Hurricane Gustav, Landfall, Energy Infrastructure and Updated Damage Models -- Thread #5 (Updated 9/1 21:00 EDT)

Posted by Prof. Goose on September 1, 2008 - 4:00pm

Hurricane Gustav made landfall in LA just south and east of NOLA as a Category 2 hurricane.

Models done after landfall and their damage forecasts are included below.

The Louisiana Offshore Oil Port, or LOOP (see JoulesBurn's story on the LOOP here), and Port Fourchon, which has historically been a land base for offshore oil support services in the Gulf, was in the path of Gustav and is expected to be damaged. As you will see below, a good bit of oil and natural gas is also expected to be taken offline: some for weeks, some for much longer, according to Methaz' models.

Matthew Simmons, of Simmons International says this about the importance of the LOOP:

LOOP is the only facility in the Gulf to unload VLCC tankers which carry over 2 million barrels of crude. They can in theory be "litered" by unloading onto smaller tankers that can make it into the Gulf Coast ports but this is very lengthy timewise and the spare capacity of these smaller tankers is slim. We get about 1.2 million b/d of crude imports through Loop. (+/- 10%)

Our next update will likely be in the morning. Keep scrolling, there's a LOT of maps, data, and information in these posts. We appreciate your help accumulating resources, stories, and newstips in the comment thread below!

Updates today from Chuck Watson at KAC/UCF:

Here's the 9/1 update:

Well, I think someone (who out of modesty shall remain nameless) forecast several days ago, Gustav would hit unfavorable conditions in the northern Gulf and never make it back to mega-storm strength. That seems to be the case. Center landfall with peak winds of 100kts or maybe slightly less looks to be at Grand Isle, at 8am ET - as of 730et the "eyewall" appears to be touching land.

I'm mostly sticking with the synthesis from last night (based on multiple models) as to impacts, and we're now in a "wait and see what the inspections bring" mode. The big question is what if any major damage the LOOP suffered and (perhaps more vulnerable than the LOOP itself) the connection pipelines to shore. Baseline estimate is 10-14 days for the port itself. Radar shot (7:30am ET) with tracks and LOOP labeled attached.

Production: Unless something broke that shouldn't have, we expect production to be back up to 60-70% within 30 days, and back to 95% by the end of the year. We expect a long-term hit of 3% or so since this swath went through some areas that Ivan, Katrina, and Rita missed and some older, less productive wells will not be restored.

Refineries and distribution: Mainly short term disruption due to precautionary shutdowns, no long term unless we get unlucky with pipelines.

All in all, my thinking is that this could have been a lot worse. Storm was disorganized crossing the OCS, so waves and storm surge will be lower than they should be for a storm of this size and intensity.

Here is Chuck's landfall composite for Gulf (GOM) oil and NG production, which covers the GoM loss for the month of September in to the context of overall oil production, imports, and refining. Note for those crunching the numbers that since GoM is about 25% of US production, 40% of the GOM's contribution of 25% is 10% of the total US production.

COMP ATCF Forecast Time: 2008090112 14 day: 8.21 MMBBL ( 52.36% normal), gas 63.50 BCF ( 65.91% normal) 30 day: 19.98 MMBBL ( 59.46% normal), gas 145.98 BCF ( 70.70% normal) 60 day: 43.01 MMBBL ( 64.00% normal), gas 304.43 BCF ( 73.73% normal) 90 day: 95.23 MMBBL ( 94.47% normal), gas 586.06 BCF ( 94.62% normal) 6 mon : 195.13 MMBBL ( 96.79% normal), gas 1205.43 BCF ( 97.31% normal) 1 year: 400.48 MMBBL ( 97.96% normal), gas 2478.60 BCF ( 98.67% normal)

Interpretation: the models say that 40% of GOM oil will be offline for 30 days and ~30% of GOM NG for will be offline for 30 days--followed by marginal increases in GOM supply (both imports and production) through the next months. (E.g., the 60 day number for oil is 36% shut-in, but between 60-90 days, the number goes down to 5% of GOM oil shut-in.)

