The Shape of Oil to Come

Posted by Rembrandt on October 12, 2007 - 10:00am in The Oil Drum: Europe

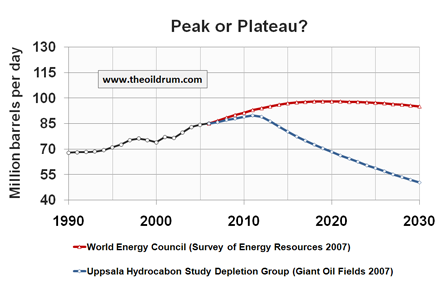

This article is about the way in which oil production is going evolve. Will there be a sharp peak, or a long lasting plateau?

Our future is highly dependent on the way in which worldwide crude oil production is going to decline. If it goes rapidly, declining with a few percent each year or more, than it will be very difficult to complete the energy transition without severe economical consequences. If production stabilizes and plateaus for a decade or longer, after which the period of long decline begins, it would provide much greater means to sustain the present economy. Stability is needed to scale up alternative sources of energy sufficiently to replace crude oil during a transition period of decades.

Within the world of independent forecasters both the peak and the plateau scenario exist. The group of sharp “peakers” are mainly represented by the experts within the Association for the Study of Peak Oil and Gas (ASPO). The best publication out there so far is that of the Uppsala Hydrocarbon Study Group (UHSG), which is led by ASPO President Kjell Aleklett.

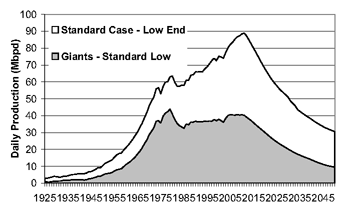

In his PhD thesis, Fredrik Robelius has outlined the fate of the Giant oilfields, that drive crude oil production, and came to the conclusion that production will peak between 2008 and 2018, at approximately 90 to 95 million barrels per day. With the more likely scenario stating that the peak is in 2012 after which a sharp decline occurs. By 2030 he suggests production could have declined towards the low point of 50 million barrels per day.

In his PhD thesis, Fredrik Robelius has outlined the fate of the Giant oilfields, that drive crude oil production, and came to the conclusion that production will peak between 2008 and 2018, at approximately 90 to 95 million barrels per day. With the more likely scenario stating that the peak is in 2012 after which a sharp decline occurs. By 2030 he suggests production could have declined towards the low point of 50 million barrels per day.

Figure 2 - Fredrik Robelius

The group of “plateau” forecasters are widespread. Coming from a variety of organisations such as the BGR, the World Energy Council and energy consultancy PFC Energy. The analysis of the latter results in maximum production being reached around 2014, at nearly 100 million barrels per day, which would be maintained for a decade after which a slow decline occurs.

The plateau scenario would be far more beneficial for the world because it is not likely that it will lead to widespread liquid fuel shortages. Other liquid sources or equivalent energy sources can in that case fill a large part of the gap between supply and demand that is going to occur. The world could step up the pace significantly for the energy transition to succeed, leading the way for the time when production worldwide is going into actual decline. If this decline would occur immediately after the peak without significant preparation instead of a plateau, a worldwide liquid fuels crisis is inevitable.

Differences come mainly from disagreement related to the role of technological progress on valorising oil reserves into producible reserves.

What drives oil production?

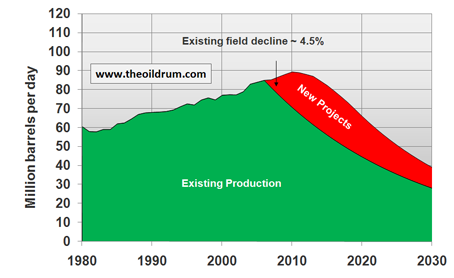

From statistics we know that since the beginning of 2005, crude oil production including unconventional has been on a slightly upsloping plateau (see Oilwatch Monthly). It can be concluded from different reports, that in the the same period of time, 4 to 5 million barrels per day of new production have been added to supply (Skrebowksi, 2006; Koppelaar, 2006; CERA, 2005) . Which implies that present world production is declining at a rate of 4% to 5% annually. When looking at the scheduled new oil fields coming on-stream in the coming years, one can see a continuation of recent supply additions. Approximately 5 million barrels per day will be added each year up to 2010. From this it can be concluded that the present situation – a plateau that started in 2005 - is stable for now as long as no major factors are going to change. This situation is plotted in figure 3 below, where we see production increasing through an up sloping plateau until 2010, continued by a down sloping plateau until 2013 after which the decline sets is. In total this scenario amounts to total present recoverable (proven + probable) reserves of 1220 billion barrels, which is in line with current estimates from the IHS Energy database.

In relation to the peak or plateau question, this raises two questions. For how long will the oil industry be able to add such a large amount of new production each year? And the second being, is the decline rate of 4% to 5% stable or will it increase or decrease in the future?

The answer on the first question is dependent on two developments, future oil discoveries, and additions from unconventional plays. The answer to the second question is dependent on technological developments that add reserves, keeping the decline rate down, and on the production expectations for the giant oil fields in the world (Robelius, 2007).

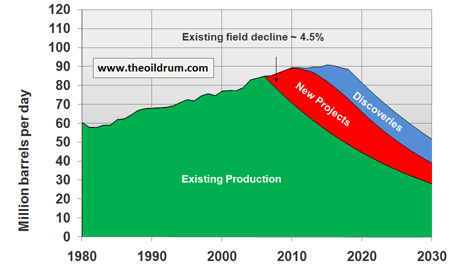

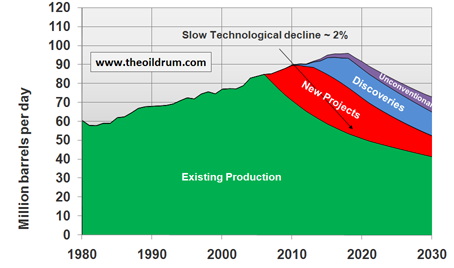

From historical data we know that discoveries peaked in the 1960’s and have been declining ever since. Presently we are discovering on average one barrel for every three consumed. The continuation of this trend, which is very likely given the lack of new regions that have not yet been explored, would imply a remaining amount of oil yet to be found in the order of 100 to 250 billion barrels. The effect of 170 billion barrels of new discoveries in the coming 15 to 20 years is shown in figure 4 below. This would extend the present plateau until approximately 2017, under the assumption that the present decline rate of 4.5% will remain stable.

Figure 4 – The effect of 170 billion barrels of discoveries on the shape of oil production, assuming a continuation of the present decline rate of 4.5%.

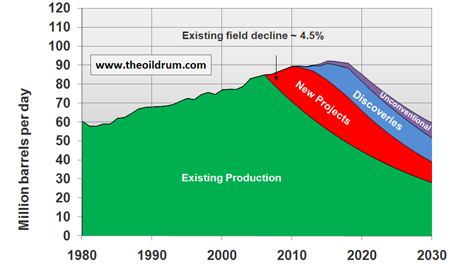

While discoveries can influence the extension of the plateau, unconventional crude oil is not likely to have such an influence. With unconventional in this article I mean oil sands, oil shale, polar oil and heavy and extra heavy oil. Present scenario’s for these sources of unconventional oil estimate a production level between 8 to 12 million barrels per day in 2030 (Campbell, 2006; IEA, 2006). This is too little and too late. The effect of approximately 12 million barrels per day by 2030 of unconventional production is shown in figure 5 below, which only slows the decline setting in 2017 slightly.

Will the decline rate continue at 4.5%?

