A Brief Economic Explanation of Peak Oil

Posted by Euan Mearns on September 26, 2011 - 3:35pm

The following is a guest posting by Chris Skrebowski, the ex Editor of Petroleum Review and longtime ASPO and ODAC member. Chris is the founder and Director of Peak Oil Consulting Ltd. The article was published on the ODAC website on 16th September.

For a number of years there has been an arid debate between economists and geologists about Peak Oil. The geologists maintain that Peak Oil (maximal production) is a geological imperative imposed because reserves are finite even if their exact magnitude is not, and cannot be, known.

In contrast many economists maintain prices will resolve any sustained supply shortfalls by providing incentives to develop more expensive sources or substitutes. The more sanguine economists do concede that the adaptation may be slow, uncomfortable and economically disruptive.

The reality, I believe, is that both groups have part of the answer but that Peak Oil is, in fact, a complex but largely an economically driven phenomenon that is caused because the point is reached when: The cost of incremental supply exceeds the price economies can pay without destroying growth at a given point in time. While hard to definitively prove, there is considerable circumstantial evidence that there is an oil price economies cannot afford without severe negative impacts.

The corollary is that if oil prices fall back to and sustain levels that do not inhibit growth, then economic growth will resume, with both recoveries and downturns lagging oil price changes by 1-6 months.

The current failure of most western economies to achieve anything more than minimal growth this year (2011) is most likely because oil prices are already at levels that severely inhibit growth. Indeed, research by energy consultants Douglas-Westwood concludes that oil price spikes of the magnitude seen this year correlate one-for-one with recessions.

Looking at conventional cost curves shows incremental development costs range from $45/b (Saudi) to $90/b (Canadian Tar sands and Venezuelan Orinoco heavy oil) with most of the incremental deepwater sources in the $70-80/b range. Simplistically, the historic production cost curve goes in increasing cost order: Middle East onshore, other OPEC onshore, non-OPEC onshore, OPEC and non-OPEC deepwater, Canadian tar sands/Venezuelan heavy oils. Incremental costs broadly follow the same order.

It should be noted there are wide divergences in estimates of oil development costs depending on what is included and the treatment of financial costs, profits and overheads. Those used here are estimates of the prices needed to justify a new, large development.

For most OPEC producers oil and gas revenues are their principal source of income and government revenues. There is much literature to show that when oil prices rise, producer government expenditures rise and absorb most if not all of the gain very quickly.

The so-called ‘Arab Spring’ has added a further twist to this process. Governments in a number of OPEC countries and some non-OPEC producers have dramatically boosted government expenditures to reduce the risk of social upheaval leading to their being overthrown. Increased military and security expenditures feature alongside greater hand-outs and benefits to the population.

Saudi Arabia dramatically illustrates this phenomenon. On the latest budget projections, Saudi needs an oil price of $90-100/b for its revenues and expenditures to balance and if it is not to run deficits and consume financial reserves. It is likely that many, if not all of the other, OPEC members have revenue/expenditure break-even oil prices comparable to those of the Saudis.

This means that, whatever the public statements, most OPEC members now require oil prices around $100/barrel to balance their books and will seek to secure higher prices by restraining supply if necessary. However, under sufficient economic pressure oil prices would fall with severe impacts on Opec budgets.

As Saudi Arabia is the only oil producer with significant reported spare capacity, its policies effectively set the world selling price for oil. All other suppliers are effectively price-takers and will sell at the highest price available to them. Producers other than Saudi Arabia have the negative power to drive prices higher by reducing production but there are few, if any, prepared to forgo current income in the hope of greater income at a later date.

As a consequence the Effective Incremental Oil Supply Curve (EIOSC) is, in reality, surprisingly flat and lying somewhere in the $80-$110 range. For the immediate future this is the most likely range for oil prices. A recession has the potential to drive prices down to the $40-60 range but this is likely to be relatively short-lived as reviving economic activity, triggered by the lower oil price, would then drive oil prices higher again.

An escalation of oil development costs is happening now and will continue because the world’s endowment of ‘easy’ oil production is past. As of 1Q 2011, the IHS/CERA Upstream Capital Costs Index had risen to 218 from the 2009 low of 200 and is now on trend to pass the 3Q2008 peak of 230. Increasing producer government expenditures in both OPEC and non-OPEC countries also means that the EIOSC will tend to rise.

The rise is actually being driven by the depletion of the low-cost, easily exploitable oil and its replacement (for the moment) by less accessible and higher-cost oil. The chances of any significant and sustained price fall, barring a major global depression, look remote.

Incremental non-OPEC supply in the period 2011-2016 in increasing order of costs comes from biofuels (various sources), shale oils (US now, China later), NGLs (various sources), Brazil (deepwater), US (offshore), Canada (tar sands), and with smaller gains from the generally lower cost Colombia (onshore) and Kazakhstan (onshore and offshore).

For OPEC incremental supply in 2011-2016 may come from their current spare capacity, predominantly held by Saudi Arabia, or from new capacity. Only three OPEC members have realistic plans to expand capacity. The largest increment comes from Iraq, with rather smaller increments from Angola and the UAE. Even major projects such as Saudi Arabia’s Manifa field development 2013/15 only offsets depletion and does not add net capacity.

The Table below attempts to show the size and likely cost of these incremental supplies.

The main oil and NGLs production gains anticipated for 2011-2016 and their likely development costs.

|

Country |

Production gain (million b/d) |

Incremental oil Cost ($/barrel) |

Comment |

|

Non-Opec |

|||

|

Canada |

1.0-1.2 |

70-90 |

Tar sands |

|

Brazil |

0.9-1.1 |

60-80 |

All deepwater |

|

NGLs |

0.5-0.7 |

50-80 |

Various sources |

|

US offshore |

0.2-0.3 |

70-80 |

|

|

US shale oil |

1.2-1.5* |

50-70 |

Bakken et al |

|

Colombia |

0.2-0.4 |

40-60 |

|

|

Kazakhstan Offshore |

0.1-0.2 |

70-80 |

Multiple delays |

|

Kazakhstan onshore |

0.1-0.2 |

50-70 |

Delays |

|

Other non- Opec |

0.2-0.3 |

40-70 |

Mostly Africa |

|

Opec |

|||

|

Iraq |

1.1-1.3 |

40-60 |

Security concerns |

|

Angola |

0.6-0.8 |

70-80 |

deepwater |

|

UAE |

0.4-0.5 |

50-70 |

redevelopments |

|

Opec NGLs |

1.4-1.6 |

40-60 |

|

|

Other Opec |

0.5-1.0 |

40-80 |

Rises & declines |

*Bank of America/Merrill Lynch

Thus the geologists are right that the depletion of low-cost oil will produce Peak Oil but it will not be caused by a shortage of oil resources.

The economists are right that there is no shortage of oil resources or oil substitutes but have so far failed to recognise that there is an oil price which cannot be afforded and this constraint will create and define an economic Peak Oil to be differentiated from a geological Peak Oil.

Ideally we need to identify a price curve to show the point economic growth is constrained to the point of vanishing but we are confronted with a paucity of data. We believe that $147/b in mid-2008 helped trigger the ‘Great Recession’ but the global economy was weakening from late 2007. We know that the run up in prices to around $120/b in 2Q 2011 brought growth to a near halt in a number of western economies and notably in Europe. But in this case, the economies had not really recovered from the ‘Great Recession’. Douglas-Westwood analysis also shows that in mature economies, such as the US, there is a significant economic impact at over $90/barrel. In contrast China can probably sustain oil prices in the $100-110 range.

We also know that the low oil prices of late 2008/early 2009 helped stimulate both an economic recovery but also a rapid recovery in oil demand. In 2010, oil consumption rose by 3.1% globally according to the BP statistical Review of World Energy June 2011, the fastest growth in oil demand seen since 2004. Various studies have shown a close correlation between sharp oil price rises and US economic recessions with only the dotcom recession of 2001/02 proving the exception that had no oil price component. Indeed a study by University of California-San Diego economist James Hamilton, links oil price spikes to 10 of the last 11 recessions.

