Metal Minerals Scarcity and the Elements of Hope

Posted by Rembrandt on July 9, 2009 - 10:53am in The Oil Drum: Europe

This is a presentation by Dr. A. M. Diederen, given at the Oil Drum/ASPO Conference at Alcatraz, Italy in June 2009. It can be downloaded here: Global Resource Depletion: Metal minerals scarcity and the Elements of Hope, PDF 24 slides, 0.5 MB

Slide 1

If policy does not change, the ongoing growth in global consumption of metals will cause shortages, aggravate energy scarcity and obstruct the transition towards a sustainable economy.

For my analysis the collective work presented by ASPO-members and at TheOilDrum has proven to be an invaluable source of information. I would like to especially mention the work of Prof. Ugo Bardi, because he has inspired me to look further into the issue of metal minerals depletion.

This presentation elaborates on my paper “”Metal minerals scarcity: A call for managed austerity and the elements of hope”, published at the website TheOilDrum.com on May 4, 2009 (http://europe.theoildrum.com/node/5239) and at the TNO website on June 24, 2009 (http://www.tno.nl/).

Slide 2

Metals scarcity is becoming one of the most urgent global problems, comparable with energy scarcity which is its root cause.

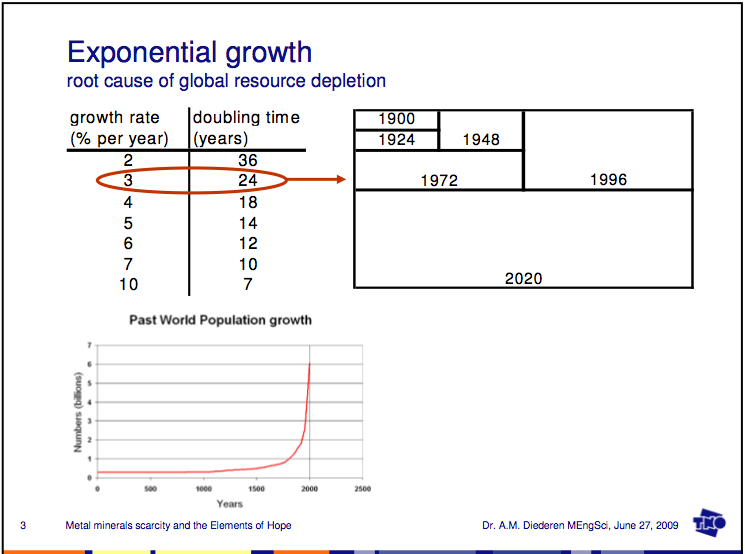

Slide 3

The underlying problem is exponential growth of the world’s population and associated consumption of natural resources. Earlier this year, the IMF (within the context of the current global crisis) stated that a “healthy” world economy grows each year with 3% or more. Sustained growth of 3% per year means a doubling time every 24 years. Compare this with the average growth of China’s economy during the last 15 years and associated growth in metals consumption: 10% or more per year, meaning a doubling time of 7 years (or shorter). This is of course nothing less than a Ponzi Scheme.

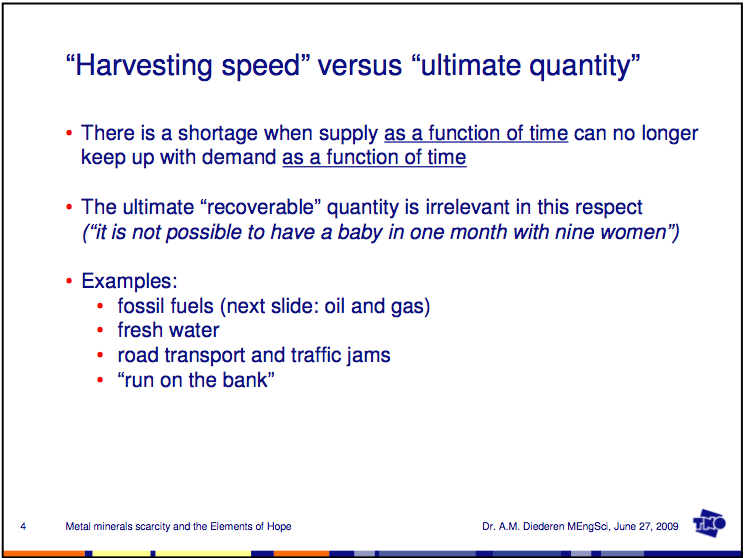

Slide 4

I would like to lend a phrase from the peak oil community and apply it to mineral resources as well: it’s not the size of the well that matters but the size of the tap. About a quarter of the earth’s crust consists of silicon, yet we are already short (for years) on pure enough silicon to make high efficiency solar cells. Of course we can purify the less favourable sources of silicon, but this takes (lots of) energy.

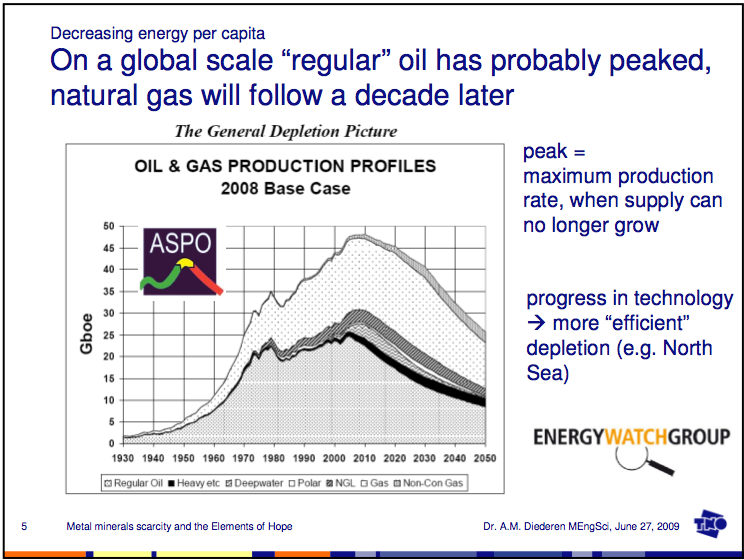

Slide 5

As with energy, also for metals one should not be misinterpreted as saying that we are running out (of metals). We are running out of “easy” metals, i.e. high ore grades at favourable locations.

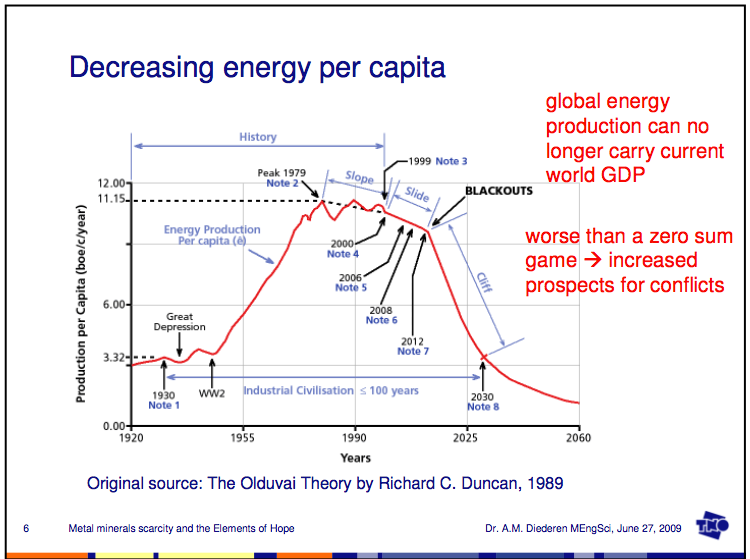

Slide 6

This graph is the scariest graph I’ve seen in years if you think about its implications. It’s even worse than a zero sum game: even zero growth at one part of the globe will inevitable cause shrinkage at another part of the globe (until we have some other economic paradigm). Looking at our history, I find it hard to be optimistic about a future without serious conflicts.

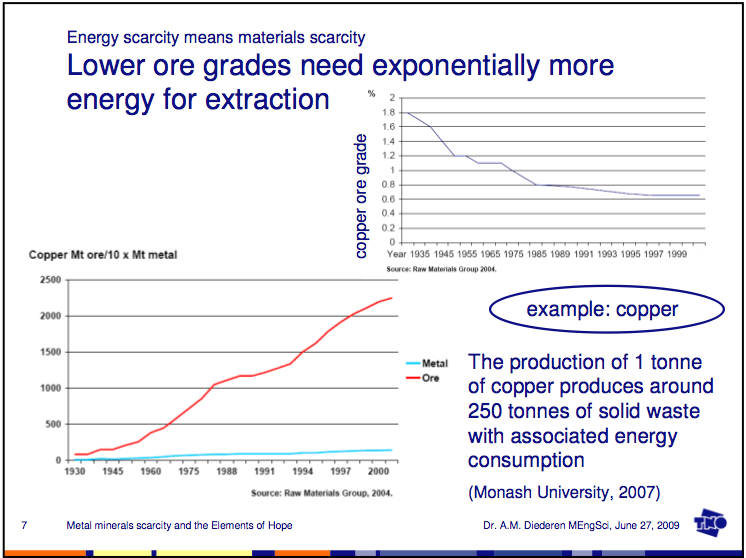

Slide 7

A typical critique on stating that we are running into metals scarcity is the notion that you will find 300 times more ore as you lower the ore grade with a factor of 10. This misses the point that you need much more energy to keep extracting the same amount of metal. Even when the ore grade is more or less stable (example: copper over the last few decades), you still need increasingly more energy to extract the same amount of copper because you have to dig deeper and handle ever more quantities of solids to get to the ores. Of course lower ore grades aggravate the situation and increase energy expenditures much more because of the amounts of solids which have to be processed to keep up the production rate of concentrated metal.