The scenario in figure 5 above, with a plateau extending for a decade, is very dependent on the future evolution of the decline rate. As mentioned before, technological development can add reserves to the present oil fields of the world, so called reserve growth, and thus slow the decline rate significantly. For more details about reserve growth, I wrote a three part series about this topic, published on The Oildrum last year (1), (2),(3). Estimates and opinions on reserve growth differ widely. For the purpose of this scenario exercise, we take the figure of 500 billion barrels presented by Ray Leonard as the consensus conclusion of one of the latest HedBerg Conferences on the future of oil production. More information about this conference can be found in the interview of journalist David Strahan with Ray Leonard about the HedBerg Conference. The figure of the Hedberg conference leads to a recoverable conventional reserves estimate of 1890 billion barrels (1220 billion from present reserves, 170 billion from future discoveries and 500 billion from reserve growth). How likely this amount of reserve growth is going to occur will be discussed later in the discussion at the end. The effect is shown in figure 6 below, where we see that a sum of 500 billion barrels does not lead to an extension of the plateau, but to a much slower decline rate after the slightly higher peak.

On the other hand, there is also a significant downward potential because of the giant and super giant oilfields which dominate production. In his PhD thesis, Fredrik Robelius did a splendid job on analysis the largest oil fields in the world. A set of 507 giant and supergiant fields, contain around half of the words presently expected oil reserves that are going to be produced, according to the IHS Energy database. Their share of present total production is 48%, or in production terms, 40 million barrels per day. From his model, Robelius expects that these fields are the main driving force behind the shape of oil production yet to come. When this group of fields, that has been on a plateau since the ‘80s, starts to decline, world production will go with them. In figure 7 below the low standard case from Robelius is shown, assumptions behind this scenario can be found in his PhD. thesis on page 126 and 127, such as the expectation that the ultimate production of the supergiant Ghawar will be 105 billion barrels.

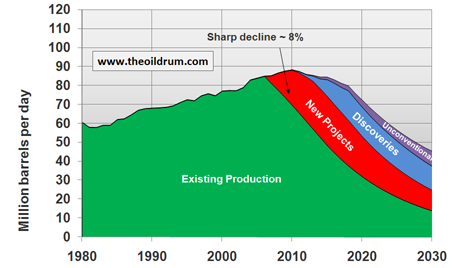

Next to the decline in production from the super giant oilfields, which is bound to increase decline rates, deepwater production will also have a significant influence. Deepwater fields have a rapid upslope, a short peak and a rapid downslope, because that is the most economical way to produce the oil from deepwater fields. In total, deepwater production is expected to ramp up to 9 to 12 million barrels per day at the beginning of the next decade, after which a annual decline of 10%-15% sets in (Campbell 2006, Robelius 2007).

A scenario of what could happen to the shape of oil production because of these downward potentials is shown in figure 8 below. Here we see production increasing to a peak in 2010, after which the decline sets in which increases rapidly at the end of the next decade. Leading to a recoverable conventional reserves estimate of 1170 billion barrels (1000 billion from present reserves and 170 billion from future discoveries).

Conclusions

1)If the global decline rate of existing production of 4.5% continues, oil production is likely to plateau at a level of 90 million barrels per day around 2010 until the end of the next decade, after which a moderate to sharp decline sets in.

2)If the global decline rate of existing production of 4.5% slows down to 2%, thanks to the addition of 500 billion barrels due to reserve growth, production will likely increase with some bumps towards 95 million barrels per day at the end of the next decade, after which a slow to moderate decline sets in.

3)If the global decline rate of existing production of 4.5% increases to 8%, due to the effect that the end of the era of giant oil fields and declining deepwater production has, production will likely peak around 2010 at 88 million barrels per day, declining slightly to 80 million barrels per day at the end of the next decade, after which a sharp decline sets in.

Discussion

The discussion on peak oil has progressed significantly since the article on the end of cheap oil was published in Scientific American (Campbell & Lahérrere, 1998). Presently there is a converging agreement that we are going to enter a period in which supply can no longer meet demand, giving way to sustained high oil prices. Either because of the expectation of a long production plateau for one to several decades, or a peak after which a sharp decline sets in. My scenario exercise supports mainly the view of a peak with a sharp decline. The conditions in which a plateau can occur for more than a decade are an unlikely amount of reserve growth, significantly above 500 billion barrels, and/or much higher unconventional production increases.

As to what is the most likely scenario, I expect that the increase towards a higher decline rate, as shown in figure 8, is going to occur. The reasoning behind this is a combination of developments, 1) The end of the era of giant oil fields, where there was a sustained base of production of 40 million b/d, which is going to fall away, 2) The end of a sharp increase in production thanks to deepwater, which is going to go away with an equally sharp decrease, 3) The fact that the world has produced more reserves in the past three years than have been added from discoveries and reserve growth (Robelius, 2007; J.S. Herold, 2007), 4) The effect of above ground factors on production, which will lead to higher declines, because from 2009/2010 onwards there will be a significant gap between personnel supply and demand (CERA, 2007), there is a problem to scale up sufficient oil rigs for exploration and production (Simmons 2006), unrest and geopolitics are delaying new oil fields developments, and keeping production down in several countries such as Iraq, Venezuela and Nigeria, which is not likely to change for the better in the future.

References

Campbell C. (2006), The availability of non-conventional oil and gas, Prepared for the Office of Science and Innovation, Department of Trade and Industry, 16 pages, London

Campbell C. & Laherrére J. (1998), The end of cheap oil, Scientific American, March 1998, p. 78 – 83

CERA (2005), Worldwide Liquids Capacity Outlook to 2010, CERA Advisory Services, 58 pages

CERA (2007), Engineering Talent Squeeze --“People Deficit” -- Likely to Cause Further Delay in Some Oil & Gas Production Projects through 2010, Cambrigde Energy Research Associates

Herold J. S. (2007), Global Upstream Performance Review 2007, 29 pages

IEA (2006), World Energy Outlook 2006, International Energy Agency, Chapter 3, pages 92-94, Paris

Koppelaar R. (Oktober 2006), Oil Supply Analysis 2006 - 2007, ASPO-NL Newsletter, 4 pages

Robelius F. (2007), Giant Oil Fields - The Highway to Oil, Faculty of Science and Technology, PhD.,Uppsala University, 168 Pages

Simmons M. (2006), Limits to Growth: The Impact of Rig Scarcity, Oil & Money Conference, London, 23 slides,September 18, 2006

Skrebowkski C. (April 2006), Prices holding steady, despite massive planned capacity additions, Petroleum Review, p. 28 - 31

http://science.reddit.com/info/2zf7k/comments

resubmitted this morning...if you are so inclined...we thank you for your support.

Thanks Rembrandt, I always find your posts very informative and top quality.

hmm... maybe but it seems that growth is occuring mainly in the other liquid category:

growth in C+C seems to have stalled despite planned new supply from megaprojects:

From: Chris Skrebowski, "Prices holding steady, despite massive planned capacity additions", Petroleum Review, April 2006.

It seems to me that these forecasts have been somewhat optimistics and were forecasting something very close to business as usual (i.e. ~2%/year growth in supply). The actual production plateau was not predicted (see chart above). Have you conducted a post-mortem analysis?

The presence of a plateau is not obvious on your Figure, it seems that production growth from 2005 to 2010 is pretty much inline with the growth we had between 1982 and 2005.

Is the decline rate stationary? if you look at production decline in mature regions, the decline rate seems to linearly accelerate (~0.13% per year):

For instance, the logistic model predicts a linear dependency between the decline rate and the cumulative production as a fraction of the URR:

Decline rate(t)= K*(1-2*Q(t)/URR)

Khebab,

Your final graph is interesting. Are you estimating annual decline as the percentage increase of [this year] over [previous year]? Would you care to speculate about the reasons for the change in character of the curve after 1960? Before then it seems almost uncorrelated year on year, whereas after 1960 it gets much smoother and remains so for the next four decades, apart from the last hurrah (Prudhoe Bay?) in 1978-ish. What changed in 1960?

RE: Are you estimating annual decline as the percentage increase of [this year] over [previous year]?

Yes.

RE: Would you care to speculate about the reasons for the change in character of the curve after 1960?

Noise is a lot stronger before 1960 but I really don't know why. Maybe it has to do with the way the data was collected.

I will suggest and answer as to the "why" the US curve smooths out after 1960.

