A quick review of some current numbers on domestic crude oil stocks and the like

Posted by Heading Out on February 25, 2007 - 7:00pm

I was reading the story that Leanan had posted on the IEA estimate for oil demand, and it struck me that we are in that navel gazing part of the year where we try and estimate what will happen to oil supply and prediction. Since it helps to have data, let’s see what the crude oil and gasoline situation looks like, using the EIA data.

It is worth remembering, as we look at the history of crude stocks over the past year that, about twelve months ago we were looking into a future that was anticipating a second bad hurricane season, as well as the usual geo-political machinations and technical problems that would combine to limit crude oil supplies. In the end these were not as severe as we had expected, and the precaution of building oil stocks for the summer was not, this past year, needed as we had a more benign summer than usual.

In addition, the increase in price, helped to increase domestic production a little over that from this time last year, although the overall trend, taken from 2005 is still down (and this time last year we were still seeing some effects from the three hurricanes of 2005).

Crude imports have been a little more volatile over the past year, perhaps reflective of the price swings that we have seen.

On the other hand, when one considers that all this has to go through the refineries to be converted into something useful, one sees that the flows have been a little more stable. Although it is worthy of note that we have only increased production over the previous year, since September.

Looking at the resulting gasoline production, this has been significantly above last year, though, again, some of this reflects the restoration of refining capacity.

When taken with the changes in the amount of gasoline that is imported:

which has also shown some recent volatility, means that there has been an increase in demand, that this combined production must meet. This is now running about 400,000 bd ahead of this time last year, indicating, perhaps that the public may now consider that we have weathered “the latest energy crisis.”

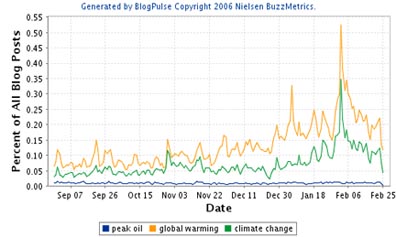

Well, while this may prove the fickleness of the popular attention span, peak oil is perhaps not the only issue so treated. As the weather has got worse over the last month, returning to more of a normal pattern, so global warming has dropped a little in popularity according to blogpulse although that and climate change are now much more of a topic of conversation than peak oil. We will see how that works out over the course of the rest of the year.

It is a bit of a change from this time last year . However we have still to start looking at what the forecasts are going to be for hurricanes, this year, and whether we will end up having a good, or a bad, season. We shall see.

Folks, also consider this a reminder to positively rate these articles (using the icons under the tags in the story title) at reddit, digg, and del.icio.us if you are so inclined. Also, don't forget to submit them to your favorite link farms, such as metafilter, stumbleupon, slashdot, fark, boingboing, furl, or any of the others.

These posts are a lot of work, and the authors appreciate your helping them get more readers for their work however you can.

US Personal Savings Rate:

http://www.bea.gov/briefrm/saving.htm

I estimate that net oil exports by the top 10 net oil exporters are down by about 8% from 11/05 to 11/06.

Average monthly spot crude oil prices are about two-thirds higher in the 20 months after 5/05, versus the 20 months prior to 5/05.

Note that the US Personal Savings Rate went negative in the second quarter of 2005 (5/05 is in the middle of the second quarter).

In November 2005, Chip Cummins, in the WSJ, documented forced oil conservation in Africa.

IMO, the US has, in aggregate, been going into debt to outbid regions like Africa for declining net oil exports.

The problem we are facing is that the next round of bidding for declining net oil exports will be against regions like China and the EU.

US personal savings rate is a completely worthless number. It does not include 401ks or any other investment in stocks. 401k saving and stock investments are the greatest change over the last 20 years, and as they are calculated out of the "savings rate", the savings rate is inversely correlated with 401k's and stock investments. Without comparison to the investment rate, the savings rate is worse than meaningless, it is missleading. If this number would have any correlation to reality, we would be in a great depression, which we obviously are not.

However, comparing apples to apples (same methodology), the savings rate on the chart prior 5/05 was positive, after 5/05, negative.

As noted, this corresponded to about a two-thirds increase in average crude oil prices.

And we are seeing, after 5/05, what appears to be a meltdown in US housing prices in several areas.

