Khurais Me A River

Posted by JoulesBurn on March 12, 2008 - 9:24am

Khurais. It is the best of fields. It is the worst of fields. It is another chip off the old block, destined to prolong Saudi Arabia's dominance as an oil producer. It is a chink in the armor of the Saudi Oil Miracle, a symbol of a lesser future. Do tell, which is it? Amidst a lot of speculation, there are a few knowns. The Khurais Megaproject is the largest integrated development project in Saudi Aramco history. Slated for completion at the end of 2009, it includes the expansion of oil production in the Khurais, Abu Jifan, and Mazalij fields. These fields lie approximately midway between Riyadh and the Ghawar oil field, and sea water for injection will be piped in from the Arabian Gulf near Dharahan. The completed project is stated to have a capacity of 1.2 million barrels of oil per day. This article will present an early look at the Khurais development using satellite images and a review the scant data available for Khurais in an attempt to assess its prospects in light of much skepticism.

Khurais. It is the best of fields. It is the worst of fields. It is another chip off the old block, destined to prolong Saudi Arabia's dominance as an oil producer. It is a chink in the armor of the Saudi Oil Miracle, a symbol of a lesser future. Do tell, which is it? Amidst a lot of speculation, there are a few knowns. The Khurais Megaproject is the largest integrated development project in Saudi Aramco history. Slated for completion at the end of 2009, it includes the expansion of oil production in the Khurais, Abu Jifan, and Mazalij fields. These fields lie approximately midway between Riyadh and the Ghawar oil field, and sea water for injection will be piped in from the Arabian Gulf near Dharahan. The completed project is stated to have a capacity of 1.2 million barrels of oil per day. This article will present an early look at the Khurais development using satellite images and a review the scant data available for Khurais in an attempt to assess its prospects in light of much skepticism.

This article is another in a series on the oil fields of Saudi Arabia studied using Google Earth. For an introduction to this topic, see the first few articles at Satellite o'er the Desert.

For a previous Oil Drum post on Khurais, see this entry by Heading Out:

From the old to the newer, or a thought for Khurais and its companions.

Great Expectations

In "Twilight in the Desert", Matt Simmons questioned whether Khurais could possibly produce that much oil given its spotty prior production record. In contrast, Saudi Aramco lauds Khurais as "the fourth largest oil field in the world" in its Saudi Aramco 2006 Annual Review. Which of these views of Khurais' potential is correct? In contrast to the situation for Ghawar, there is only a limited amount of public data available for Khurais upon which to base an external opinion. Simmons' assessment was based on two Society of Petroleum Engineers (SPE) papers. The first of these, A Production and Operation Review of the Khurais Gas Lift Project (SPE 11447) by Chornoboy and Englehart, addresses efforts in the early 1980s to increase production. The second, a 2002 paper by Al-Afaleg et. al. entitled Successful Integration of Sparsely Distributed Core and Welltest Derived Permeability Data in a Viable Model of a Giant Carbonate Reservoir (SPE 77743-MS), describes an attempt to model previous and potential future production for Khurais using data from well logs and core measurements. For those of us playing along at home, the latter provides some information on the production history and field geology as well as well maps which facilitate a satellite-based investigation of the development status as of December 2007.

Satellite Imagery for Khurais Fields

Shown at right is the geographic setting for the three fields which comprise the Khurais project. The boundary for the Khurais field, corresponding to the oil/water contact, was obtained from well layouts in SPE 77743. The boundaries for the other fields are not explicitely defined in that paper, but there is enough supporting data to enable good approximations.

Shown at right is the geographic setting for the three fields which comprise the Khurais project. The boundary for the Khurais field, corresponding to the oil/water contact, was obtained from well layouts in SPE 77743. The boundaries for the other fields are not explicitely defined in that paper, but there is enough supporting data to enable good approximations.

A fourth field often included as one of the satellites of the Khurais complex, Qirdi, has apparently become the southern tip of Khurais. The total area for the three fields is approximately 1600 sq. km (620 sq. miles), with the Khurais field accounting for 2/3 of the total; this is an area nearly equal to that of the Uthmaniyah section of the Ghawar field.

Google Earth currently (2/2008) displays high resolution DigitalGlobe imagery for the northern half of the Khurais field and nearly all of Abu Jifan dating to mid June 2006. There are also DigitalGlobe preview images of the same vintage images covering the remaining areas. DG previews dating to September 2007 also cover small sections of Khurais, as indicated with blue outlines in figure at right. Finally, two Spot5 preview images provide a blurry but nonetheless informative picture from the end of 2007 in the region of Khurais within the green outline.

