Back-to-the-Future Look at Oil Prices--Will Higher Prices Bring More Supplies?

Posted by Prof. Goose on July 10, 2007 - 10:45am

In 1982, I had a fascinating lunch with my boss's boss's boss, Arco's VP of the Southern Region, Tom Neal. This was at the height of the last oil boom. The price of oil was $32/bbl headed to $100 (everybody knew). I was a 30 something oilman wannabe, Neal had achieved significant success. He taught me about economics that day. He and the VP of the Northern Region, Tom Wilkinson (one had to be a Tom to be a VP in those days), had had a meeting with Peter Drucker. At the time of the meeting, oil had just begun to show some signs of weakness and people were expecting a slight near-term decline in the price of oil. Drucker had asked these two very savvy VP's how low the price of oil would go. Both had mentioned numbers in the low $30s. Neal then told me that Drucker asked them to tell him their worst case scenario. What is the absolute worst that could happen to the price of oil? Neal said he responded with a value of $28 as the absolute worst. Drucker told them that he thought the price would drop to $14, which is about what the price was when the oil boom started in the mid-1970s. Both VPs were aghast, but disbelieving. But by the time of my lunch with Neal, he was beginning to think Drucker was correct.

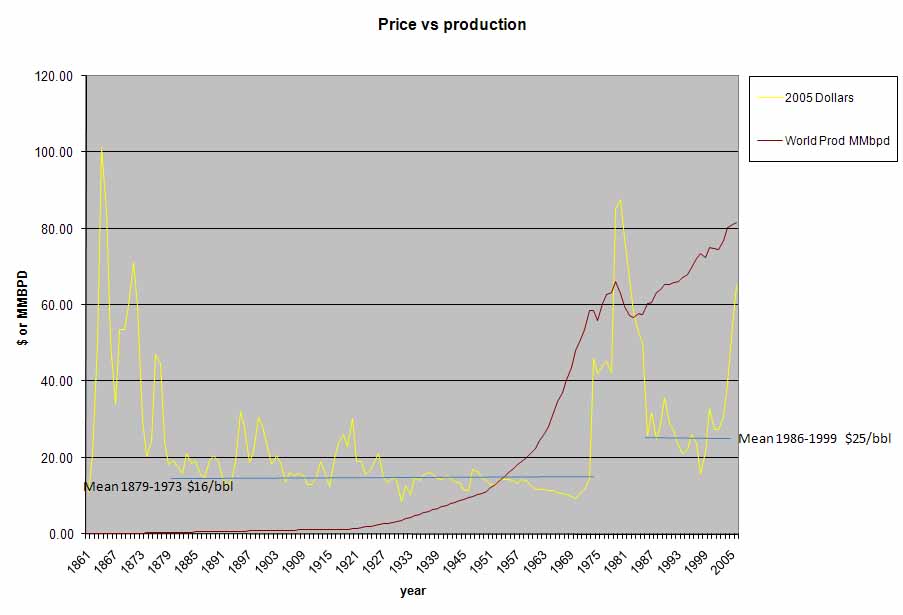

Drucker's reasoning was based upon the idea that a cartel can't control the price forever and when the price of a commodity goes above the long term average (inflation adjusted) price, it will inevitably fall back. Drucker told Neal and Wilkinson, and Neal told me about the Tulip Bulb cartel. In 1593 an enterprising Dutchman named Charles de L'Ecluse developed a tulip bulb capable of being raised in Europe. A cartel was formed to control the supply. Europe went wild for them. By 1623 a tulip bulb could fetch 1000 florins (the average monthly wage was 150 florins). By 1635, 40 bulbs went for 100,000 florins and in 1636 Tulip bulbs were a commodity on the stock market. But then, the price was too high and people decided that they didn't care that it was a tulip, they weren't going to pay that much for a tulip. Prices weakened, and eventually they plummeted back to where they had been at the start of the frenzied boom. Drucker was saying that the oil boom of the 1970s was a repeat of the tulip bulb cartel. In 1982 the price(inflation adjusted) and production profile for the entire history of the US oil industry looked like:

Drucker's suggestion at the time made perfect sense with the historical data. Anytime over the past 100 years that oil went above its average price, it would inevitably fall back to that level again. The average price was $15 dollars in 2004 dollars.This is especially true post-1879. In general, after commercialization, oil prices remained relatively flat during the early stages of production history. Eventually Drucker was correct, the price for oil in April of 1986 was below $10 per barrel. This phenomenon is quite widespread and is implicitly believed in by the economists. As price rises, entrepreneurs go out and produce more supply driving the cost for the commodity back to its historical inflation adjusted average.The purpose of this article is to refute the concept that non-renewable commodities follow the same curve.

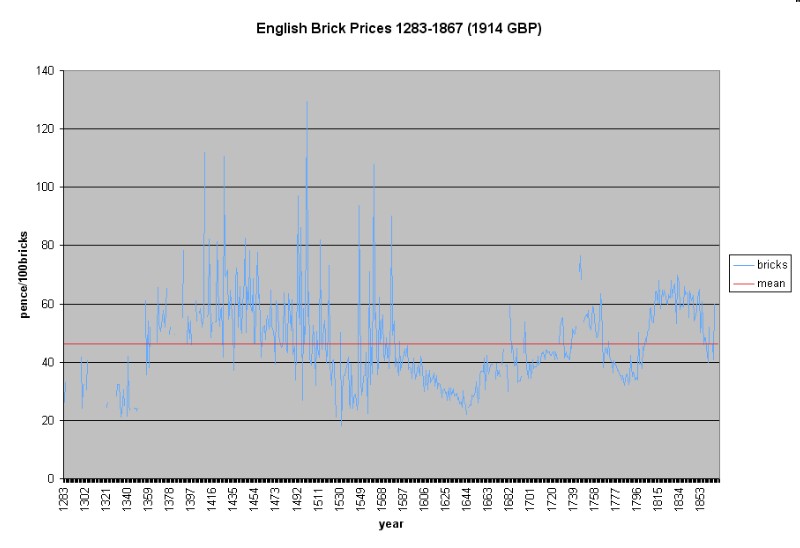

Let's look at bricks.1 Bricks are the perfect renewable commodity. There is a world of clay to be baked, and demand does not yet threaten to wipe out the supplies. If brick prices go to high, the average farmer can quickly build a kiln and make them for himself, assuming even moderately acceptable supplies of clay. So, what does the price history of bricks look like? In inflation adjusted pence,2 adjusted to 1914 pence, the price of bricks from 1283 to 1914 looks quite flat. Technology seems not to have cheapened the real price of bricks.

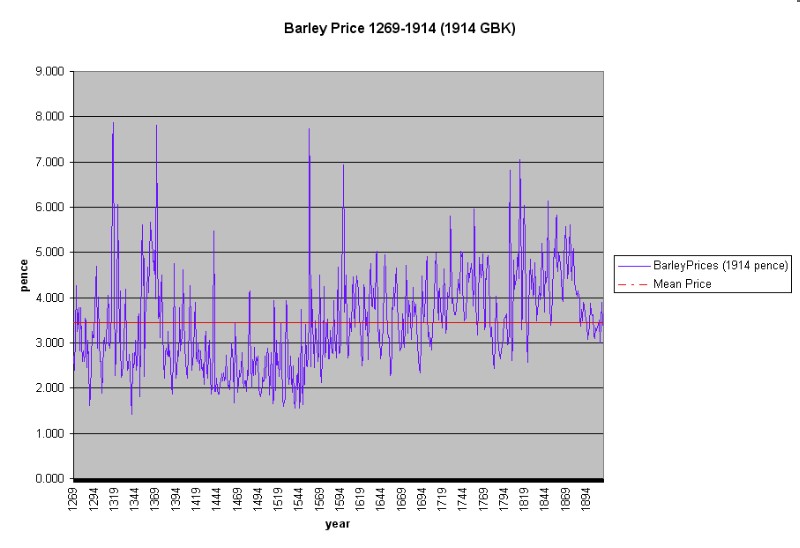

Likewise, Barley prices have remained flat throughout that same time interval. They, too, are renewable.

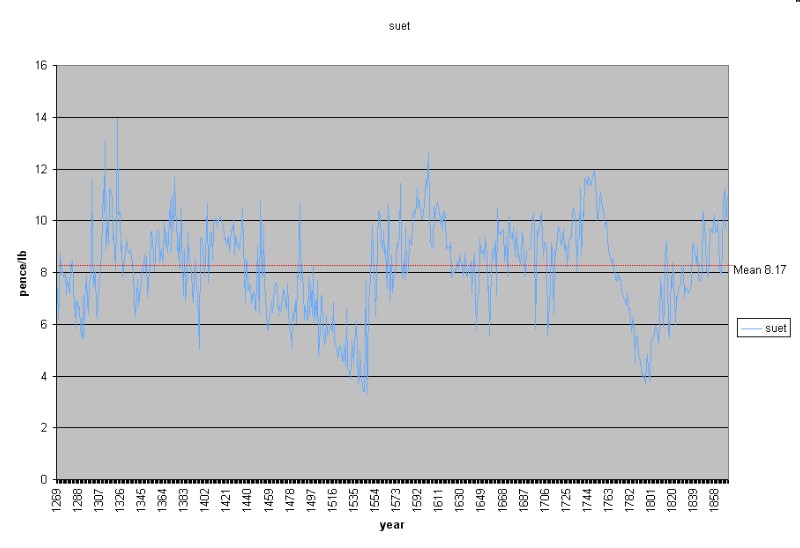

Suet, beef or lamb fat which melts about 21o C, is equally renewable and the inflation adjusted price has remained relatively flat for the 600 years of this data. When the price gets too high, farmers can 'renew' the flocks and herds and produce more suet.

