Repost: Gas Tax Increases Revisited

Posted by Prof. Goose on August 18, 2005 - 10:08am

This piece was originally posted 6/19/05, but seems important after hearing Chris Farrell of Business Week on NPR this morning suggesting (thanks NC for grabbing this quote):

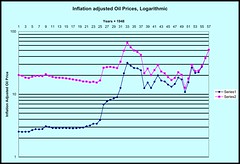

The chart presents inflationdata.com yearly average data, plotted on a logarithmic scale. This unit of time flattens out the spikes in prices, which is probably a more valid measure of sustained price.

The blue line in the graph is the raw price, the pink line is the inflation adjusted price.

As was suggested in the comments in the post below (where you will find an interesting discussion of gas taxation and whether or not it is regressive, which was then followed up by a post on the subject by Ianqui which had good comments too.), this kind of a plot does have a more interesting story to tell.

The data tell us that the price of oil averaged $51/bbl so far in 2005, whereas oil averaged $66.20/bbl in 1981, adjusted for inflation. (edited to add: I think we're at around a $53/bbl average now for '05...)

It is interesting that we think of the shock in 1979 as being the time of the highest prices (at least I did). However, prices were much higher in 1981 than 1979 (according to the data available at inflationdata.com).

An interesting history lesson I found at a site on the history of oil prices: events in Iran and Iraq led to another round of crude oil price increases in 1979 and 1980. The Iranian revolution resulted in the loss of 2 to 2.5 million barrels of oil per day between November of 1978 and June of 1979. In 1980 Iraq's crude oil production fell 2.7MMBPD and Iran's production by 600,000 barrels per day during the Iran/Iraq War. The combination of these two events resulted in crude oil prices more than doubling from $14 in 1978 to $35 per barrel in 1981.

That means, by this way of looking at the data, we're not actually at 63% of the 1981 high in 2005 as I discussed in an earlier post.

Instead, with this more valid data, we're at 76% of the 1981 price!

That means the call for alarm should be even greater than it was in my earlier post on gas prices.

The data tell the story. Find some method of demand destruction. Now.

What we do with the remaining difference and when we do it is going to be one of the crucial public policy decisions of this generation. And the time to make that decision is not far in the future.

Now, granted, I was but a mere pup in 1979...but I do remember President Carter in his sweater. I remember my parents bitching profusely about gas prices (what were they, 50c a gallon?). I remember the lines of cars on television every night. It wasn't pretty. People were losing jobs left and right. It wasn't Bladerunner, but it wasn't pretty either.

The real conundrum, in my opinion, is how to destroy demand so as to come in for a soft landing, even if we are heading towards a 1979 to the googol (ed: not google the search engine, and googol is the correct spelling as I just learned in the comments) power. (no pun intended, I assure you.)

I advocate taxing gasoline now. Abruptly. Quickly. Severely. Better to bend the shit out of the economy now than completely break it later.

If we were to somehow organize and convince Congress (which is, of course, unlikely...and perhaps this is a pipe dream because it would so wildly unpopular that it would be perceived as political suicide unless the peak oil case was made and made well) that a 50c-$1/gal tax on gas now would make their political futures brighter than the alternative. I maintain that's the first rational course of action as I've said in many posts on this blog.

The first step to convincing anyone in elected office is demonstrating that there is a problem that, if not solved by them, will hurt them politically. If politicians can ignore something, they will, because it is politically expedient for them to do so.

The second step is finding politicians that actually think oil policy is in their purview (it is, from the conversations I have had thus far considered a "private and corporate" matter, not one for the public sector to regulate...and THIS is going to be a real problem if that mindset does not change...).

Remember, politicians, if they are anything, they are the ultimate in rational actors. That's why I have spent so much time talking about the tragedy of the commons and the governing of the commons.

As I said in the comments a few posts back, this is why politicians will wait to build the wolf trap until the wolf is at the door. The problem is that the stuff to make the wolf trap is out in the workshed.

