The Finance Round-Up: December 19th 2007

Posted by ilargi on December 19, 2007 - 12:57pm in The Oil Drum: Canada

At this particular moment in time, banks are about as heavily exposed to mortgages (as a total percent of assets) as they have ever been. Further, banks are holding an enormous quantity of commercial real estate loans, especially in the rah-rah areas such as Florida, the Southwest, and in California.

The FDIC reported last year that more than 50% of all the banks in the southeast and west regions had exposure to commercial real estate loans that exceeded their total capital by 300% or more. Holey smokes! ....

....To put it in the simplest of terms, the total amount of bank capital in the entire country is a little over $1.1 trillion while more than $11 trillion in real estate loans exist meaning that a 10% to 15% loss on those loans would translate into the complete bankruptcy of the US banking system. What this all means is that we have a crisis of solvency, not liquidity.

Currently the Federal Reserve has teamed up with a few European central banks to provide vast new sources (unlimited really) of liquidity to the banking system. The central banks will allow specific institutions (big banks) to trade in their piles of dodgy loans for electronic piles of cash for a specified period of time. After a period of time the banks will have to buy those dodgy loans back, at par and with cash, at some point in the future.

If those loans are bad (‘bad’ like a $500,000 mortgage on a $300,000 condo) then this maneuver by the Fed simply won’t work. Instead, we need to quickly recognize that the loans are simply going to permanently underperform or enter default. This means we will probably lose a financial intuition or two (or thirty) along the way, but delaying the inevitable does not change the outcome, only the length of time you spend in pain.

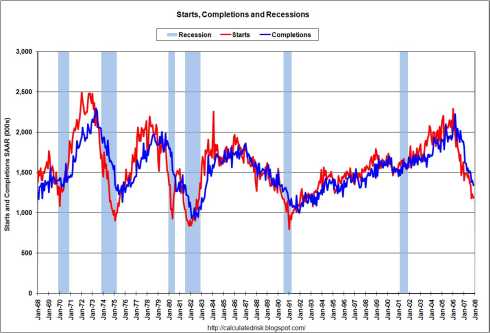

Single Family Starts Fall to Lowest Level Since April 1991

The government is promising $45 trillion more than it can deliver on Social Security, Medicare and other benefit programs. That is the gap between the promises the government has made in benefits and the projected revenue stream for these programs over the next 75 years, the Bush administration estimated Monday.

The $45.1 trillion shortfall has increased by nearly $1 trillion in just one year, according to the administration's "Financial Report of the United States Government" for 2006. And, it's up 67.8 percent in just the past four years. In 2003, the shortfall between promised benefits and revenue sources over a 75-year period was put at $26.9 trillion.

The shortfall includes Social Security and Medicare in addition to Railroad Retirement and the Black Lung program. When the gap in funding social insurance programs is added to other government commitments, the total shortfall as of Sept. 30 represented $53 trillion, up more than $2 trillion in just a year, the report said.

Subprime Securities Market Began as 'Group of 5' Over Chinese

Representatives of five of Wall Street's dominant investment banks gathered around a blonde wood conference table on a February night almost three years ago. Their talks over take-out Chinese food led to the perfect formula for a U.S. housing collapse.

The host was Greg Lippmann, then 36, a fast-talking Deutsche Bank AG trader who aspired to make mortgage securities as big a cash cow for Wall Street as the $12 trillion corporate credit market.

His allies included 34-year-old Rajiv Kamilla, a trader at Goldman Sachs Group Inc. with a background in nuclear physics, and 32-year-old Todd Kushman, who led a contingent from Bear Stearns Cos. Representatives from Citigroup Inc. and JPMorgan Chase & Co. were also invited. Almost 50 traders and lawyers showed up for the first meeting at Deutsche Bank's Wall Street office to help set the trading rules and design the new product.

"To tell you the truth, it's not very glamorous,'' Lippmann says. "Just a bunch of guys eating Chinese discussing legal arcana.'' Those meetings of the "group of five,'' as the traders called themselves, became a turning point in the history of Wall Street and the global economy.

The new standardized contracts they created would allow firms to protect themselves from the risks of subprime mortgages, enable speculators to bet against the U.S. housing market, and help meet demand from institutional investors for the high yields of loans to homeowners with poor credit.

Fed Shrugged as Subprime Crisis Spread

Mr. Greenspan and other Fed officials repeatedly dismissed warnings about a speculative bubble in housing prices. In December 2004, the New York Fed issued a report bluntly declaring that "no bubble exists." Mr. Greenspan predicted several times — incorrectly, it turned out — that housing declines would be local but almost certainly not nationwide.

The Fed was hardly alone in not pressing to clean up the mortgage industry. When states like Georgia and North Carolina started to pass tougher laws against abusive lending practices, the Office of the Comptroller of the Currency successfully prohibited them from investigating local subsidiaries of nationally chartered banks.

Virtually every federal bank regulator was loathe to impose speed limits on a booming industry. But the regulators were also fragmented among an alphabet soup of agencies with splintered and confusing jurisdictions. Perhaps the biggest complication was that many mortgage lenders did not fall under any agency's authority at all.

Credit crisis worsens as Alan Greenspan says the Fed is powerless

Fallout from the sub-prime mortgage crisis wreaked further havoc yesterday as Bank of America, Wachovia and PNC all said that investment write-downs would be worse than forecast as the credit crunch worsened....

....Mr Greenspan noted that home prices had risen sharply around the world and that increases in the United States were only “average”.

He believes that there was little that the Federal Reserve could have done to prevent credit markets from seizing up in August: “After more than half a century observing price bubbles evolve and deflate, I have reluctantly concluded that bubbles cannot be safely defused by monetary policy or other policy initiatives before the speculative fever breaks on its own.”

In Reversal, Fed Approves Plan to Curb Risky Lending

“Unfair and deceptive acts and practices hurt not just borrowers and their families,” said Ben S. Bernanke, chairman of the Federal Reserve, “but entire communities, and, indeed, the economy as a whole.”

The new regulations, expected to be approved in close to their proposed form after a three-month period for public comment, amount to a sharp reversal from the Fed’s longstanding reluctance to rein in dubious lending practices before the subprime market collapsed this summer.

The proposed changes, which do not apply to standard mortgages for borrowers with good credit, stopped short of banning all heavily criticized practices in subprime lending and did not go as far as many consumer groups had sought. But they won praise as worthwhile steps from some industry critics who had long complained that the Federal Reserve under its former chairman, Alan Greenspan, persistently ignored signs of trouble.

“Reading these proposals today is almost painful,” said Dean Baker, co-director of the Center for Economic Policy Research, a liberal research group in Washington. “These are all just simple, common sense regulation. Why couldn’t Greenspan have done this seven years ago?”

If the measures had been in place earlier, they would have applied to as many as 30 percent of all mortgages made in 2006.

Some advocacy groups that had warned for years about reckless practices said the Fed’s move was too little and too late.

You Can Almost Hear It Pop

By Stephen S. Roach

The American economy is slipping into its second post-bubble recession in seven years. Just as the bursting of the dot-com bubble led to a downturn in 2001 and ’02, the simultaneous popping of the housing and credit bubbles is doing the same right now.

This recession will be deeper than the shallow contraction earlier in this decade. The dot-com-led downturn was set off by a collapse in business capital spending, which at its peak in 2000 accounted for only 13 percent of the country’s gross domestic product. The current recession is all about the coming capitulation of the American consumer — whose spending now accounts for a record 72 percent of G.D.P.

Consumers have no choice other than to retrench. Home prices are likely to fall for the nation as a whole in 2008, the first such occurrence since 1933. And access to home equity credit lines and mortgage refinancing — the means by which consumers have borrowed against their homes — is likely to be impaired by the aftershocks of the subprime crisis. Consumers will have to resort to spending and saving the old-fashioned way, relying on income rather than assets even as mounting layoffs will make income growth increasingly sluggish.

For the rest of the world, this will come as a rude awakening. America’s recession is likely to shift from homebuilding activity, its least global sector, to consumer demand, its most global.

