Peak, What Peak?

Posted by patzek on November 19, 2012 - 1:26pm

[Editor's comment: This article is by Dr. Tad Patzek, chairman of the Department of Petroleum & Geosystems Engineering at The University of Texas at Austin. Dr. Patzek's research involves mathematical modeling of earth systems with emphasis on multiphase fluid flow physics and rock mechanics. He is also working on smart, process-based control of very large waterfloods in unconventional, low-permeability formations, and on the mechanics of hydrate-bearing sediments. In a broader context, Patzek works on the thermodynamics and ecology of human survival and energy supply schemes for humanity. He has participated in the global debate on energy supply schemes by giving hundreds of press interviews and appearing on the BBC, PBS, CBS, CNBC, ABC, NPR, etc., and giving invited lectures around the world. This article first appeared on Tad's blog Life Itself.]

Before I discuss the logic behind negating a peak of production of anything, let me sum up where we are in the U.S. in terms of crude oil production. According to the Energy Information Administration (EIA):

The United States consumed 18.8 million barrels per day (MMbd) of petroleum products during 2011, making us the world's largest petroleum consumer. The United States was third in crude oil production at 5.7 MMbd. But crude oil alone does not constitute all U.S. petroleum supplies. Significant gains occur, because crude oil expands in the refining process, liquid fuel is captured in the processing of natural gas, and we have other sources of liquid fuel, including biofuels. These additional supplies totaled 4.6 MMbd in 2011.

Let me parse this quote.

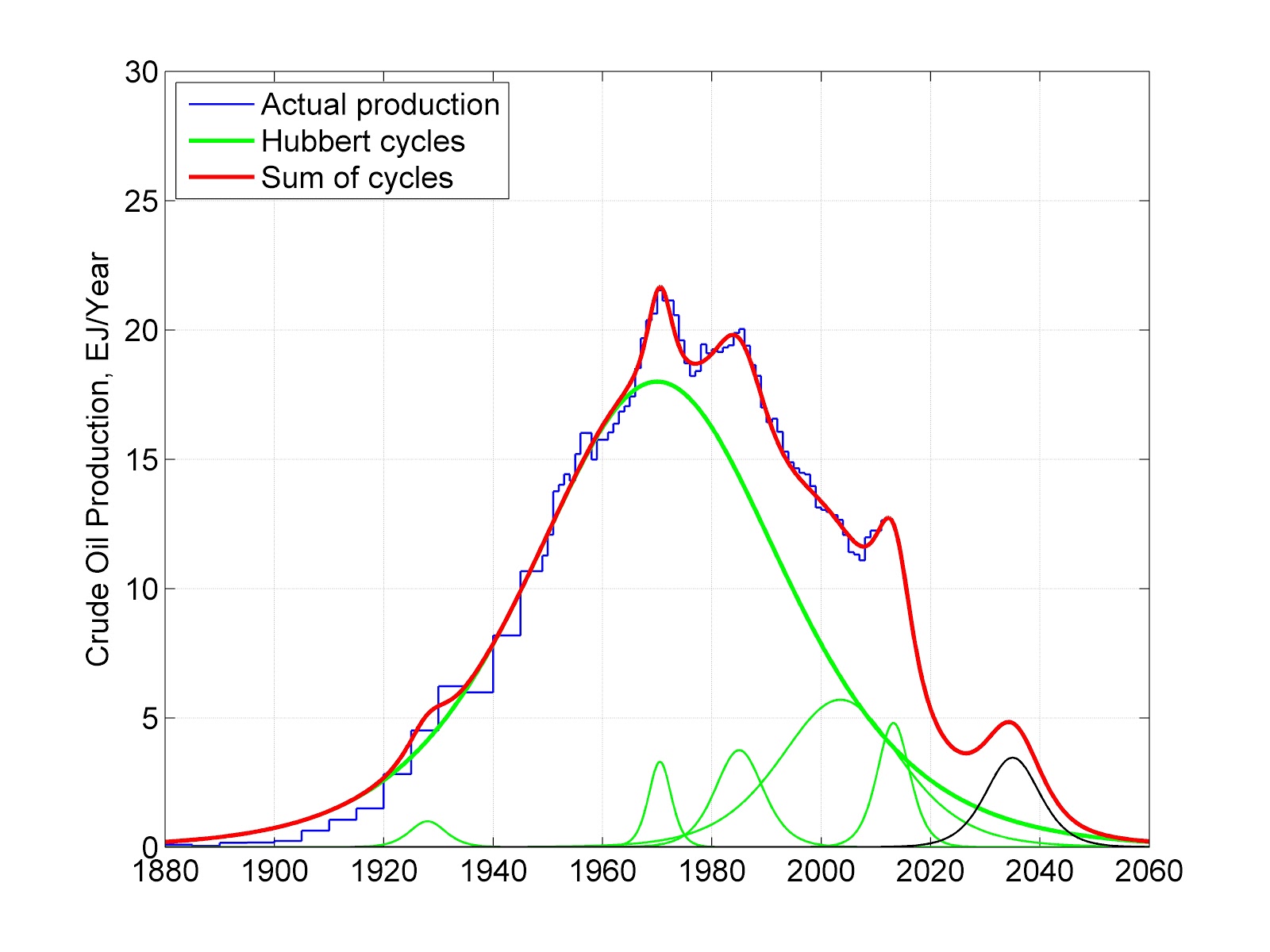

First, let's look at the history of oil production in the U.S., shown in the chart below. The vertical axis is scaled with a unit of power, exajoules (EJ) per year, very close to quadrillion BTUs (quads) per year. To convert from EJ/year to millions of barrels of crude oil per day (MMbopd), divide the vertical axis by roughly two, so 20 EJ/year is roughly equal to 10 MMbopd.

Historic production of crude oil in the U.S. is resolved into several Hubbert curves. The tallest one is the original Hubbert curve published in 1956. The smaller curves starting from 1960 were generated by producing shallow, deep and ultra-deep Gulf of Mexico, Alaska (mostly Prudhoe Bay), and then everything else that was not in the original curve: large waterflood projects, thermal and carbon dioxide enhanced oil recovery (EOR) projects, horizontal wells, hydrofractured wells, etc. The broad curve peaking in 2002 was introduced in late 2002, and the model represented fairly well the U.S. crude oil production until 2010. The last small green curve on the right was introduced last month to describe the Bakken and Eagle Ford shales, as well as the increased production of crude oil from the Permian Basin near Midland, TX. The right-most black curve depicts a hypothetical production of 7 billion barrels of oil from the Arctic Natural Wildlife Refuge (ANWR) in Alaska. So the last point on the blue step-line represents 5.7 MMbopd produced in the U.S. in 2011. This rate is predicted by EIA to grow to over 6 MMbopd in 2012.

Now, let's look at the refinery gains in the second chart. These gains arise because petroleum products are usually less dense than the crudes they are made from. Therefore, refinery gains are not really a replacement of imported crude oil, and demonstrate only that since 1993, the U.S. refining has been moving towards heavier crude oil feedstocks.

Oil refinery gains reported by EIA since 1993 hover around 1 million barrels of all petroleum products per day. These gains arise because the densities of petroleum products (gasoline, kerosene, diesel fuel, jet fuel, heating oil, etc.) are less than the density of crude oil they were made from. It is like making a low calorie butter or cheese from a normal butter or cheese by puffing them up with bubbles of air. Through refinery gains, we have not created new energy. Instead, we have just puffed up the crude oil feedstock by cracking heavier hydrocarbons and hydrogenation. Thus, refinery gains do not really count as a new source of energy, but only as a source of an increased volume of petroleum products.

