The financial crash has a simple cause and a simple solution

Posted by Jerome a Paris on March 16, 2008 - 10:01am in The Oil Drum: Europe

[UPDATE] JP Morgan agrees to buy Bear Stearns for $2 a share (Stock closed Friday at $30).

Also, Fed cuts rates (on Sunday) from 3.5% to 3.25%.

The WSJ has a decent article describing the current financial crisis and pulling no punches:

Debt Reckoning: U.S. Receives a Margin Call

The U.S. is at the receiving end of a massive margin call: Across the economy, wary lenders are demanding that borrowers put up more collateral or sell assets to reduce debts.

The unfolding financial crisis -- one that began with bad bets on securities backed by subprime mortgages, then sparked a tightening of credit between big banks -- appears to be broadening further. For years, the U.S. economy has been borrowing from cash-rich lenders from Asia to the Middle East. American firms and households have enjoyed readily available credit at easy terms, even for risky bets. No longer.

The diagnosis is no longer, as still a few weeks ago, of a "softening" of the economy, with troubles limited only to arcane financial markets:

Bob Eisenbeis, a former executive vice president of the Federal Reserve Bank of Atlanta, says the problem is more than an inability to find ready buyers for assets. "It is time to step back and recognize that the current situation isn't a liquidity issue and hasn't been for some time now," said Mr. Eisenbeis, the chief monetary economist for Cumberland Advisers. "Rather, there is uncertainty about the underlying quality of assets -- which is a solvency issue, driven by a breakdown in highly leveraged positions."

A crisis of liquidity means that you have assets, but cannot sell them in time to pay the debts you have. A crisis of solvency means that the assets you have are worth less than what you owe. It is often hard to tell which is which (is your asset illiquid because it takes time to sell, or because it is worth less than you are expecting to get for it?). A liquidity crisis can turn into a solvency crisis, if people are forced to liquidate assets in emergency fashion, and thus to drop prices to raise cash as quickly as possible - thereby creating market prices for these assets that are lower than before, and putting others that hold similar assets in the situation where their assets are suddenly worth less.

But we had an underlying solvency crisis from the start, given the unrealistic lending that had taken place - such as the "ninja" loans (no income, no jobs or assets) that were provided in the heat of the mania and which could only ever be repaid if house prices kept on going up. Asset prices were propped up only by the fact that people were able to borrow unreasonable amounts of money to bid for them, and were able to borrow such amounts only because they were seen to be acquiring valuable assets - ie the whole thing was a grand illusion, sustained by a collective loss of common sense, helped with massive dollops of self-interested propaganda by the financial, construction, real estate and media industries.

Now it's the same thing, in reverse. People cannot borrow, thus cannot bid for assets, whose prices fall down as they need to be sold - and those deep in debt need to sell (ar dump the assets to banks that then need to sell). As prices go down, all loans based on collateral dry out - and more generally banks are getting stingy as they struggle with all those doubtful assets on their hands, so lending dries out. This is what's called "deleveraging" in the case of the hedge funds, and it's as painful for financial assets as it is for real estate.

Kenneth Rogoff, a Harvard University economist, says the current difficulty has many mothers -- the housing bubble, the subprime problem and the fact that the value of U.S. imports has long outstripped the value of exports. The current account deficit -- the broadest measure of the trade deficit -- burgeoned, and the U.S. needed to borrow ever larger amounts of cash from abroad to fund it.

For years, Mr. Rogoff and like-minded economists harped that the U.S. current account deficit was unsustainable. But despite the belief that it would necessarily reverse, it kept growing through the first part of this decade, going from 3.6% of gross domestic product at the end of 1999 to a record 6.8% at the end of 2005. Lately, the deficit has seen a slight narrowing, but the combination of credit crisis and the economic downturn may have proved the catalyst for a faster, and potentially more dangerous, adjustment.

As in the first paragraph of the article, this is the closest this article, which correctly describes the current winding down, comes to the underlying cause, but it's simple: the country was living on foreign credit.

But I get the feeling that this is part of an attempt (likely to get louder as things get worse) to blame the "foreign" bit rather than the "credit" bit.

I hope I'm wrong, but as we begin to see loud calls for bailouts (unfair, as they reward the bankers that created the problem in the first place, but, you see, the alternative is worse), the availability of a ready-made outsider scapegoat is likely to be irresistible.

And yet, the fact remains that the problem is not who provided the credit, but the fact that it was provided in such large amounts.

Because that sea of debt had one real purpose: hide the fact that income for most are stagnating.

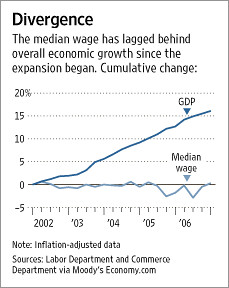

I never tire of posting this graph of the "W economy", because it summarizes in a nutshell what happened: growth happened, but was not shared widely. Thanks to wage stagnation, made possible by the threats of outsourcing and offshorization, and by consistent policies over the last 30 years to deregulate and liberalise markets, starting with labor markets), the fruits of growth have to a large extent been captured by a very few - but this has been hidden because consumption was propped up by readily available debt and the apparently growing virtual wealth of homeowners.

I never tire of posting this graph of the "W economy", because it summarizes in a nutshell what happened: growth happened, but was not shared widely. Thanks to wage stagnation, made possible by the threats of outsourcing and offshorization, and by consistent policies over the last 30 years to deregulate and liberalise markets, starting with labor markets), the fruits of growth have to a large extent been captured by a very few - but this has been hidden because consumption was propped up by readily available debt and the apparently growing virtual wealth of homeowners.

The problem is that, while a lot of that growth was illusory (and is now unraveling), the wealth re-allocation that took place thanks to it was very real, and, in particular, the mechanisms ensuring that an ever grower share of the pie get into a few privileged hands are still in place, and will bite even more harshly as the pie shrinks.

In short:

The middle classes got a shrinking share of a growing pie, apparently staying somewhat ahead.

Now, they are about to get a shrinking share of a shrinking pie.

The current economic consensus - that of "labor market reform", of "unsustainable liabilities of Medicare", of "protectionism is the ultimate danger" -is that of those that think that economic prosperity is correctly summarized by the value of the Dow Jones Index. That consensus has not really worried about income inequality, and has seen increased leverage as a sign of ever more efficient financial markets rather than of a bubble. That consensus is part of the problem, not part of the solution.

And you see that all the currently proposed remedies are focusing on ways to make the pie be (or rather, look) bigger than it can - more money injections, more cheap debt, more support for the financial sector.

They are the problem, not the solution.

Too much debt and not enough income was the problem.

And the solution is simple: stop debt (this is happening on its own anyway). and boost income.

How do you do that when there isn't enough money around?

By creating real activity rather than the highly-leveraged money-shuffling 'arbitraging' kind.

And, as it were, there is a sector that is "real" and has an urgent need for action: infrastructure, and in particular energy-related infrastructure.

A plan that focuses on a few simple things:

- massive public support for energy efficiency refurbishment of existing homes;

- a massive, New Deal rural-electrification-scale plan to build renewable energy assets and the corresponding grid infrastructure;

- a similarly massive plan to develop smart public transportation, both locally and intercity;

Spending the money currently wasted in Iraq on these 3 things alone would provide a real boost to the economy in the sectors that actually need it, would reduce oil&gas consumption and carbon emissions, and be an actual investment for future generations, as opposed to the current drain on the future that's been engineered via debt used on mindless consumption of junk.

Add in plans to boost the minimum wage (especially in the relevant sectors) and tax imports of carbon-rich goods, and you'd have a pretty damn good economic - and geopolitical programme.

