British Geological Survey Bowland Shale Gas Assessment

Posted by aeberman on July 19, 2013 - 5:00am

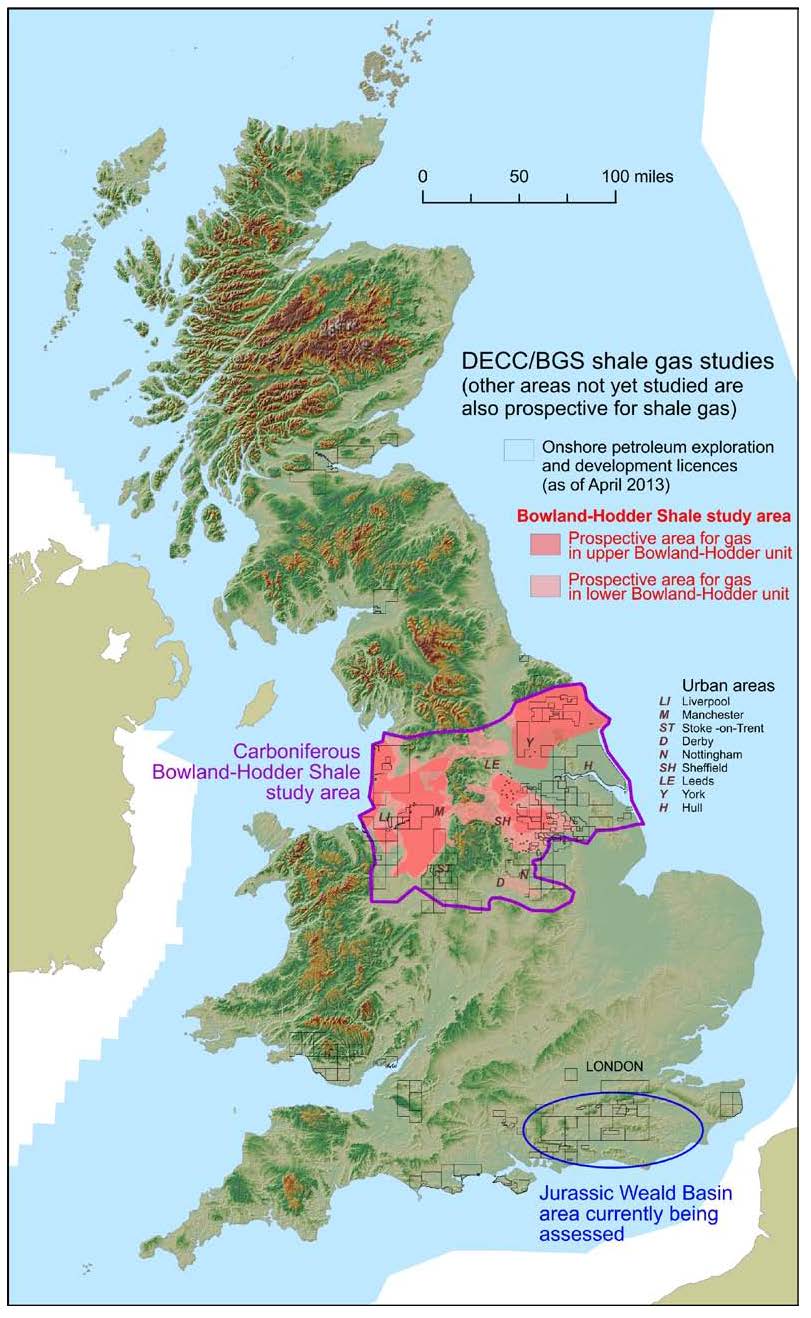

The latest exuberant shale gas news comes from a report by the British Geological Survey estimating enormous new shale gas resources in the central UK. On June 27, 2013, the British Geological Survey (BGS) released a natural gas resource assessment for the Bowland Shale in the United Kingdom stating that approximately 40 trillion cubic metres (1,300 trillion cubic feet (Tcf)) of shale gas exist in 11 counties in northern England (Exhibit 1). The BGS report, unfortunately, only addresses gas-in-place (total resources) and not extractable resources (technically recoverable resources) much less reserves (commercial supply). The most-likely reserve potential of the Bowland Shale is only about 42 Tcf (3% of gas-in-place) after applying methods used by the U.S. Energy Information Administration (EIA) and Potential Gas Committee (PGC).

