Peak Oil and Reflexivity and Peak Oil

Posted by nate hagens on June 8, 2008 - 10:15am

A good many years ago, I read George Soros' "The Alchemy of Finance", which introduced me to the concept of reflexivity, which in a nutshell is when observers of a phenomenon can't help but impact the phenomenon itself via their 'observing', thus changing the original underlying fundamentals and setting in motion a boom-bust dynamic (i.e. more exaggerated trends in both directions). Since Mr. Soros recently spoke to Congress regarding the oil futures market 'bubble', I thought I'd take a closer look at the concept of reflexivity, both as it relates to oil and commodities in general, as well as its broader implications for efforts in raising awareness of global resource constraints.

"The situations that men define as true, become true for them." Sociologist William Thomas, 1928

Though Soros applied the idea of reflexivity to financial markets (and had huge success), its origins are in social theory. Social (science) phenomena are influenced by a two-way interaction between perception and facts, thereby making it impossible to ascertain a true stand-alone 'fact'. Thus, reflexivity is basically the ecological/systems concept of 'positive feedback' merged into the social sphere where thinking, acting human agents create circular relationships between cause and effect in real-time. Flanagan (1981) and others have argued that reflexivity complicates all three of the traditional roles that are typically played by a classical science: explanation, prediction and control. For example an anthropologist working in an isolated tribal village may impact the native peoples culture and behaviours in unknown ways- e.g. her observations will not be independent of her participation as an observer. This contrasts to the natural sciences, where one set of facts follows another irrespective of what anybody thinks. This is a central example of post hoc ergo propter hoc reasoning that is prevalent in modern Walrasian welfare economics.

In financial markets (which include oil futures), reflexivity occurs when prices themselves influence the fundamentals and that this newly-influenced set of fundamentals then changes expectations, thus influencing prices. This process then continues in a self-reinforcing pattern until it has overshot equilibrium. Because the pattern is self-perpetuating, markets tend towards disequilibrium- where every outcome is uniquely different from the past. (This of course flies in the face of most everything I was taught at the University of Chicago Business School)

Here is what Mr. Soros had to say about reflexivity in a 1994 speech at MIT:

"I am in fundamental disagreement with the prevailing wisdom. The generally accepted theory is that financial markets tend towards equilibrium, and on the whole, discount the future correctly. I operate using a different theory, according to which financial markets cannot possibly discount the future correctly because they do not merely discount the future; they help to shape it. In certain circumstances, financial markets can affect the so-called fundamentals which they are supposed to reflect. When that happens, markets enter into a state of dynamic disequilibrium and behave quite differently from what would be considered normal by the theory of efficient markets. Such boom/bust sequences do not arise very often, but when they do, they can be very disruptive, exactly because they affect the fundamentals of the economy."

"The theory holds, in the most general terms, that the way philosophy and natural science have taught us to look at the world is basically inappropriate when we are considering events which have thinking participants. Both philosophy and natural science have gone to great lengths to separate events from the observations which relate to them. Events are facts and observations are true or false, depending on whether or not they correspond to the facts....The separation between fact and statement was probably a greater advance in the field of thinking than the invention of the wheel in the field of transportation.

But exactly because the approach has been so successful, it has been carried too far. Applied to events which have thinking participants, it provides a distorted picture of reality. The key feature of these events is that the participants’ thinking affects the situation to which it refers. Facts and thoughts cannot be separated in the same way as they are in natural science or, more exactly, by separating them we introduce a distortion which is not present in natural science, because in natural science thoughts and statements are outside the subject matter, whereas in the social sciences they constitute part of the subject matter. If the study of events is confined to the study of facts, an important element, namely, the participants’ thinking, is left out of account. Strange as it may seem, that is exactly what has happened, particularly in economics, which is the most scientific of the social sciences."

Well, economics has been the best path dependent allocation mechanism for a competitive species finding a huge energy subsidy, and as such has developed complicated econometrics and other empirical formulae that appear to be laws. Since energy has always grown, the 'rules' for economics seem like science, but the observations that economists consider to be facts, are based in large part on the specific inputs and history from this cultural system.

More from Soros:

"Classical economics was modeled on Newtonian physics. It sought to establish the equilibrium position and it used differential equations to do so. To make this intellectual feat possible, economic theory assumed perfect knowledge on the part of the participants. Perfect knowledge meant that the participants’ thinking corresponded to the facts and therefore it could be ignored. Unfortunately, reality never quite conformed to the theory. Up to a point, the discrepancies could be dismissed by saying that the equilibrium situation represented the final outcome and the divergence from equilibrium represented temporary noise. But, eventually, the assumption of perfect knowledge became untenable and it was replaced by a methodological device which was invented by my professor at the London School of Economics, Lionel Robbins, who asserted that the task of economics is to study the relationship between supply and demand; therefore it must take supply and demand as given. This methodological device has managed to protect equilibrium theory from the onslaught of reality down to the present day". from George Soros speech to MIT in 1994

The upshot of this is that 'facts', as seen from the financial market participants persective, actually change the behaviour of not only the investors, but also the corporations, policymakers, institutions, etc. In studying supply and demand we impact supply and demand.

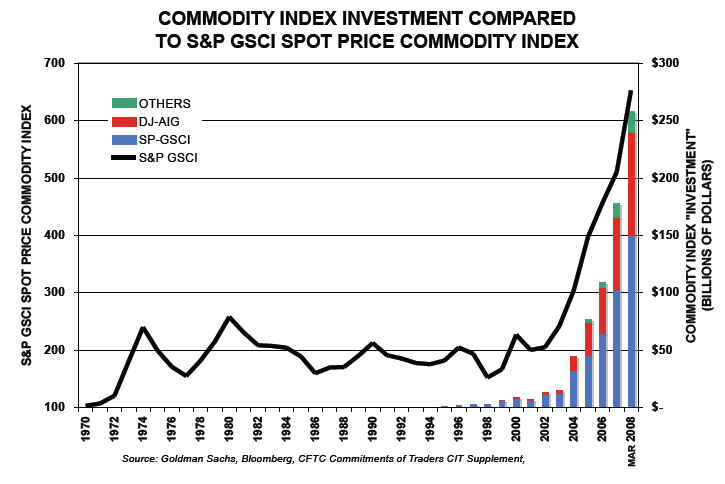

With this background on the concept of reflexivity, let's take a look at commodity futures markets. In 2004, the total value of futures contracts outstanding for all 25 index commodities amounted to around $180 billion. At that time, that was 240 times smaller than worldwide equity market cap of $44 trillion. Recent estimates of the global derivative markets notional size are northwards of $600 trillion. This compares to US GDP of about $13 trillion, and around $8 trillion of new inflow into investments each year (savings). The total global equity market and debt (bond) markets are around $50 trillion each.

Source: Michael Masters Testimony to Congress, May 20 2008 (pdf)

Commodities have not had a boom since the late 1970s, and until recently have played a minor role in general portfolio asset allocation. Combined with media coverage (e.g. Jim Rogers) and rapid growth in demand and tightening of supply, commodity markets have had explosive moves the last 5 years. Pension funds, sovereign wealth funds, university endowments and other index speculators have been allocating money away from stocks and bonds into commodities. A common way for these entities to invest is to allocate a % of their capital to commodities in general, without taking a particular sector or timeframe, e.g. they buy exposure to commodities via the front months of each major contract and just before they would have to take delivery of the physical, roll into the next closest futures month. There are several major commodity tracking 'indexes' that differ slightly in their respective commodity weightings. The red, green and blue bars in the above graph track the dollars invested in different indexes compared to the black line which is the SP spot commodity index.

