EROI Update: Preliminary Results using Toe-to-Heel Air Injection

Posted by David Murphy on March 18, 2009 - 9:27am in The Oil Drum: Net Energy

In August 2007, a post titled Extracting Heavy Oil: Using Toe to Heel Air Injection (THAI) introduced readers of The Oil Drum to a technology for producing an upgraded extra-heavy oil from Alberta Tar Sands without the environmentally messy and energy-intensive surface mining procedures that currently dominate extraction. The post provided a first-look at producing and partially upgrading Alberta bitumen in situ. In this post we make preliminary estimates of the Energy Return on Investment (EROI) of the THAI process.

In August 2007, a post titled Extracting Heavy Oil: Using Toe to Heel Air Injection (THAI) introduced readers of The Oil Drum to a technology for producing an upgraded extra-heavy oil from Alberta Tar Sands without the environmentally messy and energy-intensive surface mining procedures that currently dominate extraction. The post provided a first-look at producing and partially upgrading Alberta bitumen in situ. In this post we make preliminary estimates of the Energy Return on Investment (EROI) of the THAI process.

The Alberta Tar Sands continued to garner interest through the first half of 2008 because of declining conventional oil production in Canada, the apparent success of the Steam Assisted Gravity Drainage (SAGD) process and the increasing price of crude oil. Today they are still of interest as the countries of North America (and around the world) desire cheap, abundant crude oil from politically stable regions (See Unconventional Oil: Tar Sands and Shale Oil - EROI on the Web, Part 3 of 6). However the subsequent financial collapse during the second half of 2008 has caused many tar sand projects to be deferred. In fact, Canada's oil-sands industry has hit the skids, spreading a deepening gloom over Alberta's economy, and to some degree, across the country. Some expansion projects that were under way in the Fort McMurray region have been put on the shelf, as oil companies slash their budgets to reflect the new economic environment in which they operate – that is – a world of lower oil demand and, at least compared to the summer of 2008, low oil prices.

The environmental benefits that the THAI process appears to offer include lower water and natural gas requirements, and a smaller surface footprint when compared to similar extraction technologies used in the Tar Sands, e.g. SAGD. However, in August of 2007 when the first post on The Oil Drum was written, there had been only about one year of pilot operating experience, and the news from the Whitesands Project cited problems with sand contamination in the extracted bitumen.

Can the Alberta Tar Sands Help this Situation?

In December 2008, with over two years of pilot operating experience from the Whitesands Project, the operator Petrobank filed an application with the Alberta Energy Conservation Resources Board (ECRB) and Alberta Environmental for the construction and operation of a 10,000 barrels per day (bpd) THAI commercial facility, called the “May River Project Phase l” (see here and type in permit application number 1600065 – warning: large files). This is of particular importance from an EROI perspective because the documentation accompanying the permit provides the opportunity for an energy performance review of a proposed commercial THAI facility based on actual operating data from the Whitesands Project. Our attempts to acquire more detailed information directly from Petrobank were denied.

In this post a retired oil refinery engineer and TOD member “daveinmarinca” and EROI Guy review the project facilities design and energy performance with the goal of establishing a preliminary EROI for the THAI process in Alberta. Daveinmarinca is an arms-length investor in Petrobank Energy and Resources Ltd., the company that patented THAI™, and otherwise has no ties with the company. We intend for this post to be an objective and academic analysis.

A Brief Review of- and Updates to- the THAI process

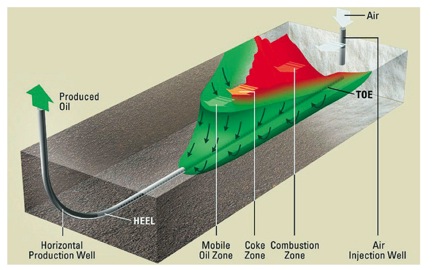

We review here the THAI process; for a more detailed review please visit the original post by Gail. The THAI process utilizes well pairs consisting of a vertical air injection well and a 700 meter horizontal collection well (Figure 1 at the top of this post). First, the vertical air injection well is preheated with steam. Next, compressed air is injected and oxidation (i.e. combustion) is initiated to create the “mobile oil zone”. In effect some of the bitumen is burned to give heat and mobility to adjacent bitumen. As the hot bitumen drifts downward and down slope it transfers heat to other bitumen, causing that to be fluid too. As oxidation and oil production proceeds, a broader combustion zone is established until the well reaches its production capacity. Each well-pair at the Whitesands Project had a thermal-hydraulic limit of 555 bpd per well.

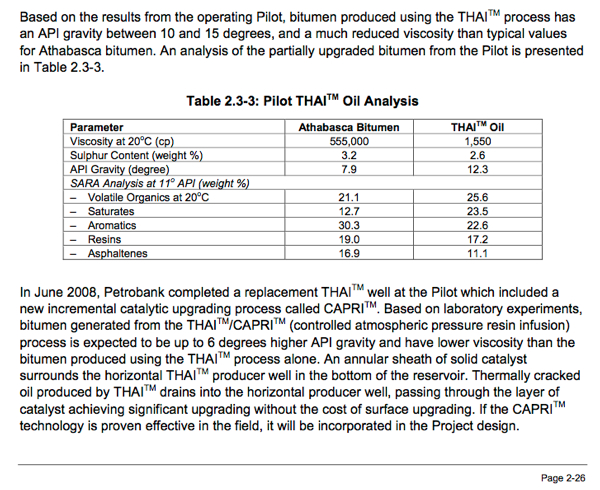

Table 1 (below) lists the physical properties of the virgin bitumen and the THAI oil analysis at the well-head. According to Petrobank, the thermal cracking in the reservoir, which is an inherent feature of the THAI process, reduces the viscosity, sulphur content and asphaltenes while increasing the API gravity and lighter hydrocarbon elements. This results in a lighter, higher quality product that is easier to refine than the in situ bitumen and requires less diluent for shipping.

Preliminary Estimates of the Energy Return on Investment for the production of bitumen using THAI

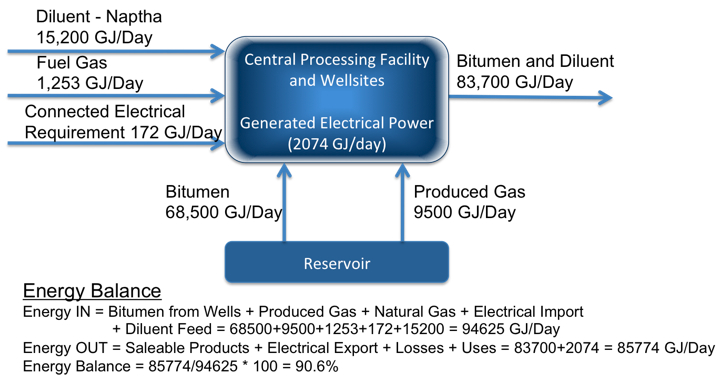

The permit application includes an energy balance from which we can make coarse estimates of a range of EROI values that we might expect from the THAI process (Note: 1. All the permit performance numbers and the EROI analysis are based on Whitesands THAI performance without CAPRI™ as provided in the project permit documents – CAPRI is not discussed in this post. 2. The diagram below was re-created from the files submitted by Petrobrank in order to increase clarity. For the original diagram please see the permit application linked above).

