The Resurgence of Risk – A Primer on the Developing Credit Crunch

Posted by Stoneleigh on August 14, 2007 - 10:15am in The Oil Drum: Canada

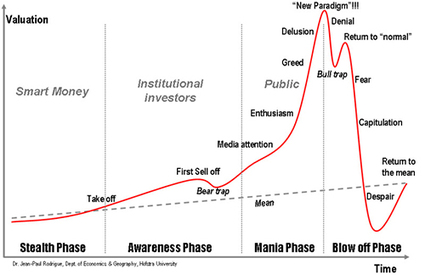

We have been living in inflationary times, for as long as most of us can remember. The money supply keeps expanding and prices increase over time as a result. Central bankers have many tools at their disposal which they can use to tweak the economy – they can raise or lower interest rates, can control reserve requirements for fractional reserve banking and can inject liquidity into the banking system, among other things – and we have become used to thinking that they can prevent the kind of 'economic accidents' that previous episodes of excess have led to in the past. Especially in recent years – since the apparently successful containment of the dot com aftermath - we have acted as if risk were a thing of the past. Sliced, diced and spread around Wall Street and the rest of the global financial system, risk has seemed tamed, contained and controlled, until last week that is.

For years, industry insiders and so-called experts have proclaimed the virtues of slicing, dicing, and repackaging risk. They waxed on about how borrowers and savers, and society as a whole, could only benefit from such machinations. They suggested any sort of exposure could be disbursed and dissipated to the point where it essentially disappeared. Some even claimed that the crises of the past would no longer exist.

Yet amid the hype and assurances, few supporters spoke of the dark side of wanton and widespread risk-shifting. They didn’t seem — or want — to acknowledge that by combining complicated risks in unfamiliar and unnatural ways, the end result could be an uncontrollable monstrosity—one that eventually turned on its masters.

Nor did they heed the notion that by scattering risk into every nook and cranny of the global financial system, the vast web of overlapping linkages virtually guaranteed that serious problems in one sector, market, or country would trigger far-reaching shockwaves.

All of a sudden, markets are reeling around the world, deals are unraveling, the mainstream press is talking about a credit crunch and the world’s central bankers are injecting unprecedented amounts of liquidity to calm the markets. Risk has made a comeback, and in that environment the evident concern of the central bankers does not seem very reassuring.

The Dot Com Crash and Money Dropped From Helicopters

As the dot com boom morphed into the dot com bust (threatening to become a full-blown meltdown by the end of 2002) central bankers cut interest rates drastically and held them down for a long period of time.

In 2001, the US Federal Reserve Bank, the spigot of credit in America’s debt-based economy, drastically slashed its interest rates 84 %, from 6.5 % in 2001 down to 1 % in 2002. The Fed did so because the collapse of the dot.com bubble in 2000 had so damaged US financial markets (the NASDAQ fell by 80 %) the Fed feared a depression could result.

As Ben Bernanke was preparing to take over from Alan Greenspan at the Federal Reserve, he promised to drop money from helicopters if necessary to prevent deflation. Having spent his academic career studying the causes of the Great Depression, Bernanke understood the danger of deflation and was determined to avoid the liquidity trap by maintaining the demand for credit. As good as his word, Bernanke, and Greenspan before him, oversaw a doubling of the money supply since 2000. Adjusted for changes in the money supply (inflation), real interest rates (the nominal rate minus inflation) were negative for several years. Instead of dropping money from helicopters, Bernanke dropped free debt.

The key in all of this is not inflation, as most believe. The Fed says they are most worried about inflation risks, but the reality is that they are most worried about deflation risks. Always. Always deflation. The Fed has no choice but to always remind us that the risks are tilted toward inflation, just as the Treasury Secretary, whichever one happens to be in office at the time, must always say that the U.S. maintains a strong dollar policy, even if monetary policy and fiscal policy are conspiring to devalue the dollar.

Fractional Reserve Banking and the Expansion of the Money Supply

Fractional reserve banking allows banks to lend into existence money they do not have (on the assumption that their depositors will not all want their money back at once), provided that they keep a certain percentage of their deposit base with the Federal Reserve to cover withdrawls. Ten percent would once have been a typical figure, but since the 1990s, the Fed has deliberately shepherded reserve requirements down, essentially to zero, through dropping required reserve percentages, reducing the categories of funds needing a reserve and allowing funds to be swept from a reservable category to a non-reservable category overnight (using sweep accounts). As reserve requirements have fallen, banks have been able to expand the money supply far more rapidly than would previously have been the case, at the cost of removing the cushion they previously held as insurance against financial accidents. As with everything else, the resilience has been stripped from the system in the name of efficiency, in this case in the use of capital to generate maximum returns.

The Housing Bubble and the Debt Mountain

The combination of drastically reduced reserve requirements and negative real interest rates predictably led to a borrowing binge of epic proportions, increasing what was already a dangerous level of indebtedness. Many of those whose fingers had recently been burned in the stock market turned to real estate, and, by extension, all of the supporting industries surrounding it. People moved to larger properties, bought investment properties, renovated, upgraded and re-equipped. The surge in demand, and depreciation of the currency through rapid expansion of the money supply, led to a huge increase in property prices. This enabled owners to use their appreciating properties as ATMs, at first using the windfall for luxuries, but increasingly relying on it to fund basic living expenses through refinancing. This created both a debt mountain and a structural vulnerability to a fall in property prices.

Banks offered credit to those further and further down the credit-worthiness scale, with scant regard to the ability of those borrowers to repay their loans. Instead of holding debt on their own books as they would once have done, banks now make their money from fees and sell the loans on to investors as mortgage-backed securities. As they no longer bear the risk of default, they are unconcerned about it. They often asked for little or no information from prospective borrowers – often no proof of income, employment or even identity - leading to the label of ‘liar’s loans’.

With rates so low, borrowers were far more concerned with the level of monthly payments than with the balance outstanding. Exploiting this blinkeredness, banks offered a range of loans called neg am ARMs – adjustable rate mortgages with negative amortization. Borrowers were offered low ‘teaser’ rates for the first few years, paying less than the interest owed on their loan during that time, while the unpaid interest was added to the principle in the meantime. Often they signed the loan documents without understanding the concept of teaser rates. At the end of the teaser period, the full monthly interest payment would be due on the now larger principle at the new prevailing interest rate. As interest rates have increased recently, monthly payments on resetting ARMs are often set to more than double. In October of this year, $50 billion dollars worth of ARMs will reset, with a further $30 billion a month doing the same for over another year.

Marginal borrowers, who were often already only barely affording their existing payments, are highly unlikely to be able to afford the new ones. Their only recourse would be to sell, but falling prices have made this difficult. Some are already in negative equity – owing more on their home than its current market value. Foreclosure lies ahead for many, but mass foreclosure sales will depress property prices, exacerbating the debt problem for a wider range of borrowers. Even many quite high-income families have been enticed into a lifestyle their income could not support, and could find that falling property prices push them over the edge. As sales will be very challenging, and bankruptcy laws have been tightened, many people could be tethered to unpayable debts for a prolonged period.

Financial Engineering – Hedge Funds, Derivatives, Leverage and the Repackaging of Risk

[In December 2006], another bit of news reached us: the derivatives market , in which hedge funds tend to speculate, has reached a face value of $480 trillion…30 times the size of the U.S. economy…and 12 times the size of the entire world economy. Trading in derivatives has become not merely a huge boom or even a large bubble - but the mother of a whole tribe of bubbles…dripping little big bubbles throughout the entire financial sector.

The ability to expand the money supply almost infinitely has been seized on by financial engineers interested in finding new and tempting ways to dress up leverage - seemingly eliminating risk while actually making it endemic through the financial system. The resulting derivatives have been called ‘financial weapons of mass destruction’ by Warren Buffet.