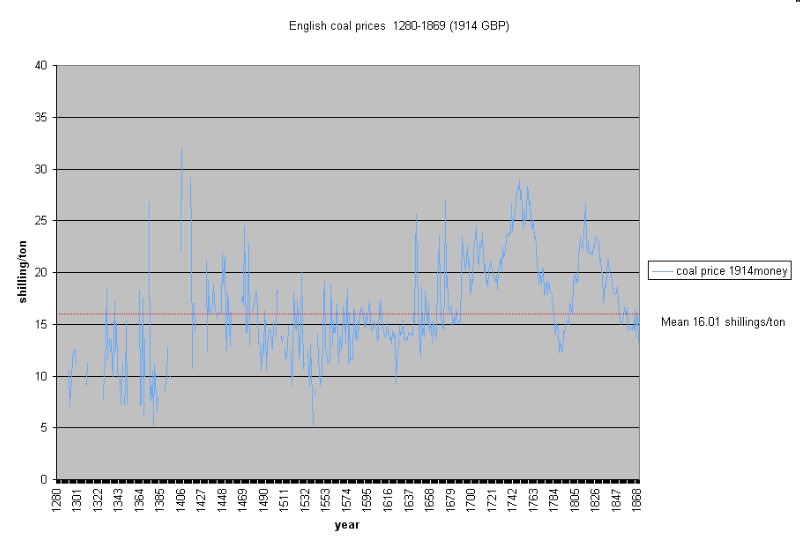

From 1280 until 1869, coal prices remained flat. It is very difficult to find newer historical coal prices without having to pay Platt's large quantities of money.But, early in a non-renewable commodity history, the price can remain flat (and the time frame shown below is certainly early in the production curve).

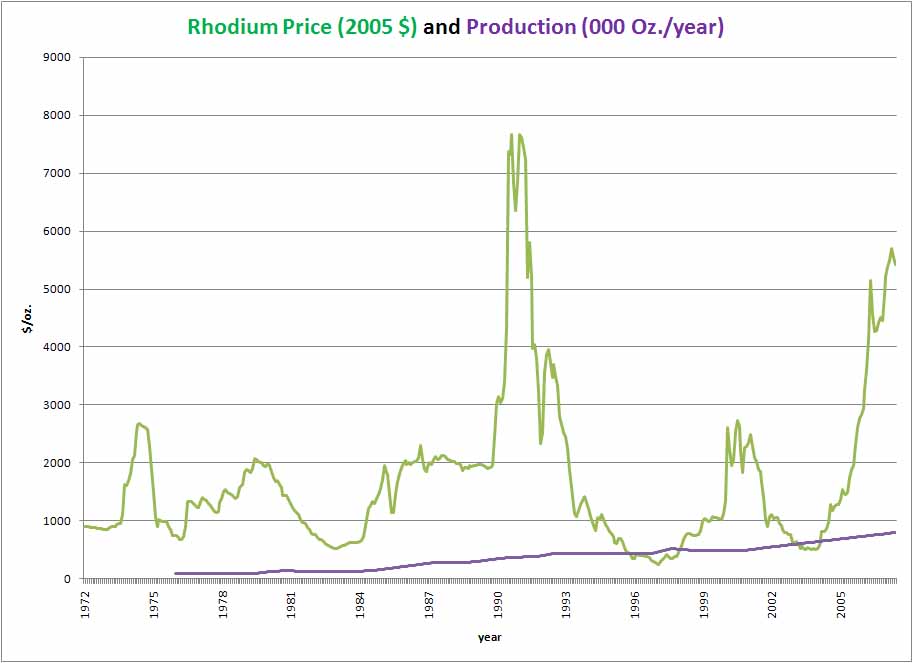

Looking at this data, one would be tempted to think that the economists are correct. That if the price of oil rises, new supplies will come in to dampen down the price. But what happens when one runs out of a substance? Rhodium is the rarest metal of which commercial quantities are produced. Rhodium is often associated with platinum so if you want to find rhodium, find platinum. South Africa's Merensky Reef formation's sulfide deposits have the richest source of rhodium on earth, 17 parts per billion, compared with 258 parts per billion for platinum.Rhodium is the only known catalyst capable of breaking nitrous oxides into harmless and non-polluting nitrogen. Since there are no primary rhodium deposits on earth, and rhodium is produced solely as a by-product of the mining of platinum and palladium, rhodium can't, in general be profitably mined alone; to be profitable, it also requires the selling of platinum and palladium. Because the laws have mandated the use of catalytic converters there is a demand for rhodium. Automakers, to ensure a continued supply of rhodium, use a platinum, palladium, rhodium system in the converters. This ensures that rhodium will be produced because there will always be a demand for platinum and palladium. Because rhodium must be used in diesel catalytic converters, demand often outstrips the supply. Automakers use about 60% of the production with the chemical, electrical and glass-making industries using about 15%. One interesting difference between oil and rhodium is that in 2001, 40,000 ounces of rhodium were obtained from recycled catalytic converters.

In looking at the chart above, one can see an interesting phenomenon, which will become important for understanding the future price of oil. The high spike in rhodium prices in the early 1990s was not solved by a massive increase in supply. Supplies have been constantly increasing at a very slow rate each year. Price spikes are solved by demand destruction. A presentation May 15th, 2006 spoke about this:

Bill Sandford:

If you look at the numbers in the book, this year we’re suggesting another year of deficit for rhodium. So that’s on top of last year, which was also a deficit. And the market was already very tight coming into this year. It’s a very small market, as you know, a tenth of the size of platinum and palladium, easily distorted. A few years of deficit, some fund buying as well, and it’s all become rather spiky. As for the future, well you can bet that all the car companies are looking at the situation and they are pretty much the market for rhodium. Since 1990 when rhodium was $7,000 they’ve been very careful about the amounts they use. It’s a market which they probably find a little bit frightening really. So taking Rhodium out is actually not that easy. NOx legislation is getting tighter and tighter and therefore there will be a need for rhodium. But I think I’d agree with Mike. We’ve never given a price forecast for rhodium, I don’t think this is a good time to start."

Q1b

But its fair to say that you haven’t seen anything changing on the demand side that would make you think that there would be much less rhodium used in the next 12 months compared to the last 12 months?

Bill Sandford: No.

Mike Steel:

Well, I think as Bill says, especially in the auto sector, the use of rhodium in autocatalysts is still critical to their effectiveness and in the total scheme of things it’s not such an enormous cost to the auto company. Of course they don’t like anything that’s a high price, but I think they realize they have to have rhodium to make their catalysts work. Sure in some other sectors, wherever it’s possible, people will be looking very hard at the use of rhodium and trying to get it out wherever they can. And one has to say on the other side, in the longer-term, there will be more rhodium coming out of South Africa - if and when Eastern Bushveld operations are successful and when there’s more UG2. So it’s a question of timing and the problem with the rhodium market, as Bill said, is that it is very thin and therefore relatively small differences between supply and demand can have a disproportionate effect on the price."3

What we have with rhodium is a necessary commodity (legally necessary) which is hard to come by. Interestingly, the production has gone up more rapidly than oil. Rhodium production has gone up 66% from 15 million tons per year in the 1976 to 25 million tons in 2007, but the price has gone up almost 600% (in inflation adjusted numbers). World oil production has only increased 40% during the same interval with the price only going up 50% (inflation adjusted), and we whine about the price of oil! The pattern we see is that the price is going up in the face of increasing production. One could argue that increase is not rapid enough to sate the demand and that would be correct, but this is because the supply is very, very inelastic. We also see short-lived superspikes in the price. As with the tulip bulb mania, the spikes are ended because the customers simply won't pay that much for a rhodium. The economic response, as Mike Steel above said, is to try to get out of it wherever they can. During high price spikes, research is aimed at figuring out how to get by on less of the expensive material.

The interesting thing about the rhodium price curve is it's spikiness. This is reminiscent of the early days of oil, when, because of the rarity and low productivity of the early wells (<50 bbl/d) any new demand or new supply could wildly gyrate the price. The price for rhodium appears flat, but how early is it in its production history? And what is the impact of its dependence upon platinum for 'survival', given that it is merely a by-product? However, the rhodium curve does not have the same appearance as seen in suet, bricks, and barley. While one might argue that the inflation adjusted value is flat, it isn't flat in the same way as barley and other renewables.