There is hope that young consumers from rapidly growing developing economies can fill the void left by weakness in American consumers. Don’t count on it. American consumers spent close to $9.5 trillion over the last year. Chinese consumers spent around $1 trillion and Indians spent $650 billion. It is almost mathematically impossible for China and India to offset a pullback in American consumption.

Stephen S. Roach is the chairman of Morgan Stanley Asia

The next subprime: Reverse mortgages

The defense of reverse mortgages is similar to Alan Greenspan's defense of adjustable rate mortgages -- they are a "valuable tool" for managing one's finances. And "just because some have abused it doesn't mean that it is not something worth doing," said Martinez, representing Florida, where the potential for cashing in big on reverse mortgages is undoubtedly huge.

But reverse mortgages aren't always a good deal -- they can be substantially more expensive than home equity loans. And as the subprime lending scandal proved, if you do something badly that does get abused, well, maybe it isn't worth doing after all.

And you don't have to look too far to find that the budding world of reverse mortgages is ripe for abuse. Amusingly, even as I was reading the transcript of yesterday's hearing, I received an e-mail with the subject header "Reverse Mortgage Quote Sheet" -- ostensibly advertising a job where you could earn "$2,000 to $8,000 per month part time, filling out a Reverse Mortgage Quote Sheet." (Just imagine all the out-of-work subprime mortgage brokers jumping at that opportunity.)

Doubts on $1.2 Trillion of Debt

Moody's Warnings on FGIC, MBIA Cast Doubt on $1.2 Trillion Debt.

Moody's Investors Service's warning that the top credit ratings of FGIC Corp. and three other bond insurers may be cut casts doubt on $1.2 trillion of municipal, corporate and asset-backed securities. Moody's late on Dec. 14 placed the top Aaa insurance ratings of Stamford, Connecticut-based FGIC and XL Capital Assurance Inc. in New York under review for possible downgrade. It affirmed the Aaa insurance ratings of Armonk, New York-based MBIA Inc. and CIFG Guaranty in Hamilton, Bermuda, though it said the outlooks were "negative."

If the insurers lose their Aaa ratings, so too may the securities they guarantee, forcing some holders to sell the bonds because of their investment guidelines. "Everyone understands the systemic risk if even one of these companies is downgraded," said Peter Plaut, an analyst at hedge fund manager Sanno Point Capital Management in New York.

The systemic risk is present whether or not the bond insurers rating are cut. People keep acting as if everything is OK as long as ratings are maintained. However, this is not wish upon a star and you get your wish fantasyland. Enron's debt was rated "investment grade" by the rating agencies up to several days before it went bankrupt. The same games are being played now.

Is Another Financial Bubble in the Cards?

Even as the shock waves of the sub-prime mortgage meltdown are still shaking the foundations of the American economy, rumbles are beginning to be heard of another market rocking event on the horizon. It seems that another bubble may soon burst, its fragile surface already showing the signs of a slow leak due to hits taken from the foreclosures crisis fallout.

Credit cards are beginning to show weakness, and with $920 billion in credit card debt held by Americans, trouble in this market has the potential to be just as traumatic for the markets as the sub-prime mortgage meltdown, following a similar road to the bottom.

Several of the nations biggest banks have expressed concern about the trends in consumer credit card spending. American consumers are spending more than they earn, carrying record setting levels of debt. Meanwhile, savings are at their lowest point since the Great Depression.

One in Five Expect to Borrow to Heat Homes This Winter

For perhaps as many as 27 million American adults, keeping warm this winter will mean borrowing money and 20 million will use credit cards to be able to afford their heating bills, according to a CreditCards.com poll.

Nearly 12 percent of Americans say they will need to borrow money to pay winter heating bills; 9 percent will need to use credit cards to be able to afford their heating bills....

....Heating bills are rising at a time when utility companies across the country are broadening electronic payment options for customers, including allowing credit card payments for utility bills. Personal finance experts say paying for basic living expenses with credit cards makes sense only if you pay off the entire balance each month. They also warn that carrying a revolving balance encourages people to live beyond their means while racking up interest charges that can plunge families deeper into debt.

Goldman success brings unwanted attention

At Goldman Sachs Group, success has become something of a liability. For years the investment bank has inspired praise and more than a little envy for its perennial dominance of investment banking, exceptional profits and its Who's Who of influential alumni.

Lately, its financial wizardry has stood out even more as it thrived, even as most of its rivals were saddled with billions of dollars in write-downs and credit losses.

Goldman is expected to report a record $11 billion of annual profit on Tuesday, including billions of gains from bets against the subprime mortgage market. Rivals, such as Morgan Stanley and Merrill Lynch & Co Inc., have ousted top executives and are expected to cap the year with money- losing quarters.

And while year-end bonuses are expected to be flat or smaller across Wall Street, Goldman payouts will rise to roughly $18 billion. On average, that is about $600,000 per employee, or double the average paid at other firms.

The disparity of results has some accusing Goldman of having an unfair edge or of hiding its mistakes. The presence of former Goldman CEO Hank Paulson as U.S. Treasury Secretary has one New York tabloid columnist convinced Goldman gets inside information on the bond market.

Analysts forecast C$2bn writedown at CIBC

CIBC, Canada’s fifth-largest bank, is facing subprime-related writedowns in excess of C$2bn (US$1.97bn) next year, analysts said. CIBC has already written down almost C$1bn of investments linked to the US mortgage market – more than any other Canadian bank. Analysts expect it will face more and could even have to realise losses next year.

Earlier this month, Gerry McCaughey, CIBC chief executive, said the bank had “underestimated the extent to which the subprime market might deteriorate and the degree to which that would impact securities that were structured to be very low risk”. CIBC declined to comment on the reports, including one by its own investment banking arm.

Darko Mihelic, at CIBC World Markets, said: “We estimate [it] could lose as much as C$2.4bn pre-tax in the first quarter of 2008”. Mr Mihelic, who has been covering CIBC since 2001, does not have an investment opinion on the stock.

The Toronto-based bank said it had $9.8bn in hedged derivatives contracts linked to American subprime mortgages at the end of its fourth quarter. These contracts could face “significant’’ future losses, the company said.

André-Philippe Hardy, of RBC Capital Markets, said: “CIBC’s exposure to collateralised debt obligations backed by assets related to US real estate and residential mortgages is by far the largest of the Canadian banks”. Mr Hardy expected this exposure to result in C$2.3bn in pre-tax writedowns in the first quarter of next year. Jason Bilodeau at TD Newcrest, expects writedowns of at least C$2.6bn and as much as C$7bn.

Dodge Says Canadian Banks Need 'Incentives' for Innovation

Bank of Canada Governor David Dodge said the country needs to look at how to boost "incentives'' for banks to become more innovative and efficient.

Allowing banks to grow, for instance, would provide "efficiency gains,'' Dodge wrote in a commentary published today in the Globe and Mail newspaper. Other public-policy questions that need to be "discussed'' include foreign ownership rules covering the financial industry and "concerns about concentration of market power,'' Dodge, 64, wrote.

"Competition leads to innovation,'' said Dodge, who is retiring as of Jan. 31 after a seven-year term as central-bank chief. "We should continue to look for ways to improve the framework so institutions can compete across pillars of the financial system.''

Canadian banks are forbidden from marketing insurance products from inside their branches, limiting their ability to expand in that sector. The country's five biggest banks also have been prohibited from merging with each other since 1998.

Corporate Corner: Asset-backed commercial paper

At it’s simplest level, ABCP refers to short term debt instruments issued by entities (usually trusts in Canada) called special purpose vehicles or SPVs (“conduits”), which are designed with a view to funding themselves with ABCP. The idea is to create a vehicle that will hold financial assets off the balance sheet of the originator.

So for example, a company that finances a lot of cars for its clients using lease financing can take the leases off its balance sheet by selling them to a conduit. The conduit raises the money to pay for the leases by issuing ABCP.

