A Monster from the Deep

Posted by Euan Mearns on December 21, 2011 - 3:29pm

With relatively little fanfare on the international stage, Lundin Petroleum and Statoil (and partners) have just recently jointly discovered one of the largest oil fields ever found in the North Sea. The Aldous Major South - Avaldsnes discovery on the Utsira High structure is currently estimated to contain 1.7 to 3.3 billion barrels of recoverable oil. The astonishing thing about this discovery is that it has lain undiscovered in a mature oil province for so long providing ample encouragement for explorers to go on exploring.

The recoverable resource estimates have grown with every well drilled and with a new delineation well spudded on 28th November, further news on the size of this giant is expected in early January.

This post is joint with Rune Likvern. One of us (EM) owns common stock in Lundin Petroleum.

The Aldous Major South - Avaldsnes story has been a year in the making. The 16/2-6 discovery well was announced in September 2010, but the story only gained traction on 30th September 2011 when the recoverable resource estimate was substantially increased following evaluation of data from the 16/2-7a sidetrack well. Prior to then recoverable resource estimates for Avaldsnes were in the range 100-400 million barrels - not enough to get overly excited about. The 16/2-7a well extended the area of proved hydrocarbons but also "proved" that Avaldsnes and Aldous Major South were part of the same gigantic structure. Avaldsnes is now estimated to hold 0.8 to 1.8 billion barrels of recoverable oil and promises to be a giant field in its own right.

A note on terminology. The term resource is normally used to describe the quantity of oil in place and the term reserves used to describe the amount of that oil that can be economically recovered. At this stage of field appraisal, none of the oil in Aldous Major South - Avaldsnes can yet be booked as technical reserves. Instead the term recoverable resource is employed.

A note on well numbering convention. Well number 16/2-6 means that the well was drilled in Norwegian quadrant 16. Each Norwegian quadrant is divided into 12 blocks, and this well was drilled in block 2. It is the 6th well to be drilled on this block.

Shortly after, Statoil announced the results from the 16/2-10 delineation well on Aldous Major South on 21st October, which prior to then was estimated to contain 0.4 to 0.8 billion barrels recoverable resource. The 16/2-10 well proved a much bigger resource that is now estimated in the range 0.9 to 1.5 billion recoverable barrels.

Thus the combined Aldous Major South - Avaldsnes structure is now estimated to contain between 1.7 and 3.3 billion barrels of recoverable oil. The 16/5-2S well currently drilling represents a significant step out from the existing wells towards the south of the field. Success is not to be taken for granted. For example, the mapped structure is dependent upon accurate interpretation of seismic and the occurrence of oil is dependent on the presence of the reservoir sandstone in this part of the field. Should the well fail to find oil, then the resource estimate may settle toward the lower end of the current range; however, should it be successful then ever larger numbers are to be expected.

This recent presentation (large pdf) from Lundin states that the oil is intermediate grade with API gravity of 28˚ (slide 31) and that oil is "dripping out of the cores" (see picture on slide 31). Furthermore the water depth at 115 m is shallow by today's standards as is the depth to reservoir, which is only 1900m. All this seems too good to be true and as a rule of thumb, when something is too good to be true it often, though not always, is.

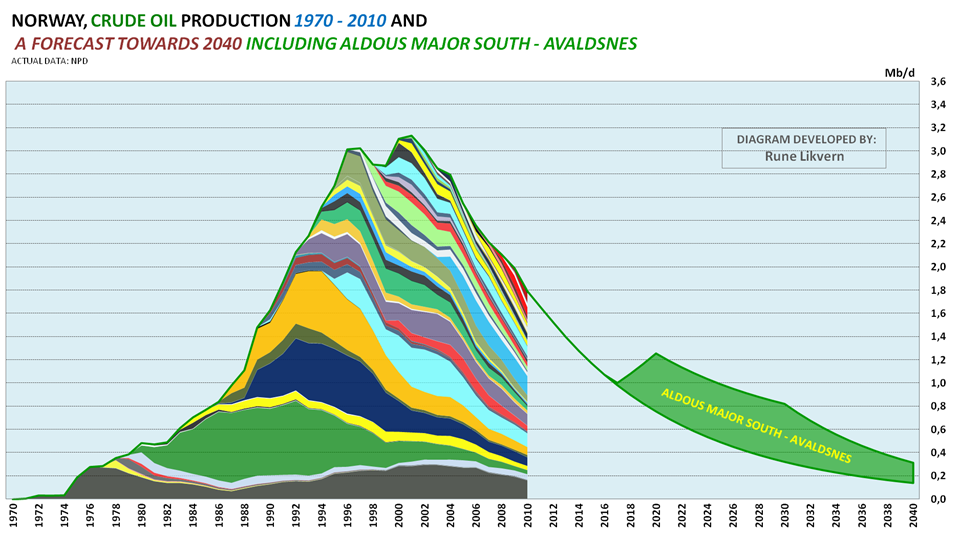

This discovery is remarkable since it will not only transform the fortunes of Lundin Petroleum and provide a welcome boost to Statoil, but it may also materially affect the future production profile for Norway. Norwegian oil production peaked in 2001 at 3.42 mmbpd (crude+condensate+NGL) and has been declining at an average rate of 5% for the last 9 years. The impact of Aldous Major South - Avaldsnes coming on stream towards the end of the decade is shown below. The field may build to a plateau production rate of around 500,000 bpd and remain on plateau for 11 years. The stacked production chart extends to 2040 and shows 3.3 billion barrels production from this sleeping giant. Production decline may be reversed for two to three years while the field is building to plateau. In 2040, this one field may account for over half all Norwegian oil production.

Whilst the discovery of Aldous Major South - Avaldsnes is a welcome boost for future North Sea production, with the world consuming 88 million bpd, 3.3 billion barrels of recoverable oil represents only 38 days of global oil consumption.

Some more interesting views of Avaldsnes from this recent Lundin presentation (large pdf)

http://www.lundin-petroleum.com/Documents/ot_co_presentation_e.pdf

The last slide shows the location of the 16/5-2 appraisal well that is currently drilling. The structure here is very flat, and well down the flanks, this location would expect to encounter a thin oil column if reservoir sandstone is present. If the seismic interpretation is out (depth conversion) then the oil water contact may fall within the top seal and the well will be a duster. But this works both ways, and the top structure may be encountered at a level higher than expected giving rise to a thicker than expected oil column.

So how many fields comparable to this one have been discovered annually for the last four or five years?

Is she hits 500,000 bpd, this will offset (very very roughly, no napkin handy) perhaps as much as ten percent of the decline of existing older fields.

We better be drillin' Baby, and everywhere , not just in our own yard. sarc

Congratulations on owning a piece of it;I hope it is a big enough piece to pay for your oil needs for the rest of your days!

With global liquids "production" running at 88 mmbpd, and assuming 5% declines, we need to add 4.4 mmbpd new capacity every year to stand still. So you are right, this one field will offset about 10% of global declines for 1 year. We need to discover about 10 of these every year. In the North Sea, we are running at about 1 every 10 years. the last was Buzzard back in 1999 (?)

A "What If" scenario, North Sea C+C production (blue) in 1996 lined up with global C+C in 2005 (different vertical scales):

WT:

there it is again - I gotta wonder, what does this graph look like with the times scaled in proportion to the amount of respective recoverables - right now they're both 26 years, but Global is a much bigger curve, meaning that what is a 'feature' of the global curve might look just like the entire NS curve.

Example: one day of activity on the DJ might look exactly like one year - but it would be foolish to call it predictive.

I don't doubt the two graphs resemble each other, but this one could well be misleading.

Here is the global crude oil "Gap Chart."

http://i1095.photobucket.com/albums/i475/westexas/Slide05.jpg

The EIA shows global 2005 annual crude oil production at 73.8 mbpd, after a rapid increase in production from 2002 to 2005. Six years later, through August, 2011, the average rate for 2011 is (so far) 73.8 mbpd (a zero rate of change over a six year period). So, where have we seen production plateaus of six to seven years, around a crude oil production peak?

After a rapid increase from 1993 to 1996, North Sea production hit 5.8 mbpd in 1996. Six years later, in 2002, it was 5.8 mbpd (a zero rate of change over a six year period). Production came off the plateau in 2003.

