And some (natural gas) answers are expensive

Posted by Heading Out on July 8, 2008 - 10:00am

| When problems start to arise, it is common, and often wise, to focus attention on the issues that the problem starts to generate, and to reduce attention on less obvious other problems. So it is at present, when the rising price of oil, and its consequent impact on gas, and thence more general prices, is showing the vulnerability of the economy to the supply of this critical fuel. |

But there is another fuel with an almost equally critical role in some aspects of our daily lives and that is natural gas. And with a growing reliance on Russian supplies and the Russian gas pipelines that also carry gas from places such as Turkmenistan, I think that more attention should be given to a statement made by Alexei Miller, CEO of Gazprom, last Thursday.

Gazprom forecasts that Russian gas prices will reach 500 U.S. dollars per 1,000 cubic meters by the end of 2008. "If oil prices exceed in the future 250 dollars a barrel, then gas prices will grow to 1,000 dollars per 1,000 cubic meters," Miller said.

The CEO was accompanying the new Russian President on a visit to Azerbaijan, where Gazprom are lining up the purchase of Azerbaijani natural gas, and intends to purchase the maximum amount possible “at market prices.” This comes at a time when Russia’s Finance Minister is recognizing that Russian crude output has peaked.

The reduction of crude output and the unstable pension system will create serious problems in the Russian economy, the minister said.

I discuss my concerns about the coming global decline rates in my next post, and certainly, having just read Petrostate – Putin, Power and the New Russia by Marshall Goldman I am not filled with confidence that Russian output will do anything to correct the global decline that is coming. But in the shorter term, winter is coming to Europe, and with it will come an increasing Western dependence on gas that flows out through Russian pipelines.

Please note that I did not say that the dependence would be completely on Russian gas, since the coming purchase of Azerbaijani natural gas, and that from Turkmenistan is likely to be a portion of that which makes its way West. However, while in the past Russia has been able to dictate the price that it paid for Turkmen gas, this is no longer the case, as starting next year Turkmen gas will also start to flow to China. And this will have an impact on the price that Russia must pay for the supply.

The Turkmen gas supply to the Chinese will in no way affect the volumes of supply to Europe and to Ukraine, as the gas would be brought from different fields, but it could implicitly influence the price growth, Alexander Narbut, a Ukrainian expert in energy issues said in comment to a Regnum correspondent in Kiev.

Besides, the expert noted that the influence on the price of supply is expected in the future only, as far as, according to existing arrangements, the gas prices for the Chinese do exceed the prices of the Turkmen gas supplied to Russia.

(As an aside Ukraine is anticipating a bumper harvest to help it pay it’s gas bill.)

The importance of gas supplies from these regions has not been lost on Russia, particularly given the Russian President’s background, and he was, this past week, in Turkmenistan, and Azerbaijan before ending up in Kazakhstan. In all three places the topic was Russian purchase of natural gas.

Medvedev and Nazarbayev on Sunday discussed the construction of a pipeline for Caspian Sea gas through Turkmenistan and Kazakhstan and increasing the capacity of an existing line, according to a statement on the Kremlin web site. They also discussed cooperation in "nuclear energy, peaceful projects in space, and matters of CIS integration," the statement said. . . . . The talks followed a similar course to those held Friday in the Turkmen capital of Ashgabat. Speaking after talks with Turkmen President Gurbanguly Berdymukhammedov, Medvedev underlined the need to quickly build the pipeline, which would consolidate Moscow's hold on energy transit from the region.

Russia has sought to undercut the Western push for the region's rich energy resources by buying most of its natural gas and selling it on to Europe.

Medvedev and Berdymukhammedov also issued a joint statement underlining the importance of the new pipeline along the Caspian. An agreement, Medvedev said, would be implemented "in the near future" after Russia, Kazakhstan and Turkmenistan complete the necessary formalities.

It may be remembered that the West has been pushing the alternative Nabucco pipeline from Turkey. Turkmenistan gas would be supplied to that pipeline through the Trans-Caspian Gas Pipeline. That alternative routing is still debated, but not, as yet implemented, and the recent Russian actions underline their opposition to it. Their willingness to buy up all available supplies (and sell them on to the West) is illustrative of this intent.

However, as the quote at the top makes clear, along the way, if the Russians are going to have to pay a much higher price for the gas at the source, then once it has worked its way through several countries, with their transit charges, the price in the West may have gone up a fair bit, and Russia still makes a profit.

"After gradual transition to world prices, which are inevitable, the issue of orienting these [gas] flows to other countries will be taken off the agenda. If Turkmenistan raises the price, the profitability of gas supplies to Russia or through Russia increases," Sergei Prikhodko told a briefing on the eve of Russian President Dmitry Medvedev's visit to the energy-rich Central Asian state.

That profit has been significant in the past, since only last November, recognizing the possibilities of competition, Russia increased the price it was paying for Turkmen gas.

The state-run Gazprom, which supplies 25% of Europe's gas, currently buys Turkmen gas for $100 (£48) per 1,000 cubic metres. The price will rise in 2008 to $130, then rise again in the second half of the year to $150, Gazprom said.

The year before they had increased the price 40%.

At a September 5 (2006) meeting in Ashgabat, Gazprom CEO Alexei Miller caved in to the pricing demands of Turkmenistan’s fickle dictator, Saparmurat Niyazov. The Russian company agreed to a roughly 40 percent price increase for Turkmenistan’s natural gas -- $100 per 1,000 cubic meters (tcm). The deal covers purchases through 2009.

For months Gazprom had resisted Niyazov’s sudden effort to jack up the gas price from $65/tcm to $100/tcm, prompting the Turkmen government in July to lambaste Moscow’s energy policies. At one point, Ashgabat characterized Russian officials as "dogs and agitated monkeys."

It has been suggested that part of the reason for the purchase it that it will replace Russian supplies that may otherwise fall short, due to poor investment – in either way it looks like a good deal for Central Asia, and an expensive one for Western Europe, and ultimately for us all.

Update Leanan has two stories on this today, both aimed at warning Ukraine that it will have to pay more this winter, the first is from Reuters and repeats Miller's warning.

Miller has repeated his view that Gazprom's export prices in Europe will reach $500 per 1,000 cubic metres compared with $400 now as they follow record high oil prices with a lag of six to nine months. That story notes that Ukraine is currently paying $179.50 for natural gas, that Russia is buying from Turkmenistan for $150 (the price went up from $130 last week).

The other story, also from Reuters is an interview with the author of Natural Gas in Asia, Jonathan Stern, who while drawing some of the same conclusions I have given above, also notes that, since 80% of the natural gas that flows from Russia to Europe goes through Ukraine, this poses a threat of a contentious January not just for them, but also for Western Europe. (Particularly since the other 20% he notes goes through Belarus, and we just haven’t heard that row yet). With Continental Europe more willing to look after itself first, this may make it even colder for those folk on the end of the pipeline.

