Peak Oil - April 2011 Update

Posted by Gail the Actuary on May 2, 2011 - 1:27pm

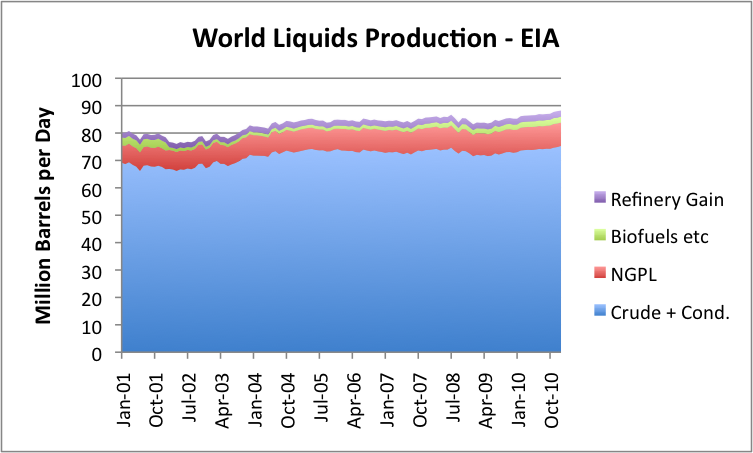

The US Energy Information Administration’s January oil production figures are out, and they show record oil production. Where are we headed from here?

While production for January is up a bit (219,000 barrels compared to December), the monthly numbers bounce around a fair amount because of planned maintenance. They are also subject to revision. Figure 2 seems to indicate that the production amounts are trending upward a bit, probably in response to the recent higher prices.

The amounts in Figures 1 and 2 are not entirely up to date, since they are only through January 31, 2011. All of the disruption in the Middle East started at the very end of January, and the disruption in Libya's supplies did not start until February. The earthquake in Japan took place March 11. OPEC estimates that OPEC and world oil supply fell in both February and March, with Libya's production falling by 1.2 million barrels a day between January and March, with only small supply increases elsewhere offsetting this. World oil prices continue to be high. At this writing, West Texas Intermediate is about $111.50 a barrel; Brent is about $122.

So what do we expect going forward?

Eventual Decline, but not Following a Hubbert Curve

It seems to me that the story about what happens in the future with oil supply is much more complex than what depletion and new supply alone would suggest. As I explained in a previous post (Our Finite World version and Oil Drum version), the actual downslope is likely to be steeper than what a Hubbert Curve would suggest, because economies of many importing countries are likely to be adversely affected by rising oil prices, and because demand (and tax collections) are likely to be low in countries that lose jobs to countries that use oil more sparingly.

Hubbert assumed that nuclear or some other cheap alternative form of energy would allow business to go on pretty much as usual without oil. We know now that we are close to the downslope, but no inexpensive alternative has been developed in quantity. Because of this, actual production is likely to be less than the amount that is theoretically possible. This happens because of indirect impacts of inadequate oil supply, such as recession when prices oil prices rise; riots when food is in short supply; and inadequate demand for oil because of jobs move overseas to countries using less oil, leaving many unemployed.

In some sense, if oil prices could rise indefinitely, we would never have a peak oil problem. The high prices would either stimulate production of alternative types of energy or would enable oil production in areas where oil is very costly to extract. The indirect impacts mentioned above prevent oil prices from rising indefinitely. These indirect impacts seem to be related to inadequate net energy for society as a whole. Theoretically, if oil prices could rise indefinitely, we could even end up using more energy to extract a barrel of oil than really is in the barrel of oil in the first place--something that is hardly possible. The fact that rising oil prices lead to impacts that tend to cut back demand seems to be a way of keeping prices in line with the energy the oil actually provides.

Which countries are able to buy the oil that is produced?

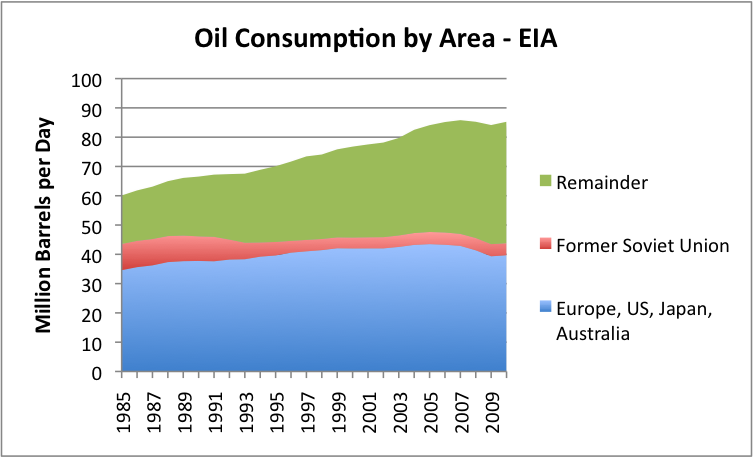

If we look at oil consumption by area, we find the following:

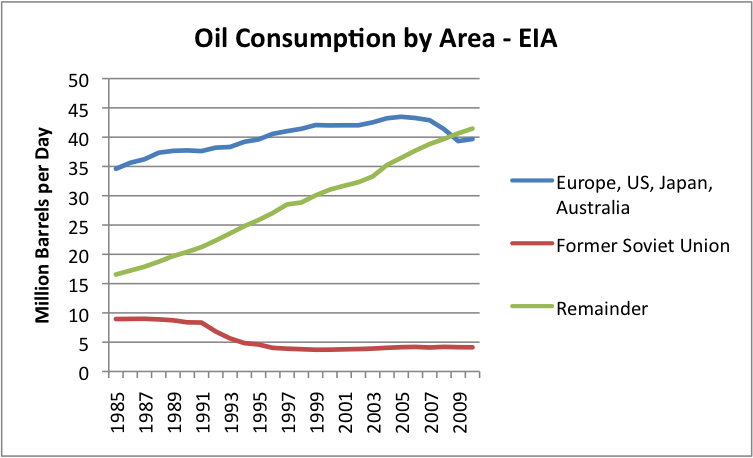

It is clear from Figure 3 that consumption of my grouping called "Europe, US, Japan, and Australia) is much flatter (and recently declining) than that of the "Remainder." The Remainder includes oil exporting nations, plus China and India and other "lesser developed" countries, many of which are growing more rapidly than countries like Europe, US, Japan, and Australia.

I have plotted the same data shown in Figure 3 as a line graph in Figure 4. The latter figure shows even more clearly how different the oil use growth rates have been.

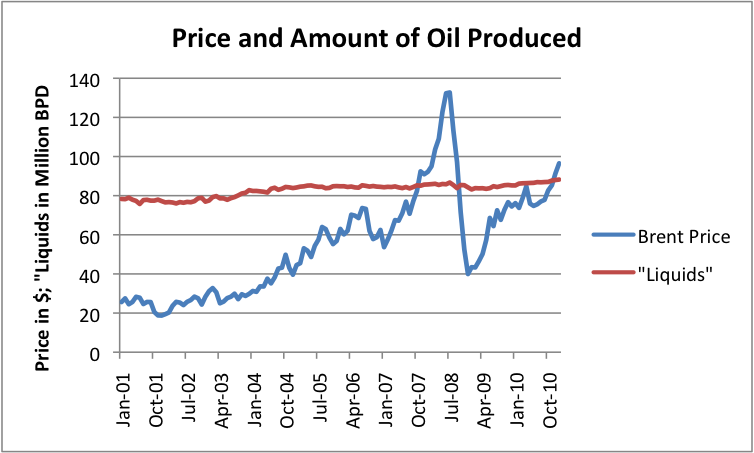

If world oil supply is close to flat (shown in Figures 1, 2, and 3), Figure 4 shows that we have a potential for a real conflict going forward. The "Remainder" countries in Figure 4 will want to continue to increase their oil usage in future years, even if oil supply remains flat. This is likely to lead to considerable competition for available oil and high prices, such as we are seeing now. About the only way the "Remainder" countries can increase their oil usage is if oil usage by the "Europe, US, Japan, and Australia" group declines.

Many people believe that the only alternative to adequate oil supply is for the amount of oil produced by oil companies to fall and because of this, for shortages to result. While this scenario is possible, especially in the presence of price controls, in this post we show another way that oil consumption can be limited.

A very common way that oil usage (consumption) can be expected to decline is if high oil prices induce a recession. The countries that seem to be most susceptible to recession are countries that are (1) oil importers and (2) are heavy users of oil, since an increase in oil price has the most adverse impact on the financial health of these countries. When recession is induced, there are layoffs. These layoffs reduce oil usage in two ways: (1) less oil is used for making and transporting products that these workers would have made, and (2) the laid off workers are less able to afford products using oil, so reduce their purchase of oil products.

Because of this relationship, competition for oil is likely to be very closely related to competition for jobs in the future. The countries that get the jobs can be expected to get a disproportionate share of oil that is available.