Khurais Production History

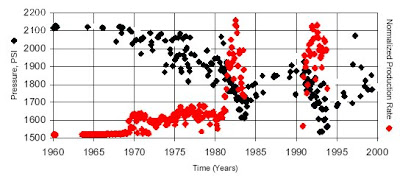

Why hasn't Khurais been more fully developed? Khurais was discovered in 1957, but oil was not produced to any large extent until the 1970s. Shown below is a composite of oil production and Arab-D reservoir pressure based on data from SPE 77743. Production was via primary depletion. The production increase resulting from the 1980s Gas Lift Project described in SPE 11447 is apparent, as is a later production spurt in the 1990s. The steady drop in reservoir pressure as the oil is extracted is indicative of insufficient support from the aquifer.

Khurais production (red) and Arab-D reservoir pressure (black) 1960-2000

Khurais production (red) and Arab-D reservoir pressure (black) 1960-2000

The production values are normalized, but Simmons gives a value for overall field production as 68,000 barrels per day in 1980 and reaching a maximum of 144,000 bpd in 1981 (although the above figure suggests a year or more later). The number of flowing wells in the 1970s is unknown, but at least 50 wells (some of which were new) were contributing to the rate in the early 1980s. A total of 50 wells would yield a flow of somewhat less than 3000 bpd from each.

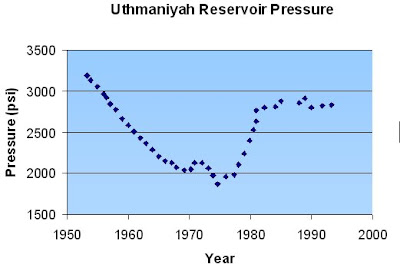

The pressure behavior obviously does not portend well for long-term production, but it must be remembered that the field was being produced under primary depletion. For example, compare this with the pressure drop observed in the Uthmaniyah area of Ghawar prior to the onset of water injection:

Arab-D reservoir pressure in Uthmaniyah. Data from Benkendorfer et. al., "Integrated Reservoir Modelling of a Major Arabian Carbonate Reservoir" (SPE 29869)

Water injection in Uthmaniyah first began along the flanks in 1966 with gravity assist and then with a pressurized system in 1973. According to one estimate, pre-injection oil production was likely under 400,000 bpd--but still perhaps 5-10 times higher than that from Khurais. Differences in the quality of the reservoir might be the primary cause of this. However, it may also be important that the initial static pressure in Khurais is quite a bit lower than that for the Ghawar fields such that the primary drive mechanism is solution gas rather than aquifer. In any case, it is somewhat misleading to compare oil production from Ghawar under water injection with Khurais under its own steam.

What of the boost in production in the 1980s? This effort to increase production was misread by Simmons as "gas injection", a technique used in 'Ain Dar and Abqaiq in earlier years to maintain reservoir pressure. What was actually employed in Khurais was "gas lift". The distinction between these two is given by Schlumberger as:

gas injection:SPE 11447 does report problems in some of the 50 wells (in Khurais) where gas lift was employed, but gives an overall positive assessment of the effort. Since it was written while production was ongoing, any reason for stopping production (beyond the decline in the price of oil) is not clear from the paper. Curiously, the Gas Lift project is not mentioned at all in the latter 2002 paper (SPE 77743), even though this would seem to have been critical in accurately modeling oil production during the 1980s and 1990s.gas lift:

- A reservoir maintenance or secondary recovery method that uses injected gas to supplement the pressure in an oil reservoir or field. In most cases, a field will incorporate a planned distribution of gas-injection wells to maintain reservoir pressure and effect an efficient sweep of recoverable liquids.

- An artificial-lift method in which gas is injected into the production tubing to reduce the hydrostatic pressure of the fluid column. The resulting reduction in bottomhole pressure allows the reservoir liquids to enter the wellbore at a higher flow rate. The injection gas is typically conveyed down the tubing-casing annulus and enters the production train through a series of gas-lift valves. The gas-lift valve position, operating pressures and gas injection rate are determined by specific well conditions.

2001 Well Survey (SPE 77743)

By 2001, there were 131 wells placed in the Khurais complex, with 80 of those located in the Khurais field itself. Saudi Aramco initiated a study to determine the best strategy for a full development of the complex. Well logs and measurements on well core plugs were used to determine reservoir stratigraphy, porosity, and permeability. These data were then used to construct a 3D model of the oil-bearing zones.

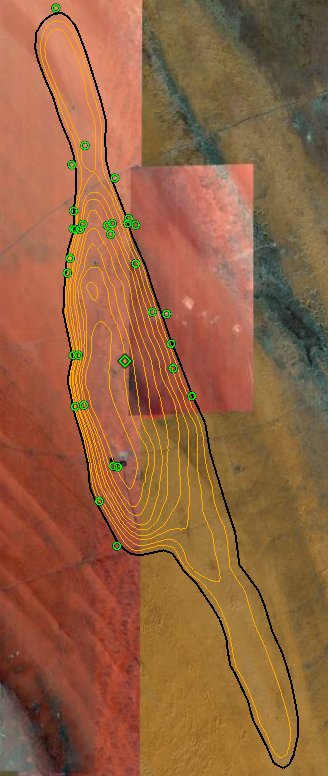

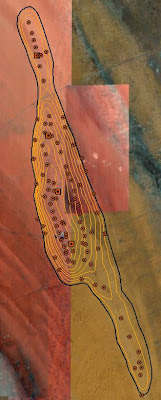

Shown at right are the 2001 wells identified using Google Earth. Superimposed on the image are contours indicating the top of the Arab-D reservoir, the major oil-bearing structure in Khurais. This formation is an asymmetric anticline with dips averaging 2 degrees and 8.7 degrees on the eastern and western flanks respectively. (Click image for a larger version).

