The Oil Potential of Iraqi Kurdistan

Posted by Euan Mearns on January 11, 2012 - 11:22am

Whilst much of Iraq may be viewed as in a metastable social and political state, the semi autonomous northern region of Kurdistan has enjoyed relative peace for a number of years. This has enabled the regional government to develop oil exploitation laws and to lease much of the land to foreign exploration and production companies.

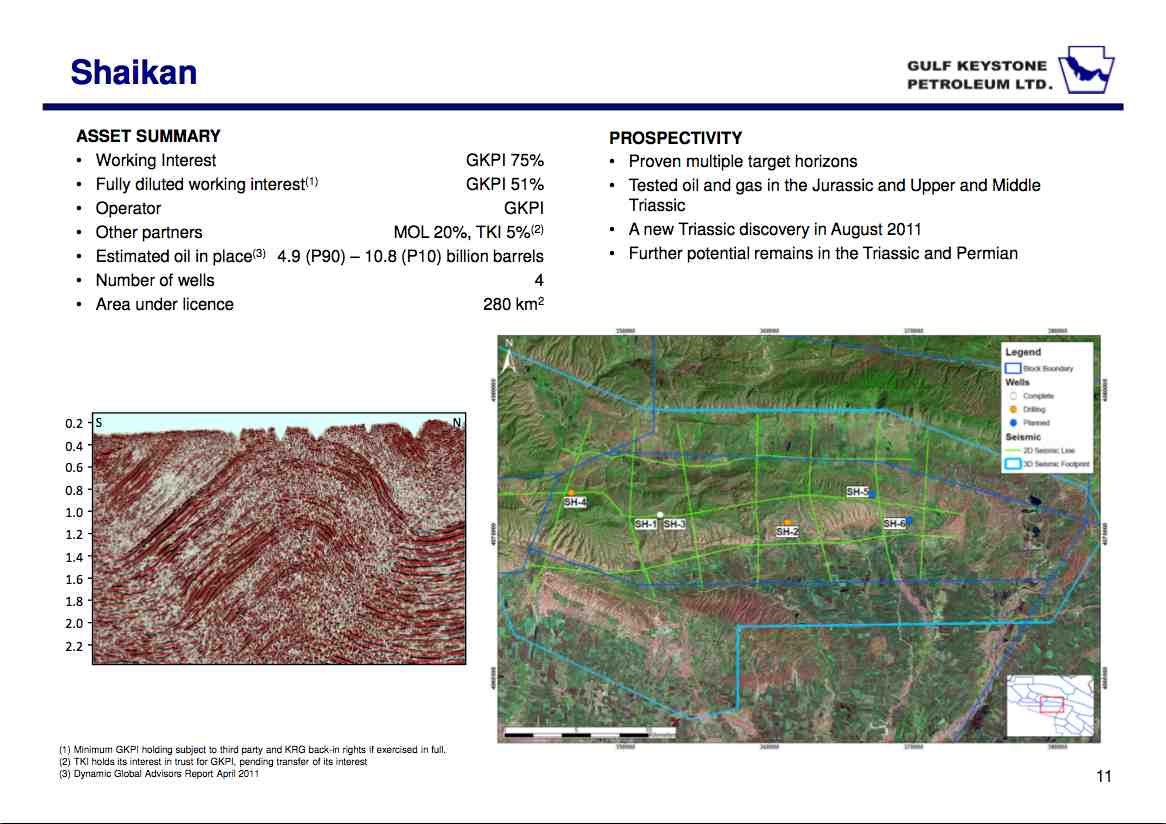

Regional operator Gulf Keystone Petroleum has been involved in the discovery of the Shaikan Field, believed to hold between 8 and 13.4 billion barrels in place with appraisal of this giant (potential supergiant) ongoing. Gulf Keystone Petroleum believes that Iraqi Kurdistan may hold 45 billion barrels of oil reserves (recoverable?) lending some credibility to Iraqi claims of 115 billion barrels reserves for the whole country. This compares with a total of 53 billion barrels of oil produced from the North Sea up to the end of 2010.

Disclaimer The author has recently purchased stock in Gulf Keystone Petroleum and Petroceltic whose company presentational materials provide the backbone of this post. Readers need to be aware that information contained in corporate presentations is not necessarily reliable, although companies listed on the London Stock Exchange are regulated and need to be cautious about what they say. For example, Gulf Keystone's reports on reserves on the Shaikan Field have been audited independently by oil and gas field auditors Ryder Scott and Dynamic Global Advisors.