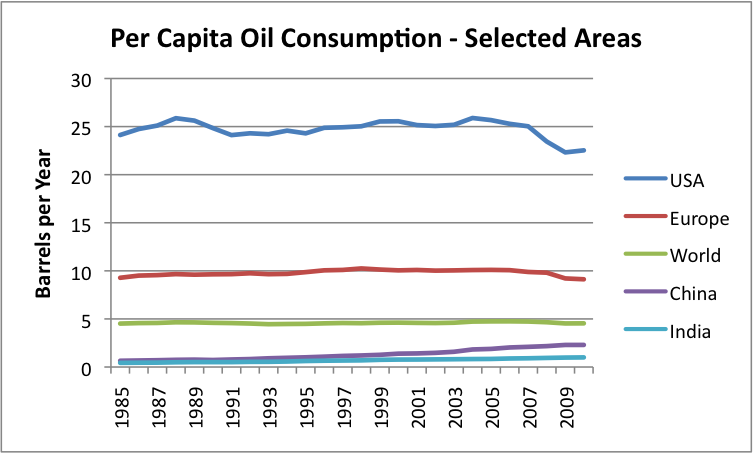

If we look at per capita oil consumption (Figure 5) on a world basis, it has been close to flat since 1985, because oil production until very recently rose enough that oil growth more or less corresponded to population growth. China and India's per capita oil consumption rose, meaning that the oil consumption of someone somewhere, such as the Former Soviet Union, needed to decline.

Future Oil Supply

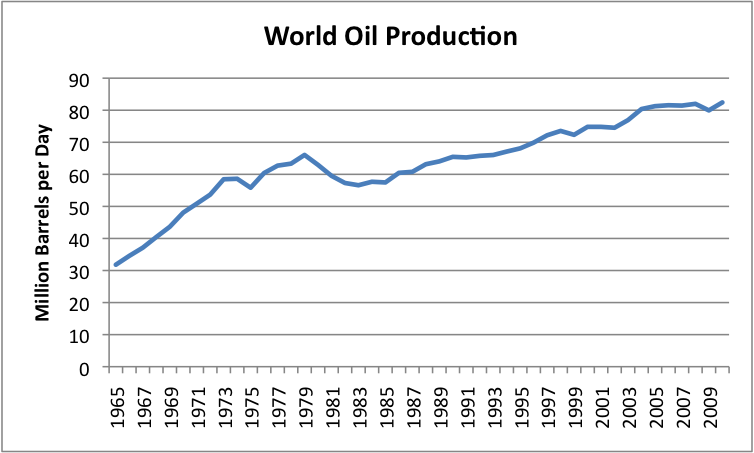

If we look at historical oil production (Figure 6), it has been fairly "bumpy":

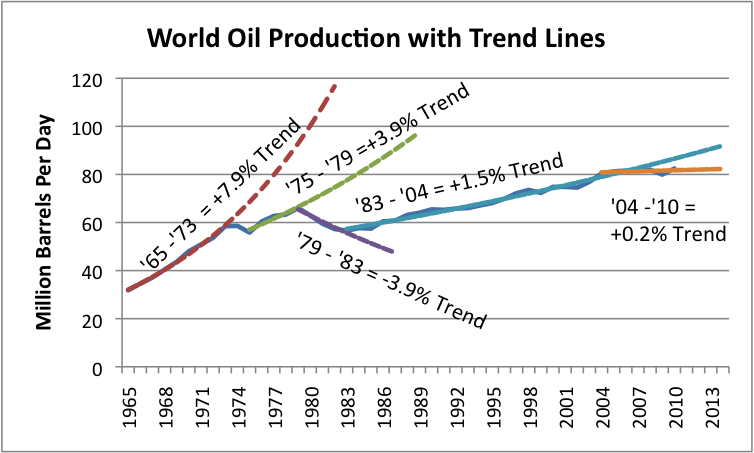

By fitting trend lines, we can see where oil production seems to be headed:

What we can see from Figure 7 is that the growth rate of world oil supply has gradually been slowing. The growth rate was highest in the 1965 to 1973 period, at 7.9% per year. Then we hit the "oops" period of 1973 to 1975, when we ran into conflict with OPEC regarding oil supplies. The trend rate dropped to 3.9% in the 1975 to 1979 period. Between 1979 and 1983, oil consumption dropped to a -3.9% per year, when we picked some of the low hanging fruit regarding oil usage (mostly by eliminating petroleum from electricity generation and downsizing automobiles). The trend between 1983 and 2004 shifted to +1.5% per year, and since 2004, seems to be about +0.2%.

There are so many countries involved, that it is not easy to identify one country or area that is rising, but one country of note is Iraq. Its production in January, 2011, seems to be up by 300,000 barrels per day, relative to mid-2010, based on the latest data. Thus Iraq seems, for now, to be helping to keep world oil production flat, or even growing by a bit, despite increasing depletion elsewhere.

Looking at Figure 7, it looks like the "trend" in trend rates over time is down. In the absence of other information, we would expect production to remain at its recent trend rate of 0.2%, or alternatively, the trend rate could take another step downward, probably to an absolute decline in oil production. A recent announcement from Saudi Arabia suggests that its ability to offset declines elsewhere in the future is likely to be virtually nil, so a continued decline in production from the North Sea and elsewhere will need to be made up with new production elsewhere, or will lead to a worldwide decline in oil production.

World population has been growing. If oil production remains flat or declines, and world population grows, this means that someone has to be a loser, in terms of per capita consumption. I am not certain how this will turn out, but I see at least three forces that may come into play:

1. Countries may figure out that permitting jobs to move to less developed countries is not in their best interests, and start increasing protectionism. This will tend to keep demand more level (higher for importers, and lower for growing economies). The overall impact on oil demand is less clear--less oil will be needed for long-distance transport, but more oil will be needed to maintain current lifestyles of workers.

2. Countries that are in financial difficulty may find themselves increasingly shunned, as they seek to "restructure" their debt, and may find themselves increasingly cut off from buying oil products and the goods that that are made using oil products. This will tend to reduce aggregate world demand for oil, by reducing consumption in specific countries that have financial difficulty.

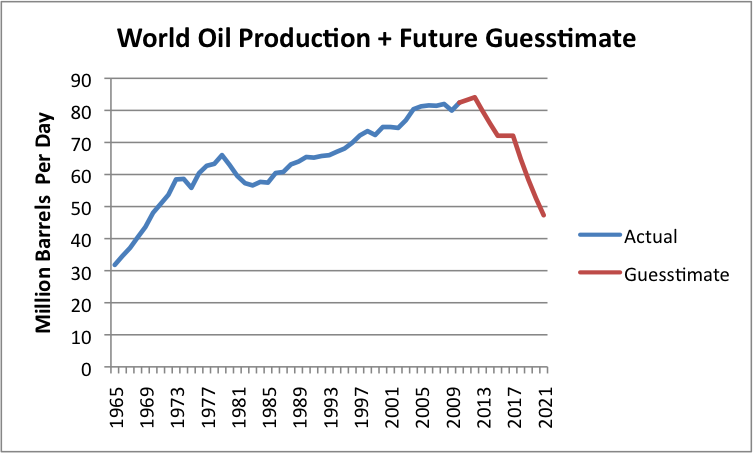

3. There may be recession affecting a number of countries, reducing their demand for oil. We don't know how exactly that this will change the shape of the world oil production curve, but Figure 8 shows my very rough guess as to how supply might be affected. (Your view may differ.)

It seems to me that as we go forward, we are likely to see a jagged pattern in oil production decline, reflecting a combination of less demand for high-priced oil as oil supplies continue to be very tight, except at high prices. In addition, some countries can be expected to increasingly drop out of competition for oil, as their financial situations deteriorate. Thus, the pattern for decline in oil consumption can be expected to vary significantly from country to country, depending on their policies and their financial conditions.

Clues as to Which Countries May Drop Out First

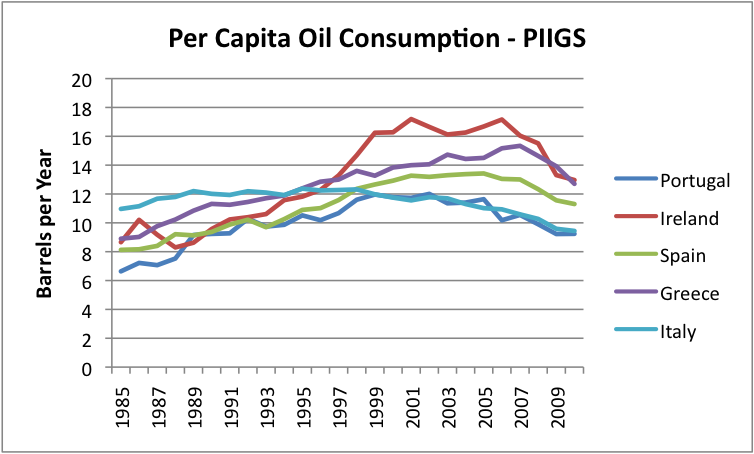

If we look at the per-capita consumption of the PIIGS countries, we see that for the most part, these were countries that increased their consumption of oil, and then were not able to maintain the increase.

