Tech Talk: A Review of North American Future Oil Production

Posted by Heading Out on November 14, 2011 - 4:18pm

This is a good point to recap the intent of the current series of Tech Talks that appear here on Sundays. Internally, this marks the end of the segment that has dealt with North American oil and natural gas production. The series is not an in-depth review of individual fields but rather seeks to paint a broad background against which to judge the realities of the coming changes in the global supply/demand balance. More detailed discussions are provided by the excellent analysis of such folks as Jean Laherrère, who is even now examining in more detail the production records from the wells in the deep waters of the Gulf of Mexico.

Perhaps more critically, it comes when there are increasing indications that the investment being placed on renewable energy around the world as a replacement for fossil and nuclear power generation might not be adequate to meet the need. For example, this week the British Institution of Mechanical Engineers has pointed out to the Scottish Parliament that their renewable targets for 20% total energy and 100% of electricity production by 2020

did not appear to be supported by a rigorous engineering analysis of what is physically required to achieve a successful outcome in the timescale available.

It is relatively easy for politicians to promise that energy supply is adequate into the foreseeable future. Euan Mearns, for example, has repeatedly written and guest hosted articles on The Oil Drum which show that supply requires infrastructure and planning over many years, without which (and the absence is evident) those promises become not only unrealistic, but also unattainable.

Just as I wrote this, the White House announced that the decision on the Keystone pipeline would be postponed until after the election next year. In a sense the Administration view echoes the opinion of one of those opposed to the pipeline:

“It’s not like we’ll have an oil shortage,” said Mark Lewis, a partner at the law firm Bracewell & Giuliani who specializes in oil and gas pipelines. “We’ll continue to get product from the sources we get product from.”

If Canadian tar-sands oil moves to Asia, Lewis said, then the U.S. would just continue getting its oil from regions like the Middle East. And the Canadian oil sands would most likely still be developed, with that product entering the same global market.

This series is testing the truth of those remarks and that opinion by looking at the realities of future production and the oilfields that it will come from. As mentioned above, this began with a look at the resources of North America, and it is time to review what was found.

UPDATE The new figures for the Alaskan pipeline were posted and have been added at the end of the post.

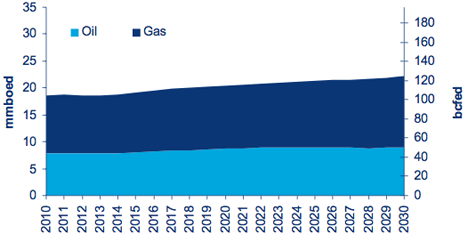

When this series began last April it set out to look at the potential future changes in the North American oil and natural gas supply. There were three different parts to that supply. The first is the historic oil, that coming from existing wells and fields, often coming from stripper wells around the country. Then there were the supplies from fields that are currently being developed and where production is continuing to rise, such as in the Bakken fields of North Dakota and Montana. And then there is the potential that will come from finding and developing new fields in the relatively near term. Perhaps as an indication of my own “Oops” moment, I used the Energy Plan proposed by Governor Perry to illustrate the potential future additional fossil fuel that might be available over the next two decades. That was very similar in promises to a Wood MacKenzie Report prepared for API, and released in September. To give my comments on those projections, I will look first at the summary of projected increase in oil production from that report. This is divided into two parts, the first assumes that current policies continue, and it sees energy supply growing as follows:

The plot shows an increase in oil production from 2010 to 2030 of some 1.2 mbd, which in the overall scheme of things is not really that much change from the present over the twenty year time interval (0.7% per year). Natural gas, on the other hand, is expected to rise some 14.4 bcf/day (1.2% per year), which is a little more impressive.

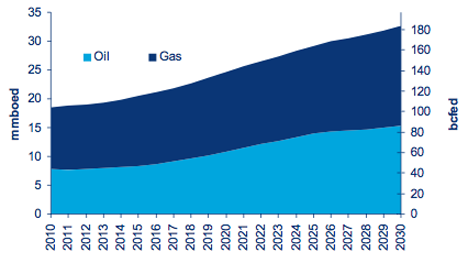

However, if all the wishes of the industry were to come to pass, (the development policy case) then Wood Mackenzie sees considerable potential for supply growth.

In that developed condition, Wood Mackenzie sees oil production increasing 7.6 mbd to 15.4 mbd by 2030, while natural gas production rises by 36.8 bcf/day to 96.9 bcf/day.

The first concern that I have with these plots is that of the declining reserve. In previous posts I have discussed various estimates for the decline in production that occurs in existing wells over time. This occurs with both oil and natural gas wells, and changes with rock type, well type and other factors. For example a recent post by Fractracker on the performance of 756 Marcellus wells notes that horizontal gas wells declined an average of 39% in the last year, while vertical wells declined 47.6%, though those numbers do not reflect wells that were closed because they were no longer producing (16.7% of the horizontal wells and 6.9% of the vertical wells). Figures from other gas shales have reported decline rates in the Haynesville, for example, of 85%. In conventional oil wells (and reservoirs such as the Bakken are, for this discussion, considered as unconventional) the decline rates now lie above 5% . What this means for US production is that, just to stay even, the industry has to add at least 360,000 bd of new production each year, to maintain a roughly 7.2 mbd level of total oil production. (and that is likely to be, at best, the average gain in production over the next ten years from the Bakken and Niobrara combined).

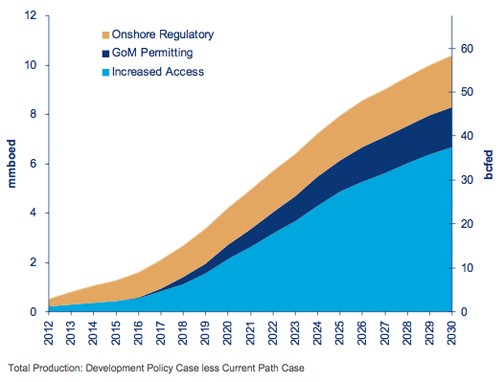

So where does Wood Mackenzie see the gains in production from the “development” case?

The problem that the map shows is that much of the new discovery and development is anticipated to come from the offshore, whether it is East Coast, West Coast, Gulf of Mexico or Alaska. In comments on the post discussing drilling off the Atlantic coast, my quote on it taking four to ten years for production following the start of leasing led to kindly admonishment by Art Berman, Harry Flashman and Rockman on the overly optimistic view that this represented, with the reality of development being more likely to occur over decades. This holds even more true for resources off the Alaskan coast, where the on-land infrastructure is not currently in place. And it fails to recognize the antagonism that state governments (such as those I mentioned from New Jersey) have toward offshore drilling on both coasts.

The current increase in oil production in the United States is, in part, due to the development of long horizontal wells, with multiple fractures along those wells to improve flow to economic levels from shales that were previously uneconomical to drill. As long as enough production can be achieved from such wells to keep them viable for the oil industry they will be developed. When they cease to be then they won't. The rapid decline rates that are found for these wells (as was shown in the posts on Bakken and Niobrara) mean that as production moves from the sweeter spots in the reservoirs out to the leaner fringes, a point will be reached in a few years where those economic factors will come into play. As that time approaches, the price of oil (for a variety of reasons) will be sufficiently higher than it is today to encourage greater overall production than might be anticipated from today's figures, but it will be nowhere near enough to meet the levels of US demand. And it will still curtail overall production.

The gain in production that Wood Mackenzie sees in moving to the “development phase” does not really kick in, were all things to come to pass, until about 2016. And even then the main initial gains are assumed to come from the easing of regulations, which is, I rather suspect, a wish rather than any reflection on what might realistically happen.

The delay in granting permission for the Keystone pipeline will shift some 700 kbd of US supply out another year at least. But that does bring up the issue of the oil sands. They are the one source where the deposit size is known and adequate, and where gains to help meet demand could be achieved. However, with the delay and possibly even denial of the pipeline, it is now quite possible that the Canadian Government and the other parties concerned might hear again the same blandishments from China that persuaded the Turkmen; and when we finally get around to giving grudging permission for Canada to sell us more oil, that additional oil sand crude may already be heading overseas through pipelines running west.

