LNG To The Rescue?

Posted by Dave Cohen on November 27, 2006 - 6:27pm

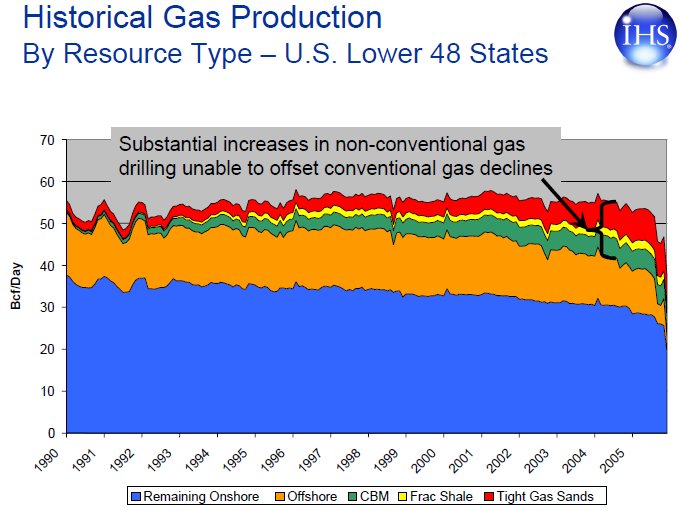

Declining U.S. Lower 48 Natural Gas Production

Source: North American Oil & Gas Plays Focus on the Non-Conventional (pdf) from IHS Energy

The decline in output is 2.2 trillion cubic feet (TcF)

off the 2002 baseline

Figure 1 — Click to Enlarge

This story will discuss the emergence of a globalized LNG market and the ability of that market to supply the high volumes of LNG that the United State will need to avoid future shortfalls. Will such a globalized market really come to pass? What form will it take? What does the current LNG market look like? How will the United States become integrated into the expanding LNG trade? These are the questions we shall examine here.

1. The LNG Market — This Moment in History

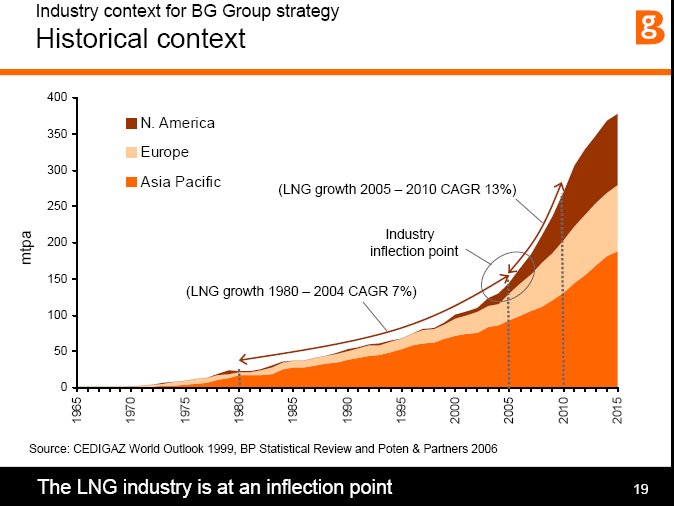

In the grand scheme of things, the idea is that the globalized LNG market of the future will make natural gas a fungible commodity worldwide. Newbuild LNG requires huge capital expenditures for liquefaction trains, tankers and regasification terminals. Heretofore, transporting natural gas has been mostly constrained by the existence of pipelines, excepting the robust LNG trade in Eastern Asia. LNG is now at at inflection point, as shown in Figure 2

An Inflection Point for the global LNG Market

A 13% compound annual growth rate (2005 to 2010)

From a presentation by the BG Group (pdf)

Figure 2 — Click to Enlarge

As you can see, the global LNG trade is projected to expand about 150% by 2015 with a large share of new exports going to the United States.

2. The LNG Market — Past and Present

LNG trading is regional because it takes place in two large separate markets, the Atlantic Basin—west of Suez— and the Pacific Basin—east of Suez. As Figure 3 from the EIA's World LNG Market Structure shows, prices & volumes have been historically higher in the Pacific Basin.

Sample prices in the Atlantic and Pacific Basins

LNG prices are usually expressed in U.S. dollars per million

Btu (MMBtu) ≅ 1,000 cubic feet of natural gas (Mcf)

Figure 3 — Click to Enlarge

Because the Asian countries have little access to natural gas pipelines and have little or no domestic production, LNG imports have provided the bulk of their natural gas supply.

Three countries in the Pacific Basin - Japan, South Korea, and Taiwan - accounted for 68 percent of global LNG imports in 2002. Seven European countries received 28 percent of global imports, while the United States imported the remaining 4 percent.Demand for LNG and prices fluctuate seasonally, particularly in the Atlantic Basin (Spain, the U.K., the U.S.) but also in some Pacific nations like Korea. As the EIA notes, past EU prices have been linked to competing fuel prices, such as low-sulfur residual fuel oil. In Asia, prices have been traditionally linked to the price of crude oil. In the United States, the EIA states that:Japan has long been the world's largest LNG consumer, importing 2.6 Tcf (54.6 million tons) of LNG in 2002. However, the Japanese share of the global LNG trade fell from 66 percent in 1990 to 48 percent in 2002.

In the United States, the competing fuel is pipeline natural gas, and the benchmark price is either a specified market in long-term contracts or the Henry Hub price for short-term sales. Importers and exporters involved in U.S. LNG transactions are exposed to a significant level of risk given the high degree of price volatility in U.S. natural gas markets.Here's an example of many of these factors at work, published on October 23rd of this year.

Shipments of liquefied natural gas (LNG) to Europe are running close to record levels as the continent prepares to meet peak demand in the cold winter months.Obviously, there are price disparities in the LNG Atlantic Basin market and no global benchmark price exists.Import terminals in Spain, Belgium, Britain and elsewhere are operating at full capacity to take in cargoes attracted by European prices that remain higher than those offered in the US market, though not above levels in Asia.

"All the terminals are full," an LNG trading manager at a major energy company said. "European prices have been high since the summer, they are still very high. I think imports this year will probably be higher than last year."

"There are some spot cargos coming in, but it's getting very difficult to find a place to put them (because of the squeeze on import capacity)," he said.

Another industry source said cargos had recently been diverted away from Spain, Europe's largest importer of LNG, because of a lack of available storage space.

LNG trading has always been dominated by long term contracts and low liquidity. Despite the rare story about an LNG tanker bound for the U.S. which is diverted to Spain, the spot market is miniscule. However, there is great flux in both contracts and pricing. Despite many new players—both importers such as India (Dahej regasification terminal) and exporters such as Egypt (Idku liquefaction plant)—entering the market, new contracts, while more flexible than in the past, are still mostly long term deals, though there are now some shorter term (1 year) contracts. BG Group's LNG Top to Bottom -The Pure Play Perspective presentation indicates that approximately 12% of the 2005 LNG trade consisted of short term & spot contracts —predominantly the former.

Although one would think that many new players in the LNG market would put downward pressure on price, demand is high and supply is tight—it is a sellers market. For example, China just inked a 25 year, $25 billion deal with Petronas (Malaysia) for LNG delivery to start in 2009. The Australian recently reported on the situation.

Malaysia's government-owned Petronas has signed a contract to supply Shanghai with liquefied natural gas for 25 years, at the rate of $US 6.34 ($8.25) per million British thermal units [mmbtu].It is noteworthy that, unlike in the past, these Asian contract prices are not tied to the crude oil price. BG Group (Egyptian LNG) expects the market tightness to hold until at least 2012, as shown in Figure 4.This is below today's market price but still more than double the $US 3.10 the Australia LNG consortium is receiving through its 25-year contract to supply Dapeng terminal in Guangdong, which started in June.