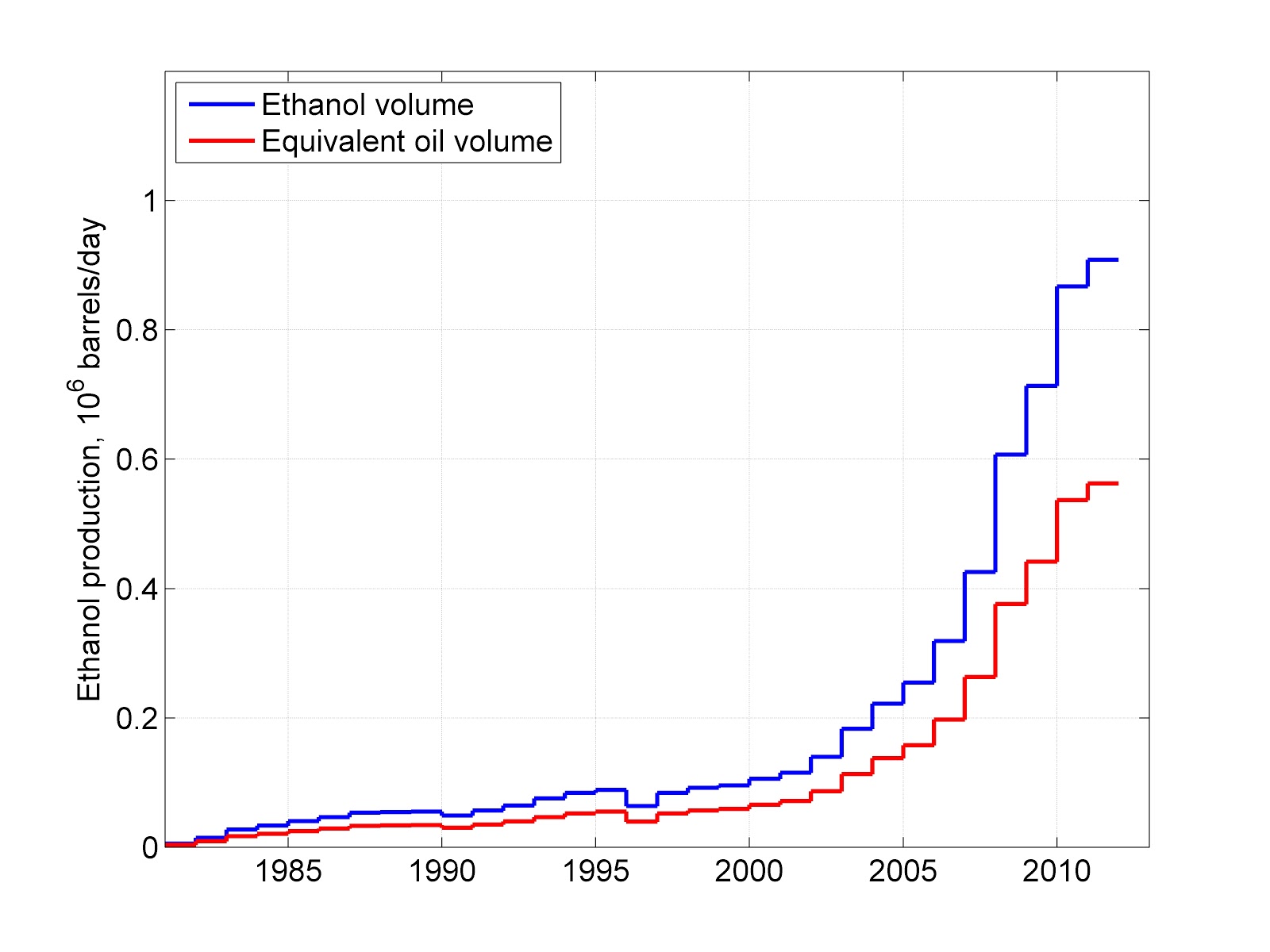

Corn ethanol comes next. I described the ethanol story completely in 2004, in my most popular paper ever. There was nothing new I would add in the intervening 8 years. Basically, ethanol is obtained from burning methane, coal, diesel fuel, gasoline, corn kernels, soil and environment. We destroy perhaps as many as 7 units of free energy in the environment and human economy to produce 1 unit of free energy as corn ethanol, and make a few clueless environmentalists happier and a few super rich corporations richer. The story is even worse for switchgrass ethanol. Finally, your mileage would drop by 33% if you were to use pure ethanol as a fuel for your car.

Production of corn ethanol in the U.S. Because ethanol has a lower heating value, its volume would be much lower when converted to equivalent crude oil.

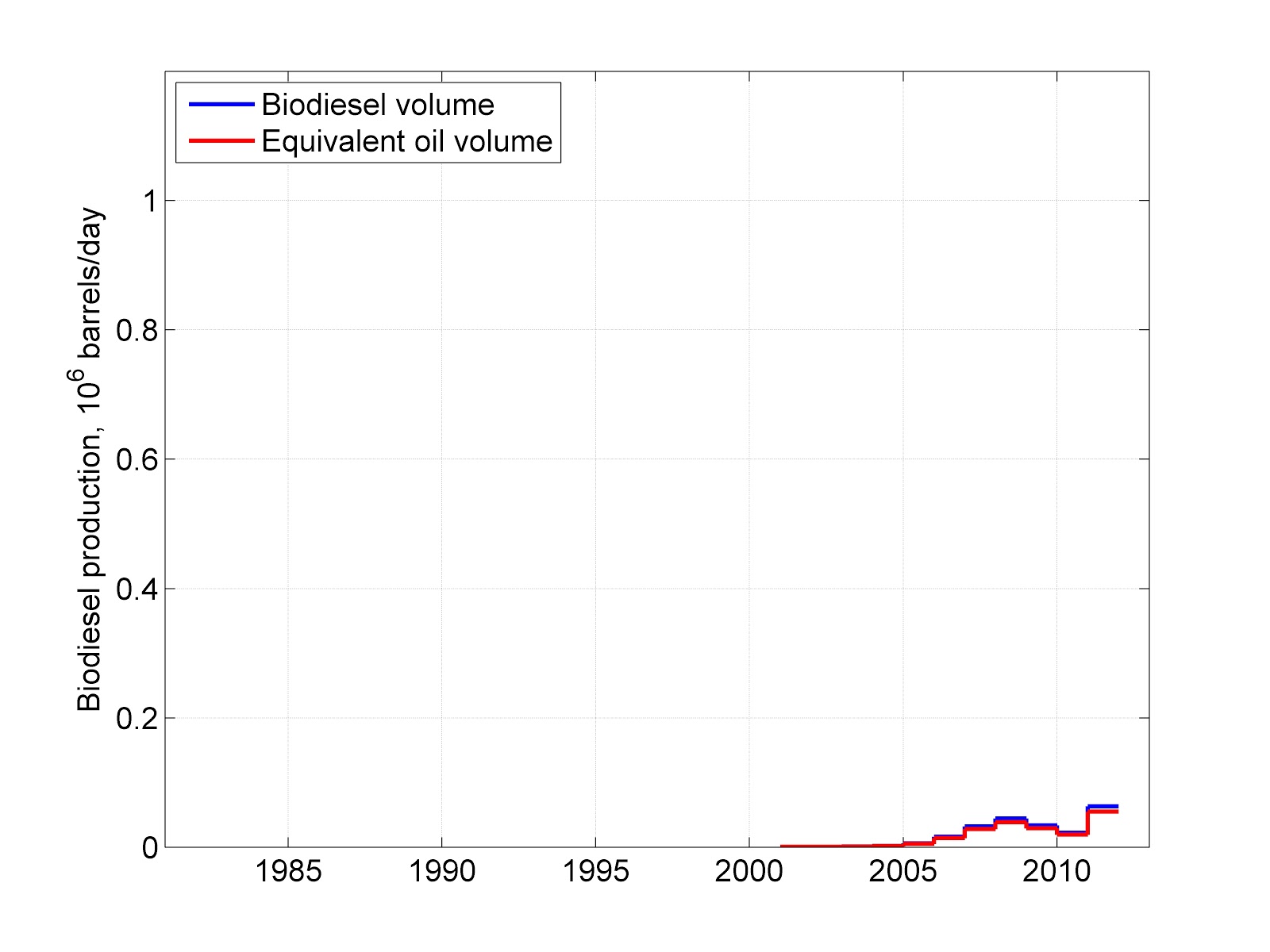

Production of soybean biodiesel in the U.S. is almost irrelevant, but also highly environmentally damaging. Since most of the obliteration of the irreplaceable biota occurs in the tropics, in Brazil, Argentina, Africa, and Asia Pacific, we really don't care. Either way, the rate of biodiesel production in the U.S. is too low to write home about it.

In summary, of the 4.6 million barrels of the other "oil" produced in 2011, 1.1 MMbopd were refinery gains, and another 0.6 MMbopd was the equivalent volume of oil corresponding to the production of roughly 0.9 MMbpd of ethanol. Biodiesel production was in the noise. I fear that EIA simply added volumes of the various fuels without converting them to oil equivalents based on a common oil density and heating value. The rest of the other "oil", 2.9 or 2.6 million barrels of oil equivalent (again I do not know how EIA made their conversions) were natural gas plant liquids and lease condensate. All of these liquids are significantly less dense than crude oil, and a proper conversion lowers their volume contribution by 25 percent.

Needless to say, refinery gains do not inject new energy into the U.S. economy, just add volume. Also, propane and butane are not crude oil, and ethanol is not a hydrocarbon. The only hard number here, 5.7 MMbopd of crude oil production is something to write home about. This level of production requires an incredible amount of new technology and technical skills that are available only in the U.S. My department graduates each year about 150 petroleum engineers of all levels, who make this huge effort such a smashing success. Their starting salaries are in excess of three-four times the national average for college graduates. And they all have jobs.

In conclusion, Russia is using similar technology to increase their rate of crude oil production to over 11 MMbopd, and Saudi Arabia is barely hanging in at 9-10 MMbopd. Both these countries also produce large volumes of lease condensates and natural gas plant liquids. The rate of U.S. crude oil production is a little more than 1/2 of either of these two rates, and we are no Russia or Saudi Arabia when it comes to producing oil per unit time. But this is just fine, so let's stop deluding ourselves with such tenacity.

In the next blog, I will talk about the various techniques of denying existence of peak oil (or climate change, or anything else we fear or do not like).

P.S. So, did I miss anything in my discussion of the EIA quote at the top of this blog? Think carefully... Yes, I did.

In 2011, we consumed 18.8 MMbpd of petroleum products, less by 1.6 MMbpd than our consumption of petroleum products in 2005. With less cash in pocket, less driving, and more efficient cars, we have destroyed demand for almost as much of real crude oil as all other imaginary "oils" quoted by EIA and dutifully propagated through the clueless mediadom.

Why isn't this achievement front-page news? We finally use less crude oil! We are more efficient! This incredible news is evidently not as sexy as making up imaginary "oil" to be on par with the Saudis. Have we gone mad?! I take it back: Have we stumbled even deeper into the destructive imperial madness that has infected us for the last 11 years?