Whether, at that point, we can then

continue to get our oil from regions like the Middle East

is a point that I will look at as this series continues, and we start to examine the long term potential of sustained oil supply from regions overseas.

Oh, and a quick P.S. for those who remember the post on the Alaskan pipeline, in August it was running at an average of 538,623 bd, with the annual average now running at 568,471 bd. In August they were still publishing the data from the previous month, but the site does not show either September or October averages!

UPDATE The new Alyeska numbers have now been posted, thank you. October average flow was 589,068 bd, and that brings the annual average to 574,616 bd. So the numbers have risen a little. Winter has, however, now arrived.

What is the likelyhood of a US take over of the Canadian oil industry either through a joining of countries or a force takeover? Does the Monroe doctrine apply to Canada? It may seem ridiculous at this point but...

Davidel

david - Zero IMHO. To be blunt the American people might accept stealing the resources of some other countries if the situation becomes really bad here. Many have already turned a blind eye to past efforts to swap a little blood for oil. But to kill folks that look like us for their oil...not very likely. And if you know many Canadians then you'll understand we would probably have to kill every one of them. By great coincidence just watched a movie last night about Canadian troopers in WWI. They sent 600,000 of their 7 million population to the front. About 60,000 didn't make it back. And that wasn't fighting on their home ground.

In fact, given various personal connection, if such a conflict did arise Texas might join up with the lads up there. In fact, now that you have me thinking, between the two of our societies you might want to reframe your question as to who should be afraid of whom. LOL

Thanks ROCKMAN and a special thanks to Heading Out for the Tech Talk series.

David

Rockman, I like your idea of Texans teaming up with the Cunucks.

About the:

Do you recall "The War Btwixt the States" ???? Brother fighting brother, cousin and mother "if necessary"?

When wealthy, industrially-crippled peoples who have not known hunger or cold for generations start feeling hungry and cold...

Mother Nature is Not arbitrary and capricious, although it may seem that way to the delusional Homo saps.

She is, however, quite tyrannical - especially when distracted airheads declare their way of life is non-negotiable.

(I'll put my money on the Texans and cunucks - provided the military is divided evenly between the two parties - if the pile of hungry, cold and desperate flesh gets the military, then I put my money on the pile of hungry, cold, desperate flesh)

The major invasion you are likely to see is Texans moving to Canada for a place to live after Texas becomes a permanent desert.

I think the concept of this question is both humorous and misplaced. There is no issue with the US buying Canadian oil. There is an issue with US approval of infrastructure to import Canadian oil (as well as Montana and North Dakota shale oil. Perhaps calling shipments of shale oil from Montana and North Dakota imports is incorrect, but the idea is similar.)

The question of the two countries going to war seems to be a red herring on several levels. Canada doesn't really have to fight the much larger US forces off (likely with a very nasty protracted insurgency that would not be limited to Canadian territory). All that would be required would be to make a war more expensive than the price of just buying the oil. Given the US military's prowess in spending huge amounts of money, I suspect that the lesser goal of making it more expensive to fight rather than trade wouldn't be hard to achieve.

It would be better to deal with what is likely to happen which is that a pipeline expansion or a new pipeline through British Columbia are much more likely than before the Keystone XL project was put on hold. Either the pipeline expansion (from Alberta to Vancouver with no new right of way required) or a new pipeline from Edmonton, AB to Kitimat, BC would then be used to sell tar sands oil to the Pacific Rim countries including China.

The implication of selling tar sands oil through the Canadian Pacific ports is not that the oil would be denied to the US market, but that US refiners and consumers would have to bid against other customers and would likely have to pay more for the oil.

I believe that further down in the comments Robert Rapier makes the point about the difference in price between West Texas Intermedate and Brent crude prices.

There seems to be more and more difficulty in the US political system in getting ANYTHING done. This latest decision on the Keystone XL pipeline is actually fairly minor in comparison with some of the whoppers that happened over the past few years.

Americans keep trotting out this idea of a forcible takeover of Canada. Next year we are celebrating the 200th anniversary of the last time this was tried. Jefferson said it would be "Just a matter of marching". Well, actually, it involved a lot of shooting and burning, and the Canadians turned out to be better shots than the Americans. A number of cities - Canadian and American - got burned in the course of the conflict, including Toronto and Washington.

In a repeat of the conflict it would probably involve nuclear weapons rather than torches. Canada is a potential nuclear power. It doesn't have any nuclear weapons at the moment, but Canadian scientist were involved in building the ones that were dropped on Japan. I estimate the time from when US troops crossed the border to the time the first Canadian plutonium bomb was completed would be a few weeks. Give Canadian scientists a year or two to work on it, and they probably could come up with one that would fit in your carry-on luggage.

Rocky - Thinking about it more a Texas/Canada compact make a lot of sense. But not all of Canada of course...just the west. Imagine a n/s strip from the Gulf coast heading straight north. We can include our midwest and RM states...more like us than the rest of the country. Just think of the revenue from collecting the airline fees for allowing folks to fly from LA to NYC.

This is sounding better and better the more I think about it. And if Ottawa and D.C. put up a fuss? No problem: we have enough guns in Texas we can loan y'all some.

Most historians, and almost all non-Canadian scholars, reject the idea that annexation of Canada was an aim of the War of 1812 (despite what some American rabble may have exuberantly thought). Instead, the invasion was a military strategem designed to provide leverage for other goals against the British, who were arming, and establishing Indian nations to slow/prevent WESTWARD expansion of the new American state, in the wake of the Lousiana purchase of 1803 (which was a French attempt to give the Brits something else to worry about), and who were restricting American maritime trade per the illegal Orders in Council.

Incidentally, I would anticipate greater ties via NAFTA, rather than any military incursion. Perhaps at some point we'll get back to not needing a passport and/or background check to cross the border (idiotic American policy having led to Canadian retaliation post-9/11).

BTW, the recently changed Canadian citizenship laws gave my father dual Canadian citizenship (via his mother, a WWII nurse).

Invading Canada and annexing more territory was certainly a secondary objective of the War of 1812. In fact, Britain revoked most of the regulations that were annoying the US before the US declared war. The US decided to go ahead with the war anyway. The peace treaty that was signed in 1814 mentioned none of the purported causes of the war, since they had become moot by that time.

I understand that this is how the history is typically taught in Canada. It's not how British or American or French historians view the war.

The U.S. declared war well (several months IIRC) before word of the British suspension (not repeal, which came later) of their illegal orders to impede U.S. neutral shipping reached the New World. Did they take back the guns they'd given to the Indians, Did they return the Americans they'd forcibly impressed?

Annexation of settled Canada was at most a 'we'll take it if we can get it' tertiary aim.

Aim #1: Stop Britain continuing to treat the U.S. like a mercantilist colony by stopping U.S. ships, preventing trade with the Continent, and impressing American seamen (previously attempted by peaceful means under multiple U.S. presidents, which did not stop until after the war).

Aim #2: Prevent the British from blocking/slowing American expansion into: A)areas already ceded by Britain (the U.S. Northwest Territory of 1787), B)the Lousiana Purchase and C)eventually the Oregon territory (explored by Lewis and Clark, and already a U.S. aim), and D)Florida. Even during negotiation of the treaty in 1814 Britain proposed carving out land (from land they had ceded to the U.S. in 1783 after the revolution, and which had been a formal U.S. territory for 27 years) for an armed Indian confederation (of the tribes they had armed against the U.S. PRIOR to, and during the declared war) between the several United states and the Louisiana purchase.

Part of the reason some Americans may have thought Canadians would welcome them as liberators in 1812, was that in 1810 the former Loyalist British (1763-1783) colony of West Florida had joined the U.S. after declaring independence from New Spain (a British ally at that point). The Brits were still arming Indians in East Florida against the U.S. under the Spanish adminstration as late as 1818, when the U.S. executed two British agents.

What most of us fail to do is think in the correct frame of reference. Would we take over Canada and Mexico now? No. Would we take over Mexico and Canada if our people were starving and Canada was sending their oil to China? Of course.