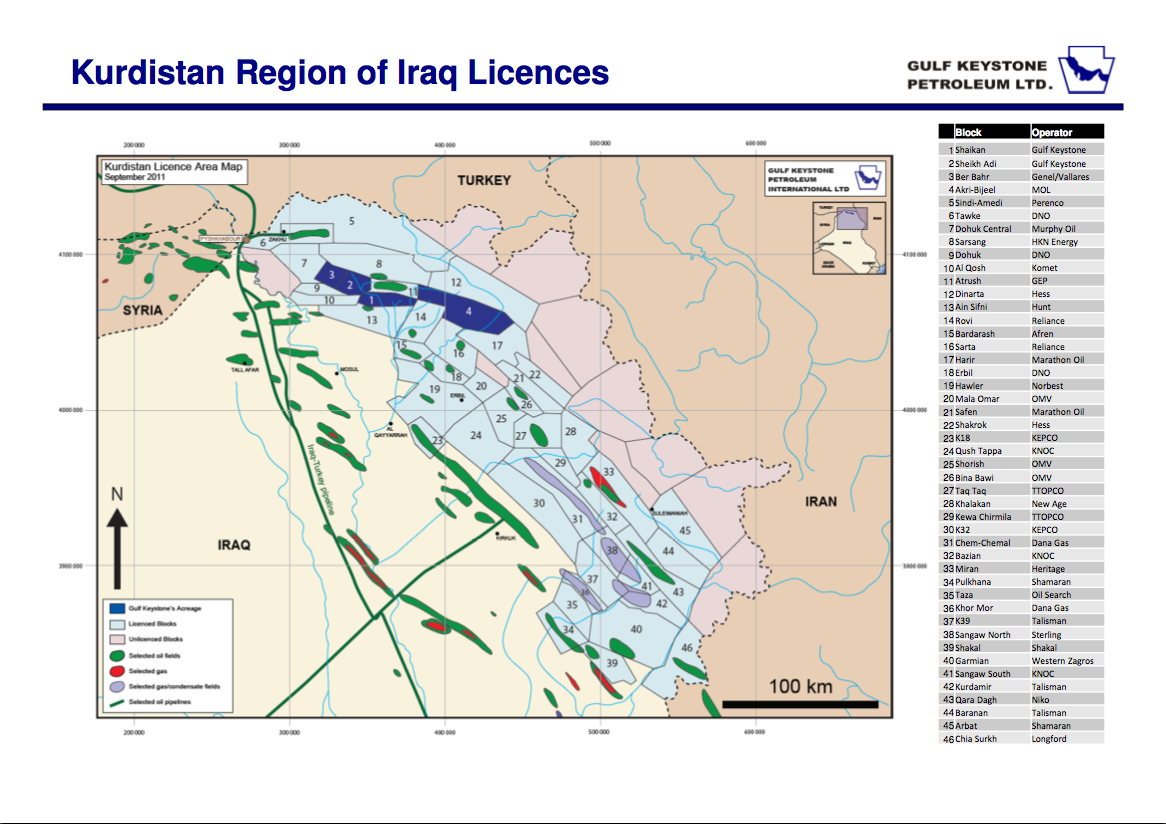

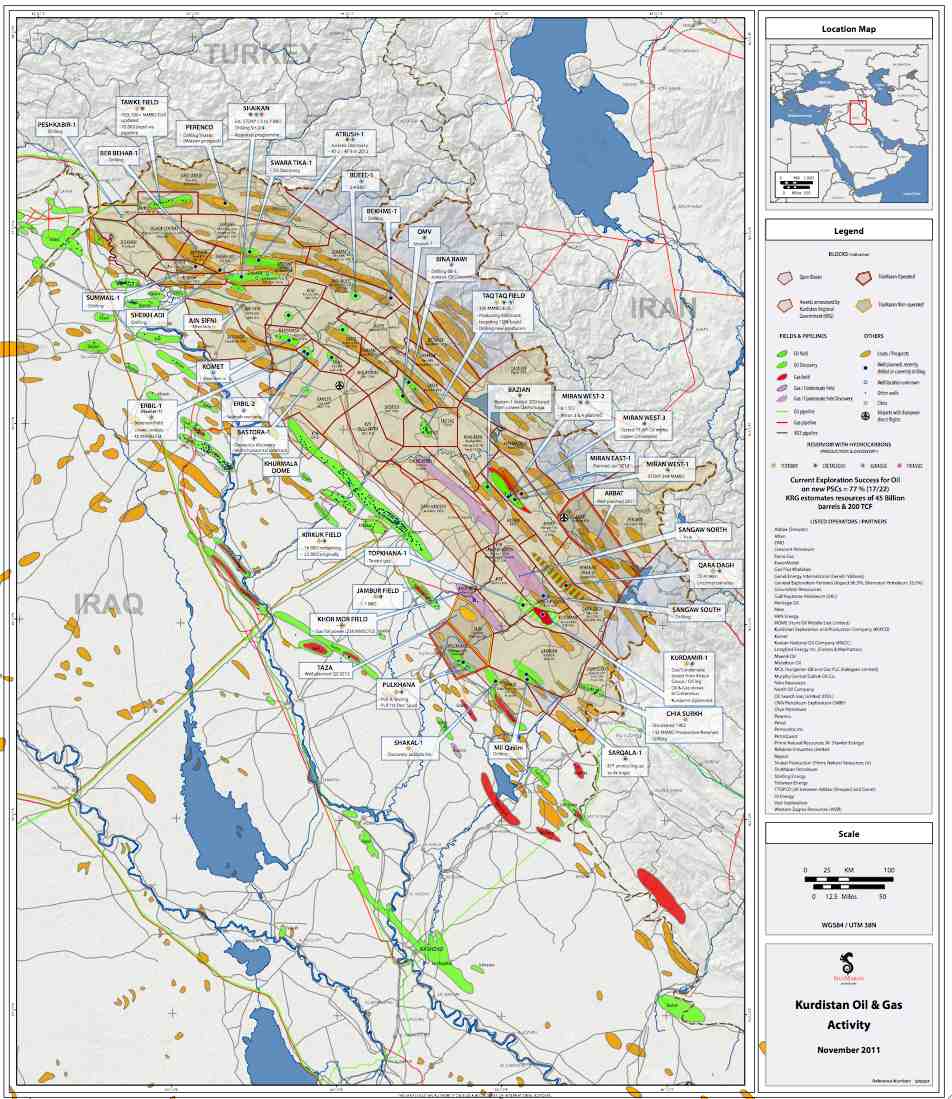

During a recent review of the activities of small oil companies listed on the London Stock Exchange, I came across some interesting presentations on the oil exploration activity and potential of Kurdistan in northern Iraq. Everyone will know that Iraq has been in a state of unrest since the US led invasion of 2003 that has just recently come to an end. But in the North, the semi autonomous region of Kurdistan has been much more peaceful. Elections were held in 2005 and again, four years later, in 2009. The Kurdistan Regional Government has proceeded to divide the territory into