These structures benefit the originator of the asset sold to the conduit because often the assets are more credit worthy in isolation than the originator is, taken as a whole. Going back to our example, the auto dealer that originated the leases will have all kinds of other businesses and issues associated with its ongoing operations which would make financing challenging.

However, the leases it writes form a pool of fairly homogenous legal contracts with a diverse community of obligors that are fairly easily analyzed and can attract favorable funding terms.

These structures also benefit investors in ABCP because they give investors access to the types of assets, like leases, that would normally be reserved to banks and other large financial institutions. Those assets deliver higher rates of return than most other types of investment. If the underlying pools of assets are sufficiently strong, the ABCP issued can be very highly rated by credit rating agencies, meaning the potential for default is very low. This tends to increase investor confidence and funding costs.

However, there are potential challenges in these structures. First, ABCP is typically short term in duration, while the financial assets of the conduits that issue ABCP are typically longer term, with maturities of three to five years. This issue is addressed with liquidity lines, addressed in more detail below. The second issue is the quality of the underlying assets. Events can occur that can affect the underlying quality of the asset pool.

“There’s a giant game of chicken going on here”

Government officials and politicians must wait longer to find out how banks and investment companies will deal with asset-backed commercial paper (ABCP) investments crisis.

The Yukon government was unable to recover the $36.5 million it invested in the market at the maturity dates in late August and early September.Investments of more than $30 billion from investors ranging from the Ontario government to Air Canada and others have remained frozen due to the liquidity problem.

Last Friday had been set as the date for an announcement on how the issue would be dealt with. However, the Pan-Canadian Investors Committee, which was formed to fix the problem, has now set a new deadline of Jan. 31.

“We’re basically back to where we were on Dec. 13,” Clarke LaPrairie, the assistant deputy Finance minister, said this morning.

Canadian Investors `Fed Up' by Commercial-Paper Plan Delays

Perimeter Financial Corp., a Toronto-based brokerage, is offering buyers and sellers a marketplace to swap the frozen debt ahead of any restructuring proposal.

``We're focusing our attention on continuing to keep our market open for people who want to trade,'' Perimeter Chief Executive Officer Doug Steiner said in an interview. ``I would suspect we will get a few more bids and offers, though probably not a lot more.''

Perimeter has been unable to match buyers with sellers since it began operating Nov. 14, with some offers of about 50 cents and 60 cents on the dollar.

``The common wisdom is that these things are not going to be fully valued,'' Steiner said. ``Obviously, if people are expecting to get their money back seven years from now, they'll be trading at a discount.''

The Caisse, Canada's biggest pension-fund manager, is the largest holder of non-bank issued commercial paper, with about C$13.2 billion. Other large holders include National Bank of Canada, the country's sixth-biggest, ATB Financial, an Alberta bank, and Transat A.T. Inc., owner of Canada's largest charter airline.

TD Bank throws wrench into Canada ABCP repair

The largest investors in Canada's C$33 billion ($33 billion) of ABCP issued by groups other than the country's big banks are trying to hammer out a fix-it plan for the market, which ground to a halt in August when buyers panicked about possible links to the troubled U.S. subprime housing market.

The investor committee, headed by veteran lawyer Purdy Crawford, missed its deadline on Friday to announce details of a repair.

Instead it made an announcement on Saturday that was thin on details and asked investors to give the panel another six weeks to work on a solution.

The Globe and Mail newspaper reported over the weekend that the last big issue on the table was getting financial institutions to agree to backstop the longer-term notes that the commercial paper is being converted into in case of future defaults or margin calls.

The newspaper said the committee asked each of Canada's big five banks to pony up C$500 million but that TD refused because it has no exposure to the non-bank ABCP market. The paper said the top two officials at Canada's central bank had put some pressure on the banks to move talks along.

Canadian commercial paper remains frozen

The group is handling 21 remaining trusts that have not traded since mid-August and that hold about 33 billion dollars, or $33.5 billion, of commercial paper outstanding, according to a statement. One fund, the 2.1 billion-dollar Skeena Capital Trust, has already been restructured under the process and awaits investor approval.

The plan would have three different solutions based on the assets backing the trusts, the statement said. One would be for about 3 billion dollars worth of commercial paper backed by "traditional, unleveraged" assets. Another would be for about 3 billion dollars in commercial paper supported by U.S. subprime assets.

The third would be for commercial paper that has a combination of leveraged and unleveraged assets, which makes up about 27 billion dollars of the frozen debt.

Holders of $33-billion of seized-up asset-backed commercial paper who opt not to support a proposed restructuring of the notes will be left to fend for themselves, warns the head of a committee overseeing the plan.

The proposal, which has yet to be fully mapped out, must be approved by at least 66% of noteholders in each of 21 frozen trusts for the restructuring to go ahead.

But if some trusts fail to win the required support, those investors "would be on their own," Purdy Crawford said in an interview.

In other words, the investors would have to fight it out with other creditors for a share of the remaining assets in what would likely be a forced liquidation of the trust --hardly a hopeful scenario.

But some may decide that the alternative is no better, since it is expected that noteholders who sign on to the restructuring will be required to give their right to go to court to recover losses, which could exceed 50% for some trusts.

ABCP Crisis Delays Credit Union Merger, Again

A merger of the British Columbia and Ontario credit union centrals has been put off for another six months because of "valuation issues in the non-bank asset-backed commercial paper market."

The merger was originally slated for Oct. 1, but had already been delayed till the end of this year as the credit unions tried to figure out how to complete the transaction when numbers for their ABCP holdings were not available. A committee that was supposed to resolve the ABCP crisis had set a deadline of Dec. 14, but that deadline passed without any resolution.

"Valuation of each central's holding of non-bank ABCP is essential to closing the transaction at fair market value," the credit unions said in a press release.

Call to relax Basel banking rules

The Government must suspend a set of key banking regulations at the heart of the current financial crisis or risk seeing the economy spiral towards a future that could "make 1929 look like a walk in the park", one of Britain's leading economists has warned.

Peter Spencer, of the Ernst & Young Item Club, said conflicts caused by the Basel system of banking regulations, which determine how much capital banks must raise to keep their books in order, are the root cause of the crunch and were serving to worsen the City's plight.

The regulations meant that banks forced to take off-balance sheet assets from troubled structured investment vehicles on to their books had little choice but either to raise money from abroad or cut back dramatically on their spending, he said.

He warned that, if London's money markets remained frozen and the authorities retain the strict Basel regulations, the full scale of the eventual credit crunch and economic slump could be "disastrous".

Investors stunned by ECB's €350bn

Short-term market interest rates in the eurozone plunged at their fastest rate for more than a decade on Tuesday after the European Central Bank stunned investors by pumping a record €348.6bn worth of funds into the markets.

The size of the injection - which was intended to calm the markets over the critical year-end period - was twice as big as the ECB had indicated would have been needed in normal circumstances.

The bank said some 390 private sector banks in the eurozone had requested funds, which have been offered for two weeks at 4.21 per cent, well below the previous prevailing market rate.

"The sheer magnitude of the operation caught the market off guard," said Win Thin, Brown Brothers Harriman's senior currency strategist, who said there was talk that banks from the US and UK might have taken funds at lower rates than they could secure from their own markets.

Money Market Rates Tumble; Central Banks Inject Funds

The central bank measures have had mixed results. The one- month dollar rate fell 2 basis points to 4.95 percent, 70 basis points more than the Fed's key rate, according to the British Bankers' Association. The cost of three-month loans in pounds declined 4 basis points to 6.39 percent, 89 basis points more than the Bank of England benchmark, the BBA said.

The ECB action ``doesn't address the fundamental issues of banks hoarding cash and while the central bank has succeeded in stabilizing the shorter-term rates, it makes little impact on the longer-term rates,'' said Lena Komileva, an economist at Tullett Prebon in London.

The cost of borrowing euros for two weeks is still 45 basis points higher than the ECB's benchmark financing rate. It was 9 basis points higher at the end of June.

