Peak Lite Revisited

Posted by Robert Rapier on July 16, 2007 - 10:00am

Introduction

While I believe that a global peak in worldwide oil production presents an unprecedented challenge to the way most of the Western world lives our lives, I do not believe that world oil production has yet peaked. However, in looking at the new oil capacity that is scheduled to come online, and contrasting that with the projected demand growth, it became clear to me over a year ago that demand was going to rise faster than new supply could come online.

This prompted me to propose the idea of "Peak Lite." It is "peak", because the symptoms will mostly manifest themselves as those of a true production peak: Not enough supply to meet demand. In fact, we have already passed the point at which there is enough $25/bbl oil supply to meet everyone's desires. But production can still grow in this scenario, which is why it is "lite". In that case, people may underestimate the significance of the problem.

Visualizing Peak Lite

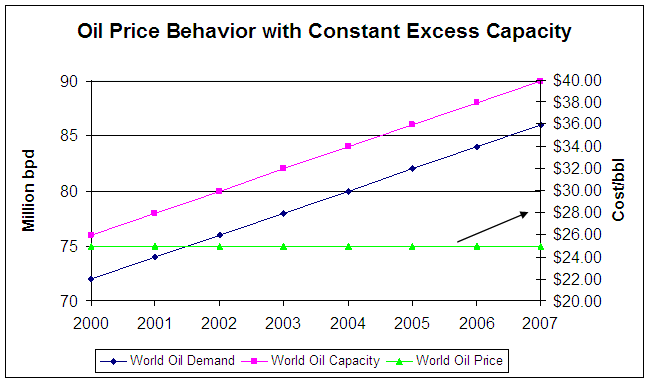

If excess capacity had not been eroded in the past 5 years, I believe the oil price would have remained around $25/bbl as shown in Figure 1 (figures are for illustrative purposes only and are not intended to reflect exact prices and volumes). This figure is based upon the presumption that a constant 4 million bpd excess capacity existed from 2002-2007. That is enough excess capacity that even a fairly large disruption in supply can be managed by bringing excess capacity online.

Figure 1. Projected Oil Price Behavior at Constant Spare Capacity

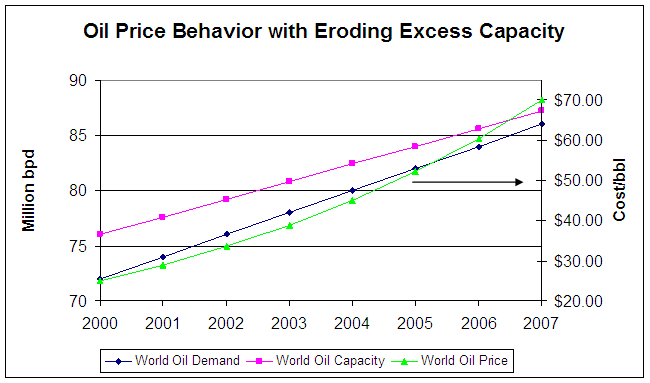

Figure 2 shows a more realistic picture of the behavior of the oil market over the past 5 years. As excess capacity has eroded, the price has risen and volatility (no volatility effects are simulated) has increased because any disruptions (or perceived disruptions) may be difficult to manage.

Figure 2. Projected Oil Price Behavior with Eroding Spare Capacity

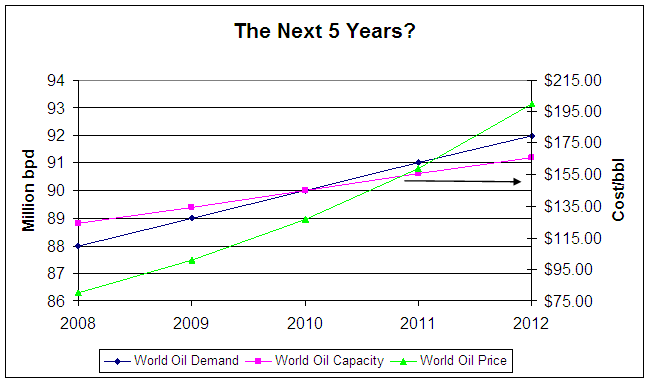

If current trends continue, Figure 3 may provide an indication of things to come, although I do expect the price rise to be incredibly volatile. I also think we will see periods of stability as demand is destroyed, but once the wealthier countries are the ones left bidding on the remaining oil, the price will likely increase dramatically.

Figure 3. Oil Prices in the Future?

Figure 3 shows demand exceeding supply in less than 5 years, although the exact timing is uncertain. And while some will argue that in economic terms demand can't exceed supply, in real terms it can. If a man starves to death because he can't afford food, does this mean that he did not demand food? No, he did demand food, but perhaps could not afford the supply at the market price. Many will find themselves in this position as prices increase, although demand for oil is admittedly more elastic than demand for food.

The IEA Endorsement

The International Energy Agency (IEA) has now endorsed the same general idea. In their July 2007 Medium-Term Oil Market Report (available for now here), they reach the conclusion of Peak Lite:

Despite four years of high oil prices, this report sees increasing market tightness beyond 2010, with OPEC spare capacity declining to minimal levels by 2012. A stronger demand outlook, together with project slippage and geopolitical problems has led to downward revisions of OPEC spare capacity by 2 mb/d in 2009. Despite an increase in biofuels production and a bunching of supply projects over the next few years, OPEC spare capacity is expected to remain relatively constrained before 2009 when slowing upstream capacity growth and accelerating non-OECD demand once more pull it down to uncomfortably low levels.

It is possible that the supply crunch could be deferred – but not by much. The demand side of this analysis is based on country-level GDP growth forecasts from the OECD and IMF, which amount to a global average of around 4.5% annually.

Lowering GDP growth to around 3.2% per year from 2008-2012 reduces annual oil demand growth from 2.2% to around 1.7% and the call on OPEC crude drops by around 2 mb/d by 2012. But this merely postpones by a year the point at which oil demand growth surpasses the growth in global oil capacity – in effect, delaying the return of minimal spare capacity by only a few years (unless the trend in upstream

capacity growth changes).

They further note that it isn't only the oil markets that look tight:

But the oil market cannot be looked at in isolation. Not only does oil look extremely tight in five years time, but this coincides with the prospects of even tighter natural gas markets at the turn of the decade. Over the past 25 years there has been substitution away from fuel oil and towards natural gas. However, when natural gas supplies have been insufficient or there have been supply problems (such as those seen following Hurricanes Katrina and Rita in 2005, Russia in 2006), fuel oil has been the natural substitute. By the end of the decade, such flexibility may be constrained, producing upward pressures on all hydrocarbons.

The IEA suggests that current OPEC spare capacity is 2.50 million barrels per day, but this will dwindle by 1 million barrels per day by 2012. I believe the erosion of spare capacity we have seen since 2002, when oil was around $25/bbl, is primarily responsible for the price increase to the $70/bbl range. With several million barrels of spare capacity, there are a many different producers that can bring capacity online in the event of a disruption. As that capacity erodes, there are fewer options for bringing on supplies if they are needed. The price creeps up, and volatility increases.

Whereas OPEC may not have been able to control prices in 2002 because there were too many suppliers to compensate for throttled production, in 2007 it is clear that other suppliers can no longer compensate for idled OPEC capacity. OPEC members have seen that as long as they maintain solidarity, they can maintain a floor price for crude oil (maintaining a ceiling is a different matter, as volatility in a tight market can push up prices much faster than they can react).

What to Expect

In the event of a worldwide peak in oil production, there won't be enough oil to go around. Poorer countries will find themselves priced out of the market at various price points. The situation will be the same for Peak Lite, and this is what we have observed in the past 2-3 years. Many developed countries have seen their oil consumption rise over the past 2 years, even though world oil production has been slightly negative. This means that demand destruction is occurring in some locations. I expect this trend to continue.