You can review natural gas production, consumption, import and export trends at the Energy Export Databrowser.

You'll have to forgive the fact that the map incorrectly identifies any FSU nations as the entire FSU (older mapping software) but you can still get interesting charts like the one below for Turkmenistan:

If you want to do your own analysis you can also visit the data page which has an archive of BP Statistical Review Excel workbooks and ASCII CSV versions of the oil and gas data from the 2008 workbook.

Have fun with the data!

-- Jon

Thanks!

Hello HO,

Thxs for the keypost. Natgas is arguably more valuable than crude when one's considers the Haber-Bosch process to make Nitrogen fertilizers [urea & ammonia], plus as a feedstock for other essential industrial chem-products. The sulfur extracted from sour natgas is critical for beneficiating raw phosphate ores, too.

We can always substitute human & animal energy [poorly, of course] for the transportation function of crude powered ICE engines, but there are No Substitutes for the Elements of NPK and sulfur to leverage photosynthesis above a Liebig Minimum.

The sooner we globally move to full-on O-NPK recycling and regular crop rotation for natural Nitrogen soil-fixation, the more remaining Natgas that can be used for other essential needs. The early stockpiling of I-NPK, but then using it very sparingly, to help us bridge over during the transition period to a full organic system is very important, too.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Natgas is arguably more valuable than crude when one's considers the Haber-Bosch process to make Nitrogen fertilizers [urea & ammonia], plus as a feedstock for other essential industrial chem-products...

You say arguably, so I'll argue -- here goes: Oil-based transport cannot possibly be replaced by human and animal energy on the scale necessary to sustain the global industrial economy. Without it there is no Haber-Bosch or much else. So while nat-gas is certainly critical, I would still put it second to oil.

Except for that, what you say makes a great deal of sense and will therefore be ignored.

I seem to be having a rough day. I've just been stabbed through the heart, shot in the neck and hit by a large truck.

1) How would you rank these events in order of importance to my future?

2) Who is to blame for the entire situation?

3) (extra credit) How could a candidate for public office use my misfortunes so as to derive the greatest electoral benefit?

Well pardner since yer in a arguin mood, I will venture to say that when you say to sustain the global industrial economy I would say that sustaining the global industrial economy is not essential and in fact quite deleterious to life as we knew it. How do you say in law "who benefits?"?

As I am sure you well know, the Haber-Bosh process is not dependent on the sort of global ind. economy we now have, it was invented In the very early 20th century and I am also sure you realize that oil may be going but it will be around for quite a while yet, I imagine there should be enough left to enable us to process the last of the natural gas into fertilizer, unless us Canadians burn all thet natural gas melting the prairies. So follow the bouncing market ticker and lets all sing: Oh bury me not on the lone prairie, it stinks of such things as nitrogen oxides (NOX), sulphur dioxide (SO2), volatile organic compounds and particulate matter, don't you agree. ( BTW, anyone know how to import musical notation ?)

I think this from Bob Shaw bears repeating:

The sooner we globally move to full-on O-NPK recycling and regular crop rotation for natural Nitrogen soil-fixation, the more remaining Natgas that can be used for other essential needs. The early stockpiling of I-NPK, but then using it very sparingly, to help us bridge over during the transition period to a full organic system is very important, too.

... and Bob have you bought a duck yet? Mine seems to be self replicating and is in brood mode right now. Great little composter and NPK producer. I can see it now, a world covered in ducks!

Ducks do not fix nitrogen. The nitrogen in their waste is from plants and is less than you would get by plowing the plants into your land. Ditto the K and P.

Not that I have a problem with ducks, especially over rice.

If we want to fix nitrogen, we can. Natgas is just the cheapest source of fixed nitrogen. Now if we could just get our fertilizer plants started up again so we don't have to indirectly import half our food supplies from overseas.

Siwmae (Hiya) WK!

Actually my white-clover undersowings, growing strongly as ground cover in my no-till food plots beneath my positively BURGEONING food-plants (see! mine's bigger'n yourn! Nyah!) do seem to be fixing atmospheric nitrogen pretty effectively, just as the experts say.

Also, the plots get composting-john output, once it's been well composted in the holding bins. And the free-ranging Muscovey ducklings (with their Turkish [Anatolian, Kangal, Karabash, Akbash, take your pick of these names and do a Youtube search] Shepherd Dog bodyguard) are taking up a lot of nitrogen, phosphorus, and other goodies, in the form of slugs, snails, etc., and passing them along to the beds in the form of their collected night-droppings. Collected and spread by me, that is. The duckling don't go up on the raised beds. You can multiply detailed local tactics of food-growning like this endlessly, using the permaculture methods.

Bob's right: if we can just drag ourselves into being slightly brighter than yeast, and get sophisticated organinc growing going bigtime, in the form of the many already-proven tactics of permaculture, we should be able to replace the horrendously inefficient, abysmally low productivity of industag (see here: http://www.permaculture.com/drupal/node/141 for more vindication of that assertion) with an organic agriculture that could, realistically, feed everyone -- whilst we do something humane but effective about our current population overshoot.

But WILL humans behave more wisely than yeast......? What do you reckon! --RhG

Just curious, how do you keep the ducks off the raised beds? And what do you feed the dog with?

Damn fox got my duck. Bit through the wire to get a grip and then ripped the wire netting off the night cage. Poor duck didn't stand a chance :(

Too bad about your duck.

After my ducks went and ravaged my bed of broad beans, I got hold of some plastic fencing that one can get at hardware and agriculture stores cut it into halves about 2 feet high and that seems to have done it for my Indian runners and Khacki Campbells which don't fly even that high and are not much in the jumping department either, (I wonder how they survived long enough to become domesticated). That fencing is easy to move and set up using a stick pushed into the ground every so often to make it stand.

Thanks Crystal. Yes, I used something similar, but to keep the duck on the bed prior to planting. The trouble I find with some Organic/Permaculture methods is that they're difficult to scale. I'm currently looking to extend my area of cultivation to 5000 m2 (1.25 acres) per year. Fencing becomes a headache in the end and try finding enough mulch to cover an acre.

Interesting about the Khacki Campbells. One of the reasons I had to cage my duck was due to it flying over the fences. Otherwise it would have been in a different area and safe from the fox. I should have clipped her wings, but she seemed so proud of them I didn't have the heart :(

When dealing with nature (or reality) then I guess sentiment has to be replaced with pragmatism.

5ooo m2? Well Burgandy, that's more energy than I have.

My vegetable garden is about 3500 sq feet and the rest of a quarter acre in fruit nuts and berries.

