Thank you for helping us spread the word and facilitate the conversation...we broke our monthly record (from last month)!

Posted by Prof. Goose on June 30, 2008 - 7:30pm

TOD:Europe also broke its monthly record--over 150k visits in the month! Talk about a "wow." Congrats guys, well done.

TOD averaged ~28k unique visits a day and ~61k views a day. Google analytics estimates that around 336,000 different visitors (by IP) came through here in the month of June. Wow...

The whole TOD enterprise doesn't happen without all of you coming here and taking part. We thank you for your patronage, your helping spread what happens here around the web, your civilly intelligent participation, and your enforcement of the norms we have created here. People can inform and learn from each other, and we thank you for making it happen.

More site stats under the fold, including our top referrers, which are sites you should patronize at every opportunity.

My colleagues here are pretty amazing people, aren't they? They work their rears off. :) Thank them the next time you get a chance--they deserve it, at least in my humble opinion!

You all are one hell of a community.

Please patronize our top referring sites (in order of number of referrals over the last three months):

http://energybulletin.net

(And if you haven't been back yet, make sure to go check out Energy Bulletin now that they are back online after their server upgrade. We feel your pain, EB. Welcome back.)

http://peakoil.com

http://lifeaftertheoilcrash.net

http://jameshowardkunstler.typepad.com

http://en.wikipedia.org

http://globaleconomicanalysis.blogspot.com

http://krugman.blogs.nytimes.com

http://leasticoulddo.com

http://andrewsullivan.theatlantic.com

http://powerswitch.org.uk

http://econbrowser.com

http://radiohead.com

Site stats:

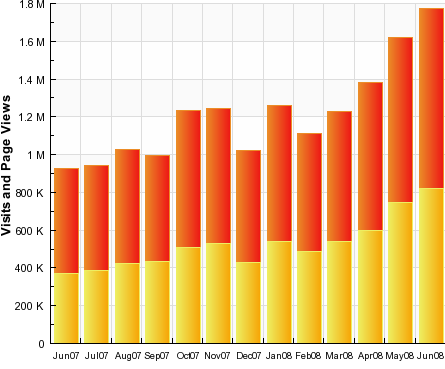

VISITS

Total 12,053,046

Average Per Day 27,901

Average Visit Length 5:30

This month's visits: ~820k in 30 days.

NB: 28k visits a day is pretty amazing...and humbling.

PAGE VIEWS

Total 28,998,438

Average Per Day 60,143

This month's page views: ~1.8M in 30 days

I'd like to see traffic plotted against the price of oil.

I would imagine they are strongly correlated.

That's exactly what I was thinking. If this is a 'peakist' site, then why are people going to visit if it appears wrong and/or unlikely to affect their own lives?

Hello Cohesion,

I suspect you're wrong on this one.

Check out the graphic at the top of this page from the BBC: http://news.bbc.co.uk/1/hi/business/7083015.stm

It's hard to see how traffic could increase at the sort of rate you see after 2000.

It helped that the folks to started this site--Prof. Goose and Heading Out--had the foresight to figure out exactly what was happening, and that the price of oil would rise. I am sure that sites selling vacations and SUVs would like to have as good statistics.

Thank you for creating and maintaining the premier energy website on the www today. TOD has been and is my first stop for any breaking news on the subject of energy. The quality of the posted research and subsequent discussion, IMHO, is unparalleled. "Hats off" and many thanks to the editors of and many contributors to The Oil Drum.

THANK-YOU, THANK-YOU, THANK-YOU all who devote their time and expertise. Without such, I would be miles behind in my understanding. Two years ago I was on the "plenty" side of the debate, a fool for believing "official" numbers. I'd probably still be spouting "But there's three trillion barrels out there just waiting to be pumped."

But it was the bottomless oil wells of Arabia that first got my attention. You know, the kinds of wells where the more you pump out, the more there is. Magical! Mysterious! And in the end, not so marvelous!