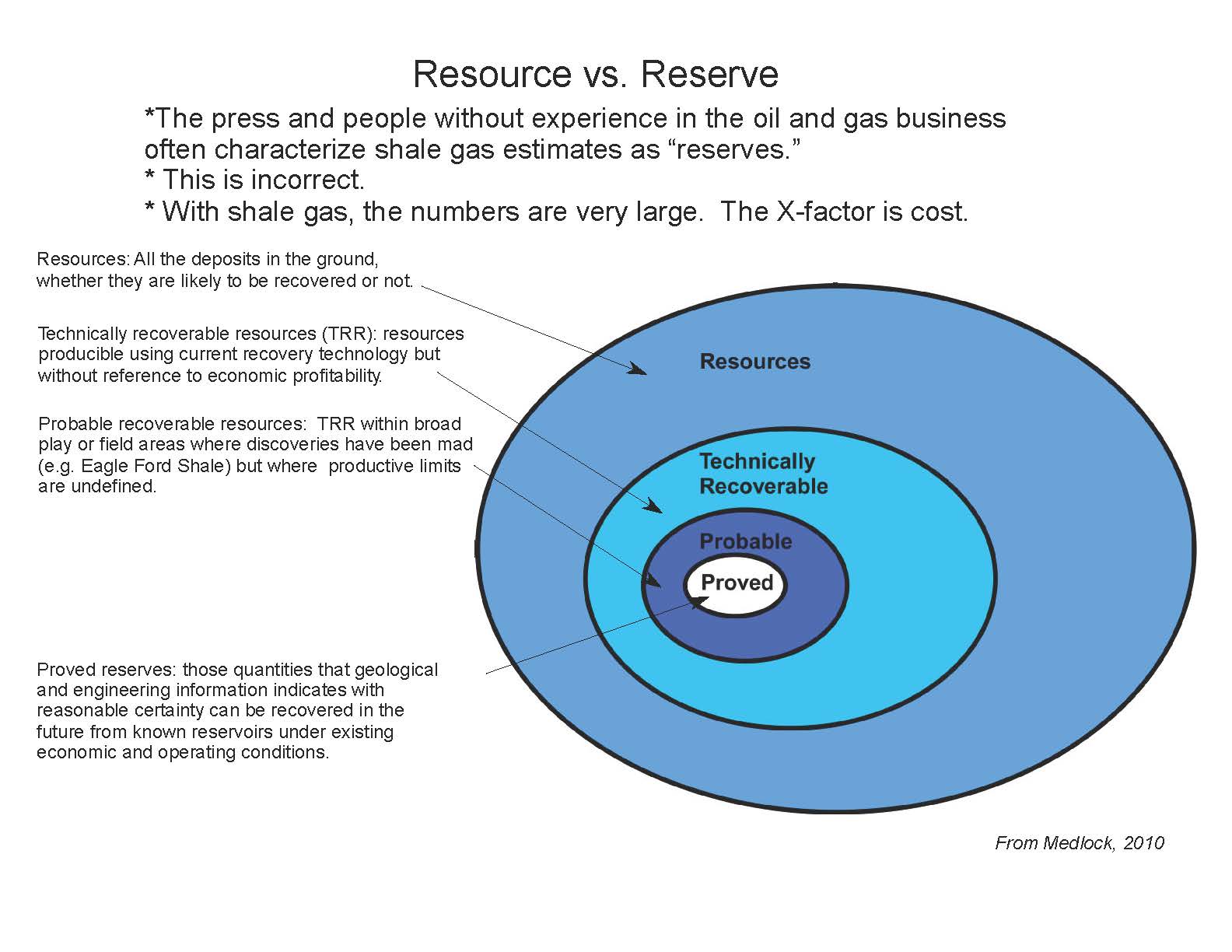

The potential for misunderstanding of shale resource estimates is great. Various organizations have published resource estimates for shale gas plays in the U.S. and around the world. These reports are commonly misinterpreted as representing commercially producible volumes of gas.