First, if you run a time series analysis on the variance(on the monthly data) you will see there is a periodicity in production of ~2.5 years. Even though they are much smaller in amplitude now, they persist to this day. What it looks like (and models out) is a damped sinusoid.

As the base magnitude of production increases (and "spare capacity" becomes challenged and decreases in both real and relative magnitude), the variance decreases.

Part of this change in amplitude may have been a policy change (and remember OPEC formed in 1960, though they didn't really flex their muscles until 1973). US imports grew significantly during the late 1940's and 1950's from 9% to over 20%, while oil exports fell essentially to "zero."

But in the period of the 1960's, oil imports also stabilized, as a percentage of the total, at around 20%. So, in a growing consumption modality, US production (or imports) could still act as the swing supplier though the degree of "spare capacity." was quickly being "consumed." And remember, the Texas Railroad Commission was also the 800 pound gorilla in the room with regard to US production.

A similar situation can be seen in the global data. If there is a great deal of "spare capacity" in oil production (and you have the storage capacity for what is produced), then you can see a great deal of variability both on the growth side and the downturn side of the production curves that are underpinned by economic conditions. This high degree of variability is seen in data all the way up to 1991.

But in the upturn in production that began in June 1993, the monthly variation became noticeably smaller (almost non-existent) as global oil production increased from about 60 million barrels per day in 1993 to about 67 million barrels per day just 5 years later in 1998. A short sputter between 1998 and 1999 and much monthly variation before resuming a runup into early 2001. Another short sputter into 2002 and then the last runup from 2002 into 2005 with somewhat larger monthly variation than seen in the late 90's run.

But since 1993, the variability (other than economic downturns) has become much smaller than in all previous data.

This diminishing variability looks like what happens when you have strong growth colliding with capacity issues and, in the case of the US in the 1960's, the coming peak. I suggest the same is likely to be true on the global scale, though we have many more "types of oil sources" than we had when the US peak occurred in 1970.

This is not to say we cannot have large spikes in production, but it seems less and less likely. Anyone know of any new Ghawar's planning to come on-line?

As an aside; in a class I teach, I start the class out on corn and wheat production with a progressive reveal of the curves and actually tell them what they are looking at. Then, I show this US oil production data and tell them "Here's 110 years worth of production data, and obviously we've gotten good at this. So, based on what we've done and been able to do so far, where do you think we will be in 40 years?" I also show them the growth variance curve that shows that while percentage growth is getting smaller, growth is still occurring. Then I give them the finer detail (monthly) from 1920 through 1970 so they can see the seasonal effect and the diminishing variability "for the past 50 years" prior to the 1970 peak.

Well, nearly all of the 40 students in the classroom just mentally extend the production out into the future and come up with an answer of "about 6" (representing the billions of barrels produced for a year, though they don't know that).

And then I put the graphs up with all the data since 1970 included and reveal what they are looking at. "Past performance does not guarantee future performance." Knowing what underpins the data, however, is useful.

Great story about your class!

Can you show us the examples you show in your class, or share the data if you have it in a xls format?

I could use that in the class I teach :)

plucky underdog:

In the late 1950's the world began to really use a lot more oil and gas. The oil finding rate was just about at its maximum, and nationalisation was a storm cloud over the horizon. OPEC hadn't been started It was the good old days of the "free market capitalism" approach to the oil business.

As the world changed from coal to oil for its fossil fuel BTUs, the amount in export trade went up a huge amount. At the beginning of the Second World War, Texas produced 60% of the oil and petrochemicals in world trade, although Texas was producing about 5 million barrels a day.

The rest of the oil in world trade came from Iran and the beginnings of the mid east fields from Shell and Anglo-Iranian Oil, now BP.

When the market was smaller and thinly traded, the decline rate was more closely tied to the performance of individual fields or groups of fields. But as the markets grew, the decline rate had a much larger group of producing field to average it over, so the curve got flattened. At any rate, thats my hypothesis and Im stticking to it. Bob Ebersole

Bob, Rembrandt: your explanations sound coherent... anyone know when the US became a net importer? (the readily-available data series on the Web don't go back as far as 1960, let alone before). I'm going to look at the data for the UK, which recently became an importer as well.

Khebab, westexas: if it (production rate volatility) really is affected by the switchover to export, does this analysis have any interesting implications for the predictive power of ELM? Not trying to muscle in on your zetetic bailiwick, just interested.

It appears that the US became a net importer right around 1949, 21 years before we peaked. Because of a rapid increase in consumption, the US actually showed a pretty rapid collapse in net exports.

Thanks Khebab for your useful comments

Correct

Correct but is this a temporary trend or a sustained one? That is the big question, which is very dependent on what is happening in Saudi Arabia, Russia and Iraq.

Yes, I have the projects in my database, and did some post-mortem work. One could even argue that the decline is somewhat smaller, if the decline in Saudi is voluntary. I still don't feel that we have a definite answer on this.

That depends on how one defines plateau. I called it an upsloping plateau, which in the light of demand growth is correct (demand outstripping supply).In the absolute term it is incorrect. Next to that it also depends on what numbers one takes, Liquids Production has increased with 1 million barrels per day from 2005 to 2006 according to the IEA. However the EIA figures do not show such an increase but a "real" plateau.

The point of this exercise was not to look at a plateau vs peak from a micro scale but from a macro scale. Ill try to be more clear next time in my definitions!

First we need to define what we mean with decline rate, in this post I looked at the total stock of existing fields (including those in a built up phase of production, on plateau and already past-peak). Your chart seems to include total production over time, not total production from a point in time. And then the development of the decline rate over time of that amount of production.

As to whether the decline rate is stationary, it is not. According to some it goes in cycles because of the addition of new production (in the case of existing stock through technology), and the outfasing of quickly declining oil fields over time. The technological vision is that the decline rate can be slowed down in a period of high oil prices.

To my opinion it is not correct to compare the development of decline rates in one oil producing region to another. This will lead to bad estimates because each region has many different characteristics. The problem here is then again a lack of data. While logistic models in general if sufficient correct data input is supplied can give an excellent outcome, we don't have such data. Fortunately over time we are getting somewhere, data quality is improving!

I was looking at your last figure with a 8% decline and I was thinking: why not exploring a range of possible decline rates and take the one that is giving the best match between the bottom-up analysis and recent production levels for C+C? a kind of maximum likelihood parameter estimation, I wonder what value it would give?

I too think comparing Chris past predictions with his great mega projects studies, plus a comparison of predicted new projects vs. delays, would be very useful in calculating a current world decline rate. Roughly, if Chris has been expecting 1Mb/d more each year, and if we are actually flat/down a bit, then his number for world decline (4.5%?) should be adjusted upward, say to 5.5% or so. Unfortunately, it looks like the rate is accelerating...

Why don't you take a stab at it?

That's a good idea, looking at Figure 8 it looks like the decline rate should be more around 7-10%.

Important that this dependence reduces to the Gaussian profile that Stuart discovered a couple of years ago that fits the USA production.

i.e. solve the equation

dP(t)/dt = (k-at)*P(t)

leading to

exp(kt-at^2/2)

When I look at your first two graphs (the horizontal axis on the third one is too compressed to easily read) it appears that we are likely to have as much oil in ~2020 as we do now.

How is consumption projected to change over that 10+ year period? How many new vehicles on the road and how much more/less efficient might those vehicles be?

Correct, whether that will be the ultimate outcome is unknown, but this simple exercise shows that this could happen.

I cannot say, that requires some analysis on what type of vehicles can come on the road at what pace. Probably quite somewhat more vehicles on the road thanks to the development of electric cars, biofuels and more efficient vehicles.

The question I find more intruiging is where these vehicles will be driving ;-)

Rembrandt, while I respect your careful scholarship, I'm wondering what mechanism you envision will actually get all liquids production over 90 mbpd? It appears to me that price is not doing it. Despite the price of crude doubling and doubling again, the world is currently producing a slowly declining level of both conventional crude and all liquids. It appears to me that the price of oil has reached a level that causes price increases in everthing necessary for oil production, limiting future mega-projects.