How much of a resistance would Canadians put up against the world's most well funded military force, who just so happen to be located right next door? At best, it would be a large, WWII-like battle that the Canadians would, of course, lose. Who seriously thinks the Canadians, with their tiny population and even tinier military budget, could put up a successful defense against a military that is 10 times better funded than the second most well funded country, Great Britain?

We need to change our frame of reference to reflect a future where the global economy has already collapsed and there are many resource wars going on all over the world. There is far more of a chance that there will be great wars over resources than the slim chance we will all get together, hold hands, and plan for a soft landing.

Starving people do not maintain the same level of moral integrity as they had growing up being fed with silver spoons. History is a great teacher and the evidence is very clear.

Given your setup the Americans may find themselves facing Chinese forces. Also would they be in any condition to do that?

NAOM

Chinese supply lines would be a nightmare IMO...Americans would have extremely short ones in comparison. I don't think the Chinese would have much of a chance protecting Canada.

The Chinese don't have the logistical infrastructure to conduct a war much beyond their borders. What they would more likely do is call their loans and put the US government into bankruptcy.

The Chinese don't have the logistical infrastructure to conduct a war much beyond their borders.

Name three countries that have such beyond border capabilities these days.

What they would more likely do is call their loans and put the US government into bankruptcy.

Right that would empty our arsenals--denude our fields, and sink our fleets.

The money would be 'printed' and we'd deal with the inflation, which would be a very interesting to follow if the $ was still the world's reserve currency at the time (it certainly doesn't look like the € will be taking that spot over any time soon-is the £ coming back?). Believe me we have the financial doomsday machine hard wired to worse these days.

The Chinese would mainly need those supply lines only after they managed to land significant forces on North American soil - and I would guess that this landing simply could not happen under current conditions, or anything close.

Yes, the Chinese could dispatch a large naval force, possibly with let's say 200,000 troops and equipment, headed for some point on the west coast of Canada. But this would make the D-Day invasion seem like skipping over a small creek. And U.S. intelligence would (should) see all of this building up before the ships even departed. And before they got anywhere near landing on the Canadian shore, the Chinese force would most likely be hit with an all-out naval/air attack that would ultimately leave most of the Chinese armada on the bottom of the northeastern Pacific ocean. And I could be wrong, but I don't think that Canada really has sufficient naval/air power to tilt the balance in such a conflict out at sea (on Canadian soil it might be a slightly different matter).

I'm not saying it wouldn't be a hell of a battle, and if the Chinese deployed aircraft carriers (and I think they recently ordered some) then the American forces might even see some of their own ships and planes sent to the bottom. But the Chinese would be approaching the biggest "aircraft carrier" of them all (the U.S. mainland) and I would expect relentless waves of American air attacks, on top of the already substantial U.S. naval assault. It might take a few days, with significant American losses, but barring something totally unexpected, I can't imagine the final outcome being in any serious doubt. It might be something like the famous WWII Battle of Midway, fought in the northcentral Pacific, north of Hawaii (but without the preemptive weakening of U.S. naval forces from the Pearl Harbor attack, a few months prior to Midway).

A military invasion may look like a cakewalk.

the problems arise when you have to deal with an occupied, now enemy population.

Which is why occupations never quite turn out as planned...

The thought of this scenario is just insane. I really doubt the northern states (MN, WI, ND, MT, etc) would go along with an invasion of Canada. I guess our government is crazy, but this one seems a little far fetched.

In the War of 1812, the Northern states opposed the war, and it was the Southern states that were the promoters of it. The New England states nearly seceded from the US over it, and the Northern militias often refused to cross the border into Canada, which made an invasion difficult.

Don't know if you heard but there was a civil war a few decades after that which settled the secession issue. It is very unlikely we will be having another one. The US that emerged in 1865 was and entirely different country than the one that entered war in 1861. The US Civil War probably didn't get too much coverage in your history books as Canada was busy becoming an independent country at the time, but it still tops the casualty count for US conflicts-more than 50% higher than WWII which had 20 x more US casualties than the War of 1812 which had about 3 x the US casualties Iraq/Afghanistan has had. We do seem to be in the habit killing our soldiers.

I've lived in several northern tier states over the course of quite a few years, the locals would get over Canada's right to independence pretty quickly if push came to shove, but that just isn't going to happen, the business interests are way too intertwined.

By the way how is it Skagway is still part of Alaska--that country whose monarch you keep on your currency certainly didn't back you up in 1903 did it? Of course you might be able to annex all of SE Alaska by offering its residents a decent health care package--but then that secession thing would pop back up so that probably won't work?- ) Ah here is a solution to a couple problems--the US could give SE Alaska to China to settle its debt. That would give China ports you could directly pipe your tar sand oil to and rail your coal to--then we all could sit down fish boil right on the beach, no fires or nets required.

It's interesting that so many americans immediately think of an obvious frontal assault - it must be something in the water.

Cooler heads have historically controlled US policy, and rather than 'invade' canada the US would impose diplomatic and economic power over the canadian politicians to force them to send as much oil as the US could accept southwards.

Even if push came to shove, the US is much more likely to fund an 'Alberta Liberation Front" to blow up the westward pipeline - forcing oil to flow to the whim of the US.

The reality is Canada and Mexico are already vassal states to the US and as and when the US wants the oil will flow where they choose. I'm not even sure that Brazil and Venezuela will have much choice. Rather than consider the oil prospects around the continental US, consider them around the double continent - that's more realistically the US purview.

Whenever I mention peak oil my peers (who don't take my ideas particularly seriously) jovially suggest military intervention to solve any supply problem, a discussion topic we then run with for amusement purposes. It's too easy to imagine. Maybe that's why?

I do agree that the diplomatic/economic measures would likely be used before any military movements, and that those may well be enough to get Canadian oil going predominantly our way.

Oh I think the US probably WILL use main military force, probably to maintain and enhance control of South America and it's resources. However for Canada and Mexico it's unlikely to be needed. The only tweak to that is possibly the US being 'invited' in to solve Mexico's problems.

Well the military actually studied such scenarios. And we kinda played one out in Iraq. And former Defense secretary Gates will tell you, it just cannot be done. You can't just steal oil from a country (unless maybe you plan on genocide). The infrastructure is just too vulnerable. We can take over a country, but if you try to steal oil from an unwilling population, those thousands of miles of pipelines will be constantly hit by bombs. Tankers will be attacked, loading depots will be attacked, well-heads will be bombed, etc.

You just cannot use a military to steal oil . . . it is not an economically viable plan. It is cheaper to buy the oil on free market than it is to steal it with a military.

Actually it can, but I'm not about to give anyone ideas.

The US public isn't about to starve - too much good agricultural land. Any gov that seriously thinks about attacking Canada will be laughed out of office for engaging in incompetent evil.

The US and Canadian cultures are as similar as two countries can be. I have more in common culturally with my Canadian friends than I do with maybe 2/3 of my own country (that's probably true of my Canadian friends also, their country is also very large).

To become culturally Canadian most Americans need only to learn what night is hockey night, what a loonie is, and how to relax a bit.

War with Canada over oil? How ridiculous - if it came to that it would be better to dissolve the Union and apply to join Canada's confederacy. Too much in common.

It is unlikely that an American invasion of Canada would result in a WWII-style defense. It would more likely be a guerrilla war with Canadian snipers picking off US soldiers from behind the trees, and a lot of improvised explosive devices. The main difference from Iraqi IED's would be that the Canadian insurgents would have access to plutonium.

Hmmm, now that's what I call an IED.

NAOM

just because you have plutonium it does not mean you can build a bomb in a few weeks. it a bit harder then that. you also need the triggers. A few years perhaps.

Also, they said take the oil like the government is selling the gasoline you put in your car right now. Who would get this oil? a multinational companies like BP? Then what is the point?

Canada has a long history of nuclear development that goes back to WWII.