The US shows the pattern of rising oil prices slowing economic growth most clearly, probably because oil products taxation is low, which means that changes in the price of oil feed almost linearly into the economy. As might be expected, the effect becomes more damped in European economies which levy high rates of tax on oil products in general and on gasoline and diesel in particular.

Oil producing countries subsidising fuel use can apparently be virtually immune in terms of the impact on economic growth in the short run, although the impact ultimately shows up as spiralling government expenditures as well as lavish and inefficient use of fuel. Venezuela and much of the Middle East are notable examples.

In consumer countries with fuel subsidies, price support programmes are often accompanied by price caps. In the face of rapid oil price increases either national budgets are hit or fuel shortages appear as has been the case in both Iran and Pakistan among others.

According to the IEA’s World Energy Outlook 2010 the largest government subsidies to oil consumption, in 2009, as a percentage of the price and in descending order were: Iran (since reduced), Saudi Arabia, India, Egypt, Venezuela, Indonesia, Iraq, China and Algeria.

But all these countries are ultimately hostage to Chinese demand. By itself, China represents about half of demand growth for most commodities in a typical year. The growth of the Middle Eastern economies and commodity suppliers like Brazil, various African countries, as well as Australia and Canada are largely derivative of China’s growth. If China’s demand were zero, Brazil’s mining and oil sectors would be weak, and with them, the Brazilian economy as a whole.

What price, then, can China bear? The historical record shows tremendous volatility, but in general, it would appear the country can afford to spend 6.3%-6.7% of its GDP on crude oil expenditures, or approximately $100-$110/barrel. When prices are above this level, both China’s oil consumption and GDP growth tend to fall. This is a good bit higher than the $90/barrel estimated as the bearable price for the US and Europe.

Why is China’s tolerance higher? Because the value of oil is higher there. For example it is fairly clear that the economic benefit of the first car in a family is much greater than that of the third. Similarly the productivity gain from the first truck in a commercial fleet is greater than that of the twentieth. This observation suggests that rapidly industrialising economies such as China and India have a higher marginal productivity from an incremental barrel of oil than in more developed economies.

This in turn poses a terrifying question: Would this higher price tolerance mean developing economies could keep developed economies in growthless stagnation by paying oil prices that were just above those that bring developed economies to an economic halt?

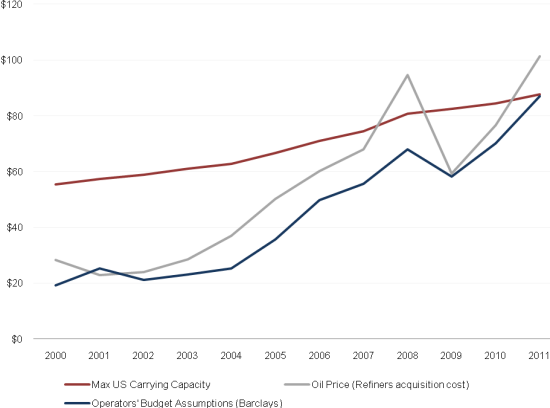

The challenges are clear. Historically, the oil prices used by companies for project approval remained well below the carrying capacity of the US economy. For example in 2004 operators were approving projects assuming a $20 oil price, even though the US economy was theoretically capable of handling a price near $60. However, in its most recent survey, Barclays Capital indicates that operators’ budget assumptions have risen to $87, literally the maximum carrying capacity of the US (and probably European) economies.

Thus, on current trends, the oil companies will be approving projects that deliver oil at prices literally unaffordable to the advanced economies.(Graph 1 below)

Graph 1 Oil Prices: Refiners’ Acquisition Costs, Maximum US tolerance levels, and Operators’ Budget Assumptions for Project Approval.

Source: Barclays, IMF, EIA, Douglas-Westwood Analysis

Undoubtedly the reality would be less clear cut, as economic growth in emerging economies also stimulates activity. For example, China’s rapid growth has created a huge pool of capital; thus the US saw a dual shock in 2008, caused by the low cost of capital, on the one hand, and the high price of oil, on the other. But emerging market growth should, as a practical matter, provide export markets and low-cost capital to assist the advanced economies to adapt to living within smaller energy budgets.

As adaptive responses come through in terms of more efficient vehicles, social and organisational changes such as more home working and the improving economics of energy alternatives, economies will become better able to cope with higher oil prices and suffer less economically.

However, adaptive responses, on the basis of the reactions after the first (1973) and second (1979) oil crises, are slow (taking 10-20 years) while oil prices have been faster moving going from $25 to $100 in the eight years between 2003 and 2011.

If adaptive responses were fast enough and large enough, oil prices might be broadly stable. They clearly are not.

There is a measure of adaptive response in the efficiency gain for oil in use. The adaptive response is to use oil more efficiently or to back out lower added-value uses of oil or to move to other fuels. Either way this shows up as improved efficiency in use (volume of oil per unit of GDP). For many years this has been running at around 2%/year (although some sources believe 1.2% to be a more accurate figure). The IEA now uses a figure of 3% suggesting they believe the process is speeding up.

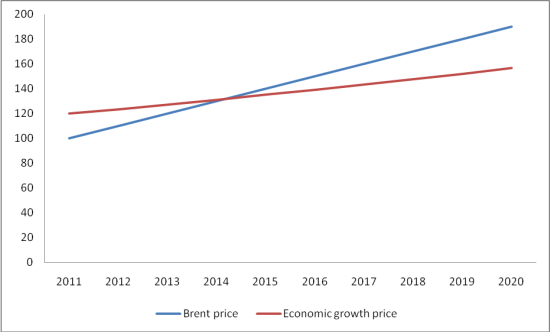

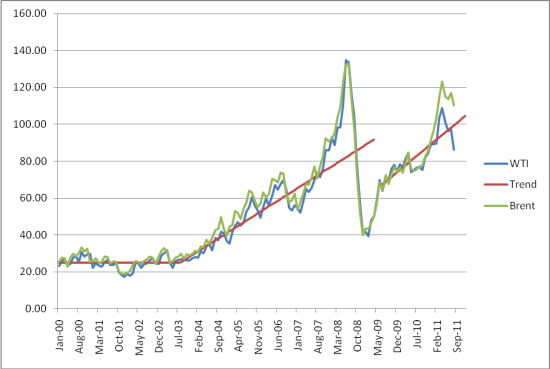

Between 2003 and 2008, oil prices rose at $10/year. Post-recession this trend ($10/year) has re-established itself (See Graph 3). Graph 2 (see below) plots an oil price rise of $10/year and a productivity gain of 3%/year (adaptive response). The graph shows the price increases, driven upwards by depletion, outrunning the adaptive responses that higher prices induce, to give a crossover in 2014. The crossover gives the timing of the economically determined Peak because an oil price is reached that is economically destructive and cannot be paid for any length of time.

Graph 2 Plots Brent oil prices rising at $10/year (blue line) and a price that allows economic growth growing at 3% year to reflect an increasing adaptive response (red line). The crossover point gives the economically determined Peak Oil when sustained growth becomes impossible.

This analysis now gives an alternative method of determining the likely timing of Peak Oil. The other method is to determine the net flows of incremental capacity (new capacity minus depletion) and to balance this against the most likely growth trajectory.

The dating of Peak Oil using this economic approach gives almost identical results to calculations based on net incremental supply (new capacity minus depletion) with both approaches showing 2014/2015 as the crunch point. This coincidence is not surprising as most of the remaining oil development projects are high cost (Deepwater, Tar sands, Arctic).

Oil prices are likely to spike in the run up to Peak Oil, whether this is reached because of geological constraints or affordability constraints. This will be economically destructive. It may have the effect of bringing the Peak forward as rapidly changing prices tend to inhibit appropriate investment, particularly if there is significant price volatility within the price trend. Some of the larger and financially stronger companies may be able to maintain investment through the cycle but the weaker ones will find this difficult.