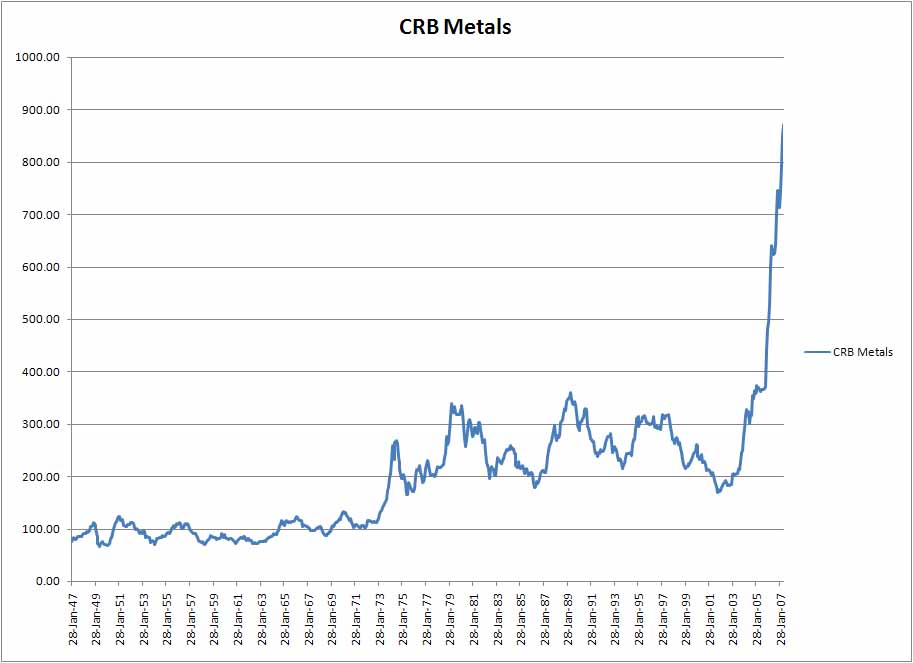

So, what about a basket of non-renewable commodities--the precious metal index? There is a perfect index which shows that a basket of metals, which are non-renewable, are not behaving the same as the renewables shown above. The CRB index Metals sub index is shown below. One can see three periods; a step-function from pre-1973 to post 1973 and another step function beginning in 2003. Clearly something is very different is happening.

A recent New Scientist article, and a book written in the early 1970s may explain what is happening. Some readers will be old enough to remember the Club of Rome's Limits to Growth book in the early1970s. The book was about civilization running out of various resources. When the oil prices took off in the early 1970s, the Press, with its usual inability to get things right, concluded that the Club was correct and we were running out of resources.

But, as Matt Simmons pointed out, the Club wasn't talking about the 1970s, they were talking about the early part of this century. A few weeks ago I got my New Scientist magazine, and it contained an article on rare earth metals and the reserves vs current usage. Apparently the metals sector is having as much trouble finding new reserves as is the oil industry. Here is what the article says in one of the charts:

"If Demand Grows...

"Some key resources will be exhausted more quickly if predicted new

technologies appear and the population grows

Antimony 15-20 years

Silver 15-20 years

Hafnium ~10 years

Tantalum 20-30 years

Indium 5-10

years Uranium

30-40 years

Platinum 15 years

Zinc 20-30 years."4

It is clear that the historical view of economists, that high prices will bring new supplies and thus drive down costs, may not be efficacious in the case of non-renewable commodities.

Now, let's go back and look at oil. Above, I showed the chart, used by the economist Drucker to convince my vice presidents that oil prices would always be flat. But let's look at what happened, in inflation-adjusted dollars since that time. The collapse in the price of oil was caused by the development of the big North Sea fields, which, by 1982, had brought to the market 2.6 million barrels per day which hadn't been there in 1975. The collapse of the prices in the 1980's was caused by new supply. But today is very different. We are increasing supply, and the price is rising, indicating that world demand is driving this round of price increases. Oil, like rhodium, is now a demand driven market. Unlike rhodium,oil can't be recycled from old gas tanks. The oil price curve seems to be a mixture of the rhodium spiky curve AND the CRB step-function curve.

The interesting thing to notice was that even with the collapse of prices in the mid 1980's, the mean price for oil, in inflation adjusted dollars, didn't return to its historic value of $16/bbl. It formed a new, higher price floor of $25/bbl, which, I believe, reflects the demand.This new floor is reminiscent of the new floor seen in the CRB index. One would be hard pressed to claim that OPEC had the ability to control the prices in the late 1980s. This chart, along with that of the CRB index, raises a serious question about the faith of the economist who believes that inflation-adjusted prices should be flat over time. Does this actually apply to a non-renewable resource like rhodium or oil, or coal? Does it only apply early in the history of the logistics curve? In the case of oil and rhodium, we have rising production AND rising prices, both on a short term and long term basis.

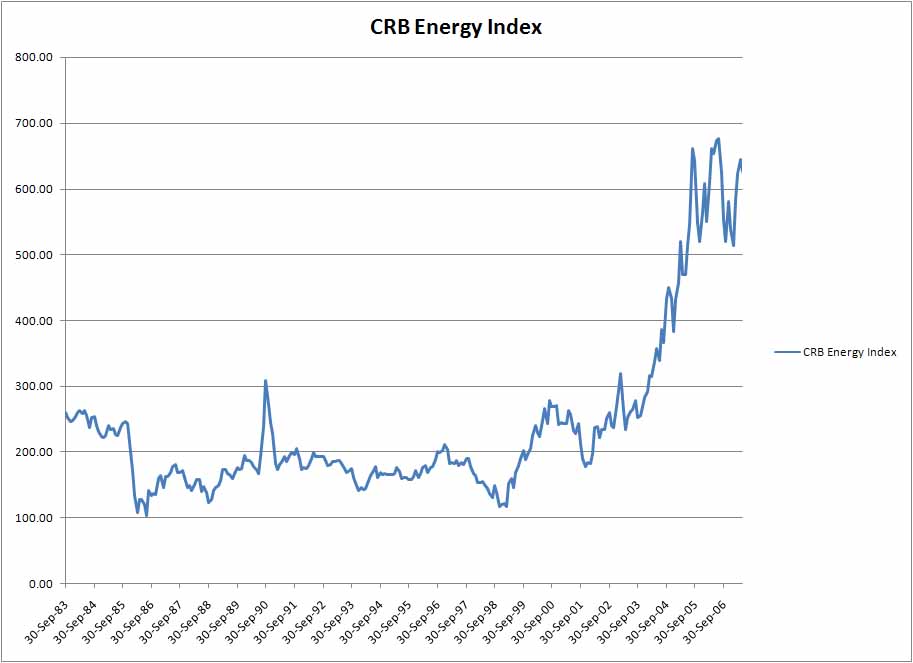

Another case is the CRB Energy Index. It shows a step-function, but it isn't behaving as a renewable commodity.

These last few charts are showing behavior which is unexpected based upon the inflation adjusted, commodity flat price theory. So, what will the future prices look like? Let's go backwards to the future.

In physics, one learns that the laws of physics are time-reversible. For example, if you want to know where that cannonball came from, if you know it's velocity and direction, you can reverse the direction of time and find out where it came from. Similarly, you can fire a cannonball in the opposite direction at the same speed and you should whack the other guy's artillery.Some physicists believe that the expansion of the universe will one day reverse and the universe will shrink down to cause a Big Crunch. To study this they simply time reverse the equations governing the expansion. This may work with the price of oil as well.

Under this assumption, let's reverse time in the above chart and take a back-to-the-future look at the price history. The only time we know of in which oil was quite rare is the period between 1861 and 1879. Maybe we can learn our future by looking backwards and reversing time.

As one goes from 1969 back towards 1861, one sees a generally rising price. One also sees price spikes increasing in amplitude as one goes further back. Here is a list of the price spikes going backwards toward ever decreasing production

| year | peak | previous | percentage |

| low | drop | ||

| 1926 | $20.90 | $12.40 | 41% |

| 1920 | $30.15 | $12.83 | 57% |

| 1899 | $30.36 | $18.60 | 39% |

| 1895 | $32.02 | $12.21 | 62% |

| 1876 | $47.13 | $20.29 | 57% |

| 1871 | $71.05 | $33.79 | 52% |

| 1864 | $101.12 | $10.70 | 89% |

As one goes into a period of very short supply, one should expect that as with rhodium, people will try to avoid using oil. To paraphrase what was said of rhodium, people would be "trying to get it(oil) out wherever they can." Getting out of it wherever we can will take many forms and will cause the price drops seen in the 'back-to-the-future' interpretation of the oil price history.

This coming aversion to oil will take many forms. Probably the quickest reaction will once again be the purchasing of fuel-efficient vehicles. But that can only reduce demand so much. At some point, where possible, people will telecommute. This is not a popular option with most bosses. Eventually it will take off, but today, I simply don't believe the numbers I see. This from a UK news article:

"By the same token, the US Department of Energy projects the number of telecommuters will reach 29.1 million by 2010, thus accounting for 27.4 per cent of the US workforce. This translates into a projected savings of 300 million litres of fuel worth more than $100 million." http://web20.telecomtv.com/pages/?newsid=41257&id=e9381817-0593-417a-8639-c4c53e2a2a10&view=news

This is nearly unbelievable, because this should be reflected in a drop in gasoline usage--something recent history (not to mention prices) has shown to be false. Of all my friends, I only know of one true telecommuter--my youngest son. He is a software programmer--a darn good one, but he works from his apartment. He tells me that some of the apartment residents are suspicious of this guy who stays home all day and doesn't go to 'work'. He loves the 'commute', down the hall to his table in a little cubby set up for work. If even 10% of the workforce were telecommuting, he would not be getting the reactions he gets.

This article defines a telecommuter as someone who works at home at least some time during the week. It says there are 32 million telecommuters in the nation. By that definition, when I was Exploration Director for China, I was a 'telecommuter', but I saved no fuel.Everyday I drove to work, buring up energy as I went. I arose at 5am, and was checking my email from home at 5:30am. I then drove to the office at 6:30 am, returning by 6pm. After a brief dinner, I would be once again doing email from home until 10:30 at night. I was a 'telecommuter'. Such silly definitions of telecommuting illustrate how hard it is to get real data on the number of people who really do work at home. However, this major re-structuring of the US workplace will happen when oil prices get too high (no predictions on what price that is), but it will cause one of the deep drops in oil price when it happens. Unfortunately, it may occur so late in the game that the drop in price will not last any longer than those gyrations seen between 1861 and 1879, when the oil price stabilized (relatively speaking).