And, you, corn ethanol lovers, read this and fear the future.

P.S.P.S. Five years after my well-researched plea to the EU Ministers of Environment and Transportation, EU is considering limiting use of biofuels:

The European Commission intends to limit the use of biofuels derived from food crops to 5% for transport fuel. This would be a substantial change to its present biofuels policy. According to the EU’s climate-change and energy commissioners, Europe wants to cap the share of energy in the transport sector from food crop-based biofuels at current levels. The proposal, a draft of which was reported by Dow Jones Newswires, clashes with the target of having 10% of the energy used in transport coming from renewable sources by 2020. This goal was set by the EU three years ago because food crop-based biofuels account for most biofuels available in volumes at the moment. New types of alternative fuels are being developed, but they are mostly at the laboratory stage. At the same time, biofuels are expected to be the main renewable energy source used in transport in 2020.

Despite the obvious insanity of the last sentence, I say: Better late than never, dear Europe, and much better than the U.S.A., which seems to have a policy of accepting political donations from mega agricultural companies and all kinds of other companies, rather than having an energy policy.

(P.S.)-cubed on 11/13/2012. The Wall Street Journal insists on an alternative reality view of EIA reporting, by stating in a Review&Outlook piece, "Saudi America," that:

The U.S. will increase its production to about 23 million barrels a day in 10 years from about 18 million barrels a day now, the IEA predicts.

I have no idea what IEA predicts, but I surely know that this number is incorrect, if it implies current production of liquid hydrocarbons in the U.S.A.

Well, maybe like that Leonard Cohen song goes, 'everybody knows'. So, as someone else-- perhaps many others-- once suggested we do, many of us just 'play the game', 'play pretend'. If we didn't, Wall Street would crash overnight or something... Maybe Steven Chu or Tariel Morrigan said that.

If you play pretend, the crash will be less severe and everyone will have time to prepare, so some theory goes... Well, that seems about as rational as the rest of it.

'Civilization is too big to fail'. Forget history, make that your mantra. Just keep repeating it over and over to yourself and it will all work out. But you have to believe it. Visualize those hydrocarbon lakes on Titan if it helps.

And get back in your car and go to work. Earn your salary, pay your taxes, mortgage, mow your lawn, deal with the bank, etc., and play the game.

Oh, and don't worry about progeny. It will all sort itself out. If you toe the line.

Regarding refinery gains:

When you take a long hydrocarbon chain molecule from a heavy crude batch, then separate it into two smaller molecules (lighter liquid) you need a couple of hydrogen atoms to replace the C - C bond that has been broken. This hydrogen usually comes from natural gas (CH4), so refinery gains are NOT FREE. They have taken energy from natural gas and embedded it in the processed crude. Besides, the heat to drive this process also comes from natural gas.

EIA clearly does not deduct energy from natural gas account when saying refinery liquid production increased due to refinery gains. We are taking from one energy account and transferring to another (with some loss). On a net energy basis refinery gains are a net loser.

I have a metaphor: Creating a leak in a boat to seal another leak.

Leak? What leak?

(Hidden behind bulkhead.)

It is all about net energy and that is how we should present our global energy production and use.

Net energy is the best indicator of useful work as it takes into account the lower EROEI ratios of newer resources coming on-line.

If we used net energy in all of our arguments it would soon be clear that we now live in a negatively sloped net energy production world.

As the world's population numbers continue to rise and the net energy available to that rising human population per capita is calculated, the real picture is painted.

I don't understand why both net energy and population parameters continue to be ignored HERE on the TOD! I understand why the rest of the world ignores these trends but it seems even the most enlightened few that live in the TOD world are also hesitant to accept the true situation. Of course, the further away we are from the industry that provides our paycheck, the easier it is to see the forest for the trees. Perhaps the thought of the 150 year ride down the back side of the fossil fuel bell curve is just too depressing to think about. Regardless, the truth will improve our plans and policies and help mitigate the suffering. Not a soft landing but a softer landing.

NET ENERGY - POPULATION These are the two most important parameters in the energy discussion, by far. Funny how rare it is to hear their sound.

Indeed. I've been sounding that trumpet for years.

For you doomers, my latest rantings FWIW.

George, if I read you correctly, your death-wish appears, paradoxically perhaps, as a bit of a live-wish manifest over time as a dangerous lock-in.

David Korowizc speaks about that and of course I sort of suggest it in my first comment here-- the idea of playing the game that you then can't easily or safely opt out of. Maybe a little like some movie-version of joining the mob and then trying to quit it and having your life threatened if you do.

Your net energy point is well taken. When taking into account the efficiency (or lack thereof) of most energy-converting machines (35% at the top end), and adding this to the mix, it would appear we are net losers all the way around.

The mirage is produced by economics. As long as money can be made from net loss energy schemes, they will somehow seem to be practical.

It's just silly to say that Net Energy and Population are somehow missing from the conversations or the focus here. They've been gone over again and again.. with long and tedious repeats of the same points. While surely they have their proponents and their skeptics.. it's hardly an unheard note in this arena.

If you're saying we haven't reached a solid consensus or come up with a clear solution to either point, well then let me be the first to wish you luck on the quest.

They are surely both key aspects to our energy predicament, each one woolly and scratchy in its own way. What would you do about them?

Sorry for being "silly", jokuhl, but when you say, "somehow missing from the conversations or the focus here." don't you think that covers just about the entire gambit? I mean, missing is never being said and focus is like the only thing being said. Right? So, I guess in that context, I am "silly". It would difficult to be anything but!

What would I do about them?

1) Not be afraid to say population is the most important parameter when talking about resources.

2) Remind the masses just how bad the IEA's past reports were and how they adjust them every year to better match reality. It should be obvious by now that they willfully do this so people don't panic or change their dreams of consumption. If we just used more simple net energy numbers, it would be far harder to hide reality with confusing and hard-to-pin-down terminology. Most people just need a whiff of doubt and they run with it.

3) Always bring up net energy as the best indicator of our energy situation. Not GDP or refinery gains or net production of any form of energy, regardless of form or cost. Everything else is just used as a smokescreen.

With that said, I understand that the task of enlightening the masses is futile and that humanity has to learn The Great Lesson the hard way. I only hope that the few small groups of people, many of them here on TOD, can keep a more consistent message of what is going on. Then we can say, "Well, it was all explained clearly on TOD (and other forums and papers). Perhaps that is just beating a dead horse and gets boring so we tend to mix it up for fun.

Perhaps we could vote on a suggested list of resources that people can view that will give them the best picture of reality. Something like a short program that can be followed, step by step, that lays it out in a clear way that most of us here agree with. How about a big green button that says, "If you are new or need a review, click here!" The TOD curriculum.

Then again, perhaps just enjoying a peak of human civilization is time better spent. ;)

Sorry if my retort was offensive, TT, but I was responding to this line..

.. and they are simply NOT ignored here. We see continual appeals to the importance of both. I don't object to their importance, either.. while I do find the Pop. thread to be simply wearying, with their regular forays into catcalls of Eugenics and 'Stalinist Culling' and such. But above all, is the reliable resurrection of the plea that asks why we never talk about Population!

As far as outreach.. I'm afraid the Economists keep hogging the mic's, and people seem to let them, being so comforted by the reassurances that their money will be safe and sound.

Bob

I see EROEI and population brought up all the time here, maybe more in the Drumbeat. It's just harder to quantify. Of course everything comes back to EROEI, that's the whole driving dynamic behind Peak Oil. And it's also the source of the current disconnect between the purchasing power of money and the resources available to back that up.

As we run out of cheap easy oil with EROEI of 100:1 we move on to slow unconventional oil with EROEI below 10:1. This is enabled only partially by technological innovation, but mostly by high oil prices. And counterintuitively to the mainstream understanding, this actually unlocks lots of "new" oil that wasn't available before. This is the apparent paradox we are witnessing now, exactly as predicted by Peak Oil "theory", which is that as we "run out" of oil, our economically recoverable fossil fuel reserves actually grow, but this is only due to increasing prices.

The problem with the new unconventional oil sources is they are slow and expensive, and this kills demand. Eventually a peak, or plateau, is reached in production rate after which it declines.

Of course the cornucopian media latches on to the increase in recoverable reserves from unconventional sources as evidence that technology will conquer adversity, that our reserves are growing faster than our yearly consumption of them. This can continue for centuries, they argue. But take oil price back to $50 and see how many reserves we'd have left!

This increase in reserve size can't continue indefinitely. Eventually geology (or social collapse) takes over from price as the predominant parameter limiting production rate. What the media doesn't talk about is the dropping EROEI as reserve sizes increase. As Gail's triangle in the TOD post the other day shows, the reserves of unconventional fossil fuels at the base are quite large.

But it would have been more effective to draw that triangle differently, with a base that fizzles out into nothing, rather than being a hard line which tends to suggest at a quick glance that they are equivalent kinds of fossil fuels at the top and the bottom. But the base has such a low EROEI that at some point we won't be able to support society properly anymore even though we're still sitting on trillions of tonnes of fossil fuels. So without renewables, society ends somewhere at the base of that pyramid; where exactly, who knows, which is why there should be no hard line at the base.

Well there is one thing that is silly. And that is to imply that all different forms of energy are fungible. That is silly to the nth degree. You cannot fly a jet plane on coal, or electricity from a dam, or anything but petroleum for that matter.

