Peak Oil: How Supply Crunch Can Lead to Lower Prices (for a while!)

Posted by Gail the Actuary on August 5, 2010 - 10:30am

This is a guest post by George Mobus. George is an Associate Professor of Computing and Software Systems at the University of Washington, Tacoma. His blog is Question Everything.

There seems to be an on-going debate among peak oilers and many economists as to which came first, the chicken (peak supply flow) or the egg (peak demand). The first is attributed to the classical peak oil theory that when about half of the oil in the ground is pumped out, extraction rates start to go into deceleration and eventually peak, thereafter going into decline. The oil price spike of 2009 was quickly interpreted in this vein, the price of oil reflecting the fact that peak had come at last and oil was just going to get more expensive with declining supplies. There were dire fears that oil at that price would trigger a recession, which seems to have been the case. But then the price fell precipitously leading other analysts to conclude that the spike might have been an anomaly set off by speculation and that the subsequent reduction in oil flow rates was due to demand destruction owing to the effects of a global recession.

The problem with these kinds of interpretations is that they often look for a prime cause in a linear chain of cause and effect. In this case the prime cause would have been peak oil and all else follows. A general truth behind this explanation is that oil is depleting and will indeed, if not already, become so expensive, both in monetary and energy terms, to extract that our production rates will begin to decline and less and less oil will flow over time. But the economic system that is dependent on oil is far more complex and no linear model can really explain what we have been witnessing in terms of oil prices and economic activity (the general so-called health of the economy).

Feedback, Mutual Causation, and Dynamic Systems

Real life dynamic systems are dominated by complex feedback loops, most of which operate over different scales of time. This latter fact is very hard to represent in typical systems dynamics models since the latter tend to provide only one size of time increment (Δt) for a time step and to represent much longer time scale phenomena. It is necessary to use extremely small time constants in your equations – and hope the precision is OK – and run your model for excessively many iterations.

But it is this mixture of short and long time scale phenomena with mutual feedback that cause system variables to behave seemingly erratically. In an attempt to try and grasp what is happening in the oil industry at a macro scale, I have employed two approaches to linking the many variables involved in the oil markets and the general economy in causal diagrams that might help shed some light on the interactions and subsequent seemingly unpredictable behavior of the whole system.

The first method is to show the large scale feedback loops in two domains: the consumer economy, and the debt-based (financial) economy to show the relations between the variables. These diagrams are based on outlines provided by Gail Tverberg (personal communications) from her financial markets perspective.

The second approach is to put together a systems dynamic model which attempts to combine several short and long-term loops that may help explain the seeming dichotomy between peak oil and peak demand and why the price system doesn’t seem to operate in the classic, and direct, economic supply-demand fashion we would expect. This article provides a first look at the developing model in an attempt to gather useful feedback from readers to help improve it.

Going Through the Loops

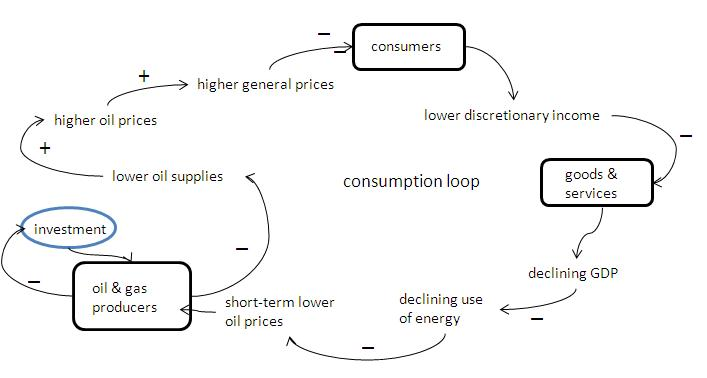

I’ll start with a simple loop diagram to show the long-term feedback between oil supply fluctuations, prices, effects on consumers and the economy, and how these eventually feedback to cause an opposite effect on supplies. This feedback loop is surprisingly similar to the phenomenon of homeostasis found in biological systems. Lowering supplies, possibly from diminishing extraction rates put upward pressure on oil prices, but that has an impact on consumers’ discretionary spending.

Figure 1. Oscillatory-like behavior results from long-term feedback through the consumer-based economic system to counter the direction of oil supplies and prices.

Consumers buy less stuff resulting in a softening of the economy. But that, in turn, means less work and hence less energy consumption. Lower demand puts downward pressure on prices causing producers to reduce their short-term production. And that, in time, drives the price of oil back upward. The time constants for this loop are probably measured in weeks or months with the severity of the swings based on shorter-term factors. For example, one could add a smaller loop to the above diagram in which oil investors (speculators?) monitor the supply on a weekly or even daily basis and try to anticipate the future with bids they think will make them a profit in the future. This, aside from often being inaccurate, at best, acts as an amplifier that drives the swings upward and downward more than simple supply/demand pressures would do.

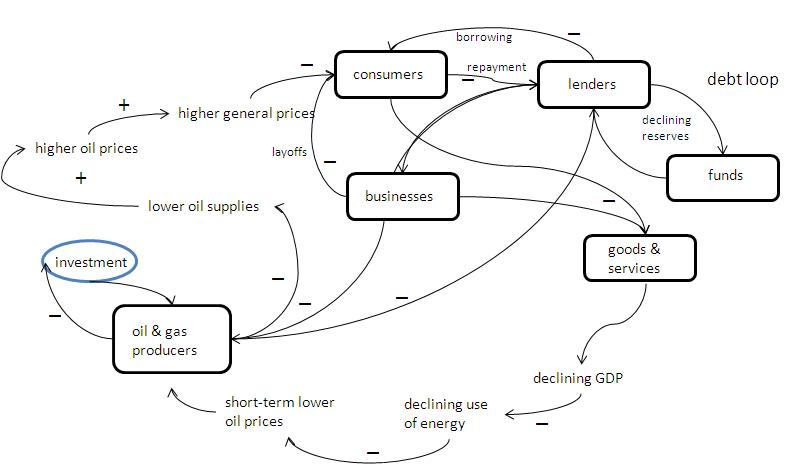

A somewhat more complicated picture emerges when we include the business world as consumers of energy and suppliers of jobs, and the banking role played in lending operating and investment funds to both consumers and businesses. Figure 2 shows these additional factors and how they may affect the overall cycle.

Figure 2. Businesses and consumers (who are also workers) borrow money from lending institutions to cover operating and capital costs with the intent of paying back the loans when work picks up. Due to the long-term average declining supply of oil, however, less work can be done making it difficult for both borrowers to service their debts. This additional negative feedback loop adds more difficulty to the supply loop since oil producers must rely on debt financing to expand their extraction efforts.

Oil supplies, relative to demand, are determined by the extraction rate supported by global producers. In the short-run producers (like Saudi Arabia) can up or down modulate their flow rates in order to adjust the supplies on a short time scale. However, in the long term, producers need to invest more capital and exploration costs to hopefully expand their production. They will do so only if for some period of time there appears to be a comfortable floor price for oil. They perform analysis of their returns on investment (ROI) just as any other business would to see if the investment today would pay off at some future (perhaps ten years off) time. In both figures above, the blue oval represents this investment time delay which introduces even more uncertainty into the problem.

However, there is one undeniable fact that can be shown to, in the long run, continue to drive supply relative to demand lower, and keep upward pressure on prices and that is the peaking and subsequent decline of oil extraction. The tendency for prices to inch upward acts like a speed governor damping demand and continuing to push the economy downward as less work gets done. Workers who lose their jobs, furthermore, will be buying less and thus acting to keep a consumption-based economy subdued (recession or worse).

Building a Simple Model

The second approach I am taking is to build a simple model of the dynamical system that impacts oil prices using feedback loops from both the supply and demand sides.