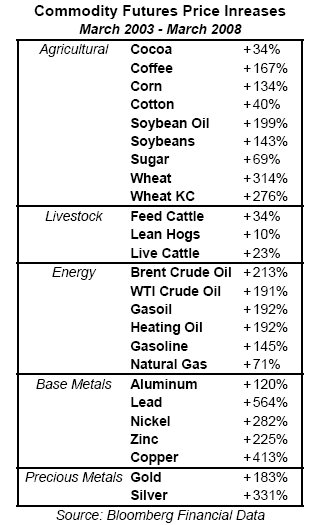

This explosion of funds into commodities, combined with fundamentals, has created some hefty price increases in the major commodity groups:

Source: Michael Masters Testimony to Congress, May 20 2008 (pdf)

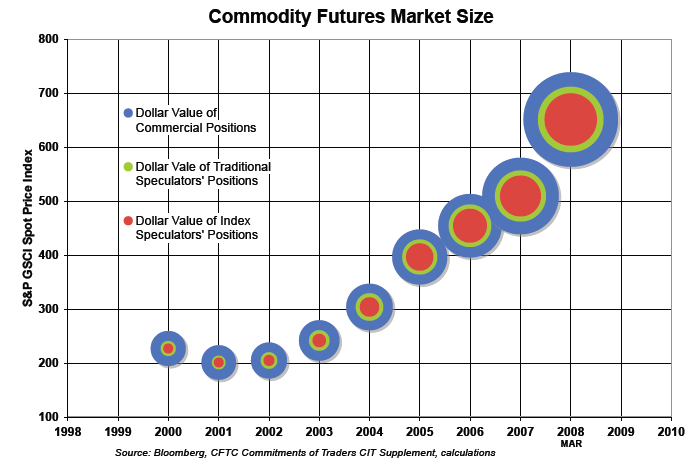

The combination of price increases and more funds allocated to commodities has obviously increased the total size of the 'commodity market'. Notice in the below graphic that the amount of index speculators (red area) as a % of the total has risen over time, again a function of their own performance, and general commodity price increases:

Source: Michael Masters Testimony to Congress, May 20 2008 (pdf)

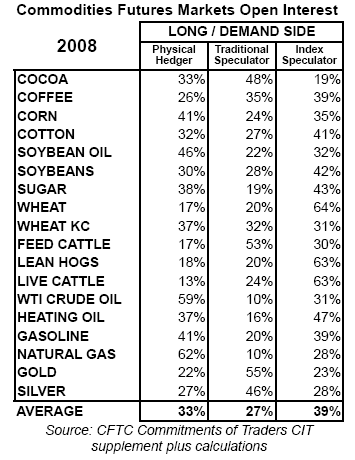

The transfer of 'money' into 'real goods' (or at least paper represntations of them) has been widespread. Commodity-index funds controlled a record 4.51 billion bushels of corn, wheat and soybeans through CBOT futures, equal to half the amount held in U.S. silos as of March 1. According to Mike Masters, in his Congressional Testimony last week, speculators have now stockpiled, via the futures market, the equivalent of 1.1 billion barrels of petroleum, effectively adding eight times as much oil to their own stockpile as the United States added to the Strategic Petroleum Reserve during the last five years. Since there is a positive feedback mechanism with futures index funds, the demand for futures actually increases as prices go up - the opposite of what one would expect from price-sensitive consumer demand.

There are currently position limits for futures contracts for speculators:

Position Accountability Levels and Limits

NYMEX Crude Oil Futures - 1,000 U.S. barrels (42,000 gallons): Any one month/all months: 20,000 net futures, but not to exceed 3,000 contracts in the last three days of trading in the spot month.

NYMEX Henry Hub Natural Gas Futures - 10,000 million British thermal units (mmBtu): Any one month/all months: 12,000 net futures, but not to exceed 1,000 in the last three days of trading in the spot month.

NYNEX Heating Oil Futures - 42,000 U.S. gallons (1,000 barrels): 7,000 contracts for all months combined, but not to exceed 1,000 in the last three days of trading in the spot month.

Exemptions

The Commission and exchanges grant exemptions to their position limits for bona fide hedging, as defined in CFTC Regulation 1.3(z), 17 CFR 1.3(z). A hedge is a derivative transaction or position that represents a substitute for transactions or positions to be taken at a later time in a physical marketing channel. (Source JPMorgan Chase)

Hedgers have no position limits but do have reporting requirements. Currently, an index speculator can call up a bank and request exposure to say, $100 million of oil and enter into a swap - the bank then hedges this via the futures markets - in this way the speculator has bypassed the official position limits, skirting the current intent of the rules. There are rumors that due to pressure from hedge funds, politicians, etc. (either in an effort to reduce energy and food prices or reduce the pain on their short positions..;-), that the definition of 'hedger' is going to soon become more restrictive. In theory this would relieve pressure on commodity prices, as the large positions by index speculators would have to be reduced (e.g. sold). However, it is not clear to me that this rule alone would drop oil prices: 1)there exists a large short interest in oil that counterbalances the index longs -e.g. some large 'shorts' would have to reduce their positions by covering too, 2)at the end of each calendar month, someone is taking delivery and paying these high prices, 3)if speculators were largely responsible for the oil price spike, where would all the stored oil be that they were taking delivery on?

With this brief overview of the commodity markets, let's now revisit the concept of reflexivity.

REFLEXIVITY - TAIL, DOG, WAG?

Back to Mr. Soros:

"So we can observe three very different conditions in history: the “normal,” in which the participants’ views and the actual state of affairs tend to converge; and two far-from- equilibrium conditions, one of apparent changelessness, in which thinking and reality are very far apart and show no tendency to converge, and one of revolutionary change in which the actual situation is so novel and unexpected and changing so rapidly that the participants’ views cannot keep up with it."

Wheat might be a good example of the 2nd of these three conditions. After breaching an all time high of $6 last summer, wheat continued until it peaked over $12 per bushel (hard red wheat hit $25). Droughts in Australia and Eastern Europe exacerbated a low inventory situation and people were caught off guard - thinking and reality now differed. In 2007 Americans consumed 2.22 bushels of wheat per capita. At 1.3 billion bushels, the wheat futures 'stockpile' by index speculators was enough to supply every American with all the bread, pasta and baked goods they could eat for two years (Masters). Yet despite the large bullish position, indeed perhaps because of the large bullish position, wheat futures reversed their asymptotic rise in similar dramatic fashion, with the speculators riding it up and the physical hedgers sending it down. (Sidebar - there is still a massive index speculative position in wheat, despite a nearly 50% selloff, a relevant datapoint to those who believe index speculators are primarily to blame for crude oils rise.)

Dec/08 Wheat futures - daily prices

Here was an example of equilibrium overshoot in two directions, eg. large 'runs' both up and down. Speculators were behind, reached, and got out too far ahead of fundamentals in this case. But what about oil? I would contend that a 1200% increase in price since 1999 and flat production since 2005 with a growing world economy is consistent with either the 2nd or 3rd of Soros' 3 conditions. Whether we have overshot equilibrium or are in a situation of revolutionary change is still an open question. But let's step back first with a thought experiment.

Imagine that there were no Ken Deffeyes, Matt Simmons or Colin Campbell. Imagine that M. King Hubbert spent his retirement playing Parchesi with his wife and not modeling future oil depletion. Imagine that when the UK hit is second (and final) peak in 1999 that no one noticed, and that market participants didn't pay attention to the subsequent 12 fold increase in oil prices. Imagine we didn't know that the energy return on crude oil had declined from over 100:1, to 30:1 to around 10:1. Imagine that Nigerian rebels and Iraqi freedom fighters couldn't cause daily spikes in crude prices by their actions due to the fragility of supply and demand. Imagine that bandits weren't stealing scarce diesel fuel at night in California. And, imagine if places like theoildrum, or ASPO or energybulletin didn't continually posit data and questions that pushed the envelope of conventional energy wisdom. Consider then only geology. That we use horizontal drilling and nitrogen and water injection, that we are drilling more and more wells all around the world using the latest seismic technology, etc. That the EIA continues to model supply forecasts with demand forecasts, because supply has never really been a constraint in the past....Would oil prices be approaching $130? Would T Boone Pickens be interviewed with a mixture of awe and fear on CNBC? Would there be major military presence in what was formerly the fertile crescent? Would Saudi Shura (Parliamant) be voting to keep more oil in the ground for higher future prices? Probably not. Yesterdays 'facts' are influencing today's perceptions which are influencing tomorrows realities.