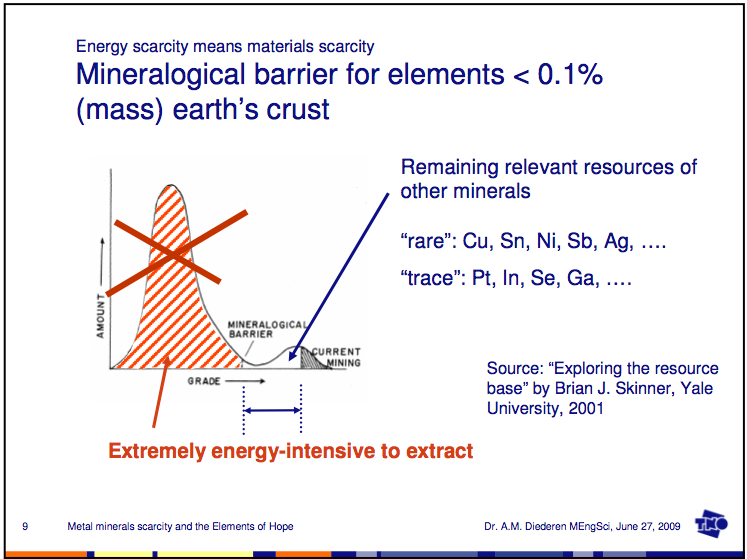

Slide 8

Below the so-called mineralogical barrier (a certain low ore grade), essentially you should pull the source material (e.g. a piece of rock) chemically apart to extract the individual metals. Combined with the enormous amounts of low grade source materials required to maintain a certain production rate of metal, in an energy constrained world the vast majority of resources is out of our reach.

Slide 9

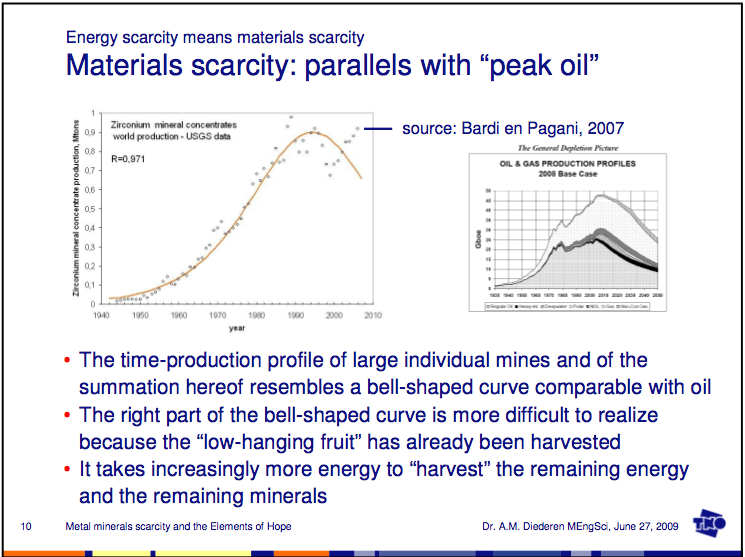

This graph could be valid for all non-abundant metal minerals and it shows that at lower ore grades the amounts of source materials first may tend to go down, not up. This may aggravate metal minerals scarcity.

Slide 10

The work of Bardi and Pagani in recent years showed the striking similarities between peak oil and peak minerals.

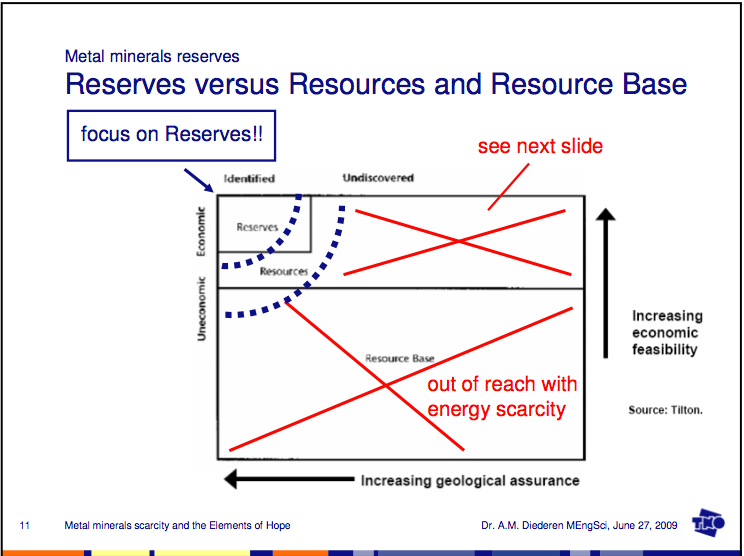

Slide 11

A typical critique on stating that we are running into metals scarcity is the notion that the free market (the laws of demand and supply) will upgrade parts of the resources or the resource base into reserves once reserves start to get tight. This has seemed to be true for decades when there was cheap and abundant energy available. However with energy scarcity, the big lower part of the graph in figure 11 is out of reach (red crossed lines). We should also let go of the notion that vast amounts of rich ore deposits lie waiting somewhere to be discovered (red crossed lines), see slide 12.

In short: it looks quite rational to focus on reserves instead of the huge amounts of resources and the vast resource base. Of course there are many cases to be made to argue that the boundaries of the reserves may be stretched in favour of larger quantities; however there are as many cases to be made to argue that with an energy crisis not even the currently stated reserves remain within our reach to be exploited (blue dotted lines).

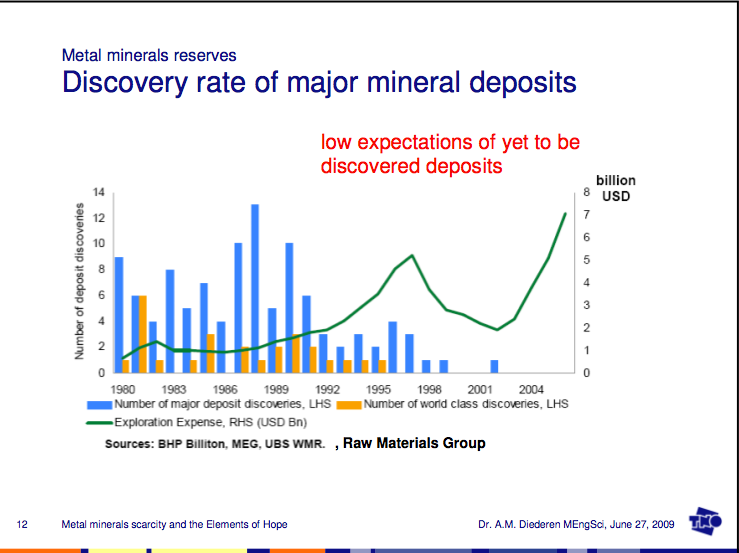

Slide 12

In analogy with oil scarcity: it’s highly unlikely that we will find another “Saudi-Arabia” or another “North Sea” of rich mineral deposits.

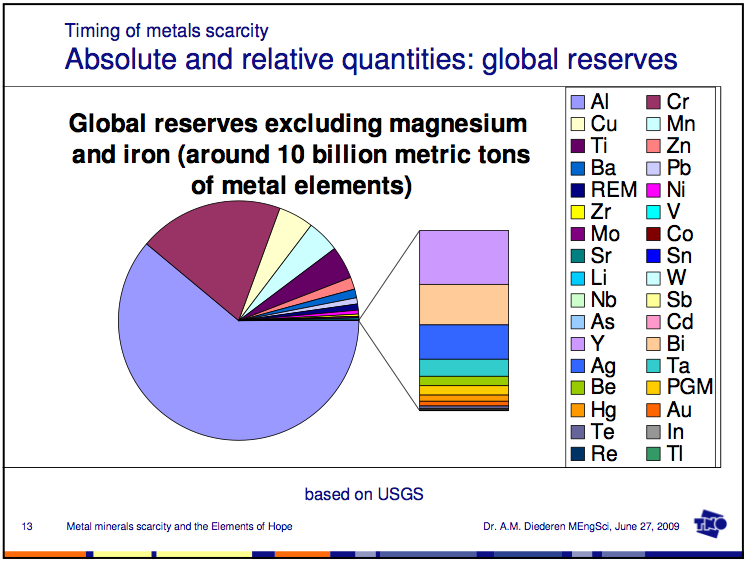

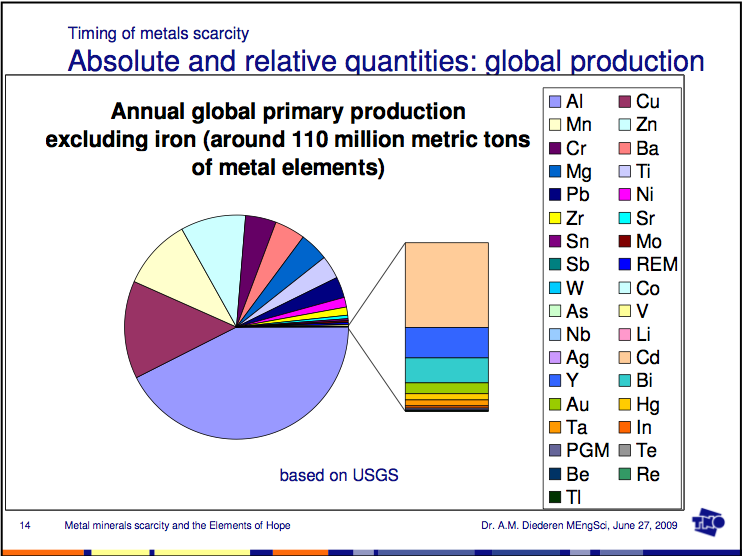

Slides 13+14

Using the only consistent global database (from USGS) on metal mineral reserves and global production rates, one can paint a picture what it actually means if we focus on reserves. All data from USGS are converted (where necessary) into metal element content for consistency, see the paper ”Metal minerals scarcity: A call for managed austerity and the elements of hope”, published at the website TheOilDrum.com on May 4, 2009 (http://europe.theoildrum.com/node/5239) and at the TNO website on June 24, 2009 (http://www.tno.nl/).

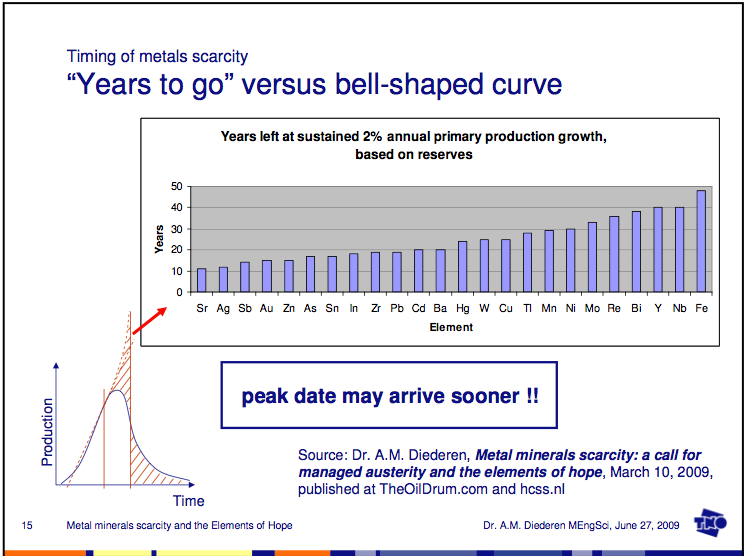

Slide 15

Using a simple calculation, including sustained annual growth of only 2% (the IMF states 3% growth or more is needed for a healthy world economy), the bar chart in slide 15 can be drawn to give a feel for the urgency of metals scarcity. Of course in reality we do not experience a sustained global production growth until year “n” and a subsequent drop to zero production in year “n+1”. This is depicted in the graph in the lower left corner of slide 15: a production peak is reached years before the “lifetime” of the bar chart has been reached. Bardi and Pagani recently have published data on several metals which indeed already peaked.

