Why isn't the price of gasoline even higher?

Posted by Gail the Actuary on July 9, 2008 - 10:00am

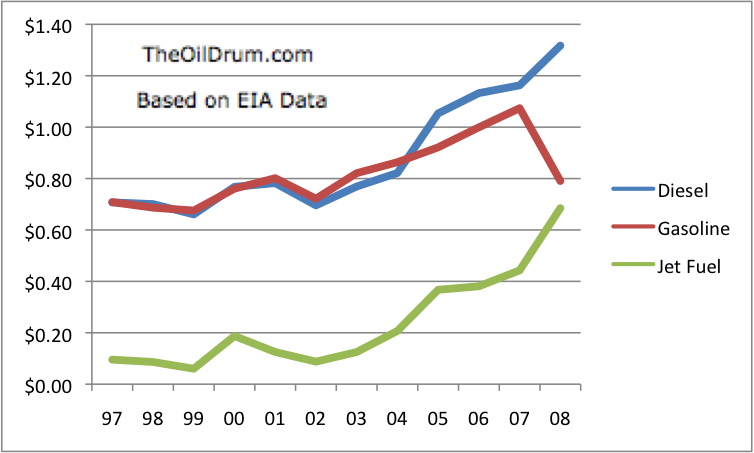

| In the last year, the price of gasoline has risen by 38%. The prices of other fuels have risen much more--diesel has risen by 64% and jet fuel has risen by 91%, and the price of West Texas Intermediate (WTI) crude oil has risen by 100%. Why aren't gasoline prices rising more than they are? Some will recognize this as the "crack spread" issue. |

I see several possible explanations, including a long term shift in prices valuing diesel (or "distillate") more highly than gasoline; political pressure to keep gasoline prices low; and integrated oil companies not really needing a high gasoline pricing margin to keep overall profits at an acceptable level. I do not see ethanol as playing a significant role at this time. Regardless of the explanation, refineries and gasoline stations that are not part of oil conglomerates may find this a difficult storm to weather.

Figure 1 shows that the differential between the retail price of gasoline and the per-gallon cost of crude oil has recently dropped dramatically, leaving a much smaller margin to cover expenses and profit. It is this shift that I am discussing in this article.

In this post, I divide my observations into four sections:

1. General observations and background

2. Changes in world product demand and recent US consumption

3. Who are the market players, and why this matters

4. What might be ahead?

In this post, I have not tried to address the question of how the futures market fits in with this situation. If prices in the futures market align with what buyers and sellers of the physical products would pay, futures markets shouldn't be an issue. If the futures market is tending to raise the price of some products and leave others artificially low, this could be contributing to unusual differentials that seem to be occurring now. For example, if speculation is playing a role in the high price of crude oil, but is having a lesser impact on gasoline ("RBOB"), it would seem like this could be causing dislocations of the type we are seeing.

Section 1. General Observations and Background

There are several problems with trying to analyze very precisely how much margin refineries need to be profitable. One problem is that refineries make a mixture of products. Another is that one really needs to break out costs more finely than I am doing in this analysis, to analyze very precisely what is happening. A third problem is that many of the costs, including refinery operation costs and some taxes, will vary with the price of crude oil. Thus, one would expect an upward drift in pricing margins over time, as we are seeing for diesel and jet fuel in Figure 1.

Clearly, the particular comparison figures make a difference also. In Figure 1, I am using average retail prices for regular gasoline, for diesel (all types combined) and spot prices for kerosine-type jet fuel at New York Harbor. Gasoline, distillate (which includes both diesel and home heating oil), and jet fuel are the three biggest categories of US petroleum products.

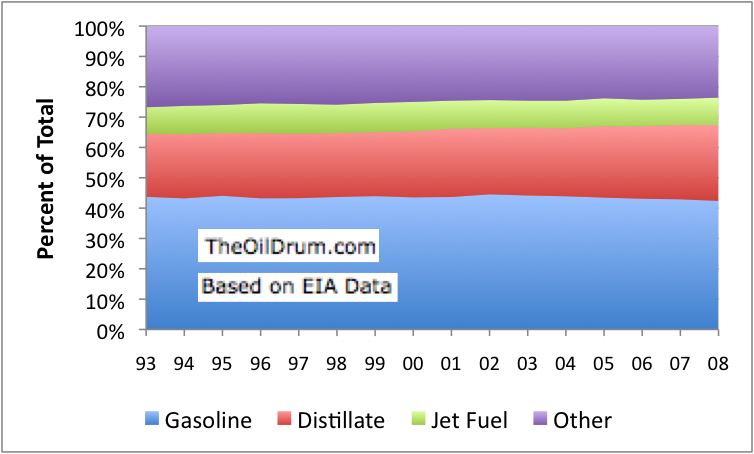

If we look at the output of all US refineries (Figure 2), we find that recent years, the distribution of the production of the various petroleum products has remained relatively constant.

Figure 2 shows that gasoline production has remained in a tight band at 42% to 44% of US refinery output. Distillate, which is used for both diesel fuel and heating oil, has gradually climbed from about 21% of output in 1993 to 25% of output in 2008. Jet fuel has been fairly constant at about 9% of total production. The "all other" category has declined from 24% to 21%, as distillate production has grown.

It seems to me that there are several reasons why shifts in production don't happen very quickly. For one, the mix of oil fields feeding our refineries changes only very slowly over time, and the particular oil going into a refinery is a significant determining factor of the mix of products coming out of the refinery. For another, even if a refinery has "cracking" or "coking" capability so that it can change the mixture of products it produces, it is expensive to use, and only a part of the refinery output will use it. Also, our built infrastructure uses a particular mix of products. This mixture can change over time, but only fairly slowly.

What does this pricing shift mean for refineries?

I think there are really two issues. One is that margin for gasoline refining is dropping. In fact, since we are looking at the difference between the retail price and the cost of crude, it is the whole top-to-bottom margin that is dropping, so there is less available not only for refineries, but for other operations such as gasoline stations. There have been many reports in the news recently about gasoline stations closing because of financial problems.

The second issue is that margins for diesel and jet fuel do not seem to be rising enough to make up for the drop in the gasoline margin. It is difficult to tell for certain, without knowing how much of the costs are fixed costs and how much are variable costs. I would expect that costs of refining would be quite closely tied to the price of crude, because refining is very energy intensive. If companies are looking at only the dollar spread, they may be underestimating how much their costs really will rise with higher crude prices, and think that the pricing margins for distillate and jet fuel are more adequate than they really are.

Because of the differences in margins by product, refineries may be able to improve their financial results if they can change their mix to generate more distillate and jet fuel, and less gasoline. Overall, they may still come out behind in terms of profitability, if pricing margins for distillate and jet fuel have not risen enough to offset the decline in the gasoline margin. Refineries that are producing a lot of gasoline now and lack the capability to change their mix will almost certainly suffer a loss of profitability with the current pricing margins.

Section 2: Changes in world product demand and recent US consumption

Recent US consumption trends

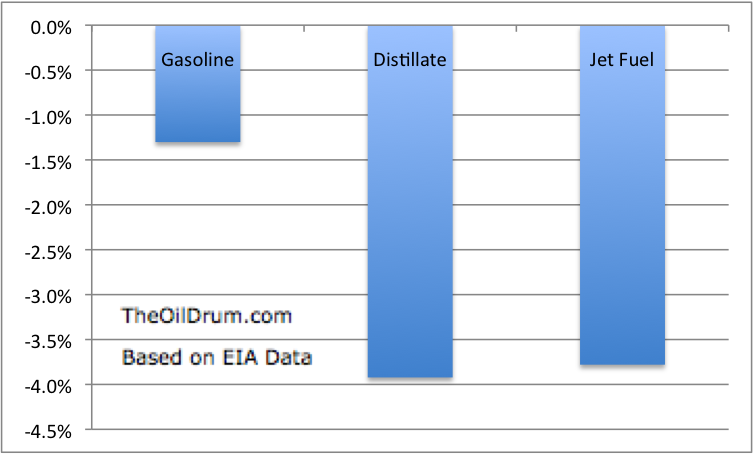

If we compare US consumption of various oil products in the first four months of 2008 with the corresponding amounts for the first four months of 2007, we find that US gasoline consumption dropped less than any other product.