By 2001, there were 131 wells placed in the Khurais complex, with 80 of those located in the Khurais field itself. Saudi Aramco initiated a study to determine the best strategy for a full development of the complex. Well logs and measurements on well core plugs were used to determine reservoir stratigraphy, porosity, and permeability. These data were then used to construct a 3D model of the oil-bearing zones.

Shown at right are the 2001 wells identified using Google Earth. Superimposed on the image are contours indicating the top of the Arab-D reservoir, the major oil-bearing structure in Khurais. This formation is an asymmetric anticline with dips averaging 2 degrees and 8.7 degrees on the eastern and western flanks respectively. (Click image for a larger version).

Where the Oil Is

Khurais has three oil-bearing reservoirs: the Arab-D and Hanifa (both API 33 degrees), and Fadhili (API 36 degrees). Most of the wells have been drilled into the Arab-D, with an unknown number into the Hanifa. At least 7 wells have been cored in the Fadhili reservoir, but it has not been produced. SPE 77743 presents a stratigraphic column for the Arab-D reservoir. Unfortunately, absolute thickness of the Arab-D is not revealed. However, this reference:Anthony E . Adams and Mohamed S . Al-Zahrani, PALAEOBERESELLIDS (DASYCLADACEANS) FROM THE UPPER JURASSIC ARAB-D RESERVOIR, SAUDI ARABIA, PALAEONTOLOGY, VOLUME 43 (2000)describes a well in south Khurais with an Arab-D layer of 65 meters (213 feet) thick lying at a depth span of 1647-1712 meters (5400'-5617'). Even less has been revealed about the thickness or areal extent of the Hanifa (or Fadhili) reservoirs, although the thickness of the Hanifa in Abqaiq is about 100 m (300 feet) with an areal extent equal to 14% of that for the Arab-D (JoulesBurn, blog post in preparation).

Arab-D Porosity

The stratigraphic column in SPE 77743 includes porosity log measurements. In contrast to Ghawar, where the Arab-D zone 2 has the highest quality, the sweet spot in Khurais is zone 1 (the upper 40%). Zone 2 occupies the middle 20% of the Arab-D, with somewhat lower porosities. The remaining 40% is zone 3, with still lower porosity. The authors excised the scale information, but if one assumes the major divisions correspond to 10% intervals, I have estimated average porosities of 24%, 12%, and 5% for the three zones. Irrespective of the absolute porosity values, this implies that 2/3 of the oil in the Khurais Arab-D lies in zone 1. Below the oil-bearing layers lies 300 feet of the impervious Jubailah formation followed by the Hanifa reservoir. As is the case in Abqaiq, there are fractures through the Jubailah which provide pressure continuity between the Arab-D and Hanifa reservoirs with all sorts of unfortunate consequences.Permeability

As per SPE 77743, permeability of the Arab-D reservoir in Khurais was measured both from core samples (small scale permeability) and from well tests (large scale). Core permeabilities, presented in cumulative probability distributions, range from a median value of 100 mD in the north to about 5 mD in the south with little variance east to west. However, the effective permeabilities measured in the wells is often much higher (over 10x), particularly along the crest of the anticline, due to fracturing. It was because of this high permeability that proportionally more wells were drilled into the crest. Upon water flood, the risk will be that wells drilled near these fractures could water out early. It is perhaps for this reason that a 3D seismic study was conducted over Khurais and Abu Jifan from 2004-2006 in order to dilineate the fractures.How Best to Get the Oil Out?

The Khurais oil field seems to have many of the challenges encountered previously by Saudi Aramco before in other fields. Haradh III is one model for how Khurais might be developed, given the lesser quality of the rock relative to the rest of Ghawar as well as the problems with fractures. The challenge of exploiting two reservoirs (Arab-D and Hanifa) has been confronted in Abqaiq, although not (as of yet) successfully. How will this field be developed?

A June 2006 announcement by Abd Allah S. Al-Saif, Aramco senior vice-president exploration and producing, revealed the following:

...the Khurais development plans include drilling 310 horizontal wells and installing facilities for injecting 2 million b/ d of seawater. Included in the 310 wells are 125 water injection wells and 17 observation wells. Al-Saif said the producing wells will have single 1-2-km long laterals and be instrumented with modern real-time, intelligent, downhole completions with "smart" electric submersible pumps. The injection wells will have 1.5-km long laterals, he said.