The “energy balance” as calculated by Petrobank is 90.6% implying we think that for every ten units of energy taken from the reservoir 1 unit is used up in the process. This is not an EROI calculation, rather it is an assessment of the efficiency of the Central Processing Facilities and Wellsites. In other words they calculate that 94,625 GJ/day flow into these facilities and they produce 85,774 GJ/day of products, for a conversion efficiency of 90.6%.

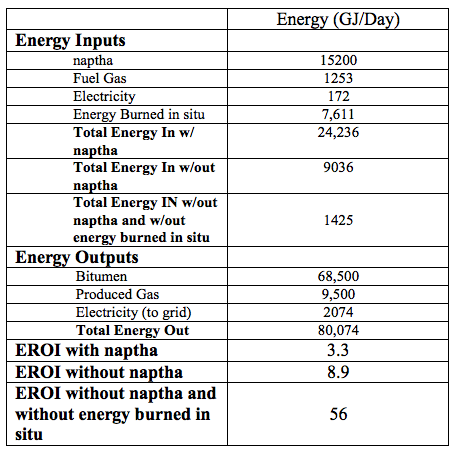

We calculate somewhat different numbers, and our preliminary EROI for the THAI process is between 3.3:1 and 56:1 (Table 2 - below), depending on the input energy allocated for naptha (diluent which is generated from outside the immediate system, usually during the fractional distillation of oil) and the amount of input energy allocated to the bitumen burned in situ. The estimate of 3.3 includes as an energy cost 100% of the energy content of the naptha and 100% of the energy content of the bitumen burned in situ. The estimate of 8.9 excludes the entire energy cost of naptha, assuming that it is recycled, and the estimate of 56 excludes both the cost of naptha and the cost of the energy burned in situ.

Table 2. Various preliminary estimations of the EROI for the THAI production process.

Asssumptions:

One major assumption in the EROI calculation is that the input energy allocated to the bitumen burned in situ (combustion zone) is only 10% of the original oil in place. This amount is as close of an estimate as we can make from the reports filed by Petrobank. If this 10% is correct, then the total amount of recoverable oil in the system under study is 76,111 GJ/day (68,500 / 0.9), which would mean that the energy burned in situ is 7,611 GJ/day (76,111 - 68,500).

Another potential issue involves the air injected into the combustion zone. After the first post on THAI we learned that in order to maintain combustion below ground the concentration of oxygen in the injected gas must be increased. We have read nothing on the permit application indicating that this is the case at Whitesands, so we assume implicitly that these costs either don’t exist or have been incorporated into the costs associated with the central processing facilities and well sites.

Discussion of EROI estimates

There are three complicating factors that become immediately obvious when calculating the EROI for the THAI process.

First, the energy content of the naptha is quite large, yet this GJ amount is not burned or used in any way aside from decreasing the viscosity of the bitumen so that it may be shipped via pipeline. Clearly there is an energy cost associated with both the physical mixing at the processing facility and subsequent separation at the refiner, but this, presumably, will be less than the energy content of the naptha itself. Consequently, if we assume that the cost of the physical mixing of bitumen and naptha is included in the costs of the process facility, and exclude the separation costs at the refiner since the boundary of this analysis is the central processing facility, then the appropriate EROI estimation for the THAI process is 8.9:1.

Second, and perhaps an issue that is more contentious, is the energy value assigned to the bitumen burned within the “combustion zone” of the THAI process. The THAI process according to Petrobank uses the heat energy released from the oxidation of a portion of the original bitumen in place to thermally crack the remaining bitumen, lowering the viscosity and, it seems, increasing the quality (API) of the bitumen that is extracted. Since this bitumen is already in the ground and cannot otherwise be used, and there is no additional financial or energy cost to attain it – it is essentially “free”.

There are three reasons, however, as to why the energy cost of the bitumen burned in situ should be included in the EROI calculation. A) There is an “opportunity cost” of the bitumen burned in situ. By burning this bitumen in the combustion zone the opportunity to develop it at a later time by some future technology is lost. B) The THAI process does not work without the heat energy provided by the exothermic combustion of bitumen. So even though this bitumen comes at no additional “cost” to the firm, it still acts as an energy input to developing the bitumen. C) There are various environmental costs that occur, such as the carbon dioxide produced during combustion. As a result, we include the energy of the bitumen burned in situ as part of the energy input to the THAI process in our base case. However, we have no unequivocal position on including or not this energy input.

Third, the bitumen shipped to the refinery is still far from “light, sweet” crude oil and needs significant refining if products other than asphalt are desired – i.e. gasoline. About 10% of the energy content of a barrel of “standard” oil is used in the refining process (Szklo and Schaeffer, 2007), and we would not be surprised if that number were higher, maybe much higher, for the bitumen produced at Whitesands. Furthermore, if the system boundaries in this analysis were extended to include the refinery and all costs until the end-user (i.e. the person at the gas station filling up their gas tank), the EROI would decrease substantially. For example, Hall, Balogh and Murphy (2009) calculated that the EROI for oil extraction in the U.S. decreased by about two-thirds of the original EROI once they included the downstream energy costs, including: refinery costs, non-fuel products, transportation costs, and use infrastructure. Therefore it is reasonable to say that the EROI for the THAI process might decrease by about two-thirds if gasoline is the desired product.

An additional cost we were not able to consider is the infrastructural cost for the air supply (e.g. vertical wells) or extraction systems (e.g. horizontal wells). We assume that all significant operating energies are covered in the above table.

We conclude, based on this preliminary analysis that the THAI process appears to represent a somewhat better process to recover “oil” from tar sands than other above ground methods, as previous estimates of the EROI from surface extraction of Tar Sands have been around 5:1. The highest estimate of the EROI of the production process using THAI is 56:1, while the lowest estimate is 3.3:1. This is clearly a large range, but it is up to the reader to decide which number is most appropriate. We believe that even though the oil burned in situ is “free” in the financial sense, it is a required energy input to the THAI process and, from this perspective, this energy should be included in the estimation of EROI from THAI – resulting in an EROI of 8.9:1, which is an improvement over other tar sand extraction processes, such as SAGD. We welcome additional data and contrarian or other comments.