The only other LNG contract signed by China - all are through the state-owned China National Offshore Oil Corp - is with BP's Tangguh project in Indonesia's Papua province, to supply the southern province of Fujian from early 2009.

The price originally agreed for Tangguh's LNG was even lower than that from Australia's North West Shelf: $US 2.49/million btu.

LNG Supply & Demand

Figure 4 -- Click to Enlarge

Supply tightness in the Pacific Basin has been aggravated by declining production in Indonesia—the world's largest LNG supplier— and, in the Atlantic Basin, delays in bringing Norway's Snohvit LNG liquefaction capability onstream.

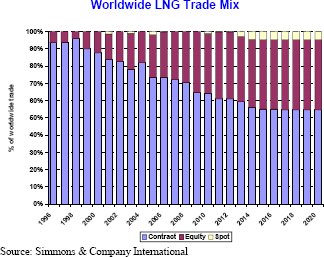

According to the Simmons & Company report Liquified Natural Gas published in April of 2005, spot sales will continue to be negligible, but there will be a growing equity trade as shown in Figure 5.

The LNG Trade Mix — Projected Long-term

Contracts, Equity Positions and Spot Market

Figure 5 — Click to Enlarge

Growth in worldwide LNG portfolios and deregulation in European and U.S. LNG import markets have enabled the recent emergence of a revised, "integrated" LNG strategy. Whereas Japanese LNG markets continue to operate under take-or-pay contracts with regulated utilities as buyers, the U.S. and European markets appear to be evolving on the basis of tolling-style arrangements whereby suppliers of LNG can obtain access to the deregulated natural gas end market by paying an operating fee to the regasification terminal owners and still maintain rights to the gas at the other side of the terminal... As an alternative to the tolling arrangement structure, some large integrated players are taking equity ownership interests in new [regasification] terminals. This has became a more viable option in the U.S. following the FERC's Hackberry decision, which set a precedent for closed-access terminal structures, which, unlike rules for pipelines, allow terminal operators to restrict access to imports through their facilities.Note: Prior to the FERC's Hackberry decision, open access to U.S. LNG regasification terminals was required. As the Simmons report notes, "... rather than being forced to operate on a spot basis in the delivery of LNG volumes to the U.S., and therefore subject to competition-driven price risk, LNG traders can lock-in contractual rights to deliver to a specific terminal or build their own dedicated facility."

Integrated players like Shell increasingly seek and establish equity trade arrangements.

Royal Dutch Shell plc has announced two major additions to its global Liquefied Natural Gas (LNG) portfolio. In Qatar, the company has joined forces with Qatar Petroleum (QP) in the development of the large scale Qatargas 4 LNG project, while in the United States Shell has agreed to acquire additional capacity at the Elba Island LNG import terminal in Georgia.Because of the huge capital expenditures for newbuild LNG, long term contracts (like the China Petronas/Malaysia deal) or integrated equity arrangements will continue to dominate the LNG market. As Dave Hughes (Canadian Geological Survey) said to the author in personal communication, "Simmons is right on the issue of a spot market for LNG for the near future - nobody spends $12 billion on a liquefaction, transport and regasification chain without long term contracts."

Platts summarizes the current LNG market in an article with the misleading title LNG trade helps foster a global gas market.

Liquefied natural gas is one way of removing price differentials between gas markets but, there are still big regional differences. A lack of liquidity makes trading the preserve of the asset owners. This was one of the conclusions drawn at the CWC World LNG Summit in Rome mid October.The Platts conference report, which is worth reading, reveals just what an unstructured, chaotic mess the LNG markets are at this time. Right now, integrated equity players with access to large, dependable upstream natural gas supplies and midstream (liquefaction, tankers) or downstream (regasification) assets have the advantage. Independent "pure" traders looking for arbitrage opportunities, as they exist in the oil markets, are at a disadvantage. So, as the anonymous trader said, the world [is] still a long way away from a fungible LNG market. Let us now turn to the future.So far, the companies making the most noise about LNG trade have been those with the upstream reserves and access to cargoes.

Pure trading outfits on the other hand are kept out by the lack of commodity and capacity at different stages of the supply chain.

This suggests a degree of immaturity where the incumbents control enough to keep out new entrants. One trader told delegates that what he was primarily concerned with was not prices but volume and churn, and he did not see either of those in the LNG cargo market.

"Traders won't touch LNG, it's a waste of time." Another agreed that the world was still a long way away from a fungible LNG market.

"The bid-ask spread in the Atlantic is too wide to guarantee any return unless you have a unique advantage," he said.

The prices agreed in these cases would not be likely repeatable, and so they would be of little value in establishing a benchmark.

3. The LNG Market — The Future

The standard story about the future LNG trade is that it will evolve toward the kind of markets that exist for crude oil and other commodities today, with global benchmark prices similar to those set at the Nymex and Brent indices. Furthermore, this global price smoothing must develop as theory dictates because of the large number of new players coming into the LNG market, especially from the MENA (Middle East & North Africa) nations, as shown in Figure 6.

The Evolving LNG Trade — the Atlantic & Pacific

Basins with the Middle East in the Middle

Figure 6 — Click to Enlarge

The Petroleum Economist gives us the standard view (flash website).

The world's dependence on MENA natural gas is set to increase "because that's where the gas is" [quoting Willie Sutton]. But the MENA nations also benefit from their location —midway between the large gas markets of Asia-Pacific to the east, and North America and Europe to the west.Once consequence of this is that distances to markets are generally large, making liquefied natural gas (LNG) an increasingly competitive option when compared with pipeline supply. In some cases — such as Qatari exports to the US — it is the only feasible option...

A second consequence is that the increasing contractual flexibility of LNG — not just in the still-small spot market, but also in long-term contracts — means MENA LNG will play an increasing role in the globalization of what are presently regional gas markets. LNG tankers leaving Qatar, for example, could choose at short notice to go west rather than east, or vice versa.

As the International Energy Agency (IE) stresses in a recent review of the world's natural gas markets: "Middle East LNG, in particular, will link Atlantic and Pacific markets, transmitting price signals between them ... Increasingly, LNG will end up in places that provide the highest netback." The result will be that gas prices in Tokyo and Seoul will increasingly be influenced by what is happening at [the] Henry Hub in the US.

It seems impossible to reconcile this view with that of Simmons and the nature of the LNG trade as described just above. Consider Simmons' three large barriers to access in the LNG market — quoted from page 4 of their report.

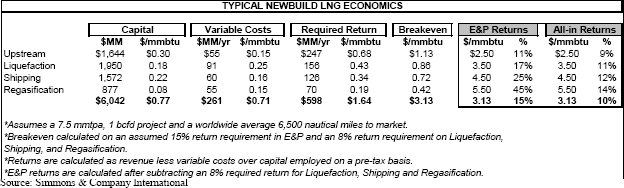

- Barrier 1: Access to reserves. We estimate that, in order for an LNG facility to return its full capital investment under target conditions, a source gas field, or fields, holding at least 10 Tcf of reserves is typically required.

- Barrier 2: A big balance sheet. A typical 7.5 mmtpa [million tons per annum] LNG project requires approximately $6 billion of capital

investments, including $1.6 billion in upstream capex, $2 billion for a liquefaction facility, $1.6 billion worth of ships and a $0.8 billion regasification facility (unless another option for a secure long-term market can be found).