One surprise is the use of relatively short single-lateral horizontal wells, and another is the use of electric pumps. In contrast, the two most recently (or nearly) completed megaprojects, the Haradh III increment and the Khursaniyah (AFK) expansion, both utilized multi-lateral maximum reservoir contact (MRC) wells for producers. Achieving 1.2 million barrels per day from 168 producers requires an average well productivity of 7142 bpd. By comparison, the single-lateral horizontals in the Haradh II increment reportedly only provide about 3000 bpd of production. Will these be sufficient? Time and future satellite imagery will tell.

Quick, Let's Get Started!

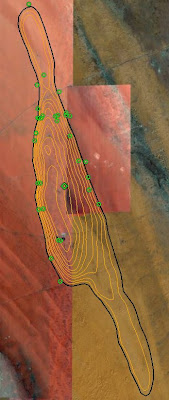

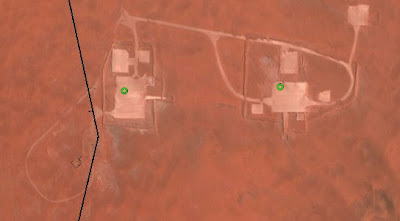

Saudi Aramco met with contractors in March 2006, and in early June announced that Halliburton had been awarded a 3-year contract to drill the wells. Based on satellite images taken less than 2 weeks later, the awardee wasted little time getting things going. Shown at right is the Khurais field with new well development sites indicated by the green placemarks. One drilling rig is also being readied (green diamond in the center of the field). Most of the initial drilling sites are for injectors including a pair on the western flank shown in the closeup below.

Saudi Aramco met with contractors in March 2006, and in early June announced that Halliburton had been awarded a 3-year contract to drill the wells. Based on satellite images taken less than 2 weeks later, the awardee wasted little time getting things going. Shown at right is the Khurais field with new well development sites indicated by the green placemarks. One drilling rig is also being readied (green diamond in the center of the field). Most of the initial drilling sites are for injectors including a pair on the western flank shown in the closeup below.

Most of the sites are still being prepared, and many earth-moving vehicles are visible as seen below for a group of sites near the northern "bottleneck".

Such a rapid deployment of equipment does not seem possible, even with Halliburton now calling the U.A.E. home. Either they knew well in advance of the contract announcement, or perhaps Saudi Aramco initiated the drilling themselves. It is also noteworthy that this development is occuring nearly simultaneously with the extensive drilling of new wells in Ghawar. Outside the field, the graded areas directly to the east are the likely sites for additional infrastructure being constructed including gas and water facilities. Foster Wheeler was awarded a contract a year prior which included a central processing facility.

September, 2007

Moving ahead about about 15 months, an updated picture is obtained using low-resolution preview DigitalGlobe images as overlays. There as been considerable progress on the central processing facilities and seemingly the construction of an airstrip.

|  |

Central Processing facilities east of Khurais in June 2006 (left) and September 2007

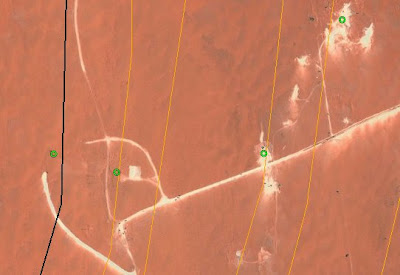

Similarly, a region to the southwest also shows a number of new well locations. |  |

Well development in SW Khurais in June 2006 (left) and September 2007

December 2007

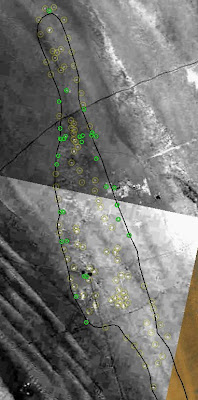

As noted earlier, there are two December, 2007 images from the Spot5 instrument which cover nearly all of Khurais. These images are monochrome, and the preview images for these have even less resolution than the DigitalGlobe previews. However, the fresh sites are remarkably distinct even at this resolution as shown at right. The sites visible in 2006 are indicated with green placemarks, and faint yellow circles indicate additional identified sites for the end of 2007 (Again, click image for larger version).

As noted earlier, there are two December, 2007 images from the Spot5 instrument which cover nearly all of Khurais. These images are monochrome, and the preview images for these have even less resolution than the DigitalGlobe previews. However, the fresh sites are remarkably distinct even at this resolution as shown at right. The sites visible in 2006 are indicated with green placemarks, and faint yellow circles indicate additional identified sites for the end of 2007 (Again, click image for larger version).