Resources are the volume of natural gas in a particular formation, also known as gas‐in‐place (Exhibit 2). This has no relation to what is physically or technically producible much less commercially viable. The technically recoverable portion of total resources--Technically Recoverable Resources (TRR)--is that volume that can be produced using present technology. It similarly does not include commercial factors. This is the gas volume most often publicized and confused with reserves, the economically producible subset of technically recoverable resources. The EIA states that TRR represents approximately 25% of gas-in-place for most shale formations.

Technically recoverable resources are generally divided into three categories based on uncertainty. According to the PGC, probable technically recoverable resources are those gas volumes that are currently being produced in gas fields such as, for example, the Barnett or Marcellus shale plays. Although the history of production is only a few years to perhaps ten years, there is some degree of confidence in projecting ultimate recovery from early producing rates. Possible resources are thought to exist based on new field discoveries. In this category, there is little production history and large areas of potential gas development must be inferred. Speculative resources are gas volumes that are thought to exist but that have not yet been drilled. These clearly have great uncertainty. Reserves are the volume of technically recoverable gas resources that can be produced at a profit based on present assumptions about cost and price. Supply is the much smaller portion of reserves that has been developed and connected to infrastructure so that it is available on demand to consumers.

I first applied the EIA guideline of 25% Gas-In-Place to determine TRR for the BGS low, high and most-likely gas resource cases for the Bowland Shale (Exhibit 3). Next, I used the relative percentages of probable (32%), possible (43%) and speculative (25%) TRR taken from the PGC's latest assessment of the U.S. technically recoverable resource base. Finally, I assumed that 50% of the Speculative TRR would be commercially producible, since there is no production from the Bowland Shale, and used this value as the potential reserve estimate.

This approach suggests that the most-likely reserve for the Bowland Shale is approximately 42 Tcf. While this is a substantial volume of gas (roughly equivalent to the Barnett Shale accumulation in the U.S. based on a recent evaluation by the Texas Bureau of Economic Geology in press), it will hardly change the energy future of the U.K. Based on well productivity from the Barnett Shale, it will take approximately 30,000 wells to fully develop the Bowland Shale potential reserves.

While the Bowland Shale is the same geological age as the Barnett and Fayetteville shales in the U.S. and is known to be an oil source rock like the U.S.shales, there is no evidence to suggest that U.S. shale production is an analogue for Bowland gas-producing potential. Among the most important factors in shale gas play performance are high organic content, high thermal maturity and high silica or limestone content. These produce brittle shale reservoirs with large volumes of available gas. High organic content also results in creation of important porosity where kerogen is converted to gas because of a volume change.

So far, there is little geochemical data for the Bowland Shale and, while some of the data appears to be in a similar range as for the Barnett Shale, lack of comprehensive data is a risk factor in assessing the potential of the play. Each shale gas play is different and, until industry knowledge is greater, must be viewed as a “one‐off” opportunity with a considerable learning curve, unanticipated costs and commercial risk.

Thanks for the informative article. There's a lot of speculation in the UK that the Bowland Shale is a lot thicker than most of the US Shale plays and that this will be a factor making it more economically attractive to develop - perhaps offsetting some of the other factors that will make it less attractive here, such as planning and lack of drilling rigs and skilled operators. Is there any evidence to support this thickness argument in the report?