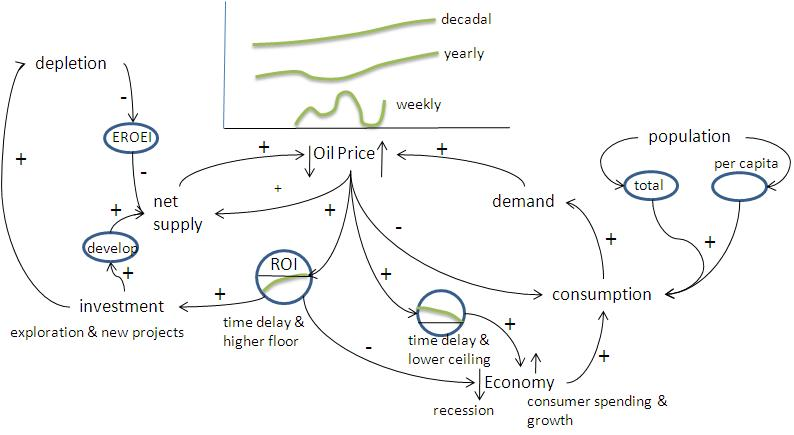

Below is a causal loop diagram of some of the major factors playing in the dynamics of oil and economic activity. I have explicitly left out players such as oil market speculators, financial institutions, and governments since these, in my opinion, act more like noise generators than meaningful feedback actors (except for my remarks about debt financing above). Perhaps a later, more refined model could incorporate them, but I think this version gets the major ideas across.

Oil price is the single most visible variable that people attend to in trying to get an understanding of the oil market. In the diagram, just above the Oil Price variable I show three different time scales of price tracking. The actual scale is not as important as is the shapes of the curves. When tracked on a weekly basis (for example as seen in the right-hand column of an Oil Drum page), the price appears quite variable. Lately the variability has been over a range of three or four dollars per barrel and monthly tracks put the range between $70 and $80 per barrel. This is fairly volatile by historical standards.

Figure 3. A causal loop model of oil price and economic activity dynamics. The arrows represent directions of influence. Positive signs attached to arrows means that the influence is in a numerically positive direction. Negative signs have the opposite meaning. The blue ovals represent various kinds of time delays or longer-term acting feedbacks.

Looked at over longer time scales such as a year or ten years we see the definite trend lines tending upward as various economic and physical factors create downward pressures on the net supply (i.e. EROEI is trending downward). In the longer term, it would appear that oil prices do follow the law of supply and demand as reflected in prices (assumed here to be held in constant dollars to avoid complications due to things like fiat money inflation).

Why then do we find periods when the price of oil is depressed by comparison with the trend? We are now prone to chalk it up to demand destruction which leads to an oversupply and thus downward pressure on price. Let me go through the various loops to see if we can see the pattern of supply crunch followed by price hikes, followed by demand destruction, followed by price deflation, but more importantly see these in the context of the overall economic activity and what it means to the health of the economy.

Starting on the left-hand side of the diagram, note that the variable ‘net supply’ has a direct positive impact on oil prices, but to generally drive them down. That is, the greater the net supply of oil, the lower the price should be, all other things being constant. The reason I chose net supply and not gross (which is the numbers most people attend to) is because of energy return on energy invested (EROEI). The time delay oval in the diagram represents a longer time-scale phenomenon in which EROEI is declining thus meaning that it takes more oil (or equivalent energy form) out of the production stream to produce the next increment of energy in oil. The net supply is what is left to supply the economy.

EROEI is driven most strongly by the physical realities of depletion of a fixed finite resource under the Best First principle and the sheer force of gravity. The only way to boost net supply against the ravages of EROEI is by increasing investment in new exploration and development, both of which take time (blue oval) before they begin to impact the net supply, and then only if depletion rates in already producing fields have not yet overwhelmed the new project production capacity. Investment, however, also hastens depletion (some shorter term developments like enhanced recovery may accelerate depletion).

Thus the net supply is a balance between on-going extraction from existing investments added to by new investments but countered by use rates in the economy. Oil companies make their investment decisions just like any other business based on the perceived return on investment (ROI), their profit prospects. ROI considerations are also made over time scales similar to development rates so the oil companies need to see some price stability that appears to provide a sufficient floor assuring their minimum ROI over the life of the new projects. If prices remain stable over this time scale, oil companies are willing to invest. But as the energy costs (and monetary costs reflecting that) reflected in EROEI continue to rise, especially if greater than anticipated, this can have an overall dampening effect on the process, generally reflected in putting a higher premium on future revenue streams as a kind of insurance.

The demand side of the diagram is influenced most by the rate of overall consumption in the economy. In the OECD nations, economies have largely moved to a consumer-based model which means that the more people spend the more the gross domestic product rises. Today we live with this myth that a growing GDP is a sign of a healthy economy.

But the caveat is that all economic activity, services, manufacturing, waste disposal, everything requires energy to do the work. As the price of oil has increased this has had a dampening effect on the economy in terms of general upward pressure on prices of everything. Labor is an example. People, especially in the US, live lifestyles that are extremely energy intensive. This isn’t just the energy they use directly to drive their cars or heat their houses. It includes all of the embodied energy in every product they purchase, every service they obtain, and every plastic package they put in the dump. Consumption is the big energy use driver in the developed world. This is as opposed to energy used to manufacture more energy efficient tools and appliances, which over their lives would help reduce the total energy demand rather than simply push it upward.

As one would expect, when demand exceeds supply oil prices do go upward (and that has been the long-term trend). This in turn leads to higher prices that help dampen consumption. We see this most effectively in the price of gasoline, but also in the price of foods that need to be shipped long distances. The oil price-consumption-demand feedback loop is the closest thing we have to a market-based regulation mechanism. The demand destruction, however, isn’t just left to consumers alone. When they start buying less, businesses that would ordinarily sell to them start to pull back. Economic activity in general declines, leading to a possible recession. It then takes time for this general reduction in energy demand to work its way back to the oil price variable. And all the while, the supply side resulting from prior years’ investments has pushed up the net supply (or at least its potential) so that once again prices are pushed downward from the overall trend.

The arrow looping back directly from oil price to net supply represents the shorter-term response of the oil industry to price declines or rises – the so-called spare capacity that can be turned on or off like a spigot. Since that is a generally small percentage of total maximum extraction capacity its impact on overall movement may not be that great.

The overall behavior of this system with respect to oil prices is similar to a final wave form in a superposition of various frequencies and amplitudes but with a generally upward trend. It is probably not possible to tell exactly what factor will cause the final ‘peak’ of energy flow in the classical Hubbert sense. But in a way it doesn’t much matter. The flow will peak and then decline and without a suitable substitute, the economic activity will follow suit. That much is certain.

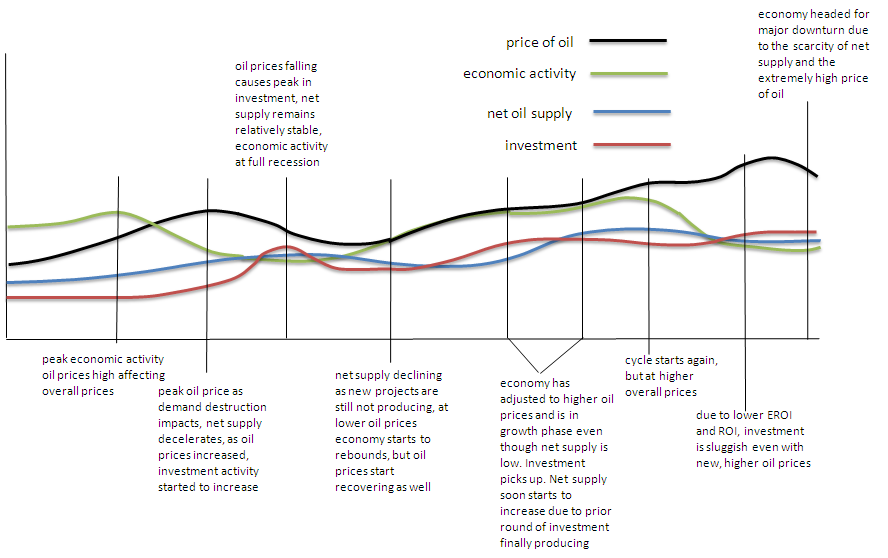

Figure 4 is a hypothetical graph of several of the variables as a time series. This is just a hand-drawn output from the above causal diagram and should not be taken too seriously. Consider it instead as a form of hypothesis. Once the above model is built and running, we might expect the output to look like this.