PLAN, PLANt, PLANet

Errol in Miami

Actually, I don't think it is so much the price of Oil that is causing all these projects to increase in cost, as much the price of Iron Ore, Coal and skilled labour.

Iron Ore and Coal are driven by the industrialization of the world outside the OECD. China's economy now uses about as many resources as Japan and continues grow at 10% per year. The future of the world is likely outside the current OECD.

Thanks for your comment notintodenial

The word currently is important in your sentence. There are many projects in the pipeline (shown in red, giving an additional production of approximately 25 million b/d over time). We will have to see whether these are going to be developed quickly enough, and how the decline rate develops.

I am working on a project analysis for 2007/2008 to see whether the current plateau is going to change next year or not. Will take me a month or two to finish it though probably (it's a lot of work, and I have a lot of other things to do).

Rembrandt, thank you for reminding me that price signals require years to work their way through stucture-intensive industry, and also for the the excellent analysis you generously contribute.

PLAN, PLANt, PLANet

Errol in Miami

I too have been thinking about price, and its effects on supply growth (or at least stemming decline). It seems to me to be too often neglected.

Obviously there's a supply curve and a demand curve, and they meet to determine the price. They also shift over time. Over the past century, the demand curve has been shifting towards greater quantities for a given price (more people willing to pay $30 for a barrel), and there's every reason to expect that to continue (though the rate may slow as high prices encourage conservation). The supply curve has also been shifting towards greater quantities as investments are made to develop more fields, tankers and pipelines are built etc. The result has been rising quantities with stable prices (volatile of course, but not trending).

Now that we're bumping up against geological restrictions on supply, and depleting the largest and best fields, that's changing. Going forward, [i]fewer[/i] suppliers are going to be willing to sell at a given price (as their lift costs rise or they simply water out). For supply and demand to continue meeting, prices have to rise, probably dramatically.

But as prices rise, we can still climb that supply curve. The short-term supply curve is obviously very steep beyond whatever "spare capacity" currently exists -- you simply can't ramp up production as much as you'd like overnight. But what's the slope of the longer-term supply curve? Right now the oil companies are largely using their profits for dividends or stock buy-backs, because they're conditioned by cyclical thinking into believing prices will go down again. Eventually they'll realize that the paradigm has changed, that prices will keep rising (at least until we come up with a decent alternative for transportation, which looks a ways off). How much investment would be driven by the [i]anticipation[/i] of $150 or $200 oil?

In short, I'm expecting a fairly long plateau in quantity with steadily rising prices driving the development of resources that are currently non-economical.

peace,

lilnev

Rembrandt:

Thanks for a thoughtful key post on our actual world oil supply situation. I appreciate your hard work and attention to detail.

You've not included any contribution from what I consider to be the most profitable unconventional oil sources, redeveloping old petroleum reservoirs in post mature basins, which could actually double or triple the ultimate recovery of all fields that peaked before 1980.

I'm a landman and an independent in the Texas Gulf Coast, one of the most mature basins in the world, so my level of expertise is beyond a laymans but still pretty limited. However, I do know that few of the techniques that are raising production in the current supergiant and giant fields have been applied to old fields. Secondary recovery-waterflood-was not standard in the United States until after 1970, and not general until after the 1980 price spike. #D seismic was not practical until the advent of inexpensive computing in about 1990, and the same with horizontal drilling or CO2, thermal or solvent tertiary development. If the international fields are like the US fields, only about 10% of the oil originally in place has been produced, contrasted with the 50% to 70% of the OOIP being currently produced from fields.

As Steve Andrew's of ASPO USA noted, its not the size of the tank, its the size of the tap. It seems unlikely that production from redeveloping old fields will do anything but slow the decline rate and extend the plateau, but it could add significantly to the ultimate world recovery. add Bob Ebersole

"Improved" extraction techniques that are raising production in super giants usually allow you to get oil out faster, but in turn that also means that you run out faster. The upslope is steeper, and so is the eventual downslope-- just look at Cantarell, which now faces alarming depletion rates due to nitrogen gas techniques used to ramp up extraction. I'm predicting that we're going to see a steep downslope, and be cut off quickly as nations with rising internal demand stop exporting their surplus.

Deuterium,

I wasn't commenting on fields that are currently producing like Cantarelle, but rather on fields like Baku which was discovered in the 1880's and few reservoirs waterflooded or the giant American fields that were far past their peak in 1980.

There's a great paper on CO2 enhancement published by the US Department of Energy and available online. I'd link it but I'm a computer moron, but its entitled "Ten Basin Oriented Strategies for CO2 Enhancement" .

try this:

http://www.fe.doe.gov/programs/oilgaspublications/eorco2/east-central-te...

I'll finished this post, then looked for the link again to try to hook up. But any rate, the DOE says that on fields like that the production averaged around 10% of the original oil in place in the United States, so that leaves a target of the balance of the oil in place-as much as 6 times the primary production, as a target for tertiary production. This assumes that the US has a big enough sample of the world basins for its statistical conclusions to be useful worldwideThe particular assessment i linked to shows 80 billion barrels from the Giant Fields of the Texas Gulf Coast and the Panhandle. Thats right, the geographical assessment makes no sense, it seems to be all oilfields outside the Central and east basin platforms of the Permian basin, but the info is good.

Bob Ebersole

Deleted comment, I misread your post, sorry

there's a guy at texas a&m named datta-gupta who's been working on methodology and software to have a second shot at mature oil fields:

(from http://www.netl.doe.gov/technologies/oil-gas/Petroleum/projects/EP/ResCh...)

An Integrated Approach to Characterizating Bypassed Oil Saturation in Heterogeneous and Fractured Reservoirs Using Tracers

Akhil Datta-Gupta (datta-gupta@tamu.edu

DE-FC26-02NT15345

Goal

The goal of this project is to develop a systematic and cost-effective approach to the design and interpretation of Partitioning Interwell Tracer Tests (PITT) to infer hydrocarbon saturation distribution in highly heterogeneous and fractured reservoirs. The key elements of this approach are a very fast streamline-based flow simulation technique and a rapid and novel history matching technique that exploits an analogy between streamlines and seismic ray tracing. This approach will be orders of magnitude faster than conventional history matching, resulting in significant savings in computation time and manpower. The integrated approach will take advantage of the dense spatial coverage of the seismic data for static modeling and the strong coupling of interwell saturation variations to partitioning tracer response. The outcome of this research will be a systematic approach to the design and interpretation of tracer data and practical, PC-based software tools providing high-resolution saturation estimates in the interwell region by combining well log, seismic, and partitioning tracer data.

Performers

Texas Engineering Experiment Station, Texas A&M University, College Station, TX

Petroleum and Geosystems Engineering, University of Texas at Austin, Austin, TX

Results

The major project accomplishments to date are the:

* Development of a “generalized travel time” inversion scheme for interpretation of field tracer response via inverse modeling that can result in orders of magnitude savings in computation time and significant cost savings in terms of manpower (days as opposed to months).

* Generalization of the streamline-based simulation to describe fluid transport in naturally fractured reservoirs through a dual-media approach. An examination of the scaling behavior of the computation time indicates that the streamline approach is likely to result in significant cost savings for large-scale field applications.

Benefits

The streamline-based inverse modeling has resulted in a dramatic cost reduction in terms of computation time and manpower when compared with traditional history matching. Field scale tracer test interpretation can now be carried out in a matter of days as opposed to weeks or months, and this makes the technology accessible to small operators. The approach is particularly advantageous for high-resolution geologic models consisting of millions of cells that are now routinely used in the industry. The streamline approach has been generalized to model water injection in naturally fractured reservoirs through the use of a dual media approach. Researchers have shown that the streamline models exhibit a linear scaling of the CPU time as opposed to a quadratic scaling for finite-difference simulators. This has the potential of significant savings in time and manpower for field-scale applications in fractured reservoirs.

