A Dollar beyond the eighties

Posted by Luis de Sousa on October 1, 2007 - 7:00pm in The Oil Drum: Europe

The US Dollar Index (USDX) is a measurement of the strength of the Dollar against six other freely exchangeable currencies. Since 2002 the Dollar embarked in a secular downward trend that brought the greenback to historic lows today.

|

The USDX secular trend and rDollar channel since January of 2007. Click to enlarge. |

This a crosspost from the European Tribune

Last August the first stages of a deflating housing bubble in the US brought a credit crunch that had visible impacts in much of the financial system of the Wealthy West. In a short space of time the Dow Jones lost almost 1000 points and most stock exchanges in Europe are yet to recover. Still during that time there was no visible move upwards on the USDX, which kept sinking piercing through the physiological barrier of 80 points.

On the 18th of September the Federal Reserve meet with an interest rate move on the menu as a way of giving some breathing space to those in trouble by the credit crunch.

The last time I wrote about this subject I wasn't that convinced of a strong move by the Federal Reserve. The Dollar was already below 80 points and in fact 5.25 wasn't a big number after all. Naturally I was wrong and the Fed cut the interest rate not by a quarter but by a full half point.

Panic, most people thought, and it was with panic that the markets absorbed the news. On the weekend of the 9th of September an analyst at Bloomberg was warning that we would see the Euro go through 1.40 and Oil go through 80 $/b before Christmas. Well, we got that in less than two weeks.

The Dollar entered a secular decline in the first half of 2002 that kept pushing the currency down until it got close to 80 points by December of 2004. During 2005 it paused in the wake of steady interest rate hikes by the US Federal Reserve, just to resume by the early days of 2006 when it started to become clear the rate hikes wouldn't last forever.

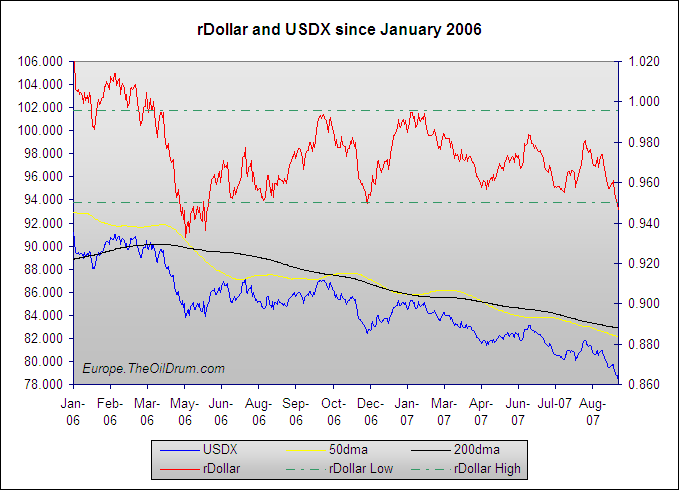

Secular trends are usually visible on the 200 day moving average (200dma) of a certain traded title or index. When the trend is up the 200dma marks the price floor, when upwards marks its top. In the case of the Dollar index (USDX) this is quite visible in the periods between early 2002 and late 2004 and between early 2006 and now.

Another useful measurement is the relative value of the title or index against its 200mda. When on a secular trend the value is usually kept inside an interval of the percentage of its 200dma. For instance between 2002 and 2004 the Dollar kept between 90% and 101% of its 200dma. This relative value is usually represented with an "r" prefix, in the case of the Dollar we get the rDollar.

The next graph shows the evolution of the USDX and its 200dma and in parallel of the rDollar since the beginning of 2006.

|

The USDX secular trend and rDollar since January of 2006. Click to enlarge. |

The secular downward trend resumed its slow roll by May of 2006 when the 200dma started pointing down again. Since then the rDollar has kept steadily in the interval 95 - 99.5 %. Every time the rDollar reached close to the lower bound of this interval a bear rally set in that brought its value up, just to gain more steam for the next decline. That is, until last week.