The liquids fuel problem is serious and just pretending we could, like overnight, convert to electricity or something else, is truly silly. Conversions will come slow and hard and at great expense. And some things will never be converted.

Ron P.

This whole culture is silly, and far worse.

It's not just about EROEI of course, but the level of sanity/insanity behind its use.

I think the EIA has been playing fast and loose with the petroleum statistics. As noted last week, the EIA Annual Review for 2010 states that the US produced a total of 9,443 mbbls/d, of which US crude production at 5,512 mbbls/day (which includes lease condensate), NGPL's at 2,001 mbbls/d and processing gain of 1,064 mbbls/d. The difference of 866 mbbls/d appears to be made up by biofuels.

Total product supplied is said to have been 19,148 mbbls/d, with imports minus exports totaling 9,434 mbbls/d of that. The amount of crude imported was 9,163 mbbls/d. From these data, the total crude supplied to the refineries was 14,675 mbbls/d, of which 62% is imported.

I've previously suggested that assigning all the processing gains to US production is factually incorrect, instead the processing gains resulting from refining imported crude should be added to the total for imports. For a rough guess, using the fraction of crude imported given above, 664 mbbls/d should be subtracted from the US production and added to the import side of the accounting. This revision reduces US production to 8,779 mbbls/d and increases imports to 10,098 mbbls/d, increasing the fraction imported from 49% to 53%.

Of course, the EIA misses the whole discussion about biofuels, especially ethanol, which require a large input of fossil fuels to produce the final product. The EIA ignores this fuel input, showing biofuels as an input to the front end of the refining process. With ethanol production now using about 40% of the US corn crop, it would be more accurate to consider this portion of the US agricultural system to have been added to the energy supply system and the energy used would thus become an internal consumption which would be subtracted from the petroleum energy available to the rest of society. Doing this calculation would increase the fraction of energy imported, which would give a more realistic picture of our situation...

E. Swanson

Black Dog, thanks for the very clear picture of current US production, this really lays it open.

Alas, they don't even subtract the energy inputs to the fossil fuel industries, e.g., all those trucks hauling fracking fluids.

Sorry Guys but you have missed the point on refinery gains. It is a mirage. Remember the 1st law of thermodynamics.

Energy cannot be created or destroyed. US refiners continue to quote their refining capacities and products in barrels - a unit of volume which is meaningless unless a density unit is also quoted. What you should consider is the mass unit. In ALL refineries if you measure in units of mass it should add up to 100% plus the mass of hydrogen and other inputs added which increase the mass. ( methanol for an MTBE unit for instance). When the crude is distiller in the crude unit it will produce a number of products with different densities and therefore different mass per barrel. Measure the products in barrels and you will have the following barrels per tonne.

Butane. 11

Naphtha 9

Gasoline 8.7

Jet 8

Diesel 7.5

Vacuum gas oil 6.8

Fuel oil 6.5

In a cat cracker, with no hydrogen addition the mass of products is constant but because the volume of LESS dense light products exceed the total volume of HEAVY dense products , hey presto there is a refinery gain - in volume but not in mass.

Some refinery gain is due to the addition of hydrogen but typically this is 2-3% of the overall mass flow. Refiners love to sell in units of volume as they can benefit form the sleight of hand of selling a less dense and lower energy product to unsuspecting drivers. When energy density is compared in mass units there is NO significant difference between gasoline, jet or diesel. It is about 42-44 MJ per Kg but very different in volume units. That is why diesels appear 30 % more fuel efficient on volumetric terms but in reality the differnce is much less.

A number of people have posted the same argument each time "refinery gains" are mentioned, but it does not universally hold true.

Cracking can be done without addition of hydrogen, either by separately coking the heavier fractions of the crude before cracking (producing large volumes of solid carbon-rich petroleum coke, frequently a desirable byproduct which is further improved for use in metallurgy), or coking by deposition on the catalytic cracker unit itself (usually simply burned off in batches).

In neither case does any non-crude-oil energy input contribute to the increased volume of the light hydrocarbon products. Indeed the liquid products are of considerably less mass and energy than the input crude petroleum.

Indeed to the best of my knowledge hydrogenation in cracking units is not the norm. The main use of hydrogen in petroleum processing is in fact to remove sulfur and nitrogen from the fuel -- in which process it does not add energy to the desulfurised fuel product, but rather to the sulfuric and nitric acid byproducts.

http://en.wikipedia.org/wiki/Hydrodesulfurization

The hydrogen may be generated by steam reformation of natural gas, but coke from crude oil is also used as feedstock for steam reformation.

Yes, thank you for clarifying that. I've tried to clarify it for people before, but your explanation is much better. People tend to assume that "refinery gain" comes from adding hydrogen, but that's not generally true - in most cases it comes from removing carbon, ie "coking". Refineries prefer to do it that way because hydrogen is very expensive, and petroleum coke is a valuable product. In either case, the EROEI is much less than unity - in the case of coking, it is less than zero.

From a chemistry standpoint:

If the refinery is breaking H-C bonds in the hydrocarbon chain molecule and producing free C (which you call coke), then the liquids produced have shorter chain molecules (total number of carbons reduced). Fewer H-C bonds mean lower energy. So using catalytic cracker that produces coke removes energy from the resulting liquid.

My claim of lower net energy in the oil product still stands regardless of refining method. In either case refinery gains should not be counted as energy production.

Ideally EROEI for an energy source would be the ratio of final work done to the sum of all gross energy consumed, e.g. for a coal power plant the kWh delivered to users divided by the embodied energy of all the inputs. This would take into account the conversion efficiency of inputs and outputs, e.g. the distance of the coal plant relative to the mine and final loads could be a trade-off of energy used to transport the coal vs. the energy lost by electrical transmission. For transportation I suppose it would convert to passenger-miles per joule, again based on refinery losses, engine efficiency, maintenance, etc.

Consistent use of energy units such as Barrel of oil equivalent (1 BOE = 1.7 MWh) would be a step in that direction. Using volume is clearly a ploy to improve the numbers, as is the double counting of barrels that are used for production (e.g. a BBL used to extract 2:1 shale oil counts as 3 BBL, to make 1:1 ethanol counts as 2 BBL). This won't fool Mother Nature.

Ideally EROEI for an energy source would be the ratio of final work done to the sum of all gross energy consumed but that still leaves out something that is very difficult to quantify--the relative value of each unit of work to the economy. Very murky stuff there--and it is at the heart of the debate--good luck fleshing that out. ERoEI only becomes an issue when the most critical units of work (they will make themselves obvious as the economy rapidly increases their value) suck up almost all the energy and almost none is left to go out and multiply (its value) in this unfathomably complex economy.

I didn't want to go there, but yes, critical uses will soon become more obvious. Energy production and transportation will be prime needs and determining their EROEI will be straightforward and essential.

Consumer choices such as large-screen vs. small-screen televisions, LEDs vs. compact flourescents, Hummers vs. Tatas, could be "informed" by an embodied energy tax similar to the VAT. Or just pay for them with energy chits as in the technocrat economy.

Well, a problem with EROEI is that all energy is not equal in cost. Hence you can run arbitrage between various energy sources. For example, Natural gas is pretty cheap right now so even though the EROEI of tar sands oil might not be great, the fact that the main energy input is cheap natural gas allows the tar sands to be made at not too high of a price.

Money is what matters in the real world not EROEI as Rockman has pointed out many times.

"Money is what matters in the real world not EROEI as Rockman has pointed out many times."

Funny, but I couldn't disagree more. I claim that the EROEI is all that matters in the real world. Then again, I guess it all depends on the definition of "real world". In fact, in my real world, money means nothing compared to net energy.

In any finite system of interest, if you don't have your EROEI set high enough, no amount of money, currency, gold, policy, technology or voodoo magic is going to change the inevitable.

Sure, short term systems often rely on a way of distributing resources that are very important and can seem to overshadow the importance of net energy. However, in the long term, none of that matters if there is not enough net energy to support the complexity of the system. You can be sitting on a mountain of resources but starve to death if you don't have the net energy needed to transform those resources in a way that supports your own complex system. The higher the net energy you have, the more complexity you can support, depending on the other available resources.

Money follows net energy, not the other way around. If there is not enough net energy, humans would not have enough time, beyond finding enough food, to invent money as a way of figuring out what to do with their free time.

Yes, surely money is an abstraction from real work; ie energy.

We should be more correct here -- it's about exergy, not energy. Exergy is useful energy available to do work. This then incorporates the concept of EROEI.

Has there verb been an exergy keypost on TOD to explain the concept?

EROEI isn't nearly the whole story - utility is.

Oil can be an energy sink and it will be viable to extract ie I can't put coal in my chainsaw.

An oil well could be drilled with electric power, oil sands can be extracted with eg natural gas inputs and nuclear electricity - the EROEI could potentially be negative - but I will still need liquid fuel for my chainsaw.

You see, it is not as simple as it appears. I have never seen it discussed, but I know that the end use of the oil matters too - there can be energy gain here also that is not practical with other forms of energy - but it is not considered EROEI.

To clarify: I can buy 2 quarts of gasoline, assume EROEI of minus 10 on these 2 quarts, ie it took coal, gas, electricity equal to about 5 gallons of fuel to put these 2 quarts in my hand. I go out on my property, which is a mile from the nearest electricity, and cut 2 cord of maple to heat my house - the maple is equal to about 280 gallons of fuel oil. About 2 cups of gasoline in my tractor gets the wood back to my house, by the way.

