What would $120 oil mean for the global economy?

Posted by Chris Vernon on May 11, 2008 - 7:15pm in The Oil Drum: Europe

The pdf is a short report written by Robert F. Wescott and published in April 2006 by Securing America’s Future Energy. It was written when oil was ~$60 a barrel and addressed a scenario where the price of oil surged to $120 due to coordinated terrorist attacks on global oil transport infrastructure. Well, here we are, two years on at $120 oil (without the attacks) so it’s worth revisiting the analysis in light of the conclusion:

|

Click to download pdf |

The scenario is not identical to the present situation, Wescott’s terrorism induced $120 involves a rapid spike upwards however the analysis is based on the $120 price being sustained for a year. This long term high price is similar to today’s situation.

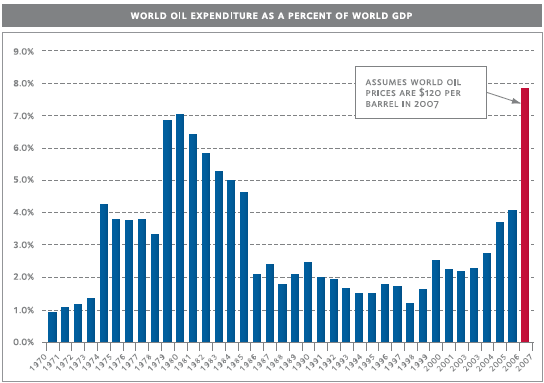

The most interesting chart from the report shows world oil expenditure as a percentage of world GDP:

Wescott points out that historically this metric has been in the range of 1-3% and recessions have occurred when the expenditure exceeded 4%. $120 represents approximately 8% of world GDP, higher than at any time in modern history. Two studies are cited: The International Monetary Fund (IMF) suggesting a $5 increase cuts world GDP by 0.3% so it follows that the $60 to $120 doubling would reduce world GDP by 3.6% and the US Federal Reserve estimates that a $20 increase reduces GDP by 0.75%, which would result in a loss of 2.3% from the increase to $120.

With world GDP growth averaging 3.5% over the last 30 years we are clearly in the ball park of a global recession due to oil price, before even considering today’s other difficulties in the credit and housing markets.

Wescott associated $120 oil with $5 a gallon gasoline in the US and $8-9 a gallon in Europe. In April 2008 the average price of a US gallon of regular petrol in the UK was $7.98 (April '08 national average 108.1p/litre and assuming £1 = $1.95). In the US a gallon is $3.61 (EIA). How has he managed to be right on one count but off when it comes to the US? Current retail prices lag the oil price by several weeks and with low taxation the US price is more sensitive to changes in the oil price. Prolonged $120 oil is certain to increase today’s US price by a larger proportion than the European price.

Wescott forecast that inflation would rise from 2-3% to 6-8% and that interest rates would increase to combat this pressure. It was noted that as growth slows the reverse decision may be taken to ease credit conditions. We seem to have skipped the first stage of increased interest rates and moved straight to cuts, in an attempt to break the “credit crunch”.

Whilst a radical claim two years ago $120 now seems conservative. This week we have two new forecasts; in a major departure from previous downward predictions Daniel Yergin of CERA is now suggesting $150 this year and Goldman Sachs are talking about $200 within the next six-months to two years.

In conclusion, Wescott’s paper makes some interesting observations and we seem to be on the trajectory he identified. However three things are tempering reality against the scenario presented:

- the value of the dollar has decreased somewhat so today’s $120 is not as high in comparable terms as Wescott’s

- the rise from $60 to $120 has been a steady climb rather than the abrupt terrorism induced shock and

- we are yet to experience the full year of $120 that the report assumes.

The core prediction is one of global recession, history suggest that and whilst the Wall Street Journal article didn’t use the 'r' world this paragraph requires little further analysis:

"That would put oil at unprecedented price levels, even going back to just after the Civil War," said Stephen Brown, an energy economist at the Dallas Federal Reserve Bank. A sustained price of $150 a barrel, he estimates, would shave around 1.8% percentage points off U.S. economic output in the first year, and a further 1.5% in the second year. The U.S. economy in the first quarter grew at an anemic 0.6% annual pace.

Wall Street Journal

This is the response of the MSM (Times of London - David Smith, a known PO sceptic)

Why high oil prices are not squeezing us more

Economic Outlook

David Smith

IT is hard to keep up with the price of oil. No sooner have we got used to $100 a barrel than it is in the $120s. Will the price rise to $150, $200 or even $300 a barrel? How far can it rise without doing severe damage to the world economy?

A few days ago Arjun Murti, the analyst at Goldman Sachs who predicted three years ago the price could top $100 a barrel, said the “superspike” could take it to $150 or $200. His prediction had more impact than a similar forecast days earlier from the president of Opec (the Organisation of Petroleum Exporting Countries).

Neither Murti nor Chakib Khelil, Opec president, are disinterested observers. Goldman is one of the world’s biggest traders in energy derivatives and Opec has a vested interest in a high oil price. But Daniel Yergin, president of Cambridge Energy Research Associates, has previously predicted a fall in prices and also thinks $150 is likely.

That would be enough to push petrol up to about £1.25 a litre and diesel to £1.40, well over £6 a gallon. It would also, one would have thought, be enough to tip some economies over the edge.

Indeed, why isn’t the rise in prices we have seen already having more of an effect? For those who were brought up on the rule of thumb that every 10% rise in oil prices led to a 1% drop in global growth, the resilience of economic activity in response to sky-high oil is surprising.

Those rules of thumb are, however, no longer relevant, according to the National Institute of Economic and Social Research. In January 2007, oil dipped briefly below $50, and futures markets pointed to a price over the next six to seven years in the $50s and low $60s. When the institute did its latest assessment, oil was above $100 and the curve suggested it would stay around that level.