Technorati Tags: peak oil, oil

"We should institute a $0.50-1.00/gal gas tax. This would help reduce demand and show that markets work. The tax would allow individuals to make decisions on how best to deal with higher gas prices. This would unleash the technical innovations that the U.S. is capable of and find alternatives to high oil as well as improve efficiency. The high price caused by the tax, even after demand is reduced and oil prices moderate, would show that the economy can cope with higher energy costs."I couldn't agree more (as that is pretty much what I said in the original post on this topic)! (Also, it should be noted that the statstics in the post have not been readjusted to reflect this last month's increased prices, but that just means we're even closer to the all-time adjusted-for-inflation price than we were when I wrote the original post.)

The chart presents inflationdata.com yearly average data, plotted on a logarithmic scale. This unit of time flattens out the spikes in prices, which is probably a more valid measure of sustained price.

The blue line in the graph is the raw price, the pink line is the inflation adjusted price.

As was suggested in the comments in the post below (where you will find an interesting discussion of gas taxation and whether or not it is regressive, which was then followed up by a post on the subject by Ianqui which had good comments too.), this kind of a plot does have a more interesting story to tell.

The data tell us that the price of oil averaged $51/bbl so far in 2005, whereas oil averaged $66.20/bbl in 1981, adjusted for inflation. (edited to add: I think we're at around a $53/bbl average now for '05...)

It is interesting that we think of the shock in 1979 as being the time of the highest prices (at least I did). However, prices were much higher in 1981 than 1979 (according to the data available at inflationdata.com).

An interesting history lesson I found at a site on the history of oil prices: events in Iran and Iraq led to another round of crude oil price increases in 1979 and 1980. The Iranian revolution resulted in the loss of 2 to 2.5 million barrels of oil per day between November of 1978 and June of 1979. In 1980 Iraq's crude oil production fell 2.7MMBPD and Iran's production by 600,000 barrels per day during the Iran/Iraq War. The combination of these two events resulted in crude oil prices more than doubling from $14 in 1978 to $35 per barrel in 1981.

That means, by this way of looking at the data, we're not actually at 63% of the 1981 high in 2005 as I discussed in an earlier post.

Instead, with this more valid data, we're at 76% of the 1981 price!

That means the call for alarm should be even greater than it was in my earlier post on gas prices.

The data tell the story. Find some method of demand destruction. Now.

What we do with the remaining difference and when we do it is going to be one of the crucial public policy decisions of this generation. And the time to make that decision is not far in the future.

Now, granted, I was but a mere pup in 1979...but I do remember President Carter in his sweater. I remember my parents bitching profusely about gas prices (what were they, 50c a gallon?). I remember the lines of cars on television every night. It wasn't pretty. People were losing jobs left and right. It wasn't Bladerunner, but it wasn't pretty either.

The real conundrum, in my opinion, is how to destroy demand so as to come in for a soft landing, even if we are heading towards a 1979 to the googol (ed: not google the search engine, and googol is the correct spelling as I just learned in the comments) power. (no pun intended, I assure you.)

I advocate taxing gasoline now. Abruptly. Quickly. Severely. Better to bend the shit out of the economy now than completely break it later.

If we were to somehow organize and convince Congress (which is, of course, unlikely...and perhaps this is a pipe dream because it would so wildly unpopular that it would be perceived as political suicide unless the peak oil case was made and made well) that a 50c-$1/gal tax on gas now would make their political futures brighter than the alternative. I maintain that's the first rational course of action as I've said in many posts on this blog.

The first step to convincing anyone in elected office is demonstrating that there is a problem that, if not solved by them, will hurt them politically. If politicians can ignore something, they will, because it is politically expedient for them to do so.

The second step is finding politicians that actually think oil policy is in their purview (it is, from the conversations I have had thus far considered a "private and corporate" matter, not one for the public sector to regulate...and THIS is going to be a real problem if that mindset does not change...).

Remember, politicians, if they are anything, they are the ultimate in rational actors. That's why I have spent so much time talking about the tragedy of the commons and the governing of the commons.

As I said in the comments a few posts back, this is why politicians will wait to build the wolf trap until the wolf is at the door. The problem is that the stuff to make the wolf trap is out in the workshed.

