Ghawar reserves update and revisions (1)

Posted by Euan Mearns on May 2, 2007 - 11:13am in The Oil Drum: Europe

In this revisions post I want to update my views on Ghawar reserves incorporating 4 main changes:

1. A model base assumption error in the way initial reserves in Uthmaniyah were calculated is corrected.

2. The data vintage for the Linux oil saturation map has been revised to 2002 (from 2004).

3. 2002 based figures are re-based to 2006 by adjusting for 4 years production at 5 million barrles per day.

4. The production prognosis for Hawiyah has been revised down.

These adjustments result in the initial whole field reserves figure rising to 173 billion barrels and show the field in a more severly depleted state in 2006 than previously shown.

Uthmaniyah

In my original post, the oil column thickness in Uthmaniyah had been reduced from 180 to 144 ft in the initial STOIP calculation and from 180 to 120 ft in the 2004 reserves calculation. 180 ft is the net reservoir thickness reported by Croft.

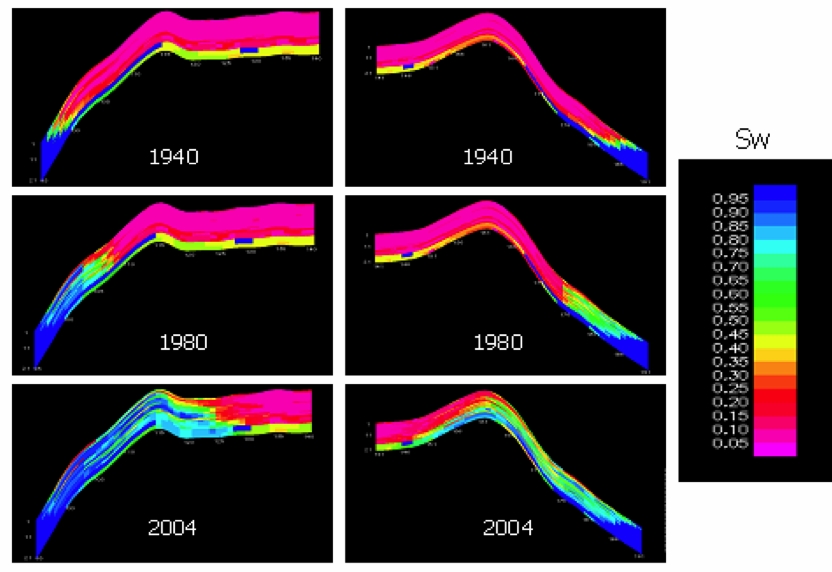

The reason for this reduction was the observation of water at the base of the Uthmaniyah saturation profiles as shown below.

Oil saturation profiles in Uthmaniyah. Image source: Water in the gas tank by SS, original source is: Water Production Management Strategies in North Uthmaniyah Area, Saudi Arabia, SPE 98847, June 2006.

My interpretation of these profiles now is that they show a complete Arab D Zone 2 and Zone 3 section. The low oil saturation sections at the base of the Uthmaniyah profiles therefore are interpreted to be non-reservoir beds in Zone 3. In short the Uthmaniyah profile is believed to be about 250 ft thick, of which 180 feet is net reservoir, full of oil before production began.

The reduced oil thickness height of 120 ft in the 2004 (now 2002) calculation has not been changed, as this is an allowance for edge wedge effects and along strike variations in column thickness.

Using oil full 180 feet in Uthmaniyah has the effect of boosting my estimate of initial stock tank oil in place to 173 billion barrels from my initial estimate of 162 billion barrels.

This revision brings my initial STOIP value in line with the number reported by Simmons that was 170 billion barrels.

One consequence of boosting the initial STOIP in Uthmaniyah is that it also boosts the estimate of the amount of oil that has been produced but as the estimate of the amount of oil remaining is unchanged this increases the estimate of depletion in Uthmaniyah.

Vintage of Linux oil saturation map

In my original estimates it was assumed that the Linux saturation map was showing the condition of the reservoir in 2004. One key piece of evidence that has shifted my view on this is the interpretation of the oil layer thickness map (Figure 11, IPTC 10295) that was presented by Stuart here. This shows a significantly narrower oil ribbon in the crest of South Ain Dar than I have interpreted from the Linux saturation map. One explanation may simply be information transcription errors. Another explanation is that the data used to construct the Linux map pre-dates 2004.

Memmel pointed out here that they may have been testing the Linux super cluster technology doing simulation runs on various data vintages and combined these lines of argument point to the Linux map pre-dating 2004 and I have settled (for the time being) on 2002 as a more likely vintage for this information.

I disagree with the arguments that Linux may date from the 1990s. If this were the case then northern Ghawar would already be dead, in which case, how did the Saudis manage to produce at 10 million bpd in 2004 and 2005?

The Base Case and High Case reserves estimates shown in Tables 1 and 2 show updated estimates for Uthmaniyah and are now based on a 2002 assumption for the Linux map.

| Base Case | Initial STOIP | Initial Reserves | 2002 STOIP | 2002 Reserves | % depleted | Produced |

|---|---|---|---|---|---|---|

| N Ain Dar | 20.4 | 12.1 | 2.51 | 1.49 | 88 | 10.6 |

| S Ain Dar | 16.4 | 9.69 | 2.78 | 1.65 | 83 | 8.04 |

| Shedgum | 21.1 | 11.3 | 9.58 | 5.14 | 55 | 6.15 |

| Uthmaniyah | 54.4 | 36.6 | 9.67 | 6.50 | 82 | 30.1 |

| Haradh | 29.7 | 13.4 | 18.7 | 8.42 | 37 | 4.96 |

| Hawiyah | 30.6 | 13.8 | 24.7 | 11.1 | 19 | 2.62 |

| Totals | 173 | 96.8 | 68.0 | 34.3 | 65 | 62.5 |

Table 1 Base Case reserves estimates for Ghawar oil field in 2002, Saudi Arabia. All figures in billions of barrels.

| High Case | Initial STOIP | Initial Reserves | 2002 STOIP | 2002 Reserves | % depleted | Produced |

|---|---|---|---|---|---|---|

| N Ain Dar | 20.4 | 14.3 | 3.14 | 2.21 | 85 | 12.1 |

| S Ain Dar | 16.4 | 11.5 | 3.48 | 2.45 | 79 | 9.06 |

| Shedgum | 21.1 | 13.4 | 12.0 | 7.62 | 43 | 5.78 |

| Uthmaniyah | 54.4 | 43.4 | 9.67 | 7.48 | 83 | 36.0 |

| Haradh | 29.7 | 15.8 | 18.7 | 9.90 | 37 | 5.86 |

| Hawiyah | 30.6 | 16.2 | 24.7 | 13.1 | 19 | 3.09 |

| Totals | 173 | 115 | 71.7 | 42.8 | 63 | 71.9 |

Table 2 High Case reserves estimates for Ghawar oil field in 2002, Saudi Arabia. All figures in billions of barrels.