The problem is the most of America's population has been living, by design, above its means. It is kept dependent, fearful and distracted while problems are pushed into the future and, coincidentally, a happy few profit handsomely. This was not sustainable and, indeed, it is crashing down around us. The good news is that the solution to this financial crisis will also go in the right direction to solve the even bigger problems of global climate change and resource depletion. And hopefully, economic hardship will prove to be a bigger motivator for action than anything else.

Jerome - in 1990 we sold a flat in Oslo (Norway) in a property market in free fall. The year before our flat would have been worth about 1.2 million NOK. From memory it went on the market at offers over 850,000 NOK and we thought if we got well over it wouldn't be so bad. In the end we sold for 650,000 NOK - and were pretty gutted - though we got out with about as much as we had paid and paid off our loans etc.

The moral of this story is that in a rising market you go for "offers over" in a falling market the reality is "offers under".

I agree entirely with your comments about miss allocation of investment funds in complex financial derivatives etc - instead of investing in the real economy. Spend money now on energy infrastructure that will make a difference to everyones future should be the call going out from McCain's and Obama's camps.

The problem with wages you describe may be even worse. Flat wages have been supplemented by consumer debt backed by rising asset values. That credit may no longer be on offer - indeed debt may have to be repaid - and with rising prices stemming from high energy costs and a plumeting currency - the GBP £ will win the race to become the basket case currency of the year - fueling inflation - many families are in for hard times.

But in fact they don't know what hard is. When I was a lad I was lucky if I got a chocolate bar for Christmas.....

There is a major cause for the world financial crisis, Alan Greenspan. Of course, the world economy had to slow down, but Greenspan made certain that it would fall like a stone in a well.

After years of reseaarching it, I have one word to describe the culprit: Reaganomics--What George H. W. Bush correctly described as Voodoo Economics.

My prescription for its solution remains the same: Massive rollback of the US Empire and use of the monies saved to finance the energy and trasnsport programs Jerome mentions. But that will not be enough as radical change must also occur in the USA at the federal level of government, in the way elections are conducted, and in the organization of media.

It goes deeper than that. We need to rollback and redefine the things we consider 'success' and 'progress'. More and bigger stuff than the next guy has to stop being advertised, on Wall St and on Main St, and we have to recognize (which perhaps needs marketing) that social relationships and freedoms on top of ample basic goods are what bring us the most long term satisfaction. Competition is part of who we are, but we should eschew the conspicuous competition for yachts, sportscars, and more digits in ones bank account and change our competitions to more healthy, less impactful endeavors like sports, games, information, knowledge etc. The American people are not bad, nor stupid - they have just been fed the wrong type of message for a generation or so. There is a large disconnect between perception and reality, which is currently the biggest problem.. (We did what?!!!)

Hi Nate--I agree we need a Culture Shift. But to accomplish that, we must reform the corporate media which sent the "wrong" message in the first place. Not that anyone comments on what I write, but I've written about the need for a paradigm change since I joined theoildrum.com almost at its inception. Such a change requires behavioral change by the body politic, as you've pointed out in your essays. Since the late 1990s, I've wrestled with what ought to be the goal of the new, Post-Modern, economy--one not based on money. Knowledge and Wisdom ought to be the goals of a cooperative culture/society that relegates (discredited, old-culture) wealth formation to the commonweal and its promotion. Such a culture does go against some attributes of the human animal, but it also stimulates other attributes buried far too long, IMO. We've seen what the power of media can accomplish in generating the current dilemma; it can also be used to help us solve the dilemma, but radical change is required.

Karlof - here is someone in France with the same thought:

France seeks new growth measure

http://news.bbc.co.uk/1/hi/business/7177100.stm

Hi pondlife--Thanks for the link. I'm not the least surprised that Stiglitz is involved as I've been following his course since he quit the World Bank in the late 1990s. Nor is it surprising that the IMF would make such recommendations. The French are quite right to determinedly resist such policy advice as it would work to destroy the commonweal they've struggled to achieve.

So often, the US economy is measured by the number of new single family homes, which is invariably an incentive to further sprawl.

Former California Governor Jerry Brown said something similar in the 70s; we need to not just focus on money income but psychic income. Growth that is meaningful to the individual and the society should be focused not just on economics but on spirituality, wisdom, and happiness.

And I, being somewhat naive, thought there was some chance that this might occur. Didn't happen and, if anything, we are farther from that ideal now than we were in the 70s.

Excuse me for being cynical, but as the financial shit hits the fan, people will become even more fearful and greedy and their brains will lose all capability of dealing with these problems in a manner that fully recognizes things like peak oil, climate change, the environment, and personal psychic growth.

Before you can build a new house, you need to tear down the old one.

"But to accomplish that, we must reform the corporate media which sent the "wrong" message in the first place."

The wrong message is now engrained across the generations. We have been suckers, for the most part - muppets, with someone else's hand up our rear ends (excus3e the visual). I'm all for changing that, but it will be a hell of a fight... minor changes will be purely cosmetic.

the media controls which messages we sheeple are to see, hence: Obama approval ratings. As far as I can tell, the media machine has already crowned Obama as King!

The sheeple are too concerned with what the media tells them, from Britney to Dancing with the Stars. The news is only sensationalistic, not exactly newsworthy. The commercials are only designed to get you to part with your money. thats all. The media is largely controlled by corporate, corporate runs this country, not the self serving politicians. these politicians seem to be more concerned with steriods in professional sports and pork barrel projects rather than fiscal leadership. we are doomed!

Nate,

I made the transition from business (chem plant manager) to the boondocks (among other jobs, the elementary school custodian) over 30 years ago. My experience indicates that it requires developing a new reality to succeed and be satisfied. This is almost impossible for most people.

A good example of this is when our city friends (MD, architect, college professor and similar occupations) visit us in the boondocks: They enjoy the serenity, the beauty, etc. but they always ask what we "did" meaning activities. It doesn't do much good to say "we live" and that life and work are mostly one.

Eventually, people may realize they have been screwed. See Charles Smith's essay When Belief in the System Fails http://www.oftwominds.com/blogmar08/belief-fades.html

But, they won't have spent the time considering alternative realities to prepare themselves mentally for the change - whatever it may be.

I think one thing that would help to transition is a security blanket. Perhaps, similar to the one posited in Ecotopia.

Who knows.

Todd

Agreed, we need to Bhutanize our system, and begin striving for a higher GNH (gross national happiness) instead of a greater GNP.

If ‘we’, instead of focusing our competitive drive on producing something more efficient than the other guy, had spent all our competitive energy playing football and chess, we would likely have starved to death by now:).

On a more serious note, competition only makes us worse off when some amongst us can improve their relative ranking by banning and prohibiting others from competing as vigorously as they otherwise would.

The causes of the current credit meltdown are too much regulation, not too little. Were it not for various levels of governments’ ability to, through zoning laws and the like, make the simple act of providing a roof over ones head, almost prohibitively expensive, we would not have had a debt run-up to begin with. Guaranteed. Strip away all regulation involving building and construction, and there would be an immense supply of dwellings, likely several per head.

In every unregulated industry, overproduction is the norm. The simple fact that not all providers judge future demand with equal accuracy, with some inevitably over estimating it, ensures that. Only in regulated industries like housing, health care and education, can those better off and politically connected prevent this from happening, in order to maintain their own power and status as gatekeepers to a scarce resource.

Simply get government at every level out of people’s lives, decisions and wallets, and a society at our current technological sophistication would provide an absolute overabundance of virtually everything to virtually everyone. There is simply no reason, other than the vanity of the political classes, for government to play a larger role in people’s lives today that they did when America was first formed.