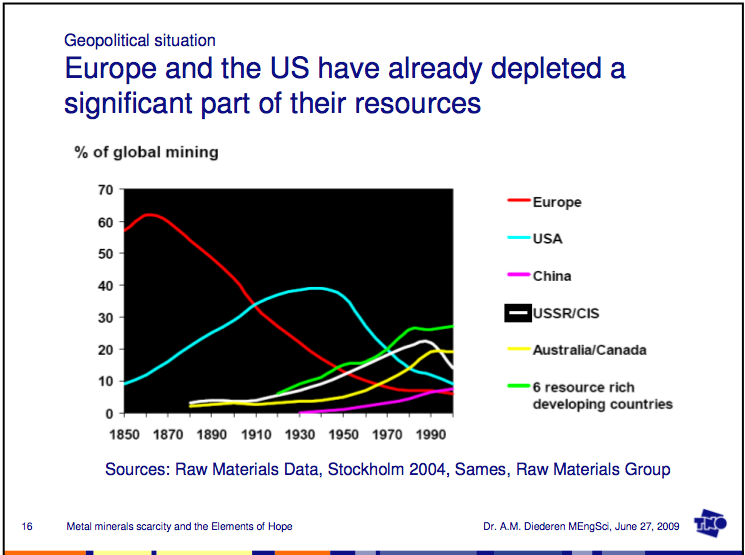

Slide 16

To make things even worse, as with oil and gas, global (or average) metals scarcity will be preceded by spot shortages due to the non-linear distribution and depletion of metal mineral resources across the globe. The industrial revolution started in Europe and later the US became an industrial giant, so it comes as no big surprise that both Europe and the US have depleted a large part of their mineral resources.

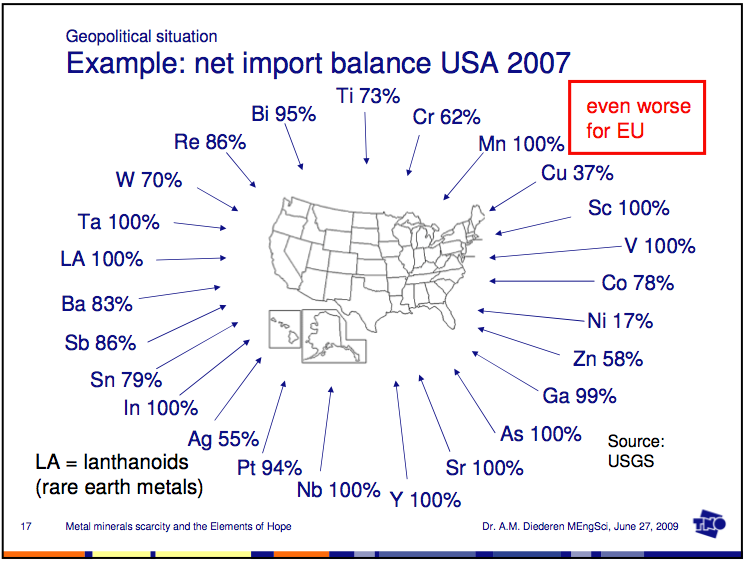

Slide 17

The United States, although still an important primary producer of metals, is strongly dependent on imports of various strategic metals, often 100%. The situation for the European Union is even worse than the picture of slide 17.

Slide 18

Many important metals are produced for a large part in only one or a few countries. A striking example are the so-called rare earth metals (REM) for which China dominates world production. REM are required for various kinds of high-efficiency applications in technologies which are needed to make a transition towards a more sustainable economy, away from our dependence on fossil fuels. An example is neodymium, required for high-efficiency permanent-magnets needed for generators (wind mills) or motors (electric vehicles).

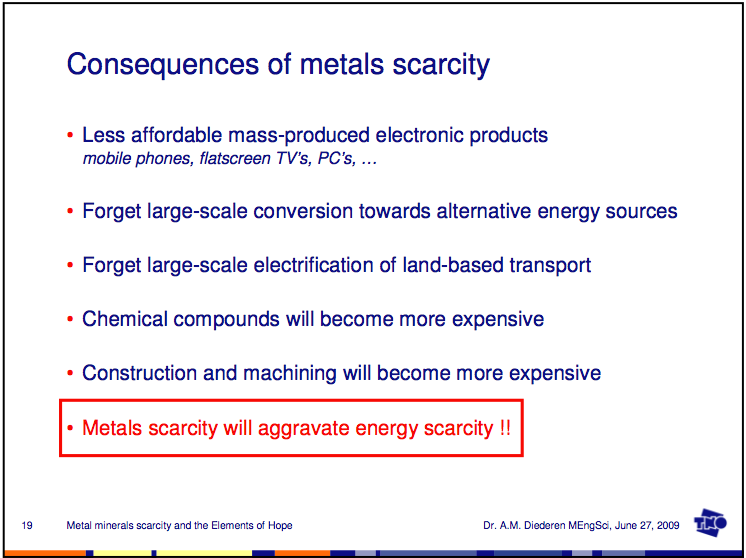

Slide 19

The consequences of metals scarcity will be serious. Not only various established sectors like machining and the chemical industries will be affected. Especially the promising “new” sectors will be hit hard. For example there are no satisfactory substitutes available yet for essential and already scarce metals for efficient and mass-produced solar cells, permanent-magnet drives/generators (wind mills, hybrid cars, electric cars), catalysts, fuel cells, batteries and various electronic devices (telecommunication, displays/ touch screens/ plasma screens, micro-electronics).

Without a shift from scarce to less scarce metals, a large-scale transition towards a more sustainable economy doesn’t stand a chance. Moreover metals scarcity aggravates energy scarcity because the energy sector is one of the largest metals consumers. This applies to the whole chain from exploration, production, storage and distribution up to conversion into the desired forms of energy.

Slide 20

There are six solution frameworks to diminish our dependence on scarce metals: using less, longer product lifetime, more intensive recycling, substitution with less scarce metals, a new product design philosophy and adapted inventory management.

Realization of these solution frameworks challenges people’s ingenuity and creativity and offers meaning and purpose. “Using less” requires nothing less than some form of managed austerity. Also technology can play an important role by enabling dematerialization (like film rolls which have been replaced by digital photos). A number of solution frameworks are facilitated by reducing complexity in order to enhance quality and diminish waste.

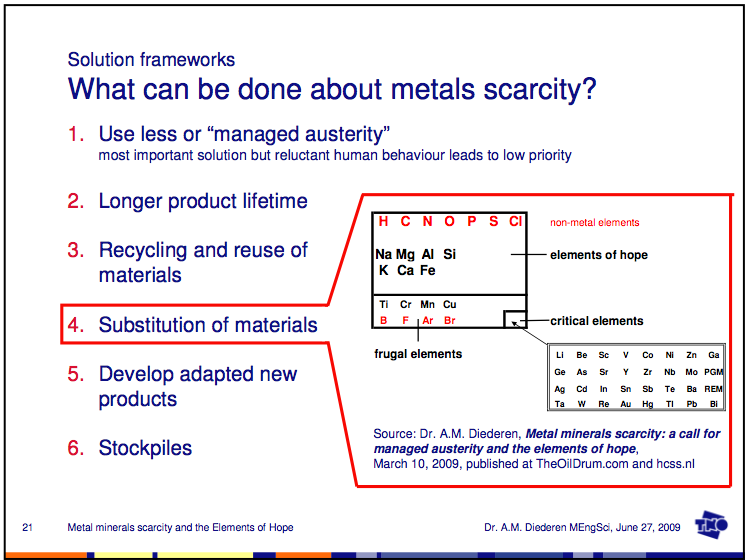

Slide 21

A particularly powerful solution framework is the substitution of scarce metal elements by the most abundant elements, the so-called Elements of Hope. This requires engineering sciences as well as disciplines like agriculture and biosciences. The scarcest metal elements are called the critical elements and these should be saved for essential applications where substitution with less scarce elements is not possible. The frugal elements are much less scarce, albeit scarcer than the Elements of Hope, and should be used predominantly for those applications for which there is not yet a substitute with current technology (example: chromium for stainless steel).

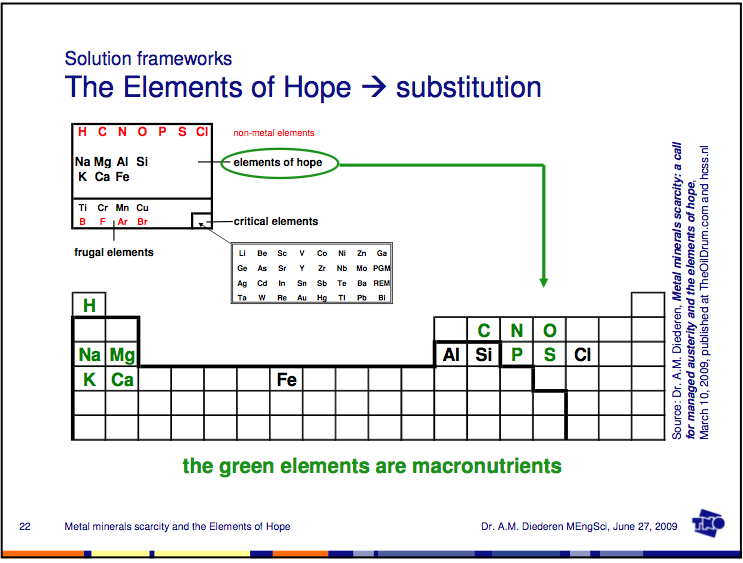

Slide 22

The Elements of Hope are potentially inherently environmentally friendly and sustainable as they contain all macronutrients of life and lack any heavy metal.

Slide 23

If policy does not change, the ongoing growth in global consumption of metals will cause shortages, aggravate energy scarcity and obstruct the transition towards a sustainable economy.