Technorati Tags: peak oil, oil

The tax doesn't have to kill the economy. Counterfactual: what if six months ago gas taxes were raised by $.50? We've seen that US gas demand is pretty inelastic, but also that the economy has so far adjusted to the higher prices. Instead of the money flowing overseas, it would have stayed here.

Eventually, rising prices reduce demand. If prices are going to rise anyway, better that the money be used for our own benefit than for the long list of unsavory folks we buy oil from.

People greatly underestimate the value of oil. I have read that in the entire life of a man he might generate enough energy to equal 7 barrels of oil, and yet to a man we consume 25 barrels of oil each year. A jet full of Californians flying to Cairo to see the Great Pyramid consumes more energy than it took to construct the Great Pyramid.

My personal opinion is that energy is far too precious a resource (charcoal, coal, oil, gas) to allow private individuals to own it and profit from it. I have no faith in the markets except for their ability (no doubt using the invisible hand) to take from the pockets of many and put into the pockets of a few.

ChrisS has some issues with a surtax on gasoline usage. So do I. For one, where would the revenue go? But also

This is tantamount to saying that the energy markets do not work and must be pushed by action at the federal level. Now, I vaguely remember a recent energy bill that indicated what current government policy is....

Since American energy markets are heavily skewed toward large corporate interests doing business as usual (read, "corrupt") and a surtax is political suicide, a debate on such a tax seems pointless except in so far as such a debate calls the efficacy of the energy markets into question.

Yes, gas tax! If the taxes go to produce other more efficient systems: public transportation, rail, efficiency research of various types, this would create jobs and products that would continue to prop up the economy.

and then put that money into this:

http://www.breitbart.com/news/2005/08/18/MTFH69017_2005-08-18_13-53-52_SCH850008.html

Institute a tax to make markets work provided the best laugh of the day so far. A better strategy would be to eliminate all of the subsidies throughout the "energy" sector and dismantle the great majority of the "national security state"--our Empire--which would liberate almost one Trillion dollars annually to aggressively fund primary source energy systems--wind, solar, tidal, wave, geothermal. But with the government consumed by Liraq and intelligent falling and the bribes it receives to maintain the status quo, such pragmatism would probably give me a heart attack.

Don't know if this has been posted yet, but I thought it was interesting: An article called "Past the Peak: How the small town of Willits plans to beat the coming energy crisis". Will it work? Can it be done?

As long as we're laughing, didn't Bill Clinton help elect Newt Gingrich by proposing a seven cent gas tax? I wonder who would be elected after a proposed $1 tax...

The market only works under pure competition. And by pure competition, I mean the economics definition, and not the common meaning. In pure competition, the marginal cost of a new supplier or cinsumer coming to market is zero. That means that there are no barriers to entry. This is a highly artificial situation, and in practice, we are confronted by oligopolies/monopolies on the supply side, and oligopsonies and monopsonies on the demand side. Though for consumer items, it is close to free competition. The situation is particularly acute on the supply side because of the high cost of entry into the market. In pure competition, the consumer and suppliers are on equal footing. Also, pure competition results in ZERO profits. That is the definition of competition. The existance of profit means that there is not a competitive situation.

Anonymous, there is certainly no monopoly on the consumption of gas. There are hundreds of millions of consumers out there. So to the extent your argument works, it suggests that gas prices are too high and if anything the government should take action to bring them down.

I agree with Karlof1's comment that the notion of adding a gas tax "to prove markets work" is a contradiction in terms.

The truth is that the idea of a gas tax is such a non-starter that it is ludicrous even to discuss it. If your house is burning down, someone who suggests pouring gasoline on the fire is not going to be well received.

Maybe after gas goes back down, if it does, then there might be a case to be made to cushion the rises and falls by adjusting the taxation level. Raise taxes when prices fall, and lower taxes when they rise. This way people wouldn't be whipsawed by wildly changing prices and it would make it easier to budget and plan expenditure levels. But trying to raise taxes when people are already hurting is politically insane.

Last I checked, oil is a consumer item. Also, what you mean to describe is known as "perfect competition," which results in "economic" profits--just large enough to maintain the company in its niche, but not enough to attract new entrants. New entrants are motivated by "excess" profits. Of course, PC is pure textbook as very few markets are perfectly competitive, since one needs "perfect information" for a market to have PC.