As I’ve written before, a Californian real estate market devoid of regulation, would likely have the vast majority of the population living in huge condos in one of a wall of 40-60 story high-rises stretching from Cape Mendocino to Cabo San Lucas. With high speed rail running the length close behind. While the ‘rich’ would likely still live ‘better’, by occupying larger, nicer equipped units on higher floors, even the so called ‘poor’ would at least have a spacious beachfront condo. Not too shabby compared with the kind of rat infested projects our ‘progressive’ overlords currently see fit to provide them with.

Huh? The poor would live in rat infested slums - not beach fount condos

I once thought somewhat along these lines. I don't now. Government, in its regulatory guise, does serve the purpose of not letting people screw up the lives of other people. Can you imagine what the land around a chemical plant would be like in the world you describe? Love Canal would be a beautiful meadow in comparison.

The world, and people, do not run how Ayn Rand would have us believe it would if government would just keep its hands off. Government does good things. It also does incredibly bad things, but that's where we, the people, are supposed to enter the picture.

Karlof1, I expect that American opinion will gradually change as it becomes apparent that there will be no 'upward mobility' in their futures. TPTB have used upward mobility to give Americans the impression that no matter how dense the individual there remains the opportunity for riches. Once that veil is gone, caused by a replay of the great depression, I think we will see a sea change of real politik, accompanied by a return to popularity of populist and left leaning politicans. Heuey Long, Eugene Debs, etc, come to mind.

Once the general population realizes that their opportunities for a 'better life' are severely limited they will turn to politicians saying that wealth should be spread eqitably among the population, and not be hoarded by the few. Globalization will unwind because of severely constrained economies. A return to nationalisim might ensue once Americans see what globalization has done to their country, their jobs, their lives. Militant union organizing and activity, now strictly channeled into 'company unions', will rise again. Strikes will come back into vogue when workers are not able to feed their families with their paltry pay. MSM will lose their viewers if they don't cater to the new wave of populisim...so MSM will change to continue to generate revenue and stay in biz. The right leaning politicians that have convinced people that 'unions are bad and socialistic', and limit opportunities for advancement, will not remain popular, except among the haves.

Judging from availability of FFs in the US, and the amount of debt owed by all governments and individuals in the US, the coming economic collapse might be much worse than 1929. The US has been dependent on the savings of other countries to provide an unsustainable level of spending by individuals and various US governments. That is going to end.

Hi River--I don't think we have the time for "American opinion [to] gradually change." Further, the elite will dig in their heels to avoid the sort of needed paradigm change I describe above as it is totally against their albeit very selfish interest as Lasch described in Revolt of the Elite. The contrived political dialog generated for the presidential election is a case in point, as were the examples provided during 2000 and 2004. IMO, Americans are dominated by media more than any other polity. For that polity to change with the rapidity required, the structure of media must be destroyed and rebuilt.

Actually, the scenario you envision, while positive and to be hoped for, is probably less likely than a further descent into fascism and even more extreme free market "solutions". I think that is the plan, but I will hope for the best.

*Voodoo Economics*

Well, my article was originally more polemic and political, and I toned down that angle for the TOD version, but I mostly agree with you. Deregulation and the ideology of greed, disguised as freedom, is what's at the bottom of all this.

"Deregulation and the ideology of greed, disguised as freedom, is what's at the bottom of all this."

Now thats calling a spade a spade and IMO what the world needs more of both now and more importantly later when it starts up again after the crash.

The price of freedom and the American Dream is a boom and bust economy. But since the country was founded on those principles, can a change of culture ever happen?

The weird thing is that all the macro economic stuff is reasonably well understood, and the US has the definitive example of how bad it can get when things go wrong, the Great Depression (Bernanke's pet subject apparently). Yet deficits and debts are allowed to expand willy nilly, while successive administrations watch it happen.

Yeah-real wierd. How much money do you think Hank Paulson would have if the USA fed guv had never run deficits? A hint-it wouldn't be 700 million. This deep rooted belief that everyone who controls the USA is stupid is utterly ridiculous. To shake it, try ignoring what they say and try to observe what they do.

I was assuming that the people "in control" are smart, which is why it looks weird. At some point, there should be some intellectual realisation that things are going out of control and require negative feedback. What you appear to be suggesting is that money trumps any nagging doubts that people might have. I suppose you are right. Everyone takes the money and hope the system doesn't crash on their watch - in fact take a little extra in case it does crash!

The implication is that a free society based on market principles can never be sustainable. Socialism, anyone?

No, you were assuming they are logical.

Free market principles my arse. Privatize the profits, socialize the costs.

Noam Chomsky: The Free Market is Socialism for the Rich

Hello Jerome--I looked around DailyKos and eurotrib.com for a link to your non-TOD version. I, and I'm sure others, would very much like to read what else you had to say on the matter. And thanks very much for your efforts and analysis, even though it would be great not to need them.

I was going to write that nothing massive would help, because it only ramps up the throughput and it's the throughput at diminishing marginal returns that has put us into this fix.

That would have been a hasty mistake, because massive rollback is the necessary strategy as karlof1 points out. Radical change in the USA at the federal level of government - yup - and it's not only the federal level that is illegitimate. But it might not change into a good thing - careful. Change in elections, change in media. Those presuppose a change in the societal memes by which we organize ourselves.

How bad a situation are we in? On a scale of 1 to 10, where do you put yourself in appreciating the situation? I got asked those yesterday - fascinating because really that asks one to judge how much one doesn't know. I figured I was around a 3. Along those lines, I highly recommend Byron's "The Path Through Infinity's Rainbow" - reviewed by Carolyn Baker in a Drumbeat maybe a week ago.

Byron writes very clearly and is easy to read. There is no fix, no matter how massive, other than fundamental social - if not biological - change. Covering New Mexico with solar PV and girdling the earth with HVDC will not work unless we first change our society. As Dawkins puts it - the next evolutionary step is the meme - assuming, of course, that we can take such a step.

cfm in Gray, ME

Hi Dryki--It's good to know that at least one other person openly agrees. Now we just need to convince 200 Million citizens of the Metropole.

Huh? What about the rest of the world?

Sorry. It wasn't my intention to snub the rest of the planet. It's just that only US citizens get to vote in US elections; thus the need to convince them.

Karlof1,

There are at least three of us. I, too, have been writing about the need for a fundamental paradigm shift since I started posting on TOD. Carbon taxes, construction of public transportation systems, rail electrification, renewable energy subsidies, etc. are ineffectual bandages on external sores as long as the internal cancer of competitive accumulation rages on unchecked. And in fact these bandages are not being applied because the growth of the cancer is sucking up the necessary resources.

The social and political solution to our problems is conceptually simple (if not operationally so): Voluntary simplicity and mutual support. I am not holding my breath, however, waiting for such ideas to receive any respect.

Roger,

One of the main reasons people/society will not change is because they have had no exposure to other realities. As I noted up thread, our friends don't even understand our life in the boondocks. Look at TOD posters, there are only a handful of us who are actually "doing it."

Right now I'm out there cutting firewood (I came in for a break.)now that yesterday's snow has melted. When I get burned out on the wood, I'm putting the cover back on the strawberries to be followed by gopher patrol. Compare these activities to the millions who are getting fat asses eating junk food and watching TV.

Todd

Today my family made cheese with a group of friends. I worked in the greenhouse and planted some spinach. Getting 4-5 eggs per day from the hens. My wife is reading out loud to the kids right now instead of turning on the dvd player.

Like you, I have not found that my extended family comprehends this much, though a lot more people around town are taking up new hobbies and starting new cottage enterprises along these lines.

It helps that the world beyond seems to be falling apart. Folks want a sense of control over important things in life.