Background

One of the goals of reservoir characterization, particularly in mature reservoirs, is to identify unswept regions containing high oil or gas saturation for targeted infill drilling or enhanced recovery. The project goal was to develop a systematic and cost-effective approach to the design and interpretation of PITTs to infer hydrocarbon saturation distribution in highly heterogeneous and fractured reservoirs. Unlike other efforts in this area, the focus of this research was to identify the location and distribution of remaining and bypassed hydrocarbons in mature oilfields. This represents an enormous resource—on the order of 100 billion recoverable barrels in domestic fields.

Summary

The project utilized the unique features of streamline models to develop an efficient approach for interpretation and history matching of field tracer response. Researchers investigated the relative merits of the traditional history matching (“amplitude inversion”) and a novel “travel time inversion” in terms of robustness of the methods and convergence behavior of the solution. The research shows that the traditional amplitude inversion is orders of magnitude more non-linear and the solution likely to get trapped in local minimum, leading to inadequate history match. This project’s proposed travel time inversion has been shown to be extremely efficient and robust for practical field applications.

The project generalized streamline-based simulation to describe fluid transport in naturally fractured reservoirs through a dual-media approach. Researchers compared their results with a commercial finite-difference simulator for waterflooding in five-spot and nine-spot patterns. For both dual porosity and dual permeability formulation, the streamline approach shows close agreement in terms of recovery histories and saturation profiles, with a marked reduction in numerical dispersion and grid orientation effects. An examination of the scaling behavior of the computation time indicates that the streamline approach is likely to result in significant savings for large-scale field applications.

Project performers have also developed several alternative ways of using PITTs in oilfields for the calculation of oil saturation, swept pore volume, and sweep efficiency and assessing the accuracy of such tests under a variety of reservoir conditions.

==================================

Prof Datta-Gupta has also co-authored a textbook on this technique:

Datta-Gupta, Akhil, and King, M.J., Streamline Simulation: Theory and Practice, Society of Petroleum Engineers, textbook series

Thanks for the book references, I'll get copies!

I think what he's working on though is different from the type of reservoirs I'm working on, though. He's working on limestone reservoirs, mostly from the Paleozoic through the Cretateous Eras, while I'm working on salt domes on the Gulf Coast in Miocene,Oligocene and Eocene formations. There are only a few limestone reservoirs, and they're not tight-they are reefs and cap rock reservoirs on the Texas Upper Gulf Coast domes. Bob Ebersole

Some of the oldest fields that probably haven't been subjected to modern extraction techinques:

Kirkuk, Basra

what a coincidence?

Man we should send troops to control these resources.

Ohh wait.

Actually one of the biggest reasons I think that a steep collapse is coming is because of the moves in Iraq and Afghanistan. And I believe no one saw WT export land.

If the powers where willing to do Iraq without the export land model image what they are thinking now.

Tuning the extraction rate up and down using the Oil Shock model gives insight that you can't get from HL. FWIW

Right the shock model could actually correct for technical advances in extraction technology.

I don't agree that HL is wrong per-se but once technical advances are in place for a long period of time and no new ones cause significant changes HL would again be correct.

Back to the dogleg phenomena HL would settle back to the correct answer once the furious drilling campaign fails to produce results that can sustain the rate of drilling.

Your correct that HL is blind to this sort of systematic error because of technical advances but over time as real production data is added it corrects itself.

Considering that both shock and HL point to fairly steep declines already its safe to conclude that the steep decline

model is probably correct and in my opinion like global warming we have underestimated the real decline rate. Since no one has really taken technical advances into account.

deuterium, look at my posts downthread. Off shore wells that are drilled horizontally don't run out of oil more quickly than onshore wells, but rather the workovers cost 10 or 20 times as much as the equivalent workover on an onshore well, so the well can't be produced for years at low level of production with a high water cut.

Think about the geometry of a horizontal well. The centralisers on the rods rub up against the casing, rods are hard to screw and unscrew after pumping under stress, and the oil must flow by gravity through the horizontal leg to get to the downhole pump. If the well sands it must be jetted out with high pressure water after pumping the water through coiled tubing, its not like a 5,000 ft verticle well. Plus, workover rigs are mostly on a barge and require a captain and an engineer as well as the tool pusher for the workover rig. It just plain costs a million bucks for a workover that might cost $100K onshore with a rig thats trucked in and half the crew size.

That means that a well becomes uneconomic much more quickly.

Bob Ebersole

Oilmanbob thanks for your insightful comment

That is an intruiging statement. Your story makes a case for the plateau scenario, but from what is happening in the present, (very high decline rates), it doesn't appear to be happening, or if it is happening the impact isn't sufficient.

Can and will this be applied at a global scale? And what is the amount of production we are talking about? What will it add to the slowth of the decline rate? What price would trigger these techniques being applied? Do we have enough in house knowledge in the oil industry to massively imply these techniques?

Rembrandt,

First, let me disqualify myself a little. I was an english major in school, because I loved hippy girls, the beautiful sounds of words and was lazy to boot. I was drafted into oil and gas exploration by my father, an Oil and Gas Title Attorney , but my family's first real involvement was in about 1950 as investors in Houston. Something really strange happened, after 2 years or so I discovered I loved the oil patch and buying oil leases and had a real talent for parts of it. I can follow many mathematical arguements and know a lot about geology, geophysics and technology, but my best guesses about physical quantities are just that, good guesses.

I really appreciate the bottom up analysis that you have generously shared with us, and I could no more do your work than a duck can tapdance I'm really awed by your work, and Khebab's,Stuart's, Ace's and the rest of the quantitative guys with real mathematical skills.

Oil production and consumption has been increasing staedily for years, and the fields that I consider candidates for tertiary development all had their peaks before 1970. The world produced about 60-65 million barrels per day. The natural pressure in the fields was expended, and the fields will have to either be repressurised through waterflood, gas injection or CO2 injection to get much production, and that will be both expensive and require lots of high level engineering. So I'd say as a practical matter that if we could get 5 million barrels of oil per day for the next 30 years this would be a resounding success.

If you'll look at the National Petroleum Council reportgraphs, they suggest that in 2050 the world could get 40 million barrels of oil per day from tertiary develpment, which I consider wildly overoptimistic. Westexas suggests that all this type of production will do is slow the decline, and I think he's right about this. But the resource is real and should extend oil production a long time past my life, though, although not at the rates they suggest.

Why its not being done as yet is based in contemporary history. The big oil companies started to consider the US to be geopoliticially unsafe about 1973 when Richard Nixon put price controls on US oil, followed by the Windfall Profits Tax. They changed the whole focus of their exploration to natural gas offshore in the Western Gulf of Mexico in shallow water areas. They were barred from drilling in the California and West Coast areas after the Santa Barbara blow out, and NIMBYism was created in Florida and the US East Coast too, and the Exxon Valdez oil spill at Cook Inlet barred them from ANWAR. This was an reaction to the sixty years of political manipulation by the owners of the major oil companies who had resisted the New Deal, sold gasoline to the Japanese in their war of conqest in China, and the Nazis in their invasion of Poland. The majors redeemed themselves with their efforts in 1942 building pipelines to the East Coast of the US. But, all my life the Major Oil Companies have caused major problems in both the USA and the rest of the world. Now 88% of the exploration areas of the world is controlled by National Oil Companies (source:API), and nobody except themselves have considered it to be unjust or undeserved.

The Upstream arms of the multinational oil companies are designed to do one thing-locate and produce new Giant and Supergiant oilfields. And they are superb at that, now they are pretty well out of new areas to explore, although deep water technology is adding new deepwater areas, and therefore more prospects. The big boys can't make money anymore on establishing new fields or even step-out wells onshore in the USA. Their internal overhead is so bloated that a 10 million barrel of oil reservoir won't make them any money . They sold off almost all their Gulf Coast and Mid Continent production, they are operating very few fields except in the Permian Basin and California in the USA. In other words, they no longer have acreage positions or wells in the old fields in the USA onshore basins, and the ones that they do have still are mostly already developed.

Bob Ebersole

OMB...I really appreciate your abilities to be a liaison between the hardcore petro-statisticians and the laymen here at TOD.