Author’s Note: We would also like to mention that EROI analysis is just one of many important analytical tools or “lenses” through which we can view energy resources and technologies. As is the case with all quantitative and qualitative analyses, there are limitations to EROI analyses, and we at TOD: Net Energy are planning to discuss at length the limitations of EROI in the coming weeks.

Thanks David.

Here is a related post by Robert Rapier, An EROEI Review, which mentions brazilian ethanol from sugar cane having a similar, (but different) calculation problem to THAI. In that case the oft-cited EROI of 8:1+ is over-stated, because the bagasse is not counted as an energy input. Nor should it be, as it has very real energy opportunity costs (could be used for electricity, bio-gas, etc.) So that drops the EROI of sugar-cane ethanol to around 3:1. (in the first comment in that post there is a relevant graphic)

The case study above of THAI is different, because from the perspective of modern society that bitumen sitting underground has little realistic opportunity cost - heating in situ is (probably) it's best use. From that perspective the 56:1 number is 'realistic', though from a wide boundary systems approach, it only appears that high because the input is 'free' (of such low quality it is costless). In energy terms it is burning/accessing a fossil source 'quicker' at a cost of making its URR smaller - (one of problems of EROI is it treats renewable and fossil inputs as equal).

While 56:1 is very high, the 'energy gain' available to society would be limited to the # of joules/barrels of flow rate per unit time from this process. E.g. root vegetables have an EROI of about 30:1 but we can't get 86 mbpd of potatoes. Do you have any sense of the scalability of THAI? Can it be used throughout Athabasca? Also, you mentioned it uses less water than SAGD or mining - do you have any data on that?

Hi Nate,

My understanding is THAI™ can be applied where ever SAG-D can be applied. Alberta estimates the total resource at 1.7 trillion barrels. I'm guessing 1+trillion of the resource is a candidate for THAI™. It is also applicable to producing heavy oil with the same kind of recovery and upgrading performance. Saskatchewan has 21+ billion barrels of heavy oil. The first pilot in Saskatchewan will be a JV with True Energy/Kerrobert to come on stream this summer.

The scalability of THAI™ is confirmed in the May River Phase I application of 10,000 BPD of a 100,000 BPD project when fully developed. You can apply that to the entire SAG-D resource to get an idea of the significance of this development for North America.

The produced water is what I would call an industrial quality fresh water and is suitable for use by SAG-D operators. The information in the permit application states 2 barrels of water for every barrel of THAI™ produced bitumen.

In my opinion, the process will likely export electrical power to the grid as the available joules in the lean process gas are considerably in excess of the 25 Megawatts called for in the permit energy balance for plant utilities. In other words, the EROI will likely be greater than the highest of the three numbers calculated from the data in the permit. For this posting, we went with the data published. As this is the first scaled up commercial demonstration facility, I believe all the utility requirements are conservatively presented (larger than required).

Late to the party here this morning...thanks to google alerts for cueing me that the post is up :<)

Re: 100,000 BPD project

I`m having trouble estimating how much producing THAI wells that would represent. What is the nominal flow rate (net of water volumes) expected from a single producing well? is it 2,000 BPD/well?

"What is the nominal flow rate (net of water volumes) expected from a single producing well?"

555 BPD/well x 18 wells = 10,000 BPD partially upgraded bitumen.

I'm wondering if the process is capable of using the process gas from operating wells to start new wells. If this is the case, the limits on THAI are effectively removed. Surface mining and SAGD require natural gas to produce hot water and steam, but THAI supplies its own process heat.

I suppose the next step is to do on-site coking to upgrade the full product stream to something that requires no diluent.

"I suppose the next step is to do on-site coking to upgrade the full product stream to something that requires no diluent."

The next step is catalytic cracking in the reservoir to further upgrade the product to reduce/eliminate the need for diluent and this article gives a good overview.

WHAT LIES BENEATH

Poised to launch the CAPRI component of its in situ toe-to-heel air injection production technology, Petrobank aims to upgrade bitumen before it ever comes to the surface

http://www.oilweek.com/articles.asp?ID=601

Where does the 30:1 figure apply, is it large mechanized potato farms in Idaho, or is it postgrad student out intermittantly digging with shovel while working on dissertation?

That's because it's not an energy input for anyone outside the ethanol plant's walls.

How is this not EROEI 8:1 for society?

***

The problem here is that you're erroneously conflating two things:

#1 has an EROEI of about 13:1, while #2 has an efficiency of about 65%, and combining these two gives us the 8:1 EROEI of cane ethanol.

Think of it this way: suppose farming cane was EROEI of 100:1, but the conversion was only 8% efficient. This still returns 8 units of energy to society for every 1 unit it invests in the process, but your calculation would say it took 1 unit of farming energy + 92 units of bagasse energy to generate 8 units of ethanol energy, for a massive energy loss of 8:93. This scenario shows the error in your calculation more clearly: the calculation predicts a huge net energy loss (93 units -> 8 units = -85 units), when in fact there is a net energy gain (1 unit -> 8 units = +7 units).

Pitt - I disagree. That lignin could be used for something else. The above graphics show the same process (cellulosic or sugar cane ethanol) measured in two ways. The bottom diagram shows traditional EROEI = energy out / energy in. The top graphic indicates that the intermediate step biomass K2 (the bagasse) has an energy opportunity cost as it could be used for other energy uses. This 'loss' of availability has to be considered, which translates to EROEI = (Eout +(E lost-Ein)) / E lost.

Here are numbers from our pending publication:

In a different economy the bagasse might be used in many other energy technologies; heat, biogas, electricity, etc. that would have higher social efficiencies. So the bagasse has to be considered an energy opportunity cost, and if not counted as an input it will overstate the EROEI. This is relevant if we would change how society used energy. There would be less need for high energy surplus liquid fuels if things were done more locally, or with more electricity, etc. Again, this gets at energy quality and is not something I would debate too an extreme, but I think it is correct.

Excellent overview of THAI. Thanks for the new (at least to me) information. Regarding the issue of "include in-situ fuel or not", I lean toward the position that "it should be included IF the deposit being recovered is shallow enough to be mined (eg. mining and water processing would allow recovery of that resource as well), else if the deposit is too deep to mine, then not included (it would never be recovered anyway)." Also of note. Including the "lost fuel" THAI uses in recovery in the EROEI is nearly comparable to including the 45% unrecovered oil left in a standard light-oil field into that system's EROEI.

So, EROEI = 8.9 if deposit < 100 meters deep, else 50+ something.

A further question. In the documents you read, any reference to groundwater issues? I know groundwater is an issue with in-situ coal gassification.

Lengould,

Good insight. I agree that if there was a clear "use" for the oil burned in situ it would definitely be considered a cost. The files that I had did not list well depth or any groundwater contamination issues- but I will keep looking. This project is still in an early stage so the environmental impacts have not been assessed - if they ever are.