This 'financial crisis' may well prove to be the Big One, the greatest 'crash' in history, potentially worse than the Great Depression, a slump we may never recover from. Unfortunately it doesn't have a simple or single cause, and the solutions are anything but simple, to think otherwise is perhaps a comfort, but an illusion.

ditto

A short time ago expressing negative thoughts about St. Alan Greenspan at best earned one a reputation as a krank. More likely one was thought to have psychiatric problems or to be a Communist.

A short time ago expressing heterodox economic opinions on TOD provoked a flurry of knuckle-rapping posts by doctrinaire Austrian professors, effectively forestalling discussion.

For most of the population the range of permitted thought is narrower than in Brezhnev's USSR, and this has been the case for a generation. Only a crisis has created some space for thought. We are all poorly equipped with intellectual tools to address that crisis.

Well, my newest post is about Greenspan, the bubble man: wrong but unrepentant

Oh my! You read our scribblings!

Having received such an honour I had to read your link. Scout's honour, promise to read European Tribune more often.

AFAIK you work in the financial system at a fairly high level. I am boggled that someone with an evident brain can function or be accepted in such a venue. In my time I have known two friends who functioned somewhat at your level; each tolerated because it was known the primary allegiance was to alcohol and thus free-thinking could be no threat.

Greenspan and looting indeed. What I should expect from a disciple of Ayn Rand.

Right on.

Read and understood. Right on right on right on my brother. Thank you.

Specifically, in 2005 Greenspan exhorted lenders to be creative in extending credit to as many as possible. It seems clear now this was with either malice aforethought, given what he had done to interest rates (literally creating free money for banks to lend), intending to create a bubble and sweep ever greater wealth in to the hands of the top 1%, or out of utter stupidity. I don't buy that he is a stupid man, so I go with the former.

This thesis is supported further by the Bush/Cheney admin ending reporting of real inflation and M3. Hiding those two numbers hides a LOT that is obvious to all. Those two numbers tell a hell of a story.

Anywho... Same thing happened before the last Great Depression.

Culprit #1: Former Federal Reserve Chairman Alan Greenspan was no smarter than a fifth grader.

More of a clarification than a disagreement: ninja (and "self-certified" loans in the UK) started off as "no provable income, no jobs or assets" and was based on the entirely sensible realisation that many self-employed people, consultants, etc, didn't have a guaranteed monthly income stream in the way the employed do but many were consistently brining in enough money to pay a mortgage. But what started off as "you convince a good faith mortgage broker that, although you can't document it, you're a good risk and they'll sign off the forms" became "mortgage broker gets commission up-front regardless of long term loan viability, so why shouldn't they not sign off almost anyone for almost any amount". So one key lesson is that people will figure the way to score best under the specified reward structure, so come up with rewards tied to long-term planning.

As someone who may be self-employed in the future, I'm very much hoping that self-certified mortgages don't vanish from the market, just become meaningfully assessed again.

Those self-assessed, as well as five times (and more) annual income, and "buy to let" mortgage schemes are largely responsible for the unsustainable increases in UK property prices over the last few years.

I'm not denying that. One very wrong factor was that people were allowed to "opt for" self-cert even when they just had regular jobs with payslips. But the fact remains they were initially created for the very sensible reason that people who couldn't produce some sort of guarantee that their income stream was large enough (and anyone self-employed might have their customers dry up completely in some extreme circumstance so they don't have the GUARANTEE conventional mortgage paperwork requires) nevertheless in general had enough money to pay the mortgage every month but couldn't fit into traditional mortgage lending checklists. My understanding (it was a couple of years before I was financially able to even think about looking for a mortgage) was that you had to provide an explanation to the mortgage broker and he had to genuinely believe you before he'd sign off a self-cert mortgage. The ONLY reason I hope self-cert stays is for those self-employed people who are going for sensible multiples of their average wage, not to enable lying about income to increase the amount you can get to insane levels.

Quite amazed that you just take a person's word for it. In India, if you cannot produce payslips, then you need to show a copy of your last 2 years tax returns as proof of income.

Srivathsa

Yes, same in France - you need pay slips or tax returns (or both). It's the one thing (together with the fact that banks won't let you have more than a third of your proven income as debt service) that makes me think that the real estate prices in France are somewhat more sustainable in the medium term than in other bubbly economies - or at least that banks won't go down under because of them.

Slightly off-topic but . . . no French real estate bubble, or at least a manageable bubble, and a highly electrified transportation system fueled largely by nuclear power. Would you say France is in better position than most countries to weather the unfolding financial-system-meltdown/PO crisis, or are there other factors offsetting these advantages?

Thanks.

Possibly a less bad situation... but road transport, like elsewhere, has grown a lot more than rail transport, and rail is good for passenger transport rather than merchandise, these days.

On the plus side, France also has a nice agricultural surplus, with highly productive land - hopefully even so with less oil input...

In Switzerland, Pay slips, with work contract, tax forms, bank account open to scrutiny, a certificate of moral probity (no drugs convictions, prostitution, etc.), an empty police / penal blotter (parking violations allowed), and if self employed or ‘older’ or ‘different’ heavy life / health insurance, which may if missing be imposed by the bank, that is suggested but in fact a condition.

However, comparisons are maybe not apt. In the canton in which I live, in Switz., less than 15% of ppl own their own homes. Home ownership is exceptional, and the exceptions are not only the rich or upper classes - just exceptions, of many different kinds. Farmers, old estates, co-ops, small-holders, movie stars, bankers, and even campers (who own the ground they camp on.)

It's very easy to get fake payslips etc. several companies advertise in the Sunday press.

AKA fraud, a prosecutable crime.

In the UK, if you don't go the self-certified route it's generally 3 years signed-off accounts with average level of net profits being at a level suitable for the mortgage. Given that in the first couple of years you're probably investing in business expenses, growing your contacts, etc, you can probably forget the first two or three years as having a profit level high enough, so it's about six years after starting the business before you can apply for a mortgage. However, what's relevant to paying the mortgage is whether your future income stream is likely to be stable, which low figures in the initial years have little predictive bearing on.

When I say "self-cert" I mean that documentation that fits a mortgage-droid's checkboxes doesn't exist (which made it very difficult for self employed to get a mortgage twenty years ago), but both sides are genuinely convinced the income steam is suitable. The more abusable forms should go, I agree.

It was interesting to note a complete lack of attention to the UK's growing trade deficit in Alastair Darling's budget last week.

That increase in deficit caused, in part, by our increasing fossil fuel imports as North Sea oil production continues its inexorable decline.

Meanwhile, our brain dead news media is still talking about an "uncertain economic future". I think most of us here are pretty certain about the direction our economies are headed.

You obviously missed PM Gordon Brown on Radio 4 last week. He assured me that we are entering...

“a new era of opportunities for all… a new age of ambition; a chance in the first decades of this century to build the Britain of our dreams”…

His dreams are our nightmares.

An age of opportuninty to pull together as a community!

An age of ambition where we compete with our neighbours at vegetable growing.

In chance in the first decades to completely reorganise society!

That is what he meant.

Marco.

In this article on "UK Energy Security" I try to quantify the growing trade deficit from declining oil and gas production.

http://www.theoildrum.com/node/3130

When I look at the oil and gas price assumptions used then, these seem hopelessly optimistic = $80 / bbl for 2008 - hahahahhahahaha.

Things must be much worse than depicted here. The only light on the horizon is that the US seems to be in much worse shape than we are. We can gloat over comparative misery.

I agree with everything you said. But the US has lower population density and a great deal more oil and gas left than UK. Even though we burn through it at an atrocious rate with only a pittance going towards long term infrastructure - and even if we were to tighten our belts to the maximum, we couldn't get by on our own oil. (Scotland will be better off than England for much the same reasons).