In order to sell mortgage-backed securities to investors, banks packaged them into different risk tranches of Collateralized Debt Obligations (CDOs) – investment, mezzanine and equity - concentrating the lowest risk elements in funds able to earn an investment grade rating. In order to sell the higher risk tranches, banks commonly set up hedge funds with enough seed capital to sell the securities to themselves. As housing prices rose, the securities appeared less risky, and so were able to attract outside investment and to be leveraged by being used as collateral for further loans. High performing funds, during the era of rising house prices, were tremendous engines of credit expansion.

Alternatively, equity and mezzanine tranches were often sold to large institutional investors, such as pension funds, willing to unwittingly accept illiquid securities with fictional marked-to-model valuations ultimately based on the ‘documentation’ provided with liar’s loans. These investors were chasing yield without realizing that they were chasing risk. The practice was colourfully referred to by insiders as ‘landfilling toxic waste’.

Rather than selling the risky securities, banks could also keep them, and the cash flows they generate, but insure them against default through a Credit Default Swap (CDS) – swapping the risk of default for a cash payment. The underwriting institution can then aggregate the CDS income stream into pools, themselves divided into tranches with different risk profiles. These synthetic CDOs are based, not on cash flows derived from borrowing money, but on cash flows derived from insurance premiums paid to cover the risk of mortgage default. Institutions can even insure against the risk of default on securities they do not own – creating synthetic CDOs and effectively shorting subprime mortgages or risky corporate bonds while once again hugely expanding supply of leveraged credit. Any default could therefore result in claims to underwriters many times as large as the supposed value of the underlying securities.

The danger is that underwriting institutions willing to accept huge amounts of risk in exchange for apparently being paid to do nothing, may not actually have the ability to pay out on default. The original institutions did not seem to ask too many questions of those to whom they had readily assigned the risk of default, but risk does not go away merely because one institution has paid a fee to another. The risk guarantee is only as good as the credit worthiness of the guarantor, and one commentator has described many credit default swaps as being guaranteed by Madame Merriweather’s Mud Hut in Malaysia.

International banking rules say that banks have to hold a certain level of spare funds (or reserves) to protect themselves from the danger that their loans might turn bad. However, since the banks had sold the risk of default on to somebody else, they could now argue that they did not need to hold these funds.

To anybody outside the world of finance, this might look odd (after all, the banks were still making loans); but the regulators accepted this argument, since the risk had moved, in accounting terms. And that let the banks free up funds to make even more loans. It was the financial equivalent of calorie-free chocolate: almost too good to be true.

Conflict of Interest - The Role of the Ratings Agencies

The ratings agencies that grade securities for investment purposes, and also depend on doing business with the same institutions whose bonds they rate, gave high ratings to mortgage-backed securities and did not lower them even as the housing bubble began to deflate. As the securities were not actively traded in a liquid market, the nominal marked-to-model valuations remained constant, and so did the ratings until recently. The danger is that lowering ratings below investment grade would force many institutions to sell them, potentially forcing those ‘assets’ to be marked-to-market where real bids, or the lack of them, would result in real market valuations. That would revalue a whole asset class at a stroke – revealing that the Emperor had no clothes.

It was a responsibility that ratings agencies were unwilling to take until forced by Bear Stearns’ declaration that two of its hedge funds were essentially worthless. A small percentage of mortgage-backed securities funds have since been down-rated and more have been placed on watch, but as yet there has been no real price discovery. Many investors are currently locked into hedge funds, delaying asset sales, but financial institutions can only maintain their solidarity for so long before they will have to act to extract what value they can from their collateral, even if that amounts to only pennies on the dollar. Ratings are likely to be downgraded only when they absolutely have to be. Ratings agencies have made it clear that rating securities does not mean that they do due diligence.

Moody's: "Moody's has no obligation to perform, and does not perform, due diligence."

S&P: “Any user of the information contained herein should not rely on any credit rating or other opinion contained herein in making any investment decision.”

What then is the purpose of a ratings agency?

Private Equity and Leveraged Buyouts

As the housing market was beginning to decline in late 2006, the market for private equity deals, or leveraged buyouts, was taking up the slack and feeding the credit expansion boom. Private equity was able to use a small amount to borrow huge sums of credit in order to take large companies private, with the underwriting banks able to sell the resulting securities to investors. The target companies were then often asset stripped, loaded up with debt and sold back to the public in a private equity ‘strip and flip’. In this way, private equity was able to play off the public markets, extracting real value through the use of cheap credit loaned into existence for the purpose.

Many of these huge deals are now threatened, as investors are no longer willing to purchase the securities generated, leaving the underwriting banks holding the risk. Bridging loans are becoming ‘pier loans’ as they no longer lead anywhere.

The Inverted Pyramid - Money versus Credit (or Hyperinflation versus Hyperexpansion)

Money and credit are not the same thing, although people currently use them interchangeably. Money is a physical commodity, while credit is virtual wealth borrowed into existence. Money can be subject to inflation, either by printing currency or by debasing specie (reducing the precious metal content of coins), but does not disappear. Credit, on the other hand, can expand dramatically through financial alchemy, but has no physical existence, although its effects are certainly tangible.

Because credit is used as a money substitute in the financial markets, it acts as an inflationary force in the asset markets (and this spills over into the real world as the imaginary wealth thus created leads to overconsumption and malinvestments), but it is all ephemeral - in the end, it is still credit, not money. As soon as money is needed in lieu of credit, such as has now happened in the CMO and CDO markets, it becomes clear that the money simply isn't there."

Weimar Germany or present day Zimbabwe are examples of hyperinflation, but the Roaring Twenties and our situation are instead examples of credit hyperexpansion. Inflation is a chronic scourge, but credit expansions are self-limiting – they proceed until the debt that creates them can no longer be serviced, at which point that debt implodes in a sea of margin calls.

There is actually very little real cash out there relative to credit. The "sudden demand for cash" is in fact the world's biggest margin call to date.

The value of credit is only as good as the promise that stands behind it, and when that promise cannot be kept, value abruptly disappears.

Let's suppose that a lender starts with a million dollars and the borrower starts with zero. Upon extending the loan, the borrower possesses the million dollars, yet the lender feels that he still owns the million dollars that he lent out. If anyone asks the lender what he is worth, he says, "a million dollars," and shows the note to prove it. Because of this conviction, there is, in the minds of the debtor and the creditor combined, two million dollars worth of value where before there was only one. When the lender calls in the debt and the borrower pays it, he gets back his million dollars. If the borrower can't pay it, the value of the note goes to zero. Either way, the extra value disappears. If the original lender sold his note for cash, then someone else down the line loses. In an actively traded bond market, the result of a sudden default is like a game of "hot potato": whoever holds it last loses. When the volume of credit is large, investors can perceive vast sums of money and value where in fact there are only repayment contracts, which are financial assets dependent upon consensus valuation and the ability of debtors to pay. IOUs can be issued indefinitely, but they have value only as long as their debtors can live up to them and only to the extent that people believe that they will.

Essentially, the gargantuan edifice of leveraged debt that has been accumulated during the years of credit expansion can be described as an inverted pyramid. Its point rests squarely on those at the bottom – for instance the subprime mortgage holders who’s relatively modest debts have been leveraged into trillions of dollars worth of derivatives. Each dollar of subprime mortgage debt probably underpins at least a hundred dollars of additional debt, and these loans will go into default en masse once the ARMs begin to reset in earnest. The leverage that has magnified gains on the way up, will magnify losses in a debt implosion on the way down.