Nuclear power in Canada

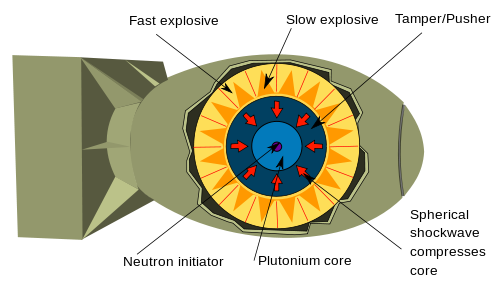

Canada was involved in the Manhattan Project in WWII, which built the two atomic bombs which were dropped on Japan. The second one, Fat Man was a plutonium bomb.

Fat Man (the bomb dropped on Nagasaki)

While Canada does not have the capability of upgrading uranium to weapons grade, it does have an awful lot of plutonium sitting around in the used fuel rods from its nuclear reactors. India built its first nuclear bomb using plutonium from a Canadian-designed nuclear reactor. In an asymmetrical war , the insurgents would more likely build a dirty bomb. It wouldn't cause a very large explosion by nuclear standards, but it would scatter radioactive isotopes all over the landscape.

"Would we take over Mexico and Canada if our people were starving and Canada was sending their oil to China? Of course. "

In an hypothetical future wherein the infrastructure for export to China exists and the infrastructure for export to USA does not ... We, the people of USA, might be able to do a lot of damage, but would we ever get the export/import infrastructure built and fully functioning? I think not. On the contrary, this is the kind of "crazy American" bloviation that has been a constant source of tension throughout the world.

Canada does not have a real nuclear deterent, but China does.

This is crazy, crazy, crazy, as in nein, nein, nein.

There is no way Canada would stand against the US. That would be considered suicide. Sure they might talk big for a short time but when push comes to shove and the new, aggressive US president says the following, "Either you are with us or against us." That will be it. Period.

Let us not think in terms of our current, friendly, system but go back to before WWII in Europe when countries were voting in crazy people that promised results.

China protecting Canada? Are you serious? No way. The only way for a country to avoid getting into a position to be completely destroyed would be to join the powerful alliance. That will most likely be the US, Canada and Mexico along with Europe and Japan. Even if Russia and China decided to form their own alliance and thus bring about the conditions for WWIII, they would not have a chance for victory.

Yes, the resulting nuclear (and other WMDs) war would be awful beyond belief but who really has the best nuclear and non-nuclear offensive capability? Not just size and number but delivery systems, tracking, guidance, software, funding, infrastructure, resources, etc.

How would China and Russia deal with our advanced fleet of nuclear submarines? Not well at all.

Many people are calling for the reduction of the US military complex (Ron Paul, etc.) but it is very unlikely to happen, especially when it is becoming more clear that resource wars are very likely after the collapse of the global economy.

Someone brought up insurgency. Let us look back in history when many leaders did not even allow the losing side to live, especially the men. I think the coming resource wars will strip away much of the social development that took place after WWII. Do people remember the fire bombing by many countries? Do you really think we are that much more advanced, socially, to never do that again?

Humanity will continue to be controlled by those who have the most strength and resources, just like the animal kingdom. Things may start off nice, like both sides lining up and following strict rules of military conduct, but will quickly deteriorate once one side starts to lose or feel significant counter force. Then the gloves will come off. In a world where there are 6 billion too many people for Earth to comfortably support without fossil fuels, life will be cheap, indeed. Sad but true.

I feel the best way to prevent a horrible landing is to get enough of the big players together to design a softer landing. If there are two sides with any serious amount of power, we may well be in for a war that makes WWII look like short conflict.

We must remember to consider human nature - people would rather kill and go out with a bang than die a slow, miserable death by starvation. We are, after all, the genetic result of societies that defeated their foes, sometimes with unbelievably horrible means.

The coming situation that humanity is about to experience will be unlike anything that has come before. The ride down the fossil fuel bell curve will test us to the limit. Are we really just yeast or can we work together and live at peace, sharing the limited resources at a level that keeps Earth in balance?

Read my post. This is crazy talk.

IMHO, attack of 'America' on Canada at the time hypothesized will lead to a massive loss of life in both countries. When hostilities stop, the population in America will be reduced to the point that America will have no need of Canadian bitumen, but that lack of need will be a minor item on a long list of unforeseen, unintended consequences. And none of people who are blogging here today will live to see the actual, long term result of such an attack.

I don't think I said that China would protect Canada, just that they had already a real 'deterent', which so far as I can tell is code-speak for an ability inflict massive, indescrimanent destruction on major regions of the world, enemy and friend alike. We (Americans) are not alone in our ability to do evil.

Maybe this sort of bluster now, before there is any real dependence on Canadian bitumen in either the USA or China ... Maybe it will deter Canada from dealing with China, but your original post had the attack coming far in the future when the infrastructure for export to China was already in place and in use and USA had already long delayed infrastructure for import of bitumen into lower 48.

If you prefer to discuss the use of bluster now as opposed to attack a few decades in the future then there are other reasons for calling that proposal crazy and evil. That case is harder to make without calling stupid people stupid, which I grant is impolite and would be censored as such.

Peace.

http://www.jeffrubinssmallerworld.com/2011/11/10/wti-brent-spread-costin...

Jeff Rubin: WTI-Brent Spread Costing Canadian Producers Over $1 Billion a Month

Excerpt:

Here are some links that "Undertow" provided on Drumbeat threads. First, WTI crack spread chart from Bloomberg. You can of course go back for several years.

http://www.bloomberg.com/apps/quote?ticker=CRKS321C:IND

And here is the Brent crack spread chart:

http://webfarm.bloomberg.com/apps/quote?ticker=ACK321A:IND

Here is a WTI/Brent spread chart:

http://ycharts.com/indicators/brent_wti_spread

Regional US crude oil stock chart (not much change in Midwest):

http://www.eia.gov/oog/info/twip/twip_crude.html#stocks

Cushing inventories:

Monthly:

http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=MCRST_YCUOK_1&f=M

Weekly:

http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=W_EPC0_SAX_YCU...

Note that weekly Cushing inventories have dropped 26% since late March, 2011.

My conclusion (again based on Undertow's work): Mid-continent refiners are generally not passing on the benefit of lower WTI prices to consumers. They are capturing the huge increase in the WTI/Brent price spread as refining profits, at the expense of both Mid-continent producers and consumers.

And of course, Canada is the single biggest victim of what is basically an unprecedented grab for profits by refiners. Life is good for Mid-continent refiners, until they ultimately drive away the most secure source of crude oil imports into the US. The US is currently dependent on imports for about 60% of the crude oil inputs into US refineries, and Canada supplies a very large portion of that input.

"What is the likelyhood of a US take over of the Canadian oil industry either through a joining of countries or a force takeover?"

China is already taking over the Canadian oil industry:

http://247wallst.com/2011/07/20/another-oil-sands-producer-acquired-by-c...

The Monroe Doctrine was actually about European powers meddling in the Western hemisphere, which America chose to reserve as its own private meddling grounds. I think that you refer to Manifest Destiny, the doctrine that held that the USA was entitled to expand to fill North America. That doctrine has been expanded and improved in recent years to include American Exceptionalism, which holds that America has a divine mandate to do whatever it wants.

Wikipedia has excellent historical articles on these movements.

This whole rediculous discussion exemplifies why I no longer waste much time tuning in to TOD.

now now don't get too upset boys like to sit down and have a couple beers over a board game once in a while

Well, no, this is getting too far off topic for me. It's one thing to respond to a question about likelyhood of a US take over of the Canadian oil industry (not very likely), but when we start to debate how much Canadians know about the US Civil War, we're getting badly off track.