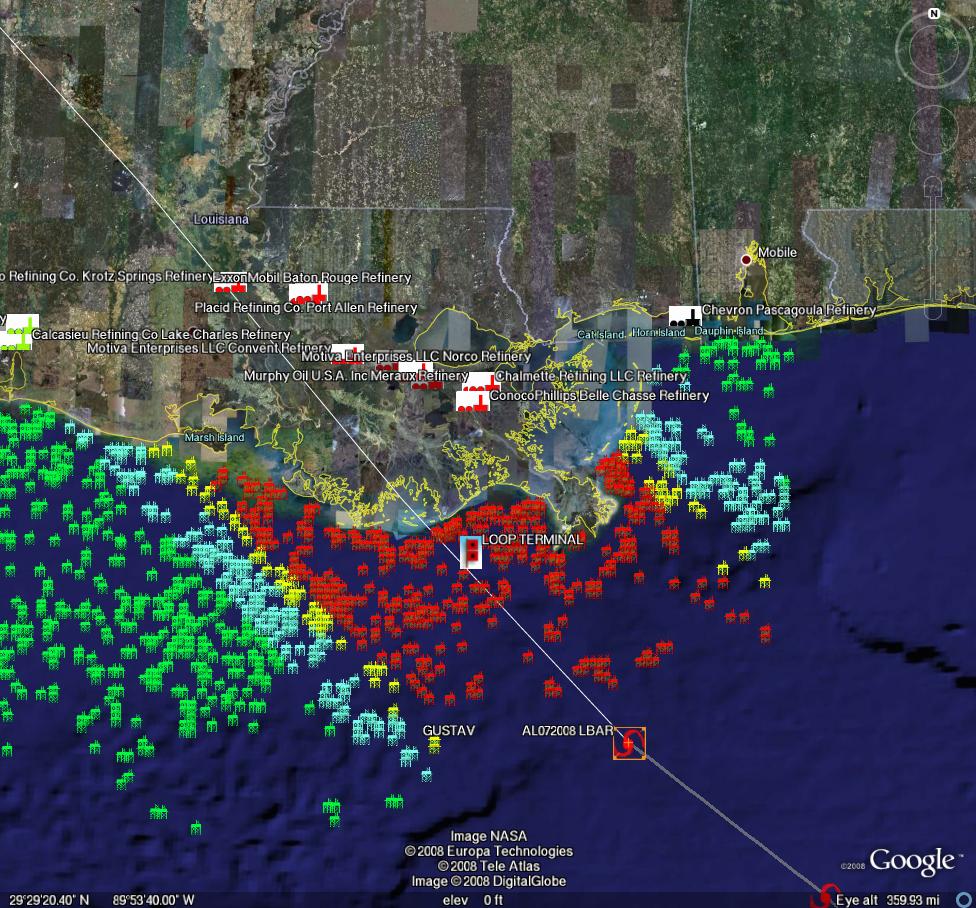

UPDATE: 10:00 EDT 9/1 - Graphic below is damage models based on LBAR hurricane forecast track, key is below. Numerical damage estimates are below the fold for oil and natural gas shut-in and damage.

Path/damage estimates using LBAR 10:00 EDT forecast-click twice to enlarge

For all graphics: Rigs/Platforms: Blue: evacuated only; Yellow will require inspection before restart; Red: damage requiring repair; Refineries: Black: operational impact (partial shutdown) Green: Operational impact (full shutdown) Red: Damage likely; Ports: standard hurricane flags for wind

We are not hurricane experts at theoildrum.com. Neither are we experts on damage forecasts to oil and gas infrastructure from weather events (though thankfully we do have an expert that helps us). What we try to do, and have been doing for over 3 years, is articulate the fragility and urgency of our nation's, and our world's, energy situation. As Hurricane Gustav moves nearer, and professional meteorologists and energy analysts gauge the impact it may have on our energy infrastructure, feel free to browse our archives of hundreds of empirically based analyses and perspectives on the myriad energy issues that form the backdrop not only for this hurricane, but for any exogenous event that disrupts the increasingly uneasy balance between energy supply and demand in our modern interconnected world.

There are many resources under the fold (by clicking "there's more" in this post), including details of the latest oil/infra damage estimates from Chuck Watson at KAC/UCF as well as lot of other resources including rig maps, models, google earth maps, and a lot more in the comments.

Click map to go to WUnderground

LAST 24 HR FORECASTS FROM CHUCK WATSON

Here's Chuck's 23:00 EDT 8/31 update:

Synthesis of data available at this time: The Loop looks to take a direct hit. Estimating minimum 14 days down time assuming it holds up to specs. Peak waves probably in the 40-45 ft range offshore, so any remaining older stuff built to the older air gaps are probably toast; the newer stuff (55ft gaps) should be OK, but will take a few wave hits. Some potential for undersea slumping and scour - bet we loose some pipelines. GOM overall production will probably take at least a 3-5% permanent hit; pending new wells. Bunch of minor damage to "refinery row" (in along the river); most should be back up in a week or so, if product is available. Humanitarian note: this isn't a great track for NOLA, but the weakness we're seeing on the normally stronger side of the storm may save it from worse damage.