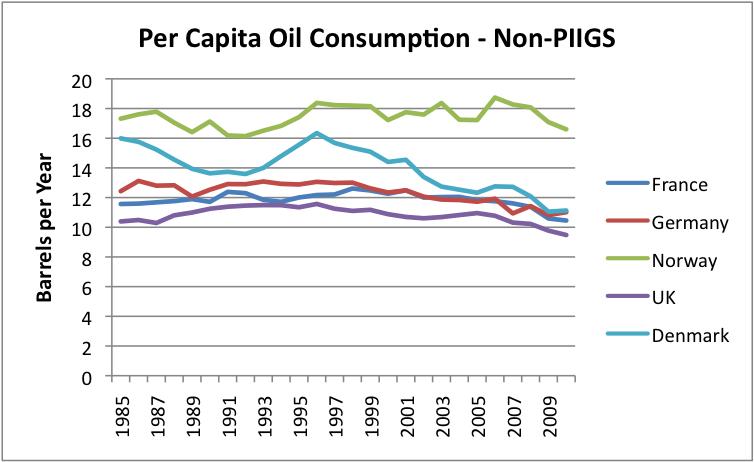

The difference is quite striking when we compare per-capita oil consumption to a few of the non-PIIGS European countries.

Why is there such a different pattern between the PIIGS and the non-PIIGS? I haven't researched the situation extensively, but it would seem as though the PIIGS countries tended to be agricultural countries that tried to develop more diversified (oil intensive) economies. They expanded and incurred a lot of debt, and now this debt is becoming difficult to pay back. As far as I can see, this economic growth was not based on the growth of stable, fairly cheap supply of electricity, such as hydro-electric or coal. Instead, growth depended fairly heavily on oil use, and the cost of oil rose. It may be that part of this growth in oil use occurred because of an improvement in standard of living--more cars, more vacations, bigger homes.

My working hypothesis is that when oil prices went up, the economies of the PIIGS countries had too much debt for the new industries to provide enough revenue to service both the higher costs of oil and the debt costs. Countries which didn't try to grow in this way didn't have as much difficulty, although high oil prices are still a burden for them. They may eventually run into debt problems, just a little later.

What are China and India and some of the other countries that are growing rapidly doing differently, that their economies haven't collapsed? One thing they have going for them is the fact that their oil usage is at a vastly lower level, even after rapid growth. Another thing that they often have going for them is growing electricity production, using an energy source that is relatively cheap. In the case of China and India, this is mostly coal; in the case of some of the other lesser developed countries, it is hydro-electric.

It seems as though at some price, each country will hit recessionary pressures and drop back in its demand for oil. This price will vary by country, depending on the country's current debt situation, the extent to which the country can continue to "grow" its economy based on a growing source of cheap electricity, and how well international trade holds up with increased protectionism and higher oil prices. Countries depending on growing hydroelectric and coal-fired electricity are likely to hit limits, too, as these supplies reach natural limits.

One situation which may affect how long oil prices can stay high for the United States is the existence of QE2, or "Quantitative Easing 2." This seems to keep the dollar low relative to other currencies, thus allowing commodities prices to remain high. QE2 is scheduled to end June 30, or earlier. If it is allowed to expire, it would seem as though interest rates could rise materially (because QE2 also keeps interest rates low), and could lead to a rapid deterioration in the financial condition of the United States. If this should happen, it would seem as though the United States could be one of the countries that enters recession and significantly decreases its demand for oil. Of course, high oil price by itself may lead to this outcome quite soon, also.

We cannot know how all of these forces will play out. Generally, I would expect that there will continue to be an upward push on the price for oil because of rising extraction costs, and because unrest in the Middle East is causing countries to provide additional benefits for their citizens, further raising their costs (estimated to be $95 barrel by the Wall Street Journal). As long as the world economy is expanding, rising demand will also tend to pull oil prices upward, because many countries are trying to compete for a supply of oil that is barely growing.

The various countries around the world can be expected to be in differing positions with respect to their ability to pay high oil prices. Gradually (or not so gradually), the weakest ones will be pushed away from buying oil, either because of debt defaults and shunning by exporters (unless they have goods to trade in return), or because of recession, or both. World oil production seems likely to decline as the number of countries that can afford to continue to purchase high-priced oil declines. Ultimately, oil consumption can be expected to drop to close to 0, because no country will be able to afford to buy very much oil at a high price, and because oil companies will not be able to maintain necessary infrastructure for a very limited supply of oil.

I don't think that we can expect an analysis of the theoretical capacity of future world oil production to tell very much of the peak oil story. We really don't know how much of the oil which seems to be available will actually be produced. A lot of the story will depend on the ability of individual countries to keep their economies in good enough shape that they can afford to buy high-priced oil. Many residents of countries that are shut out from oil supply are likely to find that oil products are not available at any price.

Originally published on Our Finite World.

Gail, glad to see someone step in to play something of the role Rembrandt once played here. Can we expect a monthly report along these lines from you, or is this a one-time thing.

I would just start by suggesting the same thing that I suggested to R--that the first graph not be "total liquids" but rather C&C, otherwise we are involved in ever shifting goalposts, imho (though I realize that your post may be serving slightly different purposes than R's).

I do wonder how much longer the world can support oil at over $100 before a new mega-recession hits. Are we weeks away from a new crash? Months?

I'm wondering this too. Anyone have a sense when we're going to see the new recession start, and when oil prices are likely to top out in this cycle?

I have a call but not a forecast as it is pretty much impossible to forecast accurately and consistently when trying to time the markets. Things change quickly and todays forecast/call might need adjustment tomorrow and my "call" might be adjusted this month or tomorrow. That said...

I believe people adjusted psychologically and financially to $4 per gallon during the last hike. People who needed to began migrating to smaller cars, different commuting methods etc. at $4 did so already. Energy is also now much less of GDP than it used to be due to energy efficiency.

My call...oil is not going much under $100 again (the cost of marginal barrel is that already for European producers and the Saudis are likely really pissed at Obama for Mubarek and his messes in the middle east (ie Libya) and doing him Obama no favors and the Saudi budget is dependent on $90 anyway)...and the economy goes into negative growth when people make their next shifts (ie. to the inevitable smaller cars, less travel, etc.) at around $5.50-$6.00 per gallon. We might see $150-200 a barrel and if I had to guess it might be this summer or if not, next spring.

That said, I could change my guess tomorrow, nobody can possibly have an always accurate short term and timing chrystal ball in our complex and fast changing world. That and a dollar will get you a cup of coffee (at least this year).

At least partly in response to the Libya shortfall, refiners in both Europe and the USA have run down their inventories, in spite of reduced spring demand. Now with the summer driving season approaching, they will have to restock. Brent is very likely to go to $140/b in the next 3 months.

"That and a dollar will get you a cup of coffee (at least this year)."

Not in my neighborhood.

I notice a number of folks raising this issue recently - namely why haven't we had a recession since the price of oil is now up to over $120 (Brent)?

I would like to suggest that depends on who you believe regarding GDP growth.

I tend to follow John William's Shadow Government Statistics rather than believe the official government line. We have been in recession for many years.See the blue line in the link below.

http://www.shadowstats.com/alternate_data/gross-domestic-product-charts

The economy turns slowly - I didn't expect it to be in recession already. At soonest my guess was that by this summer we'd be in recession officially, but that's just a random guess as I haven't looked at the leading indicators or any of the other data that usually helps figure that sort of thing out.

I think part of the reason is QE2, which is helping keep the dollar low and the stock market high. It also helps keep oil prices magically high. I think another part of the reason is the 2% forgiveness of Social Security payroll tax that started January 1. This was as intended as stimulus, but it really is ending up being offset to the higher oil prices. Natural gas prices are low this time around, so this may be helping a bit. And as you say, the GDP numbers are probably somewhat distorted, to make things look better.

There is also issue of things taking time. I think quite a few folks are talking about the possibility of a recession, perhaps this summer, after QE2 ends.

Yes, an oil report, any oil report is greatly appreciated.

The problem we have now is that the EIA doesn't have funding to keep up its International Energy Statistics. EIA sent out a Press Release, and Gregor MacDonald wrote a post about the problem.

I feel really sick about the situation, because that is my main source of data. IEA data is sort of available, but it is a pain to work with. Much of the data is behind an expensive pay wall. BP data is good, but it only comes out once a year.

I suppose if oil supply is a problem, the easiest way not to have to worry about it is to stop collecting data on the subject. (Kill the messenger!) I should write a post on the subject, but have been busy lately.

Well one step slightly better than fraud is to hide the facts. Not surprised at all and a very very bad sign of a major problem for oil.

Think of it. No funding for the most profitable business in the entire history of the world.

Anyone have any ideas. LOL

I noticed too that besides the data going away, the 2012 edition of Annual Energy Outlook is going away.

If it becomes too hard to say anything reasonable, just stop putting out the report!

What the EIA is doing is like turning off the fuel indicators in a plane. I put that into an image:

http://www.crudeoilpeak.com/?p=3157

I am not surprised that they eliminated funding.

I have also gone back and forth on complaining about lack of data. But after a certain amount of time, one realizes that the redundancy in the data that already exists is plenty good enough to model everything that needs interpretation. The key thing you will find is that every subset of data forms tightly interlocking elements of the overall model. Its a lot like having a compact disc that is heavily scratched up but that still plays perfectly well. The trick is the redundant data that exists in the media.

I find the news regarding the defunding of EIA incredibly troubling. I was suprised not to see this show up in the Drumbeat yesterday. Regardless of your position on energy policy, shooting in the dark is not going to be the way forward. I find it hard to believe this could be cut without some understanding of the ramifications. Is anyone aware of an opportunity or effort to repeal this defunding? Any ideas as to where pressure could be applied to bring this back? Any EIA employees that will be fired that may be willing to give us some inside information on how this came about?