Had it not been for that rise, America might have grown 2% this year rather than the 1.3% the institute expects. Growth in Europe and Japan would have been half a point higher. But in Britain, however painful the energy squeeze, the effect is calculated to be small, a mere quarter of a percentage point off growth (the smaller effect is because North Sea oil and gas production, while in decline, is still significant). The inflation effect is bigger, roughly a percentage point across all the advanced economies, but a far cry from the old days.

Ray Barrell, an economist with the institute, said the big change is that economies are less directly sensitive to oil prices than they used to be. The “energy intensity” of growth – the amount of oil, coal and gas needed to produce an increase in gross domestic product – has halved since the 1970s, reflecting greater energy efficiency and the shift away from heavy manufacturing.

Labour markets have also become more flexible, said Barrell, so workers accept temporary reductions in real wages when energy prices rise, while in the past they would have demanded compensation. The wage-price spiral used to mean expensive oil led to inflation, unemployment or both. Central banks now are under less pressure to act to head off the “second round” inflationary effects of dearer oil.

Life would be a lot easier if oil prices fell. So what will happen? Fans of mine are fond of reminding me I once wrote that the sustainable price of oil was $40 a barrel. I fear some of them did not understand the subtlety of the point so let me try again. It was based on BP’s statistical review of world energy, which shows the real (inflation-adjusted) price of oil right back to the Pennsylvania oil boom of the 1860s.

Real oil prices were very high at the start of the period, above $100, but came down by the 1880s and stayed roughly within a $10-$20 range, with occasional jumps, for the next 90 years.

From 1973 to 1985 there was a spike, initially to the equivalent of the mid $40s, then a peak of over $100, on Opec’s flexing of its muscles and the Iranian revolution. Prices then dropped, averaging $20-$30 in real terms from the mid1980s until 2003. In cash terms, the recent rise above $40 happened only in 2004.

The question was how much prices needed to rise to allow for tighter supplies, rising demand from China and India – as set out in a new paperback of my book The Dragon and the Elephant – and rising costs. Nobody denied this meant a permanently higher level of prices.

Goldman Sachs suggested a five-year average of $60 a barrel, which was at the high end of predictions. Most other forecasters expected a rather smaller adjustment. Everybody, including me, expected prices to be higher than in the past, but not this high.

So today’s prices are unusual. Inflation and the dollar’s weakness mean the $40 I wrote about three years ago should be adjusted to between $50 and $60. But that is a long way from $125, which is what the market says oil is worth.

Anybody who doubts something odd is going on should look at the reaction to last Wednesday’s announcement of a large rise in crude stocks by the US Department of Energy. Instead of falling, prices hit a new record. “It’s going higher because it’s going higher,” said one trader. Did somebody once write of the wisdom of crowds?

In the four years since oil prices broke above $40, global demand has risen from 82.5m barrels per day (bpd) in 2004 to an estimated 87.2m this year. Supply has just kept pace, rising from 83.4m to 87.3m in the first quarter.

Interestingly, demand in the advanced economies is predicted by the International Energy Agency to be 48.9m bpd this year, 0.5m lower than four years ago, with even North America’s oil use down. So it seems that many countries are responding to higher prices in the normal way.

But demand in emerging economies is up 5.2m bpd, driven by China, up 1.5m bpd; the Middle East, up 1.3m; other Asia, up 0.8m; Latin America, up 0.8m, and Africa, up 0.4m.

So when will the oil bubble burst? Probably not until there is more solid evidence that both supply and demand are responding to higher prices. The higher the price, the more likely such a response. But it takes time. In some economies, like China, prices are controlled. Much oil is bought on long-term contracts, not reflecting current market prices.

As I have said before, oil spikes eventually end. But they do not always end quickly.

PS: David Cameron is not the first Tory leader to launch a plan to revive manufacturing. John Major did so after succeeding Margaret Thatcher. Even so, this government launched what it described as Britain’s first ever manufacturing strategy in 2002.

The Tory initiative is welcome, coming when much is expected from manufacturing. Strong growth should be part of the rebalancing of the economy away from consumers. But industry is in danger of falling at the first hurdle, output having dropped in March. Still, a future Tory government that is serious about manufacturing would be good.

Cameron announced the party would link up with Rolls-Royce, “embedding” officials in the firm.

All well and good, but we are entitled to be a little sceptical. The announcement came as the Tory leader was about to head north to campaign in the Crewe & Nantwich by-election. Did somebody think of Crewe (where the car company used to be) and Rolls-Royce, put two and two together and make five?

david.smith@sunday-times.co.uk

I agree with David Smith that modern economies can tolerate higher oil prices than they could in the past, but all that means is oil prices will go much, much higher before there is some demand destruction. Energy is still essential a modern economy, even if it represents a smaller share of GNP.

Also, much of the demand coming out of emerging economies is artificial because of price caps and fuel subsidies in those countries. They are not getting the price signal because their governments are paying the difference. Clearly this is unsustainable.

I am not sure this is true. Unlike the 1973 Oil Embargo where shortages hit everyone equally, current price escalation progressively punishes based on economic strength. Foreclosures are an example. Impact on weaker economies and basic food is another. Food transport is 97% dependent on oil; it does not matter how much corn there is in Iowa, if you cannot transport it to Chicago.

Economic momentum hides the nature and rate of the decay. People at the lower spectrum of economic strength have a weaker voice, but they have mass and growing desperation.

Economic Growth equals Energy Growth times Efficiency Growth

Crude Oil supply stopped growing in May 2005. There is still momentum but that started decaying when crude oil production stopped growing. Oddly enough, 2005 is when the EIA stopped updating the following graph (I do not believe in conspiracy, just incompetence). I added from 2005 and the foreclosure curve.

A major risk is that policy makers, insulated from consequences by economic advantage, have and are not acting relative to the severity of crisis. Without hope and understood course of action, the social fabric may shred along economic strata.

Bluntly, Peak Oil is a civilization killer and we are facing it with a total lack of leadership. Or, maybe more correctly a "let them eat cake" type of incompetence.