Yes, one of the possible interpretations is that many people thought the following: "oil stocks are going gangbuster, let's move assets from cash into oil stocks", and that they moved the money to other stocks (instead of cash) when the oil prices crashed. No doom here, just economics.

Oil prices are currently about one dollar below the average monthly price for the 20 months following 5/05 ($62, Brent), versus $38 in the 20 months prior to 5/05. The range in average monthly oil prices in the 20 months after 5/05 was from $54 to $74, through 1/07.

This had no effect on the US Personal Savings Rate?

Your making the assumption that Americans have assets besides their house and a bit in the 401k in general I don't think so.

I think you will find that amount of money invested directly by Americans in stock as part of a personal saving is minuscule at best out side of say the top 5% of Americans.

Now of course they have some money that is technically theirs in 401k's and pension plans that is being invested I'll grant you that and its not a small a mount of money but its not liquid wealth either.

The equity in their homes if any is all Americans have in general.

Many Americans will be facing real poverty if our economy slows.

Actually I suspect that Bush knows this and also I'm positive he knows the real situation in KSA. In a sense America has a dwindling chance to do something while it is still the worlds only super power. The war in Iraq and probably soon Iran is what he has chosen as America's last big move. He doesnt give a damn about Joe six pack since the American middle class is toast. At best we can be assured of enough desperate men willing to be cannon fodder during the oil wars.

I don't agree with his moves or decisions but if you make the above assumptions then they make sense from a neo-con perspective. The scary part as the collision of Peak Oil (Mexico) , Depression and War makes conditions ripe for the imposition of a wartime government and the suspension of democracy in America.

This would be the real tragedy.

Just the fact that a fairly realistic analysis of the situation with some simple assumptions makes even the probability of the suspension of democracy in America is scary to me.

"The equity in their homes if any is all Americans have in general.

Many Americans will be facing real poverty if our economy slows."

Duh!, ya' think so? Somebody please tell me how that is any different than most of post WWII history....well, except the 1970's, when you had hoards of baby boomers coming out of college who had no savings, college debt, and not even equity in a home....oh, did I mention they also faced double digit inflation, double digit interest rates and double digit unemployment and oil prices at what would now be nearly $100 per barrel?

The problem with all of these charts is that they are far too short, it is almost impossible to judge anything using a two or three year window....(ahh, it makes me think of the glory days of the tech bubble..."See, this stock only go's up!!" Question: "How far back does that chart extend?" Answer: "I didn't bother to look....let's see, uh, about a week...but see, IT ONLY GOES UP!" :-)

RC

Remember, we are only one cubic mile from freedom

I'll tell you - since I was there in the 70's, starting a family, buying a home and no debt other than a car to repay.

Compare to today as noted Here, today:

http://www.news.com.au/story/0,23599,21288836-2,00.html

PROPERTY experts have offered a bleak picture for Australia's youth, with only one in 14 believing members of Generation Y will ever be able to buy their own home.

I think this is much like the US. Today is diametrically opposite to the 70's - a time you can only grasp a glimpse of from videos and books. The primary difference was the US, Aus, Canada and the UK were producing countries - now (except for minerals from Aus and Canada) we are consumers, little more.

Ian Down Under said,

"I think this is much like the US. Today is diametrically opposite to the 70's - a time you can only grasp a glimpse of from videos and books."

I am assuming you mean that remark editorially, and not in my personal case, as I got my first job selling gasoline in 1974, and graduated high school in 1977, so I well remember the 1970's, a period when I would not have dreamed of starting a family because I could not have possibly afforded a house to start to one in...and in which I saved $20 per week from a dollar an hour job to buy my first car cash because (a) no bank would loan money to anyone just out of highschool, and (b) even if they would, I could not afford to pay the then common 18% interest rates, which would have made a $2000 dollar used car (not that uncommon then) cost about $8000.

I will not argue with the source you linked, but I am willing to bet that the mood would have been about equal to that of 1979, after the second major fuel crisis in less than a decade, war in the Persian Gulf, and oil prices per barrel at what would now be near $100 per barrel. It was great fun in those days putting in for jobs, at which point the receptionist would tell you, "go ahead and put it in, but I can tell you it's going in the garbage at quitting time, we have 500 people putting in for 3 positions here...."