Figure 4. A hypothetical time series showing lead and lag times between the major variables in the above model. Representative conditions are marked to give some idea how the various factors play around one another over time. This might be representative of our current situation with the end of the graph representing a possible “double dip” recession (green line).

Impacts of the Financial System

Another factor that further complicates the picture and which I have not tried to explicitly include in the above model is the role of financing investment and consumption from debt instruments (as shown in Fig. 2). Debt financing is feasible when the economy is growing, because what that means, in terms of the above model, is that more energy is flowing per unit time. It means that as far as anyone can tell, there will be so much more work accomplished in some future period that resources allocated now will be more than paid for later, i.e. the debt will be repaid with interest and the future profits will be realized.

The OECD and major developing countries had built an elaborate and complex infrastructure of debt financing, including systems for betting that the debts will be paid off (derivatives), that essentially burst when the pin prick of $100+ oil poked it. The resulting debt unwind has had a very negative effect on further financing of new projects and so could accelerate the effects of depletion in a much shorter time than we had originally thought.

Couple that with the recent debacle in the Gulf of Mexico, Deepwater Horizon and the oil gusher, and we have an even more dubious picture. In all likelihood there will be considerable increases in regulation costs, technology for prevention, and insurance premiums against cleanup costs. All of these should realistically be counted as more energy costs and further declining EROEI.

Conclusion

Oil extraction and delivery rates, so-called production, and oil prices have dominated the focus of attention as causal variables in understanding our high energy economy, its growth or decline. But the system is significantly more complex than can be understood just by tracking these variables. Many factors interact over multiple time scales to produce the behavior of the economy and prices of energy commodities like oil. This paper has attempted to sketch out a causal loop model involving some of the most, but not all potentially, relevant factors that play against one another to produce the dynamics we observe. What this model suggests, as a kind of hypothesis, is that the overall long-term trend toward diminishing net oil supply (due to peak oil) will have an overall upward pressure on oil prices as changes in demand lag behind.

Once the price of oil reaches a critical threshold it creates a drag on the economy that results in a downward trend and possible recession. That, in turn can have a negative impact on the price of oil as producers attempt to compensate by producing less. The longer term impacts of decisions to invest in additional capacity (and exploration) can respond to oil prices only so long as there is a general steady-state between economic activity, related demand, and a floor support for oil prices. But these investments take years to pay off, and in the meantime, other short-time scale events may diminish the expected ROI, further putting a dampening effect on producers’ willingness to invest in the future.

All along the decreasing EROEI resulting from having to find and extract increasingly energy expensive oil (also reflected in the monetary costs of new, exotic projects) puts a downward pressure on net oil supply to the general economy meaning that the cost of everything experiences upward pressures. Eventually price increases will propagate through the consumer economy and result in lowered purchasing power for everyone but this effect creeps at a slower rate that is hard to detect.

This model can be tested with real data to see if the correlations fit the predictions of the causal model. As always, more research is needed.

Thanks George!

Very interesting post.

Some of this may seem kind of complicated to the newcomer who expects that there is only one way for prices to go--up!--as long as peak oil is a phenomenon. There are a lot of things going on at once, as George explains.

One of the easier things to understand is that high oil prices tend to cause recession, and this in turn leads to less demand and lower oil prices (at least for a while). Peak demand and peak supply are thus closely related.

Another that may be harder to see is that high oil prices tend to lead to higher debt defaults and indirectly to cutbacks in credit availability.

The cutback in credit availability (like recession) can lead to a lower demand for all energy supplies, including oil, natural gas, coal, and electricity in general. This can dampen demand for new production of all sorts, including wind and solar PV.

George points out other interactions as well. So the situation is indeed complicated.

Some of this may seem kind of complicated to the newcomer who expects that there is only one way for prices to go--up!--as long as peak oil is a phenomenon

A 'porpoising' effect seems the most likely, though trending downward with respect to GDP and 'paper' wealth. And the response of different countries (based on their current and future exposure to oil prices/shortages) is likely to be widely variant, so the model would need to be run for each. Some countries may have little direct dependence on oil (e.g. Costa Rica) but may be hit hard by indirect dependence (tourism).

Indeed, this is a multi-variate feedback control financial problem, and other factors include;

- The current GDP of a nation (or region) - highly consumptive countries might see greater impact.

- Reliance of a nation on the import or export of petroleum or petroleum-influenced commodity

- Policy direction ("We need to encourage consumption" vs. a thrust for energy efficiency, conservation, renewables, etc)

Might a model be able to extract signals out of the noise of GDP, oil prices, and other data? Are those the correct data points to be monitoring (i.e., might we use instead HDI, GPI, or GNH)?

George, I agree with your implied pictoral inside some of the 'bubbles' that each of the them will have properties such as;

- Time delay

- Amplitude (varying by input level and time)

It might be interesting to train a neural network with historic data based on key indicators to see if it extracts useful patterns, though it may not know how to deal with something like peak oil as it is not precedented in the last century of related commodity data (at the level of dependency that we have on oil).

My thinking is that a systems dynamics model will allow us to postulate causal relations among both historically tracked variables (like price, supply, and demand - suitably adjusted for inflation, etc.) and the non-tracked, but more important variables (in my opinion) like net energy. If we then plot known historical data in an appropriate time series and it follows the causal model closely, that will help us have a better sense of what to expect from the non-tracked variables.

Neural nets are ok for pattern recognition and categorization tasks, but don't provide much information about causal relations (except the ones in our brains that are actually geared to encode causal relations! see: Toward a Theory of Learning and Representing Causal Inferences in Neural Networks

George

What about the pricing done in US dollars adding to the confusion, or did I miss this? I refer to headlines like,

" the price of oil increased today based on the decline of us dollar as investors......"

It is often hard to follow all the reasons why for the fluctuations in price as it porpoises, although we often do adjustments for historical comparisons.

Thanks for the great article.

Paul

I fall back on the old ploy - all other things being equal! The model isn't concerned with predictions of prices but rather with the dynamics of prices relative to the other variables.

Thanks for the interesting post. It raises quite a few important points.

How much does the "momentum" of the energy industry exacerbate the problem? For instance, once the industry adjusts to a certain global flow rate, a sharp reduction in demand will lead to excess capacity back up the supply route (sort of like water-hammer in pipes). Tanker ships are already en route, refinery production plans established, etc. I wold expect that a gradual decline in demand would have less price volatility than a sharp decline in demand.

Yes! Exactly. These are the kinds of questions we should be able to ferret out if we are to claim we understand the oil (or any complex) markets. Unfortunately standard neoclassical econ doesn't do this very well.

This post begs the question: can the free market move us off oil without causing the economy to contract due to the large price swings that come with resource scarcity?

My view is 'no.' Businesses have trouble dealing with high price volatility. They can sometimes hedge effectively but often they bet wrong and often those bad bets can be lethal. Dave Cohen produced this graph to show how prices react when scarcity of a resource occurs:

A more effective approach than just letting the market enter this oscillation phase would have been to gradually increase the price of oil over time along a predictable time table. Purchase decisions would be influenced by the relatively higher cost of oil compared to its alternatives at the time of purchase as well as the expectation that the price would increase in the future, thus improving the ROI of the purchase even more.

Steve from Virginia pointed out that, given how the economy is structured now (especially the U.S. economy), the "economic damage" pointed out in the graph above might actually occur even at the lower price point for oil. It's a valid point but I don't have a way to prove or disprove that idea.

(Another more general criticism of the graph is that "economic damage" is a subjective term. If one believes, as I do, that the economy is unsustainable as it is run now, then "economic damage" might actually be viewed as "economic rehabilitation" or even "giving the poor planet a break.")

In any case, now it seems that price volatility is unavoidable and all businesses must get good at guessing future oil prices and/or hedging.

Hence why Lloyd's of London just warned:

http://www.chathamhouse.org.uk/files/16720_0610_froggatt_lahn.pdf

One nit to pick about the otherwise excellent article. This assertion:

isn't substantiated. Given Jevon's Paradox or the more recent Khazoom-Brookes Postulate, I actually think the assertion is false under the conditions of the immediate past. Efficient energy use reduces its price and allows us to use it for less and less essential purposes so that we now have devices that help us do a wide variety of non-essential activities.