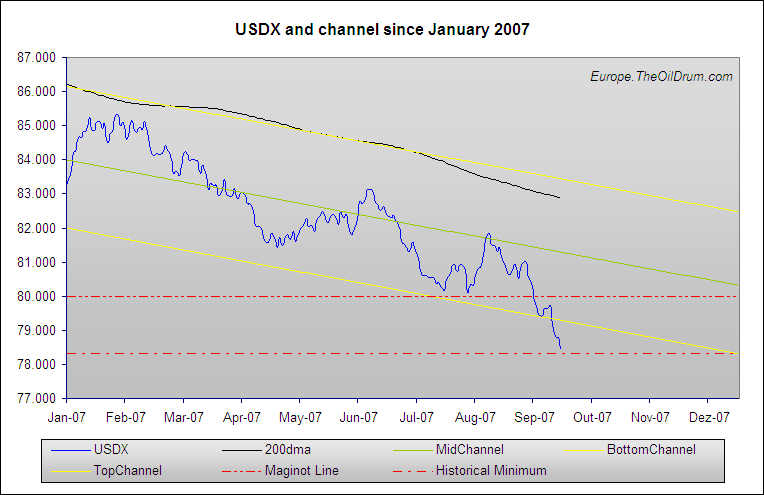

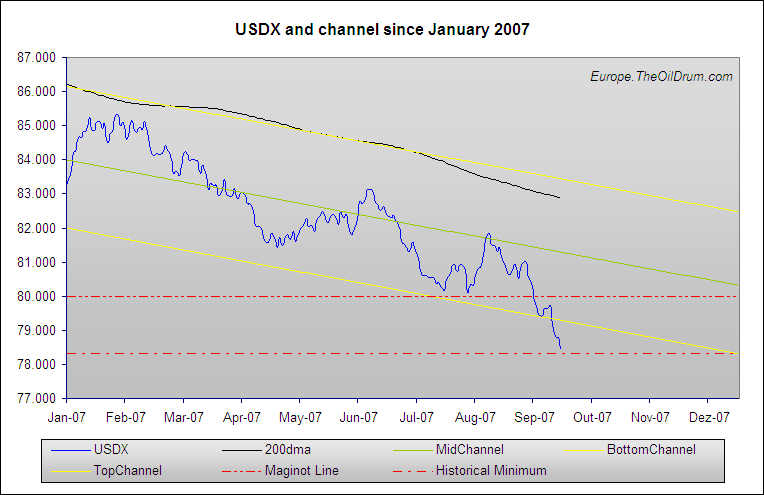

On the next graph this interval is represented in a different way. A line was fit to the 200dma and then replicated at the previous lower bound of the rDollar thus creating a channel and then replicated again at the middle of this channel.

|

The USDX secular trend and rDollar channel since January of 2007. Click to enlarge.

As it can be seen the USDX broke the Maginot Line by early September and two weeks later broke the previous rDollar lower bound neighing rapidly on its all time low. The term Maginot Line was coined by Roland Watson in 2004 and is indeed an interesting concept. And has long announced by various analysts the USDX was shocked up after crossing it.

Presently the 200dma seems to be moving to a steeper shape and at the same time there's a new rDollar bound to observe. Looking back to the previous three bear rallies they were progressively weaker and short-lived, announcing the acceleration of the secular downward trend.

Again, I personally don't expect this kind of movements to develop as fast as last week, my best guest is that a new bear rally is forming, but the acceleration of the 200dma is indeed worrying.

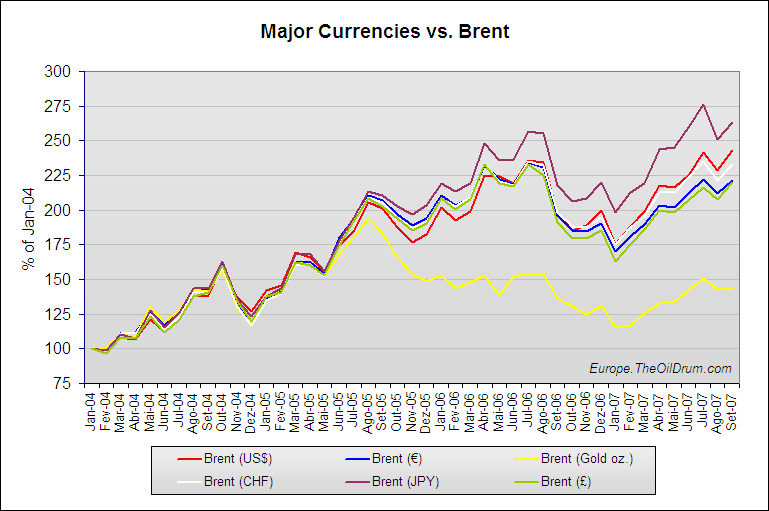

At the same time Oil visited its own records. The Brent blend pierced again the 80 $/b barrier and the WTI went as far as 84 $/b on what looked like panic trading. To understand what happened there's a graph worth updating:

|

Major currencies against Brent. Click to enlarge. |

Basically to take home from this graph is that Oil is at an all time high only against the Dollar. Against other currencies Oil was more expensive in the summer of 2006 or in last July. Against Gold the all time is still in the summer of 2005, but it is interesting to see that since the beginning of this year Gold has kept weakening against Oil.

We haven't seen record high Oil prices this month, just a very weak Dollar.

Looking ahead

Where will the Dollar end? Who knows, some say 70, others 60, others even hint at 40 with the full reversing of the "head-and-shoulders" previously formed. Unless there's a serious steering from the current policy by the Federal Reserve the secular downward trend is here to stay. At least until the Trade Deficit is brought to the ground, or in a worse scenario until when most of the Dollar currency kept as foreign reserve currency is dumped in the market the USDX will keep going down.

The crossing of the Maginot Line was left unattended by most of the media, possibly because it is more a psychological barrier than a real minimum. But, even if it gets back to the previous trend, the Dollar will one day close below its all time low (78.33) possibly during the next months. And then we'll see how weak it really is.

[Update 01-10-07] : This text was written originally Wednesday and it took only two days for the USDX to close at a record low – 77.72. The Dollar has now completed 13 consecutive trading days below 80 points, the same amount of time it had been below 80 since the establishment of the index in the 1970s.

All of this talk concludes that the US is accepting the current resource scarcity with Inflation. After the burst of the sub-prime credit bubble the US is facing a typical stagflationary environment, whatever the monetary policy, disadvantageous results will come out.

Some people think that the inflationary crisis into which the US is stepping in won't affect visibly other economies. In my perspective that will hardly be the case. First of all the root of the problem affects every country on the planet that's a net importer of commodities (be it energy, metals, food, etc) and secondly because the US economy is not closed.

The US imports raw materials from South America and Africa, manufactured goods from Asia and Services from Europe. In its turn all will eventually suffer. In 1980 the economy wasn't as globalized and dependent on Oil as it is today but the crisis eventually affected all or most industrialized and developing nations. The US might be first to seriously face the crisis but eventually it won't face it alone.