Realistically, wars are an extremely hazardous way of acquiring resources. Too many people get killed.

my, my, my

Americans keep trotting out this idea of a forcible takeover of Canada. Next year we are celebrating the 200th anniversary of the last time this was tried. Jefferson said it would be "Just a matter of marching". Well, actually, it involved a lot of shooting and burning, and the Canadians turned out to be better shots than the Americans. A number of cities - Canadian and American - got burned in the course of the conflict, including Toronto and Washington.

has precious little bearing on a modern US takeover of the Canadian oil industry...of course when the diagram of 'Fat Man' is added in...pretty dangerous stuff to be posting don't you think...

but since you had mentioned the War of 1812 at least a time or two before when takeover of anything Canadian was mentioned I thought it would best if a bit of 19th century context were provided. The US Civil War was by far the most important war the US has fought since The Constitution was adopted in 1787. I'll leave you to ponder the implications of that but they are myriad and far reaching. What emerged from that war has much more to do with the beast your diagram is trying to ward off than does any political entity that existed in 1814.

I really was trying to lighten this up a bit with a 'Risk' board. I grew up in the belly of this beast...when it was well fed...

FOR ALL

In following the theme of a broad over view I’ll offer my personal perspective of exploration of conventional reservoirs in the Gulf Coast Basin. I’ll not focus on the numbers either. HO and others have painted that canvas quite well. Instead I’ll stick with the business side of drilling. In the end it doesn’t matter what potential reserve numbers are tossed out if the wells needed to develop that oil/NG aren’t drilled. And remember I’m just talking about conventional reserves.

As many know my privately owned company drills only conventional oil/NG targets in the onshore/offshore shelf in the Gulf Coast. We’ve drilled about $300 million of wells in the last 3 years. All of those prospects were generated by other companies. It takes many years to establish a prospect generating shop and put a viable drill program together. We didn’t want to take the time.

There is a whole subset of companies that don’t actually drill the prospects they generate. We call them “promoters”. They employ the staff: geologists, geophysicists, engineers and landmen. They buy $millions in seismic and spend $millions more leasing the prospects. Often this effort leads to dead ends: a lead doesn’t mature to a viable prospect or, even if it does, the leases can’t be acquired for a number of reasons.

Then my cohorts and I evaluate all the prospects that fit our business model. The trade when we buy such a deal: cash to cover actual expendatures such as seismic and leases, some more cash to cover their overhead and the “promote”. Typical promote is “third for a quarter”: I pay 1/3 of the cost to drill the well but only earn 25%. In essence the generator gets 25% of the well drilled for them at no cost. If it’s a dry hole they haven’t lost any money but have covered all their cost, including their salaries, and made a little cash. And if that $8 million well that they didn’t risk a penny to drill nets $80 million they get $20 million in “mail box money”.

The take away is that there is a great incentive for a promoter to do his thing if there is a market for his prospects. With current high prices there is a good bit on incentive. Yet come 31 December I’ll turn back about $40 million of my budget due to a lack of prospects to drill. Texas has more prospect generators than the rest of the world combined. Given the unique nature of ownership of minerals rights in the US we have many times the number of promoters in Texas as the rest of the world. Every promoter in Texas and La. knows my company and the big fat checkbook we have.

And we can’t find enough conventional prospects to drill. That should give some sense of what little conventional reserves may be left. We’ve actual begun our own prospect generation effort in the offshore GOM shelf. Bought $10 million in 3d seismic out there and will pull together some consultants to work it. Once the govt cut back on the permit prcess the promoters that worked offshore cut back their efforts significantly. They weren't going to invest 100’s of $millions with the uncertainty of when they might get leases/drilling permits. Even our efforts will focus solely on prospects that can be drilled from existing platforms…permitting new platforms takes even much longer. Even with that hedge we don’t expect our drilling effort will be in full swing until 2013.

Yes: there are conventional oil/NG reserves left to develop in this country. Just not nearly as many as were drilled to generate our current production. This fact is THE reason the public oils are going after every shale play they can…they have no choice. There aren’t enough conventional prospects left to support half the companies in the oil patch IMHO. The public companies have to replace their produced reserve or their stocks take a hit from Wall Street. They would much more prefer to drill for the prospects my company goes after: we make 2 to 3 times the profit many of the shale players do even with relatively low NG prices. Though their profit margin would be better most couldn’t begin to replace their reserve base. Some folks dislike the public oil companies but without their efforts we wouldn’t be seeing the gains in US production without their desperate attempts to support their market caps.

My company would be more than glad to drill the unconventional plays…Once oil and NG reach sustained prices of $150/bbl and $10/mcf. The question still remans though: can the economy sstain such costs?

I would add that most of the estimates in the Wood MacKenzie Report seem wildly overoptimistic. The US is a very well explored region - there must have been two million wells drilled in it - and all of the easy oil has been found long ago. Oil production peaked over 40 years ago and has never returned to those levels since.

Just because you open up new regions to exploration doesn't mean you are going to find oil there. Oil companies are not completely stupid and drilled the most likely prospects first. If a region has not been explored by now, it is because the oil company geologists think there is a low probability of finding large oil fields there.

Estimating large reserves for a region on the ground that it has not been drilled yet is an exercise in self-delusion.

OTOH, the Canadian oil reserves estimates are rather accurate - there is no geological uncertainty in the oil sands because they outcrop on the surface and you can map them quite easily. However, because of environmental constraints, Canadian governments will limit development to a much lower level of production than the US would like.

The Middle East is the big question mark, and although you never know if governments there are telling the truth, I think production is going to peak in the very near future, if it hasn't done so already.

Bottom line - get used to living on much less oil than in the past.

I'm sure no one here has forgotten this:

http://www.usgs.gov/newsroom/article.asp?ID=2622

Poster child for don't count on hidden pots of gold.

The USGS are amateurs at this game. They haven't a discovery model to speak of, and the only one that exists is here:

http://theoilconundrum.com/

This model estimates a URR of 240 billion barrels of oil for the USA.

As of 2002 we had discovered 233.5 billion and by 2010 it was at 235 billion.

So the valid estimate went from 7.5 billion in 2002 to 5 billion in 2010.

The USGS estimates went from 10 billion in 2002 to 1 billion in 2010. That's how you can tell that they are weak at modeling; obviously the numbers can't change this rapidly unless they were simply generated as wild-assed guesses.

Can you please explain how your model answers the same question they did, for the same area? Certainly the estimate they changed from 10 billion barrels to 1 billion wasn't the USA wide model you are referencing. What would your answer be using the same info through 2002, and what would your answer be for the current info they used?

Well, they are answering the wrong question then. Look at the full geographical area, realize how much of it has been explored and take the analysis from there. I have a difference of fact when it comes to singling out a region as opposed to a collective or ensemble set of data.

The USGS has a long track record of being wrong most of the time, and they almost always err on the high side. You can almost count on their reserve estimates being reduced when the areas are actually drilled. If their estimates were realistic and unbiased, they would err on the low side as often as on the high side, and the errors would more or less average out over the long term.

Why do you think that is the case? Political pressure? Pay-offs from promoters? Why don't they learn from their experience and change the methodology so that it better matches up with what has proven to be the case? Or perhaps their estimates assume no limits on drilling costs?

It looks like they start with technically recoverable.

http://energy.usgs.gov/Miscellaneous/Articles/tabid/98/ID/11/2010-Update...

and then move on to economic.

http://energy.usgs.gov/Miscellaneous/Articles/tabid/98/ID/68/Economic-an...

Or you are. Their question apparently involved some small chunk of Alaska, and yours involves the entire country.

Do you have any particular information which would indicate they didn't do exactly as you have suggested? Strikes me as a completely reasonable way to start, looking at the full geographical area (and applicable geologic criteria), and taking the analysis from there. Certainly professionals in the field wouldn't have skipped such an obvious first step, if you and I can think of it during the first 5 minutes of wondering how to go about this type of exercise.

If you can find such an analysis, I would be interested. Everyone realizes that the amount of math and probability theory applied to the topic has been very week over the years.

Regarding the Canadian reserve estimations being accurate ...

What really gets up my nose, and repeatedly, is WHY IS THE USGS DOING RESERVE ESTIMATIONS ON CANADIAN OIL?

