Shale Gas Assets - Overpriced Or a Liquid Turn for Mining Giant BHP?

Posted by aeberman on August 15, 2012 - 3:09am

This is a guest post by Dr. Ruud Weijermars, geologist, senior partner, and strategy advisor at Alboran Energy Strategy Consultants, and by Matthew Hulbert, Lead Analyst for European Energy Review, consultant to a number of governments and Forbes energy writer.

Australian mining giant BHP has lost a quarter of its former market capitalization since its acquisition of US shale acreage from Petrohawk and Chesapeake last year. The company is keen to point out that worldwide economic conditions have impacted the price and volume of the commodities that BHP extracts and sells on a global basis. BHP’s US shale gas assets are part of its declining performance. Having paid a whopping $19bn for the shale plays in 2011, BHP now faces serious write downs. Ruud Weijermars and Matthew Hulbert ask the serious question whether the lost value simply is a result of changed market conditions - or was the acreage already worth much less at the actual time of its purchase by BHP?

BHP management concedes it is currently assessing the near-term gas price effect on the value of its gas properties acquired last year from Chesapeake (CHK) and Petrohawk (HK). To many industry analysts this is no surprise; the economic fundamentals of US shale gas production and reserves were already questioned long before the BHP sales went through. Petrohawk had never managed to earn any operational profit from its shale gas assets over its 15 years of operations. HK sold gas below the full-cycle production cost and its accumulated losses amounted to some $1 billion when the company was bailed out by BHP last year.

In short, Petrohawk was a ‘precursor’ to Chesapeake’s recently publicized cash-flow crunch predicament. The lack of access to financing, combined with overleveraged debt and lack of operational earnings from gas wells meant one thing: sell assets quickly. One can confidently conclude that HK shareholders were remarkably lucky to receive a very handsome price – twice the market value - for their distressed gas assets in June 2011.

In our opinion, a significant portion of HK’s formerly ‘approved’ gas reserves more likely than not was overdue for downgrading to ‘contingent’ resources by the time of their sale to BHP. In ball park terms, that’s the difference between gas assets that can be produced commercially at current prices, and those which can’t (see Box 1).

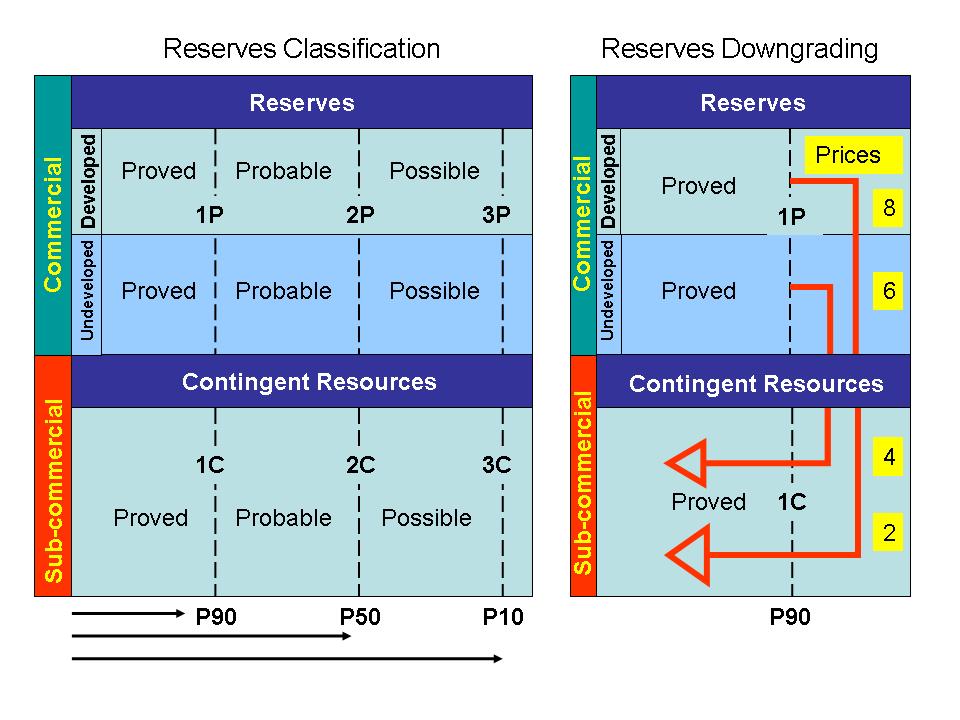

Box 1- Reserves Classification and Downgrading Principles

(Left) Proved reserves classification (according to PRMS/SEC) are those P90 volumes that can be produced with reliable technology and with economic profit using 12 month averaged market prices over the past reporting year.