$100+ oil DOES change consumption habits, but it also changes humans built in beliefs towards their futures, both individually and as nations. Earlier this week the CEO of TOTAL, one of the worlds largest oil companies, stated that new forms of energy would not be able to compensate for the coming oil and gas depletion. He also stated that new oil reserves cost $80 to procure so $80 would become the new price floor for oil going forward. We don't know that this is a fact - but is the opinion of an expert in a position to know more than the average participant. Monsieur de Margerie, via his perceived authority and public pronouncements is therby affecting the fundamentals of the oil industry. Each incremental admission, whether from the IEA, from TOTAL, or from theoildrum.com, shifts the mindsets of participants at the margin, which subsequently changes behaviours.

In 1999 with oil below $10 per barrel, the stock market at all time highs, and resource limit concerns restricted to a handful of cranky environmentalists and Hubbert acolytes, were we at 'equilibrium'? In 2001 with oil at $20? In 2005 with oil at $50? The point is that for a very long time we were not in equilibrium - the pendulum was pulled way to the left and finally let fly in 2000 - the question is, has it now past equilibrium in the other direction? Or have we moved into the third stage, where human collective awareness is accelerating knowledge about and action in the oil sector? More knowledge about finite flow limits changes professionals opinions about the future, which changes investment into refineries, changes long term contracts with exporting nations, changes military strategies, changes hoarding strategies, all of which are reflected in the price moonshot. Soros theory, which I happen to subscribe to, implies we will overshoot in both directions, because gravity and momementum will combine to send the pendulum backwards once market participants have not only caught up, but exceeded the reality of the situation. But Soros (to my knowledge) generally applied this principle to finance, and admitted to Congress he is not an expert in things energy. Reflexivity could of course have larger societal implications beyond investment booms and busts.

Nearly two years ago, in this post about the Amaranth blow up, I suggested that price floors and position limits would eventually become a reality because of the sheer size of dollars vs notional energy values. In A Closer Look at Futures, I commented:

I believe there are 3 different definitions of Peak Oil and they will come in succession.

- The point when we have used half of the oil that will ever be extracted.

- The point when we reach maximum sustained production (given that we use high technology like horizontal drilling and water and nitrogen injection, we are likely borrowing from the second half of what was normally a bell shaped curve so this point will come later).

- The point when the meme of finite energy resources takes hold in society.

For sake of this discussion, lets use the first definition, and assume we are roughly at Peak Oil now. We have used 1 trillion + barrels and have 1 trillion + left. But as discussed previously (exhaustively?), those 1 trillion barrels require a decent amount of energy to locate, harvest, refine, and distribute and this amount of `energy cost' subtracted from the gross is increasing.

Lets assume that the 1 trillion barrels nets out to 650 billion barrels to non-energy society. (Yes I chose this number specifically). Given our current world population, that equates to 100 barrels of net oil remaining for every person on the planet, (and leaves none for our children, grandchildren or subsequent generations). Any Tom, Dick or Rainwater for $4,000 can financially control 1000 barrels of oil in the futures markets, or 10 times his or her all time planetary allotment. Once Peak Oil version #3 is realized, there will be many investors clamoring to financially (or physically) control their 100 barrels, let alone 10,000 or 1,000,000 barrels. Can the futures markets absorb this? Will this make the Hunt Brothers cornering of the silver market seem like childsplay? The world uses 85 million barrels per day - and for a mere $340 million in margin, this entire amount can be controlled via the futures markets. Consider this in contrast to the $7+ Trillion invested or saved annually, and the nearly $100 trillion in stock and bond market assets. Will the market send the right signals? What smart angles will hedge funds take on this?

Isn't this what we would expect in a finite world as people wake up to real resource constraints? What is a dollar, or yen, or euro worth, really? Though Soros' ideas about reflexivity were applied to the financial arena - perhaps we the observers, are impacting the real time experiment of resource constraints in the same vein. Though geologic limits to flow rates are an ostensible signal, the real dilemmas of Peak Oil are all socioeconomic. We are beginning to realize that societies need to be 'intact' with reasonably equal distribution and allocation if the entire system is to continue it's current trajectory. But oil depletion will likely first be a tax on the middle class and poor, accelerating political pressure on things likely to exacerbate the long term situation (e.g. cutting gas taxes, scaling ethanol, giving tax rebates to help economy, etc.) On top of that are myriad human elements that are very difficult to predict. Hoarding behavior is an autocatalytic process which begets other behavioral changes once set in motion. 'Not drilling' or 'not producing' oil and gas at a certain price could also be considered hoarding behaviour. "Virtual hoarding" via futures contracts can also occur to a certain extent. On the one hand accelerated knowledge about geologic limits acts as a needed tax on finite high quality fossil fuels, which spurs investment into alternatives and quickens conservation and consumption behavioral change. On the other hand, once the cat is out of the bag, there is a greater chance of unintended consequences, as the owners of paper money might start to look at it differently. Reflexivity indeed....

SOME PREDICTIONS

Here is my 'participant' part of the equation of Peak Oil. These are not facts, but my opinions:

1)There will be extreme volatility in next 5 years in oil and gas prices. Not only day to day, but year to year. Awareness of possible flow constraints is now upon us, rightly or wrongly. This combined with the tiny size of energy commodity markets compared to investable dollars will engender large position sizes that inevitably will fall victim to the fear/greed/leverage trifecta. Attention to the oil sector guarantees increased volatility. Accelerating oil depletion of older wells and skyrocketing reserve replacement costs guarantees higher highs and higher lows...

2)The Peak Oil community (e.g. those who generally understand that oil production is either peaking now or will peak soon) will begin to bifurcate into two relatively disparate camps - a)the supply-side camp that understands the urgency but will try and address energy and resource shortage via technology, more drilling and alternatives and b)the demand-side camp who will see that no matter what the energy source, a new paradigm of how we live our lives/structure our institutions will be the only full answer to the twin problems of peak fossil fuels and a growing population. Conversations between these two camps will become increasingly disparate and tense. Supply and demand solutions will not be mutually exclusive, but some people recognize that our ends are constrained as well as our means.

3)There will be an eventual slowing and ultimately a cessation of speculation in energy markets by non-producers. This is tantamount to a change in capitalism so I don't say it lightly, but already only 6% of world oil reserves are owned by public companies - the amount of dollars NOW dwarfs the amount of notional physical resources - if printing presses are turned on while resources deplete this disparity will continue to grow. At some point people like you and I won't be allowed to buy oil futures, which is only a short step away from nationalization of the energy industry (which is the case in most countries already).

Conversations and thoughts like these are meant to raise the bar of discourse on energy topics so when real policy discussions take place, either locally or regionally, people will speak a common language. There is a fine line in peak oil outreach - more awareness is needed to accelerate renewable infrastructure and kick-start efficiency and conservation measures - yet too much awareness might cause supply disruptions (hoarding) and make it difficult for oil companies to extend the time horizon that we have access to a large baseline of production, etc. As an editor on this site, I hope we are efforting positive change, but realize many of our readers are likely tuning in to know the latest details in order to improve their own situation, financial or otherwise. One of my concerns is when the pendulum swings back the other direction, and we head towards one of those 'higher lows', that the urgency of both supply and demand response will be lost. Both oil prices and energy stocks will overshoot on the downside and we will lose sight of the long term situation. These are high stakes.

The other night at a meeting (where the guest speaker was Raj Patel) a local rancher made this same case for oil price rise, and said it was similar to the speculation in land. Such speculative buying has driven the price of land so high that people wanting to buy land for actual economic activity are finding it hard to do so.

I guess a difference is that speculators actually own the land, but the similarity is that they are buying it with the goal of resale at a higher price rather than use.

Do you see land speculation as a basically similar phenomenon?