At the point that developed countries are bidding against each other for remaining supplies, the price of crude is likely to go much higher. Until now, demand has been moderated as poor countries in Africa and Asia are increasingly unable to afford $70/bbl oil. This price point is unlikely to significantly alter the demands of the United States, Europe, or Japan, which means that at some point of capacity erosion we could see oil prices quickly shoot past $100/bbl. While I think I will win my $1,000 bet on oil prices this year, I am not confident that the price won't reach $100/bbl within 2 years.

To the extent that OPEC actually does have spare capacity, I expect them to continue to test the limits of what the world can withstand as far as oil prices go. If I managed their oil reserves, my goal would be to extract the highest possible price for the oil, but not so high as to trigger a global recession which would destroy demand and collapse the price. OPEC has gradually increased the price that they are satisfied with as they have seen that demand has remained strong at $50, $60, and finally $70/bbl oil. I expect them to continue to push this limit. By 2009, they may be suggesting $90/bbl as the price they are comfortable with.

The bottom line is that I believe the world has now reached the point at which the symptoms of peak oil are starting to manifest themselves - even though I still do not believe we have reached a true production peak. But, the consequences will be much the same as if we had.

Robert:

Surely $90 in '09 has important numerolgical significance!

Thanks for your hard work. I think I like Steve's sound bite, "Its not the size of the tank, its the size of the tap". I think we passed the peak in crude plus condensate in 2005. And, call it what you will, supply isn't keeping up with demand these days, even counting ethanol and the synthetic crude from Canada.

Schlumberger, whose opinion I value highly, suggests that we will experience an 8% rate if decline, leaving us with around 50mbpd by 2020, Matthew Simons figure of estimated world production.

Bob Ebersole

If the U.S. oil + liquids production in the past 35 years has fallen less than 50% from peak production, then you have a model of a large system decline of less than 2% per year.

At that rate, it might be possible to switch to natural gas cars in some cases and conserve some without widespread panic.

As OPEC is likely holding some production back, and other areas are below maximums due to narrow pipelines, you might get more of a flat gentle deline than a steep cliff. If you put more lines per inch on your chart it seems like a crisis of unprecedented proportions. 1-2% declines are less dramatic.

A number of people refuse to account for NG liquids in their speculative peak predicitons. NG liquids production is expected to grow with a number of NG projects being brought towards completion.

Price spikes might cause people to go without the oil. Whether or not that want gasoline, they will buy it.

The us has indeed declined at a low rate, but this is because we were blessed with deep water in the gom plus arctic reserves to tap. On a % basis the world cannot do what we did.

A 2%/y world decline may be possible, but anyway represents 2x the decline rate since 05... and we are continuing to see a geometric increase in demand from china and the exporters. The us decline came during an era when other countries were able to fill the gap, thereby allowing world and us consumption to continue climbing 2%+ even as our supply declined at the same rate. A world declining at 2%/y will have serious affects, and meanwhile NA/europe are quickly running out of ng.

If you add a U.S. inflation rate of 2-4%, then you get some more appreciation of the value of oil. There were technological advances all along the way since 1932 when it was estimated there were 10 billion barrels left in the United States. They did not have horizontal or offshore drilling yet. The technological advances to come might reduce the decline rate of some mature areas, but cannot restore the hundreds of billions of light oil gone from the world.

The problem in my opinion is not so much that oil is getting expensive. In fact if the increase were slow and steady I think we would adjust well enough and in time learn to live without. But it is the financial response that is likely to be the most dramatic. Will lenders continue to lend in a collapsing ecomony? I have heard many excuses for the dotcom debacle, but I really think it was banks upon realizing that the North Sea was in permanent decline that pulled capital from the market that killed the dotcom. If I recall correctly it was a Bank of America guy that first called the downturn and was met with ridicule, for a few days anyway. If oil is determined to be beyond peak, then I think we will see money dry up and rather quickly as those that have, move to shore up their wealth and find ways to protect it. Gold is relatively flat, so I don't think the time is upon us yet. Housing today is sort of like the dotcoms in that it relies on an increasing supply of money. I expect that the housing bust will excelerate over the next year or so, if we are well and truly beyond peak, and Kunstler will be able to finally say "I told you so". It was interesting to watch the exchange rate with the Euro drop again last week just before wall street made its heroic jump. I expect they are related since the DOW is more a reflection of the M3 money supply, than the relative health of the economy. But of course when the DOW is doing well, we tend not to dwell on other matters that are less propitious.

Hello Rainsong,

Your conjecture for slow decline has merit, but I suggest you are not giving enough weight for deleterious blowback cascading into ever greater supply disruptions. Expect ever greater amounts of pipeline explosions [Nigeria, Iraq, Mexico, etc], burning of utility company offices and maintenance vehicles [Bangladesh, Pakistan, etc], theft of copper wires and other essential equipment [now occuring worldwide], and so on.

IMO, universal Peakoil Outreach is the best way to make people understand that enhancing blowback by criminal action is a sub-optimal goal. Community protection of existing infrastructure plus rapid community conversion of these assets to relocalized permaculture is the best path.

Rioting is counterproductive: recall my earlier posting whereby the Bangladeshi people should be peacefully collecting bottles for solar hot water setups instead of making Molotov cocktails when the blackout occurred. If they want to act stupid: the Grim Reaper will gladly mow them down. Their choice.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

For example:

http://online.wsj.com/public/resources/images/ED-AG121_sethi_20070715160...

"Daddy, I sure am tired of walking everywhere. Why don't we try Not-Blowing-Up the buses and trains so we can ride them instead?"

Taken from this WSJ commentary on Pakistan:

http://online.wsj.com/article/SB118454710945867204.html?mod=googlenews_wsj

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Apparently you have never lived or worked in Bangladesh. Strikes, called hartals, which normally include putting fire to something, at least old tyres, are quite common on a number of standard occasions whether this be an increase of bus fares or brownouts. The average Bangladeshi has no choice at all. Some of the riots are even paid by politicians. Why don't you take a plane and go there to tell them that their behaviour is counterproductive? Good luck.

War is chaos, and the chaotic will die off. There was also an end to war. Columbia was going insane with madness for some time. Have not read of any recent pipeline explosions there. One might have to accept that a percentage of production will always be down due to maintenance, break-downs, storms, violence, and inefficiency. One does not need these things, but must consider they happen and factor that into the equation.

This is the rule of tens - in 2002 oil was in the $20's, 2003 $30's, etc....2007 $70's etc. I wonder how long it will hold for?

Hello Saildog,

Once people have to start the daily lugging of two 5 gallon water jugs a mile to their houses-- I would expect FF-prices to rapidly escalate thereafter.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

It's been roughly 6 months since you made your $1000 bet and prices are roughly at the mid-point between the January forward-month price and $100. Would you make the same bet now?

Robert, forgive me, I do enjoy your writing, and take into consideration almost everything you say.

But I still hope, come December 31, 2007, that you lose your bet.

- rick

It's been roughly 6 months since you made your $1000 bet and prices are roughly at the mid-point between the January forward-month price and $100. Would you make the same bet now?

The bet was specifically front month WTI. That was $60 when we made the bet, and after the recent run-up is at $74 today. So, I am in pretty good shape, barring a series of unfortunate events. If oil headed toward $100, I think there would be a lot of profit taking by speculators that would dampen that rise.

Now, will I make the same bet for 2008? No. But would I bet another $1000 that oil still won't hit $100 this year? Yes.

how are the speculators going to sell at a higher price? prices have been steadily climbing for the past 6 months with no hard supply disruptions.

without a price spike, oil will continue rising as supply falls, and it is falling oh so slowly (but soon to accelerate). may 2008 will be the death knell of suburbia and most of the USA caused by oil price explosion, and hyper-inflammatory expenses.

The bet was specifically front month WTI.

I just had to check your profile page to make sure you wern't managing a refinery taking feedstock from Cushing or somesuch...

:-)

--

Jaymax

Michael Chertoff's gut tells me the black line has already crossed over the red. The signs and symptoms are here...