This article should guide us a bit in what we should expect in the future. We have already seen a relatively short-lived gyration in the price of oil. In July 2006, the price of oil was reached a record of $79/bbl. Then by the end of September, 2006, the price had plummeted to $58/bbl and it continued to decline until the late January 2007 price of $51.11/bbl was reached on Jan.22, 2007. From there it has risen again to above $68/bbl by the time of this writing in late June 2007. This was an extremely short-lived drop in price, by 1990's standards. It says something about the strength of the demand which is driving the price rise in the last few years, but it also says something about the inability of the oil industry to bring large new production quantities online. Rhodium is an element we could live without, if we had to without seriously altering our current lifestyles. Lack of petroleum would seriously crimp our standard of living. The question is, are we about to go back-to-the-future?

References.

1. The data for this and the following analyses comes from http://gpih.ucdavis.edu/files/Englang_1209-1914_(Clark).xls

2. adjusted for inflation by http://measuringworth.com/calculators/ppoweruk/

3. http://www.platinum.matthey.com/uploaded_files/Pt%202006/Pt%202006%20Q&A%20transcript.pdf

4. David Cohen, Earth Audit," New Scientist May 26, 2007, p. 38

5. David Cohen, Earth Audit," New Scientist May 26, 2007, p.35

Copyright 2007 G.R. Morton This can be freely distributed so long as no changes are made and no charges are made.

From http://home.entouch.net/dmd/oilecon.htm

Thank you, Professor Goose. And thanks too to Professor Jay Forrester who has been pretty spot on the mark with The Limits to Growth. It's amusing to see the damned fools who never even read the study proclaim that it failed when now is the time frame when it was supposed to and is just now coming true.

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

I do not think it is correct to characterize "economists" as asserting that the long-term price of oil will be constant in real terms. There is a long tradition in economics (going back especially to nineteenth century political economists such as Jevons) that worries about resource depletion. Coal was the great energy resource of the nineteenth century, and those British economists knew exactly how important coal was to Britain. Furthermore, they knew that the supply of coal was limited, and they also knew that the best and easiest deposits were mined first.

Economics is a study of scarcity and its consequences. To characterize economists (in general) as cornucopians is, I think, a mistake. If you get five economists in a room, you generally get at least six different opinions. Economists are trained to look for tradeoffs and also to look at what lies behind the opportunity cost of production. Economic textbooks are filled with graphs that show long-run average cost curves that first fall and then rise as output rises (because the cost of inputs rise).

Economists have developed ideas about how to sustain a no-growth economy and how to find substitutes for fossil fuel. Now I grant that on a given day you can find an economist somewhere who will say something really really dumb, but that says nothing about the discipline of economics nor about the abilities of economists in general.

Among other disciplines, Peter Drucker was educated in classical economics, and most of his management writings are nothing more than applied economics. I especially liked his book, "The Age of Discontinuity."

Don: I think you would have to agree that most "economists" quoted in the MSM are little more than salespersons. They are not stupid-they are "cornucopians" because that is the only way they can make a living. In the economy of 2007, sales/promotion has infected economic dialogue, equity analysis,rating companies like Moody's, pretty well 95% of all business news. It is mostly all one big advertisement (IMO).

I agree, BrianT. Most of the economists today are infinite growth junkies, which is why I call them court astrologers. The number of economists who are practicing science, as defined by the scientific method (observe, hypothesize, test hypothesis, collect data, repeat) is amazingly small. Thankfully some of them are trying to develop a real science of scarcity, supply, demand, etc., but most of them are worthless priests bowing at the altar of growth.

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

"They are not stupid"

Is that correct? Come on, our situation is quite dunce-induced! But the idiocy has to work at a systems level, it has to take over institutions and ingrain itself in the culture. It works on the "cultivation of its own ignorance"--stupidity! Sorry, I just beg to differ.

It takes decades of centuries for this to happen. Particularly, in a highly developed, industrial superpower like the US. And I don't mean to be partisan at all. The culture, academia and the society as as a whole has to have a power base and ideology to make these decisions, they didn't consider massive downfalls--just like the engineers that built the WTC towers didn't test newer, theoretical impacts limits of giant kerosene filled jet-liners into their "modern masterpieces". Our societal model, to be vulgarly blunt, is like a giant Trade Center--not simply because of the threat of blow back terrorism arising from anywhere... Whether it be foreign policy or our own demented culture producing ream after ream of Mcveighs, Unabombers, school psychos, or the myriad of other less fatal mental disorders, too lengthy to go into here. Did Ford forsee PO when he was making 'lil Model T's on his invented assembly lines? Hell no! John D. Rockefeller was a power hungry, money-grubbing industrialist--"taking care of his baby". The Ultimate Cornucopian, his kid will have everything! Indeed, judging from Lee Raymond, The Oracle of Economists are indeed right in their prognostication that all is fine and delightful! *Pssssst* Let me tell you all a secret.... Economists also secretly whisper under their breaths, their medieval intellects fully intact, to his now long since dead brain's neurons' dream that money will continue, growth does that same, just like the oil, forever into posterity! John D grins in his sleep. Market innovation is evangelical in its saving power of PO. Find me a cornucopian geologist and I will show you a corporate apologist economist.

Traditional economists use a different

framework to analyze the resource price question than the one used in Limits to Growth, using aggregate demand/supply and ISLM money supply curves, etc. These contrast to the model used in Limits to Growth, which uses resource depletion and technological advances and population growth. So no wonder they don't agree -- different variables and weightings, based on different theories.

I don't think the validity of the Limits to Growth approach was attacked, but rather the conclusions -- but based on only one (most pessimistic) scenario. I don't have a copy of Limits to Growth in front of me, but I remember that they a number of scenarios. One scenario even considered "limitless technological growth."

First, Glenn, thank you for this insightful look at production, prices and resource depletion. This kind of information is vital.

Don Sailorman makes an important point about economics as the study of scarcity. Economists study finite resource depletion too - we've discussed hotelling theory and intertemporal substitution a bit here.

Re GreyZone and Glenn's references to Limits to Growth, the nonrenewable resource sector of the world3 model seems incredibly prescient now as an explanation of how increasing population-based demand intersects with the the law of diminishing returns as a nonrenewable resource depletes.

http://home.entouch.net/dmd/Oilcrisis.htm

Thank you Kenny, A couple of comments to one and all, I was relating a story of my lunch with Tom Neal, who later became President (or was it CEO?) of CNG. Back then, people were saying that commodities remained flat in inflated terms. And, the examples I showed of bricks, suet, etc, verified that observation over a 600 year period. I don't know how to say that that concept is wrong (for renewables) given a 600 year history of flatness.

But, that being said, I wouldn't want to over-generalize economists as all being in group think, that is clearly not the case. But I do think of Michael Lynch, with whom I have debated in private and on a semi-private email list. He thinks that all one needs to do is have the oil prices rise and and oil will veritably flow from them pore spaces.

The problem the Club of Rome faced was that they were too early, the press got it all wrong, and that then discredited them in the eyes of policy makers.

Good to see you here Glenn. I hope you make future contributions.

FYI, Glenn and I go back a ways. We have had peak oil discussions going back several years now. We are also both from small Oklahoma towns, both work in the oil industry, and were both raised as Creationists before shunning that belief as adults. So, we have found ourselves running in similar circles for a long time.

Now you let it out of the bag. My mother didn't know I was one of those evil oilmen. She thought I played piano in a house with red lights

http://home.entouch.net/dmd/Oilcrisis.htm

My mother didn't know I was one of those evil oilmen. She thought I played piano in a house with red lights

You must have read that book. Check out #9 this year from my reading list:

http://r2books.blogspot.com/

Very funny at times, but also very sobering at times.

Hadn't read the book, but heard that saying for my entire career in this business. I have been on enough rigs to know that my life expectancy, should I chose to work there would be about 10 minutes. Those places are dangerous--and I did have one very, very embarassing accident on a rig--luckily, I think I have squelched the story and no one knows anymore

http://home.entouch.net/dmd/Oilcrisis.htm

There are so many "scientists" who seem not to be able to shed Creationism who are brought up with it, or oddly enough, convert to it once they "see the light"--they do the inverse of what you two did! *blink* *blink* I am amazed that someone could actually get a biology degree and become a creationist. I would think the most demented logic would break down at some point, but it seems to hold water, per se.

I'm happy you guys made it out to to the non-provincial way of viewing the world! And here's to many more who shun childish beliefs once held, for we can only hope--since we can't convince. Discussing peak oil may be difficult, but trying to take away peoples fairy tales about existence is nearly impossible.

I'm surprised there isn't some "former Creationists against Creationism" organization... There must be one, right? I probably just don't know about it.

Michael Behe published his new book recently... What makes these people tick? I just don't understand it, at that level... Still, I guess sometimes the well educated classes can be the most dense, in many respects.

There are so many "scientists" who seem not to be able to shed Creationism who are brought up with it, or oddly enough, convert to it once they "see the light"--they do the inverse of what you two did!

I have seen polls suggesting that only about 1 in 1000 biologists are actually Creationists. It's just that they are very vocal, and are trotted out at every opportunity.

Economics is about marginal costs and income and the tendency of the invisible hand to drive prices in perfect markets to that point where supply and demand intersect, leading to consumer and producer surpluses for those able to operate more efficiently. (I am not sure if I managed to encapsulate the whole of Eco 101 in one sentence there but at least I tried!). Buried in here somewhere is the notion that the price of a commodity over time in inflation adjusted terms is constant.