Figure 3 indicates that consumption during the first four months of the year dropped by -1.3% for gasoline, -3.9% for distillate, and -3.8% for jet fuels. Other products, not shown on Figure 3 include residual fuel oil, -21.6%; asphalt, -13.1%; and natural gas liquids, -5.8%. Overall consumption of petroleum products decreased -4.2%, which is a huge change. These amounts are calculated on an average daily basis, and reflect the fact that 2008 is a leap year.

Thus, what we are seeing is that gasoline, with a disproportionately low price increase, is holding up better in consumption than other products, with larger price increases. Part of this is the fact that with the lower price increase, Americans have had less need to cut back on their demand. Part of it, too, is that it has been possible to continue to get imports, even with this relatively low price increase, indicating that overseas demand for gasoline is not high, compared to other products.

Part of what is happening is that US exports of petroleum products are increasing. In the case of distillate, we have shifted from being a net importer to a net exporter (Figure 4).

Four months is a fairly short time period, and I am not certain that shifts in consumption among the various petroleum products during this period are necessarily indicative of longer-term trends. There is considerable seasonality in American's automobile driving and in the use of heating oil, and this may be affecting the numbers. It is interesting that gasoline prices have continued to stay disproportionately low, even after the summer driving season would normally have begun.

The world market is perhaps beginning to value distillate more highly, relative to gasoline, because of its greater energy content.

I think part of what may be happening, on a worldwide basis, is a change in the relative value of distillate and gasoline. Gasoline started as the higher valued fuel, but is now becoming the lower valued fuel.

As I understand it, when the United States first began refining petroleum, gasoline was viewed as the premier product. It was cleaner burning than diesel, and cars that ran on petroleum had quieter engines. The majority of petroleum produced in the US was light sweet crude oil. With such crude oil, it was easy to produce a high proportion of gasoline, with little refining effort.

With these considerations in mind, the US auto fleet was built using gasoline as its primary fuel. Refineries were optimized for producing the maximum amount of gasoline. The price of gasoline was set as high, or higher, than that for diesel. Diesel was viewed as almost as a byproduct that could be sold at a lower price to support gasoline sales.

When petroleum was cheap and plentiful, this approach may have made sense. The catch is that diesel is really the better value, in terms of the number of miles per gallon that vehicles are able to drive. Part of this difference is because of the higher energy content of diesel relative to gasoline, and part of this is because diesel engines tend to be more efficient. Another problem of the past--the bad odor of diesel emissions--has also been eliminated by removal sulphur from the diesel during the refining process.

Now that the price of petroleum is increasing, the consumers are becoming increasingly aware of the value of distillate fuel. We see this in several areas:

• European countries many years ago recognized the greater inherent value of diesel compared to gasoline, and taxed the use of gasoline so as to discourage its use. In recent years, there has been more and more shift toward diesel powered cars, as the lower cost and higher mileage of diesel cars becomes more important to consumers.

• India and China have also have adopted tax structures that favor the use of diesel cars over gasoline vehicles.

• Diesel is becoming the fuel of choice in a wide variety of applications around the world. These include electric power generation; backup power where power interruptions are a problem, and many industrial applications. Recent cold weather also increased the demand for heating oil around the world, further adding to demand of distillates.

With these shifts, world demand for distillate is rising more rapidly than demand for gasoline. Europe in particular tends to have left-over gasoline to export. I would expect the amount of left-over gasoline from around the world to grow, or decline less, as it continues to be the less-favored product.

At his point, biofuels are not really an issue for distillates. Costs are proving to be very high using palm oil or rape seed. Thus, there is no possibility of increasing distillate availability using biofuels, unless there is a scientific breakthrough.

Ethanol impact

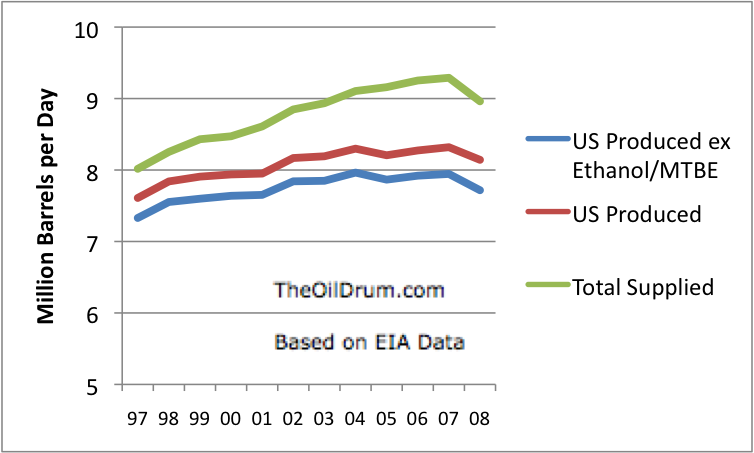

Other authors assume ethanol production is increasing gasoline supply, and that this may be helping to hold down gasoline prices. While this is theoretically possible in the future, to date ethanol added to the gasoline mostly offsets MTBE taken out of the gasoline supply.

When ethanol production was ramped up in the 2004 to 2006 period, one of the major purposes of ethanol was to act as a replacement for MTBE. MTBE is an oxygenate that many states banned because it contributes to groundwater pollution. MTBE is made from natural gas and had the side-benefit of extending the oil supply fairly cheaply.

The EIA provides data showing the total amount of oxygenates (MTBE + ethanol) added to the gasoline supply. Between 2003 and 2007 these increased from 343,000 barrels a day to 374,000 barrels a day, an increase of 31,000 barrels a day. This is hardly significant.

Of course, if one ignores the prior MTBE use, ethanol is adding to the fuel supply today. In the future, ethanol is expected to further increase the gasoline supply. Even if the amount is small, the higher supply may help hold down gasoline prices, and further exaggerate the shift in prices between gasoline and distillate that we are seeing. Longer term, the effect of this will be to encourage refiners to produce more distillates and less gasoline.

Section 3: Who are the market players, and why this matters

Refiners are the real buyers of crude oil

If one stops to think about it, the most direct factor determining crude oil demand is the number of refineries bidding for the crude. In general, refineries would prefer to be at full production, except when they are off-line for maintenance.

If refineries believe that they cannot sell all of the product they are making at a satisfactory price, they might also choose to limit production. One example of this would be refineries in China, where retail prices have been capped, but refineries must still buy crude oil at the market price. China recently raised retail prices. One might expect this to increase crude oil demand from refineries there, since they will now be able to sell their products at a better price.

Another example of refineries that would choose to limit their purchases is refineries that expect to lose money on the product mix that their refinery can produce, given current pricing margins. An example of this would be almost any US refinery that makes mostly gasoline using sweet light crude such as WTI, and is not set up to change its product mix significantly.

If a refinery is part of a vertically integrated oil company, it may be willing to live with very low refining margins, because even with these low refining margins, the profitability of the company as a whole is adequate compared to non-petroleum companies. In fact, vertically integrated petroleum companies may actually prefer these low refining margins, because with "normal" refining margins, there would be great hue and cry for excess profits taxes on these companies. If margins are low, vertically integrated companies may be using refining losses to offset part of the profits generated by, say, producing oil at $50 a barrel and selling the refined products at current prices.

I doubt that any politician would challenge artificially low refining margins for gasoline, since it means lower gas prices for constituents. In fact, pressure from politicians may contribute to the relatively low gasoline prices we see.

When it comes to buying gasoline overseas, these lower prices may not a huge problem, because the gasoline that is on the market is surplus gasoline, produced as part of the refining mix. Producers of the gasoline may be willing to take any reasonable price, if other buyers are not available.

The problem, of course, is that if gasoline prices are depressed for any reason, non-vertically integrated refineries are at a huge disadvantage. They are forced to buy crude oil at a high price and sell gasoline at a low price, because they have no other choice, and have no other companies in the group to share the poor results with.

Some non-integrated refiners can change their product mix to optimize profitability. These refiners may do better, although there is no guarantee that they will be profitable. If integrated petroleum companies are able to live with low enough margins, it is possible that it will be virtually impossible for non-integrated companies to produce a product mix that will provide an acceptable profit level.