BTW...I HAVE seen a duck tap dance before...jk ;-)

Thanks, Dragonfly 41. We all bring different perspectives to looking at peak oil, and cooperate and teach each other. I love this blog.

I'm getting for free information that various experts are working on in real time. We help each other, and because of our varying backgrounds but emphasis on the scientific and technological approach, we get the benefit of near real time peer review of questions and possible solutions of the world energy and growth problems. The Oil Drum is an amazing way to solve problems related to energy and the environment, and we've only begun to scratch th surface of its utility.

The example of this I'm thinking about is the biofuels/ethanol/cellulistic ethanol/biodiesel solution to the liquid fuels problems of the peak. It was just beginning to be examined when I first started reading the blog about a year and three or four months ago. Almost everyone who reads this blog is predisposed to like a sustainable, renewable solution to our energy problems, and we were blessed in that one of the regular contributors, Robert Rapier got his Master's studying celluistic ethanol.

But by the time this group had finished studying the possible solutions, various members of the group reviewed the math and came up with documentation about the inputs, the fertiliser, the diesel for tractors and ect. made all these "solutions" not very practical and an evironmental disaster in the making. The result, diseminated by he stock market/speculator guys that read the blog is that ethanol is now having a hard time getting financing and will likely never be scaled up. Think about it, the truth is that the most opportune time to implement ethanol has passed, everone questions it and its unlikely to end up with massive subsidies with a new president in 2009.

I think this is a model of how TOD will actually work for the world. We're all ied to various companies and organisattions, yet no institution controls TOD. We are using the internet to jump outside our various views of the world.

I think the article Matt Mushalik and I did a few days ago looks at a similar question, from a different perspective.

We found that if one adjusts EIA data for the loss of production during Hurricane Katrina, it already looks like we may have reached a peak in late 2005, and are on the way down.

We also found that there are only a few countries that currently have increasing production. Apart from China and Russia, the only countries with increasing production are shown in this graph. The amounts shown in the graph are the amounts by which production has increased, ignoring their "base" production before the period began.

If we include China and Russia, the total incremental production we get worldwide from growing countries is only equivalent to 1.2 million bpd, per year.

If you are looking at replacing 4.5% of 73 million barrels of crude oil per day per year, that amounts to a required increase of 3.3 million barrels of crude. Where are you going to get the rest of the increase? Some of it will be in China and Russia, offsetting declines on other fields. There is perhaps a bit of other new production in some of the declining countries, but the level of decline of these countries was around 4%, even with this new production.

When one looks the question this way, the question gets to be where we are going to get the incremental new production. We know China and Russia are going to start declining in the next few years. The countries in the growing group are going to have a hard time maintaining their current growth in the future, because of infrastructure issues. Iraq and Saudi Arabia could perhaps add a little, but haven't actually shown that ability so far. It looks like we don't have many places to find the additional required growth to keep overall production from declining further.

you step out the door in the early morning and close the door. You hitch the ox up to the wagon that is bundled high with switch grass. You drive out to the train you get there around noon several people ahead of you, your switch grass finally gets loaded on the train your account card is scaned and you get a recipt you can also see it on your cell phone. at the back of the train you get the ox cart loaded up with very black soil. as you are slowly heading back home the train puffs off. you hope you can get home before it gets too dark.

My grand father was a Blacksmith I am a Lawyer My Grandson will be a Blacksmith.

Where will your grandson get the energy to melt down metal? Breeder reactors?

Where will your grandson get the energy to melt down metal? Breeder reactors?

charcoal

pyrolisis of wood producing burnable gasses that can be made into liquid fuel. I hope creating stable carbon can one day earn carbon reduction credits.

Is Conoco Philips with ADM working on this ?

They got Biodiesel credit for chicken fat.

things gasification and terra preta

...or a solar furnace. 2500+ oC, not a problem. Throughput is low though.

Save aluminum foil, preferably unused. Not a great mirror, but material's dirt cheap.

Gail, interesting data

You seem to be very certain of your case, how do you know?

Regarding Russia, the newspaper article that everyone quotes is a July 10, 2007 Moscow Times Article:

The IEA was quoted in the Moscow Times as saying

If you put in a more realistic decline rate than 3%, the result is clearly worse. Claude Mandil of IEA is quoted as saying:

This statement doesn't say Russia, per se, is declining, but it is not expected to increase enough to make up for the decline in other countries.

Other comments that seem to bolster the view of a near term decline in oil production is this one from Jeffrey Brown:

Also, Jeff Rubin of CIBC in Canada, speaking at this year's ASPO conference sees little growth potential for Russian oil, according to Heading Out:

Finally, in the papers circulated to staff by Euan Mearns on October 11, Ferdinand Banks of University of Uppsala, Sweden in "Architecture of World Oil" says:

Regarding China, part of the evidence is in the form of lack of production. Production is barely inching up:

2005____3,609

2006____3,686

2007 YTD July___3,725

Also, Prof. X. Pang of ASPO China, speaking at the ASPO conference in Ireland, presented this chart:

Let's just say that Russia has a starring role in the projected net export crash by the top five net oil exporters. Details to follow.

It will be interesting if they can continue to upgrade extraction methods with western technology and if this slows their decline rate.

But on that note Export Land has a bit of a catch 22. Countries like Russia that might offset some of their future declines short term via a technology infusions would earn more money and thus it would further spur internal consumption.

So I think its a zero sum game for the most part once a country stops increasing production. In effect any advances with technology only result in higher internal consumption/faster growth.

And with all that it seems Russia has done a good job of throwing out the western oil companies so its not clear that they will actually do any significant upgrading of their technology.

A huge issue for Russia and Alaskan production that I just thought about would be melting permafrost it looks like we probably will see a lot of melting next summer and this external threat may seriously damage Russian production.

Its the Arctic equivalent of a hurricane. Not to mention shorter time periods for things like ice roads.

Memmel, suggesting that the Russians need US Multinationals in order to adopt tertiary development methods is arrogance. The Russian oil business produces about one-half of all the oil in the world, the OPEC nations about 35% and the multinationals together with the rest of national oil companies the balance. The giant service companys control the technology that the Russsians would need to modernise their industry,and i'm sure will be delighted to continue working there. The only thing that changes for them is the name on the invoice. Bob Ebersole

In July of 2007 Russia produced 13% of all the oil in the world. Even if you added the former Soviet States you still would not be up 20% of all the oil in the world.

Ron Patterson

Actually I disagree I think the western oil companies are the kings of extraction. Its not just technology but years and even decades of experience working over oil oil fields. And the smaller players that produce a lot of oil in the US cannot be dismissed.

If the problem is getting blood out of a turnip I think the western oil companies are the best, cost are another issue.

Now I disagree with if these methods in general result in greater URR or just higher extraction rates.

As far as I know all advanced extraction methods have been developed in the west and in in particular this US/Canada.

FWIW, a friend of mine, who is a Russian oil analyst (ie he works for an investment bank, and tells clients what Russian oil stocks to buy or sell) and who has been looking at Russia for ten years (ie he's not a newbie and has very high-quality contacts) reckons that Russian production will not increase more than 1-2% above its current level. The main reason for this is the tax system in Russia - marginal tax rates on production are extremely high.

Cuchulainn

Graphs with various trend lines are fine when dealing with "Engineering availablity(or amounts of Oil that may be pumpable over a period of time)".

But the real problem in the Oil market is 1)The law of Supply and Demand this is well known. But there there is

is also the "fear of running short" a Psychology well known during the 70's when people lined up at gas stations often on a daily basis becaused they had the fear of running short, "hoarding" is also another strategy caused by the fear of running short, this also ocurred in the 70's when people not only queued at gas stations but hoarded gasoline in jerry cans at their homes. If the prices increase quickly in the northern hemiphere summer 2008 as market conditions suggest (oil prices tend to rise quickly and to higher than expected levels when supplies are tight due to demand elasicity problems in this market).