Canaries in the Coal Mine

http://www.theoildrum.com/node/2749#comment-209910

Thankfully, not rats in a drain ditch

"demand has been moderated as poor countries in Africa and Asia are increasingly unable to afford $70/bbl oil."

Demand isn't moderated. They are still demanding; they just can't afford to buy a commodity where the supply is less than demand.

Starving people can't afford food, but their bodies still demand it. But Michael Chertoff's gut has never rumbled from hunger before.

The Borborygmous Rat

According to my unsophisticated methodology there are 32 countries or areas in the world currently experiencing energy shortages. These have been reported in their local media within the last week. Most of these areas are in sub Saharan Africa but there are a few exceptions: Algeria, Argentina, and briefly Mexico which experienced some power failures to some 1200 business do to the gas line attack.

Interestingly, the price of energy is becoming a big issue in the South Pacific. Notably Saipan, Fiji, and PNG. I suspect local news media will report energy shortages soon. Pacific Island coverage has always been very very sparse, so the extent of energy issues might be grossly unreported.

Today was a bad day as Malawi was added to the list and Algeria returned with chronic gas shortages in Algiers. The Philippines, India, Zambia, Zimbabwe, Liberia, Bolivia, and Ecuador all had local news reports of energy issues within the past 12 hours.

WharfRat: "Thankfully, not rats in a drain ditch"

Definitely, but it does feel like a nine mile skid on a ten mile ride.

:>)

That is what makes "demand" an almost meaningless word in the PO debate. What people often mean is "how much can the world afford to buy at this price", not "how much do people want".

Demand will always be for more than is supplied when it comes to energy. If you take a years' supply of oil, distribute it, and then ask "who wants some more?" there will always be a few billion hands up. When you ask "who can afford some more", there will be a lot fewer.

The whole debate over supply vs demand is just an economics exercise. It gives little insight into the real number of people hurting for want of oil...

"You can never solve a problem on the level on which it was created."

Albert Einstein

Robert, IEA is calling for 88 mbpd demand in the fall of this year but production is going to be down around where it is now - 85 mbpd or maybe a hair higher, unless KSA antes up over 2 mbpd of production. Further, the current peak in all liquids and in C&C are both behind us. The all liquids peak looks breakable but C&C? I don't think so without some extraordinary event.

Question: Let's assume that 2005 was C&C peak and 2006 was all liquids peak. How far into the future do we have to go before you change your position and recognize those dates? One year? Five years? Ten years? I am not suggesting that you recognize those dates now, I am just curious as to what array of factors would cause you to reassess your position. Do we need to see year over year declines larger than X%? Or what other factors would cause you to recognize one of the current peaks as the actual peak?

For me, my position is simple - I'll revise my belief in a peak date when we get higher production numbers than prior. My belief is testable, falsifiable, and adaptable to the facts. Right now 2005 is the peak C&C year no matter what anyone else wants to say. And it will remain the peak year until production exceeds that.

Ghawar Is Dying as we slide Into the Grey Zone

"The greatest shortcoming of the human race is our inability to understand the exponential function.

I'm with this guy; I get a chuckle out of this.

Matthew R. Simmons, head of Simmons & Company International, a Houston-based energy investment bank, doesn’t just believe that peak oil has already happened. He told EnergyTechStocks.com that in another year or so the world will wake up and say – in Simmons’ words – “Oh, damn. We peaked in May 2005.”

http://energytechstocks.com/wp/?p=47

Not RR, but my take:

1) Several consecutive years of actually falling production (not a mere 'plateau').

OR

2) Combined and straight admittance of final global peak production from those with the biggest reserves and biggest anticipated spare capacity (i.e. KSA/Iran/Iraq/etc).

Option number 1 isn't going to be very helpful and option number 2 just is not going to happen.

I'm with Deffeyes/Simmons and the rest of the bunch on this. It cannot be known for sure until it's in the rear view mirror (for some years) and by then it's mostly academic rather than of any practical value.

Or, you could define the peak as 'the end of cheap oil' ... if so, then I think we are now at that point and I think RR might agree on that.

If 'the end of cheap oil'is indeed here now then I think a lot of people are going to be caught out ... CERA for example!

Xeroid.

xeroid,

I'm with you. We can argue with the cornucopians forever about when we are peaking in which commodity, and what is oil. But its damn hard for anyone to argue that enough oil is going to come on the market to satisfy everyone's wants and needs at a price of say, 1 Yeargin($40/bbl), except of course, Daniel. Bob Ebersole

Or, you could define the peak as 'the end of cheap oil' ... if so, then I think we are now at that point and I think RR might agree on that.

Yes, I agree with that. In fact, in 2005 when oil crossed $50, I told my then boss that it would never go back down to $50. He laughed and said that we were just in a bubble.

But the purpose of this essay is that while I think oil has not yet peaked, it doesn't matter. If my thesis is correct then for all practical purposes we have peaked.

How much production growth do you think is left in the system, Robert? 2mbpd? 5mbpd? I certainly will not hold you to this since any guess any of us make is just as likely to be wrong as right.

I do find your second paragraph illuminating:

So are we, for all practical purposes, past the question of "when" and should we be discussing "what do we do" instead?

Ghawar Is Dying as we slide Into the Grey Zone

"The greatest shortcoming of the human race is our inability to understand the exponential function.

How much production growth do you think is left in the system, Robert? 2mbpd? 5mbpd?

I have thought that we might squeeze 5 mbpd on top of where we are at, but the more time that goes by, the less chance of that we will have as we continue to deplete existing fields. But I think there is probably 2 mbpd idled around the world right now.

So are we, for all practical purposes, past the question of "when" and should we be discussing "what do we do" instead?

Regardless of any position I have ever held on peak, my position that we need to be addressing the eventuality right now has been consistent. I have never suggested that we don't need to be moving ASAP to slashing our fossil fuel usage and changing the way we live.

"you could define the peak as 'the end of cheap oil'"

For me, that was '72; 24.9 cents a gallon. Not much of a way to define peak oil.

Quite how the concept of demand can be reduced to a figure when the price is an unknown is beyond me. Where's the Demandometer? What would demand be if the price today were $25? How many solar panels and Priuses would have ben sold? The Idiot Energy Agency talks about a demand of 88 million, but how do you know it was there if only 85 are produced and sold? I'm sure they have a mumbo jumbo to cover their behinds, but as has been said, predictions are very difficult, especially concerning the future.

The salient fact in all this is that some OPEC producers are not about to be bribed to increase production, assuming they are capable, by a higher product price because they know the price will rise regardless. This nightmare in which inevitable future elasticity of supply figures into current pricing is as good a reason as any why the military is in Iraq. While all sorts of excuses as to why we should stay or leave are bandied about, those 'enduring bases' will endure as the oil patch police station for quite some time, Congress notwithstanding.

I always knew it wasn't going to be pretty.

Robert,

Thanks for your lucid presentation--top notch, as usual.

Now just one teeny tiny quibble about usage of the term "demand."

In economics, the term "demand" is well-defined; it includes both the willingness and the ability to buy something at a particular price. For the man starving to death, there is no demand for bread because he has no money to purchase any bread at any price. For me, I go out to buy bread I don't need, let it go stale and then feed it to the birds, but because I'm willing and able to fork out $2 a loaf (or whatever the market price is) I get counted as part of effective demand.

Thus "demand" has nothing whatsoever to do with needs, except insofar as these needs can be financed with money. If you have no income and no savings, then you can demand nothing, no matter what you need nor no matter how urgently.

Because usage in economics is so well established, so long established and so unambiguous, my inclination would be to stick with the definition of "demand" in economics rather than redefining the term or expanding it to correspond to current sloppy usage by journalists.

Robert's (and our) concern and intent in using the word demand is pretty clear. On a crowded life raft with one quart of water, "demand" clearly exceeds supply. If you don't like using the economics term, what word do you suggest?

I suggest using the terms "demand" and "supply" as they are defined in the discipline of economics. For one thing, only by adhering to such usage can there be any credibility among economists (who regard incorrect usage as a symptom of fuzzy or incorrect thinking--not without some justice).