Also do you have any sense about whether liquids production will play any part in the economics? I've heard it said that it's economic to frack in the Marcellus almost regardless of the gas price because the liquids are so valuable, does it look like that will be a factor here?

Hoover,

The thickness of a shale is important up to the point that the induced fracture radius can access gas volumes. Since the fracture radius is a few hundred feet at most (based on micro-seismic studies), it is unlikely that shale thickness of more than about double this amount will contribute gas unless additional lateral well bores re drilled from the same vertical hole--a plus but also a cost.

The evidence presented in the BGS report acknowledges the scarce geochemical data available and the difference between subsurface and outcrop samples. That said, all indications are that the Bowland is quite thermally mature and this limits the potential for liquids. The propaganda about the Marcellus Shale's economics based on natural gas liquids must be viewed with caution. There is only a small area in southwestern Pennsylvania that has "wet" gas (and the Btu value is nothing exceptional at that compared to true wet gas); the sweet spot in northeastern Pennsylvania is 100% methane so no liquids there. Typically, the economic uplift cited from NGLs does not incude the percentage of revenue taken by plant operators which may be 50-75%.

As always, believing what the companies say about there profits must be calibrated by their financial statements. For most U.S. companies in the shale plays, free cash flow does not match their grandiose claims of huge profitability. Average capex-to-cash flow ratios are 1.5-2.0 and that is hard to square with fabulous IRRs.

Art

"Average capex-to-cash flow ratios are 1.5-2.0 and that is hard to square with fabulous IRRs." Does this mean 1.5-2.0 money is spent for every money flowing in the other direction?

An article by Deborah Rogers on the topic:

http://energypolicyforum.org/2013/06/19/huge-capex-free-cash-flow-not-in...

Thank you Art, I'm grateful for your responses.

If the economics are there planning and lack of drilling rigs and skilled operators will be solved. Geology however take to much time to fix and this is the basic problem with fossil fuels.

Deborah Rogers has an article on Shale Play economics, you can search for:

Huge CAPEX = Free Cash Flow? Not In Shales

Today (the first day of the summer parliamentary recess) the prime minister has announced that shale gas will attract half the tax rate of other gas wells in the UK - 30p instead of 62p.

Several senior ministers, and the prime minister's family , have commercial interests in the shale gas industry.

I am very doubtful that much of this gas will ever become an economic reserve. 30,000 wells in such a densely populated region of the country is unthinkable.

My biggest concern is that this will kill off investment in off-shore wind turbines. We have the best wind resource in the world!

A case history from the Barnett Shale Play, in Texas (MMCFPD = mmcfpd = million cubic feet per day, cfe refers to natural gas + natural gas liquids converted to gas equivalent):

A couple of items follow, emphasis added, from 2007 regarding Chesapeake's DFW Airport Lease, in the Barnett Shale Play.

In 2007, Chesapeake estimated that late 2011 production from the lease would be up to 250 MMCFPD, and they estimated that production would continue for at least 50 years. In 2007, they also said that the lease " likely contains one of the thickest and best-developed reservoir facies anywhere in the play."

Actual late 2011 production from the lease, based on some data that Art Berman sent me, was only about 35 MMCFPD. Of course, the sharp decline in gas prices had an impact on drilling, but it's interesting to take a look at how the wells that Chesapeake drilled and completed on the lease in 2007 have done over the past few years. (That info is found below.)

Chesapeake Announces First Natural Gas Production from Dallas/Fort Worth International Airport Lease with Initial Sales of 30 mmcfe Per Day from First 11 Barnett Wells (October, 2007)

(Search for above title for link)

And here is an item from the July, 2007 American Oil & Gas Reporter:

Chesapeake Images Barnett Shale Beneath DFW Airport

(Search for above title for link)

Update on Wells Completed in 2007

Production data that Art Berman sent me showed DFW Airport production of 52 MMCFPD in January, 2008, which would presumably be attributable to the 21 wells drilled and completed in 2007. Some data that Rockman sent me show that the wells still producing from the 2007 group produced 2.6 MMCFPD in April, 2013 (with 10 of the 21 wells already having been plugged & abandoned).