I am going to try using a mustard cover crop this fall as it is supposed to die away nicely. I plant in intensive beds (no dig) so that there is no room for mulch. If I had more land I would likely be spreading things out and undersowing as Rhisiart Gwilym (above) is doing. On mulch I think that what might be a passing thought is paper mulch, there is just do much paper about. My wife shreads just what comes through the mail and that gives bags more than enough, for the carbon layers, in the kitchen compost. Would need a pretty heavy duty industrial shredder though I guess:(

Never said it fixes nitrogen, said it produces it, and I hope you are ploughing with a horse as you will never get a horse egg from a tractor ... hmm then again, maybe you should think about getting a duck and forget that horse, as I remember, their eggs have a distinctly fishy taste:)

yes it can. hybrid cars and electric cars are moving forward very fast. GM is trying to the volt out ASAP. many mining machines can go electric. international shipping is slowing down and adding sail power!

Detroit 3 race to build fun, fuel-frugal cars

http://www.freep.com/apps/pbcs.dll/article?AID=/20080706/BUSINESS01/8070...

John15, you crack me up.

Do you mean the same Volt that is now projected to cost $45,000? (As far as I know, Tesla has always projected its electric sedan to cost $60k so the price may go higher still.)

And the same General Motors that will be looking for a bailout soon because in inflation-adjusted dollars its stock is worth the equivalent of $1.50 per share back in 1950? (That's an indication that investors generally don't think its prospects are good, by the way.)

http://online.wsj.com/article/SB121495482307421193.html

It must be fun to live in your world.

-Andre'

"Do you mean the same Volt that is now projected to cost $45,000? (As far as I know, Tesla has always projected its electric sedan to cost $60k so the price may go higher still.)"

The prices WILL go very high. But even they won't be able to overcome absolute shortages of multiple commodities, as Peak Everything arrives progressively. Ramping prices aren't doing anything to alleviate the energy crisis, are they?

Geology trumps economics, eventually.

I live in a apartment so where am I supposed to plug my volt in ?

My favorite is that the new EV's are aimed at city/apt dwellers the one group that has

no place to plug one in and has alternative public transport. Pets.com all over again.

My job is far enough away that I don't have enough charge to do a round trip where do I plug in my volt ?

We just lost our house because of a subprime loan and we bought this shiny new volt but we don't have a place to plug it in and are short of cash but they are hard to sell around here few people can afford them. The value has dropped so we are just going to let it get repossed.

GMAC announces a mandatory 50% down payment on all volts. GMAC because of severe credit problems and delinquent accounts caused by people stopping payment on gasoline cars now worthless in the switch to the volt have announced a 50% downpayment minimum on all volt loans. GMAC was forced into this move to stop hemmoraging losses on most of its existing loans for gasoline powered cars.

The massive drop in demand for existing gasoline cars has also put most potential volt buyers off.

I'd like to buy a new volt but my current car is worth far less than I owe so I'm going to have to drive it for a while. Luckily enough people bought volts that gasoline prices are down so it does not matter now.

I can come up with thousands of scenarios.

Bottom line if by some miracle you manage to get the fleet to turn over rapidly to electric you also just made the value of the 17 million cars sold over the last five years close to zero.

EV's not only suffer from the same deflationary effects as rail on existing infrastructure but they also with a little common sense don't work for a lot of car owners.

I will give you that if we has started serious investment in EV's 10-15 years ago before we hit peak oil and put the infrastructure and most importantly developed electric rail for all the people that for numerous reasons did not have the infrastructure to own a EV. Then they fit in.

I actually think they will eventually have a useful niche market for the fairly wealthy i.e top 20% of wage earners.

And smaller runabouts for city use may be popular.

But they only work as secondary transportation options for a few with rail being the primary.

If I can manage to get my dream post peak living conditions and EV's exist I might buy one but I'll also get a 250cc motorcycle but this is only if things work out well for me and if they did I'd not consider myself the average customer but a fortunate person. So I'm convinced they will be around and that as the market develops they will have a important niche. Assuming that rail head parking lots can be electrified which is sensible the biggest use case is getting to the train from your house.

Given the fanatics that have switched from drinking the Corn/Ethanol cool aid to EV's its almost worthless to discuss real markets that might exist for EV's.

And I won't reply anymore to EV's someone who cares can do a keypost on them.

This is a NG thread :)

And NG is not looking good globally.

Good luck burning that NG coking heavy sour crudes.

If gas prices go down, the value of all the cars sold over the last five years will not go to zero.

How high does the price of gasoline have to go before you write off your new car and switch to an econobox diesel with 50MPG? 20$ per gallon? That's what it will take.

Maybe the SUVs wind up in the cities making two mile commutes and the efficient cars wind up in the country making fifty mile commutes. It's the market at work.

Then your stuck back into a partial substitution and Tainters collapse.

You have dropped demand just like we did with the NG/Oil substitutions of the 1980's resulting in a short term collapse of prices. In the case of oil only 15 years. In the case of the volt if it goes this way at best given the market that can actually use it a few years of slowly rising prices.

Diesel commuter cars are even worse then EV's diesel is what runs are economy wasting it on some jerk driving to the office is even stupider than a EV.

The good news is that because diesel is so critical and demand for diesel to keep the economy going is so inelastic diesel is responding faster than gasoline making econobox diesel not a wise decision.

Every now and then the market does the right thing.

If we succeeded in partial substitutions then we deal with peak oil and having to move to electric rail with even less resources.

The good news is we are so friggin greedy that from my total analysis we won't be able to pull off another partial solution we will be forced to either walk or move to electric rail.

I'm willing to live with another fiasco like corn ethanol if thats what I have to do. It might buy me a few years to save more money and prepare for a post peak lifestyle. So from a purely selfish point of view I hope that EV's have enough success to delay things another year or two.

And more power for diesel econobox's or better gasoline powered ones so I don't have to pay higher food costs for your stupidity. I could use the time and at the end of the day since we are probably going to end up putting the rail in with manual labor it probably does not make a huge difference in the end anyway.

Finally the problem is the market cannot look far enough ahead to see the dangers raised by partial substitution of finite resources to level prices. Its not a calculation the market can perform.

In fact I used the market itself to discover this problem. If you know what your doing the market will tell you that its gotten caught in a partial substitution downward spiral.

Its already signaled that its caught in a spiral your simply ignoring what the market is really telling you.

Its market analysis which scared the living crap out of me not some tree hugging ideal.

Hmm, you are a bright guy, memmel. There are a lot of bright guys around though, and most are still wrong most of the time about most things.

A lot of them would also disagree with you.

Your analysis seems pretty rigid, and makes a lot of assumptions that no unexpected events or breakthroughs will happen.

Take high altitude wind, for instance, if that worked then the power problem would be solved.

Now I am not saying it will work, but there is no way I can determine ahead of time whether it will - and neither can you.

You have moved in recent postings from arguing your case to abusing those who differ from you, and haven't helped your argument by so doing.

You may know a lot, but there is no perfect analysis out there, and you are human not infallible.

If people are to prepare and take action, then they're going to have to make working assumptions.

Under current circumstances it is probably better to make preparations based on things that will exist in an imperfect future, rather than what may exist in a perfect future.