Instead of misusing the term "demand," I'd go to the dictionary and thesaurus--probably the term "need" comes closest to what Robert means.

I do believe it is worthwhile to use correctly defined terms, both for clarity and for credibility.

My question was a sincere one. I would note, however, that as with many words, there is more than one valid meaning to the word demand. Webster offers not only the economics definition, but also the more common one, i.e., "a seeking or state of being sought after." I don't think the fact that a specific discipline has adopted one specific meaning for a word means it cannot continue in its more common usage. For example, in psychiatry, "panic attack" has a very specific meaning, rather different from the more common use.

If we go to words like "need" or "requirement" we are still very fuzzy because there is a wide range of what would be considered need.

I think for credibility among psychiatrists, the term "panic attack" needs to be defined as the psychiatrists define it. There is nothing wrong or obscure or quirky about the usage of "panic attack" by psychiatrists. If you want to talk psychiatric symptoms, use the correct vocabulary. Similarly, if you want to talk about economics, use the correct vocabulary.

Incidentally, in sailing we have hundreds and even thousands of well-defined terms that have a particular meaning in sailing. "Beating" means something very specific in sailing, and it has nothing to do with hitting anybody.

"Pinching" means something specific and something not to do in sailing, and there is no synonym to be found outside the sailing vocabulary. It would be quite wrong to redefine "pinching" to mean, for example, sailing close to the wind. (Pinching is when you try to sail too close to the wind and stall out the sail and hence slow down the boat.)

I see nothing to be gained by misusing the term "demand." In the context of economics ("supply and demand") terms are well-defined, and I think it is very useful to respect and adhere to these traditional and established definitions.

Consider some real life examples.

Last year, the New York Times profiled several American drivers, as oil prices climbed past $3 per gallon.

The only drivers who had really curtailed their total miles driven were the ones physically incapable of buying gasoline, e.g., a college student who literally did not have the money to buy gasoline to drive home every weekend to see his girlfriend.

In economic terms, we might say:

"Despite an increase in price, quantity demanded also increased, which reflected an underlying increase in demand. Some people were priced out of the gasoline market."

Perhaps the appropriate terms are "quantity demanded" and "quantity supplied".

Yes, this is a legitimate economic concept...it is called a shortage. It represents a disequilibrium in supply and demand, where quantity demanded exceeds quantity supplied. I'm not sure how to insert an image here, but here is a link to graph that depicts this:

http://en.wikipedia.org/wiki/Image:Price_of_market_balance.svg#file

Our friend, Homo Economicus, assumes that markets will tend toward equilibrium, so in the absence of external constraints, the supply curve will shift outward and/or the demand curve will shift inward until a new quantity demand and quantity supply are equal.

I'm glad that classic Economics has reared its head. The lay person will usually think it's about money, but it's really a social science.

'Panic attacks' are very real, and it does not necessarily have anything to do with truth. Take bank runs earlier this century. All that's necessary is the *perception* that a bank is on shaky ground, and the depositors will make it self fulfilling prophecy.

The same will happen with oil. As the price climbs, moments of panic will set in. "Hmm, I don't NEED gas right now, but I might in the future. I'd better get it now." If supply gets thinner, but is still available, binge buying like this will set in.

Ever see the grocery store before a snow storm? Something about snow must bring the bread and milk lover in everyone. (personally, beer and steaks would be at the top of the list ;-)

The same will occur on the supply side. As countries see their supplies dwindling, they will likely hold back production for domestic use.

The best we can hope for is that the demand and supply curves flow smoothly against each other. That way, our economies can make relatively orderly adjustments. Given shocks and jolts, politicians get jumpy, and generals get itchy.

. . . and that would be bad.

Gasoline turns bad after a time, (several months) so caches would quickly become useless after a time (max 2 years).

a long term outlook on sshort term survival

Hi Don,

In many cases the term "demand" is simply not enlightening when strictly defined in that way.

From your post further down:

"Demand is the willingness and ability to pay for a good or service based on prices and quantitities."

When it comes to oil, there are plenty of people in the world - billions perhaps - who want more gasoline/oil for heating/etc., but cannot afford it. They are not really figured in the "supply and demand" model. It seems rather lacking...

What about a "supply/demand/would like/really need" model? :)

"You can never solve a problem on the level on which it was created."

Albert Einstein

Don, is it possible for demand to exceed supply? Or put another way, given the economics definition of demand above, what is the definition of supply? Since Robert is using barrels of oil as the good, would supply be the amount extracted in a given timeframe, or the total amount available to be sold, including both the amount extracted and the amount in inventory?

We had an argument a month or so ago in which WRS was arguing that the oil companies are manipulating the market to keep prices high, and part of the discussion was at which point the prices are set, at the gas pump, or somewhere higher up the supply chain. That brought up the question of what counts as supply, and none of us were economists to settle the question.

The following definitions are from "Economics: Making Good Choices" by Don Millman, 1996.

"Supply is willingness and ability to sell a good or service based on prices and quantitities during a certain period of time." page 76

"Demand is the willingness and ability to pay for a good or service based on prices and quantitities." page 56

The the ability to pay for a good or service is essential to the concept of demand. There is no reason not to use well-established definitions that are clear, unambiguous, generally well-understood, and useful.

Note that "demand" refers to (an implied) demand curve that covers a range of quantities at a range of different prices. Similarly for "supply." To refer to a particular point at which transactions occur, economists use the unambiguous terms "quantity demanded" and "quantity supplied," which mean, respectively, amount bought and amount sold. (Note that the amount bought is always identically equal to the amount sold--true by definition.)

There can never be a situation in which quantity demanded is greater than quantity supplied. It is possible to draw on a graph a downward sloping curve (demand) that does not intersect an upward sloping curve (supply) simply by truncating the curves. In other words, at a high enough price, zero would be demanded. (One million dollars for a gallon of gasoline.) Similarly, at a low enough price, zero would be supplied (twenty-five cents for a barrel of oil, for example). Thus it is possible to draw graphs where there is no point of intersection between the demand curve and the supply curve.

In the real world, we do get an intersection, and that price is the transaction price and quantity at a particular moment in time.

("Equilibrium" is a whole 'nother can of worms; let us not go there today.)

Um, "Economics: Making Good Choices" sounds very familiar. That wouldn't be the title written by a former economics professor who later took up sailing instruction, would it?

I do recognize that Prof. Millman is an eminent scholar, but you wouldn't have a book from a lesser light to confirm the definitions, would you?

I just dug out an old econ text from among the family heirlooms and it makes clear that demand must have teeth.

i.e. the economic agent really has to be willing and able to buy commodity x at price y

For what it's worth the text is Economics 5th ed. Lipsey, Purvis and Steiner (1985)

Har dee har har!

PG has no compunctions about "blogwhoring".

Why should you?

In equilibrium, Qd = Qs. However, it is possible for Qd > Qs or Qs > Qd if external constraints interfere with the pricing mechanism.

An economic shortage occurs if Qd > Qs at the current price level. On the other hand, an economic surplus exists if Qs > Qd at the current price.

Examples of external constraints include "price floors" (e.g. alcohol) and "price ceilings" (rent controls in some areas). In the absence of externally imposed constraints, the demand and/or supply curves should adjust, resulting in a new equilibrium price.

As for the oil market, I think the current situation is best described by shifts of both the demand and supply curves. Higher demand for oil at existing price levels shifts the demand curve to the right. This causes a temporary increases in oil prices, which encourages suppliers to increase exploration and production. As suppliers increased production, this shifted the supply curve outwards. In the end, the new market equilibrium was often in the neighborhood of the previous.

Nowadays, the outward shift of the supply curve is not keeping pace with the outward shifts of the supply curve. Hence, prices are rising. In fact, some would argue that the supply curve is no longer shifting outward. (The supply curve for oil can only shift outward if the gains from new production more than offset losses from depletion). If the demand curve keeps shifting (globally, 2%+ a year--or even only 1.6% per OPEC) in the face of a non-shifting supply curve, prices will continue to increase. However, that's nothing compared to what will happen when the supply curve begins to shift inward due to depletion! The question is, "are we there, yet"?