These kind of comparisons are meaningless over long timespans. Demand will always "barely keep up" with supply, which will always "barely keep up" with demand. Otherwise, we're either burning nonexistent oil, we're exhausting stored oil that runs out in a short period of time, or we're spending loads of money on new storage facilities as oil reaches the brim of the loading docks.

The contrast between demand and supply is only useful in examining particular relationships between countries, or in examining short-term trends where there is significant storage potential.

As all the new money being printed to finance this consumption is being recycled by those at the

top of the Malthusian chain (i.e. Dubai and Norway). Our outdated measures of economic growth will continue to look like everything is fine (until it isn't). In the late 70's, there was an actual and significant

decrease in the amount of oil consumed in the US - this was the cause of the recession, not high prices.

Only the poor will really feel it this time, and in our economic metrics, they don't seem to matter much.

Abandoned Ford F-150s with 0% financing in the trailer parks are the tell. Even the repo man does not want them.

That is my take as well.. the oil price as a percentage of global GDP has it all backwards.. The total GDP is the profit from burning the oil

The economy is your power consumption. The price is what exactly? The gap between the fuel cost and the total GDP is your profit margin or a measure of efficiency if you like.

Boris

London

Mention of money gets my attention!

In a series of postings at Question Everything I have been exploring the question of "what is money?" in reality. All talk of comparing oil price in monetary terms with GDP (also in monetary terms) is doomed to erroneous conclusion. Dollars as a measure of anything are notoriously rife with error and distortions. The problem is that the dollar is no longer representative of a real physical unit. Noting that energy available to do work is the only REAL currency in the world (economy + ecosystems) that has unambiguous meaning, I have proposed that we adopt an energy standard as the basis of valuation of money.

You can follow some of my reasoning and analysis of large-scale impacts of adopting this standard at the above link.

Trying to understand the price/cost of oil using the current measuring device is like trying to measure distance using a rubber yard stick (Samuleson).

George

http://www.postcarbon.org/ has all the MP3s they have ever done. Over 500.

I've been listening to the old stuff, and the talk of how $100 was going to bring the economy to a halt.

The enterprising could dredge early posts here on TOD, Peakoil.com or energybulitin.net for predictions that didn't happen when price hits X.

(My datapoints on gas $5 (next bill size), minimum wage and minimum wage after taxes have yet to be met.)

{and for some reason galeon won't post to non-main page oil drum but konqueror will}

Some feedback loops are slower than others. Note the recent study posted on TOD of the housing bubble being at least partially popped by fuel prices.

Don't go countin' no chickens jes' yet, bucko!

Cheers

A few months back, some economists cited in the Wall Street Journal were quoted as saying that if/when oil hits $125 to $150 we go into recession. Now we are at $125. Some say the increase is a result of the weak dollar. A study by Federal Reserve Bank of Dallas, however, shows that the price increase is less for the Euro, but nevertheless a major increase:

http://dallasfed.org/research/energy/en0802.cfm

For the last 3 years, global oil production has pretty much plateaued at 86 million barrels per day (a tad over one cubic mile of oil per year). Many say that oil production has peaked: ASPO Ireland, Matthew Simmons, the late Samsam Bakhtiari, T. Boone Pickens, the German based Energy Watch Group, and the U.S. Army Corps of Engineers (who else did I miss???), and now Daniel Yergin apparently thinks that Peak Oil is here.

Oil production will probably begin to decline this year, at one or two percent per year. Then, within a few short years the decline rate grow to between 4 and 8 percent a year:

http://www.theoildrum.com/node/3236

http://www.theoildrum.com/node/3203#more

http://www.theoildrum.com/node/3060

But the decline rate for the U.S. will seem far steeper: as U.S. oil production slows, as oil exporting nations reduce exports, and as more oil is consumed in the production of oil. Meanwhile back at the ranch, demand is increasing at about 2 percent per year. You can see where this is leading ): .

These realities will bring about strong price competition for oil. In 3 to 5 years, one can imagine big oil price increases at $250, $500, $1000, or $5000 per barrel. Such prices will generate high inflation, recession, and unemployment. Public policy decisions will to center on the "Qicksand Effect," as Chris Shaw describes it: http://www.onlineopinion.com.au/view.asp?article=5964

The choice will be, shall we spend precious and increasingly expensive energy on alternatives and renewables, or shall we conserve that energy? The nation is ready for a Manhattan type project to develop alternative energies. But there is little real evidence that this approach will enable the nation to plant, harvest, and transport food and necessities and heat our homes and hospitals, etc. Before the nation embarks on the "Manhattan energy Project," it would be a good idea to give serious study to this question. One thing is certain, if a Manhattan energy project is created, it will go forward with some plan that will consume much fossil energy, even if that plan digs us faster toward energy depletion. Maybe a wiser policy is conserve the energy, engage in risk management planning, and try to make the hard landing a little softer. Landing is a euphemism for the number of fatalities. It would be helpful for Congress to commission the National Science Foundation to study the problem. This would limit the role of politics in answering scientific questions.

You said it far better than I could.

Instead I think we are heading for a crash and a hard landing would be good, relatively speaking. A soft landing is far too much to hope for.

Conservation and powering down is probably the best option but really a pipe dream. Human nature will not allow it.

What one person, locality, state or country does with conservation will have an equal and opposite.........using and/or hoarding that which is left over.

I do think when the proverbial penny drops The Manhattan Project zeal will result in half finished and poorly planned projects and mitigation schemes in all manner of locations and strengths. They will probably end up as monuments to desperation and deck chair shuffling.

If our human nature had allowed it we would have begun future planning in the 70's. Our nature hasn't changed in 30 odd years.

Our situation is akin to a spaceship on a journey to a new world.

The occupants on their journey have used too much air, food and fuel on parties and joy trips. Everyone will die if they all continue to consume as before. Some can survive, if...........................

there are very few choices.