Maybe Australia was doing better than the U.S. South in that period, but I can tell you from my experience it was helll that I would not want to live through again.....but guess what? We did live through it, all the kids that thought they would never own a home finally did (many delayed, mind you) and it turned out to be the best economic period in history for 20 years thereafter.

What most worries me about the "Y" generation or whatever is that they grew up in a period in which they NEVER saw a down market.....and by the squalling and moaning I am hearing in what so far has been a brief and shallow slowdown, it's debatable whether or not they can take it.....

RC

Remember, We are only one cubic mile from freedom.

I graduated with a BS in 1979 in California in deep debt, during that time, people were being shot in gas lines in LA. I had to work for a couple years before going back to school. During the 2 years working, my rent went from $150 per month to $360 per month while I got a 5% raise. Returning to school, I had to take out a 12% student loan. While I expect the economy to worsen, it has a long way to go to get as bad as the 1970s were for many folks.

I grew up and graduated in the same time period, Roger, and I am going to have to question your anecdotal numbers. The US minimum wage in 1974 was $2.00. In 1976 it advanced to $2.10. In 1977 it advanced to $2.30 and in 1978 it advanced to $2.65. If you worked for $1 per hour you should have been getting tips. If you did not get tips, then that was your personal choice to work under those conditions. I graduated in 1976, Roger, and never, ever, even in the midst of the rust belt as steel plants and coal mines closed around me, did I find myself unable to locate minimum wage work.

Grey Zone

Graduated H.S. in 74, worked my first job as a sophomore at $1.20/hr. flipping burgers in 72. Dishwasher for a time in 73 at $1.45/hr.. Worked at an amusement park as a ride operator in 75 making $1.65/hr. In between some better higher paying factory jobs. Point is Minimum Wage laws were governed by intra and interstate regulations. If your employer did not operate in more than one state then the minimum wage laws in the state were in force not the Feds. Lots of loopholes for underage workers and in general state mins. well below the Feds.

While the 80s and 90s were very good for investments they were hell on paychecks. Over the course of 24 years in my public transit job the purchasing power of my paycheck dropped in real terms about 20%. Compared to many working families who did not have the benefit of a union I did pretty good by losing only 20%. The 25% of Americans with a BA or BS live in a very different world than the 75% who lack degrees. We now live in an age where none of the benefits of economic expansion and increased worker productivity is going to those workers who are generating that wealth. We have the dichotomy of increasing wealth and increasing poverty at the same time as America continues to become Mexico.

This guy is sick and tired of the "redefinition of savings." Perhaps there are some vested interests in this? You think?

http://themessthatgreenspanmade.blogspot.com/2007/02/stop-trying-to-rede...

Westexas,

I agree with what you say as being a strong indication of the slide of the average American’s financial well being. It’s an epidemic of vast proportions, and the debt of this country is a strong signal that we are in trouble. The average voter puts politicians in place who will tend to do as they wish, which is all too often to give generously to the public welfare. I saw a news article today that claimed that about 1 in 6 in this country is receiving public assistance, and much of this was Medicaid. Health and Human Services is the largest outlay for the government, beating out the DoD. This can’t go on forever, so something has to give.

Also in the recent news were articles concerning the health care cost problem. A number of politicians and others were discussing how this might be “fixed.” From what I could see, all the ideas they presented were nothing more than ways to shift those costs around, or spend yet more government funds! Health care costs have been skyrocketing. Which is no surprise when you consider that the professional health care providers and the corporations that run the public hospitals know they can charge just about whatever they wish, because the bill will get paid in most cases by private insurance or the government. I was recently hospitalized myself, and remember well a number of doctors who charged me $300 an hour! How plain can it be? Just how many of us average citizens could afford to pay that out of pocket? Not very many, so we are stuck with paying insurance and being bled of our work over our life times! Either way we get the shaft. The poorest among us rely on the government. How can someone who makes $6 or $7 an hour afford any kind of decent health insurance? They can’t, it’s that simple. Many have been living off the rising asset price of their home, but not now!

As a research scientist working in health care related basic research, I feel fairly comfortable putting forward the suggestion (without having researched it) that the major driving force behind the rise in health costs are new technologies, treatments and drugs. An uncomfortable side effect of research efforts directed at curing diseases is the increase in treatments, usually more expensive, which are introduced into standard medical practice. No opinion on whether this is justified or not; however, I do believe that shifting some research money from medicine to sustainable environmental policy better happen soon.