On the particular case of Europe the crisis has a different flavour from that of the US; here the problem is a currency on a secular upward trend against the Dollar. For now other major currencies are moving along the Euro, but if some of them stop moving that way we are in trouble (the sterling is unfortunately doing that).

Prices are becoming increasingly higher than in most of the world and that can't simply go on. Last week in Dublin I paid 11€ for two pints of lager, that's 15.5$ for a liter of beer. Eventually a deflationary crisis will hit Europe.

There have been serious calls on the press for a move on the interest rates set by the ECB, in order to stem the Euro's strength. Although not doing that exactly, Trichet took the chance given him by the sub-prime burst to loose the money supply lending hundreds of billions (US bn) €, but to no real effect. The problem is that at 4% the rate is already at an historically low value. A move downwards might be inevitable, but Trichet has to realize he has only four rounds in his barrel so he'd better use them sensibly.

And so we leave the Age of Cheap Oil and move into the future with Stagflation.

Previous log entries on the subject:

For now other major currencies are moving along the Euro, but if some of them stop moving that way we are in trouble (the sterling is unfortunately doing that).

I did a quick look some currency charts, the Euro has been gaining vs. most of the Asian currencies, particularly the Yen.

The Yen has inverted a downward trend against the Dollar in recent months that by itself is noticeable, attending to the fact that interest rates in Japan are close to zero.

As for the other Asian currencies, are you sure they are not pegged to the Dollar?

Luis,

The Hong Kong Dollar, Taiwanese Dollar, Renminbi are all pegged to the dollar. Currencies like the Indonesian Rupiah are (to my knowledge) not pegged, but generally 'heavily influenced' by their central banks to remain closely tied to regional Asian currencies (and hence the USD). The Japanese have no formal stated policy of currency targeting BUT given that the Japanese economy is still domestically weak and hence very dependent on exports, the Japanese government are VERY reluctant to see the JPY appreciate to any degree against the Asian currencies (and hence the USD). Hence both in terms of 'soft intervention' = central bankers and finance ministers' rhetoric and ultimately 'hard intervention' = selling JPY for USD in the forex market the Japanese will not allow the yen to strengthen against its Asian peers.

Thus, ultimately, the whole of Asia is tied to the USD.

All of the Middle East is also tied to the USD, since the large petro-exporters there (with the exception, since just recently, of Kuwait) peg their currencies directly to the USD or to their (USD-pegged) peers.

So, what can the USD weaken against? The only currencies 'left' are the major South American currencies - the BRL and MXP - the Antipodeans - the AUD and NZD and some others like the ZAR, RUB, CHF. Basically the Euro stands out as the obvious direct competitor of the USD, though. It has a big, efficient, liquid, well-regulated capital market which the other currencies I have mentioned before - BRL, MXP, AUD etc. - do not (to some degree or another). Thus the Euro is directly taking all the strain of the USD weakening.

I agree with your comments about the USD/EUR looking 'overbought' at current levels (just on short-term technicals). But I do think that 1.47-1.50 is a distinct possibility within 12 months.

Regards,

Cuchulainn

Thanks for adding this info Cuchulainn.

I (and probably most other people) was expecting 1.40 by years’ end the soonest, and there you have it in September still. If the trend is accelerating we can see all those scenarios pretty soon, I fear.

I agree with you that the Japanese will do everything to keep the Yen from running up, but it seems to me that it’s pretty much out of their control at the moment with the rates as low as they are now.

My reasoning about the Euro is the following, if the other major currencies move along, the countries with Dollar-pegged currencies will simply move to a basket of currencies (like Kuwait did) and avoid launching the Euro through the roof. If the Euro is found to be the only real alternative to the Dollar, Europe can be headed for a whirlwind.

So who gets hurt more by the depreciation of the dollar versus the Euro, Americans or Europeans? Nixon's treasury Secretary John Connelly said about the dollar prior to Bretton Woods, "It's our currency, but it's your problem".

Now it may be everybody's problem. But the pain may be felt in Europe first. And Europe's only option for reducing that pain may be to try to pressure China to let the Yuan appreciate, which will meet with strong resistance.

I still expect this is headed for a negotiated solution, Bretton Woods Two.

The dollar may be the poison gas, but Europe is the canary in the coal mine.

Yeah Jack, that's a good point that many people don't see. If the Euro goes through the roof we are in big trouble. But the US will feel it too, because foreign resources (especially energy) will become inaccessible.

The Bretton Woods Two is a good idea and possibly the only reasonable way out of the current mess. I hope it is possible.

Luis: There are problems associated with a fundamentally strong currency (Euro) and there are problems associated with a fundamentally weak currency (US dollar). The difference is that with a strong currency there are options (lowering interest rates, printing of said currency). With a fundamentally weak currency there are no easy fixes.

Brian you're conceptually right, but as I wrote, we have interest rates at 4%, there's not that much room to steer.

Luis: A global bidding war for declining oil exports is looming- a powerful currency is very important in that bidding war.

Luís,

Bretton Woods Two is a good idea, but it won't happen. The US fundamentally changed around 1975 with the dismantling of the Bretton Woods agreement. Prior to that the US was interested in helping the world. "Rising tide lifts all ships" and what have you. After that the US shifted to a zero sum game with the IMF, World Bank, WTO, off shoring, etc.