Demand and supply shifts provide only part of the explanation. Also important are the shapes of the curves--especially for the supply curve. From what I understand, the supply curve for oil is quite steep, therefore, relatively inelastic (I would like to verify this). Increases in price generally encourage more production, but production increases are generally less than proportionate to the price increase itself. My guess is that the global supply for oil will eventually become vertical, meaning that Qs cannot increase, regardless of price. (I'm trying to figure out whether this occurs before or after the supply curve begins its leftward shift--or if I am completely off-base!).

Debbie

In the short run, the price elasticities of both demand and supply for oil (and oil products) are highly price inelastic.

Over longer periods of time, both demand and supply may be price inelastic--but not to the extreme degree that they are in a short run of months or a few years.

One huge reason for the extreme price inelasticity of demand for gasoline (and similar oil products such as diesel or jet fuel) is that in the short run there are no good substitutes. None. Zip. Nada. For example, car pooling is not a good substitute for buying gasoline for most Americans. Scrapping the new Ford Excursion and buying a Prius is an example of finding a substitute, but for most Excursion owners this deed is too horrible to contemplate.

Over time, substitutes such as light rail and electric cars may make a big difference; this year and next year and the year after they will make almost no difference to the price elasticity of demand for gasoline.

Thus in the short run in my opinion the result will be 1970's style shortage events especially if you believe the market is underpricing oil. For example if you believe in peak oil you would consider the current prices way too low to correctly account for the inelastic nature of the market. This reflects the short term nature of the oil market which is primarily concerned with supply/demand over a few months.

Then of course you run into the issue that alternatives get very difficult to implement once the market correctly recognizes peak and reprices oil correctly. Since a significant amount of oil is needed to implement alternatives.

I don't know what this is called but its the situation where a farmer eats next years seed corn rather than starve to death.

How about "quantity demanded", "quantity supplied", and if necessary, "quantity shifted into (or out of) storage"?

In order to understand the simulation and the discussion, we need to be more rigorous than in ordinary lazy journalistic discourse, so even "need" is too vague - I can't determine what a Y axis with that label means. Otherwise, we simply don't know what we are talking about - and I don't mean that in the way we use the expression to mean fibbing or spinning, but in the literal sense of not knowing.

Now, since a simulation could not possibly be run without building a considerable set of assumptions about elasticities and prices into the initial conditions and the operating code, it would be interesting to know what assumptions were actually made. That would answer Petrosaurus' Demandometer question.

These may be outdated, but provide a few demand and supply estimates (source: IMF 2006, http://www.imf.org/external/pubs/ft/wp/2006/wp0662.pdf).

Note: NEER represents the U.S. dollar nominal effective exchange rate

Don Sailorman,

Or lust after in their hearts, if you use the born-again christian terminology. It seems pretty ridiculous to project demand for a long period after supply can't keep up.I find these extended curves to be neither clear nor credible.

I think that what you say comes down to the observation that once we get far, far away from current prices it is hard to figure out what supply or demand would be. In 2007 dollars, I do not have the faintest idea how much oil would be supplied (over time) at $1,000 per barrel--nor do I have a clear idea as to what quantity demanded would be.

Economists, by the way, generally do not use graphs in their professional work. "Graph" is actually an abbreviation for "graphical equation," because what you are really doing is showing an algebraic equation on graph paper. Graphs were invented to make concepts easier to learn for students. Properly used, they are good at that. In the great majority of economics classes, however, graphs are NOT properly used, because the student gets the explicit or subliminal message: "Memorize the graph. Don't worry about what it means."

In teaching economics I always constructed graphs slowly, step by step, starting with the axes and a discussion of independent and dependent variables. Next I'd go to a table of numbers, and only later plot this table of numbers. Most economists cannot write or teach their way out of a brown paper bag. Most economics textbooks (with the notable exception of the one I wrote:>) are virtually unreadable--all right as reference works (e.g. for definitions) but almost useless as learning tools. The reason for this failing is that publishers try to please the profs (who dictate which book the student must buy) rather than the hapless students.

There are, however, more than a few good economics textbooks out there, e.g. all editions of Samuelson, starting with the first in 1948 and one of my more modern favorites by Colander. The reason I wrote an introduction to economics text is that I thought all of those on the market were more obstacles than aids to learning. Another really good economics textbook is the famous one Alfred Marshall wrote more than a hundred years ago. Now there is a book to be proud of--where the graphs are clearly explained and the footnotes are full of calculus and algebra.

Don Sailorman,

At a thousand bucks a barrel I'll borrow my son's pickup, go out in an old oil patch and find an old unplugged well, lower a tin bucket on a rope down the well and start hauling oil up! My father talked about seeing a fellow actually doing that at the old Humble oil field in Harris County, Texas back in the 1960's, although he used a winch.

Thanks for the explanation. My memories of Economics 101 are a little fuzzy. It was over 35 years ago and I was smoking a lot of pot at the time.

While you are correct when looking retrospectively or at current conditions, projected supply and demand are under no such constraints.

As long as we are clearly looking at "projected demand (historical pricing)" and "projected supply (historical pricing)" and trying to evaluate what the real situation will be to bring those projected curves into sync, I believe we are on solid ground from the economist's definition of supply and demand.

Keyword: "projected". Use it and avoid these arguments in the future.

Of course, from a Peak Oil perspective, what is most interesting is production capacity or "potential supply", which has the particular characteristic that economic supply cannot exceed potential supply.

Under present circumstances, this analogy is too maudlin and confusing to be useful. It's an emotional trigger but it does nothing to help me understand what the quantity on the Y axis of the graphs "really is". For an historical graph, it might be "quantity lifted at the well head", "quantity available for end-use consumption", "quantity actually consumed", "quantity actually consumed plus quantity stored or released from storage", or who knows what else. For these simulations, it could be any of an even greater variety of things, as for historical data I can look up the price, but here price seems to be a hidden variable. So I haven't even got a proper way to use the graphs to project the trajectory of the emotional issue.

With respect to that emotional trigger, it has already been true for many years that while some folks have been able, say, to freely and profligately consume oil products to go on endless business or show trips that could have been accomplished as well and fully over the telephone or the web (not all such trips but probably the great majority including, e.g., most of Al Gore's book-signing events), others don't have "enough" for "basic needs", whatever that means and whatever those may be. So it adds little or nothing to the discussion in the keypost, even though it is a terribly important matter for a different discussion, but one that is not at all new.

Agreed. You can also see this use of "demand" in the graphs, because when the price increases of a commodity, the amount demanded should decrease.

"Demand" is not the same thing as a claim, a want, or a need, which are better words for describing what is happening here. You can demand a barrel of oil today if you have $80, and you will actually get the barrel demanded when the $80 has been exchanged. You cannot demand a barrel for $25, nor can you demand a barrel if you have no money.

It's almost like "demand" and "capacity" on the graphs are two different ways of actually looking at oil supply.

Ah, but a gun might get you your barrel in the absence of money.

Adjectives can be helpful. Consider 'Economic Demand' or 'Buyers' Demand' on the one hand and 'Political Demand' or 'Overshoot Demand' on the other. 'Overshoot' will fit most food shortage situations post-peak.

_____________

Exxon-Mobil CEO Rex Tillerson says that "the world’s oil would not run out in his lifetime". Means nothing... this guy doesn't buy green bananas.

Then Don, I suggest you start by complaining to the IEA. They are using the term "demand" to mean what the world wants versus what can be delivered and they are the ones that are now saying there is a "shortfall" between "demand" and supply.

Further, I find the constant redefinition of plain English terms by economists to be useless philosophic prattling about how many angels can dance on the head of a pin. I will consider your useless definitions when you back them up with the scientific method. But oh! I forgot! Economics considers itself special and exempt from the scientific method yet still a science. If you want to redefine a term, show me the theory and the math behind the term AND the experimental data that validates the theory. I also find the constant redefinition of terms to be an attempt to steer the conversation into a dead end, the false dead end of free markets and infinite growth.