Daniel,

Yes, you are correct, or at least that’s what I read in a recent news article. The patients and doctors are ordering the new technologies, treatments and drugs you speak of. Since many of these have insurance, whether it is private or government, they want the best treatment possible. Who can blame them? I would do the same.

Cheers

Daniel, I can offer no hard evidence to back up this statement, so maybe you can comment..

A very level headed friend of mine is also in UK drugs research. His comment to me many years ago was that his company spent far more more budget on 'marketing' than they did on research [presumably sports event freebies, oiling greasy palms for purchasing committees etc]. When I pressed him to guess [obviously he wouldn't know details] he figured maybe 5 - 10 times as much!

your thoughts??

If the US had the same income tax structure as we did in the 50s and 60s the cost of social services we be no problem. Repeated cuts in tax rates of corporations and the wealthy is what has put us in this dire situation.

The problem is globalization. It's the corporate tax rates that have really plummeted. From as much as 40% of tax revenue to only 7%. Our tax structure is made for the world that existed in the 1930s. Today, companies just incorporate in the Cayman Islands or some such place, and avoid paying taxes. Even if they don't, they are competing against corporations that do - at a big disadvantage.

I would pontificate that if the level of benefits had been held constant then we would not have any problems. The problem is the tit babies are always wanting the government to do more for and thus the government overspends. Causing inflation and devaluing your purchasing power the problem you eluded to earlier. Total taxation levels (meaning the percentage of your income you give to the bloodsuckers) are much higher today than in the 50's and 60's especially for the well to do.

Hello Biologist,

The stock market correlation to reality can be incredibly fast, instantly wiping out most 401ks and other stock investments. It has happened in the past and will undoubtedly happen again. The personal savings rate may just be a solid indicator of what is coming next.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Please back that up. The definition of personal savings from the BEA is

Personal saving. Personal income less the sum of personal outlays and personal current taxes.

Unless they count contributions to 401ks as personal outlays, you are incorrect. I am pretty sure that since 2005, the average american has spent more than he made, and has either pulled from savings or (more accurately) went further into debt to balance in vs. out.

I totally agree with you. There seems to be a great misunderstanding, that somehow 401k etc are not included in the savings number - this is very, very wrong. In fact, everything is included.

The BEA has a recent paper out with a few alternative ways of measuring the savings rate (eg including car purchases as "investment") here: http://bea.gov/scb/pdf/2007/02%20February/0207_saving.pdf

Their conclusion: "Alternative measures of personal saving neither change the conclusion that personal saving has fallen dramatically in the past two decades, nor do they imply any decrease in the record levels of national borrowing of recent years...."

Regards

"US personal savings rate is a completely worthless number. It does not include 401ks or any other investment in stocks. 401k saving and stock investments are the greatest change over the last 20 years, and as they are calculated out of the "savings rate", the savings rate is inversely correlated with 401k's and stock investments. Without comparison to the investment rate, the savings rate is worse than meaningless, it is missleading. If this number would have any correlation to reality, we would be in a great depression, which we obviously are not."

What value will stock investments and 401K saving have when the fractional reserve banking system they rest upon can no longer increase debt do to declining net energy? Those financial instruments only have value based on continued growth of the system. I would say 401k saving and stock investments are completely worthless numbers right along side the US personal savings rate. Promises based on ever increasing energy inputs that are not going to be there. What the numbers may be foreshadowing is there is not much more net energy to be squeezed out of the system considering the US has virtually shipped its entire industrial base to countries that use less energy per capita.

==AC

This issue seems to come down to how much longer overseas investors are willing to invest 800 billion a year in the US economy. I don't believe this decision will have much to do with reality. Eventually these investors will stop financing US growth but I doubt we can draw conclusions about the timing.

Hi Daniel,

From what I have read, overseas investors stopped buying US treasuries quite some time back - now it is only international central banks printing money to support the Ubber Central Bank in the US. For now it is in everyone's interest to keep the system running, and it will until...

Had not meant to distinguish private and governmental investors.