Adjustments from 2002 to 2006

One flaw in my earlier post was that the reserves estimates were based on a 2004 assumption and I made no attempt to update these to 2006. The new 2002 based estimates have now been updated to 2006 by accounting for 4 years production at 5 million bpd as shown in Tables 3 and 4.

| Base Case | Initial STOIP | Initial Reserves | 2006 STOIP | 2006 Reserves | % depleted | Produced |

|---|---|---|---|---|---|---|

| N Ain Dar | 20.4 | 12.1 | 0.76 | 94 | 11.3 | |

| S Ain Dar | 16.4 | 9.69 | 0.92 | 91 | 8.8 | |

| Shedgum | 21.1 | 11.3 | 3.7 | 67 | 7.6 | |

| Uthmaniyah | 54.4 | 36.6 | 4.3 | 88 | 32.3 | |

| Haradh | 29.7 | 13.4 | 7.1 | 47 | 6.3 | |

| Hawiyah | 30.6 | 13.8 | 10.3 | 25 | 3.5 | |

| Totals | 173 | 96.8 | 27.0 | 72 | 69.8 |

Table 3 Base Case reserves estimates for Ghawar oil field in 2006, Saudi Arabia. These are the figures presented in Table 1 adjusted for 4 years production at 5 million barrels per day. All figures in billions of barrels.

| High Case | Initial STOIP | Initial Reserves | 2006 STOIP | 2006 Reserves | % depleted | Produced |

|---|---|---|---|---|---|---|

| N Ain Dar | 20.4 | 14.3 | 1.5 | 90 | 12.9 | |

| S Ain Dar | 16.4 | 11.5 | 1.72 | 85 | 9.79 | |

| Shedgum | 21.1 | 13.4 | 6.16 | 54 | 7.24 | |

| Uthmaniyah | 54.4 | 43.4 | 5.29 | 88 | 38.2 | |

| Haradh | 29.7 | 15.8 | 8.59 | 46 | 7.17 | |

| Hawiyah | 30.6 | 16.2 | 12.2 | 25 | 3.96 | |

| Totals | 173 | 115 | 35.5 | 69 | 79.2 |

Table 4 High Case reserves estimates for Ghawar oil field in 2006, Saudi Arabia. These are the figures presented in Table 2 adjusted for 4 years production at 5 million barrels per day. All figures in billions of barrels.

Hawiyah

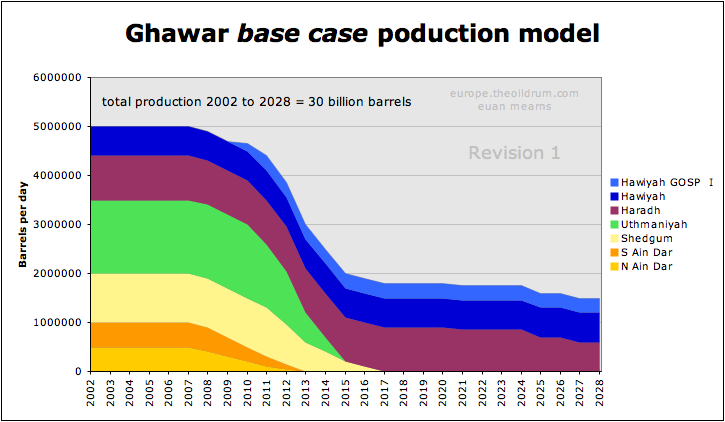

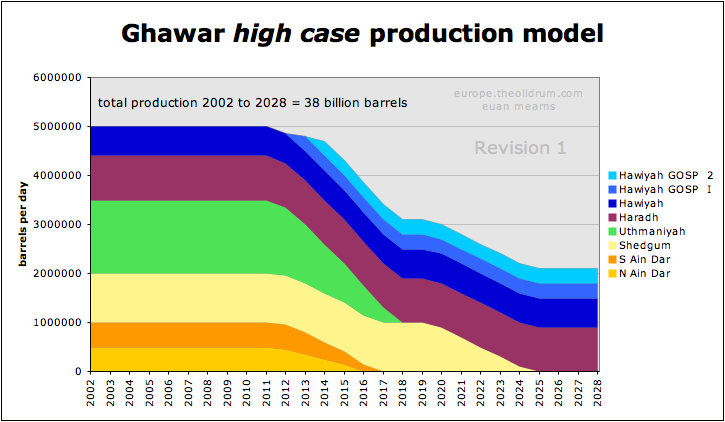

The discussion about high initial water saturations and SuperK problems in Hawiyah leaves me less certain about eventual recovery of oil from this region. In my revised production forecast (below) I have therefore reduced the anticipated expansion of this area by one GOSP (300,000 bpd) in the Base Case and High Case scenarios.

Bunyonhead also pointed to natural gas liquids production from Hawiyah that is most probably coming form the Permian Khuff formation. The report on this is a bit equivocal and it is not clear whether natural gas liquid (which is petroleum) or liquefied natural gas (LNG) is being produced. So I have left this Hawiyah “NGL” production off the forecast for the time being.

A revised spreadsheet (rev1) can be downloaded here.

Base Case production scenario up-dated for revisions presented here. This places Ghawar on the cusp of production decline in 2007.

High Case production scenario up-dated for revisions presented here.

In summary:

Estimate of initial oil in place = 173 billion barrels (same for High and Base cases)

High Case

Produced oil = 79 billion barrels

2006 reserves = 36 billion barrels

69% depleted

Base Case

Produced oil = 70 billion barrels

2006 reserves = 27 billion barrels

72% depleted

It needs to be noted that these relatively minor adjustments I have made here have a fairly dramatic effect on the reserves prognosis and state of depletion of Ghawar.

It needs also to be noted that I documented 4 areas of possible reserves underestimation in my original post and these still stand.

Euan,

With regards to Hawiyah production from the Permian Khuff, the articles I read stated unequivocally that the liquids production was Natural Gas Liquids, NOT Liquefied Natural Gas. The link you posted (http://www.hydrocarbons-technology.com/projects/saudi-aramco/) is pretty clear on that.

Current NGL production is 170 kbpd, scheduled to rise to 480 kbpd by the end of 2007.

As far as I am aware, there is no present or planned production of Liquefied Natural Gas in Saudi Arabia.

Yes - but ethane - C2H6 - is a light gas that will only go liquid if cooled. Methane (CH4), Ethane, Propane and Butane are all gasses. It is only when you get to Hexane (C6H14) and higher chanes that you would call it NGL.

I'm not 100% sure on this but it was the comment about 310,000 bbls bpd ethane that led me to say the report was equivocal.

Ethane is used in LPG (liquified petroleum gas) in varying proportions together with propane.

http://en.wikipedia.org/wiki/Liquified_petroleum_gas

LPG drives many taxis in Australia. It is liquid under pressure and ambient temperature and therefore requires a special tank which is fitted in the boot

I think propane and butane compress to a a liquid at ambient temp.