One of the issues with peak oil is that America is so oblivious to the rest of the globe.

American gasoline prices are, by far, the lowest in the developed world because of lower taxes.

Retail Premium Gasoline Prices per Gallon, US$ 8/1/2005

Belgium $5.74

France $5.54

Germany $5.88

Italy $5.75

Netherlands $6.50

UK $5.95

USA $2.49

Source: http://www.eia.doe.gov/emeu/international/gas1.html

Europeans pay over twice as much, on lower incomes. If my recall is correct, Europe as a whole has about the same number of cars as the US, far more with small engines and diesels; drives shorter distances, and uses about half the amount of gasoline as the US in total. A higher price for gas has a lot to do with it.

For other comparative prices as of March 2005:

http://money.cnn.com/pf/features/lists/global_gasprices/

Let me see if I get this...

We should raise the gas tax because CORRUPT corporations keep the price of gas too low?

And this...

With the tax revenues, we can then spent it as "we" want? Dude, I'm already spending it as I want, which is NOT paying more taxes.

It would be a tragedy if the peak oil discussion is captured by the bunch of socialistic liberals like I'm seeing too often on this board. After listening to some of these moonbat ideas, nobody would believe you when you'd have something useful to say.

Please, gang, let's get a grip. We're all in this together so let's work together.

Anybody actually WANTING the government to introduce yet another tax is a madman!! 43% of the population is already working for the government and being paid by us other 57% - and those of us in that 57% are working from January until June or July JUST TO PAY TAXES WE OWE!!

Read my lips - "Taxes? We don't need no stinking taxes!!"

And exactly when has the government EVER upheld its promises with respect to revenue appropriations?? All this would do is allow for more pork barrel bullsh&t and unnecessary road work, Mississippi dredging, monument building, museum remodeling....dammit but this fires me up!!

The government simply does not need more of our money!! The military is already spending more than the rest of the worlds armed forces combined!!

C'mon people!! This is the yoke we are all controlled with - you want more taxes and more laws? When right now they are passing things into law SIGHT UNSEEN??

AAAAARRRRGGGGHHHHH!!!!!!!! (spooky falls to floor, twitching, drooling and babbling incoherently while his extremely shapely but very liberal wife wags her head knowingly)

Look at Social Security if you want a real look at what the government does when you give them your money!!!

Look at the IRS and how they treat the people who pay them!!

Note the pleasant attitudes of many federal employees and how they want to help you out - NOT!! (USPS excepted)

Galdarnawhaggitflumarobulzyygibbet&*($%^#@$^(("{

(spooky's wife places a bit of cloth between his clenched teeth as he convulses on the floor, and then proceeds to make him a very strong adult beverage)

Yes, gas tax! If the taxes go to produce other more efficient systems: public transportation, rail, efficiency research of various types, this would create jobs and products that would continue to prop up the economy.

Um, isn't this like taxing cigarettes to fund cancer research?

Of course it is Rob!!

The government promised this exact type of admixture funding with the big tobacco settlements - funny how that money just kind of disappeared....

(spppoky shakily accepts his beverage from his wife, and settles into a lotus position in front of his laptop)

"(spooky's wife places a bit of cloth between his clenched teeth as he convulses on the floor, and then proceeds to make him a very strong adult beverage)"

OOOOH! Something seems to have hit a nerve eh spooky!!! Think of all the tariffs on that cloth in your mouth and the luxury taxes on the booze in your drink!!! EEEEEEEEEEEEEEEE

Seriously though, people like you who see taxes as some sort of genuine intrinsic evil really make my skin crawl. TAXES ARE THE PRICE OF CIVILIZATION!~!!!! Name one complex society that has lasted any noticable amount of time without taxes of some form? Go ahead, i'll wait....

And i love the added hilarity of using Social Security as an example to incite others into your blinding tax rage...it is possibly the most popular government program in the history of the world and it accomplishes this extreme satisfaction with the lowest (or pretty damn close) administrative cost of any other government program! WHY DO YOU HATE MY GRANDMOTHER~!@!!@~!@~!#$#$@

Taxes can have 2 completely different purposes: 1) to raise revenue and 2) to change consumption patterns.