- Barrier 3: Destination for the gas. The high degree of capital investment required for the LNG business makes a secure market for the product a strategic imperative. Historically, this has occurred through direct take-or-pay contracts with end-market consumers (the prime example being the Japanese utilities). Going forward, we expect that the end market will increasingly come in the form of equity sales into deregulated markets in North America and Europe, whether through tolling arrangements or in some cases through outright ownership of regasification terminals.

In light of these barriers, the strong trend toward long-term or equity LNG contracts (as shown in Figure 5 above) now makes sense. An integrated equity arrangement is not flexible ie. tending toward spot sales — the whole idea is to control as much of the entire supply chain (upstream gas field to downstream regasification terminal) as possible in order to create a secure, long-term source and sales destination for the natural gas. Without a substantial spot or short-term sales market, it is hard to see how a truly fungible market can ever be achieved. The standard view — expressed by LNG tankers leaving Qatar, for example, could choose at short notice to go west rather than east, or vice versa — flys in the face of reality. Furthermore, in a tight LNG market, importers will also want to lock-in the best price they can get by guaranteeing a long-term buyer commitment, as demonstrated by the deal between China and Petronas (Malaysia).

There are two markets for LNG —the Atlantic and Pacific basins — and, most likely, there always will be. Moreover, Qatari LNG is a long way from almost anywhere. We can refer to this as the LNG price distance premium, which will be discussed in the section below regarding the United States. It is 6,480 nautical miles from Qatar to Japan. To Portugal, it is 3,307 miles. To the US Gulf Coast, it is 9,687 miles. India is the clear winner — it is only 1,290 miles away. (Average distances from Simmons.) How can there be a benchmark LNG price, even in the Atlantic Basin, if the U.S. Gulf Coast is 6,380 miles farther away from Qatar than Portugal is?

In conclusion, the LNG market would seem to be sui generis, unlike any other — the standard view is a simplistic analogy. Newbuild capital expenditures are huge since they involve three separate, expensive components — liquefaction, shipping and regasification as shown in Figure 7 below.

LNG Newbuild Economics — from Simmons

Figure 7 — Click to Enlarge

MENA LNG will be sold under long-term contracts or equity arrangements in both the Atlantic & Pacific markets. The spot market for this new gas will remain small. The LNG trade will never be fungible in the same way crude oil is. Let us now turn to the prospects for the United States in the world we have just described.

Integrating LNG Exports into the U.S. Market

If we build it, will they come? —paraphrase of a famous quote from a baseball movie.

Let's review the problem facing the United States as North American natural gas production declines continue going forward. Figure 8 is from Dave Hughes' presentation from ASPO-USA.

The LNG Logistics Problem — from Hughes

Figure 8 — Click to Enlarge

Hughes estimates that the North America faces natural gas shortfalls of between 4 and 11 trillion cubic feet (tcf) per year in the future. As argued in the preceding sections, that new supply will not come from a large LNG spot market. Rather, the both the U.S. must have long-term contracts or equity deals in place with foreign suppliers like Qatar.

April, 2006Some of the Qatargas 3 LNG will be shipped to the new regasification terminal at Freeport, Texas, as we learn here.Marking the beginning of the execution phase for two of the world's largest liquefied natural gas (LNG) developments, Qatar Petroleum (QP), ConocoPhillips and Royal Dutch Shell plc (Shell) bore witness today as H.H. Sheikh Tamim Bin Hamad Al-Thani, Heir Apparent of the State of Qatar laid the foundation stone for the Qatargas 3 and Qatargas 4 projects.Combined, the projects are expected to generate approximately 2.8 billion cubic feet per day of natural gas, the majority of which is targeted for delivery to the United States....

Qatargas 4 volumes are intended to flow into natural gas markets in the eastern U.S. For this purpose, Shell, as a sponsor of Qatargas 4, has entered into agreements with Southern LNG Inc. and Elba Express Pipeline Company LLC to acquire additional capacity at the Elba Island LNG import terminal as well as in a new natural gas pipeline. Both projects will be filed with the U.S. Federal Energy Regulatory Commission (FERC) for approval in the third quarter of 2006.

In December, Qatargas 3 executed a sales and purchase agreement with ConocoPhillips for the full train output which will be marketed primarily in the U.S. ConocoPhillips is one of the leading marketers of natural gas in the U.S. and following its acquisition of Burlington Resources, it will become the largest natural gas producer in North America.

ConocoPhillips has taken a 30% interest in Cheniere Energy's proposed Freeport LNG project on the Texas Gulf Coast. Freeport, with a lbn cf/d receiving terminal, is scheduled to start operations in 2007. ConocoPhillips will pay plant construcbon costs of up to $450m and plans to use LNG shipments from Qatar, Nigeria and Venezuela, where it has stakes in LNG projects or gas fields.Other agreements are in place. ExxonMobil and Qatar Petroleum Progress LNG Project indicates that LNG from Qatar's RasGas liquefaction trains 6 & 7 will be "delivered to the target markets, principally the United States" to the Golden Pass receiving terminal in Sabine, Texas. The terminal is "expected to be 70 percent owned by an affiliate of Qatar Petroleum, with affiliates of ExxonMobil and ConocoPhillips each owning a share in the balance of the interest in the terminal". Thus, some equity arrangements are already in place for LNG exports to the United States. Read the Company Exposure to LNG part of the Simmons report for more details.

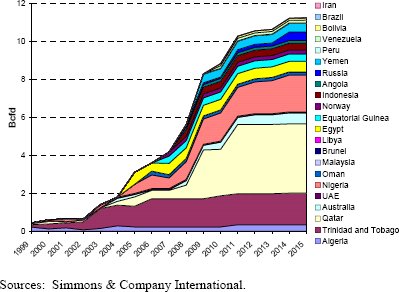

As implied by Figure 7, the problem is simply this: Is sufficient LNG going to be imported soon enough to meet U.S. demand in the face of continuing domestic natural gas production declines? The Simmons LNG report (cited link repeated) predicts that the U.S. will be importing 11 bcfd (billion cubic feet/day) by 2015 from the sources shown in Figure 9.

U.S. LNG Imports by Source (Bcfd)

Figure 9 — Click to Enlarge

If all goes well —this is a big if — the U.S. will manage to import 4.015 trillion cubic feet of additional gas supply from LNG by 2015—right at the low end of Hughes' range. As Figure 9 indicates, all the supply comes from the Atlantic Basin or the Middle East with the exception of Australia. It is unclear if the Russian exports will come from Sakhalin II (Pacific Basin) or whether the Simmons report is dated, written before the Russian decision to send Shtokman gas from the Barents Sea by pipeline to the EU rather make it available for LNG exports to Europe and the United States. By far, the largest export shares are from Qatar and Nigeria —excluding on-going exports from Trinidad & Tobago. For all this to work, all the requisite liquefaction trains must be operating in the exporting countries in the envisioned time frame and long-term or equity contracts must be in place.

The Hughes slide (Figure 8) points out the huge build-out necessary to support exports of 11 Tcf to the North America, as well as the NIMBY problem with location of new regasification terminals. A look at Hughes' slide #21 (link above) reveals that there is ample new capacity coming on-stream to support imports of 15 bcf into the U.S. by 2015. However, almost all of the new receiving terminals are on the Gulf of Mexico coastline. The NIMBY issues have prevented approval of new terminals on both the East & West coasts. The Northeast will be partly served by new Canadian receiving terminals such as Bear Head in Nova Scotia. The great concentration of regasification facilities in the Gulf coast area will require a large build-out of new gas storage in this region as well as alter the U.S. gas distribution network.

