What is happening with oil prices ?

Posted by Big Gav on July 7, 2008 - 8:00pm in The Oil Drum: Australia/New Zealand

"Oil is an incredible, irreplaceable gift of nature which packs energy in a dense, easily transportable form." - Jérôme Guillet – Energy

Industry Investment Banker

The hard facts

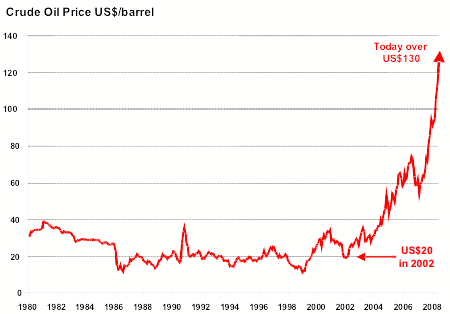

- The world price of oil in US dollars has doubled in the last year (June 2007 to June 2008) from US$67/barrel to over US$135/barrel

- The world price has gone up by 6 times in 6 years, from US$20/barrel in 2002 to over US$135/barrel by mid 2008

- With hindsight we can see that the great cheap oil era lasted 16 years from 1986 to 2002 when the price was mostly in the range $15 – 25/barrel, coming off a $39 peak during the "oil shock" of 1980 (equivalent to about US$95/barrel in 2008 money). The short sharp spike seen at the end of 1990 was due to the first Gulf War.

Within Australia we have been somewhat insulated from the latest sequence of price rises by the falling value of the US$, so our petrol and diesel prices have risen by comparatively less as the A$ has climbed to around US95 cents, as shown in the chart below.

In Australian dollar terms we have seen the price of oil rise by "only" 3½ times in 6 years.

Obvious questions raised by the price rises are:

1. What has caused the startling rise over the last 12 months?

2. Why has the price risen steadily for the past 6 years?

3. Why shouldn't we get back to the $20/barrel we enjoyed in the 1990's?

4. What caused the noticeable dip in price from mid 2006 to early 2007?

5. Why does the oil price seem to be going up at an accelerating rate since the dip in 2007?

6. Has the price stopped going up yet?

7. What prices might we expect over the next 1, 3 or even 5 years to come?

Source: 1986 onwards - EIA monthly WTI spot price in money-of-the-day

http://tonto.eia.doe.gov/dnav

Pre 1986 EIA Refiner Acquisition Cost of Imported Crude Oil in money-of-the-day

http://www.eia.doe.gov/emeu

Starting with Questions 1 and 2, the accelerating curve of recent price rises is due to the growth in oil supply not keeping up with steadily growing demand around the world.

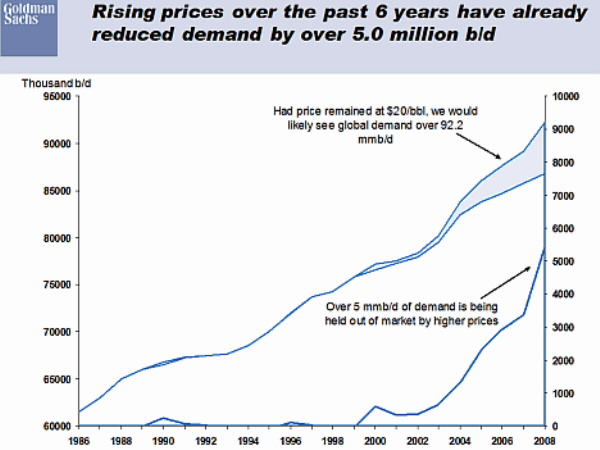

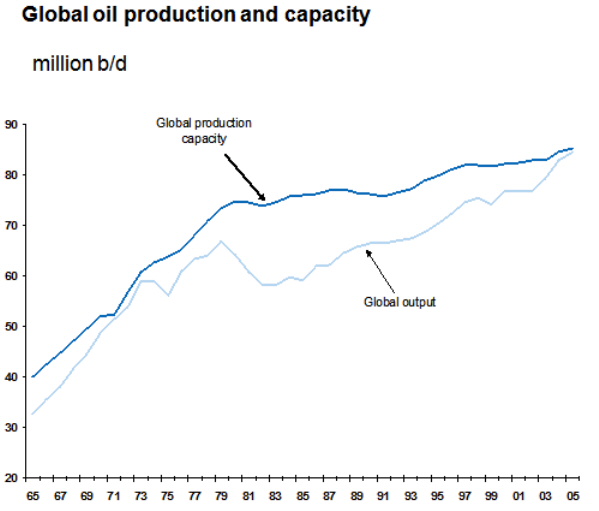

Oil is getting more expensive because surplus production capacity has diminished and continues to diminish, as shown in the chart on the next page. Oil industry volumes are of enormous scale (86 million barrels per day – a barrel is 159 litres), and the costs of supply infrastructure are in the billions and trillions of dollars.

Lead times for new industry infrastructure are typically 3 to 10 years. All new mega-projects on the production

side are well known out as far as 2012, and few seem likely to boost global supply by enough to overcome declines in old oil fields. See

the comprehensive listing of oil megaprojects at http://en.wikipedia.org/wiki

Rapid demand growth is often blamed for rising prices – demand growth in developing countries, particularly

China and India, and in key oil supplying nations such as Saudi Arabia and Russia. But the decline of mature oil fields throughout the world

is an even greater source of demand for new oil supplies than the growth of end user demand. Declining fields are losing 5.2% of total oil production per year thus requiring about 3.5 million barrels/day of new oil each year for the global oil supply to stay the same. (Nobuo Tanaka, International Energy Agency) http://www.iea.org/Textbase

The balance between growing capacity from new infrastructure investments and declining output from old infrastructure has seen global production capacity climb at a slower rate than consumption for the past 25 years, as shown in the following chart.

Source: Goldman Sachs based on EIA data

Convergence of the two curves shown above indicates serious supply tightness over the last 2 years which explains much of the recent price surge, with perhaps $5 – 10 per barrel in volatility added by an influx of investment funds seeking a safe haven from the falling US$.

The analysis by Goldman Sachs in the next chart below suggests that price rises to date have already destroyed demand amounting to about 5 million barrels/day or 6% of current world consumption. Any further price rises may be expected to cause further demand destruction and consequent hardship for those being priced out of the fuel market.

This brings us to Question 3 – Why shouldn't we get back to the $20/barrel we enjoyed in the 1990's?

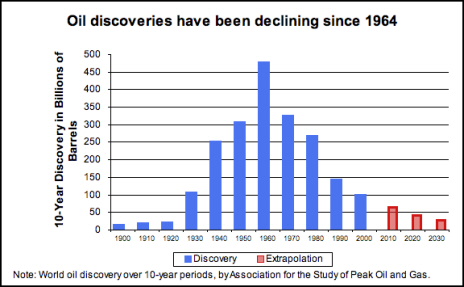

It's simple – the world has used up practically all the easy "light sweet" crude oil that used to pour out of desert sands for $3 – 4/barrel and be easily refined into saleable products. Discovery of oil peaked more than 40 years ago – see the chart below.

Not only is it costing much, much more to find and extract each new barrel of oil (typically $60/barrel for new deep offshore wells) but most of the oil we can now get is shifting towards "heavy" and/or "sour" grades that require billions of dollars of new investment in refineries to process them.

"The oil is getting harder to extract. Most oil comes from ageing, waning giant fields discovered long ago. There are no more giant fields to find, only lots of small ones, difficult ones or fields deep under the ocean. The remaining crude oil is heavier, thicker, dirtier, quite simply cruder! It's difficult to get out, expensive to get out, slower to get out. So, the rate of oil extraction will decrease." Michael Lardelli on Perspective, ABC Radio National, 26 June 2008

There is no going back to $20/barrel

short of a world recession that shuts down demand for oil, and for everything

else.

Now let's look at recent price volatility. Question 4 – What caused the noticeable dip in price from mid 2006 to early 2007?

Prices climbed during 2005 due to Hurricane Katrina and fears of war with Iran, then kept on climbing until August 2006.

"Oil was in a bit of a bubble

in July 2006. The way you could tell it was in a bit of a bubble was

that speculators were net long by a large number of contracts (115,000)

and inventories were high. . . . The oil situation now is very different.