As an Average Joe (married, three kids, mortgage, average IQ), I've...

1. Learnt one heck of a lot over the past months visiting here;

2. Been thrilled at the level of detailed reply from Todsters to my often simplistic questions and observations.

Though not fully aboard the PO boat just yet (I still believe the Hubbert Curve will look more like a slowly declining plateau to a cliff), there's certainly enough regularly-updated content here to keep anyone with even the slightest interest in current energy-related affairs absorbed for hours.

Well done Keepers-of-TOD and keep up the great work!

Regards, Matt B from Australia

Hi Hi Joe Average, In response to a question you asked me a while ago, Sorry I dont get here often enough. "Why dont we see this stuff in the MS media" That is simple. In the USA "particularly" there is no Organized media, Ronald Reagan got rid of it, Organized media (not Independant media or Corporate media) is the government funded media set up purely for public education, so that citizens can be properly informed and make properly informed decisions, So to give an exampole, ":PBS (sold by Reagan) sponsered by Chevron and BP " does a report on Peak oil, running a story counter to there sponsers current line, and Jim Lehrer goes on about Peak Oil blah blah blah. Now we will cut to a comercial break, "The new Heavy Chevy SUV is the most powerful in its class etc etc, Next Jim Lehrer returns and says, we will now end transmission due to lack of funds, our sponsors have pulled out

I hope that explains it to you.

As one who has been visiting regularly since 2005, I must say that this site is one of my favorites, if not my most frequented site on the web. The information from this site is invaluable to those of us seeking to peek through that door or passage way into the future. I am looking forward, however, to the next gem that Stuart may have for us. Keep it rolling!

I've been a Peak Oil guy for about 5 years now but of late I've noticed there seems to be some acceptance it actually exists lately. Recently CNBC has been harping on Peak Oil & Canada's Globe and Mail had a multi-issue discussion on peak oil so it's possible the general public is starting to Google it and coming here.

This is nice to see. I still find more than a few people who get that glazed over look when I talk about Peak Oil to them. I just happen to be lucky enough to be working in the industry so my opinion seems to matter. Not often you have an oil & gas guy telling you to use less ;_-)

Hey hey,

What do the colors signify? Yellow and orange in the graph correspond to what exactly? New visitors vs people with accounts?

Thanks in advance,

Tim

Yellow is visits and orange is site views... :)

By the calibrated-eyeball method, that chart up top looks vaguely exponential. So would the mantra about exponential growth against a finite base apply? ;)

Depends on whether the grid fails. Could alter the shape.

As one of those new visitors, let me thank you for putting together such a fascinating resource for understanding the immense changes that are in store for the world. I knew literally nothing about energy production four weeks ago. Now I can terrify all my friends with my knowledge of the subject whenever it comes up. I have this site and energyinvestmentstrategies.com to thank.

I can't recall how I learned of TOD, but it has been a real learning tool for me and I have spread the link to scores of people including econ profs and so forth.

What a treasure! Thanks to all who write articles and those who comment. Geniuses all.

The work you are doing here is invaluable. Thank you for having the courage to say and write the things that are unpopular. Many "evils" in the world happen simply because good people don't speak up.

But the contributors to The Oil Drum demonstrate that good people can and do speak up.

What's more, we're fortunate to have such eloquent and incisive thinkers representing the peak oil case.

You'll probably never know the impact you've had on the world. It's certainly more than just the number of people who studied here because they then spoke to their friends, colleagues and families. Some of them then spoke to public gatherings and in several cases perhaps the media.

You certainly opened my eyes and my wife and I are preparing as a direct result of that. I'm working with my community to prepare it, too, and I'm sending people back here who ask how they can learn more.

Thank you to everyone behind the scenes for making all that possible,

-André

Equal Congrats!

I send people here regularly.

It has helped immensely with educating my colleagues about what is happening in the transportation sector, specifically the airlines.

Keep up the good work; I will continue to send as many new visitors as I possibly can.