Based on the 18Z (2pmEDT) update: While not wonderful, the forecasts for GOM infrastructure continue to improve. While the NHC forecast remains pessimistic, and Gustav shows some signs of trying to regain its strength, it is not having a lot of success. For wave and surge generation, organization is key - even if the spot winds pick up, unless the wind field is organized well overall surges and waves will not be as high as the raw wind speed might indicate. Our surge models are dropping water levels significantly (still, 18 ft will ruin your day). Surge model run is attached - much less dramatic than the Cat 4 maps floating around. Damage trends for other models are improving as well. This is looking less and less bad for the GoM Oil/Gas production, IF the post-Katrina improvements hold. The disorganization and track shifts have reduced the threat to the LOOP - makes me happier. I'm really thinking that by tomorrow evening we will be talking about "dodging a bullet". Final word: DON'T NOT EVACUATE JUST BECAUSE THINGS LOOK BETTER! These are just models. Don't bet your life on it.

Production/Damage Estimates

(UPDATED 10:00 EDT 9/1)

Here are production estimates from Chuck Watson:

Here's our final pre-landfall composite: COMP ATCF Forecast Time: 2008090112 14 day: 8.21 MMBBL ( 52.36% normal), gas 63.50 BCF ( 65.91% normal) 30 day: 19.98 MMBBL ( 59.46% normal), gas 145.98 BCF ( 70.70% normal) 60 day: 43.01 MMBBL ( 64.00% normal), gas 304.43 BCF ( 73.73% normal) 90 day: 95.23 MMBBL ( 94.47% normal), gas 586.06 BCF ( 94.62% normal) 6 mon : 195.13 MMBBL ( 96.79% normal), gas 1205.43 BCF ( 97.31% normal) 1 year: 400.48 MMBBL ( 97.96% normal), gas 2478.60 BCF ( 98.67% normal)

Early on 8/31, when models were improving, Chuck said:

This is looking less and less bad for the GoM Oil/Gas production, IF the post-Katrina improvements hold. The disorganization and track shifts have reduced the threat to the LOOP - makes me happier. I'm really thinking that by tomorrow evening we will be talking about "dodging a bullet".

Final word: DON'T NOT EVACUATE JUST BECAUSE THINGS LOOK BETTER! These are just models. Don't bet your life on it.

Here's a new graphic for the forecasted surge from Chuck (17:00 8/31 update):

Also, an important Safety Tip: it is VITAL that folks DO NOT use our info for evacuation planning (this means you, Alan!). Our discussions here are with respect to a bunch of hardware, not feline or even human lives. We don't want to be wrong on either the high or low side, especially since being wrong on the high side has bad consequences for pricing, that's why I keep emphasizing this thing may not be as bad as the models are predicting because there are signs and portents the storm will not gain as much strength as forecast. If you are in an evacuation zone, get your pets, get your insurance paperwork, and GET OUT.

--

A note on our modeling process: we take the official NHC track, the raw computer model tracks like GFDL, HWRF, LBAR, etc, and even run our own in-house fast cycle track/intensity models. These track and intensity estimates are feed to our main hurricane model (TAOS), which computes the wind, waves, storm surge, currents, etc. at each point in our database of over 50,000 elements in the GoM like rigs, platforms, pipelines, pumping stations, refineries, etc. We then have engineering

models for each type of infrastructure that calculates the damage and estimated down time for that element, as well as downstream impacts (eg if a pipeline is down, the upstream elements can't pump and the downstream elements don't get product).

Chuck has put together a dynamically updating page that will reflect the latest damage models/forecasts at this link: KAC/UCF models. We will be updating this thread with damage estimate and breaking news as this story unfolds, as well as post another story on why Hurricane Gustav or any exogenous supply event is potentially critical in a world with little slack in supply of high quality oil.

HPC 5 day rainfall estimates (12z 8/31)

PRODUCTION/INFRASTRUCTURE MAPS AND REFINERY INFORMATION

Here's a link to a really good map of oil refining/SPR storage facilities in respect to the path of Katrina (NB: OLD TRACK MAP!) and here is a listing of production and refining capability for the state of LA.