Reserve Growth of Alberta Oil Pools, USGS OFR 08-1194

http://pubs.usgs.gov/of/2008/1194/pdf/OF08-1194_508.pdf

Input data the generate 1-D burial history models, USGS OFR 2005-1412

http://pubs.usgs.gov/of/2005/1412/pdf/OFR-2005-1412.pdf

It's our EXPLETIVE DELETED oil! If they want the data and the interpretations, just go to the NEB in the old Amoco - now Murphy Oil Building or the ERCB in Bow Valley 2 and ask.

The Reserve group actually has some good geologists like D*br* and M*r*l*n, but their stats are awful. Perhaps it's because this is the best foreign data they can get, so they can test run the accuracy of their models.

I dunno.

It's kind of redundant for the USGS to do reserve estimates on Canadian oil fields since the Canadian regulatory authorities are doing their own reserve estimates, and they have access to all the drilling cores, well logs, and long-term well production data, which companies have to turn over to governments as a condition of being allowed to drill.

I suppose the USGS does it because they can get the raw data easily - just order it on CD-ROM from the appropriate Canadian government agency. You can't get this kind of data from most countries, and especially not the major oil producing countries like Russia and Saudi Arabia where they are considered state secrets.

So, they can second-guess the Canadian authorities, but it's unlikely they will come up with a better guess because the Canadians are more familiar with their own geology.

Didn't you look at the graph they made? It shows us blowing past the previous 1970's peak of 10mbpd. Isn't that enough proof for you? ;-)

Do they really believe that craziness? Aren't they basically saying that the US oil production biz is run by idiots since the vast majority of the country is open for drilling yet they've been in decline for the past 40 years. Do they really think the remaining off-limit areas would double production?!? The coast of California definitely has some oil and so does Alaska . . . but enough to double production? C'mon.

These guys not only deny near-term global peak oil, they deny USA peak oil that already happened 40 years ago!

It's a little bit counterintuitive, but I have concluded that the key to onshore Lower 48 success is exploration. Given the generations of geologists who have looked at the same production and sample show data, it's very unlikely that one can find a million barrel plus conventional field (nice field for a small operator, less than a rounding error globally), by drilling the tenth offset to a one well field or strong show well.

This should say it all.

It might, if it didn't have both a geographical and economic overlay on it.

I have seen maps of wells for example along the gulf coast and it is full of holes. Then looking on a map of US, how large are the restricted areas? Price of oil is around six or seven times as high now as 1998.

The US is certainly pin-cushioned, and always getting more so. US oil production is also currently at its highest point in some 6 or 7 years now? Maybe pin cushioning and oil production aren't as correlated as expected? As far as prices, using nominal crude prices since the late-90's to present to extrapolate a conclusion from is no different than choosing a time frame from 1979 to 1986, extrapolating from that and declaring that oil will soon be free. These assumptions of how a long term business cycle works in comparison to short term price fluctuations just isn't all it is cracked up to be.

for all that extrapolation difficulty it doesn't seem the DOE did that bad at guessing 2010 world oil prices back in the 1984

No one else used in this chart, which I lifted out an Alaska Power Authority economic feasibility report on the then proposed Susitna dam (yes we have that project moving forward again), was as close. Of course the DOE would have looked real bad a decade or so ago when oil was under $20/barrel. So much for crystal balls

"The question still remans though: can the economy sstain such costs?"

Another consideration is "what will be the costs to your company if oil and NG reach sustained prices of $150/bbl and $10/mcf?"

In other words, how much does the law of limiting horizons fit into future production?

Is it possible that costs can rise even faster than sustained oil prices?

JWS - Your inference is correct: higher oil/NG prices = more drilling = higher drilling costs. We're seeing that big time right now in Texas right now thanks to the Eagle Ford Shale play. But the oil patch service industry thrives on volume. Before they let a drill rig sit in the yard collecting dust they'll lower the price. But as long as operators are standing in line waiting on a rig to drill their well they'll pay the going rate. Even with the high demand today I still get some discount prices from some of my vendors. But I do know that some divisions of the larger service companies are restricting themselves to their largest 4 or 5 clients.

But at the end of the day drilling costs won't kill the effort regardless of how high or low oil/NG prices go. What will happen in times of high prices is that it will take longer to get wells drilled. The service companies recognize how volatile the market is and won't make the mistake of expanding their capabilities too fast as they've done in previous booms.

Thank you, Rockman, for all you have contributed based on your first hand knowledge.

You say: "But at the end of the day drilling costs won't kill the effort regardless of how high or low oil/NG prices go."

Others have expressed a cost of the 'marginal barrel'. And I would assume that much of the new oil you are going after is close to being marginal. As less expensive oil is depleted, it would seem to me that the marginal barrel cost must go up.

So some drilling that is deemed profitable now may not be in the future?

JWS - The public oils complicate the economic profile. Profit for those companies isn't as important as replacing reserves. There are many public companies that would drill every shale well they could even if they made no profit and just got their capex back. I once drilled a number of wells that a public company knew would actually lose $18 million but the effort also increased the stock price over 200%. Granted that's an extreme example but the goal was still the same: increase market cap by whatever method is available... profitability will be whatever it will be.

Remember about marginal bbls: most wells aren't drilled to find marginal bbls. They may end up with marginal production but that's after the fact. Optimism, especially during high oil/NG price periods drives the system. The results often don't match the expectations but "we’ll make up for it with the next well". I can’t tell how many times I’ve heard such statements from managements of companies that have disappeared over my 36 years. LOL

One of the little ironies about the rebound in Lower 48 production is that we are seeing increased Lower 48 activity and production, because of generally rising annual oil prices--because global conventional production in 2005 was at about the same stage at which Lower 48 conventional production peaked in 1970 (based on HL models). After the hurricane related decline that we saw in 2005 and in later years, US C+C production rebounded to 5.5 mbpd in 2010 (versus 5.4 mbpd in 2004), and it will probably average about 5.7 mbpd in 2011.

And of course there is the net export question. Note that only 12 of the top 33 net oil exporters in 2005 showed increasing net oil exports from 2005 to 2010, and it appears that only two of the 12 countries with increasing net oil exports are located in the Western Hemisphere--Canada & Colombia.

Global Net Exports (GNE, 2002 to 2010):

http://i1095.photobucket.com/albums/i475/westexas/Slide09.jpg

Here are two projections for Available Net Exports (ANE):

GNE & ANE Projection (2010 to 2020, -0.1%/year rate of change in production):

http://i1095.photobucket.com/albums/i475/westexas/Slide10-1.jpg

GNE & ANE Projection (2010 to 2020, -1.0%/year rate of change in production):

http://i1095.photobucket.com/albums/i475/westexas/Slide11.jpg

I'm pretty confident that the US will eventually turn to a desperate, Drill, Drill, Drill strategy as the decade wears on. Environmental concerns and opposition tend to be mere blips, on the longer timeline. A good example is Australia which has now passed a carbon tax--and yet--the country remains a vast open pit of resource extraction (with much more to come).

The shale regions of the US will definitely produce more oil. That's pretty obvious. However, I doubt very much the price of oil will cooperate much with need for visibility in oil and gas company investment planning, as price soars and crashes repeatedly. Willingness to invest in new supply will occur, but will be halting and cautious.

What the perennial supply optimists don't realize, as they make their linear supply forecasts, is that the US would be extremely lucky--even with "lots" of new supply--to see the same level of production we see today: around 5.5 mbpd. Such is the math of existing decline(s).

There's been a recent flurry of triumphant pieces in the global press heralding a new era in US oil production, but of course this is fallacy of composition at its finest: a small increase in oil extraction rates has been blown up into a mission accomplished banner.

I prefer to forecast the worst outcome of all: we madly scramble for the next tranche of high cost oil, get all of the environmental destruction that entails, and yet wind up circa 2020 with no, net, new supply and even higher prices.

G

That worst outcome is probably the most likely one. It's the BAU way, as it requires no significant deviation from current thinking (very little) on the idea of extraction limits in the face of economic damnation. At the same time it seems renewable energy interest in the MSM has waned.