Local service stations are intermediate buyers of gasoline.

It seems to me that the situation with service stations is not all that different from the situation with refiners. The gasoline produced by various refineries is placed in the pipeline, and service stations purchase it. The service stations that are owned as part of vertically integrated operations may be willing to live with a very low margin between the retail price of gasoline and the wholesale price of gasoline, because the loss can be offset against profits elsewhere.

Non-vertically integrated gas stations are put in a difficult spot, because they have to compete for customers with the vertically integrated gasoline stations. Quite often, there are two gas stations on a single corner. If one station sells regular gasoline for $4.09 a gallon, it is difficult for a nearby station to sell gas at $4.29 a gallon. Even $4.19 is a stretch.

Section 4: What might be ahead?

It is not clear how long the very low refining margin for gasoline might last. If underlying issue is a shift to greater demand for distillate and jet fuel, relative to gasoline, it could take years to completely resolve. If political influences are involved, it is possible that the situation could resolve after the next election.

If refining margins continue at their current levels, I would expect many bankruptcies among refiners that are not integrated with companies that also produce crude oil. This could happen around the world, since the issue is not particularly a US only issue. The refiners at greatest risk of financial difficult are those that currently make primarily gasoline and lack the capability of switching to other products.

EIA data indicates that utilization rates in the United States have been drifting downward, as shown in Figure 6. This might indicated overcapacity of certain types of refineries.

It is possible that the failure of a few refineries making primarily gasoline (and lack the capability of switching their product mix) would help get refinery supply back in line demand, at least with respect to refinery capacity for light crude. The smaller number of refineries for light crude would reduce the number of companies bidding for light crude, and would therefore cause its price to drift lower. Profit margins for remaining refineries would tend to rebound if there is less competition, and would help get the situation back to more normal pricing margins.

A problem might occur if there are too many refinery failures. It is theoretically possible that the world could be left with inadequate refining capacity if an excessive number of refineries fail. I expect that at least some governments would step in before they allowed a local refinery to fail, since output of a local refinery is often the source of local petroleum products. If governments get involved, pricing margins could remain distorted for a long period.

I expect that quite a few service stations are likely to fail also, especially ones that are not part of integrated companies. The failure of a few service stations is likely to have little impact, except in rural areas where service stations are rare. In these rural areas, some people may find it necessary to drive long distances to find a service station.

If diesel is gaining in demand relative to gasoline, I would expect the price for sweet medium grades of crude to rise closer to the price of sweet light crude oils, since medium crude yields a higher proportion of distillates and jet fuel. This shift in crude oil prices will tend to help get refining margins back to a more normal level.

If there are failures of non-integrated refiners and service stations, these are likely to start fairly soon, if refining margins remain low. Refineries and service stations are likely to find it difficult to maintain adequate credit facilities to borrow the funds they need to buy crude or gasoline. Once they lose their lines of credit, they are likely to go out of business quickly.

These are ideas of mine. I would be interested in hearing readers' ideas as well. Some of you have a lot more hands on knowledge of the situation than I do.

Here is the key. When refinery utilization has some room to increase, and demand is soft, it is very difficult to maintain margins. There is always someone there to fill a supply gap if necessary. That is one big difference from a year ago that has kept margins soft. Inventories got very low last year, and there was no additional supply to keep them from falling to record low levels. Therefore, price rose to (then) record levels.

The other factor is that - at least the last time I checked - gasoline imports were much stronger this year than a year ago. That's what kept inventories from falling through the floor this year.

Glad to hear your comments. You are a lot closer to the situation than I am.

I think the stronger imports this year are related to the relatively low demand for gasoline from Europe etc. that I mentioned, at least partly because of the continued switch to diesel.

Clearly US refinery utilization has been coming down for several years, providing the extra refineries to compete to fill the supply gap.

Gail,

The Chinese are buying up diesel to run stand-by generators because of power shortages.The recent earth-quake has made the very tight electricity availability even worse because of hydro dam damage. SE Asia, and possibly middle east refineries sell of surplus gasoline to Australia, and probably US and rest of world.

Until China can build enough nuclear and coal power plants to supply electricity diesel will remain at a premium. India's new refinery that is designed to use heavy crude may also ease diesel shortage when it comes on line later this year.

If US has to go to rationing, better to be on gasoline as many essential services will get the diesel first. Also increases in CAFE standards should mean more a reduction in gasoline use. Fast tracking real big improvements in CAFE( INCLUDING SUV'S AND LIGHT TRUCKS)could really hold down to some extent further gasoline price rises.

I think you are right about the Chinese and diesel for backup generators. I think we are seeing more of that in other parts of the world.

I agree with you, too that rationing of diesel is likely to leave little for the regular driver.

I don't think CAFE standards are going to be all that important. They phase in too slowly. The economy will be in such poor shape by the time they become effective that there will be few new cars built. People are already sufficiently frighted by the high prices of gasoline that they are looking for higher milage cars, and I expect that to have a fairly big impact now and in the near future. The changed attitudes is likely to do more, quicker, than CAFE ever could.

Gail: That is basically my read of things too. Increased imports of finished gasoline to the US have depressed prices here and put the hurts on domestic refiners. As I understand it, you can generally get more gasoline than diesel out of a barrel of oil, and the US consumes 43% of the world's gasoline, so we're basically the beneficiary of the rest of the world trying to refine a sufficient amount of diesel to power themselves. I wrote two articles addressing this, and much credit to Robert for my education along the way:

High Gasoline Prices Are Here to Stay and The Big Picture on Q2 2008, Part 1

I heard today that some of the US refineries have been trying to add cracking capability, so they have more flexibility in what they produce, but have had difficulty in getting the EPA to approve the changes. This leaves them tied with less flexibility.

The thought that I had, particularly in Europe (which is mirrored in usage to the US) is to go for a petrol powered vehicle. Not only are prices of diesel going up fast, but with the increased costs goes an even fast shift to diesel powered vehicles by most people (we are already past the stage where diesels are the majority).

However there is only so much flexibility in the refinery outputs (think that's what Robert said) and so is likely that its diesels which will feel the pain more in Europe. That goes double if rationing comes in, when trucks all use diesel and would have first dibs on supplies.

Thoughts?

One of my pals is considering a LPG car.

I have no idea what the security of supply is on that, or if taxes are going to be increased until there is no benefit - apparently they have risen by rather more than the tax on petrol in recent times.

If I remember correctly, you are in Britain.

I would consider an LPG car a short-term solution. Britain is headed for a natural gas shortage in the next few years according to Euan. Since the electric grid there uses electricity, this is a real problem. Britain is at the end of the supply line from Russia, and closer supplies are declining.

Britain it is Gail.

Darn nuisance these electric grids that use electricity! :-)

I know what you mean though.

A cold winter in Europe could see the cuts start this year.

Still, we have Gordon Brown on the case - or 'the revenge for Culloden' as he should be called.

Interestingly, it was the 'prudent Scottish bankers' who lost perhaps half of the money the country possessed in the Darien scheme, with a little help from perfidious Albion, and got bailed out as part of the terms for the Act of Union.

Somehow I doubt the EU will want us.

Yes, I'm starting to feel cold just thinking about this winter.

The Russia - Ukraine dispute may cause a crisis in Europe this time, and I heard somewhere (probably here) that Russia are also diverting some of their gas to electricity generation to replace the reduced output from their hydroelectric generation.

I'm only thankful I'm not in Ireland, which is even further away from the source.

FYI the P in LPG stands for Petroleum. I don't think any serious amounts of propane is created with natural gas as a feedstock, and I don't know if butane has even been tried before. LPG is oil, so doesn't really make any meaningful difference with regards to Peak Oil, although it can be cleaner burning than the higher hydrocarbons.

I just got back from Hong Kong one week ago. All the taxi's were LPG because gas is heavily taxed. Much of transportation was electric. The british style trams (double) were very odd-looking.

All the glazing was single layered glass. That bothered me, with all those ACs blowing like madness!

GAIL,

What did you think of T.Bone Picken's Nat Gas solution he presented yesterday?

I thought it made good sense, but I know a lot of people here would denounce it just on principle.