Next decade we will see what we are made of, all of us, irrespective of country. I still have hope, but the sooner the truth of our situation is articulated, the sooner we can get over the denial and arguing and roll up our sleeves.

Actually, there may be something to that. Short of starvation, percieved relative advantage over others is what humans find satisfying. Perhaps the US gov't should do (or simulate) an EMP burst to take out communications infrastructure and start USSR-style propaganda. If soccer moms were reassured that all the other countries had been destroyed in nuclear retaliation, they could feel downright smug about eating rats & rice.

This is offered mostly tongue in cheek, but really all that's necessary for happiness (in most) is to believe that others are more miserable. When americans stop believing that, watch out.

Woody Allen a Jewish American writer/comedian once said: "There are only two legitimate states of human experience: Misery and Horror. Therefore if you're simply miserable you should be grateful."

Misery loves company so if you happen to be well off it's a real good idea to keep it to yourself. In other words if you drive a Mercedes its time to trade down to a Chevy subcompact.

By the way the main stream media in the U.S. has already passed the USSR in propoganda - that's why TOD is read by growing numbers of enlightened citizens. MSNBC/FOX News/CNN are infotainment for the masses.

When you go to work and listen to the water-cooler chatter you quickly realize that the average Joe doesn't have a clue why all of this is happening. I keep my opinions to myself because my views are "so depressing".

I think the financial crisis is sort-of a different topic from Peak Oil ... but from a US-Centric perspective (all I can offer since I live here), I think it was a path chosen in the wake of the -first- energy crisis in the 1970s. Our strange relationship with the Middle East became progressively stranger, and has mutated and metastasized into what we have today. The notion of a balanced budget disappeared ("we just need to get through this crisis, and prosperity will return, and then we can repay the debt"). Petrodollars replaced precious-metal dollars, but without a clearly defined ratio.

By the 1990s or early 2000s this abandonment-of-budget was shared by millions of "middle class" homeowners, but industry was moving to where cheap energy (and cheap labor) still existed, and we have entered a period of a "service economy". But the trade imbalances have continued -- the Internet and the Dot-Coms didn't save us (whoda thunkit, they can do that stuff just as easily in India). Now US agriculture is facing higher petrol costs, and that economic pillar is crumbling.

It was inevitable that these macro-economic issues would eventually filter down to the bubbas in the McBurbs.

As I have previously noted, IMO there will not be nearly enough exported energy available to generate the economic activity necessary to pay off US debts or to generate the projected stock market earnings, which leads to two questions:

What is the intrinsic value of the 100 largest financial institutions without the 100 largest oil fields?

What is the intrinsic value of the 100 largest oil fields without the 100 largest financial institutions?

I foresee serious problems ahead for people trying to make a living off most non-food and non-energy investments. BTW, I agree with your recommendations.

WT

Is the answer to your first question may be zero, and the answer to the second may be tending towards to the value of life itself.

This is what bothers me about the UK. What is the real value of our financial sector, as opposed to the value our politicians tell us its worth?. If we have no energy, can't grow food we're stuffed. Real value is from minerals to; warmth, shelter, clean water and food. Money has no intrinsic value.

What about knowledge, technology and infrastructure? Are they not worth anything anymore? While I think things are not looking good, I don't think it's too late to move back into engineering and energy sectors.

I'm also interested in how people think technology/the internet could potentially help us. We have fairly large dense cities which are easier to 'wire up' to allow people to work/learn from home/nearby and also deliver produce to. Also most cities are on the coast which allows for cheap delivery/transport on the sea. We also have a big advantage in being native English speakers, so much of the knowledge is available on the internet for free in a language we can speak.

We also have fairly plentiful renewable energies (wind,tidal,wave) the option for nuclear power (at least in the short to medium term) and lots of fresh water for farming. Sure we might have to cut our lawn, walk the dogs or, god forbid, get public transport. Basically stop wasting money on entertainment, 'lazy' services (dog walkers etc...) and time consuming red tape.

Without energy to exploit knowledge, technology, or infrastructure, the three are pretty much valueless. Computers do not create anything. They are tools to help in the creation of things. We could give everyone in the world a computer, internet connection, and let them merrily type away. At the end of the year, we would all have starved to death. I say this even though I work as a software engineer.

As to "wasting" time on dog walkers, etc, what happens to the people who have those useless jobs when everybody decides to abandon their use? What happens when all those people don't have any money to pay for the things that the "useful" people create?

I meant that they should be retrained and put in more useful jobs. In a crisis it becomes a lot easier to mobilise the workforce into important areas, and computers/technology/internet help us do so quickly. Computers also help us minimize the amount of energy we need to do things.

The new Intel CPU uses 30 watts under load, and a monitor another 30 watts. They allow people to work/learn from home saving vast sums of power on transportation and many man years on working out solutions only using the amount of power they could generate themselves.

There is plenty of oil, it just production can't keep up. Food will be the last thing people stop buying, and we earn more than enough to pay for new power stations (we could also pay for the work force with an Greenback Dollar type fund) and can produce enough food during a down period if we stop buying frivolous items and move excess workers to help farmers (core supplies) etc...

So, Bear Sterns has financial derivatives on its books that are roughly the size of the entire US GDP?

http://globaleconomicanalysis.blogspot.com/2008/03/bear-stearns-bankrupt...

Massive Derivatives Mess At Bear Stearns

Bye Bye Miss American Pie.....

WT: The ironic thing is that the company playing the role of White Knight (JP Morgan) is the wildest cowboy of them all. IMHO, to paraphrase GWB, "the shmuck taxpayer will pay ANY price" on this one. The only problem is that you could literally drain the coffers of the entire economy to bail out these boys, and within a month they would be in trouble again. The USA has been letting the 12 year olds load up on Meth and Jim Beam and drive the family around in the minivan.

At this site we used to point out that we needed to discover another 3 or 4 Saudi Arabias' worth of oil. Now we're discovering that our banks are hiding another 3 or 4 Americas worth of debt.

1) You will see that the quote refers to notional amounts of derivative exposure. Imagine I buy $100,000 of one year Euro futures, then use that to buy back one year dollar futures. I have $200,000 in derivative exposure. However, I have no risk because they are exact opposite trades and hence offsetting. The top line number is meaningless.

2) Derivatives are not debt.

"As I have previously noted, IMO there will not be nearly enough exported energy available to generate the economic activity necessary to pay off US debts or to generate the projected stock market earnings, which leads to two questions"

Prove it.

Our outlook for the top five net oil exporters (about half of current world net oil exports):

http://www.energybulletin.net/38948.html

The 2005, 2006 and estimated 2007 net export data for the top five are as follows (EIA, Total Liquids):

2005: 23.5 mbpd

2006: 22.7

2007: 21.7

While some smaller exporters, like Angola, are showing increasing exports, there are also smaller exporters like Mexico, on track to approach zero net exports around 2014.

In addition, there is increasing evidence that coal and natural gas reserves--and especially exported volumes of coal and natural gas--are overestimated.

An even more serious problem seems to be that we soon are falling to the bottom of the net energy cliff. If the same trend is valid as for the North American natural gas which can be reasonable it is all over by 2015! As nuclear power needs rather much inputs it will alaso be hard to keep going. Large scale wind power is also costly to build and much of the worlds electricity is now coming from burning fossil fuels in power stations.

Well, there's always hyperinflation.

If you like this little crash, you will LOVE the Peak Oil crash, coming this year! And we will all have a front row seat.

A front row seat?????

We are all in the same boat!. Unless you have a 5 acre bolthole in some hidden

valley with good water, soil and secluded enough so that no machete weildinig ex-suburbanite

can take your food and rape your chickens.