THANK YOU

I first learned about peak oil from Joseph Riva ( google him) in 1998. I spoke with Colin Campbell in 1999 and Matthew Simmons in 2001 I spent many years looking for the kind of internet site that would help me traverse the interesting times we face. I found you in the days of Freddy etc. and it has helped me immensely. Thank you all for your input, effort and time. My family and friends will be just a little better off because of you.

I’m a new member and have been a lurker here as of May this year. I heard about this site from the comments section of an online version of an English newspaper. I’m ashamed to say that I new nothing about Peak oil or Hubbert’s Curve. The knowledge I’ve gained is frightening and has been a tough mental burden to bear as my family in England are more than just sceptical (they doubt my sanity I think) and while my wife is at least tolerant finds it difficult to take in especially in the absence of coverage from the MSM. Whilst I am a believer I just keep hoping that we did not hit the peak in 2005 & that the assembled wisdom in the peak community is some how flawed. I can not help but feel pessimistic in the extreme when I consider the lack action of the leaders of the developed world. My thanks to this site for giving me an opportunity to prepare and increase the chances of survival of those I care about although there is a part of me that wishes I could have been left in blissful ignorance.

Regards,

M Tremain

London, England.

Firstly, kudos to all the commentors here at TOD. This is one of the rare sites where discussion is civil and flame wars are kept to a minimum.

Secondly, kudos to Prof. Goose and his team for their relentless efforts to keep TOD fresh and on target.

There are some leaders (i.e. Roscoe Bartlett, congressman in USA) who are well aware of PO and try to sound the alarm bell every time they can. Unfortunately what you are witnessing is human behavior at the massive scale. It is very difficult if not impossible to move an addicted herd away from the spice fields and out into the desolate desert of reduced energy consumption.

Having been studying climate change science (as an amateur) I really got to grips with this site (and other PO sites) around 2 months ago. The oil price rises finally forced me to "clear my desk" of climate science and seriously consider what you are saying. For what it's worth from all I've read I think you (TOD) make a pretty good case on the whole.

I now find that had I been looking for an immediate disaster rather than reading science that interests me, I'd have been looking in the wrong place. Peak Oil seems likely to be the more pressing and immediate threat to humanity. With climate change then compounding the problems we face.

I'm still hoping I'm wrong but I suspect we're headed for a "Perfect Storm", (in time sequence):

1) The impact of Peak Oil hits us economically - ongoing.

2) Climate impacts from the ongoing loss of Arctic ice hit agriculture exacerbating food price increases - likely within a decade, then ongoing.

3) Methane releases from the Siberian oceanic shelf and from melting permafrost kick global warming into a higher gear - probably slow on human timescales, but with real risk of rapid spikes that could be significant on decadal timescale.

Against a background of falling EROEI I think we'll find the impacts of 2 and 3 greatly magnified.

Regards, and thank you for your careful, considered, and persuasive arguments.

Cobbly.

(I'm pressed for time and don't want to spam this board with OT discussion - so if people don't accept human driven climate change, that's fine.)

May I give you a mental postcard: a Welsh Male Voice Choir singing 'Diolch yn fawr iawn!'( Thank you very much! ).

Goddess bless you.

I have been lurking here for around 4 years, I live in Barbados and I have tried to explain to people who would listen the coming challenges. Few were and are interested. I would like to thank all the hard working contributors, you have enlightened me substantially. As a direct result I now own a small motorbike and I spread the word here as much as I can.

My deceased wife was a Welsh girl and she introduced me to Welsh choirs and singing. I consider this to be one of the highlights of my life.

Thanks very much.

Regards.

Thomas.

Poll idea: who uses information gained here to debate on more general topic internet forums?

I regularly bomb at least 2 other forums who occasionally have a gas price thread.

Boris

London

Me too, Boris!

The best thing was using info from here to deconstruct a Webser Tarpley video.

Many thanks to those that make the site possible.