We shall see what happens, but clearly multiyear production plateaus, prior to a decline, are not unknown.

the famous Yergin Gap. yea, you're preaching to the choir, but 6 or 7 years divided by 120 is different than divided by 26. I'm not saying I'd be unimpressed by teh 'corrected' graph, but maybe it's not impressive or you'd have it trigger ready. Agreed tho, we shall see what happens.

I'd say that TC has a point, but I'd put it differently:

The scales need to be comparable to have a valid comparison. The North Sea vertical scale covers 67% of the range (from 2 to 6M bpd), while the Global curve covers less than 25% of the range. That's misleading. If the scales were similar, we'd see that the global curve is much flatter, and not really that comparable.

I guess some zero rates of change are more equal than others.

Indeed they are. Global growth rates were much lower before the current plateau - that makes a difference.

And, of course, narrowing the analysis to C&C is useful for analysis, but in the end it's total liquids that matter, and those are still growing.

I guess the rate of increase on the way to plateau makes a difference to you, but the purpose of the comparison is to show that multiyear plateaus, approximately a zero rate of change over a multiyear period, are not unknown. I wonder how much money the global oil industry spent to show no material increase in global crude oil production for six straight years?

From 2005 to 2010:

Total Liquids, inclusive of low net energy biofuels, increased at 0.5%/year (EIA).

C+C (EIA) and Total Petroleum Liquids (BP) were virtually flat.

Global Net Exports (GNE, Total Petroleum Liquids) fell at 1.3%/year

Available Net Exports (GNE less Chindia's net imports) fell at 2.8%/year

If we extrapolate the 2005 to 2010 trends, in 19 years China and India would consume 100% of GNE. Furthermore, this extrapolation suggests that half of post-2005 Cumulative Net Exports available to importers other than China & India would have been consumed by the end of 2013. Other than that, the supply situation looks really swell.

I guess the rate of increase on the way to plateau makes a difference to you, but the purpose of the comparison is to show that multiyear plateaus, approximately a zero rate of change over a multiyear period, are not unknown.

The purpose of the comparison appears to be to show that the curve of world production is similar to that of the North Sea. It's not. Even if that's not your purpose, the chart is still conveying an inaccurate impression on the reader.

What is the point of the chart, other than to suggest that world production might fall as quickly as North Sea production?

If we extrapolate the 2005 to 2010 trends, in 19 years China and India would consume 100% of GNE.

That's an interesting extrapolation, but of course we know that things won't happen that way. If Europe, for instance, still needs oil in 2030 it will bid high enough to get some.

On the other hand, if most exports went to China and India that would be very bad for them, and good news for other importers. Chindia's balance of trade would be terrible, and the BOT of other countries would be greatly improved.

Looking only at oil recovery that is not bad for one field, but one must also take into account the declining ERO(E)I of the old giant oil fields which is very important to completely describe the world oil situation.

Low hanging fruit that can be sold as high hanging fruit?

Major profit, I would think

Or is it not that easily extractable?

I think the Norwegian government may be thinking this too - no such thing as a free lunch;-(

As odd as it sounds the shallow nature of the field may be why it wasn't discovered until now. Much of exploration is based on trendology. You don't find oil unless you look where it is. I'm not familiar with N. Sea geology but this particular section of rock may not have a history of producing in the basin. They may have studied this area for a decade but if they were only looking for deeper potential they might not have focused on this section. This discover could have much greater significance than just what this field will produce. If this reservoir actually is a newly established trend we might see dozens of new wells targeting it across the basin.

One key to offshore exploration is using direct indications ("bright spot") of the presence of hydrocarbons sometimes seen on the seismic. While this technique can ID NG it often won't show oil reservoirs. That may have also been a key to the lateness of the discover. The sediments in the N. Sea are thousands of feet thick. And the potential traps don't always line up vertically. IOW it takes a great many wells to test every potential trap. The industry uses various techniques to cull that number. There may have been a number of valid (though incorrect) assumptions made over the years that kept this structure from being drilled. It might have eventually been ID by reprocessing of the original seismic or new data was shot. The processing methods are constantly advancing...much like most computer tech. They may have eventually seen a weak bright spot that gave them hopes of an oil accumulation.

I'll take this opportunity to pounce again on folks who tend to focus/argue about URR instead of flow rates. As noteworthy as this discover it's good to put it into the perspective of PO. Just a meatball calculation based on the numbers the Norwigians are putting out now and assuming a typical water drive reservoir: it will take a minimum of 15 years and more likely 20+ years to deplete the field. Yep...a lot of oil by anyone's standard. But unlike a DW GOM oil field it won't be recovered in 6 or 7 years. But it certainly represents a nice inheritance for Norwigian tikes born in the last few years.

This has been a dark horse. It is the largest discovery in Norway since the 1980s and I think it currently ranks as the 3rd largest Nowegian field to date with high end estimates pushing 3Bb recoverable or more (behind Statfjord and Ekofisk, which both stand at 3.5Bb recoverable). I have seen one article claiming it is the largest discovery worldwide, this year.

http://www.geoexpro.com/article/Surprise_A_Giant_New_Field/22e19796.aspx

The surprises in the field size and its presence were on a number of levels:

1) There was inconclusive evidence of a decent trap from the seismic data

2) It was assumed that the Utsira High 'hindered' migration of hydrocarbons into this area. Thus it was difficult to explain how oil migrated from the mature source rock in the Viking graben to the field. It either had to migrate through basement rock, or follow a long, cicuitous route around the high.

Spare a thought for the original licence block holders. They drilled a fraction to the east of this years ago and and walked away with a duster.

o/t - Thanks. That confirms my WAG that some had written the area off as low potential. We all have seen that numerus times: "Don't drill below 14,000' in this area...there's no potential". And then 5 years later someone discovers a $500 million field at 14,500'. Many years ago a friend was drilling a wildcat where no one had drilled that deep. Kept drilling deeper and seeing nothing. Investors finally ran out of money and they stopped. Before he could lease the land again and drill some more ExxonMobil took the leases and twinned his well. Less than 300' below where he stopped drilling his 15,000' well XOM discovered a field (Chalkly....Cameron Ph, La.) worth over $7 BILLION at today's prices. My freind Mike was 29 yo and had a 2% over riding royalty on the well. Yep: his share would have been $140 million. You can imagine he probably thought about that well at least once a day for the rest of his time. He still had a good life at least until he was lost at sea when his aircraft went down in bad weather.

OFT - Or anyone who knows: What geological age is this reservoir and what is the stratigraphy ?

Observations:

28 deg API is not much different than the much maligned Manifa project. Although, I assume this is sweet vanadium free crude.

There was a time when a core dripping oil was not considered a good thing. The belief was that high permeability rock would be flushed with drilling mud and any moveable oil would already be drained from the core before it reached the surface.

ban - I was going to point that out also but passed. Sorta like that scene in "Armagedden" when oil was blowing through the derrick on that offshore rig and all the hands were laughing and patting each other on the back as the oil splattered on them. Replace that image with the scene on the rig at Macondo. No one was laughing then. Just another variance between Hollywood and reality.

In answer to some of the questions here. The main reservoir is Upper Jurassic Huggin Formation. I think one reason the Utsira High has been in part overlooked is that the highs quite often have had reservoir stripped off or not deposited. In this case, a transgressive shallow marine sand was draped across the structure as the whole basin sagged and this followed by deposition of Cretaceous mud on top.

Rockman is right in that this is shallow reservoir for N Sea, at this depth you'd often expect biodegradation and heavy oil. But as already noted here we have good quality oil in fabulous reservoir. There are also migration issues, but this seems to be the apex of big hill draped in mudstone and oil seeping out of neighbouring kitchens has had nowhere to go once it reached the top of the hill.

I agree that those who drilled and missed by a fraction many years ago must now feel sick as dogs - but it wouldn't surprise me if some of the geologists involved then now work for Lundin (this is conjecture, I have no specific knowledge, but this is the way things work, frustrated geologists walk away with ideas in their heads).

It would also appear from the Lundin slides that the reservoir is in a downfaulted block flanking the high. That might account for the reservoir not being scrubbed off in this case.