Leanan stated it in a comment to Gails's story about the vulnerability of The Grid (to paraprase);

Less Energy means less Net Energy.

What this means in a few words less than C.J. just provided, or has published in his paper (on the coffee table thank you very much), is the decrease in petroleum fuels will result in a decrease of all energy sources. All the other energy methods are capitalized, constructed and maintained with petroleum fuels. Biomass, tidal, solar or wind will not compensate for the loss; and, nuclear will not fill the gap. There simply will be less.

This is a paradigm shift in our outlook for considering alternatives. And, it only supports the power down protocol. The chances of coming up with an alternative (and it would have to be multiples better in free energy) for petroleum fuels to seamlessly slip into our BAU has two chances - slim, and none.

On a personal commentary, I think TOD should stop running advertising for all these financial firms for profiting on the Peak Oil situation; such as The Backdoor Play Exxon Doesn't Want You to Discover, or the Bakken Black Gold Rush. Doesn't the slick opportunism, pandering, or soulless merchantialism ever stop? It's not funny anymore people, time to grow up and be a fully functional adult part of the species.

Can't wait to see that oil bit (see ad by www.InvestmentJ.com/Peak_Oil). Does it release the techno-genie from the deep offshore depths, or cause angels to dance on the head of a pin while extracting multiple deposits among highly fragmented deep structures at pennies per barrel? Parasites feeding on the desperate perspiration of those trying to eek out the last of the profiteering capitalism fantasy. I feel dinner coming back for a second round and it isn't going to taste so good this time!

"On a personal commentary, I think TOD should stop running advertising for all these financial firms for profiting on the Peak Oil situation; such as The Backdoor Play Exxon Doesn't Want You to Discover, or the Bakken Black Gold Rush. Doesn't the slick opportunism, pandering, or soulless merchantialism ever stop? It's not funny anymore people, time to grow up and be a fully functional adult part of the species."

I second that and would add that it is getting harder and harder to stomach.

The advertising is a brutal reminder, no doubt.. but isn't this also a fine example of 'Capitalism Selling you the Rope to hang it with?' The Messages here are rarely in conformity with the assumptions behind these Ads.. why not take their money to leverage new ideas?

We've all grown up with an increasing awareness of the glowing promises in marketing, and should be able to keep our heads clear as to what they are and are not. Maybe it's even Churchill's 'Protecting the Truth with a Bodyguard of Lies..'

Bob

I believe that the ads are auto generated by google adds. TOD doesn't have control over what is displayed unless it drops google adds, but then TOD would need another source of revenue to continue operating.

TOD faces ever present dangers of being co-opted by corporate interests. Those TOD editors who post high tech energy projects can be hired subsequently as consultants or speakers for the industry they have promoted. Without knowing it, they can be rewarded and thus corrupted. This is why governments attempt to regulate the activities of public officials during and after government service, at least for a short period of time.

The mission of TOD can be compromised. TOD posts many technofixs relative to the number of posts dealing with preparations for Peak Oil impacts. The message to the many readers among the public, industry, and government is that we can fix Peak Oil problems. This provides support for a Manhattan Energy Project, instead of what is needed -- a scientific study by the National Academy of Sciences/National Research Council.

One of the main problems with the posting of the technofixes is that rarely if ever do the sponsors provide a real EROEI analysis. A real EROEI analysis must include all of the energy that is consumed in all of processes getting to the final product, from all of the ores, components, and parts from all over the world, and the transportation of parts, products, and employees, and the factories and energy that supplies them, and the salaries of all the employees in a thousand processes and transportation to get the technofix to market and then maintained, and all of the oil, natural gas, and coal that all of these thousands of employees use when they spend their salaries. Opportunity costs must be included too, for example, if biomass is taken out of production. And a real time frame for the life cycle must be established, given that Peak Oil means less oil to maintain everything, and that the power grid will go out.

TOD editors are making a big mistake if they attempt to play the role of the National Academy of Sciences. Rather, TOD can play a role in asking Congress to commission the NAS/NRC to study these issues. We could have a letter writing campaign to Members of Congress. Maybe they would favor this approach. I'm sure that most of them don't know what direction to go in concerning the energy crisis.

I would disagree in that over the years the readership has been well served by those in industry that have taken the time to provide information and their time to write on areas of their expertise. The degree of willingness to provide this advice has been a considerable contribution to the worth of the site. It has not been something that I have seen being much abused, as you would suggest.

I actually disagree with you on what the best path forward is (and yes I have been on an NRC panel). There was a program back in the 1970's out of NSF run by a guy called Bill Hakala. They were looking at different novel ways to drive tunnels (the plan at the time was to run a high-speed rail tunnel down the East Coast). For the first year he sensibly said that if you could come up with a half-way feasible concept, then he would put up $100,000 for you to do a one-year study and the odd experiment to prove whether it was viable. There was a lot of useful information generated on a wide variety of ideas (a Pueblo in NM got a new sewer system out of one idea) including some surprisingly good results from a couple of ideas that initially some of us thought were crazy.

My comments about technofix posts have to do with co-optation of editors/contributors who are located all over the globe, and their possibly being influenced on what to post. I'm not sure how you know that this has not been a problem, nor will be a problem. Influence is hard to detect. This is a problem for every organization.

You seem not to know what I am talking about when I refer to a NSF study, and you seem therefore to indicate that the NSF should not undertake a study similar to the 1977 study,“Energy in Transition 1985-2010”:

http://books.nap.edu/openbook.php?record_id=11771&page=R1

This 600 page study is the most comprehensive energy policy analysis ever undertaken. The study utilized some 350 scientists from various fields, with a mix of the scientists from industry, universities, government, and non-profits. Information was shared, panels provided findings to a central panel that wrote the report and recommendations. Scientists who concurred or disagreed with the findings or recommendations included statements in an appendix, so all analysis and recommendations could be challenged. It is the ideal approach for policy analysis.