Otherwise redefining "demand" is BS, pure and utter garden fertilizer. I'll trust a theologian before I trust most economists.

Ghawar Is Dying as we slide Into the Grey Zone

"The greatest shortcoming of the human race is our inability to understand the exponential function.

Economists created the terms "demand" and "supply." Some publications, e.g. the aptly named "Economist" and also "The Wall Street Journal" use the terms "demand" and "supply" correctly, because their editors demand correct usage.

In Sweden, they give Nobel Prizes in Economics. Note that none are given for any other would be social "science." Could it be that those Scandanavians are on to something?

The so-called Nobel Prize in Economics is not a good argument for economics as an exact science. It should actually not even be called Nobel Prize, because it is not sponsored by Alfred Nobel and was not mentioned with a word in his testament. It was instituted and paid for more than half a century later than the other prize categories by the Swedish National Bank "in memory of Alfred Nobel".

What other prize than one for economics would a bank institute?

But I agree with you, that in an article about economics the terms demand and supply should be used in their well-defined economic sense.

Don't be cute, Don. You know better. A science is any study that applies the scientific method, not circular logic.

Human logic can conjure up all sorts of silliness. It is only when logic is coupled with real factual observations which give rise to a testable, falsifiable hypothesis that we have a real science.

Ghawar Is Dying as we slide Into the Grey Zone

"The greatest shortcoming of the human race is our inability to understand the exponential function.

Demand as used on economy has a definition. Demand as used by the IEA has no definition.

"What the world wants" is no definition, since if gas were quoted $0.5/gal everybody would be driving like crazy, and wanting a lot more gas than today.

"What the world wants" by current prices is what is being sold (i.e. production - stock increase). The price will always change to make that true, even when there are gorvernments manipulating it.

So, I'd say to stay with the definition from economics or define it again. Using a loose term, that is defined nowhere is bad style.

Wouldn't the concept of consumer surplus be useful here? If I pay $80 for a barrel of oil but it is worth $100 to me then the transaction isn't truely equal to both parties (assuming its worth $80 to the seller). In addition to the barrel of oil I still have the 20 bucks. Now I understand its conceptually complicated because if I'm buying multiple barrels, each additional barrel is worth less to me. I don't value all of them the same and neither does the seller.

But I'm not an economist. Presumably there is an equivalent 'consumer deficit' which accounts for all things not purchased but desired. This is the concept we are trying to define. But its difficult to put sterile words on a sensitive topic like the demand (no wait) consumer deficit of something as important as food.

Since world population and world income are increasing, Robert is probably correct that demand is increasing. The demand curve is moving to the right. What Robert's essay doesn't cover is that the supply curve is moving to the left--that is, oil supplied at a given price is decreasing, because the cost of production is going up. More oil will be expensive tertiary recovery from older fields, extra heavy oil, and expensive deep water oil. This will tend to magnify the price impacts of increased demand.

Involuntary Oil Production Decline in a Multi-basin System

One thing I'd like to say is I think we are underestimating the purchasing power of the poorer nations. In general incomes are distributed unfairly with 10% or less of the population controlling 90% of the wealth. Oil usage in these nations is similarly unevenly distributed not to the extent money is but lets say 50% of the oil is used by 15% of the people. Its easy to think of each poor country as a micro version of the world with the wealthy class mapped on the United States.

What this means in my opinion is yes you will have demand destruction for the poorest people in these countries but the wealthier people actually have purchasing power higher than the average American and remain as competitors on the world oil markets.

Only when the internal economies begin to crumble and the wealthy flee will you see a demand drop in these countries.

In general however these wealthy refugees will continue to be competitive for oil although they may be in a new country.

As and extreme consider your generic tyrant ruler of a African nation his oil usage remains effectively constant regardless of the state of his nation. Thus as bidding wars develop for the remaining oil the number of bidders is actually quite high. Yes we do have poor people that are losing now but they did not use significant quantities of oil and oil products in the first place so removing them from the market results in only a brief reprieve.

The poorest people leaving the oil markets in combination with some conservation in the wealthier nations is probably what

has allowed prices to remain relatively low to date but the point is even as demand destruction continues in this group we probably won't see it free any significant quantities of oil. Thus we have probably effectively gotten as much out of this group of oil users as possible.

Expect that either today or soon for the bidding for the worlds oil supplies to be between groups of equivalent wealth.

Robert, I thought this was a very good article. Memmel makes a good point about the purchasing power of rich people in poor nations.

I believe we need to think of demand destruction not in terms of nations, but in terms of people. As prices rise, poorer people in all nations will be affected. It would be complex to try to quantify the price level at which a certain percentage of people in each country drop out of the market. I suspect it would be something like this: at $100/barrel oil, U.S. oil consumption will drop 2%, Chinese consumption will flatten, Ugandan consumption will drop 15%, and Saudi consumption will continue to increase at 3% per year. I'm just guessing at those numbers, but the point is that nations as a whole are not affected so much as groups of people within each nation. Some very poor people in the U.S. whose lives were especially dependent on oil are already hurting.

Right.

Now here is the problem with a market of this form. We quickly end with a stalemate where price increases are not able to effectively curb demand once the reserves of poor are removed.

Its of course difficult to estimate how much demand is from poor that can be effectively priced out of the market but just looking at the economies of various countries point to it being a fairly low number in the range of greater than 1mbpd but probably less than 10mbpd. If we could find information on oil usage in a third world country by income instead of relying on anecdotal evidence it would be useful.

The problem regardless is once these consumers are removed we are left with a Mexican standoff situation where demand is very inelastic to price signals since substitution would require a major change in lifestyle. Instead these consumer will stay in the market until oil prices cause general economic conditions to change and removed these consumers from the market. In short the American consumer will continue to purchase gasoline until they lose their job and max out their credit cards and are thus simply physically unable to purchase gasoline regardless of price.

In my opinion the current oil prices have been high enough for some time to eventually cause this sort of economic collapse its simply that the massive debt taken on by the world has allowed the world economy to continue. KSA if they actually have reserve capacity has already made a horrible blunder and the real economy has already been sunk by high oil prices with only inflation/dept of the fiat currencies keeping things going in the short run.

But geologic depletion marches on so even though a crumbling economy may offer some short term price relief any chance of a rebound will again hit geologic constraints. The net effect is at each economic event we have a large pool of people no longer part of the oil economy. For western nations the presence of this new class of true poor similar to third world countries is unprecedented.

memmel, I agree that the ill effects of the steep rise in oil price from 2005 to the present have been concealed by growth in money supply and easy credit.

Since all the industrial countries are currently expanding their money supply at 10%+, I think it's reasonable to expect an approximation of the mid-70's early 80's experience: nasty recessions and double-digit price increases.

Back then, the pain was followed by a boom resulting from low oil prices (due to conservation efforts and increased exploration). However, since we have done the cheap and easy conservation and exploration is unlikely to find many elephant fields, any "recovery" this time will probably find KSA able to get top dollar for whatever oil they care to sell.

I think it's possible that KSA's very well-educated ruling family are directing their affairs about as well as possible...

PLAN, PLANt, PLANet

Errol in Miami

I don't believe that KSA has 2mbd of spare capacity thats real or longer term i.e greater than the 90 day definition.

http://globalpublicmedia.com/transcripts/2647

The technical definition is not very comforting. To my knowledge KSA has never clarified their claim of 2mbd of spare capacity. I find the fine print disturbing.

So we can only hope that KSA is actually maintaining a real cushion even if they are in decline. If they don't we have no control of prices or more troublesome a change in perception when a event happens that causes prices to spike and we find out the taps are dry.

I happen to think they have some real excess capacity probably less than 1mbpd and that they are capable of a 2mbpd burst for at least 30 days I don't think they can make it to 90.