ECB's $500 Billion Loan Won't Help Solvency Problems

Minyan Peter had this to say:

$500 billion is an enormous amount of money. To put it into perspective, $500 bln is 5% of total US banking system assets. My eyes are on LIBOR. If $500 bln doesn't move the rate...

Furthermore, everyone should remember that the $500 bln is funding just through year end. Come January this will need to be refinanced or rolled over.

- Corporate defaults are not front page news yet.

- Commercial real estate woes are not front page news yet.

- Credit card issues are not front page news yet.

- Rapidly rising unemployment is not front page news yet.

The key word in all for point above is "yet". News about housing, subprime lending, SIVs, and other related stories are what dominate the headlines now. However, second, third, and fourth waves of the economic tsunami are coming. Right now, most of those stories have not hit the front page yet, certainly not day after day. They will.

If this $500 billion "emergency funding" was just a year-end phenomenon, that would be one thing. But this is not a liquidity issue this a solvency issue and a growing solvency issue as well. See Missing the Boat on Monetary Easing for more on this topic.

You can't cure drug addicts by giving them more drugs nor can you cure insolvent credit junkies by dramatically increasing the size of the loans. I suspect the "emergency" is going to last a lot longer than the ECB thinks.

Northern Rock gets more guarantees

The government deepened its involvement in Northern Rock on Tuesday, offering to guarantee more of the stricken mortgage bank's liabilities as it battles to find a private-sector buyer.

Facing growing speculation it could be forced to nationalise the country's fifth-largest mortgage lender, the government extended its guarantees to include virtually all Northern Rock's senior debt obligations, a move aimed at providing stability and at protecting the bank's credit ratings.

A ratings downgrade would further unsettle financing arrangements and would delay an already protracted sale.

Treasury's Rock guarantees widened

The Treasury has granted a request from Northern Rock to extend the deposit guarantees issued by the government to include uncollateralised debt.

It said guarantee arrangements previously announced in September and October will be extended to include "all uncollateralised and unsubordinated wholesale deposits and other borrowings which are outside the guarantee arrangements previously announced by HM Treasury."

London Leads Biggest U.K. House-Price Drop Since 2002

London led the biggest drop in U.K. home values for at least five years this month as higher mortgage costs and the prospect of further declines in prices kept away buyers, a report by Rightmove Plc showed.

The average London asking price fell 6.8 percent to 384,632 pounds ($774,000) from November, the largest decline since the survey of real-estate agents' listings began in 2002, Britain's most-used property Web site said today. Across the U.K. as a whole, home costs dropped 3.2 percent, also the most on record.

SIV liquidity problems: The next wave looms

Funding problems for the structured investment vehicles at the heart of this year’s liquidity troubles are far from over, despite the move by a number of banks to step in to support their vehicles, reports the FT’s Paul Davies on Tuesday.

January will bring the start of a second wave of liquidity problems for SIVs as the vast majority of medium-term funding starts to come due for repayment, according to a report from Dresdner Kleinwort analysts to be published on Wednesday.

SIVs rely on cheap, short-term debt to fund investments in longer-term, higher-yielding securities. This cheap debt has come from both the very short-term commercial paper markets and from the slightly longer maturity, medium-term note (MTN) markets. CP funding has long dried up and much of what was sold has matured.

So far, SIVs have primarily felt the impact of collapsed CP issuance, Domenico Picone at DrK told the FT. Outstanding MTN for the 30 SIVs currently stands at $181bn, which will be the next liquidity challenge they face, he added.

This represents almost 65 per cent of the value of the SIV sector in mid-October, and it is likely that SIVs have shrunk a great deal more since then.

Shrinking the US Dollar from the Inside-Out

There are two reasons for the dollar's demise. One is the practice of American corporations offshoring their production for US consumers. When US corporations move to foreign countries their production of goods and services for American consumers, they convert US Gross Domestic Product (GDP) into imports. US production declines, US jobs and skill pools are destroyed, and the trade deficit increases. Foreign GDP, employment, and exports rise.

US corporations that offshore their production for US markets account for a larger share of the US trade deficit than does the OPEC energy deficit. Half or more of the US trade deficit with China consists of the offshored production of US firms. In 2006, the US trade deficit with China was $233 billion, half of which is $116.5 billion or $10 billion more than the US deficit with OPEC.

Schwarzenegger Will 'Declare Fiscal Emergency' In Weeks

Gov. Arnold Schwarzenegger said Friday he will declare a "fiscal emergency" in January to give him and the Legislature more power to deal with the state's growing deficit.

Schwarzenegger made the announcement Friday after meeting with lawmakers and interest groups this week to tell them California's budget deficit is worse -- far worse -- than economists predicted just a few weeks ago.

The shortfall is not $10 billion, but more than $14 billion -- a 40 percent jump that would put it in orbit with some of the state's worst fiscal crisis, those who have met with him said.

A fiscal emergency would trigger a special session and force lawmakers and the governor to begin addressing the shortfall within 45 days.

"What we have to do is fix the budget system. The system itself needs to be fixed, and I think that this is a good year, this coming year, to fix it," Schwarzenegger said in Long Beach, where he was promoting his plan for health care reform.

Trouble Indicator? Limits on Savings Bond Purchases

Continuing yesterday's report, where I suggested that the Fed is getting ready for some serious financial problems, another example of how the 'wagons are being circled' has come up. This was in an email from a "C-level" (ceo, coo, cfo etc) type of a national bank which shall remain unnamed:

"I wasn’t sure where people were getting info about bank restrictions. Then today I got notice that, starting 1/08, savings bonds purchases will be limited to $5000/yr per SSN. We haven’t heard anything about restrictions on wires.

While I don’t disagree with your conclusion about where these things are headed, I gotta tell you that the initiative for monitoring and restrictions is coming from government, not the banks. Believe me, I wouldn’t be doing half the things I have to if it weren’t for regulatory mandate."

Not to take this fellows word for it without checking, I clicked over to the TreasuryDirect web site and sure enough:

Annual Purchase Limit For Savings Bonds Set at $5,000M

FOR IMMEDIATE RELEASE

December 3, 2007The annual limitation on purchases of United States Savings Bonds will be set at $5,000 per Social Security Number, effective January 1, 2008. The limit applies separately to Series EE and Series I savings bonds, and separately to bonds issued in paper or electronic form.

[...]

The mainstream media needs to free itself from lock-step with the Growth Machine, which it has followed as obediently as it did the Bush White House to a trillion dollar war in Iraq.

Understand that what comes next had better not be more of the same-because big sovereign nations underwriting our national debt are not waiting for fiscal sanity's appearance on the scene. It is one thing to squander our own national wealth. It is another thing, to squander theirs.

The reason the Florida Local Government Investment Pool is in trouble is because it invested in exactly those risky derivatives tied to mortgages that have fueled the Growth Machine, which in turn bribed local legislatures in the cash-infused atmosphere where regulation was thrown straight out the window. They used to get away calling it, "the free market".

No longer.

It is not enough to regulate the lenders, the mortgage brokers, and tighten standards for consumers. The operating schematics of the Growth Machine need to be fundamentally changed, or, we can just wait for the result: an ownership society rewarding, first and foremost, vultures.

Paulson Favors Fannie, Freddie Buying Jumbo Mortgages

Treasury Secretary Henry Paulson said Fannie Mae and Freddie Mac, the largest sources of finance for American mortgages, may help ``jump start'' the market for the largest home loans.

Paulson said in an interview today that he favors temporarily allowing the two companies to purchase so-called jumbo loans, which exceed $417,000. He said the proposal should be part of a package of legislative changes governing the two government chartered companies....

....Paulson said he agreed with Federal Reserve Chairman Ben S. Bernanke, who suggested to lawmakers that they consider allowing Fannie Mae and Freddie Mac into the jumbo mortgage market. ``I think Ben Bernanke and I are on the same page,'' Paulson said.

Bernanke indicated in a Nov. 8 hearing that he favored letting Fannie Mae and Freddie Mac buy mortgages of up to $1 million. He noted that it was up to Congress to determine the amount.