Speculators are now net short. Inventories are very low of the products

and types of oil in demand." http://www.theoildrum.com/node

When the 2006 hurricane season passed

without incident and oil supplies remained marginally ahead of demand

the market appeared to decide that risks had been over-priced, and prices

fell by $10 - $15/barrel for the start of 2007. Then they began rising

again.

Is our situation getting worse? Question 5 - Why does the oil price seem to be going up at an accelerating rate since mid 2007?

Actual oil prices are set by refiners bidding to buy tanker-loads. Recent media fuss about speculators refers largely to oil futures prices rather than actual spot prices for which a buyer and a seller have to actually exchange funds for a tanker-load of crude oil costing between US$100 and US$400 million. Not many speculators have this sort of cash or know what to do with a 250,000 tonne tanker.

This year many refineries have been finding it harder to buy oil of a grade they can economically refine, especially the 50% of US refineries located in the Gulf of Mexico who are suffering steep declines in overseas supply from their nearby sources in Mexico, Venezuela and Nigeria.

Mexico is in oil-induced political and financial turmoil because its one massive oilfield Cantarell has gone

into rapid decline for geological reasons while Mexico's (subsidised) domestic oil consumption is growing. Mexico is seeing its largest single

source of foreign income decline every month, while domestic demand for oil is growing at a pace that will see Mexico become an oil importer by 2014 according to some estimates. (http://www.theoildrum.com/node

Mexico’s Oil Production is Collapsing

At the same time

- Venezuela's output is declining, partly due to Hugo Chavez's ejection of foreign oil companies.

- Nigeria's output has been reduced to its lowest level in 25 years by terrorist attacks from local guerrillas

- Russia's output (which is only exceeded by Saudi Arabia's) has unexpectedly declined by 0.9% this year

- Britain's North Sea oil peaked in 1999 and is declining at 5% - 8% per year.

The table on the following page shows, for oil exporting nations, net export declines accelerating from 2006 to 2007. Monthly data for 2008 shows that the overall downward trend is continuing. It is the declining volume of tradeable oil on global markets that is causing steep price rises this year when we are seeing only moderate abatement of growth in global demand.

More buyers are pursuing a tightening supply of exported oil, so small variations in availability are all that is needed to push deal prices upward. For example, on 28th June Bangladesh, hard-hit by energy shortages, was reported to have struck a deal with Kuwait for supply "at a premium price".

If declines in the supply of tradeable oil were not enough to create a tight market, buyers are reacting nervously to talk of attacks on Iran by Israel or the USA, and it only takes a rumour to send oil prices on another upward jump.

Source: datamunger at http://www.theoildrum.com/node

Units – thousands of barrels per day

Critically, Saudi Arabia appears now unable to perform the role of market stabiliser that it played from the 1980's until the 2000's on the basis of its known ability to pump up to 20% extra volume at short notice. Depletion of Saudi Arabia's giant oil fields appears to have taken away its ability to help the world in this way, though the Saudis will not directly admit they no longer have this power.

It seems likely that since 2007 OPEC has lost effective cartel power because few of its members have the ability to pump more oil. This means the cartel as a whole can do practically nothing to bring down prices even though key members like Saudi Arabia have much of their wealth tied up in Western economies and are clearly concerned about damage to their own interests if oil prices go any higher – thus the Saudi conference held on the 22nd of June 2008.

So what happens next? Questions 6 and 7 – Has the price stopped rising and what prices might we expect over short-term and medium-term planning horizons?

Price rises did indeed pause in mid-June after an astonishing $11 run-up on Friday 6th June. Traders may have been waiting for an outcome from the Saudi conference on 22nd June, which was soon seen to have provided little new knowledge or cause for optimism.

Game on. Futures topped $140 for the first time on 26th June.

So what will next week, next month and next year bring?

"Predictions are always difficult, especially about the future."

Niels Bohr

There are essentially two patterns of oil price prediction being made by informed pundits:

- Ongoing steady price rises driven by the continuing supply-demand squeeze

- A big discontinuity caused by demand destruction of a major sort, followed by a short period of lower prices then a resumption of ongoing steady price rises driven by the continuing supply-demand squeeze.

Pattern A – Ongoing steady price rises

Proponents of ongoing price rises are betting on geopolitical and economic stability and the ability of a resilient world to keep steadily adjusting to rising oil prices, as we have done for the past six years.

Typical projections of this type are from Jeff Rubin, Chief Economist at Canada's CIBC World Markets. The following table is from Jeff Rubin's April 2008 report http://research.cibcwm.com

Two months later Rubin has revised his April price projections drastically upwards in CIBC WM's June 2008 report http://research.cibcwm.com

He explains "We are compelled to once again raise our target prices for oil. We are lifting our target for West Texas Intermediate by $20 per barrel to an average price of $150 next year and by $50 per barrel to an average price of $200 per barrel by 2010."

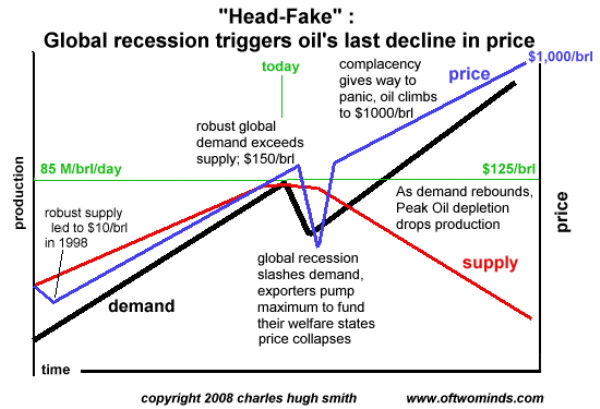

Pattern B – Price moves down then up on a rising trend

The other school of oil price projections makes the common-sense point that serious demand reduction and perhaps economic recession in some countries will be triggered when oil prices reach a critical level – when "demand destruction" becomes really destructive. Proponents suggest that such a free-fall in demand from one or more larger consuming countries such as the USA will be dramatic enough to drop price back to, say, US$100/barrel for a period of time.

Some writers guess that the critical price point to cause such sudden and significant demand destruction may be US$200 - 300/barrel, based on percentages of world GDP, but the accompanying analysis is weak and the arguments published to date do not convincingly pinpoint a critical price for oil above which it cannot go.

A graphic example of the "dramatic recession" school of price projections is shown below. Given the great variety of geopolitical events and economic factors that could influence actual supply, demand and price there is little hope for more precise forecasting of price and timing than the indicative story set out below.

Conclusion:

Stay awake, expect oil prices to be in dynamic movement.

Conservatively, plan for US$200/barrel by 2010, but don't be surprised if a recession somewhere drops price back to US$100, for a short while, or sudden war in the Middle East sends prices skyrocketing.

Expect the fundamentals of fading supply growth and growing demand to push prices ever higher in the 5 year horizon, perhaps well beyond US$300/barrel.

The implications in terms of Australian pump prices in A$/litre are shown in the table below. These pump price estimates are made on the basis of some reasonable assumptions:

- Current excise and GST rules stay the same, keeping Australia's fuel taxes significantly lower than any other OECD country except the USA, Canada and Mexico

- Australia's prices continue to be driven by average Singapore refined product prices. Singapore product prices are most influenced by the price of Malaysian Tapis crude which normally sells for a few dollars more than US West Texas Intermediate

- Freight, insurance, wharfage and wholesale and retail margins rise only moderately with world oil price

- A$/US$ exchange rate moves up from the current 95 cents to parity due to continued weakness in the US$ compared with commodity-driven support for the A$

- No net impacts from the Emissions Trading Scheme which starts in 2010 and might add another 10 cents/litre.

Indicative Estimates of Pump Price

|

Tapis price

US$/barrel |

Australian capital city pump price A$/litre |

| $140 (today) | $1.68 |

| $200 | $2.07 |

| $250 | $2.45 |

| $300 | $2.80 |

| $500 | $4.30 |

"When you think a litre of petrol costs too much, ask yourself how much you would have to pay someone to push your car 10 kilometres."

Finally, let's look on the bright side. There is plenty to like about moderately higher oil prices, if communities, businesses and economies take heed and get time and help to adjust.

Less traffic, less congestion and less pollution would be a big plus for most of us.

New business opportunities should spring up in areas such as energy conservation, Natural Gas conversions, cleantech industries, electric vehicles and freight optimisation.