(Right) Downgrading of proved reserves to PRMS contingent resources is mandatory when depressed US natural gas prices render shale gas plays sub-commercial (yellow labels, indicated in $/Mmbtu). Projects that do not meet the economic hurdle are relegated to Contingent Resources - it is an off/on switch, so 1P moves to 1C, 2P to 2C and 3P to 3C.

In the past, operators may have used different price/costs for Probable and Possible reserves versus that used for Proved. Under PRMS and SEC 2009 this is no longer allowed - all reserves technical categories use the same economic criteria - so 100% move to Contingent Resources when the project cash flows are negative (undiscounted). There is always some issue on whether projects economics are based on Proved or 2P internally, but as far as the SEC is concerned, must be based on Proved.

The core of the problem with shale acreage valuation is that the net present value of gas reserves has become as volatile as the gas price itself. But companies have been slow in exercising due diligence if not outright reluctant to depreciate assets. In spite of the low gas prices in 2009, 2010 and 2011, companies like Chesapeake and Petrohawk continued to aggressively book proved undeveloped reserves (PUDs). Both Petrohawk and Chesapeake needed these new reserves on their balance sheets - without these reserve additions, they would have landed into collateral default. And although SEC rules mandate companies must duly impair PUDs when overall project cost have become uneconomic, PUDs now account for nearly half of CHK’s (and former HK’s) proved reserves. Chesapeake’s reported proved reserves comprised 42% PUDs in 2009, and the proportion grew to 47% in 2010, and settled at 46% in 2011.

Oddly enough, once a company has sunken the cost for well development of a PUD, the developed proved reserves need only be impaired if the annual cash flow turns negative, which would require gas sales to dip below operating expenses. In the well’s subsequent life-cycle, SEC rules leave room for continued classification of a well’s resources as reserves, as long as annualized cash flows remain positive. This encouraged companies to continue quickly sinking cost in wells that may not, in fact, ever have been economic (on a full cost basis) in the first place. By doing so, companies quickly 'prove' the reserves of a new shale gas play, and the acreage value rises. This also means that many US shale gas companies have essentially ignored full cycle economics. The sunk cost game continues even today.

Investors still appear prepared to bear the cost, but may not be fully aware of the additional risk.

With gas prices plummeting, the SECs former ’premium label’ of proved reserves has lost its stable foundation. In fact, full cycle economics for the majority of US shale gas plays has been largely negative for the past four years. The SEC has been lenient and one might speculate that overly aggressive reserve reporting appeared an affordable governance risk for shale gas operators. There has been no favourable gas price for adding proved reserves, yet unconventional gas companies have booked reserves by operating aggressively on a sunk cost basis. As a result, US shale gas investments have now become less secure than the reported reserves suggest – something investors seem to haven glossed over far too lightly.

What has become a point of growing risk for any shale investors is that they are saddled up with acreage for which cumulative net cash flow over the life-cycle of the project has turned dramatically negative. The sunk cost has artificially inflated the acreage value. When gas prices collapsed in 2008, the industry’s main focus was to find creative solutions for looming liquidity problems. The solution offered by companies now is to spin off assets and cash out. The 2011 acreage sales to BHP duly came as blessed relief for the financial backers of Chesapeake and Petrohawk, easing liquidity worries and providing an affirmation for the supposed ‘net present value’ of their shale assets.

But what shale players really needed much more than shifting sub-economic acreage off their balance sheets was a rapid rise in gas prices. Alas, continued oversupply of natural gas in an isolated North American market pushed prices lower, well below production costs. As a result, positive net present value has evaporated in the vast majority of US shale acreage, only speculative ‘future value’ remains.

The strikingly large number of assets up for sale suggests vendors see no positive cash flow coming out of these plays anytime soon. Indeed, hardly any of the uneconomic US shale gas acreage can provide valuable collateral for cash transactions. Asset sales by cash-starved shale companies can only be completed by cash-loaded counterparties that don’t have to go hunting for external financing. Any financial broker worth their salt would want to see all of the claimed net present value of acreage in place at the time of purchase; testing for compliance with proved reserves reporting guidelines is certainly part of that requirement. One wonders - who will buy any of these inflated shale gas reserves?