Ethane would be too high a pressure for basic domestic use. And it's a chemical feedstock, so too useful to burn??

i think you are refering to condensate (c6+). which is more or less stable at stock tank conditions. lpg (primarily propane) is stored in a pressurized vessel. ngl refers to the whole range of intermediate components (c2 - c6) which can be liquified by cooling and are components of gasoline and chemical feedstocks. lng is liquified methane.

and with all of these designations, it is important to remember that they arent a pure single component. condensate will contain a small fraction of methane for example.

methane b.p. -161 ºC, ethane b.p. -88 ºC , propane b.p. -42.1 ºC, butane b.p. -0.5 ºC, pentane b.p. 35-36 ºC and hexanes 68-70 ºC

Amazing work Euan.

Not a pretty picture, not going to help my sleep...since I was just about to go to bed.

Anyone want to revise anything up...good news would be nice :-P

Is Stuart almost ready with his article?

Again, great work Euan!

I wouldn't look for Stuart to ease your mind. In fact, when Euan starts making it hard to sleep, we know we're in trouble. Prior to this, in comparison, Euan has been a ray of sunshine.

Your right. All we need is for Robert to be convinced and I think we have consensus of the top TOD researchers/analysts. I don't think Robert will do this until it is well after the fact and obvious to all.

Link to a document about Iran's plan to convert their whole car fleet to natural gas by 2015- maybe they are aware of what's happening in SA too?

http://www.iags.org/iran121206.pdf

Excellent work, Euan!

One comment on your base case production model is that the production rates in 2007 to about 2010 may be too high. I know that you may not agree.

2006 Reserves = 27 Gb.

2007 production = 5 Mb/d*365/1000 = 1.83 Gb

The annual reserve depletion rate = 1.83/27 = 6.8% which appears too high.

A general rule of thumb is that if remaining reserves are produced at more than 5%/yr, the reservoir could be damaged (eg excessive premature water/gas intrusion into oil column) causing the total amount of oil extracted to be suboptimal.

"maintain production at a healthy annual depletion rate of 4-5%"

http://www.mees.com/postedarticles/oped/v49n10-5OD01.htm

"ASPO’s Oil Depletion Protocol (Campbell 2004) is a scenario that aims to persuade national governments to cope with declining oil production equitably and peacefully, on the world scale. An annual depletion rate (the percentage of remaining global oil reserves produced each year, currently about 2.5% per year) is calculated by experts"

http://dreamsend.wordpress.com/2006/10/08/the-fetishism-of-apocalypse/

"Iraq’s historical maximum production rate of 3.5 million b/d represents a 4% annual depletion rate for its published 31 billion bbl of reserves"

http://www.ogj.com/display_article/236021/7/ARCHI/none/none/Iraqi-oil-1:-Production-now-a-fraction-of-potential/

"Russia’s production rate was 9.4 mbpd with oil reserves of 72 Bb which corresponds to an annual depletion rate of 5%."

http://www.niqash.org/intern/getBin.php?id=312

Given the above, an annual depletion rate of remaining Ghawar reserves could be 5%/yr which would ensure that the reservoir is not damaged due to overproduction.

For your low case of 27 Gb remaining, Ghawar would produce at 3.7 Mb/d in 2007 (27 Gb * 5% * 1000/365 days) and your high case of 35.5 Gb corresponds to 4.9 Mb/d in 2007 (35.5 * 5% * 1000/365). The production rates would decline further post 2007.

Ace - I actaully agree with this. If you worked out the decline rates as a function of declining sub-areas (e.g. N Ain Dar) then you will get even higher decline rates and it wouldn't surprise me if the Saudis cut right back on production in these areas to protect the reservoir and allow resegregation of oil and water. This is actually what I've said from the outset - that recent production declines may be in part voluntary aimed at resting tired reservoirs. So if anyone wanted to build a voluntary reservoir management restraint function in here and have decline starting earlier and proceeding more gently I'd agree that was a sensible approach.

Following your decline rate model you maybe want to view the field as two halves - a rapidly declining North and a stable (growing?) South.

Where has this resting of wells been practiced?

Hello Euan and Ace,

The Voelker PDF goes into great detail on qualifying backflow, DFN coning, and zonal thieving problems encountered during shut-in/resting periods, but unfortunately doesn't give us any quantifying detail on the areal extent of these DFNs/per Ghawar subfield. A glimpse is only provided on page 66, frame 96:

---------------------------------------------------

A specific example[51] which has implications on the geometry of the thin, permeable facies associated with super-k, is that of an Uthmaniyah well which backflowed

over 1000 B/D upon shut-in, into a thin interval located at the top of Zone 2A, a common stratigraphic location of super-k intervals (5.4.2).

-------------------------------------------------

The best waterfront glimpse is provided for UTMN circa [2000-01] in the MORABT map page 76, frame 106. Sure would be nice to have this for the entirety of Ghawar to see how much would be green area in 2007.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Hi Euan,

Thnaks for that suggestion, I will break Ghawar into sub fields for forecasting in my model.

In your base model forecast you show both North and South Ain Dar having no forecast production in 2013. Do you think that North and South Ain Dar will be abandoned completely or will they continue producing some kind of hydrocarbons (oil, NGL, gas)?

My guess is that they may start a massive program of tertiary recovery using gas injection. So in reality production may go on for decades at a greatly reduced rate. They can also have a program of infill drilling - the well spacings here are still enormous. And they can opt for infield water injection - i.e. injecting water into swept zones to improve sweep efficiency. So my forecast is really just for the final stage of dry oil production with associated wet area production.

Euan,

One other minor aspect to take into account. Take your Uthmaniyah fig and scale the left hand images to match in with the right hand. You get a fairly good correspondance to the known shape, and it demonstrates something else as well. The thickness of the reservoir that you can measure off the image, and thus the amount of original OIP is lower to the left (west) of the reservoir. A good 10-20% less IIRC.

My second cut at numbers will need to await some spare time and a working codebase to do fuller calcs. What porosity values are you using? Do you have better than the Twilight in the Desert figures? Compariable questions for the original water cut and the eventual production %age?

Finally, have you noticed something interesting? Dates for the decline of Ain Dar, Uthmaniyah and Shedgum (in my case) are very close together, within a few years. That's 4Mbpd in essentially one hit. Why would that be?

PS I still put the Linux plot back in the 1990s, primarily because of what I've said all along. That plot is of one layer of cells, it says nothing about depth. Its perfectly possible for it to be layer 2 of the model and still be correct for remaining reserves from a 1990s date.

GaryP - here's my attempt to vertically (height) scale Uthmaniyah - OWC 250 ft higher to the W and structure high point 250 ft higher to the E.

This shows you point that the reservoir appears thinner to the E. I am still involved in a debate with SS about different vertical thickness and vertical height scales being used. The reservoir here should be 250 ft thick - but using this height scale gives too small thickness. There are other ways of fitting these profiles to the topgraphy, and no doubt SS may come up with something different.

I am using average porosity values and average net reservoir thickness values given by Croft for the various producing regions (you can see what I've done if you download the spread sheet). Swi and recovery factors are determined from the saturation profiles following methodology described in Part 1. These gross recovery factors are then reduced using a sweep efficiency factor - again details on spread sheet.

Finally, my production models show N and S Ain Dar and Uthmaniyah all declining together, but Shedgum IMO is in better shape - remember the discussion about IPTC 10395, Fig 8 saturation map. So my models show Ain Dar and Uthmaniyah declining first, then Shedgum followed in 20 years time (notionally) by Haradh and Hawiyah.