Note this information is from Petrobank's own documents released over the past few years. HTH.

The Whitesands Project Geological Cross-Section I am looking at shows the oil sands at a depth of 1200 feet and having a depth of 100 feet.

The water/steam is used to pre-heat the well (three months?) as opposed to a SAGD well where it is used all the time. The wells have a projected life of up to 10 years, after which a second series of wells will be drilled to continue the recovery process.

"The central processing facility (CPF) is also planned to incorporate leading edge technology to produce a high-quality water by-product for industrial use, utilize oxygen enriched injection air, recover hydrocarbons from the produced gas stream and manage greenhouse gases."

I'll add a comment on the comparison to mines.....the reservoir is too deep to ever be economic for mining. Also, the permit application filed in December 2008 with the Alberta ERCB and Alberta Environmental includes a complete (and very detailed I might add) EIR (Environmental Impact Report). I believe the ERCB deemed the application complete last month which means the formal government review process has begun.

Regarding ground water, the stratigraphic well data shows an extensive shale rock cap over the reservoir. I'm not a geologist and can not comment on the integrity of that cap to protect the ground water however I'm confident the ERCB geologists are and do. Geologically, May River looks like a typical SAG-D reservoir of which many have been permitted and are in operation.

Two questions that may influence the EROI significantly:

* Where does the CO2 go (is it disolved in the "oil", and is it blown of during refining, or does it stay in the ground)

If the CO2 escapes to the atmosphere, the cost to prevent this will have to be added to the equation

* What are the landscape restoration costs after the "mine" is closed.

(How does this mining technology change the landscape)

http://www.petrobank.com/hea-thaiprocess.html Petrobank Energy and Resources website shows some graphics of the layout of a THAI installation. The picture shown shows all forest cleared from the production site, but I see no reason that should be necessary (unless the ground temperature gets too high to allow trees to live. Even if so, they would recover very rapidly after the fairly short production period.) Appears to be a lot of surface "used up" in the illustration, but that may just be the artist. Don't forget, in a real situation the wellhead pairs are nearly a kilometer apart).

The CO2 comes back out from the production well. Capturing CO2 should be possible IF pure oxygen rather than air is used as the oxidizer. Would likely need some development work / trials, and add input energy costs in oxygen separation expense.

* Where does the CO2 go (is it disolved in the "oil", and is it blown of during refining, or does it stay in the ground)

It is blown into the atmosphere, I believe using hte exaust gases to generate electricity is in the May River plan, its not clear if this is included in the analysis

If the CO2 escapes to the atmosphere, the cost to prevent this will have to be added to the equation

Agree this should be done, should be done on coal fired power plants also but its not

* What are the landscape restoration costs after the "mine" is closed.

(How does this mining technology change the landscape)

This is not a mine, the surface facilities are like conventioal oil wells

In teply to a message fruther up, there is no net water consumption, if fact it is a water producer. (It uses some water durung start up, but produces water over the life of the well)

Thanks very much from an interested non-engineer. You have made everything clear, especially the boundaries and tradeoffs for making these types of calculations. This makes it much easier to discuss with friends, who like me, have limited geology, oilpatch and engineering knowledge, but are interested in a general sort of way.

From that perspective, it looks like the biggest gain is the possiblility of limiting environmental devastation and water and natural gas use -- that alone is commendable.

In the end, it seems like our world will be able to produce increasingly limited amounts of liquid fuels for an ever-increasing price, and for and increasingly specialized (probably mostly military) market. This sort of calculation makes EROI essentially irrelevant -- it's sort of like calculating the EROI of rocket fuel or moon rocks -- but since it is clear that the oil can be produced, it follows that it will be produced and will flow to whoever has the power to command it.

At least THAI doesn't tear up the landscape so badly as above-ground processes!

"the biggest gain is the possiblility of limiting environmental devastation"

Welllll. Maybe at the local level. But if we extract and burn all the tar sands oil along with all the coal and heavy sour stuff, we are guaranteeing an uninhabitable planet.

But maybe that's not important--just a minor inconvenience?

Finally, some people are starting to "get" it. I've been saying for a long time that between this and in-situ coal gassification, climate issues are a more imanent problem than petroleum shortage.

The problem in the Oil Sands is water. Too much and too little. The infeed water is not enough, especially if production capacity increases, and there is too much tailings water. (We're working on a project currently to deal with the ground water seepage). It looks like THAI will go a long way to aleviating this problem.

Now that Canada has 1.7 trillion barrels of recoverable oil we're going to have to revise an Arab saying:

My grandfather rode a mule,

My father drove an F150 with a four inch lift,

I will fly in a jet,

And my son will have to swim everywhere because the sea levels rose.

(And, I'm a Lumberjack and I'm o.k.)

I don't know if this has been discussed elsewhere in this thread, but think about what this means if the Oil Sands have 1.7 trillion economically recoverable barrels? I know there will be two outcomes:

1. The Americans will start liking us again.

2. A second Tim Horton's will open up in Ft. Mac

First, kudos to Dave & Dave for making something sensible out of the very poor available information on this process!

What's important to me--and I would think to any TOD reader--is the flow rate. As I told daveinmarinca when we met to discuss THAI about two years ago, let me know when it gets to 100 Kbpd, because until then, it's not really that interesting.

While the promise of 1.7 T bbls is exciting, if it plays out at a max production rate of, say, less than 1 mbpd, or takes many years to reach that production rate, how exciting is it really, in the long run? It still wouldn't even fill the gap of declining Canadian conventional crude.

I also have severe reservations about whether developers could, if needed, extinguish the fire, e.g. if there were a problem with it burning beyond the desired boundaries, or leaching into fresh groundwater. A conversation I had with Heading Out at ASPO a few years back about his experience with putting out underground oil field fires, only to have them spring back to life again a year later, really gave me concern with respect to THAI. I haven't seen that issue addressed anywhere.

It certainly does seem like a very desirable alternative to surface mining of tar sands, though, if those issues can be worked out.

Chris,

I've asked a couple of times about specific production rates at the test project, and no response yet. And I remain interested in why they scrapped their plans to expand the test project.

Also, here is a quote from the post:

I think that it is a contradiction in terms to describe a part owner as "arms-length." I suggest that a more accurate description would be:

From the Petrobank release, linked down the thread (emphasis added):

It appears that the test wells are intermittently producing up to 400 BOPD per well.

Finally, sorry to quote anonymous sources, but a Canadian oilman I talked to a year or so ago at a conference (I don't remember his name) offered the following opinion about Petrobank. His opinion was that they were using the hype of the THAI process to drive their stock price up and then use their inflated stock price as currency to buy conventional reserves with stock. He said that they had actually done quite well with their conventional production. In any case, this was his opinion.