The key adaptive response to high oil prices, at least initially, is fuel substitution. In the 1970s, around 25% of all oil went for power generation as heavy fuel oil. Currently, oil in world electric power generation is 4% and falling, having been backed out by coal, gas and nuclear generation. Similarly the use of oil for space heating (gas oil/furnace oil) is in decline and largely displaced by gas although efficiency in use and improved insulation have played their part.

Gas to liquids (GTL), Coal to liquids (CTL), Biomass to liquids (BTL) and Enhanced Oil Recovery (EOR) all have the potential to increase oil liquids supply as does Algal oil. At the moment only GTL costs are economically robust and then only if there is a guaranteed supply of low-cost gas. According to the IEA currently the lowest cost of these potential incremental supplies is CO2 EOR then GTL, other EOR, BTL and CTL.

The new challenge is, that with 70-75% of oil going into the transport sector globally and 80-85% in the US how can or will this be substituted? The radical change – moving to electrical power – is not yet fully economic and is really only applicable to surface transport. Biofuels are being actively promoted but are really only fuel extenders. In addition the food or fuel challenge has not been fully resolved. The so-called second and third generation biofuels solve the food/fuel dilemma but are not yet economic. The use of natural gas for transport in places like Pakistan, India, Brazil, Iran and other emerging economies is becoming fairly widespread. However, in all economies, any transition takes significant time and investment.

In short the ability to substitute oil-derived transport fuels, other than in the longer term, is quite limited while transport demand is growing strongly, particularly in Asia, Africa and South America. In addition there is an existing global fleet of over 800 million vehicles that run on gasoline and diesel.

High added-value uses of oil such as solvents and lubricants will almost certainly withstand higher oil prices and efficiency in use will be driven by higher prices. Petrochemicals feedstock are another high added-value use but even here there has been a notable move from using petrochemical naphtha to the Natural Gas Liquids (NGLs) ethane, propane and butane.

In short, the relatively straightforward substitution of heavy fuel oil and heating oils has already been mostly done while the hard task of substituting transport fuels has barely started.

All the indications are that adaptive responses have failed in terms of both size and speed to restrain the steady rise in oil prices seen after 2003. The only break in the steady oil price increase occurred as a result of the 2008 economic crisis and the subsequent ‘Great Recession’.

Graph 3 Shows the development of oil prices and illustrates the $10/year trend (red line)

The conclusion appears to be that:

Unless and until adaptive responses are large and fast enough to constrain the upward trend of oil prices, the primary adaptive response will be periodic economic crashes of a magnitude that depresses oil consumption and oil prices. These have the effect of shifting consumption from incumbent consumers—the advanced economies—to the new consumers in the developing economies.

This is exactly what happened in the last recession when between the start of the recession in January 2007 and its effective end in 1Q 2011 demand rose by 4.3 million b/d in the non-OECD area and fell by 4 million b/d in the OECD area.

Acknowledgement: I would like to thank Steve Kopits and Robert Hirsch for all their help and support and for valuable input to this article.

Copyright: Chris Skrebowski 19/8/2011

There's at least one missing step in that argument.

You say that $100 is required for oil states to 'break even'. Yet go back only 6 years and $30 was considered a high price for oil.

To justify that step, you'd either have to justify that spend had gone up 3 times, costs had, or that some other route had changed the finance books of the big exporters.

As it is, it sounds as if this is accountancy, not real world. Most of the production wells are the same wells, with low ongoing costs. New developments are more expensive, but even with higher despot spends, the balance sheet isn't going to have been very positive in 2004 and only break even now.

Surely a National Oil Company's books are just included in those of it's government. By definition a NOC is an extension of a government, and so when the government says it now needs $X to break even, it implies that the government spending has increased.

It's just the same as if BP suddenly started spending billions more on water coolers and pencils. They would argue that they now need the price of oil to be $X to break even. The fact that water coolers and pencils have no intrinsic input to oil production doesn't effect the companies break even value for each barrel of oil.

Real world is indeed the black sticky stuff, however the price of oil is accountancy.

Exactly. It is not just the price of getting the oil out of the ground. It is the price of pacifying the many citizens of the country who must now contend with the higher cost of imported food, and of providing other needed government programs. Unemployment rates in many of the oil exporting countries are very high. Government revenues must come from pretty much the only source of revenue that those countries have--oil revenues. So those government keep increasing their "take."

I make this same point in my post from a couple of days ago, explaining why the EIA forecasts in IEO 2011 are wrong. In that post I say:

I fear that prices to support the 'needy' producers will become seen as politically 'greedy' by struggling major importers like the USA. How long before a nationalist is elected who publicly asks 'Why is our oil under their sand/permafrost ?'

2016, most likely. ELM should be biting pretty hard by then.

The point I was getting at Gail was that if I can spot the logical disconnect between those two point, so can anyone else reading it. From a 'primer' perspective its better to provide evidence of the diversion of lots more monies over a short period of time than to get the whole dismissed as ill conceived scaremongering.

Now actually, I don't think the in-country costs, the bribes, etc. have risen anything like the degree the oil prices have. I think money is getting diverted into sovereign and other wealth funds which give a nice escape route for the country leaders once things go bad. Sure there are more baubles to placate the prols - but that's not where most of the money goes.

$30 to $120 on production that only slowly declining is a LOT of money.

Has the real (not official CPI) inflation of the USD been factored into these kinds of figures? IMHO that could add dozens of dollars onto the oil price by itself.

gary - You bring up a point that focuses on where our discussions break down. Statements regarding "what it costs to produce" oil can be taken in very different ways. Some take it to mean the actual costs to operate an existing well. Typically that is rather low. I can sell all my oil for $20/bbl and still have a positive cash flow after royalties, production taxes and operating expense. OTOH I couldn't consider drilling any new well for $20 oil. And as I've mentioned before I've seen operators produce at a small net loss for a period of months instead of shutting a well in. Various practical reasons for doing so.

Thus it's not inconsistent to say the KSA won't do a lot of drilling at the same low prices they continue to produce at. In fact, many operators try to increase their production in the face of falling prices. Even the term "break even" isn't easy to define. For most it doesn't mean selling oil for what it cost to drill and produce. Break even could be taken to mean a zero ROR. Few operators would make that investment. And then there's the problem with predicting future oil prices. There may be a KSA prospect that would generate an acceptable ROR for them at $80/bbl. So with oil above $100 they might drill...or not. Most projects take a couple of years to pay back the original investment. If the KSA is concerned that oil might fall below $80/bbl over the next year or two they might choose to preserve their capex.

An even better example: the Eagle Ford Shale in Texas. Once completed these well will flow oil naturally and thus have very low operating costs. So you can keep producing you EF wells with prices below $30/bbl. Today there about $2 billion/yr being spent to drill EF wells. But if oil was $30/bbl I can guarantee you that not one well would be drilled but not one producing well would be shut in either. New wells are only modestly profitable at $90/bbl. Existing wells are profitable at $30/bbl.

Clear as usual ROCK.

Is Eagle Ford Shale production/flow/cost similar to that of Bakken Shale? I mean similar in the mechanical sense if that is the right word. It would seem the low operating cost of the existing wells (even at much lower flows than they came in with) makes shale oil production quite a bit different animal than tar sand oil production.

I think the issue about production costs concerns incremental production only. Because depletion is relentless, it must be replaced at a rate of around 4m barrels per day every year. It is the cost of that new oil, averaged over a number of producers that effectively drives current prices (averaged over a period). Thus the demand curve for oil is typical for a non-elastic product and it indicates the market will take all the available oil at any given price within a fairly wide band. Supply on the other hand is constrained by cost as set out above. In addition in any given short period of time it seems that supply cannot increase irrespective of price - ie it has zero price elasticity of supply over a short period. It doesn't matter what the reason is for it being zero. People talk about "above ground factors" vs geology. They miss the point that because supply is constrained there is a feedback loop into human behaviour - the so called above ground factors. The war in Libya is a good example: the oil wasn't available and that impacted the market. It was still a reserve, still sitting there underground. It may as well have been on the moon. It wasn't available to the market; and increased the global price of oil.