I think, for the purpose of preparation, it is better to get rid of the problem rather than try to solve it. Remove the need for personal transportation rather than attempt to substitute it with some inferior product. The transition phase can be covered with existing technology, possibly tweaked to give more fuel efficiency.

Darned if I can understand why it is alleged to be a perfect future rather than one in which most ride not very powerful Chinese style electric bikes, with a lucky few having a modest development from the present Prius car.

I think that these 'If I ruled the world' solutions are non-starters, and usually take no account of the different conditions in different places.

Put simply, as long as personal transport is practicable, people will use it, regardless of some theoretical consideration that they shouldn't want it.

Public transport is greatly stressed during rush hour, and not very efficient when operating at low load factors.

For some reason many who want to dismiss electric powered transport are keen on people bicycling.

At a tiny cost in electricity most for whom bikes are impractical can have electric bikes and trikes at reasonable cost, and attain most of the same benefits, for instance not having to employ a bus driver on a half empty bus.

France for instance has plenty of cheap electricity, so why would they want to walk everywhere when it is totally unnecessary?

The light vehicle production in the States is around 17million per year, not over 5 years.

Countries such as Israel and Denmark which are serious about them are also building fact charging networks, so avoiding charging problems for apartment dwellers.

There is no reason at all why modest electric bikes and trikes should not be usable by city dwellers in most places.

The Volt, just like GM, will not work, but the replacement for the Prius should be fine, and if you accept the limitations pure EV's can be done.

I would agree that EV's will not form a straight replacement for the current fleet, but will take some time and have a relatively low level of sales - but peersonal mobility should remain at a fairly high level if you don't mind getting wet.

The devaluation of the current fleet occurs because of the price of petrol, not the introduction of EV's, which will simply give some level of mobility to those lucky enough to own one.

Nonsense, all you need for haber-bosch is hydrogen gas and air. You can get hydrogen from just about any energy source you can think of; NG, coal, biomass, elecric power(could even be currently near-useless intermittent power like wind) or oil etc.

Natural gas just happens to have the nice property of being very cheap when it is stranded nowhere near a customer you could economically build a pipeline to.

The technology to produce ammonia from water, air and electric power without going via the haber-bosch process(quite a bit more efficient) is in the testing stage.

You not need any new artificial fertilizers if you recycle human and animal wastes.

Non green revolution seeds need much less fertilizers of which the micro nutrients are already in soil, of the macro nutrients 4 kg of nitrogen per acre come from rain and snow, 1 kg phosphorus come from river sediments that are spread in floods in rivers that happen every few years. You can have those floods if you use non green revolution seeds that our ancestors were using since 12,000 years, since they require less water per kg yield more water is spared so you start having river floods again.

Doing the non green revolution / traditional agriculture you can easily support 2.5 people from every average arable land, 20 inches rain or 2 acre-ft water or 10 inches rain and 1 acre-ft water etc. The key is to settle down at a diet with less meat, 62.5 gm per day per person in a 2000 calories per day diet, half of that meat must come from "white" sources chicken and fish.

Humans are currently using 6 billion acres out of 15 billion arable acres on planet. Having a population of 6.5 billion people we can adjust with our current usage of arable land.

Even if we do go for green revolution seed we can recycle human and animal excretions, this solve two problems: we no more polute fresh and sea water with human and animal excretions, we not need artificial fertilizers anymore (this free us from dependency on natural gas).

Hello Bob,

I'm thinking we might go easier on the four letter acronyms and give more play to words that ordinary folk can readily comprehend, such as "humanure."

But seriously, there are of course human and animal sources of O-NPK, if we keep to your terminology.

It would be nice if there were some Oil Drum type number crunching being done on this. Maybe it has been, and I'm just not aware of it.

If all human manure (globally, or in a region such as the U.S.) were composted and then returned to the soil, what percentage of current Haber-Bosch derived nitrogen could be replaced? I know Richard Heinberg has cited the figure that H-B has effectively doubled the amount of nitrogen available to the global ecosystem, and concentrated it specifically on producing food for humans. I don't suppose that humanure recycling could fully replace current levels of H-B fertilizers, but exactly how close could it come?

And your suggestion to stockpile I-NPK is well taken, since it will take time to scale up Organic NPK. This is true in the case of humanure composting, where it is recommended for safety purposes that an active bin attain temperatures of above 120 degrees F during its first year, and then be left to set for another year before it is safely used on crops. Such precautions might be even more important when it becomes a system used by most of the population.

Obviously it would also greatly slow the loss of usable phosphorous. How much? And how much fresh water could it save? And how much energy which is currently used to transport sewage, if the composting were done at a backyard or neighborhood level?

Clearly it's something that we have just got to do if civilization is to survive.

Google Joseph Jenkins and Humanure for more details.

And how much of a difference could more extensive propagation and rotation of leguminous plants, including legume trees, make? The latter can be spaced appropriately in the middle of a wheat field, a la Bonfils, and periodically cut back so as not to give too much shade to the main crop, the trimmings returned to the surface of the soil as additional organic matter.

And for another idea I haven't seen discussed on this forum, what would be the merits of F.H. King's idea to build a canal system in the southeastern U.S., modeled on the Grand Canal of China. His 1911 book Farmers of Forty Centuries is a marvelous read in any case. Basically the main branches of the proposed canal would extend from the Mississippi into Missouri, Arkansas, Louisiana and eastern Texas, and a second through Mississippi and Georgia, then branching up through the Carolinas to the DC area, and down through Florida. Not only could this be the centerpiece of a new transportation system in the southeast. From the viewpoint of sustainable agriculture (which was the focus of his studies in China, Japan, and Korea) the main purpose would be to greatly slow the loss of fertile soil and nutrients from the Midwest into the Mississipi Delta. He describes how the extensive canal systems were maintained by peasants themselves, in service of their own interest in making lands as fertile as possible. A major activity was dredging the silt from the canal bottoms to apply to their fields, along with the shells of the large snails that could be found with it. These were just two of the practices that allowed Asian farmers to maintain the fertility of their land through many centuries, whereas, as King saw even then, the U.S. was rapidly in process of depleting its natural heritage.

BTW, if anyone wonders, my active bin reads 130 degrees F this afternoon.

Should have said Gulf of Mexico rather than Mississippi Delta - referring to the point at which valuable nutrients are actually irretrievably lost.

I've been asking the same question myself. Quantitative data are of the essence. Or as Professor David MacKay puts it in his online book on Sustainable Energy:

David MacKay's site is here:

Sustainable Energy - Without the Hot Air:

http://www.withouthotair.com/

MacKay doesn't discuss agriculture, but his quantitative approach to sustainable energy is absolutely essential and should be applied right across the board.