Having the world place a higher value on energy from oil will change a lot of business decisions, improving our resource efficiency and enhancing sustainability.

Anawhata comments: The above is my effort to explain the recent history and possible outlook for oil prices to non-TOD audiences who lack awareness or understanding of peak oil. I think all of us know how tricky it is to explain these big issues to intelligent people who simply lack the basic knowledge we take for granted about peak oil. I have chosen to focus this piece specifically on prices, with the minimum possible mention of related causes like oil field reserves, depletion rates, the export land model and so on. Most of these topics underlie my argument, but are not highlighted because I will lose the audience if I stray too far away from the central topic of prices. I have anchored the whole argument around the undeniable facts of recent oil price history.

You will see TOD contributors' fingerprints and exact words throughout, and I hope I have credited key people correctly and sufficiently. In any case, TOD thought leaders, you know who you are. Thank you for educating and informing me and so many others. I welcome suggestions to clarify and improve the story, remembering that I have to keep it as simple as possible for a lay audience. In particular please help me correct any errors of fact or understanding on my part.

As PG would say, thanks for your support:

http://www.reddit.com/info/6qkze/comments/

This is an excellent introduction to peak oil. I hope that you can update it at appropriate intervals over the next couple of years.

I have already dawn it to the attention of those friends and relatives whom I have so far not been able to persuade that peak oil is real.

Great read! I shared this with "Family First" Senator Fielding (Australia), for what it's worth. Afterall, he should be made aware of the concept of PO, shouldn't he?

Regards, Matt B

It'd be the first thing he's aware of, ever!

He is aware of "Recycling" (Although apparently not "Reducing" or "Reusing"...)

In the following pic, he has recycled the Black Knight costume from Monty Python and the Holy Grail.

electricity can power a car just like oil can

Amen brother. I'm glad most electricity comes from fairies and not something like coal.

"Amen brother. I'm glad most electricity comes from fairies and not something like coal."

just coal?

Yup, just coal and other fossil fuels. You see, solar thermal, wind, and whathaveyou in the renewable sector clearly aren't suitable for electric vehicles because instead of spending a few seconds plugging them in when we get home at night to charge over a 8-12 hour window, we would actually spend an extra ten or fifteen minutes going to a fast charging station, which would have to be built, just so we could whine about how we can't power a car with renewables due to problems with intermittency. ;)

Are you being sarcastic?

Electric motorcycle recharged from Solar PV...

http://www.zevutah.com/page/motorcycle.htm

Sounds "suitable" enough to me.

;-)

Just a bit. Besides, it's unpossible I tell you, unpossible! ^_^

John15, why do you keep harping about irrelancies?

Nobody denies electricity cannot theoretically power cars in spades in the future.

Further, it is theoretically possible that we can generate most of our electricity from non-fossil fuels in the future.

However, we do not live in the future. We live in now.

Now 99% of our car fleet in the world runs on fossil fuels.

Now, more than 60% of our electricity generation worldwide comes from fossils, most of that from coal.

The problem as you very well know is getting from now to the theoretical future in very rapid steps in a time of potentially declining net energy availability and restricted mobility due to decline in available oil.

Have you any idea about energy project finance costs, project completion times, finance deprecation times, car fleet replacement rates, PHEV mass-manufacturing capacities or electricity grid challenges in the real world?

Talking about a theoretical future where everybody is happy when we have 'such and such technology' generating us an abundance of cheap, non-polluting electricity, which we power our PEVs with is not only misleading, it is intellectually dishonest.

You have to face the reality.

Even EIA projects coal to increase annually 1.7% p.a. until 2050.

If you have some magic scenario how we can remove all that coal generative capacity in 20 year or so and replace it with cheap, clean & abundant energy of your choice with minimal risks, low financing, while growing economies and ensuring a win-win for everybody, then I think World Bank, IMF, UN, OECD, EU, US, OPEC, and the Nobel committee are all ready to listen to you.

And don't you think we don't want that to happen? Don't you think people don't want these issues solved?

But harping about theoretical possibilities and not facing the hard realities is not going to get things solved.

Instead of heaping criticism on someone without providing any numbers of your own, why don't you sit down, do the calculations and show it can't be done ?

I've never seen anyone do this using present day cost figures for CSP, solar PV/thin film, wind, biogas, geothermal, hydro and ocean power options and taking into account projected changes over the next decade.

I suspect you haven't either - so instead you indulge in a whole lot of hand waving and tell people to face the (unquantified) "reality"...

<sigh>

Gav, Please read again very carefully what I wrote.

This is not an either-or issue, we both acknowledge that.

However, in any fair argumentation, the proof of burden is on the one making the claim. I did not see a single shred of proof from John15. I did provide latest EIA AEO 2008 assessment for coal use growth up to 2050.

And you are right that the only calculation that I can refer to is the only publicly available high level calculation in the world that I know of, that of Hirsch et al.

I never claim it cannot be done (100% certainty).

I'm claiming the scale issue is very, very large and the time available for completion appears to be very short based on oil depletion forecasts.

My main point is the obvious thing that claiming it is theoretically possible does not make it so.

Theoretical possibilities are not realities until built.

However, having studied energy companies locally, I can attest that the average 5 year permit process, 2-3 year financing process, 7-10 year build time and the 10-25 year depreciation time does not make things easier. Especially when the industry is made ever more so confusing by constantly changing political winds and legislation, the volatility in the CO2 emission trading market and primary fuel markets (gas, coal, oil).

Please do not mistake me for a dichotomic doomer, because I'm not one.

Now, I've provided one very big study reference in this post.

Let's see if John15 can post one that backs his claims. One that is based on physical/financial high level calculations - not just lab-tech breakthroughs about algae and back of the envelope musings about how cheap pv is going to be in 2020.

Just saying 'it can be done' is as silly as if I had said 'it can't be done' (which I didn't write, if you read carefully again what I wrote).

*PS as for real-world solution: I am consulting both energy companies and politicians locally on this. That's what I mean when I say mere assertions get very little done.

there are plenty of BEV in use right now as we speak. hybrids are electric and they are in use right now. it wasn't too long ago that people said hybrids were a joke and now they can't keep them on the lots!

did wind suffer from the huge drop in oil consumption in Denmark? those who offer answers won't suffer from from high energy prices because they are producers of energy.

And in the now there is still lots of fossil fuels available.

In the future is when fossil fuel availability will decline, meaning talking about what can be done in the future is exactly what we're already doing.

Why is it wrong to talk about near-future solutions to near-future problems?

Actually John, no it can't. Power a car, yes. Like oil, no.

I filled up my people carrier yesterday - tank takes 80 litres diesel. Incidently would have cost £106.40 at todays price of £1.33/Litre, US$210, A$220. Wasn't completely empty so I didn't quite achieve the magic £100 fill up (yet).

Anyway, the point is that today I will drive approximately 750 miles - from central Scotland to halfway through France - with a vehicle loaded with people and camping equipment, before having to stop for fuel, provided I keep the speed reasonable.

Please provide us all with details of the electric powered vehicle which is in production, or even on the distant horizon, which can even come close to providing that kind of utility. Then provide details of the investment required, and the roll out times for replacement of the current fleet.

the prius. probably a dozen or more hybrid and electric cars are going to be introduced in the next 3 years and that's not even including bikes and scooters.

who cares? people can just drive less if they have to. I also question whether the fleet needs to be turned over. one could just convert an ICE car to an electric.

high school kids did it.

http://www.treehugger.com/files/2008/02/high_school_homework_make_an_ele...

ups is using the zap.

http://www.treehugger.com/files/2007/11/ups_delivering_1.php

Just in case you may have been fooled by the smoke and mirrors ... in reply to the question

John15's only solution offered is "the prius" ... in fact, the Prius is powered by PETROL and emits 104g/km

http://www.toyota.co.uk/cgi-bin/toyota/bv/frame_start.jsp?id=MSR_PRIUS&C...

John15 says "who cares?" ... I do for one, since it is important for me to know what the future can't be ... what is left is what might be.

Clearly, from John15's answers, an adequate number of affordable electric cars for the masses is unlikely in the immediate future.

IMO his other solution offered "just drive less" is much more likely (and is happening already) ... using less is otherwise known as a recession, it isn't BAU. Plan on that assumption.

OUCH!!!......John15 thats gotta really hurt!