California Attorney General Jerry Brown Subpoenas Countrywide

California AG Jerry Brown is very interested in investigating loans made to borrowers with yield spread premiums (YSP).

Some people characterize these “hidden” fees as broker “kick-backs” that are essentially built into your mortgage by bumping up the interest rate, and the lender pays the originator of that loan extra money for doing so.

Brokers have taken the stance that it offsets a borrower’s closing costs. I feel that both views are true, but in recent years, yield spreads have been severely abused and YSP has been used mainly to produce more revenue for the loan officer, brokerage and the lender.

More cash per loan seemed to be the underlining theme of the subprime lending era, because the theme sure wasn’t “what’s best for the borrower.” Often loan officers were asked by their peers or managers, “What are you rev’ing on that loan? How much did you charge on the back end?”

This is no industry secret. Very rarely was it used to offset a borrower’s closing costs.“That’s a big temptation, it seems to me,” Brown said in a recent interview.

For all the talk of swindled homeowners and manipulative lenders, my only comment is that it takes two to tango. Sure the borrowers lied, but they couldn’t get any money if the lenders weren’t so eager to give it to them. The lenders certainly put people in risky loans, but it was ultimately the borrowers who wanted to get some money for consumption.

There’s a real mental and moral disease in all layers of American society today. From government to business to consumer, it’s all about getting what I can from the system with consequences be damned. The most optimistic of us hope there’s a way to continue the shell game through future re-financing, the worst of us do not care one bit

Mortgage-Relief Plan Divides Neighbors

The prospect of aid for some borrowers, but not others, brings another layer of discord to neighborhoods already racked by plummeting home values, rising bank repossessions and vacant houses whose owners simply up and left....

....Corona lawyer Nathan Fransen says he has nearly 100 clients trying to avoid foreclosure but none appear eligible for the rescue package. "The government has misread California. Most foreclosures here are on loans that haven't adjusted, meaning that people can't afford what they have now," says Mr. Fransen. He lives in a gated community where he says dozens of million-dollar homes face foreclosure. "The plan won't help much here, and the problem is going to get worse."

U.S. government subprime effort off its pace

A program unveiled by U.S. President George W. Bush in August that is trying to save tens of thousands of homeowners from foreclosure has aided just 266 borrowers so far, according to government data released on Monday.

The initiative, which helps high-risk or low-income borrowers win better loan terms by insuring mortgage payments, targets recent homeowners whose loans have a built-in interest-rate spike that made them miss a payment.

More than 1.8 million borrowers could face mortgage rate spikes by the end of next year, according to the Federal Reserve Board, with the mortgage costs rising $350 a month.

Until Bush relaxed the rules, borrowers who missed a payment would not have been eligible to refinance under the Federal Housing Administration -- a program from the Depression era designed to make home ownership more affordable.

Officials behind the new initiative, called FHA Secure, said it is on track to move 60,000 delinquent borrowers into stable, fixed-rate home loans. But between September and mid-December, only 266 such borrowers have cleared all FHA hurdles.

Real Estate Radio USA (http://www.realestateradiousa.com), a leading Internet talk radio show, is taking the initiative to help stop the foreclosure crisis by offering to reinstate the mortgages of those in homeowners in foreclosure.

Each month beginning January 28, 2008, Real Estate Radio will be giving one lucky listener the opportunity to stay in their home and stop their foreclosure proceedings. The promotion is open to homeowners anywhere in the USA.

Homeowners in foreclosure can register to win by logging onto Reinstate My Mortgage! (http://www.reinstatemymortgage.com), the promotional website set up by Real Estate Radio USA. In order to participate, the homeowner must be in foreclosure, and have an auction date or sale date looming. At random each month, a listener who has registered will have their mortgage reinstated and be able to stay in their home.

Another foreclosure record was set in November as 1,336 properties were offered to the highest bidder on the courthouse steps in Modesto, Merced and Stockton.

Now here's the real surprise: Only 17 of them sold, despite lenders offering deeply discounted prices.

Every weekday, starting about noon, auctioneers seek buyers for foreclosed properties of all shapes and sizes. But more times than not, no one bids.

That's because foreclosed homes typically have unpaid mortgage debt far in excess of their current value. When no bidder is willing to pay off that debt, lenders usually get stuck owning the homes. That happened 411 times in Stanislaus County last month, sticking lenders with more than $139 million in unpaid mortgages, according to ForeclosureRadar, which tracks mortgage defaults.

US housing crisis reverberates around the globe

Some experts say there has been a "decoupling," meaning the rest of the world is less dependent on the United States. But any slump in the US is still likely to have a global impact.

"We think 2008 will be the 'year of recoupling,'" says Peter Berezin, a Goldman Sachs global economist.

"The mortgage meltdown in the US has clearly affected global financial markets," he noted, adding that "the weakness in the US housing market is starting to raise concerns that the global housing market may suffer a similar fate."

Subprime dampens festive holiday spirit

Hong Kong, China creating their own toxic property debt?

It may be the season of office holiday parties and long lunches, but investors in Hong Kong and China have been warned to be alert for a sobering subprime chill. And festive spirits in the mainland markets could be in short supply with renewed speculation Beijing might be about to unveil another rate hike, never mind most people must work through the holidays.

So far, Hong Kong and most of Asia have largely skirted the growing subprime crises. Not only is the property misery in the U.S. not our problem; it has even prompted some global funds to retarget funds to safer havens in Asia. But last week Joseph Yam, the Hong Kong Monetary Authority chief known for his distinctive silver mop of hair as well as being the world's highest paid central banker, raised a red flag that local banks will not escape unscathed.

His comments sent small banks, deemed the most vulnerable into a sell off on Friday with the likes of Fubon Bank Hong Kong (HK:636: news, chart, profile) falling 8% and Dah Sing down 7%. Bank of China Hong Kong is estimated to have HK$10 billon ($1.28 billion) exposure to subprime-related investments but is better protected by its larger size. Next to the blowouts seen by UBS or Citibank in recent days, this looks like little more than a rounding error.

While that may be reassuring, as we try to guess where the next fault line of subprime contagion could surface, it is surely not too much of a leap for Asian central bankers watching U.S. housing crumble (and likely also the U.K., too) to ask,

"Could it happen here?"

Here, inside the 217-year-old Shri Ram Hari Ram jewellers, all that glitters really is gold. Rows of glass cabinets showcase masses of bangles and jewel-encrusted rings. Sideboards sparkle with delicate, chandelier-like earrings, and spotlights illuminate extravagant Indian wedding necklaces, headpieces and ornate nose rings — once the preserve of maharanis but today the birthright of every middle-class bride-to-be.

“For Indian women, owning a certain amount of gold is a must and if you are like me then you have lots,” beams Chopra, 41, who, like most of her fellow countrywomen, is loath to reveal the exact value of the jewellery she keeps squirrelled away in her bedroom strongbox.

“When we marry, we’re given lots of bangles and necklaces and such by our families, which we keep for the rest of our lives. Also, during our married lives, whenever we can put some extra cash aside, we buy gold to keep for our daughters’ weddings.”

Little wonder that India’s astrologically auspicious marriage and festival season, which lasts from late September to early December, has long been a frantically busy period for the country’s jewellery industry. But in recent years, all previous sales records have been smashed. Rapid economic growth has given rise to what amounts to a gold rush.

According to the World Gold Council, demand for jewellery is up 38% in the last 12 months, even with the gold price at $789.50 an ounce. India is now the largest consumer of the precious metal in the world.

Wheat markets soar on renewed tight supply fears

U.S. wheat futures surged more than 3 percent on Monday and surpassed $10 a bushel for the first time as strong U.S. export numbers amid dwindling world supplies prompted funds and investors to rush to cover positions. Industry officials added that wheat prices, which have nearly doubled this year on crop worries in Australia, the United States and Europe and strong global demand, are likely to remain firm until a clearer picture emerges about U.S. plantings in January.