Yeah, me too. I drop a few quotes and a link to TOD.... tends to be a thread killer. I like to think the thread ends because the other posters have gone to TOD.

Regardless, I always seem to get the last word ;-)

I found this site right at the beginning, having noticed something not quite right about the crude price. From the very outset it has been the most insightful place to go on the web regarding the subject of energy.

Keep up the good work!

Yes, thank you all! It is amazing that such a site exists (You are way cheaper than CERA and lots more accurate.) The volunteer expertise is just amazing. I have been reading TOD for three years now, and the amount I have learned is mind-boggling. I regularly regale my friends with knowledgable rejoinders to news stories about new oil finds, tar sands, ramping up nuke energy, light rail, etc. TOD is a national treasure. So glad more people are finding you.

Well, you shouldn't discount the key role that CERA and Daniel Yergin have played. As a general rule, it has been safe to assume that oil prices would trade at about twice Yergin's predicted index price, within one to two years of his prediction, AKA "The Yergin Indicator."

Unfortunately, it appears that Yergin has of late become much more circumspect in his price predictions. However, we can still use his 2004 price prediction as a unit of measurement (One Yergin = $38 per barrel). Tapis is closing in on Four Yergins ($152).

And we should never forget that CERA/Yergin, ExxonMobil, OPEC, et al, have--in effect--urged Americans to continue buying SUV's to commute to and from large suburban mortgages.

Hi Prof Goose and Staff,

In my opinion TOD is the finest blog site on the internet.

However, Resist, resist, resist, the temptation to fix what ain't broke. The next resist is the death knell, resist trying to increase your readership.

If your stuff is good the readers will find you. If YOU try to increase your readership, the failure clock starts ticking.

It was said that the original Napster P2P never advertised or did any promotion and ended up with 6 million members. Then they were closed down under copyrite laws.

Hi, reindeer.

This is an interesting point of view that one hears from time to time. In my experience, it's often spoken by someone who doesn't have a business background (I don't know whether you do or do not have a business background).

I don't put much stock in it myself. That would be like suggesting to Apple that it stop its catchy iPhone ads that raise awareness and establish the brand. I suspect your idea translated to Apple ("let the iPhone sell itself") wouldn't get very far with Mr. Jobs, nor should it.

I think the people behind The Oil Drum are committed to spreading the word far and wide, and they can count on me to do the same.

Best,

André

Hi Andre,

I have played small business for over 40 years but that is neither here nor there, its not my main line.

I hide behind the Intellectual conundrum," Is it better to do the Wrong thing for the right reasons or the Right thing for the wrong reasons"??

Our present Industrial/Commercial system only dates back to 1792. Apple only 30 years. The failure clock IS ticking. Olduvai Theory says 2030-2040 and its over.

Graham

I came across the idea of peak oil several years ago on the exit mundi site. As you might expect it was quite scary. In a nutshell, if we do not have an alternative when fossil fuels become very expensive, our civilisation is going to have massive problems.

I came across this site in the last year and have become worryingly addicted to visiting it.

I am not entirely convinced that you are right (and dearly hope you are not). For all your facts and figures you cannot account for the unknown future discoveries? If I was to describe many of what are regarded as mundane modern technologies to people living less than a hundred years ago I do not think they would believe me.

In additon, how can you accurately predict future consumption in a World of increasingly expensive energy?

That being said I am not suggesting that we should bury our heads in the sand and presume that someone will solve the problem. I think that the idea of seeking energy sources other than fossil based should be embraced by everybody (I vote we ignore planning procedures and start building 20 nuclear power stations in the UK today, right near my house is fine) alongside with significant energy conservation.

What I really do not understand is why many of you bother with this site. I have read many postings which basically say ‘We are screwed, there are no alternatives’. If you believe that, why bother with this site. Stop wasting your time drawing fancy graphs and get out and enjoy what little remains of this golden age.