Euan,

If you do a x-y propostional scale to the western bit, then put it next to the eastern, you can then compare with the other cross section we have and determine:

a) that they are of different spots along Uthmaniyah, since the morphology is different.

b) that there is a general change in thickness across the cross section with is not unimportant when calculating reserves etc.

(units here are arbitrary)

c) the changing height of the OWC west to east, and north to south is also important.

250ft thick reservoir I think means zones 2 & 3, but its fairly clear than the OOIP only goes to ~190 feet, which ties in with the croft figure of 180ft average over the whole reservoir.

As regards Shedgum, don't forget the effect of the Shedgum leak area on the recoverable oil in the north of Shedgum. As we discusses if fig 9 is in the far south of Shedgum then there could be a distinct difference between North and South. In particular Fig 14 with the blue and green spots all over areas of Shedgum wells calls much into question.

It is easy to get the idea that just because the model says oil production will be the amounts shown, actual future production will match the model.

In fact, "above ground" factors such as revolution, war, or monetary collapse of a significant part of the world could greatly reduce production. So could a program of planned slower production.

Also, even if production of the amounts shown is made, the amount available to say, the United States, will depend on a number of factors, including:

1. Amount retained for personal consumption in Saudi Arabia

2. Amount required for use in production, given declining EROEI

3. The US's ability to purchase the oil, considering long term contracts of others, monetary difficulties of the United States, future transportation difficulties, the amount others are willing to bid for the oil, Saudi Arabia's willingness to sell the oil to the US (versus other bidders), etc.

Because of these considerations, it seems like we should be looking at your graphs as representative of the maximum amounts that might be available, not the expected amounts.

hi gail...if we have worldwide monetary collapse, what are we going to use to pay for the oil? and for what purpose? ..to drive to a job that no longer exists? to a store with no goods?..... oh, yes, yes abdullah, one caldwell banker for a barrel ...look at him! good teeth..he will work hard in the fields!

Kilograms of corn, wheat, soybeans, beef, pork, chicken, etc....

The Middle East is going to need our food exports as much as we are going to need their oil exports!

reduced oil and natural gas means reduced food.

i am replanting my 4.5 acre hay field..you can substitute grain field if you wish. my neighbor claims that will take 40 hrs. of tractor time. at 5 gal./ hr , that would be 200 gallons of diesel or ~$600 at todays prices....extrapolate 10 years....are we going to be exporting food , or using it ourselves?

You mean forty minutes, not forty hours. You couldn't take forty hours to plant a field that small if you had only one mule and he was lame.

working small irregularly sized fields can take a lot longer than a larger field. i just finished chisel plowing a 25 acre field. crossing it twice took about 10 hours. i chiseled up my field one time yesterday - 2 hours. i dont want to use herbicide, so i will disc it maybe 3 times to kill all growth. so chisel plow 2-3 times, 6 hours. disc 3 times 5-6 hours. drag field smooth 1-2 hours plant 2 hours roll rocks with drum roller, 2 hours. so 16 hours, probably.

my point was about fuel, it's accessability and food supplies. we haven't produced more grain than we consumed as a world for the last 6-7 years. what happens when fuel becomes less available. fuel=food.

This revision to the “production scenarios" seems to approach them to what can really be expected.

However, is still fails to recognize that the present Saudi production is well bellow the production achieved in last two years. (And, for sure, that overall reduction integrates at least in part a reduced production from Ghawar.)

Also, the predicted production profiles are still unexplained: Why should all 6 sections of this very big field start to decline exactly at the same time, both in the Base Case and in the High Case profiles? (After all, the depletion percentage of each sector is presented as very different in tables 3 and 4…)

How can a giant field sector, depleted to 91 or 94% (table3), keep a stable production up until now?

How can N. Ain Dar, be NOW depleted to 90% (table 4) and still keep a 100% stable production to 2011? Are the present water separation facilities able to deal with the present and future water cuts?

I recognize that I feel a little vexed by the absence of even a very short answer to my comment in the previous issue of this analysis:

Is the present and the future production of Ghawar a marginal issue that does not deserve more precision and discussion? Is this extensive analysis intended to be a mere thought exercise that is not concerned with practicalities and details like the production models?

Frankly (and bluntly) I think Euan seems to have a mental block related to (caused by?) the previous TOD discussion with SS (and with other TOD participants): He simply cant accept that at least some sectors of Ghawar are ALREADY in decline… So, basically, he stops his analysis when he would be unable to avoid the unwanted conclusion.

"[Euan] simply can't accept that at least some sectors of Ghawar are ALREADY in decline… So, basically, he stops his analysis when he would be unable to avoid the unwanted conclusion"

I do not think this is a correct interpretation of Euan's views. Judging by what he has written, I would say his question is more how is Saudi able to maintain production even at present rates if Ghawar is in greater decline than he has illustrated. It is a great question.

Judging by what he has written, I would say his question is more how is Saudi able to maintain production even at present rates if Ghawar is in greater decline than he has illustrated. It is a great question

Would a 400,000bpd secret infusion from a nearby country help in that effort?

...and the american public gets to pay for the war and the oil guys get the profits...not quite as promissed that oil profits would pay for the war.

That would be the worlds biggest scandal.

Occam's razor. Since the production actually is declining, and the only point of argument is whether it's voluntary or involuntary, the simplest and most conservative explanation is that the Saudis have no choice in the matter.

Here is a three page story from late April about the oil meters and stolen oil etc.

http://www.alternet.org/story/51218

Seems the game of pin the donkey about meters working, not working, investigations, and fraud are all at play.

Quid Clarius Astris

Ubi Bene ibi patria

No, no. It would be very rational on the part of the Saudis to stretch out their asset. There's no a priori reason to exclude that. Whether it's true has to be determined by getting at the facts. So all the debate and research is very needed.

I would think that at least some oil producing states ARE stretching out their supplies. There is a huge amount of pressure on them from you know who not to, but I can't believe none will be able or willing to resist. The Saudis are extremely vulnerable and may so fear their "friends" that they don't dare. But surely they recognize their own interest in doing so if they could.

The situation resembles monetary deflation in one respect: if money is becoming more valuable, you hold on to it. This simple fact will have a profound effect on supply going forward. So there is a very general aspect to this debate between SS and EM. I have no idea who is right this time, but EM is going to be directionally right in some cases in the future.

The problem with this approach is they are playing with fire so to speak and don't even realize it. Right now we use "modern" just in time methods extensively in the oil industry.

And thirty days supply of gasoline is not a lot esp since you will have big problems when you hit 15 days or so.

PeakOil.com has a long running thread on gasoline distribution in the US. The rest of the nations in the world either have a more chaotic system or a similar JIT. Next the oil infrastructure is old along with many of the workers. And resources are very tight. These are just the basic time bombs going off in the oil industry.

If KSA either has oil and is conserving or does not it does not matter the end result is the same. The Western nations will quickly go into positive feedback and our oil economy will self destruct. So the hold back concept will not last long they will either soon be pumping for all they are worth or we will know they don't have it conservation after world peak is not a option for KSA or more correctly not for the current rulers.