A person asks what electric vehicle will travel 750

miles.....loaded with people and camping gear and luggage....and you say a Prius.

The example given is ridiculous - that particular requirement is a rare outlier compared to fundamental travel needs (though a Prius clearly can go 750 miles, and more fuel efficiently than a regular vehicle - though it isn't an EV).

Hybrids, plug-in hybrids and electic vehicles exist already and the car industry is rapidly shifting towards building them - true or false ?

Friends of mine have a Prius. They drove Brisbane to Sydney (913km) on 45L. That is great mileage of 4.6L/100km.

I just drove Melbourne to Sydney in a Prius. Similar distance, similar milage.

There's only ONE answer, TODAY.

We (the world) are, currently, producing about 15 Billion Gallons of Ethanol, annually. This production will power 30 Million Cars 300 BILLION MILES @ 20 mpg (500 gpy.)

That's TODAY! We can increase this by a facto or ten like rolling off a log.

What were those "TODAY" numbers for Electric, again?

Some concerns:

1) There were 600 million cars worldwide in 1997. Where do you get the 30 million number from?

2) even with 300 million cars needing power, fueling with ethanol gives 1000 miles per year per car. 83 miles/month. 19 miles/week. 3 miles/day. I cycle more than this.

3) Much ethanol production is dependent on fossil fuels for fertilizer and pesticide, and must compete with food production. Ethanol production is more likely to decrease by a factor of 10 rather than increase I think.

Ethanol can't be transported in pipelines, and freight railroads are already at capacity just keeping power plants supplied with coal and parts of California supplied with ethanol for 10% blends.

Sure it can. Morgan Kendrick is doing it in Florida, right now.

And making ethanol (even in the limited quantities available so far) has plunged 100 million people into deep poverty and created soaring food prices and made the danger of starvation real for millions more people.

Apart from that (and the fact it can only be scaled so far) its great.

I don't suppose you'd want to give sources for any of that would you?

Naw, I didn't think so.

I'd be happy to.

In the meantime please stop acting like a moronic troll - its a big challenge, but I hope you can rise to it.

Here you go:

http://www.guardian.co.uk/environment/2008/jul/03/biofuels.renewableenergy

http://www.guardian.co.uk/environment/2008/jul/03/biofuels.food

http://www.treehugger.com/files/2008/06/biofuels-push-30-million-into-po...

How many more would you like ?

In any case, with the world population rising to 9+ biullion people in the coming decades, you can be sure that using cropland to produce fuel instead of food will increasingly be seen as an anti-social act.

There are better ways - clean energy and electric transport than pursuing the foolishness of first generation biofuels (my mind remains about about next generation techniques, none of which exist at any meaningful scale as yet).

I don't agree with a word that the ethanol guys says, but don't feel that abuse is appropriate.

It is particularly concerning when it originates from a moderator.

The guy was dishing out shit. If you're gonna dish it out, you gotta be ready to take a bite yourself.

Dave - as you well know (having experienced it many times yourself), if you abuse me, I'll abuse you back.

If you keep doing it, I'll delete your comments, and if you persist furher, you'll be banned.

In addition, you personally are no position to criticise others (though your holier than thou attitude doesn't surprise me one little bit, having seen that many times before too) having crudely abused many commenters over the last 6 months, for which you have been warned repeatedly.

You really appear to have no sense of irony in your disregard of site rules.

You allegation of my abusing others are unfounded - perhaps you would care to substantiate by showing anywhere that I have called someone a 'moronic troll' because we disagreed?

Yeah, well at least I'm smart enough to wait till there's actually a report before I start "quoting" it.

Guardian misrepresents coming World Bank Report.

It seems it was Transportation Fuels after all. What they, probably, won't throw in is the effect of Horrble Government Policies on holding land out of production (EU 10% of their wheatland, the U.S. 34 Million acres of rowcrop land, etc.) Export/Import Tariffs, Droughts in Australia, China, Argentina, etc.

Common sense should have told you that with Rice (Asian long-stemmed,) and wheat being the most commonly eaten foods on earth corn ethanol in the U.S. couldn't possibly lead to 75% price incrreases in food around the world. The USDA is probably about right with 2 - 3%.

And, yes, I was being a little snarky. If you think that justifies the moronic troll appelation (and, it makes you feel better) have at it.

You might, also, consider this:

EU Farmers Protest raising Dairy Quotas as WORLD PRICES FOR DAIRY PRODUCTS SOAR.

Maybe you should have read all the links before shooting off half-cocked once again.

Here - I'll save you the trouble of clicking :

Drought in Australia is something that happens (more and more frequently), which is why turning food grown elsewhere into fuel pushes prices up (and starves poor people).

You can't say its the drought that is to blame when good crops are being turned into liquids to burn in car engines, it just doesn't work.

Corn based ethanol is an atrocity, and pretty much everyone understands that now.

frankly, I really don't care about a vehicle that can travel 750 miles on a full tank or whatever. we're talking about electric powered cars.

I would think TOD would ask why do you need to go 750 miles to camp?

From wiki link nos. in bold, they sound about right, in any case all numbers are pretty much jagged stabs in the dark - world, energy end use, 2006:

13% biomass - that means cutting down trees/plants and burning them, or using agri. detritus, minor. Cow patties! Turf I suppose falls with coal.

hydropower - see the infrastructure and the need for running water: 3%

geothermal, wind, solar, ocean waves: .8 % (point eight.)

other - tapping underground hot water springs, informal solar use such as drying fruit, %?

biofuels - ethanol, biodiesel, vegetable oil (eg palm oil), biogas - to what degree this production has an acceptable EROEI, what role the subsidies / infrastructure have, and in what measure they are really ‘renewable’ (not in a closed system anyway imho), and how much they use up resources that would be better used in a different way are all subject to *heated debate.* For that reason, even end use stats are useless, and coming up with some number is moot.

That is it, and it doesn’t look good. Solar might find some devp. if the will was there. Electricity is basically made from fossil fuels (though I didn't include nuclear, which is non renewable in the common definition...)

You could simply be in less of a hurry.

A spute hybrid is halfway there already, and nobody *needs* to drive 750 miles in a single day to go camping.

I strongly suspect that a Ford F150 would make a beautiful electric vehicle. Though as a conversion I expect it would lose some carrying capacity, it would maintain more than enough capacity for camping gear. In fact, a compact pickup would probably be even more convertible, and more appropriate.

Of course, if you want BAU then you are just going to be SOL shortly.

a prius is a hybrid electric vehicle. and no, I mentioned more than just the prius.

To echo xeroid, THE PRIUS IS NOT AN ELECTRIC CAR. It's an ICE with a short-range battery-only facility. It uses as much fossil fuel, and certainly costs more to build and maintain, than the most fuel efficient diesel MINI or Ford Focus.

The kind of EV that could replace a 7-seater MPV with a 700-mile range is years away and will probably never be manufactured.

Once permanent oil decline sets in, people will barely be able to afford to wear-out tyres (tyres are made from a lot of oil and little bit of rubber), let alone use up scarce and extremely expensive electricity to footle about in cars.

Long distance road transportation will probably always be primarily powered by liquid fuel; fossil or - heaven help us - biofuel. It will be mostly confined to moving to goods and food, with buses for people in places where rail is impractical.

Mass car ownership - the phenomenon that pissed away a priceless legacy of fossil energy - was an artefact of cheap oil. It is already dying inch by inch at $140 a barrel.

Here in the UK, I predict that in 10 years time, most people will still be driving the same car they own today, or the next one they buy. They will use them rarely, when they can afford the fuel or really, really need to go somewhere.

If they're earning a lot more more than most, they may own a small EV for local trips. But most people - and this is what really scares today's car makers - won't bother buying a new vehicle. When people's income is down 25-40% (conservatively) compared to the cheap oil era; fuel costs per mile have quadrupled, and the relative cost of a new car has trebled, what are they going to prioritise when food and home heating costs are also much higher than today?

We can only maintain economies and lifestyles built on cheap energy with more cheap energy. Where is it coming from?

There is a super efficient electric vehicle on the market NOW. The TWIKE is made in Germany. The discovery channel show Daily Planet did a show that covered this one. I think it will be great for use in the city especially. When I can get one in Canada, I will try, but the 2008 production for North America is all sold out.