I'm sure eventually we will get a chance to find out exactly what KSA is capable of. I was hoping someone would sleuth out given what we know about Ghawar exactly what KSA's spare capacity might be and what the nature of that capacity is.

memmel,

spare capacity is often hard to define. If a well has good pressure, which the Saudi wells do to produce at the rates they produce, then the well is choked back by using a very small valve so that the pressure is maintained and the formation drained evenly. Generally, the slower you produce a well the higher the ultimate recovery. Calculating the Maximum Efficent Rate (MER) is not an exact science, but believe me, it exists.

In the early days of Texas production many fields were produced far in excess of the M.E.R. and the reservoir energy was wasted so that huge amounts of oil were left behind. In 1932 the Texas RailRoad Commission started to require that all fields be analised for the MER and that the amount of oil produced would not depress the market. The most famous example of this was the East Texas field, and allowables were set at 19 bbl. a day. In WWII the allowables were lifted, and the field produced at a much higher rate, but after the war the production was choked back. That's whats meant by spare capacity.

The question is can the Saudi's produce at a higher rate without harming their production? I'm sure that they can produce more oil, but why would they want to risk ruining their fields for the sake of cheap oil for American SUV's?

The other thing we don't talk about much here on TOD is their perception of our society and our imperialist policies. The Wahabi's are very much puritans-they consider western society decadent. I do too, but I'm quite corrupt and enjoy decadence. They are probably still angry with the way they've been slurred by us for the last 40 years, and certainly upset with the way we've supported Israeli aggression against the Palestenians. I don't think Osama Bin Laden is a great anomaly from their culture. And lastly, they consider the way we used North Sea production to cut back on their revenues as an act of economic war.

The Saud's seem to view us as the goose that laid the golden egg, and they have the string of energy dependence around our necks. They're not going to tighten the string so as to strangle us, but if we get old and stop laying, they'll pluck us and cook us. Our only chance is to break the string-but we're not going to do it, so prepare to be roasted!

To the second part the chances of them actually increasing production are slim IMHO for the reasons you mention. Once they have confirmed world peak I actually expect another Arab Oil Embargo to force elimination of Israel. The reasons for the first one have not gone away. I'd guess they are waiting at least another six months at least until they see real declines in non-OPEC production just wait till non-OPEC production is in confirmed decline..

Next given the wells are choked down how long can they be opened up without causing damage I'm going to take a wild guess and suspect its less than 90 days. Also we assume they are still doing well rotation so this can be stopped for a time again I suspect less than 90 days. In reading about Texas production it seemed wells were run for some time above MER before sustaining damage to the field.

Memmel,

figuring out how long the wells can be overproduced is petroleum engineering. I'm not an engineer.The Saudi's have the best engineering in the world, but their engineers are bound by confidentiality agreements. So, my guess is we'll never know until the data is irrelevant.

Bob Ebersole

That's a good way to think about it.

In fact, to the contrary of some expectations, Africa has been increasing its oil consumption lately. According to the BP Stat Review, "other" African oil consumption--excluding Algeria, Egypt, and South Africa--was up 4.2% over 2005. Over the same period, US consumption fell 1.3%, and the OECD consumption fell .9%.

"Poor" countries bought more oil last year, "rich" countries less.

According to this:

http://www.nationmedia.com/eastafrican/current/Business/biz1607073.htm

5% of Uganda's population has access to electricity so their energy consumption, theoretically, could only go up. But the price is expensive for these folks so it's unlikely to go up by very much.

The best prediction for oil consumption is a country's rise or fall of gdp. A poor country might be growing fast, like china, and consumption will naturally rise almost irrespective to increases in price. A rich country with fairly stagnant gdp will probably see declining use if prices are rising.

In cases such as Nigeria, you have the disenfranchised taking up arms to redress this inequality. The result so far is that the poor of Nigeria are taking substantial amounts of oil off the market, meaning that nobody gets this oil.

Back to Peak Lite... I would guess that an assessment that sees higher production in the future (than the currently valid peaks) depends in part on countries like Nigeria getting back up to full production. Personally, I see little chance that the rebels in Nigeria will ever disappear or have all their demands met. In fact similar scenarios in other countries might further mitigate against 'Peak Lite' and in favor of 'Peak Heavy.'

I don't know about Nigeria in particular but I assume people in Nigeria with money rely on a black market probably supplied by the militants to get their gas/oil supplies. And in general these supplies are protected. The average citizen still able to afford gasoline at the nominal market price is left with it being unavailable. The point is shortages/hoarding/power control the actual supply and its not controlled by free market prices. I think that black markets are just as driven by influence and power brokering as price bartering product for power.

This leads to dissatisfaction and more insurgency damaging the oil infrastructure rinse and repeat. The point is some sort of free market balance between price and demand is not the driving factor in who actually gets oil.

The point is I don't think peak lite or peak heavy are really relevant if we have developed a gap between supply and demand. The actual oil supply will be less than both predict from now on out.

Your point could be condensed to: class divisions will come to be more salient than identities based on nationalism. This was a main criticism made of both dependency and modernization (or development) theories (the former itself a vigorous critique of the latter).

As several others have pointed out on TOD: we will likely never see PO "face-to-face". That is, the raw realities of either geological (Hubbert's Peak) or economic (peak lite) constraints will always be cloaked by more proximate interests and/or by symbols and language deriving (necessarily) from the oil age. We already have a good glimpse of this in the way the long war on “terrorism” conflates with and masks, yet is not reducible to, oil interests and needs. Which interests will seize/exercise the tools to frame how people think about PO?

This is very interesting to me. Could you please expand on this:

Thanks!

What else is new, it has always been that way and will always be, at least in the foreseeable future.

I won't make the same comment twice - but the flood doesn't even seem to be on the horizon anymore, and may have already reached the ebbing waterline, but Peak Lite does have the endorsement of the IEA.

Up till now, the American economy (in terms of oil usage) has not crashed, and while we can speculate about minor countries with major problems, no other major economy has either.

In terms of an oil company, caution in terms of price is certainly warranted. But in terms of production, if the world economy tanks, heroic efforts to extract more oil are less likely - and whether depletion or decline, it isn't standing still. And the above ground factor of climate change will also play a hard to decipher role - increased production as formerly forbidding polar areas become accessible, or decreased production in an attempt to restrict atmospheric CO2 levels from growing without effective controls.

Call it 'Peak Like' or 'Peak Lite' - only when the production numbers exceed the past will we know that we haven't reached peak yet. I'm not holding my breath - and the fact that various data sets are changing, to become more inclusive, is noteworthy.

Cheers to the most sensible article I have ever read on the oil drum. Good work.

Another interesting thing to remember is that we had "Peak Lite" once before, in the 70's. Throughout the 70's, we had a plateau in production, not an actual decline. But putting the breaks on the prior demand growth created the price spike from $2 to $40 with the resulting economic dislocation.

Peak Lite, even if that is all we get from 2005 to 2015 will be bad enough.

Those are nice charts. If we had more reliable data on REAL oil reserves, we could run a simulation. What if China has 200 million cars by 2030. What if the number of automobiles in India quadruple in the next 15 years? It would not be too hard to figure out, with the proper information and past patterns.

r.d. vincent

Well you should have bought the futures. You would have made over a three bagger already. But it may be more fun to win the bet.

Regards

I've felt for some time that what we realy need to be focused on is price. The simple fact is, as you have stated, the price is going to go up, it is going to go up sharply, and it is going to keep on going up for a long time to come.

"Peak Oil" sounds like a very abstract concept to many non-technical people. Oil at $200/bbl (compared to $20/bbl just ten years prior) is something far more concrete that they can understand. Translate that into equivalent amounts for a gallon of gasoline and you really get their attention.

From the aspect of pure economic theory, price will "solve" the problem of supply and demand. As supply plateaus and falls, increasing prices will bring demand in line with the available supply. Those increasing prices will also make more expensive resources like oil sands and oil shales economic to exploit. An economist could therefore say that there really isn't a "problem", and in a certain sense they are right.