Bottom line is its a charade and it can at best but them lest than a year before the ruse is up. Sooner or later even with our busted refineries we will run down our oil storage and the rest of the world more importantly is not standing still just because some oil tanks in Oklahoma are full and a few refineries are down.

With Brent trading as high as it is now KSA position is already suspect.

Hi memmel,

Thanks.

re: "The Western nations will quickly go into positive feedback and our oil economy will self destruct."

I'm wondering - any chance you've read the posts from "Pitt the Elder" over this last week, particularly WRT agriculture? http://www.theoildrum.com/node/2510#comment-185193

I'd be interested in your take on them. As they seem a somewhat different view, perhaps, and I'm interested in exploring this further.

I think biofuels Ethanol etc are the primary problem on the agriculture side for two reasons first you have no surpluses with biofuels since any extra grains or soybeans will be converted to fuel. Next as the prices for these rise you get conversion of agricultural land to grow bio fuel. These two effects will predominate in the short term. Of course this induces a feed back of higher fuel and NG prices that is the longer term and coupled with peak oil. This is the feedback loop most people that are peak oil aware fear. It is of course the "big one" but its cycle time is longer becoming vicious once biofuel themselves are a major input into agriculture. Thats when this train picks up its pace and we have to make hard fuel or food decisions. Then later of course food becomes a issue but this is I think a long term problem 5-7 years post peak. Of course the immediate effect is exports will drop dramatically so poor importing nations will get hit with both rising food and fuel costs when they can least afford it and the poor Indian/Third world farmers are far more sensitive to fuel/fertilizer costs so I don't think its correct to consider their finical situation to be the same as a western fuel farmer. Don't forget they don't make a lot of money and they have to feed themselves and families first. I suspect you will see the poorest give op on expensive green revolution methods because of cash flow problems. They make more money feeding themselves with the old methods and selling less product once they cannot afford to buy fertilizer. People for some reason are not considering that the green revolution is only marginally profitable in the third world even though it has increased yields rising fuel costs will cause this to flip to not be profitable before rising grain prices can offset the costs.

These guys are not that far removed from subsistence farming and the will go back. Once they do the rising prices and lower costs will drive even more to revert as peak oil ensures that fuel/fertilizer costs continue to rise.

The third world farmer is in general going to take a similar approach to oil producing nations. They are going to slash operating costs and make what ever money they can without spending a lot on external inputs. Global Warming and the resulting variable weather will take out the fools that try to keep playing the green revolution game. The ones that spent no money will at least get food to feed themselves.and keep their land. And probably buy the land for cheap from the bankrupt green revolution farmers further driving conversion to sustainable methods that don't require money.

So yet one more feedback loop initiated by peak oil.

IPSA. Larceny on such a grand scale as to be almost unimaginable. Bush & Co. get their cut which goes into their own pockets. Saudi's sell as their own. US gets continued supply(but not the ill gotten gains). US taxpayer pays for it all.

Hi Cid,

And the ones who are invaded pay in money, as well - and in the unimaginable quantity of tears http://www.washingtonpost.com/wp-dyn/content/article/2006/10/10/AR200610... for those whom one loved as life itself.

This is the point. In my first post on this subject the discussion was about the fabulous individual well productivity.. I said "in this waterflood, high individual well productivity is inversely related to production stability".

Anyone in the oil business knows the ultimate outcome of a bottom water drive in a world class reservoir... natural or induced. It is not a pretty thing.

FF

FF,

See my comment below that I started hammering on, after reading Matt Simmons' book and after reading the first article in the WSJ on Cantarell.

In both fields we had rapidly thinning oil columns between rising water legs and gas caps (primary in Cantarell, secondary at Ghawar), in reservoirs where the permeability to water and gas is much higher than the permeability to oil.

The simultaneous decline/crash of the two largest producing oil fields in the world--which at least until recently accounted for 10% of world crude oil production--can only be described as a catastrophe.

I also repeatedly stated that the East Texas Oil Field--1.2 mbpd of water with a 1% oil cut--is now where all of these super giant water drive fields are headed.

Jeffrey-

You have been way out in front of me on this deal and I respect your opinion greatly but I must interject as follows...

The problem with Ghawar is the permeability to oil greatly exceeds the permeability to water.... Most relative perm curves start with oil at 1.0 at connate water. The endpoint relative perm to water at residual oil saturation is like .3 let's say (typically, and numerous reservoir textbooks/ SPE papers support this)

Now... let's think about the moving water oil contact... above it is oil at essentially connate water.. below is breakthrough water saturation say .65 on average. The oil and water viscosities are essentially the same. So the term mobility comes into play here.... mobility being the effective permeability divided by the viscosity.... Above the WOC the oil is actually 2-3 times more mobile than the water below.

Now, compound this with a coarsening upward sequence with higher absolute perms as you move up and up and up.

People talk about water coning.... have you ever seen a gas well downdip of a structural high that you had to swab gas into.... cone the gas down. We had one in Hardin county we had to swab 30 hours straight to get the gas back if we went down.... Why does the gas cone down.... because its mobility is greater than the water. Theoretically water coning is not a problem in Ghawar... in fact the oil should cone down like gas. Gas is 100 times more mobile than the water... whereas the oil here is 2-3 times let's say.. so the effect is much less dramatic.

Now the import of this is that people talk about the marvelous horizontal MRC well technology that is "not properly being accounted for".

My opinion is that economic horizontal wells exist in crap rock... the Austin Chalk, Barnett, Antrim..... because the other option (a vertical well) is a big fat zero.

There is nothing that negative to capitalize on with a horizontal well in North Ghawar.

And when you are experiencing a 33% water cut in something like the above the grim reaper is knocking at your door.

So, if the water was highly mobile in comparison to the oil, there would be a greater quantity of oil left at a given water cut.... the problem is .....it is not.

FF

I'll have to defer to you on this, but in water wet reservoirs, I thought that the permeability relative to water was almost always higher than to oil. But my petroleum engineering eduction consisted of about nine hours of introductory engineering classes.

But the key point that I was making was that both fields (at least the key part of Ghawar) had rapidly thinning oil columns, in other words, they are rapidly becoming depleted.

Oil operating at connate water.

Water operating at breakthrough Sw (60% or so).

Read respective relative permeability on y.

Since I'm not in the oil business, could you elaborate?

Ming - I think you are having problems reading the stacked production profiles. All segments do not decline togther - but when one segment starts to decline it pulls the gross stack down - giving the illusion to the untrained eye that all are declining. Haradh is barely declined at all, Hawiyah is actually expanded and Shedgum begins to decline a few years after Ain Dar / Uthmaniyah.

What I've done is try to measure the amount of oil left and worked out how it can sustain production at historic levels.

What a number of observers fail to grasp is that Ghawar could have produced at 15 million barrels / day - but was never pushed that hard. N Ain Dar could probably have produced at 2 million bpd - but has never exceeded 600,000. So instead of having rapid unsustainable rise followed by uncontrolled decline, the Saudis have chosen to under-produce which favours maximum recovery. It also allows them to chug along at a hugely depressed plateau deep into field maturity.