At the time that Adam Smith was pontificating about his invisible hand, the earth and her resources were believed to be infinite for all practical purposes, even if it was known that they weren't. This is where classical economics started and it is where all modern economics, especially neo-classical economics and Marxism have their roots.

This idea of the "infinite" nature of resources is thus very deep rooted and it permeates the thinking that drives governments and the iron triangle. Here is a 2006 quote from Nick Minchen, Finance Minister, in the Australian Parliament: “the extent to which there is exploration for; and discovery of oil, is a function of price”. It was made at the time of last years run up in prices.

"Resource economics" is a sub-discipline of modern economics where the concept of sustainability has been given some thought. It is "where utility (consumption) is non-declining through time". For this to be possible it was proposed (Hartwick) that total capital, that is non-renewable natural capital (e.g. oil) and man-made capital (knowledge and physical assets), would be held constant. The idea being that "sufficient rent" would be saved from the extraction of the non-renewable resource to invest in the man-made capital so that the rule would be observed.

And thus, overall, the neo-classical price theory could be maintained - as the non-renewable resource petered out it would smoothly be replaced by a suitable substitute. Nick Minchen went on to say in the same statement that substitutes such as oil from shale’s would become available as prices dictate.

Minchen evidently lacks an understanding of the laws of thermodynamics; and he is by no means alone. Nevertheless a number of economists, among them Herman Daly, noted the impact of increasing levels of entropy frustrating efforts to replace "low entropy"/high value non-renewable resources. Although he said this 40 years ago, it is remarkable to witness the fiascos that are corn ethanol production in the US and syncrude production from tar in Canada today in the light of what he said.

My own humble view is that to an extent these economists were right - sufficient rent earned from the extraction of oil should have been invested in real alternatives: mass transit, localization, conservation and perhaps even substitutes. If we had husbanded this precious resource and not made endless plastic junk, built a huge infrastructure around cheap flights, or insisted on driving around the city in SUV's, we might have just about achieved this. Had governments done their job, they would have abolished income taxes in favour of energy taxes and forced investment in these solutions. Prices of energy (oil and substitutes) might indeed have remained constant over time.

But we didn't. And that is why we are here. We didn't because of the great 20th century divide between Marxism and capitalism (driven by neo-classical economics) and its very deep aversion to intervention from government of any kind. To this day, neo-classical economists abhor government intervention. This is perhaps why the Hirsch Report was buried so quickly. At its heart it advocated a switch to socialism: for the high energy/oil economy to be changed into a low energy/low oil economy, with a minimum of disruption, it would have to be centrally planned.

The discipline of economics does indeed have a lot to answer for. How is it that economics demonstrably understood the problem very clearly; and yet failed to bridge this divide? How did Nick Minchen and thousands of influential people like him get half trained?

Saildog wrote:

I agree. Indulging in a little futurism:

* there will be no significant action until an obvious energy crisis hits.

* when the crisis hits, the US will try to get the Market to fix the problem (with tax incentives).

* European countries are more likely to take strong collective actions (AKA government intervention).

In Europe, governments will be able to direct scarce liquid energy resources to where they are most needed (agriculture, mass transit, medical, ...). In the US, energy will flow to where the money is, so look for class divides to increase.

This has me wondering about the electric grid: is it possible to ration electricity? (other than with price). As people substitute electricity for liquid fuel, electricity demand could surge (think plug-in hybrid cars).

AFAIK, the only way to ration electricity is with rolling blackouts to selected neighborhoods.

Don't try to predict the future. Get ready for it.

I posted part of this on another page.

One of my thoughts is that oil price will only go a bit higher then it is now, maybe $90 crude.

Then unemployment increases about 3 percent a year.

Unemployed don’t use as much oil per lack of income.

So in ten years, unemployment would only be about 35 % .

In 20 years about 65 % and so on.

Unemployment is not a problem because Bush needs cannon fodder.

So , no problem, we can have business as usual as long as you or I are not one of the unemployed.

I am preparing to be unemployed.

.

DocScience

http://www.angelfire.com/in/Gilbert1/grid.html

.

I don't know how they got half trained, but the thought just occurred to me that there is something that even economists can't call renewable--land. Say a human, standing, need 1 sq meter of space to survive. That limites the human population to 10^14 people,(assuming that one can live standing on water). or 100 trillion. At that point there is no more room for another person. Now, regardless of the price of land at that time, a higher price will not bring forth more land.

Somehow the economists fail to see this ultimate limit to growth.

http://home.entouch.net/dmd/Oilcrisis.htm

I'm afraid your thought experiment seems to break down, seismobob, as it's possible to both build towers and underground caverns to stack your hypothetical human beings vertically. Although there is a theoretical limit to how deep the caverns can be, there is no limit to the above-ground vertical towers. In fact, they can grow right up into space, limited only by the size of the universe, which is currently thought to be infinite. Therefore, we will never run out of land.

(Similarly, we will never run out of oil either, although not because supply is infinite, but because we will eventually transition to better substitutes well before the last drop is exctracted.)

The Supply/Demand equation is practically in our DNA. Sooner or later, given a supply disruption and a price increase, we expect to see an increase in supply and a reduction in demand. Looking back in time, this has been the case for the worldwide oil market. However, regional models like the Lower 48 generally, and Texas, specifically, have not fit the pattern.

Here in Texas, we had the biggest drilling boom in state history as a result of about a 1,000% increase in nominal oil prices from 1970 to 1981. Oil production went from about 2.5 mbpd in 1962 to 3.5 mbpd in 1972 back to 2.5 mbpd in 1982. The overall Lower 48 started its long term decline in 1971.

My point last year was that Saudi Arabia and the world, in 2006, were at about the same stages of depletion at which Texas and the Lower 48 started declining (based on their respective HL models).

And I expect to see the same supply/price response, to-wit, higher crude oil prices = lower (conventional) crude oil production. I expect nonconventional crude oil production to only slow the rate of decline of total crude oil production.

PNM electric Integrated Resource Planning presented

and

Wind energy demand?

I attended and brought up the subjects of 1 fuel supply and 2 who gets electric power curtailment first.

I submitted the written questions

PNM has a fleet of fuel guzzlers which may run into liquid fuel problems in the not-to-distant future?

Great stuff.

And amusing, considering it I read it the same day as I found this science article, which casually says:

So, have you been able to convince any VPs with your charts and graphs?

When I became aware of oil depletion back in 1998, it was very lonely. Today, people in the industry, the oil industry, are aware of it even if some are in denial. I was the Exploration Director for China for Kerr-McGee and dealt with some rather high government officials in China. One day my boss, the country manager, and I had lunch with China's strategic planner. The very first question he asked us after the pleasantries were over was, "do you believe in peak oil?' It is amazing that they know of the importance of this question and our politicians think it crazy. Both my boss (a VP) and I told him that while Kerr-McGee didn't have a position on the topic, we both thought that peak oil was near. So, yes, many VPs in the industry are aware of it.

Glenn (aka seismobob)

http://home.entouch.net/dmd/Oilcrisis.htm

In 1956 Shell geologist M.K. Hubbert predicted that U.S. oil production would peak in the late 60's or early 70's many did not believe him. When oil production peaked about 1971 people believed that he was correct.

Numerous geologists and other peak oil theorists have stated that we do not have enough data to be able to get a conclusive peak oil date, especially from the OPEC nations. Professor Kenneth S. Deffeyes, predicted a world oil peak might occur in 2005. Conventional oil production has been declining. The oil + liquids curve near flat. ASPO predicted that peak oil + liquids production might occur in 2010, their model predicted near flat production 2009 - 2010. Due to variations in OPEC policies and conflict in Iraq and Nigeria, these are only estimates. Either one of these nations might soon double their production if the conflicts will end and their laws allow it. Nigeria is OPEC and might respect OPEC quotas although some nations have varied from them. Iraq has no production quota, nor do they have a stable govt.

http://www.princeton.edu/hubbert/current-events.html

Since oil production has been close to flat the last two years in spite of prices tripling within a decade, there is some concern that Deffeyes might be right about the world being very close to peak oil production. There is evidence that if high oil prices will not bring higher oil production due to deep offshore rig shortages, political instability, the cartel, and maturing super giant fields, then we might see conservation efforts and fuel switching.

EOR methods have been tried on old fields and this has been of some value. There were numerous recompletions, cleanouts, fracture stimulations, and variations to water and gas injection that prolonged the life of old fields at a lower than original production rate. Polymer flood has been tried at the Daqing, China giant oilfield, yet the field was declining in production. Some of the polymers and surfactants were expensive.

Tar sands technology is increasing every year, yet Rome was not built in a day. The peak of the Athabasca field is many years away.

By some estimates the U.S. might be able to increase the fuel efficiency of their vehicles if high gas prices will create incentives for them to do so. There is evidence that the sale of SUV's and minivans has peaked.

Prof. Goose,

A student of physics myself, I've considered time reversal of the price curve as well. There is one flaw with this method. It doesn't take into account fundamental changes in the need for oil. As time has gone on our society has constructed itself around the availability of cheap oil. As such, I don't think it is reasonable to simply reverse time to extrapolate. I have thought that it is reasonable to modify the time reversed prices with a linear or exponential, time dependent multiplier which takes into account a society that is increasingly dependent on oil.