A number of other issues (eg. natural gas energy content and processing) are covered in the Developing U.S. Market section of the Simmons report. One final issue to look at is the distance premium as we have termed it in the previous section. Obviously, North America is a long way from where the gas is, while Europe is closer. Consider Figure 10 below from Simmons, where you can see that LNG transport is a significant factor in deliveries to the United States.

Figure 10

The Simmons report calculates that the total LNG shipping cost per nautical mile/mmbtu (cents) is 0.0133 for tankers holding 138,000 cubic metres of gas and 0.0111 for larger tankers holding 216,000 cubic metres. Recently, there was an inaugural voyage of Qatari gas to Mexico.

Ras Laffan Liquefied Natural Gas Company (RasGas) made its first delivery of liquefied natural gas (LNG) from the shores of Qatar to Mexico on October 8, a press release issued by RasGas said. This historical event followed a spot sale to Shell Western LNG B V by Ras Laffan Liquefied Natural Gas Company (II)...A simple, rough calculation shows that the journey added approximately $1.32/mmbtu to the cost of the gas. As previously noted, distance is yet another factor that will discourage a world gas price or perhaps even an Atlantic Basin benchmark price.The voyage of 22 days over a distance of 9,915 nautical miles was routed through the Suez Canal and the Straits of Gibraltar to the Terminal de LNG de Altamira, Mexico. Terminal de LNG de Altamira is the first LNG receiving terminal in Mexico and came into operation only in August of this year...

The vessel was built in the Samsung Heavy Industries, Korea, and has a cargo capacity of 138,000 [cubic metres]

Conclusion

The more one delves into the future LNG trade, the more complicated the situation looks. A lot of factors must come together to make much larger globalized markets a reality. Pertinent LNG issues will be addressed at the 7th Annual LNG Summit: Trials and Tribulations of Integrating LNG in the U.S. Market to be held January 18th & 19th in Houston. Reading the presentation abstracts gives you a sense of what the LNG industry is worried about.This report is meant to give some insights into what will happen and needs to happen for the LNG trade to meet expectations, not only in the United States, where domestic production is in exponential decline, but all over the world.

These posts are a lot of work, and the authors appreciate your helping them get more readers for their work however you can.

Terrific keypost,Dave!

C'mon TODers--rattle the Tipjars please!

Repost of my Reddit comment:

-----------------------------------

This is a critical report that is very well written and quite detailed in pointing out the impending natgas crunch in North America [NA]. The super-far LNG transport distance from the MidEast to NA has a built-in cost disadvantage that will economically hammer NA consumers.

IMO, NA needs to start a maximum effort at super-insulation of homes, solar water-heaters, and other conservation measures so that we can still afford to buy LNG to make petro-fertilizers. Otherwise, not only will we be sitting in the dark freezing our asses off, but we will be starving too. It is far past time for a NA call to 'all hands on deck' for massive change. Please read & study, then forward to other family members, friends, and community leaders.

---------------------------

Have any engineers studied the possibile viability of a gasline jumping the Atlantic from Liberia, Africa to Brazil?

This is the shortest distance across 'the pond', and mostly below the primary hurricane routes. It seems that such massive LNG boiloff over the tremendous ME to NA transport distance combined with the required future huge #'s of LNG tankers and regasification plants could be economically offset by a pipeline.

The pipeline could be submerged [to escape the surface weather & waves], but supported by buoys and floating pumping stations [similar to the giant FSPOs at offshore oilfields]. Computer sensors on the buoys could reel out or reel in cable to prevent the buildup of 'whiplash' effects in the pipeline. The US Navy should have no problems protecting the pipeline trans-ocean corridor from attacks.

IMO, seems like the enormous costs involved for this pipeline would more than offset the costs of liquifaction of natgas, then the LNG tanker costs and boiloff loss, plus the final regasification stage. This is where a very accurate ERoEI and net energy analysis of the two methods [ships vs pipeline] could be absolutely critical-- but the potential savings would be huge over time.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Political (see the # of national boundaries crossed)

Terrorism/Military - Several people do not like the US. Hard to think of an easier target (Iraq has a hard time keeping the pipeline to Turkey open).

Pipelines can be very efficient movers, but they still take energy. The embedded energy in the pipeline is large as well.

I think the EU will pay a small premium for diversity of supply (not TOO much Russian gas) and Japan is looking for replacements for Indonesian gas. Add a bit for China & Korea and I see minimal amounts coming to the US.

Outside T&T, our friends in Venezula, West Coast of SA (see earlier), the best US prospect for new LNG is that island of stability, Nigeria. Shipping distances are not that much further to US Gulf ports than Spain/UK and the US Gulf seems to be where most new US LNG ports will actually be built.

Russian LNG to Eastern Canada with some going south also seems like a "good deal". So far, new East US LNG ports seem few & far between. AFAIK, Canada already has one contract for Russian LNG.

The US will, IMVHO, just become the highest cost NG in the world. Supply & demand.

Best Hopes,

Alan

And the US $ may be weaker soon as well. The recieving terminal is the lowest cost part of the supply chain, so alternative destinations besides the US (say Japan) are entirely possible.

One bright spot, LNG will provide a price floor for wind turbine generated electricity in the US.

Alan

Thxs for your thoughtful reply, as usual. True, this pipeline would cross many [currently hostile] borders, but it could also offer a path for the

US to make many friends.Admittedly, a BIG IF.These countries cannot afford a pipeline on their own, but if we built this across their geographies and pre-agreed to share some percentage of the gas with them--it could really help their societies. If my

webrider ideahas any merit: it could also form the backbone of an above-ground transport system across Africa, then across South America [SA], then up the Central America spine to join the proposed SuperNafta Corridor and Hirsch's fifteen favored detritovore states.True--I am thinking more

wild & crazy ideas, but if this is possible, then these people would have a very strong incentive to protect the pipeline vs blowing it up. As we all know at the present time: it is very cheap and easy to attack a slow-moving tanker.Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

! produced = extracted from the guts of the earth.

From what I remember some of the bigger players had shut in some wells - at least that is what was reported.

Last weeks report was 3.450 Tcf. I heard max was ~3.5 Tcf.

Alan

--Jim Kunstler

USA can count on T&T and possibly Nigeria and would also be able to take a lot from Venezuela if they could heal the rift with Chavez, not to mention Russia (Shtokman et al) if they could learn to stop telling Putin how to run his country. Putin and Russia hold many many more cards in the energy supply game than the USA, and the US would do well to buddy up with them rather than trying to dictate how they should behave.

For Qatar (and Iran [South Pars]) Europe will would have to compete at the margin with Asian buyers.

Gazprom does not want low prices, but could afford them. LNG projects need higher prices to work out.

No way LNG tankers can outcompete Russian gas pipelines to Europe. Even LNG tankers from North Africa to Southern Europe will cost more than Russian gas costs. Russia will lose market shares due to greed or political factors.

In this respect, it is not difficult to be suspicious of recent bilateral conversations between Algeria and Russia, given that Algeria is one of the strong candidates to be the marginal LNG supplier for Europe. IE the Algerians set the price (knowing that Russia will not compete for this marginal sector of the market) and Russia benefits from the (high) price set.....

Algeria knows that Russia can flood the European market with NG and crush prices and therefore will not try to compete on volume supply in Europe.....

So US bound gas from the west coast of South America is likely to be small to zero.

Do NOT underestimate LNG shipping costs. Not only are the tankers several times more expensive, the insulation varies with destination due to boil-off.