Until now, his debt was an asset of the fund, and was being used as collateral against loans ten times its value. But the moment that Mr. Jones gave up on the idea of home ownership, the value of his mortgage simply disappeared. The paper asset, which derived its value from Mr. Jones’s promise, was destroyed. This had a cascading effect, since Mr. Jones’s mortgage was being used as collateral to borrow money to buy even more subprime mortgages, many of which were also defaulting. Assets purchased on borrowed money were now worthless. Only the debts remained, and suddenly there was more debt than the original amount that investors had put into the fund. These original funds would be needed repay the debts incurred by the fund. Nothing is left to return to investors.

Liquidity Traps and the Mood of the Market

Central bankers act as midwives for credit expansion – manipulating the cost of credit in order to encourage borrowing and lending. However, this cannot continue indefinitely as it does not occur in a vacuum. Central bankers have a range of options open to them, but ultimately the financial circumstances, and the mindsets, of both borrowers and lenders are important to whether or not credit expansion can be maintained.

The Fed really only can do two things. They can lower margin requirements for banks, the amount of capital they have to hold to make loans. That it has already driven to basically zero. So the Fed cannot allow banks any more “leeway” than it already has.

They can also perform open market money operations like REPOS and coupon passes. The Fed calls up big banks and buys their government bonds out of their portfolio. But they don’t buy them with real money; they buy them with credit newly created just for that purpose. The big bank can then lend that credit out in a much greater amount because the Fed only requires them to keep a small fraction of that credit to support whatever the bank wants to lend out. This is our wonderful fractional reserve system. If everyone went to the bank to get their “savings” at once they would find that they could get out less than 1%.

But here is the key. The bank must ultimately be willing to lend it and then find some investor to borrow it. This has been no problem whatsoever over the last several years. Now most investors realize that they have too much debt, that their level of income cannot support it. Banks realize this too and have increased their lending requirements. The last borrower is always the most aggressive speculator.

So most market participants are now looking for ways to pay back debt (deflation) just when the Fed is desperate to get investors to borrow more (inflation).

This conundrum is a form of liquidity trap - a shortfall in demand for credit that the policy tools of central bankers have great difficulty influencing. Keynes referred to this type of scenario as “pushing on a piece of string”. We are still in the early stages of this credit crunch and as yet, the Fed has not employed all the tools at its disposal. Most notably, it has not yet cut interest rates, likely due to recent Chinese threats to dump the dollar.

As the dollar should benefit from a flight to quality as credit spreads (the risk premium over treasuries) widen, there should be scope to cut interest rates later in the year. It is likely, however, that this will be less effective than the Fed would hope.

The theory is flawed. Central banks promising new credit to strapped banks only helps them with their current problems. It will not get new credit into a system that can't take anymore. Banks, given their situation, are reducing drastically their new commitments, as they should. Borrowers can't afford to borrow more.

The continuation of the credit expansion will remain dependent on a supply of ready, willing and able borrowers and lenders, and those already appear to be in short supply.

A trend of credit expansion has two components: the general willingness to lend and borrow and the general ability of borrowers to pay interest and principal. These components depend respectively upon (1) the trend of people's confidence, i.e., whether both creditors and debtors think that debtors will be able to pay, and (2) the trend of production, which makes it either easier or harder in actuality for debtors to pay. So as long as confidence and productivity increase, the supply of credit tends to expand. The expansion of credit ends when the desire or ability to sustain the trend can no longer be maintained. As confidence and productivity decrease, the supply of credit contracts.

A significant headwind faced by the central bankers is the dramatic change in the mood of the market in recent weeks. It is said that humans have only two modes - complacency and panic, and markets, being a human construct, are no exception. The current mood of the market is one of fear, and if fear becomes panic, it can remove liquidity from the market far faster than even a central banker can pump it in. Actual cash is in short supply, and the many investors are afraid that the game of musical chairs will end before they can grab one of the very few chairs. If they do manage to find a chair, it will be difficult to convince them to part with it, no matter what the inducement. Risk has made a definitive comeback.

Deflation and the Mother of All Margin Calls

A credit expansion cannot be sustained indefinitely. At some point the burden of debt begins to stifle the ability to produce. The debt industry can take on a parasitic life of it’s own, becoming an integral part of the culture, from the level of the individual, as documented by James Scurlock in Maxed Out, to the level of corporations and government. The attention paid to assessing credit ratings, monitoring credit activity, hounding defaulters, writing off bad debt, juggling minimum payments, thinking of creative ways to exploit leverage, and encouraging every last entity to take on more debt in order that predatory lenders might wring out every last penny of profit, is attention not paid to productive activities of the kind that build successful economies. Eventually, it requires so much energy to maintain that economic performance suffers and extracting sufficient profit to cover interest payments on ever-increasing credit balances becomes impossible. A mood of conservation eventually takes hold, replacing the expansionary fervour, and reducing the velocity of money.

When the burden becomes too great for the economy to support and the trend reverses, reductions in lending, spending and production cause debtors to earn less money with which to pay off their debts, so defaults rise. Default and fear of default exacerbate the new trend in psychology, which in turn causes creditors to reduce lending further. A downward "spiral" begins, feeding on pessimism just as the previous boom fed on optimism. The resulting cascade of debt liquidation is a deflationary crash. Debts are retired by paying them off, "restructuring" or default. In the first case, no value is lost; in the second, some value; in the third, all value. In desperately trying to raise cash to pay off loans, borrowers bring all kinds of assets to market, including stocks, bonds, commodities and real estate, causing their prices to plummet. The process ends only after the supply of credit falls to a level at which it is collateralized acceptably to the surviving creditors.

In such an environment, financial values can disappear very quickly, leaving behind only stranded debt. All it takes for an asset class to be devalued is for as few as two parties among many to agree to a new lower price. The remainder need do nothing, other than refrain from disputing the new valuation, for their net worth to fall. In this way, a few discounted house sales can bring down the value of a neighbourhood, and that lost value, which may have been underpinning a hundred times its worth in leveraged debt, is magnified through the inverted debt pyramid. The majority who do nothing end up watching the investment value of their assets plummet, while the owners of debt attempt to call in whatever value they can, from wherever they can, through margin calls.

The United States faces a severe credit crunch as mounting losses on risky forms of debt catch up with the banks and force them to curb lending and call in existing loans, according to a report by Lombard Street Research.

"Excess liquidity in the global system will be slashed," it said. "Banks' capital is about to be decimated, which will require calling in a swathe of loans. This is going to aggravate the US hard landing."

"The complexity of this era of credit liquidation," as Robert Smitley wrote of the Great Depression in '30s America , "is far too great for the mob mind to grasp. It is hardly possible for them to see the picture wherein about $700 billion dollars of physical and intangible wealth is attempting to be turned into about $5 billion dollars of money."

How much intangible debt now needs to be squeezed back into how much real money? It would be easier to find a cheap mortgage – with no ugly ARM once the teaser is finished – than guess at those numbers today.

The Comptroller General of the United States is still sounding the warning alarm,,but few appear to be listening:

"The US government is on a ‘burning platform’ of unsustainable policies and practices with fiscal deficits, chronic healthcare underfunding, immigration and overseas military commitments threatening a crisis if action is not taken soon, the country’s top government inspector has warned."

http://www.ft.com/cms/s/80fa0a2c-49ef-11dc-9ffe-0000779fd2ac.html

Today in the New York Times C1 section and the Wall St. Journal C1 section (Wednesday, August 15, 2007) I read that some money market funds are actually invested in collateralized mortgage obligations.

What about my "cash account" at my brokerage?

Business News from Reuters:

Dow -161 11:08 edt

http://www.reuters.com/article/marketsNews/idINN1443019520070814?rpc=44-...

<

The only business news from CNN this morning so far: 'Mattel has major toy recall'.

------

If there is no Devil, then why do we dance with him?

You state that money is a physical commodity. This is a result of much wishful thinking. The article you link to may contain the phrase but not much of an argument.