Technology alone is not going to save us. A holistic approach to the vast underlying problem of exponential growth and overconsumption requires involvement of various disciplines. “Using less” requires nothing less than some form of managed austerity and involves disciplines like psychology, philosophy, law, finance, economics, system dynamics and politics. Nate Hagens has explained during the discussion after this presentation that we need to understand and implement all that we know about human behaviour for any solution to stand a chance of becoming viable (see the recent excellent work by Nate Hagens).

Slide 24

The free market alone cannot solve these problems. Some form of government intervention for the sake of collective interest is required. How does a country like China approach these problems? Can we learn something from them?

I thank Dr. A. M. Diederen for detailing the current and projected states of mineral resources and the mitigations needed to avoid even more severe shocks to the world economy.

"Managed Austerity" is indeed the primary way we can avoid the fate of every yeast population in a contained environment (such as a vat of beer). Convincing ourselves that we should take measures to do so will be difficult when some politicians will seek election on promises of a return to the seductive lifestyle of conspicuous overconsumption and bountiful leisure (which always seems just out of grasp).

It's little wonder China has been buying up mineral resource rights around the world with their cash reserves.

China's industrial ascent and descent will span a much shorter interval than ours, and ours won't have been that long from a historical point of view!

The key will be which one will outlast the other. The funny thing is China can make much more rapid changes to its 'lifestyle' (simply by decree) than can the West ("gotta have that SUV and powerboat no matter what those environmentalists say. America's

lifestyleWay of Life is non-negotiable!").This was a very informative talk. One thing I was shocked by was the data of 97% of rare metals production in China. Is that a geological fluke, or that they developed economy of scale? Are other countries now attempting to remedy this, etc?

Also, I would like to know what % of rare metals mining costs are energy, and how this % has changed over time...

(P.s. extra thanks to Rembrandt Koppelaar for not only organizing that event but for formatting these presentations...)

Dr. Diederen sent me an e-mail saying that he probably won't have time to answer questions today, but will tomorrow. So if you put questions up today, check back tomorrow for answers from Andre Diederen.

Hi Nate,

All(?) of the Chinese REE production comes from the Bayam Obo deposit in Inner Mongolia. My father(former Molycorp geologist with experience at Mountain Pass, California) worked on this for the Chinese back in the early eighties. During this period, China mined Bayum Obo as an iron deposit (very high grade specular hematite ore) and stockpiled the REE as they lacked the hardware and metallurgical expertise to process it. Processing is a bitch, as you must achieve five nines purity; .99999 - at that purity even stainless steel is too contaminative.

The deposit is very cool! It is(probably) a volcanic carbonatite...volcanoes with dolomite(like limestone but with Mg) lava. I have several specimens and a lot of translated Chinese scientific articles. One of the specimens is a flow-banded lava composed of fluorite, hematite and basnesite(a REE catch-all mineral); bands of purple, silver and white! Anyway, the deposit is huge.

There are other REE deposit which could be mined, but Bayam Obo is so big and rich and annual consumption so modest, that nothing else would be competitive...at least that is my take on it.

Processing is the principle cost, and it is very energy intensive, but the total finished production is pretty modest...the annual world supply of some of these REEs would fit in a briefcase.

thanks - i guess a good companion piece would be "How Dependent Are We Becoming on Rare Earth Elements?"

Mea culpa, there is more to Chinese REE production than just Bayan Obo. Sichyaun and southern china also product some as well.

Looks like annual Chinese production in 2005 was about 200,000 tons but the finished production of purified product would probably be less than 100,000 pounds, though that is just a WAG at this point.

As for dependency...haven't a clue really.

Hi Nate,

The German Fraunhofer Institute for System and Innovation Research (ISI) has recently published a book (in German) on our growing dependance on certain raw materials for emerging technologies. ISBN 978-3-8167-7957-5, google on "Rohstoffe fuer Zukunftstechnologien" and you will find a link to a pdf-version of the book.

Amonst others they conclude that in 2030 we would need 3.82 times current world production of neodymium (Nd) for applications such as permanent magnets and laser technology. In 2006, these applications account for 55% of global annual production of Nd.

These are geological marvels and sound beautiful. In some ways, it makes me sad that they are mined! Though not as visually conspicuous, it brings to mind the cutting of tropical forest for fine furniture wood.

Hi Nate,

The monopoly position of China regarding rare earth oxides (REO) production can be broken by countries like the US and Australia by developing exploitation of other deposits on their own territories. The question is at what cost as compared to importing REO from China (if China even exports the quantities needed by us).

I do not have information on the energy share in REO mining cost or the energy share in rare earth metals refinery, and neither on development of these cost over time. Good question. It's of the utmost importance when analyzing energy input in metals mining and refinery that ALL energy input is being taken into consideration, not just explicit use of diesel fuel, electricity and so on. To give an extreme and odd but striking example: years ago some guy gave a presentation on the US Airborne Laser (based on public information), stating that the energy content of each shot (designated to shoot down a ballistic missile in its boost phase) would cost only a couple of dollarcents worth of electricity. That's because the power is huge, but the duration of the laser shot is extremely short. Wow, how cheap! But taking into consideration that at the time of the presentation, the construction cost alone of 5 ABL's would cost 7 billion USD (lasting how many shots? maintenance cost? fuel cost of flying the Boeing 747 ABL platform?) and that with each shot the huge chemical laser would consume about one metric ton of chemicals (to be dumped in the air after each shot), you'll understand that the real implicit energy and total cost per shot is very much larger.

The danger is that singleminded proponents of renewable energy, claiming this to be a 1 to 1 solution to replace fossil fuels, make the same incomplete assumptions on energy input in metals mining and metals refinery, making a similar shorcut as in the extreme example above to "justify" that the energy share in total cost is of no real concern. In the ABL example, this logic would dictate that even an increase in electric energy cost of a factor of one million would be of no consequence to the viability of using ABL's.

Andre,

Surely you can give an estimate of the energy required for mining and refining all metals except the "metals of hope"( which use perhaps 5-10% of the worlds energy consumption)OR a figure for all metals?

As far as renewable energy( as electricity) replacing oil, we can estimate that it will be better than 1:1, in other words the 160-200MJ used to refine and present in 1gallon(or 4litres)of gasoline can be replaced by 10kWh(36MJ) of electrical energy used in a similar sized vehicle such as the Toyota RAV4( ICE;31mpg ) compared with the RAV4_EV(0.2kWh/mile). This is about X5 less energy. In fact each gallon of gasoline uses about 5kWh of energy just in refining from crude oil.

Hi Neil,

I have an even better question for you: surely you can give an estimate of the energy required for producing oil and gas? I'm sure you know the answer, tracking back the vast amount of reactions on various themes from you on this blog.

*********************

If the answer would be just a few percent, does this than undermine the credibility of Peak Oil?

*********************

By the way, your example in the lower part of your question/remark from July 10/11:44am reminds me of the airborne laser example I gave earlier: you just calculate with gasoline and electricity. You conveniently forget the embedded energy contained in the hardware. Also there might be constraints with cost and availability of primary goods required to realize the hardware, especially in case of mass production.

Andre,

I don't know for natural gas, but refining oil takes about 10% of its energy content so for the US that would be about 4% of total US energy use. If you add in refining losses and the cost of distribution, building refineries and service stations its probably another 15% for a total of 10% of the entire US energy budget, and would guess that its about the same for the rest of the world. I would say that's a significant energy use, considering its only delivering 30% of total energy. Hydro and wind energy probably have the lowest embedded energy costs of renewable energy(1-5%).

Now you are presenting an article about mineral availability so you should present some numbers about energy use, especially those critical metals such as copper, neodymium, tin, uranium, nickel,......

The comparison of an electric vehicle(RAV4EV) and an ICE(RAV4) is comparing almost identical vehicles so the infrastructure for manufacturing is almost identical. There may be constrains in availability of Lithium, Nickel, Copper, not present in an ICE vehicle .. but unless we have a number for energy used to produce these metals its hard to know what the constrains will be.

Thanks, Andre for this post/presentation.

In many ways, this post is more troubling that your earlier post. The low amounts discovered in recent years and the high net imports of rare minerals are especially concerns.

You say (Slide 19)

Do you see any chance that the use of less rare minerals for say, batteries, will permit BAU?

Hi Gail,

I believe in the need for electrification of part of (land-based) transport, but I very much doubt that we will be able to swap from hundreds of millions of fossil fuel powered vehicles to the same extravagant amount of electric vehicles.

Batteries are expensive and lack the performance offered by liquid fuels. The metals needed for the best batteries are also the first to show cost constraints (lithium, nickel, cobalt). Just the battery pack for an electrified Volkswagen Golf costs 40,000 Euros (around twice the price of an normal Volkswagen Golf).

Elaborate, please. Are you suggesting that the citizens of the PRC have been marks in some billion man grift? Or are you simply comparing China's rate of growth to that seen in Ponzi schemes? Or?

Hi Dude,

I'm just suggesting that exponential growth at large is nothing but a Ponzi Scheme. The graph at the right hand side of slide 3, valid for a sustained annual growth rate of 3%, is already ominous in a world with physical limits. But look what happens if you make the same graph for a growth rate in the order of 10% for a significant number of years: if you put the second largest rectangle at today (2009), the largest rectangle becomes 2016 (and the next doubling occurs in 2023).

I referred to China to show that sustained growth rates in resource consumption (including a number of metals) do happen (>10% for the last 15 years prior to the current crisis).

Slide 17 is a perfect example of how interdependent our economy has become. Should we suffer a breakdown in global trade, we will find our industrial "carrying capacity" greatly reduced. Catton's "Overshoot" here we come.

Slide 12 is also shocking. So much for the "we just have not looked hard enough" argument.

Please elaborate further on the "Forget electrification of transport". Is is possible to cut back in non-transport areas enough to free up materials to use for electrification? (say shifting telecommunications to fiber)?

Thanks for this excellent post!

The "Forget electrification of transport" hinges on neodymium, an essential component of the best permanent magnets. Neodymium magnets make smaller and lighter electric motors and generators possible. These in turn make electric cars (and hybrid cars) practical.

Electrification of transport is still quite practical in some ways: electric trains, etc. were used long before neodymium magnets were invented.

in the Q and A after this talk, Andre was asked about that comment - IIRC he said forget SCALING of electrified transport using CURRENT technology, or some such.

The point, to me, of this and other wide boundary talks, is that we flit from limiter to limiter and energy has positive feedback impact (in negative ways) on many other industries -i.e. metals and other non-energy input situations don't remain static while cheap energy depletes

This is a dangerous statement because though there is an trend towards the use PM motors (I have first hand experience of this trend), it is not essential and induction motors could be used, though they need more copper in the windings to carry the magnetising component of the current.