Just to give you a rough idea of where things are, the map above is a probability swath for Katrina (OLD TRACK MAP!) with the Thunder Horse platform as the red dot, and the other purple dot represents the Mad Dog development (100,000 bd); the Holstein development that produces at peak, around 100,000 bd of oil; and the Atlantis field that may have ramped up to around 200,000 bd in all. Put together these projects have the potential of around 650,000 bd, but as can be seen, they were sitting in an uncomfortable spot relative to the track of the Katrina.The white dot is where Port Fourchon is. This is where the Louisiana Offshore Oil Port, or LOOP, is located. Rigzone pointed out that this is where the foreign tankers offload, Google and Terraserve maps you can see that the area is very low-lying. One of the big concerns is that there will be sub-sea landslides or other ground movement that might affect the LOOP. Were this to be disrupted, then foreign tankers would need to be diverted elsewhere, with the likely port being Houston.

We have accumulated resources from previous hurricans below, but we'd like to find updated materials if you know of them. Recent refinery maps, recent rig maps in the gulf, recent gas fields, SPR facilities, the Intercoastal Canal, pipeline stations and transfer points, etc., etc. Leave links in the comments please.

Also, here's the EIA's Alabama, Louisiana, Mississippi, and Texas Resources pages. They will also likely come in handy. Also, here's a link to the national page.

Here's another good resource for infrastructure maps and such. (scroll down a bit)

Here's a map from CNN with large and small refineries laid out. (though it is an old storm track)

Very detailed piece by RIGZONE on rigs and other infrastructure in the area. (thanks mw)

Here's a flash graphic of the oil refineries and rig maps from Hurricane Rita, it emphasizes Beaumont and Galveston's importance. Click on oil production in the tab. Note the many rigs on the east side of the storm that will get the brunt of the damage from the NE quad of the storm...hence the high long-term GOMEX oil production damage estimates below.

Here's a link to Rigzone's coverage of Gustav.

You want a detailed map? Well here's the probably the best MMS map I could find. Very detailed and lots of interesting stuff. (VERY big .pdf warning)

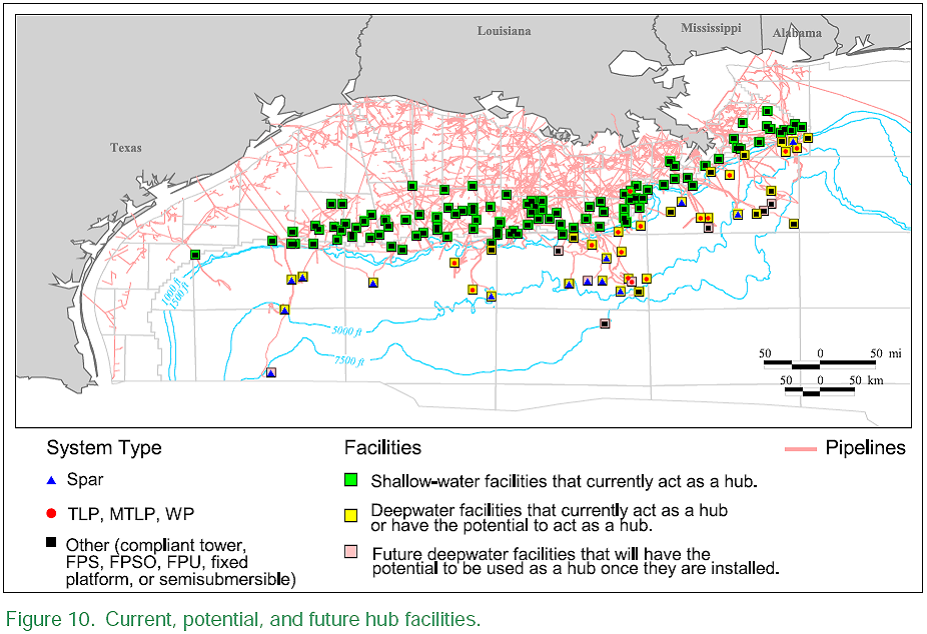

Also, Scott Wilmoth at Simmons & Co was kind enough to send us this map. The map below captures only deepwater infrastructure. For a complete list of deepwater development systems (includes operator, depth, location): http://www.gomr.mms.gov/homepg/offshore/deepwatr/dpstruct.html

(Please deposit new relevant links, graphs, and comments in this new thread...we have updated the resources part of this post with new maps and some more old maps and articles from Katrina on the LOOP and Port Fourchon--important parts of the infrastructure, as we learned about three years ago. Please leave personal anecdotes and themes unrelated to hurricane for the other upcoming 'bigger picture' posts, as yesterdays information was difficult to upload for those on dial-up)

Here's a good live local feed where you can follow events:

http://www.wwltv.com/video/?nvid=57429&live=yes

One of the analysts on CNBC thinks that it is a very likely that the Continental Pipeline, which goes all the way to New York, will be forced to shut down, because of a lack of product supply, due to the number of refineries that are shut down.