Gold is a physical commodity. Whether or not you put the king or a president on a specified lump of it is ceremonial. Paper money is paper, also a physical commodity. When it says 'will pay to the bearer on demand', it pretty much explains itself as a form of debt.

If we define money as a physical commodity, there isn't very much out there. I could go on and on, but I don't think there is much more to say unless I want to get into negating the ceremonial obfuscation of the financial world since Gutenberg and Paterson brought forth the Bank Note, the official IOU or I Owe You.

While alchemy failed to turn lead into gold, Paterson turned gold into paper - just as lucrative for a while, for a few. While both paper money and gold have a notional value, only one is a significant physical commodity. Hogs or barrels of oil would do as well, but are harder to put in your pocket. All economies are, in the final analysis, barter systems; money is just a more convenient intermediary mechanism.

The rest of your post is pretty airtight, welcome, and very accessible. Well done. Too bad people only seem to realize there's a pile of dishes to do after the party's run out of booze, or credit in this case.

I realize that paper money is debt based, but the point is that even something as flimsy as paper still has a physcial existence. Short of having a large bonfire (or reissuing the currency as Russia did some years ago), it isn't going to disappear the way pure financial value does when as few as two people simply decide an asset (and by extension an asset class) is worth less they used to believe.

If that financial value was propped up by credit loaned into existence for the purpose, then when the value disappears, all that is left behind is the debt. Credit is far more ephemeral than paper.

Petrosaurus,

This is likely the time when all the gold comes out of the strong boxes and is sold for cash to prop up the economy, and gold has very little intrinsic value. It can be used for jewelry, and electronic connections, and as an art supply (gold leaf). Any other value is just an agreed upon value, just like paper money. Land and productive capacity is the only wealth, but they may not be fungible if we have no currency.

Gold and silver can get you robbed and killed. The value is likely to crash too.

My point is don't put your faith in specie, or paper anything. Good luck!

Well, I guess I'm in pretty good shape then. Sitting on a few acres of forest & farm land including mineral rights. Over the Black Warrior Basin, which also provides me with a little beer money. ;) One other thing that works well as currency, btw, is 'shine. :) Learning to make your own is worthwhile.

Gene, just tell the revenooers that your building your own home ethanol plant!

Y'all been watching too many old movies; revenoors are my best customers. They are "fuel" conscious also. :)

Heh, I was just thinking that prostitutes (or perhaps these days porn) and booze can almost be said to have "intrinsic value" in that one can hardly imagine demand for them ever being destroyed.

Not being much one for pimping I'm starting to take a real, um, shine to the prospect of distilling as a relatively bomb proof post-carbon livelihood. Desperation to run cars on anything that burns, coinciding with exploding demand for something to kill the desperation, should make for the mother of all growth industries.

Cheers,

Jerry

Ah, moonshine production. Good idea! Uh, except you'll have to stand in line with the ethanol producers and hungry people just to get the core ingredient: grain.

Then again, you could grow your own potatoes....

You can't buy bread, or pay your rent with gold or silver. You have to sell it, trade it from paper money.

If everyone is selling, and nobody is buying, then gold is little different from any other asset; it might be more liquid, but it still has to be liquidated to be of any use.

We paid off our land, and our heirloom fruit trees are two years old. Hopefully next year they will bear. Getting off the money wheel is the best thing my wife and I ever did (besides getting married... :)

What we call "money" is simply a portable and convenient mechanism for valuing real goods and labor that would otherwise be bartered for. Practically everything you can think of that can be strung on a vine, stuck in a purse, or pocket has been used to fill that role. Rocks, shells, etc.

The barter system ( I got cattle, you got women, let's trade. :) )is still alive and well world-wide, including the USA, which really irritates governments (of all types, including religions ) because they have no control of it for taxation purposes. An arbitrary assignment of value to a bag of rocks or string of seashells makes it much easier than taking a cut of veggies and livestock. Breaks my heart - NOT.

Excellent piece Stoneleigh.

Fannie and Ginnie Mae are being floated as the buyers of last resort for liar's mortgages and more. We remember Fannie as that quasi- public private corporate entity which hasn’t been able to provide an audit in several years.

A related tie-in is the change in U.S. bankruptcy laws, which effectively create a new perpetual surf class.

This is indeed an important point. I mentioned this briefly in the article. Indentured servitude comes to mind.

A perpetual surf class?

That IS funny, Rick.

Somehow doesn't sound all that bad, does it?

Gnarly, dude.

Ah yes, SERF, o.k.? A serf underclass has no time to surf, or spell. Serfs up!

Serfs down!

Indeed.

Perhaps worth noting, though, something that I have discussed with Nate on these lists and others: that a society which surfed and ate breadfruit and smoked wackyweed would be a society which needed nothing much more than a way to make surfboards. Turning society into surfers is probably the best we could hope for. (feel free to substitute alternate local exhilarating hobby).

One question I have is what does the world look like if all of the stuff that was put in place in the last few years gets unwound and goes away?

It seems like we have a whole lot of bond defaults, as businesses cannot repay their debts and homeowners cannot pay the loans on their houses and cannot sell them for what they are worth. Insurance companies, banks, and hedge funds that hold those loans will be in tough shape.

We will still have a lot of physical houses. I am not sure exactly what happens. Are lots of folks evicted, and they move in with friends, (or become homeless) so that there are lots of unoccupied houses that deteriorate quickly? Clearly the market for building new houses nearly disappears.

We also have lots of businesses. Do they just go out of business because they cannot repay their loans? Or do they go to bankruptcy court, come out the other end without much debt, and continue sort of as usual?

The banks have FDIC insurance. There is virtually no cash in this, so it would not by itself hold up more than a few small banks. But I can see this as an excuse for a different type of re-injection of credit into the system by the federal government.

What thoughts do other people have?

Following is a missive I sent out to some joint venture partners last week. BTW, I've heard rumors of money market funds taking losses because of mortgage backed securities.

WesTexas, Jeffry,

that's exactly right. We are importing 14.25 million barrels per day now, 68% of the oil we use. I have no doubt that we will use all we can produce domesticly forever.

The most important thing that people at this site can do personally is follow your good advice-get debt down, learn to get by on half your income. In other words, economise.

Learn to get your needs locally, build a community, and stop buying Wallcrap from China. Use your money at the local hardware store, keep your neighbor in business. Maybe he'll remember when the trucks stop running and you need a padlock. Buy from the local farmer, its fresher and tastes better. Find all you need in bicycle distance, localise.

And get something you can do or make to barter.Make art, learn to cobble, get handsaws and chisels and do old fashioned carpentry, learn to garden, get some shovels-produce. Get a real job .

Yeah, I know the whole economy will fall apart if everyone does this, but since most people won't follow good advice, I'm not worried. I do know that even if Jeffry's wrong your life will be better, a whole lot less stress. Its his (in)famous ELP program. I prefer to be in a city, but he says farmland. Like Alan from Big Easy, I'm in a port,Galveston, which has a great hospital and medical school, fishing boats, public transit and 1% of city revenues dedicated to the library system, a college Texas A&M Galveston Campus, a nursing school, commmunity college.

Don't forget to relax a little and have fun, after all the Mayan calender gives us to 2012!

It was mentioned yesterday that Donald Trump had commented on this and I think it's a good idea. - People should just stay put and negotiate like hell with the banks for better terms. Don't just give in and take it. Make the banks and financials work hard for their pennies on the dollar.

-Don

Gail,

There is nothing I can see that would halt the drawdown process anytime soon. It has to simply play out to a large extent.

Many people will be foreclosed upon, many businesses will close and milllions of jobs will vanish. There is a large group of banks out there that are basically insolvent at present. In attempts to stay alive and in business, they have no choice but to call in every single loan that they can. This will be true for mortgage loans, business loans, everything. Don't forget: they have shareholders, and are obliged to try to do what they can. Too bad for the newly homeless and unemployed.