It's related but different. They aren't making any more land, so I expect 'infinite' dollars will chase 'finite' land in the same way that dollars chase oil. But land isn't liquid at room temperature and in order to maximize the Ricardian rent on land, you need lots of other inputs: people, energy, equipment, etc. There are also unique local economic characteristics in each region that limit true global fungibility for land, beyond pure speculation. We aren't going to start resource wars over land in Mendocino county, but certainly could over oil.

Also as far as land goes a lot of the land bubble was driven by the housing bubble. If the intended use of the land is for a subdivision and your getting 150k-800k and acre for finished lots then the original cost of land is almost no object. This was a huge factor in inflating land values. With the subdivision market effectively gone then agricultural uses garner a much lower price. This effect is so large and it still being felt that other economic aspects of land are probably buried.

Since land is only one of the inputs into agricultural use with oil a predominate other on the cost side you have a strong factor driving down what farmers can pay for land.

Next farmland has a robust rental market similar in some respects to the housing rental market if land prices get to distorted it becomes better to rent than to own. Once this point is reached upward pressure on farmland for farming drops off rapidly. This is what generally collapses speculation in farm land.

I'll stop there but I suspect that land prices will eventually collapse as farmers become limited by the amount they can invest in diesel and fertilizer vs crop prices. Leaving little cash to speculate on buying more farmland and rent vs own calculation favors rent.

I'm a big fan of Soros, his theory of reflexivity and have enjoyed both "the alchemy of finance" and his new one "the new paradigm"...I still believe most Americans are underestimating what is happening with oil....right now demand is around 86.5 million barrels and exceeds supply of around 85 million barrels per day. We're depleting at around 6 million a day which we have to make up to get to 85 million a day.....supply does NOT cover demand.....as far as demand destruction...our slowing US economy/ subprime crisis , recession etc has lessened US demand by around 400k barrels but emerging asia (China, India ) has picked up 500k barrels....I believe we can only expect so much demand destruction anyway the reason: as anyone who has taken econ 101 knows ...Oil is the classic text book example of "price inelasticity of demand" in other words...."Goods that everyone worldwide needs, cannot consume less of, and cannot find substitutes for even if prices rise. For such goods, the price elasticity of demand is considered inelastic" Crude has essentially decoupled from the weak US dollar story. Yes, the dollar will probably remain weak and yes, it is a factor. Oil is not really just a dollar story but is a supply/demand story. Emerging Asia (China and India ) will continue to see phenomenal growth rates...they are essentially emerging from their dark ages and entering the modern world...they have just begun, they have along way to go....oil is going alot higher from here...and yes, pullbacks, even major ones will happen along the way....as an investor these are opportunities to make money...the trend will end up reasserting itself...we need substitutes for oil in a massive way, right now nothing can be done in a big enough way to stop this ...hopefully this will change soon....in the meantime get long and stay long----Patrick Kerr of OilGasFutures.Com

I'm with you on "price inelasticity of demand" of petroleum-based energy in general. There is a little buffer where the world can destruct some demand, but once we get down to cutting out the fluff, what then. We all still need fuel/energy to run the world the way it is. At that point, when we've cut the fluff, price will rebound and then BAU ceases. Instead of cutting fluff, we cut the lesser essentials. Some countries are already to the point where they gone throught those cuts and are starting to cut things that we would all call essential for survival.

agreed

I predict OPIC - the Organisation of Petroleum Importing Countries.

Either the big economies organise between themselves, or they get taken to the cleaners by those still able to export. The unthinking market won't be allowed to control.

Oh, and 'reflexivity' is just the sociologists and economists trying to inherit the mantel of Quantum Mechanics and the Undercertainty Principle. The difference IMHO is QM have had the time and inclination to develop predictive equations that work.

I don't know much about quantum mechanics - has it been/can it be applied to human behaviour?

While some people try and superficially use the language of quantum physics when talking about sociology, psychology, etc, I think it's all bunk. QM specifically applies to physics at very tiny (sub-atomic) scales, and at larger (macro) scales even in pure physics the quantum characteristics disappear. Same for relativistic physics, which only matters at very large scales of time and space. E.g., at the human scale of masses and motion Newtonian physics is accurate and useful.

QM is apparent at atomic and molecular scales. One much larger example is a Bose Einstein condensate in which a single quantum state can extend over thousands of atoms.

Quantum mechanics works at all scales and speeds, and relativity works at all but the smallest scales. It's the *difference* between the older, simpler newtonian physics and modern physics that's only apparent in special situations.

This "reflexivity" concept seems to be an attempt at creating a social-version of Heisenberg's Uncertainty Principle (as garyp notes) - which states that the greater one knows the location of a particle, the less one knows about the particle's momentum. The very act of measuring the particle's position changes the momentum of the particle.

However, since human behavior is only dubiously quantifiable, "reflexivity" is only loosely relevant. So, IMHO, it cannot be applied to human behavior, since I cannot fathom how one would apply Feynman's path integral method (i.e. "sum over histories") to human behavior.

Perhaps, when Hari Seldon is born, and develops psychohistory, we will have the appropriate mathematics to apply quantum mechanics to humans. ;-)

Watch for positronic brain development.

Its not quantum :)

This is classical physics but same result. A chaotic system by definition has infinitely close initial conditions that diverge exponentially over time. This means you don't have to invoke quantum to get a effectively unknowable future result. In addition the system is slam full of noise and incorrect assumptions so a lot of the players are acting on false assumptions. This is of course rapidly coming to a close but as of today the market has not correctly priced crude.

So the net result is that the classical model that I believe models the system i.e a forced logistic equation simply give the result that the system is becoming chaotic and effectively unpredictable.

The island of stability if you will or only stable orbit however you want to put it is that no matter what happens people have to eat and for the foreseeable future they have to have oil.

This rush to stability itself destabilizes the system causing more people to rush to stability.

http://en.wikipedia.org/wiki/Stochastic_resonance

Although the market has a lot of things wrong it has figured out that everything but oil/food/water now has a dubious valuation and this includes the fiat currencies.

The noise from the mainstream media and puppets in control now simply further destabilizes the system. Even though many people hold incorrect assumptions about whats happening the growing consensus is no one believes the puppet masters any more.

In any case a noisy chaotic system with very small islands of stability is sufficient to explain the current situation and effectively as unpredictable as a quantum system of any complexity. Actually less since a quantum system esp model as Feynman path integrals always finds the perfect solution. So a quantum market would pick the perfect answers (plural intended)

In any case I think we will see hoarding become a huge issue over the coming months in a lot of countries esp later in the year as countries scramble to find diesel to get the crops in.

Next year the repeated warning we have gotten about NPK issues will probably become a issue and we could well have crops planting curtailed by lack of diesel and yields lowered by lack of NPK. Global warming will throw in its own curve ball.

This thing can blow up so many different ways now its become impossible to figure it out.

That is, of course, true - but my analogy to Foundation needed to wrap back to the original question on quantum mechanics. :)

I think this is an important and astute observation. The amount of "trust destruction" has greatly increased. Will it reach the point of critical mass?

In theory, would such a quantum market exist in all possible states, and then "collapse" into one of the states at the moment it was observed? ;)

I couldn't agree more.

Aye, I believe hoarding has already started to begin?

http://www.bloomberg.com/apps/news?pid=20601072&sid=aCvsbL.iegY0&refer=e...

I don't know why people are picking on this as an example of hoarding, it completely isn't. Is there something special about storing oil in tankers?

It's sour crude that Iran can't find buyers for, even at a hefty discount. For Gods sake, it even says that in the article you linked to.

Google Robert Prechter and socionomics if you're interested in reflexivity, especially if you want it quantified (fractals and Fibonacci). He's been developing these ideas since the 1970s.

Great article by the way Nate. These ideas need to be discussed, as the flaws of the current paradigm become increasingly obvious. Emotionally driven human herding behaviour is critical to market dynamics. Markets are not rational or efficient and there is no such thing as equilibrium. Equilibrium implies negative feedback, but markets swings at all degrees of trend are based on positive feedback. In financial markets, demand increases as prices rise and everyone chases momentum, and demand falls as prices fall. Trends change suddenly once the greatest sucker has been fleeced, rather than gradually trending back towards a 'set point'.