Try saying that to the people paying the prices, though! "Demand destruction" is not just a sterile academic terminology -- behind it will be countless millions of stories of increasing pain and sadness.

We really cannot do very much about the fact that prices ae going up; any effort to change that fact will probably cause more problems that it would solve. The key question is: how do we (both we as individuals, we as communities and nations, and we as H. Sap.) cope with and adapt to the reality of rapidly rising oil prices (and ultimately all energy as users switch to substitutes)?

I disagree price won't solve the problem in my opinion the gulf between supply and potential demand for oil will be solved by shortages price is not the driving factor. Secondary demand destruction by loss of purchasing power from more general loss the ability to earn money to by oil will be a issue but this is not the primary way supply and demand will be balanced.

I don't understand why people think simplistic price/demand equations apply to oil. They don't apply to food we have already seen that demand seems to be inelastic why expect some magical price point that will make price a driving factor in controlling demand.

Here is what I consider a optimistic view point.

http://www.energybulletin.net/17574.html

However real events.

http://www.econbrowser.com/archives/2005/06/how_high_do_oil.html

Indicate that a 86% increase in price resulted in a 26% drop in demand. Also note in the 1980's we had a lot more room to conserve than today. This ratio is a bit debatable since it uses projected growth so is probably high.

Generally today we are finding that demand is very inelastic

with price so how can people assert price will control demand ?

It makes no sense but of course supply and demand must meet and the other choice is shortages thus expectations of a classical price driven supply demand curve are mistaken.

Memmel, ultimately you may be right, but with so many people driving Suburbans and Escalades, demand may be inelastic in the short run, but in the long run there is a tremendous amount of conservation (i.e. elasticity) that is possible.

The switch from a Suburban to a Prius is often derided in these pages as somehow trivial, but that represents an 80% reduction in crude oil consumption, and that corresponds to a 3% decline rate for FIFTY YEARS!!!

By then maybe we have a solution, or maybe we don't, but at least we have sufficient time to try to come up with something.

Prius / Suburban = 21% = .97e50

Ken

I don't think thats how it will work out. Instead the model I'm proposing is given 10 SUV drivers today the effect of peak oil and high prices will cause one of the SUV drivers to loose his job his McMansion and his SUV. The other nine will continue to drive SUV's and live in McMansion until the grim reaper again strikes tossing another into bankruptcy.

Now these unemployed former SUV drivers will do whatever they have to to survive probably rent closer to work but with dual income families this may not in general be possible. Next they probably will get at least a slightly more fuel efficient car but probably not a prius again results will vary since the older gas guzzlers are cheaper and these people have no savings. However now that they are bankrupt assuming they do find jobs they probably have more real cash available to spend on fuel. Only the case of persistent unemployment results in a significant decrease in fuel use. This scenario requires a increasing number of former SUV owners to go to basically zero oil usage to support the needs of the remaining McMansion/SUV drivers.

Now of course the McMansion/SUV drivers who still have jobs can't afford to sell the SUV or the McMansion since they are way underwater owing far more than they are worth and basically broke only continued employment is keeping them afloat so they are just waiting for the axe to fall.

The key point is the only way I think we will see real demand destruction in the US is by forming a new lower class of people that basically cannot find steady employment and cannot afford to drive.

I picture people sleeping in their SUVs, and only going home on weekends. A Freestyle with its seats down actually looks like it might be comfortable.

That will be the final destination of most RVs: permanently stationed in employer's parking lots, providing a home away from home for workers who are reduced to a weekly commute.

Now that could happen!

I have been thinking about our adaptations to higher and higher gas prices. People cannot just leave the suburbs in droves because they can't all move into urban or rural environs in droves. Especially if the economy tanks. Where will they get the money to build new housing for the 50% of people who live in suburbs.

But this concept of people sleeping in the parking lot at work and only going home on the weekends is very insightful. People have travelled from home to follow the work before.

Very good thinking.

CAS

Bring memories of one move I saw I think a Chevy Chase one where this redneck relative living in his RV was cleaning out the waste from the bathroom.

RV's actually have significant requirements when parked and the cost of moving them is pretty high. Its probably more realistic for people to move into manufactured housing parks created in the parking lots of unused office space and for the office space to be converted to residential areas.

In a lot of the cases this will be "former" RV's now very cheap because of Gasoline prices. Why would you think people would have the money to keep maintaining the alligator in the suburbs better to sell or walk away. Trying to do both is probably more expensive than either continuing to commute or moving close to work.

Also of course unemployment and unsteady employment will be a big issue. Suburbia is dependent on a continuous supply of people with reasonable incomes willing to smoke the crack of suburban living once this stream dries up suburban home values fall and continue to fall. Few people are willing to purchase a deprecating asset that cannot be used to earn money especially when uncertain employment and high transportation costs make being able to move close to the job important.

I've also got this vision of rows of porta-potties and tents in my mind thanks.

What I meant was that once the RVs are parked, they are parked for good, no more driving them around. The weekly commuters use cars or soemthing else to get home. I am thinking that an employer that otherwise couldn't get employees would be willing to at least put in electric/water/waste hookups to convert a section of their parking lot into an RV park. That's a pretty small price to pay to stay in business, and puts a mostly empty parking lot to good use. Employers could round up the used RVs themselves for pennies on the dollar, and then rent them out to their employees to create another profit center - it need not actually be a cost of business at all.

Still thats a hecka of a lot of poop your talking about.

Think RESOURCE! Build a digester and generate biogas (methane) from the stuff. Then sell the residue to a nearby organic farmer -- or plow up the lawn surrounding the facility, work the stuff in, and grow crops.

This mode of thinking needs to become SOP ASAP!

Since most Americans set in cubes pushing papers around how many of the jobs are going to be their post peak. And are these people going to have this big house in the suburbs to go back too ?

Or is the reality that these parking lots full of junk RV's will be filled with people working as day labor and their poop will flow into a open sewer and then into the local water supply as government services break down.

I think your right that the shanty towns of the future will start life as useless RV's pulled into the parking lots of abandoned low rise office buildings close to remaining employers. But these people won't have a car won't have a big house in the burbs to go back too and often won't have a job. This means we won't be offering them basic services.

What your really talking about are modern "Hoovervilles".

The twist is RV's can be used to create one quickly.

I think what people will do is try and drive these people out of the area. The chances of them getting decent sanitation, food and water are slim. I don't think you quite realize how cruel most Americans are esp to those who fail at the "American Dream".

If I managed their oil reserves, my goal would be to extract the highest possible price for the oil, but not so high as to trigger a global recession which would destroy demand and collapse the price.

As well as the capital markets in which dominant national oil producers put back the ginormous profits.

What exactly is the difference between "Peak Oil Lite" and "Peak Oil"?

As far as I can tell it is but the difference between

1) Oil production is going to go down because of geology regardless of human activities, no matter how heroic

vs

2) Oil production is going to go down because of geology and the realistic assessment of human activities.

It seems to be mostly immaterial. Peak Oil #1 is dealing with a hypothetical straw-man argument. Peak Oil #2 ("lite") is real life, and that's what people ought to be dealing with.

If oil producers voluntarily leave oil in the ground (in practice spending less on capital investment now) because they think it is appreciating faster sitting there rather than being produced now, how is that different from Orthodox Peak Oil?

There is only one difference that I see, and perhaps Peak Oil Lite might actually be (long term) beneficial.

What it means is that producer awareness of Peak Oil and their price/investment structure in light of this means that the date of Peak Oil has been moved forward, but the decline rate from the peak will be less steep than otherwise.

I.e. we'll take the hit sooner, but soften it. Mad Max might not come to pass, and if the consuming nations are smart, they'd recognize this "voluntary Peak Oil" as meaning that we have more time and money to invest in preparing.

I suggest that as a change of public motivation strategy Peak Oilists de-emphasize the "geology==inevitability==collapse" and encompass the scenarios that say that human factors will keep prices rising, and so we ought to deal with it as The Real Peak Oil anyway.