I doubt large wind turbines will ever use permanent magnets any more than turbogenerators do. There are advantages in having a wound rotor for control purposes (KVAR and voltage control), but again more copper use.

Electrical machines use more material in proportion to their output as size reduces. A 1000 2MW wind turbine alternators will use more iron an copper than a single 2GW alternator (or 4 500MW sets as is normally used in a 2GW coal fired station). For example, for transformers of similar proportions, KVA is proportional to the fourth power of the dimensions, material use (copper and iron) is proportional to the volume ie third power of the dimensions.

Other than that, the notion that we can ever increase mineral use, without regard of cost and energy use to extract the minerals, makes sense. The economic model of supply and demand must have limits. A pub may sell a 1000 pints an evening at a cost of £2.00/pint, might sell 500 pints at £4.00/pint but would not likely sell a single pint for £2000.00!

Hi JonFreise,

I believe in the need for electrification of part of (land-based) transport, but I very much doubt that we will be able to swap from hundreds of millions of fossil fuel powered vehicles to the same extravagant amount of electric vehicles. We will simply lack cheap abundant metals to make huge amounts of affordable batteries, catalysts, fuel cells, permant-magnet motors and so on.

I like your suggestion to free up materials from other applications. In this way we can save critical materials to be used for essential applications. Only part of transportation is essential, And then there are the many other sectors which are vital for our society and need resources as well (food, shelter, energy, healthcare, education, safety and so on).

I would draw a drastic conclusion from the data presented here: industrialism as we have known it is coming to and end in this century. Hydrocarbons, metals and minerals are all underground resources, and they will all become unavailable to us, gradually or not so gradually perhaps.

That means our only way out is reliance on above ground resources, re-integrating ourselves into the cycles of life that exist on the surface -- in a word, returning to the soil, though in a more intelligent and scientific way than ever in the past.

When I see the word sustainable, I always wonder what it can possibly mean if not the above.

The key issue for me is retaining the science, or at least as much as we can, that we learned in the oil age and its run up. That means retaining global communication. Those are the two aspects of globalization that we must strive to retain. (Retaining the physical flow of goods on anything remotely resembling its present scale is out of the question.) How do we do that without the metals and energy we have now? It is crucial to develop ways of stretching out supplies as long as possible so that we can retain global communication and science as long as possible. Its up to our descendants to see if it's possible to retain and global communication network using only above (or nearly above) ground materials.

The other big thing to realize is that depletion of metals and minerals means ever greater destruction of the above ground ecology in order to get the m & m, i.e. destruction of our only ultimate resource. The tar sands are but one spectacular example on the hydrocarbon side. I'm sure there are many examples with m & m. (The ratio of tailings and collateral damage to end product goes ever higher.)

Edit: fascinating post!

I think it is not just global communication we need, but our knowledge that we have developed over the years. If electricity starts to go, electronic files will be lost. Paper books are helpful, but are limited to those who are physically close to them, so can read them. They also deteriorate with age. I wonder how many will be left 100 years from now.

Absolutely. It's a little like the case of the fall of the Roman Empire, the Western one at least. During the Dark Ages it was left to the monks and the Arab scholars to retain classical learning. The difference is that this time there's no foreseeable Renaissance. One looks at the vast amount of knowledge we've accumulated about cosmology, physics, chemistry, the earth itself and one wonders: how much will we be able to retain? And how?

One thing is for sure: if there were ever a need for international pooling of resources, this is it: finding a way to archive material in a way that will still be accessible one hundred, two hundred and more years from now by a materially much poorer civilization.

Edit: To slightly correct the above analogy I would say that although material decline is unavoidable, a new Dark Age is not -- it depends on whether we can find a way to retain global communication and archive our knowledge store.

Thanks for these comments. I really agree about communication.

I would only point out that the last time around the Renaissance wasn't foreseeable either.

wow

this is doomer cornucopia.

what do you call a group of doomers?

a huddle of doomers

a muddle of doomers

an imprecation of doomers

a prediction of doomers

a kuntsler of doomers

a peak of doomers

a decline of doomers

a gloom of doomers

a curse of doomers

an agreement of doomers

Hi polytropos,

And what do you call the vast majority of people who are either in entrenched denial or refuse to even contemplate the possibility of overshoot and subsequent decline? How about unfunded optimism cornucopia?

the irrational exuberance of cornucopians

The problem with some people on here is that they obviously want society to collapse because they have a radical back to nature agenda so key facts, which do not neatly fit the desired industrial society is doomed spin, get left out. Yes, there are very really challenges in the decades ahead but is it not slightly odd that the elements U and Th would not feature in this presentation? Could that glaring omission be because they potentially offer a way out on the energy supply side that could alleviate problems associated with fossil fuel production decline and may even eventually help shift the mineralogical barrier ever so slightly opening up many more marginal ore deposits for commercial production? The real game changer eventually in that regard would be nuclear fusion of course.

Hello Exiled Scot,

See my posting at the bottom of this thread please. The highly optimistic Cornucopians, who obviously did not want society to collapse back in their day, were more than happy to execute their radical back to nature agenda. How soon we forget that we will do anything, absolutely anything to get the Elements NPKS to boost our topsoil.

Please recall my earlier postings with the terms: dead-reckoning, dead-weight, and dead-heading. Or read here:

http://livinghistoryfarm.org/farminginthe40s/crops_04.html

--------------------

By 1815, England was importing so many bones for bone meal that people on the Continent starting complaining:

"England is robbing all other countries of their fertility. Already in her eagerness for bones, she has turned up the battlefields of Leipsic, and Waterloo, and of Crimea; already from the catacombs of Sicily she has carried away skeletons of many successive generations. Annually she removes from the shores of other countries to her own the manorial equivalent of three million and a half of men... Like a vampire she hangs from the neck of Europe."

---------------------------

EDIT: Don't forget to google Waterloo Teeth as I bet that was a fun job for an optimist...

I will eventually start to look at the depletion dynamics of these elements. Do you have any references to depletion studies of U or Th that are ongoing?

Or are you in the camp that these materials will last forever, and can't be bothered to help us do some digging? (so to speak)

They will last forever. A ton of granite contains uranium and thorium with the energy equivalent of about 50 tons of coal or 220 barrels of oil. But we won't ever have to go for such low-grade ores.

Hi Exiled Scot,

I sure hope you're right with part of our future energy coming from uranium and thorium, so in that sense I'm an optimist. The simple reason for me to not include U and Th in my paper from March 10, 2009 (and this presentation which is based on it) is because the USGS data I used don't include these. But U and Th are special cases anyway, because their intrinsic energy value (for nuclear fission) justifies to go to great lenghts to concentrate the stuff from mineral deposits.

I welcome any solution framework that alleviates the problems. Who wants collapse? A doomer offers no perspective and no solutions, I do see perspective and solutions. It's just not a given that we live in a fairy tale with the obligatory happy end: some problems are real and deserve some serious attention. Better safe than sorry. Hope for the best, prepare for the rest.

This is NOT a doomer site. It's not a site for unfunded optimism either.

I'm very much in favour for research on nuclear fusion, because we simply need it. However, even the most outspoken proponents working with it admit that we will not see a commercial fusion reactor up and running before 2045.

Why would we need it? You just mentioned U/Th fission, so I guess you are aware that we could go that route for all the world's current and future electricity and heat needs, if we want to. Technically, this is much less of a challenge; we could actually start a slow ramp-up immediately.

What do you think would be the purpose of shifting "the mineralogical barrier ever so slightly"? Do you think it should be some other generation's problem to figure out what to do about declining metal production?

Of course, it's a reasonable position to want to delay the problem for someone else to solve (or, more likely, to adapt to) but I don't share such a position. As we still have a lot of concentrated energy in a very useful form, and only 6.7 billion people, wouldn't this be a great time to figure out how to power down and live sustainably?

Even growing up in a developed country like Scotland, I am only two generations away from experiencing small scale subsistence non-mechanized agriculture and heard enough about what it was like to know it is not something I would ever want as a lifestyle choice. The upheaval involved in a return to those conditions would be cataclysmic. The aim should be to make industrialized society work, in my opinion. If commercially viable nuclear fusion is ever realized there will be no need to power down. Nuclear fusion, increased efficiency (Western society is incredibly wasteful at the moment) and various renewables can help bridge the gap as the effects of peak oil set in. The elements of hope part of the article point the way to enhanced sustainability. I would agree with the author that certain elements need to be used much more intelligently than is the case at the moment.

I'm not sure what you mean by "enhanced sustainability". Some behaviour is either sustainable or it isn't. Did you read the above article about metals production? Even with a miracle of unlimited energy, this is still a finite planet, including a finite environment.

If you don't think unmechanised agriculture is a tempting prospect then go for full scale permaculture. Why does agriculture have to be the only way to feed people? There are alternatives to what you think of as industrialized civilization.

The definition of sustainability is pretty simple. If we can't figure out how to use resources, renewable and non-renewable, at no more than their renewal rates and can't figure out how to stop damaging our habitat, in all sorts of ways, then it's not sustainable. (Maybe there can be some discussion about consuming extremely small quantities of certain non-renewables but that is unlikely to result in anything resembling BAU).

Can an industrial civilization be sustainable? That's a key question. If it can't, is there another kind of civilization that would be acceptable? If not, then let's take the brakes off, put the pedal to the metal and head for that cliff; no doubt an exhilarating ride to oblivion.

Gail,

If electricity starts to go, electronic files will be lost.

Do you mean if we loose the ability to produce any electricity we will not be able to read electronic files( or laser etched CD's) or to re-charge lap-tops? The problem with files will be computers that read them, some should survive most of us don't throw them away, I have 3 old computers somewhere in a box.

If so is this plausible, countries like Canada get 60% of their electricity from hydro, why would it vanish? As long as we have one ICE vehicle and a little ethanol we can recharge 12 volt batteries.

Paper books are helpful, but are limited to those who are physically close to them, so can read them. They also deteriorate with age. I wonder how many will be left 100 years from now.

Considering that books printed on acid free paper last >500 years and probably longer, I would expect >90% of documents on acid free paper to be around in 100years unless we have a global nuclear war or a direct major asteroid strike. Universities have all PhD and MSc documents printed on acid free paper, so at least some of the important works will survive, may loose the Sunday and week-day tabloids, not a big loss.