I don't know what the plan is. I don't know how this is going to play out, but the US was a generally positive force from WWII to 1975. Then from 1975-Gulf War II it was a generally negative force with an ostensibly positive mission. I expect that in the coming years the US will drop the pretense and become an overt tyrant.

Tim

"It saddens me that this brave experiment in self governance is failing" -my next door neighbor.

And so we leave the Age of Cheap Oil and move into the future with Stagflation.

With no cheap energy source to bail us out.

Any predictions on when we will pass through 70? 60? The runaway subprime train has only struck with the first car so far; the rest of the train continues to bear down in slow motion...

I don't like much making predictions on prices, especially now that the downward trend seems to be accelerating. Wait for the dust to settle and see if a new channel is divisible.

Now that the Dollar crossed all previous support lines it’s anyone’s guess were will it stop, but bear in mind that as it goes down the pressures behind the secular trend will fade away.

Everybody seems to be attracted like moths to a candle by the two doomer keyposts today. While I don't mind some of that, its both improbable and unremittingly gloomy. IMHO, association witk survivalist sorts is why peakists get labeled a cult. Way too many doomers/survivalists are in fact dangerous psychopaths-the latest was the man in Las Vegas who taped himself having sex with a three year old, but it goes back in US history as long as I am aware. They go from the apocalypse sorts like Warren Jeffs and Jim Jones of the Peoples Temple, to the Unibomber squirrel and Timothy McVeigh. I don't know if this type of philosophy attracts them, or that if a certain type of paranoid is attracted to visions of the world on fire. The Iranian suicide bombers with their vision of the 12th Imman seem to have them too.

The other thing thats possible is that so much of people's lives are spinning out of control that its easier to focus on a fantasy than to admit that we are all scared and powerless. Look at this key post. I'm lucky in that I'm in oil exploration and prices are rising, but if I love my home and don't want to move to Argentina or Costa Rica (true most mornings) there's really not much I can do for the 17 months, and there's no telling what that bunch is going to do. Attack Iran and murder a few million more? Short the market first and take the cash overseas and into gold, stored on their Paraguayan fiefdoms? Dare the world to come after them with the Praetorian Guards from Blackwater and tactical nukes, keeping the rest of their army at Dubai in the new Haliburton headquarters?

Bah, Humbug, I can get seduced into this craziness too!

And I know its happening.Part of and possibly most of the oil field manufacturing has moved from factories and machine shops in oil field towns like Houston and Fort Worth to where its just assembly of foreign parts and a US sales force. The oil patch equipment is made closer to where that bulky, hard to ship stuff is used. I don't know if the industries are going to survive this new downturn in boom times caused by the narcistic management style cutivated by the corporate-owned media. The guy who owned the local machine shop with 30 good paying jobs being a hero at church and at the little league game of the kids he'd bought shirts for has been replaced by the cost-cutting accountant who ships the jobs overseas. Bob Ebersole

Oilmanbob, I'm kind of with you on the doomer thing, I think the doomers go too far. There may be a collapse but it's looking like a relatively slow motion collapse (or maybe that's just the way it looks when you're in the middle of it). One correction (I'm sure you didn't intentionally make this mistake), the psycho in Las Vegas didn't "have sex" with a 3-year old, he raped her.

All I know is that its evil, violent and inexcusable to do that kind of thing to a baby.

Bob Ebersole

Almost as bad as economic analysis heh?

SW

Rape & tape is the norm for that sort - then they pass 'em around. There is a sort of barter economy - gotta prove you're one of the in crowd before they're willing to share.

I used to teach computer forensics to police officers. The first time I did it I was quite surprised at how little they cared for anything security related and how fascinated they were with means to automatically find and review images. I didn't really know what they dealt with ... so I asked during a break ... and stopped the guy after about thirty seconds - it was just too frightful.

Yeah, cause THAT is really representative of the typical Peak Oil doomer . . .

This latest salvo by the media to paint all survivalists as pedophiles is not unintentional. Their masters require that they discredit good work such as yours.

That's a useful term, "doomer." It's essential to many religions: There's one way to heaven, and every other road leads to doom. Even people who think they're not religious in the slightest get seduced by that general scheme. Then it's used backwards: If things are basically going well, why then we must be on the road to heaven; if things aren't, then the road to hell. So a lot of the "political" arguments are really this sort of religious attempt to read the tea leaves in some god's cup, and deduce from them just which particular road is the one true way, and whether we're collectively on it.

This of course is essentially nonsense. There are many, many ways forward that will essentially be good for the greater number of people. The quest shouldn't be for the one true way, but for any of those ways which are good. Very few ways lead to utter and irrevocable disaster - there are some, and we must of course avoid them at all cost, but they aren't remotely in the majority, let alone every single way but the one true one.

So now it costs more to spend dollars in Europe. Is this a reality of things out of balance, or is it a fairly accurate reflection of Europe's being governed better at present, both in government and in businesses? Strong social programs survive. Check. Executives are not wildly overpaid. Check. Many of the advantages US businesses used to enjoy have been learned from, and applied to some success. Check.

The euro has earned its strength. America is being punished by the currency markets for its relative idiocy. America may even take a lesson from this turn, institute things like universal health care and caps on executive compensation, and surpass Europe again in a few decades. Meanwhile, it was okay living in Europe even when the dollar was much stronger; it can be okay living in the US when the euro is much stronger.

"Everybody seems to be attracted like moths to a candle by the two doomer keyposts today"

What doomer keyposts? Did I miss something :)

I find the financial / macroeconomy posts quite a change of pace for myself. Finance trends come and go. Businesses are cyclical.