I should write a post about the US natural gas situation. Our supply is up a bit, but demand is up even more. One part is electric utilities using more natural gas; another is other kinds of uses, such as private autos making use of the fact that natural gas is presently cheaper than oil in terms of its energy content.

What I see as happening is various uses sending the natural gas price up to close to parity with the oil price. The amount of natural gas produced will go up a bit, but not a lot, because it takes a long time to put in pipelines. Also, we are close to maxed out on drilling rigs. Unconventional gas will be hard to ramp up much, because so much drilling is required.

At the higher natural gas prices, people with the new NG cars will find they don't save much money relative to gas engine cars. The fuel will not be widely available, because at current NG production levels, there isn't much NG available for cars. The price of electricity will soar in places that depend on natural gas, like much of the Northeast, California, Texas, and Florida. Homeowners will be up in arms.

About this time, natural gas supply will peak, and production will begin to decline. Then we will have all of the new users competing with the utilities, the ethanol plants, the plants making low sulfur diesel, the fertilizer plants, homeowners heating their homes, and regular manufacturing plants for NG. There will be a lot of unhappy former NG users.

Excuse me Gail if I missed your answer to research24 in which he asked your opinion about T Boone Pickens' proposal. Perhaps you missed it but yesterday on Nightly Business Report on PBS he gave some details. His idea is to use the windy corridor in the middle of the country to generate electricity and use natural gas as transport fuel. He would use electricity for transportation where possible and use LNG for auto and truck transport fuel by adding natural gas filling units to existing gas stations at a cost of about 400K per station(yikes!). He would use the grid to heat residences and run industry more.You of course will see lots of problems with adding all this capacity to a grid which is old and creaky and which couldn't absorb all the new input without a massive build out. Your post was very good and explained a lot about the refining business. I would be interested in seeing a list of the various refiners including what their capability is vis a vis coking and cracking equipment on site, output capacity etc. I have also read that some products like asphalt may become increasingly expensive because some of the newer refineries with the new coking units can squeeze more distillate out of their crude and don't have to sell off the residual asphalt cheaply.

You are right. I didn't see the details of T Boone Pickens' proposal. I think a major hold-up to Pickens proposal is that it would need a huge overhaul of the grid. I don't see that happening within 10 years, even if Congress appropriated money tomorrow, and started work on getting contractors to first design the upgraded grid, then actually get the parts and build it. By 10 years from now, US natural gas will be past peak, as will oil. It is hard to see anything major happening at that point.

I am afraid I don't have a list of who has what in terms of coking and cracking equipment on site. Perhaps one of the readers knows of such a list.

I know that asphalt and residual oil are already disappearing, as refineries with crackers and cokers refine them into higher-priced products. The oil companies see this is a way of getting maximum profit from the crude oil, but it is leading to a lot less asphalt.

All rickshaws in karachi are running on either CNG or LPG, 80% are on LPG, 20% on CNG.

A move to CNG and LPG replaces using NG to upgrade heavy sour oils not to mention the other critical uses for NG.

In my opinion we are heading quickly towards a world with the following fuel desirability levels.

light sweet > sour sweet > NG/LPG > heavy > heavy sour.

This is profoundly different from todays world with the heavy crudes priced at a premium to NG.

If I'm right then the light sweet vs heavy sour spread is going to widen considerably and NG cost reach parity and surpass the heavy oils.

This means refining the heavy sour crudes will quickly become only marginally economic. Your better off simply using the NG and propane directly. Your example shows this sort of transition.

CNG is actually the only real competitor for diesel in heavy trucking so expect a long term trend towards CNG is na lot of areas for heavy transport. Or better flex fuel trucks.

http://www.cleanfuelsohio.org/email_vol14.htm

SWACO’s truck was converted to run on a blend of compressed natural gas (CNG) and diesel fuel by U.S. Energy Initiatives Corporation (formerly Hybrid Fuel Systems), based in Atlanta. The system installed by U.S. Energy includes a computer interface that adjusts fuel blend levels recalibrates the engine on the fly for optimal combustion. Other installed components include tanks, lines and a pressure regulator for the CNG.

“This is the cool part about my job,” said Tim Berlikamp about the new heavy duty CNG vehicle in the SWACO fleet. “This is what I love to do.”

Needless to say at some point there will a huge squeeze on gasoline supplies from the critical industries via optimization of refineries for diesel production and directly using CNG and bypassing refining of the heavy sour oil unless they are steeply discounted.

Needless to say export land faces a big problem if the exporting countries are setting on large supplies of heavy sour oil KSA and Iran are two that come to mind. They will see economies continue to grow light sweet prices go up and no demand for the heavy sour oils except at what they consider insulting prices.

What do you see happening with medium sweet? I was thinking it would move up relative to light sweet, because it is easier to make distillate from.

I think the medium sweets should track the lights. And your right you get more diesel out of them.

It really all depends on the various spreads not the absolute prices. As far as I know medium sweet is about equal to light sweet if you have a reasonably complex refinery.

One thing we don't do on the oildrum which is a shame is pay more attention to the spreads and prices of the various grades of crude vs NG/LPG although the absolute prices will continue upwards its the spreads that really matter if a refinery cannot make money refining certain inputs it won't refine them the absolute price is not relevant.

This is another place where free markets tend to have a tough time overall price increases tend to squeeze spreads but to meet demand you need the spreads to widen the net result is a fairly viscous upward spiral until demand drops. The problem is of course there is no downward pressure the spread is being widen via price increases not decreases. Oil producers might even make the claim that the market is well supplied because no one want to pay the prices they are asking for lower grades of crude.

But I can't imagine that any of the worlds crude producers esp the largest one would do something like that.

Two replies.

Overall I think that a move to flex fuel trucks that can handle a mix of diesel/biodiesel/CNG/LPG etc makes so much sense that we will go that route.

If we just assume simple carnot efficies the NG+heavy source = 60% and diesel -> mechanical = 60%.

60%*60% = 12% efficiency

But burning the NG/LPG directly but mixed in with diesel gives you 60% a 48% increase in efficiency.

Given that trucks take known routes and the service stations that provide fuel for trucks retrofitting to handle pressurized ng/diesel mixtures should be fairly easily doable. And given the premium for diesel the economics should work out.

You can dissolve a lot of NG into diesel under pressure.

Found a patent on this :)

http://www.patentstorm.us/patents/5315054/description.html

I learn something new every day. I had never heard of dissolving NG into diesel.

Me too - I never knew that 0.6 * 0.6 = 0.12

Crap :)

Its .36

The difference is then 0.6-0.36 == .24 or a 24% loss in efficiency.

Way to many dead brain cells and this is why the population of Nigeria is 300 million :)

Now you know why I quite doing synthetic chemistry a few mistakes like this and kapow.

I had my fair share of ohh shit moments esp if the reactions where in german.

One of the things I've learned in life is do not start a synthesis translating the german on the fly !!!

They like to put very important info near the end like what not to do to keep from blowing yourself up.

Saure and what this ? ohh crap.

In any case its a significant loss in efficiency so the argument still holds.

Hydrocarbons are quite soluble in each other. This is where all the gas comes from when you pump oil and take it to atmospheric pressure just like co2 in water.

I've got no idea what the exact solubilities are but its pretty high.

Found this.

http://pubs.acs.org/cgi-bin/abstract.cgi/jceaax/2004/49/i03/abs/je034138...

Thats not diesel closer to gasoline and I did not grab the paper but they are pretty high.

This trick is played with gasoline in the winter extensively i.e dissolving in volatile hydrocarbons.

I can't find the exact numbers but at least 10% is reasonable and a lot more at moderate pressures.

Adding in stuff like propane would probably help a lot.

It should be in this paper bit no access.

http://www.osti.gov/energycitations/product.biblio.jsp?osti_id=5244383

Diesel's kind of hydrophilic, and methane is of course completely nonpolar, so old or wet diesel may very well be a poor solvent for methane. But their mutual solubility is a complex function of pressure & temp in any case, so it would be tricky, to say the least, to volatilize the heavy liquid and the gas in a constant ratio.

"Like dissolves like" suggests you'd have better luck dissolving propane in gasoline.

http://www.globalfia.com/downloads/manual.pdf

page 14 has some constants but I can't quite figure out what they are saying.

But they seem happy enough to use simple mole fraction calculations.