We will probably have some local electricity, but I am not sure how much widespread electricity. If you have files on your hard drive, and have electricity, you will have the information. But once the computer wears out, the information will be gone, unless somehow, somewhere, we somehow stockpile computers and storage media (in a location that has electricity as well). Widespread dissemination of that material will be difficult, unless we have something like the Internet that continues.

You say acid free paper lasts >500 years. But asphalt roofs don't last anything like 500 years, and we likely won't be able to replace the asphalt tiles. In the south, we need pesticide, or termites quite quickly do away with the wood in buildings. We probably won't have heating, air conditioning, or dehumidification, so things will hold up much less well than we are used to. If we can store books some books in caves in a desert, we are probably in good shape, but I don't think we can assume our buildings are going to hold up that well.

hmmm... I wonder about some sort of super-stable microfiche material? If all that was necessary was magnification, it could be retrieved more or less indefinitely in the future by monks with handmade microscopes. Actually, that leads to more notions... I'll give it some more thought...

Gail,

I was thinking of libraries built before oil,using glazed clay tiles or slate shingles, still used in most parts of the world except US and Canada.

Why again is the N American grid not going to continue operating, especially if in the future, all vehicles are electric powered, it would seem that maintaining the grid will be as important as maintaining middle east oil is today? It's not as though very much oil is used to maintain the grid, the most critical FF will be NG for peak demand until this is replaced by solar energy. In the meantime the continued growth in wind will allow all coal fired electricity to be phased out over a 20-30 year period, long before oil will be too valuable to use in ICE vehicles and helicopters.

Ummm in case you haven't noticed we are in the middle of the Greatest Depression, money for maintaining and improving the electric grid is going to be quite impossible to come by. We're still in a credit crunch and most of the metals and minerals that are going to be required by the US to create it's fleet of electric vehicles lie in China, Bolivia etc. What makes you reckon that in a negative sum game these countries will be friendly?

Might I quote Stoneleigh from The Automatic Earth, http://theautomaticearth.blogspot.com/2009/07/july-1-2009-renewable-powe...

"Ummm in case you haven't noticed we are in the middle of the Greatest Depression, money for maintaining and improving the electric grid is going to be quite impossible to come by."

You may have not noticed that several billion was just appropriated for electric grid upgrades, one of the first items on the Obama agenda.

as well as the low EROEI of renewable energy

Wind energy appears to have an EROEI of >40:1( for turbines >1.5MW) on a MW used to MW delivered basis. Refined oil products EROEI appears to be <10:1 on a delivered basis. In the last 6 months the US added 8GW of wind capacity, a 25% increase bringing wind energy from 1.6% to 2.0% of total electricity production, in the middle of a major recession. Why would we want electricity to travel in a two way direction? As far as I know wind turbines don't use electric power.

On what basis are you in the "greatest depression"?, still a very high proportion of the 15-65 age group are actually employed, it always feels like a depression at the bottom of a recession, especially if you are one of those unemployed. People are still buying gasoline at >$2/gallon, still buying millions of new cars, are the roads deserted on weekends, or Friday nights? If you want to see what a depression looks like visit a third world country with 50% unemployment, notice almost everyone walks, all vehicles have half a dozen passengers, buses and trains have passengers on the roof. When more people are walking along the streets than driving and when every car has 3 or more occupants then you will be able to say you are in the greatest depression since the 1930's, but still way better off than then.

On what basis are you in the "greatest depression"?

Well sir,

1) Biggest debt bubble of all time with a current 375% Debt to GDP ratio

2) Broadest measure of unemlployment at 16.5%, with the Center for Labor market studies at North Eastern University putting it at 18.2%

3) With the average work week being at the lowest it's been since the data started at 33 weeks.

4) Because of collapses in world trade, industrial production and stock markets all over the world, http://www.voxeu.org/index.php?q=node/3421

5) Because youth unemployment in the US is 24% and only 19.8% of Graduates are getting a home

6) Greatest wealth loss of all time so far, 14 trillion and counting

7) I live in a third world country and welcome to the club or atleast see you soon :)

"bringing wind energy from 1.6% to 2.0%"

I think that's for the months of March, April and May. June is back down to 1.6% and, overall for 2009, the lastest EIA STEO is estimating 1.6%.

Wow, except the fact that she is completely wrong with her assumptions. Power plants were in fact built during the depression and in fact power consumption increased with those that still had jobs, despite what she claims. There was in fact growth during the depression. That is my biggest pet peeve. People love to throw out figures of how much it will cost to update the grid, build new power plants, etc, without deducting the money that will be spent doing such things anyways. We already spend billions towards grid updates, new power plants, and transmission lines each year. These costs need to be factored out before we can get anything in the realm of a true figure on how much transitioning to something else may cost. /end rant.

If you have read the Automatic Earth from time to time and the previous TOD Canada posts from 2005, you will realize that Stoneleigh is the foremost forecaster out there on the web. The previous great depression will be nothing compared to what's coming, the scale of the current crisis is much bigger, and oil production increased from 1929 to 1939, we shall have no such luck as the peak is past and investments will be cut back sharply. You are welcome to question her assumptions on the site's comment section! She is highly polite and rigorous with her analysis. Cheers.

Someone had already pointed out her error and no rebuttal was offered, so I do not see the point in pointing it out again on a 8 day old post. I am familiar with TAE and do respect her economic forecasts and advice, however on that one post her facts do not match the real world examples we have. We also have a real world example of oil production collapsing by 14% during a recession and we still built power plants then. I will stick by my statement that stating 'nothing will be built during a depression' is flat out wrong. If she meant to state, nothing will be built in THIS depression, well that remains to be seen.

Also, nuke plants do not take decades to build, as stated, but I will not get even more off topic in this post and do that debate here.

The problem isn't that the grid itself uses too much energy, it is a combination of things. The grid uses a lot of minerals that are getting rarer. Also, the grid needs to be kept in repair. This generally means highways and trucks designed for that purpose. In some parts, it means helicopters capable of repairing downed lines. Trying to keep all of this going is going to be very difficult. Even if we do keep up some parts, it is likely that other parts will be lost.

Also, we import a lot of parts of electrical transmission systems. If, because of financial problems, our ability drops greatly, we will have problems keeping the grid repaired.

Gail ..

All the info we'll ever need is being stored by

this company .. mostly underground in salt deposits ..

http://www.ironmountain.com/index.asp

We'll just need to remember where the storage

facilities are located ..

Triff ..

It would seem like our ways of disseminating this information, even if it is saved, would be very much reduced.

I have no fear of loosing history again. Books used to be handwritten on animal skins or papyrus. Few people could read or write, and books were often one of a kind.

The amount of lost history is staggering. The Emperor Claudius, for example, is known to have been a prolific writer, authoring numerous books including histories of the Etruscans and Carthaginians, none of which survive. Much of Tacitus’ "Annals of Rome" and "History" have been lost, the surviving Annals were half found at Corvey Abbey and half at Monte Cassino, which was destroyed in WWII.

A remarkable story is told in “How the Irish Saved Civilization”, which tells of the collapse of the Roman Empire in the early 400’s when the Rhine River froze over and the starving barbarians crossed en mass. The boy who would become St. Patrick established a monastery in Ireland, where many of the classical documents were passed down through the ages.

http://www.amazon.com/Irish-Saved-Civilization-Hinges-History/dp/0385418...

I have a theory that one of the main contributions to the age of learning was the introduction of paper making to Europe, via Persia which had been occupied by the Chinese Empire. A paper mill is known to have existed in Sicily in the 12th Century.

Acid free paper is archival, especially the calcium carbonate filled type. Acid paper was used extensively in the last 150 years, but better process chemistry that allowed alkaline sizing (water and ink penetration control) and higher pigment (filler) became popular in the 1990’s. Alkaline papers will last for centuries if kept dry and away from insects and rodents.

It could be that we don't.

I strongly agree with the comments in your post here.

It's hard for me to feel any sympathy for the current yeastlike growth, but I do feel sorry for any subsequent societies which might try to arise. It'd be nice if some rare elements were socked away for them rather than the locust-like dispersion of all useful concentrations of anything.

If people were able to focus on more of a thousand-year horizon, which is still brief in any reasonable terms, it would make sense to spend energy and time now learning sophisticated stuff like how to synthesize spider silk without a global extractive infrastructure. Can't be impossible if a bug's butt can do it.

Spiderwebs, glass, cellulose and the common metals: it'd be interesting to explore in advance what could be done with them working with very low energy inputs.

Yes, that's another big question. To what extent can biological (or surface m & m) materials replace currently used metals and minerals and the hydrocarbons that produce and mold them? There's a book, 1491, I forget the author, in which pre-Columbian (American) Indian technology is discussed quite a bit.

Can anything replace copper? Will we see the building of a biological internet using end-to-end electric eels? I'd be shocked. Ok, I'll go away.

Aluminum and copper-plated aluminum wire is basically inexhaustible. Not nearly as good as copper but it is servicable.

We are so *%#$^#*@. Slide 12 showed we haven't made one single major mineral deposit find since 2004. Not to mention that with the current depression major investments in all energy and metals sectors will be cut down! :(

Fascinating -- and sobering -- presentation.

There may be some interesting feedbacks here. In the absence of discoveries, the unit cost of extraction for scarce metals is going up, with the cost of diesel as an important component. As long as prices for scarce metals increased, this was manageable. When oil went into orbit last year, the economics likely tanked.

Now oil is back down, taking diesel with it and easing the pressure. But unit cost of extraction (ex-diesel) is still going up due to depletion, making producers increasingly intolerant of fuel price increases. It may be that rather than hit a 2008-style price spike in oil, tomorrow's $80/bbl will feel like 2008's $100+/bbl, at least to the mining industry. Meanwhile, oil producers need prices of $80+/bbl to invest in new production. Vicious cycle.

The only thing pushing back on this is the relative abundance of iron and coal (to make steel, and even high-grade coal is showing signs of lower availability).

After reading this post I would almost welcome a scathing comment from someone denying its validity. Very few people are willing to contemplate a future this bleak.

If you put this with the view that we need to stop use of fossil fuels as soon as possible, it really does come out dreadfully. I have to think that there has to be some indirect favorable impact on CO2--perhaps indirect impacts will limit fossil fuel use over the longer term, so artificially limiting such fuels now may be less important.

If this is the case, using fossil fuels now to produce the more common minerals, substitution, and recycling might still be reasonable partial solutions.

I don't know about denying the validity, but would like to add that modeling the depletion of resources such as mineral ores is quite a bit different than the depletion of oil. Although oil has an analogue to grades of ore, enough of the oil has been of a homogeneous nature that we can distinguish the discovery and production of the better "grades" of oil from the poorer quality (tar sands and oil shale).