You mean the Colonial Pipeline, not Continential.

So the NYMEX products delivery point is New York and NYMEX values are headed lower Thurs Fri & this morning. That sure is curious, itsn't it?

Research24 requested:

"I'd sure like to hear an explanation of how "the powers that be pound oil values down."

How, exactly, do they do that?

Kindly explain."

Here's a couple of links that explain how. They arent directly oil related but its the same game, different commodity. Gov groups that operate in secret are never self limiting. Ron Paul has made direct contentions along these lines.

http://www.gata.org/node/5074

http://www.financialsense.com/fsu/editorials/dorsch/2007/0809.html

The big change of late in all futures markets is much more of the activity operates from offshore accounts. There's no accountability?

How do they do it? Massive NYMEX sell orders. They're active in stock futures. Why is it a stretch to think they're also active in metals and energies.

The system is heavily gamed.

Notice last Wed morning I predicted Gustav would hit cat 4, severely disrupt oil production and distribution and NYMEX markets would sell off just like they did with Katrina. Quote and link here:

http://downstreamventures.yuku.com/topic/2133?page=1

Thanks--hadn't had my coffee yet.

Could be a conspiracy. Or, could be normal market action. Looks like a typical "buy the rumor, sell the news" situation to me. The oil contract rose early last week on decreasing open interest. This was probably just short covering because of Gustav. Now that "we dodged a bullet" mentality is operational this morning the market falls back to mid-August lows, where it's testing the bottom.

I still don't believe that, because in the end the facts would rule.

However, whether it is government, or large hedge fund or whatever, energy markets are illiquid today, which means some millions in margin can really push them around. And they are down sharply. RBOB and Heating oil are down well below where they were BEFORE we even knew we had a hurricane...(and low gasoline inventories going into today???)

Gustav weakened after Cuba and never regained its potential - we dodged a bullet, so it IS rational to have some energy sell-off short term, until actual damages are known. This is now 6th or 7th storm in a row when energy has sold off...It's lulling us into complacency....;-)

The DOE also announced this morning that they're ready to tap the SPR if needed, so that has a psychological effect. Before Gustav, we were in a bearish trend anyway. Gustav's storm surge is a lot less than Katrina's, so the selloff makes sense. It'll be interesting to see if the $110 price floor will be breached this week.

Louisiana Seeks Strategic Petroleum Reserve Release

Good afternoon, folks. Long time since I've posted, but like always, I remain obsessively addicted to TOD and always appreciate the perspective and insight this community is able to share. That being the case, I have a question for any who is up to aswer it: It is my understanding that the SPR contains crude oil only, not distilled products such as gasoline and diesel. That being the case, I don't quite understand how the release of that stock would be of any benefit in the next week or so, if indeed, it turns out that there has been significant refinery damage (not known at present). If the gasoline stations in southern Louisiana have to wait for shipments of refined products to arrive from other regions or countries, I would think they may be waiting a while. Am I wrong?

Dred

Nope, precisely right. :) See westexas' and memmel's comments in this thread.

But the mayor might not know that much. He may just think the SPR is there in case of shortages and there is a shortage in LA, therefore it is time to release it.

Actually he's the guvnur. My guess is he is ignorant of the facts. Of course I think it highly likely that some SPR oil will be released, assuming there is more working refinery capability than crude to supply them. I don't think anyone could argue that a short term release to cover a temprary weather related shortfall is a misuse of the SPR. But even if absolutely no physical damage happened, the shutdown, evacuate, evaluate, startup delays will mean product shortfalls are in the pipeline.

My read is a quid pro quo to GWB & Cheney.

LA Governor calls for SPR release just before election, (unlike evil, irresponsible Democrats who alos called for pre-election SPR releases). GWB wisely does so, in excess of any production shortfall.

Alan

The US will have to import more gasoline and diesel also of course because of high diesel prices world wide we where exporting a significant amount of diesel so our customers will also have to find alternative sources.

Now despite the current price situation for crude oil this new demand for imports of finished products is not provided by the Tooth Fairy, Santa Clause or the Easter Bunny. In fact no mythical characters are generally involved in oil production and refining operations.

However SPR releases to refineries that are not in operation is as close to mythical as one can get.

Its not pleasant to look behind the curtain and realize how the world really works.