Regrettably, the SEC has not been vigilant in scrutinizing reserve reporting practices of the US shale gas industry. Its new reserves reporting guidelines, effective 2009, require companies to promptly downgrade reserves if any of their acreage is no longer capable of commercial gas production over a trailing 12-month pricing window. This downgrading of PUDs is supposed to be done by industry ‘self-regulation’. But everyone involved in the shale gas business has the sword of Damocles dangling above their heads: whereas proved reserves are established ‘net present value’ collateral, contingent resources are not – it’s a binary on/off switch. The avoidance of downgrading proved reserves to contingent resources means the evaporation of a company’s debt collateral is averted. It’s not like the financiers behind companies like HK and CHK ever want to hear of reserves downgrades either, proved reserves provide the main vehicle to support corporate debt. Who would put their heads in the reserves impairment noose with collateral default as an immediate outcome?

BHP management has had an opportunity to comment on the content of this article. BHP says it did not rely on Petrohawk’s and Chesapeake’s gas reserves figures and conducted its own independent analysis, with total unproved resources being the largest value of the acquired properties. BHP further says its Petrohawk acquisition was largely driven by its liquids content and value -- in line with BHP CEO’s assertion at a recent APEA conference in Australia.

We contend that our analysis is sound: HK’s production was 95% natural gas liquids at the time of its sale to BHP, and its portfolio of proved reserves was extremely lean on liquid reserves. The Permian basin acreage acquired by BHP was not developed at all by Petrohawk at the time of the sale. BHP says Permian production is now 80% liquids. BHP management may have played a smart hand by recognizing undeveloped liquid resources, which could put its newly acquired shale acreage firmly in the black.

On the other hand, if BHP shareholders feel the company overpaid for shale assets, they may well decide to press for recourse and attempt to recover losses from CHK and Petrohawk’s sellers. The first step would be a probe for compliance with SEC and FASB reserve accounting rules at the time of their lucrative sell-out to BHP. Although both companies had part of their reserves affirmed by outside consultants, if auditing firms would refuse to affirm the PUDs they would likely have been replaced – the shale gas industry is well-known to be rife with undue pressure on external reserve auditors.

Whatever the outcome of the final reserves write-downs, readers should perform their own due diligence analysis considering the risk premium for companies having primary assets in newly evolving shale plays with unproven reserves.

All in all, the impending reserves write-downs would be a good sign of industry’s compliance with SEC reporting rules – setting a much needed standard for self-regulation by due diligence as intended by the SEC. The shale gas industry dearly needs such a move -- to uphold best practices for sustained investor trust.

References Cited:

1) Weijermars, R., 2012. Jumps in proved unconventional gas reserves present challenges to reserves auditing. SPE Economics & Management, Vol. 4, N0. 3, SPE 160927-PA;

2) Weijermars, R. & McCredie, C., 2011. US Shale Reserves – Inflating US Shale Gas Reserves, Petroleum Review, Vol. 65, No. 780, Dec issue, p. 36-38;

3) Weijermars, R., 2011. AAPG Search and Discovery Article #70106 of Forum Presentation, AAPG General Assembly A, 12 April 2011: Security of Supply - Operational Margins at the Wellhead and Natural Gas Reserve Maturation - http://www.searchanddiscovery.com/documents/2011/70106weijermars/ndx_wei...

I think BHP framed its world view on the assumed success of fracking not only in the US but globally. Some of the share price drop is also a result of plans to cancel the construction of an iron ore loading port in Western Australia, a uranium mine in South Australia and a coal field in Queensland. The coal and iron ore projects needed the Chinese economy to keep growing and the uranium mine was to be powered by gas from an old field that was to be revived by fracking.

For decades BHP drank the indefinite growth Kool Aid and it suddenly hit them that this wasn't so. Maybe they have had a late conversion to steady state thinking. CEO Marius Kloppers (a PhD in chemistry) missed out on the annual bonus. Ditto the chief of another big mining company Rio Tinto. However I think they will learn from their mistakes and do things differently in future to stay ahead of the pack. One thing they will do differently is pay less for new acquisitions.

Great article guys. I hope everyone takes the time to absorb it. I think it very wise to avoid getting too “numerical” in the presentation. IOW to not miss the forest for the trees. I’ll just offer a couple of personal insights.

“The avoidance of downgrading proved reserves to contingent resources means the evaporation of a company’s debt collateral is averted”. Perhaps companies avoided loss of collateral value on paper but not in the eyes of the oil patch financial sector. This would apply to conventional bankers and even more so to the “mezzanine banks”. Mezzanine banks are actually investment companies and thus can take greater risks than a conventional banker.