At the beginning of the journey, NG that boils off is feed into the ship engines. A bit more expensive than bunker fuel, but no big deal. Soon, 100% NG to run the ship and then the rest is flared off.

A "less insulated" LNG tanker (less insulation > more LNG capacity for a given sphere holding tank) suitable for Algeria-Spain trade does not work well for Qatar-US trade.

Other than T&T, Venezula and perhaps West Coast of SA, the US is further away from all LNG sources than other major buyers. Shipping costs are not just tanker day rates but also loss of cargo.

Qatar-US LNG shipments will require super insulated tankers (high $$$ per BTU delivered) and still arrive much less than full.

My "gut feel" is that Qatar will chose to use it's NG for GTL before it ships LNG to the US. And Japan, China & the EU will be able to outbid the US for Qatari LNG (and perhaps outbid local GTL).

So I have bought ECA & CNQ.

The US is not able to put together the long term planning required for LNG, we are badly positioned geographically and we will be the ones left out IMHO. A basic assumption (so basic that it is unspoken I think) is that the (spot) market will provide. Well, there is no LNG spot market to speak of, and we are passing the long term deals.

Two cold winters in a row and I see damage to US industrial output and widespread electrical blackouts along with very high ($30+) NG spot prices.

Alan

If/when Qatar (with Russian et al help) has saturated EU & East Asian markets, then I think Qatar is likely to invest in GTL before still more LNG bound for US markets.

Remember, Indonesia LNG production is declining and Japan in particular is looking for more LNG supplies for replacement, not even counting growth. (Per memory, Indonesia told Japan that existing contracts will not be renewed since NG will be needed domestically. These contracts were almost half of Japanese LNG imports).

It is a long haul from Qatar to Japan, still further to the US.

BTW, yes I did read with great interest your article :-)

Well done !

Alan

I don't see how QATAR and African gas can all go to Europe.

Many of these projects are targeting US. Unless Europe jumps in with high gas demand and high prices, US will get its shares.

T&T goes to highest bidder, so it might not be US.

Australia has lots of gas that have not been spoken for yet.

District heating is the method of choice in northern Germany. The central furnaces often burn natural gas first in a DCHP config and they are building more. NG also underpins the waste incinerators that are so popular here - nothing burns hotter and gets that waste up to the required temperatures like NG.

You can buy natural models of most VWs, a few Renaults and I think one Toyota. Filling stations are all over the country - though not as ubiquitous as many CNG car owners would like. This would be a big problem if not for the aux. 20 liter petrol tank they all have.

Point. It is conceivable that Europe could increase its gas consumption by shifting/converting its infrastructure in that direction. More production of polystyrene for insulation and CNG cars alone are two areas that could lead this push...

There might not be enough LNG production capacity to satisfy LNG demand in the world, but the bottle neck is due to uneven demand. Europe, US, and Asia want LNG during the winter. There is lax demand for LNG during summer. This makes it very uneconomical for suppliers to expand LNG production capacity.

From the supply side, we are seeing resource shortages due to high price oil/gas to drill for more gas that is cheap enough to supply LNG trains. QATAR has signed up to sell lots of LNG, but I have yet to see them drill and install production wells to satisfy LNG production capacity for the next 5 years. I have seen several LNG regions hit snafus with their natural gas production wells, leading to significant delays.

Bechtel et al seem to have no problems building LNG production capacity on schedule and within budget.

South Koreans have no problems meeting ship building demands. With additional shipyards in China and shipyard expansions in Korea, ship building demands for the next 5 years will easily be met if not ahead of schedule.

Which leads us back to natural gas as the limiting factor. I am not seeing a whole lot of area that can produce enough natural gas to support many more LNG production facilities. This makes me think the LNG building boom will be a very short live.

City Norm Tue. Wed. Thu.

Great Falls, MT 38/19 1/-19 4/-4 25/8

Bismarck, ND 12/32 30/19 9/5 18/-2

Denver, CO 47/20 38/25 14/12 26/0

Omaha, NE 42/24 68/39 41/14 21/11

http://wwwa.accuweather.com/news-top-headline.asp

I never heard of this. How you get this idea?

The only gas flare system on these ships are for emergency use.

Hmm if they aren't using the boil off for the engines then they have to flare no choice. I've not dealt with methane but having worked with liquid nitrogen I'd have to guess they would have to flare some. I don't think its only for emergencies as you suggest.

This article suggests they dump it as methane instead of flaring.

http://ec.europa.eu/environment/clean_marine/pdf/bijlsma.pdf

If this is true then LNG ships could contribute significantly to global warming via methane dumps.

memmel,

But why wouldn't they be using it for the engines?

RC known to you as ThatsItImout

Why wouldn't they be using it for the engines? Because the engines are designed to use bunker. I think. I don't know.

Efficiency and waste are interesting topics. How much does a regular engine cost vs. one the can use the boil-off. Base-load. Remember coal/hydro. What is the deal when you recompute everything percentage-wise with higher costs(oil, NG, etc.)

Is LNG tanker design forward-thinking and what is the "cost" of that. Tanker design can't be much different from airliner design. Guesses about the future have to be made at some point.

Airbus and Boeing. The only two. Their fates have swung back and forth how many times? Every one hedged to the max. Who is paying the hedge?

Good questions, Roger. Thank God Goose is sleeping tight.

LNG tankers go faster than oil tankers. LNG cargoes are time sensitive (they disappear) and fuel costs (when loaded) are close to NA. I am unsure how fast they go back in ballast.

LNG insulation varies depending upon the route it is designed for. Engineers calculate boil-off per trip. Less insulation means more cargo per sphere but also more boil-off. Malaysia-China & Algeria-Spain optimized tankers are different from Qatar-US tankers. This inhibits the development of a spot market.

Alan

LNG tankers that run on BOG use more natural gas than what is boiled off. That is why the industry is moving towards modified diesel engines that can use BOG and diesel fuel. There are a few other engine types to maximize efficiency.

There are also refrigerators that convert BOG back to LNG. These refrigerators are powered by diesel. These are the most efficient LNG tankers. Mainly due to natural gas powered units in these ships are not COGAS units.

would be discovered within days. Shoot first ask questions later.

it sure is a pickle. The north american natural gas crisis will eventually be the end of NAFTA or of Canada as a sovereign state. Much more likely (though rarely voiced) is a provincial splintering along energy lines. Alberta plus...someone new?

The results of a LNG tanker being destroyed in port would be much worse than an oil tanker.

I would think that all it would take is for a couple of them to be successfully attacked and it would put a real crimp in world wide LNG shipping?

And what would it do to insurance costs that have to be passed on to the consumer of the gas?

http://www.ch-iv.com/lng/incid1.htm

Early technology, yes, but LNG becomes NG quickly when exposed to the environment.

Think of water thrown into a fire. How quickly does it boil away ?

Alan

This statement, like other of your ramblings on international matters, is incorrect. Canada, under NAFTA, could restrict natural gas exports to the US, but would have to curtail domestic supply to do so.

Here is the relevant article from NAFTA:

Article 605: Other Export Measures

Subject to Annex 605, a Party may adopt or maintain a restriction otherwise justified under Article XI:2(a) or XX(g), (i) or (j) of the GATT with respect to the export of an energy or basic petrochemical good to the territory of another Party, only if:

(a) the restriction does not reduce the proportion of the total export shipments of the specific energy or basic petrochemical good made available to that other Party relative to the total supply of that good of the Party maintaining the restriction as compared to the proportion prevailing in the most recent 36-month period for which data are available prior to the imposition of the measure, or in such other representative period on which the Parties may agree;

The fault lines run North to South, not East to West.