Governments are powerless in the face of all this. The amount of credit that would be required to let broke and unemployed people stay in their homes, by the millions, combined with the credit needed to keep businesses going, would overwhelm a government's financial capacities. If they'd try, their currency would sink like a stone.

And it's not just the US. I posted some articles on yesterday's Round-Up that should make clear that European (and Asian) banks and funds are much deeper invested in MBS, CDO etc. than they let on. Here's another one: Eurobanks may take months to reveal subprime woes.

After another credit shot of €7.7 billion today, the ECB has now injected almost $300 billion into its banks. While this has calmed markets somewhat for now, it will just evaporate. All these people, the banks, the funds, and governments, are becoming aware that they sit on rapidly decomposing paper. And they are like deer in a headlight.

Once it gets officially downgraded, read: soon, many will by law be required to get rid of it, since they can only hold AAA. What will it be worth? I think 10 cents on the dollar is a good guess for now, but they would still all have to find buyers for that price. But still, 10 cents is better than nothing. And so is 5 cents.

I think the closing quotes in Stoneleigh's excellent article say it quite well:

Everyone will be forced to choose that $5 billion (or$10, $25, $70 billion), since it's better than nothing.

It's very important to put numbers on the mortgage and subprime problem. The best I've seen on this is: http://www.loanperformance.com/infocenter/whitepaper/FARES_resets_whitep... (from First American Real Estate Solutions, which claims to be the number 1 source on real estate in the US, used by Moody's)

- FARES projects approximately $300Bn loans at risk over the next 5 years from interest rate resets, and, as losses will represent the loss on collateral, approximately $100Bn of total losses to the financial system, spread over 5 years. Note that losses are after the bank/lending institution takes ownership of the collateral (house) and sells.

- A weakness of the study is that only the loans made in 04 and 05 are represented, most likely significantly underrepresenting 06 and years before

03. (study completed in 2/06, but I haven't found anything of good quality newer) So one should increase the total at risk amount (unscientifically) by approximately 30-60% to account for the extra years.

- Another weakness of the study is that interest rate reset is at current interest rate levels -- all bets are off if interest rates rise significantly -- but note that much higher interest rates are not extremely likely.

- Study assumes a level of 30% from the approximate $1 Trillion in loans that will reset at risk, which the author considers "conservative" -- and walks the

reader through his methodology. I would tend to agree as the average mortage and other credit card interest payments to income is currently under 18.20% (see

http://www.federalreserve.gov/Releases/housedebt/default.htm) -- which indicates the average consumer in the US is NOT hurting by any means.

- All in all what is most interesting is that the total amount is manageable, as the total housing stock value is approximately $18-20 trillon, and value of

outstanding loans are approximately $10 trillon (according to Moody's). The defaults and losses will be spread over at least 5 years, representing in total

3% of total mortgage value (number from the study, although more like 5% taking into account other years) and losses at 1% of total mortgage loan value.

I assure you not in California. Once these houses go underwater and the loans reset everyone will walk. The payments are simply to high on these loans compared to income.

Your making a big mistake assume this will be like past housing busts when loans where not so out of proportion with income. Also at least in my area home equity loans are a big problem and its not clear that they are getting included correctly. So you will probably see up to 70% of the homes sold in the last four years in California go into foreclosure in addition you probably will see 10% of the homes sold over the last 30 years go into foreclosure because of HELOC's.

This I expect to play out over the next three years for the first wave say about 30% and the next 5 for the rest before it finally ends.

Also a lot of the HELOC money was used to buy speculative properties in California and other states all over the country so a lot of these California foreclosures will cause multiple additional for closures in other states and even a lot of homes in Canada and Mexico.

Of course its different in California.

Ok, one more estimate of the size. Stratfor had an interesting article on the subprime issue yesterday, comparing the current mess with the Savings and Loan mess of the early 80's:

"Federal Deposit Insurance Corp. estimates that the total amount of assets involved in that crisis was $519 billion. Note that these are assets in the at-risk class, not failed loans. The size of the economy from 1986 to 1989 (the period of greatest turmoil) was between $4.5 trillion and $5.5 trillion. So the S&L crisis involved assets of between 8 percent and 10 percent of GDP. The final losses incurred amounted to about 3 percent of GDP, incurred over time."

The current amount of subprime loans out are between $500Bn and $1.2Tr (estimates from Reuters and NERA, respectively). This comes out to 3.8% to 9.1% of gdp. On the basis of these numbers, the current subprime problem can be compared to a smaller version of the 1980's SNL crisis.

I don't think you quite understand the problem.

In California maybe 10-20% of ALL buyers bought a house they could afford to make payments on. And this does not include how many of these are involved in "flipping" most of the flipper that drove up prices in other markets are from California.

What you need is how many people bought with 20% down and a debt/income ratio of 5 or less over the last 5 years in California and further did not try and flip houses or HELOC.

This gives you the number of buyers who won't be underwater with a 20% reduction in prices. Considering that for values to return even to high California income/home ratios of about 5/1 vs the standard of 3/1 for the rest of the nation we have to see a price cut of about 50% the only ones who would make it out at the end at ZERO are the ones that paid 50% for their homes. So tell me how many Californians did that ? Everyone else in California that was involved in the recent bubble either through a HELOC flipping or crazy loan will be underwater and generally way beyond their budget as the ARMS reset.

A 100% rise in home prices that takes the ratio of price to income from already high 5/1 to 10/1 is going to be a absolute bloodbath. And again a lot of these people have ARM loans on multiple homes across the US. And again you have to know how many with good credit "liberated" all of their equity in California. Most of the sob stories in the local paper are about people that have had homes for 10-15 years that HELOC'd themselves into foreclosure.

So for California its armageddon and certain because of the flipper houses to hit other states.

What you need is how many people bought with 20% down and a debt/income ratio of 5 or less over the last 5 years in California and further did not try and flip houses or HELOC.

One. Me. A thirty year fixed at five and a eighth. It would still be at a debt/income ratio of 5 or less if I wasn't laid off.

All the people I knew in CA that listened (about 75%) bailed about 2 or 3 years ago. Originally I thought that it was the safe move while leaving some money on the table.

In retrospect it turned out to be a good move.

The ones that want to bail now aren't going to need much luggage.

Richard Daughty doesn't see it that way:

And what should be clear from Stoneleigh's article is that we are not talking about a subprime or even a mortgage issue here. That's nothing more than the first pimple in a 7-year adolescent acne hell.

Subprime loans are important in that they were the vehicle that provided a large part of the leverage for building a zillion new homes, and corporate buy-outs, and home price rises, and equity withdrawals, etc etc. It's precisely that leverage that wasn't there 25 or 10 years ago, and that makes this malaise so much bigger and different. Subprime falls, everyting falls. The inverted pyramid. S&L could fall on its own. This is 100 times bigger. Leverage.

This is an all-out complete credit and finance crisis. Neither S&L nor LTCM were that vast. Not even close. Just look up US personal and federal debt numbers, then vs now.

To wit: look at what's happening to the Leveraged Buy-Out market. It's dead.

Nothing subprime, nothing housing necessarily. Just credit crunch. If people feel better believing that this is not the case, go right ahead. But comparisons like the S&L one fail on just about every point by now, already.

And the horse hasn't even left the barn, it's just flaring its nostrils.

Stoneleigh,

Thanks for your hard work! But, I don't mind telling you that its terrifying, it looks like the bottom card in the house of cards has been palmed, and its all tumbling down. I sure hope the powers that be can hold it together, but I'm suspecting that it can't because of the worldwide dispersion of our debts, between China and the OPEC nations, a least 2 trillion dollars in debt instruments is in the hands of countries that love us not.