I see our minister of finance, Wayne Swan, has been giving smug speeches extolling Europe to sort out its economic problems following acceptance of an award for being finance minister of the year. Which is ironic, because I bet he doesn't have even the vaguest clue of the concepts Chris has set out in this excellent article.

Dog - I know it sounds like a picky thing but you make my point about the terminology we use. "Production cost" is the cost to produce an existing well. Your incremental production would be from the drilling of new wells. That's the development or exploration cost...the cost to add new wells. We can drill a lot more new wells (your incremental production) with oil at $100/bbl and not so many at $30/bbl. But with oil at $30/bbl we would continue to produce all existing wells. Not a big point but it seems to be the source of some misunderstanding when folks discuss the effect of prices on oil production.

I do fully agree with you that the above ground factors will strongly over print the geologic side of PO. Not so much how much oil will be produced but who has access to it and who will be shut out by price or other factors.

A couple of factors that affect oil states' budgets over this time span are food prices, which have approximately doubled, and population. Saudi Arabia, for example has about 10% more people to feed than in 2005.

Combine those two, and it's clear that the same oil price from 6 years ago, with, as WT points out, flat to declining net exports, is not going to support the same level of gov't services/subsidies.

Hence the Arab Spring - or at least a major contributing factor to it...

Fascinating article. I had one idea for an adaptive response awhile back, but I have no idea how practical it is. If anyone would be willing to give me some feedback on it I would appreciated it.

The idea is a cross between taxis and buses. The vehicles used would probably be large vanes or shuttle buses. People who wanted to use this service would contact some kind of central control (through a website, cell phone app and/or a number they can call) and give their location along with the location they wish to reach. The central control would take this information along with the location of its vehicles (gained through some kind of GPS device) and calculate the way the vehicles can deliver the passengers to their location with the least amount of driving. I realize that this problem is similar to the traveling salesman problem, and that there is probably no easy way to solve it, but with enough computing power some kind of solution can probably be worked out even if it isn't completely optimal. The central control would convey the results of its calculation back to the vehicles (perhaps through something similar to the navigation devices many cars now have).

Something like this?

http://www.aberdeenshire.gov.uk/publictransport/a2bdialabus/index.asp

Yes, that is vary similar to what I was thinking of. I'm glad to see someone is working on it. What I was thinking of was apparently called Demand responsive transport, but the version of Demand responsive transport I was thinking of is a little different than what the wikipedia article describes. The version I was thinking of was a little more like a high tech version of Share taxi without fixed routes. It's use would be for areas that have fairly dense population like cities where people might normally use cabs or fixed route public transportation. I think that it might be possible to make a system that would have an advantage over taxis in price and over fixed route public transportation in convenience.

This system already exists in many low-income countries, in a much simpler form :

These are just collective taxis :

- taxi would wait at a starting station to have enough people to start the trip.

- if one consumer stops earlier on the trip, the taxi can then pick up another customer on the border of the road till the end of the trip.

- you can pay a premium to start the taxi for yourself only, but he will still try to pick up 1 or 2 more customers while on it's way ... :)

I've used it, it was both practical and economical.

Yes, it is a high tech version of collective taxis without the fixed or semi fixed routes. The idea is that instead of using fixed routes you use a computer to try and find the most optimal route possible.

Look up SMART JITNEY. Lots of people have commented on this over the years. Seems bloody obvious good idea to me, given cell phones and GPS. I tried to start one in my little town, got shot down by car lovers. The one I liked best was "Damn, if I didn't have my very own car, where would I keep my condoms and dope?"

Thanks for directing me to SMART JITNEY. I found the concept interesting. It seems like a good way to reduce gas consumption in a hurry using existing technology and infrastructure. The only thing that worries me is that there doesn't seem to be much in the way of incentives to motive the drivers in this system but I'm sure something could be worked out if needed. My idea was a lot less grand. What I was thinking of was something more along the lines of a business operated in conjunction with the current system.

They had that in the Philippines, I rid on them a few times. It's called trikes by the locals. They simply drove around on streets picking up people who flagged them down at random. I think a locator app with a freelance group of drivers could work.

Ideally the amount of new technology should be kept to a minimum, so if it could be done with just a cell phone app that would be great. Also the idea of freelance drivers seems good. The more I've thought about this the more I've thought that this should be run less like a taxi service and more like a dating service (minus the dating part).

What I'm picturing right now is something like EBay. EBay doesn't really sell anything. It's just a service that matches buyers up with sellers. Both buyers and sellers are EBay’s customers. Maybe this system could work the same way.

People would download the app and fill out some kind of profile page. The information on the profile page would include the usual stuff (Pictures would be mandatory I think). If they want to be a driver it would also contain a description of their vehicle, a picture and other relevant information (maybe there would be a separate profile page for each of the driver’s different vehicles). When the drivers are willing to drive they will click on something that lets the system know that they a ready and which vehicle they are in. When passengers want to go someplace they will tell the system where. For each passenger request the system will calculate the extra distance each vehicle will have to drive in order to fill the passenger’s request. The top five vehicles which have the shortest addition distance will be listed to the passenger along with the price that they will have to pay to each driver, and the time to arrival. Prices will be determined by multiplying the extra mileage the driver would have to drive times a rate the drivers will choose for themselves. The passenger will be able to view details about the drivers including ratings that other passenger assigned to them (Maybe a five star rating system) and comments. They will have a limited time to look at the information and make a decision. If they don’t make a choice in time the system will recalculate distances again. If the passengers choose an offer the offer will be transmitted to the driver who will have a chance to confirm or deny the offer within a limited time. If the driver confirms he/she will be directed to the passenger and if they deny the system will recalculate again giving the passenger a new set of options minus the driver that refused. This will continue until the passenger either gets a ride or quiets the program. After each transaction drivers and passengers will have a chance to rate each other. The business operating this would make a profit by charging some set percentage of each transaction. Honestly I think this idea is very feasible. The only thing I’m worried about is possible liability issues.

While places like the UK only let a taxi pick up one fare for one journey in some Latin American countries they can pick up other passengers on the way, though they will only do that if the direction is similar. If you want to go from B to D you may end up with another passenger from C to E but if the other wants to go from C to A then they are out of luck.

NAOM

I wonder what the laws for this type of stuff are like for where I live. If I ever wanted to try and make this idea work I suppose I would have to find out. The legal issues, to me, seem like the biggest hindrance. I think the technology could work out. If you had enough vehicles using this system you would probably always have at least one which was going in the right direction to make picking up the passenger going from C to A possible.

Here's one approach to the technology side: http://openvrp.com/

Now take your idea and instead of having drivers, use autonomous vehicles like Google and others are working on, and there is the potential to significantly improve transportation efficiency while largely maintaining the convenience of private vehicle ownership.

In my opinion (which I have not researched and cannot back up) having human drivers in each vehicle would make the cost of using such a system more expensive than the current cost of owning/using a private vehicle.

It depends on individual circumstances. Consumer advocacy organisations often report that for many people, the cost of owning and running their own vehicle is significantly more that using taxis in daily life, and renting a car for longer trips. Depreciation and finance costs are the big-ticket items.

Driverless taxis will be significantly cheaper than driver-operated for the single-passenger use case. Shared taxis (as discussed above) often have eight or more passengers and the cost saving is correspondingly less.

Eliminating the cost of the driver will make it possible to extend public transport to many places and times where it is now too costly because of low patronage.

Thanks for the link. It could prove very useful. The creation of autonomous vehicles would be a revolutionary technology. It would probably make the group that invented it a lot of money, while at the same time making many borderline transportation ideas financially feasible.