I can live with that, even if it puts a crunch on my wallet. I've lived through one hard depression. Yes, job was hard to find. Yes, I couldn't afford a lot. Yet, here I am, alive and well, more than 15 years later.

Peak oil however, may not be such a cyclical thing that comes to pass in 7 years (not necessarily anyway). At least not in my life time.

I'm all for more of these distracting posts on finance, economy and other normally cyclical events :)

I do agree with you on one thing though: collapse (if any) of complex societies is a multi-generational act in slow-motion (ref: Tainter's work on this). Societies tend not to collapse overnight and personally I find Mad Max type scenarios amusing at times, and annoying at other times.

Tell that to the ghosts of those who died at Chaco Canyon as that entire native American civilization destroyed itself. Mad Max? Ha! At least in Mad Max they didn't eat you.

"The greatest shortcoming of the human race is our inability to understand the exponential function." -- Dr. Albert Bartlett

Into the Grey Zone

A note on slow motion.

It is relative. If you talk every change in the financial markets to death each and every day then it is slow motion. If you are going to work and supporting a family and one day the price of beer is $15 a liter than it is lightning quick.

Tim

thx Luís interesting perspectives – although slightly above my head for some of your eco-tech phrases.

But I can tell charts from other stuff when I see them.. … (…freely after Bush)

What oilmanbob is flying just above here is beyond me (?) but any doom talk does not belong associated with your post Luis..

paal, It isn't associated at all with Luis's post. He is examinining in a very fair manner the problem with the US currency devaluation which is mostly being ignored by the press and television in the United States.

My point is that because people feel powerless in the USA, they are retreating into fantasy. What can I do as a citizen to make the mad dogs in Washington stop? What can any of us do? But the doom talk fills the other two posts today, and this collapse of our currency is why I think everyone is writing about doom. I'm sorry that that wasn't clear.

Bob Ebersole

OK oilmanbob, then I’m sorry for insinuating / suspecting otherwise – but frankly I could not make it “any” reply to Luis at all either!

And according to your reply here I “see you crystal clear” – and I thus agree to much of what you write. Although these “initial minor shocks” are for now – kicked away … just for now, or are the shit put just under the carpet?

(the sun will rise in the east – also tomorrow)

Luis,

As we've discussed here before we face a ramp up through the first of the year and then two quarters of very ugly ARM resetting here in the United States.

We see news about bank runs in the U.K. and hear rumors of pending trouble in Spain, but is there a simple, well laid out resource that will explain where and when the trouble will start?

I wonder who is holding the bag on that half a trillion dollars worth of ARMs, or is that situation so complex no one knows exactly where they are? It would be nice to see a global distribution map, but I suppose no one is talking in hopes they can unload their troubles, as the Canadians recently found out to their dismay.

Is there value in arranging one's finances here so bank deposits are stored in euros rather than dollars, or is the infection just a step behind for the other currencies?

-SCT

SCT,

Why don't you look into a Canadian bank,its sure a lot closer to northern Iowa. Also, you might look into some oil and gas royalty trusts. They are like real estate investment trusts in that they distribute most of their earnings and are physical ownership in a property rather than stock. The two I like best are Sabine Royalty Trust, which pays 11.33% yield and costs 44.07 and Permian Basin Royalty Trust (PBT), which pays 11.33%, or $0.14 per share per month and costs $15.50/share.

But I'm not an investment advisor. Check with your accountant, and do the work yourself.

The nice thing about royalty trusts is since they are physical ownership of a comodity they are inflation protected. The bad thing is they can't grow, except as to the price paid, they are a depleting asset. But check it out, Neal. Gold and silver coins don't pay anything. Bob Ebersole

They way I see it the problem is that no one really knows the extent of the ARM situation, and hence the cascading lack of confidence that resulted in a credit crunch.

The USDX crossed the Maginot Line the first time this year on the first week of August in intraday trading; two days later the Dow Jones lost 400 points. Can the USDX be a barometer? I don’t know.

As Gail wrote yesterday the paper currencies floating freely against physical resources (especially energy) are set to some kind of disruption once growth stops. The Dollar is just the first one to go down; if the case is serious enough the others will simply follow, so you can work your finances from there.

It's interesting that today we have the US budget for defense -- a whooping 648 Billion dollars. That is about 2000 for every man woman and child in the US. The amount for defense is about 1/4 of the total 2.8 Trillion dollar budget. Is this really necessary?

Looking back on 2007, we paid 243 Billion in Interest on debt. All this unnecessary spending is really putting the squeeze on the US$ as we accummulated more debt to fun our excess. Not only we the US consumers are over our head in balancing our finance; but the whole government as well. The US$ will keep falling until this problem is addressed.

Dinh Ton very nice look up!

and those numbers are NOT necessary, and thus stupidly wasted – “particularly that share running the Iraqi war…”

They’re there for oil that one is a no-brainer, and even pronounced in clear text by G-span. Now, at this stage there is marginally more oil (or same?) reaching the markets than before the war, but at the same time very much oil is used by the US army - simply to run/maintain the situation …. Rendering a break even scenario? (all in all no more oil comes to town)

Ultimately – if/when the potential (in the future) is ramped up for Iraq regarding oil-exports …. The time is up, at least if any of the near future Peak Oil-prospects are kicking in and turns real … AND then actually all sane politics will have to turn on a coin – “thinking HARD how to get rid of the black shit… as a driving factor in the society …”

ON top of all that – any oil from Iraq that will/would enter the world markets – are up for the grabs for any player that can buy … Say if US “steals” all Iraqi oil – then there will be “more” available somewhere else – ready to be bidden for … IT’S A big goody-bag every day .. up for the grabs –

How much better off would this planet NOT have been – and thus prepared for what’s to come

a) without this war

b) global acknowledgements of that PO is imminent and ?

c) global warming would have been “a self solving walk in the park”

Take the whole of the US army budget and turn it into RENEWABLE ENERGY solutions, and the US will get some extra KWhrs/calories – isn’t that what they are there for in the first place ? kwhrs and calories?