You do not give any reason for this position. I am perplexed that you would oppose an NSF study of energy policy. This is the only way to get the best scientists in different fields to analyze diverse complex questions that are interrelated, which is the context of energy policy. A central problem of Peak Oil is a lack of analysis about what policies will serve the public best. As well all know, a lot of lives are at stake. Congress and the president need advice, and they are hearing vastly different solutions. Given the importance of Peak Oil, it is amazing that the NSF has not been examining overall/comprehensive energy policy on a continuing basis since 1977. How could we let 30 years of study go by.

Dear Heading Out and Cliff,

re: Heading Out says:

"I actually disagree with you on what the best path forward is (and yes I have been on an NRC panel)."

And then he says,

"...some surprisingly good results from a couple of ideas that initially some of us thought were crazy."

HO, did you mean to say "I actually AGREE WITH YOU..."

If we clear this up, I may be able to go on to ask my questions.

A few months ago, someone had posted a neat little graphic looking like an upside-down pyramid, showing our energy infrastructure as having the least amount of investment of all the industrial sectors.

My guess is that the powers that be are terrified of the prospect of the enormous amounts of M3 in the world, looking for a home, will target commodities. Its my observation they are doing just that.

For a while, equities was absorbing M3. Then the Nasdaq crash.

Then Real Estate was absorbing M3. Now the subprime crisis and credit crunch. No more frivolously lent money to be gotten from investors who used to trust financial institutions for "a sound investment".

How does one store wealth? If equities, its worth only what others say its worth, and no one really has a "need" ( a felt deprivation ) for most of it. If real estate, most of its value was based on one being able to qualify for massive loans.

If one stores wealth in currency, the government just prints more, diluting the worth of the currency one holds.

Not only that, government has the gall to demand tax payment on the pittance of interest the bank offered, while simultaneously denying any deduction for the depreciation of its value. Talk about a *major* disincentive for anyone to keep wealth as deposits in a bank!

Then, on top of that, bank savers have to compete by offering their savings, which takes years of labor to accrue, in competition with the Fed, which opens up the discount window and offers banks whatever they want for peanuts.

Its a wonder anyone has bank CD investments.

Commodities, especially food and energy, represent one of the few things there is a natural limit to. This has become apparent only during the past couple of years.

We still have all the gold ever mined - somewhere. We didn't burn it. And its kinda useless. Its just something to have and trust others will value it and will trade something useful for it.

But there are other things in very limited supply, non-replaceable, and not being replenished. Potash. Phosphorous. Petroleum. And we *need* ( a *felt* deprivation! ) them. King Midas of lore shows us just how valuable gold is. How valuable is a glass of water?

In a scenario where you were marooned in the desert for a while, that one glass would be worth your life savings!

When it all boils down to what is really important to keep the whole circus on the road, its water, petroleum, and fertilizer. Water recycles naturally - and there is plenty of it, its just its in the wrong place or salty. Energy can be used to move or desalinate water - so that leaves Energy and Fertilizer as the biggies.

And that's what we are seeing going through the roof.

No one seemed to get all that excited when real estate prices doubled as a result of the flood of liquidity our Fed put into the system as a result of the Nasdaq crash.

Now we are seeing a paniced populace investing in the fundamental infrastructure which everything else depends on to run. Its like a person - denying healthy habits for years - now experiencing the results of unhealthy living and is finally taking steps to preserve the core biological system that runs his body.

Sums up my view pretty well. I get irritated when people advise paying off debt in the current environment. The correct thing to do is take on more debt as long as one can see a way to make the payments and relatively low interest rates can be had.

There is little reward for saving anymore, if there ever was any. Maybe keep enough cash on hand for emergencies. The general policy of the Fed is to make it impossible to earn a real income from savings and eventually wipe them out.

While a relatively small percentage get into trouble with too much debt, for most Americans debt is a protection from the irresponsible fiscal and monetary policy of the government. Add in the crazy foreign adventures of the Empire and debt becomes absolutely necessary to offset the inflationary effects on commodities of permanent war.

Taking on more debt is good? Until you lose your job, and can't afford to finance the obligation. Being tossed out in the street doesn't strike me as sound fiscal policy. Sure, interest rates are relatively low, but domestic savings are at a negative rate right now. How long can the average household keep operating in that kind of state?

Let's say that US households managed to cut their expenditures by 10%. It would be good for their bottom line but devastating for the economy, incurring massive job losses. If they keep going the way they are, they're bled until they have to declare bankruptcy. We have a painful path ahead of us.

In a time of uncertainty, I locked in some certainties. I sold my large(ish) house and paid cash for another one, half the size, 3 blocks from a bus stop. The value of my house may drop, but then so will everyone else's. I may lose my job, but I'll still have a place to live. Gas may go to $10/gal., but I can ride the bus. I'm certain by paying off my house, I'll miss out on some good investment opportunities. I've also nearly eliminated the possibility of losing the capital I do have.

I spent a lot of time talking to my grandmother in the years before she died. The Roaring '20s sounded an awful lot like 1995-2005. She also told me that when the Depression hit, a lot of people thought "It can't happen to me.", but did.

Taking on *fixed interest rate(so they can't jack up rates when hyperinflation hits)* *non-collateralized(so they can't take your house when you lose your job)* debt may be a good idea if you can find it at low interest rates, and you have an easy means of investing it to gain significant return in order to offset inflation...

But if everybody could do that, there wouldn't be a recession. Recessions feed on themself by drying up those opportunities, as well as the money to put into them - If we cause one by pumping m3 to 400% of its previous value, the point where we reach the dollar being worth 25% of its former value (all other things being equal) is not some magic brick wall where we're able to call it over. By that point, everyone's livlihood is shredded, noone trusts investments anymore, banks have failed, everyone has lost their job and is trying to save money in a shoebox. Noone can buy anything from your promising new business because they don't have a job to pay for it.

The economy is not simply combinatorial (for a particular input, you get a particular output), it's the world's most complicated state machine (for a particular input and current condition, you get a particular output).

