a process that on first glance seems to flaunt the second law of thermodynamics -- a diffuse energy source turning into a concentrated form. Everything we do now will have to face up to the fact that we will do a real-time conversion of entropic forms of energy (wind, solar, etc).

Fossil Fuels are the greatest subsidy to mankind ever devised. We will enter the age of non-subsidies, everyone working together to struggle through.

But then again, you are very confused in any case. What is money "going into storage" but a subsidy? Like I said, idiot.

Cut out the name-calling, please.

Agree.

It's all about negative vs positive entropy. Not sure why that isn't the main stay of discussions here on TOD.

Additionally, FFs are massively subsidized - i'd argue way more than alternatives. Gasoline has arguably a 5$/gallon subsidy.

WeekendPeak

Glad to see another sailor on TOD. When we sail we use no fossil fuel (except for that embedded in the hull, mast, boom, wire stays and synthetic lines). And we don't pollute, either. Finally, sailing conquers depression and despair that too much reading of TOD can induce.

M. Simon-

Wind energy is expensive relative to coal fired power because A. it is being built with today's dollars instead of the old dollars used to build most coal plants, B. Coal is subsidised with an underpriced fuel (relative to it's true value and it's very low production rate in nature), and C. Coal is subsidised by passing it externalities (pollution, global warming) off to the general public.

Any new generation is going to be the most expensive, since it is built with today's dollars. But customers of the City of Austin Utilities and Xcel Energy (in certain areas) who chose the wind option years ago are now paying less than their beighbors who stuck with then-cheaper coal.

As to wind's variability, I suggest you read the Minnesota Wind Integration Study. In general, they found that as you increase the region you draw wind power from, the variability declines significantly. Now if the US gets its' act together, and builds something like the European Super Grid, then we could make wind a much more dependable source.

Also, the above mentioned study found that, at least in Minnesota's case, up to 25% wind generation could be accomodated without significant balancing and backup costs, because they already consider the loss of a tie line from Manitoba to be their worst case scenario. In many areas, the worst case scenario would be a couple of nuke plants going offline simultaneously. And contrary to fossil fuel industry claims, no additional spinning reserves are required.

Can you cite a legislation like the "Transportation Efficiency Act of the 21st Century" which extend the ethanol subsidy ($0.51 per gallon). Specifically legislation where the government pays the coal power generation industry a small fee for producing an amount of watthour.

If you didn't see the Daily Show a couple of days ago when An energy independent future aired, go and look at it now. Clips of how eight presidents talked about needed to work on oil independence. It is wonderful! I am sure it was mentioned on Drumbeat before. There is an article in Drumbeat today talking about it too.

Hah, that was good. R Rapier has a post about this, too: The Cost of Energy Independence. Hope to see it here soon.

"Signs of Hope as BP Captures Record Oil Amounts

Good days are relative for BP, the company responsible for stopping the largest offshore oil spill in the nation’s history. But the last two days brought moderate signs of progress in the company’s struggle to contain the catastrophe flowing from the floor of the Gulf of Mexico."

Maybe it's my thinking, but I believe that this is not something that shows hope... recent revisions on the flow of the oil, now seem to indicate that the current rate of caption may be only a percentage of the actual amount of oil.

A notice on media: I used to work at a newspaper, and it's introducing to note a few facts:

If you go on the major websites and track were Oil stories show up and on what page, we are noticing an interesting theme:

- Cnn.com no longer has a lead gulf story, on EITHER the U.S. or Main site

It instead has been moved to a small vote box on the right side, and main page has a SMALL video link in the list of stories.

- Usatoday.com still has a main story, but their lead has changed to World Cup.

- NewYorkTimes.com has little mention of it, one small story below the lead.

- Latimes.com has even less, only one link in located "in the news" section

The problem with America is our short memories....It is already "old news", and in the newspaper business, the news must be fresh - that's why celebrity gossip and other tabloid news is always talked about, because it is ALWAYS changing....

Maybe it's because I read all these forums, or I just love our natural world...this should be the biggest news since, probably 9/11...This is a serious situation, very serious, and getting more so, that is barely even being covered in mass media...

Does anyone else see a problem with this?

~Dawn

A few days ago, Gail made a passing mention of Australia 'raising it's mining tax'. For clarification, I'd like to make a correction:

Australia does not have a 'mining tax'. By law, all minerals and such belong to the States. They place a Royalty on the extraction of the minerals, which must be paid on volume.

The proposed Recourse Super Profits Tax (RSPT) is intended to give miners a tax credit of 40% for all costs - including Royalties - in a mine until it is profitable. After it is profitable, taxes are to be paid as they always are (Company Tax Rate is currently 30%. As part of the RSPT it is proposed to reduce it to 28%). One a mine is more than 6% profit, the RSPT comes into effect, placing a 40% tax on profits over 6%.

This is a 'resource rent' tax. The Australian Minerals Council made a submission to the Henry Tax Review promoting a RRT (as well as raising the GST). That was back then, when it was all theoretical. Now that it's looking like a reality, they're fighting tooth and nail.

Immediately after the RSPT was announced, the AMC met with the leader of the Opposition (Liberal-National, Liberal in name, not nature), Tony Abbot. He came out in support of the AMC, and against this 'Great Big New Tax' (the previous GBNT being the currently shelved Carbon Pollution Reduction Scheme. Ironic that a fundamentalist Christian who thinks Climate Change is "crap", saved Australia from a shockingly-designed Emissions Trading Scheme with enough many industry kickbacks and exemptions that it was actually worse than nothing). The AMC has comissioned several advertisments which are full of blatant lies and deliberately out-of-context quotes.

In a twist, the Mining companies are busy trying to rip up prime farming land, particularly in SW Queensland, which is itself prime National voting territory. Prominent National identity Barnaby Joyce has been vocal in his support for Farmers, not Miners. He must have some mixed feelings about all of this.

The proposed RSPT would actually benefit smaller miners, but it's the big Miners (Rio Tinto, XStrata, BHP, FMC) with their big wallets who are making all the noise. Several people have pointed out that the miners are basically trying to roll a democratically-elected Government in one of the most stable Democracies on the planet.

All this is now up in the air, as the Prime Minister was rolled in a sudden and unprecedented overnight leadership challenge, brough on by his plummeting approval ratings, which were caused principaly by his complete backdown on action on AGCC ("the greatest moral challenge of our time"), 'crash or crash through' method of politics, and overly-verbose speaking habit (ironically, his 'there's going to be a spill' speech was one of his clearest).. The new PM (Julia Gillard, Australia's first Female PM and second only Ranga) has removed the Governments RSPT adverts from circulation, and has asked the AMC to do the same, as a measure of good faith.

Expec the 'new' RSPT to remove the 40% tax rebate (hurt small miners) and increase the cut-in point from 6% to, say 10% or 11%.