Geronimoooo(!)

It seems that everyone believes the dollar is going lower. I presume those who intend to make money on this have sold the dollar short.

One thing is that the crowd never picks the turns, but sometimes makes money following the crowd until they all get a big surprise and then get fleeced.

Looks to me that everyone is down on the dollar. I think that it is likely that it will surprise everyone and gain against the Canadian, Australian, and South African currencies, and maybe the UK pound. It probably will continue to lose against the Japanese and Swiss currencies.

Just my take, but I would not put money on the line at this point.

Henry, you have a point that the Dollar looks oversold at the moment, and as I wrote initially. I expect a new bear rally at any moment. But bear in mind that the dynamics behind the Dollar devaluation are way deeper for investors and speculators to revert it on exchange trading.

Unfortunately, that particular index is fairly arbitrary.

Over half of the index's weight is assigned to the Euro, even though the EU accounts for only $550B of the US's $3,650B total trade (imports+exports), or just 15%. Similarly, the EU accounts for only 25% of non-US world GDP (by PPP).

And even those numbers are too large, since the EU includes the UK and Sweden, whose currencies are accounted for separately. Adding in their representation, 3/4 of the index's weight is EU countries, meaning it's an extremely narrow measure.

By contrast, this index compiled by the St. Louis Federal Reserve, is "[a] weighted average of the foreign exchange value of the U.S. dollar against the currencies of a broad group of major U.S. trading partners." 26 countries or regions are listed, including all of the ones on the other index, plus other key currencies like the Mexican Peso - key because it's the US's fourth-largest trading partner after the Euro area, Canada, and Japan - and China's renminbi (fifth largest).

According to that much more representative index, the US$ is just about down to where it was at the beginning of 1997.

Pitt, check some of the previous comments. That index includes several currencies pegged to the Dollar which makes it quite worthless.

I agree with you though that the USDX lacks some pondering against other important currencies.

Quite the opposite - any index which arbitrarily excludes currencies which are pegged to the US$ will artificially overstate the effect of currency movements on the buying power of the US.

Fundamentally, it doesn't matter why the yen, renminbi, and peso are closely tracking the US$; what matters is that those currencies are remaining in similar exchange rates to the US$, and so trade with those countries - which are three of the five biggest trading regions for the US - stays roughly as cheap or expensive as it was before.

Even if you restrict your view to oil, three of the four biggest suppliers of US imports - Saudi Arabia, Mexico, and Venezuela - have pegged, flat, or falling exchange rates.

The USDX simply lacks. It's little more than an index of the US against the EU, and it's misleading to paint it as representing the US$, either in terms of trade or in the larger world economy.

I propose the PDX - the Pitt Dollar Index. It is an index of the Dollar only against Dollar-pegged currencies. It is usefull because it ponders the Dollar against the (at least up to now) world reserve currency of choice - the Dollar.

Luis: It is only a matter of time until the US government adopts the Pitt index. They can use BubbleVision to promote it big time. It will be a good fit with 1.2% inflation and a GDP growth rate of almost 4%.

Is ridicule and absurdity the best response you can muster against a critique of the fundamental problems with the index you've chosen? That does nothing to increase our knowledge, and serves only to lower the tone of the discussion. I had expected better from an author with regards to his article on the numerical analysis of a dataset.

The index you've chosen to analyze is deeply unrepresentative of either the world economy or the US's place within it. Indeed, it's not at all clear what that index does do a reasonable job of representing.

Assessing the strength of the US$ in terms of the global economy and/or trade and/or the oil trade in particular is a valuable and informative thing to do, but you need to start with appropriate data to do so, and the USDX is not an appropriate dataset for any of those assessments. The only dataset I've seen that directly relates to any one of those is the trade-weighted exchange index I linked, which shows the US$ is down about 25% since its high in early 2002. That's a substantial drop, but it's not necessarily a sign of doom, since the dollar rose just as rapidly in the five years before the high as it has fallen in the five years after.

Unfortunately, it sometimes appears as if some people here evaluate information based not on how authoritative it is, but on how negative it is. While confirmation bias is a known human frailty, rational discussion requires that we at least try to evaluate information objectively, no matter how much it agrees or disagrees with our cherished beliefs about impending doom.

And, in this particular case, the best available information isn't quite as doomy as the USDX. That happens sometimes. Not always - practically everything coming out of Iraq, for example, is more negative than was expected - but sometimes.

I was hoping you could take a joke. Could you just point what's there to gain from comparing the Dollar against itself?

The point is to examine the relative purchasing power of the US dollar.

If 99% of the world's GDP was in currencies that were pegged to the US$, would you advise us to look only at the 1% that wasn't? Or would it make more sense to look at all 100% of the data?

The real world isn't that extreme, of course, but that's the basic idea. From the point of view of purchasing power, why an exchange rate moves or does not move is less important than what that exchange rate does. Before the renminbi was unpegged, the fact that it followed the US$ down had a substantial effect on the cost of US imports; why should that information be thrown out, but a very similar effect from the peso be included?