Care to speculate on what sort of dislocation this will case in shipping resources? Will there be enough tankers in Europe (or elsewhere) ready to re-deloy to the US market? What is the cost to send an empty tanker overseas to return to the US with refined products?

I've got no idea its going to be a rush to the spot market obviously.

In my opinion the big deal is the US diesel exports that are lost this is going to throw a serious money wrench in the works.

Given it looks like we probably will have more hurricanes in the gulf unless we get really lucky this event may be enough to cause a serious global diesel shortage. Given that diesel is critical for agriculture movement of goods and services etc etc we may be in for some short and long term blow back from this one hurricane. Further out it puts a lot of pressure on heating oil production just in time for winter.

In particular this could well be the event that sends Pakistan into serious turmoil. Attempts to subsidize diesel will have no effect since we now simply don't have enough diesel in the world right at harvest time.

Of course the US is myopic and only cares about gasoline prices.

Home heating oil is of course also distillate, like diesel. The evidence seems to be that people have been waiting to get their tanks filled. (In June, US distillate consumption was down 9.7% from a year ago, according to EIA data). It seems like this disruption is going to make it more difficult to find enough home heating oil to fill all of the tanks.

Is it clear that people are "waiting" rather than just not needing it due to a warm winter (07-08) or more frugal use due to hgher prices last winter? It seems that both our winter and our summer have been milder this year than most (so. cal.), although we don't have a lot to do with heating oil in this part of the world..

-d

How the world works and how the markets work can be completely different ;).

That being said, I went long today after the selloff.

Your argument for manipulation holds up only if one accepts the notion that futures controls real oil price. That notion has been disproven time and time again, including in the latest inter-agency task force investigation which concluded that they do not.

You may note that there is a $4.50 spread today between futures and WTI.

$9 billion of oil is traded every day and that makes the market a wee bit too large and costly for any entity to manipulate. And since many people assert that evil governments manipulate all markets, that would suggest a massive gov't slush fund for the sole purpose of manipulating so many markets.

It is almost amusing to suggest that paper speculators can control the price that Saudi and Russia sell their oil for. If they thought there was downward manipulation they merely have to hold to their asking price and the market would turn within a day or two. If anyone CAN manipulate the price, those two producers can, and they certainly wouldn't want to do it downward.

No it is not too large.

The large banks set the price for just about everything. That is why there is now a reported shortage of precious metals and the price keeps falling. Of course sooner or later it is going to backfire, but I think the large banks will profit from that as well. They will just go long at the right moment.

http://silveraxis.com/todayinsilver/

"Total Commodity and Equity Futures & Forwards Notional Amount: $308.1 billion (from FDIC Statistics report — this is the closest breakdown for commodities)

COMMODITIES (including off-exchange forward contracts):

(1) JP Morgan Chase Bank, National Association: $126.3 billion (futures only: $74.5 billion)

(2) HSBC Bank USA, National Association: $36.2 billion (futures only: $4.5 billion)

(3) Citibank, N.A.: $16.8 billion (futures only: $15.1 billion)

(4) Bank of America, National Association: $12.6 billion (futures only: $12.2 billion)

(5) Wachovia Bank, National Association: $12.2 billion (futures only: $12.2 billion)

(6) Bank of Oklahoma, National Association: $0.3 billion (futures only: $0.3 billion)

(7) Other: $0.1 billion

TOTAL COMMODITIES: $204.5 billion (futures only: $118.8 billion)"

RE precious metals market manipulation.

I find Mish Shedlock's take on this pretty convincing. I've been reading various gold & silver bugs bloviate for years about this. I think they are full of it.

Besides, the gold and silver markets are tiny compared to the crude oil markets. Apple to Oranges.

Almost correct but actually only one is needed to manipulate prices.

Iran

Direction has changed and Gustav is moving along the coast rather than going ashore. Almost like it's targeting the oil infrastructure.

U.S. Refineries, Offshore Output Shut by Hurricane

Mexico crude export port closed for Gustav -govt

I think refiners learned their lesson about panicking and buying on parabolic price rockets. Were I a buyer, I'd sit tight and wait to see how things develop before tossing hundreds of millions up the cliff. I'd probably rather reduce my output than toss those dollars away. In other words, they learned a lesson they had forgotten long ago since its been thirty years since the last parabolic price increase.

The speculating banks and hedge funds no longer have the money (borrowed)to do what they did previously, since most of them took a big bath on their speculations.

A good site to follow progress of current hurricanes is: http://www.stormpulse.com/.

Maybe most people know about it but just in case not I am posting it. It gives hourly updates of eye location, forecast wind speeds, expected tracking, etc. Hope this is useful to someone.