Stranded gas, coal etc are cheap for a reason - they are not as useful.

EROEI applies in a very broad sense, clearly there must be a very positive source available somewhere. I don't think its as useful a parameter as many would have you believe though, since we are facing a crisis of utility more than anything.

It is clear to me that if we cannot find a source of power with comparable utility, we will be seeking oil that is available only at a loss of net energy, it will be profitable in some cases to do so, and there will be investment capital available - to what extent I don't know, but it will happen.

We won't be left with BAU by any stretch of the imagination in that case though.

Money is what matters in the real world not EROEI as Rockman has pointed out many times.

I'd argue that there is an apparent and temporary disconnect between energy and money enabled only by ridiculously cheap debt (low interest rates), all imposed by the Fed. This leads some to believe that money is what matters in the real world (which it currently does), rather than energy. But this is only due to the ponzi scheme monetary system I'm always harping about. This rubber band is about to snap and the two concepts of energy and money will come back in line with each other soon, and this will be effected through a catastrophic collapse of the world's financial system.

That's along the lines of what I was thinking before reading your comment. Money seems somewhat divorced from reality, from nature/natural mechanisms, land, resources, energy, labour, whatever. "We" only pretend it's married. Maybe it's kind of married, but has affairs, children from those affairs and sexually-transmitted diseases (fractional reserve/financial instruments/magic money-potions/etc.).

If it's 'created out of thin air', as it is often described, then it has little or less to do with energy or a lot of other things, except where it begins to mess with/bump up against natural reality and then "runaway 'growth-house' effects" start happening-- your rubber band.

These days, what with financial corruption, money doesn't even appear to have much to do with its own rules anymore.

The gold standard and fractional reserve seem questionable just for those reasons and I have heard discussions along the lines of money needing to be tightly based on energy or land or somethings like that, or perhaps not being used at all, and using instead, credit, gifts, barter, truly local/ethical currencies, and/or similar.

While I have a hard time understanding money and trying to gives me a bit of a headache- (although some, who may appear to understand money, have a dubious grasp of its effects/dynamics)- it's yet another human system that can get mired in complexity and disasters of its own kinds.

That arbitrage is what conceals the true energy cost of any particular source. A 20:1 source can be leveraged to 40:1 by passing it through a 2:1 source like shale oil.

The overall EROEI is now 40:21 but the 2:1 producers make a nice profit and furthermore can claim the entire reserve as recoverable at the current cost.

After depletion of the 20:1 source they might have to use their own oil for production. Now half of the reserve is consumed to get the other half, and the extraction rate has to double to provide the same net output. A 100 year supply becomes a 25 year supply.

And that is assuming there is no increase to offset the loss of the 20:1 source. The price can be expected to rise correspondingly.

The US has refinery process gains of over one million barrels per day. That is almost as much as the rest of the world combined. They have to be counting refinery process gains on imported oil.

Ron P.

That is correct. The EIA is counting "refinery gain" on imported oil as "US oil production". It is a totally bogus product by any standard, and the only reason I can imagine them doing it is to artificially inflate US oil production statistics. This has to be politically motivated.

And the IEA bought into the EIA's misinformation (call it a lie) with their latest report, which means either that they don't understand the EIA's reporting or they are complicit in the act of overstating US production. Your choice...

E. Swanson

There is an addition factor which the EIA is not going to want to make clear. US oil imports are increasingly coming from Canada, and most Canadian oil production is now from the oil sands as Canadian conventional oil production declines and oil sands production increases. Canada now exports more oil to the US than it consumes itself.

The product which is exported is mostly bitumen, which is not "tar" as some people would have you believe, but it is about the heaviest grade of oil you can buy. Midwest oil refineries no longer have sufficient domestic oil to keep running, but there is lots of Canadian bitumen and it is very cheap to buy (although not to produce). They upgrade it using coking, and make a ton of money turning it into gasoline.

Despite the fact that the EROEI of coking is negative (there is an energy loss), there is a huge refinery gain in going from very heavy bitumen to much lighter gasoline. The EIA counts this as "US oil production" despite the fact it comes from the Canadian oil sands and involves a net loss of energy.

That's another factor in the huge "refinery gain" the EIA and therefore the IEA is counting in predicting the US will exceed Saudi oil production. It's not really oil, in physical terms it's some kind of an extreme vacuum, or a form of negative energy.

Furthermore, importing extra heavy oil from Canadian bitumen (aka, tar for those who don't understand that tar is derived from coal) sands requires the addition of some dilutant to the mix to reduce the viscosity enough to allow the mix to flow thru pipelines. Looking quickly at the EIS for the Keystone XL pipeline from the US State Department, one learns that the chemical makeup of those dilutants are company proprietary information. It's likely that these are made up of lighter fractions of crude oil, such as naphtha or even some NGPLs. The fractions with the lowest boiling point temperature would most likely be mixed in during the coldest months of the year when the oil would be most viscous.

The source of those dilutants is unknown, but there have been comments about building a pipeline from the US to Alberta to provide those chemicals. If this is done, the dilutants would be (are?) added to the export column of the EIA data, but would then be returned to the US along with the heavy oil and then recovered at some point during the refining process. The result could be like a loop within which (almost) no change in the total quantity of material occurs, but which appears as a reduction in total imports due to double counting in the EIA volume based data...

E. Swanson

Looking quickly at the EIS for the Keystone XL pipeline from the US State Department, one learns that the chemical makeup of those dilutants are company proprietary information.

Proprietary, shmoprietary, it's only the State Deparment that doesn't know what's in it. If you Google, "Western Canadian Select", you'll find out more than you ever wanted to know about it. They're trying to sell it, after all.

Western Canadian Select What is Western Canadian Select crude?

...followed by a chemical analysis of the most recent sample of it.

What is going down the pipelines is a mixture of oil sands bitumen, conventional heavy oil, synthetic crude oil, condensate, and pentanes plus. The mixture varies from day to day. The buyers don't really care where it came from or how it was mixed, they only care that it meets specs, i.e. the chemical analysis is right.

There are pipelines carrying diluent from the US to Canada, and it is getting to be a big business with the increase in Canadian bitumen and heavy oil production. There are also rail cars full of bitumen going south, and carrying condensate and pentanes plus on the backhaul.

Canada's tar sands unexpected winner from fracking: Kemp

I'm kind of fond of the Cochin pipeline because I did some systems analysis on their computer pipeline monitoring system.

Environmental group blathering about water shortages and natural gas shortages aside, the biggest constraint on Canadian oil sands production is a shortage of condensate for diluting the bitumen for pipeline transport, and the US is really going a long way toward solving this problem, albeit inadvertently..

You say that naptha prices are falling??? A US gallon of Coleman camping fuel which I believe is naptha was selling in Canada for around $19 this summer. That is considerably more than I have ever had to pay for this fuel.

"Refinery gain" is definitely a misleading statistic but there is a point there. It is good to do your own refining. Jobs, value-add, refinery gain, etc.

Since Rudolph Diesel built an engine where farmers could grow their own fuel, it seems a bit contradictory to limit the use of biofuels. Grow peanuts and make your own fuel. Can't have that. Canola farmers in Canada have been known to use canola oil in their diesel engine cars. Such as it is in The World of Peak Insanity where the fools rush in where angels fear to tread. Gotta be financial chicanery.

http://www.meristem.com/agtech/ag04_04.html

Farmers can grow non food biomass to synthesize diesel.

Sounds like you have never tried to run a transport or other business on bio fuel like biodiesel. My customer in North Dakota converted several vehicles to run on 100% bio diesel. His company sold millions of gallons of the stuff over the last two years. Problem is that during cold weather it has to be heated to keep from gelling at low temps (much higher temp than for fossil diesel). Also, pure biodiesel tends to soften some rubber, leading to leaks in fuel system.

I think biodiesel as a small percent of total fuel volume, perhaps 5% or 6% of each gallon, does make sense. But to portend that biodiesel can replace fossil diesel 100% in most applications is nor more than hopeful thinking, at least for the US, and especially since it has a hard time competing on a price basis. Right now my ND customer that markets biodiesel said that with the high soybean price compared to crude oil biodiesel cant compete. The market is not favorable for biodiesel replacing most fossil diesel, nor will it be for the foreseeable future.

So, economics dictate that biodiesel will not replace most fossil diesel, rather than technology dictating such a shift as you imply.

Of course you can! Farmers growing their own fuel for their tractors is one thing. The problem is when you want to scale that to provide diesel or ethanol for all the private ICE powered automobiles so everyone can continue with the happy motoring fantasy.

The other day I made a comment that there were three things that the human race just doesn't seem to be able to really understand.

1) The exponential function as explained very well by Dr. Albert Bartlett.

2) The laws of thermodynamics, specifically net energy and how it applies to things like biofuels. Dr Ted Patzek explains that pretty well.

3) Chaos theory and tipping points, here we get into pretty advanced mathematics rather quickly but the general concept itself isn't all that difficult to grasp.

"Farmers growing their own fuel for their tractors is one thing."

I wonder how the land use would compare to feeding a pair of mules?

Some time ago in the TOD realm this discussion was had...maybe several times...