Surprisingly real solubility at pressure seems hard to find this suggest simple mole fraction arguments are probably good enough and they are infinitely miscible into each other.

Memmel

Was "sour sweet" meant to be "light sour"?, was tending toward a chinese menu...Neven

sour light :)

Bad day it seems.

1.2 million cars out of a total fleet of about 8 million cars are running on LPG in Thailand. More and more larger trucks are switching to CNG.

Robert

Pretty much all Hong Kong taxi's are LPG powered. A ride costs 15 HKD for the first two km. Just a bit more than 2 USD.

If oil was expensive, I sure didn't notice it there.

I think you are right about trying to look ahead to where the supply will be in the future.

It looks now like the tightness in supply will be worse on the diesel end of things, so petrol (gasoline) might be better, especially if taxes aren't too terribly unreasonable.

I have a hard time seeing refinery outputs changing very far, vary fast. We have basically the same oil fields and the same refineries. We can process a little of the oil differently and produce more diesel, but it is hard to see how the percentage will go up very much, very quickly. My graph of US refinery output shows how slow things have been to change here.

Well things do change anecdotal evidence indicates the US has continued to expand refining capacity esp complex refining capacity. The good news about the complex refiners is they have a lot more control of the product mix and can produce more gasoline and diesel from the heavy high sulfur crudes. The combination of excess refining capacity increasing NG costs and until recently decreasing spreads has not been good to complex refinery operations. I don't know about the rest of the world but I'd guess that both Europe and South Korea have also expanded to more complex refining and same for Japan.

http://www.secinfo.com/d17EG1.1Gq.htm

Generally complex refineries are associated with processing of cheaper heavy sour crude but I don't see why they can handle lighter crudes or a mix. Robert can correct me if I'm wrong. Residuals are residuals so cokers work on the residuals of light sweet processing just as well as heavy sour.

It would be a great number to know but the relative fraction of the worlds oil converted to diesel and gasoline is probably a good bit higher today then five years ago because of expanded complex refining operations. This has put strong price pressure on residual products such as bunker fuel, asphalt and fuel oil.

Of the two diesel and gasoline diesel demand is more inelastic and used in commerce etc and has to expand with the economy you don't have a choice.

This has caused diesel prices to continue to increase inline with oil/NG costs while the extra gasoline is sent to the US.

I expect this trend to continue for at least another year with gasoline substantially lower than diesel and refinery utilization below capacity at least in the export land refineries. As long as we continue to have growth I can't see the spread between gasoline and diesel collapsing all that much for a while.

Fuel oil prices are also worth noting they are very strong and its another area where demand at least in the US is fairly inelastic. Some conservation is always possible of course but a big demand drop is probably not possible over the short term. So expect fuel oil prices to trend up more inline with oil prices.

Now I have heard of a new refinery in Spain that will only produced diesel no gasoline its also geared towards biodiesel. This statement was from a business man involved with the project I can't see how they cannot produce some gasoline but he was not a engineer. I did not press him on these "bold" statement.

This implies some sort of FC transformation as part of the refining process or using the lighter products for hydrogen or something. Needless to say a world wide move to emphasis diesel production over gasoline will make increasing economic sense and does not bode well in the long term for plentiful cheap gasoline imports into the US if its economically possible to significantly change the diesel/gasoline fractions.

I think the economic incentive to optimize for diesel will continue to grow overtime how well this can be done is going to determine how long relatively cheap gasoline continues. FT processes in a GTL/CTL context may not be economic but as part of a complex refining process they may well make sense. Googling indicates that its used in refining but I'm just getting patents. I don't see any technical barriers to optimizing extensively for diesel and producing little if any gasoline.

So Robert is it possible to move refinery output almost entirely to diesel and lower level products ?

Do you or anyone else have links where we can find breakdowns of petroleum products produced in other countries besides the United States? It would be nice to be able to look at some actual distributions of gasoline/diesel/other.

I know that it is possible to have very different mixtures. This is slide showing the mixture for Hawaii. I would presume they are using something other than light sweet oil as input.

If you want to start modifying refineries for more diesel, it would be cheaper to keep the gasoline and get rid of the kerosene and jet fuel.

If you want to go with petrol, you could get a Prius or get a B class subcompact with the smallest engine available, usually a 1.0L. Either one should use about 5L/100km with the Prius being better in the city.

http://www.reddit.com/info/6qy7u/comments/

http://www.reddit.com/info/6qy7y/comments/

http://www.reddit.com/info/6qy80/comments/

I agree that gas prices are oddly lower than one would think they would be.

I have long advocated that Nancy Pelosi and Harry Reid launch investigations into why gas prices aren't higher.

The Democrats should also enact a "Paltry Profits Program" to compensate refineries for their low profit margins.

LOL!

One cubic meter of natural gas has as much thermal energy as one liter petrol (37.8 MJ). If crude oil is $140 per barrel, $140/159 = 88 cents per liter then natural gas should be $880 per thousand cubic meter. That is not even considering refinery profits.

We have had a whole slew of links posted with NG producers predicting thermal parity between oil and natural gas.

My mondo meta model says that all energy sources eventually go to the same price minus a quality discount.

This means that in the end you pretty much pay the same for energy electric/oil etc. Sort of a singularity at this point only efficiency gains work.

The only way out is renewable/nuclear electricity coupled with efficient electric rail. But eventually all fossil fuel conversions are forced to a constant.

For example if the price of gasoline rises enough that CTL is viable coal would be diverted from electric production to CTL driving up the price of electricity. Eventually without expansion of renewable or nuclear you reach a sort of balance with no real benefit of one method over another. Rail of course still wins even in this case on efficiency grounds but rail without a move to renewable electric rail is not a long term solution. Its still one of those partial solutions that only delay the day of reckoning.

What we have to do is pretty clear we don't actually have a choice except to pass on the burden to later generations but they will have to deal with it with less resources then we have today.

Whats funny is most 18 year old kids don't realize that their parents are robbing them blind.

My kids are a little older than 18. They really don't like hearing about this. I don't think they have thought about the "robbing them blind" aspect.

Liquid fuels will always be at a premium because they're easy to store in vehicle fuel tanks. Gas or coal may approach the same price per unit heat as oil, but there will still be a discount because of the inefficiencies of GTL/CTL conversion. A carbon tax will make coal even less economical.

Price is not (directly) related to Cost. Price is an agreed amount that the consumer is willing to pay and the producer is willing to accept. The refiners cannot arbitrarily raise to price to any level and expect people to buy it. The consumer is (should be) unconcerned with the production costs of the product. The consumer is only concerned with the value of the product to himself.

There is a relation between Price and Cost and it is quite simple. If the cost exceeds the price then the product doesn't get produced (Thereby reducing supply and raising the price). However, as I understand it, gasoline is a byproduct of deisel production so in that sense it is "free" to produce (We've got it, we might as well sell it). This argument ends up working for any given product from a barrel so what the refiners really care about is whether the total product price from a barrel of oil exceeds the cost of the oil and the processing. If it does then the barrel gets processed and the prices for each component get set in their own markets without regard to the individual component's cost.

It seems to me that with gasoline there is a limit to how fast the price can rise before people stop accepting the price as "normal". If the price rises slowly, people keep driving, if it rises quickly people cut back on driving. Even if the total price rise is the same. Diesel and Jet Fuel don't have the same constraints as demand is less immediately flexible for hauling.

--

JimFive

Whether or not diesel is as immediately flexible, I thought it was interesting that its usage had dropped by more than gasoline usage in the first four months of the year.

I think there may be a little flexibility in usage. I think shipping has been switched to train as much as possible, to reduce fuel usage. Trucks used to drive back empty, or deliver only a few goods to a store in a remote location. I think that some of these inefficiencies are now being taken out of the system.

I think that as with gasoline the death of the housing market has a far larger impact on diesel usage then efficiency gains. Given the amount of construction materials shipped by truck and the changes we have seen I'd say 90% or more can be attributed to the implosion of one of the largest US industries thats heavily dependent on trucking a lot of supplies. Efficiency gains are in the noise.

The problem of course is that once the housing industry is effectively gone we really don't have another big industry to collapse. Its down to what your saying retailers being careful with shipping costs and less overall spending etc.