You could, I suppose, argue that you're not interested in the purchasing power of a US$, but rather trying to use its movement as a barometer of the country's economic health. In that case, it might be reasonable to factor out pegged currencies, since those don't give you information on how the market values the US$. It's not at all clear that's a sensible approach to economic forecasting, though; the EU's GDP growth was dismally low during the 2002-2005 period, even while the euro gained over 30% against the US$.

In any case, though, the USDX is a bizarrely arbitrary index, and won't give reasonable results for either question.

Pitt: Re relative GDP growth in the USA and other countries/areas: the US government can publish any number it wants for GDP growth-the currency markets are not forced to accept it. The same applies for the published inflation rate. I wouldn't put too much reliance on US guv figures for either at this point.

While true, the US government's official numbers are very close to the OECD's numbers, and they appear to have a much more detailed method of evaluating GDP growth than simply to copy-and-paste numbers from the appropriate countries' governments; indeed, one of their goals is to make data from member countries comparable despite differing definitions of, for example, unemployment rate.

So the official US GDP growth numbers appear to be externally verified, and hence more credible than any available alternatives.

The point is not to compare the dollar with itself, but rather to compare the dollar with the basket of currencies of those countries that the US actually trades with, rather than just Europe. Since many partners have currencies tied to the dollar, there will be little cost increase in products they ship us, eg china and many other asian countries. Even japan does not really allow their currency to float but intervenes, selling their currency (they can print as much as they like) and buying dollars, thus protecting their exporters and our buyers.

One source is linked below; this US gov source shows that the dollar has fallen 7.3% y/y vs. the trade weighted currencies of all our trading partners, compared with a fall of 12.5% vs the Euro, and provides a better indication of future inflation of imported goods.

http://www.federalreserve.gov/releases/h10/Summary/

OTOH, the ME oil exporters buy more from Europe than they do from the US. So, to the extent they buy from Europe, they do not enjoy a full $70/b but more like $60; accordingly, while they complain out loud that oil is too high, they might privately think that, if anything, it is too low.

You get SO CLOSE to hitting the nail on the head here, and then miss it completely.

The USDX was based on the respective currencies place in global trade. Originally it listed several European currencies, but that has been reduced to just the Euro.

The reason the Euro carries so much weight is that with the exception of the dollar, it is the largest global exchange currency.

Whether we can expect import prices to increase or not is not just a function of the dollars relative strength as compared to whatever nation we are importing from. Who they trade with downstream is equally important. If the nation in question both exports finished goods and imports raw materials, food, whatever, from the US (neutral trade balance), then the relative strength of the USD to other currencies does not matter and a direct comparison between the two currencies would be a valid method of estimating potential price increases.

Sadly the above scenario is essentially a pie in the sky one...it is simply not the way the world has worked out.

In the real world, the vast majority of our trading partners do not maintain a neutral trade balance with the US. They export to the US but import primarily from other countries so they have to pay for their imports in non dollar currencies. As the dollar falls, their purchasing power decreases and changing their own currency peg does nothing to address the problem so they end up raising the price of their exports to make up the shortfall thus decreasing the dollars purchasing power in the US despite a hard pegged currency.

On the up side, the US does still get some benefits when it comes to cheaper labor in the producing nations since it is only imported goods in that nation that increases price pressure.

I suppose in theory you could calculate total trade, balance of payments, and currency used among all our trading partners and try to come up with an index based on that data, but frankly that would be a nightmare, which is why the USDX just goes with currencies as a percentage of their global trade exclusive of the dollar.

At the end of the day, people use the USDX because it works pretty well. The various numbers advanced by the Fed over the years (and there have been plenty) that treat the matter like the US and its trading partners live in a vacuum and only trade with the US matters have historically been extremely poor indicators of dollar purchasing power.

What matters is that the US is being outbid on products. It doesn't matter how much it comercializes with the ones outbiding it.

And the evidence for this is?

The price of oil has gone up, but there's no indication that the US has been unable to pay the higher price. Indeed, demand growth in the US has been stronger than in Europe, despite the rise of the Euro vs. the US$.

Unless you were talking about some other products, but which? And is it any more than usual, since price competition in global markets has always meant that not everyone will get everything they want?

I think this is public (the word public is in the URL...), but here's a list of global currencies and their % change against the dollar year to date for 2007. It's from the Wall Street Journal Online.

It's interesting to see which currencies we've been doing better than (some African countries, only a handful though).

The only thing keeping inflation in check is that China has tied the Yuan to the USD. If we imported everything from Europe we'd have 7-10% price inflation base on the weakness of the dollar alone. As it is, the Yuan shift should have resulted in 3.9% higher prices at Wal-Mart this year so far.

http://online.wsj.com/mdc/public/page/2_3020-worlddollar.html?mod=2_0032

There are other options. 1) Historically, European manufacturers have not passed the full impact of currency appreciation on the US consumers, because if they tried US consumers would 2) reduce the levels of exports from Europe.

Luis de Sousa, I have to agree with you on the dollar....there is no end in sight to its fall. If Uncle Ben decides on another 50 basis point cut on the Fed Funds rate we could see a 10% drop in the US dollar before the end of the year. One has to remember....Americans cannot function without inflows from foreign capital in the tune of 3 billion a day. Unfortunately, foreigners are starting to realize that Americans are dead-beat consumers who can't pay their bills.