This is about a 95% simple percentage decline in a little over five years, or an exponential decline rate of about 60%/year in monthly production (2007 wells only).

Total cumulative production from the 21 wells completed in 2007, based on Rockman's data, appears to be 16.5 BCF, or about 0.8 BCF per well, after a 95% decline in production from January, 2008. Note that Art Berman puts the average EUR per well on the DFW Airport Lease at about 0.9 BCF per well.

It does seem that Chesapeake's proclamation that the DFW Airport gas wells would produce gas for at least 50 years is a "little" on the optimistic side, especially since about half of the wells that they publicized in 2007 have already been plugged and abandoned. Odd that they did not issue a press release about that.

Here's a thought experiment. Assume that the 21 wells they put on line on the DFW Airport Lease in 2007 were the total gas supply for the country. In a little over five years, our total gas supply would have dropped by 95%. This is the revolution that will power us to a virtually infinite rate of increase in oil and gas production?

A recent Citi Research report confirms much of what Art Berman and David Hughes have been saying about shale plays. Citi Research puts the decline rate from existing US natural gas production at about 24%/year. So, based on this decline rate, all we have to do in order to maintain a constant US dry natural gas production rate of 66 BCF/day over the next 10 years is to put on line, over a 10 year period, the equivalent of the peak production rate from 30 Barnett Shale Plays. The Citi Research report also implies that the industry has to replace about 100% of current US natural gas production over the next four years, in order to maintain constant production. Consider that for a moment--the industry would have to replace the productive output of every US natural gas source, from the Gulf of Mexico to the Bakken, in a four year period, in order to maintain the current natural gas production rate.

Question:

Where do we get statistics about shale oil wells which have been plugged e.g. in North Dakota? This file shows only producing wells:

https://www.dmr.nd.gov/oilgas/stats/historicaloilprodstats.pdf

You might check out Drillinginfo but you will need to subscribe, or I think that they will do research for a fee. Alternatively, you might send an inquiry to the state regulatory agency.

Ralph W,

Thanks for your comments on government interest in the U.K. shale plays.

The assumption that shale plays around the world will proceed much like those in North America is doubtful. For one thing, not all shales are equal--the U.S. plays are all completely different geologically and economically. Also, costs are far more expensive in Europe because of present lack of major service company presence to support the drilling and completion of wells. The fact that there is almost no private ownership of mineral rights outside of the U.S. and Canada is a huge factor--there is no incentive for U.K. landowners to support driling and production. As you mention, population density is another important factor that many forget to consider--the footprint of shale gas developement is large and not necessarily consistent with what the public wants.

The economics of offshore wind must be carefully examined to be sure that they include all costs. I have not seen any positive economics for the large offshore projects proposed for the eastern U.S.

Art

This list stolen from a comment on the Guardian website

The towns and cities listed in the resource area have population of about 4 million. Total population will be higher.

That's "Revealed: Fracking industry bosses at heart of coalition" (Sunday Independent, UK, 14 July 2013)

http://www.independent.co.uk/news/uk/politics/revealed-fracking-industry...

There was an Al Jazeera story on fracking in UK

UK gas find sparks fracking controversy

http://www.aljazeera.com/video/europe/2013/06/201362716349225126.html

The video in this story

http://blogs.aljazeera.com/blog/europe/uks-fracking-dilemma

was withdrawn. I saw it on IPTV. It had a map showing shale gas along the South Coast at Balcombe

All this shortly after NASA climatologist James Hansen had warned the House of Commons' Environment Audit Committee to leave unconventional oil and gas in the ground

http://www.publications.parliament.uk/pa/cm201314/cmselect/cmenvaud/uc60...

The withdrawn Al Jazeera video is mirrored here: http://www.youtube.com/watch?v=7VTzPlZDQO4

So 42Tcf, thats enough for about 30 years of British natural gas consumption. I'd say thats a gold mne, considering the North Sea is declining every year.