I am sure I will keep visiting this site out of morbid fascination. I will some be changing my car for something that does 50mpg and insulating the cavities in my walls. During an election, energy policy will be my number one concern. However, if there is negligible change in society by Christmas I want to see some posts from people saying why they were wrong (particularly remember one guy posting quite cavalierly ‘I see the wheels falling off by end of 08’ earlier this year.

I have started visiting TOD site recently and I am more aware now that Peak Oil and Gas will be the big issues of the next few decades. I greatly appreciate reading and learning from the good work of many of the people connected to the site. The silence from the mainstream media here in the UK about this issue is deafening, and is similar to the fact that they also do not understand or appreciate how the banking system works - the fact that banks can create large amounts of new money by lending it into existence, so causing inflation and boom and bust cycles. Keep up the good work guys, it's great to know the truth rather than fantasy. Simon, North Yorkshire, UK

TOD writers are definitely smarter than yeast!

But what about everyone else?

Ernest Cline's insightful sound and light show offers one perspective:

http://www.youtube.com/watch?v=a15KgyXBX24

"Dance Monkeys Dance"

Thank you, and impressive indeed! I learn a lot here. (But it's a time-consuming addiction!)

A note of caution on the "unique visitors" count though: those of us who still have only dial-up access get a different IP address each time we dial-up.

DrumBeat seems to be the sole public access running commentary on the speed at

which the effects of Peak Energy are being felt globally.

Continually thought provoking.

Congratulations on the numbers and many thanks for all the effort.

Thanks a lot for this great site, and congratulations!

Antonio

Santiago, Chile

Although I dont comment very often,Iam on TOD every day.This site gives everyone a chance to learn about our fragile world.I have an organic veggy farm.I worry about fuel prices and supply.Would be harder work if it was done by animal labour,but can be done.Cuba is doing it with animals.THANK YOU TOD .

This comment goes especially to Prof. Goose and Gail. First of all congratulations on TOD and on yours research! I agree that we (as global community) should move beyond fossil fuels and someday there will be PO and it is best to be prepared and independent of it.

BUT Gail and others -IF your calcultions are not true or accurate then DO you all know what are YOU doing? You are helping in spreding HUNGER AND PANIC AND POVERTY of those who are already poor by helping speculators/manipulators and politicians to be more wealthy!

I think Gail and PROH.Goose know what they are doing,or they would not be spending thier precious time educating us on what is really happening in the world around us.We must educate our children and family,as to what is really going on.

Well I think that they know a lot about oil but Im just saying that you must be carefull in times like this.Becouse oil is above 140$ and mass psychology could easily bring it up to 200$ in few days without any solid reason. When they say there is PO or there will be PO within 2-3 years and demand would become higher then supply why is crude just 140$ why not 1.000$? Why there is not a single critic on this site or someone who thinks diferent? Why just left of this tag is banner with a link on American futures trading - ad is Buy Long Term Crude! Buy rather gold then oil!Gold has no important usage value so if gold is to be hedge against dollar and goes up to 2.000$ who cares, but if oil is to rally we will all be hurt!!! Price of oil soared 40% from beginning of a year and what deep fundamentaly happened in six months?

And one thing i learned there is no such thing like free advice!

Short term oil prices if not to be sustained ARE BLADE WITH TO SHARP EDGES low oil price is also dangerous! Worse thing then inflation is inflatory expectations becouse inflation can be measured but inf expectation could become limitles!

Mahir,

I’m going to offer you my perspective as far as “what deep fundamentaly happened in six months”. I don’t even consider myself an armchair economist like you occasionally find bouncing around sites like this. But I invite you (and everyone else here) took take hard shots at the very simple pricing model which follows.

I’ve been a petroleum geologist for over 30 years and have rubbed elbows with crude buyers as well as clients who were producers. The current supply/demand explanations for the run up in crude prices the last few years are often offered without looking at the real fundamentals. Again, this will seem overly simplistic but remember my background.