Nice working digging that data out, WT. So, if they could do 2,000 such wells, they'd still be short of 1 mbpd. I wouldn't begin to speculate on how long that might take, if it could be done at all economically and practically speaking. Nor do I have any way of knowing if your anonymous source is right or just talking smack.

I don't understand all the technical details here, but it sounds like a fairly complex process. EROIGuy, do you know if all the input energy (including steel and other materials) has been accounted for with the separators, condensors, de-sanding units, etc., plus replacing worn-out units?

Finally, an EROI ranging from 3 to 56 is so wide as to be virtually useless. I can't see many investors jumping into that one without a much narrower range. Although I do wish all the luck to daveinmarinca (he's a good guy) and other investors in the technology.

For now I'm content to yawn and move along, nothing to see here...

Hi Chris,

The purpose of the post is two fold 1) to explore EROI analysis using THAI™ as an example and gain reader input on the three different approaches we used for calculating EROI and 2) update what is known about the technology from the information provided in the permit application. I am very grateful to those who have taken the time to read the post and give their opinions as to how the remaining "stranded bitumen" that is oxidized and drives the whole process is valued in the EROI. While not currently a priority in government or finance, the approaching twin financial and energy cliffs are generating interest in EROI and net energy analysis and for The Oil Drum to arrive at consensus on this aspect of the analytical approach will be helpful going forward.

For a non-renewable energy source, should we ignore the energy content of the raw material (bitumen in this case) when calculating EROEI? If we do so, we paper over the non-sustainable aspects of some energy sources, which ignores peak production and depletion, which is a prime educational mission of this site. If not, then the 90% figure would be closest to correct.

i believe it is fair ignore the energy "loss" due during extraction, as stranded oil after extraction isn't used in EROI calculations of an oil field -- the calculation is energy in against energy out -- inefficient extraction due to burning some of it before it comes out the wellhead is neither here nor there.

What does come out the wellhead instead is C02, which may have both an energy and economic price to deal with, and so should be counted.

The same argument with the naptha, only the part which gets consumed during processing should be counted, but against that the energy cost of the process should be on the - side.

I've always wondered who exactly these studies are intended for. Can't recall a politician, CEO, or economist expound on energy returns - financial returns, yes, of course. These exercises, while quite interesting, have an aura of ivory tower intellectualism about them - are you seriously thinking you'll sway policy in the months ahead with these documents? Or that 30 years of work by Hall, Pimentel, and so many others, has lead to rational decision making involving considerations of energy throughput? About the only people outside the environmental or environmental economics movements I've heard bring up EROEI were ethanol proponents - who dismissed the whole concept as a fabrication cooked up by the petroleum industry to cast doubts on their product, or indeed, in the case of Dave Bloom, came up with calculations that it's the petroleum industry that's the unsustainable energy sink. Barring mainstream validity from peer review of these calculations - barring training enough peers, for that matter - what sway can these informal back-of-the-envelope ruminations have?

Dude--

have you ever heard a politician expound on differential calculus, let alone quantum mechanics??

Does that make them irrelevant, "ivory tower" mumblings?

No. "Swaying policy" was not and is not the goal of this post.

NeverLNG - Good point.

I would add to that esteemed list: Daly, Ehrlich, Catton, Campbell, Georgescu-Roegen, Hubbert, Holdren, Tainter, Cottrel, Odum, and many others.

Instead we have listened to Greenspan, Friedman, Paulson, Samuelson, Summers, etc.

Because they don't sway policy is the fault of policy not of the ideas. Net energy was made into law in the 1970s then when imports started up and oil prices crashed it was forgotten about. ALL the decisions being made in Washington recently are detriment to long term health of system - we are heading for change in how things are organized and valued.

EDIT* - Federal Reserve to buy $1 trillion of Treasuries and agency bonds. Hmm. Fed is backstopped by Treasury. Treasury is backstopping itself. This is why we need biophysical analysis...

The "leaders" of the present are almost certain to ignore any enlightenment from this site. But those who survive to be the leaders of the future may well do so on the basis of being better informed thanks to ToD.

I think the studies are intended to understand what is true. And societies ignoring what is true is what gave Jared Diamond such rich source material for his book "Collapse". (Or another way to say it, no one in Minnesota knew what a stress fracture was until the bridge collapsed, and then everyone wished they had.)

But if EROI is really 10:1 or better for THAI then all climate scientists should be using much larger supplies of oil than have been discussed here. Because at 10:1 they are very likely to be exploited over the next 200 years.

Hubbert Linearizations may not account for these resources correctly. We may end up with a very fat tail.

Neither Hubbert (nor Deffeyes) linearizations dealt with that-which-is-not-oil-but-is-now-called-oil.

Which was a bit shortsighted - or indicative of a narrow focus. I get the impression from Hubbert's writings that he expected humanity to take the rational course away from FFs towards nuclear (his initial outlook) or solar (later musings), that reason would win the day soon and that unconventional hydrocarbons would barely dent the smoothness of the curve. Or perhaps the smoothness derived from him considering price shocks and geopolitical dust ups irrelevant to the inevitable course of things. Like Deffeyes said about the world HL, it progresses smoothly enough, even factoring in earth shaking events like the Great Depression, WWII, and the Carter administration.

Wonder if an anti-THAI could be developed? Some kind of advancing freeze wall to snuff out those coal fires in Centralia PA and China, the latter 3k miles long as I recall.

Easy. Simply stop injecting compressed air.

Better yet, fill with captured CO2 (perhaps dissolved in water to increase the heat capacity and decrease vapor pressure).

The fact remains regarding PO, the downward slope of the curve will be slightly less steep, but still downwards. If you could see the money pouring into Ft. Mac to achieve the minor incremental production increases to date, it is easy to see that capacity output from the Oil Sands will not offset global production rates.

Here's a little front porch analysis -really! Just sit on my parent's front porch and watch the number of ATCO trailers and mining truck tires that are being transported on Hwy. 5 to Ft. Mac. This is the preferred route for truckers for the Vancouver to Ft. Mac run. I didn't believe it when my dad told me until I drove the highway coming in from Jasper.

Our engineering meetings are held in Calgary, and if we need to go to site we hop on the corporate jet and make the day trip. No hotels in Ft. Mac - thank God. This may seem quite ordinary to Americans, but for the Canadian low key way of doing things it is getting crazy.

Certainly correct about Hubbert & Deffeyes. Of course, Hubbert also noted that a one-third increase in projected URR for the Lower 48 only postponed the projected peak by five years.

BTW, as noted down the thread, perhaps I missed it, but I haven't seen any verified numbers on the sustained production rates from the THAI test project. I am also curious as to why they abandoned their plans to expand the test project.