license blocks, many of which have subsequently been leased to foreign oil exploration companies (Figure 1). The oil rights of the Kurdistan semi-autonomous region have not been recognised by the Iraqi government and operating in this area therefore carries significant political risk. Most of the blocks have been leased to small companies and until recently the oil majors have been shy of taking risks in Kurdistan that may compromise their relationship with the Iraqi government.

Geological setting

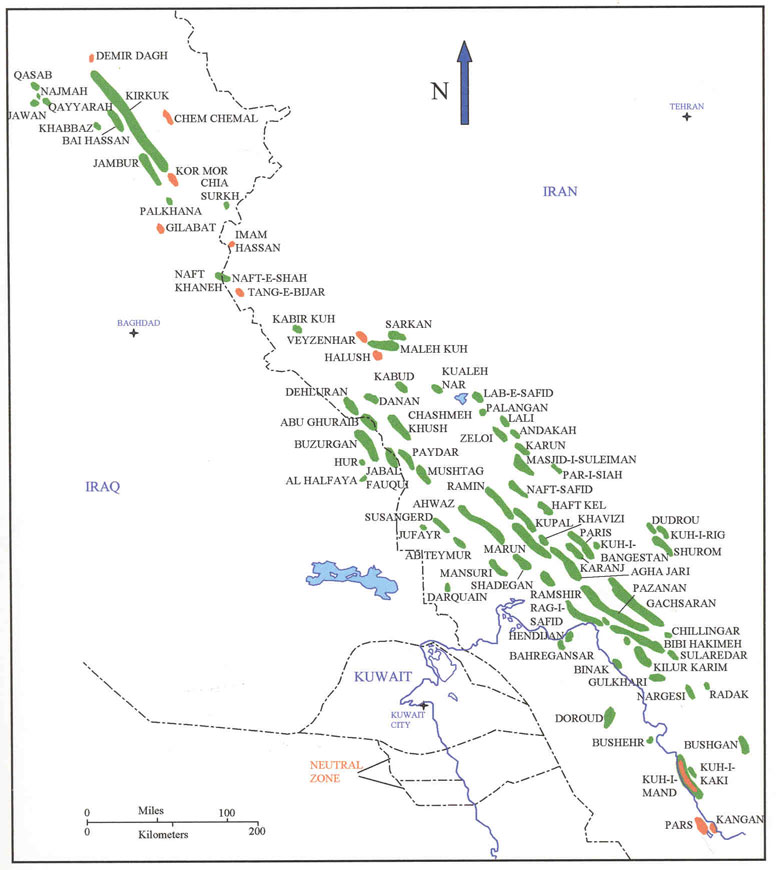

Kurdistan forms part of the Zagros Fold Belt that is a prolific oil province in Iran and Iraq to the south and west (Figure 2).