World food price rises set to hit consumers

Global food prices will come under further pressure today as benchmark prices for cereals at much higher levels come into operation, making it almost inevitable that a second wave of food price inflation will hit the world's leading economies.

In Chicago wheat and rice prices for delivery in March 2008 have jumped to an all-time record, soyabean prices are at a 34-year high and corn prices at an 11-year peak.

Knock-on price rises are set to hit consumers in coming months, raising inflationary pressure and constraining the ability of central banks to mitigate the slowdown in their economies.

A first wave of surging cereal prices hit the wholesale market during the summer and has fed through the supply chain and contributed to rising inflation.The increase of eurozone food price inflation to 4.3 per cent in November was one of the main reasons for the jump in the zone's annual inflation rate from 2.6 per cent in October to 3.1 per cent, the highest in six years. In the US, annual food price inflation of 4.8 per cent in November contributed to a rise in the inflation rate to 4.3 per cent.

Thank you folks for doing the lifting on all this stuff.

JOhn

There's an awful lot of stuff in here that is US focused and while I agree they may be 'ahead of the down-curve' I'd like to read more on what people are saying about whether things like 'The Crunch' is going to spread...

Anyway, thanks for sifting through the pile...

Nick.

Nick,

The US is the focal point of much of the finance news, simply because much originated there. But we also have articles today from/about Canada, China, India, UK and the EU.

And whether or not people are saying that the credit crunch will spread, one look at the $500 billion credit injection from the ECB says enough. One of the articles points out that this is just till year's end, it will have to be rolled over early in 2008.

Yes, all of it is spreading, and if you ask me, there is no way it could not be far worse than we know so far, simply because of every single involved party's propensity to smooth things over and postpone and so on.

And don't forget that the reason, as well as the reasoning, behind the continuing freeze on Canada's ABCP, the ECB giant injection, and many more measures taken, is optimism and hope that the markets will restore and rise back up. Without that hope, actions like these are utterly useless.

So what if the markets keep on sinking? The hole has just been dug that much deeper.

-well, that's partly my point.

When Oil hits US$150 the ceiling will be falling in on the US by their words. In the meantime KSA, Russia and the other Net Exporters will be doing very well. High oil prices are not necessarily bad for the overall global economy but locally the effects could be severe and if you are very highly geared to its use and have a loud media, well, its going to sound like the end of the world isn't it...

Nick.

Obviously, oil at$150 a barrel won't just hurt the US. As I just said, the EU gets pretty desperate. And KSA can export oil, but their financial holdings will sink just as fast as deep as those in other countries.

And then we're not yet mentioning third world countries. Or Canada, a major exporter, where the economy is about to have a brain seizure, oil income or not. Or the UK, a former major exporter, which when in comes to housing and mortgages looks worse off then the US. Or China, which will lose a huge chunk of its customer base in the EU and US.

The financial demise does have a link to oil and its price, but is quite capable of causing severe mayhem all by itself.

Regarding the top article:

10-15% loss on the entire lot of loans seems pretty unlikely to me. You have to remember that the majority of real estate loans are prime loans and the average LTV is in the 50%s. Real estate might go down 10-15%(or more) but that doesn't mean you are going to take a loss on your loan. Commercial real estate still has delinquencies of <1% and losses next to nil. The subprime market is a disaster and losses will be severe there but it is still a small % of overall real estate market.

Nate, I think you are wrong about the sub-prime word, because the MSM talks about it to avoid talking about the much broader crisis in housing:

A couple of links, a light one and a hard one about “We are all sub-prime now":

http://calculatedrisk.blogspot.com/2007/11/upside-down-in-america.html

http://calculatedrisk.blogspot.com/2007/11/what-is-subprime.html

BTW, calculatedrisk.blogspot.com is the best US housing info website, IMHO.

prime, subprime, alt-a etc. if the average LTV is 50% that means the real estate market (assume 11 trillion is correct - I thought it closer to 13 million) is 5.5 trillion in equity and 5.5 trillion in loans. if the ENTIRE market drops 20% (and it of course could drop more), then that is 2.2 trillion off the top. On average this would represent a loss to homeowners only not to the banks who make the loans. Of course its the shape of the distribution that matters - are 20% of houses fully paid off and the rest have 20LTVs? Im sure I could find this datapoint somewhere. My main point is there is a great deal of equity in homes still held by individuals - the entire real estate market is not a loan. If prices go down it will certainly effect the economy, but it doesn't imply the entire banking system as insolvent.

I don't think that the author of the original article even talked about rising energy prices, and its negative effect on the values of large McMansions in outlying suburbs.

The problem is much wider than housing market debt, even if that includes subprime, Alt A and much of what is now prime. Lending standards for all manner of debt have seriously deficient in recent years. As if housing wasn't bad enough, we are seeing problems looming on the horizon for commercial real estate, credit card debt and car loans (to mention only a few). If equities fall, then we will also have a substantial problem with margin debt (which is more out of hand than in 1929).

The risk we are facing (IMO) is a downward spiral where assets are sold to pay off debts, but in doing so the value of assets is undermined, causing a further round of distressed sales. Many things - including real estate - could be sold for pennies on the dollar (with widespread debt default), as they were during the Great Depression.

Point of note. Today the margin requirement is 50%. In 1929 it was only 10%. Quite a disparity. We'd need to know the % of stocks currently owned on margin compared to 1929 to make a better analysis. But margin requirements are much higher today than then.

And the charts Ive seen showing the sheer magnitude of day trading/speculation as % of economy are more a function of our national addiction to maladaptive reward signals than leverage in equity markets.

Nate, we only know that all the letter-soup of commercial paper based and leveraged on top of Mortgages Based Securities (and later in CDO, ABCP, and SIVs), is bringing great banks to their knees and paying big interests not to the Fed, but to sheiks and chinise SWFs, etc. A little list of great american banks trying to keep their reserve requirements in place:

http://www.marketwatch.com/news/story/morgan-stanley-sets-57-bln/story.a...

By Paul Krugman;

Unknown housing territory

I’m still trying to work out the implications of this, but some thoughts about the size of the bubble: at an aggregate level, the housing bubble looks like something we’ve seen before. The rise in the price-rental ratio was somewhat larger than the rise that took place in Los Angeles in the late 1980s, but in the same general ballpark.

However, the aggregate numbers conceal some big differences among metro areas. According to the OFHEO data, prices in Houston rose only 26% over the last five years. But prices in Miami rose 115%. That is, the bubbles in the most bubbleicious areas were bigger than anything we’ve ever seen — and there’s every reason to think that the required fall in prices in those areas will be much bigger than anything we’ve seen since the Great Depression.

This is just an awesome adjustment. Add to it the subprime mess, and past experience with housing busts may give us little guidance as to how this all plays out.

Nate,

the margin requirement at the exchange is 50%, but what about all the leverage that is used it todays credit paper market? A google search "typical leverage in CDOs" resulted in numbers from 3 to 25 with 10 as mentioned being typical. The mess with this type of debt is widely reported, take

"Let's talk about ETFC - E*Trade Financial. Yesterday Citidel took a big equity stake in them, unloading $3 billion worth of mortgage backed securities - for $800 million.

That's 26 cents on the dollar, as I mark it."

source:

http://market-ticker.denninger.net/ 30/11/07

for example. These losses happen at the same time with (right now) possible losses in the stock market. Moreover,

does the typical speculator really use only so little leverage?

What I read over and over is that the typical hedge fund uses around 10 times leverage and if it is financed by

a fund of funds this fund uses leverage too. Taken all this leverage together the comparison with 1929 looks not far-fetched.

Im very concerned. More than concerned, Im scared. Im just trying to keep the facts straight - a comment was made about stock market leverage - I pointed out a factual difference in margin requirements, which is quite substantial. My take on all this is the economy will go south and create positive (bad) feedback mechanisms - it will be indirect depression instead of direct. But no one knows - all we can do is connect the dots as best we can and there are more and more new dots each week.