I think we will get a clearer picture as we head into next spring since it will be our first spring not building houses in about 50 years. It really how demand evolves over next spring and summer forward that will give us a good idea how much conservation is possible without major infrastructure changes.

In my opinion it will probably simply track the economy fairly closely with failing retails sales reflected in decreased diesel usage. In the past when the housing market stumbled VMT went flat given the size of the bubble and the strong gasoline prices it makes more sense that it will first decrease sharply then go in a much gentler decline thats slowly flattening.

I thought it was interesting that the Department of Transportation's analysis of vehicle miles driven in the US does not distinguish between cars and trucks. The 1.8% decline in miles traveled in April is thus a mixture of car miles and truck miles. The biggest decline was on rural interstates, where I would expect a lot of truck traffic. That, plus the bigger decline in distillate fuel than in gasoline, leads me to believe that truck traffic contributed quite a bit to the decline.

Its whatever the fuel mix required to build out and populate your standard subdivision :)

If you have the data you can figure out the total fuel inputs required to take raw land and convert it to a subdivision. Not building one 200 house subdivision is a lot of gas and diesel asphalt etc etc not used.

Also of course the new happy McMansion owners need all the furniture and new SUV to hall the kids around to soccer and make the longer commute back to the city for work. None of this economic activity happens when you fail to build the subdivision. And of course you have to build all the strip malls and malls to support the subdivision and fill them with crap.

I'm actually surprised that we only got a 1.8% decline but given that the builders just now started defaulting

maybe we have more to go. My own guess was more like 3-4% decline once housing was truly DOA. I'm a bit alarmed we only have 1.8% so far.

I don't know what the percentage is for the housing market vs other hard industries that use fossil fuels but its got to be large. Either my guess is mistaken or we have a further 2-3% decline in consumption before gains from the death of housing are no longer possible.

I would think that diesel and distillate users are primarily industrial. Efficiency gains such as driving slower, and making aerodynamic improvements to existing vehicles fleets ought to be more likely when a corporate beancounter is looking over your shoulder. And of course a slowdown in construction, which is mainly diesel powered. Other charts I had seen had claimed diesel demand (US) was increasing, but perhaps they counted exports.

I would thinking low value uses (or at least uses prone to fuel switching) such as space heating, and power generation would be declining fairly rapidly. I think these areas typically use the heavier grades.

I live in what was once a boom town on the Gulf coast. You can tell that the construction is in the tank since ALL the Mexicans are gone. Two years ago they literally overran the place. As to who all that construction benefited, my guess would be Mexico #1. I can't detect that, other than grocery stores and check cashers, we locals got much of anything out of a glut of condo building other than the mess and traffic, and increased taxes. Of course, we now have 50 fingernail shops, 10 tatoo parlors and five cell phone stores, along with a big box wine store and golf ball store. Tremendous economic growth there.

Some alarming figures on oil use in coal generated electricity:

http://ambivalentengineer.blogspot.com/2008/07/burning-coal-is-burning-o...

High oil prices add a lot to the cost of coal.

Of course, more trains should be electrified. That takes time though.

You are right about transport of coal using a lot of oil.

I think that whether we want to increase electricity either by shipping more coal long distances or by using transmission wires, we run up against infrastructure constraints. Our trains and tracks are pretty much maxed out now, and our transmission lines for electricity are serious problem as well.

If you want to figure the real cost of long distance transmission of electricity through the grid, somehow you need to get the cost of the necessary grid upgrade factored in as well, and paid for by someone. Read about the problems here.

High oil prices will add much to the cost of everything, including natural gas. Lots of rigs manufactured and drilling, lots of workers driving around in trucks, lots of workers and employees commuting to work. And all employees and stock holders make salaries/dividends and spending them and thus consuming oil.

It's called Peak Oil :) or :(

Don't remind me of our dependence on oil! And don't start bringing up fertilizers and plastics I'm scared enough already!

If it wasn't so sad, it could have been funny.

I think this is called "the deck of cards mode of societal collapse" where an interdependant system goes down due to one of its parts failing. I've read the theory behind it, now I'm getting to see the theory applied.

Gee I feel like I'm back in high school science lab.

8-)

There was a great article posted back in January called The Failure of Networked Systems. If you haven't read it, you should.

I think the financial system is heavily networked also, and tied in with oil/gas supplies. That is one of the reasons I think the financial system will be one of the first things to go, even before physical shortages of the oil and gas are major problems. People and businesses will not be able to pay back their debts, and it may cause a debt implosion.

Generally most people declare bankruptcy before they stop eating.

Ask any top model and she'll disagree with that. They stop eating and then make even more money.

Its not that sad actually. Its just over consumption.

Average american use a constant power of 11,000 watts and has annual income of $40,000 (GDP per capita). Average pakistani use a constant power of 206 watts and has annual income of $750.

Using tube wells you can have 10,000 cubic water sustainably at an average acre that get 2000 cubic meter water from rain and canal. The 5 times boost is due to pumping underground water that get there in rains and canal water of previous centuries. 20% of the water pumped that is 2000 cubic meter per acre get evaporated, run-off etc but its replaced by annual rain and canal water supply so on average the ground water volume remain same thats why sustainable method.

From these 10,000 cubic meter water available you can grow 47 tons of sugarcane that results in 3384 liter ethanol and 470 kwhr electricity after the energy used in making ethanol. You have to use 20% of this amount to power tube well to pump ground water so you have a net 2707 liter ethanol and 470 kwhr electricity for you. This is equal to (2707 * 0.67) + (470 * 3.6 / 37.8) = 1859 liter petrol which is equal to constant power of 2300 watts per acre.

That way if you agree to live in as much energy and economy as in pakistan you only need to have one tenth of acre producing bio fuels for you.

It is very interesting to hear your wisdom from Pakistan!

Unfortunately, sugarcane does not grow well in a large part of the world. In the US, it is only produced in Hawaii and three southern states. I found statistics that show that Pakistan is a large sugarcane producer. I did not know that. Here in the US we all hear about the success of Brazil in producing ethanol from sugar cane, but that success is not without its costs, and at any rate, the US can't produce much sugar cane.

In the US, some sugar is produced from sugar beets, but I understand that sugar beets are not a good raw stock for biofuels. Can anyone comment on the viability of sugar beets as a source of biofuels? One advantage of beets over corn is that they do not require as much water as corn, and they can grow in much worse soil than corn.

As I understand it, processing beets might be a manageable issue, but the low yield per acre lowers it's potential. In order to get high yield per acre, fast growing tall dense vertical plants are great, as they take up less space horizontally per unit of energy grown. Miscanthus or switchgrass are examples. Only the beets contain sugar. Same for corn ethanol, only the corn contains sugar. The beets' plants do not contain enough energy per area. If they did, and cellulosic, pyrolisis, or other advanced BTL were commercialized more, then maybe it's more interesting. I don't know if the yield will ever be as good as Miscanthus or switchgrass though.

Any sugar beets farmers out there that would care to comment?

I personally think there is some potential for seaweed. Fairly high yields are demonstrated. And some of them contain a lot of oil. Being flexible and in the water, they can make do with less structural material (cellulose) while still growing vertically so high oil production per unit of area is possible. Japan used to have a sea farm for biogas (electricity) production if memory serves. Don't know how viable the concept is. But at least it doesn't take up farmland.

Interesting idea!

Different climates are good for different species, thats why bio diversity. My understanding is that any place near to tropics is good for sugarcane production, if you are too north or too south of tropics you can't have significant sugarcane due to climate but then you may have other crops that better suit your climate.

Pakistan has just 60 million acres arable land for a population of well over 160 million, so we have like 0.4 acres per person, hardly to produce enough food. Usa on the other hand have I think atleast 600 million arable acres for 300 million people, 2 arable acres per person, so though sugarcane is not an option for usa there would be some other crop that can provide energy.

The whole point is scaling down. The per capita energy consumption of western world is simply too high. Only if it can reduce to 50 times to the levels of india, pakistan etc it can be get from biofuels.