Hello TODers,

My thxs to all that replied to my posting. Yep, I have posted the weblink to the Humanure info many times before here on TOD and other forums, but it is always good to see other TODers repost it for any recent TOD-newbies.

http://www.wired.com/science/planetearth/news/2008/06/nitrogen?currentPa...

--------------------

As Food Crisis Looms, Key Research Remains Underfunded

If there was ever a field crying out for innovation, fertilizer is it. Most fertilizer production depends on a 99-year-old industrial method known as the Haber-Bosch process, which produces ammonia, the chemical precursor to nitrogen fertilizers. By one scientist's count, the 87 million tons of ammonia that are produced each year by this process feed 40 percent of the world's population (.pdf).

However, the energy-intensive Haber-Bosch process depends on using lots of natural gas, both as a source of hydrogen and for the power needed to cook the chemicals...

-------------------------------

International Fertilizer Assoc charts & graphs:

http://www.fertilizer.org/ifa/statistics/indicators/pocket_production.asp

-------------------------

In 1980 the developing countries accounted for 31% of the world nitrogen fertilizer production. By 2000 their share had increased to 57%.

Over a third of the world's production is in just two countries, China and India.

------------------------

Once China & India start running into severe natgas supply problems, or any country for that matter, I would expect their economies to start collapsing as nitrogen, thus food supplies start shrinking. If they cannot afford the long distance, energetic transit cost of I-NPK imports, then things will proceed to get even worse. Again, IMO, rapid ramping of native O-NPK recycling is the best method to smooth the downslope ride.

Regarding my acronyms: I like to use I-NPK & O-NPK because it help simplify and distinguishes the vast differences between the many types of industrial & organic fertilizers, yet also clearly shows the Elemental Commonality across both classes. It also helps promote thinking about the NPK ratio; how topsoil needs a balance of nutrients to promote a healthy plant. Also, since I don't touch-type: these acronyms are easier than banging out the longer words--> 'industrial or synthetic' and 'organic or natural' every time.

Lastly, to those that pose good questions to me in their reply: I wish I could really help answer your valid concerns. I don't have the data-wizard expertise like the TopTODers; I fumble along the best I can. I have posted before asking for some real experts to flog this dog further along with a Peak Everything Analysis Overview. Time will tell.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Hi Bob

I am working on some data on hybrid systems in Asia (China), where augmentation with synthetic N coupled with intensive village in situ recycling, doubled yields of grains from 1960s. Internationally traded grains originating from USA, Canada, Australia, depend on much higher annual re-stocking of soil nutrients with synthetic N and mined P & K, and on massive mechanization. Fossil fuel input is very much higher for this latter production.

We need the numbers.

Phil

You provided a useful link.

I note that priority for N fertilizer should be possible in a post-PO world.

Hi Phil,

I thought fertiliser use per acre was relatively low in the countries you name?

http://wolf.readinglitho.co.uk/mainpages/countries.html

Which countries are best equipped to survive peak oil?

Bangladesh looks in big trouble from this....

Hi Dave

Good question - thanks for link.

Your question perhaps needs to be rephrased as 'how much synthetic fertilizer per tonne of grain'.

Farming is multifactor, each having potential to be a limiting factor.

USA & Canadian wheat is low yield per acre, relatively low NPK fertilizer input per acre, grown on vast mechanized acreages. Moisture (and perhaps related long term soil integrity) is often the limiting factor. Fuel for mechanized cultivation is probably an absolute.

USA corn (maize) is high fertilizer input, high yield, but also highly mechanized.

All of the above relies on soil nutrients being fully restocked annually from external sources.

Other countries traditionally ate most of the grain primary production (e.g. 80%) in situ, and to a large extent still do so. A high proportion of re-cycled nutrient input, plus river muds etc., means these days that augmentation with synthetic N goes a long way (yields can be very high per acre, with relatively low synthetic fertilizer per tonne, and with very little mechanization). For these intensive systems in favorable traditional areas (e.g. Asia), soil N is typically the critical limiting factor.

Previous estimates, Dyson, 1999, http://www.pnas.org/content/96/11/5929.full

have suggested a doubling of synthetic N production to meet 21stC population peak numbers. Natural gas for ammonia could go to 10% of annual NG supply? Post peak natural gas (say 50% lower than now), we could guess 20% of NG being needed for fertilizer at that stage?

Better numbers are needed country by country.

Phil

Figures are awful for fertiliser use.

The Bangladesh figures I assumed were for artificial fertiliser, but if that is not the case then they appear in a more favourable light.

I can't even locate figures on how much of the UK's fertiliser is imported, and how much produced here using UK natural gas, so how much that will use of our depleted resources and how secure it is is unclear.

The population forecasts are not good, as they are relying on Business as usual, and this will not apply in a post peak world.

Here are some initial estimates I have attempted:

http://www.theoildrum.com/node/4267#comment-376371

4267

And in the posts around it.

Let's hope things are not that grim, but I think the risks are more significant on the downside of UN projections than the upside.

Siwmae Steve,

1) One effective way to short-cut the making safe of humanure, that I'm just ramping up here now, is to feed it, liquids and solids both, to comfrey beds, then harvest the comfrey to feed both plants and animals. It's phenomenal at this. And you can get over a hundred tons an acre per year, sustainably, once you're expert enough. And well established plants can subsoil-mine as well, as much as eight feet deep. This is only a tiny vignette of what comfrey has to offer. Deserves extended study by serious organic food growers. All varieties are good, ridiculously easy to establish and grow, and tough as hell. But Lawrence Hills's famous 'Bocking 14' variety, developed with the help of us earth-grubber members of the HDRA decades back, is the champion, if you can get it.

2) I believe Matt Simmons is getting extensively interested in coastal and inland water transport in N America, putting his carefully-harvested money where his mouth is. That bodes well. He usually seems to know his arse from his elbow when lots of other 'experts' are still manifesting extreme confusion. Good luck with waterways. We still have quite a lot here in Britain, with potential for resurrecting a lot more.

3) The Chinese experience that you describe sounds very like chinampas. Anyone with cultivable ground lying low and near to (unpolluted) water should look into that, together with duck/fish culture. That can offer levels of sustainable, ecologically-benign productivity that makes even permaculturists gasp with delight. Bill Mollison, having started life in Australasia, has always been very hot for comprehensive rain-harvesting, using contour-chasing swales. That can enable this sort of acquaculture, even if your place isn't down in the swamp. Worth a look for anyone worried about sufficient water availability in the near future.

Heading Out,

Again some useful information and well formulated thoughts.

What I find interesting is that few Europeans seem aware of the new geopolitics of Russian energy.

It seems like complacency and a firm belief in the market to solve any future natural gas (or other energy) supplies have put people at ease….until they freeze in the dark.

A closer look on Gazprom’s forecast (Gazprom now controls 85 – 90 % of Russian natural gas production and produced approximately 550 Gcm/a in 2007 and has a monopoly on all natural gas exports) on natural gas production held up against the declines within EU (Norway with growing natural gas production will only partly offset these declines) ought to take away the sleep from many European politicians.