Only rationing or a high price reduce energy use. Without either of those items, efficiency tends to increase energy use in aggregate.

In your price / time graph, is it possible that the price at which it becomes economic to invest in alternatives is

higher than the price that damage to the economy occurs? could we in effect be in an industrial system which is so dependant on cheap portable dense liquid energy, that it is impossible to transition smoothly to an alternative energy source or more efficient use of said oil?

In other words, $100 oil might simply lead to steady economic contraction in line with the oil supply, until society fundamentally reorganises itself, probably at a much simpler level?

In other other words, is collapse now inevitable?

Exactly...that was what I trying to convey when referring to Steve from Virginia's comment.

My answer to the question is: "hard to say." It would be good to explore this some more with some data and analysis.

In the meantime, there is a good chance that we are heading into a depression even before high oil prices bite again so we won't be able to run a clean experiment, as it were. And even if we limp along until 2013-2015 (when I and others, including Lloyd's expect the next oil price shock) without entering a depressionary spiral, when the next oil shock hits we will likely enter one immediately just because of the debt overhang that needs to be cleared.

In other words, your question is never going to be satisfactorily answered, I believe.

That comment reminds me of the slow self-realization of the dire predicament and onset of death that occurs to Lord Jim in Conrad's classic of the same title. IOW, could the first price spike, in 2008, have been a fatal shot to the global economy and we are only slowly becoming self-aware of the circumstances? I think the ongoing financial crisis supports this notion, and the fact that the first spike and related nosedive has left global economies in an unstable state.

We seem to be planning/modeling/hoping for a cardiac patient that can withstand undergoing multiple heart attacks over a prolonged period, but perhaps the first one has us marked as terminal regardless of more, and the next one could be the last.

It's fiendishly simple, just follow the bouncing oil price:

Basically what aangel said! As long as the production of alternative energy capital equipment and infrastructure (as well as installation and maintenance) are subsidized by fossil fuel energy I suspect there will never come a time when the price of oil will make alternatives look good (allowing a suitable time delay for the price of oil to work its way through the supply chain). Alternatives, to be truly renewable (sustainable) must supply their own power for production of replacements and operations into the distant future. If that can happen, then they should be viable even if their final EROI is not much more than say 10:1. But, that also means our civilization will be living at a much, much lower energy consumption standard (in my view a good thing).

It would be interesting to look for and hopefully someday see: PV manufacturing, or wind turbine plants that eventually install enough renewable product(s) that those product(s) supply all the energy the plants use or at least enough for an 8hr day shift.

Raw material aquisition, processing, transport, as well as transportation and installation of the finished products all rely heavily on fossil fuels at this point. Renewables have a tough row to hoe before becoming truly "self sustaining" energywise.

We should be building and installing renewables with urgency and purpose while fossil fuels are affordable. Some are already doing this. When we are forced to prioritise our use of petroleum in particular, the costs of everything goes up.

Raw material aquisition, processing, transport, as well as transportation and installation of the finished products all rely heavily on fossil fuels at this point.

Not really. Mining is often electric, as is processing. Rail can easilyi be electric. I know you know this, more or less, but it needs to be said: oil is useful, and we use it extensively, but we don't "need" it in the longterm.

Renewables have a tough row to hoe before becoming truly "self sustaining" energywise.

The very high E-ROI of wind power means that it's cost won't go up much, compared to it's benefits.

My educated guess is that existing worldwide wind and PV power already provide enough energy to totally supply the required electricity for current PV and wind manufacturing. However it's transportation that accounts for the (vast?) majority of the energy currently used to finalize installation of renewables (and that includes transporting workers, not just products). And given that transportation is generally not already electrically powered, that is the real kicker. Potential 'solutions' would involve switching more transportation to modes that can easily be run on electricity (i.e. trains), and using less energy to transport products and workers to installation sites (i.e. the end of global supply chains being typical).

Don't forget, however, that the electricity (form of energy) produced by PV, CSP, wind, etc. needs to not only account for its own regeneration but produce enough electricity profit or net energy to supply some form of economic activity. The scaling argument comes down to a clear case that these alternatives will never scale up, nor could even conceivably ramp up in time to match the demands of our current (US-level) economy and probably not even a northern European-level of consumption. Thus we have to consider this from both the minimum acceptable consumption level (to have a decent but not exuberant life style) of energy needed and the maximum possible supply that alternatives could supply.

It is likely, in my judgment, that given the time required and the resources (energy and financial) at hand, that the supply from alternatives (and I include nuclear in this) cannot ramp up to fill the gap that will be created as fossil fuels decline post-peak. This is especially the case if the alternatives are expected to bootstrap themselves to net energy levels while our society converts from liquid/coal fuels to all electricity (if that is even truly feasible). That is because a bootstrap is essentially a major long-term investment the payoff of which will be discounted in our classical profit-motive, capitalistic, private ownership model. The payoff won't come for years while we build up the excess capacity to generate self-sustainability AND net energy for consumption. Today's capitalists are not about to find that a profitable investment. Besides, once we do have self-sustaining energy production, the margins are likely to be exceedingly low so the long-term profit picture will be bleak at best.

I bet you the major energy companies have done this calculation and that is why their involvement is nothing more than keeping their hand in the game in case there is some kind of breakthrough game changer. They are not committing their stockholder's capital to such a program.

My thought is that the only rational way to solve our energy problem is to make a herculean effort to reduce waste and really stupid discretionary uses of energy, continue to work on whatever increases in efficiency that we can find (that can be quickly and cheaply deployed - we can't wait 20 years for the fleet of cars on the road to swap out to EVs) AND nationalize all energy production to get rid of the for-profit/short-term investment mentality. The market will not accomplish what needs to be done in the time needed to do it. Politicians, unfortunately, will not be able to do it either. There needs to be a major, revolutionary change in our whole economic and political system for such a process to be feasible (which thus makes the solution infeasible!) What are the chances????

George

It's way too early to speculate about the effects of peak gas and coal. Peak oil can be bridged with coal and gas, if need be.

Capitalists routinely invest in stuff that won't pay off for many years. This is no problem. The markets' short-sightedness is a myth.

Do you have a basis for this assertion? Why wouldn't the margins be typical?

Such an effort will take place when motivated by economics. There is a lot of low-hanging fruit so I have no doubt it will work well, especially in the US.

None. But you are wrong, fortunately. The markets can handle this if we let it.

It is likely, in my judgment, that given the time required and the resources (energy and financial) at hand, that the supply from alternatives (and I include nuclear in this) cannot ramp up to fill the gap that will be created as fossil fuels decline post-peak.

This is entirely unrealistic. For better or worse, we have enormous amounts of coal. We have plenty of time to ramp up wind, solar and nuclear.

The much larger challenge is ramping up low-CO2 sources of electricity quickly enough to avoid really serious climate change. Unfortunately, due to the invisibility of the changes and the lag-times involved, I'm not optimistic about this. PO, by comparison, is a piece of cake.

Alternative already look good: rail is cheaper than trucking for many things right now; wind is cheaper than oil for electrical generation or home heating; the Prius is cheaper than a comparable ICE vehicle to drive.

The alternatives are here, and cost-effective.

Perhaps. To replace the battery pack costs $2600.

LCD and plasma screens were very expensive in the beginning, b/c they were so nice compared to the old bulky CRTs. Thus some early adopters were willing to pay a high price, even though production hadn't been ramped and R&D-costs weren't amortized yet. But we knew early on that LCD/plasma would eventually be real cheap, as the raw materials cost, as well as transportation costs, where lower. The rest is just getting the production scaled and optimized.

Now, what is the raw materials cost of batteries?

IIRC, it's a small percentage of the current $350/kWh price of li-ion batteries, well below 10%.

Well, so far the battery seems to last the life of the car: Toyota reports almost no replacements, even with some cars at 13 years of age, and some tax drivers putting on 250K miles.

That price, of course, includes a hefty markup: OEM car parts traditionally are very pricey.

Would you happen to have a link for that price?

Good morning,Aangel

I generally find your arguments very persuasive, but today I see a possible variable you might have overlooked, at least in what you have posted here recently, in respect to Jevons paradox.