The fact that grades of minerals follow more of a continuum makes it more difficult to model as a homogeneous fixed-volume quantity. The reason for the continuum in minerals is easy to explain. Minerals have been around much longer than fossil fuels and have been able to disperse via tectonic shifts and other slow global processes, and essentially form a Pareto distribution as demonstrated by the quote

Oil also follows a dispersion but the geological time frame is short enough that the distribution shows up in sizes of reservoirs, instead of "richness" of deposits.

Bottom-line, I have shown that dispersive discovery of oil shows the fat-tail phenomena, but that fat-tail behavior is dwarfed by the fat-tails of graded mineral deposits. The caveat, I agree, is that any refining of these minerals is obviously limited by available energy, so we will have excess resources (either unmined, undiscovered, or un-recycled), but without energy to do anything with it.

This applies to hydrocarbons too! I believe that a lot of the URRs will not be Ultimately Recoverable. This is because of the interaction between metals and minerals end energy. Degradation of ores can render hydrocarbons unrecoverable. Not to mention that the shrinkage of the global industrial infrastructure beyond a certain point renders it non-functional.

Here is a little bit of hope.

The majority of the energy usage in mineral extraction and refining is not oil based. Following is a typical breakup of the energy inputs:

- Explosives - gas based but could be derived through electric only

- Overburden Removal - Electric draglines

- Mining - Electric shovels

- Mine transport - Diesel trucks but could be replaced by electric conveyor systems

- Ore raw processing - Electric base

- Stockpiling and handling - Electric base

- Transport to port - diesel trains but could/is replaced by electric trains

- Shipping - oil based

- Unloading/handling - electric based

- Processing and refining - predominantly electric but gas and coal is used depending on the mineral.

Of course this is just typical and will vary depending on the country, mine type and mineral but, most (All ??) mineral extraction could be performed with relative ease using only electric power. Refining is a little more difficult with the big problem being iron.

While we can easily convert the mining and refining operations away from a dependance on oil, unfortunately, this just puts off the problem for a few more years unless we establish sustainable power generation.

My main takeaway from listening to this fascinating talk was that slide 10 (peak minerals) is a consequence of peak oil / energy. There is a huge abundance of all the metals we need in the surface layers of the lithosphere (upper continental and oceanic crust). If we had infinite energy, then it would not be a problem mining the lower mineral grades to gain the metal resources we need.

What we are facing is the collision between "high grading" fossil fuel and metal mineral resources. In future we will have to mine increasingly lean ore grades using a declining amount of energy.

As an antidote to this bleak scenario we will hopefully have the presentation from ETH Zurich which showed how the Swiss (and a handful of other countries) are essentially recycling everything which significantly reduces their need to import new raw materials.

One final comment. Care needs to be taken in distinguishing between rare metals (gold, platinum, rhenium etc) from rare earth elements (REE) which are the Lanthandie group found at the bottom of the periodic table - lanthanum, yterbium, neodymium, samarium, europium etc. In mining operations there is normally a target mineral - for example molybdenum, but then there will be a range of accessory metals that are recovered and it is often these that make the operation profitable. For example, the Olympic dam copper mine in Australia is also the worlds largest U deposit (low grade). The REE elements are a bit different and normally occur as phosphates and not normally as secondary mineralisation associated with main stream mineral deposits. However, the Indian Th deposits are I believe hosted in the phosphate mineral monazite that will likely contain abundant REE - so if these deposits are ever mined for Th this should diversify REE source.

SOME of the "rare earth" elements are not that rare when compared to the more common metals we associate with eg cadmium, chromium, tugsten and vanadium. Unfortunately I have lent out my book that gives relative abundance, so working from memory. The first 10 most abundant elements eg, Oxygen (50%), silicon (25%), aluminium (8%), iron (7%), sodium, potassium, titanium, magnesium (can't remember the other 3) make up 99% (ish) of the earth's crust.

We could probably do an entire post on the fascinating subject of the rare earth elements (REE or lanthanides). Two main groups are commonly distinguished: 1) the so-called light rare earths (LREE; lanthanum- or cerium-group; ions of larger ionic radius) typically concentrated in mineral deposits related to carbonatites and 2) the heavy rare earths (HREE; yttrium-group; ions of smaller ionic radius) typically concentrated in very different mineral deposits related to granites. For various reasons, partly related to labor and environmental costs, China currently leads in production of both.

Typical by-products or co-products of the LREE in carbonatites might include thorium, niobium (a.k.a. columbium), titanium, barium, and strontium, among others (including iron in China). Typical co-products of the HREE might include a completely different suite of elements including tungsten, tin, and many others. During mining of the HREE, some co-production of LREE may occur from the accessory phosphate mineral monazite.

The main point is that even for this extremely coherent group of elements, complexity abounds, and trying to lump them together can lead to confusion. Each rare earth element, in general, has a specific use or uses, and their geochemical abundance varies all over the map (in an interesting, coherent way related to atomic number). Yet many REE occur concentrated together (i.e., in solid solution) in common carbonate, phosphate, and silicate ore minerals. As Bryant mentions above, separating them from each other in ores is a highly technology- and energy-intensive task.

The REE group might therefore be a poster child for the concept that once energy becomes scarce and expensive, so potentially will every element whose mining depends heavily on energy. Not because we are necessarily running short (many REE are geochemically rather abundant), but simply because we will no longer be able to afford to process them.

We are only talking about small amounts of Neodymium, not on the scale of copper or zinc use, so even if it requires X100 more energy this is still very small and the price of a wind turbine will not change if the price of Neodymium is X100 greater as only a few 100kg's are used in a $5million turbine.

The assumption "once energy becomes scarce and expensive," is only valid IF we cannot replace FF with abundant wind and solar energy, and this is only true IF we cannot extract metals using the existing non-FF that we have today. Both seem to be wrong assumptions, both wind and solar are becoming cheaper and are only slightly more expensive than oil or NG.

There are no neodymium mines, so its relative price is mostly a non-issue. You have to look at the profitability of mining and carefully recovering the entire suite of rare earth plus associated elements. Rare earth metals are a commodity. Barring government intervention (tariffs, domestic price supports, etc.), the low-cost producer always wins the market. Right now that producer is China.

I know you think that energy will never become scarce and expensive. Obviously, many here disagree. Right now energy is a relatively minor cost of mining, compared to everything else. That may well change, especially as metals depletion advances. What is probably still more important though, is the possible effect of abruptly higher energy costs on the entire world economy. With insufficient demand, mining shuts down. Look around you.

As I've stated previously, I personally consider it more likely that peak production of most metals will result more from prolonged economic contraction than from terminal resource depletion, simply because that will occur first (and probably has already started). The main post considered mainly the supply side of the equation. I think it should also have considered the demand side.

"If we had infinite energy, then it would not be a problem mining the lower mineral grades to gain the metal resources we need."

There would be if you're really talking on a massive scale; you'd have huge areas of land/crust completely depleted of minerals needed for life.

Wouldn't you? If you're pulling up hundreds of thousands of tonnes, extracting all the metals and returning the result, well, as mud (?) not stones, that's a pretty big impact on the area. If any random part of the crust will be mined in this way, mining operations would cover enormous areas, and the social and environmental impacts would be far greater than they are at present.

Thxs for this keypost. IMO, just another reason for Tiger Woods and Justin Timberlake [love those eco-names] to start plowing the USA's 16,000 golf courses as they go defunct. Please imagine all the metals, energy, and other resources devoted to this sport at your local level, then all the way up to the major Pro Tournaments with their cameras on cranes.

From the steel in golf carts and course maintenance machinery, to the titanium and graphite in clubs, to the rare earth elements for the range-finding equipment & computers, and much more...even to the monumental waste of water, I-NPK, and toxic pesticides & herbicides.

I fear we won't sufficiently ramp in time permaculture, Kunstlerization, full-on O-NPK recycling by SpiderWebRiding, or Alan Drake's ideas. Instead, it will be a lot of machete' moshpits.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Thank you for posting this and linking to a PDF. This is very interesting and important. You could also link water resource limitation to mineral availability. I liked the link to energy, nice work!

I believe the mineral we have to worry about in the medium term is phosphate. Substitutes will be found for other elements like lithium and indium. As to rare earth elements there are huge quantities untapped in the tailings dump at Olympic Dam though I believe lanthanum is more abundant than neodymium.

The Chinese resource buyout is a mixed blessing. I know people who lost their jobs and were then rehired because Chinese interests took over their ailing mining employer. On the other hand the arrest in Shanghai of a Rio Tinto executive on 'spying' charges suggests the Chinese want to exert undue influence. They could be in a snit over the failed RT buy-in offer or Obama's talk of carbon tariffs. I suggest that neither the US nor Australia increase coal exports to China when the south of that country runs short.

I'm not sure a descent/crash is inevitable. Another interpretation is that we are on a race to create a sustainable energy supply before the other resource constraints bite big time. I think all of the logical responses are similar to those needed to delay a crash, but the endpoint is very different. Even assuming this is possible (obtaining enough longterm sustainable energy, to continue to produce increasingly poor grades (as the economics dictates)), the more we continue wasteful BAU practices the more likely the bad outcome becomes.

I'm not sure a descent/crash is inevitable.

It is very difficult to visualize radical change. How many people visualized the current economic crash despite the ominous rise in debt over the last decade and the numerous warnings by many economic analysts. Bill Bonner wrote two books explaining why the crash was inevitable:

http://www.amazon.com/Financial-Reckoning-Day-Surviving-Depression/dp/04...

Not only is a crash inevitable, but it has begun, starting with the economy. The problem is that we are at the end of the “growth model” economy and are in transition to the sustainable. This is not by choice but by necessity because the developed countries have exhausted their economic potential energy in that we have done such a good job of innovation that we have reduced production costs to the point that human labor for many goods is below the cost of energy and materials. The increasing scarcity of energy and materials will dramatically increase cost of goods. We have also nearly exhausted the thermodynamic potential to convert energy to work, having increased efficiency 10 fold in the past century and are now approaching theoretical limits.

The end of the “growth model” is the end of the ability of governments to raise taxes. Therefore we may be only a few years away from the sort of social collapse as in the former Soviet Union. The federal government is on course to run out of money as states like CA already have. There is a danger that police, fire and EMT jobs will cut just when we are facing skyrocketing crime and social unrest.