...I think I remember several folks agreeing that the amount of land needed to grow vegetation required to either make liquid fuel for a farm's equipment or to feed a farm's beasts of burden is ~25% of the amount of vegetation grown on any given size of farm parcel (I assume there is a minimum sized parcel to which this applies).

Does this memory check with other TOD-sters?

Hey hey Ulan,

I remember some discussion of pasture or hayfields for draft animals being in the 1/3 ~ 1/4 of total acreage range. I don't remember any numbers for biofuel acreage as a fraction of total land, but I do remember that the metabolic efficiency of a human walking is comparable to that of the Internal Combustion Engine. I would assume that that relationship, more or less, holds for draft animals. So, if the net efficiency is pretty close I would assume that the percent of acreage must similar.

The Old Gray Matter also dredged up this side note on the Model T which I then verified and cited from Wikipedia: The car's 10 US gal (38 l; 8 imp gal) fuel tank was mounted to the frame beneath the front seat; one variant had the carburetor (a Holley Model G) modified to run on ethyl alcohol, to be made at home by the self-reliant farmer.

Thanks,

Tim

Yes, that's my recollection, too. About 25% of the land had to dedicated to feeding draft animals, whereas only about 10% has to be dedicated to growing soybeans or canola for tractor fuel. The advantage of draft animals was that the animals could harvest it themselves, and they could use land that was too steep for a tractor - very useful for farming hill country, less so on flat plains.

The old Model T could run on gasoline, kerosene, or alcohol. It could also run on unrefined condensate direct from the well, which was popular during the Depression. My mother hated it because they hadn't removed the sulfur from it and the exhaust stank to high heaven. They called it "skunk gas", but it was very cheap.

No modification is necessary: just adjust the carburetor jet appropriately. For gasoline, screw the adjustment all the way in, then screw it back out two and one quarter turns (that's at sea level -- the optimum setting varies with altitude). I'd guess opening it about three turns total would work for ethanol, though I've never run a Model T on ethanol. In my youth I did run one regularly on kerosene, though. Except in the hottest weather you have to start it on gasoline, but it runs fine on kerosene.

Carburetor jet adjustment was a standard procedure with the Model T. I've seen vehicles with an extension on the adjuster so it can be adjusted from the driver's seat, though I don't think that was ever standard.

The Wikipedia entry addresses both points. Interestingly

I take this to mean 1% of land growing potatoes could provide farm fuel for the other 99%. Sounds way optimistic, but maybe he meant just cultivation, which does not take all that much fuel, as opposed to planting, plowing and harvesting?

Oil consumption in 1925 would have been a fraction of current consumption so it would have been feasible to satisfy that demand with ethyl alcohol.

And the energies/materials required for the centralized infrastructures (manufacture, pipelines, refineries, roadways, etc.), centralized bureaucracy/paper/tree-use/waste/plastic recycling plants; duplication, shipping times, one-trick ponies, etc.; versus manure, composting, food, heat & energy from composting; decentralized/local-distillation/food/labour/currencies, redundancies, over-engineering to last, roadway-construction for mules ;) , mule-shoe/saddle or harness replacement/construction, and so forth. (Funny perhaps, but true.)

What's economic about certain economies exactly?

"Today's Farmer's Almanac is published by Monsanto." ("and The Queen is on welfare [and some money]").

"Of course you can! Farmers growing their own fuel for their tractors is one thing. The problem is when you want to scale that to provide diesel or ethanol for all the private ICE powered automobiles so everyone can continue with the happy motoring fantasy."

Two neighbours and I are making contest plans to convert wood gas/alternative transport engines that will get us to town and back (100 miles return). One is planning to do this with his boat, and two are converting their trucks. I might build a small car or convert a beater as I can't bring myself to change my 86 Toy PU

I suppose the prize will be bragging rights and a bottle of Crown Royal or good scotch. And we will all share in the winnings!! I guess the whole point is that if our linking road transport becomes dodgy, we will still be able to trade for stuff...all in theory of course because I am sure this paved and seldom traveled highway will stay open forever. :-)

Paulo

Who is limiting the use of biofuels?

It seems fairly obvious that the exact opposite is true. The world, and in particular the US, are aggressively promoting and subsidizing biofuels.

I don't think that there is anything wrong with a farmer or anyone else using bio-resources for fuel or other non-food purposes (alcohol, clothing, etc.).

But in almost all cases humans are willing to pay more for calories that human consume rather than calories that humans use for energy.

Without subsidizes for biofuel production, we would not be diverting nearly as much food production capacity to liquid fuels.

In fact, I don't really believe that there is a food versus fuel conflict at all. It is completely created by biofuel subsidies.

That's right. The use of biofuels is being promoted by subsidies in developed countries, which results in higher food prices worldwide as land that could be used to produce food instead is being used to produce fuel.

In fact, I believe that Brazil is currently importing fuel ethanol from the US and using its own sugar cane crop for producing sugar. The price of sugar is high enough that it's cheaper to import corn ethanol from the US than produce ethanol from their own sugar cane.

This is despite the fact that sugar cane ethanol is more efficient to produce than corn ethanol. The whole system is driven by US taxpayer subsidies.

"in almost all cases humans are willing to pay more for calories that human consume rather than calories that humans use for energy"

- I wish that was true, but unfortunately it is not. That is because we're talking about different people doing each. The average citizen of the rich countries spends several times more just on car fuel than the total income of each of the billion or so poor people in the third world who can barely afford enough food to survive. (And that's not counting other energy uses such as home heating.) As petroleum becomes scarcer, and attempts are made to replace it with biofuels, the price of food increases and some people starve - but not the people using the biofuels. This can be blamed solely on the biofuel subsidies if biofuels indeed are a net energy loss to produce.

"People who own cars have more money than people at risk of starvation. In a contest between their demand for fuel and poor people’s demand for food, the car-owners win every time."

http://www.monbiot.com/2004/11/23/feeding-cars-not-people/

Many thanks for this post, at this point it must be considered that this IEA "report" (which the press even manages to "bump up" in the "right" direction) is pure propaganda.

The knowledge IS within the IEA, it truly is pure propaganda.

And the financial adjective can be added to propaganda above.

That this report is propaganda isn't saying that it is "IEA propaganda".

Note : An interview of Fatih Birol on "European Energy review" :

http://www.europeanenergyreview.eu/site/pagina.php?id=3970

(free account required but sufficient to read)

Extracts :

And a post from Antonio Turiel about the 2012 report :

http://crashoil.blogspot.com/2012/11/espuela-del-weo-2012-la-aie-reconoc...

Which shows below graph :

So that if the report has a very optimistic message regarding the US (and the one on which the press has jumped) the overall global message provided really isn't that optimistic ...

Basically being : conventional oil has peaked in 2006.

To be compared with equivalent 2010 graph :

In the post linked below, I extrapolated six years of declines in what I call the ECI ratio (ratio of total petroleum liquids production to liquids consumption), in order to estimate post-1995 CNE (cumulative net exports) for the Six Country* Case History. At the end of 2001, estimated remaining post-1995 CNE, divided by 2001 annual net exports per year was 5.1 years. The actual ratio turned out to be 2.5 years.

In a similar fashion, I extrapolated the six year 2005 to 2011 rate of decline in the GNE/CNI ratio (ratio of Global Net Exports to Chindia's Net Imports), in order to estimate post-2005 Available CNE (Available Net Exports, or ANE, are GNE less Chindia's Net Imports). At the end of 2011, estimated remaining post-2005 Available CNE, divided by 2011 ANE, was 7 years. ANE is the volume of net exported oil that is available to about 155 net oil importing countries around the world.

More detailed numbers:

http://www.theoildrum.com/node/9622#comment-930369

As noted in my post, these numbers appear to be impossibly pessimistic, but then we have the Six Country Case History.

*Indonesia, UK, Egypt, Vietnam, Argentina, Malaysia, all members of AFPEC (Association of Former Petroleum Exporting Countries).

Didn't read the full report, but it appears that "under the cover of the optimistic shale oil US message", it isn't that optimistic at all, a quite detailed review of the report by Matthieu Auzanneau below (but in French) :

http://petrole.blog.lemonde.fr/2012/11/21/lagence-internationale-de-lene...

Maybe a translation could be done for the oil drum

Remains to be seen how and if this will be relayed in the MSM ...

To play the "Devil's advocate" a bit, about :

One could say : "Ok, so you just add these as needed when the original prediction doesn't work anymore ? And you want us to believe this "theory" ?!"

More seriously, what kind of "confidence" can we have today regarding URR values for shale oil fields under development, and the number of shale oil fields in the US (or elsewhere) that could be developed, for instance what about below :

http://www.businessinsider.com/shale-oil-field-santa-barbara-bigger-than...

?

And how about the current SEC rules regarding booking these reserves?, as I understand these were modified for shale gas, same for shale oil ?

"...the state risks getting left behind as the rest of the world dives into shale..."

They talk as if it has a shelf life. It has been in the ground for a long time, it will keep, it is not going anywhere.

Yes for sure, although considering previous human behaviour, if the thing is found and the way to get it out is available with a profit, it tends to be taken out ...

That is true, I think you have identified the situation. When they can just pull it out of the ground and make a ton of money, make it as fast as you can, get your return paid back quickly....seems a bit mad at times.