Alberta feels a greater obligation to its US neighbours, than to Ontario. 'Let those Eastern Bastards freeze in the Dark' was a bumper sticker only half in gest in the early 80s.

Also the National Energy Policy (NEP) under Trudeau (scholars remembered the Soviets had something similar in the early 1920s called the NEP) did huge damage politically. It's still a big issue in Alberta, 25 years later-- it's been brought up more than once in the recent Conservative leadership campaign in Alberta (Alberta is a de facto 1 party state so the 'election' for the Legislative Assembly is irrelevant, it is the Tory leadership race which counts).

Canada will not cut off energy supplies to the US. Ontario (and Quebec) will be in the same boat as New York and New England. But Quebec has hydro power.

NAFTA itself is sacrosanct: to keep ticking over economically, Ontario needs access to American automotive markets for its car plants. After 9-11, when the US froze the border for a week, there were nearly layoffs in Ontario-- it's simply a stage in the de-aggregated vehicle supply chain of the big manufacturers, shipping partly assembled cars pack and forth across the border.

There was no jest in that at all :-)

Alberta has enjoyed a measure of fiscal independence within Canada due to its oil royalties. The NEP was a political initiative enacted to ensure the Federal government remained the dominant force in the country. The Federal government already had enough problems dealing with Quebec and its aspirations to independence; it wanted to cut the legs out from any other province inclined toward a similar independent stance.

Alberta is now seeing a decline in conventional oil royalties. The royalty regime for non-conventional oil (tar sands) is extremely low and remains very low until the operator has achieved CAPEX payback. The operator is therefore faced with a choice between further capacity expansion and investment resulting in a continuation of the low royalty regime or an option of making no further investment and facing a transition to a higher royalty regime. This is a strong incentive to further investment (we can either invest in our future or give the money to the government). Looking forward, it is likely that Alberta's fiscal independence will decline and it will become more dependent on the Federal government.

Cheers!

Alienated and rural Alberta of the 70s and 80s is a far cry from the urbanized Alberta of today, thanks in large part to the huge influx of ethnic and provincial migration from among other places - Eastern Canada.

Ft. McMurray is the second largest city of NFLD while Torontonians are a dime a dozen on the streets of Calgary.

The province's new found urbanisim has contributed greatly to the political and ideological landscape and if you think Albertans are going to let their parents 'back home' freeze in the dark vs. Americans... guess again.

As for NAFTA, we can continue to go round and round on this one for as long as you like, however, the simple fact remains: No heat = No economy. Period. End of story.

Regardless, Canada and the US would both be better served by starting a dialogue on continental conservation and mitigation strategies -nukes for the tar sands for example- before shortages or GW fully kick in.

Anyhow, the United States needn't worry so long as both Bush and Harper are in power.

That said, no one here can possibly fathom what exactly will transpire when the inevitable supply and demand deficit occurs, however, I submit that through the collective efforts of ASPO, TOD, Simmons and the like, Americans and Canadians will not only be able to convince their respective governments that the topic of energy decline needs to be discussed tout de suite but that viable mitigation strategies can and will be fostered together.

We have one - yes - one Trans-Canada Natural Gas pipeline that runs entirely inside the Canadian geographical border and it is unclear if it has the capacity to fully supply Ontario, Quebec and points east at the current rate of consumption.

Sitting here in Ontario, Canada I feel very vulnerable . . .

P

- ground source heat pump. But you are vulnerable to soaring electricity rates. My aunt installed one at her farm (Collingwood) it has been an excellent investment.

- air source heat pump. Won't work on the coldest days. I don't know much about this technology, though.

- wood heat. A good wood furnace could be an excellent investment (make it dual-fuel, if you can). Milnes in Toronto still delivers coal, I believe-- I tried to find a website for them, but could only find this directory entry:

Milnes Fuel Oil LtdUpdate Listing

Tel: 416-481-6141

1815 Yonge St

Toronto, ON M4T 2A4

Coal may be illegal under Ontario air pollution laws: not sure.

4. first and foremost: insulate! insulate! insulate! The quickest win for most homeowners is to insulate their homes better.

- Solar water heaters seem to be a technology with some success, as a supplement to existing home water heating systems.

- home cogeneration systems are not yet widely available see www.whispertech.com . They use a Stirling Cycle engine principle, and typically run off gas (could run off hydrogen). Worth keeping an eye on.

- buy a highly efficient car. Either a Toyota Prius hybrid, or (when available) a modern European diesel (50mpg+ in highway driving is not unusual). Toyota expects that by 2010 half its sales in Europe will be diesels or hybrids.

5. write to your MPP and the Ontario Energy Minister and tell them you think it is a good idea to build new nuclear stations. About half of Ontario's current generating capacity is nuclear, but after 2020 this begins to fall.http://www.powerauthority.on.ca/ipsp/Page.asp?PageID=924&ContentID=4049

6. join Citizens Action groups which encourage energy conservation and alternative energy.

7 . encourage friends, especially businesspeople, to imagine doing business and living with much higher gas prices, and so encourage them to to think about buying more fuel efficient cars, insulation, etc.

One problem I have at the moment with 6 are that such groups tend to be anti-nuclear. My own view is that we are out of time on Global Warming, and nuclear technology is 'back on the table'. I say this as a very strong supporter of wind power, but there are limits as to what Ontario can do with wind power (even if the opposition of landowners in Western Ontario is overcome).

But the environmentalist movement has yet to catch up with me on the nuclear question.

Canada has large wind resources, the limits are much higher than you appear to think. North Dakota is #1 US state in wind , South Dakota #3 (much larger texas #2). North of ND is Manitoba with Western Ontario close. Wind can come on-line much faster than nuke.

Manitoba has 5 GW of hydro to develop. Long term contract to the East. 34 GW of hydro yet to be developed on Canada, some in ON.

Redeveloping existing hydro plants can extract a few more %. New York just finished a long term redevelopment of it's Niagara hydroplant.

Air source heat pumps are fine down to about +5 C (GREAT for New Orleans) but their efficiency drops after that. Good source of supplemental heat on milder winter days in ON, but only a supplement.

Best Hopes,

Alan

To which, I might add that savvy governments in ONT and QUE would be smart to consider promoting the movement of idle forestry resources into complementary industrial sectors i.e. pellet or biofuel production.

http://www.theaustralian.news.com.au/story/0,20867,20826381-643,00.html

But Stanford's Program for Energy and Sustainable Development (PESD) projects that Nigeria will supply only about 20% of Qatar's output by 2025 on page 30 of this presentation

Other countries are also significantly different, such as Australia -- PESD has Australia producing almost 100% of Qatar's production while Nigeria does not even mention Australian production as significant by 2025.

What is odd is that that the PESD report was done in conjuction with the Baker Energy Institute -- which also presents the Nigerian presentation. I emailed both PESD and the Baker Institute on this glaring difference but haven't received a response. The institutes might as well be say "our projections have a margin of error +/- of 300%."

A couple of questions about your Post:

Re: #1, Figure 7 gives a breakeven shipping cost of newbuild LNG of $0.77/mmbtu. That's for the CAPEX. Additional shipping costs are as stated. Look at the Simmons report for details.

Re: #2 I did not look at the updated FERC terminal list. Look at Hughes' presentation (as cited) to get the list as it was in September. It's always changing.

The limiting factor is supply.