The only way we will recover is for the developed countries to recognize that the growth model is dead and to plan the transition. Instead of trying to salvage the US auto industry we should be implementing progressively increasing fuel taxes. We also need to declare automobile free zones in central business districts and start building streetcar lines.

According to The Rise and Fall of Infrastructures there was a 55 year transition period between canals/railroads/roads/airlines:

http://www.iiasa.ac.at/Research/TNT/WEB/Publications/The_Rise_and_Fall_o...

This is illustrated graphically with S curves in:

http://www.amazon.com/Predictions-Societys-Telltale-Signature-Forcasts/d...

A recent (7/1/09) article in US News by Kent Garber laid out another “inconvenient truth”. The article outlines a scenario that has China holding a monopoly on the critical rare earth elements market. Can we really afford to procrastinate and “once again” demonstrate our ignorance of the strategic and commercial importance of more critical American natural resources? Much of the new technology necessary to start “the green economy” depends on rare earth metals.

Rep. Mike Coffman of Colorado (amendment into the House's defense budget bill – reviewing rare earth concerns) and Sen. Evan Bayh of Indiana (proposed requiring the defense department to evaluate the extent to which the country's weapons are dependent upon rare earth metal supplies) have proposed legislation that would help.

Thorium Energy, Inc. CEO, Ed Cowle has been trekking to Washington to talk to congressmen, senators, and agency officials. “Part of their problem, says Cowle, is getting people to realize there is actually a problem”. As Jack Lifton, a longtime metal analyst, says, "The Chinese are depending, as they always do, on the myopia of the American investment community that only sees to the end of its nose."

We need to develop domestic supplies through companies such as Molycorp and Thorium Energy, Inc. before China becomes the sole source. Everyone needs to make sure that their Congressmen understand that we do care.

The Diederen presentation makes a few assumptions:

1) energy per capita(not just oil) is going to decline dramatically because alternative energy cannot be developed ( at the scale required)due to coming critical shortages of metals."metals scarcity will aggravate energy scarcity" this is worthy of a separate article, but before this can be accepted the other assumptions need to be challenged;

2) "minerals extraction is a significant energy user", but I did not see any data on this, is it 1%,5%, 10%,20% of total world energy use? I think >90% of energy use is for steel and aluminium production, both are recycled at a very high rate. My guess is that ALL other metals(excluding Fe,Al) require less than 0.5% of the present world energy use, and are unlikely to be unavailable because of energy availability. Neither Fe or Al use large amounts of oil but do require very significant amounts of coal for production, but only small amounts of electricity for recycling.

3)Remaining reserves are 12-50years based on 2% per year increase in use, is this any different from 20, 40 years ago(ie reserves only increase as needed) or are remaining reserves decreasing.

4)as copper ore grades decline what is the evidence that more energy is being used in extraction and how much more? For example acid and bacterial heap leach is now being used on low grade ores.

5)The rare earth elements are as abundant as zinc and copper but use is <0.1% of these commonly used metals. Rare earth deposits in US are not mined because China produces them at a lower price( not because ores were exhausted). Use of neodymium is not very price sensitive, so other lower grade resources(Monazite) could be used.

Some of the other slides are just misleading for example Zirconium use, there is no shortage of Zirconium just a shortage of demand. The EU and US % of mining has declined but has absolute amounts of EU and US mineral production declined or other countries production( Eg Brazil, Australia ) increased?

Remaining relevant resources; high grade deposits of Al and Fe may only account for 1% of these elements but they are still very very large. Mg is presently extracted from sea water and is never going to be depleted. Silicon? does anyone believe we are going to run out of high grade deposits of silicon dioxide?

The post I originally wrote got eaten -- here's the gist of it.

1,2) increase in energy cost may make specific activities uneconomic, even if they only use a small percent of energy.

4) see Ruth (1995) -- modelling of extraction limits from a thermodynamics pov, Roma, Pirinoc (2009) --- overall economic analysis framework no significant conclusions.

RE: The final comments on Al, Fe, Mg, Si -- even the author of the article agrees -- those elements are among the "hope elements" (slide 21) with no significant extraction limits in the medium term future.

This was a worrying aspect of the presentation. That there may be some elements that offer hope, simply because there is a medium term abundance of them.

The presentation starts out by making the case that the simple statistic of a resource base is meaningless when it comes to ore grades and energy required to access and extract that resource. Then it apparently offers hope that there are some elements that are so abundant that they could take some of the strain, if we can develop the technology to substitute them for scarcer elements. It also suggests that using less will get us through this crisis.

But isn't it true that even constant consumption (a virtual impossibility in a growing - in more ways than one - world) will deplete reserves? There will always be a point in the future when production will start to decline, if we consume non-renewable resources. So how is switching to the elements of hope "more sustainable"? Unsustainable is unsustainable; only the time period will shift.

We either figure out how to live sustainably (and surely that means consuming no more non-renewable resources - or at most a tiny fraction of the recoverable resource base) at all and consuming renewable resources only at their renewal rates, or below, without damaging our environment. The target, ultimately, should not be to consume less of these elements but to consume none of these elements. Recycling is possible but this would, inevitably, provide a very limited resource supply.

Agree with you about zirconium. It is geochemically abundant in the accessory mineral zircon. If its production peaked this probably represented a peak in demand and not supply. This apparent error was discussed for a previous exposition of this thesis on TOD; I was somewhat surprised to see it repeated here. Not a good example!

Agree also that use of percentage of world production as an indicator of decline is potentially confusing if world production has been greatly increasing. Nevertheless, probably no industry professional would argue that EU and US mineral production hasn't been declining, in general owing more to unfavorable domestic cost structures and foreign competition than to incipient depletion.

I understand that the highest grade deposits of silicon dioxide (quartz), those most suitable for high purity silicon manufacture, are actually relatively rare. They require a second step of purification, one generally provided by the natural process of metamorphic recrystallization (aqueous dissolution and reprecipitation under high temperatures and pressures). This purification step could be carried out in the laboratory, but at very much greater cost than letting nature do it for free.

This natural beneficiation step for silicon is somewhat analogous to sufficient burial (heating and squeezing) having changed oil shale into oil, or the natural surficial weathering that over millions of years changed low grade siliceous iron formations into high grade iron oxide ores (a form of rust), or granites into aluminum hydroxide ores (bauxite). Nature can make very good ores, even of silicon, but the correct sequence of events, and preservation of the results, can be rare.

Interesting--I hadn't heard that about silicon deposits before.

I think the problem with ore mining is not looming shortages or energy input per se but dependence on fossil fuels. For example it creates 1.7 tonnes of CO2 to make one tonne of steel using coke as a reducing agent. Mining consumes vast amounts of diesel and ANFO explosive. The aluminium smelting industry consumes 11% of Australia's coal based electrical generation.

Realistically I don't see aluminium smelters running on heavily wind and solar based grids. Perhaps they should all relocate to hydro rich countries. If that or enhanced recycling are inconvenient then heaven forbid we should pay more for aluminium via carbon taxes.

Short range mine trucks could run on batteries rather than diesel. Explosives could be made from air and electricity. Reduction of iron ore and oxidation (roasting) of sulphides could be done with natural gas or nuclear thermal hydrogen. This will obviously cost more. The problem is not that metals are running out but that fossil fuels will be more expensive due to either depletion or legislated carbon penalties.

Boof,

It's the scale of energy use, even though Australia exports large amounts of metal ores and processes some such as Al, mining only uses 5% of the national energy budget and processing another 10%(steel and aluminium). Steel production uses less than 10% of world coal production. Does the world produce enough wind power(40GW average) to refine all the steel, copper, neodymium, and aluminium and cement to continue growing wind power at 30% per year? I am sure it does, with lots left over.

Realistically I don't see aluminium smelters running on heavily wind and solar based grids.

Why not electricity is the same, what ever the source, solar and wind variations can be balanced by EV recharging, pumped hydro. When we have replaced all coal based electrical generation we can worry about the small amount used for steel production.

The thesis of this article is circular ;"energy shortages give rise to metals shortages that prevent alternative energy resources being developed"

If neodymium was as rare as Ag or Au, and the only resources were in China, and neodymium was essential for electric cars and wind turbines, nuclear and solar power, and a high proportion of the worlds energy was used to extract and refine metals then we would have a problem. But since NONE of these assumptions apply to generating non FF energy it's hard to go beyond "ENERGY SHORTAGES", let alone metal shortages.

Only one of Australia's five or six aluminium smelters claims hydro as a major power source and that plant (Bell Bay) happens to be next to two gas fired generators and an inverter-rectifier station for an HVDC cable. That's some backup. Since the process uses molten salt a supply interruption is a big deal. The industry claims it must have baseload power or I'd guess a supply guarantee.

To be able to do that on a grid that was say 50% wind and solar might require extraordinary measures such as automatic supply rationing to other industries. I think they expect to pay 2 or 3c per kwh 24/7. Of course the aluminium industry could have giant battery banks or its own carbon taxed FF generators but they like the idea of permanent special treatment.

General question; should we be using throw away alfoil in cooking?

They are building aluminum smelters in Iceland. Cheap geothermal electricity. During the California brownout they closed the aluminum refinery and sold their electricity back to the grid. They made more money selling electricity than selling aluminum.

That's a good point. Aluminum smelters require cheap 24/7 electricity. OTOH they can site them whereever is most advantageous.

Recycling aluminum takes 5% the energy as the first time.

Robert,

That "five percent" is all any old farmer should need to know about the future price of aluminum.

Any body recycling cans and other aluminum scrap who can find a safe rent free place to store his scrap can reasonably hope to see aluminum prices go thru the roof if the economy ever turns around.

Aluminum is the only affordable light wieght substitute for steel in cars and trucks,and with ten dollar fuel and battery powered vehicles,cutting curb wieght is going to be the holy grail of vehicle design-maybe even more so than battery performance,since cutting wieght helps in both electric and gas or diesel mode.

\\

But what is the ratio of minimun operating power level(to keep the molten materials from freezing) to the nominal production mode power level? If that ratio is smallish (say 1:10), then it should be feasible

to run them on mostly cheap time varying electricity, plus a small amount of guaranteed baseload (which can be relatively expensive). Not running production 24/7 would certainly reduce the rate of return on capital employed, but it need not be a show stopper.

If your business competitor is running his smelters 24/7 on Icelandic geothermal power, I don't think you can match his price with this business model. Even after his shipping costs. Even if it were free to idle your smelters, if your smelters aren't running 24/7, you aren't going to make money.

I'd say Icelandic smelters are powered by cheap hydro, not by geothermal.

General question; should we be using throw away alfoil in cooking?