In the absence of good data, decisions will be made on the basis of rumor, wishful thinking,magical thinking, innuendo, politics,conspiracy theories,denial, and hidden or not so hidden agendas. Oh, wait .....

People had some pretty good data in 2008 and now, when they show up at the pumps. And yet, there has been little meaningful change in behavior.

For all those people who bought brand, spankin' new SUVs since 2008, did they think that high gas prices would be a one time thing, never to be repeated again? Did they think the government would fix the problem? Did they think that technology or some amazing brand new discoveries would fix the problem? Maybe. Or maybe they just didn't give a damn.

I would prefer to err on the side of conservatism when it comes to future availability. But that's just me. If the whole thing implodes, I am past caring. People will change when they have no other choice.

From my work experience, most people hate data. Reality bites. Better to create your own reality. That way there is less accountability.

In sum, I can't see how the data has done much good. We are determined to be stuck on stupid.

I was at the EIA conference last week, and they said that they had added a special session after the conference was supposed to end to discuss what changes were going to be made. Unfortunately, I wasn't able to attend, because the timing conflicted with my flight.

If someone would organize a betting pool, I'm in. My bet is "oil" (as in Brent) hits 160 dollars in the first two weeks of september, and then crashes.

There's something slightly odd when reading a 'Peak Oil Update' supposedly for April when the one of the graphs used is only covering up to Oct '10(over half a year back):

http://www.theoildrum.com/files/Price%20and%20Amount%20of%20Oil%20Produc...

Besides, I'd like to maintain that it's also important to note the rate of investment into new oil wells versus the actual amount of oil gotten out, and if you look at that data, you see that we're investing more money than ever before in history, yet, we are essentially running on the same spot, only that we have to run faster and faster just to stay in the same place.

In short: an unsustainable situation.

I think it was Leanan who said in one Drumbeat back that people are pretty worthless at forecasting and I think that danger to hubris should perhaps be contemplated when you post this überdoomerish graph:

http://www.theoildrum.com/files/World%20Oil%20Production%20Incl%20Future...

Uppsala University's estimates, made by genuine experts who've looked at great detail at all the major Giant Oil Fields, said that oil production will be around 75-76 mb/d in 2030. You are at 46-47 as early as 2021.

I'm not saying I know exactly what will happen, but that's the entire point, none of us do. We should perhaps be a little more careful, then, painting extreme scenarios with such dramatic graphs.

I wouldn't be surprised at all if this post became the new 'ace 2008 post' where he basically did the same thing as you do right now, but he did it in '08. He's now widely ridiculed and discredited.

Here's ace's post from 2008, now widely off the mark(not even close).

And will this ultradoomerish scarefest be the 2011 equivalent?

http://www.theoildrum.com/node/3623

I've been struggling with that as well - that Uppsala's projections show about a 1% decline rate in all liquids production. From asking people whose opinions I value on this, I've pieced together a rough guess which I think is plausible, starting in 1-3 years: 1-2% decline in all-liquids, 2-3% decline in C+C, and 4.5-5.5% decline in available net exports of C+C.

Agreed. I remember seeing graphs with projections of Russia & KSA dropping immediately off a shelf, when in reality they have pretty consistently pumped oil. We won't know when the wheels will come off on world oil production until it occurs. And until then it would probably be more prudent to simply report information as it becomes available.

With super straws extracting its probably a case of 'full on' until the fat lady sings, and when that might be is a crap shoot. For now it's BAU at higher prices and as long as the world economy can still put the pedal to the metal it will. Just make sure not to get disenfranchised until the whole system dumps. Otherwise you'll be in a world of hurt long before everyone else and what a lonely feeling that will be. Much better to have lots of company, as misery loves company.

It's not just super straws!! In 2010 vast amounts of oil have been discovered around the world. Iraq, Brazil and West Africa will greatly increase production in coming years.

Iraq, Iran, the Caspian Basin, and Central Asia could be producing more than they are, were it not for geopolitical factors.

The data shown is the latest available, which is through January. The fact that the last tick mark is at October 2010 doesn't mean anything--the actual data goes through January.

Uppsala University may have "genuine experts", but I would characterize their forecasts as closer to an upper bound for what can happen (although a true breakthrough in extraction techniques could raise it). They have completely omitted the impact of anything like a major recession, or huge financial problems, or Middle East war, or Middle East political instability bringing down governments, or governments voluntarily cutting oil use because of CO2 problems.

As I see it, it is the above ground factors that will be the problem limiting oil supply. How does one forecast them? Just pretend they don't exist?

The forecasts in the 1972 book Limits to Growth suggested that the real model for the downslope is more like "overshoot and collapse" than the downslope implied by a Hubbert Curve. I explain this issue a bit more in this post, The Context of Hubbert's Peak in World Oil Forecast, up now on Our Finite World and the ASPO-USA Newsletter.

That "überdoomerish" graph doesn't match a 2 trillion barrel URR just looking at it. It is maybe 1.6 trillion eye-balling it. Where did that chart come from?

I spent some time looking at the Uppsala thesis when I was working on The Oil Conundrum, since it essentially tried to do a lot of what I was working on. Overall I wasn't completely impressed with it because Hook didn't do the innovative academic analysis that one hopes would come out of that kind of environment.

I think Ace made a mistake in doing that bottom-up analysis, which demonstrates that you can't project based on information that you haven't counted. I don't go that route myself.

The point is that 2 trillion URR is something like an upper bound, not the expected amount.

If we could count on a business as usual world for the down slope, without huge financial problems, everyone fighting over everything, food prices that are too high for the common people, and interference with international trade, then maybe we could count on 2 trillion URR. It seems quite likely to me that much of this oil will be left in the ground. Some may be rendered non-economic by higher taxes, but more of it will be left because of wars, and or because drilling equipment can't be repaired because of revolution or international trade problems, or because of financial problems cut of some would be producers (perhaps the US) from buying needed parts in the international market.

What is needed is more like "Limits to Growth" modeling that includes other limits besides oil. Looking at geology alone gives a misleadingly high impression, in my opinion.

As usual, you are quite right, Gail. We face financial and economic limits, political and governmental limits that are every bit as binding as geological limits. Of course, the geology is "fundamental" in the sense that the geological limits do not change, whereas financial and governmental limits do change.

In ten years I expect that the U.S. will be a command economy, much as it was in World War II. I also expect a much more rapid ramp up of Coal To Liquids than Heinberg says is possible. Our dictator (for I think democracy in the U.S. will be in name only in ten years) will struggle to maintain some form of BAU by mobilizing resources to get the last of the oil and also to make rapid transitions away from conventional oil.

Of course, I've been wrong before. But if I err, I think I'm erring on the side of optimism.

This is an issue I have been trying to get some attention for. Geological limits includes all of the physics involved. A theoretical model based on these fundamentals tells you the boundary of the dynamic. The psycho-social factors will be bounded within this limit. The theoretical model doesn't tell you what will happen within the boundary but it tells you what can't happen. For example, my theory based model tells us that the down side of depletion, assuming the maximum possible extraction rate subject to the constraints imposed by declining EROI, shows that the down rate is much greater than Hubble's curve or other math-based models show. Ergo, if correct, technically, the fall off in oil (all fossil fuels) extraction will be dramatic in the limit. Compound that with factors that Gail brings up and one moves a good deal closer to the doomer view.

George

PS. The linked page has a graphic that shows this model.

"expect a much more rapid ramp up of Coal To Liquids"

It will be interesting to watch what happens in this space

Australia is facing some large changes in its balance of trade, due to the need to import more oil as domestic supply declines ... and so we see projects such as this evolving

http://www.platts.com/RSSFeedDetailedNews/RSSFeed/ElectricPower/6041846

But I do wonder how much will end up being actually consumed in Australia (given the Chinese partners)

CTL is some of the dirtiest tech around, and a huge CO2 emission source. The CTL plants in South Africa (SASOL) pollute the air on a vast scale; the plume is clearly visible from satellites across a large portion of the subcontinent at times. Johannesburg stinks of sulphur compounds regularly from the CTL plants hundreds of km away. Sore throat, sore eyes, sick feeling.

If this is the future, we are stuffed.

It doesn't have to be quite that dirty. If hydro supplies the electric and the CO2 is piped off to pressurize an oil field it could look better than the tar sands. There is a proposal for such drifting around the Alaska. I saw a presentation on it given to the legislature about a year ago but the numbers floated were more than rough. With sustained high oil prices I'm sure the 'plan' will resurface. A couple pretty fair sized--diameter and length--pipes were in the pictures. So it may well just be someone's pipe dream.

pipes were in the pictures. So it may well just be someone's pipe dream.

Baaaaad.

Just a little?- )

remember I live in a state where the most popular bumper sticker for a long time was 'The Alaskan's Prayer'

" Oh Lord please gives us another pipeline, we promise won't piss it all away again this time!"

LOL - I've seen such sentiments expressed; but with Aberdeen as the place that won't piss it all away if they get a 2nd chance!

The graph at the top of the page is misleading. It makes it look like we have recovered the 2008 peak in CC and it is smooth sailing to greater glory from here on out.