These are different concepts. Quantum mechanics has been "popularized" to mean a lot of things it isn't. It is a physical indeterminacy and the act of measurement itself "affects" the outcome. (Some might say: there is no "outcome" down there at all, there is just a probability field.)

Soros is talking not just about the act of measurement itself, but the subsequent reports of this measurement throughout the economic system. So if e. g. Hubbert, Deffeyes, Simmons, TOD, etc. etc. all formed a private club to study and discuss "peak oil" among ourselves, our acts of measurement would not affect the market. Once our private club starts to publicize its findings or make market investments, then that upsets the apple cart.

A better analogy to Soros (still imperfect) would be trying to come up with a scientific method of predicting the outcome of computer programs (whether they would crash, loop, or stop). You could, of course, try to write a new computer program to predict the outcome of computer programs . . . but then of course you don't know whether your new computer program will crash, loop, or stop . . . this is an undecidability paradox similar to Goedel's proof -- it can't be done. You just have to run your program in the real world and find out.

Keith

A pretty good parallel, I think. A clue for the concept as Soros uses it, is Karl Popper's assertion that "No scientific predictor can predict its own future results". Soros is Popper's disciple through and through.

The infinite loop solution can be eliminated since we have finite inputs. I.e the program is running on a battery powered laptop. So finite resources actually eliminates one of the solutions thus this problem is more solvably insolvable then the halting problem. Technically this is true for any computation engine that obeys the second law of thermodynamics eventually heat degradation or disorder causes the system to become unable to compute.

I'm not sure if this is known or not.

Next for the same reason only the finite negative outcomes are possible if you don't introduce a new source of power of sufficiently large size so the set of solutions we consider positive can be eliminated again just based on the second law. If you did introduce it this would be the semi-renewable society we talk about renewable enough on time scales that matter to us.

So again this problems solution domain is a smaller infinity than the halting problem.

Next we can invoke the fact that its a complex forced system with positive feedback. Almost all equations that describe such systems have chaotic domains. I have no idea if a proof exists that the all do or not.

Given that these types of equations don't have a closed form one can argue that a week proof of some sort exists that the lack of general closed solutions equals chaos.

This assumption eliminates all of the closed simple solutions that have been presented as predictive models of the future evolution of oil extraction. So we can with some caveats eliminate this entire set.

So it fairly sure bet that everyone that has touted a model for the evolution of oil extraction to date is wrong. Some will eventually be more wrong than others but this is another group of solutions thats we can eliminate with some certainty as being wrong. The ones that require some sort of unified response to peak oil or selfless behavior are probably more wrong than others but in general this is not even relevant.

They are all wrong.

And finally and last but not least our computation engine is certain to be running a incorrectly coded program since noise exists in the system. This means of course even if stable regions exist in the perfectly coded algorithm noise in the system will ensure it explores a wide range of possible solutions and even recodes itself. It a non-linear driven mutating system. Think of it as a battery powered laptop being periodically dropped on the floor and zapped with static electricity. Simulated annealing is what this is called. Thus the chance of remaining close to a stable solution given its forced and noisy is effectively zero.

We happen to know that every 4 billion years or so given a constant influx of energy this computation engine gets smart enough to discover the halting problem.

However outside of this one briefly stable solution all others lead to the program halting early in execution.

Therefore given the odds its a safe bet that the outcome is our own simpler algorithm we call civilization we halt when stressed like all the other attempts before us.

In my opinion the fact that the algorithm or system refuses to recognize that without a lot of work the certain outcome is halting ensures that halting is the outcome. Thus the only solution that works is the one that recognizes or codes around the vast number of halting cases. In fact this is exactly what life figured out after a few billion years.

So in a pretty perverse way the fact we are unable to admit we are up shit creek without a paddle ensures that we are about to go over a waterfall.

I find it a bit sad that we are capable of discovering the halting problem yet is a group unable to except the obvious even though its the very reason we exist in the first place.

Seems like a common problem with much classical physics is that it focusses on closed systems. Prigogine was a leader in pushing thermodynamics beyond the second law. Peter Wegner:

http://www.cs.brown.edu/~pw/

has done something similar with computation. The work of Landauer et al. on the thermodynamics of computing is certainly fascinating and very valuable, but AFAIK it is still about closed systems. It would be great to see that work extended to open systems - how information and energy flow though a computational machine and how such machines behave with such flows.

Reflexivity seems to be another push beyond closed systems, where the environment of the system is developing ideas about the system, and the system itself also has ideas, and the system communicates with its environment, so really it is a two way street with each set of ideas influencing the other.

Perhaps the iterated prisoner's dilemma could be the simplest example of this kind of system:

http://www.prisoners-dilemma.com/

This computational approach is not a lot different from what I'm saying about forced logistic systems.

The natural system if you will would in general obey the logistic except when strongly forced.

The addition of intelligence or computation via markets and demand coupling adds a tremendous amount of force to the system.

As and example consider the long reaching effects of the 1970's Arab oil embargo.

So complex open computational systems can take on surprising values or produce surprising results.

This is in my opinion closely related to the underlying chaotic nature of such systems.

Chaos can be though of as a poormans version of Feynman's path integral. Instead of exploring all of phase space

at once like quantum a chaotic trajectory explores a significant amount over a finite time.

The actual differences are probably small. For the prisoners dilemma consider 100 prisoners with partial

corrupt and potentially incorrect information passing.

Actually knowing you can communicate is in itself a message.

I think if any real progress is made in this area it will be from theorems developed in information theory

that are insensitive to the details of the physics. This is why I think chaotic dynamics is a dead end the approach

yields little useful results.

Yes....Reflexivity in sociology: difficult to describe, as it means different things in different contexts or for different authors.. cause and effect interact (seen from systems theory); or more tritely, one comes back to the (human) observer effect - see the anthropologist in the top post who affects the community she is studying - thus influencing her own vision (though the feedback loop is often forgotten.) The concept was indeed in part borrowed from QM to scientifize - that is a Frenchism - some common sense notions. It also, however, has roots in the idea of a ‘self fulfilling prophecy’ (Robert Merton, but See William Thomas, 1920’s or so) - the idea that how humans define (conceive, view, understand, etc.) situations become the “reality”.

These ideas - reflexivity, effect of measurement, observer effect, Rosenthal effect (something similar: expectations create reality, as when researchers are told the group of rats are ‘intelligent rats’ - lo and behold they perform better than the others, etc.) are all a bit muddled in social / psychological science. Vague ‘principles’, ‘laws,’ caveats, rules of thumb, that attempt to grasp, in some way, the interaction between human perception, concepts, and events in the real world, or ‘facts’ - proper, accepted, descriptions of the world, events, etc.

All such thinking has its roots in a constructivist pov: humans construct a view of reality, and ultimate ‘true’ reality is unknowable, and so possibly irrelevant or uninteresting. Of course, science and conventional wisdom furnishes us with some rock bottom statements or concepts that many or most accept as ‘true’ - cars burn petrol, men desire women, stars exist, plants grow... (Economists, technotopists, seem to accept a whole lot of other precepts as ‘true’...)

Really, the constructivist pov is all that Soros and the OP are referring to, imho at least. Sorting out what is ‘really real/true’ vs. what are human constructs and how these deviate from 'truth' is unresolved (duh!) - in fact everyone has their own version of that divide.

Yes, there was a speaker in "Beyond Belief 2006: Science, Religion, Reason, and Survival", Stuart Hameroff, who believes that quantum theory and mircotubules at least partially explains the process of consciousness. Hameroff is the associate director of the Center for Consciousness Studies at the University of Arizona.

Quantum Consciousness (website)

Beyond Belief 2006 session 4 (google video)

Stuart Hameroff (wiki)

"Reflexivity" also borrows heavily from chaos theory and complexity theory.

Chaos: Making a New Science, by James Gleick (Amazon)

Yep.