Encouraging: A capital gains tax is designed to encourage longer-term investment, by getting people to leave their funds invested for a minimum period of time. The government gives up potential tax revenues in order to encourage longer-term investment.

Discouraging: Taxes on alcohol, tobacco, gambling are designed to discourage overconsumption of these items. They're also a great "revenue enhancer" for the government. We don't tax cigarettes to fund cancer research: we tax to keep smoking levels down, and we use the revenues in a way that seems morally appropriate.

A gas tax would raise revenues, but the real purpose would be to penalize consumption. There are problems with a gas tax--it's regressive, and hits the lowest incomes hardest, but you can design rebates to compensate for that.

What's happening now? Gasoline taxes are low, and they are used build and improve highways. The low tax doesn't cut consumption (obviously), and the reinvestment in roads encourages consumpttion.

Doesn't sound like a very smart solution for peak oil to me.

You're right, Sampo. Taxes are the price of civilization. So considering the blog we are on, where have our taxes led us? Just a little thought...

I am not against taxes per se. I am very much a libertarian - when the 50% of the GDP is from government spending, something is amiss. I feel that government is alltogether too big, too intrusive into the affairs and rights of the people, and so corrupt as to be nearly useless without riots or other acts of civil disobedience.

The federal government is too big and has become a business unto itself. There are many who would argue based on the last two elections that even the process has been irrecoverably corrupted. When government can take your property because it deems YOUR land better suited to someone elses endeavor, what does that say about the state of the courts and legislature?

I do not believe that money at the federal level is well-spent, and it certainly is not distributed fairly or efficiently. Based on the government we have today, I do not believe feeding the monster in your den will placate him forever...so I abhor further taxation and believe we have more than sufficient legislation to cover every single decision we make in daily life. In effect, we have conflicting and at times contradictory laws enough to employ legions of lawyers for even a simple issue such as a persons right to die or not wear a seat belt or helmet.

It works at the state level, and if the states were not so beholden to the feds to get our tax money back into the state coffers, we would be much better off. So, no new FEDERAL taxes - that sound better? Let each state decide what it needs and then the people can actually have a say in their governance.

Now, back to my toddy.... (spooky's voice echoes, "Sweety, where is my blood pressure medicine?")

No more taxes. You people miss the fact that every dollar that goes to the government is used pretty uniformly to restrict freedoms, not to "do bold new research."

I advocate waiting for all this sh*t to hit the fan in a major way, and as much pain as that might cause, it is still the Right Thing(tm) as far as a free society goes. Let the market respond. Everyone says "the market can't respond fast enough." But it will respond far more efficiently than any government-sponsored research. Give the government more money, we'll get more research into hydrogen projects, which we know is completely useless.

No more taxes. Keep the governments hands off my money. Forward-thinking individuals (like us) are already making adjustments, and we will lead the way if/when oil shortage hits.

But in any case, NO MORE TAXES!! If anything, cut taxes and FORCE the government to close as many of its bloated offices as possible. They produce nothing of value and provide a far worse "brake" on the economy than energy prices could at any level.

Missy

There is no conflict between wanting the market to work and raising gasoline taxes. If we don't raise taxes, then scarcity will drive up prices and we will use less oil, period. It will take longer, and the transition will be much more painful, but it will happen.

The point of social engineering through taxing gasoline is not to make the market work, but to make it work faster so minimize the social cost of the (very long and painful) transition away from oil.

As I've said before, the optimal approach on gasoline taxation would NOT be to wack everyone with a big, all-at-once increase, but to announce a schedule of increases, something like an addition 25 cents/gallon every 3 months ("a quarter pwer quarter") for the next 3 years. This would lend a considerable deal of certainty to gasoline prices. It would result in people taking steps now to conserve (e.g. downsizing cars, changing their routines to drive less), knowing that they won't regret the change a year or two from now.