PetroSlurp,

The U.K. consumed 3 Tcf in 2011 (http://www.eia.gov/countries/cab.cfm?fips=UK). 42 Tcf yields about 14 years of demand, not 30.

The point of the post is merely to put the BGS report in perspective. This is a lot of gas (assuming people are happy with 30,000 wells to exploit it) but it's not the enormous volume reported in the press of 2,300 Tcf.

Art

I did some fast head calculations, you're definitely right. Question is, is it worth it.

So how many years current gas usage in Britain does 42 Tcf represent?

All you nay sayers neglect to mention the price of natural gas in Europe, which is much higher than in the USA. This is the game changer for USA economics, and means you cannot make these comparisons, without factoring in that difference. Argentina now pays $7.50 per MBTU's, which makes even that country far more attractive than the USA. Not sure what Europe pays Russia for their imported nat/gas supply, but my guess it's higher than the USA's depressed price. Add to that the low taxes, and it looks to me like England is a go.

There is also money to be saved by the fact that fracin Texans speak English, (more or less). A similar culture and the same legal system, makes for greater efficiency in training programs, and day to day operations.

Let's go to the UK an get fracin.

Thats because the Europeans peg the natural gas price to the oil price, while the natural gas price is independent in North America. Thats why the US economy is taking advantage of cheap gas, while Europe is paying a heavy price and the Russians, Norwegians and Qataris are laughing all the way to the bank.

There is also the question of costs, and as noted up the thread, even in plays with a lot of production history, like the Barnett Shale, the reality can fall far short of optimistic expectations, unless the Chesapeake guy was misquoted, and he meant to say that the wells should last for at least 50 months, not 50 years:

Westborne,

Is objective analysis naysaying?

Nowhere in the post do I say that this is not a lot of gas or that it should not be pursued because of its size. The point of the post is to place the BGS report in context.

The price of natural gas in Europe is high because it is indexed to crude oil price; it is lower in North America because is it not. Oil-price indexing may or may not continue to be the practice over coming years but it was not a factor in this analysis of potential resources.

Art

Continental Europe has traded gas markets which de-linked from oil prices in 2009. Hence why all the big European power and gas companies, which do have oil-index-linked long term gas supply agreements with Russia, had to scramble to re-negotiate those contracts. It was a nightmare and they almost lost their shirts.

The UK, which I think is the country in question here, has had its own traded gas market since the 1990s which have never ever been remotely linked to oil prices.

For anyone interested, UK gas prices are currently trading in the range of 65 - 75 p/therm (spread is summer to winter) at the National Balancing Point. 10 therms make 1 MMBTU so with an exchange rate around 1.5 USD to GBP those prices are equivalent to about $9.75 - $11.25/MMBTU.

One thing that still surprises me is that we (UK) are paying less for LNG than Japan and Korea, somebody is missing the arbitrage value. It seems like too much money to leave on the table and I simply can't believe that situation will last for ever, although it may be Asian prices that end up coming down rather than UK prices going up.

I don't believe in US LNG exports, and I don't see LNG prices coming down significantly, if they do I think China will buy all day long until they come back up again. That's why I think the UK probably will be able to develop a shale gas industry, albeit it will probably not be all that game-changing and certainly won't stop LNG from being our marginal gas source (and hence setting prices). Still, a small shale gas industry is better than none in my opinion; it all good jobs and tax income for the good guys.

Art,

I'd suggest that you use more language of probabilities.

People like certainties, which is why the following phrasing is understandable:

"While this **is** a substantial volume of gas (roughly equivalent to the Barnett Shale accumulation in the U.S. based on a recent evaluation by the Texas Bureau of Economic Geology in press), it **will hardly** change the energy future of the U.K. "

But, it should perhaps be:

"While this **is likely to be** a substantial volume of gas (roughly equivalent to the Barnett Shale accumulation in the U.S. based on a recent evaluation by the Texas Bureau of Economic Geology in press), it **will probably not ** change the energy future of the U.K."