The real fear is that if a panic hits the market about "Peak Oil" and countries like The UK,Norway,Canada, Mexico and Iran and posssibly Russsia have to reduce exports because the voters in those countries want to preserve "domestic reserves" for their own citizens. This "hoarding behaviour" could become a major problem in world Oil Markets and just a small Peak Oil threat could quickly become a major shortage as producers with declining reserves withold from the market due to domestic pressures.

I expect this to happen and for Peak Oil becoming a very sudden Crisis for world economies.

Is not the SPR just a form of whoarding [sic}?

Good post the only problem is production to date has failed to meet the predictions so they are already wrong.

So the question is why might these approaches be incorrect ?

The biggest case is that reserver growth via technical advances is overstated and in my opinion by a fairly large margin.

This leads to the Yibal effect for the big fields.

Next I understand that over 50% of the current worlds oil production is from offshore basins. Until fairly recently most of these basins kept production high via two approaches advanced extraction methods with a lower URR vs Onshore and expansion of the fields to the point we have reached deep water drilling.

HL which seems to have so far done well predicting real oil production is a heuristic equation that assumes past performance is a good indicator of future performance. In general most other reserve estimates are also similar in nature.

At no point has our increased ability to keep high production rates been taken into account the only point that technical considerations seem to be included is the famous dogleg in HL plots around the peak as expanded drilling campaigns are used in attempt to keep production rates high.

The problem is that although this shows in a fairly obvious manner the reality is that technical advances over the decades have increased our ability to maintain production rates by multiples if not a order of magnitude.

HL which has done well to date seems to have a systematic upwards bias.

Now back to predictions of a slow decline and even later peak that so far are actually wrong. If I'm correct that we have badly overestimated URR and production profiles as the world peak we can expect sharp declines.

And finally from a technical perspective smart christmas tree wells or super straws intuitively represent the peak of oil extraction technology in both cost and maximizing extraction rate.

This last technical marvel is being deployed today.

If this is true its no coincidence that production rate is slowing sooner then expected and points to this technical bias as real and valid and that technical advances are no probably no longer a viable way to increase production rates.

Memmel, yours it is an interesting perspective but also a very speculative one.

We don't have a factual basis to make these assumptions.

Memmel,

I always enjoy your posts although I seldom agree with the conclusions you draw. You have a terriffic ability to ask questions that move my thought processes into a different groove. I find it really very useful. I hope the stuff I look at has the same effect on the pure and applied science types that inhabit The Oil Drum.

I think the concentration in offshore drilling is more for geopolitical reasons than geological reasons.

Think about the nature of an offshore rig. They are a boat rather than a platform sitting on the bottom. In production, many production platforms reach the bottom in shallow waters, but they are still ships. They are built and transported in water and the tool pushers are a type of seaman.

The move into offshore exploration overseas took place mostly post 1980. The majors concluded that because of price controls and the Windfall Profits Tax, the USA had moved into the geopoliticially challenged category. This also reenforced their tendency to manipulate the US system, but it moved them to safe areas for drilling and production. At the same time, a lot of the foreign areas that the big boys had thought were great places to drill and produce were nationalised, the biggest wound being the nationalisation of Aramco. As many of the most promising areas have reached maturity in exploration, its clear that Ghawar was the biggest and best field on earth, and it seems to have peaked.

Offshore rigs are safe. They drag them in mostly in international waters, and they are hard to interfere with by a country with a weak navy or pirates/guerrillas with speedboats. By contrast, land rigs have to be trucked in or driven in, and the oil or gas has to get to ports to be sold. Look at the situation in Iraq right now as a good primmer in the difficulties of onshore production in an unstable area. Pipelines get blown up, and in the first Iraq invasion by the US, Burghan in Kuwait was set on fire by the Iraqi Army and the production was very seriously impaired, probably had some really serious reservoir damage although that's just my guess.

The result is that its a heck of a lot easier for a big oil company to justify an offshore prospect than an onshore prospect in places like the Niger Delta. And other really promising areas like the Congo part of the African Great Lakes basin is going to languish.

An oil company doesn't find oil unless it drills, and the multinationals are limited by their size, water depth technology and the geopolitical risk to the continental margins and water depth of less than 1,000 ft. There may be some truly fantastic plays that are camoflauged bypolitics, and thats shown by the Chinese oil companies exploring in Darfur and the Sudan and the dope lord half of Columbia. Bob Ebersole

The approach to projecting "the shape of oil to come" via the guaging each of the factors involved - decline rate of existing fields, new production added, new discovery, change in technology, and so on is all fine and good. But it seems to me that it's doing it the hard way. The Hubbert method is actually a discounting mechanism, the "easy" way, that automatically factors in all these hopelessly complicated things plus some things you or I aren't going to be thinking of. It accounts for old field decline vs new field addition, the changes in the technology and economics of extraction, and many, many more important factors. So where a dissection of the factors such as this one agrees with Hubbert's approach, I think it's probably about right; but where there's disagreement, I favor the Hubbert result. That's for conventional oil, of course. As conventional oil production goes over the peak, unconventional oil, especially deep water, is going to dramatically effect the shape of the curve, as it already is. And here, the Hubbert method doesn't account for it well, so the "hard" way must be used to try to guage it. You make a good point in that the deep water production that is helping to prop up world supply is from ocean reservoirs that behave more like a gas field - sharp ramp to the high production level, a relatively brief production history, then a sharp collapse adding to the likelyhood of the sharp fall off scenario you describe. I don't know how anyone can determine just how much deep water oil there is. It seems like the biggest source of uncertainty in projecting the total liquids peak.

See my above post it eventually gives the right answer but their seems to be a good case that its a fairly high prediction of both future production and URR.

To repeat but keep it short. The dogleg effect has been recognized as an aberration around peak as the nature of the drilling campaign changes fairly dramatically as attempts to keep production up.

Technical advances cause the same errors in the data set but they are hidden and more systematic. WT uses the rule of thumb that production peaks about 60-70% of URR with HL. But if this technical bias is correct it may be say 80-90% of the real URR if technical advances where systematically used to enhance production.

Note that KSA is probably the poster child for an area that may be significantly overestimated by HL.

One that probably is not overestimated is Russia since few of the technical advances where used through the production cycle and the ones that where employed where used for a long time allowing the HL method to account for them.

Actually Russia is a good test case since its just now deploying advanced western extraction methods. If production remains higher than WT HL predictions its safe to assume that a lot of this is just super straw effect.

So if I'm right I think that Russia will actually enter a bit of a plateau or slower decline over the next few years and not decline quite as WT has predicted.

Memmel,

Russia is mostly onshore production. King Hubbert drew up his data from analising onshore basins because offshore didn't exist very much before his retirement and death, just as the 3D seismic and horizontal drilling didn't exist, or producing tar and calling it oil.Bob Ebersole

Well its a combo of onshore/offshore and technology advances thats the issue.

The problem is that both offshore and technical advances that increase production rate over time have a inflated URR vs onshore. So mixing the two data sets gives results that are inflated in respect to URR.

HL will still get the peak date correct and the peak production since its a heuristic equation. But if the production is strongly weighted to offshore which tends to be pumped fast and you leave a lot of oil behind as you discussed before because of economic reasons. The HL will underestimate the post peak decline rate overestimate URR.

The reason it probably continues to fit well up till now is that production in offshore basins was expanding fairly rapidly up until recently. Since HL uses past data to predict the future this expansion factored in to in effect hide the nature of offshore vs onshore wells.

At global peak this expansion effect drops off and we can see the effects of offshore drilling vs onshore.

This is why all the bottom up analysis are off by 10-15 years in prediction peak. We have a lot less oil remaining

then even HL is predicting. Considering that most of the volume declines are early on then 10-15 years is pretty far off.

In my opinion the URR calculations could be off by as much as 20-30% because of the move offshore and technical advances. HL is better but its probably high by at least 10%.

This is just considering the volume of oil thats predicted to be pumped over 10-15 years by bottom up that probably does not exist.

Think about it if the peak predictions are off by 10-15 years that means that the URR estimates are also way off.

Think about the volume of oil needed to maintain a 10 year plateau at 90 mbpd or more and overcome depletion.

If we peaked now then URR estimates are garbage.