Exactly, Euan! KSA has done a remarkable job balancing the tightrope between acting as swing producer and keeping Ghawar healthy. But in having done so, at least for North Ghawar, we are seeing the end in sight after 70 years (an astonishingly long time for a field to produce at these rates!!).

Your scenarios call for basically a loss of 3 mbpd production from Ghawar overall over the next several years (5-10 depending on base case or high case). This is exactly what I was talking about when I said that KSA's days as swing producer are probably about over.

Yes, KSA could have produced 15 mbpd but they thankfully did not and consequently have managed to keep North Ghawar alive this long. And they certainly could not produce that 15 mbpd now.

One thing we can count on is a 3 mbpd drop, from Ghawar alone, over the next 5-10 years. How many small fields is it going to take to replace that? How many "giants"? Replacing the production from the granddaddy of all supergiant fields is not going to be a trivial task. The peaking of Ghawar is going to be the most noticeable event as we cross through peak into global decline.

Thanks for the update, Euan! People also need to consider that Euan is the "optimistic" voice amongst the TOD team. I am sure that Stuart's assessment will be gloomier. The only question is how much so?

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

Right, silly me, I failed to notice that, in the charts.

That single fact addresses most of the problems I presented.

Still, some other problems remain:

1.

Do you “feel” (I know there is no public available data on that) that the (present) reduced overall production of S. Arabia allows for 5Mb/d from Ghawar? Do you believe that the 1Mb/d reduction in production from the last 8-9-10 months was totally the result of “resting” other fields (and leaving Ghawar at its “standard” plateau)?

2.

Based on table 4 and in the High Case production model, and considering only N Ain Dar, do you believe that a flat 0.5 Mb/d can be maintained for 4 more years, while depletion goes from the present 90% to 95%? Do you think that would be achievable within a reasonable investment in new water treatment facilities?

(We all have read about the new 12 Mb/d facility that is being contracted. That will only be ready near the end of those 4 years and, in any case, its scale does not seem enough for this job. Do you think simple upgrading of the present facilities will do the job during the next few years?)

3.

Finally, do you expect the Saudis to spend all that money to keep the Ghawar plateau production flat for 4 more years (leading to a very fast decline afterwards)?

Would it not be much more reasonable to dispense with that enormous effort (and cost) and to accept an earlier decline at more benign rates?

(I think the second is the obvious “natural” choice and, besides much reduced investment costs, it would mean a fatter production tail at a moment when oil prices can be expected to be at higher levels…)

1. no

2. no - its a model presentation - earlier but more gradual decline is more likely

3. probably

Latest production figures posted by FF quoting WSJ was that the field was still producing 5 million bpd

Ghawar & Cantarell: "Two warning beacons--burning brightly in the night sky--heralding the onset of Peak Oil."

Folks are wondering how the big giants could all be close to the same situation at the same time. Might there be field production coordination among the countries owning these large fields? I know Mexico is not a member of OPEC, but surely they speak with each other.

The same could be said for the multiple fields in Ghawar. KSA may have just managed the production rates across fields to even out their declines. It may not be a coincidence that they are all declining at the same rate...it may have been planned.

No. The chief culprit is exponential growth. Exponential growth in oil consumption dwarfs even a supergiant field like Ghawar.

In the period from 1950 to 1960, the world consumed more oil than in all its previous history up to 1950. In the period from 1960 to 1970, the world consumed more oil than in all previous history up to 1960. In mathematics, every doubling is more than the sum of all previous doublings. Global consumption has just about doubled again since 1970 but this time it thankfully took almost 40 years rather than 10 but the growth is continuing and it must stop.

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

I can't speak about oil, but I can see a very general reason for what I call convergence: once one resource begins to deplete, it accelerates the depletion of associated resources -- those used in its production, those that can substitute for it. Certainly the downslope of oil will drastically affect water supplies, some metals, certainly all energy substitutes, now food via soil, etc.

Actaully even I can give one brain-dead oil example -- certainly the depeletion curve in the US has had a major affect on the curves of other regions. But that's not an answer to your particular question.

Since OPEC's rules allow a country to produce in proportion to its reserves, wouldn't that also cause them to hit peak about the same time? That is, they're all producing the same fixed percentage of their reserves each year, so it seems like they'd run into depletion issues around the same time as well.

OK, but what about Mexico and Cantarell? They're not in OPEC.

Hi D,

re: "...it may have been planned." My impression, which others here have the expertise to comment upon, is that actually, the management of extraction has differed quite a bit, WRT quality of same. So, this is perhaps - to some degree - a coincidence, avoidable at one time. (But, too late now.)

or, as old hank sang "i saw the light"

I've tried to visualize the implications of your forecast on the total Saudi Arabia production:

The figure below gives Saudi Arabia production for crude oil and NGPL (data from the EIA: Monthly Energy Review for CO and the International Petroleum Monthly for NGPL).

I've added a simple domestic consumption forecast based on a population forecast by the UN and a constant number of barrels per capita at (see here for details). In order for exports to remain at their 2005 level and assuming the aforementioned consumption model, production needs to grow by (orange dotted line on the charts).

Saudi Oil Production Peak

Saudi liquids production is expected to peak in 2009 and capacity is not expected to grow beyond 12.5 mbod according to a statement reported by Bloomberg:

http://www.bloomberg.com/apps/news?pid=20601072&sid=ataHAA7GX3js&refer=e...

Projects after 2009 might only replace systemic production losses in older project areas.

Hello Rainsong,

From the Bloomberg text: "Saudi Arabia can pump 10.8 million barrels a day now, according to Bloomberg estimates. It produced 8.5 million barrels a day in March and could have pumped 2.3 million more barrels a day. That spare capacity typically would be used to fill gaps in supply caused by disruptions in oil-producing regions."

It sure would be nice if they gave us Aramco links so we could verify this to our own satisfaction. Why should we just take their 'estimates' as verbatim truth?

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Hello Totoneila,

instead of a link to real Aramco data I take what the Saudis said and what happened with the price of oil. At around 35$ (sorry, I do not remember price or time) the Saudis said ... we will pump more to keep the price below 35$. At around 60$ they were saying ... the economy can live with this price, so why lower it? Even at the peak of 78.7$ there was no flood of oil on the market.

To me 10.8 million barrel sounds more like a wish than a reality.

Some Bloomberg reports on oil defy at least my understanding of logic and causality, take todays "Oil Trades Little Changed After Falling on Gasoline Output Rise"

http://www.bloomberg.com/apps/news?pid=20602013&sid=aI1WMSVBPy4E&refer=c...

for example.

Instead, the long-term increasing price of oil points towards a relative shortage, no excess capacity and - peak oil.

Gunther

An interesting article.

Oh I increasingly think the Saudis are handling this brilliantly.

They're starting to take the approach that due to climate change, need to cleaner fuels, etc. we need to reduce our global consumption of oil. And all they are doing is recognizing that and doing "their part." Brilliant, I tell you!

http://www.bloomberg.com/apps/news?pid=20601072&sid=ataHAA7GX3js&refer=e...