Using the original EIA data at http://www.eia.doe.gov/ipm/supply.html (xls file 1.1d) we are less than the 2005 peak and are falling. The increase is just a recovery from the drop in production after the 2008 financial meltdown. Don't expect 75 mbd of CC in 2013.

The original EIA data was stopped months ago, this is where the latest data is.

Production is 3 million barrels per day more than 2005.

http://www.eia.gov/cfapps/ipdbproject/iedindex3.cfm?tid=50&pid=53&aid=1&...

Since propane and butane can be used as transportation fuels they should also be taken into account.

http://en.wikipedia.org/wiki/Propane

New and converted vehicles are using butane and propane.

http://www.lpg-vehicles.co.uk/

http://uk.cars.yahoo.com/car-reviews/car-and-driving/vauxhall-vectra-1.8...

The graph is plotting C&C and the comment pertains to the original EIA C&C data (through October 2010, as is graphed). Whatever plotting program was used to produce that graph is putting the October 2010 peak at 2008 levels.

October, 2010: 74.080

July, 2008: 74.686

May, 2005: 74.190

The claims being made are that C&C will be increasing or not falling for the next 20 years. Total and utter rubbish not supported by any data.

dissident

Gail has said the last data point is Jan 2011, sometimes graphing tools do not write all months which it picks up data from the data sheet.

The amounts in Figures 1 and 2 are not entirely up to date, since they are only through January 31, 2011.

EIA data is down at the moment, but I have

May 2005 74,186,176

July 2008 74,669,571

Nov 2010 74,140,356

Dec 2010 74,895,362

Jan 2011 75,828,635

This is why the graph shows 2005 and 2008 highs exceeded, because it has been.

My last post to you, I was trying to be helpful, but if you want to cross swords with me, make sure you come armed with some facts.

Where exactly can data be found on investments into new oil wells?

Prof. Aleklett's Uppsala estimate, which can be found here:

28/4/2011

IEA oil crunch warning: governments should have worked on it 10 years ago

http://www.crudeoilpeak.com/?p=3130

has curves showing the oil-geological and technologically possible maximum production. What Gail is saying is that there will be many factors, including debt, impacting on the ability of countries to buy oil at high prices. At the same time there will be recessions following oil price spikes, reducing demand.

The EIA crude oil data for 2010 do not seem to be reliable. There are big differences to IEA, OPEC and JODI data as shown here:

http://www.crudeoilpeak.com/?page_id=51

Im interested in the rate of price increase

It seems we are on the same upward slope & rate of increase as 2008, at roughly the same time of year.

I am surprised there is so little coverage of this in the MSM

Last time Brent broke before WTI, and this time Brent is leading WTI

Should we start a betting pool to wager what the price peak will be this time, and when it will hit?

Getting right back on the horse after you fall off.

Past Oildrum forecasts being wrong about the peak, going right back with a new forecast (guestimate) of sharp declines in world oil production in 2013-2015. ten million barrel per day drop over 2 years. then start losing 6 million barrels per day per day per year starting in 2017.

I forecast 0-2% annual growth per year, with an average of 1% growth past 2020.

Oil production growth mainly from Iraq, Brazil, Kazakhstan, Canada. crude, condensate, and NGL production world production of 90+ million barrels per day in 2020.

There will also be substantial growth from oil shale not just in the Bakken and north Dakota but other similar formations in the US, Canada, China, Australia and other countries.

Advanced nuclear fission (factory mass produced reactors like China's pebble bed and Russia's breeder) and forms of nuclear fusions could also have breakthroughs.

Butane and propane and ethane are worthless in terms of moving the world, since the life blood is diesel fuel. Besides including all these faux oils in the new goalpost (moving goalpost) for oil production you are making a mockery of sound science.

Tell me about crude oil. Then talk about falling off of a horse.

Thanks for playing though.

All the fuels you quote have higher energy densities per pound than diesel and are hardly "worthless" in terms of "moving the world", whatever that phrase means in reality as opposed to hyperbole. Your post is nothing but one hyperbolic, not to mention clichéd phrase after another, culminating in a phrase more apt for a Sunday game of soccer than a debate about energy.

The simple test of how worthwhile a gallon of propane is should be embedded in the price and I hardly think you believe it so worthless that you would personally supply a small fleet of 24' trucks with propane anywhere around the price of "worthless". This fleet may not move the world, but it does move a lot of furniture all over Southern California.

Just for completeness then. Please post here the actual percentage of trucks in the current world we live in that use propane relative to the ones using diesel fuel.

Thanks for the theory.

Now lets get down to the practice of dealing with REALITY for the 99.999% of things moving around the world!

Your move, mate. LOL. But the soccer thing was interesting to bring up ;-)

Did you notice that I was using the same fuels as Gail's estimate?

As for ctude. Crude had a new peak in January, 2011

Crude was at a peak in January.

Are you saying there is tons of new oil?

Or are we statistically the same as we have been for say like 6 years now. LOL

Cause I honestly do not read the tea leaves on oil. You need real growth in supply and 5-6 years of zero growth means nada to me.

Having a "new peak" doesn't fix the basic picture, that oil production is not rising fast enough to keep oil prices down and continue business as usual. If you can't see the "new peak" on my graph, perhaps it doesn't mean a whole lot.

As I see it, it is quite possible that we will add a bit more production until we hit financial problems. It is possible that we will just have another recession (with a dip in output/prices/demand), but it could be a permanent recession, at least for some countries with severe financial problems.

Who cares about peaks? The issue is production increments. Either we raise production, or we don't. If we don't, our growth based economical model will not work. End of BAU as we know it. Anyone here who belives we can grow oil production 1% per year (for example) for any period of time in the future? I know Nordic Mist is somewere in that terriotry. I am not.

Not so fast.

The fact is that some propane and butane is used for transport. butane is blended into winter grade gasoline, and is also mixed with propane to make Liquified Petroluem Gas (LPG) which is automotive propane, or "autogas"

There are actually 13 million LPG vehicles in use around the world - this is, admittedly,a drop in the bucket of world cars, but they are there, and they are using this fuel.

http://lpgaustralia.com.au/site/

What is probably appropriate is to include the amount of propane and butane that is being used for automotive use in the graph.

Propane and butane are sourced from both petroleum refining and NG processing.

Sure 13 million but how many cars and trucks are there on the planet.

I get 806 million cars and light trucks (2007).

1.6%

But of course the real stat is miles and gallons of fuel used.

How much crude is used for things for which propane, butane & ethane could substitute, like petrochemical feedstock?

BTW, when you forecast growth when do you start the linear fit from 2001 from 2004 from 2010?

Cause Gail shows it is 0.2% growth since about 2001.

Why do I need to subscribe to your forecast when reality said 0.2% the last say 10 years?

You can't just make an assertion like that without some kind of analysis math to back it up!

What does that have to do with oil?

Gail has no math to back up her guestimate of a collapse. She just has some intuition about higher decline rates. Ace and others had math analysis of charts and were completely wrong.

I think that oil shale from the Bakken and horizontal multistage drilling will add 2-3 million barrels of oil per day by 2020. 1 million from North Dakota (350,000 barrels already). This process will or is being used in Texas, Canada, Australia, China and other places.

I think that Iraq will add 4-6 million barrels of oil per day by 2020.

I think that Canada will add 2 million barrels of oil per day by 2020.

I think Brazil and Kazakhstan will add oil.

I think declines will be offset with more enhanced drilling techniques. CO2, water, natural gas injections and better imaging and computational well analysis to recover oil locked in older fields.

I think that Petrobanks THAI process will prove out by 2015 with 100,000 barrels per day and will be fairly well proven by 2012-2013. This will get them other deals to work with other operators.

I think that Libya will get back into production before 2015 (one way or another).

Your Panglossian view is lacking mention of nanoreporters.

"Excellently observed, but let us cultivate our garden."

Well, you can try my models on for size. I still assert you have no math, and it is not a valid argument to misdirect the lack on your own ability onto your opponents.

... lots of opinions, yet no math or links to a deeper analysis, unless you are trying to be sarcastic.

Question to anyone other than WHT

Has he ever produced a chart for Brazil?

Has he ever produced a chart for Nigeria?

Has he ever produced a chart for Russia?

Has he ever produced a chart for Iraq?

How accurate have they been?

I am a non-stop machine when it comes to innovative analysis, my friend. You do not realize MNFTIU.

To figure this out, all you have to do is look down-thread right about here: http://www.theoildrum.com/node/7831#comment-799587

For the rest of the evidence, check out The Oil ConunDrum

I must really get under your skin for the amount of math irritation I cause you :)

WHT

By now everyone who reads the Oil Drum has realized that you can only predict countries going into decline 10 years after the fact.

Kind've like the old joke that economists have predicted 9 of the last 5 recessions.

A weather forecaster is allowed to make multiple predictions of a forthcoming front. A lot of good that would do to fix it to one official forecast.

This is closer to weather forecasting than to economics.

Actually a few of us who really outgrew that prophecy groping quite a few years back see WHTs plots as excellent ways to organize what can otherwise be very disparate material into a manageable framework which we use to 'dead reckon' our own guesses forward. Had to use that term because it so aggravates WHT--but of course he probably has figured by now that some of use terms with a bit of poetic license now and again. In this case 'dead reckoning' would encompass most every behavior Nate tried to quantify in his post grad work and much, much more.