Also, back in the here and now, just the one year estimated decline in net oil exports from Venezuela & Mexico in 2008, about 650,000 bpd, was close to two-thirds of total Canadian net oil exports

"I haven't seen any verified numbers on the sustained production rates from the THAI test project. I am also curious as to why they abandoned their plans to expand the test project." My understanding is the drop in the price of crude has forced them, like everyone else, to control costs and the focus now at Whitesands is getting third party rateable THAI™ production data from P1, P2 and THAI™/CAPRI™ data from P3b at minimum cost. I believe the decision to essentially shift the scope and expenditure for the recently permitted Whitesands three well expansion into the May River Phase I 10,000BPD project was purely a business decision and, to me at least, demonstrates confidence in THAI™ as a commercial process. Its helpful to remember these are the people who introduced Stacfrac to the Bakken and are participating in the continued development of that technology in both the Bakken and nat gas production in tight formations. Technology innovation and development has been and continues to be their strength.

The value of the Bitumen burned in situ can be recovered by using it as a "geothermal" heat source for steam for preheat for the next well series or as a steam generator for a waste heat generator for electricity to the field grid. Therefore all it is a deferred payback of an input, analogous to the solvent input to allow pumping the bitumen. Actually a very elegant method. LQ

"......Bitumen burned in situ can be recovered by using it as a "geothermal" heat source for steam for preheat for the next well series or as a steam generator for a waste heat generator for electricity to the field grid."

To capture much latent heat as steam you would have to put in a series of pipes much like a ground source heat pump. This would not be like geothermal wells but instead have to be a closed loop system. Capital cost of this would be high, especially for a system that would produce heat for a relatively short period of time (a few months?). This does not sound feasible

Oil sands and heavy oil will become more important.

Hence, it is particularly interesting to compare "THAI" with the conventional oil sands production method like SAGD (Steam-Assisted Gravity Drainage).

Needless to say that SAGD only has a low recovery of bitumen from oil sands (25 % for SAGD vs 70-75 % for THAI), furthermore SAGD has fairly high capex and is dirty, clumsy and hence fairly obsolete.

When comparing the EROI then IMHO it makes no sense to consider the energy required to convert the produced bitumen to gasoline and other refinery products. The conversion of the bitumen at the refinery (or upgrader) is another process

Nice! (And scary, because we can't afford this CO2 in the atmosphere).

I have not had time to read the documents. Do they list the cost of drilling the wells and putting in all the buildings and infrastructure? It looks like a lot of steel for a very short life well. Two horizontal wells can't be too cheap. They don't have to do hydro fracture, but there is quite a bit of other site work needed to house the air compression stations etc.

Those would be my main questions. It seems the direct energy costs are covered, now we just need the embodied energy in the equipment and labor.

Much of the compressors etc would be able to move to the next well, so considerable savings on a long series. I wonder if it would be possible to directionally drill away from a central collection point. So you would have a circular pattern, like a daisy, where each "leaf" was a THAI process. Then at least the collecting, separation, and mixing facilities would not have to move every well.

Jon,

Can we call that "Daisy Drilling" ha.

Petrobank cites a CapEx cost of $15,000 per flowing barrel. So I think a coarse estimate is: 10,000 bpd x $15,000 per flowing barrel for the May River Project = $150 million.

Thanks! And I thought natural gas facilities were expensive. Ouch!

If 10% of the naphtha is lost in each refining pass (same as barrel of oil), then it looks like the max out of the system is about 25:1 not including the tar sands or indirect energy. It will be interesting to see how it all turns out.

The naphtha is a solvent added at the pipeline to reduce the viscosity for shipping....it is not processed with the bitumen by the receiving refinery...rather it is distilled out before processing of the bitumen begins and is 100% recycled or sold as chemical plant feed. In terms of the energy balance around the producing wells and surface facility, there is no naphtha stored or used on site. The THAI™ upgraded bitumen has a significantly reduced viscosity and will be pumped to the pipeline with no naphtha added. In summary, the naphtha is solely a diluent required by the pipeline company for shipping.

IIRC the optimal design is a production well complex in the center surrounded by six injection well triple sets in a heaxgonal pattern, that way by interlacing the hexagons they can recover something like 85% of the accessible sands with one set of infrastructure. I even saw it claimed by someone that the air injection/heating complexes could be used for adjacent sets pusing air into two sets of well bores feeding THAI sets working away from each other. If that turns out to be true then the extraction well set would take in the fluid from 18 horizontal bores and each injection complex would feed six steam/air/O2 verticle wells.

Not sure how that changes the ultimate EROI but it would certainly reduce the environmental impact of both the injection and production well sites.

I already thought we were on the edge of no return with CO2 emissions, this will firmly push us over the tipping point if it is as economically attractive as it appears to be at the moment. Maybe I will get to see what the world looks like after the climate flips to hothouse after all.

While your adding the trillion barrels to the CO2 equation don't forget that this technology could be quite useful for Orinoco Oil Sands so there is another trillion barrels to burn as well, weeee!

Previous reports on the Drumbeat have indicated airborne pollution from the THAI process far exceeded expectations. I don't recall reading if the emissions exceeded federal standards for Canada or Alberta. Obviously more than just CO2 is emitted from this process. Large amounts of partially oxidized hydrocarbons are likely to come out of the ground with the bitumen, especially since this is such an uncontrolled process where the ratio of O2 and hydrocarbon is not constant.

Also, if sulphur is present in the bitumen, then the resulting combustion will produce sulphur dioxide. This would have to be trapped or this poisonous gas would become a major hazard for the local population and workers.

Controlling this airborne pollution will require energy along with some capital investment. What about this effect on the EROEI?

Short answer: Decrease EROI. By how much? - nobody knows. I can offer this information, though. Carbon Capture and Sequestration technologies for Coal-fired power plants reduce efficiency by about 30% - so it could be a considerable decrease in EROI...

depends on the boundaries. SOME life cycle or EROI analyses look at cost to remediate CO2, but most exclude it. That is another problem with EROI - hard to parse environmental externalities into energy terms. But with all the shortcomings, it is still the best direction we have. What is a 'dollar' anyways? Do the value of amazon forests or dolphins decline if we have deflation or credit crisis?

"What is a 'dollar' anyways? Do the value of amazon forests or dolphins decline if we have deflation or credit crisis?"

Very astute way of putting it Nate.

In Kentucky and West Virginia, they often give the damage done by mountaintop removal in dollars...when what we are blowing away is an ecosystem that took tens of millions of years to create. These are systems that cannot be replaced once destroyed with all the dollars in the world, it takes natural processes and millions of years.

Thus in cost comparisons, it is easy to "prove" that alternatives such as solar and wind are fantastically expensive, because we fantastically discount the destruction of what can never be replaced once lost.