Marco.

Yes, A very large boat with severe corrosion in its bottom. A few on board know the bottom is about to fall out, but most are partying and are oblivious. In this instance ignorance is definitely bliss!

rape your chickens.

Thanks for the laugh !!

Since, just minutes ago, I was continuing research for a similar bolthole - with chickens - it really highlights the circumstance some of this encompasses by making light of it.

I find that making light of the issue helps keep me sane. It takes real guts to follow through in your mind the full ramifications of a steadily decreasing energy base. It's amusing sometimes when I talk to other poeple intelligent enought to 'get' the problem, come to their own conclusions, then watch as more than half of them thrust their heads sand-ward!

Then if it's someone I would rather keep as a friend we resume talking about Britney Spears and the plight of the Minkhe whale. If i don't like them I make funny twitching facial expressions and politely excuse myself to the bathrooom with some tin foil and a couple of pencils to stick up my nose.

Marco.

Please continue providing sanity. We need it.

Heh.

Note to self:

: get a bunch of gaddamned ugly chickens.

heheheh.

Hopefully, this won't get deleted. If it does, I will completely understand.

This guy goes into a brothel, but it's so busy there's nothing available. The guy's really desperate, begs for anything.

"Well, we got a chicken."

"A chicken?!"

"Sorry. That's it, fella."

"Ah, alright. How much?"

"Fifteen bucks."

"Fifteen bu..! Damnitalltohell...."

He hands over the chicken and is sent into a bare room with a bright light to do his business, where he does, indeed, spend quality time with the chicken.

The next week the same guy goes in again and they're so busy he can't even get the chicken.

"We got a show, tho."

"A show?"

"Yup. Live."

"How much?"

"Five bucks."

"What the hell..."

So the guy goes into the theater where the show commences. There's a silhouette of a man spending some quality time with a goat. Grinning, he turns to the guy next to him and says, "How desperate do you have to be, eh?"

"You think that's bad?" says the other. "Last week there was some guy up there with a chicken!"

The original is a little coarser in language. :)

In a world going crazy, laughter is the best medicine.

Cheers

Good one-keep them cumming.

Yet another Oildrum discussion diverted into discussions of sex with chickens.

Chicken-raping is serious. It's why they cross the road. I once had this housemate from Alaska up near Fairbanks somewhere, and he had stories to tell. Apparently "chicken sexer" isn't just a job up there, it's an adventure, and he would describe his technique in detail upon request. Which was apalling, but also hilarious because his wife was a prim and proper liberal who was always looking down her nose at us construction workers. The "chicken thing" was a nice counterbalance at parties.

However, it isn't just warmth-seeking Alaskans who are that pragmatic; the book Reading Lolita in Tehran notes that the Ayatollah Khomeini wrote a scholarly discourse on (rhymes with chicken-plucking) in which it was not only highly recommended as a way to avoid sinning, but tips were given on just who could reasonably eat the deceased rape victim and who shouldn't.

Really.

If Clinton had been that forthcoming, the BJ wouldn't even have been news.

I won't have a front row seat. I just shook hands on purchasing a 40 hectare ranch in a valley with a stream running through, taxes $60 per year, spring water, 2 meters of rain per year, temps 50 to 90, got coffee on it, citrus, sugar cane, 2 cows, 2 horses. Plan to sell the cows, get some chickens, get some wild rabbits and set em free, get rid of the coffee and plant macademia trees and Maya nuts, get rid of the cane and plant beans, squash, carrots, peppers and stuff. Yes, I'm crazy, I know. Come join me. clifford.wirth@yahoo.com

My wife and I would be happy with an acre or less! With the things I'm reading about intensive farming, hydroponics, aquaponics, etc., just feeding yourself just isn't that hard. What seems to be hard is making it work as a source of income. I'd be happy with just having a roof, self-sustaining food supply and water. A little extra to buy this or that now and then, perhaps. The wife, though, she's wanting to be part of a community. I think the idea makes her feel safer. Makes sense, of course.

Cheers

PS, ever seen "The Postman" with Kevin Costner?

Yup, but the original book by David Brin was better written (although the movie version was much closer to a vision of collapse from now instead of from 25 or so years into the future).

peak oil is at least 3rd or 4th in our list of problems.

Do you consider resource deplation (non-oil), population explosion and climate change, (amongst a backdrop of financial collapse) to be numbers 1,2 and 3 on your list?

I would not be so quick to try and rank them all! It's all a game of paper, scissors, stone,water to me. (that kids game you play with your hands - presume you know what I mean)

Resource depletion, toxic planet, cancerous growth, climate change, economic inequality - those are the five I use. They are all intimately related each to the other, but listing as five fits what one can keep in the head and provides different rhetorical angles. They are not orderable and cannot be dealt with independently.

If we are to evolve memes and change our way of thinking and the society that implements that thinking, then we need to put the point of the argument on "growth". That the only smart growth is shrinking. Then the others start to become tractable. We're adults - time to stop growing. And if we shrink our numbers, then there is more sunlight for each of us and that can be turned to healing the damage we've caused (if we shrink enough and fast enough).

While it makes sense to me that we are at an evolutionary crisis, that meme stuff is purely speculative. YMMV. Enumerating the 10Million names of God might work just as well.

cfm in Gray, ME

I have a hypothesis. After speaking with a friend at one of the above mentioned firms tonight, I asked him how this will all turn around - how firms like Lehman, Piper Jaffrey, Jeffries & Co, etc. will make money again in the future, let along command large multiples of earnings? His answer was leverage - too much leverage was a bad thing, but Wall St needs leverage to make money because the normal returns weren't high enough.

If this is true, and anecdotally I believe it is, then this credit hyperexpansion is a natural and predictable sidecar to peak oil. Once aggregate net energy peaks (and this is the 'hypothesis' part, as I can't prove this though believe it to be true), then the traditional economic engine that combines natural resources with technology and energy to create magical economic growth starts to sputter. In order to maintain a certain level of growth in the system, especially in the 'service' side of things where many of the brightest and most ambitious of our species make their way, borrowing in increasing amounts to juice returns that once came from basic industry is a natural response for a large group competing for 'more'.

If one can earn 4% but by borrowing 10 times ones principle can turn this into 10-15%, especially if the 'perceived risk' is low, then it will occur. Some variation of this is what happened. Maxing out in energy surplus is going to cause us to borrow from somewhere, - we've already tried the banks - that probably won't happen again for quite a while so expect further borrowing to come from the poor, the environment and the future.

Nate, it's called 'running on fumes.'

it's called "money making money"

This is a non-starter from the get go, to begin with, never gon'a happen.

It would be like believing that energy can begat energy wtf?

Every culture and religion has addressed this, but every time we convince ourselves that this time it's different.

I entered this forum touting a tech that defied the 2nd law of thermodynamics even though I had worked with engineering and physics for 18 years. Yes I was an ASS.

If you believe that money can make money you too are an ass.

Great observation.

....so expect further borrowing to come from the poor, the environment and the future...

This sounds like junkies I've unfortunately had to deal with on occasion over the decades. They will do Anything, lie, cheat, steal, assault, etc... to 'borrow' some cash for a fix. Even throwing a junkie face first down a cement stairwell doesn't deter them from their appointed rounds for very long. They are beyond reason. Death however works dandy. And since junkies love to prey on each other, this is often a win, win situation for society.

This financial event horizon we are rapidly approaching, at a minimum, will make Wall St feel, at least for a while, like it was thrown face first down a cement stairwell. But just like a junkie, it won't stop it's addiction, only the Grim Reaper is capable of that.

Jerome

Meanwhile, W soft shoes his way into retirement. At least, O and H have been pushing the whole green jobs things very hard, which would include alternative energy infrastructure.