I think this is a fair criticism, demand is much greater so the symmetry is lacking on the demand side. However, one can't burn what one doesn't have. Look at Cuba or North Korea. When fuel has been scarce, they do with other forms of transportation and when fuel, temporarily, becomes available, they don't switch from donkey to an SUV instantly. If one thinks about the time between 1859 and 1875, the supply vs. demand was highly variable. No matter how much a farmer in 1890 wanted a car or a motorized tractor, he simply couldn't afford it. If oil supply became available, the price plummeted because the citizens were not turning in their horses for gas guzzlers. The 'demand' at that time consisted of actual demand plus actual wishes. But wishes didn't get those 19th century farmers a motorized vehicle of any kind.

In the future, when oil is scarce, demand will drop quickly, because, one can't burn what one doesn't have or can't afford. Wishes don't count for demand. If some guy making $25,000 a year wishes to be able to drive a car when gasoline is $20 per gallon, that won't count for demand--it will still remain a wish. So, all in all, I think that at the end of the day, some near symmetry will prevail.

http://home.entouch.net/dmd/Oilcrisis.htm

If some guy making $25,000 a year wishes to be able to drive a car when gasoline is $20 per gallon, that won't count for demand--it will still remain a wish.

I'm planning on "charging it"

Glen Morton,

Thank you for your hard work! I really appreciate the effort that you put into your post. The main problem I see with your projections is the demand decrease due to economic depressions/recessions isn't accounted for enough. If the credit squeeze results in a real tightening in consumer credit cards along with the end of the 2nd mortgage ATM monkeyshines, people won't be able to afford fuel beyond enough to get them back and forth to work. This will cause a real limit on the price peaks.

But generally, I think you're right. Inexpensive oil isn't going to come again. In order to stretch the supply, we're substituting biofuels and unconventional supplies-the tar sands. Their cost of production will probably be the floor for oil supplies.Bob Ebersole

Thank you for the kind words. Your comment is probably the answer to the post immediately above yours, which I also answered with somewhat similar reasoning. While I didn't think of the credit crunch, it is apparent that one can't burn what one doesn't have and demand can not in actuality be above supply.

I mentioned North Korea. I am probably one of the few Americans who have met North Koreans. They have a sad life in their country. The ones I met were in Beijing at a North Korean restaurant I went to with a high level Chinese government official. The waitresses were N. Korean military--they were gorgeous! :-)

http://home.entouch.net/dmd/Oilcrisis.htm

The BP Stat review provides prices for various coals, 1987 to 2006 - not a lot of data but always something.

Yeah, I know, but that is such a small amount. I even wrote the DTI in the UK, but they don't have good data either--amazing.

http://home.entouch.net/dmd/Oilcrisis.htm

With all due respect to Glenn Morton, I think he glossed over what happened in the mid-1980's. As I recall and as described in Yergin's book "The Prize", the Saudis' opened the taps in 1985 and the resulting flood caused the price per barrel to drop to around $10. Their reasoning for doing this was that the other members of OPEC were cheating on their quotas and the Saudis' were attempting to discipline the other members.

These days, the discussion about Peak Oil is based on the notion that there simply will be no easy way to increase the production of cheap, conventional oil. If oil were the only source of energy to run things, especially the transport system, it would be extremely unlikely that the price would decline and stay down. Rather, the long term trend would be upwards as demand from an increasing number of users faced a declining supply. Of course, there are many alternatives, though the ones for liquid transport fuel are also problematic. Worse yet, many of the alternatives presently considered are not renewable, thus they will eventually peak out too. Instead of looking for upward spikes over time, perhaps we may see downward spikes of short duration, while the overall trend continues upwards.

E. Swanson

Chavez fired many white collar types from the Venezuela state oil company, I think it might have been within the past few years. Probably the ones doing the physical labor were kept.

After Chavez took over the heavy oil projects in Venezuela production there declined.

http://www.bloomberg.com/apps/news?pid=20601072&sid=aWhkVDHNX2vk&refer=e...

While I certainly can't speak on behalf of Hugo Chavez, I would like to note that it is certainly possible to imagine a policy approach that goes like this:

"We want to get control of our own energy resources, even if it means a short-term fall in production. The oil will still be in the ground, available for future use at higher prices. And if all hell breaks loose, we'll need it for our own domestic consumption more than we'll need a bank vault full of nearly-worthless gringo greenbacks".

It always amazes me to read articles like the Bloomberg one above, which ignore the possible existence of longer-term, non-US-centric strategies...

Larry

Re: the Saudis' opened the taps in 1985 and the resulting flood caused the price per barrel to drop to around $10. Their reasoning for doing this was that the other members of OPEC were cheating on their quotas and the Saudis' were attempting to discipline the other members.

Another reason, sponsored by Reagan, was to destroy the Soviet Union oil industry.

You mean destroy the Soviet Union, which they were successful at doing (let me note I'm not endorsing the Reagan administration here, or the Soviet Union for that matter, by any means!) I thought Saudi mainly opened their taps to bankrupt the Soviet Union, per Reagan Admin. requests., once that was accomplished it was back to the drawing board and now today, we are finally, it seems, losing our grasp on them... As China attempts to wheel and deal, and Iraq spirals out of control.

My favorite old geology prof from college (the best stratigrapher I have ever known and I have known a bunch) is currently going to Mexico for 3 month consulting stints for Pemex via Schlumberger, since Pemex cannot hire outside help. He says there are hoards of the aforementioned white collar refugees from Venezuela there who fled the idiocy of comrade Chaves. Their general take, according to my old prof, is that Venezuela is screwed on its production. All the good people are gone and management of the fields goes to Chaves cronies and goons. A few predicted Chaves will come to a Mussolini type end in the not too distant future (as in charred corpse drug through the street).

He also says the Mexicans are in abject panic about their production and seem short on even ideas about what to do, hence his presence there.

Mose in Midland

Pat Robertson will certainly be gleeful if those few are right...

The main reason that the guys at PDVSA got canned was their support of the failed CIA sponsored coup during Chavez's first term as president of Venezuela. The people of the republic are quite happy with him, they gave him a vote of over 60%. My prediction is that the PDVSA leeches will end up like the Cuban sugar plantation owners and mafia as permanent trouble makers.

Mussolini only ended up hung and burned after the Italians lost their war and were occupied by American troops. They were pretty happy with him when he was making the trains run on time.

Keep reading that Midland paper, Mose. It's giving you such a wonderful perspective on international affairs.

Bob Ebersole

So Mose,

A democratically elected Chavez is an evil villain just because he does not support you vision of a demostic oil industry.

Are you not just using talking points provided by the US right wing to make a political argument not a technical argument.

And, Oh, by the way, some of us believe that Bush stole the election in 2004 thanks to Rove - ergo he was not rightfully elected!

But heh, at least I am honest enough to sya that is what I believe. Where's your honesty?

prole, I've got your answer here:

"27 year petroleum geologist living in Midland, Texas. A massive heretic regarding manmade global warming (can we grow wheat in Greenland yet like the vikings did?)"

:/

But Bush didn't steal the election, Rove won it... There's a difference, Get your facts straight, David!

Your dead on there slick. Comments about Venezuelan expats are right from them, not me. Of course most people here at TOD never meet a commie they did not love, after all, they have always brought such joy to the world. Still pissed the the Prophet from Tennessee was not allowed to steal the election instead? Poor babies.

Most likely my last post here anyway, my formerly well honed gag reflex seems to have weakened from reading the non-technical drivel here. The technical stuff is top notch so will still visit, but as for everything else, the Daily Kos would be more enlightening, and that is an insult in case you are wondering.

Best luck and hope the gub'ment saves you.

Mose in Midland

Hey there buster brown, thanks for amazing comment! Such insight, and skewering criticism surely needs to stick around here, please don't leave us...

Of course most people here at TOD never meet a commie they did not love, after all, they have always brought such joy to the world.

Interesting, the 'ole "you're all goddamned communist bastards" hat trick. Real smooth, Mr. Mose.

Still pissed the the Prophet from Tennessee was not allowed to steal the election instead?

Since you clicked the "reply" on my comment, I assume you have made a mistake as I haven't whined at all about Gore, so another real KO--with that punch! In fact, I mostly bash Gore, but how can you be expected to know all this when you simply go out with a Midland hatchet towards anything and everything "liberal" (oh no, I'm sorry, I meant communist! Yay for Stalin!) on the block.

The technical stuff is top notch so will still visit, but as for everything else, the Daily Kos would be more enlightening, and that is an insult in case you are wondering. Best luck and hope the gub'ment saves you.

You have such tact, I'm envious. I wish I could write terse, rational statements like you, Mose. Anyone who disagrees with you is a "communist" and you assume I want the government to save me! Hah! I laugh at you. You clearly have no nuance, and don't know much--except, hopefully, how to find some oil--at least your good for something. And that is an insult in case you are wondering, although not a very good one. Just the usual dashing liberal commie nihilism.

THE VIKINGS DID NOT GROW WHEAT IN GREENLAND !!

A GW denier myth, based on a single letter from a clergyman who visited Greenland (and apparently wanted to "talk up" settlement there).

Below is an eMail from Throstur Eysteinsson, deputy Director of the Icelandic Forest Service, head of their assistance to Greenland Forestry, a PhD in Forestry from the Univ. of Maine.

Hi Alan

Good to hear from you!

I won't say that the description below is an out-and-out lie but it is an exaggeration. There are fruits in Greenland but they are all small. The closest they have to apples is northern mountain ash (Sorbus decora). It produces pomes (like apples) in clusters, each about the size of a blueberry. Like other mountain ash species, the fruit is supposedly edible but not very good (I know, I've tried them).