A crude seller will offer his product at a price he sets. Not what the refiner wants to pay and not at a price which represents what we want to pay at the pump. No one can force a price on a seller. The seller is free to set the price regardless of the supply/demand situation. If the seller can’t find a buyer at his price then he’s free to cut back his production. Many are asking/demanding that Saudi increase production so prices are pushed down. But if they were to offer an extra 500,000 bopd to the market they have no requirement to offer it for less than $140/bbl. At the moment there are no buyers for that extra production. What we’re really asking Saudi to do is lower their asking price so they take market share away from another exporter. That could push the other exporters to lower their prices…or not. They might be content to sell less oil while keeping upward pressure on prices. Consider Mexico: it’s absolutely confirmed – they are depleting very quickly and in the next 5 to 10 years they’ll loose 60% of the government’s income. What would you do if you were them: sell your reserves cheap now and save them knowing prices may be higher down the road. A tough game of chicken when you consider you’re playing with the lives of millions of your citizens.

Thus it brings us to the basic question of why the refiners are paying the asking price. Very simply, the refiners, though their profit margins have shrunk, know that they can pass on the bulk of the increase to the consumers. Valero, out largest US refiner, could easily tell the producers they aren’t going to pay over $100/bbl. So the producers say “Fine…no oil for you because we have buyers who are willing to pay the price”. Then Valero goes from making a small profit to bankruptcy in a blink of an eye. Even though current production capacity may exceed demand there is no pressure on the producers to sell for less because they are satisfied with their current market share and income. Essentially there is little to no incentive for the producers to compete with each other on pricing.

Now let’s jump back to 1986. The early oil price spike sent the world into a deep recession and cut consumption by about 15% (10 million bopd). Suddenly the producers were loosing market share so they began lowering their asking price (remember…the producers will always be the ones setting the price) so they could take customers away from other producers. This period truly showed how ineffective OPEC was as a “cartel”. Crude prices didn’t immediately plunge. Saudi kept cutting back their production and loosing market share as the other members kept lowering their prices. Eventually Saudi was faced with shutting in their entire production stream to maintain pricing. At that point Saudi opened their wells up and quickly drove oil to $10/bbl. But, I’ll keep reminding you, Saudi set the price at $10/bbl. It wasn’t us or any other buyer.

Crude oil prices have been climbing for several years although at times in big spurts. Trust me, after the price meltdown in the 80’s Saudi et al have been watching the world economy very closely. They know another world wide recession would hammer prices again. They also know it takes a year or two for the effects of higher crude prices to filter through the world’s economies. But they also know that most of the exporting countries are in decline. Even more important: Saudi knows something none of us can be certain about – true Saudi decline rate. Saudi may be at PO…maybe not. But most of the other exporters are there now.

So to sum up this long ramble it’s the lack of competition among the exporters combined with the ability (so far) of the world economy to absorb the price increase that has led us to where we are today. Certainly the world economy is retracting. India, often mentioned after China, as a growing buyer of oil, appears to be collapsing as we speak. Time will tell if the world wide demand destruction outpaces declining production rates. There are a few big projects coming online in the next few years. I won’t guess how the demand destruction/production declines/new production will balance out in the next few years. Nor do I believe anyone else can make an accurate prediction. But I do know that in 5 years Saudi will set the price for their oil. And it may be $200/bbl or $40/bbl. But it will be their choice. All we (and the rest of the world) can do to effect that decision is conserve more/drill more.

Hi Mahir,

I can make no claim to be an expert on peak oil, geography or anything else, but I find the arguments on this web site to be extremely persuasive. When you state that demand might become higher than supply you are asuming it is not already done so, a cursory glance at B.P’s statistical review of world energy 2008 seems to indicate a small decline in production although it only deals with last year, the oil price would indicate that the situation has deteriorated rather than improved. I hope to god that Prof. Goose and Gail are in some way incorrect I would certainly rather loose my whole life savings in oil futures and be wrong than be right and suffer the worst case senario of peak oil.

Been following Peak Oil for less than two months, this website has been a fantastic source of information. Many thanks.