This vehicle uses no oil and requires little electricity.

www.twike.com

Can someone tell me that this doesn't at least help with the problem of high gas prices? I realize that this vehicle needs to be mass produced.

For one thing, it has a top speed of 53 mph, and it costs 20,000€ for the basic version with the smallest battery pack. The 20Ah battery that gives a 100 mi range costs an extra 7,000€. Battery costs are prohibitive for any vehicle larger than, say, a 70 lbs Segway or electric bicycle. 18650 Li-ion cells are mass produced in the billions for laptop batteries. They cost about $4 each, and capacity is 2 Ah at 3.7v. The Tesla Roadster uses about 7,000 of them.

For comparison, a motor scooter like a Honda Elite 80 with the same top speed but minus the weather protection costs $2,400 and gets 70-80 mpg. If you can live with a 35 mph top speed, a 50cc motor scooter costs $2,000 and gets over 100 mph.

I'm part of what is probably a typical suburbian family.. a quick tally would suggest that between our two cars, we have about 6000 miles commuting and 3000 miles holiday/family visits travelling.

Clearly, replacing one of our cars with an EV of some sort for those 6000 commuter miles would drop out oil consumption a lot (perhaps >70% since the other 3000 miles are motorway-intensive).

As for what EV to get, I was looking at this:

http://www.powacycle.co.uk/Salisbury-Lithium-Polymer-Electric-Pedal-Bike...

So although you are technically correct that EVs are not currently a direct replacement for all car usage, for an awful lot of journeys they can act as replacements, especially for 2-car families.

Actually Hag, I've got one of those too. I've been commuting with it for four years, now I try to save it for special occasions like yours (wave as you pass through Lyon please!) -- I reckon I can run it for 15 years at least under those conditions.

And I won't complain about paying whatever price the diesel costs in 15 years' time.

But I sure as heck won't be commuting with it, or anything like it.

Dunno, granted it isn't fully electric but you might be able to go camping with a few people in one of these, eh? Might even be room in there for a few bicycles and kayaks for side trips.

http://transit.metrokc.gov/am/vehicles/hy-diesel.html

Now imagine if the darned thing weren't shaped like a box and were designed with some basic knowledge of aerodynamics to boot? Nah, furgetaboutit can't have any of that new fangled idea of conservation and fuel efficiency now can we? Everybody must go out and get yourself a new 5.0 L Land Rover with all wheel drive and big fat mud tires and a giant winch for pulling tree stumps mounted on the front.

You wouldn't want to go camping by bus with your friends family and neighbors. Heck they might think you weren't a rugged independent outdoorsman, they might think you were a green socialist or something even worse.

Ride a Bike or Take a Hike!

This type of vehicle could get yourself, your family and several hundred of your closest friends from scotland to france, and you wouldn't even have to fill up when you got there. I suspect that one or two may even have been built over the years ;-)

Here.

Yes, it's a train; so? Is there some fundamental impediment to travelling by train from Scotland to France? My understanding is that you can make that trip today, although not all of the rail will be electrified.

If you truly need to travel into rural areas - and if you're going camping, you don't "need" to - then you could rent a vehicle at the end of your train journey, immediately cutting your petrol requirement to a small fraction of its former level. If the problem is only those last miles, it's much less difficult to electrify them. Miles Electric Vehicles has been building production EVs for years, and has an 80mph/120mile sedan planned for 2009.

Electrified rail costs and benefits have been covered pretty well by Alan, so I'll refer you to his posts. The EV is targetted at $35k-$39k MSRP, which is a little under twice the price of a comparably-sized petrol sedan (Camry), but at US$9/gal in France, you'd expect to make back that difference after burning about 2,000gal of petrol, or about 50,000 miles of driving. Or much less, in a fuel-restricted world.

The rate at which the current fleet is replaced will depend enormously on what rate is required. Fuel is currently not that expensive, so I wouldn't expect rapid uptake, or conversion of whole car factories to produce EVs. By contrast, a fuel-limitted world would see much more demand for EVs, and hence much more rapid uptake. It's impossible to say with any real certainty how replacement would go in any particular scenario; however, one interesting thing to note is that 50% of US miles driven are accounted for by cars 5 years old or less, meaning that any rapid shift in the market will be reflected quite quickly in overall efficiency.

All sorts of things can make a car move, but really it seems silly that if I want to go from A to B I should use all that energy and pay all that money to drag a tonne of steel with me.

Electric cars are feasbile but high power equipment like trucks excavators fishing boats large ships the list goes on slill need liquid fuel!.

Actually, a lot of giant-scale mining equipment runs on electricity.

And electric trucks and SUVs have appeared too...

http://www.treehugger.com/files/2008/06/world-most-powerful-electric-tru...

http://www.ens-newswire.com/ens/may2008/2008-05-21-092.asp

http://www.phoenixmotorcars.com/

For regular vehicles, Tesla have announced an electric sedan to go with the roadster too now.

http://www.inhabitat.com/2008/07/01/new-submission-29/

I think there are now something like 30 companies currently producing or trying to produce electric cars. This is the result of just a few years of high prices. What do you think the world's vehicle manufacturing industry will look like in 5 years time ?

In five years, not much different to today on the surface. GM will have gone bust. Chinese brands will be appearing in small numbers in Europe and elsewhere, just as Chinese small motorcycles and scooters are already doing in the bike market. There'll be a widening gulf between large luxury cars for those who can afford the fuel (and taxes), with low-cost, low-CO2, low tech cars for the increasingly hard-up majority.

Beneath the surface, though, the wheels will be coming off for many manufacturers.

With lower disposable incomes and reduced access to credit, their traditional customers in the West will have to save long and hard to afford new cars. All the time, the rising cost of energy will make cars more expensive to make and more costly to fuel when people eventually get together enough cash to buy one. Sales volumes will shrink and weaker car makers will go to the wall.

Unlike the 1970s, Governments have learned the foolishness of trying to keep dying auto giants going with public subsidies for the sake of jobs. In any case, the Governments will have their hands full just trying to keep the power grids up, food distribution going and public transport running.

By 2013 the descent down the other side of the peak is likely to be starting - snuffing out any last hope of a return to growth after the nasty recession of 2009-2012.

IF people have used the next few years to pay down debt, cut their energy use and, if possible, save some money, there may be enough liquid wealth available to prevent the complete decline of large scale passenger car manufacturing. I'm not holding my breath on that one.

The roadblock facing the car industry is not technical, it's economic. Even if the first few years of energy descent are not completely chaotic, private car ownership will be so far down people's lists of financial priorities that car makers will be a great place to lose money.

I'm with memmel and others who have posted here that it will be probably 30 years before a stable auto industry re-emerges that is suited to a steady state economy. I wouldn't be surprised to see one or two names from today still around, together some Russian and Asian brands that will emerge in 2015-2025.

Technologically, the vehicles and infrastructure will probably look pretty amazing but in most communities there will barely be one vehicle for each street, let alone two on every driveway.

The plug-in planned by Toyota looks far more economic than GM's planned Volt, which is over-specced.

To run for their planned 40 miles they need around a 16kwh battery, and lithium batteries currently cost around $1000kwh, so you are adding about $16,000 to the price of a car.

This is too expensive for most to switch.

The new Prius plug-in is aiming for a more modest 10mile all-electric range, so at around 4kwh it would come in at a more modest $4,000, and with mas production they are hoping to halve the cost of the batteries, and at that price they are more likely to have a mass market than the expensive Volt.

For the daily commute that would give an effective range of 10 miles, as they could recharge at work. That covers more than 50% of users even in the States, whilst those who drove 20 miles each way would still halve their fuel bills.

Advanced lead-acid batteries using capacitors to prevent deep discharge would be still cheaperhttp://www.csiro.au/news/UltraBattery.html

UltraBattery sets new standard for HEVs (Media Release)

Costs for those might run at $160/kwh, not counting the capacitors, so you should be able to get a good performance from less than $1,000 cost premium.

Power use might be around 6kwh for a 20 mile a day trip to work and back - around 300/watts/mile as you would not totally drain the battery.

So one GW of power generation would run around 4 million cars at this level of use, so for the 1.6GW nuclear plants 30 million Australians of whom half might run a car that would take around 3 plants.

Solar power might require an installed capacity of 2kw per car to make up for intermittency, and this and wind power would combine very well with a fleet of EV vehicles as the storage is taken care of.