Reflexivity in the context given deals with the flow of information through the system, and the feedback implications of that flow. It gets into complexity, the interesting bit being the meta level outcomes (eg what the totality looks like and does).

You could conceive of a QM system that would work similarly. Probably something involving entanglement and interacting systems of particles.

The interesting bits are where the attractors are for different levels of information flow - since they correspond to mode switches within the operation of the larger scale system.

The probability is that and understanding that peak oil is here would represent a sufficiently low level important event to force a switch of attractors (and with it modes of operation). Think of it as supercooled water turning to ice.

excellent insight.

I don't know much about quantum mechanics - has it been/can it be applied to human behaviour?

Has been, yes. Justly? No, except as metaphor in some cases.

Reflexivity occurs everywhere, because you have systems everywhere, whether in biology, in society, in cosmology. Things interact, nothing stands in total isolation. It's a truism.

The thing is to trace the feedback loops and cycles in each different phenomenon. But even after tracing, one does not achieve complete predictability -- systems of cycles very often engender behavior that cannot be deduced from the components participating in the cycles.

What's a meta for? To make an analogy...

When I read the post, the analogy that came to mind was that of a flock of birds, well settled in trees, until a kids appears, flinging a stone into the leaves. The birds fly away, but the direction they follow is the same, each deciding where and how to turn not based upon some knowledge of where the next roost is, but based upon the decision of the bird next to it. The same with some of our markets. In a time of calm, each bird/investor can determine its own way, but when frightened, each bird/investor reacts according to the movements of another frightened bird/investor, and not necessarily in maximization of its own self-interest. The flock flies together, and it takes a strong will and stout heart to move differently.

Oil markets are, and will for a long time be, in a state of crisis, and the birds/investors will be reacting to the movements around them, rather than sitting in a roost in Omaha, figuring out what is the best strategy for the long haul. Maybe that's why we had the spikes in wheat earlier this year, and the wierd jump and fall in WTI today.

You misunderstand the concept a bit. It's perfectly possible to understand a system up to a certain degree by looking at feedbacks and cycles and stuff. But complex interactions and chaos is not the same as reflexivity. Reflexivity becomes a problem when you are an unseparable part of the system you want to predict.

Then you can run into grand scale, real-life versions of the Liar's paradox, where whatever you say the truth is, the act of doing so may change it into something else. From the outside, that may look like chaos. From the inside, it's more subtle than that, and you're stuck on the inside, much as you would like to see it all from above.

This is really closely tied up to what Karl Popper (Soros' great teacher) wrote on historicist ideologies like communism. By declaring rules of evolution that society supposedly follows, and getting people to believe it, they changed the future they were supposedly predicting.

My first thought on hearing the term reflexivity was that it was a variant of the uncertainty principle one of the cornerstones to Quantum Mechanics. As pointed out above simultaneously measuring momentum and position is limited by Plancks constant. This is quite different but the concept is similar in that one recognizes that all actions have consequences and that the magnitude of uncertainity can be quantified. Without going into long discourses, there have been several papers in Science and Nature etc. in the last few years providing evidence that Quantum Mechanics occurs at scales larger then atoms and molecules where it clearly applies. There are in fact numerous books about the possibilities of QM applying to human behaviour. The best that I know is the late Anton Wilson's book "Quantum Psychology". He had degrees in mathematics and psychology. There is also a book by Prof. David Boehme (also deceased) which I consider the best non-fiction book of the 20th century titled "Wholeness and the Implicate Order".

not really the "uncertainty principle" is an artifact of operating at the fundamental limits of physical scale.. you can only "see" with one photon at a time hence your accuracy is limited by the scale of said ruler or photon... for instance

(there is a lot more to it but you get the drift) observation at a fundamental physical levels means "poking" something with energy (simplification) which alters the thing you are trying to see

Soros reflexivity may have some useful ideas in it but economics does not operate at a fundamental level... Economics is a load of stuff that happens.

however the What if scenario you present is intriguing

Boris

London

Heh. The number of replies shows the predilections of a lot of TOD readers.

QM and heisenbergianism as it might be compared to reflexivity in economics is only a metaphor. And no one has yet come up with a decent mechanism for human brains having a quantum aspect to them, nanotubes notwithstanding. They are best understood as chaotic/complex systems with infinite dependence on initial conditions.

However, if it's gonna be raised, let's give QM its due. It isn't just a way of figuring out answers to problems of tiny stuffs... it is perhaps the most spectactularly well-verified physical theory we have. AND it says that the universe is mighty friggin' peculiar. If one actually takes it seriously, they must take a whole lot of other stuff seriously... for instance, among the "what does it actually mean" explanations, the only class which doesn't involve 'magic' or privileged frames of reference or imputing magical powers to human measurements are the Everett many-world interpretations. A good primer on that would be David Deutsch's "Fabric of Reality", particularly if you ignore the last few chapters.

Moreover, quantum indeterminacy can be rather arbitrarily ramped up into the macro world, it's mostly subject to restrictions in information flow in terms of what is "entangled" with what; though that's just a language/math convention for describing a static multiverse from a restricted point of view.

Peak oil may be played out in infinite different ways in multiversal block time; and most of 'us' are probably in a lot of them. Booga booga....

I predict OPIC - the Organisation of Petroleum Importing Countries.

I think it will be more along the lines of regional alliances - the EU, Shanghai Cooperation Council, North American Union, etc. China and India did try this cooperation on oil on a small scale a couple years ago (http://www.cbsnews.com/stories/2006/01/13/ap/business/mainD8F3JRD01.shtml). In the end, I think it will be every country or region for itself.

It only works if the majority join in, but its an obvious route for big government to impose control on the market - so I think it will happen. The critical item is that most exports go by sea, and that pipelines are fragile.

The two disruptive items are Russia (exporter and military power) and China (importer and economic power) - find a way to keep them out of the game and the rest can be bullied into accepting imposed allocations and prices.

Methinks Soros, with his (IMO wrong) comments about an "oil bubble" is just having a (market manipulating) fight with his old friend Rogers. Soros' stock performance this year is probably negative (from his new book). I'm sticking with oil and natural gas stocks. Go "bubble"!

I think Soros said that oil was in the makings of a bubble but not a bubble. I can't disagree because oil is already at inflation-adjusted all-time highs.

In case it was unclear, all the Soros quotes in the above post were from his 1994 interview, NOT from his recent congressional testimony.

At some point people like you and I won't be allowed to buy oil futures, which is only a short step away from nationalization of the energy industry (which is the case in most countries already).

It would have to be enforced globally, however, and I think that is unlikely. Hedgers still need to hedge, and the auction format disappearing is not likely. Speculators provide liquidity and are essential. Individuals could simply move their investments offshore to more investor-friendly exchanges.

Ya - not an easy answer to this one, as it would start a slippery slope, but I think eventually there will be no choice. And hedgers wouldn't need to hedge if they were paid by government or some other entity.

That scenario would not be nationalization of a commodity, but rather globalization of it. I can't think of a historical precedent of globalization of a commodity.

To make it clear although its in other posts. Whats happened is that the market participants have realized that commodities represent a store of value, wealth, money once they are constrained. Thus the market action on the market has been to transform commodities into real money destroying the power of fiat currencies.

Globalization of a commodity is simply another way to say our currencies now have a defacto peg to commodities central bank manipulation only causes pain. The central bankers of course realize this and call it a bubble. In reality its a anti-bubble that prevents them from blowing another fiat currency bubble.

This means of course as more people figure this out that they will pour wealth into commodities since investments outside of commodities and critical industries actually have zero nominal value with sharp drops in market value and this will until this new economy becomes renewable and stabilizes.

The central bankers and governments are just whiners because OPEC took their ball and won't give it back.

"The central bankers and governments are just whiners because OPEC took their ball and won't give it back."

Memmel - Thats just effing brilliant. The concept of your post illustrates an ability to step out side the problem and float around it, assessing the "big picture" in a way than noone (I love this new word, noone, has worked its way through the internets) else has.