The development plan at this point appears to include injectors spaced 1.5 to 3 km apart with producers located 4 km updip. In addition, there are several clusters of producers where the well spacing is also about 1.5 km, including a large cluster in the south central part of the field. I have tentatively identified about 60 additional sites which, when added to those found in 2006 (about 20), gives perhaps a third to a half of the number allotted for the Khurais field portion of the project. Of course, given the, given the quality of the 2007 images used, the uncertainty is large.

Comparison with Haradh III

Although the Khurais project was planned with single instead of multiple laterals, it is still interesting to compare this picture with the layout for the Haradh III increment. In a previous article, the Haradh III well layout was aligned with the satellite imagery, as show at right. The spacing of injectors around the periphery and distance from the injection line to the producers is similar to that observed for Khurais.

Khurais Development vs. Other Drilling

It is clear that development of Khurais has ramped up considerably in 2007 relative to 2006. Of interest is the magnitude of this effort relative to maintaining production from existing fields. Saudi Aramco seemed to provide an answer to this question as reported by Oil Daily Reports:This continued drilling of Ghawar in 2007 is comparable to what I found for 2006. If what the satellite imagery above shows is only reflective of 85 wells (plus a few in 2006), 2008 should be a busy year in Khurais.In December 2006, Saudi Aramco announced its 2007 exploration and drilling budget of almost $4 billion - nearly double the draft budget and full quarter of Aramco’s 2007 capital budget.

...Aramco plans to drill 427 onshore and offshore crude oil development wells in 2007. Approximately 134 wells will be in or near Ghawar, while 85 will be drilled in Khurais, and some 50 drilled in Khursaniya.

Abu Jifan and Mazalij

I haven't presented any imagery from these fields, and there has definitely been activity there in the last couple of years. However, the lack of high resolution imagery for Mazalij prevents any clear before and after comparisons, and the (real or apparent) colorations in the imagery for Abu Jifan makes me a little queazy. For example, look at the image below, found on the east side of the field. I can't identify this as anything related to oil production, but there is a similar site not too far away. It looks rather like it's located in Mordor. If you look closely, you can possibly spot orcs and maybe smell the sulfur.

Unknown development in the Abu Jifan oil field (view in Google Maps)

Conclusion: the Good, the Bad, and the Unknown

An early glimpse of the Khurais development has been afforded by satellite imagery using Google Earth. A review of two SPE papers on Khurais suggests more favorable prospects for Khurais reaching its stated production targets than often assumed, although whether this can be done with the planned number of wells remains to be seen (hopefully by satellite). The good: a large field with good porosity in the upper part of the Arab-D reservoir, mixed permeability (at least not overly tight like Shaybah), and light grade crude. The bad: fractures at the crest (the double-edged sword of higher early production but with earlier water encroachment). The unknown: less effective waterflood (as suggested by the need for electric pumps), whither simultaneous (but likely problematic) production from the Hanifa reservoir. One other unknown is whether the fields, once "commissioning activities have been completed"*, will run at "capacity". </sarcasm>*see the Khursaniyah project delay

great work joulesburn. the graph of pressure vs time shows that the reservoir pressure declined from about 2100 psi to around 1800 psi in the time frame shown. this probably gives a clue as to the slow developement of the field(s), given that heretofor, the saudi's had excess capacity.

what many probably dont realize is that with the relatively high reservoir temperature, these intermediate gravity oils are volitile under depletion. the upshot of which is that as pressure depletes, a mobile gas saturation developes and the gas/oil ratio rockets. having a high gas saturation at the start of waterflood can only lead to bad things. water displaces the low viscosity gas and leaves the higher viscosity oil behind, resulting in excess water production.

once again, it appears that aaramco is a good reservoir manager.

2 million bpd water injection against a peak primary of 140,000 bpd would lead to a disaster if the reservoir were depleted to a high gas saturation.

Perhaps that is why they didn't do a serious gas injection effort like they tried at Abqaiq and 'Ain Dar, resulting in an annoying gas cap.

One mystery is why they tried production again in the 90s (the big ramp up after the Gulf War), unless maybe the only reason they shut down in the 80s was because of low prices.

It is either for mining or a m1551e base. Any coal in them thar hills?

As to the possible base, did you note the offset in the gate? Several site look emplaced but there is not much evidence, at this resolution anyway, that the perimeter is patrolled.

What is a M1551e base?

missile?

I was pu22led by th1s at f14rst, 2.

Seems Joules will get a paranoid post with every article (last time I did the honors).

So it's pronounced "Cry"? I dig the Julie London reference.

I really don't know if that's how Khurais is pronounced (it's probably two syllables for starters), but I figured it was worth it for those who would read it that way. For those who wonder who Julie London is, wonder no more:

http://youtube.com/watch?v=ByUOFV5TusE

Could it just be a gravel pit? With as much road construction as must be occuring, high quality road base would be essential.

It seems to complex for that, and I don't really see a pit.

My best guess is that it is temporary housing for the folks drilling Abu Jifan. The perimeter fence is clearly designed to keep the dunes out, especially with the configuration of the gate.