The biggest problem is getting EV's built in time.

Toyota plan a million a year build by 'the early years of the 2010 decade'

Even with a ramp up of those plans due to continuing shortages of oil and allowing for the efforts of other manufacturers it is perhaps difficult to see more than 4 million or so being built a year by 2012, when the oil crunch will be well and truly here.

So can people stay mobile, also taking into account that most incomes will be much reduced?

It seems clear that much more modest electric bikes and trikes will provide much of the answer, with far more modest costs and power needs.

Hardly a case of carrying on trucking, but considerable personal mobility should remain.

Long-distance trucking is much more difficult, as batteries are basically inadequate for it.

To the extent that rail can take over this seems likely, and in the case of Australia perhaps some trucks could use natural gas - I am not sure how practical that is for large lorries.

Shorter distance delivery vehicles are possible within today's technology:

http://www.j-sainsbury.co.uk/cr/index.asp?pageid=63&caseid=vans

J Sainsbury plc : Responsibility : Case studies : Case studies - Environment

Rotating the fleet can't be done overnight though, so a lot of problems remain.

"and with mas production they are hoping to halve the cost of the batteries"

If this is the case then the GM solution is going down to 8k. Also tech improvement is probably going to be another 20% in a few years bringing the battery cost in the GM idea down to about $6000. This is ballpark what the tax rebate is likely to be on these cars.

As far as production constraints, there is no real reason that the industry can not switch over to total serial hybrid in 5 years. The only real bottleneck is likely to be battery production but the whole idea of ganged cells seems to lend itself to mass production. Whatever estimates being given by the car companies are likely their estimate of demand rather than what they could actually produce if they had the orders. I suspect that the demand response is going to shock even the most ardent supporters of the tech.

The US, up until this recession began was at a run rate of about 16 million vehicles per year. The heavy use driving fleet is around 100 million vehicles. This could turn over in 6 years once the ramp is in place.

At a premium of $16k over a petrol car, I can't see GM having the volume to drive battery costs down.

At a premium of $4k initially, Toyota will have.

Toyota is also going to be here in 2010, whereas it seems much more doubtful that GM will be.

If we were talking about a BAU scenario, I would have thought it would be possible to transfer most production to EV vehicles by, say, 2015.

We are going to be trying to do this though whilst coping with the mother of all recessions, falling incomes and high oil prices.

Under those disrupted conditions then I can't see production of more than a fraction of the current annual vehicle production.

So basically for financial rather than technical reasons I would see most of the production consisting of electric bikes and motorbikes.

France may be an exception to that, as demand for building nuclear power plants and its agricultural products may sustain it's economy far better, and it has a low cost base for electricity for industry from it's nuclear fleet.

Where will all of the electricity come from, what source?

Gas>LPG>Coal/Nuclear>Fast Breeder>Renewables>Fusion

+massive downscaling of demand.

Nick.

Electricity certainly can power a car but I think it will take quite a while to replace even 50% of the petroleum-burning fleet. Modern civilization has been built on the assumption of cheap, abundant and never-ending oil (even though we have always known that it could not last forever). Most people live too far from their place of work - where they go each day to do their little bit to prop up the economy - to be able to walk or cycle. Decades of growth in private vehicle ownership has led to a public transport system only a fraction of the size necessary to replace cars. It currently would not be able to replace half of the cars in the cities or even a quater. A monsterous investment in bus services (which themselves use petroleum) and trains and rail infrastructure would be needed, costing many, many billions of dollars and probably taking several decades to complete.

As I see it, we simply aren't prepared for the end of cheap oil.

Very good article - a bit disturbing as well. I see the price of oil has subsided a bit as the dollar has regained a little bit of lost ground. Can't see it lasting though.

1. the problem is people can just drive less. car pool or ride the bus all w/o having to do anything with the existing stock of cars.

2. modern civilization was not built on cheap and abundant oil. during certain times it was, and certain times it wasn't. that's a mute point with oil at $140(for now).

I really like the idea of mute points. Good to practice with them now and again.

Yes! John is moot, but, unfortunately, not mute. Since he's either JD or an industry shill, Best Hopes for Both to Happen Soon.

Cheers

I wouldn't go so far as to ignore the externalized costs of automobile use, and fossil fuel use in general. That oil may have been cheap to purchase a few decades ago, but it's marginal externalized cost via use in automobiles alone in the states as of 2003 was estimated at ~$270-1,780 billion. In the past, when oil was far cheaper than it is today, I imagine that costs in some cases were worse due to far fewer safety features and primitive emissions systems.

We're spending ~$585 billion per year on gasoline at $4/gallon, plus another ~$175 billion on new vehicle purchases, and at least ~$270 billion on externalized costs. On the low end automobiles in America cost ~$1.03 trillion bucks a year, and on the high end ~$2.54 trillion. It appears the efficient electrics ala the Aptera are ~20% more expensive to purchase per year assuming the same rate, at ~$210 billion per year, but would only require ~$50 billion per year in renewable energy costs, not to mention the reduction in maintenance costs and eventually the fleet rollover rate. Even w/ oil at ~$30-40/bbl during the good ol' days of 2004, the difference in costs would still be at least ~$450 billion and possibly $1,900 billion. Aren't we blessed to have "cheap" oil! ;)

That being said, I doubt Americans will enjoy giving up their perceived "freedom" on the road any time soon, regardless of what the costs are.

...and don't forget the body bag count because of being forced to go sort out whoever is using their new found wealth 'wrongly' with their new toys in the Middle East...

Nick.

I've seen a few informal guesses as to how much that costs, but no one has included it in their papers AFAIK. Sufficed to say it would be huge, unless of course we devalue human life in the estimate. :(

My guess is that John is provided by the hosts of this

site.......much like a Pinata is provided for the

amusement of children at a Mexican birthday party.

John15: Have you ever seen those "bumper cars" at

an amusement park?

They have a metal pole on the back that reaches to

the ceiling to an electrical grid.

We can build an electrical ceiling over all the roads,

parking lots, driveways etc etc etc.

And we can eat cotton candy and ice cream and live

happily ever after while we watch Jetson cartoons.

Just ignore the kids John - some of them are a bit poorly socialised (not to mention out of touch with what is both practical and possible).

Ever seen a tram Neph ? I think they invented them about a century ago - they work quite well (in those cities that didn't rip them all out after GM and Firestone decided to destroy the industry).

As Nate always says, don't feed the trolls... He is plainly ignorant, man needs to read Tainter's or Jeff Vail's books or something then maybe he will get "it".

"It is difficult to get a man to understand something when his salary depends upon his not understanding it."

-Upton Sinclair

JD's a katana to this guy's butter knife.

Kinda makes ya miss Hothgor, doesn't it?

Might I remind people of the Reader Guidelines?

"4. Treat members of the community with civility and respect. If you see disrespectful behavior, report it to the staff rather than further inflaming the situation.

5. Ad hominem attacks are not acceptable. If you disagree with someone, refute their statements rather than insulting them."

If you think he's ignorant, that should make it easy to refute his statements, no? If you're going to try, I'll refer you again to the Reader Guidelines:

"2. Make it clear when you are expressing an opinion. Do not assert opinions as facts.

3. When presenting an argument, cite supporting evidence and use logical reasoning. "

At another board I frequent an old-timer posted to beware of the commodity bubble bursting. He posted this:

I asked him how in the world we will have synthetically produced coal for $60/barrel. He hasn't answered me yet. Is this person way off base? and why?

Thanks to anyone willing to educate me.

The problem is scalability. The world can - and does - make some syncrude from coal and maybe that cost is $60 or even less. But if you tried to make enough of it to offset the declining availability of crude you would soon find cost escalations similar to those now being experienced by oil companies trying to bring up enough oil to meet demand. There may be a hundred or two hundred years of coal at current usage, but at a vastly acelerated usage coal would soon become much more expensive and scarce.

My modification of Tainters collapse includes the folly of simple substitution. We had cheap oil for 16 years because we substituted NG for oil in a lot of use cases this had two effects it kept prices low but it also ensured that remaining demand for oil was in a market with no easy substitution. I like to think of it as a compression phenomena like a spring we causes a compression with this event and thus the markets became inelastic. Where we substituted for oil electric generation etc NG became critical and oil became critical for transportation. But the reward was lower prices.