And yes, the tax revenues shuold go into something worthwhile, like building wind farms to help power all the PHEV's and all-electric cars we'll be buying in just a few years. Nothing would help reduce our oil consumption and air pollution more than moving as much of our transportation as possible away from oil and toward renewable sources.

As for destroying the demand for oil, it happened once, it will happen again:

http://www.grinzo.com/energy/stats/us_oil_cons_overview_1950_2003_gr.html

Well, Lou, your answers -- which I mostly agree with -- seem to lump you together with me as a socialistic liberal.

My use of the word "corrupt" is meant to convey the idea that small innovative alternative energy companies do not have as much opportunity in the current US energy market since they do not have the big subsidies the major oil corporations have enjoyed for years.

So if the gasoline tax went directly toward subsidizing 1) energy efficiency and 2) alternative energy source development, then I guess I'm all for it, sort of. It would still hurt the poor predominantly.

You guys know that crying-in-their-beer socialist liberals like myself give occasional thought to those in lower income brackets.

Well..... to think that the US government is going to bring a solution to the peak-oil problem is an illusion. No matter what the taxes are. The US politicans and the whole government is formed and held by special intrest groups. You know what they are; oil & natural gas, weapon, automobile, tabacco and sugar industries (just look at the background of the Bush administration people, there's oil all over the place). And we know what drives them; short-term profits.

The current oil-war-situation is not so bad for most of them.....

So, the most propable respons of the government will be; just the announcements of the deterioating situation. No actions other that those that will maximize corporate profits on the short term.

Maybe the solution is comming form ordinairy man.

If they can come up with this:

http://www.gizmag.co.uk/picture.php?s=23&p=4397_9080531638.jpg

They surely can think of a peak-oil solution! ;-)

OK, Roger, that picture is giving me confidence that we'll solve this peak oil situation.

But have you seen the forest walking machine?

Or, as the Google people told Jim Kunstler when he spoke to them about peak oil, "yo! dude! we've got technology!"

Dave and others who think oil companies are energy companies:

Oil=fuel

Energy=something that can do work

The oil exploration companies do not do anything (in the main) other than find and sell oil and gas - like Exxonmobil

An energy company delivers energy to your door - like ConEd.

They are not synonymous, not similar, and should not be confused. Especially, they are not interchangeable - it's like farmers and food companies. Statements encompassing both are likely to be very inaccurate.

OK, people, it's time to get serious about peak oil. PG, HO, Ianqui, SuperG -- this song should be available on the frontpage. [WAV file] You can read the words but listening is much, much better, trust me on this.

Come and listen to a story about a man named Jed

A poor mountaineer, barely kept his family fed,

Then one day he was shootin at some food,

And up through the ground came a bubblin crude.

Oil that is, black gold, Texas tea.

Well the first thing you know ol Jed's a millionaire,

Kinfolk said "Jed move away from there"

Said "Californy is the place you ought to be"

So they loaded up the truck and moved to Beverly.

Hills, that is. Swimmin pools, movie stars.

For J, Spooky, karlof1 and the rest of us "old" folks who remember the good 'ole days.

The Beverly Hillbillies! 8)

Anonymous - energy versus oil companies.

Point taken and I am referring to companies that provide energy sources (oil & gas) or the ability to tap into energy sources (solar panels & wind turbines). I am certainly not confused about the difference between ExxonMobil and ConEd.

Actually Dave, I tend to think that THIS song should be available as a link on the front page:

Nothing but Flowers, Talking Heads (from 1988, mind you)

Here we stand / Like an Adam and an Eve / Waterfalls / The Garden of Eden

Two fools in love / So beautiful and strong / The birds in the trees /

Are smiling upon them / From the age of the dinosaurs / Cars have run on gasoline / Where, where have they gone? / Now, it's nothing but flowers

There was a factory / Now there are mountains and rivers / you got it, you got it

We caught a rattlesnake / Now we got something for dinner / we got it, we got it

There was a shopping mall / Now it's all covered with flowers / you've got it, you've got it

...

This used to be real estate / Now it's only fields and trees / Where, where is the town / Now, it's nothing but flowers / The highways and cars / Were sacrificed for agriculture / I thought that we'd start over / But I guess I was wrong

The remainder of the lyrics found here.