They may not foreclose because then all that debt becomes worthless, but they sure won't lend us much more, except as extensions of the interest on the loans. Its like we have become an IMF basketcase country, and our spending is going to come under control no matter what. It may be the end to the war, to social security, to our military's money, to everybody's pension and 401K.

This has tipped me over. I thought George W. Bush was the second worst preident after Franklin Pearce because Pearce allowed the Civil War to happen. If we have now become a nation that can't even defend itself, Bush is the now the worst.

For your entertainment:

http://www.bartcop.com/posters/hi-rez/worst-president-ever.pdf

That would be great news if the US couldn't sustain its military. (At least we, the others, would be safer.) But I really doubt that'll happen.

It is way more likely that your government cut civil spending and sends the country into a much bigger recession just to keep the military running.

A military weak USA would not make me feel safer.

What for coal to liquid schemes as the troubles grow. The airforce will take it hard - 80% of the military's fuel use is their stuff.

SacredCowTipper

Kerosene is a product of coal gas manufacture and was first made from coal, kerosene from petroleum is a substitute. Don't worry, jet fuel isn't going away. The planet may die because of global warming, but the US will still be able to distroy it with nuclear weapons. Does that make you feel safer? (source, Wikipedia article on coal gassification) Bob Ebersole

Well, military power in the hands of the adventuresome Bush administration does not make me feel safer. The same in the hands of an administration that qualifies as a rational actor in terms of foreign policy would be a better thing. A nice, slow motion slide in the use of military force until we're back to cavalry would be better but ego and circumstances would seem to place this out of reach.

Magnus, I am truly ashamed for you, to see you write this.

You are a SWEDE, for heaven's sake. And, apparently (and thank God) not a representative one.

I might also say that some tens of thousands of your forefathers joined the Waffen-SS to fight for Hitler. Hey, it's not that much of an insult. My own grandfather died fighting for Hitler, but he at least had the excuse of being German, and your people weren't even occupied by Nazi Germany at the time. (Apparently the Wiking division has next to no war crimes to its name).

Old habits die hard, huh? Any old Fascist will do?

A militarily weak USA? It already exists (and in truth always has done).

Please wake up. Someone who lives in the land of actual military genius (Gustavus Adolphus, anyone?) ought not to be trembling about the vanishing of a largely imaginary US military power.

Franz--

I'm a U.S. service academy grad and ex-officer, so please don't accuse me also of being fascist because I think that a militarily weaker U.S. would not be a bad thing. Say what you want about an alleged 'imaginary US military power', but a lot of people are dead, maimed, or homeless by its actions. I doubt they thought it was imaginary. I do believe in a strong defense from actual threats; I don't believe in power projection for the sake of maintaining an unsustainable lifestyle.

Sweden had quite a run after Gus invented the mobile cannon. Eventually 100 million Soviets figured out how to overwhelm 8 million Swedes.

200 million Soviets figured out how to overwhelm 100 million Germans. We let them march to Moscow and then watch the mercury drop. Let's see how much good those tanks will do them when the temperature is below the cloud point of diesel fuel. Wonder how well a horse drawn supply line works when it is 55 below.

Nitpick here... I believe the panzer tanks had gasoline engines. The Russian tanks had diesel engines which added to the problems the Germans encountered. They took over fuel depots left behind by retreating Russians only to find lots of fuel they couldn't use.

Yes, but the Germans had captured a lot of diesel powered Russian tanks. :>)

USA has been in better shape, Americans were once the realy good guys. If you dont take care of your democracy, economy and infrastructure we will instead get a world that might be dominated by Putin:s Russia or China. The best to hope for then is EU and India.

The instability alone after a US downsizing would make lots of transactions more expensive and could initiate arms races and so on.

Our biggest shame during WW-2 was to allways trade with the dominant power in exchange for some goods and not being invaded. The nazi war machine used lots of swedish iron ore, lumber and industrial products.

That some people got the dumb idea to travel to nazi controlled areas and volunteer to join the nazi military where their personal decision and not government policy. The government policy where to forbid open recruiting on Swedish soil and that people could do whatever dumb thing they wanted with their lives after leaving Swedish territory. There were Swedish volunteers on all sides of probably every conflict before and during WW 2. Those who fared worst were probably those who volunteered for Stalins Sovjet who were tortured and sent to gulag to die as spies. The nazis were unfortunately intelligent enough to use the volunteers.

The foreign debt can be handled. We can simply print out however much money we need and ship to the foreign countries in 747s.

Of course, from that point on, we will need to run a balanced budget, produce all products we need internally, and pay for all imported commodities with gold, silver, euros, etc. Personally, I think it is a great idea.

I think we should wipe all private and public debt, pay off foreign debt with printed money, then go back to the gold standard. I bet the average person would come out the other end of that operation in much better shape.

I love this. Back in the 70's, 80's and 90's Africa was going to the wall paying back loans the IMF made.

I think the US should be similarly forced to the wall.

How convenient now that you are all messed up with debt it should all just be forgiven.

Then what happens to responsible people who have a small apartment or are renting? What happens to the speculator with 12 properties does his debt just get wiped and he owns that property.

It's a mess pure and simple. They should have allowed proper recessions and redistribute wealth in the form of wage increases to the middle class. Not the idle losers at the top and bottom.

Fools. You lent to us in our own currency. We can print as many dollars as we want. "Africa" went to the wall paying back the IMF loans. The bigmen in charge had already stuck the money in their foreign back accounts. Why would they care?

http://reddit.com/info/2f4yb/comments

http://digg.com/business_finance/The_Resurgence_of_Risk_n_A_Primer_on_th...

If you are so inclined...

Thanks Stoneleigh for your very clear and insightful writing on a very confusing subject.

I tend to agree with your opinions and conclusions, however, I've heard all this before. This has been the doomsday scenario since Nixon closed the gold window in the 1970s. And each time we approach the precipice, disaster is averted and we go into another growth cycle. So even while I agree that there is a wolf outside somewhere, how do we know it's at the door this time?

My question is: do you think it's possible that we'll avert this disaster once again, or do you think it's a sure thing?

While I don't look forward to the hardship that these problems will cause me and many others, I think it's better to clean house now because it will only get harder to recover in the future. On the other hand, maybe it's not possible to recover if we slide too far now, so it would be better to send in the helicopters and continue as long as we can.

-Don

I think the credit expansion has essentially reached its limit - the point at which efforts to restore liquidity are about to be over-run by a stampede for the exits. I don't think the helicopters can help, although they may well be able to make things worse....

Being a reader of the author Kevin Phillips, I can’t help but feel that in a way this has happened before, to complicate the situation of people of the United States, the U.S. is in the same relationship with China that the British were with the U.S. a couple hundred years earlier. That is, “offshoring” hollowed the British Industrial Revolution too.

Quite so. I covered this point in March in an article called Entropy and Empire.

This article represents a good overview of credit market issues.

Combine those issues (which are systemic and not going away) with the advent of Peak Oil (or Social Security/Medicare insolvency which are other systemic problems).

That's the point where we will find ourselves unable to avert disaster.

Neither politics nor industry is forward looking enough to handle Peak Oil. "Profit Today" is one of the mantras that will bring us down.

Sure enough, in the past, we could grow again.

But this time may be different, if we remember that our mission is Peak Oil analysis and note Ace's forecasts.

This fall will put a NAIL in this coffin. We are looking at a global shortage of 3.5MMBPD starting in 4Q07 into 1Q08...and it never improves from there on out.

So I think a new bubble ISN'T possible...although they will TRY.