You make a good point about stock market margins, but I think that only applies to the "official" markets. Several brokerages have opened their own exchanges that are not covered by SEC rules, not to mention that much of the 680 trillion dollars of the derivative market is not covered by margin rules, and that's precisely where people have gone nuts with leverage. I'm sure part of the motivation for these "innovations" was precisely to get around the formal margin requirements. The net is I don't think we're that much better protected than we were in 1929. I will also note that many people put the start of the Great Depression in 1928. The stock market crash was spectacular, but it was a "feedback" more than a "forcing".

I think it is also important to note that many of the truly safe mortgages are money losers for banks. For example, I have very good credit, and I was able to get a mortgage back in 2002 at a very low fixed rate. The banks are making nothing off me. I mention this because I think we sometimes assume that because there are a lot of relatively safe mortgages out there that they will offset the bad mortgages. But you can't offset losses with something that doesn't make money.

The margin requirements restrict only money borrowed from the broker of record. They don't touch money borrowed from other sources - like money borrowed by hedge funds in yen at ridiculously low interest rates, for example, and then injected into the U.S. markets. This is the international BigBoyz equivalent of you taking a cash advance on your credit card and buying stocks with it. At any rate, the real leverage is in the debt markets. The average hedge fund borrowing short-term and investing in longer-term, ostensibly AAA-rated securities employs 14x leverage to juice the spread. All told, the derivatives market has ballooned to nearly $700 trillion and is easily 4x the size of the cash market it is ostensibly hedging. Straight-lining DTV as though the derivatives markets don't exist ignores 80% of the problem. This is why a blowup in subprime - which will surely spread as mortgage resets in Alt-A and prime kick in in the next few years as home prices continue to decline - ignited a bank run in England and has caused the credit markets to freeze. If this were a straight-line DTV problem, would the the ECB have found it necessary to flood the European markets with $500 billion?

Yup

the first hedge fund I managed had as our core strategy buying 10 year treasuries on 9 times leverage. When our black box got a buy signal we would buy 100 million 10 year notes (with 10 million in equity) and finance the rest overnight until the position closed. Based on the rules at the time, most brokerage firms would give us a 2% haircut for 2 Year notes and 5% haircut on 10 years, meaning we needed 2% and 5% margin respectively. But we put up much more collateral than was required - our strategy optimized the risk adjusted return of average monthly return / standard deviation. If the price on TREASURIES would ever have gone down 20% while we were long, all of our capital would have been gone. We made 5% in 1997, 94% in 1998 and 1% in 1999 and shut down that fund. But treasuries don't usually move that much. The point of this story is there needs to be a value-at-risk discussion when talking about leverage. If someone is leveraged 100-1 on something that moves 1 or 2 basis points per day, its completely less risk than being leveraged 10-1 on high yield bonds.

The vast majority of leverage currently is interest rate and currency swaps which TYPICALLY don't have huge moves. One never knows though...

Nate: IMO, pretty well everybody that uses high leverage feels that their situation entails low risk. LTCM felt their strategy was low risk. Supposedly currently JP Morgan has the potential to bankrupt the company 30 times over, so obviously they feel their strategies are low risk. The problem for the economy as a whole is that when the SHTF with these "low risk" strategies the average taxpayer has to pick up the cleanup tab, one way or another-this same taxpayer gains zero profit from successful hedge funds of this type.

Of course, if one's equity in a property is 50%, the value of the property has to drop by over 50% before lenders are at risk.

However, things are much worse than that in commercial property where the "equity" can be tiny. Banks have $212bn at risk in commercial property In the UK, property funds have declined substantially and some are making it difficult for investors to liquidate their holdings (e.g. ISA's etc.)

Austrian economist Ludwig von Mises summed it up many years ago:

http://online.wsj.com/article/SB119802116320237959.html

Now, Even Borrowers With Good Credit Pose Risks

By GEORGE ANDERS

December 19, 2007; Page A2

If the CA home sells for say $400,000, this couple would be hit for a tax bill on $435,000 in income, unless they file for bankruptcy, which is quite likely.

This couple is the topic of two articles in the Round-Up:

Financial degenerates

Mortgage-Relief Plan Divides Neighbors

Or they change the law which is quite likely.

Merrill Lynch estimates $500 billion of losses on residential mortgages. I think the tab now is already $80 billion and the confessionals keep on coming.

Throw in another $500 billion of losses in commercial real estate, private equity, leveraged buyouts and corporate junk. A tally of $1 trillion seems reasonable. Call it 6-7% of GDP. About twice the losses of the S&L mess from a generation ago.

As per point two, it has been clear for months to readers of the Finance Round-Up, and many others, that we're not talking about a subprime problem. Why that keeps on being brought up I don't know, other than it fits nicely in what media, politics and industry would like us to see: a small, manageable issue. Well, it is not, as is clear, once more, from the articles above.

Point one, commercial real estate, is addressed here:

Hello Ilargi,

Thxs for this thread. I am not a finance guru, therefore, I would like more explanation and speculation on why the US is imposing citizen purchase limits on US Savings Bonds.

Is this to basically force those with savings to invest in biosolar mission-critical investments? It makes sense to me vs allowing people to buy more debt instruments to continue the 'something for nothing' mindset. Thxs for any reply.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Bob,

The article about limits on certain bonds and other instruments says in essence that there are people suspecting a move by regulators and/or banks to limit people's ability to switch their money into assets that are easily redeemable, i.e. that could cause line-ups at banks.

I do like your more altruistic take on it, don't get me wrong, but the article mentions no such forward-looking benevolence.

Time to cut open the Tempurpedic and start stuffing!

I just said on the Drumbeat:

All levels of government face a potential triple strike. First, decreasing tax revenue, second, loss of funds that were invested in shady paper, and third, no buyers for the bonds that kept the ship going.

5 minutes later, in comes this from Bloomberg:

It's everywhere, It's everywhere.

THE COMING REAL ESTATE BUST IN EASTERN EUROPE

http://www.financialsense.com/editorials/petrov/2007/1219.html

Hey it´s not only in eastern Europe. We have it here in Sweden also. I have read stories of folks that make a living in Stockholm of buying condos and piff them up a little for a sale profit. The Swedish housing bubble is a little bigger than in USA according to an article from the economist.

This ceartainly looks like a global phenomen, and propably will be a commensurate global bust.

Look out below.

I must say, that the crisis developes faster and uglier than i thought it would. I thought we were headed to a depression due to PO, but i was not fully aware of this enormous global creditbubble.

Three years ago i began personally to leave the financial system as much as i could. I got out of all mutual funds and started to accumulate gold bullion and cash. Recent time i have taken out the cash from my bankaccounts in form of bank notes.

So now after three years of preps i have left the system with my savings, and can´t do much more than stand on the sidelines and watch the oncoming trainwreck.

For those who have not done anything, the time is running out i believe.

Leap 2020 the french think thank and others foresee that the financial system collapses 2008. What that means practically i don´t know, but i guess it will be earthshaking. Those not prepared will propably be left poor, perhaps for the rest of their lives.

Maybe we all will be living in interesting times.

As we look forward to electing the captain and officers of the Titanic next year here in the US, almost anything is possible.

As several people have noted, the problem is to get the "cash" into the hands of the people, rather than loaning it to banks that are unable and/or unwilling to loan it out.

I remain fascinated/baffled/concerned by the debate between you guys (we've already had the inflation, deflation is here) and people like Jim Puplava (inflation next year) at Financial Sense.

Wouldn't direct injections of cash into consumer's pockets be the signal for a final round of inflation?

Hey

The system is doomed.

GOT GOLD?

Hey if the system is doomed GOT FOOD! Gold is pretty but not terribly tasty.

You should have it both. I have it.

Hello WT,

If Greenspan just wants to openly get cash to those that will spend it quickly: recall my earlier post where it would be a simple matter to electronically jigger the casino slot machines to suddenly start paying off bigtime.