Dr. Patzek, I don't have the time at the moment to replicate your analysis but I think your negative opinion of biofuel facilities has a glaring error. Your switchgrass paper assumed a 43% energy efficiency and from there determined an approximate primary energy input to the facility; however, modern designs work much more like paper mills than they do like corn ethanol. Non-fermentables from the biomass are burned for combined heat and power. The enzymatic cellulosic ethanol facilities that you modeled are sized to export steam and electricity. See, e.g., Frontier Renewable Resources at Kinross, MI or POET Project Liberty. They require no external primary energy input as all necessary processing energy comes from the feedstock.

Cellulosic ethanol projects will burn their lignin coproduct, unlike corn ethanol plants whose economics are heavily dependent on the value of their distiller's grains, which require additional energy input to dry.

I don't have expertise in any other areas so I didn't review the other bits of the study in detail, though I didn't find anything else I disagreed with. However this oversight has the potential to reverse your conclusion.

"If switchgrass planted on 140 million hectares (the entire area of active U.S. cropland) were used as feedstock and energy source for ethanol production, the net ethanol yield would replace on average about 20% of today’s gasoline consumption in the U.S." - Patzek

Don't plant switchgrass, don't use fermentation and don't try to replace all refined gasoline. Plant Miscanthus, gasify, synthesize fuel and replace 20%-30% of refined gasoline from 30 million acres. That should be enough to replace middle east imported oil to the U.S.

If we are creating scenarios, you could also plant miscanthus (or giant king grass), burn it in a steam turbine and create electricity for cars and other purposes. I haven't run the numbers and don't know how the volumes compare, but expect it would be similar.

However, unless someone can show me data indicating that these crops can really produce the numbers their proponents claim, I'll be skeptical that this is a more commercially viable pathway than using the same land for food (or that the grasses can produce commercial yields on land not suitable for food).

Miscanthus and other grasses have been around for a long time and I haven't been able to find any reliable trial numbers that would support an optimistic case. I see optimistic tons/HA figures tossed around, but not the supporting trials.

Jack,

Here are some of the links I have.

http://www.freedomgiantmiscanthus.com/miscanthus-licensing-individual.html

http://www.cisionwire.com/quixote-group/r/repreve--renewables--freedomtm...

I think the claims from Cool Planet are ideal conditions and should not be used for production figures. I use 2000 gallons of synthetic gasoline per acre, not their 4000 gallons.

Thanks for this. But I was looking for some data on actual trials.

I have looked at biomass and oil production for a lot of crops and even in some fairly obscure cases there are academic or government studies available. I am surprised that although Miscanthus and Giant King Grass have strong promoters, they have vary little analytical support.

I am in Asia and am really more interested in biomass combustion, so my questions concern tons/ha and heating value. There have been various attempts at projects using one of the grasses here over the last five or more years, but none has taken off. And five years is plenty of time to have developed fairly advanced trial plots and data.

I have to believe that the reason we aren't seeing real trial data is that it isn't good, or wouldn't pass scrutiny.

Ever since CalGuy posted his comments about the wonders of Miscanthus I myself have been looking for the hard data.

I have found a lot of cherry picking of the data from those that are promoters and probably have a vested interests. That having been said what I have found is that the FER (fuel energy ratio) and the NEV (net energy value) for Miscanthus generally seems to be somewhat more favorable than maize and switchgrass, frankly not much to write home about as far as I can tell. It seems that all biofuels must still obey the basic rules of Ecosystem Thermodynamics and as far as I can tell, I'm sorry to report, there still ain't no free lunch.

I have skimmed eight different papers so far from different universities from all over the world. Here is an example of the kind of information I have been looking at. This one in particular shows data that are somewhat favorable towards biofuels in general.

http://www.life.illinois.edu/delucia/Publications/Davis%20LCA%20TiPS.pdf

Though to be frank I have not checked to see where their funding comes from and if consequently they may be somewhat less than willing to take off the rose tinted glasses they may be wearing...

I think I tend to agree with this statement of yours

Cheers,

Fred

There are trials conducted by universities, the DOE and Agriculture Departments. I don't think they would convince you no matter what they said, so why bother?

Good way to avoid providing links to said studies...

If these grasses were really that great then the market would have already jumped on it. Or maybe, like the water powered car, it is being kept away from everyone by government conspiracy...

Honestly, if we are comparing Miscanthus, or any plant out there, to solar PV as Dr. Patzek is the exercise is academic. If I recall correctly the best photosynthetic efficiency is around 3.5% (though some rather bombastic biotech companies are claiming an implausible 7.1%). Of course a PV panel will beat that, even if it needs three times the area for tracking, shading prevention and the like. The comparison to solar PV still does not address the fact that the resources required for biofuel production vs. solar PV are very different, but let's not delude ourselves here: pinning your hopes on algae or miscanthus, in terms of pure conversion efficiency, is a fool's errand.

These algae and grasses are nice curiosities on small scales, the problem is scaling them up to replace fossil fuels. Not gonna happen.

I disagree. Ultimately gasification will do no better - and likely worse - than fermentation in terms of mass yield on carbon and in terms of usable liquid fuels energy production. The rule of thumb for Fischer-Tropsch and most other GTL processes is 50% of your feedstock used to fuel the process; with biomass it's likely higher because additional energy must be expended to drive water off.

Miscanthus also will make a bad feedstock for gasification for reasons other than its energy content. There's very little industry experience designing feeders for gasifiers that use fibrous fuels. Feeders need to form pressure-resistant plugs with the feedstock input in a continuous fashion; fibrous grasses or softwood wastes are particularly ill-suited for these types of application. There have been some high-profile failures of biomass gasification in part due to their lack of suitability for current designs. Range Fuels, besides its other failures ("you mean passing syngas over a methanol catalyst ISN'T going to make ethanol?!?!") had a lot of trouble feeding hog fuel into its screw-plug based gasifiers to achieve economical throughput.

These guys seem to think it will work with thermochemical conversion, but what to they know?

http://www.extension.org/pages/26625/miscanthus-miscanthus-x-giganteus-f...

This article was first linked to in a post by Ulenspiegel, one week ago in Monday's (Nov 12) DB. I quoted it in a post of my own, pointing out that it gave a complete answer to my question

So, some of us read it up to a week ago but, it is still a very good piece and worthy of it's place as a key post for the folks that did not follow Ulenspiegel's link.

Alan from the islands

Patzek,

I cannot comment on your oil figures, but your ethanol and sustainability researched document is full of holes. Your entire argument against corn ethanol is based on a worst case production model. Fair enough when the US insists on producing corn ethanol in the worst possible way, but you fail to examine the production methods when considering sustainability.

US corn ethanol production would if translated to transport be the equivalent of having all vehicles deriving backwards, and aircraft flying sideways. The corn farming community have failed to adapt to new farming practices, specifically non till faming, and the destillers fail to use bio fuel in their production process. The vehicle manufacturers do not produce efficient high compression E100 engines of the type that was being developed by Saab in the 9 litre size for commercial vehicles. With such an engine all farm production and transport would be achieved without fossil fuels.

Your solar energy assessment, apart from being way out of date from a number of perspectives, is as mono dimensional as the rest of your document. Take the fact that present day solar systems can be up to 60% efficient, and future systems will nearer to that level, and rethink your article and you will see that sustainability is not just possible, it is easily achievable and far more cost effective than fossil fuel energy systems. Solar will not replace fossil fuels completley for a very long time, and the use of liquid fuels will continue indefinitely when viewed from the current day perspective.

It is wrong to assume that a renewable sustainable future will be a continuation of the present, exactly as is but with a different energy source. And it is wrong to assume that people would even want that to be the case. But it is also wrong to assume that a sustainable energy future is...less...than the present in terms of opportunities and quality of life.

Citations?

I second that!

It is not hard to find this information, people:

http://extension.umd.edu/publications/pdfs/fs514.pdf

http://www.google.com.au/#hl=en&tbo=d&rlz=1W1TSHN_enAU359&sclient=psy-ab...

One of the many advantages of non till farming is that less of the organic matter is left on the ground and becomes available bio fuel to power the distillation process heat and electricity.

Saab's 9 litre E100 engine engine project became a casualty of their financial collapse, but the concept is rock solid. Egines specifically designed for ethanol's high octane rating perform far more efficiently than flex fuel engines.

Solar energy posters below point in the right direction on overall solar efficiency. There is a lot of technology to emerge in the near future in this area.

As I say Patzek's research in this direction is way out of date and totally missleading.

You also need to take in the dramatic developments in the electric powered aviation, the best compendium of which is at the Cafe Foundation Blog.

The principle valid criticism of transition to renewable technologies is the achieveable pace of change. We are talking about a 50 year time frame here. And the other variable is energy availability. Is there enough oil left to perform the transition, the rebuilding of so much infrastructure? That is the relevency of Patzek's article here.

It doesn't matter how efficient Saab's engine is, or the conversion efficiency of biomass into ethanol, there isn't enough productive land available to power even a partial conversion to biofuels.

Null Hypothysis,

It is not about the efficiency of the engine, it is about that all of the production machinery can operate on the renewable end product fuel, eliminating the use of Fossil fuels in the farm production and the fuel distillation processes.

On your other point, clearly you are a Business as Usual person who will be the last to give up their gass guzzling HumVee super SUV's.

The most probable future for personal transport 60 years out is 70% personal vehicles being electric fuel from rooftop solar systems, 25% ultra efficient (100 klms/ltre) bio diesel cars and 5% remnant vehicles from the naughties.