RC

Nowhere yet have I seen any mention of what happens to the Nitrogen in the "air" which is injected onto the THAI well. There's going to be much more N2 than CO2 in the resulting mix of gases, so it would be likely that separating the gases from the liquids would result in a high N2 gas fraction, which would make it difficult to separate and sequester CO2. Perhaps the Petrobank report mentions this aspect, but I haven't had the time to read it nor am I likely to do so...

E. Swanson

It is true that in the current configuration the offgas is loaded with N2 and be hard to sequester. Petrobank recently filed a patent for a variation on this system where they take the CO2 output add O2 and reinject it which should produce a more pure CO2 stream.

In answer to a question further up Petrobank intends to capture the sulfur and sell it, they licensed a process for this (Cyralsulf sp?)

Something missing from this discussion also is that despite the fact that the pilot in the oil sands Petrobank believes the most important application of this technology is for heavy oil, they are involved in 2 JVs to use this technology in heavy oil fields. They believe this will significantly increase recovery and produce an upgraded product. Not sure how you would work the EORI on this?

is aparently a baseless concern. Better information available at:

http://www.petrobank.com/webdocs/whitesands/WHITESANDS_Project_Expansion... Integrated EUB/AENV Application -- addresses environmental issues

http://www.petrobank.com/webdocs/whitesands/Integrated_ERCB_AENV_SIRs.pdf Supplementary responses from PetroBank to questions from Energy Resources Conservation Board.

Detailed analysis of air pollutant emissions are in the second item. eg, for NOx: "Annual Modeling Results: The overall maximum predicted annual average NOx concentration at or beyond the site property line was 13.0 μg/m3 (0.007 ppm). Adding a background value of 3.5 μg/m3, this corresponds to an overall maximum predicted annual average NO2 concentration of 16.5 μg/m3 (0.009 ppm). This concentration is predicted to occur on the fence line 111 m northeast of the incinerator stack and is well within the allowable AAAQO of 60 μg/m3 (0.032 ppm) for annual NO2. Figure A-3, located in Appendix A, shows the maximum predicted annual NO2 concentrations over the entire modeling domain. Appendix A also contains Table A-4, which shows predicted maximum concentrations for the various modeling scenarios, as well as modeling input and output files and a wind rose for the Edmonton Namao Airport."

All H2S is to be converted to SO2 in an incinerator, and is apparently within standards. Some very low volatile hydrocarbons to be released (strays in the exhaust gas stream, top-gas from the product storage tank). The documents state that, though in this pilot project the volumes are so small the equipment required to recover these and use as generator fuel cannot be justified, in future on full-scale projects it is anticipated these will be recovered as fuel.

"Annual Modeling Results: The overall maximum predicted annual average SO2 concentration at or beyond the site property line was 8.7 μg/m3, and with a background value of 1.0 μg/m3, results in a maximum of 9.7 μg/m3 (0.0037 ppm). This concentration is predicted to occur 232 m south of the incinerator stack and is within the allowable AAAQO of 30 μg/m3 (0.011 ppm) for annual SO2."

Further on, discussing using the produced gas as fuel "Although it is feasible to remove the carbon dioxide, the levels of nitrogen make this gas very difficult to treat to fuel quality." As stated above, until they prove out a method to do oxygen injection without nitrogen, CO2 removal will be cost prohibitive and unjustified. Replacing nitrogen in injections with recirculated CO2 will change that, though.

According to the second report you listed, all the pollution data is PREDICTED based on MODELLING, not emperical data based on actual tests of emissions from the expanded Whitesands development. The report does explain that incineration will reqire the use of an external fuel source to reduce the unburned gaseous hydrocarbons and hydrogen sulfide to less harmful products. If the hydrogen sulfide is reduced to SO2 then the THAI process will still contribute to acid rain.

At any rate the handling of the emissions (15,500 cubic meters or 550,000 cu ft per day per well) would require significant additional energy input that has not been figured in the EROEI calculations in this article.

If the H2S can be captured with an amine loop (and there's enough to make it worthwhile), it may be possible to convert it to H2 using molten copper (H2S + Cu -> H2 + CuS); the hydrogen would be available as fuel or for upgrading bitumen.

Being deeply concerned about CO2 emissions, I am rather sad to say that this looks economically promising. If the EROEI (excluding naptha) is greater than 10:1 that means the total CO2 emissions will not be significantly greater than those from, say, conventional heavy oil, and probably less than the same useful energy from a standard coal fired power station.

There are relatively few inputs and waste outputs to the process apart from naptha and CO2, so it should scale better than current tar sands methods. How fast it could be scaled up is an engineering question. The tar sands reserves are large, and a large fraction of the 'original "oil" in place' appears to be recovered by this method. I do not see it being ramped up fast enough to do more than soften the blow of peak oil.

The only thing that may hold this process back is the cost. If the engineering costs are too high it may remain uneconomic, as we descend into peak oil permanent depression, but somehow I doubt it.

encore acq company recently announced a termination of their hpai(high pressure air injection) projects:

"Encore Acquisition Company, Q4 2008 Earnings Call Transcript"

http://seekingalpha.com/article/120336-encore-acquisition-company-q4-200...

Their HPAI process is/was designed for conventional oil wells, (essentially trying to bypass the CO2 costs of EOR), not for shallow bitumen deposits like THAI. Irrelevant.

"Irrelevant."

relevant to the extent that mobility ratio is relevant.

Wonder if it is possible to avoid using this resource? Heating a thick layer of bitumen carrying ground creates a hell-on-earth landscape that is far worse then any strip mining. And the CO2 releases from these kinds of low grade fossil fuel sources is realy bad. That the financial crisis makers it harder to finance these investments is one of the few good things with the crisis.

I didn't find any evidence that "Heating ... creates a hell-on-earth landscape" in the environmental assesment documentation i read. eg. the nearby first nations main concern was that the small unnamed stream which runs within 100 meters of the site MUST remain in original condition....

Do you have a reference?

A question that might warrant answering is how much the near-surface gets heated and hence /or how much nasty vapors might leach out of the ground surface rather than come out via the official pipeline. Is that being measured or validly ruled out?

My reference is a WW2 project in Sweden where oil shale were heated with resistive heaters and the boil off collected in condensers and refined, the heat treated area then fumed for decades. But those areas were shallower, with a less thick heated area and less permeability then oil sands.

Have you ever been to Ft. Mac? The short unconcerned answer might be "Who cares?". It's another case of nobody really wanted to go there in the first place, then money came along, and now people are worried about the environment in the area. This may sound highly un-PC, but would be the underlying truth, the whole area could be transformed into a festering pit of hell-like landscape and no one outside of the area would ever know the difference.

The debt is blood and it must be repaid.

Hello EROI Guy, thank you very much for this analysis.