Before, I go any further, I have to defer to people that are much better at this than I am, in general and you in particular, but take a look at the upper left corner. Isn't that a fairly significant excavation?

Here is its sister site to the south. There is much less activity, but certainly the same thing.

Well, if those ponds scattered all over aren't oil they have to be fire ponds. That means they're doing something there that tends to blow up a lot.

At the top left of the original site are three tanks with a filling station. They look a lot like liquefied gas storage of some sort.

I read this excellent article the other day while I was preparing The Saudis Are Blowing Smoke Again.

I would have cited it, but my focus was not on details of the new fields scheduled to come on-stream.

It's a pity that we don't know more than we do. All we do know was summarized by you. Good job.

Will Khurais achieve 1.2 million b/d? I'll take a wait & see attitude, although we'll never really know, will we? The Saudis won't ever tell us how the field is performing.

-- Dave

"Will Khurais achieve 1.2 million b/d?"

as you say, wait and see.

otoh, there is really no reason why it couldn't, given a field 620 sq miles with 168 horizontal producers, 125 injectors and an injection rate of 2 million bwpd.

i get the feeling that this is to the saudi's as the arctic is to bp, they havent developed it because they havent needed to (that damn waterflooding is such a lot of work).

This is a great piece that helps our understanding of Khurais a lot.

One question - I have a memory of reading (can't remember where) that the Arab-D in Khurais isn't as fully charged as in Ghawar. Have you looked at that at all? Is there any data on the papers you read on the initial position of the OWC?

One thing that might have useful information is the USGS publication on the greater Ghawar petroleum system, which has a lot of details on the source rock and the process of charging the reservoirs.

I remember reading that too. I think it was in relation to one explanation for the uneven OWC in Ghawar, with moving water sweeping upwardly moving oil more towards the east, and hence Ghawar got more of it. The question is, how much more could Khurais have held? In SPE 77743-MS, Arab-D contours suggest better closure to the north and east than the south and west. Perhaps it would have all leaked out through Abu Jifan and beyond if there was a lot more that came up from below.

I haven't seen anything discussing the OOWC for Khurais, but I am doubtful it has been produced enough for there to be much difference. There was probably more uncertainty in where it was since they had so few wells near it (similar to early Haradh), and this seems to be reflected in other versions of the field boundary.

I've read so many different positions on Saudi oil, from Simmons pessimistic view to google oversights like this one, and have to conclude that the Saudi's have done a wonderful job of keeping us all in the dark. Fact is we can speculate all we want, yet the truth lies deep under their desert where it will remain for many years to come. As long as they are pumping out 9+ mpd then its probably best to just leave them to do their business as they please.

Regardless of Saudi future oil production at current rates or slightly greater, fact is they can never produce the amount of oil needed to supply an ever expanding world economy. And thus, Peak Oil as we know it still remains that plateau upon which we have remained since May 2005.

As demand continues to outpace production, the price of oil will continue to rise.

“And thus, Peak Oil as we know it still remains that plateau upon which we have remained since May 2005.” Posted by Cslater8

At this point in time, it should be possible to date the beginning of the “Bumpy Plateau” that we are almost certainly now on. May of ‘05 is the current date of Peak Oil (C+C), but it is not the beginning of the Plateau. If I recall correctly, there was a Peak in C+C production in April of ‘04; this remained the Peak until May of ‘05, which only beat out April of ‘04 by a small amount, something like several hundred KBD.

So I would tentatively date the beginning of the Plateau to April of ‘04. My memory or dates could well be wrong, so anyone feel free to correct me or suggest another date for the beginning of the Plateau.

Antoinetta III

You are just a couple of months early. The current plateau began in June of 2004.

Ron Patterson

Excellent! This is a long overdue article. I am not able to do more than scan it right now, but I can say this....if Khurais can't deliver big, our watcha' stuff is hanging over the fence in the worst way...we will see....:-)

RC

Thanks joulesburn, this is excellent information. I have a hunch that as you and other OilDrummers analyze more and more of these satellite photos, a relatively accurate picture of the overall situation in places like SA will emerge.

I must wonder, however, what the quality of data and analysis are like at places like the CIA, DoD, etc. - i.e. government agencies with tons of technology and top-notch analysts bought and paid for by the Amerkan taxpayer. I suppose it is completely unreasonable to expect that ordinary citizens like you and I should have access to this information.

On a side note, I think that, in general, we would all benefit enormously if we devoted more of our TOD discourse to questions like this:

What kind of relationship to gasoline/petroleum do you and I WANT to have?

How much consumptive discretion do you and I have right now? (Several obvious examples (1) We could stop playing on gasoline-powered toys like snowmobiles and riding lawn mowers immediately, and (2) We could stop driving our children to structured extra-curicular activities and tell them to find constructive things to do at home or within walking/bicycling/transit distance.)