Northern Rock's run on the bank with thousands of depositors standing outside the branches a few weeks ago was due to the fact that their bank bought lots of American subprime mortgages. The fun has just begun.

The dollar decline will continue even though there will be up days. The important aspect to understand is the difference between Federal Reserve (FR) notes and electronic dollars. Antal Fekete in his recent article "Can we Have Inflation and Deflation at the Same Time?" explains

Most people fail to understand the difference of inlfated dollars. When analysts talk of the Fed printing dollars to fight deflation....it is the "electronic dollars" that are increased and not the printed FR notes. Most people who try to withdraw FR notes (dollars) of large amounts from their local bank realize the trouble it is. Many banks have a limit of say $2,000 dollars. You must call ahead to be able to withdraw larger amounts. Furthermore, even if you wanted to withdraw large cash amounts, today all you can get are Bank Drafts (electronic dollars).

There is a disconnect going on in the dollar arena. Between FR notes and the electronic dollar...again Antal Fekete

Thus this is what happened to Northern Rock. It could easily move across the Atlantic to the United States. In reality "Stagflation" might be brushed aside by "inflation cum deflation"....again Antal Fekete...

This is a very interesting realization that most people fail to comprehend. The flight to safety will be out of electronic dollars to real ones. In the end as the financial system and the dollar declines further, it won't be dollars people will be hoarding...rather gold and silver.

In line with all of the above, Bloomberg today reports Fed Fails to Restore Creditor Confidence, Pimco Says

This credit and defaulting debt crunch isn't over by a long shot.

Sooner than later a lot more folks are going to be clamoring: Don't just show me -- Give Me My Money!

;-)

Your post does not address the volume of transactions that are purely electronic now. I got gas today, then a snack later, and no physical material of any kind changed hands for these transactions.

I do thing you're right in saying that it all devolves to specie at some point, but this electronic vs. FR notes aspect is something I'd not considered previously.

So ... is that little balance in my bank account going to work like the electronic dollars or the FR notes?

Sacred.....just like what happened in Northern Rock...those customers wanted real money...english pounds they could fold and put in their pocket. And yes...everyone's bank accounts are electronic. What's even worse...401k's, pension plans, IRA's, mutual funds and etc are electric.

The fun is just beginning and it won't be over until the phat lady sings.

Actually, they were happy to see their balances tranferred to an account at another institution. It's not that they had to have the paper in hand,,they wanted to know that they wouldn't lose their savings. Once the wire transfer was complete they were happy.

I could see that for $BIGBUX, but if all you have is gas & snack money to the tune of 0.1% of the FDIC maximum ... I would keep a little bit in the bank card for stuff like that - Iowa towns roll up the sidewalks at sundown but the gas pumps still respond to plastic.

SRSrocco, please forgive my lack of fiscal sophistication, but there is something about Mr Fekete's article I don't understand (and he didn't include personal contact info):

Mr Fekete says that the supply of physical FR notes is limited because they must be collateralized by a (limited) supply of T-bills. My question is, can't the Treasury offer an essentially unlimited amount of T-bills, thus collateralizing an essentially unlimied amount of FR notes?

PLAN, PLANt, PLANet

Errol in Miami

When the US was on the gold standard, gov't spending was limited by the amount of gold held in reserve to back the spending. Once off the gold standard, a theoretical limit to US gov't spending had been that we had to issue debt and have a buyer willing to purchase that debt at a reasonable interest rate.

I can think of no outcome except for hyperinflation if the US Treasury simply prints (or electronically produces)T-Bills every time they need to print a USDollar and then prints (digitally creates) another US$ to buy the T-Bill.

Funny thing is, one of the largest purchasers of US gov't issued debt (TBills) recently have been Carribean banks. Does anyone really think these carribean banks are stepping up themselves to purchase US Tbills? It's so preposterous that it is laughable... Carribean banks are buying US Tbills in the quantities that China, Japan and the EU are?

It seems to me that we are on the path of monetized debt now. The US gov't spends money for whatever emergency du jour, war or policy, prints T Bills as collateral for the resultant debt and then creates more US$'s so an intermediary can buy the TBill.

Some things may go down in price for American consumers because of supply/ demand fundamentals of that product,,but the currency component is inflationary.

IMHO anyway

The supply/demand fundamentals of peak oil are bad enough,,the fact that we are destroying our national currency at the same time makes the outcome hard to fathom..impossible really,,

That's not correct. NR is itself a sub-prime lender. It's problems arose, I believe, due to the fact that it funded many of its mortgages (long term lendings, usually for 25 years) by money market borrowings (short term borrowings, such as 3 months). The money markets froze and so it couldn't borrow short term to cover its liabilities,

Peter.

That is correct. It had nothing to do with NR US subprime exposure. NR was unable to roll over its current paper and needed to borrow money from someplace. The BoE was willing to help. As NR borrows short term to fund its long term lending, it's going to need funds from somewhere to refinance its regularly maturing paper into new loans. Since its usual suspects where disinclined to stump up it had to get funding sources arranged. So it did. With the BoE. It's just that Mervyn would have preferred to keep it secret. Just as all the members and stooges of TPTB prefer.

Blue Peter that is correct that Northern Rock is not a subprime lender...but according to a Q & A article from the TimesOnline......(http://business.timesonline.co.uk/tol/business/money/savings/article2452...)

This is the information that I was regarding to about having exposure to subprime. I was incorrect in stated they had subprime loans...but rather direct and indirect exposure.

Of course the main problem is as Fekete states, "borrowing short and lending long".