Already done. In South Africa and many places in the West Indies the minivan is a critically important element in the transport mix. Nominally built for 10-16 people these vehicles can often be seen carrying double that number with remarkably cheap fares. A trip of around 6miles was less than $2 in St Lucia. Minimal overheads, minimal safety standards, low barriers to entry (a cheap second hand van) and a robust approach to defending your route seem to be the main ingredients.

Thanks for the info. I learned a lot from the people on the thread.

Following is a chart showing Global Net Exports* (GNE) and what we define as Available Net Exports (ANE). ANE = GNE less Chindia's combined net oil imports. At the 2005 to 2010 rate of increase in Chindia's net imports, as a percentage of GNE, Chindia would consume 100% of GNE in about 20 years.

ANE fell at an average volumetric rate of about one mbpd (million barrels per day) per year from 2005 to 2010, from about 40 mbpd in 2005 to about 35 mbpd in 2010.

*Top 33 net oil exporters in 2005, those with 100,000 bpd or more of net exports in 2005 (BP + Minor EIA data, total petroleum liquids). Note that 21 of the top 33 net oil exporters showed net export declines from 2005 to 2010.

Chris and Jeff's analyses support each other. As oil becomes more expensive due to extraction and processing price increases, many exporting nations continue to placate their populations with oil price subsidies, which induces an increase in internal consumption, reducing exports, which in turn promotes scarcity, which in turn raises oil prices.

When the price reaches a level that inhibits economic growth, recession occurs, driving the price down. After efforts are made to establish a 'recovery', renewed economic activity again results in high oil prices, starting the cycle all over again. Since there will never be a return to low oil prices during periods of sustained economic growth, the chance of there every being sustained economic growth is approaching zero.

There will likely be a series of politicians promising a return to the glory days of continually expanding GDP, and too often gullible voters will give them the chance to make futile, damaging policy, porpoising slowly downward between mirage recoveries and progressively deeper recessions/depressions.

Peak oil has never been about 'running out', but the global production peak. ELM and economy-draining prices are becoming a clearer part of that picture. Kudos to Chris and Euan for sharing this article.

One of the charts we are working on is a rate of change chart for production, consumption and net exports for the top 33 net exporters, from 2005 to 2010. The highest observed net export decline rate for this time period was in Vietnam. Following are Vietnam's numbers from 2004 (their recent production peak) to 2010:

2004:

Production: 430,000 bpd

Consumption: 260,000 bpd

Net Exports: 170,000 bpd

2010:

Production: 370,000 bpd (down 14%)

Consumption: 340,000 bpd (up 31%)

Net Exports: 30,000 bpd (down 83%)

This is a classic case of "Net Export Math," and this, in my humble opinion, is the single biggest factor that will continue to affect global economies in future years, but it is basically almost invisible in the MSM.

From latest "ASPO briefs"

I suppose those Vietnam numbers are all liquids because they are a little high according to the EIA. The EIA has Vietnam production 403,000 bpd in 2004 and 318,000 bp/d in 2010, a drop of 21 percent. JODI has Vietnam production 409,000 bp/d in 2010 and 324,000 in 2010, also a drop of 21 percent.

Not to worry though: UPDATE 1-Vietnam 2012 oil output to rise 6.7 pct y/y -paper

16 million tons works out to be 116,800,000 barrels of oil or 320,000 barrels per day. But that would only get production back to 2010 levels, up from a considerable drop they are experiencing this year. June production, according to the EIA, was 283,000 bp/d.

Ron P.

I was using the BP data base (total petroleum liquids).

I think that you missed the key part of the article that you linked to (emphasis added): " . . . drawing more from fields both offshore and overseas. . . "

They are specifically counting on increased production from properties owned by Vietnam in Russia.

Yeah, I missed that, sorry. Looks like Vietnam will be a net importer, perhaps as early as this year or next year for sure, importing oil from Russia which they count as theirs.

Ron P.

Jeff, as you've mentioned before, there are different types of exporters, and they appear to be roughly based on a matrix of the two following categories (though there are certainly gradients and outliers);

Production costs:

- Low production cost: As prices rise to encompass hard-to-extract/process resources (such as tar sands, heavy/sour, deep water, etc), the margin of 'profit' realized by these countries allow them great latitude to subsidize energy costs to the citizenry (or

- High production cost: The margin is so low that

Ownership:

- National: The government owns (directly or indirectly) the production assets, reaping the revenue gains

- Private: Private oil companies acquire leases and assume all other costs/benefits from production

How much an exporting country increases its internal consumption varies with respect to these parameters. For example, a low production cost country with a national oil company will be able to subsidize energy prices to its citizens to a much higher degree than a high production cost country where the oil profits are realized by private companies.

Thoughts?

The bottom line to me is that so far at least I haven't seen any examples of any oil exporting countries (at least those with a material amount of consumption) showing a multiyear production decline, that have cut their consumption sufficiently to pull their net export decline rate above their production decline rate. Denmark is a case in point. From 2005 to 2010, their production fell at 8.3%/year, and they cut their consumption at 1.4%/year, but their net oil exports fell at 19.5%/year. They would have had to cut consumption at 8.3%/year to keep their net export decline rate down to 8.3%/year.

Exactly! I wish I could get on CNBC and scream that in everyone's ear. I wish I could make every politician understand that very simple fact. Then they would understand it's all because of peak oil! They can trot out all liquids numbers and tell us that we have not reached peak oil but it should be obvious even to a fool that petroleum exports are well past peak. And exports are what we have. We cannot consume what Saudi Arabia produces and then consumes themselves.

Peak oil is in the rear view mirror. It is the end of growth and the beginning of collapse.

Ron P.

I think some do understand it. They just do not dare say it for politcal reasons which have been discussed many times on TOD.

A politician's number one priority is re-election since not being re-elected means game over. Peak oil is a downer issue with no solutions acceptable to the public.

It is the classical lose-lose issue. So politicians can only dance around it and never confront it openly.

If they did they would be hit with PR like that surrounding Yergin's book promotion media blitz.

The big lie that people want to believe sells. The truth is a dog nobody wants. And you know what happens to it:

http://www.youtube.com/watch?v=03jOl1xG084

That video made me sad.

Ummm yeah, me too.

That said, that's business. It sounds cold and callous, but it's the truth. Who's going to pay to feed all those animals? Like they said, spay and neuter your pets.

Now, if only we could do the same to humans before TSHTF and we see ourselves being turned into Soylent Green. Remember, no one will cry about that either, because I'm pretty sure the governments of the day will try their damnedest to ensure that no information leaks out about their new source of whatever they call it (aka Soylent Green). Sounds ludicrous I know, but it has happened before (cue Nazi Germany) and there is some evidence of it happening now (e.g. Chinese government harvesting the organs of Falun Gong members).

Sigh...

Now I'm even sadder.

We're veeting from the article topic, so let's stop this thread here.

Best,

K.

" The masses have never thirsted after truth. They turn aside from evidence that is not to their taste, preferring to deify error if error seduce them. Whoever can supply them with illusions is easily their master; whoever attempts to destroy their illusions is always their victim"

"The Crowd" A study of the popular Mind

Guatave le Bon 1896

Nice quote, and oh so true today. Also reminds me of Ibsen's An Enemy of the People (1882).

This supports an idea I have been looking at recently. The greatest single factor inhibiting adaptation and adjustment of large scale energy use in the US is the entrenched interests, who have 'captive' politicians with guaranteed seats in Congress. It is common and even fashionable to blame the shortcomings and failings of society on our 'elected leaders' but in fact they have little choice in the matter either. A revolution is needed, certainly; the first thing we have to do is free our elected officials. They are being held, mostly against their will and certainly against their better judgment, by the interests that control the electoral process. Until this imbalance of power is addressed, real policy change is not possible.

Exactly.

Though I suspect that if they did understand it it would provide the justification for "drill baby drill"- except this time there would be a chorus from the Democratic side as well.

Yes, but growth does not suddenly increase. It's like getting momentum from a very long, loaded train, it takes time. And just as the economy begins to get some momentum oil price rises again, and each time we do this dance the overall economy tapers down more. It can only take so much tapering before it topples.