I was wondering about the 'tetons' bordering the fault.

'Low gas oil ratio ? Where are they going to get electricity to operate the submersible pumps ?

Rhetorical ?'s, all.

Doesn't the electrical power for running such pumps (and just about everything else on the oil rig) come from diesel-powered generators (internal combustion engines)? Or, if natural gas is available at the site, then maybe that's another option. But, I don't believe that Electric Submersible Pumps (ESP's) normally depend for their power on having a high enough gas content in the crude oil output.

There was at least one very unfortunate exception to this, at BP's GoM Macondo site in April 2010, when they briefly had their diesel engines running on BOTH diesel fuel AND a mixture of air with a high content of natural gas, direct from the well (instead of only air). The engines then revved out of control, with the this unintended boost of methane "turbo-charging", further complicating the unfolding disaster.

Diesel is an option. Without a natural water-drive, or water injection, a low gas oil ratio reservoir will leave as much as 95% of original oil in place. A water drive or water injection field will eventually, in the not too distant future, produce large volumes of water, thus the need for submersible pumps.

Now I'm wondering what is the GOR ?

Euan,

In the major Swedish newspaper Svenska Dagbladet the chief geologist (Hans-Christen Rønnevik) has been presented. He started at Oljedirektoratet (state authority) in 1972. Went to Shell for one year and then to Saga Petroleum in 1984. When Saga was bought by Statoil (1999) he received an offer for early retirement which he did not appreciate. He and four colleagues revived DNO. Lundin bought part of DNO and so they came to Lundin.

It is said that they used a model that proved to be successful when working for Saga further to the north. If you want to read the article maybe it is possible to get it understandable in English from Google Translate.

http://www.svd.se/naringsliv/geologer-visar-vagen-till-det-svarta-guldet...

I have no experience in this sector of the North Sea but it is interesting to note a well drilled in 1976 sits almost bang on the oil water contact. I could reasonably expect that there was seismic support for that drilling location (i.e. a structural trap) and that the team back then just missed the big one. I suspect though that there may be evidence for hydrocarbons in the 1976 well files and that is it may well be part of the field albeit in on the edge. In that case, and purely from a statistical point of view, the field was discovered in the 70's but not recognised as being commercial or worthy of appraisal.

Excellent worm can opening ! How about calling it a 'near miss' ?

What about the seismic, though ? That would put the discovery in the improvement in technology realm.

ban - I actually like calling them "near hits". makes it easier to sell the next well...and the one after that dry hole.

See my comments below regarding the "discovery" of the Kuparuk Field.

Yes, I saw it and appreciate your science based perspective.

On the slight chance that anyone on TOD is interested in the history of the discovery of Kuparuk, the best reference is in one of the AAPG case studies:

Kuparuk River Field--U.S.A. North Slope, Alaska

W. D. Masterson, J. T. Eggert

AAPG Special Volumes

Volume TR: Stratigraphic Traps III, Pages 257 - 284 (1992)

AAPG pubs? But I always thought in peak oil circles, AAPG is...DA DEBIL!!!!

That would depend on whether or not one wants to learn more about the geology of petroleum, and the history of exploration. If you don't, you are quite free to ignore the reference. I posted it only for the benefit of those few who might wish to go beyond the typical amateur level of geologic discussion on TOD.

I apologize for my sarcasm not being more explicit. I agree with you.

No worries. I was a bit grumpy when I replied, not having had enough sleep at the time.

TOD demons are:King Abdullah, Iran, Venezuela, EIA, USGS, IEA, BP, Yergin and China.

SPE and AAPG get a 'get out of hell' pass.

Wow. I converted those files to HTML and posted them for Datapages as a summer job in 2001.

The kitchen (s) here are to the west, and so it is possible for a down flank location to the east to have "zero" indications of hydrocarbon. I'd guess if they had residual HC etc that they may have come back and drilled another well. Mapping the structure has all to do with resolution and depth conversion and I'd guess that Avaldsnes is drilled on 3D seismic, non existent back then.

Very true, Rockman. For an example from ancient North Slope history, Sinclair was looking for oil along trend to the west of Prudhoe Bay, in the same part of the section that produces at Prudhoe. They drilled through, and tested oil from a thin section of the shallower Kuparuk Fm. However they didn't think that it was significant enough to follow up on. It was only later, after Sinclair was merged into ARCO that geologists realized that the Sinclair Ugnu #1 had actually discovered the Kuparuk oil field.

This North Sea discovery also illustrates why I caution against putting too much faith in any estimates of the ultimate oil potential, or lack therof, in any particular basin. For example, there has been much comment on TOD regarding the USGS estimate of oil from the NPRA, which has not panned out. However, people need to remember that these estimates can be wrong in either direction. Basins thought to have little remaining potential may in fact still hold some significant oil fields. It just takes someone willing buck the conventional wisdom, and spend money to look.

It's also helpful to remember Hubbert's 1956 "If, then" statements: If Lower 48 URR are about 150 Gb, the Lower 48 peaks in 1966. If Lower 48 URR are about 200 Gb, the Lower 48 peaks in 1971. Fifty billion barrels of recoverable reserves postponed the projected peak by five years.

Meanwhile, our data analysis showed that the supply of global net oil exports* available to importers other than China & India (ANE) fell at 2.8%/year from 2005 to 2010. I estimate that the 2010 to 2020 rate of decline in ANE will be between 5%/year and 8%/year. Even with the rebound in US production, the dominant post-2005 trend has been that the US is being outbid for access to a declining supply of global net exports (using BP's production and consumption numbers, 84% of the decline in US net oil imports from 2004 to 2010 was due to reduced consumption).

*Top 33 net oil exporters, BP + Minor EIA data

I'm surprised to see such a large structure being unfaulted. I suspect the pressure data from the wells suggest connectivity?,, but the seismic is not of good enough quality to identify intra-reservoir faults? Fields typically get more complex with additional well (and production) data. Be interesting to see what happens here.

One possible reason this field has continued to get larger with additional appraisal - this is not a simple closure, but has multiple highs with saddles between them. Geologists are reluctant to map oil accumulations across structural saddles unless the data really compels them to do so. It appears as though the data has driven the geologists to that interpretation here.

Well you can see the multiple closures from the 3D image I post up top. The 16/2-7 well which is down in the saddle I think proved same oil water contact, same aquifer / oil column pressure regime (its normally pressured) and same oil geochemistry, enough for them to say that these are two big closures joined below the common spill point between them.

As for faulting, the main reservoir (Huggin) is reported to be quite thick, clean sand, so fault sealing would not be expected to be a major macro reservoir issue.

But at this point its worth noting that Aldous Major North (AMN) suffers from some of the complexity that you allude to that undoubtedly exists else where in the field. AMN found oil, but in poorer reservoir.

the supply of global net oil exports* available to importers...the US is being outbid for access

US consumers only have to bid higher to get access. Why don't they?

Well, if a driver sells his Tahoe, and buys a Prius, how much value has he lost? Why spend a lot of money for a tiny bit of extra value??

Everyone only has to pay more to buy a Ferrari. Why don't they?

True - a lot of people who could afford Ferraris don't buy them. Why? Because they don't add much. A Prius will get you to work.

More importantly, what you're suggesting is that hybrids and EVs are unaffordable. That suggestion is highly unrealistic - a Ferrari costs quite a bit more than the average car (the average US car cost about $30k in 2011). A Prius costs less (at $22k-28k) than the average car. So does a Leaf (at $25k).

Hybrids, EVs and plugin hybrids are extremely affordable. They're affordable to buy, and much cheaper to operate ($1,500 less per year, which adds up quickly).

Right?

Eehehe, over a half of a total production that will be reducing almost 20 times from now! Wow! (And exporting how much, please?) It is like saying that Saudi will produce the 100% of oil in 2090, with 1 barrel a day.

Euan, I've a question about the lower end production cutoff point for the North Sea oil province. The charted projections take oil out to about the 150 thousand barrel a day level. That is far lower than what is considered the no flow level for the single pipe from Alaska's North Slope unless substantial investment into and redesign of TAPS happen. Where is the no flow level from the North Sea?

I don't think the two systems are analogous. The main issue with Alaskan Pipeline is the amount of heat pumped into the system along with the oil. When the heat energy drops too low then there is risk that the oil begins to "freeze" in the pipe i winter, that is to say that waxes are precipitated and clog up the pipe.

There is not the same temperature issue in sub-marine pipes in the North Sea and there are lots of em.

The real issue in North Sea is low sustained oil price (should it occur) and decommissioning of major infrastructure. In other words, $40 for a few years could see large numbers of production nodes shut down.

It's true that the main export pipelines carrying separated crude aren't likely to clog up, but it's a different story for infield pipelines carrying untreated 2 or 3-phase flow direct from the wells. For these there's often a minimum acceptable temperature and flowrate.

But it's more than just a pipeline issue. For many years, total expenditure on the UKCS (i.e. CAPEX + OPEX + DRILLEX) has stayed surprisingly steady at about £10 billion/year, correcting for inflation to 2008. The industry is mature; it relies on continuing availability of a large number of supply boats, helicopters, DSVs, drill rigs, onshore support bases, etc; if oil prices go down, the hit is mainly on profits and Government take.

It can be argued that a sustained oil price above £100/barrel (again at 2008 values) is impossible. If so, then we need a minimum flow rate of 100 million barrels/year, or 270 thousand bpd, else EBITDA turns negative and the industry is heading for bankruptcy. Support bases must close, whilst rigs and DSVs must redeploy elsewhere in the world. Once the industry is clearly seen to be in crisis, with large numbers being paid off, the decline may become self-accelerating.

Calculating when the UK industry falls off the cliff is an interesting exercise, complicated by the fact that many of the assets - whether pipelines, vessels or engineering offices - are shared with Norway. Norwegian depletion is not nearly so advanced, so even when UK production falls below minimum standalone level, Norwegian production may still maintain North Sea BAU for a few years longer.

150 thousand bpd is probably a reasonable estimate for the minimum level of UKCS production below which we start the big shutdown. I did think of putting together a full-length post on this, but I can't be bothered.

Thanks Scottishforester and Euan. Your replies helped me flesh things out some. I did realize the pipes delivering oil from two regions weren't analogous. I could have worded my question better.

Maintenance costs/oil price would seem a major life limiting factor. How big an issue is corrosion of those undersea pipes and valves? Sweet as it is North Sea oil must take is toll on the steel eventually.

BP kept the corrosion issues on it's North Slope feeder pipelines out of the limelight until fairly recently when the black puddles got too big to hide. TAPS no flow level may be getting all the headlines but the repair state of the entire feeder line system is no small concern itself-and many in the know were troubled by that long before spill of March 2006. The situation on North Slope could well have an analogue under the North Sea.

Corrosion is a big issue for the flowlines carrying untreated well fluids, and also for water injection lines, but less so for the main export lines. Note that North Sea oil is - on average - not nearly as sweet as in the early days.

If you look at https://www.icmmed0ty.com/fps/content/brochure/brochure.asp?sectionid=12 , it seems fairly clear that BP expects to close down the Forties Pipeline System for economic reasons rather than corrosion reasons. The Forties line used to be pigged regularly and I expect it still is. I'm not sure about our other main export lines, but I shouldn't think any of them are as bad as the TAPS. After all, they were built more recently, with better steel and better engineering.

But our maintenance costs include accidental damage, riser fatigue, anode exhaustion, FPSO cracking - all sorts. The maintenance bills don't get any less, even though production is getting less.

I should add that the minimum flow rate at which the Norwegian oil industry shuts down will be higher than for the UK, partly because Norway is a higher-cost country. But also, by the time things are getting critical in Norway, the UK/Dutch/Danish sectors will already have shut down, so the infrastructure costs cannot be shared. Minimum operating level for Norway might be as much as 300 thousand bpd. Mind you, that still means that a young Norwegian oilworker can look forward to a much lengthier career than his British counterpart.

In the language of addiction this is like finding a lost bag of crack the "head" had previously lost.

More dope, less hope? Or to use the words of congress, "kicking the can down the road?"

Vaccination time?

Dredd - I would say it rates a little better than that. It could add up to a $300 billion boost to the Norwigian economy and around $60 billion to their sovereign fund for their future generations. Folks should remember the only reason such fields are being developed is to make a profit and not to mitigate PO. And the Norwigians seem have just done an excellent job of accomplishing that.

Yeah that's the thing, these are short term profits. It's like Alberta touting all the economic growth and jobs the oil sands creates, as if that's a good thing. This just makes the inevitable collapse at the end when the deposits run out even worse. The politicians don't care because they are interested in the 4 year horizon, and the average person "electing" the politicians is more concerned with immediate income than what happens 10 years down the road, and there's always the denialism attitude that can be relied upon if one desires to avoid being forced to address PO.

Null - So you think it's a bad thing to add up to a $300 billion to the Norwigian economy and around $60 billion to their sovereign fund for their future generations. Interesting perspective. Sounds like the old advice as to why we shouldn't feed the hungry on one day because they be even hungrier the next day. An idea probably generated by someone who has never been truly hungry. Having grown up dirt poor and being hospitlized for malnutrician when I was 5 yo I guess I have a different perspective.

ROCKMAN, I understand that your excitement isn’t in mitigating PO but rather in the geology of the deposits (which I appreciate and try to learn from). I just disagree that “govts are developing their resources for the benefit of the citizens.” If they were then a large chunk of those FF’s being developed would be going to building out a renewable energy infrastructure, which isn’t happening.

“around $60 billion to [the Norwegian] sovereign fund” will be worthless in a few years when fiat currencies hyperinflate and the only measure of true wealth is real tangible assets, which Norway and Canada are quickly vaporizing into entropy lost to outer space forever…

My family comes from a middle class forest industry background, so I’ve never known true hunger. Of course we had our issues in the early 80’s like everyone but we got by, moving on to another part of Canada to R&P instead. In my own career I’ve moved away from forestry activities (not many trees left to cut down in BC, and the US housing bubble burst), continuing the natural resource R&P theme of my career with coal mining. But I’m under no illusion that what I am doing is for the good of society – yes, what I am doing is in a small way contributing to the unpleasant deaths of billions of people in the next few decades, and I don’t deny that (which is why I don’t plan to stay in this field for long). I’ve bought a Leaf, and for 5 years before that I went car-less, so I definitely consume less than the average person. And I’m not going to go live in a cave because that won’t do anyone any good. I’d be much more effective by staying put and publicly slamming the FF industry for what it is, and frankly I’m a little surprised I still have a job as a result; it’s made for some awkward times at work.

I don’t have a fantasy about how life should work – I understand how it does work – it works within the bounds of the cold hard facts of ecological energetics (of which FF’s are the prime example), ultimately limited by the laws of thermodynamics. Those cold hard facts are clearly sending us down the path to planetary collapse from overpopulation, absent some miraculous breakthrough in nuclear fusion technology by January 2012.

There is no evidence suggesting we are any different from the St. Matthew Island deer. We have likely overshot our ecological carrying capacity beyond what the deer did, all of course enabled by cheap abundant energy from FF’s, for which we have no replacement ready and waiting.

We could have had a replacement if we had used our abundant fossil fuels in the 70’s to build out a renewable energy infrastructure but as you point out, “No one … in the oil patch cares about mitigating PO. None of the companies or the Alb. govt have such a grand goal. It’s all about making a living/profit. I know “profit” is a dirty word in some circles.”

And for the purpose of furthering that “profit” motive, those companies and governments have thwarted the development of an alternative sustainable energy infrastructure, so that now in the face of PO, we no longer have the energy left to build one! Because those companies and governments do not represent the people!

If economic growth was really a way to improve the average person’s standard of living then Americans would be rich right now. But they aren’t and when the dollar collapses they will find out just how poor they really are despite centuries of previous economic growth. They don’t own their farmland, nor what remains of their factories. They basically own debt, and underwater mortgages on overvalued houses, and that’s about it. All of America’s wealth has been stolen by the bankers and the ultra wealthy elites in control of them and which largely own the corporations that own America’s farmland. The economy is a hamster wheel of debt slavery, a wealth stealing machine, and it uses people’s fears of unemployment and hunger to justify R&P'ing even more wealth from the planet for transfer into the clutches of the elites.

To some extent yes, but that isn’t a valid analogy because there is no substitute for food but there is a substitute for FF based oil, and if humanity is going to continue we are going to have to develop that substitute. We use oil for two things – energy and materials. And we could (and do) use other sources besides FF's to liberate energy, and the materials provided by oil could be produced with synthesis chemistry using basic molecules and energy as ingredients.

Economic growth is a good thing. Much like democracy practiced in America, once you consider the alternatives you realize that there isn't much in the way of alternatives. And if Canada can grow and prosper from exploiting their resources, good for them.

Null,

Yes, addiction has its own language. Can't miss it. It is very distinct. "Just one more" for example, "too legit to quit" for another.

The Alberta oil sands are not likely to run out during the lifetime of anyone alive now.

If production rates were cranked up to 3 million barrels per day, that is about 1 billion barrels per year. Taking an economic resource base of about 350 billion barrels at current prices, that would be about a 350 year supply of oil.

Rocky – I suspect you’re wasting your breath. I suppose some folks think I’m just trying to be glib when I point out “the oil patch ain’t your momma. We don’t exist to satisfy your needs”. I think when we geogeeks get into high gear and start blabbering about field discoveries a few folks assume we’re representing that we're on some noble quest to show how were struggling to save the day…and BAU. As you know the new Norwigian discovery is any geologist’s super wet dream. At the moment I’m getting all ginned up over the possibility I just discovered a low resistivity/low contrast oil reservoir. Too long to explain folks but it’s an oil reservoir that looks like there’s no oil in it. Not many geologists around who know how to pick up on it.

Very exciting and I could go into detail and teach interested folks on TOD about it. But some folks would think the excitement had to do with some minor effort to mitigate PO. As you know so well it isn’t about PO. No one I know in the oil patch cares about mitigating PO. None of the companies or the Alb. govt have such a grand goal. It’s all about making a living/profit. I know “profit” is a dirty word in some circles. The Canadian and Norwigian govts are developing their resources for the benefit of the citizens. Any benefit for the rest of the world is just coincidental. Folks can call it “feeding an addiction” if they like but those same folks are posting their thoughts using the grid that is generally powered by fossil fuels. Thus they are part of our collective crack house here on TOD. If some folks feel the oil industry is feeding an oil addiction I would think they would feel the same about the ag industry feeding society’s addiction to food. Guess it just boils down to one’s perception of how life works vs. some fantasy of how thy think it should work.

No: IMHO no drilling effort or flurry of big new discoveries is going to substantially change the PO path we’re on. But that’s not the goal of the mineral owners or the oil patch. It’s just about generating revenue. And yes…it’s being done with little regard to the effects on the planet. Being a good caretaker of the plane is society’s responsibility. But whether everyone can be honest and admit they support the effort is another matter. I’ve run across very few folks who, despite their stated indignation, aren’t accepting their “addiction” to ff’s and keeping that needle stuck in their arm. They might argue they aren’t getting as high as others. But isn’t that what most junkies and alcoholics say?

The most common situation is that shale laminations in a sandstone pull down the observed resistivity, thus suggesting a high water saturation, but the bound water in the shale laminations is not moveable, so a low resistivity zone could produce 100% oil.

A somewhat analogous situation can occur in carbonates, where the water saturation calculation suggests that a zone is wet, but the water filled porosity has no effective permeability, with the permeable porosity being saturated with oil.

Conglomerates in some of the N Slope reservoirs have a similar issue with micro-porous chert. Immovable water trapped within the chert pebbles give a lower resistivity, leading to errors in calculating oil saturation.

wt - what's really exciting is that I don't have shale laminations loaded with Fe rich chlorite. The tiny authigenic chlorite flakes are coating the sand grains...got the SEM pics to prove it…very classic. Last time my other geologist saw this he tried to get his company to test the zone (GOM - S. Timbalier area). They wouldn't believe him and plugged the well. Another company came back later and twinned the plugged well and completed the zone: 3,000 bopd and produced 3 million bbls of oil. I've had 0.6 ohm-meter sand produce 600 bopd. I'm on the well right now plugging it back and will move the w/o rig in and test in a couple of weeks. Very big deal: no one has found low R pay in this area AFAIK.

Rockman,

Yes, the oil patch ain't your momma, and if you're American, the Canadian government ain't your momma either. The US government might be your momma, but if it is, it should be charged with parental neglect and you should be taken away by the welfare folks.

The fact is that Canadian oil patch is in it for the profits, and the Alberta and Canadian governments are in it for a slice of the profits. The Alberta government owns the oil sands, so it is keen on developing it for the royalties (2% before payout, 25% after payout) and the Canadian government is equally keen because it has realized that it is making more money than the Alberta government from corporate income tax and GST (goods and services tax, something you don't have in the US). Somebody has to pay for Canada's free medical care, and if it's the oil industry, that works for all the governments concerned, even if the oil patch is a little dubious about it.

Similarly, the Norwegian government has $600 billion in its national pension fund, and there are only about 4 million Norwegians so each of them is going to have a really comfortable retirement, verging on luxurious. I've actually been in several Norwegian old folks homes, visiting aging Norwegian relatives. I couldn't afford furniture of that quality, and neither could you. It's all fine-grained oak and beautifully carved. It's not Ikea, baby, they keep the good wood for themselves.

But, yes, the Canadian and Norwegian governments are developing their own resources for the benefit of their own citizens and no one else. People in the rest of the world need to realize that their oil reserves are not going to change much about Peak Oil, other than that they will have a few more years to get ready for it. If they aren't ready, that's their problem.

The Norwegian electrical grid is 99% hydroelectric - only 1% fossil fuels, while the Canadian one is 60% hydro and 15% nuclear - 25% fossil fuels. Canada has some massive undeveloped hydro sites in the north, so it could back out fossil fuels completely if it really had to. Neither country is really dependent on the oil they are exporting, except as a revenue source.

the oil patch ain't your momma

No, and that would be just fine if it would stick to finding and selling oil and gas. But no, it has been interfering with public policy: buying representatives and presidents (or providing them pre-paid), and spreading disinformation.

"the Norwegian government has $600 billion in its national pension fund"

I'm curious about this. Do you know specifically how this is denominated? Is it a bunch of US Treasury bills? Stockings full of cash?

I think the Norwegians are in a for a bit of a surprise when they discover that their $600 billion is really worth no more than the toilet paper it's printed on. Similar to the Saudi's, they appear very wealthy only because the dollars they (are required to) accept as payment for their oil retain their value, which they soon won't. They are trading real wealth (hard assets like energy) for imaginary paper wealth. I think the Saudi's realize this though so I'd guess they have also accumulated a lot of gold in anticipation of the end of paper money. Have the Norwegians also been so astute? I don't know but I'd doubt it.

Soon everyone in the world will accept the fact that money IS energy, or rather a claim on it, even now with our current system. Literally. That's what a dollar represents -- ecological energy cycled up the food chain to power the person earning $12 an hour who performs work in a debt based monetary system. Money is created from debt, and debt is repaid by working your life away, and you need food to work. That's how the monetary system is set up, but right now we have an inflated ponzi scheme where the current value of the dollar is inflated way beyond what the true energy fundamentals supporting it actually amount to. When the reality of this asserts itself via hyperinflation of paper currencies, then few countries will be so foolish to trade their real money (energy) in return for .... what? Maybe mining rights? Food? BMW's? What else would you trade your money (energy) for in a world of increasingly scarce energy that's falling apart? That's why, when the reality of PO hits, international trade in oil is at some point going to stagnate because there is little of value that it could be exchanged for. Then China's going to be in a bit of a bind because demand for useless but energy-intensive electronic gizmos will drop precipitously.

I think the Norwegian pension fund mostly invests in the European stock markets, with some money in real estate and some in bonds. I have heard they have been told to stay out of the currency markets, so they may not have anything invested in US treasuries, or in any other currency for that matter.

Mostly, they're spreading their risk as far as possible, so I wouldn't expect them to lose much money on their investments. They're not stupid, you know.

http://www.swfinstitute.org/fund/norway.php

There is a great deal of information readily available regarding the Norwegian Pension Fund - most direct source is via Norges Bank (largely available in English).

Norges Bank - English

What I like is the list of companies which the fund is not allowed to invest in for ethical reasons.

Excluded Companies

Companies such as:-

Raytheon and Lockheed Martin (Cluster Munitions)

Northrop, Boeing, BAE, Honeywell (Nuclear Arms)

All tobacco Manufacturers.

Walmart (Human Rights Violations)

Vedanta, Rio Tinto (Serious Enviromental Damages)

Many others from around the globe also. I would be interested to see a comparison with how the wealthy Arab nations invest thier oil wealth. Or indeed how the USA would handle a similar bounty, were they to be sufficiently socialist to remove enough profits from the oil industry.

The State of Alaska has the Permanent Fund, started in 1976 as TAPS was about to come on line. Rather than taking profits, the approach taken was: "At least 25 percent of all mineral lease rentals, royalties, royalty sales proceeds, federal mineral revenue-sharing payments and bonuses received by the state be placed in a permanent fund, the principal of which may only be used for income-producing investments." The fund was set up forseeing the time when Alaska may no longer have major oil production. The fund is currently valued at $38,433,800,000.

Wisely, the folks who established the Permanent Fund set it up so that while "The Legislature may spend realized Fund investment earnings..." each qualified Alaska resident is paid an annual dividend from the fund. This creates strong political pressure to maintain the principle. The Permanent Fund Dividend that was paid to each resident for 2011 was $1,174.

“the oil patch ain’t your momma. We don’t exist to satisfy your needs”

"Oil patch" is the drug dealer that exists to satify its "needs", working for our dictator parent.

Both must helplessly speak the language of addiction.

That is sick, not sound.

That's like arguing that the local grocer is satisfying your addition to eating food every day, and your landlord is satisfying your addiction to having a roof over your head.

The oil patch is satisfying your addiction for driving your car from point A (e.g. your home) to point B (e.g. your work, assuming you have any) without walking there.

If you had a conveniently available electric train powered by wind generators which you could ride to work, which I did for years, then you could avoid your addiction to fossil fuels. But you probably don't have one, so it's more like having an addiction to not starving or not being rained on at night.

Hybrids and EVs are easily available throughout N America, and cheaper than the average new car.

If we publicly acknowledged the enormous hidden costs of oil (trillion dollar oil wars, just for starters), we'd see that oil is a very expensive addiction.

We don't publicly acknowledge those enormous hidden costs because of the influence of the oil industry.

Rocky, I know you don't pay the campaign contributions that buy our representatives, but they get paid nonetheless.

You can avoid the costs of trillion dollar wars by just not starting them. (It's a solution that has worked for Canada.) Wars are more a subsidy for the military-industrial complex than the oil industry. The oil industry doesn't particularly benefit from them, the arms and aerospace industries do.

You'd think we could, but then we had a guy like Tom Brokaw pandering to the 'Greatest Generation' as he cheer-led Bush's move into Iraq. Delusional snake oil salesman of the first order he and George both. Too bad the masses love being deluded.

Of course 80% of Canada's exports go to the US. Sure other people would buy the oil, but the way trade breaks down when petty regional rivalries blow up into full scale wars its hard to say how it all goes down if the big ship founders. For nearly the two centuries first the British and later US fleets (include air now) have dominated the seas and trade has flourished. There were a couple of breakdowns the most notable of which occuring about 1939-1943 . I wouldn't lick my chops too much as I contemplated the demise of the US if I lived in Canada. The disease that is festering in the Straits of Malacca and off the Cape of Gwardafuy can spread quickly, especially if state sponsored privateers come into vogue again. Have a happy holiday.

I'm not deriving much satisfaction from the hypothetical demise of the US, although I'm not one of the Doomsters and I believe the bottom is in sight.

But, back to the "breakdown" of 1939-1943. This is an obscure bit of history, but the Canadian Navy took over most of the responsibility of convoying ships across the North Atlantic. The Canadian Navy started with WWII with about 10 ships, but by the time the war ended they had nearly 1000. Their primary focus was on keeping the German U-boats at bay. They escorted convoys of Canadian, British and US merchant ships from Canadian and US ports to British ports, and back.

By the end of WWII, Canada had the third biggest navy in the world. Of course, the German and Japanese navies were on the seabed by that time, and the Russians put all their resources into building tanks.

The US Navy doesn't like to talk about this, but they suffered the worst defeat in naval history in 1942 at the hands of the German submarines. Pearl Harbor was bad enough, but the Battle of the Atlantic was much worse. The US destroyers that weren't transferred to the Pacific to fight the Japanese hid in harbor, afraid to go out, while the German U-boats sank over 400 ships off the Atlantic and Gulf Coasts of the US. Meanwhile the US Navy failed to sink a single U-boat.

At the same time, the Canadian Navy was escorting convoys of oil tankers from the Caribbean to Eastern Canada through the middle of this shooting gallery (Canada imported 90% of its oil at that time), and they managed to do so without losing a single tanker.

What the German submariners called "The Happy Time" came to an end toward the end of the war when the US finally got its ducks in a row. New US long-range aircraft closed the "Greenland Gap" in the middle of Allied air coverage over the Atlantic and sank most of the German U-boat fleet. But until that time Canadian warships were bearing most of the burden in keeping German U-boats away from the Allied convoys to Britain and keeping Canada supplied with oil.

I just thought I'd mention it since you seemed to think that Canada was completely incapable of protecting its interests at sea.

Where were the Canadian ships built? Why were they so much more successful than the US ships?

You might remember the Canadians saw the balloon go up two years before the U.S. They had two years head start on building escorts and U-boat tactics. It wasn't until the middle of '42 that the U.S. was able to provide escort in the Atlantic although some U.S. destroyers were accompanying certain legs of convoys as early as Sept '41.

http://en.wikipedia.org/wiki/Flower_class_corvette

All of the RCN complement of the Flower class were built in Canada, including the ones they gave to the U.S. on reverse lend-lease.

Interesting.

Yes, the Canadian Navy had already been in the war for two years when the Japanese bombed Pearl Harbor and the Germans declared war on the US, so it already had considerable experience dealing with submarines.

The Canadian Navy purchased most of its larger ships from the US and Britain, but had the smaller ships built in Canada. It didn't have very many large ships and most of the fleet consisted of little corvettes.

One problem with the American Navy was that it refused to take advice from the British Navy, and of course the British had been fighting off German submarines for years when the US entered the war. Among other things, the Brits had learned that it was safer to run merchant ships in convoys rather than singly, and that it was important to black out the shore lights so the submarines couldn't spot the ships by the lights. The US initially refused to do this, so the German submarines just lurked off the coast and picked off the ships one by one as they steamed in front of the shore lights. It was a lot like shooting fish in a barrel.

The Canadian Navy realized that the objective was more to frighten the submarines away from the merchant ships than to sink them, and that any kind of escort ship was better than no escort at all, so it built a large number of little corvettes and frigates rather than a smaller number of destroyers and cruisers. The submarines were less likely to find a small number of convoys of ships than a large number of individual ships, and if they did find them, the escort was a real hazard to them, so if they see a Canadian convoy, they just submerged until it was past, and then after it was gone, went back to picking off individual unescorted US ships.

I seem to remember some Canadians in Iraq and Afghanistan.

Now, is oil just an excuse for spending on the MIC? Probably, at least in part. But....it's a mighty good one. It's one that almost every president in the last 60 years has invoked in one way or another. I would think that any reasonable person would agree that it would be a good idea to remove it.

Further, I think any historian, military or otherwise, would agree that oil is a strategic war fighting asset, at least at the moment. It's no accident that nuclear energy powers so many navy ships. One can't seriously suggest that a "superpower" (which Canada obviously is not) can ignore it.

Finally, it's not a question of whether the O&G industry benefits, it's a question of whether national dependence on oil creates a national security problem. It clearly does.

And, of course, oil wars are just one of many hidden costs of oil. Pollution is big, both direct forms like particulates, nox etc, and CO2. The direct cost of oil-shock induced recessions, and indirect costs (much of our current financial crisis stems from our oil trade deficit) are in the tens of trillions).

Canada never participated in the Iraq War. The Canadian Army was in Afghanistan, but they are out now, except for training the Afghan Army.

Operation Friction?

Operation Friction was during the first Gulf War. Canada sent two destroyers and two squadrons of F-18 fighters, and suffered zero casualties during that operation.

I was talking about the second Gulf War, which is the one in which the US suffered a few thousand casualties in Iraq. Canada opted out of that one.

It's worth noting that the 1st Gulf War was much more explicitly about oil than the 2nd: Iraq invaded for oil, and Kuwait (and KSA) was defended because of it's oil.

Saddam would have been happy to pump Kuwaiti oil and sell it to the world. GWI was about balance of power in the ME, which is ultimately important because of oil. Of course some other differences were that GWI was legal, had the active military and financial support of the Arab world, most of the world was part of the coalition, Iraq started it, the U.S. actively attempted to resolve the conflict without invasion, overwhelming force was built up, there was a Powell Doctrine exit strstegy implemented, the U.S. won, and the U.S. didn't lose $1T. That's a lot of reasons to be glad GHW Bush was president. EPACT 1992 is another one. Bush I was a better president than he gets credit for. Of course, I'm not sure I'll ever forgive him for enabling his ne'er-do-well firstborn to be inflicted on us.

The U.S. did make some mistakes in GWI: Schwarzkopf admits he got snookered by the Iraqis about helicopters, and after the war they allowed the expulsion of half a million Palestinians from Kuwait by folks who would have been exiled themselves if the U.S. hadn't stepped in.

Sounds reasonable.

The key point: none of this would have happened if not for the world's dependence on ME oil.

I have a hard time imagining a world where Middle East oil is not globally economically important, as long as it's there. That's true of all major oil producers, the Middle East just has a lot more surplus than most, and a relatively fragile political structure. I can imagine a world where it was LESS important. Since GW2 was pretty much completely unnecessary, and counterproductive from a realpolitik viewpoint, and a foreseeable disaster, I'd a lot rather have spent the $1T on reducing U.S. dependence, which would have gone a long way toward reducing world dependence. I know people who are seriously conservative (very different politics than mine) who agreed with me even before GW2. Incidentally, probably the two biggest mistakes GHWB made on foreign policy IMO were the approaches taken to the end of the last war in Afghanistan (say goodbye) and to the fall of the Berlin wall(rapid privatization). One destabilized the Muslim world, the other destabilized much of the former Communist bloc. Russia is one of the biggest geopolitical risks for oil production.

I think I agree with most of that, except that I don't have a hard time at all imagining the ME much less important.

If every vehicle in the world was an extended range EV like the Volt, oil supplies would be no big deal at all.

My figures say 180 billion barrels (from the Alberta Energy Resources Conservation Board section 3-1) but maybe you have better data, but regardless that's splitting hairs. So then, Alberta's oil sands, arguably the largest reserve in the world (Venezuela is too difficult and the Saudi's may be lying about their remaining reserves), is going to save the world from Peak Conventional Oil by providing a billion barrels a year for the next 350 years (or 180, depending on whose figure you use)...

.... to supply a current world demand of 30 billion barrels a year, which is only going to go UP with the wonderful economic growth that some of us believe is going to raise people's standards of living? That is THREE PERCENT of global demand ... from the largest deposit in the world! Where are the other deposits to make up for this shortfall? All the big easy ones have been found -- that's why the tar sands have been known about for like 100 years -- they are big and easy. Maybe we'll get lucky and find another deposit in Siberia, which seems to be the last great wilderness that might hide some gold nuggets, and let's say it turns out to be TWICE the size of Alberta's oil sands. Then whooppee! We'll be able to supply NINE PERCENT of (current) global demand for 180 (or 350) years! And let's add in Venezuela at a billion per year so then we're at TWELVE PERCENT!

And with global conventional oil production about to head down the steep part of the Hubbert Curve, because the discoveries just aren't there (this Norwegian field is generating so much excitement yet it represents 1 month of global oil consumption), let's just crank up the oil sands production to offset the deficit! Putting aside the engineering miracles of ramping up this "slow oil" quickly (I know first hand; we're trying to find contractors and they are all too busy in Alberta -- there are none available) to pick up the slack from conventional oil depletion, let's say we crank up the oil sands to 10 billion a year, to supply 1/3 of (current) global oil demand. Then, all of a sudden, Alberta's reserves would only last 180/10 = EIGHTEEN YEARS if you use my figures, or THIRTY FIVE YEARS using yours.

And with an EROEI of around 3:1 for oil sands, where will all the natural gas come from to run the whole show? Can we count on 60 billion barrels equivalent of NG being available, using my numbers, or 120 billion using yours, especially when conventional oil declines will be increasingly offset with NG, for example to power internal combustion engines? I don't have the figures for North American natural gas but I have a feeling it will reach Peak too in the near future, especially under such pressures from conventional oil depletion.

I actually read the underlying studies from the Alberta Energy Resources Conservation board and made my own estimates of how much oil was recoverable. I was struck by how conservative they were - probably deliberately so. I think they were uncomfortable with Canada having the biggest oil reserves in the world, so they knocked themselves down to second place.

Geologists I have talked to who were working in the oil sands figured they could recover at least twice as much oil as the Alberta government assumed in their studies.

You can buy the data on CD-ROM if you want to do your own estimates. Alberta requires companies to release all the drill core, well log, and production data to the government (with a 1-year delay for tight holes), and makes it available to anybody who might want to drill their own oil well.

So, the Canadian industry is working with a 350 billion barrel resource estimate, and Alberta government experts admit privately that that number is probably in the right ballpark. The 175 billion barrel estimate is just an official line in the sand because you need some kind of line in the sand for the press releases.

The Venezuelan oil sands resources are even bigger, but unfortunately they're in Venezuela. The Orinoco oil sands are bigger than the Canadian ones, but Venezuela has neither the capital nor the technology nor the stable political environment to develop them. In reality, Venezuelan oil production is in decline because they aren't really capable of developing their oil sands without outside help. They used to have a lot of heavy oil experts, but Chavez fired them all for political reasons, and they're working everywhere in the world except Venezuela.

Siberia is gas prone - it has far more natural gas than oil. Certainly there's lots of oil there, but there's unlikely to be any big oil finds that would be a game changer in the global context. I've talked to Russian geologists, too. Actually, we used to hire a lot of Russian oil experts because they became widely available after the collapse of the Soviet Union.

Natural gas is not likely to be a constraint on Canadian oil sands development because, unbeknowst to most Americans, the Alberta government is planning to curtail exports to the US and divert natural gas to the oil sands. It's in the Alberta government planning documents, which probably the US government authorities have not read.

But, yes it's true, none of this is going to have much effect on Peak Oil, except for the people who get to run their vehicles on the fuel produced from very expensive non-conventional oil. Bring money.

run their vehicles on the fuel produced from very expensive non-conventional oil. Bring money.

I'll stick with trains and electric vehicles. Cheaper and better.

And you have conveniently available electric trains stopping near you, and a cheap electric vehicle in your garage, I take it? Most Americans don't have these things, you know.

Those Americans who are dependent on internal combustion engines are the ones the Canadian oil industry is catering to. The US didn't have to structure its society to lock people into being totally dependent on gasoline cars (or even diesel buses), but it did anyway.

See my comment above - Americans are not dependent on ICEs. They don't choose hybrids and EVs because the enormous hidden costs of our oil addiction are not publicly discussed.

I still have a copy of a 1990 BusinessWeek cover with a big black title:

"OIL WAR"

"I think they were uncomfortable with Canada having the biggest oil reserves in the world, so they knocked themselves down to second place. "

Yeah that 10% knock down from 1.8 trillion to 180 billion did seem kind of arbitrary. Do you know why so much of that is uneconomical?

The established reserves of 175 billion barrels of bitumen were made when the price of oil was about $20/barrel, and the Alberta government hasn't seen fit to update them just because the oil price is closer to $100/bbl. At current prices, at least twice that amount of oil would be recoverable.

In reality, it all depends on the oil price, and if the oil price keeps rising, more and more of the 1.7 trillion barrels of oil-in-place becomes recoverable.

They are sticking with the original economics because the theoretically recoverable volume doesn't really matter. It is impossible to build enough oil sands plants to recover all 1.7 trillion barrels within the lifetime of anyone who is alive today, or the lifetime of any of their grandchildren. Even producing 175 billion barrels will take more than a century under any realistic economic assumptions.

What do you think is the critical obstacle to getting to 10M bpd?

Well, other than labor constraints, I think the big obstacle to getting 10 million bpd would be environmental restrictions. The existing oil sands projects are already big enough to scare the wits out of people who see them, so I think the government authorities would put a cap on their size long before they reached the 10 million bpd level.

Repairing a bridge to the future is no bad thing?

Putting that 1,7 - 3,3 Gb of recoverable oil in perspective:

anyone knows how much recoverable oil there is expected to be in the South Chinese sea ?

Now let me see, 30 billion barrels of oil consumed world wide every year that will mean that if this field produces a total of 3 billion barrels that is equivalent to 5 weeks of world consumption. This might seem like sour grapes but I assure you it is not. This oil will not have any political consequences as it will be sold on on the open market. I can imagine that it will be far cheaper to transport this oil too the refineries at Rotterdam than too the refineries in Shanghai, it certainly wont add too the demise of the E.U. but it might just make the landing a bit softer.

Yes, but there is another monster called China. They don't mind for long shipping routes, as long as their economy keeps growing. Comment here below from Drumbeat of yesterday.

I have concluded that there may be a global shortage of calculators, because most of the world seems either unable or unwilling to subtract domestic oil consumption numbers from domestic production numbers in oil exporting countries, in order to derive net export numbers, which are calculated in terms of total petroleum liquids.

While it is true that the EIA shows that total liquids production worldwide, inclusive of low net energy biofuels, increased at 0.5%/year from 2005 to 2010, the use of a calculator shows that the global supply of net oil exports available to importers other than China and India (what I call Available Net Exports, or ANE) fell at 2.8%/year from 2005 to 2010. I estimate that the ANE decline rate will accelerate to between 5%/year and 8%/year in the 2010 to 2020 time frame.

Incidentally, Sam Foucher noted that new North Sea oil fields whose first full year of production was in 1999 or later had a production peak of one mbpd in 2005, but this only served to slow the overall North Sea post-1999 decline rate to about 5%/year (C+C).

Regarding Canada to the rescue, the BP data base shows that combined net oil exports from Canada, Mexico, Venezuela, Argentina, Colombia and Brazil* fell from 5.1 mbpd in 2005 to 4.0 mbpd in 2010.

*Brazil is a net importer of petroleum liquids, but the MSM seems to think otherwise (possibly another sign of the global calculator shortage)

Well, Canada did ride to the rescue with more oil exports, but Mexico, Venezuela, et al rode in the opposite direction, which ruined the whole effect on production.

Entirely predictable according to the Dispersive Discovery model. If these occasional discoveries don't happen, prospecting has likely come to a standstill.

Entirely predictable playing pin the tail on the donkey. No point in making it more complex than necessary.

Web, when you can predict exactly where and to what depth to drill my next well, in order to find a field like this, then I will take you seriously.

:-)

I guess you are just tickling Web, but if you take what Web said (he predicts statistically these additional finds assuming exploration continues), and combine his perspective with Yorkshire Miners 5 weeks of world consumption, you can see where we are at? Brief uptick for Norway - might keep Brit production infrastructure going a while longer than otherwise? Web has last laugh well before he gets to be old man? Seriously ;)?

You seem to be under the mistaken impression that I somehow suggested that this discovery would change the world situation with respect to PO? I did not. I make my living in the oil patch. Whether or not Web can predict statistically, on a world wide basis, that these additional finds will occur is of only academic interest (at best) to me. My influence over world energy policy is vanishingly small.

For me, what counts is predicting exactly where/how to drill my next well.

As you know, an incremental increase in production, in a given area, does not necessarily make a material difference in global oil supplies. Many people seem to mistake the former for the latter.

For example, as noted up the thread, new field discoveries in the North Sea, whose first full year of production was in 1999 or later, had a production peak of about one mbpd in 2005, and the new fields served to slow the overall post-1999 North Sea decline rate to about 5%/year.

And despite increasing production in the US Lower 48 and in Canada, the billions of dollars spent by the global oil industry from 2005 to 2011 has so far resulted in a zero rate of change in global crude oil production*, with a measurable decline in global net oil exports.

*Through September, 2011

I beleive that is what I just said: "You seem to be under the mistaken impression that I somehow suggested that this discovery would change the world situation with respect to PO? I did not."

I don't think I was disagreeing with you.

I do have the statistical foo which really makes meaningless the skills that an oil hand brings to the table. The sooner we realize this the quicker we can move on.

Now, now just what good would that statistical foo do if no one was out there getting beat up and dirty actually producing stuff for you to figure out how to model. Hard to eat the distribution of lower 48 land form slopes-and as interesting as you found that exercise I bet it didn't help you skate up a long, tough grade one iota when you where 10-20k out. Tough to keep big picture/rubber meets the road perspectives in focus in the same instant. Everyone plays a part here. I wouldn't mind seeing that projection of the oil production plateau your model produced again. Seems you posted it a few months back but I forgot to copy the it. Have a happy holiday.

It is absolutely fascinating to read these learned discussions. Far, indeed, from my personal field of endeavor. Always good to stretch one's imagination, and it gives me insight and ideas about how to approach people whose experience is very far from my own, and yet ask me for advice. (But not about oil!)

However, after almost 6 years of reading TheOilDrum, I have yet to find the answer-- Is the world going to run out of oil or money first?

Or are they the same thing?

Money and oil are not the same.

The world had money before 1900, even when it didn't use much oil.

Money is a fiction. A figment of the human imagination. If we think we need more of it, we conjure it. Ultimately, it has no real meaning or value. I'd worry more about real things, like oil (energy), soil, water...

Funny question, but I doubt it can be answered in the current paradigm. The news threw this in : http://www.reuters.com/article/2011/12/27/petroplus-idUSL6E7NR0L620111227, a refiner not being able to buy oil because of a lack of credit. So a related question could be : will the confidence run out before the oil flow runs low ? Could Norway's discovery be able to restore how much of that lost confidence ?

What are the split between StatOil Hydro and Lundin ?

Is it uniform, or does it vary by block ?

Best Hopes for the Norwegians (and Swedes),

Alan

http://www.theoildrum.com/files/slide_25.png

Alan you should spend some time looking at the Lundin presentation I link to, dwell a while on slides 34 and 35 and 41 and go figure.

If I were the Norwegians what would I do?

Would I consider this oil as money in the bank and spend it as I needed it?

That carries the risk that a desperate country might steal it. Therefore, are the Norwegians prepared to defend it from all? Could they? No. They would avoid war at all costs.

The cost of avoiding war will be to pump the oil and pocket the money. (Money=paper trash). They would then convert the trash to durable goods as fast as possible. (Hydro-electric dams)

With luck an alternative source of energy will emerge. (No1 of 8 videos.)

If they are smart they will convert a portion of that money into military assets good enough to make sure they aren't exterminated or relocated and all those nice houses and hot springs and hydro facilities and beautiful scenery becoming the property of someone who grows a strong right arm and the will to use it.

Those of us who like to talk trash (well deserved but usually completely one sided) about the Yankee mic are either too ignorant of geopolitical readily to understand it, or too cynical to admit it, but Europe is a peaceful place because nobody excepting peasants with nothing but their own miserable lives to lose can afford to mess with Pax America- for now at least.

But the days of Pax America may well be numbered.

(Peasants can get way with fighting us because jets are to expensive to use them to attack individuals, straw huts, rice paddies and such;Afghans and Iraqis because we are softhearted bullies and unable to bring ourselves to kill'em all and let God sort'em out.)

I don't know whether to laugh or cry, but this is reality.

The dominant players come and go, but the game never ends.

OFM,

congrats for the reality check.

I wouldn't say the days or even years of Pax Americana are numbered, but its decades certainly are.

In the meantime, however, IMO the best strategy for oil players like Norway and Brazil is not to invest in military assets, but to diversify trading between the US, China (Ghedaffi would most probably be alive today had Lybia been exporting most of its oil to China rather than to Italy...) and whatever the next really strong arm will be.