More important MB’s don’t just collect interest on their “loans” but usually end up with some form of ownership of the reserves. This avoids usury restrictions: by combining interest coupons with the value of the assets gained I’ve seen MB’s make a 20% to 30% return. But it is a risky business: I’ve seen MB’s lose hundreds of $millions. Additionally they also have a great deal of control over a company’s operations including drilling decisions and cash flow. Old oil patch joke: what’s the difference between an MB and a loan shark? Loan sharks tend to be nicer guys.

Back to my point (I do tend to ramble): the bank engineers (both MB and conventional) have taken much of the value of those proved reserves off their internal books. Almost a year ago an engineer with one of the bigger international banks told me they had one shale gas deal they were going to put $100 million behind. The operator had found a truly sweet spot in the trend with their wells being 3X to 4X better than average. Other than that project they weren’t putting penny in any other SG projects. They could care less what the pubco or the SEC says the value might be. These folks have their own engineers (often some of the best in the oil patch). But those numbers are for their internal use. As was implied in the report it doesn’t benefit a pubco’s financial backers to cause the shareholders to lose faith. Sometimes part of the banker’s gain is in the pubco’s stock.

“Although both companies had part of their reserves affirmed by outside consultants, if auditing firms would refuse to affirm the PUDs they would likely have been replaced” So very true. Years ago I had to travel to Oklahoma to book reserves with a third party auditor because the company wasn’t satisfied with the numbers they got in Houston. Not much of a surprise for many TODsters. But in this case the auditor in both cities was the same company. The OK branch was hurting for cash flow so its manager was willing to be more “flexible”.

I will readily admit that I’ve gotten fairly optimistic numbers from auditor in the past. Diligent and honest auditors. And I never lied nor withheld (a favorite trick) data. But folks need to remember that reservoir engineering/geology is an interpretation dynamic. Seldom anything approaching black and white. Present a coherent and logical interpretation and you may get the reserve number you’re looking for. And intentionally throwing in an obviously bogus portion of the reserve target doesn’t hurt either: the auditor can disqualify those reserves and feel like he’s doing his job. I’m told that’s not a bad approach to take with the IRS and your deductions.

And every now and then you might actually produce all those reserves those reserves you booked. Although you’re seldom still around when judgment day finally arrives. LOL.

I thought this was perhaps the most interesting point made in the article:

Here are some recently updated (late July, 2012) Texas RRC data for Barnett Shale natural gas production and for total Texas natural gas well production (note that we are using a common data source).

From 2008 to 2011, the RRC (so far) shows that Barnett Shale gas production increased by 20%, from 4.4 BCF/day in 2008 to 5.3 BCF/day in 2011:

http://www.rrc.state.tx.us/barnettshale/NewarkEastField_1993-2011.pdf

However, this increase was not sufficient to keep total Texas natural gas well production on an upward slope, and we have so far seen three straight years of declining Texas natural gas well production, with annual Texas gas well production down 6.1% from 2008 to 2011, from 19.3 BCF/day in 2008 to 18.2 BCF/day in 2011:

http://www.rrc.state.tx.us/data/production/ogismcon.pdf

In other words, several years of year over year increases in Barnett Shale gas production could not keep total Texas natural gas well production on an upward slope (using a common data source).

I believe that Texas has the longest history of recent modern intensive efforts to develop shale gas plays. But the fact that rising production from Texas shale gas plays could not keep total Texas natural gas well production on an upward slope is not an encouraging model for US and global shale gas and shale oil plays, especially since the permeability relative to gas is higher than the permeability relative to oil.

Let me see if I have this straight.

SEC rules say that proved undeveloped leases must be valued using full lifecycle cost. If a lease is unprofitable on that measure, it can't be included in reserves. But as soon as a well is sunk in a lease, it is reserves, provided that gas sales exceed operating costs, which are small.

In effect SEC rules tell listed shale gas companies "when the price threatens to fall below a threshold, you must supply more and more."

That's ... uh, called a perverse incentive.

Greg – I think you and others get it but to be sure: I spend $10 million to drill and complete a well but it ultimately only recovers $6 million of reserves. So I’ve lost $4 million. But the well is producing $100,000 of production every month with my overhead for that well running $20,000/month. Thus this is a valuable asset that’s netting me a “profit” of $960,000 per year.