Unfortunately there needs to be a price set for oil that allows for growth, but also provides suppliers a profit. But that gets into price fixing which no one wants, and it also restricts price, which will also at some point restrict exploration due to lowering eroei.

It's a pickle called peak oil.

It's like getting momentum from a very long, loaded train, it takes time. And just as the economy begins to get some momentum oil price rises again, and each time we do this dance the overall economy tapers down more.

To extend your metaphor in a physics expression, it's as if each pull ("investment")adds more weight/inertia (debt) to the train (economy), until the weight is too much for the engine (commerce) to start the train moving again.

Two opposite scenarios, only one of which can come to pass. Will Stewart above:

Chris Skrebowski, just above the fold:

Without a doubt, in my opinion anyway, the Stewart quote is the one that is most likely. The reason is that if oil prices fall back to levels that do not inhibit growth then there will be a reduction in oil production until oil prices rise to the level that does inhibit economic growth.

Not just by OPEC but by non-OPEC nations as well. The marginal barrel of oil cost to produce, from Chris' own graph, about $80 a barrel. That is well above the level that can support sustained economic growth.

Of course Chris does not state that this is possible, only that this is what the corollary is, or what the mathematics prove. And indeed, if it were possible to maintain high production at prices below $50 a barrel, then we could have renewed economic growth. The only problem is, given the falling world oil exports and the rising cost of the marginal barrel of oil, this is an impossibility. Well, what I mean to say is that if oil prices drop below $50 a barrel we will be in a severe recession, economic shrinkage, not growth.

Sooooo.... sustained economic growth will not return. Well, not according to my math anyway.

Ron P.

I disagree with much of the analysis posted in this thread. I believe that it was not the high prices itself which caused the economic problems--but instead the speed of the price changes.

While almost everyone here would agree that if gasoline reached $8/gallon in the U.S. in a couple years it would cause a major recession; note that many European countries already have $8/gallon gasoline--and this did NOT cause a recession. This is because the price changed slowly enough in Europe so that people had time to adapt.

Yes I often wonder this myself...can everything adjust accordingly? Do we have the political will to make the things that need to happen? They always told us that capitalism was the most efficient system but capitalism cannot adjust to long term trends.I remember finance classes in college and the mantra was always maximize shareholder wealth----very short term thinking.Peak oil is not even allowed to be discussed in the mainstream without making it sound like a bunch of crackpots. I believe Nicole Foss has done a very good explanation of this on the Automatic earth...I hope she is wrong...just as I hope peak oil is wrong but as time marches on they both seem to be spot on. I have young kids and fear for their future.

How much of the European price is accounted for by taxes?

I can pay a low gas price and pay for my own health insurance or pay a high gas price and have the government provide me with health care. The net consumer out of pocket could be the same.

Actually, the net consumer out-of-pocket would heavily favor Europeans, who on average spend 50-65% less than their U.S. counterparts, and for better outcomes. Additionally, Europeans also benefit from a higher cost at the pump in various ways: greater economic incentives resulting in greater average fuel efficiency in the EU vs. U.S., greater incentive to develop alternative energy and become less F.F. dependent than the U.S., a consumer mindset that favors energy thrift vs. waste, etc.

For better outcomes? Maybe some, but in my travels to Eastern Europe, I always ran into folks from Western Europe seeking medical treatment. Further, I would take my standard of living to anything Europe has to offer for my same level of education. I have to admit that 6 weeks of vacation sounds nice.

Hopefully, we avoid what is happening in the PIGS.

Perhaps you're mistaking "square feet of home" for "liveability of home". Is your suburban estate with its heated swimming pool and 1 hour commute really a better way of life than a city highrise with a nice pool and spa, walking distance to shopping and subway? I suppose it might be if guns are your hobby?

I also can hardly help noting that maintaining a more equitable income system (gini index) also means that downtown areas are very livable for everyone. Compare the possibility of a downtown condo in Toronto (rational simple living choice) to one in Detroit (bodyguard phalanx required).

Finally, I dont consider it a "nicer lifestyle" to have to ignore the medical woes of the poorest third of my society, even if I personally get medical care in a five-star hotel. Personal taste I guess. On that level, most every other OECD country has better overall population average medical outcomes than the US.

Finally, I dont consider it a "nicer lifestyle" to have to ignore the medical woes of the poorest third of my society, even if I personally get medical care in a five-star hotel

It's actually less fair than that here. The poorest portion of US society often has access to Medicaid or Medicare (of course the poorest people on social security can't afford the premiums for part B of Medicare-that is another can of worms), but figuring just who qualifies for that is aiming at a moving target.

The ones getting really jammed are the working poor, often working two or three part or full time jobs with no benefits. This population segment has been steadily increasing as the lower middle class has been all but obliterated.

The fairly low wage group just above the uninsured often have such high deductibles in their health insurance plans ($10,000 per family $5000 per person or higher) that they are barely better off than the uninsured unless they are unfortunate enough to get laid up by something really serious. A truly black comedy if it weren't so tragic. The health care bill that included no public option will hardly fix all that.

Thanks for pointing that out. PPACA (aka "Obamacare") has no meaningful provisions to:

--enact Medicare-style universal coverage to cover all U.S. citizens

--allow health insurance competition across state lines

--allow the government to bulk negotiate drug prices, or legalize reimportation of prescription drugs from Canada or Europe

--provide meaningful incentives for private insurers to reduce adverse selection, fraud, bureacratic waste or treatment avoidance

Nearly reform-free healthcare reform. Not bad for a 1,900 page bill!

The US healthcare system is only "broken" if you are not one of the people getting rich off it. It became a for-profit industry in the 1980s and it has done its intended job very well since then. The public just does not understand that its intended job is to make money off them, not keep them healthy.

A good friend of mine just received his bill after a 5 week stay in the hospital... $700,000.00 and they still don't know what was wrong with him.

His insurance will only cover $300,000.00. Lucky for him he is Italian American and can now go to Italy for free health care.

It seems to me the health care system in the US isn't broken, it's just doing exactly what it was designed to do!

Not entirely by coincidence I recently ended a five year relationship with a woman who works in this very hospital's corporate finance department, I think the fact, that I myself, don't have health insurance was beginning to bother her! That and the fact that I tried to make her Peak Oil aware, big mistake...

I've travelled pretty widely in Western Europe (though not Eastern), and have yet to find *one* Western European who would prefer a U.S. style for profit healthcare system to the dominant systems in place over there - cradle-to-grave universal single-payer coverage for all citizens. Most have been horrified at the prospect, and polls regularly confirm this observation.

http://www.gallup.com/poll/122393/oecd-countries-universal-healthcare-ge...

http://www.guardian.co.uk/news/datablog/2010/mar/22/us-healthcare-bill-r...

Nonethless, Fox News, Glenn Beck, Rush Limbaugh, etc. continue to spread disinformation about the "horrors" of European universal single payer healthcare to their perpetually terrified flock, who absorb it unquestioningly, even while issuing bizzarely incongruous retorts like "get your government hands off my Medicare!"

And for the record, the financial crisis in the PIIGS countries was a result of them following Wall Street's lead in blowing massive international mortgage debt and derivatives bubbles, not the result of providing high quality affordable healthcare to their citizens.

Hello,

There is no doubt that rapid growth in total energy expenditures in general slows economic growth (for net importers of oil/energy) for non-energy sectors as expressed by GDP (Gross Domestic Product).

Through the last 2 - 3 decades economic growth was "supercharged" with year over year growth in total debt as illustrated for the US in the chart below.

Similar developments as illustrated in the chart above are also found in many other OECD economies, like in UK as illustrated in the chart below.

For some economies total annual debt growth was above 10 % of GDP!

This debt fueled growth was clearly not sustainable and caused the financial crisis in 2008.

Debt growth temporarily allowed compensating for (and also partially caused) the compounding effects from growth in energy prices and energy consumption.