I not believe that solar or wind can provide any significant amount of energy because of too high capital cost. One watt installation is atleast $3 and you have to have 5 watts installed to get one watt continuous and another 20% to compensate for losses in storage, therefore $18 per watt. World consumption is 15 trillion watts continuous of primary energy and 5 trillion watts of electrical energy equivalent. Now thats atleast $90 trillion. Not have yet taken into account energy loss in conversion from dc to ac or capital cost in changing all equipments to dc, capital costs of having an electric transportation system and maintenance costs.

If you do scale down things become far more manageable. There is something called Purchasing Power Parity which means that even though "undeveloped" (actually undestroyed) countries like Pakistan has energy consumption and economy 50 times lower than usa but we are not 50 times poorer. Due to PPP we are just 10 times poorer. Thats because basic essentials and also not so basic stuff are 5 times cheaper in pakistan than in "developed" world. You can buy as much food, clothing, real estate, soaps, detergents, human labour etc in pakistan in one dollar that you can buy in 5 dollars in usa. Also when your country is poorer difference between rich and poor people is not that high. Rich are not extremely rich (there are no billionaires in dollars in pakistan) and poor are not extremely poor (Pakistanis have an excellent diet, a high consumption of milk, meat, fruits, vegetables and 98% people own their own houses, we are also a high consumer of cotton products including clothes, we owe very little to banks etc). Also govts are pressured to provide most of education and health care because they can't expect "poor" people to pay for these. Most people have their own farms or other businesses so you go to work when you like or take a holiday anyday you like. Work specialization is not that high, means at a job you do a diversity of tasks keeping interest level high and boredom low. Then if you have any problem since you are poor its of low scale so can be easily managed. Most of all you are envied by none :).

Thanks for your comments.

You make me want to move to Pakistan--except the 0.4 acres of arable farmland per person.

Let's have a competition to find out the least likely 'everything' that is impacted by oil!

Nick.

My visit to Wyoming was an eye opener. With natural gas production out in the "middle of nowhere", it is necessary for workers to drive long distances for necessities such as groceries and medical care. And of course extracting the natural gas requires a lot of workers driving around in trucks, visiting the gas wells.

All this is very interesting, but doesn't it need to be integrated into a more global perspective?

World oil production has increased in the last four or five years years, no?

During that same time you show U.S. refinery utilization to have declined. The oil that is not being refined in the U.S., plus the increased oil production, has to be being refined somewhere, does it not? If not, then material balance fundamentals would require that it is being stored somewhere.

How difficult is it to get a handle on what is going on globally? Are the production figures we get from some of the non-democratic governments, which lack transparency, reliable? Likewise, are the refining and consumption figures we get from opaque non-democratic governments reliable? Are their figures concerning how much oil they have in inventory reliable?

The reason I ask this is because of this report:

http://www.td.com/economics/special/db0608_oil.pdf

They use oil consumption, production and inventory statistics from something called "Haver Analytics," and these don't seem to mesh completely with statistics from other sources I have seen. Furthermore, they show global oil inventories to have increased from 88 to 90 days from the end of 2007 to 2008. That's an increase of 86 million BOPD x 2 days = 172 million BO. It also doesn't seem to mesh with some of the reports I've seen from OECD countries on two counts. First, other sources don't show any increase in inventories from OECD countries. Second, days supply from other reports I've seen for OECD countries are only 20 or 30 days, so the 90-day figure seems high. I couldn't find any other sources of non-OECD data for the first four months of 2008.

So I'm just a little bit confused.

World crude oil production has pretty much been on a plateau since 2005. There has been a small uptick in the first three months of 2008. I have plotted this, as if it were the full year number, so it may be a bit misleading.

US refinery production has been dropping as a percentage of world oil production. It looks to me like every time there is an uptick in world oil production, the new refining goes elsewhere, and the US percentage goes down.

I am suspicious that world oil supplies are a lot less fungible than people assume. If there are pipelines from a particular field to a particular refinery, the oil in that pipeline is likely to be the input to the refinery. It is the refineries without permanent arrangements, or whose old source of oil is badly declining that are out bidding for oil.

I don't think inventories are very important over the longer term. They pretty much get lost in the noise.

Thank you for your response, Gail the Actuary.

It's all fascinating stuff.

Just a couple of more questions:

Have you seen any figures as to what percentage of U.S. refining capacity is owned by the independent refiners and what percentage is owned by the major integrated oil companies?

Also, I have heard that the United States has the most sophistacated refining system in the world, able to refine a disproportionate amount of sour, heavy crudes. Is that true? And if so, wouldn't that give U.S. refiners a competitive advantage over foreign refiners?

I see in this report that it cost $0.14 per gallon to transport ethanol from Brazil to the U.S. (back in 2005):

http://www.iowafarmbureau.com/programs/commodity/information/pdf/Trade%2...

That would be $5.88 per barrel! So maybe not only are oil supplies not as fungible as people think, but maybe refined products as well.

Regarding your question as to how much of US refining capacity is owned by independent refiners and how much is owned the major integrated oil companies, I looked around on the Internet for a while when I was researching this article, but didn't find an answer. I think a fair amount of production is done by joint ventures, which are jointly owned by combinations of major oil companies. These look sort of independent, but if they get into financial trouble, I would imagine that their major oil company parents could add a little extra funds, and fix things up. The true independents wouldn't have this luxury. I would be interested in seeing some figures on independent refiners, if someone has a reference.

I am afraid I don't know if our refineries are the most sophisticated. We built a lot of them a long time ago, and have upgraded them over time. I would think the most recent refineries would be most sophisticated, wherever they are. This is just a guess though. Someone from the industry could probably answer the question better.

Gail right on.

Refineries near the coast tend to be more complex and able to adapt to varying crude grades and those inland, sitting on a pipeline or an oil field, don't. Compare Hovensa St Croix and Big West Bakersfield, for example.

The less complex refineries can't profitably handle crudes they are not set up for and the retooling and adaptation takes a lot of capital up front for plant and also the switching of crudes inline is not easy, especially given the push to reduce inventory everywhere in the chain. So to your second point, inventory reduction speaks to the risk in the supply chain being driven into the refining companies by the low margins. Just like the utilities running as little surplus power on the grid as possible...... risky business.

Thanks! Good to hear from people with oil experience!

Diesel has 10 to 20 percent more energy per volume than gasoline.

Chris Shaw says that energy is the one true currency, always has and always will. Thus diesel is worth more per gallon.

http://www.onlineopinion.com.au/view.asp?article=3837&page=0

Shaw has 4 other articles there for interesting reading.

Energy is the universal currency, if there really is one, but there is also exergy to consider - the 'quality' of energy. Diesel engines are more efficient than spark ignition engines, which adds to it's exergy alongside higher volumetric energy.

Electricity has the highest exergy, an attribute that makes it a likely candidate for future energy systems. After efficiency and conservation, the most promising pathway to mitigate the impact of Peak Oil of transportation lies in increasing the competition between oil and electricity.

Hey Cyril R. Don't forget that there is some 50%+ loss of coal, natural gas, and oil energy in producing electricity (much CO2 and stinky pollution too), then some loss of energy in transmission, then much loss in batteries. The 2nd Law of Thermodynamics must be considered.

It takes energy to get energy, and electric energy is not exception.

One must consider also the unknown and mysterious 4th Law of Thermodynamics: Electric energy is not what we need, rather we need liquid fuels.

Hey Cyril R. Don't forget that there is some 50%+ loss of coal, natural gas, and oil energy in producing electricity (much CO2 and stinky pollution too), then some loss of energy in transmission, then much loss in batteries.

Yes, electricity is 'exergy refined' in order to achieve that higher quality energy state. Even then, total losses are less than ICEV system when all losses are considered there as well. It's also easier to capture emissions and pollution in a few centralized non-mobile locations than with orders of magnitude more mobile polluters.

The main reason electricity has high exergy is that it is converted to other forms of energy with high efficiency (mechanical, heat pumps etc). What's more, there are various low carbon sources of electricity, making it more flexible than a monolithic oil system. Right now, oil has a monopoly position is many markets, because oil is convenient to store, transport and use, so exergy can't be optimized. New technology and government policy can change that. There's no rational excuse not to do it, and the window of oppertunity is short.

It takes energy to get energy, and electric energy is not exception.