Dave, from the Woodmac slide deck. This has to be one of the more seductive messages - and of course increasing access will lead to results. I'd caution, however, that the Atlantic margin of Europe is not a prolific hydrocarbon province with only occasional fields like Claire, Foinaven and Corrib being found. Similar results off shore Canada where Hibernia / Terra Nova are the exception rather than the rule. Since there is a degree of symmetry in the development of petroleum systems during rifting of the N Atlantic, an oil and gas bonanza on the Atlantic margin of USA is far from certain.

Euan:

I agree with you completely. But the political message that Governor Perry is pushing is that he has a way to provide 1.2 million new jobs to the American economy. It is these minor details as to whether any of this is really going to happen that get lost in the obfustication of an an American election period.

Several comments on the postponement of the decision regarding the Keystone Export Pipeline from Alberta to the Midwest and Gulf Coast.

1. Think of the Mackenzie Valley Natural Gas Pipeline, proposed in the late 1960's, stalled in 1973, in 2005, and finally approved by the NEB after 37 years of negotiation in 2011 ...

"Regardless, the plan is still years from development. Imperial Oil has until Dec. 31, 2013, to make a final decision on whether to proceed with the pipeline at all, although it has asked the NEB for three more years to decide. Should the company decide by 2013 to go ahead, construction would start in 2014 and production would start in 2018. The project's estimated price tag of $16.2 billion has ballooned from $7.5 billion prior to 2007".

So Keystone may get the go-ahead, eventually.

2. A while ago, our province's esteemed former premier was talking to the US Ambassador to Canada, and Mr Lougheed told him that "the US would pay world prices for Canadian oil". However, Canadian oil companies are now loosing an estimated $1 B per month, because we are (1) tied to the US market and (2) we have no large volume access to the Pacific market for oil exports at world prices.

IMHO, Keystone has been proposed 90 degrees in the wrong direction. The Canadian industry is presently being hammered as badly by lack of access to world markets as it was by the made-in-Canada National Energy Policy in the 1970's. And the National Energy Policy actually made sense from a Canadian whole-country perspective at the time. I'm old enough to remember food and fuel rationing in the UK.

I'm fighting that westward pipeline with everything I have. Squandering our resources as quickly as possible, leaving no job prospects for people when that ground sucking is finished, is not a way to "develop" an economy and country. Funny how people tout the job opportunities intense oil extraction would offer. So in other words, by strangling our economies of the energy needed to drive them, this supposedly "helps" with unemployment. This is proof beyond any retort that our monetary system is designed to steal the wealth of the middle class, and turn us into an army of rapers and pillagers of the natural resources on which we depend. I am not naive though, the US will be taking this oil when it wants it, which is why I support the Keystone pipeline. You can't get a more benign route than across the Great Plains. Sending oil to BC would be a disaster, both environmentally and economically. But short term we'd make lots of profits. Our grandkids certainly won't be thanking us.

Just a thought from an Exploration Geologist ...

Regarding the Wood Mackenzie map of the US showing where additional production may be obtained.

Regarding Washington-Oregon Offshore and Northern California Offshore blocks. This is an active margin, not an Atlantic-type Passive Margin.

These two blocks are underlain by the Juan De Fuca Plate, which is subducting under the North American Plate at the rate of 3-4 cm per year. This is in fact slower than the convergence rate in the Miocene, but it's still subducting and burying the marine sediments deeper and deeper beneath the North American Plate.

(3 cm per year = 3 m per 100 years = 3 km per 100,000 years = 30 km per million years ... hey, this is the Super Chief on a downgrade coming off Cajon Pass!

There are two major sources of terrestrial sediments, the Fraser River and the Columbia River, providing potential reservoir rock. These do not build major fan deltas out into the Pacific, in a similar manner to the Mississippi.

Instead the sediments are deposited at the feet of major submarine canyons, on the shelf, similar to that of the Congo River. But neither river is of a similar scale to the Congo. Additionally, there is no shallow water / coastal plain in the Pacific Northwest, so there will not be any Kwanza / Zaire / Cabinda / Congo B / Gabon Basin type onshore plays.

Additionally, the deep-water Subsalt Offshore Angola play works because of the presence of the same Cretaceous lacustrine source rock that is the key constituent of the onshore plays. This was deposited in a long lacustrine basin between the Kwanza Basin in Angola and the Gabon Basin (naturally in Gabon) on the Atlantic side, and in the Santos, Campos, Espiritu Santu and other basins on the Brazilian side, before the South Atlantic rifted apart. (It was one big basin with a sill at the southern end that prevented the proto-South Atlantic from flooding in, and eventually became an evaporite basin).

Deep water Offshore "West Africa" is a rift basin-type play, whereas the Pacific Northwest is an active margin subduction zone.

So ... where could a source rock be, Deep water Offshore Pacific Northwest?

Could any deep water marine source rocks be preserved long enough to be buried deep enough and long enough to reach the oil window between 65oCand 150oC and 1000m to ~4000m (and not even the gas window) before they disappear under western North America, only to be blown out again through Mt St Helens / Rainier / Hood / Garibaldi, etc.?

Would any potential source rock actually have sufficient volume (area X thickness) to generate sufficient Original Oil In Place (not Recoverable Oil)?

And how far out on the Juan De Fuca Plate would it be?

Just a thought for Rockman, West Texas, Rocky Mtn Guy, etc.

For the non-technical types, this is the sort of brain-work that has to be done before any major oil company would even consider posting Offshore Western North America.

(I seem to remember several D&A's were drilled back in the 1960's and 1970's, and I'm not sure but they might still be confidential, somehow - and in Canada they most certainly would not be).

And, of course, this work has already been done, many years ago.

I don't know much about the geology of Offshore Western North America, other than it is extremely complex. I think the drilling results back in the 60's and 70's couldn't have been very encouraging, because otherwise companies would be much more aggressive lobbying to drill it. Likely most of the potential source rock, if it ever existed, has been subducted under the North American plate and is gone for good.

The Atlantic offshore of the US can't have been that exciting either. I can recall a burst of enthusiasm for drilling it some decades ago, and the excitement diminished rather rapidly after they drilled a few wells. If you drill a few wells and find no source rock, it's likely you are wasting your time. Canada has a few good fields in the Atlantic offshore, but the number is very limited compared to the Gulf of Mexico.

Re the source rock off the West Coast, my point, exactly ... but not everybody here is in exploration. So I laid it all out.

That doesn't leave the US with very much, offshore, does it ... ???

IMHO the East Coast is more prospective than the west coast by an order of magnitude, but that's not saying much.

Shoot some big regional 2-D seismic off the East Coast, find a potential source rock and big structures with 4 way closure to drill for, and things will start to move, but nothing will happen until then.

The Canada Nova Scotia Offshore Resources Board under Dave Brown's technical leadership have written a lot of good reports to promote Offshore Nova Scotia and the analogue basins on the other side of the Atlantic. However, the Big Ones Out There are few and far between.

The best analogies for East Coast US that are actually being explored at present are the west coast of North Africa and Portugal, and neither Morocco nor Mauritania have had much luck. Cap Juby off Morocco has been waiting for an investor for decades, but it's offshore 12o API oil (really heavy muck) flowing at 3300 BOPD with a 40% water cut on the discovery well. And the offshore Mauritania production at Chinguetti was over-pressured and cratered PDQ.

We'll have to wait to see what happens off Senegal and Guinea.

IMHO, Wood Mac are blowing very large volumes of smoke for the benefit of US politicians (and the service and drilling companies). The report is comfort food with a 5 year shelf-life.

Why don't we drill and frac source rock routinely (or do we)? What's the source rock under Burgan and Ghawar? Is there an appreciable fraction of oil/gas still there awaiting freedom?

Paleo - We do that now: many of the current shale plays are the source rock. But you need to remember the very nature of the source rocks: they are the organic rich muds that are cooked and generate the oil that typically migrates to the conventional reservoir rocks. What doesn't migrate out is trapped in the source rocks. And that can only be produced after that oil migrates (over millions of years) into whatever fractures may exists in it. Remember in these shale plays: none of the production is coming directly from the shale rock itself...it's coming from the fracture net work in the shale rock. Shale by it's very nature has no permeability to flow oil or NG in any meaningfull amount...easier to squeeze juice from a turnip. It's all about fracture production. These big frac jobs aren't done to produce the shale matrix...they're done to interesect other natural fractures not cut by the original well bore.