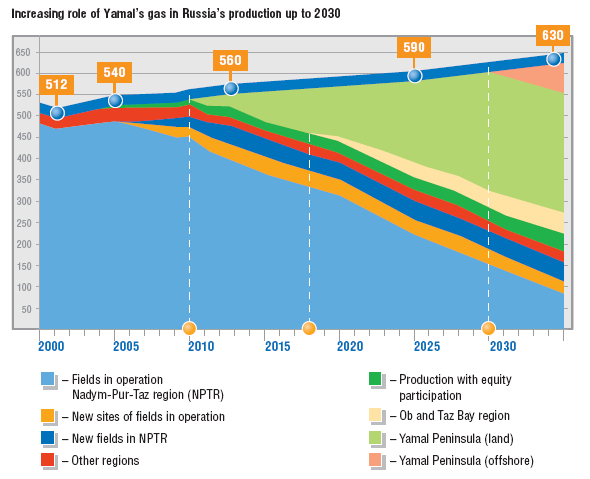

The diagram above has been lifted out from the report “GAZPROM in questions and answers (2007)”.

It clearly illustrates that Gazprom is headed towards some growth in natural gas production, but this production growth will be split among domestic consumers, Asian consumers and European consumers.

Total production growth for Gazprom is by themselves forecast to be 30-40 Gcm/a (Bcm/a) towards 2020, and with all respect that is not a lot.

Europe has for some time been sleepwalking towards a natural gas supply crunch, and the real pain could be felt this winter.

In the Energy Export Databrowser you might check out the following graphs for Natural Gas:

There's nothing like looking at the actual data to get a sense for what is happening.

Happy exploring!

jonathan,

to that I will completely agree. Lets hope the data in BP SR are close to the mark.

Thanks for the information, this is one of the issues that Euan brought up the other week. If Russia also has problems with coal so that

Russian natural gas exports may also be affected in the winter, coal exporters said, as they are diverted to make up for coal shortfalls.

then the situation could get quite ugly.

HO,

We are now obviously living in “interesting times”. One of the things which I feel is poorly understood is how cascading effects may deteriorate an already tight situation in many energy supply chains.

Let’s now go looking for someone to blame.;-)

I hope Yamal Peninsula production is a sure thing. Otherwise, it looks like production will drop precipitously.

Rune and HO, if you compare the Gazprom forecast with this from Jean Lahererererrere, they look quite similar - though you need to adjust time scale and mcm per annum to tcf.

Figure 21 Russian gas production forecast by Jean Laherrere showing how second tier fields may compensate for decline in the three giants - Yamburg, Urengoy and Medvezhye.

http://www.theoildrum.com/node/3283

It is I believe pipe dreaming that the Yamal will produce so much gas beyond 2020. Jean's forecast includes everything including Schtockman.

Europe is too focussed on import infrastructure and not looking at the supply that lies behind it.

http://www.theoildrum.com/node/3959

Euan,

I find a good fit between the Gazprom forecast and Laherrere’s forecast (converting to metric units and assuming some 10-15 % of total Russian gas production is by others than Gazprom).

I note from Laherrere’s diagram that he assumes Shtokman in production by 2012/2013, and the present development consortium assumes start up by 2013, which I believe is quite optimistic.

Shtokman is located some 500+ kilometers from land in the Barents Sea and in 300+ meters water depth. Presently they are favoring multi phase flow from the field to land. As of now there are only some experiences with multi phase flow over 150 kilometers. Multiphase flow is the source for several technical challenges like pressure drop (need to boost under way), slug flow which without proper design may expose the pipeline to frequent and irregular shocks etc.. If midway boosting is to be used they most probably will need to separate the liquids (condensate) from the gas.

Another thing has to do with logistics. If the field is to be developed with surface facilities (floater or jacket design) they most probably will need to shuttle the operators with helicopters, and as of now I don’t know of any helicopters that has a range of 500 + kilometers without refuelling.

Any others?

That I think is correct. It looks like the thinking is “if we build the pipeline or the LNG receiving facilities the natural gas will appear by some pure magic.

This is something Catton would have referred to as “cargoism”.

The pipeline system “North Stream” is primarily built to avoid transit through Poland and some of the Baltic states. A new pipeline does not automatically mean increased natural gas supplies.

Rune

Euan has been looking into this and posting about this quite a lot. I've also dabbled a bit with this issue, but not publicly that much.

Indeed, the situation can be unnerving. A lot relies on Yamal, even Alexey Miller of Gazprom seems to acknowledges this publicly.

It is interesting that the Oxford Institute for Energy Studies thinks volumes from Russia to EU will not be the problem for the next 10 years. At least, this was they opinion still in December 2007 (ref: European Gas Security: What does it mean and What are the Most Important Issues). Although they do acknowledge that supplies will be tight (c. 2010-2015) until Yamal comes online in large volumes.

They state reliability of the transport capacity and deteriorating relationships with EU. Further, they state that beyond 2010 it will not be profitable for Gazprom to expand exports to Europe. Alexey Miller also acknowledges this in a Financial Times interview on June 26th:

Of course the LNG map is still pretty much open, but if successful it'll make natgas much more fungible, opening up the demand competition. Europe can't cherry pick anymore or bicker about the price with the Asian demand surging. OIES doesn't think that the potential African LNG capacity will help Europe here much as USA will be bidding for that.

In their April 2008 presentation on Europe's natural gas situation I was surprised to find out that they've change their tone quite a bit, if I'm reading this right. They used to state that supply is not a problem for the next 20-30 years.

On slide number 32 of aforementioned presentation they clearly state:

This is quite a change and I think they are coming around to seeing that problem will also seriously concern volumes, not just price, politics and security of delivery.

Euan has done magnificent work on this issue and I expect the situation to pretty much unfold in the lines he has laid out. Of course, policy response will probably surprise us all, hopefully in a positive way. It's just that the time is running really short on major natural gas decisions, and not just for UK.

However, what even the most hardheaded politician should understand that the competition for access to energy resources is in full swing and that no country importing 50% of their primary energy mix as NatGas & Oil (all big CE countries) should think lightly about this.

BTW, the policy wonks at Rice University Jamer A. Baker III Institute...also came up with their supply/demand/natgas/lng forecasts (5/2008. This is their reference case:

Russian Natural Gas Exports

I have no idea how they came to that conclusion, but if our politicians are thinking based on that, then I guess they have no reason to worry :)

SamuM,

Thanks for posting.

I had a look at the presentation from Oxford Institute for Energy Studies, slide no.7.

My immediate reaction to it is that UK production will be in a steeper fall; this is supported by estimates recently conducted by National Grid and estimates on remaining recoverable UK nat gas reserves. (I also think Euan shares that position)

I also suspect others to fall steeper. Norway seems pretty much in line with present governmental forecasts (110 Gcm/a in referred slide vs 125-140 Gcm/a as present forecast from Norwegian authorities).