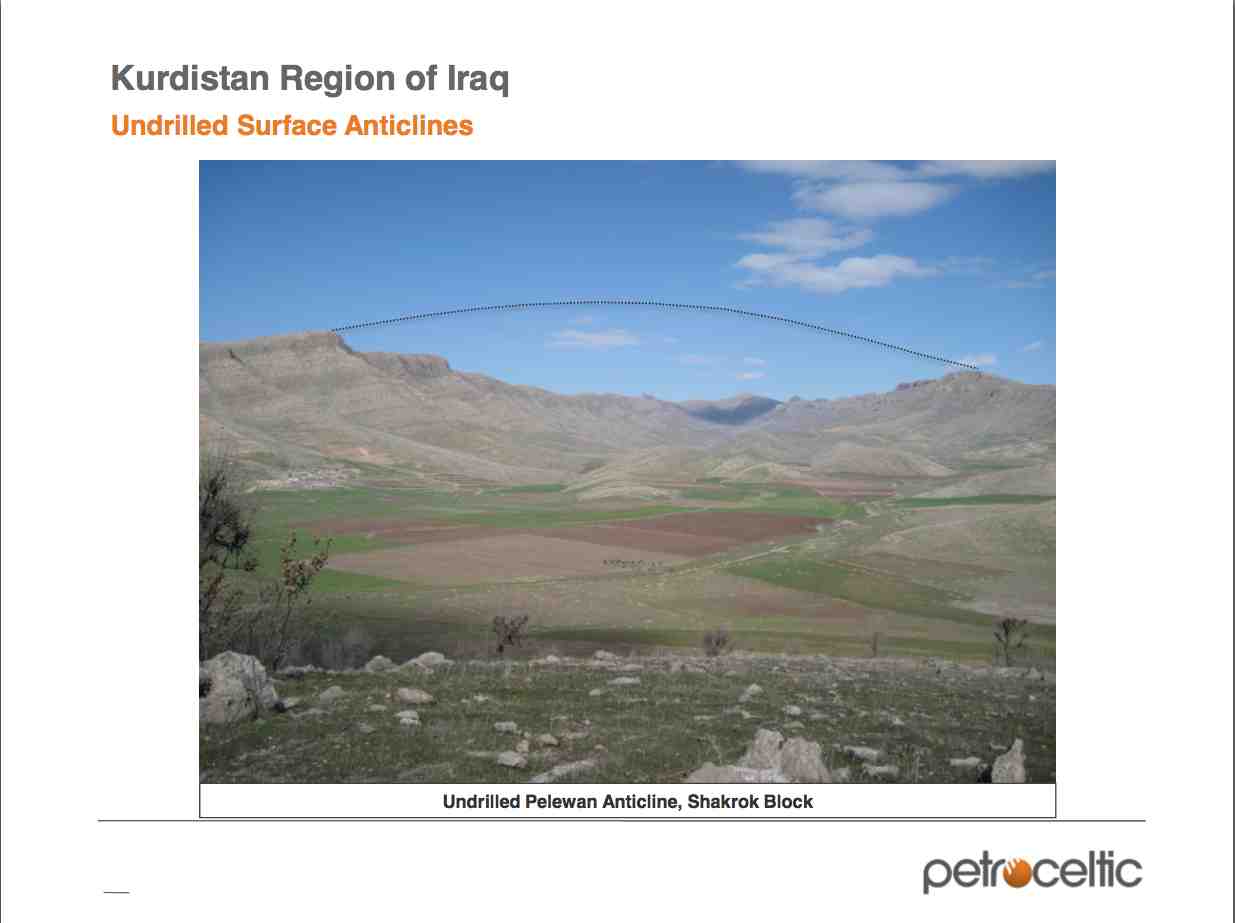

The reservoirs are of Triassic and Jurassic age and are deposited along the margin of the paleo Tethys Ocean, which closed owing to large scale plate tectonic movements during the Cretaceous and Tertiary, giving rise to the Alpine - Himalayan mountain belt. In the Zagros Fold belt, the deformation of strata is less severe and is characterised by gentle synclines and anticlines. Source rocks are depressed and warmed in the synclines and the oil formed may migrate up-dip to be trapped in the adjacent anticlines (Figures 3, 4 and 5).