It's all about the fractures baby...the fractures. LOL. But seriously, the fracture production character is a major part of why these are called "unconventional" reservoirs.

No. It isn't.

http://www.pe.tamu.edu/wattenbarger/public_html/Selected_papers/--Shale%...

Page 2. Paragraph 5.

Go talk to Louis the next time he is down in Houston, he'll learn ya up proper.

http://fekete.com/

Page 2 paragraphs 9 and 10. Looks to me like it's all about the fractures, baby!

It is. If you are talking about draining the high perm. Once that is gone, you get matrix and sorbed gas behavior dominating. Which is why I referenced Louis, he knows you can't model this stuff with fracture only drainage equations, and he doesn't. Without the matrix, you are basically left with a high pressure tank. With the matrix, you get a well with the initial steep decline followed by a long, low rate tail which resembles the energizer bunny in its tenacity.

I think that depends on the compressibility of the fractures. Straight estimated the compressibility of fractures in the ND bakken at about 80 e-6 vol/vol/psi:

http://www.onepetro.org/mslib/app/search.do

Compressibility of the fractures is not a going to be constant and will most likely decrease to essentially zero at some point, in which case the fractures would become a 'tank'.

Compressibility is one thing, but now you have to start discussing proppant effectiveness, an interesting topic in and of itself. And then we have to throw in the stress fields and how, or if, a fracture can even go back together once you crack it nearby and then it is a Humpty Dumpty debate (love technical jargon!). Noticed that one a few years back when companies were dropping proppant from their fracs and just counting on the stress fields to change the orientation of the split surfaces so they couldn't go back together again.

In either case, we still have to discuss matrix storage and sorbed gas because fracture storage certainly isn't the only storage mechanism at work. Surprised to hear it even being claimed, to be truthful.

Fracture compressibility isn't even discussed for the vast majority of gas reservoirs because of the much larger compressibility of gas, except at high pressure.

Straight, etal's study was done on hz bakken wells that were not hydraulically frac'ed, so the compressibility was for natural fractures. Straight's study was a unique opportunity to evaluate the subject becasue the oil was above bubble point and compressibility could be isolated with less ambiguity.

I noticed from your referenced paper, that Vf was treated as a constant.

Straight is a smart guy, he was among the first to utilize a radial finite difference model for evaluation of drill stem tests. One difficulty with analytical solutions is that rock and fluid properties are ambiguous and often assumed constant.

I'm not among those making the claim that matrix capacity and desorption are not a consideration.

I know. Every statement of yours I have read so far seems completely reasonable, and in some cases I was not aware of the particulars myself. Keep up the good work.

Gas companies have drilled in the Saddle Mountains/ Frenchman Hills area of eastern WA looking for gas that should be in a structure under the lava flows. They have failed. Except for hydropower and a little played out coal mine in Centralia, this area is a bust for conventional energy sources.

Summertime solar is promising; in winter, well, 8 hour days and fog tend to put a damper on that. Some good wind sites too, but they tend to be declared "Scenic areas" and put off limits. Wall to wall wind turbines in the Columbia River Gorge from Troutdale to the US 97 bridge east of the The Dalles would really be able to crank on the power if the laws were changed.

http://www.box.net/s/g3k64x0hzama2cllxhdo

This article suggests Canada's pipeline to it's Pacific coast was only intended to put pressure on the US to approve the Keystone pipeline. It also suggests that any oil shipped to ships on Canada's Pacific coast would still have to be shipped to the Gulf where most of the heavy bitumen refineries are.

That being the case, wouldn't it make more sense to just build such a refinery in BC or Alberta and then build a pipeline to the Pacific coast and send the final product to Asia or the US?

I wonder what the cost of such a refinery would be?

The US goal should be to split the proceeds with Canada, and use fully-amortized investments we already have.

If we push Canada to do a pipeline to the coast, China will build the refinery and pay for the pipeline.

IMHO, the Administration has enabled an argument between ecological interests and unions, plus imminent domain and state's rights. Canada shot themselves in the foot by buying out the Conono-Philips interest in the original Keystone, thus removing an effective lobbying body with historic sway in the areas of high concern today.

From my perspective, the key issue isn't the Keystone XL on the Canadian end, but completing some sort of new pipeline from Cushing to the Gulf refineries. That's what is driving the punishing cost differential today.

Canada and the US would do well to separate these two pipeline concerns, and re-form pipeline partnerships that better align with national business interests.

Here is the oldest joke in the business:

Question:"How do you make a small fortune in the oil business?"

Answer: "Start with a very large fortune like John D Rockerfeller and get into refining".

Refining is very capital intensive and very cyclic.

You can count on having two good years when you make a profit, three mediocre years when you break even, two bad years when you loose money, and one truly appalling year when you come very close to going out of business, in the cycle.

Build pipelines and be regulated, it's a less risky way of making money at a guaranteed rate of return on capital. Let some fool build the refinery, or if you absolutely must build the thing, get a government loan at favourable and flexible rates.

I don't know if the Chevron Burnaby site can be expanded. It's only 52,000 BOPD, which must be barely economic.

Above all, Never Ever buy a second hand refinery in the States ... for reasons of very real environmental liabilities. I was in the M&A group for a major Canadian pipeline company that fancied the idea of getting into the refining business until we did some physical inspections, including one where we stopped the car outside, got out, looked around, looked at one another, took photos to show our VP and President, and just drove off. The EPA has very good reason to go after some of these sites. The company then decided that It Was Not A Good Idea.

Any American politician who wants to shut down the EPA must be either (1) truly iggorrunt, (2) mentally defective through several generations of inbreeding or from chemical dependencies, or (3) as crooked as a paperclip, or (4) any permutation or combination of the above.

I am not sure why the prospect of upgrading the capacity of the Chevron refinery in Burnaby is an issue. A shortage of refinery capacity in Vancouver doesn't seem apparent. There is room to expand refining at several sites in Vancouver, but no demand. With gas at $5.50 or so per gallon it is unlikely crop in the near future.

If they upgrade the pipeline from Alberta to Vancouver, it makes more sense to just load the crude for shipment to refineries in Southeast Asia where there is demand for the final product. Economies of scale suggest it has to be more expensive to ship multiple streams of finished product than one stream of crude.

The Keystone XL decision has made the option of shipping crude much more likely to happen. All that is stopping it is regulatory approvals in Canada. Note that the right of way from Alberta to Vancouver already exists and would not need to be modified. The only thing that might stop Canadian approval of the project is the effects of increased tanker traffic in between Vancouver and the west end of the Strait of Juan de Fuca. I don't want to minimize this issue, but it is much smaller than routing issues that are likely to arise in creating a new pipeline.

Boomer,

There are some who say the perverse purpose of a pipeline to the West Coast from Alberta is to spread an oil slick along the Olympic Peninsula and Southern Vancouver Island. The North Pacific is very rough. From the point of view of the Canadian government the purpose of a pipeline to the West Coast from Alberta is to make some money selling crude to Southeast Asia. If it also pushes the US to allow the Keystone XL pipeline to proceed and allows the profitable export of some tar sands oil to the Gulf Coast refineries, that would be good too. Implementing both options would be better.

More expensive to ship multiple streams...but not necessarily less lucrative. Also, whatabout refining energy (hard to beat hydro).

For instance, you could send the gasoline to the U.S. West Coast, and the diesel to China.

Shutting down the EPA would be a bad idea. However, they are way past the diminishing returns point with the new rules. For instance, we buy water from the city. It comes out of the ground at a pH of 8.7 to 8.9, depending on the well. If we were to send it straight on to the surface discharge outflow, we are required to add battery acid to lower the pH to less than 8.5. Why? The local surface water is a "non-attainment area" as it is all has a pH of over 8.5, because all the local rock is alkaline. Which is why the ground water is also over 8.5.