What can we do to INCREASE our discretion? (Make connections with neighbors so we can carpool and rideshare, move to a pedestrian-oriented neighborhood, engage in local government to add transit, etc.)

This is not idle talk. We very often speak as though OTHER PEOPLE were no more than gasoline-purchasing automatons - "they" will do such and such if gas prices go up and so and so if prices fall. And of course we like to pretend that "people's" vehicular purchasing decisions have NOTHING to do with the encouragement or approbation YOU and I communicate to them.

God help us, have we all kissed off free will?

Hans Noeldner

"Civilization is the presence of enlightened SELF-restraint."

Not many oil fields like this are scheduled to yield 1.2 million barrels a day. There were also reports of other reservoirs below Arab-D. Seems like the Saudis have more oil and are not doing a nose dive in the desert.

well, the saudi's may not take a nose dive in the desert, at least not immediately. apparently, they are putting a massive effort into bringing this project into production. if they have so much excess capacity, it is difficult to see why they would need to expend this much effort. manhattan project in the desert ?

In general I tend to agree with you. Also it highlights that they probably don't have a lot of new oil fields or better prospects. They are putting this into production the moment technology reached the stage to make it feasible.

As far as production I'd suspect that 500kbd is probably a reasonable guess with a chance of it increasing close to 1mbpd or more over time. It could be several years if ever before they get the flow rate they are predicting.

But think about the time scales lest say its 200-500kbd through 2010-2011 then say starts ramping up in 2011-2015. I don't see that it makes a huge difference by that point in time. At best its going to help some with internal consumption.

So in my opinion its practically irrelevant. We would need like 4mbd really coming online NOW to make a real difference. Once the world is down 2-4mbpd the whole game will change slight changes in the production curve will at best help some on export land.

That's some nice pun-ditry there, Joules. English major in another life?

You expressed a degree of puzzlement about why single laterals were being utilized. I think you may have answered your own question when you also mentioned the major effort being undertaken to identify and avoid potentially problematic facturing. I believe that this might be the case as the cost of drilling to 5,000 feet or so is a minor consideration when when the key objective is to optimize distances from well mapped factures. Is this plausible as at least a partial explanation?

Maybe its simply faster than more complex wells. If it shaves a year off of development time thats significant if you need the oil.

But of course KSA does not need the oil right ?

Haradh was rather fractured as well. Saudi Aramco seemed to be claiming MRCs as the proven solution, but the difference between using single and multiple laterals probably isn't that much. Two ideas: 1) they want to spread out the laterals (to minimize pressure drawdown) more than would be practical with MRC wells, or 2) using downhole electric pumps precluded using MRC due to space constraints in the motherbore.

Hmm. An uncovered REDA is a dead REDA in a very short period. They run free and heat up and ... well die very very young ... and gas bubbling out of solution is for all practical purposes uncovered. If they are worried about gas coming out of solution as your post indicates, treading lightly is key.

Ergo, while I am by no means a reservoir engineer, your first idea seems to have a lot of merit.

As far as the interplay between a REDA and MRC well technology, I do not believe that REDAs will really turn the corner so as to selectively produce a particular lateral. More of shotgun than a rifle. As a result, and unless the technology has gone into a new phase that I have not heard discussed, no matter how "smart" a multi lateral MRC well might be otherwise, the pressure differential would probably express itself equally to any and all open legs.

BTW, Joules, thanks for the analysis ["wow"!]

Superspike, and why Khurais scares commodity investors, and may scare you too.

Commodities in general and oil in particular are showing all the signs of a classic "superspike".

The price "superspike" is generally caused by essentially one driving factor: Fear.

What we are seeing is investors terrified they will be left behind and buyers terrified of being left without. They thought oil was at a top back in the days when it was $80 per barrel.Then $90 and most investors thought o.k., we missed the run up (or have made all we can in it) so the oil price is at a top. Wrong again.

Now, we are past not only $100 per barrel, but nearing $110, and those who doubted oil's ability to rise forever in price are afraid. They are ticked off. They want to make money on this huge historic event, and won't be made to look foolish again!

So the money is pouring in. the "advisors" on the internet are telling everyone that "you too can make millions on futures!" Read the ads, and you will notice some old similarities. If you inserted the words "housing" and real estate instead of oil and commodities, the ads would have looked exactly in place five years ago...different bubble, same game.

But THIS TIME IT'S DIFFERENT! At least that's what the investment "advisors" are saying. But, But...we are running out of oil, right? Haven't you seen it in the news, Simmons and those guys, Simmons says it would be cheap at $300 per barrel, maybe $400, right?

Maybe. But when your hungry, a loaf of bread would be worth...?

The question is, are we showing signs of energy hunger? If so, it is still around the edges. I am still commuting 40 miles round trip to my job, because the price of a house or apartment even at so called "discounted" real estate collapse prices near where I work would pay for my gasoline until well past my retirement age. The SUV's are still prowling, and the neighbors are getting the power boat ready for summer.