That's a half-truth. Of course it takes energy to get energy, but the electric system is more efficient than the liquid fuel system, and is more flexible and diverse. Surely you can understand the danger of basing an entire societies energy needs on one or a few sources with very low system efficiency (hint, peakoil).

One must consider also the unknown and mysterious 4th Law of Thermodynamics: Electric energy is not what we need, rather we need liquid fuels.

Many people think they know what they want, but too few seem to realize what's good for them. Your definition of need is too narrow and your 4th Law has more to do with human action than physics.

Alright I'll go far afield of Gail's excellent posting - though to stay somewhat afield I am curious about a simple synopsis of the ability of various nations refining capacity - I understand the US has a lead in this and I suspect that despite/because of decreasing feedstock the ability to produce finished product from less "finished" feedstock may actually take on increased significance. Don't tell the Iranians, Mexicans or Palestinians. I just hope we don't see lot's of terrorist attacks on refining facilities.

Anyhow, you stated,

I have been giving this some thought for some time. One the one hand it is a sci-fi idea on the other it appears to be unfolding as we speak. Perhaps, never in human history has the notion of currency become more divorced from, what shall we call it, "tangible wealth". Gold is an abstract symbol of wealth -> the dollar is a a redeemable symbol of gold -> the dollar is a non-redeemable symbol of gold -> electronic digits are a symbol of dollars. Couple this with fractional reserve banking, hedging, derivatives, etc. I believe Kunstler said something along the lines of financial algorithmic turpitudes or something similar.

However, wealth is eventually tangible, if not easily defined. Is the price of oil increasing because the dollar is declining or is the abstract dollar losing value because the price of useful oil is increasing? I suspect the latter.

To go back to the sci-fi part, let's consider "exergy". If not merely, electronic digits, but "quality energy" can be rapidly transferred and is storable isn't this "currency". If wind and solar become the future perhaps payment is in kilowatts, if we are careful to prevent unneeded levels of abstraction.

I was estimating that diesel has about 15% more energy than gasoline. Different sources seem to have slightly different numbers of BTUs per gallon. I mentioned the 15% in one draft of this post, but I don't think it made it into this version.

Gail, you are correct noting the varying btu figures for diesel. Diesel picks up btus in the summer blends and loses btus in the winter blends which prevent gelling of the fuel in cold climates like here in Wyoming. My Cummins and mercedes diesels fuel mileage drop about 10% in winter. The cummins goes from 22 mpg in the summer to 19 to 20 in winter for example.

Diesel has 10 to 20 percent more energy per volume than gasoline.

On top of that, a diesel engine is around 30% more efficient than a combustion engine. I just checked the stats on a 2009 Jetta. The diesel version is 36% more fuel efficient than the gasoline version with the same size engine.

So at today's price for regular unleaded gasoline at the corner station ($4.22/gal), all else being equal (!) diesel for anything less than $5.74/gal (4.22 X 1.36, or $1.52 more/gallon) would be a bargain, right? That's way more than the current premium one pays for diesel, so it would seem that going for diesel equivalent in purchasing a vehicle would still make sense, Memmel's and Gail's points about trends notwithstanding?

Diesel engines are more expensive than gas engines. The VW TDI is one of the more affordable ones at $2000 over the price of the gas engine, but limited supply and customer demand will probably push that price premium higher. In other cars and trucks the diesel engine option is $3000-5000 extra.

I might also mention maintenance costs. Volkswagen has one of the worst frequency of repair records around. Also, your local Jiffy Lube will probably have difficulty with oil changes--doesn't carry the right oil or filters. My 26 year old son has a Golf TDI, and he has run into some of these issues. Resale value is great, though!

Yeah, right, and those diesel Jettas as so much fun to drive, too! ; )

You forgot to mention that it's also got the best anti-theft device ever put on a car: that "diesel" logo.

funny, when I bought my petrol thirsty bmw my friend mentioned, that its huge petrol motor is the best anti theft device

i am from europe though

Price of oil, gasoline, jet fuel, etc. should be figured in some kind of meaningful constant, not just in dollars. Which might take into account various parameters such as other currencies, yen, euro, and gold, silver, as apparently they still remain a standard people refer to (therefore it is often done), as well as measures such as per capita cost of food basket, or even a happiness index, etc. Very complicated problem to state the ‘real’ costs, the question has only an arbitrary, ad hoc solution.

And all that would be without totting up the cost of obtaining (extracting, refining, transporting, military adventures, etc.) fossil fuels and getting them to market, and without adding, or subtracting, the nefarious effects, such as CO2, pollution, deaths along the way, projections for the future, etc.

In short nobody has a clue, except that some ppl are feeling the pain of what for them are ‘high prices’, i.e. a change in their budgets - so that creates brou-ha-ha.

This may be a somewhat simplistic analysis of the crude/gasoline price differential but I offer it for your scrutiny.

The supply/demand dynamics are not nearly as dependent on excess capability of producers to supply a commodity as it is competition among those suppliers for market share. Though most folks are looking for the cheapest fuel price available, brand names do still carry some leverage (I’ll pay a little more for Chevron myself). A major portion of the rational for the sellers to accept the lower spread may be to maintain their market share. In the end, a refiner’s profit is hinged as much (and more, perhaps) on sales volume as it is the spread per gallon. Making an extra $.20 per gallon doesn’t benefit a seller very much if he looses millions of gallons of sales. Like all manufacturing processes there are fixed costs. It will cost a refiner a minimum of $X (fixed cost) to make a cracking run whether he pushes 200,000 bbls thru or 1 million bbls. I can’t offer the proportion of fixed costs vs. volume related costs but maybe someone here can.

I also see this market competition aspect of the supply/demand dynamics as a major factor in the run up in crude prices. Think back to the great days of $10/bbl oil in 1986. But it wasn’t just the existence of the excess capacity (about 10 million bopd)that drove prices down. As global consumption declined OPEC proved its impotence as a cartel. Members dumped as much oil as cheap as possible into the market. To prevent oil prices from dropping even faster Saudi began cutting back their production. Eventually the KSA would have to shut in their entire production stream. Hence they opened the valves and began reclaiming market share. And oil prices crashed to a level that absolutely no one had predicted as possible just a few years earlier. MARKET SHARE ACQUISITION is what drives the supply/demand model. Though it’s a factor in the process, excess production capacity itself does not drive prices down. Had OPEC acted as a true cartel and all members had cut production proportionally, higher oil prices would have persisted regardless of the amount of excess capacity. I see this same dynamic in the US refiners: if they were allowed to “cooperate” in their pricing schedules it’s easy to imagine gasoline prices being much higher.

Now let’s jump to today. When the world asks the KSA to produce an extra million bbls of oil it isn’t really asking that. Saudi cannot produce an extra million bbls of oil because there is no buyer for it. The world is buying exactly what it wants and can afford. What is actually being asked is that Saudi offer that million bbls of oil for less then the other exporters require. In other words, the world is asking them to take market share away from the other exporters. It would be this COMPETITION FACTOR that would put downward pressure on prices. But now let’s look at the different circumstances right now compared to 1986. Almost all oil exporters openly admit they are at PO. Saudi may or may not be…only time will be. Consider Mexico as a specific example. It is even being reported by the Mex. gov’t that their production is falling like a rock with virtually no near term way to prevent it. And if you didn’t know, their oil exports have provided as much as 60% of their federal budget. Ignoring the logistics question of transport, assume Saudi goes after Mex. market share of exports to the US. Mex. may not be willing to compete on a price basis with Saudi. They would certainly lose critical income right now if they were to give up some market share but they would also preserve price support for their remaining exports as well as saving production they’ll need even more desperately down the road. Though Saudi may be producing an additional million bbl oil/day, they would only be replacing the crude Mex. pulled off the market. In this scenario Saudi would only need to drop prices marginally at first and then easily raise them back up in time.

While there are questions as to how much extra production capacity the KSA may have at the moment, that factor may have no impact on the current pricing picture. Even if the KSA had an additional 10 million bbls they could throw into the market it would only generate lower prices if the KSA went after the market share from other exporters. The capability to produce more is not relevant if KSA isn’t willing to compete on a price basis with other exporters.

And a news flash just showed up this morning that truly highlights why the KSA isn’t motivated to go after a bigger market share: