Global World Product Will Not Grow at 4%+ for Five Years

Posted by Stuart Staniford on April 27, 2011 - 10:03am

This post is a lightly edited crosspost from Early Warning looking at the implications of some estimates in the International Monetary Fund's World Economic Outlook for oil elasticities, as well as the IMF's projections for economic growth.

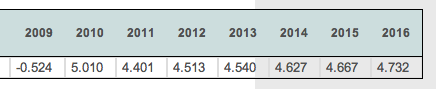

First, from the detailed statistics in the WEO database, here are the IMF's projections for world growth over the next five years:

This is annual percentage growth in total global world product, corrected for inflation, and expressed at Purchasing Power Parity (PPP: i.e., in which goods and services from non US countries are corrected to US prices assuming equivalent goods and services should be priced the same, rather than using market exchange rates).

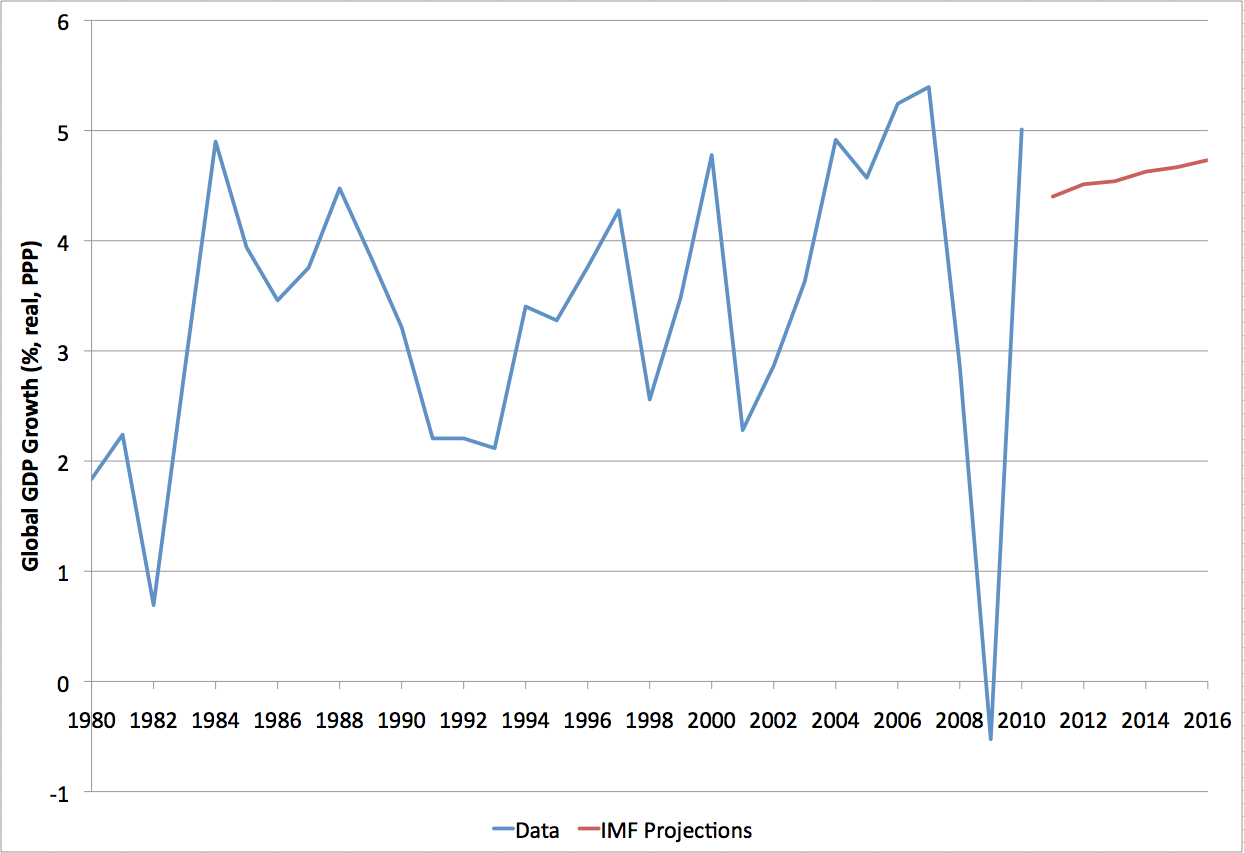

To give some idea of the context, here is the history of world growth since 1980, together with the growth projections:

You can see that the IMF is basically forecasting five years of pretty good growth - near the top of the historical range, but certainly not above it. They are not projecting any serious global slowdowns, still less an outright global recession (those are rare - 2009 was the only case in the last thirty years).

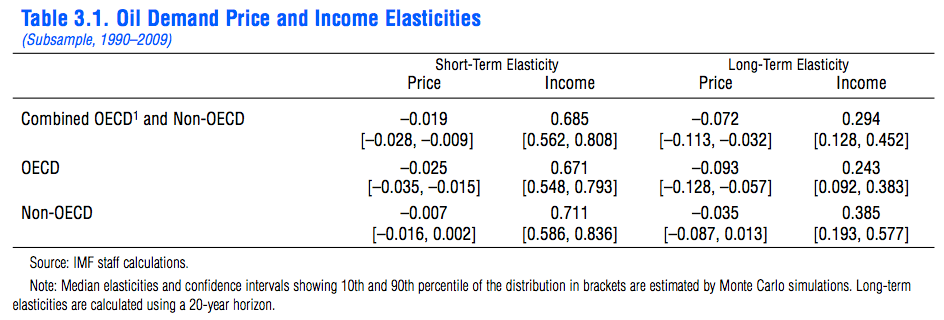

To turn this into a forecast for global oil supply, we can use the elasticities from their table 3.1:

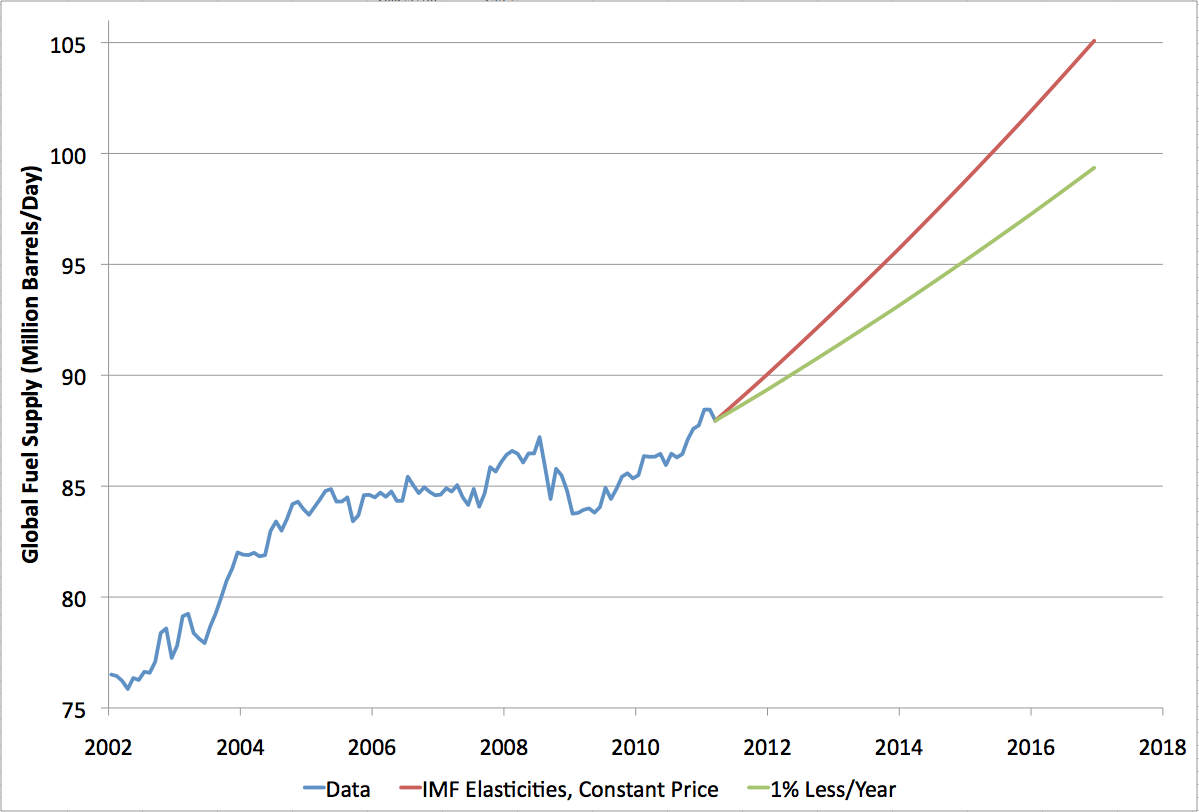

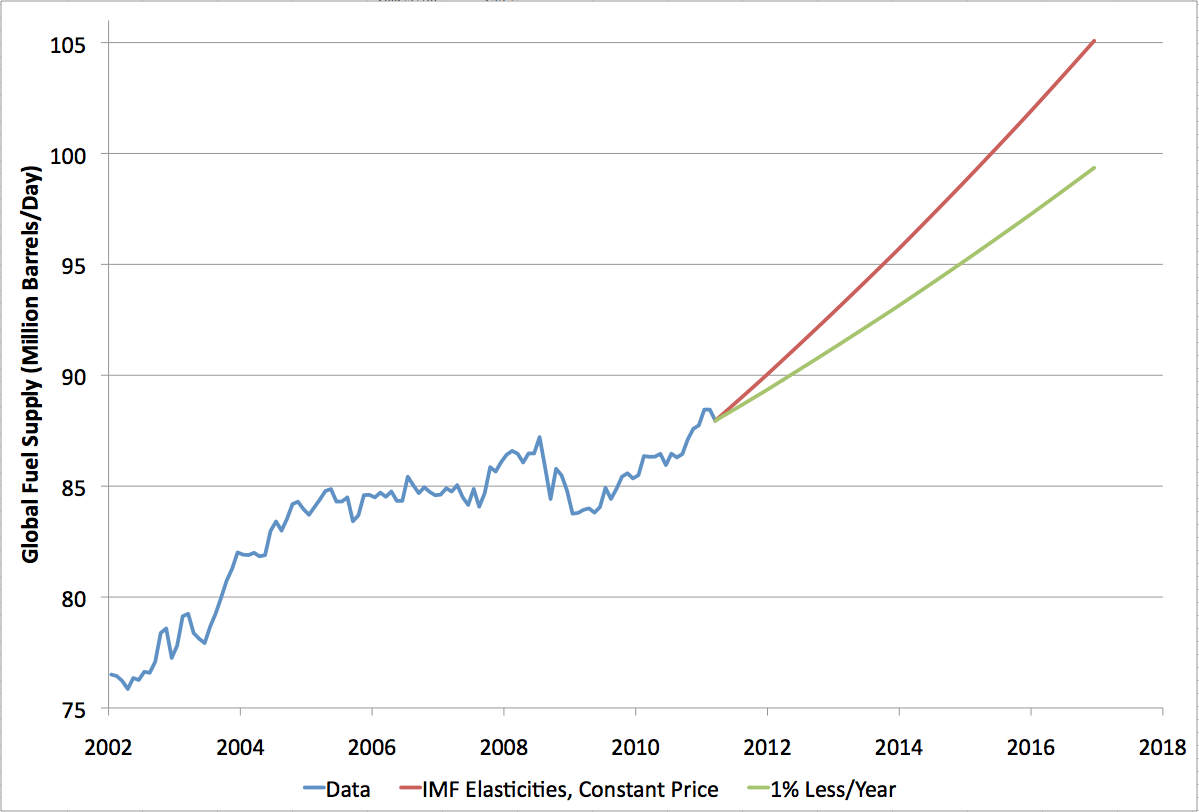

Here, the income elasticity for the whole world is 0.685. What that means, is that when global income increases by X%, other things being equal, we expect global oil supply to increase by 0.685X%. When we say "other things being equal", we particularly mean oil prices being equal. Since they have global economic growth at about 4 1/2%, an income elasticity of 0.685 implies a growth in oil supply of about 3% annually. In a spreadsheet, we can compute with their exact growth projections, and this results in the red curve here:

The blue curve there is actual data for global liquid fuel supply (the average from this post). Note that the graph is not zero-scaled to better show the changes. You can see that the red curve involves oil supply continuing to grow at a rate pretty similar to the rate since the depths of the recession, and much faster than the overall rate of the last six years (the "bumpy plateau").

This requires the world come up with another 17mbd of supply in the next five years, though it only managed to come up with about 3-4mbd over the last five years, and that took a quadrupling of prices to achieve. I don't see where this much oil can possibly come from. Saudi Arabia is saying they aren't going to increase production much if at all in the next five years. Russia is pretty much plateaued. The US is long past peak, and will be lucky to avoid further declines. Iraq is the one hope for truly large increases in oil supply, but that increase has just barely started, and is not going to amount to more than a few mbd over the next five years.

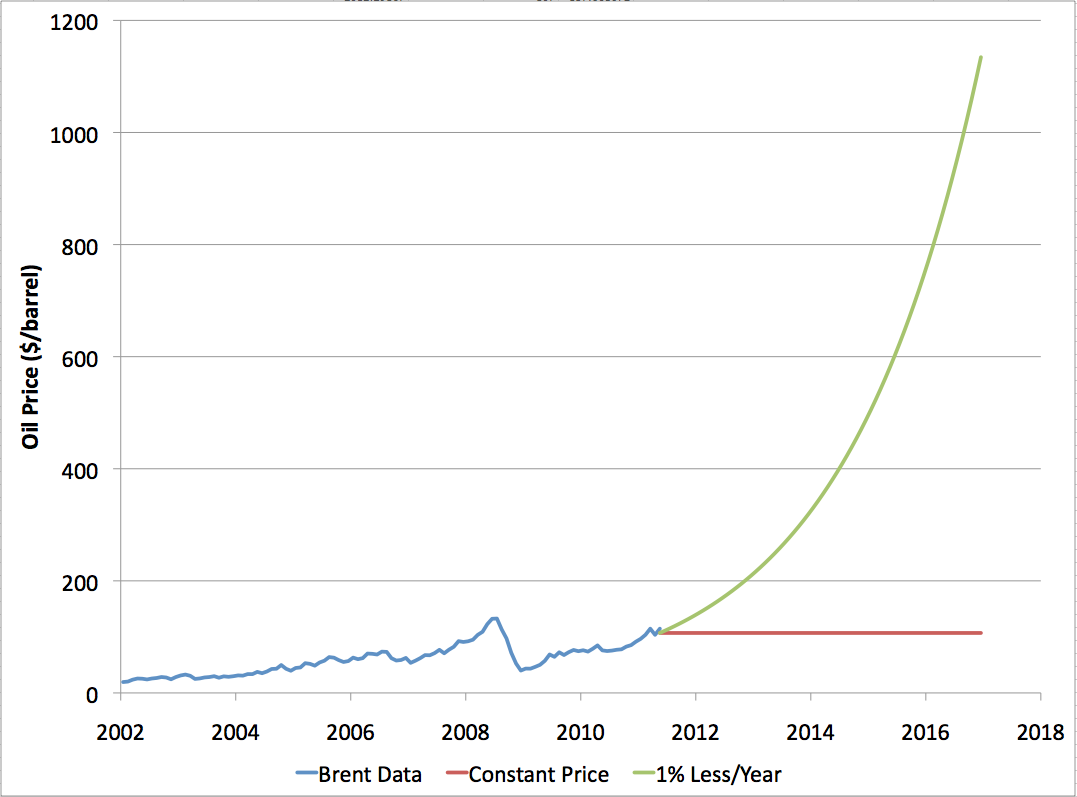

The green curve looks at what happens if you say that oil prices will not be constant, but instead will increase by enough to make supply grow at 1% less per year than the red curve. That way we only need another 11mbd, instead of 17mbd. That's still an implausibly large amount of oil. But even that causes huge problems if we take seriously the short term price elasticity of -0.019 in the IMF's table 3.1 above. That means that to reduce supply by 1%, we need to increase price by 1/0.019 = 53%. Each year. As you might imagine, prices rise to ludicrous heights in no time:

And that's just to hold global oil demand to only increase by 11mbd.

Clearly, nothing like these projections is going to happen. Instead,global oil demand is going to have to get a lot more elastic. To reconcile stagnant production with global demand, the world's people are going to have to undergo a paradigm shift similar to that of the 1980s, in which the world makes major efforts to use oil much more efficiently. Because people have experienced a complete attitude shift, they will become much more responsive to moderate price shifts than they have been in the last twenty years.

The next question is whether this kind of global attitude shift could happen smoothly, without major disruption to global economic growth. I think that's extremely implausible. Certainly, it didn't in the 1970s when the big increases in efficiency were presaged by two major oil price shocks with ensuing recessions. And in general, my mental model is that people are creatures of habit who only change their way of thinking and operating when their existing approach starts to cause them serious pain.

So I think the IMF's growth projections are seriously improbable. What is going to happen instead is that people will keep trying to grow without getting much more oil efficient, that won't work, oil prices will go through the roof, another global recession, or at least a major slowdown, will ensue, and then people will begin in earnest the work of starting to transition away from oil dependence.

I can't tell you the timing precisely. It could easily be this year, it could be next. It's even possible that some other global crisis will intervene first (like the credit crash of 2008 did). But I will say categorically that there's no way we are going to get through 2016, as the IMF projects, with business-as-usual economic growth.

If my fellow Aussie Joe/Janes by chance perused the historical graph of our national index http://au.finance.yahoo.com/echarts?s=^AORD#symbol=%5Eaord;range=5y;compare=;indicator=volume;charttype=area;crosshair=on;ohlcvalues=0;logscale=off;source=;, they might conclude levels are pretty much where they should be.

Indeed, that "steady" growth for the years ahead is still quite achievable, even if slow and declining. Some people are winners, some are losers... Does a gambler worry about lucking out? Any up-tick gives hope (it's human nature).

After visiting here for three and a half years now, I'm saddened that TPTB (and their supporters) still keep reality from my fellow people-in-the-street.

Cheers, Matt B

Stuart: Regarding the title of your article, don't you mean "Gross World Product"?

http://www.economywatch.com/world_economy/world-economic-indicators/worl...

"Global World" does not sound right...

We are the Police Cops!

Is that from Simpsons, or Family Guy? Anyway I just love it.

Bang on. Like the Tunisian vegetable seller.....there will be something. It could be a long hot summer and just the other day my neighbour recalled the speed of the Rodney King incident. Oh hell, maybe a big bunch of tornadoes will just take out Cushing.

TAE is still focused on Greek debt....

It won't be 4% growth making all the worries go away.

"I expect this old river will just up and take us all away one day".....lee remick in Sometimes a Great Notion (movie)

Our question in our neighbourhood is what happend to all the Obama promise? Not promises...but promise! He sure let a lot of 20 dollar supporters down. Did he start to enjoy the perks and attentions of the big boys? Did he get a visit from someone who told him how the world runs? If he said..."look folks, it is time to help our country...Michelle and i will give up 1/2 our assets and apply it to the national debt and challenge all politicos to do the same. And after that we are going to tax the rich...like it or not.

Paul

Think about it this way. Most people understand: if my actions cause a gangster to lose a million, I am killed. Most don't understand that the same logic applies to corporations when billions or trillions are at stake. And there are many ways to dispose of public figures without bodily harm, such as in manufactured scandals.

Obama would never, could never do anything to upset large flows of money. It's not a personal failing of his; nobody else can, either.

A while back Nicholas Cage did this movie where there was a Presidential Book of Secrets. Ever notice how fast Presidents age once they are in office? I think that many men who have wanted to be President had a genuine desire, and a genuine belief, that they could do things better, fix things, make it right.

Then they get into office and Reality walks in and gives them a great big slap up aside the head.

Following are what we show for global net oil exports for 2002 to 2009 (oil exporters with net oil exports of 100,000 bpd or more in 2005, which account for 99% plus of global net oil exports).

Note that global net oil exports increased at about 5%/year from 2002 to 2005, and then we had flat to declining global net oil exports. I suspect that this inflection point was quite a shock to oil importing countries, especially developed oil importing countries.

From 2005 to 2009, I have added Chinidia's combined net oil imports. The difference between the two is what I define as Available Net Oil Exports (ANE), i.e., global net oil exports not consumed by Chindia.

As you can see, ANE fell from 40.8 mbpd in 2005 to 35.7 mbpd in 2009. A plausible estimate is that ANE could be down to about 27 - 30 mbpd by 2015.

Global Net Oil Exports (BP + Minor EIA data):

2002: 39 mbpd

2003: 42

2004: 45

2005: 46 - 5.2* = 40.8 (ANE)

2006: 46 - 5.5 = 40.5

2007: 45 - 6.1 = 38.9

2008: 45 - 6.6 = 38.4

2009: 43 - 7.3 = 35.7

*Chindia's combined net oil imports

This table shows the detailed data for 2005 to 2009:

http://i1095.photobucket.com/albums/i475/westexas/Slide3-1.jpg

Peak Oil Versus Peak Exports:

http://www.energybulletin.net/stories/2010-10-18/peak-oil-versus-peak-ex...

That's what is happening in response to these statistics:

The African 'Star Wars'

http://english.aljazeera.net/indepth/opinion/2011/04/2011422131911465794...

This Aljazeera is interesting but is paints the picture that America made Q bomb his own people so that we could Tomahawk Libya. OK. That is a perspective. On one hand I get the idea that the Rest of the World (non European world) is hoping China becomes the dominant power, but in reality, the Rest of the World will either have an American/Western Europe master or a Chinese Master.

Pick your poison. LOL. Like one of these is a perfect happy place.

If you change "made Q bomb his own people" to "encouraged and aided a rebellion believed likely to result in a regime more to our liking," the evidence is mounting that the US did/is doing exactly that.

The rebel military commander who was sent back from comfy exile in Virginia (easy to stay in touch with Langley) is a case in point.

Sure a conspiracy theory is always there. But China is doing similar manipulations all over the continent as well. If you are not playing the little countries for their resources then you are not a superpower.

So which way is right? Which master is the "good" master?

Both powers are in Africa for the purpose of extracting resources. China is far less sophisticated at using violence to get what it wants, but most expect this to change over time. Alleged morality is just a propaganda tool, used by both sides to squelch rational discussion.

Neither, of course. Nation-states of such size must inevitably seek empire and, also inevitably, exceed their resource bases and abilities to manage their own complexity.

Both should be broken up (and likely will, one way or another). Bio-regional entities and city-states are both better ideas.

BTW

Gaddafi was tolerated - he sold his oil and people made money, but what to do now? Escobar talks about "[Gaddafi] easy to demonize", which does put a slant on events, but is short of claiming the US "made him bomb his own people". This is MENA; the Arab upheavals might not work in the interest of USA; who knows just now?

I found Escobar's description of US military African Com. interesting, though I could have done with some numbers. Can the USA afford it all? Can USA not afford it? I am not sure what Africa can afford.

PS. I noted Escobar's point that China quietly, and smoothly, pulled its 35,000 workers out of Libya recently.

I have summed up the recent IMF WEO report here, where they calculated GDP depending on various assumptions of oil supplies and other parameters:

20/4/2011

IMF warns of oil scarcity and a 60% oil price increase within a year

http://www.crudeoilpeak.com/?p=3054

It would be interesting to calculate by how much oil prices would have to go up in Australia to bring still growing imports down to declining exports of countries which actually supply that oil to Australia. There is a graph here showing the situation:

25/4/2011

Australia's crude oil imports on record high

http://www.crudeoilpeak.com/?p=3089

Stuart, I took your article on Saudi Arabia as a basis for some other calcs. I superimposed Moneef's projections and Sadad-al-Husseini projections on the CERA week Saleri graph with his maximum sustainable capacity:

27/4/2011

OPEC report: Saudi oil exports to decline

http://www.crudeoilpeak.com/?p=3102

The reality is at the bottom of the window.

Australia especially, but other countries too have been shielded from the oil price by the decline of the USD. For Australia, a major coal (energy) exporter that may continue to be the case because the price of coal has been increasing quite sharply too.

The rise in coal only really shields those who are in, or service providers to, the coal industry.

For someone in Australia who is a coal fired- electricity and oil consumer - pretty much everyone, and especially farmers, seeing the coal companies and govt making a killing is small comfort.

Here in Canada, the Cdn dollar has risen against the US at about the same rate as the Aussie dollar, but domestic fuel prices have risen faster. Canada is a major oil exporter, of course, but again, if you aren't in or servicing the industry, you don;t get much benefit. And if you are in a business that is competing for the same services then you are paying oilfield influenced prices, in which case you are going backwards.

Aggregates and averages alone do not tell the whole story

Agreed. Prices have risen some of the way, but it would be far worse without the forex gain...

As a resident in Oz I see the rise in coal (and other minerals)as protecting us somewhat from the USD rise in oil. Strong coal exports have helped the AUD to strengthen against most currencies and especially the sick USD, so a doubling in the USD oil price in the past 2 years has been only a 50% or so increase in AUD. Presumably that 50% represents the true rising value of oil and the next 50% (in USD) represents the fall of the USD.

If the AUD in the next few months became 2 USD (due to a weakening USD more than anything) then oil could be over $200 USD in that same period.

Of course a strong AUD is not good for local industry in competing against imports so the shield of coal is a 2 edged sword.

Using the price elasticity of demand of oil(assuming you believe the free market is driving oil prices) over the last decade you might be able to project the effect of demand on production but 3% increase in oil demand is unrealistic.

Of course, lot of GDP growth seems to be illusory--zero growth in the OECD with speculators jacking up commodities and bogus growth in Chindia(empty 'model cities').

In the last decade oil prices went from ~$40 to ~$100 per barrel, a 150% change in price while production went from 72 mbpd tp 86 mbpd a 20% change in quantity, so the price elasticity of demand is 7.5; ((100-40)/40)/((86-72)/72)=7.5

In 2000 the world GDP-PPP was $42 trillion USD and in 2010 it was $74 trillion

USD so on average that's a 76% change in GDP, so the GDP elasticity of demand

vs oil production is 3.8; ((74-42)/42)/( (86-72)/72)=3.9

Clearly oil price is contribution to twice the GDP elasticity.

So if the IMF says that GDP will grow at 4.5% per year over 7 years that means

the world GDP in 2018 will go from $74 T to $96 T(31.5% rise).

Applying the GDP/oil elasticity of 3.9 we get oil production rising from 86 mbpd to 93 mbpd; .315/3.9=(93-86)/86

In terms of gas price it would mean that if liquids production rises from 86 to 93 mbpd, 7% then prices would rise from $100 per bbl(speculation excluded) in 2011 to $152.5 per bbl in 2018; .07 x 7.5 = (152.5-100)/100

By this measure the world can continue to grow but the key to BAU growth

is to shift away from oil as was started in the last decade.

I'm not understanding something here -you rfigures seem to indicate a rise in only 6 mbpd is required for BAU growth whereas Stuarts figures seemed to suggest it was more like 17mbpd...

Why the discrepency? 6mbpd seems a lot more do-able and avoids near term explosive increases...

Nick.

As long as any 'rise' is comprised of ethanol & NGL's, which have only ~2/3rds the energy/volume of crude, then you have to add half to any 'rise' to get the same useful energy. So if BAU requires 6mbd, then it really requires 9mbd of these crude substitutes. Not gonna happen. I'll believe that even 6mbd can happen when I see it. Any increase from here is unlikely to be more than noise. And in any case, we are already past peak NET liquids, because of the reality noted above, and the declining EROEI of crude itself, as we move further off-shore, deeper everywhere, and into more marginal fields in every way. And well past peak net per capita, which was ~25 years ago.

If you assume that 3% out 4.5% of GDP growth is due to oil production then you must increase liquid fuels production by 21% from 86 mbpd to 104 mbpd per 31.5% x 3/4.5 = 21%

In the last decade GDP increased by 76% but liquid fuels production only went up by 20%. It appears that liquid fuels only accounts for 1/4 of the GDP growth. Projecting forward 4.5%/4 x 7 =8% x 86 = 6.88+86 = 92.88 mbpd.

Much of the world GDP growth was in non-OECD countries which use little oil

per capita and Chindia uses coal for energy.

My comment from the original post at Early Warning:

BP data shows that only in the 60s/early 70s did 5 year blocks of YOY supply growth exceed 10 mb/d, peaking at 18 mb/d 1969-1974. You know, back when geologists would throw rocks and discover onshore giant fields in the process, and crude had hovered at $2/bbl for over 20 years.

2003-2008 brought on 7012 kb/d, at the cost of erosion of spare capacity. Numbers fluctuating from 2-7 mb/d seem typical of the set; indeed 1986-1991 showed 7987 kb/d, the record post-1973. This suggests fundamental limits on what the industry can manage, irrespective of what resources are on hand.

Stuart, wouldn't you need to use the long-term price elasticity (e.g. 0.08) for later years? This would result in only 1/4 the increase in prices as shown on your curve.

Indeed, if the price rises to 'ludicrous' heights, it's probably because a ludicrously low estimate of the elasticity. Besides the long-term versus short-term issue, price elasticity is a concept that makes sense in a linear approximation. As the price begins to reach 'ludicrous' heights, this linear approximation may break down.

Indeed, if the price rises to 'ludicrous' heights in this calculation, it could be because of a ludicrous underestimate of how much demand drops with increasing price. Besides the long-term versus short-term issue, price elasticity is a concept that makes sense in a linear approximation. As the price begins to reach 'ludicrous' heights, this linear approximation may break down.

The proximal problem I see as we ride along the bumpy plateau is what happens to the world's, already fragile, debt/revenue picture if we don't hit those GPD projections. That seems the weak link to me. Anyone's pension NOT assuming 8% growth and yet still undercapitalized? I can't help but cynically imagine them settling on the lowest GDP projections that MUST come true because lower numbers would mean financial collapse--then setting all the other assumptions to fit.

I am 48. living in the UK. Already my state pension retirement age has risen from 65 to 68 in the last few years. I am paying 5% and my employer is donating 10% of my salary into a money purchase (stock market based) pension. I do not expect to ever see any return on any pension. Not a cent. My pension is my wife's property and my adopted children.

In Sweden too we are forced to invest about 1/3 of our pension money at the stock market casino. The politicians who designed the system was asuming everlasting financial growth. I have already gone through the mental process of "letting go" of that money. Like you I don't expect to ever see that money again. Also, I am just 33. If it was up to me I would have prefered they just gave my pension money away to the Salvation Army. They help homeless people.

Let me start by saying I am no pension expert but would possible solution might be to take charge of your pension in a SIPP and look to take the money out well b4 65/68. You may be able to 'get at it' by 55 -which is just 7 years away in your case. If you think the stock market hasn't even got 7 years left then its a lost cause anyway...

Nick.

Ralph,

Consider the increase from 65 to 68 to be well overdue. When state pensions were first introduced in the UK the life expectancy was only a couple of years after retiring, this week we hear that one quarter of newborns are expected to reach 100 years so something obviously has to change.

At least you are fortunate that your employer is able to contribute 10% of your salary to another pension and you will not only be relying on the state pension.

Let's make some broad assumptions and see where they go, say you work for 40 years and have a total pot of 40 x 15% = six x annual salary (assuming no inflation and ignoring the ridiculous growth of 8% often shown in pension literature. Now if you are going to live for 18 years in retirement then you can expect a pension of 6/18 = one third of your salary. It doesn't sound totally unreasonable to me but then again i have no employer contribution. What, you mean you haven't been paying in 15% for the 30 years of your working life - well then you can't reasonably expect as much when you do retire.

You need to obtain a copy of the pension rules and study them to determine your options, if you are lucky then you may be able to put the funds under your own control. Since priority is given to those already retired in the event of the company going bust it is important to understand the current funding position, i.e. does the pension have enough to pay out all the claims.

I'm not sure which actuary tables you are using to come up with 18 years lifespan past age 65 but my understanding is that at age 48(Ralphs age, and mine) if a man has no underlying health issues he will have on average 23 years of life past 65. Unless you have health issues or want to die young then you should anticipate how you will fund 30 plus years of retirement.

That is a great article. An example of economics done right. I just wish it would include how prices would increase on the "no supply growth" hipotesys. Anyway, the absurd price for 11mbd growth makes that point quite clearly.

Some other things that catched my eyes...

One: "IMF's growth projections are seriously improbable" That is true of any time, any IMF projection ;) One does not even need to look at the projection compared with past growth to conclude that.

Also, you defeated a men, it was not a strawmen, but it is also no exactly the IMF argument. Well, you refuted exactly what they said, but economists have an anoying habit of not saying exactly what they mean. When the IMF concludes that the price elasticity of oil is 0.685, it is not defining a straight line of demand X price. Instead, it means that the derivate of the demand is that, and it will approximately hold for small changes, but the limits are unknown. Economists are in the habit of postulating straight lines when they only know the derivate, but also know that the lines aren't straight*. Stating that the elasticity will change is a non-news.

* Let it to economists to embrace the mathematical notation, but remove any precision and non-ambiguity it originaly had.

Subtle but precise critique!

Interesting, my biggest concern with the IMF study is that elasticities are derived from the entire 1990-2009 period. Usually, econometric studies assume that the data statistics (first order and second order) are stationary over the entire dataset. However, consumption started really to decline starting in 2004, which covers only 5 years of the 19 years period. In short, oil demand elasticity with respect to price (and income) may be overestimated using only the median elasticity value. Note also that long term elasticity values are much more different. When you say "When we say "other things being equal", we particularly mean oil prices being equal", I believe it means that prices should stay constant equals to the average value calculated over the 1990-2009 period which is relatively low compared to the 2008-2010 average.

NewPeakist, not only does the higher gasoline price reduce gasoline demand, it may also reduce electricity demand.

Power use in homes dropping, AEP says

Trying to save money by any means available?

Figure 3.5. "Oil Consumption in China and in Selected Advanced Economies" shows that per capita oil consumption of the OECD and the US has been flat to declining since 1975. Figure 3.2. "Global Energy Demand, 1980–2008" shows growth in the vicinity of 2% in most years. Most of the growth is China and Non-OECD countries.

I'd expect that oil usage in OECD countries, including the US will decline on a per-capita basis, but this will not necessarily hurt GDP as rising prices divert the remaining consumption from lower-value to higher-value economic activities.

...and this Chinese growth has come at a time when the Yuan has been held artifically low against the Dollar but is now being allowed to rise more quickly. The last time the Yuan was allowed to substantially appreciate in a short time frame was in 1st half 2008...

Nick.

The dollar has fallen to $1.48 / euro this morning. It is doubtful whether the Chinese can stand to weaken the Yuan as fast as the dollar is falling. Therefore, I'd expect them to gently float the Yuan upwards and improve their ability to compete for oil and other resources.

The high oil prices in the US partially reflect the weakness of the dollar currency.

Merrill, I wonder how many Americans realize this point?

Americans are very provincial in their outlook. There is lots of discussion about what oil prices in $ will do to global GDP without considering that most of the oil is imported by economies that use other currencies.

In 4Q'10, the US exports were $1,714 billion and imports were $2,112 billion for a trade deficit of $398 billion.

The dollar has a long ways to fall in order to close the trade deficit, and this will cause a substantial decline in US living standards.

The trade deficit is the crazy old aunt in the attic that none of the politicians seem willing to talk about. They only focus on the fiscal deficit, which is of much less importance.

That $398 billion deficit is on an annual basis, so that's about 3% of the US economy.

So, eliminating the deficit would require reducing consumption by about 3%, right?

So, eliminating the deficit would require reducing consumption by about 3%, right?

Not that simple. You need to reduce imports by $398bn or 19%, while holding exports steady. That would be one hell of an achievement.

Just shrinking the economy by 3%, if the import/export ratio stays the same, would make a 3% reduction in 398, or about $12bn

Just for interest, US oil imports, at current prices of $120/bbl, would be $525bn for a year - so there is the target!

You need to reduce imports by $398bn or 19%, while holding exports steady.... US oil imports, at current prices of $120/bbl, would be $525bn for a year - so there is the target!

Exactly.

Now, the US reduced oil imports by about 1/4 in the last 3 years, so we're making progress!

Just shrinking the economy by 3%, if the import/export ratio stays the same, would make a 3% reduction in 398, or about $12bn

Right - we want to shrink consumption of imports, not the whole economy. Interestingly, WTO rules allow a general import tariff for the purpose of trade deficit reduction. Alternatively, we could just do the right thing all around, and tax FF in general, and oil in particular. I'd say the EU level of fuel taxation is about right...

It'll take 15 years for the US vehicle fleet to be modified to where that level of taxation would be possible. And the down-sized auto technology is all in foreign (non-US) hands.

lengould, time to get started. I'd suggest a lower level of taxation than the European Union to smooth the transition.

It'll take 15 years for the US vehicle fleet to be modified to where that level of taxation would be possible.

1st, that's not true at all. We've got the vehicles right now - it won't take 15 years to ramp up their production levels.

2nd, the straightforward solution is a $4/gallon tax, achieved by increases of $.05/month increases over 80 months. People get the price signal and can plan for it, but the pain is postponed.

3rd, if the taxes are burdensome because we still have a lot of low-mileage used vehicles in use, other solutions are much better than allowing indirect subsidies for fuel to continue. For instance, we could subsidize the junking of old vehicles which are replaced by new efficient vehicles. That sounds familiar...

the down-sized auto technology is all in foreign (non-US) hands.

Some of it. The Chevy Volt is mostly domestic - even the battery cells will be manufactured in the US fairly soon. The Ford Fusion is pretty good.

Len's comment is addressing the likely reality of the situation--it will be 15 years before the current US auto fleet will have been replaced with enough of the vehicles you mention before it could function smoothly with the high level of taxation the EU has.

I know I'm not going to replace a paid for car with a new higher mileage one any quicker than I absolutely have to--the money just isn't there for most people. It is a rock and a hard spot situation, no glossing over that. The six and a half years that you speak of is not very much longer than the note on many a new car (avrerage about 5 years in 2009) but most drivers do not have that new a car. The average age of a vehicle on the road has been increasing steadily for quite a while.

The most recent numbers that Googled right up: average vehicle age went from 9.2 in 2008 to 9.4 years in 2009. The average vehicle age was 8.3 years in 1999. Pain, anyway you cut it, though no doubt the tax increase you propose would force people to really get into car pooling and look hard and long at decent mass transit buildout.

...but I've lived here better than three score years and have been fairly politically aware since my preteen paperboy years, when the front page of the Chicago Tribune ran a political cartoon daily. Suggesting implementing that gas tax would instantly end the political carreers of any who dared. That is the reality of the situation. The only wiggle I see in that would be if the entire gas tax were dedicated to a tax credit program applied to purchase of fuel efficient cars...nothing like that is going to happen in this political climate. We really are a bit late to the dance.

Well, there's what's technically and economically possible and sensible, and....there's what's likely. The two are very, very different, as you note. At the moment, the forces of resistance (Koch brothers, et al) have stopped any further progress towards such things as GHG emissions control and a sensible energy public policy.

Now, it's worth mentioning that

1) new cars are used much more than old cars, so that cars less than 6 years old normally account for 50% of vehicle miles travelled;

2) affluent drivers account for a majority of miles driven, so that subsidies to the poor (either as income transfers, or for buying new efficient cars) would be far, far cheaper than our current system of artifically low prices; and

3) a little carpooling would be far, far better than mass unemployment due to unaffordable oil trade deficits.

hi Nick,

I was about to add one more paragraph, I'll see if I can reconstruct it.

Now if the value of the dollar is halved in the same time period, a far more likely scenario than the implementing of high fuel taxes, the same end fuel price will result. Unfortunately unlike proceeds for fuel tax dollars which stay at home, extra dollars paid for fuel because of the dollar's weakness flee the country at an ever increasing rate...at least until the demand is destroyed.

I was about to add one more paragraph, I'll see if I can reconstruct it.

I always copy my text (ctrl-a, ctr-c) before I hit "save", to prevent that kind of loss.

Yes, dollar devaluation would do the same, and far more painfully. Let's hope we reduce imports faster than appears likely.

As far as dollar devaluation goes: I'm not sure what it would devalue against. The Euro is going to be hard pressed, what with Greece and Ireland probably defaulting, and the Yuan won't be allowed to appreciate that fast. I suppose the yen and the canadian dollar could rise a lot....

I think it's pretty clear there will be no tax type solutions implemented - voters just won't accept and the gov wants a "market solution".

But that is what it has been wanting for decades, and it hasn't happened. The likely solution is that people who can;t afford to drive will stop driving, and those that can, will keep doing so.

Unless there is a real change in hybrid/EV pricing, if you can't afford gas prices, you can;t afford one of these cars, either.

The real problem with gas prices is not the price, it is the ability of the masses to buy it, or anything else. The consumer has been the engine of the American economy for decades, and now they are running out of money (and jobs), from the bottom up.

I don;t know how to reverse that situation, but until it is, prices of everything will be painful.

the gov wants a "market solution".

Paradoxically, a tax is a market solution.

It's worth saying that it's not really the gov that's blocking progress, it's the legacy owners/employees in the affected industries.

The likely solution is that people who can;t afford to drive will stop driving, and those that can, will keep doing so.

I think it's a lot more complex than that. Very few people will be unable to afford to drive, but that doesn't mean they'll be willing pay more than they have to. That means a gradual shift away from gas guzzlers. More gradual than we'd like, but there we are.

Unless there is a real change in hybrid/EV pricing, if you can't afford gas prices, you can;t afford one of these cars, either.

Almost anyone who can afford to buy a new car can afford to buy a hybrid - most are less expensive than the average new car.

Now, people dependent on used cars will have a harder time. Most will be able to buy other used cars that are more efficient, some will be able to carpool until more efficient used cars become available or use transit. A small minority will be left without options - we can only hope we find ways to help them, like another cash-for-clunkers program.

A quick and cheap option would be to allow the importation of secondhand cars from Europe (mainland) you could take several years off the turnaround time to better mileage cars being the norm on US roads.

It's worth saying that it's not really the gov that's blocking progress, it's the legacy owners/employees in the affected industries.

Not completely. The over zealous rules on diesel emissions, for example, are preventing all the carmakers, even the US owned ones, from bringing in their diesels from other markets.

Almost anyone who can afford to buy a new car can afford to buy a hybrid - most are less expensive than the average new car.

That is kinda meaningless - you don;t buy an "average" car, you buy a specific one. And the hybrid version of any car is more expensive than the non-hybrid. But more to the point, if you are really being squeezed by fuel prices, then you likely don't have the money to buy a new car - maybe buy a smaller 2nd hand one.

A small minority will be left without options - we can only hope we find ways to help them, like another cash-for-clunkers program.

There is one *major* change that needs to be made to the cash for clunkers - and that is to make it pay for retiring the old car, irrespective of whether they buy a new one or not. this may encourage some people to give up a car completely, 2car families to become one car etc. At the moment, by forcing someone to buy a new car, only those with the means to do so can benefit. People who can give up driving completely are doing their country more of a service than someone who buys a new (imported) car - they should be rewarded for doing so.

bringing in their diesels from other markets.

It's my understanding that diesel contains about 15% more hydrocarbon volumetrically. That's certainly convenient, but should it be counted as efficiency? If not, doesn't that eliminate most of the difference in MPG between gasoline & diesel?

If most people spend more than the price of a Prius, then most people can afford a Prius - QED.

if you are really being squeezed by fuel prices, then you likely don't have the money to buy a new car

This is overestimating the effect of fuel expenditures. The average car burns about 600 gallons per year. An increase in gas prices of $1/gallon raises costs by $600 per year. That's not going to put a large percentage of households in the poor house.

make it pay for retiring the old car, irrespective of whether they buy a new one or not.

Some programs have done that - it's a good idea if the only purpose is to reduce the number of gas guzzlers on the road.

A given volume of diesel contains about 12% more heating value than the same volume of gasoline.

http://en.wikipedia.org/wiki/Gasoline_gallon_equivalent

Most of the difference is in the efficiency of the combustion cycle and is related to the much higher compression ratio of diesel. The Prius gasoline engine uses the Atkinson cycle, which has a longer exhaust stroke than the compression stroke, making it about 15% more efficient than a conventional gasoline engine.

http://en.wikipedia.org/wiki/Diesel_cycle

http://en.wikipedia.org/wiki/Otto_cycle

http://en.wikipedia.org/wiki/Atkinson_cycle

According to that table, gasoline has 12% less than diesel, which means diesel has 13.6% more than gasoline.

So, a Volkswagen Jetta TDI gets 42 highway MPG, and a Chevy Cruze gets 36 MPG. The TDI gets 17% better MPG, and most of that 13.6%/16.7% = 82%) is from the higher energy density.

The TDI only gets 14.2% better combined MPG than a Corolla, so the efficiency of the two cars is essentially identical.

I know that diesel is supposed to be more efficient, but maybe that only really shows up in larger engines.

A rational policy--if such a term can really be applied to burning oil--would match the fleet's gasoline/diesel makeup to the most efficient breakdown of a barrel of oil. Overloading to either gasoline or diesel will cause waste.

Back to the your earlier question, devalue the dollar against what--well it certainly is being devalued against the barrel of oil ?- )

Overloading to either gasoline or diesel will cause waste.

Yes.

it certainly is being devalued against the barrel of oil

A tough medium of exchange...

More seriously, at some point oil prices will revert to historical pricing, as the world becomes electrified and recognizes that oil isn't nearly as nice and valuable as we thought.

Ayres-Warr (2006) has a chart showing Otto auto engine thermal efficiency of about 25% and auto diesel up to 45%, which seems higher than other data I recall that showed diesel about 50% more thermally efficiency than gasoline.

See Fig. 13 near the end of the paper and discussion starting p 21. Smil has discussed this in more detail.

http://terra2000.free.fr/downloads/expowork.pdf

Yes, that's consistent with what I've heard about diesel vs otto.

But...why isn't a Jetta TDI more efficient than a Corolla??

The Prius engine achieved 33% thermal efficiency, which is the record for a road going gasoline engine.

This sounds really impressive until you realise that the Wright Cyclone R-3350 aircraft engine, used in Superfortress and the iconic Lockheed Constellation, achieved this same level of efficiency back in the 40's!

The hybrid cars do get the overall efficiency up to or even better than diesel levels, for a price. The Euro style small diesels are more affordable than equivalent hybrids, which, incidentally, are not available in anything smaller than a Corolla, which these days is a mid size car.

For an apples to apples comparison, we need to look at gasoline and diesel versions of the same car - the jetta and cruze are different beasta.

From the Uk gov website, we can look at the Ford Fiesta [http://carfueldata.direct.gov.uk/search-new-or-used-cars.aspx?vid=25606]

Which comes with a bunch of engine options, but we'll use the smallest gasoline - the 1.2L and the 1.6L diesel.

Converting to US mpg, we get, gasoline car city/hwy of 32.5 and 53mpg, and the diesel gets 50city and 73 hwy. So, allowing for the 13% fuel difference, the diesel is 36% better in the city and 22% better on the hwy. The city performance is so much better because the diesels have much better part load efficiency than gasoline engines.

For comparison, the Prius, on the same test cycles, gets 58 city, 61hwy

The petrol Fiesta is f9,000, f12,000 for the diesel, and the Prius is f19,000.

The diesel and the have about the same annual fuel cost, but you don't have the f7,000 premium to buy the Prius.

And this is my point - for the same fuel savings, diesels are a cheaper way to do it. This is not to say we shouldn;t have hybrids, but that having diesels available means more people can get into more efficient vehicles, faster.

And for cars like the Jetta, if you ever need to tow anything, it can take 1500lbs, whereas the Prius can;t tow anything at all. In this regard, the Jetta can start to substitute for SUV's.

The hybrids are more "specialised" as city cars, but if you want more "utility" the diesel is way out in front. That is why the rest of the world has diesel engines available for almost all pick trucks, and most buyers opt for them.

In the US, diesel doesn't seem to have the same advantages.

Compare the Jetta Gasoline and Diesel versions on Edmunds.com:

Gas Diesel

Price $15,458 $23,452

MPG 24/34 30/42

Monthly Fuel Cost $146 $129

Average Cost/Mile $0.41 $0.47

Wow. I just realized that human transportation is a fat-tail effect and the fact that the average car burns 600 gallons a year means that it needs to be placed into a highly variable context. The people that will really get burned by the high oil prices are the people that live on the fat-tail of that curve, and because the tail is fat means that there are huge numbers of people affected.

This is very significant but because analysts only do Normal statistics means that they will miss it. Unfortunately TOD doesn't appreciate math posts so I doubt we will see a good analysis of that topic here.

Those who use more than the average, such as tax drivers, have it easy: it's a no-brainer that they should switch to hybrids, PHEVs and EREVs.

Taxis are indeed moving to hybrids, and are very happy with the switch. There's an interesting new company selling a drop-in hybrid retrofit for Crown Victorias, the workhorse of the taxi world.

Those who use less than the average, of course, are less affected by the increase in price.

This also applies to Europeans, which tend to drive about 60% as much as those in the US, and have vehicles which use about 60% as much fuel, for a net of 36% as much fuel per vehicle. The fact that they have about half as many vehicles per capita reduces their average fuel consumption to about 18% of drivers in the US.

Of course those who have already lowered their driving substantially, own homes well out of walking or even bicycle range for shopping and work (terrain can make this distance shorter than flatlanders might imagine) will find trimming harder. Ride sharing often entails some driving on the part of both parties and can add substantial time to the trip. How fixed or possibly falling this segment's income is will determine the degree of discomfort or outright pain. Public transit is not comint to us all. But creative solutions will likely be found, when the hard numbers are in people are reasonably good at balancing the trade offs.

those who have already lowered their driving substantially, own homes well out of walking or even bicycle range for shopping and work (terrain can make this distance shorter than flatlanders might imagine) will find trimming harder.

Yup. Rural driving is a necessity. Mountains are a pain. The north is an expensive place to heat and drive. Adds up to a problem.

Ride sharing often entails some driving on the part of both parties and can add substantial time to the trip.

If you share with just one other person you cut costs by 50%, but you minimize the extra travel and coordination. On the other hand, very low density rural living makes it hard to find partners...

What do you drive, what is it for, and how many miles?

Well you can see the front of what I drive on the picture I linked to Paul Nash down the page a screen or three, an 8 year old GMC 1/2 ton. I haven't had to haul but a few loads of building materials a year of late, but the rigs been free and clear for quite a while. Seems I'm down to about 6-8000 miles per year, it has been closer to 10-12,000 mpy some years but not lately. That varies a lot from season to season and if I work out of town--which usually, but not always eliminates driving.

It is decision time as the front half of the four wheel drive sounds like it wants money--but its handy to have a pickup around, even if I do opt for an low mileage rig to keep it company, so I'll likely put a couple Gs in it.

I happened to tune into Car TV for a minute after the hockey game today and saw the coolest little Caddy three door followed up by a very hot electric Jag. Me thinks I just might have to go out and make more money <?- ) I've been in no hurry to car shop, the choices are only going to improve. $4-5/gallon is noticed but when I'm working it budgets in and when I'm not miles are way down. It will be interesting to see how gas prices affect my wife's choices though--I have input but my wife's decisions are her decisions.

Is that true though? Isn’t the fatness of the tail a function of the elasticity of demand, which is probably a function of housing density?

Rgds

WeekendPeak

Could be. The point is that the data is readily available and someone could easily watch how that tail fluctuates. The reason that the human mobility data is so easy to gather is because it is all based on mobile phone records.

BTW, the data also implicitly includes air travel.

The idea of increasing petrol taxes is unnecessary and, as some have pointed out, political suicide. The price of oil is doing the job that a higher tax would do. The time to increase petrol excise would have been back in the 1990s.

What is necessary is to provide people with alternatives that increase the price elasticity of oil at any given price point. Like building decent public transport networks in every significant city that doesn't have one, and improving the network if there is one. Like building segregated bicycle lanes so as to make cycling more attractive. Like making cities walkable through having proper footpaths, proper pedestrian crossings and an end to roundabouts that push pedestrians 20 metres down the road just to cross. Like setting up the infrastructure for widespread car-sharing & car pooling. Like setting up an affordable and useful rural bus service.

The problem with this approach, it can be seen, is that it would promptly run into massive opposition by GM, Ford & Chrysler - and the massive auto sector behind them. All the petrol station operators, panelbeaters, car mechanics, vehicle sales merchants, parts manufacturers, road construction companies, etc, would see the danger and mobilise to stop it. And they'd do it in the name of "defending free enterprise".

The idea of increasing petrol taxes is unnecessary and, as some have pointed out, political suicide. The price of oil is doing the job that a higher tax would do. The time to increase petrol excise would have been back in the 1990s.

As a practical matter, of course you're right. Theoretically....gas taxes should be much higher. That would push people to kick the gas habit much, much faster than will actually happen.

What is necessary is to provide people with alternatives that increase the price elasticity of oil at any given price point.

Absolutely.

Like building decent public transport networks in every significant city that doesn't have one, and improving the network if there is one. Like building segregated bicycle lanes so as to make cycling more attractive. Like making cities walkable through having proper footpaths, proper pedestrian crossings and an end to roundabouts that push pedestrians 20 metres down the road just to cross.

All good ideas, though expensive and very slow. Hybrids, PHEVs and EREVs really have to be the main solution.

Like setting up the infrastructure for widespread car-sharing & car pooling.

Yes. Fortunately, with cell phones the infrastructure is already here - it just needs innovative companies, like zipcar.com.

Like setting up an affordable and useful rural bus service.

I hate buses. They're slow, very expensive and fuel-inefficient.

The problem with this approach, it can be seen, is that it would promptly run into massive opposition by GM, Ford & Chrysler - and the massive auto sector behind them. All the petrol station operators, panelbeaters, car mechanics, vehicle sales merchants, parts manufacturers, road construction companies, etc, would see the danger and mobilise to stop it. And they'd do it in the name of "defending free enterprise".

True, though I'm more worried about the oil companies, especially the Koch brothers.

Those Koch boys have been trying to unload our local refinery for a couple years now. Might have a bit to do with sulfolane Williams, Flint Hills previous owner, spilled that got into North Pole's groundwater. It might have a bit to do with the lower demand for jet fuel after the 2008 crash as well. Well at least they charge us about $4.50/gal for gasoline, which gets shipped a whole ten miles from the refinery that sits right on TAPS. #1 fuel was at that price here before the barrel of oil started to jump in March. I'm proud to do my part to make those SOBs richer.

Sounds like the good people of Fairbanks and area (love that town!) need to form a co-op of some sort to buy out the refinery. Though, with the future of TAPS uncertain, it may be a risky move. Still, if you can bargain them down to $1 maybe...

Williams sold its AK holdings back in 2004, a piddling $265 million. The bulk of that sum was from Flint Hills for the North Pole refinery and a 3.0845% ownership stake in TAPS, but some of it went toward the 26 service station/convenience stores Holiday picked up. Don't think it will be going for a dollar soon.

I looked into the jet fuel sales and found Flint Hills did well enough last year to fire up the #3 refining unit that had been shut down for a couple years. I guess one of the problems is upgrading the refinery so it can meet low sulfur highway motor fuel standards.

The Alaska RR was tossed around as a possible buyer when the refinery looked to be going belly up in 2008/9. But that stuff is really hard to read here. The refinery buys the state's in kind North Slope royalty oil, so there is wheeling an dealing always.

Then there is the content degration charge for the oil the refinery returns to TAPS, which is is more of an issue now with a 600,000 bpd TAPS flow than it was a decade or two back when the North Slope shipments were two or three times that amount. The refinery takes about 220,000 bpd of crude out of TAPS but it only consumes about 64,000 bpd to make petroleum products. About 146,000 bpd of degraded crude is put back into TAPS and sent on down to Valdez. It is this unusual arrangement that allows that refinery's output to be:

Gasoline and Naptha 19%

Jet Fuel 57%

Diesel 19%

Gas Oil 4%

Asphalt 1%

These are old numbers from Williams and might not reflect the mix with the new low sulfur road fuel requirements, but that big a diesel/jet fuel percentage is possibly a one-off situation in the refining world.

To make the whole take out/put back of crude trickier, the refinery now gets TAPS oil that is only 40F and returns oil to the pipe that is 120F thus facilitating flow to Valdez. Back in the day that oil came in to the refinery at 110F. I'm sure the Koch boys have been doing all kinds of horse trading with all the involved parties.

Speaking of TAPS, went over to MSNBC earlier and there was a picture of kids in Savoonga, AK playing on empty oil containers and an article about Shell trying to get it Arctic offshore drilling permits (TAPS could see oil from offshore in a decade if things went well). I went back an hour or two later and there is Obama and Osama on the front page. The world doesn't stand still.

Fairbanks is an alright place, glad you liked it--winters are a bit long though, posted a picture of the snow pile next to my house on Tech Talk a couple weeks back. You are in BC, right?

Hi Luke,

Yes, I am in BC, on the Sunshine Coast, just NW of Vancouver (separated by a ferry ride). Coast here is not unlike Cook Inlet.

Was up there in Aug last year on a business trip - looking at water conservation possibilities. Interesting trip - drove up from Anchorage in the evening - got up close an personal with a huge moose, but didn't hit him. Had been told no need to book a hotel, lots of rooms in Fairbanks - got into town at 1 am and not a room to be had - several bus groups had arrived that day. Only place we could get a room was the Klondike! Quite dump, that place, and an interesting night there...

Anyway, that aside, a good couple of days, (spent second night at the Sophie Station - much better and actually got some sleep) and lots of great people we met. Great dinner at some place owned by a Korean(?) woman who used to be a stripper - I had asked our hosts (Keller supply) for a place with local character and it had it.

Drive back to A. was in the afternoon, perfect weather, perfect views of Mt McKinley. Next day was down on Cook Inlet at Soldotna and finished the day by seeing a pod of whales on the drive back followed by a the legendary steak at the Double Musky at Girdwood - it doesn't get much better than that.

Unfortunately, not much business to be had, but a great trip.

Really liked Fairbanks, and the workmanlike attitude of everyone I met there. if you weren't workmanlike, you probably wouldn't want to live there. I used to live in Calgary and thought the winters there were long enough, Fairbanks would definitely be a challenge - I think you'd want to have lots of indoor projects to do.

An easy out for that refinery, just putting the residuals back in the pipeline for California to deal with!

As the flows decrease, is the plan to then close/scale down the refinery to maintain pipeline flow?

Don't know that restaurant, usually go to a 'cozy' little Italian one across from Wedgewood Manor, where the food is generally very good and can be excellent (a rarity in our restaurants). Amazing there were no rooms--several thousand new ones were added a in the not too distant past--but I guess the idea is to fill them up. You certainly started at a doozy. Yeah its' a working town, that's for sure--though a good many of us try to jam the work into as few months as possible.

Lots of people haul water (or pay to have it hauled), quite a few areas have high arsenic content in the ground water--gold country you know. I was right stingy with the stuff--until I got lucky when I drilled a good well. My how attitudes change when there is abundance, though we aren't super extravagent with the stuff. But I'm better than a thousand feet above town with little more than five hundred foot of hill above me. We get less than 11 inches of precip in an average year. A couple nine inch years and I'm wondering just how much buffer I have this high on the hill.

Sunshine Coast??? Never heard that term applied to a part of BC. Only took the ferry, back when the AK ferry left from downtown Seattle, past that area once, but I'm not quite sure where in channel we were. Seems the first night's sunset was near some place called Bella Bella or something like that, long time gone. That sunset was spectacular, the best I'd seen in my life till that time. Now I regularly get two hour shows out my west facing front window (till it stays too light--just about there now). Our sunsets can be amazing but that ocean air adds something special we don't get.

No idea what the plans are as TAPS winds down. For now the plan is for the oil companies to lay on the governor to lay on the legislature to get them to lower the taxes that the oil companies say are stiffling our oil development. Of course the oil companies won't be drilling any more up here if we do that since North Dakota and Texas seem to be sucking up all the capital at the moment. There is oil to put in the pipe--but the exploration isn't being done right now. Shell's arctic offshore plans were/are about the only big thing in the works.

North Pole is not even the biggest supplier of jet fuel to Anchorage, so there is demand at the moment--and Anchorage is in competition with Prince Rupert for the air cargo fuel stops last I heard--but Rupert is quite a bit south of the Europe/Asia routes Alaska sits on--all very intriguing.

I'm pretty sure the state would just as soon the value added oil was produced in state--then there is the oil line temperature issue. If Flint Hills wasn't putting near 25% of the flow back in at 120F the pipeline might seize up--several issues as the oil gets down to 30F and below. The crude is only 40F when it gets here from The Slope and Valdez is still 400 miles south. Very, very cold miles several months a year. It was touch and go for the restart after an emergency shutdown this winter. Seems like this low flow TAPS game is pretty much seat of the pant flying.

I can't remember the name of that restaurant in F. but anyway, it was good, the town was good, the people were good, - I could live there. And the Klondike makes for a good story - every road trip story should have some element involving a dive of a place - it would be hard to beat the klondike in that regard!

The Sunshine Coast is just 50 miles NW of Vancouver. The place you are thinking of, Bella Coola, is much further north, but still on the Inside Passage.

The TAPS thing is interesting, such a major piece of infrastructure, and not much effort it seems to have a coherent plan to keep it going. Personally I like the idea of extracting all the NG up there and turning it to methanol, and then piping that, which can be mixed with oil, though I am sure it is not that simple.

Could probably pipe LNG instead, but then you can;t pipe oil at the same time.

Sounds like it might be time for Alaska to diversify - though into what I don't know. For Alaska, Peak oil has well and truly happened.

Like setting up an affordable and useful rural bus service.

I hate buses. They're slow, very expensive and fuel-inefficient.

Actually, the sort of rural bus service that is needed is not rural pick up (like a school bus) but rural town to town and town to city services. This would then facilitate people in said towns owning EV's, even the Low Speed Vehicle type, as most of their driving is very short trips. Country towns are ideal for these as there are no freeways to negotiate, and range is not an issue, unless you are trying to drive to another town, and that's where the bus comes in. Used in this way, buses are very efficient. In stop-start city pick up traffic, they are no better than cars unless at least half full, which most of the time they are not.

If I owned a Low Speed EV in a rural area, I would very likely just put a generator on a trailer for longer trips.

Far faster and easier, and probably no more expensive.

I don;t think you would actually. The laws, currently limit these vehicles to a top speed of 25mph - that will make even a medium length trip feel like a very VERY long one.

Secondly, the laws, as currently written only allow these vehicles on streets with speed limits of 35mph or less, though I think some places are upping to 45.

And most importantly, they are simply not designed or built for high speed (highway) driving, and no one, not even their owners, are proposing that they should be.

I really like the LSV's as they represent a way to do EV's far cheaper than normal EV's, and for rural towns and small cities, they have plenty enough range for everyday driving.

For normal, Leaf type Ev's I agree the generator is the way to go. With some attention to detail, and light weight, it would be possible to make a generator attachment that was only 100-150 pounds, and so could mount on the hitch in the same way as a cargo carrier, without needing a trailer. Many people, and especially women, are uncomfortable with trailers.

http://www.minidomore.com/mini_cooper_towing/cargo_platform.php

a top speed of 25mph - that will make even a medium length trip feel like a very VERY long one.

Consider the alternatives for a 100 mile trip:

1) driving 15 miles into town (30 minutes at 30MPH); waiting 15 minutes for the inter-city bus; and taking a bus which moves at best at an average speed of 40 miles per hour, given the need to stop often = 3.25 hours, or

2) driving 3.33 hours on your LSV, and having all the advantages of mobility - not having to wait for a scheduled bus either way; being able to go any time; being able to go to any destination in any direction, etc, etc.

------------------------------

I really like the LSV's as they represent a way to do EV's far cheaper than normal EV's

The question is: what's the need for LSVs? Rural people don't buy small cars now - why would they buy small EVs??

For normal, Leaf type Ev's I agree the generator is the way to go.

And that's an extended range EV, like the Chevy Volt. In the long run, a Chevy Volt will be no more expensive than a Leaf - the smaller battery pays for the onboard generator.

I think you are misinterpreting what I am saying.

I think the LSV's are ideal for people who live inrural towns and small cities - I did not say they are ideal for people who live 15 miles out of town. if you are out on a property like that, you will certainly have a larger vehicle, for a variety of reasons. However, many farmers I know (in Australia) have a second, smaller vehicle that is used for many of the town trips, instead of the PU. You don't need the truck to pick up a bearing for the combine or to do the food shopping etc.

The LSV shouldn't and wouldn't be allowed on that 15 mile stretch of road, unless it is a 35mph road - which is doubtful.

The question is: what's the need for LSVs?

For people in and on the outskirts of town, they would be ideal. For the most frequent trips - into downtown and back, usually 5 miles or less, they are ideal. They avoid cold-start, short duration ICE trips, which are the most engine damaging, polluting and least fuel efficient. I actually live in this situation myself - 4 miles from town on 35mph winding, undulating road (with nice scenery though - a beaver pond and usually lots of bald eagles as the garbage dump is nearby). My mpg for my Ford Ranger on this trip is awful, and there are hundreds of houses on this road, or branches thereof, and everyone is in the same situation. Some people here average just 5000 miles a year.

Two car families can have one being the LSV. Running the kids into town can be done in that. Some people may be able to just go LSV only and then take the inter-city bus,(which we have) or rent a car or zipcar etc for those trips.

As for breaking up the trip onto a bus or whatever, people here do that all the time. To get to Vancouver you have to take a ferry (put Sandyhook, Sechelt, bc into google maps to see where I am) and that costs $40(return) for the vehicle and $10return per passenger. Many people just drive to the terminal, or take the bus there, and walk on, and take a bus to downtown vancouver on the other side.

This has its own advantages - you don;t have to look for parking, you are not driving around in an unfamiliar city, you have a more relaxed visit walking around downtown, or the landmark Granville Island. if you are the person predisposed to wanting an LSV, you will not have a problem with doing this sort of thing.

Also, if people have the LSV's they will be more inclined to keep their business local, and because they are saving money on not owning a big car, they have more in their pocket to spend locally. For towns and small cities, 90c on the dollar spent on cars leaves the town immediately. This is still true with an LSV, but you are only spending 2/3 the $ on the car and insurance, and almost nothing on fuel and maintenance.