It is quite possible, and even likely, that 401k and stocks are or will be worthless. I just can't buy the notion that mortgaging the farm to buy stocks is not a very bad sign.

This is what initiated the great depression. First a general housing/construction bubble that collapsed with money fleeing to the stock market and this finally collapsing.

Of course this time is different we will have a permanently high plateau of prosperity.

Note that the correct term, as used by the Bureau of Economic Analysis, is the US Personal Saving Rate, with no 's' on the end of "saving." This is because the two terms, saving and savings, have different economic meanings.

Personal Saving is derived by first calculating total personal income, then reducing that by personal taxes and contributions for government social insurance. That result is personal disposable income, which when reduced by personal consumption, non-mortgage interest payments and personal transfer payments leaves personal saving. Positive personal saving is added to personal savings, negative personal saving is deducted from personal savings.

Under the above, it is clear that saving is a flow, while savings is a stock or supply, the stock of accumulated personal wealth. If savings is in the form of assets that can appreciate in value, then it is possible for savings to increase in spite of a zero saving rate. Personal savings can even grow in the face of a negative saving rate, providing asset appreciation exceeds the negative saving rate.

Seen in its proper context, the US personal saving rate is therefore not a worthless number. The fact that it is negative tells us that any growth in US personal savings is because of increase asset valuation and not the inflow of additional saving.

In an of itself, this situation is not seen to be that serious over the short term, as evidenced by reports from the Federal Reserve Banks of San Francisco and St. Louis and Germany's

CommerzBank.

Long term negative personal saving could very well be a different story.

Hello TODers,

It is remarkable the difference in web awareness from PO vs GW. The scientists and Al Gore have done a good job in getting this message out, but Katrina and drowning polar bears have been a big help too in getting the MSM to provide bigtime coverage.

If Al Gore truly doesn't desire the Presidency anymore, I think it would be terrific if he ran anyhow just to get the press coverage for Peakoil Outreach. If he teamed with Simmons & Congressman Bartlett, they could forever link PO + GW in the MSM so that the public could quickly get up to Peakoil speed. It certainly would make the long period from now to voting day much more interesting too as the other candidates from both parties would have to respond in some manner to Al Gore's PO + GW Paul Revere Ride.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

LOL! Al Gore is a hypocritical buffoon who has credibility only with the less mentally gifted portions of the tit baby nanny state population. He is a huge turnoff to 1/2 the population who view him less favorably than the other half plus view Bush. He is polarizing and therefore a poor choice. Peak Oil would never get its due with Al Bore he already has his crusading baby GW. And once again he demonstrates a lack of vision by choosing GW over Peak Oil!

Here in Ontario, we have had a number of gas stations run empty. When prices were jumpimg before,I would hear alot about how we are being gouged by big oil companies. However, now I think people may relize how fagile the oil supply is. Just my 2 Canadian cents.

I would find it interesting if you could say a few words about how people are reacting to empty stations? I guess it makes a difference if they still can get gas down the road or not. What is your impression?

It has not been an issue of significance in Southern Ontario, as there are several chains of stations, only some of which are supplied by the refineries that are down, so indeed folks can just go down the road to fill up. I think it might be worse in the Northern part of Ont., where you have a 1 station town that might be 50 miles from the next station of any sort.

Prices have gone up about 15% around here (Hamilton) but this is still below recent high values, so while folks don't like it I doubt it is affecting behaviour much

I drive by an Imperial Oil (Esso) supply depot north of Brantford Ontario from time to time. Many trucks have different chain brand names on them. This morning the Petro Can station that I normally fill up was empty and the Canadian Tire station down the street was also dry. Although later in the day both were selling gas. Doesn't seem to be much hoarding or anything else though that I can notice.

I used the current Ontario gasoline shortage as a starter for peak oil discussions on four occasions last week - in each case my input was met with complete ignorance or the standard "lunatic" stare.

Everyone is just moving to the next open station, paying the inflated price. There is no recognition of the pending reality.

Even a discussion of the lack of local refinery reserve capacity (remember, it was only 1 refinery on fire) was met with blank stares.

SNAFU

Ancaster, ON

That blogpulse statistic is REALLY interesting. It is a great way of measuring public interest in a particular issue.