Barley was cultivated in Iceland but never wheat. I suspect that the same was true for the Icelandic settlements in Greenland. (For some reason it is usually called the Norse settlements, Norse refering to the Nordic countries. But as far as anyone knows, the only Nordic people that settled

there were Icelanders.)

All the best

Throstur

Dear Throstur,

The following was quoted to me and I wanted your comments.

From the report of Ivar Bardson (a priest/monk who apparently visited Greenland at least twice in the period from 1341 - 1347, and who was later a Bishop) "On the mountains and lower down grow the best of fruits, as big as apples and good to eat. There also grows the best wheat that exists."

Just wondering about your thoughts and comments ?

Best Hopes,

Alan

In addition to the other reasons cited KSA also had concerns over the increased investment in non-OPEC production and the degree of substitution taking place. They sought to drive the substitutes and alternatives from the market.

To a degree, present day oil industry under-investment is due to the fact that the current senior executives were in mid-career in the 1980s and observed the raw power of KSA and have not wished to risk making investment decisions that KSA might then undercut.

The fact that KSA is not making a present day attempt to curtail similar alternatives suggests that 1) they are confident that viable alternatives do not exist, or cannot compensate in the face of projected world demand growth or 2) they lack the spare production capacity they enjoyed in the 1980s or 3) their own economy would collapse if oil prices dipped much below $20 a bbl for an extended period of time or 4) some mix of the above.

I believe the geo-strategic interpretation (destroy USSR by undercutting the price per bbl) to be unlikely. KSA's actions in the 1980's destroyed the OECD oil industry and had great negative economic impact on Texas and Alberta. I cannot see free enterprise oil men agreeing to destroy their own industry (and their own livelihoods) in an attempt to weaken the USSR. This interpretation confuses cause and effect. KSA conducted economic warfare and one of the outcomes was the collapse of both the USSR and western oil enterprise. Once the economic impact on USSR became clear here may have been attempt to push down an already weakened state but this is different from having this as the initial goal.

New Account,

I agree. The Saudi's didn't help Reagan, he was a drooling idiot anyway. They took care of their own goals first, and second, and third.

I despise how the Republican Party is trying to make Reagan into some kind of saint. He wasn't. His fiscal policies were ruinous, and his domestic energy policies really hurt. Jimmy Carter was terribly unlucky, but he was the last president before Clinton to balance the budget. If we'd kept on with his energy policy we'd be in much better shape today-energy use decreased in his administration. And it was proven during Iran-Contra hearings that the Republicans conspired with the Ayatollah to keep our hostages until after the election. As far as I'm concerned, they're a bunch of traitors.

Bob Ebersole

I know that there has been a recent debate here, which I enjoyed very much, on the future of Saudi production. I believe that the Sauds are tapped out. Take a look at the bottom chart on my page on Ghawar. Their production looks like a natural decline curve for the past 1.5 years, and price doesn't seem to be affecting it very much. Nor does demand. You can find it at:

http://home.entouch.net/dmd/ghawar.htm

How are the people working in the service economy supposed to telecommute? Its hard to serve people if you aren't there.

Alan: They don't mention that is 27.4% of the workforce that will eventually be relocated to New Delhi.

Exactly.

If your job can be done electronically from your home, it can be done electronically from Apu's home for 10x less.

If an employer starts to reluctantly allow large scale telecommuting because of fuel price revolts by the employees, this will obviously come to mind. "I'll lower those whiner's gas bills, that's for sure!"

As a geophysicist, I have often wondered why interpretation, which can be done at one's home, including Apu's home, isn't outsourced to India or China. A geophysicist in China can be hired for about $30k/annum, and I will say, they are pretty good, at least the ones I worked with.

I finally came to the conclusion that if a manager of an oil company is going to spend $30-$130 million dollars on an oil will, he wants to KNOW, deeply know, and trust the person recommending said prospect. It is hard to know Apu, when he is on the other side of the world, and you can't speak his language.

http://home.entouch.net/dmd/Oilcrisis.htm

A colleague of mine recently returned from an extended stay at our China affiliate. While individually the people he worked with were eager and competent, the organization was run by what could best be described as a "party boss".

Every decision, improvement or process had to go through him or went nowhere. As you might imagine the type of person who tends to hold that position views everything new with suspicion so not much got done.

On the other hand, once they do accept a new process, technique or product there is not much to stop them from re-engineering it and make it their own.

The service industry is pretty much the only one in which people can telecommute. Factory workers, miners and farmers certainly can't. You appear to be talking about the hospitality industry, which is a relatively small portion of the service industry as whole.

Lets see, service workers:

Hotel maids

Waiters

Teachers

Doctors

Veterinarians

Sales clerks

Tire changers

Car mechanics

Dentists

etc

No question that many service industry jobs do require physical presence. But it is also the service industry that in general has the most flexibility to allow workers to telecommute, which is why I thought the initial poster's comment was a little odd.

Thank you Glenn and thank you Prof Goose for your dedication to educating this online community.

This article reminded me of a previous thread where the economics of the alternatives to conventional crude were discussed.

I believe an economist predicted that if oil rose over (guessing) $150/bbl, that oil shale would be brought into production. Darwinian (in my words) said that these forecasts are missing the point... that as oil prices rise, prices of all of the alternatives rise with it.

I believe that is the biggest problem most economists are missing. There truly is no substitute. What is the cost to mine (and ship) lithium, gallium, rhodium, and molybdnum with skyrocketing oil prices?

Darwinian (in my words) said that these forecasts are missing the point... that as oil prices rise, prices of all of the alternatives rise with it.

Costs Surge for Building Power Plants

I think it's more than that. I think we're butting up against population growth-based supply constraints on all resources. Peak oil is almost beside the point.

If we are only a few short steps away from supply constraints on many if not all major non renewable resources impeding further economic growth.

Supply constraint-induced price increases will of course impede efforts to mitigate the effects of specific supply constraints like peak oil.

This is why I sometimes am uncertain whether to hope we find a scalable alternative to oil as a liquid fuel. Just like a new deposit in a fractional banking system, a high net energy technology will max out other scarce resources while providing the energy gain. A 30:1 EROI technology will result in so much more metal, greenhouse gas, soil, water, ecosystem etc depletion if the demand paradigm isnt changed as well.

Rhodium, Gallium and other rare metals. Nice analogy to oil for non-renewables in the early 21st century. Good to see you writing here, Glenn.

best,

Dave (not the New Scientist guy)

You realize you can get high quantities of rhodium and other platinum group metals from spent fuel? The price is right now for people to start considering it.

The volume won't scale, precisely because of the small amount of nuclear fuel that you tout as an advantage of nuclear (which it is). Yes, you can recover some small amounts of rare metals from the spent fuel but I have never seen any estimates that it can replace other sources, only supplement them.

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

Sort of... the supplement isnt insignificant though...

Annual production is roughly 20 tons of rhodium from mining, while annual production from a typical light water reactor is about 19 kg per year, and world production is roughly 20 tons per year.

With 400 reactors worldwide thats about 7 tons per year, nearly half of world production allready, and that doesnt count going back and using spent fuel from decades ago. If we replace all of our coal plants with nuclear, its not inconceivable that the majority of the worlds rhodium (and xenon) supply comes from nuclear power plants.

Yucca Mountain is designed for 70,000 tonnes of spent fuel. If Wikipedia is to believed, there are 400 grams of rhodium per tonne of spent fuel.

That means that reprocessing all the spent fuel from all the current US reactors over their whole licensed life gives you only 28 tonnes of rhodium.

Of course, you need to wait 25 years before dose rates from the metastable isotopes decline before one can use it.

But at current prices of $6,000 per oz, that's about $50 billion. Is there that much demand?

Thats still half again total worldwide production, and US plants produce about 2 tons per year alltogether.

A full 10% of annual global demand can be met from US plants alone.

Ah, you don't have to. You can use the hotter stuff in industrial catalysts after just a few half lives...

Theres also the other platinum group metals and xenon in spent fuel that may make reprocessing more desirable.

If we are willing to pay $50 billion for X amount of rhodium, can't we just lasso an asteroid? Not to mention the 100,000 year supply of platinum, nickel etc. at current usage rates.

50 billion isn't nearly enough to ensnare an asteroid for retreival.

Thanks Dave (not the New Scientist guy). A long time friend of mine got excited over the past few weeks about a gallium/aluminum system which will create hydrogen when water is poured over the mixture. This friend is very smart, well educated and critical. But, he didn't calculate that this system would require 110 lbs of gallium per tank (the gallium would be recoverable and reusable). Such a quantity of gallium would cost $37,000.

The problem we all have in this area is getting people to look at the entire system, the large picture before they make a decision.

http://home.entouch.net/dmd/Oilcrisis.htm

One should recall the infamous bet between Paul Ehrlich and Julian L. Simon. It was the economist, Simon, who once wrote:

This has often been portrayed by the Limits to Growth people such as Albert A. Bartlett as a belief that copper can be made from other metals via alchemy. Nevertheless, Ehrlich lost the bet because technology had allowed metals such as copper to be replace by other substances (fibre optics, plastics, etc) and allow less usage of it. What would the result be if this bet were repeated today?

These small scale victories of economic theory over ecological theory easily lead fans of limitless growth to believe in capabilities that border on the fantastic. See Note 11 of this page, for example, where the author justifies Simon's belief in limitless copper by citing a specific example of nuclear decay (Zinc-65 decays to Copper). Perhaps in the long run economists will always be right, and that by redefining "oil" as "energy" in general we will eventually develop technology to tap into replacement sources as we have done for copper. But it is the immediate short term that everyone cares about, and if either the technology or the infrastructure is not ready in time, then it is via demand destruction rather than a techno-utopia that will allow the economist to win the next bet.