Qatar's natural gas supply has significant uncertainties as described by Dave Cohen.

Nigeria has very high political uncertainty.

Australia has uncertainty about the profitability of its natural gas reserves as described by the November 06 issue of The Petroleum Economist

If the natural gas reserves are not large enough, it does not make sense to develop LNG export capacity.

So where will the LNG come from in future years?

Both Simmons and Stanford University are reputable sources, which leads me to believe that no one knows what the future supply of LNG will look like with any certainty.

First, Nigeria is projected by Simmons to provide about 60% of Qatar's LNG to the US, while Stanford has them producing only 20% of Qatar's production by 2015 (although Simmons does not project world production by country, only by region, but does project import source to the US).

In the regional LNG supply, with total Africa is to supply about 27% of the world's total LNG by 2020 compared to slightly under 20% in the Stanford projection.

Russia does not start to produce LNG until 2020 in Stanford's projection while Russia starts producing LNG in 2008 in Simmon's projection (clearly Russia most likely won't produce LNG by 2008).

I believe LNG supply uncertainty in the timeframe out to 2015 is a potentially limiting factor and I tried to express at that in my post.

It has basically flattened the decline curve.

Texas gas production peaked at 9.6 TCF per year at the same time that oil peaked (in 1972). For 2005, total gas production was 5.7 TCF per year, down about 38% from the 1972 peak.

IMO, we will see a similar response with unconventional oil worldwide. It will probably just slow or flatten the decline curve of total oil production.

Whats the scuttlebutt in Dallas, WT? Are the operators going to continue to drill at the current rate ? Have you heard if the E&P budgets are going to increase next year in unconventional gas? It kind of seems like they're pulling in the reigns in the Houston area. The price uncertainty is making the operators more cautious.

Encana sems to be one of those companies that always drills the hot deal not the kind of prospect that makes oney. They're hot and heavy now in the bitumen play in Alberta.Who I'm really curious about is Devon and XTO, both of whom seem extremely well managed. If they're releasing rigs its going to be a skinny winter and spring. At least we can count on Dave's 32% depletion rate for gas wells to get prices back up!

How many rigs were active on that Barnett Shale play? I drove through the Dallas/Ft Worth area earlier this month and only saw about two rigs visible from the interstate.

I have been involved on a horizontal drilling oil plays in Montana and North Dakota, along with gas drilling in Pinedale, Rifle and most recently New Mexico. Dallas is a long way from here, but the perception from here was that the horizontal experience in Texas was limited to Austin Chalk and were fairly large targets. Not to bad mouth Texan directional drillers, but most had a hard time when coming up here chasing thin zones. How much problems in Barnett Shale wells were due to improperly drilled wellbores?

Encana from what I understand is backing off their drilling budget in Rifle and Pinedale also. So backing off the Barnett Shale may be part of a greater corporate plan, what ever it may be.

Regarding LNG, I keep thinking about the Texas City disaster in the '40's and how such an event with an LNG tanker would dwarf it by comparison. Looks like Trent Lott has won a terminal siting near his home town of Pasgagoula, MS.

I am curious about the Barnett Shale play, as I have considered doing some work there.

The Barnett Shale play around Ft. Worth is complicated by being under the whole western half of the Dallas Ft. Worth Metropolitan Area-called the Metroplex by its inhabitants

The operators are drilling horizontal wells, and various pipelines are buying right of ways in people's backyards. Its a screwed up mess-landmens full employment type of deal. And lawyer's too, imagine the lawsuits! I love America!

The prices are astounding-Chesapeake paid $10,000.00 an acre for a lease on the Dallas Ft. Worth Airport. The common acreage price is now at least $2,000 an acre.

The biggest operator in the best part of the area is Devon, who bought out Mitchell Energy. George Mitchell is the engineer who discovered the play and figured out how to get the gas out. XTO, backed by Boone Pickens is probably the second largest, and Anadarko, Chesapeake, Encana all have big positions, plus every other operator in the whole state. Shell is the only integrated oil company I know of operating up there . Go, have fun, but be sure to make a motel reservation well in advance. And I'm sure every topless bar has even better gossip than me!

Should be very easy to get a job so you won't have to freeze your butt in Montana this winter. Skilled personell are in very short supply. Most of the directional small target horizontal drilling is being done offshore and overseas.

I'd rather stay in Ft. Worth than be stuck for two or three weeks at a time on a rig-but, its peaceful offshore, the cell phone doesn't work and you can't spend any money except playing bouray, tonk and Texas Hold-em.

There is some production info regarding the Bakken in the IHS link above that is interesting. These wells are about $2 million each with about half the cost frac and production. These are long laterals at 9000' feet vertical section. The one that I'm on now (relieving another guy for thanksgiving holiday) will have two legs at 6000' each. A lot of wells were screwed up in the early days due to bad frac jobs, but staying in zone is not that hard up here. Most all horizontal drilling in the Williston Basin is in thin dolomitic zones. In fact the "Bakken Shale" play is in a dolomitic zone below the main shale. Burlington Resources tried drilling the shale in the early 1990's but that didn't work out very well. I had thought that something similar was going on in the Barnett Shale. I think there is a similar shale, maybe the same by a different name in eastern Louisiana into Mississippi. A lot of formations have different names but are in fact the exact same rock. For instance Selma Chalk and Austin Chalk.

Staying in zone is the key to having an oil well up here. You can spend all the money you want but if you are not in zone - you do not have an oil well.

I read a recent article in one of the oil rags about the Barnett shale having better economics than Rifle or Pinedale. I can't remember if it was in Harts E&P or World Oil.

My family wants to move back South, so Ive considered the horizontal work in the area. As far as work, all I have to do is make a phone call. I don't do offshore anymore though.

-- Dave

i wonder if these companies werent evaluated by the current wall street dictums, if they would be better off in a discounted cash flow analysis, just sticking to vertical wells, not spending the money, not getting the gas out fast, but having more left for future higher prices.

unfortunately the market doesnt work like that

I suspect the Barnett Shale is a similar case that without horizontal there is no practical way to produce. I haven't been to that area and also have not read much on it.

Vertical drilling still has many applications, but directional has its advantages. Believe me, those production numbers listed for the Bakken in the IHS presentation above would not have been possible with vertical holes.

"IMO, we will see a similar response with unconventional oil worldwide. It will probably just slow or flatten the decline curve of total oil production."

Well, as the old lady said when she pissed in the sea, "every little bit helps!" :-)

RC known to you as ThatsItImout

I have never heard of Exxon building something without knowing that they have the gas or oil in the ground.

Given US investment in North Field, and US need for this energy source, this may be another "background" reason for an attempt to neutralize Iran. Gazprom, Total and ENI are involved in the Iranian developments. The US regional military command CENTCOM is housed in Qatar so they may be sympathetic to Qatari concerns over Iranian production from this field.

Cheers!

I am almost certain that all banks will have 1st security on all assets, gas included, with a clause that no other parities can come in pari passu (on equal terms).

In bank lending, this would be equivalent to asset based lending, which is given generally to the lower/lowest quality firms.

There is bank financing for almost everything -- it mainly depends on the terms. For example, DIP (debtor in possession) financing is where a bank will lend to a bankrupt firm, only because they have a first lein on all assets and charge up the nose.

I haven't seen the LNG loan documents but I also bet they are charging a heafty premium to LIBOR to compensate for the added risk of the projects -- this is, internally, the banks have these projects rated quite high on their internal risk scorecards.