I have spoken to Alan Drake as of 9:10 CDT and he reports a dangerous crisis in New Orleans. High winds interrupted production activities this morning and 80% of daily caffeine supplies are now shut in. Dropping below the caffeine MOL has produced dangerous synergies that have left him wandering the neighborhood, instant coffee packet in hand, to see who stayed that has a gas powered stove.

The weather is cooperating nicely with this endeavor, as they've had half an inch of rain and a lot less wind than expected, despite the power outage. They expect some flooding but the dry air and shear aloft have blunted what could have been a real mess of a storm.

I am VERY happy to report that both the neighborhood Frenchman and Scot shared their excellent coffee with me.

I put on coffee as I got onto the computer @ 6:12 or so. Only a quarter cup had dripped (which I promptly drank) with the residual heat before the power outage.

Picture me, LED flashlight in hand, anxiously waiting for the LAST drop of coffee to drip down.

New Orleans roasts and packages about 25% of the US coffee supply. Restarting these facilities was a crisis priority after Katrina, as inventories were drawn down and other roasters ramped up production.

Coffee, my safe, cheap, legal and effective drug of choice !

Best Hopes,

Alan

Second only to the internet!

Glad you are safe Alan.

Best hopes for no more New Orleans/LOOP threatening hurricanes..(ruined my weekend too...;-)

AlanfromBigEasy:

I am confused.

My understanding was that evacuation was MANDATORY (see here http://www.cityofno.com/pg-1-264.aspx).

Is my understanding incorrect?

If not, then please explain why you felt that you had the choice of staying behind while 100s of thousands of others had to leave everything else behind.

Your choice of staying is upsetting.

It is decisions like yours (to stay in New Orleans even though an evacuation was ordered), that causes people to get into dire trouble and endanger their own lives as well as the lives of others (when others have to come in and save them). How many rescue workers, firemen, policemen, etc. have died in the line of duty to save another person that made a similar decision as yours?

Your decision also emboldens others to make a similar decision the next time a hurricane rolls through New Orleans (which might be sooner than we expect). People will hear that others stayed behind and think that they should do it next time (since there were no repercussions). But the next time might not be as forgiving.

If I was mayor or governor of your area, I would have the National Guard search out New Orleans over the next few days, and throw anyone they find in jail and make an example of them for the next time.

I am glad to see that you are alive and well, but decisions like the one you made are foolish - plain and simple.

The order was mandatory but NOT compulsory and there is a difference.. As was clearly explained multiple times on local news media, the cities obligation to provide a number of services was suspended by declaring mandatory evacuation. But you have a continued right to occupy your property

Mandatory evacuation affects the government more than people. It removes several legal obligations from the government and imposes others.

Absent martial law, you have a continued right to occupy your property.

As explained beforehand, there is a 24 hour curfew in Jefferson Parish and dusk to dawn in Orleans Parish.

If ANY action is preventing future evacuations, it is the Governor and Mayor preventing re-entry into the city this morning. There is no good reason to keep people out if they accept the conditions as is.

All prior evacuations except for Katrina have allowed immediate re-entry.

Your attitude is one of complete and unrestrained governmental control of private persons. The Bill of Rights was written explicitly to control those urges to control others.

Alan

Nagin pointed out last night that water levels were still rising in many locations (including the lake) which is why they were shutting canal gates and while they didn't expect major failures it would be silly to allow people back until water levels started dropping.

The lake levels are dropping this morning. No exact #s, but "several inches". The lake front levees for Orleans Parish were never under stress (the Corps was anxious to test their new pump system so they got permission to operate at 3.7' although the minimum start was supposed to be 4', I am OK with an operational test under minimal conditions).

Design is in excess of a dozen feet, with hurricane force winds driving waves.

Should we evacuate New Orleans every spring when the Mississippi River rises 15 feet or more ?

Gustav was not even close to a real stress test.

Lake levels as a reason to stall re-entry this morning ? Absurd !

Alan

So, nobody should have evacuated? It was all a mistake?

The reality is that 9 out of 10 evacuations are unnecessary, and accepted as such. Which is why quick re-entry is necessary for "the next time".

And yes, in retrospective, there should have been no mass evacuation of Orleans Parish (parts of Washington DC lived without electricity for weeks after a hurricane there). Voluntary yes. Unfortunately, the data was not available till 3 PM the day before landfall (and even then it was a not a consensus). Bureaucratic inertia was impossible to stop at that time.