Hello Stoneleigh,

A very interesting article. Thanks for putting it together. What is your evidence for the statement that "since the 1990s, the Fed has deliberately shepherded reserve requirements down, essentially to zero, through dropping required reserve percentages, reducing the categories of funds needing a reserve and allowing funds to be swept from a reservable category to a non-reservable category overnight"? As far as I know US banks capital adequacy ratios are still around 10% - ie they maintain $1 of capital for every $10 of loans (and deposits, in aggregate) - I didn't think that this had changed signficantly in the last 10 years.

Secondly, does the "household cash less liabilities" chart include mortgage debt? I would assume not, since the total mortgage market in the US is around $10 trillion. But then it's hard to believe that it is purely personal and credit card debt. since $3500 billion is more than $10,000 per person????

Regards,

Cuchulainn

See what the Fed itself (PDF warning) has to say about reserve requirements and the use of sweep accounts. The section on the recent history of reserve requirements is page 42-44.

See also Mish's commentary on reserve requirments (under the heading Massive Surge in Sweeps).

That Fed article is absolutely fascinating, thanks for the link. (Warning - for severe financial nerds only).

I particularly liked the bit on page 43 where they admit that reserve requirements were cut in 1990 to stimulate borrowing after the S+L crisis and uh..... they've kinda forgotten to raise them since. The paragraph after that makes the point you were making about 'sweeps' and how they allow banks to not hold reserve requirements against what are (ostensibly) deposits. The chart on that page (44) does indeed show a huge drop in the amount of reserves banks hold at the Fed. That is new to me and very very interesting indeed. Thanks alot for the link to the article.

Cuchulainn

There is speculation (front page Financial Times yesterday) that the ECB is going to ask the Fed for a currency swap.

Interesting recent info:

* The ECB has injected much more liquidity than the Fed recently

* Indications are that European (and Asian) banks were the primary purchasers of subprime debt

* One banker in the FT article said "Don't show me anything east of [New York] 212-area code. If you lend to those banks it could be a career ending experience."

And this fairly recently:

(Financial Times, page 1, Aug 2) “The rescue of IKB, a specialist lender based in Dusseldorf, began on Sunday when Peer Steinbruck, German finance minister, called leading banking executives to discuss a bailout. According to people who took part in the conference call, Jochen Sanio, head of Germany’s financial regulator, is said to have warned of the worst banking crisis since 1931.”

It certainly seems like the losers are going to be in Europe.

Many seem to have ignored the real estate boom in Europe and China. While the US has problems, they are in the main isolated rather than general, and the average house on the average street in Des Moines isn't that far from normal multiples of income.

This debacle will, hopefully, trim the markets down to something approaching reality in time for the real shocker of inability to print oil comes down.

Somehow I get the sense that there was a lot of money looking for a home, probably as a result of the profit from the wage differential between China and 'us'. It should have gone into solar thermal instead of McMansions. So much for the invisible hand, which seems to have been picking its nose.

I have no good guess who will fare better, but housing in the UK is a different issue to the US. We have a massive housing shortage, and very old stock. So I can't see the price dropping in free fall.

My guess is that all western assets will end up being owned by arabs and Russian mafia

http://www.bloomberg.com/apps/news?pid=20601039&refer=columnist_lynn&sid...

True, the rise in prices beyond normal wealth is bizarre. There is a feeling that lots of property is bought as 'portfolios', maybe some by overseas investors. We will have a crash of sorts, but it wont be due to too many houses

You have a bit of misconceptions about the housing bubble.

Two of the area's with the greatest gains where Massachusetts and Southern California in both areas cheap land is not readily available. Note I did not say no land or that their was not plenty of land just its not particularly cheap. So builders hesitate to tie up a lot of money in land speculation. At least in normal times. But in both places they built thousands of houses during the boom and both will suffer massive price declines. Mass is very close to England in its housing offerings but this does not prevent it from crashing.

The critical factor is pric if your customers cannot afford your product then either you go out of business or lower the price. You don't have a housing shortage if no one can afford a house. I've heard their is a massive Lamborghini shortage in Southern California so even though I'll never buy one I'm confident that prices will remain high even if Lamborghini has to go out of business to ensure it gets the price it deserves.

So just substitute Lamborghini for a house and the arguments are obviously nonsense.

I think the difference is Europe is more transparent than the US about its current financial condition. And yes they have problems but they at least seem to be working to correct them.

I feel EU does not quite have all the insider ability to manipulate problems like the US and worse Japan. So yes I think early on it will look worse but the US will not only surpass Europe but lap it a few times before this is over.

What's special about the ECB interventions the past week is the size: closing in on $300 billion. What's special about the Fed interventions is somewhat different.

Interesting that mises.org focuses on the Fed saying in that same article:

"While the purchases are only temporary — the cash must be returned by Monday — one wonders how long before the Fed grants itself the power to buy MBS permanently."

I can quote something from the WSJ:

"That the ECB flooded the market with liquidity is both interesting, and understandable, given that the ECB doesn’t have Lender of Last Resort (LLR) powers. What should have happened (and this is still a missing piece of information) under the current arrangements within the European system of central banks is that BNP, or any other bank experiencing a liquidity problem, should have had access to its respective central bank’s Lombard facility. But the ECB stepped in ahead of the national central banks."

So why is mises so obsessed with the Fed? Who's out of bounds already? -- not the Fed.

They've always been able to purchase mortgage backed securities (backed by the Macs).

The Fed clarified this in an August 10th press release:

http://www.newyorkfed.org/markets/operating_policy_081007.html

But that was just a clarification, there have been several mortgage backed repos this year prior to the recent ones (search for "mortgage"):

http://www.newyorkfed.org/markets/omo/dmm/temp.cfm?SHOWMORE=TRUE

The requirement is backing by a federal agency, so mortgage securities backed by the Macs are acceptable.

It is scary that the Fed can expose itself to this type of debt, but the Macs have higher requirements than other lenders (so sub-prime lenders have no where to turn).

Thanks for putting that together. Good piece of work that will come in handy for reference.

Wealth is measured in its future usefulness. Money is only as good as the Perception of future value (Inflation is the difference between tomorrow's perception and today's perception, or today's receipt and your perception of tomorrow's value).

Gold is good as long as there are valuable commodities which it can be traded for, or resources available to meet the basic needs of the populations. Once the System of Energy-based specialization breaks down, value can no longer be assigned nationally, and will be determined locally, depending on hunger levels.

The best course of action would be to immediately begin some kind of a Descent plan for consumption restriction. Apparently, we can't do that unless we start a bigger war first. Do we want to find out how bad a president can really get (well, a vice-president, actually)?

"If you want Change, keep it in your pocket. Your money is your only real vote."

Stoneleigh - thanks very much for this excellent, well written piece. Its one of those pieces where I understand most when reading - but am still left grappling to understand the whole.

Your description of how risk has been "sliced and diced" - explains a lot. In developing these instruments the banks did indeed reduce their exposure to risk - and of course their response to that was to expand their risk taking behaviour to compensate.

One of the best metaphors for risk I have come across is a car with a 12 inch spike sticking out of the stearing wheel aimed at the drivers chest - arguably a very safe car where serious risk is obvious to see, and behaviour will be adjusted accordingly. Compared with a 4 wheel drive, bouncy castle fitted with abs etc - which folks drive at absurd speeds with the feeling of invincibility.

It seems the banks have concealed risk and passed it on, whilst greatly increasing the risk profile of the whole system.

It is also clear that regulation has gone out of the window where the banks sell on the risk to widows and orphans - and as you say the ratings agencies seem to be failing the sytem.

One bit I didn't grasp was the inverted pyriamid - how does one poorly secured mortgage prop up several more?