Of course, we all know the Earth is hollow, right? And of course, a few billion barrels of oil here, a few billion there, and at some point, someone may begin to believe there is oil out there. Brazil was laughed off the block when they said there was oil offshore, but now no one is laughing, as American "investors" are already seeing the makings of the next bubble, and Brazil is spoken of as an aspiring OPEC member. As Iraq begins to work it's way back to civility, greed is starting to be seen, as the Iraqi's know the value of money, i.e., oil, and production begins to rise. Money, real money is being spent in fields that were once laughed off as a piss in the sea, off the coast of North and West Africa. A few billion here, a few billion there...

And there is Khurais. No one knows what it really can produce, or whether there are a couple of more fields tucked out in the Saudi desert that could rival it when the Saudi's feel they need it.

But for those "investors" with white hair on the head, it starts to seem so 1982, doesn't it?

But even the seasoned players are terrified of being left behind. THIS TIME IT'S DIFFERENT, they tell themselves as they write out the check to the commodities brokers with shaking hands, this time IT MUST BE DIFFERENT.

In the meantime, the hedge funds, the LLP's, and finally the big funds can resist it no more...the can't be left behind on this great run up. O.K., so the S&L's failed us, so the Asian bond boom failed us, so the dot com industry failed us, so the Enron/utility high flying power dealers failed us, so the real estate boom failed us, I tell you THIS TIME IT'S DIFFERENT! So in they go, into the vortex they go, with pension money, with municipal investment funds and with university endowments, all basing their assumptions on one premise: THIS TIME IT'S DIFFERENT. This is not like the 1970's, this time there will be no new supply, this time the commodities boom could go on for years, MAYBE DECADES! What looks like a normal commodities superspike and a currency crisis brought on by a trillion dollar currency burn in the deserts of Iraq is actually a permanent and never ending commodities price run up! You don't believe it? Well, your just a doubter, a dang cornucopian, and I hope you miss your share of the great wealth I have while your family suffers in the cold because you don't have the money to buy OIL! What? You don't heat with oil? Well, it don't matter, because IT'S ALL RUNNING OUT, ALL AT ONCE(?), IT'S PEAK EVERYTHING. The Earth is not flat, but indeed seems to be hollow. It's just that no one noticed it before, but we did...our generation is different, you know, smarter than the old guys, and THIS TIME IT'S DIFFERENT.

Why do I write this? Why do I make such a point of this? Simply this: PLEASE be careful. I have seen the results of these manias first hand. I know people who were swept in, and did not recover for decades. Sometimes never. PLEASE, hedge, be careful. One of the deadliest phrases to prosperity and wealth ever uttered, over and over again, has been THIS TIME IT'S DIFFERENT.

(By way of disclosure: I accept the geological premise of peak oil. IT WILL HAPPEN, and it may have already happened. There is no way to know. Being as prepared as possible for the possibility of severe supply and or price disruptions is prudent. The trick with peak oil or peak anything is that you must not only be correct in theory, but right in your timing. Whether peak oil comes now or 30 years from now matters almost nothing in the grand cultural scheme of things. We are almost certainly much nearer the end of the oil age than we are to the beginning of it, if we define the age of oil as the age in which oil and petroleum act as the principle drivers of growth worldwide. But an error of 30 years in timing is everything for an individual. It can swallow up an individuals most productive years. It can leave a person penniless just as he/she is entering the most vulnerable and feeble years of life. For many who have made an error in timing, it was the error that essentially removed them from a decent lifestyle for the rest of their lives. BE CAREFUL. Thank you.

RC

This is no superspike. This is a pretty conventional leg up. We'll have a short consolidation around $110, and then we'll have still another pretty conventional leg up.

Thanks for the research, JoulesBurn. This is how it must have felt waiting for the next installment of Dickens.

It's not just oil, its all commodities. Gold, silver, copper, iron, food, energies, etc. etc. Money is moving out of equities and into commodities... this money will vanish faster than it arrived when the slide begins. Jewelry stores are empty, not just here but asia too. Only short term investors are buying, hardly an ounce is moving out of storage.

Plot commodities over the past five years, the curve looks just as house prices did until a year or so ago. Classic bubble.

Meanwhile, australia drought is over, production will be back up this summer, we've got plenty of gasoline in storage, and we are in a deep and long recession that is not just US but will spread to europe and asia immediately... no decoupling, world wide demand destruction for most commodities coming soon.

We are in a deflationary environment, just like all recessions other than those caused by an actual sharp reduction in oil supplies. IMO the commodity bubble will pop faster than housing, prices won't be nearly as sticky.

Maybe we are past peak, even if true the recession will mask it. Maybe 2010 is peak... in this case, prices will rise again just as we try to recover from the recession.

Really amazing work. I'm in awe of the skills and time you have put into this.

I wonder if anybody at CERA ever studies oil fields in this much detail?

cheers

Phil.