We always have the simplicity of the export land model, but the workings under the skin are what are really intriguing--for some of us anyway.

that of course is the gospel according to Luke ?- )

You have that right, I do have a bias against the use of heuristics. Nate claims that people have an innate feel for how things will unfold without resorting to any kind of theory. This is analogous to being able to catch a thrown ball based on subliminally adjusting for the arc.

We have plenty of room for different mental models, and room to argue as well.

If you want to put your predictions up for world oil production, I am willing to bet you and/or Gail on what world production will be in 2015, 2016, 2017, 2018, 2019 and 2020.

We can do earlier years too but there may not be much difference in the predictions and actual results and winners would be determined by things like what happens in Libya or if other geopolitics etc...

I am winning my uranium and nuclear generation bets with Michael Dittmar.

http://nextbigfuture.com/2011/05/official-confirmation-that-i-won-three....

You are over relying on math which is not actually accurate for predictions.

I am willing to up numbers and we have to specify the information reporting source that will be used to put out the official numbers. We also have to specify the type of fuels that we are predicting.

I am also willing to have money on the line for the bets.

Refer to the crackpot index: "10 points for offering prize money to anyone who proves and/or finds any flaws in your theory. "

Hmmm ... math is numbers, predictions are quantitative, quantities are expressed as numbers, therefore predictions are based on math.

"20 points for talking about how great your theory is, but never actually explaining it."

If you want to avoid the crackpot handle, I would suggest you lay the whole thing out first.

I have already said there is no theory. I have looked at the countries and projects and made a personal judgement about what I think will happen. I think my assessment is good enough to beat your models and Gails guess.

So do you believe your math and theories enough to risk a bet or not ?

There is no crackpot theory because there is no theory

I just have fairly thorough observation of all of the major countries and projects and new recovery technology.

So do you believe your own koolaid enough to put money or even a monetary bet ?

Despite the appearance of your web site, you have Luddite tendencies. I use the same math to do all sorts of innovative analysis, including characterization of PV semiconductors and of the entropy of renewable energy. It just amazes me that a would-be technologist such as yourself has so little awareness of his environment.

Sorry buddy, look for another shill, as I feel ill just looking at the huckster ads that you link to.

BTW, I don't know the difference between money and monetary bet.

So the president of the US says to WHT, we need to secure oil imports and need to know how much oil Brazil, Nigeria, Kuwait, Mexico will produce over the next ten years. Will they be able to fulfill their contractual obligations?

WHT says "My dispersive crystal ball is a bit cloudy when it comes to country specifics"

In the future it is going to be very important for an importing country to know which countries will be reliable exporters.

Since world production is made up of countries, if you cannot do production graphs of individual countries then your input is of little use.

I would like to thank you for giving me a chance to plug the best book written on oil depletion ever: The Oil ConunDrum. I have sections on depletion on individual countries or regions and also on reservoir sizes and reserve growth on regions and countries. At 750 pages, I tried to be pretty comprehensive in my arguments, but if I were to hit everything to the detail that you want me to, the book would be a lot bigger. I tend to try to explain each mathematical model that I present, but at some point you have to realize it is time to stop. The fact that I have stopped writing for the moment is probably a good impetus for you to start reading a little bit.

WHT

So you have FSU declining from now, falling by half by 2030, that is one to bet against you.

http://www.energyfiles.com/eurfsu/russia.html

Rumania peaked 30 years ago, I think most of us already knew that.

http://www.energyfiles.com/eurfsu/romania.html

No Brazil forecast, nor Sudan, Iraq, Angola, Kazakhstan, Brazil, China , India or any other country that counts.

Clearly you do not have the integrity to put your maths on the line.

Thanks for continuing to promote my rich collection of modeling approaches. If people have an interest in the techniques that I describe, it can open up a world of analysis opportunities.

And thank you for exposing links to data hustlers that have you pay through-the-nose to predictions based on who-knows what kind of heuristics and suckers bets.

I noticed that you have not mentioned anything about what I believe to be your own territory, the UK. (The only English-speakers who call it "maths" are not from the USA) Tough to be on the oil decline curve that I predicted within a gnat's eyelash.

You do not have any modeling approaches, other than for countries which have passed peak several years ago.

The UK, when did you predict that in 2005, it was already done by men far far better and honorable than you.

http://www.btinternet.com/~nlpwessex/Documents/moneyprogrammeoil.htm

Money Programme, BBC Two, 26 March 2003, 7.30pm

"Geologist Dr Colin Campbell predicted a decline in the North Sea several years ago and claims by 2015 Britain may have to import over half its oil needs."

I will go with the "suckers" who have produced pretty accurate forecasts for individual countries, which is better than the sweet fanny Adams you have done.

Scientific integrity is important in all fields, you do a great deal of damage to the task of informing people with your deliberate obfuscation.

Au contraire. It really must annoy you to no end that I have a deep knowledge of every fallacious argument used in these kinds of discussions and won't fall for any of them. My stuff stands on its own and speaks for itself.

You evidently have opened up my book otherwise you wouldn't know that I used examples of Romania and elsewhere. Yet you can't find one detail that is wrong in the mathematical modeling. Or you are afraid to bring up some weak attempt at a criticism, knowing full well that I would come back strong. Instead you keep on using the argument of continuously suggesting a burden of proof lays at my feet. I am comfortable having developed a burden of proof (covering 750 pages). I don't have to knuckle down to your fallacious arguments of trying to move the goalposts and continuously raising the bar which is essentially the path to demanding impossible perfection. I know that the moment that I respond to a request to do this or that country, you will just pick another country. Everyone knows what kind of argument that is, and it is definitely not scientific.

WHT

Real scientists such as Kjell Aklett, Colin Campbell and others had the integrity and guts to produce production graphs of countries which they believed were going to peak in the near future.

They had the courage to put their theories and calculations up for real scrutiny that is why they are known within and without this field of study.

You on the other hand will not do so and are losing credibility by the day.

Please continue any topic-related discussion without personal attacks.

Best to all,

Kate

jaz, please listen to Kate.

I am not responding to you with ad hominens as I continue to hope that some bit of valid criticism comes out of the discussion.

WHT

You have called analysis by Gail and others ridiculous and futile, so I do not need any lessons in etiquette from you.

http://www.theoildrum.com/node/7258

You ridiculed my peak oil prediction of 2012 to 2018 even though I explained, that a more accurate prediction is really impossible. Due to the wide range of uncertainties in many oil producing countries, such as the division of Sudan.

http://www.sudantribune.com/Resolve-Abyei-crisis-peacefully,38827

Political infighting In Mexico, etc, etc.

http://af.reuters.com/article/energyOilNews/idAFN3027513520101130

What do we find, you dismiss valid questions about rates of oil production in the countries which are of absolute importance to this issue.

So when you call people who understand political considerations better than you, ridiculous and futile, the gloves are off.

I will hound you for these vital country graphs until I get them, if not then I will achieve one thing and that is to make you respect other peoples knowledge and analysis.

Especially when you are obviously clueless about matters which impact oil production just as much as barrels found in the ground.

Whatever.

Whatever

Looks like teaching you manners is going to be hard work.

Look what I found.

http://mobjectivist.blogspot.com/2005/11/fsu-oil-shock-model.html

No wonder you do not want to do any more graphs if this is how badly wrong you are shown up to be when you try.

Russia should be in steep decline according to your graph.

That is based completely on discovery data input.

I meant both of you. You both have a lot to contribute, but the arguments become distracting when personal attacks dilute them.

Thanks,

Kate

he started it :-)

*Deep sigh. Walks away from playground :}*

Typo.. meant to say non-monetary bet

I think it got changed from my Android phone as I typed.

It seems that $100+ for a barrel of oil is an awfully strong incentive to keep finding ways to keep production up. Does it make sense to forecast production years into the future, without simultaneously forecasting what the macro economic conditions are?

Eg, from what I understand China is heavily subsidizing internal fuel costs. That's not that hard to do when you have a couple trillion in foreign reserves. But those reserves also won't last forever, especially at high levels of subsidization. So perhaps it's just as important to identify the slush funds of excess cash out there, and see how they relate to maintaining current consumption at current-like prices.

Just a thought...

You are 100% correct; we have to use macroeconomic forecasts to predict the demand for oil. For the supply of oil, macroeconomics makes a big difference too; especially important is the availability of financial capital to drill and develop oil. Even for exploration, macroeconomics makes a huge difference.

Having said all that, the price of oil is a microeconomic question because it refers to only one commodity, though "oil" has a lot of variations as to light vs. heavy, sour vs. low-sulfer, and location (transportation costs).

Weeping Willow

The main subsidies are in the big oil exporting countries, such as Saudi Arabia, Iran, Iraq, Russia and Venezuela. The higher oil prices the more they can afford to subsidize, Saudi Arabia earns 4 times more than it did 10 years ago.

China reduced subsidies in 2008 and total subsidy compared to GDP is very low and goes mainly to farmers and fisherman, since they feed the nation, one may argue it is a good subsidy.

http://climatecommercial.wordpress.com/2010/09/29/understanding-chinas-f...