``Our feeling now is that with the thrust and push for conservation, for efficiency of use, for use of alternative-sources energy, we probably need not go beyond 12.5'' million barrels a day, the capacity projected for the end of 2009, Naimi said.

Weasel words.

I'm waiting for them to announce they are comfortable with 70bbl oil and won't be raising production.

These dudes are just lying. The Oildrum analysis is correct.

They would not say this bs spin stuff if they were not in trouble last time alternatives took off they buried the market.

First the claimed they where happy with 60.

Then they would not increase it since no one could convince them of demand even though India and China and large parts of the world are growing explosively with high prices and high demand ?

Next they are now claiming alternatives will cut demand.

The only thing we cannot get out of KSA is oil and the truth.

“….last time alternatives took off they buried the market….Next they are now claiming alternatives will cut demand.” Posted by Memmel

And also maybe they have finally realized that they have nothing to fear from “alternative energies.” If they are at or near Peak, the Saudis surely know that it will be absolutely impossible for wind and solar to be expanded on the enormous scale needed even to provide a supply of electricity that still would be less than to-day’s output in any meaningful timeframe. I’m sure the Saudis are also aware of the general worthlessness of Ethanol and biofuels in general, and that most other technologies are either in the lab or extant only as a “demo”; thus, even under the most realistically optimistic scenarios several decades away from large scale commercial production. And other than biofuels, virtually all the alternative energies produce only electricity, which, while we will need all we can get, is not a liquid fuel especially convenient for transportation. So I think they realize that their oil will ALWAYS be in demand, and at ever and ever higher prices; naturally they’d want to make the bonanza last as long as possible. And when supply gets REALLY tight, they can blame the producers of the alternative energies for failing to live up to whatever hype they have put out in their marketing campaigns.

Antoinetta III

Good point. Now their only problem is we print the money to pay them. I think our printing presses are faster than a super tanker.

I have a feeling that in a few years, they will be denominating Arab oil in Euros, or some other currency or set up a local bourse of some kind. I think the dollar's days are numbered.

Antoinetta III

memmel and Anttoinetta, i think your analysis is spot on. And the white house?

Antonietta, there are different possibilities to gain energy useful for transportation. a way to transform biomass or coal into diesel is also known, it is the Fischer-Tropsch synthesis. This process was used in Germany during WW2 and in South Africa during Apartheid.

An company called Choren in former East-Germany modified this process to use biomass as input.

A quote from

http://www.choren.com/en/biomass_to_energy/biomass_potential/

Prof. Scheffer at the University of Kassel/Witzenhausen says that the total bioenergy potential in Germany is the equivalent of 56 million t of crude oil units1. In theory this amount could be used to produce 30 million t of SunFuel. This would be enough to meet 50% of the total automotive fuel consumption needs in Germany – including air traffic. And there would be no restrictions on the supply of foodstuffs either.

If the potential in the high-populated Germany is that high there should be more possibilities in the US.

With an efficient use of this energy and the remaining oil the picture is not that dark, but an ever-increasing waste of energy is surely impossible.

Gunther

“Antonietta, there are different possibilities to gain energy useful for transportation. a way to transform biomass or coal into diesel is also known, it is the Fischer-Tropsch synthesis.” Posted by Gunther

First, I notice that the professor’s quote concedes that the 50% figure is “in theory”; it seems to me to be absurdly optimistic. But even if it were possible, how long would it take to build the Fischer-Tropsch industry to the scale required? Currently, Fischer-Tropsch provides a minuscule amount of oil; it would take decades for this to be built up to this point. And if we are indeed close to going off the edge of the “Bumpy Plateau.” any buildup over this time frame will be nowhere fast enough to keep up with declining C+C production .

Antoinetta III

Antonietta,

the first beta-plant is under construction, the first industrial-scale plant is scheduled for 2009.

http://www.choren.com/en/energy_for_all/beta_plant/

http://www.choren.com/en/energy_for_all/biomass/requirements/

It does not look like this will be enough to compensate for the decline of a giant oilfield. A commercial plant will need 1,000,000 tons of dry biomass a year; that has to be shipped to the plant.

Coal would be another possible input material but with a very bad CO2 balance.

In the nearer future demand and supply will be balanced by demand destruction(to borrow this economic expression.)

Imagine what smaller and more efficient cars, less holiday-air traffic and the like could do to make the remaining oil last longer.

The fischer-Tropsch synthesis is probably not the solution for the peak-oil problem but might help.

Gunther

Khebab - thanks very much for that - a reasonable first order approximation. I hope to go on to do some form of assesment on decline in other fields and growth from new projects including NGL (as you know I like C+C+NGL) and my gut feel is that new projects will in part offset decline in Ghawar - this will likely put me in line with Bakhtiari or above that line - especially if NGL is included.

You show base and high cases - do you also have a low case?

Shedgum

I am skeptical about Shedgum because there was only one cross section. I looked at some model and Shedgum appeared like a dome. If you took a cross section from 2002-2004 of the peak of the dome from west to east and the limbs to the east and west were full of water and you did not take into account that if it plunged north and south you might look into it to see if you find water to the north and south of the center. I lack structural maps with multiple cross sections, strike and dip, contours, and reservoir measurements with gradations of porosity, permiability, and thickness. A strata might differ over large distances. In some areas closer to onshore deltas, or offshore currents bearing sediments, there might have been more clay and resultant thinly bedded shales with loss of reservoir space. These sorts of things were more prominent in S. Ghawar if the report I read was true. There are too many question marks. One cross section cannot define the whole field. There were also problems when one calculated associated gas in the oil as a unit of volume but did not seem to include data for the amount of water droplets suspended in the oil even though technically it is referred to as "dry oil". I had read that there was a moisture factor of 11% in Shedgum:

Greg Croft:

http://www.gregcroft.com/ghawar.ivnu

Rainsong - we have this map from IPTC 10395 and my guess at where it may be located in relation to the remaining oil from the Linux map. Typically, the colour coding on the SPE / IPTC papers, yellow denotes an oil-full reservoir. So my take on this is that all areas up-dip form this lobe will be oil full - oil floats on water after all.

Greg Croft quotes 11% Swi (initial water saturation) as the avearge in all Ghawars sub regions. Swi is linked to reservoir quality and as there are large variations in resevoir quality across the structure we are generally agreed that Swi must also vary and this aspect of Croft's data is suspect. I used an Swi value of 5% for Shedgum.

The North Ain Dar cross section showed total water except an anhydrite cap zone of about 10 feet with some oil trapped in this impervious layer. This was what I read in TOD. If there is some other place in Ain Dar updip with oil in it, it must be a fraction of the original oil. The Shedgum cross section was probably across the thickest section of oil with the water flood advancing from the north south, east, and west instead of only from the east and west as one might easily presume when looking at a 2-D section.

The Saudi Aramco VP reported 5-12% annual production declines in existing oil fields. These might include Ghawar, Safaniyah, Berri, and Abqaiq. These have existed for some time. Berri had the lightest oil, Safaniyah the heaviest.