I am going on a bit here but this is something I have been looking at closely and am going to be preparing an EV implementation plan for a BC ski resort town - and LSV's are one of the options, and are looking the best in terms of cost/benefit for owners and the village.

And that's an extended range EV, like the Chevy Volt. In the long run, a Chevy Volt will be no more expensive than a Leaf - the smaller battery pays for the onboard generator.

It is an EREV when the engine is plugged in, but the Volt carries it all the time whether needed or not. What we have with the separate generator is an ER "app" for the EV, and one that lends itself to a rental/sharing application. Not saying we have to choose one or the other - let the buyers do that. A family could conceivably have two EV's and one generator attachment - though in the near term one EV and one ICE is more likely.

Also, the generator could plug into different vehicles - a standard hitch mounted unit and a standard plug in, and away you go. This would allow for aftermarket units - something carmakers hate, but something that does foster lots of innovation. It is possible the generator could be a small air cooled diesel, or a methanol fuel cell, or even just more batteries. You do not need to replace your EV to upgrade the range extender. This plug in option has worked well for computers but has been totally unavailable for cars - now we have a way to do it.

Would loosen the stranglehold of the carmakers but that is a good thing IMO .

Would loosen the stranglehold of the carmakers but that is a good thing IMO .

Somehow I have my doubts--vehicles intended for short trips will be made to break down if the miles are pushed up to far (either per trip or per year). Cost/weight and all that good stuff, or at least those would be the excuses the big boys give.

All of that makes sense, but doesn't answer my question:

People have the option of very small cars now - they are a small percentage of the overall car market. They had the option of the original Honda Insight - it got 60MPG, but didn't sell at all. The average new car sells for about $29k.

Why would people choose LSV's over hybrids, or plug-ins, or EREVs, or EVs like the Leaf?

Keep in mind that

1) the Prius price is well below the average price for a new car, the plug-in Prius will be around the average for new cars, and the Leaf and Volt will be around that average price in less than 5 years.

2) the difference in price between small cars and large ones is largely artificial: the cost of making a car door doesn't change much with size. The price difference is artificial market segmentation in order to maximize revenues from the various price points. If the market moves to EVs and "sedans" then that price segmentation will happen with accessories: leather seats, sound systems, etc.

Why would people choose LSV's over hybrids, or plug-ins, or EREVs, or EVs like the Leaf?

Because LSV's are cheaper to build, buy and run than any other type of vehicle. For people with not much money, and/or who need to drive regularly but not long distances, this is ideal. You can get LSV's starting at $6k, and your annual running costs would be negligible. That is one heel of a difference from any HV or normal EV.

Because of the nature of the construction of an LSV it is very cheap to make, and because it is small and light, it is cheaper to power by battery electric. It supports "localism" - a trend we are seeing more of.

In cities like Vancouver where you can use the train for a lot, but not all trips, they are a good fit. You might live near a train line but not work near it - the LSV is your commute, and for much of your other trips, you can take the train. A trip to whistler for the weekend of skiing can be done by bus (much better than winter driving on that road) and a road trip elsewhere can be a rental.

An LSV is no good for an LA commuter, because of the nature of that city - you pretty much have to battle the freeways. But for smaller cities, or good transit cities, and LSV can meet a majority of requirements for a majority of people, the majority of the time. Sure the other options can meet more requirements more of the time, and at more cost. I think people should have the choice - it is not as draconian as going car free, but it's the next best thing and certainly the next cheapest.

On the level of the whole society, it's a lot cheaper than continuing the car culture, which Nick's policy would entail. Further, the improvements to cycling & pedestrian facilities would be cheap on a gross basis and would more than pay for themselves in terms of the reduction in needed road expenditure. What it requires is a change of mind-set. And the guts to face down the vested interests who live off the fortunes people pay for living in a car-dominated society.

That's why I used the word "useful". Paul Nash's suggestion below about town-to-town services is a good one. I also think, however, that the load factor (and thus fuel efficiency) of local pick-up services will increase when people start looking for ways to travel that don't involve driving. Unit costs of trips would also decrease with increased patronage. The good thing about buses, as opposed to trains, is that they need a lot less time & capital to set up. This means a service can be started up when there's a demand for it. In cities, they can be used as an interim solution while a heavy rail service is being planned &/or constructed.

On the level of the whole society, it's a lot cheaper than continuing the car culture, which Nick's policy would entail.

Are you sure?? I think that's incorrect. Consider the cost of extending rail to every home in the country. Alternatively, consider the cost of paying bus drivers for 7-day, 24 hour coverage within a reasonable distance of every home.

cycling & pedestrian

These are great for some things, but they won't work for anyone with disabilities, very bad weather, distance, or hauling.

that would be a good habit to acquire, let's see how many months it takes me to get it down?- )

then of course there are my fat fingered strokes that always bring unexpected results?- )

I won't hazard a guess on exactly how it all could play currency wise--uncharted territory for sure ($1500+/ounce shows there is a far amount of concern out there). The Mideast is really the wild card now. If Syria fully explodes--even though they are not much of an energy player--political waves could hammer its neighbors. If such waves rock Iran with near 4mbpd production with Libya mostly offline...look out.

Interesting times to say the least. We may get lucky and skate around the edge as the status quo breaks up bit at time, but even then it will be really rocky going for a while. Of course I live where frozen big rivers have been known to break up with an explosive rush...quite exciting and unstoppable events.

I do not think that is true about pickups in the U.S. because their fuel economy has declined for the last 25 years. My old pickup gets 28 miles / gallon on the highway which is better than any new one that I have seen. The CAFE standards allowed their fuel economy to decline.

Yes, I was thinking of cars. Pickups will need to have their use pared back to the minimum really necessary combined with new models.

Nick, appreciate your ideas. Imagine if we could continue the reduction and have no imports in 12 years. I know, wishful thinking.

I've never heard anyone talk about this WTO rule before. Thanks for mentioning it.

Imagine what would happen if we even had a level of tax that was 1/4 of the European Union. That would be a step in the right direction.

Imagine if we could continue the reduction and have no imports in 12 years. I know, wishful thinking.

Yes - doable, but pretty unlikely. OTOH, I think it's very likely that we'll reduce imports by another 50%: production is likely to rise somewhat - perhaps 2M - and consumption is likely to fall by 4M from efficiency and substitution. Of course, Westexas is probably right to expect some forced conservation on top of that, which would reduce imports further...

Its not just the IMF which such projections, but the CBO and almost every other government institution. Today the FED adjusted their own forecast to the following:

my two cents (inflation adjusted):

a)they have no plan for the unraveling that would occur if growth would stop so they must keep projections growing in hope that organic growth will return

b)the FED postponed Peak Oil by QE..^n. Debt is spatial and temporal reallocator of resources from the future and periphery to the present and center. US Govt/FED added 22% of GDP to economy in past 24 months. Without this we would have been in great depression (or worse) territory. How long they can continue to move consumption forward is an open question - each time they (we) do so, we take a bite out of the health of our currency, and with it social stability that comes from just-in-time international trade. Eventually, QE..^X meets with oil prices that are unaffordable even to debt saturated consumers - this ends badly either way for holders of existing paper claims, and, if not prepared for, all of us.

You can print money, but not oil. The "stagnation" (term used by IMF) of oil production since 2005 shows that investments in oil projects didn't do the trick. The QE contributed to rising oil prices which lead to a higher ratio US oil purchase/GDP

"As we look forward at Douglas-Westwood we see a greater than 50% probability of an oil shock by 2013; indeed, given recent high oil prices, the US could find itself back in recession by summer. Notably, when crude oil consumption has exceeded 4% of GDP, the US has typically fallen into recession - in some cases in as little as 30 days, and generally not more than six months. Crude consumption as of April 22 stood at 6% of GDP, well in excess of the historical threshold."

http://www.aspousa.org/index.php/2011/04/pick-one-spr-or-recession/

regarding Fed (and other OECD central banks) postponing peak oil - I didn't mean by raising price I meant by increasing affordability (falsely, or rather temporarily) - ie. demand side influence not supply - but I agree that fed can print money, not oil- (the April Fools post here posited that Fed would start growing their balance sheet in distillate, gasoline and heating oil instead of dollars...;-)

Love this quote:

My mental model for money is similar, its the relative weighting of todays resources but besides being that it(money) also connects tomorrows resources to today (via interest rates).

Now with PO & the shrinking global GDP it does not necessarily spells doom to the debt issuer (US) because even though the pie is shrinking the US may still be the predominant (& most stable) portion of it. meaning even in tough times it may not be as hard to unload the QE assets as it seems. It all depends on the smart timing of the sale, i.e.. when others are in bigger trouble than US.

First - this analysis used short-term elasticities, but if you're talking about a long-term/secular rising trend, you have to use long-term elasticities. That's the whole point of the distinction between the two.

2nd, you can't use elasticities developed in the low price range of the price curve for the high price range: they will be very different.

In fact, this is strongly non-linear. Above about $80, investment grows in alternatives, especially batteries. As both R&D and manufacturing volumes increase, innovation and economies of scale are creating disruptive competitors whose costs will reasonably soon start to fall well below the old oil-based price norms - at that point oil consumption will continue to fall even if oil prices start falling.

At that point, oil exporters will be in deep trouble, and wish they had saved as many of those T-bills as they could....

I do agree at some price point alternatives do come into play, without any math to back it up I will make a wild guess and say it's quite a bit higher than $80. I am unsure how this applies to batteries, however efficeint, compact, and/or light they may become batteries are still storage devices and not a form on energy.

I think that Nick's statement that "investment grows" is correct, though I would say the target has been more biofuels than batteries.