With regard to the Rice University forecast, it would be useful to know more about how they developed their supply forecast.

It appears that my original post regarding Russian coal problems went missing, so the re--post I have just done is now a duplicate of Heading Out's post.

Weird.

HO: thanks for an informative post. I remain unclear about the potential for LNG to offset near-term shortages, enabling imports of gas from Bolivia, Peru, Kuwait, etc. LNG is a big issue now in Oregon, where several proposals are pushing ahead despite substantial local opposition (having been denied access to California or Washington).

Check out Euan's article for NNG supplies here:

http://www.theoildrum.com/node/3959

The short answer appears to be that LNG will not be able to do the job to the extent needed.

Here is a wild idea for transporting natural gas:

Natural gas is lighter than air. So one can make a blimp filled with natural gas. How about making blimps that are totally unpowered. Out in Siberia or whatever remote site, just fill big mylar bags with natural gas, and let these blimps float up and away with the breezes.

Eventually these blimps ought to make their ways across continents and oceans. Let the blimps have tether lines attached. Folks with lightweight aircraft, perhaps hang-gliders or sailplanes, can roam around and gather these blimps and bring them to the towns and cities where the gas can be used for cooking, heating, etc.

It's like the wild west all over again. Except insteac of rounding up grazing cattle on the range, we have gasboys rounding up gas blimps in the wild blue.

The blimps could be branded, so the payment for the gas goes to the folks who launched the blimps a month or two back, half way around the world.

It's a bit, too, like those fire blimps that Japan sent during WWII across the Pacific.

Hate to pop your ballon Jim but NG is heavier than air. But I like your enthusiasm...keep that imagination going...it may be our most valuable resource.

That's why if you're around a NG leak you avoid the low spots...the NG slowly migrates to the lows. A lot of guys working on buried NG pipelines learned that lesson the hard way.

NG is lighter than air. Propane is heavier than air.

H2 = 2 amus

He = 4 amus

CH4 = 16 amus

N2 = 28 amus

C2H6 = 30 amus

O2 = 32 amus

C3H8 = 44 amus

CO2 = 44 amus

I doubt methane has the oomph to lift a blimp. Likewise I suspect those suffocated by nat gas are actually suffocated by ethane or heavier HCs.

Too much C2H5OH = 46 amus:-)

He2 = 8 amus?????

CH4 = 16 amus

Methane is lighter than air and has been used in blimps. He is monatomic. Otherwise it is not a very good idea. It's just too expensive compared to CNG ships or LNG ships. Blimps are not cheap. Hell, LNG on airplanes is probably cheaper.

Imagine a stranded gas field in Alaska. You liquify the gas and ship it down to Hawaii on Wing In Ground Effect aircraft! Or to a mine north of sixty (north of sixty degrees, in the polar regions) where the alternative is diesel imported over ice roads in the shrinking hard freeze season.

You know, that might actually work. I could find out what the cost and demand for diesel is up in the far north and add value to this site instead of just being another reader.

But I think it's not a big enough market. Kimberlites in the interior. Everthing else is pretty much coastal. Kimberlites need to be ground up to liberate the diamonds and that takes serious power. The demand isn't enough to justify building a LNG train. And why not just fly in the diesel?

Lots of parameters of course, but if the bag is roughly spherical, the lift will grow as the cube of the radius while the weight of the bag as the square, so there should be some radius big enough to let the thing take off.

For that matter, a slightly crazier idea: at the natural gas well, just convert the natural gas to hydrogen gas. The problem then is that the gas bags might float too high to be retrievable in any affordable way!

One could always build a hybrid, like two big bags, one with hydrogen and one with natural gas. If a few explode along the way, oh well. Cattle would die out on the range, too!

Uh, I hate to pop your balloon... the molecular weight of methane (CH4) is 12 + 4 x 1 = 16 g/mol. The molecular weight of air is 21% O2 (m.w. = 32) and 79% nitrogen (m.w. = 28) or roughly 28.8 - the exact value for dry air is 28.97 g/mol (properly taking into account all the various trace gases). So, methane is lighter than air as 1 mole of gas occupies the same volume at the same temp/pressure, yet one mole of CH4 has a mass of 16g, and air 29g.

How many blimps would you need to replace a pipeline from Western Siberia to Central Europe with a capacity of 20 Gcm/a (Bcm/a)?

How long time will it take to empty the blimps? And should the emptied blimps be returned by railway?

What would be the net energy returned/blimp when adjusted for fuel for the new aerial cowboys, emptying of the blimps, repressurizing the gas for storage and energy used for packaging and returning those blimps?

You will find it hard to compete both energywise and economical with natural gas transported in high pressure pipelines.

Sometimes the economics seem to work!

Thanks,

Great picture!

How many of those bikers do you need to replace a 20 Gcm/a (Bcm/a) pipeline?

Yeah, it's hardly a scheme that will keep the industrial world economy humming along! But somewhere along the bumpy road down, maybe it can keep some people warm and fed.

It would be fascinating to know how much energy is contained in these big bags, and how far these people will pedal for this gas. Also, how much do these bags cost initially, and the expected mean time to failure [assuming no low-hanging branch punctures the bag in transit]?

Lots of trees in the photo, so maybe this natgas bubble method is currently more efficient than chopping wood or using coal for cooking and heating. But, it must be hell trying to pedal this bag along if high crosswinds or headwinds arise.

Lastly, I assume any poisonous sulfur gases are removed before the gas is sold, but I could be wrong.

Yeah!! Bikes rule more and more, OK!

I have a scheme this year to switch, finally, from owning a car to being car-free, and completing before winter my alleweder fully-faired python tilting trike (currently on the workbench) as a permanent substitute, for personal transport. I already know the extraordinary things you can do with my ordinary mountain bike and a bike trailer......

For examples of the phenomenal handiness both for easy riding and load carrying of tilting trikes, try here:

http://www.fastfwd.nl/eng/index.php

http://www.jetrike.com/

http://www.greenspeed.com.au/australia/paul/build.html (click on Picture 9)

And for a non-tilter, very easy build and excellent load carrier, runabout try Henk van Eerden's, here:

http://en.openbike.org/wiki/Python_Trikes#Henk_van_Eerden.2C_Netherlands

Can't get enough gas in a blimp to make it worth the while. The blimp would essentially be operating at atmospheric pressure.

Did anyone catch T. Bone Pickens on CNBC this ayem? He's out pushing an energy plan that centers around natural gas. Its simple and it sounds good to me.