Not only that, government has the gall to demand tax payment on the pittance of interest the bank offered, while simultaneously denying any deduction for the depreciation of its value. Talk about a *major* disincentive for anyone to keep wealth as deposits in a bank!

3 points:

1) Tax law exists as a punishment tool, not as any balance the books revenue method. (Mr. Cheney's 'enjoy your audit' comment and the IRS official 'what do you expect if you sue the President' statement)

2) If 'money' gets taxed every time it changes hands, how do you keep it changing hands?

3) in money theory there is an idea of the velocity of money. Keeping money out of savings should mean more 'wealth effect' for everyone. (The reality seems to be, if you get 1% every transaction, tis best to keep the money moving for your pocketbook no?)

1) Tax law exists as a punishment tool, not as any balance the books revenue method.

Exactly why we have a "negative savings rate" in the US, and large segments of the population are literally running without financial "shock absorbers".

We have also passed all sorts of copyright and patent law which is being used to inhibit "free enterprise", aka "competition", aka "theft of a business model", as monopolistic enterprises are threatened with someone else who is willing to do the same thing for less.

I feel the rest of the world will look upon the USA as a flower that lasted only a couple of hundred years before its own politicians foolishly crafted legislation which economically suicided the nation for the benefit of a few.

Capitalism is NOT Free Enterprise. "Free Enterprise" is considered THEFT by capitalists as the monopoly model (gang lord's turf) is rendered moot.

"This time, it's different." We just don't know in what way.

The chart shown is indeed interesting, not so much for the “twin towers” at 1979 and 1980 and now the first of what could be the “twin towers” at 2007 and 2008, but for the “big valley” of 1986 through 1999. What is hard to impress upon people is what that big valley did to investment in the energy industry, both fossil fuel and renewable. Virtually NO ONE was putting capital into the energy business in that period. It is safe to say that most folks took energy completely for granted during that period, and the rule when it came to energy investment was “who cares”.

Is it possible that the complete drought of investment in energy exploration & production (E&P), infrastructure and research could be having an effect in the decade that followed it post 2000? Surely that must seem possible?

There is a priceless quote in the keypost: “the value of the dollar has decreased somewhat so today’s $120 is not as high in comparable terms as Wescott’s”.

The dollar has decreased “somewhat”? That is like saying that hurricane Katrina was “somewhat” of a weather event!

Equally as priceless is the title of David Smith’s article “Why high oil prices are not squeezing us more”.

Who is this “us” that David Smith is referring to? As is always the case, the poorest, whether they be nations or individuals are being hurt worst and first. While oil is less of a component of wealth production in the most developed countries, I think the case can be made, and is being made by Chris Vernon that at some point high prices can indeed overwhelm the “changed” circumstances that have existed since the 1980’s, especially for those who not already prosperous, and the economy will suffer. What will suffer first is the trend toward “upward mobility” by those on the edge of breaking into a safer and more prosperous lifestyle.

This puts added importance on the issue of life planning/investment and make each decision all the more important. The crucial question for individuals in the developed countries of Europe, America and Japan and the rapidly developing economies of China and India is actually pretty simple: This time, is it really different? In other words, is this another commodities “superspike” much like the twin towers of 1979 and 1980, or are we really on the edge of the new paradigm of declining oil and gas production that will herald the need for radical new life planning and investment decisions?

The choices we make, and which scenario of the two listed above we accept as our guiding philosophy will determine our lifestyle in outlying years. It goes without saying that if we are incorrect in timing it is just as damaging to our lifestyle as being incorrect in overall philosophy.

There is absolutely no doubt that “non-renewable” fossil fuels will peak. They are non-renewable by definition, and depletion comes with that definition. So we can “bank” on depletion and peak, it is a certainty. But the timing issue is much more difficult to predict, by orders of magnitude more difficult, and being wrong on timing is being WRONG, pure and simple. For cultures, a few years or even a few decades are only an eye blink. We are leaving fossil fuels behind as the fuel that drives cultures. But for individuals, a few years matter greatly. A few decades is an infinity. Many of us remember well mistiming the events of the 1970’s, thinking that the “oil age” and the age of financial growth was essentially over then. We were wrong, and the choices we made on that mistiming has cost us dearly.

If, as the Peak oilers say, we are “halfway” through conventional oil supplies, then even accepting their logic, there is a lot of oil still out there, but where? How expensive will it be to extract? What will purchasing it do to balance of trade and national economies of the various developed nations? Will the price of oil so destabilize the developing nations that it creates economic contraction and dislocation? Can we bet against the rise of non-conventional fossil fuels such as tar sands and oil shale? Can we bet against alternative transportation such as electric vehicles and plug hybrids? Can we bet against a staggering increase in electric power production by the renewable?

Conversely, will new finds of oil at the current new prices it can be sold for drive exploration and production, and will this lead to new bursts of oil production that are unprecedented at this moment? If oil and gas is found in large quantities, how long will it last at increasing levels of consumption worldwide? Will new finds of oil drive prices down and damage or destroy the promising new renewable energy industries and alternative transportation industries? What will be the implications of carbon release in all of the above scenarios? Will nations begin to penalize carbon release in serious ways? If carbon release is penalized, will it keep life in the alternative energy sectors even if oil drops in price?

Misjudging the impact of ANY ONE of the above factors, and any one of a dozen more that I may have forgotten to mention will have an impact on personal wealth for all citizens in the developed nations. Of course, if we are facing the immediate “catastrophic” decline of oil and gas production, all the above scenarios can be thrown out, and a whole new list of problems and emergencies, and possibly opportunities face the consuming and investing citizen, and a radical new skill set will be needed.

I wish that we had better information to work with, and more “assurance” and “insurance” to protect us from the bewildering set of choices that we will all have to make, but we do not. We can only assure the consuming and investing citizen of the lack of assurances and the lack of useful information: Simple answers and simple assurances will not work. Simple “scenarios” will be so misleading as to be essentially useless. The “experts” and the “investment specialists” often have an agenda so any assistance they provide must be taken with caution. The press is a “trailing indicator” and not a “leading indicator” of events and as such provide little or no guidance, and this includes the “business” and “energy” press.