I think you have good points re: offshore. Offshoe and deep offshore has heroically put off peak, maybe not for much longer. Certainly decline will be rapid compared with land, and this effect is only beginning to be felt because offshore is relatively recent. Nevertheless, we are already seeing declines in UK/norway, US/Mexican gulf. Rapid declines offshore are IMO not properly included in bottom up analyses which use traditional land based decline rates, eg Chris 4.5% assumption.

OTOH, most production remains onshore, and traditional decline rate/URR calcs would apply. An interesting calc would be to separate world wide land and offshore production, make some assumptions re: both decline (maybe use UK/Nor for offshore assumptions), then look forward, considering how the proportion of offshore production to total is increasing.

This onshore production is basically supported by the giant oil fields that are probably all in decline. A lot of the rest of onshore production is well past peak.

My understanding is offshore is 40-50% of production and a good bit of this has been brought in since the 1980's a lot of the fields are going into decline since about 2000.

This is the "swarm" effect so in general offshore we basically have 40-50% of our production in decline and at a steeper decline rate than traditional onshore production.

And next the URR of these offshore fields is far less than is estimated because of production costs which are increasing dramatically lately esp offshore.

Couple this with Export land and other feedback issues and the chances of a slow decline are pretty small.

Rembrandt says:

But when I look at chart 3 of his (excellent) OilWatch paper, what I notice most of all is the maximum liquids production peak of 86.13 million b/d back in July 2006. This is over a year ago now. Doesn't this show we are already in decline, or is it too soon to say?

I'm new to the forums so please forgive any ignorance I might be displaying here.

I place a lot of importance on Rembrandt's OilWatch work because to me, while the analyses of when the peak might occur are interesting, the only way we are going to know for sure when the peak has occurred is by looking in the rear view mirror.

Also it helps to convince policy makers (at least here in New Zealand) if we can clearly show we are in decline as it is a far stronger argument than using the phrase "oil will peak sometime in the next decade". I think there is a perception that the term "Peak Oil" is associated with some kind of wacky Green conspiracy theory, which is why I'm wanting to use the term "declining oil production" if it is valid to do so.

Very simply, there were periods very recently that (on a graph) look exactly the same as our current situation.

1998-1999 and 2000-2002.

In both cases the Peak-Oil Guru Ken Deffeyes and the Peak-Favorite James Kunstler(based on Deffeyes work) called a peak. They were both wrong both times.

The things that they are saying now are not any different from the things that they were saying then.

Kunstler is a polemist. Deffeyes is a geologist.

Deffeyes has never explained his previous two false calls on peak and why we should believe him now. Never.

All peak predictions. I repeat. ALL peak predictions are based on Deffeyes. His record of failure is perfect.

I expect a new book soon, with a new preface and an introduction by Matt Simmons.

Should be easy. I could write it for them.

Rembrandt Koppelaar takes a hard look at numbers and is extremely disciplined. He looks at the same numbers every month. He is not predicting he is looking at history as best he can figure out.

RK is one of the most under-appreciated geniuses in the peak-oil world. He is not trying to tell you what will happen. He is showing you the rear-view mirror. If you were smart, you would stop trying to see what the entrails say, and pay attention to what he is saying.

That isn't actually true now is it. For example, I don't see any Deffeyesian influence in Skrebowski's work.

Who?

Just Kidding. Let Skrebowski speak for himself. I know exactly who you are and I don't care what you "see" or "don't see." If you are Skrebowski than I apologize for not seeing your flag.

"I don't see any Deffeyesian influence in Skrebowski's work."

You may want to take a look at that. Can any sane person see otherwise? No offense, Chris, but you are an editor here. I think when first time viewers look at TOD and see staements like that - well one of two things happens.

Idiots are influenced. People that know the first thing chuckle to themselves.

Let's play a little game.

How many headline Posts and references has Stuart Staniford had on TOD?

Chris Skrebowski?

Daniel Yergin?

No, Seriously. Just throw some numbers out there.

Hello?

Excuse me, but I can't remember Kunstler or Deffeyes calling a peak in 1998-1999 and 2000-2002.

Kunstler has always used other data as reference, and Deffeyes did call a peak on Thanksgiving Day 2005.

Could you provide some reference?

PS: Excellent work, Rembrandt, many thanks for this, you always spark the most intelligent discussions here!

Deffeyes never backed away from his prediction that world crude oil production would peak between 2004 and 2008, most likely in 2005.

He observed in the 2002 time frame that world crude oil production, contrary to what his model showed, probably peaked in 2000. But that was never a prediction.

You're not contradicting what was said - "observed" and "called" mean much the same thing.

Well here are his followup comments from up the thread:

The second statement if false. Deffeyes never predicted a 2000 peak, and the EIA shows world crude oil production to be down from 2005, while oil prices are hitting new nominal highs.

Through July, 2007, the cumulative shortfall between what the world would have produced at the 5/05 rate and what we actually have produced is about 633 mb (EIA, crude + condensate), despite record high nominal oil prices.

No, but he did call a 2000 peak, and was wrong about that.

EIA data shows oil production over the last 12 months as up from the previous 12 months, and down from the highest 12-month period, although by marginal amounts in both cases (47kb/d and 122kb/d resp., through July07).

IEA data, by contrast, shows a substantial production increase (~1mb/d) over the same period.

In the absence of a compelling reason to favour one dataset over the other, it's much too early to call declining production.

Moreover, there remains the fact that prices dropped significantly early this year, due to the unusually warm winter in major consuming countries, and that increases in non-OPEC production meant that production stayed higher and prices lower than the same time last year until OPEC cut its production. Accordingly, while production does indeed seem to be no higher at the moment than at this time last year, much of that appears to have had an above-ground driver.

Indeed, non-OPEC production is at an all-time high, even according to EIA data, with the last two months of production representing the two highest months ever. In the face of that, it's only reasonable to say there's a lack of production capability if OPEC is unable to push its production back to the levels seen last year before its cuts.

...is misleading. Picking an outlying data point and basing your argument on that is known as cherry-picking, and is not a good basis for a sound and compelling argument.

The IEA data doesn't show May05 as a particularly unusual month, casting some doubt on its exceptionality. What if the EIA revises that data point? Do you really want your argument to be that fragile?

As I'm sure you know, I was talking about crude + condensate--you know, the stuff that refineries buy to turn into refined petroleum products. Both on a monthly basis and average annual basis, world crude oil production is down relative to 2005.

Regarding Deffeyes, it is true that he said that the world appeared to have peaked earlier than what his model predicted, but he never backed away from his model.

Since NGL refinery products compete directly with crude refinery products, it's silly to ignore part of the oil supply. Indeed, both the EIA and the IEA explicitly consider the world's oil supply to consist of "all liquids".

I'm not sure why you bring this up, though, since you're not contradicting anything I said, and it doesn't make any substantiative difference.

It doesn't change the fact that he put his name behind a 2000 peak, was wrong, and hence his subsequent calls of a peak have to be treated with some level of skepticism.

It's kind of like the boy who cried wolf. The wolf was indeed real, but poorly timed and ill-considered warnings ended up doing more harm than good.

I would say the words are completely different, certainly in the given context. Deffeyes called for a peak in 2005 in the late nineties; this was predictive. Later, not realizing the 2001 reduction was on account of recession, he looked back and said that, perhaps, we had already peaked; this was a historic observation and not, AFAIK, based on any new calcs but simply looking in the rear view mirror.

His actual calcs look good in todays rear view mirror, and may turn out to be dead on - Gail points out that total liquids would also have been in 05 had it not been for Katrina - or may not. Nevertheless, for all those thinking the current situation is just like the 02 downturn, consider that the price environment is totally different, encouragaing every producer to produce every barrel. IMO, every producer is responding as best they can, just as I expect SA to produce a bit more just as soon as their new project comes on line.

Predicting the future is tough, those getting it right deserve full credit.

And it was also wrong, which is all that Echelon appeared to be saying in that part of his post:

1) The production graph around 2001 looked like it does now.