This 'Wishing upon a Star' idea is to put the unemployed 'Jimminy Crickets' to work flooding cash [not credit] back into circulation: their gambling action will create more work for those 'Ants' still employed. The winners will then race to spend it thereby greatly increasing the money velocity and economic activity. Of course, when even this cookie crumbles: it will be really ugly. My feeble two cents.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

I would caution anyone to give too much credence to anything Alan Greenspan says relating to the current financial crisis, given the extraordinary part he has played in creating it, by helping create the biggest financial credit bubble in history. A massive consumer boom based on credit and little else.

Greenspan helped to create a virtual, and booming economy, with only a tenuous link to 'reality', now, unfortunately all the chickens are coming home to roost.

Northern Rock, one British bank has now received government garantees ammounting to over $100 billion dollars, one bank, and not the biggest in the UK. Why? The reason is simple. The desparate hope that one can stop the rot and collapse of confidence from spreading to the rest of the financial sector, leading to a meltdown in liquidity and solvency that might result in a meltdown, leading to an economic slump the like of which none of us have ever seen, unless we're really old!

The housing bubble in the UK is arguably bigger and worse than in the US and very unstable. It's the biggest speculative bubble in british history and now it's bursting with dire consequences as the 'success' of the UK economy was based on growth in the City of London, the housing boom, and growth in government spending. The whole thing was based on credit and the bubble. Still people felt they were getting richer and richer, yet it was based on a speculative bubble and little else. Everyone went along with this charade. If I remember correctly Britain accounts for more than 50% of all consumer debt all of Eurpope. It's like a house of cards, and now the game is over.

WT,

There's indeed quite a to and fro about inflation and deflation. I think much of that is due to misunderstandings and different definitions.

Stoneleigh and me go with the more Austrian view on the subject, which states that inflation equals increasing money supply. For many other people inflation equals rising prices. While the latter will follow the former, the opposite is not necessarily true. Prices may rise for varying reasons, scarcity being one of them.

Recent upticks in energy and food prices seem, to me, to be at least as much driven by scarcity as by other causes. People can, to a point, switch priorities, and pay more for some items, whole foregoing others, while money supply remains unchanged.

That said, I think we're at the end of a highly inflationary period, not at the beginning. If you look at those same energy and food prices over the past 10-20 years, they have been pretty stagnant, or even dropping, until very recently. So people think there has been low inflation.

Still, we know, money supply has gone up enormously. This may seem to contradict the Austrian inflation definition. Until you look at home prices, stock markets, and a number of other assets, where prices have gone through the roof.

However, when those prices go up, that is perceived as gains in asset value, not as inflation. Why that is, is hard to say, there seems to be a bit of a blind spot there. Maybe people simply don't like it if their increased home "value" is labelled inflationary. Maybe it's because oil and grains are seen as essentially different from homes and stocks, since one is consumed right away, while the other lasts longer. Fact remains, you need added money and credit to pay three times more for the same house than you did a decade ago. It has to come from somewhere.

In our view, given that we have just run through a decade (or two) of high inflation, there is only one way to go: deflation. The money supply will shrink hugely the next few years. If $5 trillion in US home equity/value vanishes soon, there is no way that the Fed, or any other party, can dump enough cash in the market to make up for that loss. In paper investments, like the derivatives market, the well-known alphabet soup of MBS, SIV, CDO, ABCP etc.,the potential damage is far greater still, since much of these are leveraged upon assets such as home mortgages, and can lose $10 or more for every $1 that a house or share loses.

This is not just American, home prices in many countries have gone up like crazy. The UK, Spain,. Australia, Canada, Eastern Europe, pick your fancy.

If losses total anywhere from $20-$100 trillion globally, inflation becomes impossible in whatever meaning you give to the term. You would always need enough money/credit to inflate prices, and that would not be there.

All true, but if a government/central bank is determined enough they can certainly hyperinflate can't they, as in the Weimer Republic and Zimbabwe?

Of course, that drives the value of the currency down toward zero, ultimately resulting in the same deflationary contraction.

So, as the Austrians would say, it's just a question of when, not if?

However, as (I assume) the world's largest debtor, wouldn't the US government prefer to inflate away its debts?

If memory serves, debtors were seen chasing lenders were down the street in the Twenties trying to pay off loans with vastly inflated currency during the German hyperinflation. I remember seeing a one billion mark coin in a museum in San Antonio.

But how did the Weimar government get the dough into the hands of the people? Did it just give the money away? The scheme of making credit looser doesn't necessarily increase the money supply unless businesses borrow, employ more people and begin the circulation of the extra dollars.

I'd like to know how this worked in the 20s in Germany.

By discounting commercial paper at rates below inflation (making it profitable to borrow) and monetizing government debt. Businesses paid workers, government spent money.

Well, that's kind of the point. I don't think they can, because there will be so much money and credit going up in nothingness that they won't be able to print enough of it, not even to keep money supply even, let alone increase it. And even if they could, they can't force banks to lend it out, nor people to borrow and spend it.

And the nothingness is really a big black abyss. Total US domestic real estate value went up from less than $10 trillion to more than $21 trillion in a decade. And I'll bet that it goes back where it came from, there's simply no reason to believe otherwise, there's no true added value.

This graph is from today's Whiskey and Gunpowder. If average home prices drop 43% in the next 3 years, the losses there alone will range in the $10 trillion vicinity. The at least $5 trillion in mortgages used as leverage for $50 trillion in alphabet soup paper will shrink substantially, to put it mildly.

Which will lead to complications for invested funds sustaining these losses, and that in turn will work its way down to other economic sectors. All in all, if this graph is only halfway correct, $20 trillion could easily vanish in the US alone in the next few years. And I don't see the Fed printing $7 trillion yearly.

NB: Forget about 1929 and WWII for a moment, and look at the trendline from 1950 through 2000. Then notice how that trend was broken. My take is that that 50-year trend is too strong to ignore.

NB2: Note that the numbers are inflation adjusted, and then look at the 1930 low, the last major depression.

Just as a little example of the mortgage problems happened here this weekend. It illustrates that the problem is not 'subprime' necessarily. A well publicised foreclosure auction was held in a very posh gated community. Now the median price of homes in this city is around $170K and the mortgage on this home was $1M+. It has an excellent view of the river and the city and is next door to a US Senator. The highest bid was $450K which the lender did not accept.

*Well, that's kind of the point. I don't think they can, because there will be so much money and credit going up in nothingness that they won't be able to print enough of it, not even to keep money supply even, let alone increase it. And even if they could, they can't force banks to lend it out, nor people to borrow and spend it.

The Fed can buy a massive amount of mortgages on repro agreements. With a low enough discount rate this is a profitable trade for the financial institutions. Same for businesses and consumers. If you can borrow below the infation rate, it's profitable to borrow. All great inflations are stoked by government actions to keep real interest rates negative and provide generous credit. Otherwise, what good is a fiat currency? As soon as the toxic waste is dumped, lending between banks will resume. I don't think there is a Goldilocks low inflation environment here. It's inflate or die.

Yes! The inventory in my pantry has gained many $$ just sitting there for the past few months. Makes me feel so rich I think I'll go out and buy a new wide-screen TV. Hell, maybe I'll even go for the Hummer!

I don't know about the inventory, I'd focus on the pantry itself. That has doubled in value since 2002. You might have been wise to build more pantries, maybe Russian-doll style.

Many people (should) have watched in amazement as their homes, where through the decade, the roof started leaking, the paint was peeling, and the doors came off their hinges, gained $200.000 in value. You got paid just to live somewhere, even if you let it slide.

If that is possible, there surely must be a way to get paid just to eat food, drink water and beer, and, as the ultimate triumph, breathe.

I wonder how that could not be inflationary.

ive been reading this site for awhile. the prevailing attitude of the doom, the gloom, the tomb is beyond amusing considering this world is our doing and now that things appear to be going awry, as they always do somewhere for someone, many want to retire to a fortified bunker and live out a sci-fi b-movie fantasy.

let me suggest an alternative, go visit cambodia. i recently did and what a refreshing change of air. twenty percent of the population died because of the america-indochina war and its aftermath, but you would never know it. optimism and smiles everywhere despite what is undoubtably hard living.