Exploration history

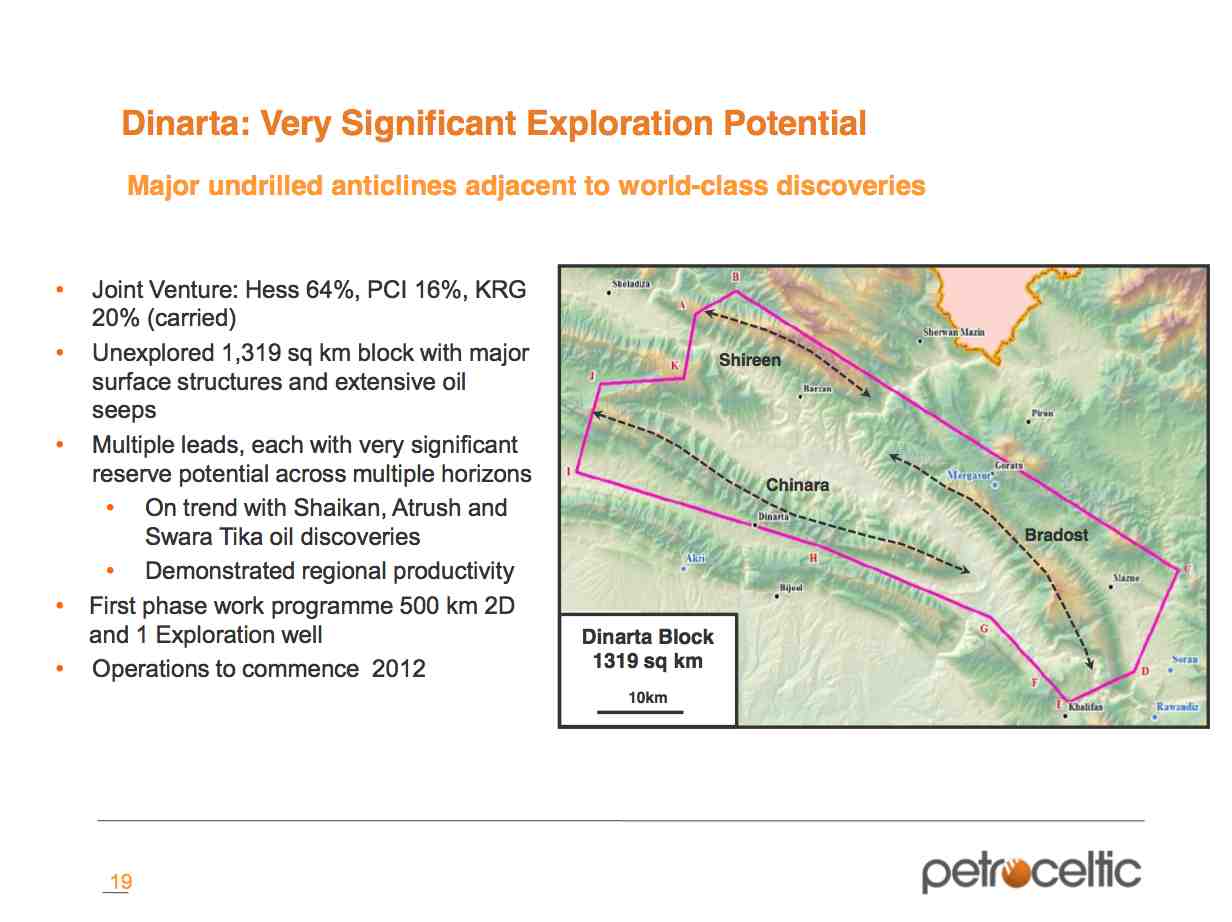

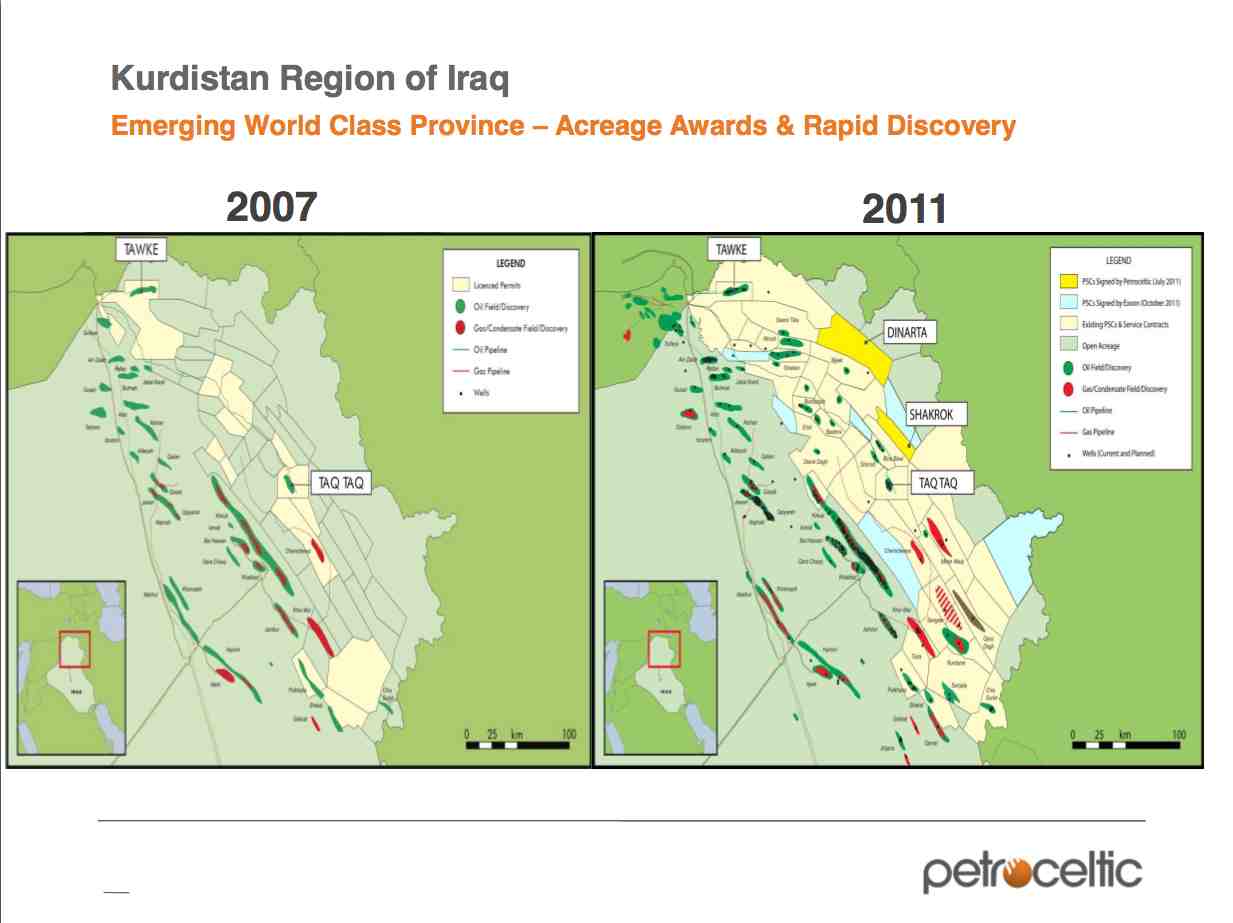

An interesting slide from Irish independent minnow Petroceltic shows the exploration status in 2007 and 2011 (Figure 6). During the Saddam era, it appears that exploring for oil in Kurdish areas did not take place at all. The Kurdistan semi-autonomous region therefore represents virgin territory bang slap in the middle of one of the most prospective oil exploration territories on Earth. Licensing and drilling has only taken off since 2007 and activity is moving at an amazing pace with several major discoveries already made. ExxonMobil was the first supermajor oil company to accept the political risk with the award of 6 blocks in 2011. A total of 6 blocks remain unlicensed.

High resolution map of discoveries and prospects in Kurdistan (large pdf).

Oil export options

Getting the oil out of this landlocked territory surrounded by countries with unstable tendencies presents a major challenge. There is an existing pipeline route called the Kirkuk - Ceyhan pipeline that exports oil through Turkey to the Mediterranean coast (Figure 7). This pipeline crosses the Iraq - Turkey border within Kurd held territory giving them some control over access. There are in fact two pipelines with combined capacity of 1.6 mmbpd which have been the subject of repeated sabotage attacks. They are clearly exposed and difficult to guard (Figure 8). This export route is reported to currently carry around 0.5 mmbpd. There will be competition for access and ownership rights between Kurdistan and Iraq.

A very recent development (14 Nov 2011) is the announcement that Vallares PLC, established by Nathaniel Rothschild and headed up by ex BP CEO Tony Hayward will merge with Genel Enerji AS and plan to build a new 400,000 bpd pipeline across Turkey to the Mediterranean. Both Genel and Vallares hold acreage in Kurdistan.

Concluding thoughts

While it is the early days, given the exploration success so far and the world class pedigree of this petroleum system, the estimate of 45 billion barrels reserves made by Gulf Keystone Petroleum does not seem unreasonable. It is reasonable to speculate that given peace, Kurdistan may export between 2 and 4 million barrels of oil per day within the next decade. With a population of 4 million, Kurdistan could expect to become wealthy like Norway and the Gulf emirates. That is if restless neighbors permit this to happen.

There are a growing number of new, very large, more or less conventional oil plays being discovered that include the sub-salt off Brazil, the Aldous Major - Avaldsnes field in Norway and most recently the news that sub-salt oil has been discovered by Maersk Oil in their first well off Angola. Combined, these vast discoveries promise to make the decline on the downside of Hubbert's peak a much more gradual affair, for a while at least.

Euan,

Thank you for some insight into the potential for oil production from Kurdistan.

What is complicating all of this is the lack of an official policy or legal framework for oil in Iraq. Because of this, the federal government has to date only awarded service contracts on fields near Basra in the southeastern part of the country, where most of the reserves are. The Kurdish government decided to proceed on its own with production-sharing contracts, but the majors were hesitant to participate because the feds claimed that any agreements signed would be unlawful and that they would be barred from bidding for Basra work. The smaller oilcos were not positioned for that anyway, so they felt their best chance was in dealing with the Kurds.

The KRG and the Iraqi government have tried to resolve the oil issue, but ExxonMobil stirred things up a bit by recently signing an exploration agreement with the KRG. Along with partner Royal Dutch Shell, XOM was granted a contract for West Qurna Phase 1 (the northern end of the Rumaila structure) in 2010. Baghdad has expressed its displeasure with the recent turn of events, and it is not clear what will happen next. So far, Iraq has said that it will not let XOM participate in the next round of bidding in the south, but it has stopped short of voiding the existing contract.

A writer on the Iraqi Oil Forum has speculated on the possible reasons for Exxon's risky move:

I don't know about the risks to companies such as Gulf Keystone Petroleum should an agreement not be reached fairly soon, but one must assume that it is not risk-free. One possible result is mergers.

Brian, Its a very interesting geo-political situation. What we know for sure 1) for decades the Iraqis failed to allow oil development in Kurdistan 2) the Iraqis have been VERY slow to enable foreign company participation in the rest of Iraq - it is almost a cultural imperative throughout the Arab world that foreign participation is very hard for them to stomach 3) without the Kurds pushing the issue hard, would Iraq ever permit exploration let alone foreign participation in Kurdistan? 4) just look at the contrast in activity between Kurdistan and the rest of Iraq!

This is not to say that the Kurds are following the best route, but they are following a very different route that has very different outcomes for foreign companies and pace of oil field development. I only hope that the Kurds have ensured they are getting a large enough slice of the pie for themselves since the commercials hate the rules being changed once the game has begun - happens all the time in the UK North Sea!

I think that the entrance of ExxonMobil may be a game changer in the geo-politics. They have traded a high chance of exploration success in Kurdistan against the low chance of ever being allowed to play ball in Iraq. I think the presence of EM increases the probability that the Feds ratify the Kurdistan rights or at least permit the development activity to proceed. I will be expecting to hear more news on new pipelines in the months / years ahead, perhaps including a gas pipe with LNG train at Ceyhan that will be another game changer.

It would seem that there is going to be a lot of squabbling over the existing pipelines - the Iraqi's need an export route for the Kirkuk oil. I was very surprised one plan was to build a pipe that went through Israel! Best thing for the Kurds is to stay friends with Iraq, allow them to use the existing pipelines and to build their own over which there would be no ownership dispute. With >40 Gbs of oil, dedicated pipelines is almost a pre-requisite. Hayward of course is used to this scale of thinking, already been involved with the Baku - Ceyhan line.

More or less the Kurds/Exxon "deal" is in the process of splitting Iraq.

http://www.washingtonpost.com/business/exxon-mobil-kurd-oil-deal-spat-sp...

http://www.independent.co.uk/news/business/news/exxon-woos-gkp-to-gain-k...

(not to forget that if US troops are not there anymore, most probably quite a bit of blackwater/Xe or others security "staff" over there)

All this will not end well...