Indeed, there is very little technically or logically incorrect about what Simon wrote.

The danger is the apparent assumption that free market enterprise will always be able to find a solution to a resource shortage, or is even the best method of doing so.

For a start, it wasn't free enterprise that gave us the power to split the atom - an ability that Simon made much of (and rightly so). Nor was it free enterprise that gave us the ability to leave the Earth and visit other worlds: which was another tenant of Simon's belief that humanity's capacity was essentially unlimited.

Yet Simon appeared to be largely of the Friedman school of thought that private enterprise should be responsible for everything, from scientific research to education to the postal service.

I agree that, in principle, physical resource shortages on our planet need not restrict our continual economic and technological advancement. But I don't see the evidence yet that laissez-faire capitalism on its own has the capability of being forward-thinking and selfless enough to provide us with the capacity to overcome those shortages.

Economics and the free market will provide.

The cost of oil will be below $40/barrel soon enough:

http://thefraserdomain.typepad.com/energy/2007/06/cellulosic_etha.html

http://thefraserdomain.typepad.com/energy/2007/06/imortant-lower-.html

http://thefraserdomain.typepad.com/energy/2006/11/sugar_cane_yiel.html

And that's just for starters.

Ethanol from sugar cane (sucrose and cellulosic) is already competitive with oil. You can grow sugar cane almost anywhere in the tropics where there is water, S America, Caribbean, Africa, India, China, Australia.......

And the men in the white coats have barely started playing with the genetics. Costs will keep dropping continuously as production ramps up.

And then the cellulosic technology will be transferred to the waste of every food crop (never mind forestry waste). And by improving the profitability of food crops, this will actually drive the cost of grains, and so food down.

And then there are the efficiency gains as Americans switch to cars with European type efficiencies. And then the US and Europe will switch to plug in hybrids using electicity to power most of their commuter miles. And mass production will rapidly drive down the cost and weight of batteries.

Such are the joys of capitalism.

Two weeks ago I was described as being 'silly' for suggesting that large scale PV installations were now economic at peak electricity prices, and so would take off in a big way, being led by the US South West. Yesterday:

http://www.upi.com/Energy/Briefing/2007/07/09/solar_energy_set_for_san_j...

As the cost of PV's continues to fall, it will drive down the cost of electricity, and so the cost, and usage, of both coal and natural gas.

We are entering the solar age, either directly via PV, or indirectly via bio-fuels.

Oil and coal production may peak more quickly than even the pessimists on this board think, because they will no longer be economic compared to the alternatives.

kagiso

Do the joys of capitalism include the massive subsidies for corn ethanol, including the $0.50/gallon tarriff on Brazilian sugar cane ethanol? How about the federal tax credits for the solar generators, and the California subsidies?

I hope you're right that alternatives will soon be competitive in price, but I'm going to bet my money on oil. And conservation. I'm planning to get a solar cell electricity set up for my home, but not because its cheaper, but because its the right thing to do.

Bob Ebersole

Using most of the growing vegetation for cellulose ethanol will deplete the soils even faster requiring much more fertilizer.

What is known about the fertilizer needed and used on these crops, and where is this going to come from on a large scale when fossil fuels deplete ??

DocScience

http://www.angelfire.com/in/Gilbert1/grid.html

.

It will happen where it is economically favourable, like Brazil and Australia, which have both had sugar cane industries for generations.

In Australia the only thing holding back the sugar industry were low prices. There is a lot more potential land available in oz for this if there is demand.

In any case this is only part of the solution. Oil is not going to disappear overnight and there are many other alternatives that may or may not work out. Over a 5 year period there appears to be a good chance biofuels may expand into a good fraction of the hole left by oil.

But oil will go up in price.

As oil goes up in price, fertilizer goes up in price.

So bio-fuels then also go up in price.

It’s that circle trap.

.

DocScience

http://www.angelfire.com/in/Gilbert1/grid.html

.

I'd like to see some numbers:

a) Percentage contribution of the price of crude oil towards cost of manufacturing pesticides

b) Percentage contribution of the price of pesticides towards cost of growing bio-fuel crops

c) Percentage contribution of the price of diesel for running farm equipment necessary to plant/harvest crops

If all three numbers were 20% and we assume the cost of diesel is more or less linear with the cost of oil, then if oil prices double, pesticides would get 20% more expensive, adding 4% to the cost of growing crops, while the doubling in the price of diesel would add another 20% - so crops would become at most 24% more expensive.

But at some point, changing tilling practises/adopting organic farming practices etc. may well prove cheaper than using excessive pesticide.

And of course, the pesticides and the diesel can be manufactured directly from biomass, cutting oil out of the picture completely. So on that basis there is no "circle trap".

What there IS is a scalability problem: there's just not enough land available to create enough biofuels to replace much of our current oil usage.

My question is, if we know plants are relatively inefficient at converting sunlight into useful energy, then why are biofuels attractive at all? Is there really no artificial way of using, say, CSP or even PV to trap sunlight and use it to generate some form of liquid hydrocarbon fuel directly, via some sort of artificial photosynthesis process? Of course, even this is inefficient compared to directly solar-driven electric motors, but if we're trying to find a solution that can allow a manageable pace of replacing the entire world's fleet of ICE vehicles, this would seem worth investigating.

It is possible to do, though the energy economics are horrible, the chemistry behind it is a reversal of the classic methane combustion reaction:

CH4 + 2O2 -> 2H2O + CO2

By applying energy it is possible to force the reaction to reverse, producing methane and oxygen from a carbon dioxide and water input stream. The only serious proposal for an application for it that I have seen to date was a way of producing a fuel on mars in advance of a human landing party, as a way of negating the (even more atrocious) energy economics of having to send fuel all the way to mars.

The actual utility of this method for large scale methane production at a glance, I would imagine is near zero, due to the lack of an undiluted input stream of carbon dioxide (if we're talking about producing liquid fuels without recourse to fossil fuels, that eliminates the use of a captured carbon dioxide waste stream (could be used i would imagine). Mars does not suffer from this problem since atmospheric pressure there is 1% of earth's, but its all CO2. Again, although i'm not sure of the details, but i would be unsurprised to see a noble metal catalyst in use (a fantastic way to increase costs, see rhodium above). Once you get the methane, it could be up/downgraded to a longer chain liquid fuel, at a further loss of efficiency.

So long story short: it is possible, but to actually consider it for anything other than a single extreme circumstance is, at least at this stage, complete fantasy. Given something like fusion power it may be possible, but as a near to medium term solution, its just not gonna happen. Far better off using electricity as your transportation fuel and redesigning the transport infrastructure. It would almost certainly be cheaper, not to mention, acheivable.

Matt

Use limeburning for your CO2 source. Use quicklime for either cement production or just have big giant pond/tower things that absorb CO2 from the atmosphere as it reverts back to limestone if you want to be carbon neutral.

Fortunately we have fission and the knowhow for doing worldwide supply with it without much difficulty.

We wouldn't manufacture methane, thats silly. We would either run CO2 and H2 over cobalt catalysts for diesel fuel or do the DME thing.

My understanding is that the proposal is to bring hydrogen to Mars not water. And then react the hydrogen with CO2 to produce methane. The energy economics are even worse but the hydrogen is only 10% the weight of the water.

It doesn't surprise me that the energy economics are "horrible", but it's hard to imagine we couldn't do better than the 1% claimed for natural photosynthesis.

Of course nature had billions of years to design a method of allowing a machine capable of converting sunlight, water and nutrients in soils into biomass to self-assemble from seeds (that the plant itself produces). To attempt to duplicate this with man-made techology that worked at significantly higher levels of efficiency would obviously take considerable effort and time, time that I doubt we really have. I certainly agree that using electricity as a "fuel" makes vastly more sense, though it's also due that we haven't come close to being able to store electricity at anything like the energy density of hydrocarbon fuels yet.

I was specifically talking about ethanol from sugar cane, both from fermenting the sugar and cellulosic.

By subsidising corn ethanol, and putting a tariff on Brazilian cane ethanol, the US is messing up the market incentives.

So the US is actually slowing down the development of sugar cane ethanol and cellulosic ethanol in Brazil.

So, consequently, the US is actually exarcebating the problem of peak oil by imposing penalties on the most profitable alternative.

If the US stopped subsidising corn ethanol and removed the import tariffs, Brazilian ethanol would be very profitable and would boom. Along with Australian, Peruvian, Jamaican, Malawian, Indonesian, etc.

The subsidies on corn ethanol, and the tariffs on Brazilian ethanol, are forcing the price of gasoline higher in the US.

The big change will come when the western oil companies, currently being thrown out of Russia and Venezuela, realise that they can buy land and distilleries in S America, Africa and Australia, and again start owning the upstream resources.

They will rebrand themselves as ethanol/oil companies, ensure that their supplies are 'sustainable' and lobby for the removal of the US / European tariffs and subsidies.

What's the EROEI of sugar cane ethanol when mechanically harvested? (Or do we expect the plantation workers to keep cutting the stuff by hand when they become wealthy?)

Nick.

Slave labor. Already happening. By comparison, the old slavery days of the 18th and 19th centuries will seem idylic

There's a rapidly growing sugarcane ethanol industry here in Australia, with no slave labour required. No idea what the EROEI is, I read 9:1 for Brazil, written by an "organic sugar cane farmer", which might imply significant human labour, but who knows.