Next you set up a parallel depletion path i.e your depleting two resources and in time with population growth oil demand reached and surpassed the peaks of the 1980's. In addition NG demand increased dramatically.

Finally you hit the real Tainters collapse situation not from outright depletion but because we now need NG in the trasportation industry to help with substitution of heavy sour crudes for light sweet crudes but the previous round of substitution has eliminated this as a source.

Coal is no different we did the same thing substituting coal where NG or oil where too expensive. The current markets for coal need coal and demand is inelastic. Trying to things like CTL simply drives up the cost of coal.

Now here is the important part our society is dependent now on all three resources coal/NG/Oil and they are used in large amounts in critical areas. You cannot take from one of these sources without increasing prices this price increase is eventually passed on lowering consumer purchasing power.

You have zero net new money or GDP created. You simply shifted the expense from your gasoline bill to your electric bill. At first this might be a nominal win but eventually you reach price parity.

A perfect example of this is corn ethanol. Initially at least it nominally saved you money but it eventually drove up both NG and food prices and now your paying out more then if you had never done corn ethanol.

We are out of free lunches we have eaten it all.

Even a move to electric rails or electric cars is not free since it limits the area accessible by high speed transport. With gasoline powered cars you get a general rise in property values across a broad area while a electric transportation system favors denser population areas. You get a exponential drop off in desirability as you move away from the rail system. Even adding a EV commute plus rail does not help since your total commute times are significantly longer then driving a gasoline powered car. Also of course roads are horribly expensive and maintaining them for a few EV's when most people are using rail does not make sense.

The point is even this solution cannot keep property values from falling exponentially as you leave the rail lines. The changing desirability pattern alone makes it obvious that you would see significant deviations from the current pattern.

And of course all the various robbing Peter to pay Paul conversions generally result in higher costs anyway so purchasing power is going down. And its going down anyway because of resource depletion.

Bottom line no matter how you work this for the next several decades each succeeding generation will have less money to spend then the preceding generation. This will continue until we move to electric transport and renewable or long lasting (nuclear) electric supplies.

Once you are in the situation that the next generation can afford less debt then the proceeding one the party is over. You cannot take on a 30 year loan for a house expecting that in 10 years someone can pay you what you payed plus inflation etc. Your interest is not covered nor your principal payments.

You can't pay 20k for a car then 5 years later all a smaller amount of people can afford are 10k cars so new cars cost 10k your car you just paid off with interest is worth 1-2k.

Same for credit card debt.

Same for companies their energy costs go up each year and the eventual consumers purchasing power goes down each year.

Bottom line is our current economic system is dysfunctional and it should be obvious to everyone that its already dysfunctional. It cannot be saved by any known technology. The wedge to scale up a new technology and its costs coupled with increasing existing costs simply reduce purchasing power of consumers.

This is another important point substitution works only if it results in lower overall costs in the short run if your goal is to maintain the status quo or business as usual.

I argue that a transformation back to rail if you factor in the losses in property value and the direct costs does not meet this criteria so we won't do it without pain and we cannot do it fast enough without a national mandate to prevent current transportation costs from increasing while we transform.

Bottom line is we are going to lose a tremendous amount of money in fact we are basically going to lose everything we spent 70 years building and restart our economies from a level similar to that of the 1930's.

It will be 30 years at least before real GPD growth returns and it will be done in ways that are low energy.

And finally we cannot make this transformation without having to deal with the population problem.

Its pretty clear that if the average Americans wealth is reduced to the level of his grandfather that

the level of wealth in the poor countries is effectively zero.

This can be seen simply because once Americans are spending most of their incomes on necessitates they don't need most of the products currently sold via world trade or most cannot afford them. These export economies don't have in general a large enough internal economy to localize without tremendous hardship.

But the sooner we recognize that we need to write off our current style of living and convert to electric rail the sooner we can get back to having functional economies and more important by not burning up the last of our fossil fuels trying to transform without pain we may have enough to help the third world transition without undue loss of life. Population can and must decline but it can be done gradually with dignity.

We can feed our current population and if we create human policies that encourage slowing and reversing population growth then we can do better overtime.

I'm not saying life would be great in these third world countries it won't be good in the first world but its possible if we act decisively and quickly to convert to reduce the suffering by orders of magnitude.

Pussy footing around talking about EV's and ways to keep our current dead end economic system going simply condemns millions and maybe billions of people to death. The chances of keeping a stable society anywhere on earth under those conditions is zero.

Memmel

Can you elucidate on "real GPD growth", We have followed a path of conspicuous consumption for the last century (with a couple of major breaks for population destruction), But as I look at it now there is no proposed philosophy for sustainable world development, Malthus was right, he just got the timing wrong in relation to humankind. In AU/NZ we have political systems that canonise the "family" and hence unlimited reproduction, but unless the human race gets a grip on the physical limitations of the world we will be condemned to an unending series of catastrophes.

Neven

Well for example most of the growth since about 1990 in the US was the result of financial manipulation.

Playing games with the financial system to blow bubbles. The dot.com ponzi scheme followed by the housing bubble etc. I'm not saying that the growth of the internet was not real and did not contribute but sane financial conditions would have probably resulted in a better more stable but rich and diversified result.

I work in computers and was a CTO of a dot.com so I know a lot about what happened.

Real GDP growth to me is increases in the standard of living without inflation.

Or you can define it as accumulation of wealth.

A simple example would be harvesting some trees for timber then waiting 100 years to make the next harvest.

And using that wood to build furniture and dwellings that last for 200 years or more.

After 500 years you have accumulated significant real wealth say owning several 500 year old handcrafted chairs.

Not you in the individual sense but society.

On the flip side temporal items such as a perfect pie are also wealth not some factory produced plastic wrapped garbage.

Industrialization created cheap imitations of wealth not the real thing as time wore on wealth began to mean bigger flashier more expensive guady baubles shoddily made with advertising campaigns and brand names far more important than the actual products which where mass produced. And then of course they either broke or where replaced with needless redesigns so your bauble "looked" old.

This however costs a lot in resources and energy and at the end when you run out of energy all you have left is the last shiny piece of crap built to the lowest standards that will crumble in 15 years.

Practically nothing we have today will last more then 15 years before it needs serious repair not the roads not the homes not the buildings etc.

The only thing Tainter and Malthus misunderstood is the concept of partial substitutions and specialization.

For example all the people excited about EV cars are complete fools. Adding EV's is simply partial substition they only work for a subset of the current use cases for gasoline but assuming we manage to succesfully pull it off which is doubtful this will lower the price of gasoline or stabilize the prices allowing continued use in other areas where EV's don't work. My best guess if everything went perfectly it would delay collapse by 5 or ten years at best. Eventually of course we will deplete the remaining resources and 5-10 years from now it will be even harder to change.

How I feel about EV's does not matter what matters is they are just a stopgap partial solution and we dig a deeper hole.

Its time to stop first and foremost because we have 6 billion people to feed.

Next we have 6 billion people who's descents hopefully less in number deserve a better life than us.

This means building real wealth.

Roads and rail lines that last hundred or thousands of years. See the swiss rails.

Sustainable energy and food etc.

Lasting structures that use passive and active natural heating and cooling etc.

Its time to start leaving our descents wealth that can pass through generations not a mess that self destructs every 15 years.

Thats real GDP growth. And certainly not stupid EV's which thank god this time we waited to long to build.

Now that I'm pretty certain we have waited to long to pull off another partial substitution and that we will hit the wall this time I'm glad we are doing it while we still have enough resources to change.

Probably for the first time in history the stupidity of our governments has accidentally forced us into a situation where we will have to change and confront the mess we have created. I'm thankful that people like me are ignored. If we don't crash we won't change but continue to dig an ever deeper hole that we may not be able to escape from.

Even if we managed to do some substitutions the added time is minimal.

Think about it the world uses 84mbpd the US uses 25mbpd if US demand went to zero.

The world usage would go up again exponentially I figure wiping out the gain from the US demand in less than 10 years. Substitutions that people are touting as saviors would at best reduce demand by say 5-10mbpd but incrementally. My best guess is this buys us a extra 2-3 years. Chinese demand alone plus a revived economy would dissipate the savings rapidly. This is the vicious dark underbelly of partial substitution.

I wish Tainter had seen it.