For the time being, we will be heavily bleeding capital no matter what with the level of oil prices. Further the Fed is increasing debt to solve the debt crisis. Is is really possible to stop this meltdown, regardless of the tools used? Infrastructure is a long term approach and will not stem the immediate crisis but it must be done.

Regardless of what we do, am I correct is saying that we will have to go through a period of moderate to severe economic pain? And by we, I mean the bulk of the American people. Truth, regardless, will not be coming from the politicians any time soon.

The complexity of the continuing financial juggling to avert a meltdown, I'm sure, is dimly perceived by most people as a form of magic. Is this just a way to hide the impotent wizard behind the curtain?

Jerome. Your bottom line, it seems, is that it is time to get real. Do you mean that there is nothing in the financial bag of tricks, and I do mean tricks, that can fix this thing?

The complex financial juggling, is a way of preventing Wiley Coyote from looking down. As long as he doesn't look down, gravity cannot assert itself. So keep up distracting him, for if for one moment

EEEEooooooow!

Yep, I pretty much mean that. We're suffering from too many bag of tricks, and more of the same, however smart, will not work. Deleveraging means what it means, and it's happening now in any case.

Melt-in-your-mouth cotton candy comes to mind.

That's just one of many problems. Another is that most of us don't know how to hold a hammer. We have the Mexicans do that for us. If money is made available for insulating houses I doubt the accounting class of Americans will be lined up for jobs. If they do they'll be competing with Mexicans. The profits will be skimmed by top management, as always.

Next time you drive along a freeway undergoing expansion, take a look at how few workers are involved.

Windmill generators are going to be produced in China even if the RMB doubles against the dollar.

Smart public transportation needs to be built by smart engineers and technicians. We've offshored that kind of work for the last twenty years. We've become financial engineers - an you can see the results of that.

I think your solution is admirable in principle yet completely naive about the realities of our situation.

Good analysis by Jerome: corporations were allowed by the free-market libertarian brainwashed politicans to transfer technology to cheaper overseas markets while filling US consumer with easy debt.

How many mammoth fortunes were made in this wholesale gutting of America?

Walmart, Dell, etc.

It is well known that for the entire world to support the lifestyle of the US and OEDC would take 3 or 4 Planet Earths.

The globalists have made that delusion a possibility in the minds of the Chinese and Indian people. These impossible expectations have been reinforced by a globalized media-Internet. Meanwhile international corporatists feed the delusion with capital and the promise to keep opening 'unfair' markets. As long as these yearnings persist there will be a tight market for oil and oil importers will be throttled.

The overall effect has been to accelerate Peak Oil by one or two decades.

Only chance in my view is for a severe economic depression to occur freezing international trade, along with a huge state effort to develop not only renewables but particularly unconventional oil(oil shale, tar sands) and to a lesser extent ethanol, because the only solution to an energy crisis is more energy in the pipeline.

That being said, it may be that it is TOO LATE already.

Sadly, I would have to agree. Building infrastructure, or anything else for that matter, during a deflationary depression is highly unlikely. Credit is already evaporating far faster than central bankers can pump in liquidity, and the rate of credit destruction is accelerating all the time. In other words, deflation has already begun. IMO we have already reached 'critical mass' and tipped over into a rapidly self-reinforcing spiral of margin calls, defaults, sales of distressed collateral, depressed prices and further margin calls. Those margin calls will reach down the 'financial food chain' until the directly affect ordinary people - with the tightening of credit, margin calls and ultimately the calling in of loans.

Ordinary people won't necessarily even have the money they need to purchase the necessities of life, let alone anything beyond that. The private sector won't be interested in building anything when risks, and therefore long term interest rates, will be so high. (With credit spreads exploding, much higher longer term interest rates are inevitable.) The prospects for earning a profit will be minuscule compared to the present time, as those to whom companies sell goods and services will not have the money to buy them.

The public sector will be completely inundated with requests for assistance at a time when tax receipts will be falling off a cliff, and the ability to extract higher taxes from those still able to pay will be decreasing rapidly. I can't see much public sector investment in infrastructure - even for maintenance, let alone new construction - when all public services will be over-stretched and probably collapsing.

IMO there are no viable solutions, other than living through a long period of depression and eventually emerging from the other side, with greatly diminished economic capacity due to the effects of economic upheaval on energy supply. Our long credit expansion has created multiple and mutually exclusive claims to the same underlying pieces of real wealth pie (as opposed to dividing the pie into ever smaller pieces, as currency inflation would have done). Now that the expansion is over and contraction has begun, that underlying real wealth will inevitably be fought over. There is nothing that can be done to prevent this.

The dynamic is Enron-esque, meaning that a rapid implosion is approaching. Already we are seeing the market beginning to pick of banks one by one, and it takes little time for self-sustaining momentum to build up. If you're interested in daily coverage of the situation, click on my profile for the link.

Stoneleigh, with the exception your deflationary call, which I expect will still be correct, your writing over the past year has been prescient and for the most part spot on in articulating this crisis.

Thank you.

We are at the 11th hour where the players in charge will dictate which of the two evils they consider to be lesser. The trend of the past decade has been to opt for little-to-zero short term pain in lieu of long term (but as yet unseen) large pain, which would point to unlimited bailouts. I suppose this could be described as 'steep discount rated culture'. But as the red grains of sand pile up, soon they will all be connected. On the other hand, discipline needs to be shown so there is confidence in the system.

Were I in charge, I would allow JPM to buy BSC for a song, strip it of its prime brokerage and any assets of value, payoff the creditors and bondholders, and let the shareholders take the loss. At some point, hopefully sooner rather than later, excessive risk has to be shown to have a very bad downside. Just like capital punishment isn't really done to 'punish' the wrongdoer but to act as a deterrent to future wrongdoing, we need to send a message that taking too much risk, even if everyone else was doing it, has consequences.

I suspect a middle ground will be reached, but I get the sense that Paulson et. al. are quite aware of the moral hazard, and won't just bail out everyone that lines up at the door. We are certainly caught between a rock and a hard place. How quickly this could turn into a series of bank runs I shudder to think.

Nate, I'm sure you must recognize the intertwined nature of the finances of BSC with the rest of the market. Their trillions of derivatives represent counter-party interdependencies and the other parties are holding their breath right now (maybe even turning blue...). I don't see how doing what you suggest would stop the cascade of the grains of sand.

my suggestion is a hybrid of discipline and bailout. No way does Bear Stearns culture or employees, with possible exception of prime brokerage and back office, fit with JP Morgan - thats like pool sharks joining a polo team. I meant that any action should not be conveyed as a 'bailout', but that the entity itself be allowed to fail, as in, Bear Stearns name no longer exists as viable entity. But confidently assure that creditors will be paid. We have to balance the knifes edge of letting bad debts fail, while giving people the confidence that the greater system is still intact. Tough act.

Someone in power will have to make a judgement call - whether to let the cards fall where they may, or hold everyones hand until there is no confidence left in the US dollar or bond market (rest of world would quickly find out that we wouldn't just twiddle our thumbs for handouts in such a scenario). I don't have any easy answers because there arent any - but I personally fall on the side of taking our lumps sooner and starting to have some integrity and accountability. But as Stoneleigh points out, there may not BE a solution.

Thanks Nate - I've always found your work valuable too. The psychological underpinnings of our predicament (or set of predicaments) are generally underappreciated and need to be explored. I'll keep reading anything you write :)

I don't think there's a real choice here when it comes to inflation versus deflation. Deflation can easily outpace central bankers, especially once market psychology has turned, as their actions will be increasingly interpreted as signs of desperation. When fear truly rules, nothing can stand in its way - not even greed. We're not quite there yet, but are getting very close IMO.