I believe the concept is valid, but only within the context of a middle to long term time frame.

A typical composite purchaser of a car that is extremely fuel efficient cannot, or at least won't, change his basic behaviors overnight.

It will take him a while to reorganize his habits to include more driving time and less of his time spent on other activities.

It probably would take the economy in general several years to reach a new more or less stable dynamic state of eqiulibruim in respect to the use of energy for various purposes.

I am curious as to how long people who are serious researchers, such as yourself,think it takes for the effects of Jevon's paradox to become apparent in actual practice.

For what it is worth,I am with Alan of Big Easy in some respects in this sort of discussion;I don't care how cheap energy is, I will not set my thermostat below seventy or so during ac season, or above seventy four or so during heating season.

Now I will read the link to the Kazoom postulate, which is new to me.

Hi, OFM.

Yes, I didn't explicitly call it out but time matters, too, though perhaps not as much as you may think. Over the medium and long term purchase decisions by other agents will certainly be impacted. However, even for an individual they can be impacted immediately.

Have you ever bought something for less than you planned and immediately said to yourself, "Since I paid less than I expected, I'm going to buy this other thing I had wanted now instead of waiting till later?"

If you have — and I think most people have — you can see that there is no time delay whatsoever between when the extra cash is available and the spending of that cash.

Even if you discover at the end of the month that there is more money left than was budgeted for at the beginning, since our desires are insatiable, resources generally do not lay around unused for very long.

"Extra cash will be spent" is a very good rule of thumb. That's why many financial planners insist that their clients, "pay themselves first" meaning that their retirement fund gets the first check during a bill paying session. If the client leaves it till the end, they might discover there is no money left and, looking back, that it was spent on things far less important than their retirement.

Same thing with oil. It will be used if it is available because it is so incredibly useful and anything, like efficiency, that reduces its price will lead to higher, not lower, consumption.

Which is an argument against conservation if your concern is the CO2 and pollution produced. As far as oil is concerned, it is a waste of time. Not true of coal, though.

However, learning to use less oil at a personal level still makes huge sense. It means that when it gets scarce, you can still afford to buy as much as you need, unlike the guy next door who still drives that full size SUV.

The personal level is the only level at which we can really get anything done in a big way on short notice.

Lots of people are doing things now that they have never seriously considered before, such as installing new windows,adding insulation,building wood sheds,installing wood fired "water stoves",and even adding sun rooms to thier houses.

They have decided that by doing so now,they will get a big return on thier money in terms of savings in energy costs in the future-a bigger return than they can get in other investments, especially any that are low risk.

I have been considering the purchase of some pv panels myself,but I have held off so far due to the fact that the prices have been dropping over the middle to long term so fast that delaying the purchase has so far been the best decision, in monetary terms.

I simply cannot save enough in five years to recover half the price of a given quantity of panels, and it seems possible that everything else equal, panel prices in real terms might decline even faster in the future due to expiring patents and the many additional small but additive improvements in cost and efficiency that will come about due to the steady increase in the number of people working in the field.

Furthermore,in five more years my old refrigerators, freezers, and air conditioners will be ready for the scrap heap, and the replacements will be far more efficient.I might even be able to buy a refrigerator at a REASONABLE price that is well enough insulated and equipped with a permanent reservoir of ice such that it will hardly ever run except when the panels are cranking, and equipped with a chip to make it run in that fashion.Ditto the freezers.

On the other hand,when energy costs shoot thru the roof,there may develop such a seller's market for panels that the real money prices actually go up-perhaps a lot, even though the industry is expanding fast.

Any links to serious articles exploring this "otoh" possibility will be appreciated, thanks in advance.

I am also intrigued with the possibility of down sizing the engine horse power of a very small car such as an old rear wheel drive(due to the greatly increased simplicity of the conversion)subcompact by installing a SMALL diesel engine, such as the ones used in very small farm tractors.

Swapping such an engine into a front wheel drive would be a nightmare for anybody concerned with the costs, but I could do the rear wheel drive conversion myself,over the course of a winter, as a hobby job, at a reasonable cost.

Such a car might only achieve a cruising speed of forty five or so, but with the engine running in its sweet spot most of the time due to its small size and consequent heavy load,the mpg achieved would be impressive indeed.

Such old cars are exempted by grandfathering from pollution inspections, and the taxes on them are trivial.

A good back yard mechanic could keep such a car running almost forever, if he could keep it from rusting away.

Mac,

Check out this website about 12/24v refrigeration. It's aimed @ boaters but is adaptable to PV or small turbines (which are both used on boats).

http://www.kollmann-marine.com/

aangel you hit the nail on the head about markets as regulators. With so many complex feedbacks with sometimes orders of magnitude time delays, markets by themselves simply cannot effectively be used to extract the kinds of signals needed to manage an economic decline as oil flow diminishes. We need good solid scientifically based understanding to drive policies re: prices, etc.

You are right about Jevon's being a problem, but for the same reason that markets alone cannot properly regulate activities. My point was simply that energy can be used to produce worthless stuff and services or it can be used to build tools that provide work leverage and hence have the potential to save energy in the future. That the latter leads to excessive use of energy by expansion of the former is very much a problem.

No, we need prices to drive policy. Science can't tell us how much of the world's warming is due to solar activity and Urban Heat Island effects and how much is due to CO2 forcing, you really expect it to tell us what a bureacrat in Washington should be paying for a gallon of gasoline? (answer: zero, he should be working on the internet from home)

I have a question- what we will we run out of before we can build enough energy sources to supply 10 Billion people enough energy to live in a house with heating and a/c with running water and 1500 calories a day and a broadband internet connection to a television and 5 lightbulbs- assuming we don't limit that development with empty worries over sustainability, global warming, or bureaucracy, and assuming that the loans necessary to build all this out can be repaid via agricultural surplus (including raising zebras for hunting), tourism (Sahara dune buggy racing), mining, or information (including Bollywood movies).

I know you'll say oil, but oil energy can be replaced. So will it be coal? Water? Silicon/Germanium/Indium/Aluminum? Uranium? Land for wind turbines?

A simple calculation is all I ask: 10 Billion people times X of resource - # resource < zero. I'm pretty sure it's not the sun, land, or saltwater.

reflecting on the history of civilization, and the clear and present pitfalls and tribulations that we see coming, I cannot help but see our civilization as a fat, bloated, decrepit old creature, which spent its life smoking an drinking and whoring and generally making enemies, in the process of dying from a multiplicity of ailments.

From time to time its addled old brain makes remarkably accurate diagnoses of the state its body is in, and what it should do about that, but eating and smoking and drinking and whoring and generally making enemies comes naturally.

I fully understand the desire to apply ointments, prescribe diets and generally look for cures. The future is getting scarier by the minute. But whatever we do, this patient is beyond saving. We may try to keep heart, lungs, liver and kidneys going artificially, but this will make for a long, painful and especially greedy death. Because this monster will eat anything and everything to save itself.

Maybe we should just help it to die and hope that some of the babies that will spring from its corpse have more sense.

lukitas

shoulders back and balls front, don't lose your dignity in the face of death

Many in the EV community have suggest that there be some type of 'floor' that gets put underneath gasoline prices in order to allow alternate fuel vehicle businesses (EV, fuel cell, bio-fule, whatever) to develop without being crushed by erratic gasoline prices. Investors and consumers cannot make rational decisions if the price of gasoline is so erratic.

Right now, I am predicting a 'gas guzzler' bubble since gas prices appear relatively low and stable and that encourages people to buy gas guzzlers. However, within 5 or so years (within the operating lifetime of vehicles purchased today) gasoline prices will probably be sharply higher leading to a glut of gas guzzlers on the used car market. We already saw this to a limited degree when gas hit over $4/gallon. It will happen again.

High gasoline prices will crush EV sales as SUV and giant pickup truck sales provide an internal subsidy for the 'alternatives'. The EV's will function but the companies won't be able to sell them at a price that (fuel constrained) wage- earners can afford.

Prius - http://www.toyota.com/prius-hybrid/trims-prices.html

Volt and Leaf - http://www.csmonitor.com/Environment/2010/0727/Chevy-Volt-vs.-Nissan-Lea...