As I see it, many countries are now at a (or has passed) the point where the economic participants (private, corporate, public) has reached debt saturation. The emerging slow down (and possible reversal) in debt growth will in my opinion also affect near future demand and prices for oil and other energy.

Change in total debt growth will in my opinion be the dominant force for the near term economic development (GDP) and thus demand and price support for oil/energy prices.

Present high oil (and energy) prices also slows GDP development and may at some point in the near future become subject to the gravity from temporarily declining demand that feeds into weaker oil/energy prices.

Structural high unemployment, declining house prices, uncertainty in the stock markets will all put additional strains on the economies as output and the tax base will shrink and also reduce demand for oil/energy.

Lowered oil/energy prices could in the near future produce false signals to the economic participants as this obscures the fact that many new discoveries (fields)/developments now require a break-even oil price of $60 - 70/bbl to become economic.

As I see our future predicament;

The oil flow now required for real economic growth results in an oil price most OECD economies cannot sustain.

The oil price now required for economic growth in most OECD economies results in an oil flow that does not ensure economic growth.

Rune,

what happened to the mortgage and credit growth in 2009 and 2010 on your chart? Am reading it correctly that there was zero growth in both categories- i.e. yoy they neither increased nor decreased?

crazyv,

From what I have seen they decreased either by down payments or defaults. The thing about debt retirement is that it is not counted in GDP figures.

Growth of debt entering the economy increases economic activity.

What happened was that the private sector went into debt saturation in 2008 and the public sector then took upon itself more debt to maintain economic activity.

Rune L

One other minor quibble (besides the fact that the U.S. chart does not show *negative* debt growth --default or repayment-- and the Euro chart does) is that the Euro chart displays government deficit spending in red and consumer mortgage debt as blue --the exact reverse of the U.S. chart. Makes direct comparison a little confusing for the casual reader.

HARM thanks,

I just did not have the time to harmonize the charts with respect to colors (one of them was already on the server).

Harmonizing will be done as time allows.

Present high oil (and energy) prices also slows GDP development

Not all energy is oil, and with high consumer prices, ie considerably >$4/gallon, higher fuel efficient replacement of vehicles and substitution (EV) will reduce the sensitivity of economies to oil price.

The US had economic growth 100 years ago with much higher real energy prices. It takes time to adapt.

Neil,

I wrote;

For the US around 60 % of total energy expenditures are now on petroleum.

100 years ago the US did not import much of its energy consumption.

That depends on future developments in the oil price and oil imports and consumers present and future ability to afford alternative vehicles, like EVs.

Energy wise the US is in a relative fortunate position.

For ease of illustration; say that the US now consumes around 5 Gb/a of crude oil, of which 3 Gb/a is imported and 2 Gb/a is from indigenous production.

A $10/bbl increase in the oil price now should thus result in $10 Billion reduction of US GDP, that is 0,0006 %.

Rune L

That's not the important difference. The important differences are that 100 years ago, real energy prices were falling and population growth was higher.

Rune and Neil, you're both making an unfounded assumption here. There's no reason to think that EVs will be a drop-in, one-for-one replacement for fossil-fuelled ICEVs. The market doesn't work like that over the long run.

The true long run substitutes for fossil-fuel powered private motor vehicles are public transport - buses, metros, and the shared taxis that Binder asks about above; more efficiency of use (e.g. car pooling, shared ownership, more efficient goods transport); and - the biggie - changing how we work and live: telecommuting, shopping over the internet for food, clothing, furnishings, entertainment, medical consultations, etc., and living closer to the places we want to visit frequently.

There will be privately owned and used automobiles, but they won't be the normal daily transport for most people. We can and will make the changes necessary to cope with declining availability of oil. It would be a lot less painful for most people if governments proactively managed the change, but I guess that's asking for the impossible.

..."and living closer to the places we want to visit frequently." How about just living closer to where we work. That one change for me meant an 85% reduction in gasoline consumption, and the bonus was a small fuel efficient apartment (essentially a large closet, but for now...it will have to do). I now spend far more on "information services" than I do for energy. No high tech, no hybrids, no electrics, but an 85% drop in consumption. We use a lot of oil not because we "must" but because it is still readily available and cheap.

RC

Rc - OK in theory but details vary a lot. We have a nice small townhome with a community pool in the burgs. A place 1/3 it's size close to my office would cost 2X to 3X what we paid. Houston has had a d/t resurgence but very pricey. A small 2 BR loft will cost the same as a McMansion 5X as large with its own pool. And it takes me 35 minutes to commute and burn up about $6 in fuel daily. I could take a commuter bus but that would triple my commute time and cost a good bit more.

Of course if fuel prices double it runs my costs up but not anywhere close to justify paying an extra $150,000+ for a new smaller home. OTOH I'm in a much better place than the typical Houston worker. And that's not by accident. We bought a place in the industrial end of town...not the the pretty burgs that are a 3-4 hour r/t from downtown. And across the highway from the largest refinery in the western hemisphere. But I like the looks of a refinery especially at night...reminds me of Christmas lights. LOL.

There will be privately owned and used automobiles, but they won't be the normal daily transport for most people.

When the price of oil is say X10 more expensive than now, why would large numbers of ICE owners not replace them with PHEV and EV's?

The true long run substitutes for fossil-fuel powered private motor vehicles are public transport

Gregvp

Expanding public transport is a very long term solution, much longer than the replacement time of todays fleet of low mpg ICE vehicles.

Moving existing suburban homes to locations convenient for public transport is even a longer term proposition.

Buses and shared taxi's will eventually have to be powered by electric. It will come down to choice between using an electric power public transport and electric powered private vehicle. I believe most will be able to afford private EV transport(either new or used) but may choose public if they live and work in a location with easy access to this. For the rest it may mean relocating work or home, walking/ bicycling,or keeping a ICE vehicle but using to just to get to the nearest public transport stop.

When the price of oil is say X10 more expensive than now, why would large numbers of ICE owners not replace them with PHEV and EV's?

Because they won't need or want any vehicle. The structural changes in urban form, living patterns, and preferences, coupled with changes to public transport, will make owning your own vehicle appear irrational. This is the long run that we're talking about here.

Expanding public transport is a very long term solution, much longer than the replacement time of todays fleet of low mpg ICE vehicles.

Really? It takes much longer to make and use mini-buses and full size buses than SUVs? Perhaps, if political pressure groups successfully obstruct the market response.

Incidentally, the vehicle fleet turnover rate seems to be decreasing. Either that, or the fleet's size is decreasing already.

It will come down to choice between using an electric power public transport and electric powered private vehicle.

For the remaining times and distances when transportation is required, yes, perhaps, although CNG powered vehicles are cheaper than electric where the market is less distorted than in the USA.

But I was trying to say that adaptations to reduce the number of trips made and the distance per trip (the actions you list in your last sentence being some of the ways this will occur) will in the long run have a big -- albeit invisible and therefore under-appreciated -- long run effect. Driving 15,000 miles per year in an ICEV will not be substituted by driving or riding 15,000 miles per year in an EV, public or private.

The change is already starting: the annual total of vehicle miles travelled is falling. I expect it to continue to fall.

I believe most will be able to afford private EV transport(either new or used)

You're more optimistic than I. Labour is available in abundance and seems likely to stay that way for the next decade at least, thanks to the decreasing cost of international communications and increasing capital mobility. Without government intervention, real wages will continue to decline for the majority.

Even if EVs become affordable to most, increasing numbers of people appear to be choosing to do without.

gregvp,

The major cost of manufacturing an ICE or EV is the cost of labor, the value of steel rubber lithium is <10% of the cost. If real wages in US continue to decline cars and houses will become less expensive. Energy, food, with low labor content may become relatively more expensive.

Even if EVs become affordable to most, increasing numbers of people appear to be choosing to do without.

With >200 million vehicles for a population of 300 million not many are doing without, even if total VMT has declined, this would be expected with rising fuel prices. EV costs per VMT are much lower than ICE costs/VMT.