Well there remains at least a small possibility, that the Fed will, publicly or not, bailout every large bank or institution that gets in trouble. This could be happening as we speak. 2-3 senior people at JPM get the nod from Fed officials to go ahead and buy Bear Stearns and that there will be 50-100 billion transfer as needed if something goes awry, etc. If this happens repeatedly we suddenly have trillions more dollars floating through the system, even in the face of lower economic growth and confidence. If they choose THIS path, then I don't see deflation, but I sincerely hope they are not that shortsighted and that things aren't that bad. Some of these mortgages in the 200-400k range held by a guy in St Paul who works for e.d Honeywell aren't going to zero.

The free market champion USA nationalizing the financial system? Thats a weird thought.

It will expose the reality: America has never been about free enterprise. It's been of the rich, by the rich, and for the rich ever since English joint-stock corporations (royal monopolies, no less) founded many of the colonies. Rich people throughout history have never hesitated to reach for monarchy, theocracy, or fascism during a crisis when they calculated a momentary advantage over the liberal-capitalist theology that they normally sponsor. The boss of subsidy-whore Archer Daniels Midland said back at the turn of the century that America hadn't had a free-market economy in a half-century. Well, that half-century was when America was at the pinnacle of its wealth & power.

I may be dense, but I still don't see how these electronic dollars get into the hands of John and Jane Doe for the spending needed to 'boost' the economy. I believe that hundreds of billions may be created by the Fed only to evaporate into the black hole of the mangled monster of a financial system.

They don't have to end up in hands of John or Jane Doe to be inflationary.

I don't see this administration doing anything but. Where's the logic? This group is all about the corporates. That's been obvious from day one. Remember, less a violent revolution, they will survive.

Remember that the '29 crash was engineered.

Remember that the Fed was created by trickery and our standard of living has been dropping ever since.

No, they will not be doing anything for you or me. Period.

Cheers

Our standard of living was a lot higher in 1945 than in 1913. And it was far higher in 1970 than 1945. But in 1971, Texas peaked, we began to let Bretton Woods collapse, and OPEC required that purchases be dollar-denominated. 1971 is the turning point in our standard of living.

The corporations loved life before 1913! The right to build sweatshops stateside, the right to send mercenaries and the National Guard to gun down strikers, the right to jack up private utility company rates every winter as the poor froze. Of course they made more money after they lost those sickening aristocratic privileges, but subsequent generations of fatcats never rested in the belief that the economy functions best when property owners are above the law. I refuse to part of any movement that glorifies the robber baron age.

Can you provide any documentation of your claim that OPEC required oil purchases to be dollar denominated? I think this is an urban myth.

It wasn't OPEC that demanded oil be priced in dollars it was the US! Having the pricing in USD (US dollars) means that foreigners have to buy USD in order to buy oil - this is a huge advantage for the US. There have been some attempts in the past to move away from USD like Saddam.... Now the USD is tanking there is talk about pricing in Euros.

Coming off the gold standard ushered in floating exchange rates and allowed the politicians to inflate the money supply thus pretending we had growing wealth year after year.

Nowadays the chief robber barons are the financiers who have used cheap money to leverage, i.e. increase their greedy speculating while knowing if it all goes wrong then the government cannot afford to let them fail and will bail them out. It was the same before 1929. I saw today the former top three at Swiss bank UBS will be paid about 90M USD despite writing off about USD 18 billion.

Stoneleigh, do you see a devaluation of the dollar coming...like the devaluation FDR did in the early 1930s?

No, the Roosevelt devaluation was after the Hoover and Coolidge upvaluation. Roosevelt didn't even counteract the upvaluation since 1914. Corn, cotton, copper, crude oil, etc, were all selling for less than before the WWI and 1921 and 1929 economic effects.

That is not nearly the case today. We are going to have a really major economic adjustment, not a minor 1933 type.

I think we'll be looking at at a series of competitive devaluations globally over the next few years - an expression of beggar-thy-neighbour policies. I don't think a dollar devaluation is imminent now though. In fact, I think the dollar will increase in value on a 'flight to safety' in the not too distant future - a surge that could be very sharp due to short covering. I think the euro will show a substantial decline at the same time, as cracks begin to show in a eurozone under considerable stress thanks to regional disparities.

I'm not so sure that it need necessarilly be an either/or proposition (deflation vs. inflation); might we not end up with some of both?

Simple Econ 101 supply & demand analyses would suggest that if there is a shift in the supply curve of energy as it becomes more scarce and expensive to produce, it will become more expensive. This will also impact the supply curves and thus prices of goods with high energy inputs, such as food. We are seeing exactly this unfold before our eyes.

Where does the money to pay those higher prices come from? Some of it is in the form of lower quantities demanded (AKA "demand destruction"). However, the demand for energy and food are relatively inelastic, so many consumers will pony up the additional dollars required. So where does that money come from? If we assume a stable money supply for a moment, then the only place it could come from is a shift in the demand curves of all things other than energy and essential energy-intensive goods. This includes a wide range of discretionary goods, it includes housing (hello!), it includes the labor market (hello!), and it includes the demand for investable savings (hello!).

Thus, it is quite possible -- and indeed predictable -- that we would have both increasing energy and food prices ("inflation" for those) at the same time that we are seeing declining prices for durable goods like housing, investment instruments, wages, and discretionary goods ("deflation" for these).

The problem with this simplistic analysis, of course, is that on the one hand the Fed is trying to inflate the money supply as quickly as it can to try to hide the deflation and obfuscate the whole situation. On the other hand, because "money" and "debt", if not exactly the same thing, are nevertheless closely intertwined in our modern economy; the accelerating decline in the value of investment instruments and the durable goods that collateralize them is thus serving to deflate the money supply.

These opposing forces are in a neck-and-neck race, and it is difficult to predict which will win out. We do know that governments in general have a strong aversion to deflation. We also know that the present Fed Chairman built his academic reputation on the thesis that the big mistake in the Great Depression was the reluctance of the Fed then to hyperinflate; he has also all but gone on public record declaring his intention to not make the same mistake. Thus, I think it a pretty safe bet to assume that the Fed will at least TRY to assure that hyperinflation wins out over deflation. Whether it CAN manage such a win, or whether excessive and imprudent lending and leverage have already hyperinflated the economy so far that the forces of deflation will overwhelm all efforts that the Fed might attempt to counteract with inflation -- that is very much an open question.

My sense of the situation is that the Fed will continue to pull out every tool in its toolbox, including tools that have never been used before and tools that nobody -- not even the Fed's governors -- even knew that they had, in a continuing effort to inflate the money supply to counteract the deflationary trend. Unfortunately, such efforts will only serve to drive down the value of the US$ relative to other currencies, and since so much US energy is imported, this will serve mainly to drive up the rate of inflation in energy and food prices rather than doing much to mitigate the continuing decline in the value or discretionary goods, durable goods & housing, wages, and investments. Eventually, the toolbox will be empty, the dollar will be all but worthless, and so will the value of most discretionary & durable goods, housing, wages, and investments. Energy and food will be sky high, and it will be difficult for people to come up with anything valuable enough to pay for them.

I could be wrong, of course, but it sure looks to me like this is the pathway we are on.

You've just shown the basics of what's wrong with Capitalism and its for-profit monetary economy. It appears my old philosophy professor was correct in predicting a Dark Age II prior to the emergence of the Poat-Modern Age; although, there is a slight chance that implementing the radical change I opine will mitigate Dark Age II.

We've been in Dark Age II for quite some time now.

I've argued to all and sundry over the last 35 years that this period would come to be known as the "New Dark Ages".