The Abqaiq cross section showed the oil near the peak of the anticline. It might soon be history like Dammam that is exhausted. If you show me a different cross section showing more oil in Abqaiq, then I might change my tune.

The Saudis issued a statement about capping oil production capacity increases in 2009. The peak of Saudi oil production might be recorded before 2009 as Saudi Arabia already cut 8% in 2006.

Peak Oil is a valid science.

huh?

water droplets have nothing to do with the determination of oil fvf. water has it's own fvf.

In Part 2 I listed 4 areas where I suspect I may be underestimating and so I'm reluctant to present a low case at this point. Once Stuart presents his work next week and the dust has settled I will probably do some more revisions - the more we talk here and via email the more information comes to light.

Euan, you have Ain Dar declining monotonically to zero froM now to 2013. However when the MRC wells water out the GOSPs won't be able to handle the water cut and output will plummet to zero, at least temporarily. One can debate when watering out occurs. what is the basis for your linear decline?

Murray - as of 2004 they only had 1 MRC well on N Ain Dar. Most wells are still verticals with short radius horizontal off shoots near the top.

The decline I show is notional, based on plateau to near zero ove a 5 year period. This is really rapid decline. While horizontal wells may water out quickly they will not all water out simultaneously - so wells will fall over one at a time giving rise to "more gradual" decline. Take a look at Figure 10 of Part 1 of this series of posts to get a feel for contact movement in relation to well geometry.

Hello Euan,

Do we have any Ghawar subfield numbers on the installation period, location, pumping time, and quantity of these short radius horizontal [SRH] offshoots near the top of the Arab zone [fig. 13 in link below]?

http://freeoil.1111mb.com/spe/spe93439.pdf

What prompted this Aramco decision to exhaust the crude early from the highest perm/porosity layer? Sure, it reduced watercuts cheaply, but doesn't that make it even harder to ramp up extra production in the future?

In short, I don't see the logic of purposely encouraging waterfront override and future zonal thieving over the lower layers of lower perm/porosity payrock.

Alternative explanation? -- unless these SRHs were topcrest located and gas re-injection was used to displace the oil and keep the water out?

EDIT: Tertiary oil recovery by building a gascap--> how much, how long has this been going on, and can this only be done at the topcrests, or can it be extended downdip quite a ways in a single layer? Thxs for any reply.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Bob - your comment about low permeability Zone 3 is a timely one - the subject of much debate behind the scenes.

One view is that primary production from this zone may be very difficult - so its possible a lot of it gets left behind and allowed to drible upwards into the Zone 2 water flood up the flanks. The sat profiles don't really look right here and I may get around to posting some other stuff on this later today.. I'll post it here.

I don't know about the timinig of short radius horizontals but think they have been used for many years. All production decisions will be a compromise - and when their water cut is getting too high to manage they may priorities dry oil production from Zone 2 above recovery from Zone 3. If they waited for Zone 3 to drain they would never get anywhere.

Euan

Bob, the above figure shows a saturation profile from the Berri Field (SPE 79718). The reservoir here is the Hadriya (not Arab D) but it is also limestone and has good reservoir quality lying over poorer reservoir quality - like we have in the Arab D.

This saturation profile shows initial Swi saturations in the range 4 to 12% in the best layers and how contrasting reservoir quality has influenced differential sweep of the reservoir with water rising over oil. The grid scaling here is much finer than Ghawar providing more detail and a more realsitic feel.

So I need to voice some reservations about the satuartion profiles we have in Ghawar and why they don't show this type of relationship between Zone 2 and Zone 3.

This paper goes on to model forward profiles in Berri until 2020 (the field came on production in 1970). Some of the profiles look pretty watered out by then.

Hello Euan,

Thxs for responding. Yep, the Berri geo-slice expresses my point exactly--thxs for posting it. It would be interesting to know the extent of this kind of optimized 'economic reservoir sweep' [as opposed to an optimized 'geologic reservoir sweep'] throughout KSA.

By accepting water override of lower payzones; by extracting the easier and higher net ERoEI layers first--KSA is setting itself up to having to climb a very steep future ramp of heavy infrastructure investment for ever less net ERoEI.

The bypassed lower payzones will require lots of MRC wells hooked to downsteam multiphase pumps to lower the backpressure sufficiently to overcome the naturally lower perm/porosity. This will require lots of money, equipment, and electricity if KSA hopes to increase total future production. IMO, it now makes more combined economic/geologic sense to accept the inherent lower extraction rates; to extend the downslope tail.

It too late now to go back, but imagine if Ghawar had been willfully developed and extracted south to north, instead of north to south. I would have argued that this would have been a more optimized geologic sweep.

This would be like a predator's metabolism: using the low net ERoEI Haradh and Hawiyah efficiently first to sneak up close to the prey, then using UTMN, AD/Shedgum [the highest ERoEI] for the final sprint.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Saudi Aramco gives future oil supply warning in their 2006 Annual Review

http://www.saudiaramco.com/irj/portal/anonymous

“Taking the Initiative”

http://www.saudiaramco.com/irj/go/km/docs/SaudiAramcoPublic/AnnualReview...

This is the first paragraph:

Aramco starts by saying that there are misperceptions about future adequacy of supply. This could be a warning flag that supplies may not be adequate. Aramco then mentions those annoying "above ground" oil supply factors: not enough oil infrastructure, not enough refinery capacity, not enough skilled people and not enough consideration to the natural environment.

Next, Aramco indicates difficult times ahead by saying:

Aramco also believes in conservation:

In the last paragraph, Aramco indicates a possible significant gap, in the future, between demand and supply:

And just in case the reader does not understand the warning from Aramco, the next section of their 2006 Review:

http://www.saudiaramco.com/irj/go/km/docs/SaudiAramcoPublic/AnnualReview...

starts mentioning "above ground" oil factors again:

And yet another statement about "above ground" oil factors from the section appropriately called "The Production Capacity Challenge":

http://www.saudiaramco.com/irj/go/km/docs/SaudiAramcoPublic/AnnualReview...

Yet more on "above ground" oil factors from "The Downstream Challenge"

http://www.saudiaramco.com/irj/go/km/docs/SaudiAramcoPublic/AnnualReview...

Aramco’s 2006 Annual Review states that Aramco has ramped up production in the past to provide a reliable supply of petroleum. However, Aramco states clearly that the issue of oil supply will become even more critical in the future. Contributing factors include the above ground “oil factors” of infrastructure underinvestment, refinery capacity shortage, regulatory and business concerns, skilled people shortage, and environmental issues. Furthermore, Aramco indicates that conventional energy investment plans could be insufficient as these plans are being made on overoptimistic energy supply forecasts from alternatives.

Aramco has given a warning about future oil supply – the world needs to draft coordinated response plans now.

Hello Ace,

Well done!

QUOTE: "Aramco has given a warning about future oil supply – the world needs to draft coordinated response plans now."

I think Simmons has already outlined the 'First Step' in a worldwide coordinated response--> full transparency and outside auditing of all oilfields.

Let's hope Aramco & OPEC will take a leadership position.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Hi ace,

Yes, a good summary. Thanks.