I know the tune, Ianqui, I know the tune.... There was a shopping mall....

Earlier, Joni Mitchell said "they paved paradise and put up a parking lot".

best,

Strange, I agree with Lou. And the impact of a fossil energy tax on the poor could be offset relatively easy by a deductible on Social Security taxes, a negative income-tax bracket at the bottom, or both.

The key to that would be fixing the tax as temporary, perhaps with a Constitutional amendment to make certain that "temporary" means what it says. Once you've started the shift in earnest and the new energy technologies are cheaper than petroleum and running down the cost curve of increasing production experience (20% for each doubling of volume), you can phase out the incentive taxes.

Or maybe not. "Tax bads, not goods" is a good idea regardless.

We complain to the Saudi's that oil is too expensive, than tax oil to raise the price.

Why not ask the Saudi's to just raise the price? That's what they'll probably do after we tax oil. If we then complain about too high oil, they'll tell us to cut the tax.

That the consuming nations realize so much of the benefit of oil extraction -- some studies show that we profit more than the producing nations -- is an artifact of the Oil Glut -- the first stage of oil. Due to the potential glut, western Gov't oil taxes are a form of rebate from the producers.

The next stage -- the Age of Growing Scarcity -- might see producers "claw back" the revenue.

Dream on people! Consumers (or our Gov'ts) have no inherent "right" to profit from oil, and eventually the producers will be able to remedy this temporary economic quirk.

EP said: "Strange, I agree with Lou. And the impact of a fossil energy tax on the poor could be offset relatively easy by a deductible on Social Security taxes, a negative income-tax bracket at the bottom, or both".

I'm having a little trouble seeing how that's going to work EP, like for example at the pump when people are buying gasoline. Do they have keep their receipts and tally it up at tax time based on income?

Not enough attention has been paid in this discussion to Rick Starr's

This really tells you what's real and what isn't.

Just how much longer are Americans going to live in this fantasy world?

Why would you want to tally gas receipts at tax time? The whole purpose is to give people an incentive to work more and burn less fuel. Letting them keep more of their income (regardless of how much fuel they burn) while taxing fuel more (regardless of how much money they make) does that just fine, no receipt-keeping required.

Am I the only one who questions why we don't reward real efficiency on the enrgy side?

I want to be able to do similar things as I do today, but just use less energy doing them. I want to drive and get 50 mpg not 25. I want to light my work space using 12 watts not 100. I want my food produced using the least amount of energy at all parts of the production system. ELIMINATE WASTE EVERYWHERE WITH RESPECT TO ENERGY CONSUMPTION.

I fail to see how this hurts our economy. Everyone except the energy suppliers should benefit. The consumer would benefit by using less energy. Suppliers of equipment would benefit by constantly releasing more efficent equipment. Entrepreneurs would benefit by figuring out distribution flows that are more energy efficient. Alternative energy might become more competitive for non liquid fuels applications.

I agree anything that shrinks oil consumption is going to hammer oil company profits and hurt everyone that works in that industry but that seems to be a fair tradeoff if the rest of the economy benefits overall. Isn't this what Europe has already done?

What am I missing in this argument? Please set me straight. Especially from people who can bring numbers to bear on cost of goods, economic output, etc.

Which would be more effective an immediate tax spike (say $.5-$1) or perhaps $.10/month for a year?

Problem: as noted by many above, it will never pass until it's far too late. Indeed, politicians are more likely to get voted out of office next election because they didn't do anything to keep prices low. At least a gallon of gas is now in sight of the price of a gallon of milk! (Milk is my measure for how ridiculously low the current price is.)

So much for belief in the market: for most of us, we only believe in the market insofar it benefits us personally. And we take market shifts as a sort of measure of the gods' favor: we reward leaders when things are good, because then it seems that the gods smile on them; but when things go bad, we turn against them, as though they have somehow offended the gods. Very pagan of us...

\*/

Immediate spikes cause immediate crises, but are harder to ignore.

Which is not to say that spikes aren't ignored. People snapped up trucks at the Ford and GM fire sales. They probably thought that oil prices would go down, which they might. But they won't go down very far or for very long.