Nonsense. The gasoline prices in Russia are at near US levels but people's wages are several times less. As soon as the government tried to cap them in the last few weeks, the refiners sent their product abroad causing major shortages. If only Russian consumers could see Saudi or Venezuelan prices, but they can dream of democracy some day.

What is Nonsense? Can you read?

Russia capped retail fuel prices in February,

If that is not a subsidy what is?

http://www.roubini.com/affiliate/google-news/6ff7ed7258d020eefb76a0acbad...

As I said, the main countries you will find subsidies is in the main exporting countries.

Subsidies to heat, electricity and gas in Russia have lead to inefficient usage but have also aided poor households by maintaining affordable energy supplies in cold regions.

The OECD analysis described in Section 3.2.1 suggests that the suppression of subsidies would lead in 2020 to extra government revenues equal to almost 6% of GDP in Russia,

http://www.iea.org/weo/docs/G20_Subsidy_Joint_Report.pdf

Do some reading will help you

You don't have to go to an oil exporting country we subsidize diesel generated electrical generation cost right here in Alaska, an oil exporting state. Village scale power generation--where bulk fuel delivery can only come by barge, which for most of rural Alaska means during the ice free season, and in many cases the extremely short season the rivers are high enough to float barges--is extremely expensive. If you don't get enough on the barge welllll

can carry

depending on the plane and configuration 2000-5000 gallons a trip--now you are talking some high priced diesel

So the state uses a bit of its oil revenue to subsidize offroad villages some

Fledgling efforts to bring more renewable energy online in rural AK are also being funded, better late than never...maybe.

No doubt that is an expensive way to get fuel!

When I was in Alaska last year I was amazed to find that that business existed, but, given that some communities are fly in only it makes sense - in a strange kind of way. When I visited the Cold Climate Housing Research Centre at Fairbanks they told me all about a housing project at Anaktuvik Pass, where everything gets flown in, of course. including fuel for atv's, and the atv 's themselves. Seemed like an ideal place for wind turbines and then battery electric atv's, but they hadn;t done that. They were looking at doing some wind turbines, and this company has done a few up there;

http://www.northernpower.com/

I think this is just the right size for town projects - small enough to easily be built and maintained, and not out of scale with the town. The big ones are just - too big - they are the modern equivalent of the baron's castle dominating the town.

No doubt Alaska is way behind the curve on wind. That is just starting to change.

Of course my wife's home town might have been a bit too far ahead of the curve. The first 100 mph blow took their brand new windmill (Danish I think) out to sea...getting close onto forty years ago now. Lucky it didn't hit the school and kill a bunch of kids--though I think it actually blew out at night. I guess the sails didn't feather and lock down like they said they would. It blows pretty good out on that long penninsula.

The whole village situation is a tough one to parse out, and I don't want start into it here. I just threw that post out there too backup Jaz point plus I thought it would be cool to post a shot of a working Curits-Wright C-46. It was quite the bonus when the three picture slide show all came along ?- )

Guantanomo is a good example: They have a single wind turbine which provides about 1/3 of their power. It saves a lot of diesel fuel and is extremely cost effective.

Another excellent analysis by Gail. Large quantities of credible data backing up entirely plausible projections and presented in a very accessible and readable format. That is a rare skill and I greatly appreciate all of Gail's tireless efforts.

How extremely sad, by contrast, that the conversations on this site seem to have been reduced to the altogether superficial and fatuous sounding proclamation that "predictions are worthless".

I think this excerpt sums it up nicely:

While I can understand the desire to avoid discussions of the fifth type, the tendency on this site to attempt stuffing ALL discussions into the first type, and then dismiss them as "worthless" if they don't meet some entirely arbitrary measure of accuracy is myopic and counterproductive.

Cheers,

Jerry

Seconded.

Gail, thanks. Valuable work.

The fundamental purpose of a model is to answer a question, presumably more readily than via empirical observation (which are often difficult for a host of obvious reasons).

Whether a model is "good enough" or a prediction holds value is a function of the question asked. All models have errors; some are useful anyway.

When dealing with oil, production estimation curves are intrinsically coupled to a price curve, in their eternal dance of supply and demand. Therefore, for any prediction of production, there must be an assumption of demand, and a matching price.

But price tolerance of demand is also a function of currency, inflation, economic outlook, and a lot of other factors. Therefore production must be as well.

Personally, I think that in an uncertain world, demanding precise predictions is foolish, demanding accurate predictions is unrealistic, and electing to remain flexible and keep personal options open seems prudent. Think in terms of probabilities instead of certainties, and available models will provide more value.

I'm puzzled why the Oil Drum which is knowledgeable about the oil industry confuses Crude and Condensate production with all liquids production. As figure 1 shows, crude and condensate production is still relatively flat with 2005. No real news here.

I think they are both pretty clear from the graph. That is why I showed both.

gthompson

If C&C have been flat since 2005 what are the 100 million extra vehicles on the roads using.

http://www.freepatentsonline.com/article/Indian-Journal-Economics-Busine...

Perhaps total liquids are not as useless as some people think.

http://cr4re.com/charts/charts.html?Retail#category=Retail&chart=MilesDr...

Miles driven in the US have not declined that much.

I don't know. You tell me.

Well I am sure that higher mpg vehicles are part of the answer.

Also the increased use of bio diesel and bio ethanol is part of the answer.

The main answer has to be that total liquids is about 3 million barrels per day more than 2005.

http://www.eia.gov/cfapps/ipdbproject/iedindex3.cfm?tid=50&pid=53&aid=1&...

All over the world people are converting petrol cars to LPG and butane powered cars. One can imagine many conversions in developing countries are not registered so I would guess many more than these figures suggest.

http://belize1.com/BzLibrary/trust13.html

http://www.afdc.energy.gov/afdc/vehicles/propane.html

So total liquids is important and is being used by millions for transportation.

More prius, less SUVs?

"If C&C have been flat since 2005 what are the 100 million extra vehicles on the roads using. "

perhaps in poor countries people can't afford oil anymore. perhaps they are consuming less so we can drive more.

jukka

That is the case for a few poor countries but the main countries that have reduced oil consumption since 2005 are United States, Japan, Italy, Germany United Kingdom, France, Indonesia, Spain, Russia.

Many of the poorest countries have increased consumption, if only by a little. Such as Ethiopia, Ghana, Bangladesh, Ethiopia, Mozambique, Namibia.

http://www.eia.gov/cfapps/ipdbproject/IEDIndex3.cfm?tid=5&pid=5&aid=2

They will be sending aid to us soon. :-)

Oil use goes where the jobs go for two reasons:

1. Jobs use oil, directly and indirectly.

2. People without jobs can't afford products made with oil. (or if they are on unemployment insurance, they can afford only less oil.

As our jobs go to lower cost areas (meaning less oil-use areas, and perhaps more coal use), oil consumption goes along.

Yes and many of those poorer countries are rich in natural resources and due to China they will get high prices for these materials.

http://allafrica.com/stories/201010041203.html

In turn they can buy Chinese finished products and at $8,640 for a new car will use even more oil over the coming years.

http://www.reuters.com/article/2011/03/01/us-autoexports-china-idUSTRE72...

Nah. They will pretend to send us aid as a cover for sucking up our resources. A little trick they picked up from us...

Global oil production is one thing, but is really not the factor that is most relevant.

Oil Available for Export (OAE) is really what matters when it comes to pricing and meeting demand.

It matters not how much Saudi produces, but how much they have left for export after they supply domestic demand, for example.

It would be of great interest to see data on global OAE. I expect we may be beyond peak with that, but the data would be revealing.

Following are what we show for global net oil exports for 2002 to 2009 (oil exporters with net oil exports of 100,000 bpd or more in 2005, which account for 99% plus of global net oil exports).

Note that global net oil exports increased at about 5%/year from 2002 to 2005, and then we had flat to declining global net oil exports. I suspect that this inflection point was quite a shock to oil importing countries, especially developed oil importing countries. At a 5%/year rate of increase in global net exports, we would have had about 53 mbpd in net exports in 2008, versus the actual number of 45 mbpd.

Also shown are Chindia's combined net oil imports. The difference between the two is what I define as Available Net Oil Exports (ANE), i.e., global net oil exports not consumed by Chindia.

As you can see, ANE fell from 40.8 mbpd in 2005 to 35.7 mbpd in 2009. A plausible estimate is that ANE could be down to about 27 - 30 mbpd by 2015.

Global Net Oil Exports Less Chindia’s Combined Net Oil Imports = ANE (BP + Minor EIA data, mbpd, Total Petroleum Liquids):

2002: 39 - 3.5* = 35.5 (36)

2003: 42 - 4.0 = 38.0 (38)

2004: 45 - 5.1 = 39.9 (40)

2005: 46 - 5.2 = 40.8 (41)

2006: 46 - 5.5 = 40.5 (41)

2007: 45 - 6.1 = 38.9 (39)

2008: 45 - 6.6 = 38.4 (38)

2009: 43 - 7.3 = 35.7 (36)

*Chindia's combined net oil imports

This table shows the detailed data for 2005 to 2009:

http://i1095.photobucket.com/albums/i475/westexas/Slide3-1.jpg

Two articles:

Peak oil versus peak exports:

http://www.energybulletin.net/stories/2010-10-18/peak-oil-versus-peak-ex...