There are no “simple” answers. Be careful, but do not be afraid to take action if you can be relatively sure that the outcome is beneficial in any energy scenario. It is hard to make a case against reducing waste and debt. Look for safety as well as growth (and despite what some may lead you to believe, there will be growth in certain limited cases and places no matter what) Take care of each other and enjoy life no matter what. We will need each other, no matter what. Even the wealthy and powerful cannot go it alone. Thank you.

RC

Roger Conner Jr

Thank you, Roger.

Well put.

Particularly liked this wrapup.. "We will need each other, no matter what. Even the wealthy and powerful cannot go it alone."

As William McDonough said it, "It will take all of us, and it will take forever. But isn't that the point?"

Bob

Many posts are in disagreement with the conclusions of this analysis, however it includes one important proviso which is, 'one year at 120'. We just started the clock.

With economic expansion at an anemic 6 10ths of 1 percent we're only a few fractions from the strict definition of a recession. Meanwhile Brazil, Russia, India and China all have economies that are continuing to grow at a very fast pace. In particular China's economy has been growing at 10%+ for several years running. They are the new powerhouse manufacturer, replacing the once great U.S. We continue to lose manufacturing with no hint of any concern from Washington. Makes me wonder what the hell their doing besides fighting for power for their own party's.

Cslater8,

If the world starts down the falling edge of peak oil in the next few years, China will be hit hard with rising energy costs and shortages. If there is a global recession or depression, there will be less demand for their products. Most of those who put money into new Chinese factories will not recover their investments. People who are buying their first cars will discover they can not afford the gasoline and squandered their assets on a vehicle they can not use and has no resale value. China is putting the petal to the metal as they race toward the cliff. Shifting manufacturing to China has allowed U.S. consumers to benefit from cheap products while China has been stuck with the bill for investment in their shinny new factories that depend on fossil fuels. Guess what happens in the U.S. when manufacturing returns during a depression and with a devalued dollar: American standard of living and wages will be lowered which will benefit the bottom line of American corporations. Even though he does not publicly discuss it, President Bush is an oil man who is aware of peak oil. I think it likely he has some devious plan that allows American corporations to land on their feet at the expense of the rest of us.

Brazil, Russia and other oil exporting nations should prosper in the near term with huge revenues from selling oil. I think the Export Land Model has merit.

Yes their economy is in full blossom ;-)

Though it is soon to wilt if they are truly growing at the rates mentioned above. Maybe they will end up going back to the abacus for learning basic arithmetic, either that or they need to have Albert Bartlet's lecture about Arithmetic, Population and Energy translated to Chinese because they don't seem to get it in English. Well, neither do most native speakers.

They are also putting the pedal to the metal on inflation: over 8% according to a current Yahoo! headline. Will that not bleed into their clients' economies?

Stagflation, where art thou?

Cheers

Didn't the abacus go the way of the slide rule?

I keep my slide rule in my shop. The sawdust doesn't bother it and the batteries don't wear out. I tried to use it to figure out how many calculations per watt-second I was getting, but it wouldn't let me divide by zero.

Well, now I suppose Darwinsdog will tell me that I am the energy source, so I should be able to figure out the calculations per calorie, times 10 for the amount of fossil fuel calories required to make/transport them and therefore a pocket calculator is more efficient, at least for addition.

:)

Jon.

Growing up, my dad wore his slide rule in a sheath on his belt, like a sword. He was never without it. I wish I'd kept his slide rule; it kinduv defined him..

I'm not sure about the relative efficiencies. I suspect that the $4 light powered pocket calculator is more efficient to produce & use than the slide rule, if all inputs were accounted for. But even if it isn't, it's still worthwhile. I don't trust myself doing mental or even paper & pencil math anymore. Just as my dad's slide rule was a part of his "extended phenotype," so my TI-83+ is part of mine. ;)

Yea, my dad remembers the slide rule holster (although he swears he never wore one), along with punch cards etc. It's hallarious when he tries to fix the computer--"I can't figure this damn thing out.....I guess I'll have to go back to DOS and fix it"

Imports to the US from China were up a very modest 1.8% in the three months to March 2008 vs. 21% last year.

Lies, damn lies and 'Government Inflation figures'...

Its almost as if they have invented a magic shroud that when applied can make the real rate of Inflation dissapear. How is it possible to exclude food and energy costs? What other necessities will soon be excluded? Anything that seems to be going up in price as they print money.

We must have negative real interest rates by now no? Yes but its not visible in the figures, its a piece of magic. The oil exporters seem to have cottoned on to what we where upto. If we insist on giving them bits of paper for one of the most precious of commodities at least have the decency to try and make them worth something...

Edit: In addition the .pdf states that $120 oil would push up the oil bill to 8% of GDP. This still sounds like a fairly low amount even if it does represent a level 'higher than at any time in History'. We have more 'energy slaves' working for each of us than a King of Old...

Nick.

Hi noutram,

Well since it is to the advantage of the government to downplay inflation they will come up with any number of measures that suit them.

Why is it to their advantage to downplay inflation? so that everything that is linked to inflation such as inflation linked bonds, pensions... are held down as much as possible so the debt is reduced as quickly as possible and the real cost passed on.

The ability to fiddle the money e.g. to finance unpopular wars is why all governments came off the gold standard. With a gold standard if a government tried to create more "money" the value of the money would very quickly go down. Over the long term prices of goods tended to decrease and government bonds held the same value for many years.

Best hopes for honest government.

Is there something I can invest in that accuratley tracks the increase in the money supply? That way a pound today is a pound tomorrow. This is the way it should work and would soon put a stop to printing money. I have some Gold but got in a bitlate and its falling now...

Nick.