I saw this a few weeks ago:

Exxon mulls $10.9 billion approach for Gulf Keystone: report

That would be a 5X last Friday's closing price.

http://news.yahoo.com/exxon-mulls-10-9-billion-approach-gulf-keystone-16...

I'd be very surprised for anyone to buy Gulf Keystone. Its one thing for ExxonMobil to get licenses and drill a few wells where the max downside is cash spent on seismic and drilling wells. Completely different spending x billion buying Kurd reserves that could disappear in a flash. But of course EM can rely upon the US military to protect its investments.

A couple of interesting slides providing perspective on the political risk and the terms of production sharing contracts.

http://www.genelenergy.com/admin/resimler/detay_resim/basin_dokumanlar/g...

large pdf

Where are stark industries when you really need them!!

Seriously though. imagine the situation where the US rents out it's army to help protect assets etc......Quick buck for the US military maybe. Ditto for UN troops maybe except give them more than pea shooters.

Marco.

Trans-Atlantic Petroleum(TAT-Amex) claims they are exploring on the Turkey side.

http://media.corporate-ir.net/media_files/irol/15/153906/TATSWIDEASConfe...

I wonder why Turkey is so underexplored ? On a broader subject, it seems many companies are taking on exploration projects in more politically unstable countries. Egypt, Yemen and to a lesser extent Colombia as examples.

I don't think the 110 Gb(or 145 Gb) claimed by Iraq includes the 45 Gb claimed by Gulf Keystone.

It is the Zagros fold belt that provides the classic world class petroleum system and this does not extend far into Turkey. Otherwise Turkey is completely different geology, though I do agree it does seem to be under explored.

Gulf Keystone's Corporate Film:

http://www.youtube.com/watch?v=lQj4Tt2fkAY

40th Oilbarrel Conference - Gulf Keystone Petroleum - 13/01/2011:

http://www.youtube.com/watch?v=bPFRZGUwet4

The message I am getting from frequent contacts within Kurdistan is that the stability of kurdistan is over rated internally never mind in relation to its arab neighbours.

Very uncertain future

Yes, but how is it compared to, say, Nigeria or Libya? Stability is relative. Anyway, as long as there's a tribal warlord we can buy oil from, it's all good for BAU in the USA.

True but every situation is different. In Kurdistan's case the conflation of instability and geography make it prone to immense volatility if the oil ever actually gets out of the ground.

We are not dealing with single political vector, say warlords and their relationship to the region. The competing political agendas at work here may bring a certain stability as there is the possibility complexity breeds interdependence and alliances... the "strange bedfellow effect"

OTOH you may just get a get a free for all.

Syria doesn't help

Interesting post - sure looks like there are a lot of oil fields in Iran!

One quibble here - it looks to me like that Figure 8 is actually a photo of the Trans-Alaska pipeline, complete with the "heat pipe" to keep the permafrost frozen - not a feature I would expect is needed in Turkey!

You're right! Here's a pic of Aleyaska in winter from near exactly same spot. Never trust Google - I'll shift it out;-)

http://www.alaska-in-pictures.com/winter-alyeska-pipeline-3235-pictures.htm

Time for the Burns Slant Drilling Company to setup shop on the Iraqi side of the border?

Yes, a bit like the stories from the Klondike gold rush, where miners would dig down in their claims, then go horizontal into someone else's. Apparently there were some pitched battles underground.

Gold - be it black or yellow - seems to bring out this sort of behaviour!

On an unrelated note: why do oil fields in the Gulf-region have a common "direction" in which they exist? (Roughly NNW to SSE, or the other way.) I'm assuming this has something to do with how these oil fields formed over millions of years.

Plate tectonics and the orientation of regional stress regimes that create the structures in which the oil is found. This is very common feature globally and is why you here explorers talking about "on trend" - since patterns often repeat, if you are "on trend" the chance of a near unique set of geologic circumstances repeating is increased.

Thank you for the clarification.

Now that you are "drilling down" on the Iraq-Iran-Kurdistan oil fields, how about jumping somewhat to the east and discuss the natural gas fields of southeastern Turkmenistan, their relation to the proposed Turkmenistan-Afghanistan-Pakistan-India gas pipeline, and the "Great Game" competition between Russia, China, India and the West for the control of this gas. It sure is interesting how the location of NATO's military bases in Afghanistan correlate with the TAPI corridor. it also appears that the West is losing this contest to the Chinese who have already tapped into the gas fields in this area.

Delete if considered off-topic but I see Gulf Keystone is making financial headlines.

Wednesday's most followed: Gulf Keystone Petroleum, Xcite Energy, Xtract Energy, Red Emperor Resources, Yule Catto & Co, Sirius Minerals