I was told early in life that I had an ability to visualize in 3D which helps in seeing the crux of an issue (it also helps in hammering out autoCad files) but you seem to go beyond this into the realm of seer.

Your ability to apply this unique ability to the issues at hand is priceless and I look forward to your post on harmonic, feedback, proximity, coupling, thingy a ma jigy.

Cheers

Thanks.

Seriously even if I'm half wrong the net result of a forced logistic function is chaotic collapse a exponentially forced logistic simply blows up effectively right away. The only solution is a massive turn down in the consumer economy and decoupling from oil.

You don't have to believe me look around you. Oil is still insanely cheap the markets have not priced in peak oil and the wheels are falling off the global economy. And this is just with forcing from primarily export land and static to slightly falling production. We have just put our toe in the realm of exponentially forced logistic functions.

Consider whats going to happen as real declines start to become obvious ?

If people can't see this thing is going to blow up in our faces unless we act then all I can hope for is what I said in a private email I don't want to be collateral damage.

And historically every single empire and civilization has ended in collapse these where not stupid people and in many cases the ruling class was all powerful. So historically some pretty smart wealthy powerful people who where dependent on maintaining the status quo have been taken out time and again by a force that overcame them. Something happened that was beyond their control. Its the height of arrogance to assume that we are that much better/smarter than our ancestors. And I'm pretty sure our ancestors felt the same way I could see the arrogance in the crumbling ruins I've visited.

Globalization of a commodity is simply another way to say our currencies now have a defacto peg to commodities central bank manipulation only causes pain. The central bankers of course realize this and call it a bubble. In reality its a anti-bubble that prevents them from blowing another fiat currency bubble.

This means of course as more people figure this out that they will pour wealth into commodities since investments outside of commodities and critical industries actually have zero nominal value with sharp drops in market value and this will until this new economy becomes renewable and stabilizes.

I probably should have said global "communalism" of a commodity (oil), which I don't see happening. A nationalized ExxonMobil would still have to bid for oil against a nationalized CNOOC. Removing the individual speculator won't reduce oil prices, and will increase volatility. Commodity investing is still considered risky given the high volatility - for example a lot of investors decided to "cut their losses" by selling in the low 120s after buying in the 130s.

I won a bottle of Dom Perignon so YMMV.

to those who say oil is speculative I just snicker and say what are you going to put your money into when stocks aren't doing so well and inflation is raging, bear stearns and subprime mortgages? the fed helped create all of this. are you going to put your money into banks that seem to drop 5% a couple times a week or oil and commodites that seem to break records and/or go up in value every year?

Peak-aware financial analyst Gary Dorsch a few weeks ago coined the phrase "oil vigilantes." That was a brilliant way to tie what is happening with oil now to what happened with bonds in the '70s. The bond vigilantes who punished the pre-Volcker Fed for debasing the currency in the stagflation years have been supplanted by the oil vigilantes. I would just qualify that it's not so much OPEC that has taken the ball away as it is institutional investors pouring money into commodities.

The issue is not really one of starting down a slippery slope but rather one of building a completely new economic edifice. Unless you accept disastrous collapse and eventual regrowth as the normal and inevitable pattern of human history, then the desire of money to make money cannot continue to be the engine which drives infrastructure investment when our net productivity starts to decline. We have to find another organizing principle for our economic activity or chaos and collapse are inevitable.

It is a puzzle how the restriction of who can participate could happen. Futures get closed out and converted to physical possession of oil. Oil gets processed into petrol and diesel fuel and sold to ordinary people. At what point in the chain of ownership does the restriction get removed? Who is responsible for the administration of this activity? The legal system that would support such a system is, to me, mind boggling.

Could you expand a bit on this, if possible? I've had the peak oil versus speculation discussion on other fora, and I still keep coming back to this point. Whatever happens on the futures' markets, someone still ends up with the oil, which I understand is quite expensive to store. And I've also seen it said that stocks are generally going down.

So, is there anyway in which speculation can drive the oil market in the absence of someone willing to pay high spot prices?

Peter.

There are two camps of thought here.

The first, represented by people like Mike Masters, from whose presentation to Congress I grabbed many of the above graphics, believe that index speculators build bigger and bigger positions (due to new capital inflows that must be invested). At the end of each month, the contracts are sold and an equal amount of the next months contract are bought - i.e. the bet is not stopped but continued. This camp believes this 'permanent bid' is a large reason for the oil rise.

The other camp believes that if supply/demand dictated it, the futures prices could go down $20,$30, $50 a barrel, irrespective of what the index funds are doing, because real producers have the ability to sell their production at any price. Remember that at contract expiration, there is someone somewhere in the world paying $130+ for actual oil. If this person is a speculator, (e.g. they can't refine or use the oil themselves), they have to store it somewhere. Worldwide non-user storage is very limited (though increasing). The wheat example above should give a clue that monster futures positions don't by themselves guarantee a bubble - there still exists a very large index long position in wheat, yet it has dropped near 50%.

In shorter version, speculation CAN drive oil prices in the very near term, but at contract expiry (which happens each and every month), someone is paying cash for that oil, and taking physical delivery of it.

Hi Nate

Great post.

The thing I can't get over with the Masters point is when *someone* actually takes delivery of the oil. If the physical delivery represented a large excess, wouldn't we see sharp downward corrections in the spot markets? As high priced contracted oil (i.e., paper oil), becomes actually deliverable oil for which there aren't actually any buyers...

Basically, I am trying to figure out the part of the feedback loop where higher prices are spurring additional production, which will be delivered to *someone* somewhere. If we had speculation pure and simple...inventories should be at historic highs ... they are not ... so, how is this speculation working vis-a-vis actual delivery of product? This has not been adequately explained in my view.... Any help would be nice.

Again, a really excellent post with ramifications that go well beyond purely financial concerns!

Herein lies one of the problems with the current system for oil futures contracts. Those who purchase contracts are not required to take delivery of the product.

Oil is essential to global commerce and to everyday Joes who need it to get from their home to their job, yet we have institutional investors and hedge funds who treat the futures market as their piggy bank and continue to drive the market higher. WTF? Someone needs to step in and put an end to these shenanigans before the entire world economy comes to a screeching halt.

In my view the Hubbert "theory" is not purely a geological theory. Nothing in geology says that you must "develop" an oil field so its output increases exponentially until depletion effects are felt. People can choose to do just a bit of "development", suck the oil out at a constant slow rate for a very long time, and then quit. In practice this is not done, because people are greedy. Hubbert described the real-life behavior of profit-seeking people interacting with geology.

I think it can be best explained (but not fully) by the Maximum Power Principle, which is the subject of my next post. Maximum flow rate has equated to maximum money which has equated to maximum social power, in the short run. It gets back to discount rates - I think Hotelling theory will end up being very wrong.

Nate, I fear your essay is moot. My view is that hoarding will ultimately occur, and probably rather soon. When that happens, the oil market will essentially and rather suddenly cease to exist. Private deals are already being made between exporters and importers. This is likely to accelerate and result in an every nation for itself, mad scramble to secure oil or perish.

Use your own imagination for what happens after this. It it unfolds this way, I don't think I'd want to be King Abdullah as the pressures on that nation will become immense.

Hey, it's a great essay and goes beyond oil.

However, yes, I think the oil market at this point is like an aging Karl Wallenda still walking between tall buildings in his 70's. There is a stable state waiting; it's only a matter of which perturbation ultimately sends it there. We're in something of a consensus trance, having tacitly socially agreed that oil is "worth just a little more than what it costs to obtain". That ain't so, it's the magic that keeps us alive in our multitudes in comfort and high dopamine.

That's the phase shift: the dawning realization that the black goo is where the magic lives and is not subject to replacement by anything. Ever. Humans are pretty delusional - wow - but this is a really really simple concept. Oil would be dirt cheap at $1000 a barrel.

There will be an abrupt phase shift, I think, after which the concept of selling oil cheaply will seem quaintly naive, like a novice hooker who only charges a nickel or Hawaiian royalty giving away their lands to the missionaries for religious salvation. The phase shift and stable state reach for us, and will find us. When Karl Wallenda ultimately spread his wings to concrete skies, were we or he surprised?