Can we calibrate it by measuring the interest in GW to say, Britiney Spears or some other celebrity or cause of interest?

absolutely. you can track whatever you want. www.blogpulse.com

Thanks! I put together a Global Warming vs Britney Spears search.

http://www.blogpulse.com/trend?query1=global+warming&label1=global+warmi...

They're of approximate equal interest :-) I guess this implies that Global Warming really has entered the public conscience at large.

I met Global Warming at a party once, but who's this Britney Spears chap?

He's a bald headed Telly Savalas look-alike.

.....good face structure though....:-)

RC

Remember, we are only one cubic mile from freedom

I was at that party. Remeber, Global wouldn't shut up about this thing called Al Gore...

Oh no, this is bad. Anna Nicole Smith, Global Warming, and Peak oil.

Boobs - the ultimate attention getter! Hmm... does Hubberts curve fit?

http://www.blogpulse.com/trend?query1=Anna+Nicole+Smith&label1=&query2=G...

This place is insane!

--rant on--

On the one hand we want to stop the use of fossil fuels because they are destroying the planet (aka global warming).

So someone suggests raising the gas tax, except you can't do that because then the poor guy down the street wouldn't be able to fill up his Cadillac Escalade and drive to the emergency room to receive free medical care.

Except that "free" medical care is getting expensive, so maybe we should think about "fixing" the system.

Of course "fixing" the system is difficult, since our corrupt government took us off the gold standard so the federal reserve (a private corporation!) could screw us all! Usury is evil!!

But the Cadillac dealer who sold the Escalade to the poor guy with 0% financing is evil too, because although he's not charging interest he's pumping the system with credit (for the feds) AND pushing a gas guzzling vehicle (for the evil oil conglomerates).

And don't even get me started on the oil companies! They're actually run by a group of guys in their underwear in the basement of some Yale dormitory with a sign on the door that says "Skull and Bones".

And meanwhile because the ocean is rising 3mm a year we need to evacuate Florida.

Only we can't do that because we're only pumping 85.4 million barrels a day around the world (we peaked at 85.5), and three gas stations in Canada ran out of gas, so we have to declare a national emergency!!

And effective tommorow we're outlawing air conditioning, hot showers, and the automobile.

But don't worry about the economy, because we can all grow food in our backyards, and Sally down the street knows how to knit, so she's going to start a business making sweaters for everyone!

--/rant off--

:)

Garth

Why no, we don't have to do anything. As a matter of fact, that's about what I think WILL be done...nothing.

Garth,

By the way you were talking, I thought you were a newcomer here, but you've been here almost six months! :-)

You know by now how it's played here....think of it as a parlor game....

1. The first player (we'll call the provocateur) proposes a problem and maybe even provides a link to the story, and declares this could be catastrophic...

2. The second player (we'll call the "dupe") proposes a workable sounding solution, or why catastophe may be avoided...

3. Then each newcoming players in alternative turn nullifies the proposed solution, the next proposes another solution, then the next nullifies or proposes impossible that solution, in successive turns, until any possible way to avert a catastrophic and horrible outcome are all nullified.

The goal is to end at a sort of checkmate (think of chess, where any movement becomes impossible), where any point in attempting a solution is rendered completely pointless, a type of "paralysis" is insured, and the string dead ends!

At the next string, a new game begins!

What the players cannot figure out is why this sort of game is not fun for the whole country, we love it so much!

(playful rant ends, hopefully with tongue in cheek...:-)

Roger Conner Jr.

Remember, we are only one cubic mile from freedom

Roger,

I understand it, but it's crazy!

10 years ago, if I had suggested that almost everyone would have a cell phone by now, people would have scoffed at me! The service is too spotty. The connection isn't clear. It's too expensive. I don't want to have a phone with me all the time. There were a million reasons why it could never succeed. And now look at them - they're replacing landlines. EVERYONE has them. I honestly wonder how I ever lived without mine.

The point is, it's easy to shoot down new things. It's easy to see the flaws. It's easy to stick your head in the sand and say that won't work.

Wind and Solar are going gang busters. They're ramping up. By the time we are two or three years past a peak in all liquids, they'll be coming into their own.

And if they aren't quite there yet, Nuclear Power Plant construction will be fast tracked. Immediately after the first set of nationwide rolling blackouts NIMBYism is going to disappear.