I believe Tesla is an investment scam or fraud.

Auto manufacturing is strictly an at- scale operation (except for Ferraris and Aston- Martins, etc.). Without cheap fuels there is no auto industry, even in China or India.

Giant vehicle sales are tax- subsidized from government- owned industries. Without the subsidies and quasi- nationalization the US industry would crash.

http://www.smsmallbiz.com/taxes/Tax-Deductible_Business_Vehicles.html

http://www.acea.be/index.php/news/news_detail/car_production_in_2009_at_...

http://globaleconomicanalysis.blogspot.com/2010/04/gm-repays-government-...

Government Motors just bought a sub- prime replacement lender for GMAC (which lost $billion$ before being taken over by the US government in 2009 at a cost of a further $17 billion. GMAC is also saddled with almost $70 billion in debt).

http://www.businessweek.com/news/2010-02-25/gmac-bankruptcy-could-have-c...

Obviously, GMAC was so successful offering 0% loans to deadbeats (so GM could move its cars off the lots) that it believes a redux is in order!

http://www.nytimes.com/2010/07/23/business/23autos.html

To remake the point that Aangel referred to in his comments, the 'floor' that you speak of is below the level of GM's and the rest of the auto industry's level of profitability. Four dollar+ gas puts the auto industry (and the airlines) out of business.

You are a bit over-pessimistic. In Europe, gasoline can cost $7/gallon and taxes & registration on cars is very high but they still have an auto industry. They just have fewer cars and smaller cars. And much better public transportation.

Things are just going to have to scale down . . . we will become more like Europe. No more driving a massive 5000lb SUV to work with one person in the car. But at $10/gallon, people can still drive a Prius or a Fiat 500.

The $41K price tag of the Volt obviously prices it out of the market for most people but hopefully it will come down in the following years. The $32K Leaf is in within reach of average people. After the $7500 tax-credit, that is only $25K. And when you consider the savings on gasoline (which will be very large when gas goes above $4/gallon again), it is a very practical car. Yes, it is small, has a limited range, and takes a while to charge. But when gasoline is $5/gallon or $10/gallon . . . well, it sure beats walking.

$10/gallon gasoline in the U.S. translates to about $300/barrel oil ($10/$2.5 = x/$75). It won't stay that high for long before the economy buckles under the strain and contracts, just like what happened in 2007/08.

That means that the savings from purchasing an electric vehicle won't come from $10 gas but instead from some lower price. Let's say gasoline — at some point — reaches and stays at $7/gal. I doubt it would stay that high for very long either but it's not a terrible working number. Let's also say the person is ditching a 22.5mpg car, the current average for the light-passenger vehicle fleet.

15,000 miles / 22.5 = 666 gallons per year

or $4662 in fuel costs

Electricity is pretty cheap by comparison right now, although hopefully we wise up and price coal electricity higher. Without going through the math, let's say it costs $500 for the year, leaving a difference of $4162.

Definitely worth purchasing an electric car if there is a model that can replace the gasoline car, which there isn't yet. The Nissan Leaf goes only 100 miles on a charge but that's on flat ground in warm weather without the air conditioning on (certainly not in San Francisco, where I live). Plus, it will probably become common knowledge not to go below 30% battery charge so that the battery pack lasts longer. An educated driver probably can expect between 30 and 50 miles per charge, in the real world, at best. (Beware manufacturer's specs...that 100 mile claim is more of a marketing number than anything else.)

In other words, there is a small market for the Leaf right now. The technology will improve by 2020 for sure but the bottom line is that electric cars have a long way to go still before they are a strong competitor to gasoline. By 2020 we should see the equivalent of a Nissan Leaf going 100 real-world miles per charge through a combination of better batteries and lower vehicle weight.

In the meantime, the Volt, which is a pretty smart idea to get the extra range, still uses gasoline so the savings won't be as great.

Probably more accurate to say the contribution of oil to the economy has to contract to support $300/barrel oil.

This can happen both by the economy as a whole contracting and by movement to alternatives.

If we are luckier than we have any right to be the movement to alternatives will be sufficient to keep the economy bumping along without too much shrinkage.

the Volt, which is a pretty smart idea to get the extra range, still uses gasoline so the savings won't be as great.

The gas engine would only be used for about 20% of the miles, for the average driver's current driving patterns. Meanwhile, the Volt will get about 50MPG when driving those miles, so it will only use about 10% of the fuel of the average car. IOW, the average driver driving 13K miles will only use about 52 gallons of gas.

Finally, using gas is a choice in the Volt: It wouldn't be hard to modify those patterns a bit to get that percentage to 10 or 15% (a little trip planning, and maybe using rail a bit), and it could be close to zero if one really wanted.

People were almost giving away Dodge Rams and Ford Super Duties right at or after the peak;a year or two later, they were/are selling for as much as four or five thousand dollars more than they were then, even with another twenty thousand miles on the odometer..

Luckily (?) for us there exist no such thing as "free market", being a theoretical concept. Your question would more be: what kind of gov. interventions and/or market regulations can we think of to prevent a system feedback / loop will run out of hand by other loops. Like anti-cyclal government spending, instead of economising, in times of economic contraction. This took us quite a while to learn... The loops that George Mobus is describing are even more complex. I found a proposal for CO2 compensation by Equator quite mind dazzling... They have an oil field under one of worlds biggest biodiversity hotspots. Leaving the oil under the ground the state would miss 7 billion " opportunity" dollars (opportunity costs?). Burning it would result in 0,5 billion tons of CO2. For 3,6 billion dollars they would be willing to leave it where it is. 7,2 dollar per ton CO2, that's a bargain. According to the Kyoto protocol, the compensation would be re-invested in energy conservation/renewables. We all know that monster(energy) projects lead to monster corruption. We have to find a way to efficiently spend CO2 compensation money.

It seems like this would be an easy hypothesis to test by trying to recreate Figure 4. with real data. The main question is one of scope: Do we just look at the US or do we try to look at the whole world? The feedback loops mentioned may not apply to the whole world equally well.

On an annual time scale, global #'s should be easy to get:

The price and supply #'s can be had at the monthly scale as well but GDP and investment would be harder to find. But they probably don't have meaningful movements at the monthly scale.

It would be nice to see real numbers used to shore up this analysis.

Best hopes for testing theories with real, historical data.

Jon

Jon, your the man for that!! Want to help?

Anybody got a good suggestion for an annual time series to stand in for "global investment in fossil fuel extraction"?

Also check out the World Bank's Open Data initiative and Google Public Data

Good links.

I liked the article, and will be sending pdfs of it to acquaintances who claim that Peak Oil is false because the price is down.

One important aspect, which we are currently seeing especially with natural gas, is pumping despite low prices, which further depresses prices. This is caused by drillers who have a debt load to pay off and must flow as much oil or gas as they can to service the debt. I'm not an expert on shale gas but my understanding from what I read about it is that they are drilling frantically so they can pay off the last well and have to drill another well to pay off the one they're currently doing. It is a race to the bottom. My conventional NG wells in central Alberta are throttled back, but even so, we are also forced into flowing a minimum amount not because we have any debt (the wells are paid off) but because we have contractual obligations for wellsite maintenance and pipeline allotments.

Here in Alberta, one restriction on conventional drilling in my experience is the stickiness of rig costs due to labour and camps. The crews still want high wages, and they have their own costs because it is a long tough drive to some of those sites, and somebody has to feed and house them. You can't always drill next to a four-lane divided highway ten minutes from the city.

Dale, perfect summary of all the hidden variables that should be factored into EROI analysis but are so often ignored.

Dear George,

I do not find many of my Facebook friends at TOD. You are the second. Fred Magyar was the first.

My understanding of your research and perspective is limited, as you know. But what I am able to grasp makes sense. Thanks for all you are doing on FB, your blog, with Charlie Hall, here now and elsewhere to help us understand, and take the measure of, the human-forced global predicament looming before humanity and threatening both future human wellbeing and environmental health in our time.

If it pleases you to do so, would you, Gail, Will Stewart, mos6507, Ghung, Jason C. Bradford, Fred Magyar and others take the time to provide your perspectives on the how a global human population numbering 6.8 +/- billion now and projected to be 9+/- billion by 2050 will impact peak supply, peak demand, peak oil, peak capital, peak soil, peak natural resource dissipation, peak pollution and peak ecological degradation?