About two years ago I was involved in technical evaluation of an in-situ technology (not THAI), and after a long discussion we decided to include the reservoir into our "control volume" in order to perform mass and energy calculations. I agree with you, it should be done the same way for THAI, and burned oil should be accounted as reaction mass consumption (for mass balances) and reaction energy generation (for energy balances). This is a common practice for processes engineers.

Also since our technology was cyclic (huff&puff), we performed calculations on a full cycle basis with total amounts, giving a more realistic figure. I think THAI pilot could be done the same way, since this pilot has start and end point, and in between mass and energy rates are not stable (as described in Petrobank's reports). All efficiency figures are strongly tied to contacted volume into the reservoir.

Thanks again.

David - v interesting. Burning underground bitumen saturated sand in this way is likely to damage minerals in the rock - feldspars, micas, clays, sulphates, sulphides, phosphates etc., and make the by-products (heavy metals and organic complexes) susceptible to leaching from acid ground water.

Nothing is to good to be true.

The in-situ energy burned cannot be used for much else and should be excluded in calculation IMO. But what about the energy to drill and build the wells - including materials?

Euan,

Thanks for the comments about the effects on minerals, I did not think about that.

With regard to the energy required for infrastructure: the closest we could get to estimating this amount was through CapEx - roughly $150 million for the May River Project. The next step in this analysis would be to add in that expense and the refinery costs as well. Maybe a follow-up post with these at some point...

The THAI field results were less than the THAI lab results in terms of upgrading the tar sands with insitu fire flood to a higher API (lighter more valuable oil), the field results dissapointed some investors. The costs of air injection in terms of BTU inputs were once stated to be about 1/2 that of SAGD steam energy inputs on a web page I could not state as a trusted or untrusted source. The air compressor may use natural gas or electricity. Air compression along with any pumps used to lift heavy oil might be considered primary energy inputs. Petrobank was studying generating electricity on site using fire flood as a heat source. CAPRI was put online late last year (2008). There have been numerous shut downs, so they do not have CAPRI field testing completed as of the March corporate presentation. Petrobank expected the catalyst to be efficient at higher temperatures than what they were able to achieve so far (March). I am not a chemical engineer, thus I cannot testify as to what the probability is the chemical reaction will be 100% as expected compared to lab results. Two of the wells have been plagued with sand production problems from the get-go; Petrobank stated a need to recomplete the wells with slotted liners to reduce the sand output that has reduced oil flow. The sand knock-out units helped some, but there is a need for more sand removal. There is also a lesser stream of light condensates produced by the process recovered in addition to the bitumen; the light oil production is a plus. The government asked for monitoring of surface temperatures, as heating shallow bitumen zones might overheat the fauna and flora above the fire zone. Petrobank has been studying the progression of the fire flood by using advanced seismic technology. Lower oil and natural gas prices have reduced the profitibility of Petrobank's other operations and the THAI/CAPRI process has not yet been reported as profitable. Continued testing is warranted after recent progress reported.

Injecting pure oxygen to get less carbon dioxide out will also be an expense that the use of steam injection units in the SAGD process do not have to account for.

Since most of the energy needed for the process originates from the bitumen zone, there may be no heavy strain on natural gas supplies and few outside energy inputs. The SAGD bitumen recovery process also may use bitumen as a source of energy, inasmuch as it is feedstock for oil that may be used to generate steam, this may not be economical with low oil prices. The costs involved might determine the methodologies used for bitumen extraction and upgrading.

Nice update - thanks for sharing.

Pure oxygen would generate exactly the same amount of CO2, but it would be more or less pure CO2 /CO mix, so easier to sequestrate than a CO2 / nitrogen mix which you get when you pump in ordinary air.

Hi all.

I think that there is a major issue that is being over looked in the EROEI calculation. The maximum output for a pair of well is 555 barrels/day (bpd). That means to get any meaningful output will require the construction of thousands of wells. In Gail’s original post about THAI,

http://www.theoildrum.com/node/2907

Petrobank felt they could reduce the sand production and get an individual pair of wells up to 2,000 bpd. In either case, you’re talking about enough supporting infrastructure that it will affect the calculations. To get a realistic value for the EROEI, you need to do a complete Life Cycle Analysis (LCA) of all of the supporting infrastructure, labor, chemicals, etc. Otherwise, you can miss major components and have a value that’s significantly off. If for example, the naphtha that is required can be replaced from products refined from the produced oil, then I agree that amount can be removed from the energy calculations. However, if it’s consumed and not replaced, then it has to be factored in because it comes from outside the system. An EROEI value around 3 to 4 is roughly what they currently operate at, but the process dramatically expands the amount of recoverable oil from 170 billion barrels to perhaps 50% - 80% of the 1.3 trillion bbl OOIP.

If this works, it’s good news and bad news.

The good news is that there would be an alternative to coal, which is the dirtiest possible lifeboat as we slide down from peak oil.

The bad news is that it the process could also be used to put off the day of reckoning when the governments of the industrial world wake up and start aggressively working to address peak oil. It will also give the global warming folks apoplectic fits.

The 2000BPD well production rate mentioned in the earlier post was total liquids; oil plus water. The 555 BPD rate called out in the May River Permit application is the nominal bitumen design rate per well with 18 wells....the total liquid production rate per well including water is likely 3 times 555 = 1650 BPD. I will speculate that the actual bitumen production rate per well from the May River Phase I will probably be higher than 550 BPD resulting in the need for less wells to produce at the nameplate 10,000 BPD rate.

Re "If for example, the naphtha that is required can be replaced from products refined from the produced oil, then I agree that amount can be removed from the energy calculations."....the diluent, naphtha, is added at the pipeline shipping point to reduce viscosity and is distilled off (refined from the produced oil) as the first step in refining the bitumen at the receiving end and recycled/sold as chemical plant feed stock at the receiving point. It is not "consumed" by the refiner but in fact is returned to the naphtha stock for reuse.

Pragmatic, exactly right. Will the newly developed oil be used to help advance the move toward renewables or to build SUV's and skyscrapers in Dubai?

RC

This is really interesting. Thanks for posting. I look forward to more news as it unfolds.

Anything to soften the decline is a good thing. I don't really see this "fixing" our near-term problems, as has been pointed out, that's a lot of wells to ramp up. That is probably also a good thing.

Perhaps I missed it, but does anyone have any actual sustained production numbers for the test project?

And perhaps I made a mistake, but I thought that I posted the following edit.

http://www.marketwire.com/press-release/Petrobank-Energy-And-Resources-L...

Mar 05, 2009 03:41 ET

Petrobank Announces Year End Reserves & Production

"Perhaps I missed it, but does anyone have any actual sustained production numbers for the test project?"...No, and I believe that is the priority now at Whitesands per the Mar 5 press release posted above.....rateable production #s.