Egypt, a classic case of rapid net-export decline and a look at global net exports:

http://www.energybulletin.net/stories/2011-02-21/egypt-classic-case-rapi...

Gail,

I was enjoying reading your post and was delighted with your good overview until.... Until... I couldn't believe it!!! Not from you! You have a track record of good posts and then you put in a totally, insanely, ridiculous "Guestimate" for future oil production. Why? 2 years from now you will be looking as silly as ACE and have to stop posting on this site!

Producing enough oil for the needs of a growing population in the world is getting harder. But the reserves discovered in 2010 were at record levels! Exploration is ongoing at record place. Your crazy collapse is just not going to happen!!!

That isn't to say that oil prices won't stay high and there won't be great competition for supplies.

Oil production is far, far, far more likely to keep bobbling along upwards for the coming years rather than collapsing. Your guestimate is just so helpless.....

The point is that we can't expect a Hubbert Curve for the downslope. I purposely didn't give a very closeup of the numbers in the graph, because I am not forecasting any particular set of numbers--just that it is likely to be steeper than a Hubbert Curve. What we are actually likely to see is "above ground" factors, like financial problems and wars making a big difference. Also, some countries may do much better than others, (perhaps those with severe financial problems doing worst), so it is not clear that world oil supply tells us much about the situation in any particular country. For example, China may continue to do well for a while, while some of the debtor nations do badly.

So I don't think my forecast is at all the same as Ace's. In some ways, I think we will go as fast as we can, as long as we can, and then things will tend to fall apart all at once (although this will still not be straight down, because of the inertia in the system). I am not giving an exact date for the change, but it could start as soon as this summer, if financial systems start having major problems.

A related and quite important question Gail - when do you expect the global financial system to break apart?

See, I think that will happen before we are very far into the downslope. Past that point the above ground factors start to look very different. It's no longer can companies afford to invest, its centralised allocation of resources at the end of a gun barrel. It's nation to nation barter.

The game isn't the same post-peak.

In net terms I think its a positive for sustained production.

I don't really have the answer. It seems like some countries may default on their loans and find themselves less welcome in the international trade arena--perhaps being required to ship actual goods in return for purchases. I can see political uprisings that cause countries to break apart, similar to the changes in the USSR. The smaller parts now constituting the whole may find it harder to trade in the world markets, each with their own currencies. It is possible that both the Euro and Dollar will disappear as traded currencies.

LPG could help more than some people think, people are already converting old cars to butane and propane and cars like this new volvo will help.

http://www.volvoclub.org.uk/roadtests/bifuel_01on_roadtest.shtml

http://www.afdc.energy.gov/afdc/vehicles/propane_what_is.html

LPG prices are far below petrol.

http://www.whatprice.co.uk/petrol-prices/recent-lpg-prices.html

Here's ace's oil price prediction from 2009. Maybe you'd like to rephrase?

Well, I don't know. it seems to me the that the world is becoming much less linear with the end of cheap oil. We are close to peak - or in the peak, or however you want to call it.

Assessing the question of the decline rate in the next 20 years(or even 10) is almost impossible to me, all you can do is try to fit a bell curve with an ultimate reserve estimate assuming no above the ground constraints. That is not a forecast, that is a purely theoretical case.

Gail assumed that oil will decline faster than what a hubbert curve would predict. You can also say that the above the ground constraints will make the plateau real and therefore will enable having a stable production until 2020. You can also say that because we are all so addicted to oil prodction growth, a world war will start in 2015. All this makes sense to me.

Beyond plateau or peak there is nothing we can say. We criticize BAU forecasts, but we do the same for post peak prodcution, by forecating a production curve wich is much too regular to be real.

Moreover, we all know there is big uncertainties on the reserves. This may require a statistical analysis, but I have the feeling that TOD article conclusions are always "hard decline rate witin 3 years".

I predict this "guesstimate" will meet the same fate as ace's infamous "guesstimates" from 2-4 years ago.

One would think that with so many . . . embarrassing . . . calls on future oil production in the past, article writers at TOD would have learned by now to be a bit more cautious in making their projections. But it seems not, it appears to be fashionable here to show that we're just about to fall off a cliff. And when we don't fall off the cliff - no problem! Try again next year! And the year after that. And the year after that. And the ...

What's really sad is that many, many people around the world visit TOD regularly, regard this place as an authoritative source, and actually take these projections seriously!

Post your reality here. As far as I can tell oil production is a flat line for the last 10 years plus or minus noise, even though the price of oil went up as much as 4-5 to fold.

Either you get that or you don't.

But Academic complaints and whining about predictions of the exact beginning of crude oil decline is sort of not the big deal.

The big deal is "WHERE IS ALL THE NEW OIL"?

I have not seen anything earth shattering in the last 10 years. Post the reality that I was missing the last decade and I will follow you then.

If I posted where I thought all the new oil was going to come from in the next 10 years or so, nobody here would believe me. Whenever someone posts stuff about massive increases in production from Iraq, it gets scoffed at by most people here. I could show you projections showing at least 700K bpd from North Dakota within 5-10 years, maybe as much as a million bpd, and that too would get scoffed at. Remember when the USGS came out with its Bakken estimate in 2008 and someone here said it might be lucky to churn out 100-150K bpd, or thereabouts? That's what gets believed around here. When production from there turns out to be double that amount 3 years hence, and is still rising rapidly, it gets conveniently forgotten and/or the bar is raised and this time claims of 700K-1 million bpd get disbelieved. But lest we quibble over production estimates of a single oil play, I could tell you, and give you evidence, of dozens, maybe eventually more than a hundred, of similar plays all around the world, each of which will churn out anywhere from maybe 50K to as much as 2 million bpd, and that these will gradually be developed over the next 50-100 years. But if I tried that, I would really be scoffed at. I could then continue on and show you the 50 billion or so barrels of oil that have been discovered off the coast of Brazil, and that most of the coast of Brazil still has not been explored, and that this is good for another hundred or so years of oil with at least 4-5 million bpd, and maybe more, but that too, would get ridiculed. And so on, and so forth.

The reality here is, whenever someone gives evidence of large quantities of oil somewhere, and gives further evidence that it can be produced in large quantities at high rates, it gets shot down on this forum, for the simple reason that most people here don't want to believe it's possible. Few people here are "concerned" about peak oil, they're mostly concerned that we won't get peak oil any time soon.

absolutely right. Doomer opinions are a dime a dozen. What really matters is what the people with money value all that oil at. This is why oil has fallen from $70 to 110 per barrel over the last 12 months. Producers clearly sense the impending glut and are pumping as fast as they can to maximize the cash flow. KSA should sell all their oil now, then buy back the cheap Brazilian stuff that will sell for $35/bbl for the next 100 years!

Seriously...plenty of picky metrics to argue about...but what fraction of our GDP will go to pay or our addiction? If more oil is being produced, great...a few people get wealthy. But the real story is the accessibilty of that oil based on my paycheck.

Abundance.Concept has a point about that chart. I usually battle hard with him, but in this case I have to agree that the profile is really suspect. It looks like it has a URR of like 1.6 to maybe 1.7 trillion barrels. And that is all liquids too! Unless that drop-off is due to some kind of demand destruction, I think it needs a re-evaluation, to put it mildly.

Yes, what I am talking about very much does involve demand destruction--people who cannot afford to pay for oil, or who live in areas whose financial systems are not in good enough condition to allow them to buy oil. It is not demand destruction from new electric cars.

Pretty please, with sugar on top, do not use the term "demand destruction" which was (I think) coined by Matt Simmmons. The term is hopelessly ambiguous, because it conflates two entirely different concepts:

1. The idea that quantity demanded will decrease as price increases, other things staying the same and

2. The idea that higher oil prices will tend to induce recession and hence lower total spending--a macroeconomic idea quite different from #1.

To the best of my knowledge, no economist uses the term "demand destruction."

It also hopelessly confuses the dynamics of the supply/demand curve: conservation versus efficiency and substitution.

There is a common assumption on TOD that increasing oil consumption is good, and that declining oil consumption is bad: I'd argue that the US's financial position has been substantially improved by it's 25% reduction in oil imports over the last 3 years.

that ambiguity is the whole point of using the term ?- )

Don,

Welcome back to TOD, the web site that serves as the official hot water springs for economists and frogs ;-)

I'm sure my fellow Brazilians, especially my friends at Petrobras, will be immensely pleased to hear that.

However perhaps we should revisit Dr. Albert Bartlett's lecture: Arithmetic, Population and Energy

Here he is talking about the vast reserves of coal in the US but we can apply the precautionary principle and draw parallels to oil recovery and production in those supposedly vast as yet to be discovered oil fields off the unexplored coast of Brazil.

abundance.concept,

I would be very interested in hearing more details on any facts/estimate that goes to the contrary on what is generally beleived here - that is a more or less imminent downslope in production/extraction rate of oil.

Well, maybe my intested it is more or less limited to "estimates" concerning next years (five or so). Beyond that, and maybe even before, anything could happen.

It's always nice to have visitors from Fantasy Island, where oil fields don't deplete.

Gail's guesstimate doesn't even posit a reason or scenario indicating why oil production would crash by 2021.