The expensive and long term mass transit are rail/trams, mini-buses are really large taxis, how is this different from the people mover SUV's?

Your math (0.0006%) seems off by a few orders of magnitude! (did you mix up fraction and percent? and forget that 3Gb and not 1Gb/a is imported)? I calculate 0.2% for a 10$ increase per barrel.

Assuming the US now has

2 Gb/a in indigenous production and a price increase of $10/Bbl results in GDP growth of $20 Billion.

3 Gb/a in imports and a price increase of $10/Bbl results in GDP shrinks of $30 Billion.

Net Effect a GDP shrinkage of $10 Billion.

US GDP around $15 000 Billion.

(Negative effect on US GDP from a $10/Bbl increase (100% X 10)/15 000 = 0,066 %.

Hope I got it right this time. ;-)

Energy conversion efficiency is a form of productivity. Increasing productivity was by far the main source of economic growth. Productivity growth has slowed for decades because the potential has been exhausted. In transportation we went from horses at 5% efficiency to steam locomotives at the slightly higher efficiency, but with rails that absorbed over 90% less power than a wagon road. Then we replaced the inefficient steam locomotives with diesel engines that are 6 or more times efficient than steam engines. Perhaps we can get a few more percentage points efficiency, but it will never be the 60 or more fold efficiency increase of the last 160 years (2.5% per year in this example). Percentage wise, the greatest improvement came with the railroad.

Electrical generation is a similar story. The change from reciprocating engines to turbines in the 1910s and the rise of large central generating stations was the peak in electricity productivity growth. This created a revolution in industry with the assembly line and mass production.

Electric motors are 3x as efficient as gasoline engines.

Wind turbines have inefficiencies in conversion, but no one counts that, because the fuel is free. We just count the joules in the electricity, which can be used much more efficiently than those used in thermal engines.

The average personal vehicle in the US gets 21 MPG: the Prius gets 50, the plugin Prius gets 85, the Volt gets about 200, and the Leaf gets infinite (and the last two get about 100 MPG equivalent, if you count the electricity).

Housing can go PassivHaus, and use zero net energy - that's pretty efficient.

Lots of room.

Rune,

I love the debt graphs. Debt concerns will probably rule the roost for a long time. Lack of oil to fuel growth will only aggravate that.

The natural gas markets in the U.S. have been sending false signals for a couple of years in much the same way you are anticipating oil may in the future. I don't know what will happen with natural gas companies (CHK is good example) but they haven't gone bankrupt, yet. It will be interesting to see oil companies profit fall and their influence wane.

I don't see much wrong with this analysis. It does however give rise to a further frightening prospect.

If a producer like Russia needs $120 a barrel next year and paying that collapses the consumer economies that need that oil, then is there not the potential for a simultaneous runaway collapse of both the producer and the consumer's economies?

For the consumers; they cannot afford to pay prices like $120 per barrel, so they will buy significantly less which will collapse their economy. They will then have even less to spend, so will buy less oil, which then turns into a fast and ugly downward spiral to a low energy state.

The reduced spend of the consumer promptly cuts the producer's income; the producer's only internally-sensible response can be to increase the price of what little it sells to sustain its internal functions. In the face of market resistance its only alternative to increasing the price per barrel is to drastically drop the price to try and sell more oil, but that cannot last as it would be selling at a loss (if the oil sale price is mostly tied to production costs) or it would be selling at a price that made it impossible to sustain its own economy or social order (if the sale price is mostly driven by sociopolitical needs). It will be a mix of these, of course, but the result is the same. Reduced demand increases the real price per unit produced which increases the gap between what the producer needs and the consumer can pay.

The market will go out like somebody has turned off the switch. Both the consumer's and the producer's economies go into a downward spiral.

Never again will the consumer be able to pay the cost of oil, and never again will the producer produce viable quantities of oil at a price even it can afford. Re-starting will be just too hard.

And we are talking about 2012 here, not some notional time in the far distant future. A grim picture indeed.

The mechanism to fiddle with the difference in value of the oil being produced (high) and the value of the things being produced with it (not high enough to pay for the oil) is the currency manipulation currently underway by lots of governments. When losses are incurred by huge banks from unpayable debts, just shovel in money and voila, situation is fixed for a while. Also lots of other ways governments can keep the game going----it is their job after all. And the people who work in the "oil patch" need food and clothes as much as anybody, inflated currency is better than none at all...

Of course, noone can beat EROI, noone can really solve the problem....but it can be maneuvered and manipulated at the crumbling margins and at the powerful center for a long time.

The problem is eventually the currency that isn't worth anything....

But starving people with no means to support themselves ( and in the highly developed cities we have built for ourselves today that means billions) will take any currency, even one that has almost zero value and buy what they can.

So the collapse could be very long and drawn out, much longer than we would expect. Decades of no growth....the world will gradually look more and more like the past---a slow and quite place--- and subsequent generations won't even understand the term "economic growth" or think about such a concept.

I can already see it happening here in the small city in Western Japan where I live. No more major construction of any kind. Incrementally more empty buildings. Basically oil-based economic activity freezes up. If you can find a backwater slow kind of forgotten place where nothing much was happening anyway I think things might be easier in such a place.

I like situations reduced to their simplist terms, and that about sizes it up pi. The rest is just a bunch of fancy fiscal footwork in order to try and somehow make up for the fact energy price input is higher than the system was gamed for or at minimum got spoiled on.

I never see the price of oil and other commodities discussed in the terms that make it possible to understand in non mathematical terms why prices can swing so wildly.

Bear with me if you will, thru an example that might seem tedious.

The figures given are for illustrative purposes only , but this is how a market REALLY works.

Suppose you want a bag of my nice apples, priced at your favorite market at three pounds for 3.99.

The store manager does not give a damn whether you buy apples, or any other particular item, so long as you are in his store buying from him.He must have apples, in reasonable quantity, quality, and variety at reasonable prices, however, as if he doesn't, you might just start shopping elsewhere.

So he really evaluates his apple stock, once this basic requirement is met, on the terms of gross profit per unit of sales and storage space.If apples are generating a good income for him, a better income than some other item , he will increase the amount of space for apples;or reduce it, vice versa.

But he MUST MAINTAIN the margin, or more accurately , an acceptable margin, between his selling price and his INSTORE purchase cost.

Now the CONSUMER sets the price of apples; you as a consumer balance you desire for apples with your income, and your desires for other fruits and foods.You can spend your "apple money " on anything from asparagus to zucchini,or even on things not edible. You do without, you substitute other fruit, or you gorge on apples as your tastes and circumstances dictate.

So you, while holding hands with the wonderful invisible hand of the market, determine the price of apples, which varies for many reasons sach as the annual crop , the time of year, the price of other fruits, your income, etc.

But thru it all, the store manager does not really give a damn about the actual price per pound.HIS concern is the SPREAD between his instore cost, and the actual price.He will make just as much money on apples purchased at fifty five cents and sold at 1.00 as he will on apples purchased at thirty cents and sold at seventy five.

He lives and dies by and for thatforty five cent SPREAD.

If the market says apples go down to 90 cents, he will only pay forty five cents.

The trucker who delivers the apples doesn't give a damn about apple prices either-he lives and dies for the SPREAD between his costs and his revenue.He is most emphatically not going to deliver a load of thirty cent apples any cheaper than a load of fifty cent apples.He must take in a couple of dollars per mile and stay busy to stay in business.

So if he hauls a load from a Roanoke area cold storage to a DC area market, it costs five hundred bucks or so.That expense is necessarily deducted from the price recieved by the cold storage operator selling the apples.

He must earn a certain amount per square foot per month to stay in business too.He is another guy who does not give a damn about the price of apples as such-he only cares about getting his markup.If the price he can get is low, then he simply and necessarily takes the difference out of the check he cuts me-the grower.

If we cannot reduce our production expenses enough to maintain an adequate margin between costs and revenue, we go out of business.