Such phrasing would reduce the appearance of naysaying. After all, describing a 14 year supply of gas as "will hardly change the energy future of the U.K." seems a bit...overly pessimistic. Especially when the supply could, indeed, be much larger than that - the dramatic upside potential isn't guaranteed, but it's not implausible either.

Nick,

Thanks for your suggestions.

On the "energy future of the U.K." statements, what I meant is that the U.K. is not heavily reliant on natural gas in its primary energy mix. For example, the U.S. uses almost twice as much natural gas per capita as the U.K.

The real problem for the U.K. and all developed countries is energy for transport fuel and natural gas will not solve that in anything less than decades at best. I want to dispell the mistaken notion that energy sources can be freely substituted.

Just because there is another 14 years of potential gas supply, how hopeful is that in the long-term view of many decades before other energy sources may constitute a meaningful percentage of total energy demand? Also, why do we have to use supply as fast as we can?

Then there are the obvious issues that will challenge development of this resource like public opposition to the physcial footprint of development and the lack of incentives for landowners (the state owns oil and gas mineral rights in the U.K.) to participate since there is no commecial benefit for them. Also, there is no guarantee that this play will work (see the last paragraph in my post).

Art

Art... great post. Also, just wanted to let you know I watched your 30 minute video on "Shale Gas, After the Gold Rush.' Really enjoyed the information in the video and had to watch it twice to absorb it all.

I also saw your recent three part video in which you stated that because U.S. oil consumption had fallen in the past several years, the annual percentage decline (or there-abouts) should be deducted from the GDP. I agree.

I believe the U.S. was consuming 20.7 mbd in 2007 down to 18.6 mbd in 2012. The decline in total liquids has to have some impact on the GDP.

Furthermore, there is debate on whether or not China has been manipulating their GDP figures. I looked at their oil consumption via a spreadsheet sent from Jeff Brown, and this is their annual change:

2010 = 9.3 mbd (9.4% increase from 2009)

2011 = 9.8 mbd (5.3 % increase from 2010

2012 = 10.2 mbd (4.1% increase from 2011)

We can see that China was still increasing their oil consumption at a rapid pace in 2010, however in 2011 and 2012 it slowed down quite a bit. Again, this has to be reflective in their overall GDP... doesn't it?

Any thoughts?

Westexas... excellent comment on the DFW shale gas figures. I am still amazed at the shale industry's overly optimistic forecasts even though we can see how dreadful the data has been already.

Lastly, there are a great deal more costs (Externalities) of the shale energy business that are not factored in... which have been reported by Deborah Rogers at the EnergyPolicyForum.com.

The fleet of trucks that it takes to drill, frack, and maintain the shale oil & gas wells are destroying the local roads. The tax revenue that is collected from the shale companies, are a fraction of the costs to repair and maintain these roads. I gather the shale companies are more than happy for these costs to be put on the backs of the taxpayers and state, rather from the non-existent profits they aren't receiving.

because U.S. oil consumption had fallen in the past several years, the annual percentage decline (or there-abouts) should be deducted from the GDP.

??

If a taxi fleet switches from Crown Victorias getting 10 MPG to Priuses getting 40 MPG, they still carry just as many passengers while reducing fuel consumption by 75%.

If construction declines, and reduces the number of pickup trucks on the road, that's already reflected in GDP statistics.

Why would GDP need to be adjusted??

Nick... your assumption makes perfect sense, however there is a pretty good correlation between world oil production growth & Global GDP growth from Gail Tverberg's article at the link below:

http://ourfiniteworld.com/2012/07/18/how-much-oil-growth-do-we-need-to-s...

She provides some excellent charts showing the change in global oil production and World GDP. They are both heading down together.

So, yes, there is a connection between total liquid energy consumption and GDP growth.