As you point out, banks care only that there is enough gas to repay the loan (with some margin of safety) and not beyond. Prices (interest margins over LIBOR) used to be quite comfortable but have dropped sharply to the mid-double digits as opposed to several hundred basis points a few years back.

Basically the authors argument was that after the 70s, the US used neo-liberal market politics to move away from the oil industries traditional reliance on long-term contracts. But that in recent years, the new national players in the global market, to the chagrin of the oil majors and us(that would be the US) have begun to return to long term contracts and thus begin to squeeze out the US. It really is a good piece on some of the machinations of the global oil markets, which have never been Econ 101.

Now if this is right, it would seem ludicrous at this time to think of anything close to a global LNG market coming into being. Global political plate tectonics are moving in a big way now, the impact of these will be pretty dramatic, with or without an immediate oil peak.

The state of California produced a very good report about this and other issues concerning LNG and it seems like a big hurdle to overcome.

These long term contracts are absolutely needed to finance the projects, and they follow the same structure as others with independent third parties ("take or pay" - i.e. the buyer has to pay even if it does not take delivery of the gas, almost impossible to cancel, very strictly defined delivery terms - but with flexibility to do otherwise subject to profit sharing with the sellers).

LNG is one of the few sectors of the oil industry where the AA or AAA-rated majors still borrow money from comparatively weaker banks and pay them pretty high margins - simply because the amounts are so huge that they cannot bear them on their own and they need help - and also because they want some measure of political cover (from nationalisation risk, say) by bringing in more parties to the table.

That's pretty interesting the oil majors won't float the development. Brings up lots of questions.

That's why noone but the big oil majors has ever been able to run a LNG project so far - it's staggeringly complex and costly - but it's the coordination of the various bits of the chain (which must all be ready at the same time) which eludes others.

I'm glad you explained "take or pay" contracts for our readers. Those expressing the conventional wisdom that envisions a robust global spot market, especially as regards larger volume exports to the US or the UK, are going to be sorely disappointed.

The time is now to set up long-term contracts at the best price possible, a lesson which has not been lost on the Chinese. In fact, India is paying dearly for LNG right now, having passed up some earlier deals. Look at The LNG boom: How India is coping.

And so it goes.Hard to do a lot of trading on that. The big players with the ability to distribute on several easily accessible markets will take advantage of price differentials to make one-off killings on arbitrage, but i doubt that it will ever be enough to sway prices on either side. The closest thing to a "market" is the Atlantic LNG trade, and we see that prices in the US and Europe are still totally separate.

Re China: they've played tough with the big players because they have the alternative of "cheap" (money wise) coal available - so they've been quite insistent to get gas prices that match their coal equivalent (i.e. $5/mbtu or less). Thus the profound disagreement with Russia on gas sales.

Indians have so far refused the concept of "take or pay", and are surprised that no one will sell to them...

If the banks fund an LNG project, there is definiately some nods and hints (although there shouldn't be) that the bank will be involved with other deals. For a large supermajor, the banks will be thinking many, many deals, not just LNG.

How can this deal make any sense for the seller ?

Who would want to lock a fixed price for 25 years ?!

Lock the quantity but the price should be whatever is

the market price at the time of delivery. What am I missing ?

http://www.bismarcktribune.com/articles/2006/11/27/ap/business/d8lln5180.txt

In other Nymex trading, heating oil gained 3.9 cents to settle at $1.7052 per gallon, unleaded gasoline rose nearly half a cent to settle at $1.5937 a gallon and natural gas finished up 28 cents at $7.998 per 1,000 cubic feet.

http://www.wtrg.com/daily/ngspot.gif

Cosselle vessels got the regulatory nod in September.

I don't see why they have to be regional vessels - at half the density of LNG but 1/3 the conversion costs, and practically zero facilities required. You could unload them from offshore buoys if you wanted to.

There are a several competitors in the CNG vessel design market that aren't as far along as the Cosselle idea is, as well.

This is a fascinating niche market opportunity between LNG & Pipelines--I wish them the best!

http://www.greencarcongress.com/2006/05/concept_natural.html

Airships to carry stranded gas!

I know how you like these innovative approaches, so I got to thinking, why not build a "motorless airship", and tow it behind and above tankers and oil carrying ships...... hmmm :-I

It would be essentially a giant gas bag in the air, towed by cable that would be spooled out on a winch and reeled in for off loading at facility incorporated at the oil terminal.

I have even considered "stranded gas" being carried that way above railcars, but the area above the track would have to be obstruction free. It might work in certain regions. It's a thought....:-)

Roger Conner known to you as ThatsItImout

Energy is used to overcome water resistance and to displace water. Energy is not 1:1 proportional to tonnage for ships.

I see airships as being a higher energy means of transport than ships.

Alan

Recall that photo posted months ago by Leanan of a Chinese family pedaling along holding up a big bag of natgas--although very dangerous--it works for some!

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Whiskey & Gunpowder

November 27, 2006

by Byron W. King

Pittsburgh, U.S.A.

:)

http://www.peakoil.com/gate.html?name=News&file=comments&sid=21089&tid=12852&mode=&a mp;order=&thold=

http://search.barnesandnoble.com/booksearch/isbnInquiry.asp?userid=0LK059A66I&isbn=0125475705

Strictly speaking an inflection point is where the slope goes stops getting steeper and starts to get shallower or vice versa. In mathematical terms where the second derivative changes sign. On your figure this occurs in about 2015

The first derivative is generally positive over the entire graph. Meaning, there are no major multi-year-declines, and the slope of the graph remains positive on a 2 or 3 year average over the entire graph.

The second derivative goes from positive to negative around 2010 (IE, the annual increase in gas supply reaches a peak and begins declining) [meaning, the slope of the graph stops increasing] .

If the second derivative is held constant running off the end of the graph, extrapolation indicates that the first derivative will hit zero (the graph will peak or plateau) sometime between 2015 and 2020.

The inflection point is around 2010-2012. There is definitely no inflection point at 2005.

Not being a mathematician, I was simply using the informal dictionary definition.

Hello all,

My post yesterday concerning ULSD (Ultra Low Sulfur Diesel) and the effect of natural gas price and supply on Diesel fuel price and supply seemed to catch some interest. I don't normally do this, but I am just going to post the link to that discussion here

http://www.theoildrum.com/comments/2006/11/26/23195/792/24#24

The reason for this I hope is obvious, as it is my view that natural gas problems are now Diesel fuel problems, due to the new nature of Diesel fuel.

I am still asking for anyone in the refinery business or in the oil trade who has access to real numbers about the volume of natural gas needed to refine ULSD to bring anything they have to TOD, all help on this will be appreciated, consider it our joint research project. It is an issue that has recieved very little attention in the press or in even in the Diesel consuming industries such as trucking. Brief sidepoint: The issues surrounding ULSD make the efforts to develop the Bio-Diesel and the GTL (gas to liquids) industry all the more interesting and critical to the future of the Diesel fuel supply, as these do not require desulfuring in the same way that crude based Diesel does. Interesting times for us oil burners!

Thank you all for all the feedback! :-)

Roger Conner known to you as ThatsItImout

My summary is this: liquefied natural gas is emerging as a worldwide energy source to supplement natural gas. There are political problems and technical problems with shipping and distributions. It may mitigate the declines of oil and delay energy peak for several years, but is unlikely to be a long-term winner as resources decline. Is this a fair summary?

The complexities of the LNG supply chain do not mix well with our short term planning horizon. And we will not be able to import significant quantities of LNG on a short term/spot basis.

Alan

Bob Amsterdam's blog (www.robertamsterdam.com) has a good post up right now about the gas cartel.