You mention October. In the UK, fixed interest mortgages have been popular for many years - x% for y years. This blunts the interest rate lever as changes in interest rate do not feed through to indebted consumers immediately. I seem to recall that their is a tranche of fixed interest debt comming up for renewal in the UK this October. In the good old days when you repaid capital and interest, interest rate rises were de-geared. If you are sitting on a fixed rate, interest only mortgage pitched at 4 * family earnings in the UK - you are probably in for a miserable Christmas.

The UK government has let house price inflation rip - and our now trying to devise schemes called "affordable housing" - 10% interest rates I imagine will create ample amounts of affordable housing.

The one crucial point where I find it difficult to agree with what you say is the deflationary conclusion. Whilst your explanation and logic seem sound, deflation with all this debt would preclude that the debt ever gets repaid and this will lead to total system failure. So I suspect at some stage, the central banks will just continue to pump in money resulting in inflation and the inflating away of both consumer and national debts. Deflation first, followed by inflation.

A mortage is an asset to the mortgage issuer (or more precisely to whomever the mortgage has been passed on to by the issuing bank). Leveraging that assetthrough credit expansion can provide the capacity to make other investments, perhaps in other mortgages. The credit-worthiness of the poor sod at the bottom of the pile unerpins a much larger credit structure.

I think system failure is indeed a risk. I think we will see margin calls where those at the top of the inverted pyramid try to press their claims on those beneath them. Most claims would go unpaid as there simply isn't enough real wealth to cover more than a tiny fraction of the outstanding claims on it, but that doesn't mean they won't try. I expect to see loans called in, and for much of the asset base now nominally owned by the middle class (actually owned by their creditors) to end up in other hands as those debts come home to roost.

As you say, I think we face credit deflation first, then inflation (hyperinflation in fact). Credit deflation is an enormous hurdle to cross first though. I would expect it to ravage the global financial system and eventually cut off international capital flows for perhaps a long period of time. Isolated national economies no longer at the mercy of the international bond market would almost certainly inflate their currencies (in a hyperinflation rather than a credit hyperexpansion) while trying to keep national 'body and soul' together.

My WAG for a timeline would be credit contraction (deflation) and depression in mutually reinforcing downward spiral for perhaps 10 years (at a minimum I would think), and localized hyperinflation beginning some time after 2020. Energy will, of course, be a large part of how this plays out in practice. Initially, energy prices should fall with purchasing power and a fire-sale of assets as everyone tries to cash out. That might not last for long though, as a global resource grab (neo-mercantilism and gunboat diplomacy) could deal a crushing blow to supply. We live in interesting times (in a Confucian sense).

I'm sure someone has used the term 'laundering' to describe this. In the underworld, especially the drug world, one 'launders' cash to make it seem legitimate. We have a much worse phenomenon here of 'laundering' credit to make it seem worth trading. Once it is laundered, it is used as any other monetary equivalent, even though there might be virtually nothing backing it up. At least a drug lord's laundered money is worth something!

For years, industry insiders and so-called experts have proclaimed the virtues of slicing, dicing, and repackaging risk. They waxed on about how borrowers and savers, and society as a whole, could only benefit from such machinations. They suggested any sort of exposure could be disbursed and dissipated to the point where it essentially disappeared. Some even claimed that the crises of the past would no longer exist.

And dilution is the solution to pollution.

Yeah, right.

Why is it that the folks who are most focused on the dynamics of money, wealth, and value seem to be the most willing to drink the koolaid at every turn, and keep forgetting that TANSTAAFL?

Interesting piece. Long story short. It went up. It will go down. It always has. it always will.

It's just that nowadays, we have a bunch of educated twits who cannot accept the reality of market declines. The solution? Get on the web and howl.

Good day.

RC

Stoneleigh,

I would argue that you have made a glaring omission in this summary. Namely, the role that China, Japan, and the members of the GCC have played in the liquidity bubble of the last decade.

Monetary policy influences the economy through four "channels." First is the money or interest rate channel of monetary policy influence. Higher interest rates raise the cost of funds which has adverse effects for home buying, consumer spending, and business investment. Second is the credit channel, which acts alongside the interest rate channel. Tighter monetary policy leads to a reduction in the supply of bank loans due to increases in perceived risk. Third is the wealth channel. Higher interest rates tend to lower the value of bonds and stocks, which lowers household net worth, leading to a weakening of consumer spending. Last is the exchange rate channel. Higher interest rates tend to strengthen the dollar, leading to a decline in the competitiveness of American products. Through the combined effects of these four "channels," monetary tightening leads to a slowdown in economic activity.

However, when the Fed tightened monetary policy 17 times between 2002 and 2006, raising interest rates from 1% to the current 5.25%, all of the above channels were essentially clogged due to the enormous and sustained purchases of U.S. debt by foreign central banks. There was no effect through the interest rate channel, since even as the Fed Funds Rate was increased, mortgage rates and other long term rates continued to decline, allowing households and businesses to continue their borrowing binge. There was no effect through the credit channel, since loans became far more available, rather than less available, as banks continued to relax their lending standards to both households and businesses. There was no effect through the wealth channel, since both stock and bond markets continued to soar (as well as real estate prices) leading households to feel more, not less, wealthy. And there was no effect through the exchange rate channel, since the dollar weakened considerably throughout the period of Fed interest rate hikes, leading to increased competitiveness of American goods, rather than decreased competitiveness. This was Greenspan's "conundrum."

In short, during the 2002-2006 period, the Fed became impotent, but instead of admitting, "I can't get it up," Greenspan declared that there was a, "conundrum." The enormous U.S. Financial Account Surplus (foreign central bank purchases of U.S. debt) is the mirror image of the enormous U.S. Trade Deficit. As long as the Trade Deficit exists, the Financial Account Surplus exists. And as long as both of these exist, one can argue, the world will be awash in credit. As Michael Pettis states on his China Financial Markets Blog,

By ignoring the true origin of the current liquidity binge, the U.S. Trade Deficit with the world, and placing the blame instead with the Fed, you are hiding the very real possibility that this liquidity binge may well continue after a brief, temporarily painful, setback. After all, the root cause of the liquidity and credit bubble, the U.S. Trade Deficit with the world, is still as strong as ever.

To your point wHoOps,

The Japanese monetary base has been allowed to double over short periods (i.e.: less than three years) three times. The last one from 2001 to 2003 -- that's 26% per year. That makes the Fed look like a bunch of sissies!

I doubt if the US consumers of last resort will be purchasing much from overseas for much longer. IMO their purchasing power is about to be abruptly cutailed. The exporting countries are going to end up with a huge overhand of productive capacity compared to much reduced demand.

Essentially, I think China is where the US was in 1929 - on the verge of a depression due to over-building almost everything and accumulating a massive pile of bad debt in the process. I think they're about to experience a set back at the begining of their emerging hegemonic dominance, as the US did and other emerging powers before them. I would argue that the US is where Britain was then, without the prospect of the cheap energy that cushioned Britain's fall from empire. I discussed this point in Entropy and Empire.

Stoneleigh says

" I doubt if the US consumers of last resort will be purchasing much from overseas for much longer. IMO their purchasing power is about to be abruptly cutailed. The exporting countries are going to end up with a huge overhand of productive capacity compared to much reduced demand.

Essentially, I think China is where the US was in 1929 - on the verge of a depression "

So are you agreeing with Whoops that the (your) deflationary scenario is dependent on china crashing?

Also the US consumption decreasing I guess is housing problems slowing the US economy.

BTW fascinating , great job on the financial issues.

I don't agree that my scenario depends on China crashing, although I think China will see a crash and that will make any kind of recovery much more difficult. I very much think that the liqidity crunch will be global. An awful lot of the financial 'toxic waste' ended up in Europe and Asia.

This article is a remarkable analysis of the current crisis. The author shows in an extremely clear way the complex interactions of real estate crisis + credit risk crisis + hedge funds strategies + credit derivatives bubble.

This is dynamite!