Following is an excerpt from a February, 2013 Fort Worth Star Telegram article on the preliminary version of the Bureau of Economic Geology (BEG) report on the Barnett Shale (apparently the final report, or at least the summary of same, did not address average per well EUR).

Several us thought it interesting that Art Berman's most recent estimate of 1.3 BCF for average Barnett Shale well EUR (I believe horizontal wells) falls between the USGS estimate and the BEG estimate. And as noted up the thread, the recent Citi Research report on the overall US decline rate for US natural gas production also supports Art's (and David Hughes') work.

And of course, in one of life's little ironies, one of Art's harshest critics, Aubrey McClendon, was fired by his own board of directors.

Report questions long-term productivity of gas wells in Barnett Shale

For link, Search for above title

the U.K. is not heavily reliant on natural gas in its primary energy mix. the U.S. uses almost twice as much natural gas per capita as the U.K.

??

The UK DECC says that natural gas is about 40% of UK primary energy, and 65% of electricity! I'd describe that as "heavily reliant". It's a significantly higher level of reliance than the US.

The real problem for the U.K. and all developed countries is energy for transport fuel and natural gas will not solve that in anything less than decades at best. I want to dispell the mistaken notion that energy sources can be freely substituted.

That seems to be going far afield from the original article. Perhaps more importantly, it's not really true. New vehicles are used much more heavily than old ones (in the US, vehicles less than 6 years old absorb 50% of vehicle miles driven), and a minority of the new vehicles use the majority of new vehicle miles driven (e.g., taxi fleets). So, NG vehicles and EVs can have a large impact pretty quickly.

Don't mistake my meaning - we need to discontinue all fossil fuels ASAP in favor of renewables (and perhaps nuclear) - NG is a mirage, in this context. Still, it's useful to be clear about on the facts here.

Nick, I would go much further than that. If there is another developed country in the world that is as exposed to natural gas for its way of life I can not think of it, certainly not the US as a whole, execpt perhaps in certain states (Texas?). The vast majority of UK homes are heated by gas (about 82%) and we have almost reached the point where I seriously doubt the ability of the power grid to operate in a stable mode without gas generation - I'm not talking about controlled rolling power outages, I think large parts of our grid would not work at all, including (and especially) our capital city and main source of wealth. All of our South-Eastern coal plants are shutting or have just shut (Tilbury, Kingsnorth, Didcott), stable power flows into London are now absolutely dependent on the large amount of gas generation in the region. There is zero political will to turn back from this, indeed there may not be all that much we can actually do to turn back within a 5 - 10 year period.

The UK is not using all that much gas for industry (genuinely interruptible), and a major loss of gas supply would very quickly mean interruptions at our power stations. It is almost impossible to turn off domestic supply of gas, if that ever happened it would literally take years to re-connect (every house would have to be isolated manually and locked before re-pressurising the local network and then unlocking the houses), so interruptions to power stations would take almost all of the hit.

I suppose Japan may be in a similar boat given the nuclear shut-downs, I assume they would re-start their nukes if they really had to (it looks like they may re-start quite a few anyway).

I'm not saying it will happen, I don't think it will. The UK will simply have to pay any price for its LNG, and we may be lucky there, there is a lot of LNG export capacity in construction. But it is a good reason to incentivise production of shale gas for the medium term as much as is economically reasonable, while we figure what to do about the long term.

This article is exactly why a place like TOD needs to exist. Where is this information from the UK gov? The UK media? The UK energy industry? The average UK citizen pays for all of those things. But they still need a group of volunteers from all over the world to define the difference between a reserve and a resource.

Mr. Berman tried publishing these kind of insightful articles in the for-profit trade publications, but the vested interests could apply enough pressure to end those attempts.

Another thread to ask why?

Thank you Art. This is a very good article. And very helpful for helping US citizens understand why there is not likely to be 100 years of cheap shale gas. Time to insulate!