So for the most part I'm not worried about the proposed partial substitutions since they don't change our out come enough to allow us deplete our remaining resources a lot more. The good news is we will have to make changes with what we have and the better news is its before we have wiped out all remaining resources.

So despite our desires it seems we will have a decent chance to change. Like it our not.

Memmel,

Congrats on your point about NG substituting for oil. It's an enormously important one and deeply troubling. It seems highly relevant to the optimistic point sometimes raised about global economic growth continuing during the 1980s while oil consumption declined - as if the same will happen again.

Here in the UK, with oil and NG switching from domestically-produced abundance to imported, er, something less-than abundance, the NG issue is crucial. Like the citizens of Rome who waited anxiously for news of grain ships arriving from Egypt, will I soon need to phone my relatives in West Wales to ask whether they have sighted an LNG tanker from Qatar on the horizon?

Memmel

The dot.com period was interesting to me in the fact that it was fairly obvious that nothing was created (everything was just shuffled into alternative piles) yet there was such excitement! Amazon et al just redefined how to do the same old thing.

I Think the EV enthusiasm is part of the grieving process, (denial?), I agree its not a solution it at best is like asking death to wait a minute. Even some of the activists ie bettertransport.org.nz I feel in denial, they are trying to use rail to solve the problem but have no notion that the whole Auckland area with its huge suburban tracts in unsustainable.

I'd not hold up swiss rail as an ideal, in my experience the Swiss are insular and obnoxious, they only exist in this way in the middle of Europe because the rest of Europe allows it, they keep everyones secrets. They have banned trucks on their roads, so the rest of Europe drives around them, no other European country could behave this way.

The other European majors have good rail networks and 'transport corridors' but more importantly their life is centered around their local area, they don't commute 100's of miles. But this has to be expected they have been doing this for many hundreds of years.

My 12 months looking into PO has opened my eyes to many things, but most what complete idiots

economists are, the myopia of the general public and the fraud of political movements.

The energy crisis, which has been telegraphed, but enthusiastically ignored will redefine our existence, let us hope that the period of denial will not last until the edge

Neven

Neven,

I looked at the dot.com as nothing more than mail-order via electronic catalog as it was building. The experience our local bookstore that had to close because of massive scale money losing dot.com's was repeated all over.

You mention the fraud of political movements. My son mentioned he supported a pro-choice candidate. I explained that abortion is a red herring, energy will effect everything he does as is the bigger issue.

D

"The dot.com period was interesting to me in the fact that it was fairly obvious that nothing was created"

Thats a pretty remarkable statement from someone that is instantaneously exchanging ideas with people all over the planet....

"I Think the EV enthusiasm is part of the grieving process, (denial?), I agree its not a solution"

The math says that EV is completely a solution and is doable with todays tech. Note that GM's first production Volt has been announced and will be on view in early September.

If the US were to replace its car fleet with even this very first gen serial hybrid electric, approximately 75 percent of gasoline usage could be eliminated by about the energy generated by 100 nuke plants at about a cost of 200 billion dollars initial investment in the nukes and ballpark 2.5 trillion in the vehicles. Operating costs of the vehicles would well be under $1 per gallon equivalent.

The only thing peak about oil is going to be price and demand.

David

Whilst the internet facilitated the "dot.com" boom it is not defined by it, I speak from experience having used the internet pre HTTP, (Yes the internet existed before WWW).

The point with the EV "Solution" that you miss is that it is simple substitution, if miraculously the US managed to swap the ICE fleet for EV's you would be still commuting a 100 miles, and the energy demand would continue to grow.

Even the much lauded electric train falls into a similar category, even if they are 400% more efficient does this a) allow you to use 25% of the energy you did or b) travel 4 times further. The advantage for humanity is that you cannot make this decision on a whim.

The US consumes 25% of the world output because it had a head start, given that this will be taken away , which logic do you apply that will allow this continued imbalance?

Neven

Neven

I too was a user of the internet before www, mostly to get papers on cold fusion :)

If you swapped the ICE fleet for an EV fleet the actual energy consumption to move the same number miles at the car level would be about 25% of current. Electric motors are way more efficient than ICE's.

I've posted the calculations here a number of times and no one has refuted them. To drive the same number of miles that the US currently drives, using an EV fleet of the same battery tech as the chevy Volt would require about 100 nuke plants of 1 GW size. Why this seems to be pie in the sky and wishful thinking I do not know. In any event the economics are compelling and will drive this conversion unless there is political interference. If the argument is that we are going to vote ourselves back to the middle ages then I have no response. Other than that the technology and the monetary incentive will do their work.

I do not understand the ongoing confusion between peak oil and peak energy. Current nuclear power engineering plus current Uranium reserves (never mind new deposits and a huge number of new technologies (thorium, breeder and ultimately fusion) are enough to ensure plenty of new energy for a very very long time. Long beyond the current technology horizon. It is only a question of price and time, neither which appear to be a big problem.

To put the 100 nuclear reactors figure into perspective, China plans to have that number completed or under construction by 2020 - not including the mass-producible pebble bed reactors.

http://www.redorbit.com/news/business/1457110/china_wants_100_westinghou...

China Wants 100 Westinghouse Reactors - Business - redOrbit

Since many of them would be of 1.7GW size that is far in excess of the power required for an American EV fleet.

I have just noticed that I gave this link in the post immediately below- apologies.

Actually, it's generally a little better than that.

The Lotus Elise gets 22mpg, while the related Tesla Roadster gets 0.2kWh/mi (incl. charging losses). At 36kWh/gal, the Elise is using 36/22 = 1.6kWh/mi, or 8 times what the equivalent electrical car is using.

8 times corresponds to 12.5% the energy consumption.

Of course, that will depend on how the electricity is generated and how much energy is expended in transmission (electricity) and refining (gasoline).

At the moment, 7% of electricity produced in the US is lost during transmission, raising the plant-to-wheel consumption to 0.215kWh/mi. Actual well-to-wheel energy consumption will range from 0.22kWh/mi (nuclear or wind/solar) to 0.5kWh/mi (42%-efficient EU coal) to 0.65kWh/mi (33%-efficient US coal). By contrast, the typical rule of thumb is that 14% of the oil is used in the production and refining process, meaning that the well-to-wheel consumption of the Elise is about 1.8kWh/mi.

Accordingly, in terms of total energy that needs to be obtained, the electric car will be between 3 and 8 times as efficient as the equivalent petrol car.

You appear to be arguing against a straw man. I am not aware of anyone who feels that we can seamlessly substitute EV's for ICE cars - they simply cannot be built fast enough.

To dismiss them therefore as worthless is to take an extreme and unsustainable position.

Even supposing that we can only produce enough to provide emergency service vehicles, a lot of lives could be saved by them.

The possibility of people using electric bikes and motorbikes you have also passed over.

It is quite true that maintaining the roads to present standards is not likely to be possible, but with less traffic that would not be needed anyway.

The US is certainly very car dependent, but that is an anomaly and it is hard to see how the still miniscule numbers of Chinese drivers being forced off the road would cripple their economy or make them unable to cope, although rising diesel prices will hit many of their costs hard.

Current plans for China include having completed or being in the process of building 100 nuclear reactors by 2020, and that does not include the mass-producible pebble bed reactors.

http://www.redorbit.com/news/business/1457110/china_wants_100_westinghou...

China Wants 100 Westinghouse Reactors - Business - redOrbit

And why, specifically, would France not be able to maintain its roads, or power electric cars to use them?

Hard times are indeed coming, but as always some areas and countries are likely to be relative winners, and are taking relatively effective steps in dealing with issues as they arise

"In AU/NZ we have political systems that canonise the "family" and hence unlimited reproduction,...."

in the us we have a tax system that monetizes reproduction. mccain wants to double the dependent deduction on fed income tax. the economic stimulus(aka consumer welfare) provided a $300 tax "rebate" for dependents that paid no tax.

elwoodelmore

In NZ we call it "Working for families", in the most cynical TV ad I've every seen the IRD (Inland Revenue) advertised this with a Father txting his daughter to come to dinner (she was in the same room but deafened by an i-pod), One of the child poverty action groups has now challenged this in court citing that it is unfair that non-working citizen don't qualify.

In the 70's we introduced the "DPB" the domestic purposes benefit, which pays single mothers to have children, the more children the bigger the benefit. When it was introduced some 8000 people qualified, now its over 100,000