This is what’s silly when they say Company A made $XXX profit last year. What they are talking about is cash flow. That number has no implication as to whether that company has had a profitable drilling program. Sort of like the guy bragging about the $1,000 he won on one pull of the slot machine but doesn’t mentioned he walked out the casino with $3,000 less than he had when he walked in. In fact many companies will have a net cash flow spike before they go under: what revenue they have is still coming in but they’ve stopped almost all new capex expendatures because they’ve lost their borrowing base.

Thanks, Rock. It's like the guy playing the slot machines has to double down every minute so that the casino won't notice his check is bad. And he can't leave the casino for the same reason.

What I don't get is how the SEC can't see that its rules would lead to massive overdrilling in just the sort of situation we have now.

I used to think that technical regulations only had technical effects. But here's a counter-example, an arcane rule that causes a huge glut of gas and eventual bankruptcies.

Greg – OK…time for us to slip our tin foil hats on so TPTB can’t read our thoughts and realize their plot has been discovered. “…how the SEC can't see that its rules would lead to massive over drilling”. That’s like asking why the feds didn’to see the potential danger of inducing banks et al t make home loans to millions who were not good credit risk?

What makes anyone think such potential results weren’t recognized? Lots of drilling/home building/defense spending = economic growth. Growth is the magic potion our elected officials/con men pitch to the public in return for their vote.

The folks at the SEC aren't stupid. They know the accounting tricks as well if not better than the oil patch. Just like the guy in the casino looking at the table odds printed right in front of him. In essence they say that if he plays most of the casino games long enough he will eventually lose everything. But he bets hoping for the high of a short term winning streak. IMHO just like many politicians/regulators undertsand that if their “games” are played long enough the result could be a huge net loss. But their priority is the short term gain…getting re-elected. Someone else will be in office when it’s time to settle up those loses.

Or more bluntly: would President Obama (or a president of any party) be in favor of the regulators switching to more logical policies that would: first – drive down the asset value of public oil; second – reduce the development of domestic FF and thus raising prices; third - see $trillions in lost equity by the pubcos as the stock prices drop. Stocks that tens of millions (including millions of union members) hold in their retirement accounts; fourth – see many thousands of oil patch workers lose jobs providing good income.

You and others could probably add “fifth”, “sixth”, etc to my list but I think everyone gets my point.

OK! Not so much a tin-foil hat thing, as Upton Sinclair: "it is difficult to get a man to understand something, when his salary depends on his not understanding it."

Upton Sinclair, and the Presidents' Prayer: "please Lord, not in my term." And perhaps a bit of George Orwell's double-think, too.

Thanks for setting it all out so clearly, Rock!

But (having read fbm1183's and Vladimir's posts below) what's the downside of changing the valuation rules to use e.g. a ten-year moving average real price, and/or allow a ten-year lease development plan? (10 years is longer than most boom-and-bust cycles in the economy at large; five years is marginal for this.)

It seems to me that changes like those would preserve value while allowing gas companies a little flexibility in their schedules. Drilling could be scaled back for a year or two when the current price threatens to fall below break-even, instead of having to be increased. Obviously there is some huge drawback I'm not seeing.

greg - Some clever folks could come up with some logical/beneficial changes to the system. The big hurdle would be the immediate impact on the market mentality: even if in theory the changes would be good for investors many might run like hell and dump their stocks. The other complication would likely be that some companies benefit and others lose up front.

One technical problem with a 10 year plan is that most mineral eases expire after 3 to 5 years. And in a hot trnd the lease may require a yearly rental payment if it hasn't been drilled, And sometimes that could be as high as the initial lease bounus. And that brings up another disconnect: Company A has 100 leases to dril for which it has booked some future asset value. But due to lease expiration and a limited of drill rigs available it will be physically impossible to drill 40 of those leases bbefore they expire. Matbe I've missed it but I've seen nothng in the regs o force companies to take this factor into account.

The question in the last line was answered higher up in the paragraph. These assets are being purchased by private equity, either by investment firms or PE-backed independent operators, outright or indirectly through joint ventures. Extremely good undeveloped gas assets are being sold at steep discounts, often for the value of the producing reserves. Pay market value for low-risk proved producing reserves, get tens of thousands of acres of resource. It's a pretty smart gamble if you have lots of money and are willing to wait it out.

Petrohawk's Eagle Ford acreage is in the condensate fairway and needs to be mentioned. I haven't met anyone who feels the Petrohawk purchase was a bad idea, it was just horribly timed (or very well timed if you're Petrohawk or CHK). And they did perhaps pay too high a premium.