You don't believe this? Here is one reason to take this seriously

http://www.oemoffhighway.com/news/10826092/new-highway-projects-providin...

Indian current projects, 50,000 klms new highways to criss cross their 3.28 square kilometer country. Now, they are not planning this new infrastructure for bicycles. It is because this company

http://www.tatamotors.com/

...has plans bigger than Ford. That means they want their share of the global depleting oil resource. Their cars might be smaller and more efficient that Chrysler, Pontiac, or Ford, but there will be 5 times as many of them.

And that is before we look to see what China is doing. In that country one cannot buy a car before they acquire the number plate for it. These are sold by the government. I am told that for Shanghai alone there is a waiting list for plates one million applicants long.

Advice for the future (20 years out), if you are insisting on hanging on to your ICE SUV, make sure that it is a diesel so that you can stockpile the fuel, and get a spare bike rack fitted in place of the spare tyre holder. You will be far more likely to run out of fuel that get a flat tyre.

Your post contains claims which appear to be seriously over the top. For example, engines optimized for ethanol with high compression ratios would likely not achieve the efficiency of a diesel because diesels run much higher compression ratios. Of course, you may be referring to a turbo diesel engine running ethanol, but that should be compared to other turbo diesel designs, not gasoline engines. There's no solar technology which I am aware of which approaches 60% conversion efficiency at the first level and all solar systems suffer from the intermittent nature of the source, which requires storage to meet demand 24/7. Any type of storage system has conversion losses, which must be compounded with the efficiency of the basic solar system.

I agree with the other posts, where's the beef???

E. Swanson

I made and have a solar hot water panel that heats 1 gallon of water 50 C (60 F to 150 F) in 30 minutes on a hot day in June and in a collecting area of 21 x 45 inches. At 1000 W/m2 for sunlight, the efficiency is 71%. Vacuum sealed solar hot water panels are supposed to have an even higher efficiency. I have no storage system for the hot water, so demand only occurs during the day.

Evacuated tube solar thermal collectors can run well above 50% efficient, even at higher temperatures. Learn how to combine multiple junction PV with that and you can cover a lot of the spectrum.

BilBb - I think I understand the point you're trying to make but it seems you also present a good argument why it's not a reasonable expectation: "The corn farming community have failed to adapt to new farming practices...the distillers fail to use bio fuel in their production process. The vehicle manufacturers do not produce efficient high compression E100 engines...". Maybe I'm misreading you but you seem to be arguing against your position from the standpoint of sustainability: if none have these changes have been made during a several year period when oil has ranged from $90 to $140 per bbl then when will this transition be made? No process can be sustainable until it's put into play. And maybe not even then but it still has to start sometime. OTOH maybe in the next 10 years or so those problems you highlight may be start being addressed. Only time will tell.

Your idea may look great on paper. I've seen many well thought out plans presented on TOD over the years. But often with the same problem: no reasonable expectation that such a plan will be enacted any time soon. But I like it when such thoughts are presented if for no other reason but to confirm our societal pig headed approach to maintaining BAU by following the same course of actions that got us into this mess.

Good point, I go on the probability of it happening versus the good done. Some may want wireless electric highways with EVs, but that is not likely soon.

What may be more likely is increased oil demand from India and China, a limited supply with bidding wars. If that starts to happen, but the alternatives are a decade away, then we should start developing alternatives now.

I heard recently that 37,000 square miles goes out of agricultural production due to soil depletion. Another source quotes 46,000 sq. mi. lost to desertification. Land in so-called developing countries is in the worst shape. Another source claims a year of corn production removes about 2,000 years of soil accumulation. Does anyone take into account the energy equivalent of soil restoration needed to keep corn production sustainable? Granted, the total land area devoted to agriculture seems to be increasing year to year, but what is the effect several years hence when that soil is worn out? And how much of the new land coming into production is a critical habitat? Has industrial monocultural commodity agriculture shown any success in reclaiming comparable acreage that has gone out of production due to fertility loss, salinization, erosion by water or wind? Or is the assumption that there will always be enough agri-chemicals to take up the slack. There's a lot of soil out there that's little more than a sponge for hydrocarbon sourced soil amendments. And while we're at it, phosphate rock production is in decline. Is it just me or is attempting to use biomass for transport fuel seem to be in the long run an exercise in futility?

And don't forget that some of the biofuel "production" is a one-time mining fossil aquifers (especially the Ogalala aquifer under the US great plains).

If drought becomes the norm in a large part of the US, I think the issue of large scale water diversions from Canada (ie. the NAWAPA proposal) will be back on the table. The idea of supplying water to the US is hugely unpopular in Canada and would entail large environmental costs. However it would be very hard to deny a close neighbour access to water if they really need it. We are also dependent on the US to supply us with fresh vegetables and fruit for much of the year (though those huge factory farmed California strawberries really suck compared to our locally grown strawberries).

I'm familiar with your corn ethanol and soybean biodiesel analysis, have you done similar analyses for Sugarcane ethanol and biodiesel, specifically using the Brazilian process?

Maximum Possible Global CO2 Emissions According to IEA's Updated Estimation of Fossil Fuel Reserves and Resources http://j.mp/MAX_FF_CO2_Emissions

We're already set for catastrophic climate change now! And our main topic of discussion is how to extract and burn more fuels. We truly don't care about our children, we care about us now.

Aug-people are over a barrel - not as much choice a there appears (though there most certainly is choice). The surest way to make a difference insofar as reducing collective impact upon what we rely upon for our long term sustenance is to sharply reduce individual consumption - but much consumption is forced upon the individual on so many different ways. Corporate income relies upon increasing consumption, as does government taxation income.It is extremely hard to extricate yourself from our wasteful culture.

I have reduced my consumption to a very large degree, yet I must take part in our economy of waste, if I don't, my house and property is lost to taxes because there will be no personal income. The town and county that get the taxes - well, waste a lot. Much of the town's waste is forced by state law - etc. etc.

re human nature,bowerbirds and peacock feathers:

Have you noticed how many people want to conserve resources by spending? Buying the latest green technology? Which generally doesn't work to conserve - because the truest conservation is a form of voluntary poverty - a very rare thing in biology.

We do care about our children. I think perhaps that is why it is so important for our culture to lie to ourselves. Otherwise anyone my age or older could talk freely about climate change and laugh about the consequences.

True, we lie to ourselves (Climate change is a hoax, I'm helping by buying this "Green" thing, etc.) so we don't have to face up to what we're doing to our children.

You aren't kidding about it being difficult to extricate ones self from the culture of waste. Extremely frustrating when you're forced to do something that is so against ones beliefs. I've been "frugal" all my life so have no debts. Like you, I've cut my consumption hugely, what helps is that I know how to repair most anything electrical, electronic or mechanical so I pick up lots of cast-offs and repair them. No TV here, no Smartphone, 10 year-old laptop... Trade repaired stuff for other things I want/need.

I did buy new off-grid PV stuff, but even there I do all the installation myself.

BTW, many my age (56) and older do talk freely about climate change and laugh. "It's too cold, warmer will be better." and so on. Usually comes from a position of ignorance like during this last election.

Does anyone know the rough sell price required (in $/kwh) to keep a nuke-coal-gas electrical plant profitable? I know - lots of variables assumed in this question, especially capital payback, variable cost of fuel, etc.. Anyone know of any studies here? Rough numbers? Tks.

Variables.. particularly just which externalities one is willing to include in the costs.

One of McKibben's main points on his current tour about the FF and Energy Industries that needs a solid pushback is the fact that there is barely any demand that they be held accountable for the masses of waste they throw into the air and water. SOME efforts have made gains for creating scrubbers and cleanup funds.. but compared to the responsibilities of most businesses and citizens for taking care of their wastes.. the uncollected costs of this make few if any of these producers profitable.

Good point - external costs (CO2). I just found this article http://grist.org/solar-power/2011-10-11-solar-pv-rapidly-becoming-cheape...

Without external costs, the author writes, "levelized cost per kWh for natural gas-fired power plants to be $0.076 to $0.092, and for coal, $0.086, both without carbon capture and storage. And in 2009, MIT issued its Update on the Cost of Nuclear Power [PDF], in which they found levelized cost per kWh for nuclear’s competitors of $0.062 (coal) and $0.065 (natural gas), without any charge for CO2 emissions."

IF (and that's big IF) we can stay on the 30-year PV efficiency/cost curve, by 2020 sunny-spot PV will be less expensive than coal-ng-nuke, and by 2040, average global PV will generate electricity for 1/3 the cost of fossil-nuke plants. If PVs eff/cost curve slows down by 50% (unlikely, but certain to satisfy the most die-hard anti-cornucopian), 2040 PV will generate electricity at 1/2 the cost of fossils.

And if more countries start realizing (and monetizing) the external costs of fossil generation, PV will become even more attractive, and far sooner.

but compared to the responsibilities of most businesses and citizens for taking care of their wastes

Putting it like that washes the hands of the 'most', who, bottom line, want energy cheap now--that shows up in virtually all our most basic shopping habits. And precious few of the holier than thous around the edges really want to see the multiplied at every transaction cost increases that occur if the 'most' quit suddenly shopping for cheap energy now and started including the future costs in their calculations. Future discounting is very real and gets much more apparent as it gets harder to 'fill the belly'. All that doesn't make me particularly optimistic about the world kicking the coal habit anytime soon.