The advantage of a phased tax increase is that it gives certainty.

You are completely forgetting about something very important. The fact is that the US can not empose oil taxes on foreign nations such as China and India. A tax on american consumption would only increase demand in China and India as the price of oil falls. In the end, all a tax would do is hurt americans while India and China accelerate thier economies which would utimately accelerate depletion.

The bottom line is that we are already well past the point where any policy changes can effect oil depletion rates. To pragmatically address the pending energy crisis, the global population needs to be reduced to about a billion people. That means five out of six people must migrate to a higher plane. Until we reach that level, humanity will suffer greatly. Unless a major pandemic occurs, it will take probably 40 to 60 years for the population to rebalance to a post-oil economy.

The only way that the US can mitigate an energy crisis is to start investing heavily in developing new infrastructure that is not dependant on oil or natural gas. Currrenly this consist of only three technologies: coal, nuclear and wind. The rest of the alterative energy solutions are not practical, including photoelectrics (solar cells), ethanol, biodiesel, and hydrogen. Ethanol, Biodiesel and hydrogen are farse, because all of them require more enegy to produce and are dependant of fossil fuels to produce. For instance, Ethanol and Biodiesel are use petroleum based fertizers, pestisicides, and also require a heat source to distill and refine. Hydrogen is mostly produced from natural gas, and is extremely dangerous and difficult to store. If we were to abandon production of these fuels, we could save more energy than any tax hikes would do.

You people need to think about the big global picture instead of thinking that making a few domestic changes will make a difference.

Yes, a slack in demand in US consumption may well increase demand elsewhere (though it should also reduce demand pressure). But I fail to see how increased demand by India and China hurts the US and the rising prices are likely to encourage consumers to economize by seeking out cheaper, alternative energy supplies. Which means (1) existing alternative energies whose price is currently uncompetitive with oil would become competitive; (2) there would be a larger market incentive to invest in and develop alternative energies.

\*/

You first. I'll supply the whisky and sleeping pills for you and all your friends who want to go along.

About the die-off -- it actually would be possibly to support more than 6 billion people if there were a design science revolution such that efficiency in every single thing we do was maximized. That would mean a whole new civilization hahahahahahah, since this one is only motivated by petty greed and the scarcity created by a SICK TWISTED implementation of capitalism whereby something like 1% of the worlds population makes the big decisions about what kind of work the other 99% will have available, all neatly controlled through the world money system. HAHAHA. Talk of investing in this and that is stupidity, as the ones with the BIG bucks to accomplish anything wont do it if it threatens the PROFIT potential, the potential to aquire assets, land holdings and what not. These poeple own the governments. CONSPIRACY NUT! Hahaha. Theres no conspiracy, just aligned interests seeking everything there is to have, oh and plus they control most everything already. These people would be quite happy to see the die-off scenario I'm sure, since then the remaining population will all have a better standard of living and be less likely to RECOGNIZE the bullshit control being wielded over them by the monied elite.

And putting money in oil, or anything else at this point other than tangable assets related to SURVIVAL is stupid as well. What the f*** kind of money do you think people will be using to buy food after the peak oil scenario? Do you honestly think that world governments will survive in their current form?? I dont think so. The money systems will collapse and the assetholders will implement something else, something even more diabolical than the existing money system.

And then there will be the new tribes! And we'll have a lovely time fending for ourselves, but also working together and making sure that our efforts actually go towards useful things. Not insurance. Or taxes. Or commuting to useless jobs that contribute nothing to humanity and are half a city away so that we can earn pathetic fiat money to exchange for chinese made shit and food shipped from 1000 miles away. All that will stop for us, and we hope you'd like to join us. Whatever, I know I'm INSANE in the MEMBRANE just cant stand the PAIN. Ishmael and B taught me a thing or two about unsustainability on a grand scale in the Taker way. Bucky taught me a thing or two about whats possible with human ingenuity. So I'm not too worried, just happy in my confidence that whatever this SHIT we call civilization is, desperately needs to come to an end. And the meek shall inherit the Earth.

- The moose.