And following the previous statement, this article, as a critique of BHP's asset purchases, is really just a consequence of terrible timing. We're not having this discussion right now if the nat gas spot price were still $5/m. There is a lot of crappy shale acreage out there, but Petrohawk's Eagle Ford and Haynesville acreage positions were/are excellent. CHK's Fayettville acreage is excellent as well- 3BCF from $3MM drill and complete works out pretty well until you get below $4/m regardless of what type of rock it's from. These are only bad purchases with the benefit of hindsight. A few of the big boys bought junk trying to get into the shale plays, BHP did not.

This needs to be qualified. If we're talking about the over-hyped, inflated acreage numbers coupled with the extrapolation of the performance in the core areas, I agree. It seems like in every play, only 30-40% of the acreage lives up to the hype. But other than the driest acreage (low BTU gas), the core areas have been economic this entire time, and most wells drilled in the last 2 years are in those core areas. As you say, these plays are very heterogeneous, so condemning the entire distribution is just as wrong as optimistic type curve extrapolation.

But on a more positive note, I agree with your discussions of full-cycle economics and SEC guidelines. Thanks for taking the time to write that.

I would like to see the authors address the Cost Center Ceiling Test, the SEC-mandated quarterly accounting test which is supposed to prevent companies from pulling off the scheme that Rockman and others describe above.

Oil company accounting works something like this: let's say you spend $100 million developing 40 BCF of gas net of royalties. Each mcf has cost $2.50. With each "unit of production", the income statement is hit with a non-cash charge (DD&A, for depletion, depreciation and amortization) which comes out of the "Full Cost Pool".

With gas at $8.00 per mcf, there is plenty of room to pay Lease Operating Expenses, General & Administrative costs, and DD&A and have positive net income. At $4.00, it's tight. Under $3.00, net income must be negative (for this illustration).

OK, the ceiling test requires a company to compare the "SEC value" of its reserves to the depreciated Full Cost Pool. (SEC value is a standard measure: constant prices & costs with 10% discount rate.) If the Full Cost Pool value exceeds the SEC value of reserves, there is a write down (charge against income) for the shortfall.

If PUDs are uneconomic at current prices, or not planned to be drilled, they must come off the books.

It's been a few years since I've been in the trenches at a public company, but these basic accounting principles haven't changed.

Vlad - Excellent details. BTW I've seen many PUD's carried on the books for years while internally the company position would be they won't likely be drilled.

The new (2009?) reserve definitions require that PUDs be part of a development plan to drill within a five year time frame. I believe they also liberalized the definition, and as a result, the proportion of Proved reserves in the PUD category increased dramatically. Before too long, companies began appealing individual cases due to extenuating circumstances that affected their timing.

The amortization scheme described above explains why companies have been so aggressive in booking 40-60 year reserve "tails" that have little economic value, in the discounted cash flow sense.

its a bit curious to me how this entire post on PUD shale gas reserves doesn't mention the five year rule. The SEC's five year rule states that the company must have a credible plan to develop the reserves within five years in order to count PUDs as P1 reserves. CHK was not counting PUDs aggressively, the high proportion of PUDs is due to their widely spaced drilling designed to hold acres by production. Can someone verify the statement made in this article that reserves must be "promptly downgraded" if they become uneconomic on a trailing 12m average price? I'm used to seeing reserves adjusted with the year end reserve report and at no other time. In the spring and fall there is also the bank bi-annual borrowing-base reserve re-determinations, but do companies really adjust their reserves mid-year based on a trailing 12 month price deck??

Honestly the entire system and nomenclature of proved, possible, and probable reserves, contingent resources etc was designed for conventional oil and gas. BHP's one and only problem was that they had counted on a higher price for gas. They violated their own maxim of only buying low-cost long-life assets, and they paid the price for it.

http://finance.yahoo.com/news/analysis-natgas-writedowns-signal-bank-191...

(Aug 17) Analysis: Natgas writedowns signal bank squeeze on spending

I think the 3 noted above would be writedowns due to ceiling test issues. It's not the reserves that are being written down but their value. The SEC value of remaining reserves at July 1 was less than the amortized cost of putting those reserves on the books.

The reserve write downs can come at any time but traditionally come after an annual reserve audit by a third party engineering firm. Quarterly estimates may be internally generated based on the most recent audited reserves.

got it, so revisions to the quantity of reserves, in barrels of oil equivalent, would typically take place with the annual reserve report. but the value of those reserves on the balance sheet might be revised according to a ceiling test when they file their results quarterly, which is what happened in this case.