Good essay on reflexivity and good thinking, but I think the oil markets will be a short-term study when it comes to money only. Other political considerations will quickly overshadow purely fiscal ones, and I think even the ELM will be overwhelmed by an abruptly changed paradigm sooner than we might think...

Yes, once I came to understand the Maximum Power Principle, I started to think that the only reasonable approach to life is an ascetic one, where you should really continually do without things (or continually try), to not consume, to limit, to look inside for peace, because the temptation is always to want "more" no matter how much one has. The MMP is our interface with our own biology and the physical cosmos at the same time so it's hard to deny it but I think it's a trap if the energy supply is constrained, even temporarily by a drought for example. I don't want to think of god(s) laughing at our oil predicament right now, but that might be what they are doing. They are probably not crying. Why should they? They don't have material needs to meet.

No you turn to art and abstract thought etc.

Look at Japanese culture and to some extent french :)

You focus on quality not quantity. Immense wealth can be generated via high quality. A fine bottle of wine a painting sculpture etc. A fine house etc. In general you do not need any more material to create a work of art or a bunch of plastic bags.

This does not preclude advancement in sciences health etc. In fact we have tremendous room to optimize our crops and biological sciences for quality. And health would be a big factor. We do have "cyberspace" which has barely been explored. Really freeing humanity to peruse interests not labor remains a noble goal and still viable.

We turned our backs on a path that is far from ascetic. Look at the worlds Monasteries in most cases they are works of art.

Consider one case study. The Shaybah Field in Saudi Arabia was discovered in 1968. It was estimated to contain 8 - 25 billion barrels according to numerous theories. The Saudis brought it onstream at 500,000 barrels of oil per day in 1998 as a long life asset.

More recently there were acknowledged problems with loss of production from exiting Saudi Fields.

The Saudis wrote contracts to boost the production of Shaybah by 250,000 barrels a day due in late 2008. This may lessen the lifespan of the field, but will help supply the world with precious fuel for a time.

Saudi Arabia has the option to increase production at some of its fields and discovered new oil fields each year, these were smaller than the giant oil fields of days gone by. Smaller fields did not last as long.

Well lets hope the Saudi's continue to waken up to the nature of the situation. We can forgive them for their outlandish production claims but hopefully they will decide to actually reduce production and reign in their internal subsidies to create a stable economy. They have enough oil and natural gas to produce high value plastics and fertilizers for hundreds of years. Coke production could readily be coupled to reasonably large steel and cement production. Not to mention using their abundant solar resources.

With nuclear they could even run enough desalination plants to have a fair amount of agriculture.

Internally on the religious cultural side they could work towards a Muslim/Arabic culture that was unique but allowed human dignity esp for women. There is no reason that deeply religious cultures must fall prey to the abuse of power thats all to common in theocracies. Having lived in Utah for a bit I think I understand the good and bad side of theocracies better than most Americans. They are not my cup of coffee but as long as people can easily opt out and the respect and foster individual growth and the members are happy more power to them.

The Saudi's don't have to go over the edge with us and unlike us they do have time to rethink what they are doing. Some of the recent moves seem to indicate that they realize this. The save the fields for future generations comments and call on Moslem unity actually tell me they are not blind to whats happening.

I suspect that decisions like the Shaybah expansion are the last time KSA will expand production.

Yes you are absolutely correct. In fact I should have thought of this. Because my job involves what you mentioned, art. No I don't create it (don't I wish) but I teach it and explain it. (A case of those who can do, those who can't.....) And to say that it means a great deal to me would be an understatement.

Nate, just a few comments re your predictions:

1) By "lower lows," do you mean $10 oil, or something else?

2) How about a camp c), "the future is unknown and unknowable" camp?

3) Speculation forms an important feedback loop that keeps prices more closely to market (unarbitraged) values, therefore will increase in the future (as derivatives generally have, etc etc, therefore continuing this trend).

I wrote 'higher lows'. The last rally we had to $80 pulled back to $57 or so. This rally to $135+ will pull back to something higher than that, and so on, into the future.

The future is certainly unknowable. But one can create a probability distribution with all the 'possible' futures one can imagine, based on systems analysis, etc. One of the possible futures will always be 'none of the above'. Determining whether this category represents 99% of the distribution or only 5% of it is part of the reason we effort on this site - to narrow the facts as much as we can thereby reducing future uncertainty. The less uncertainty the better choices we will make.

Nate Hagens -

Very thought provoking article!

I tend to agree that some form of 'reflexivity', as you've described it, is at work in some strange way in the oil market, though it's pretty hard to pin down.

Analogies are always imperfect, so comparing reflexivity with the Heisenberg Uncertainty Principle is not quite a legitimate comparison, but I think it gets the point across in a general way (reminds me that a physics professor of mine used to have a sign over his office door saying, "Heisenberg might have slept here").

What I find maddening about this whole thing is that here at TOD I hear many persuasive arguments that speculators do not and can not have a major impact on oil prices, but then I hear other equally persuasive arguments that weird things are going on and that it's not business as usual and that the game is not being played by the simple rules of Economics 101.

One comment made up-thread struck me and sort of conforms with what I have been thinking of lately. And that is the possibility of an almost total destruction of a functioning true oil market brought about by more and more consuming countries making long-term supply deals with producing countries. Each one of such deals effectively shrinks the open global oil market by the amount and duration of the deal.

Thus, it appears to me that oil may be in the process of being transformed from an openly tradable commodity into something more resembling a utility, in much the same way that in you live in a particular town your water supply will automatically come from a single supplier, no ifs ands or buts. Pehaps something like almost Iranian oil going to China, almost all Saudi oil going to the US, and almost all Russian oil going to Europe, or some combination thereof. If things become structured in such a manner, there will be hardly any oil left to trade, except among the few stragglers at the margins.

This looks like it's going to develop into a deadly game of geopolitical petroleum musical chairs, with the people left standing turning into very sore losers.

Just to slightly flog quantum stuff mentioned higher in the thread, this statement by Nate is actually a pretty good approximation of how one might develop a probabilistic philosophical approach to being one part of a multiverse; except that the probabilities represent actual outcomes which may not communicate between one another. Nice alien thinking; reminiscent of Nassim Taleb. One need not acknowledge a multiverse to benefit from thinking this way, but it might be more interesting philosophically.

On a global scale (versus the 1st world countries) seems like we also should acknowledge the far end of the spectrum: d) those people who will fall entirely off the "oil wagon" and have to learn to get-by mostly without petroleum products because their community has been priced out of the oil market. A sizable proportion of the world's population already fits in this category but of course these folks never log onto TOD, or any other forum, and we can therefore comfortably ignore them. End sarcasm.

Ahh reasonably short term predictions I love them :)

My take on the matter.

Oil is money.

Actually its generalized a bit more in that all commodities are now the new form of money. The world has moved from a fiat currency system to one back by commodities with oil the premier commodity.

Without wheat or oil the value of everything else is zero.

Thinks about this a bit given Nates post we don't have a lot of oil per capita and agricultural production has constraints. This implies a huge deflationary force is now going on in the world currency markets.

With this view point speculative positions in the worlds commodities markets represent the real world bank and so far its woefully under capitalized.

Think about it.

memmel, I agree (as usual). but what do you mean with "the commodities markets are under capitalized"?

Well oil and commodities futures are the new world bank if you will replacing government central banks.

The central banks will attempt to manipulate and debase fiat currencies but long commodities contracts now act as a store of wealth making it impossible for them to devalue commodities.

This is a reversion to a very old type of money the wealth of the country was eventually determined by the yearly harvest the only addition for us is the extraction rate of oil. This is effectively now fixed to declining every year and in terms of commodity worth highly deflationary. You now have two base choices for storing wealth. One way is that one of the large fiat currency vendors recognizes whats happened and jacks up interest rates to make the currency a store of value and continue to do this so its pegged to oil.