Chris - Thank-you for that timely yet nostalgic report. I had never read the original so it fascinating looking at how fast events are moving.

One comment re: "The International Monetary Fund (IMF) suggesting a $5 increase cuts world GDP by 0.3% so it follows that the $60 to $120 doubling would reduce world GDP by 3.6% and the US Federal Reserve estimates that a $20 increase reduces GDP by 0.75%, which would result in a loss of 2.3% from the increase to $120."

I think that one part of the equation that I have to question is if every $5 increase in the cost of a barrel of oil equals a loss of World GDP .3% forgets something. If you multiply .3 times the (60 divided by 5 or 12) that equals the 3.6% loss of GDP. However if you take each $5.00 increase and multiply it exponentially as compound interest you come up with substantially different numbers.

I guess my point is that it would be logical to assume that as this dramatic cost increase ripples through the economy it could very well end up being a financial Tsunami.

"Compound Interest is the most powerful force in the universe"

I was going to comment on that as well, but the difference is fairly small. The actual decline would be 3.54% instead of 3.6%, which is probably well within the margin of error of that initial 0.3% figure.

--

JimFive

Jimfive "The actual decline would be 3.54% instead of 3.6%,..."

How did the number get smaller? That makes even less sense. You have to multiply the total loss minus the previous years loss which speeds up the process...exponentially. Compound interest gives you momentum as the process moves forward in time based on the doubling factor. At a loss of .3% it would take 233 $5.00 increases to cut the world economy in half if it behaved on a strictly numerical logic.

However, as these rippling effects play out, the human factor of panic and fear may easily create a rising tide or an "economic Tsunami".

Because it is a 0.3% decline. start with 1000

1. 1000 *.997 = 997

2. 997 * .997 = 994.01

3. * .997 = 991.03

4. * .997 = 988.05

5. = 985.09

6. = 982.13

7. = 979.19

8. = 976.25

9. = 973.32

10. = 970.40

11. = 967.49

12. = 964.59

And (1000 - 964.59)/ 1000 = .0354 or 3.54% decline

--

JimFive

You're right. Thank-you.

That still doesn't change the human factor acting as a wild-card as events play out. People are pack animals so if a stampede starts it may over-whelm common sense.

Just a few thoughts on why the US economy has been so resiliant:

1) Foreign countries reinvesting petrodollars in US: OPEC countries (and China for that matter) have a bit of a problem--they want to sell off their dollar reserves because it's value is declining, but the fact is that they allready have huge dollar reserves, and if they sell the dollar off, their exisiting reserves decline in value (a bit of a catch-22 of US debt worldwide), so basically have to reinvest their petrodollars back in the US for fear of devaluing their existing dollar reserves to a great extent.

2) Food and gasoline inflation particularly hurt the poor and middle class in the US, so what do they do--well, besides taking on more debt of course, they cut back on the consumption of cheap discressionary goods, which are often made overseas, and discressionary gasoline consumption, made from imported crude. Combine that with the falling dollar discouraging imports, remittances,and general domstic consuption over imports, while encouraging exports, the effects of increasing oil and food inflation do have something of a rebound effect on the domestic economy, even if the effect is limited.

One word.

HELOC

Home Equity Line of Credit. Strip out heloc money and cashback from refinancing along with the surrounding employment from the housing bubble and the US economy would have already been on its knees. Supporting and far larger of course is the credit bubble from low interest rates. And of course all this plays into higher tax revenue with its own bubble on the government side. And finally don't forget the economic stimulus from the Iraq war.

In short the US economy has been given multiple and probably lethal overdose's of a cocktail of uppers. As these wear off expect high oil costs to start having significant effects on whatever fragments of a real economy remain.

Several thoughts: One of the problems with the current GDP as alluded to above is that things that are actually harm the economy increase it. This is one of the reasons why the ratio of total deficit to GDP is fairly meaningless as deficit spending inflates the GDP. In the same way, a higher oil price inflates the GDP and throws off impact and recession calculations. Thus, we need new and/or better economic metrics to measure the impact of oil prices. One of items I’ve used as a GDP substitute is infrastructure spending. Unfortunately, getting valid figures is not easy and the Congressional Budget Office has not updated their report since 1999. What a surprise. (See Trends in Public Infrastructure Spending @ http://www.cbo.gov/ftpdocs/12xx/doc1256/infrastruct.pdf)

As far as the economic impact, wealthy countries will be able to reduce their consumption more because of their larger percentage of discretionary consumption. However, once you get down to the bare bones, smaller countries with more animal power will probably be able to cope better, as they have a ready substitute. As observed here in the U.S., rural areas will be hit the hardest, as they have little ability to drive less. If its 20 miles to the store, that’s it and if you’re nearest neighbor is several miles away, then you don’t have many options of carpooling with someone either. The cost of their goods will also be far more dramatically affected by transportation costs than in major urban areas.

By the way, does anyone know of a source of oil/gasoline/fossil fuel consumption and/or miles driven by zip code, census track or block? Combining that with census data (population & median income) would give a way to geographically evaluate how higher prices will affect different regions.

As far as business sectors, those that depend the most on fuel will be the hardest hit. I’ve heard many anecdotal stories about how independent truckers, who also tend to live in more rural areas, are being driven out of business. In suburbia, I expect anything that requires gas (kids driven to activities, delivered goods, dining out, etc.) to also be hit first. Here, looking at WWII and how gas rationing affected life would be a good starting place. Does anyone know of studies that have analyzed it?

As a result, I expect to see a flight from rural areas to metropolitan regions, and those who are marginally employed or whose business depend the most on oil to loose their jobs and then require more social services (unemployment, food stamps, emergency room visits for healthcare, etc.). In the metro areas, this will put downward pressure on wages (more people chasing fewer jobs) while putting upward pressure on the cost of living (food, energy, housing, etc.). This isn't going to be pretty and our political institutions don’t seem to be capable of addressing it for fear of being attacked as alarmists or because the invisible hand of Adam Smith saves all.