The clear implication of the statement "the price in the West may have gone up a fair bit, and Russia still makes a profit" (including the link) is that Russia buys for $150 and wants to sell for $500. The following news clip from an 2006(!) article is supposed to bolster this claim. Lying about Russia is some sort of disease in the west. If you paid attention to the news, Turkmenistan, Uzbekistan and Kazakhstan want to charge $500 per tcm (i.e. European rates) for their gas. Good for them! They have no obligation to subsidize rich western fat cats or Ukraine for that matter. The supposedly "blackmail" price at $500 per tcm is still 2/3 those of oil on a joule for joule basis.

http://www.energy-business-review.com/article_news.asp?guid=52FC1116-9ED...

"The Central Asian country has reiterated that it expects around $400-$450 per thousand cubic meters of gas, compared to India's proposal of $200-$230. Turkmenistan's quoted gas price is reportedly comparable to the price it will get for supplying Russia, beginning in 2009."

Well, no I was quoting what Russians themselves have said. At present it appears that they are buying Turkmen gas for $150 (having just last week increased the price from $130) and selling it to Ukraine for $179 and to the West for $400. It is a good deal for them, and if you own the only game in town it is not unusual, regardless of nationality, to take advantage of that fact. And it was the Gazprom prediction of the $500 price that first caught my attention.

I have written about Turkmen efforts to get more for their gas here and here, and in the latter I also gave a more comprehensive description of the gas in Turkmenistan and how it might be supplied to customers.

Following Taleb's strictures on the wisdom of looking for things which will falsify a case, the information on possible hydrate production would if it works completely transform the outlook for gas supplies:

http://www.thestar.com/Business/article/455964

Getting hydrates from under the sea would be a lot tougher, but land resources alone would greatly alter the position, and would presumably start to come on stream in 10 years or so if it is as easy as the article makes it sound.

Many here may not approve due to concerns about global warming and dislike of BAU, but there is no serious doubt in my mind that if it is possible to supply gas in this way it will be done.

There's a quick Gas Hydrate Study presentation from Gazprom available on the net. It oulines some of the basic for development, transport, storage and environmental impacts. A decent read, imho.

For an overview of the world methane energy system potential, see "Implications of Methane Hydrates Availability for Future Energy Systems" abstract from the same conference as above.

thanks SamuM - looks like it is a gamechanger if it works, but the implications for GW may not be pleasant.

I am surprised there is no mention here of unconventional natural gas. Surely if the U.S. produces over 30% of its natural gas from unconventional sources, the same should hold in the future for europe and russia.

Good question the general answer is probably not nearly at the level the US has.

In general the fields are smaller hard to exploit etc. Coal Seam methane in Siberia is not coal seam methane in the US.

Almost certainly not offshore.

Canada is probably a better analog to Siberia. eh :)

http://www.cpast.org/Articles/fetch.adp?topicnum=102

This is old but its not seeing the strong increases in unconventional we see in the US.

I would say US unconventional production is similar to the US drilling campagian that gives the US half of all oil wells ever drilled. This has a lot of social/logistic/economic reasons.

Don't expect it to happen in the rest of the world none of the reasons to exploit marginal resources for minimal profits and high upfront costs exist.

The limit on coal seam methane is fresh water to dilute the salt water pumped out of the coal seam to allow the gas to desorb. America is pretty much water short where we have decent coal gas.

Alaska might have Cook Inlet coal gas for instate use if they decide not to develop the North Slope gas. Otherwise?

The Future

Pipeline Natural Gas is priced -4% below spot LNG

and LNG is priced by the most desperate OECD nation

Although LNG is more of a ocean basin market (Trinidad and Nigerian LNG are unlikely to ever make it to Japan, Australian LNG may not make it to the US Gulf Coast, shipping costs and losses will be too great) there is enough competition and shifting to make a global market of sorts.

Japan and South Korea have no alternatives to LNG (even if they someday get some pipelined NG) and the same is largely true of Spain, Italy and Southern China. Many more nations will need some LNG "to make ends meet" with LNG demand spiking after bad weather, low rainfall (less hydro) etc.

Already US natural gas prices are capped by spot LNG prices, and soon Russia will price it's pipeline gas just below recent LNG prices. Norway to follow quickly (and Dutch gas exports are shrinking rapidly).

One can easily see how competition between desperate rich nations will soon spiral out of control. Lack of LNG tankers will prevent too much diversion to distant markets, and raise spot delivered LNG prices even more (USA is at the end of the "LNG pipeline", the more distant market, for all LNG sources except Trinidad).

Alan

About a month ago the Japanese announced their commitment to build a $2 billion LNG facility over an offshore Indonesian field with reported reserves of 14 trillion cf. I beleive they've done similar deals with Indonesia but don't recall the details.

This may represent the future of much undeveloped LNG: in addition to opening up new volumes of LNG it also takes it out of market play and guarantees a supply to the facility builder. Future pricing is always a big risk factor but it won't be surprising if many such projects deliver LNG well below market price at the time.

I think there is a general misunderstanding here about unconventional gas. Most unconventional gas is not coal bed methane, but rather shale gas. Shale gas is apparently ubiquitous, with plays going on in texas, arkansas, louisiana, oklahoma, west virginia, pennsylvania, new york, quebec, british columbia, nova scotia, north dakota, montana, utah, colorado wyoming, and potentially other states and provinces.

There are MANY shales onshore in Europe and Russia (and elsewhere) that fit the profile. The economic cost is high (around $7-$8 per MCF is breakeven), and the EROI is not as attractive as conventional gas. However, I think that all these forecasts that do not incorporate shale gas are underestimating gas supply. It will come to the rest of the world.

jwr3,

Exactly tight. The shale gas and oil plays are dominating the oil patch efforts these days. Additional tight gas sand (some define them as unconventional) plays are also a big part of the picture.

While these plays were very attractive a year or two ago some of the shine has worn off. Mineral owners have become very savy due to all the publicity surrounding these plays and thus leasing cost have risen as much as 50X in some trends. An even bigger dark cloud has been the increase in steel cost. Many of the unc wells require long strings of casing to complete. We were just notified by US Steel of another big price increase. We had adjusted pricing expectations ealier this year but this latest jump has us paying now what we had projected for year end. But we've got dozens of such wells drilling in TX and are actually looking for some more drilling rigs. Still profitable but not quit as much.

Another big reason why these plays will keep pushing the rig count up is the rapid decline rates they usually present. It may sound odd but these plays are something of a trap for the big public companies that dominate the plays. While these wells add a big jump in asset value initially their rapid declines also reduce net asset value quickly. The valuation of public companies is dominated by the expection of increased asset value. If they don't replace their declined production and add new reserves they are effectively "dying". About 25 years ago I watched a Texas independent (UPRC)effectly commit suicide by drilling over 800 successful horizontal wells in what was considered an unconventional oil play at the time. Same rapid decline rates. Eventually the play was drilled up and they couldn't find enough new prospects to replace their quickly dominishing reserve base. Stock value went into the toilet and they were essentially sold for scrap.

So even though drilling and leasing costs may continue to rise, many companies will have to keep drilling even if there is a softening in NG prices. Good news for the consumers.