Sincerely,

Steve

Steven Earl Salmony

AWAREness Campaign on The Human Population,

established 2001

http://www.panearth.org/

Hi Steve,

I doubt the 9 billion figure will come to pass. Human demographic models do not incorporate any biophysical constraints or feedbacks. It is as if all the pollution, the limits to growth model scenarios, etc., just don't exist.

Since I believe they do exist, I would expect an earlier population plateau followed by a decline. Really don't have much clue how high it will go or how far it will fall over what time period, but 9 billion in 2050 then a steady population unlikely.

Jason

Hi Steve,

I personally believe that unless there is some profound global paradigm change population will hit limits sooner rather than later. For my personal amusement I've begun playing with jonathan.s.callahan's population databrowser. http://www.theoildrum.com/node/6816#comment-695197.

I don't claim to have a crystal ball but I'm not seeing population growth approaching 9+ billion, I fully expect regional contractions due to resource limits, in the next decade or two to start leveling off the global population growth numbers. To be clear I don't see this as a cause for celebration but rather a very negative consequence of our currently uncontrolled and unaddressed population growth problem.

Best,

Fred Magyar

Dear Jason and Fred,

Thanks for your perspectives. What I find wondrous about this particular thread is that George Mobus means it when he say "Question Everything". There are no "last taboo" topics or as I have said, "Examining human population dynamics is the very last of the last taboos."

As I recall, it was St. Augustine who reported to all of us,

"Men go forth to wonder at the great heights of mountains, the huge waves of the sea, the broad flow of the rivers, the vast compass of the oceans, the courses of the stars: and they pass by themselves without wondering."

Humankind has come a long way since the time of St. Augustine but I remain convinced that the willful blindness, deafness and muteness of the brightest and best among us, when it comes to wondering aloud about human population dynamics and human overpopulation of Earth, is a tragic failing with potentially profound implications for future human wellbeing and environmental health. We need to look at ourselves so that we come to more accurately understand "the placement" of the human species within the natural order of living things.....with all deliberate speed.

All that I report is to say simply that human beings need to wonder about our population dynamics and our impact upon the planetary home God has blessed us to inhabit. Forward movements toward sustainability will follow, I suppose.

Sincerely,

Steve

Dear Jason and Fred,

Thanks for your perspectives. What I find wondrous about this particular thread is that George Mobus means it when he say "Question Everything". There are no "last taboo" topics or as I have said, "Examining human population dynamics is the very last of the last taboos."

As I recall, it was St. Augustine who reported to all of us,

"Men go forth to wonder at the great heights of mountains, the huge waves of the sea, the broad flow of the rivers, the vast compass of the oceans, the courses of the stars: and they pass by themselves without wondering."

Humankind has come a long way since the time of St. Augustine but I remain convinced that the willful blindness, deafness and muteness of the brightest and best among us, when it comes to wondering aloud about human population dynamics and human overpopulation of Earth, is a tragic failing with potentially profound implications for future human wellbeing and environmental health. We need to look at ourselves so that we come to more accurately understand "the placement" of the human species within the natural order of living things.....with all deliberate speed.

All that I report is to say simply that human beings need to wonder about our population dynamics and our impact upon the planetary home God has blessed us to inhabit. Forward movements toward sustainability will follow, I suppose.

Sincerely,

Steve

Steve,

You may have noticed in figure 3 the population "loop". I didn't say much about it but I assure you it is probably the second most powerful driving influence in this whole mess. Energy flow is primary, and as you have pointed out work by, for example, Pimentel, have shown that the more energy that flows the larger the population grows. But it is a positive feedback because the more the population grows the more it demands energy! I plan on doing some more explicit modeling similar to The Limits To Growth handling of population in the near future.

As for the effects: The damage was already under way at 3 billion people on the planet. It was just hard to see it through those rose-colored glasses called progressivism.

George,

You may be slightly understating the hand that Population plays?

Personally, I believe it ranks as number 1, but there are a few other factors that intertwine with Population and the mess we now face, results from a combination of all of those factors.

In respect of population numbers, I suspect that we will see that Peak earlier, rather than later, possibly around

2030-2040 and we could struggle to get to 8 Billion!

The only areas of the world with fertility that is not either below replacement, or moving strongly to get there in the next 5 years, is Africa.

Lately, a lot of villages in India are getting TV reception, and....fertility is dropping sharply. The same thing happened in S America. Apparently, even though we consider TV a very low form of information source, it's very useful education for those who are poor enough...

George,

Your means of drawing these causal maps is confusing the hell out of me. For instance in Fig 3 it looks like you have a heap of positive feedback loops. However when you look at them carefully the loops seem wrong. For instance: Higher oil price > higher ROI > higher investment > higher net supply > higher oil price. Which is wrong, it should end up be a negative loop.

I tend to keep the nodes as quantities and the edges as descriptive simple changes - it becomes easier to see the wood for the trees and recognise the loop types in that case.

I think you left out the negative effects of decreasing EROI. But I will take a look again. I did ask for helpful feedback. Would like to get these loops about right before I code all this up! Thanks

Does that mean we will soon get to see a high resolution, full color 3D time lapse animation of the flows and feedback loops? Heck if you gave it a Wii interface and allowed for user manipulated inputs you could market it as a pretty cool doomsday consumer game. I'm imagining a quiet lagoon exploding into a feeding frenzy of giant prehistoric ichthyosaurs to represent the demand cycle >;^)

My thought would be to put the parameters in to an already existing strategy game, like FreeCiv [ http://freeciv.wikia.com/wiki/Main_Page ]

Those simulation games are fabulous for teaching the interaction of various components of a civilization — especially limitations. Nothing happens without a cost in either resources or time.

I'm a big fan (along with millions of others) of Civ4.

Yeah, but you've got to admit that a feeding frenzy of giant prehistoric ichthyosaurs, suddenly churning the waters of a previously quiet blue lagoon into a deep crimson froth, where just moments before a school of fish had been placidly swimming along, kinda grabs and focuses your attention a bit more acutely...wouldn't you say? >;^)

There are progs out there that can animate these easily, no coding.

The main problem is getting such system models balanced and stable under 'normal' conditions. Key is getting those negative feedback loops right. That and the non-linear behaviours they demonstrate to 'switch' behaviours. For instance, an individual can deal with rising fuel prices for a while, cutting back on other spends. Eventually things 'break' though, creating new behavioural loops and energising other larger scale loops. Getting that right is a right pig, even for a national level.

Could you list some you like, please? I have some animation I'd like to do and don't know the territory well at all.

Edit: I'm on a Mac primarily and prefer that platform (coming from a Unix background) but I run Windows in a virtual machine when required.

Err, just to be clear, by animate I mean allow you to enter nodes and edges and then see what happens when you let the feedback loops run. Not pictures of little people running around (aka Sim City).

You could try http://www.ochoadeaspuru.com/fuzcogmap/software.php which since its Java could work on a Mac. Or http://www.fcmappers.net/joomla/index.php?option=com_content&view=articl... using Excel. Personally I use someone's PhD output, which isn't freely available.

Ah, I see what you mean. Ok, thanks.

Nicely thought out George, and I look forward to what you can wring from this work. However, there is another factor that your model ought to include, but in practice may be very hard to quantify, and that is the effect of culture. While price most certainly has an effect on behavior, it is also sometimes overwhelmed by social pressure. It is my observation that “enlightened self interest” has as much to do with social status, as it does with economic forethought. For example, Light-duty trucks now account for nearly half of all vehicle sales in the U.S., ( Auto Sales - Markets Data Center - WSJ.com ). On the motivation of consumers, I would have to qualify this very much as a ‘want’, not a ‘need’. Many people still look down on my Prius with disdain, as surely I must be a ‘looser’ from the vantage point of their mock-monster pick-up. If an action grants enough perceived social status, it will spur actions that are contrary to survival, (like easter island), despite ‘price’ signals. This cultural influence could have profound effects on the feedback loops of your model, and ultimately the shape of the graph we are approaching in our real lives. Economies do not live outside of cultures. Unfortunately for us, cultures have more relative momentum than a full super-tanker.