And of course there's coal fired power plants and CTL too. And sure there are concerns about CO2 emissions, but people are working on that too.

And there probably will be a recession at some point. There are a lot of parrallels between us and Japan 12 years ago. They had one hell of a recession. But they're still buying TV's, and building maglev trains, and singing karaoke. They didn't all go back to the farm.

I'll probably be labeled a troll for this. Oh well.

Garth

You implicitly assume that declining liquids will boost investment in alternative energy supply. I think it is just as reasonable to anticipate the opposite effect, as the cost of making the alternatives will rise. In my view, the lowest cost response to a peak liquids scenario lies with conservation efficiencies. Conservation requires investment; for example, retrofitting buildings or installing rail transit. If government decides to subsidize your proposed alternatives, the result will be the usual one when opportunity costs are ignored: lower overall productivity and well-being.

The bottom line is there has been money invested in energy production for the last 100+ years, and that will continue. As oil gets harder and more expenisve to produce, other alternatives should become more attractive. There's no doubt in my mind that the end of cheap oil also means we end up with a lower EROEI, but this doesn't have to be catastrophic.

"gas tax"

What about back to the 55 MPH speed limit? That doesn't cost the "poor guy" anything! And may reduce his need for the emergency room anyway.

Screw that. I'd rather pay $5.50 a gallon and $.10/mile freeway tolls to go 75mph in an efficient diesel mini-car (like I do here in Japan). If people want to speed they should be able to - provided they pay for it. And when they do pay for it, all that money generated can go to medium-high-speed rail so that people can take the train instead. Have a graded ticket fee scaled to income.

Peak Oil is Over!

Go to Bloomberg to read all about it:

http://www.bloomberg.com/apps/news?pid=20601109&sid=aruMVI013R70&refer=home

The rise in rig costs contributed to the five-year jump in oil prices by driving up production costs, hindering the discovery of new deposits and slowing the development of existing finds. The oil left underground in the U.S. alone is enough to replace every barrel pumped from Iran for the next 20 years, according to statistics compiled by London-based BP Plc, Europe's second-biggest oil company.

That was close! We can breathe again! The world is saved (except for GW). WesTexas can move onto a more usual function in life. Jelly bean counting perhaps?

One should never take navel gazing lightly:

Hey! Wherte's the picture? The link:

http://www.blogpulse.com/graphs/20070226045923s4vgSUk7S20rOeQxsJTj.png

didn't work..

This is an interesting article because it says a lot about what it doesn't say anything about.

For instance, it talks about the US having enough untapped oil to replace Iran's oil for 20 years. It doesn't mention that Iran's oil is pumped, primarily from land or shallow water, while the US reserves are locked in shale. There is an old expression that you can't get blood form a stone and just this week Shell told us it isn't easy to get oil from a stone either.

It talks about the need for deep water rigs. No need for deep water rigs if there is easily obtained oil elsewhere.

It talks about the shortage of deep water rigs. My local scrap metal dealer can't start making deep water rigs. Only so many organizations have the skill to build these things and they can only ramp up just so quickly. So the shortage will likely be chronic.

It says the era of cheap energy is gone. We have to agree on that. Yet it says there is over 3 trillion barrels of untapped oil. It implies we can pump it with the right rigs,but deep water rigs have nothing to do with oil shale and tar sands.

Peak oil is a "theory." Projects are being delayed everywhere we look, there are not enough people or equipment, and all we have to do to "pump" that 3 trillion barrels of oil is fulfill those orders for deep water rigs. Ya gotta love the press.

Don't even get me started on the shortage of LNG trains.

Here is a question for the petrochemical engineers lurking here:

I note that around 15.5 million barrels a day goes into the US petrolium refinaries and that 9.2 million barrels per day of gasoline comes out.

How much of that 6.3 million barrels per day that is not gasoline gets turned into something useful, (kerosine, diesel fuel, etc) and how much is simply burnt or disposed of?

Could you provide links to back up your answer?

Thanks!

You find what the crude is turned into at this EIA site .

Thank you very much. That was exactly what I was looking for.

R.C.

Hmmm- and some of the infrastructure has also recently been exposed to

the public gaze.

Did you know that Britney Spears is an anagram of "presbyterians" ?

(Just adding an intellectual note to this thread).