Gyurash,

I certainly sympathize with your view of the mock monster trucks and the lack of need for so many trucks, but the buyers of such trucks are not always hoodwinked by status issues.

Modern small pickup trucks are very comfortable and practical vehicles, and I would prefer drive one rather than a car equally well equipped for ten miles, or for five hundred miles, due to seating and visibility considerations.

They hold up better, and cost less to drive, in every respect, over the long term, except for fuel costs.And if you need a truck even as seldom as once every few months, the cost of renting one can wipe out the money saved on fuel, or a good portion of it.

But the real consideration, from a practical pov, for the potential practical owner of a small truck,is total operating costs.

Given the great cost of purchase, taxes, insurance, repairs, and depreciation, the difference in driving a twenty mpg truck and a twenty five mpg car,or even a thirty mpg car, a few hundred or a thousand miles per month doesn't amount to very much at all.

I parked my Escort because I can't save enough on gas driving it to pay the additional insurance premuim; I just drive my older compact Toyota pickup all the time now.

On the rare occasion when I need a car, I drive the family Buick, which is usually reserved for weddings, funerals, trips to the doctor,and family get togethers.

Mac - I parked my 8 MPG full size van when I realized it was 8 gallons an hour on the highway, $24/hr just in fuel. (Wish I could get some of that $0.80/gal wholesale ethanol, it would breath new life into it.)

My F-250 Super Duty gets 17 or more, to get to $24/hr will require $6.38/gal diesel - expect it to be that in 2-3 years or so. A couple friends swear the correct after market chip will allow 23 MPG,that would allow $8.63 diesel. For what you get gas trucks can't come close for fuel economy.

Like you I live in a rural area, I need a truck to haul the tools of my trade, to haul the wood to heat my house, to plow my 635 foot driveway (I live in Central Maine), to haul my flatbed trailer etc.

I do OK by rural standards but am not wealthy. Somewhere around $30/hr for fuel is my limit - so I wonder at the options when we reach that point, which may not be that far off. Of course the obvious - get a Jetta TDI for any non-essential use, but insurance, excise taxes & maintenance have to be considered until fuel is quite expensive - but for local use, I wonder if an aftermarket kit to hybridise the truck would be practical, say a 60hp elec motor to the front tires instead of a transfer case - just thinking out loud here - or maybe stretching the diesel with propane??

Ideas?

Hi, Seagatherer,

My expertise does not extend to rechipping late model diesels-I only work on older vehicles, and I'm not a real expert even on old models-I'm just a well trained amatuer, so to speak, and I get farther behind every year.

I do mostly keep up with the contents of a few good trade publications, and I hang out often with some excellent full time mechanics who are good friends , plus I take a couple of automotive courses at the local community college from time to time.Access to the machine shop and the opportunity to get some hands on experience with computerized diagnostics under the guidance of the very good instructors makes the tuition a bargain, for somebody who enoys this stuff and can get to the classes.

I doubt if a new chip can improve your mileage very much,unless it puts your engine at risk by causing it to operate outside its intended design parameters.

An older car can be made to get considerably better mileage by rejetting the carburetor to run lean, and advancing the ignition timing.If you do this, and drive it very gently, and very carefully, you might get away with it , for a while.

But the usual result is an engine with burned valves and pistons, and broken piston rings, after a few thousand miles.

I would keep this example in mind before rechipping for economy.

Paradoxically, rechipping for power is actually less likely to harm your engine, because it will still run within normal limits except when you only occasionally put your foot in it to pass or pull away from a light.Putting your foot in it frequently would be begging for a very expensive premature rebuild.

In my personal opinion , any extensive modification of an existing vehicle drive train is virtually certain to be a mistake,financially, and in terms of reliability,unless you can do professional quality work yourself, and even then,the results are going to be questionable, financially.

The odds of being able to electrify an f250 and coming out ahead financially are probably VERY close to zero.

There are a few exceptions to the modification rule;converting to lp gas or propane might pay off, if you can get the lp cheap and fuel up at home base nearly every time.

And you can convert a gas truck with a worn out engine to a diesel, if you can find a suitable wreck with a good diesel in it to use as a parts donor;this means a complete vehicle of the same make and model, so you can get everything needed off it for the conversion.

You can convert from a three or four speed automatic -if it is in need of replacement-to a five speed stick and possibly save both on the actual repair costs and fuel expenses,but again the suitable donor rule applies.

I suppose you will eventually have to simply figure out some new tricks.

I know of a guy who built a sloped flatbed on the back of a Ford Ranger to haul a big zero turn mower.He flips down a ramp and drives right on and off, thereby saving the use of a trailer and lightening the loaded truck up considerably,so that it gets better mileage and is much more maneuvarable to boot.

And another fellow I know personally who runs a backhoe for hire business simply drives it everywhere he goes. He stays within twenty miles or so of home and cannot drive it on freeways.He makes sure to avoid being on the highway if at all possible during the morning and afternoon rushes.

The backhoe will only average twelve to fifteen mph, but there is no loading or unloading time,cutting fifteen to twenty minutes off the total trip time, and even though the machine wieghs 15,000 pounds, it gets VERY GOOD mileage, compared to a dump truck pulling a flat bed trailer AND the backhoe.

He can get to a job ten miles away in forty to forty five minutes;when he had a truck and trailer, it still took twenty minutes driving time, on secondary roads, plus the unloading and reloading time.

His additional maintainence expenses for the hoe, due to driving it on the highway, are only a small fraction of the expenses involved in maintaining a truck and trailer to haul it.

When he gets a job requiring the use of a truck, he splits it with a friend who is an independent dump truck operator.

Of course it is not likely that these solutions will apply to your own situation .

Learning to drive with a light steady foot on the gas at very moderate speeds is the single easiest and most effective way to cut fuel costs.

You are right about working culture/psychology into such models. In my other work (with Hall) I have segregated asset types in several categories (e.g. consumables, discretionary short-term, etc.) each with their characteristic build up factors. Societies that put high value on junk will have a lot of energy wasting and entropically decaying assets compared with societies that are frugal and put their work into long-term use-based assets. That looks like it will show the former kind of society will crash faster and deeper (makes intuitive sense) but I am a long way off from working out the details. That model is many times more complex than what I've suggested here.

This is all well and good but it seems like you are really just trying to somehow rationalize or justify a preconceived notion, that being that we are nearing peak oil. It doesn't wash for me. If we were anywhere near that stage the price would reflect it, we are talking Econ 101 here. You seem to understand that which is why you have tried to cloud the issue with an overly complex analysis to try to explain why prices aren't higher. The fact is we don't even know what is in the ground.

Exploration is expensive, it is done as needed when existing reserves are running low. For ANYONE to claim we know the true amount of recoverable oil on this planet is absurd. Every time the prediction has been made we are maxing out it has been wrong. I would think anyone who is making these claims might include some analysis of existing reserves, and what actual consumption is. I am not seeing that. The economy is soft here but China is booming, wouldn't they be offsetting some of the reduced demand here?

You have been on this forum for 6 weeks. I checked on that because your comment is a parrot of "standard dogma 101" and anybody who's been here a while and learned much would be unlikely to say such things.

I've been here a bit longer and can attest that this standard deterministic causal approach never works, unless you have toy problems. Human behavior at the aggregate level is stochastic and fits in better with an entropic world view. Whenever one tries to pin down a specific feedback rate, you know some that somewhere else a different feedback loop is operational (e.g. China, as Kroyall notes). Some people consider this chaotic and nonlinear, but I just believe this is the principle of maximum entropy at work. Agents and particles that act on the resources will tend to fill in all the states of the system (i.e. China taking up slack) and a model that takes this extreme variability into account will more likely capture the long-term dynamics of what we will experience. All fat-tail and Black Swan effects arise from assuming huge amounts of variation and by ignoring probabilistic effects we will essentially repeat the same mistakes that the financial markets repeatedly make.

Naive economic models ignore the missing links: resource constraints and stochastic variability. You can find lots of research that includes one of these factors but to include both is what I believe is the best direction.

then why do you think there is more?