IMO, the appropriate response is "We will not stop you from coming back, but we strongly urge you to stay where you are for another couple of days till we get the power back on, businesses re-opened and everything back to normal. This especially applies to families with children. The curfew will continue for a couple more nights."

BTW, I got the following eMail from City Council member at large Arnie Fielkow "I don't disagree. I am trying to get with the mayor".

Arnie entered politics after Katrina (he was GM for the New Orleans Saints, fired for trying to keep them here. He was a first class NFL GM and could be making $1.5 million/year in Miami or Seattle, but chose to stay here at $40,000/yr. with all of the difficulties).

Alan

"And yes, in retrospective, there should have been no mass evacuation ..."

In retrospect? You can't evacuate in retrospect, so this comment makes no sense. When there's a 10% chance of disaster, you evacuate, not because you know something bad will definitely happen, but because 1 out of 10 times, something bad does happen, and the risk is not worth it.

Hmm, according to 'The Guardian' Nagin is talking about a few days.

Now if they took 24 hours to check up, do some street clearing and check that the electric was not obviously dangerous, I would have thought that most would accept that.

If they don't discover any obvious problems in that time though, I would have thought that any longer would be counterproductive, as large numbers of people will decide to take their chances on it next time - in any case, the numbers who left next time would be lower, as any false alarm greatly reduces the number who will take action, regardless of how advisable the alert was - it is just human nature.

Nagin seems to have something of a knack for getting the worst of all worlds, with mandatory evacuations which are not compulsory, overblown rhetoric and so on - still, I suppose he figures that his term of office will be over by the time it comes back to bite, and he is covering himself by not allowing people back.

Thanks for the reply and the explanation, but I am still having a bit of trouble understanding your statements.

<< The order was mandatory but NOT compulsory and there is a difference. >>

Is there a website that explains this? The official site for the City of New Orleans (http://www.cityofno.com/pg-1-264.aspx) doesn't state this.

From your statement, I'm still not sure that I understand the explanation.

From my understanding, both mandatory and compulsory mean the same thing.

Mandatory has the following definition (@ http://www.thefreedictionary.com/mandatory):

"Required or commanded by authority; obligatory."

This definition shows that there is no choice for a mandatory condition.

As a matter of fact, the website give "compulsory" as a synonym.

Maybe you can help me understand how something can be "mandatory but NOT compulsory".

Gus is lingering now directly on Port Fourchon ...so it has hit the LOOP as a CAT 3 and is now ripping to shreds Port Fourchon as a high CAT 2. The main thing also to not is it is moving slow...so as a strong CAT 2 it is essentially staying there longer then it would as a more powerful hurricane. Thus the flooding and winds will do some astronomical damage esp the flooding to the refineries.

This is certainly nothing to brush off lightly...As a matter of fact this will cause more damage to the oil infastructor then both Katherina and Rita did combined.

Wikipedia for Port Fourchon complains about damage caused by Lili in 1992.

"Lili made landfall ... near Intracoastal City, as a weakening category one".

Intercoastal City is 100 miles west.

So, yes, expect damage at Port Fourchon.

There is a new worry in that Mayor Nagin has announced that there are three vessels loose in the Industrial Canal. It was a barge going through the flood wall above the Lower Ninth Ward that led to the great devastation in that region during Katrina.

It is now confirmed that one of the vessels is a barge, and it is giving city officials a lot of worry. Fox is reporting that water is topping the levees at the Ninth Ward. As a reminder, while the earth levees can withstand a barge impact (and down the delta they did) the thin concrete and steel pile wall cannot. When the barge hit in 2005 it peeled the pilings as an integral piece over several hundred yards, so that there was a wall of water that went into the Lower Ninth, taking out the first four blocks completely and with houses off their foundations back up to 20 blocks.

Forensic engineering has conclusively shown that was NOT the case.

Bad engineering to the point of malfeasance by the US Army built a levee that failed by itself and this sucked the barge in. The barge widened the gap by 3 to 4 feet (shown by the way that the steel was bent).

Alan

Sorry Alan, I walked that breach and looked at the whole site, including the pilings. The barge could not have got to where it ended up without a massive amount of water under it. Its alignment relative to the breach and position strongly argue contrary to that view. The steel was not bent it was literally pushed up and out of the way as the barge made its way across the breach. I have several dozen photos that argue my case.

The outer edges of the breach had steel bent back in a pattern consistent with a barge battering it's way through, but only the outer edges. This would be consistent with the barge being sucked into a pre-existing hole and enlarging it slightly.

Could you elaborate on your theory of collapse.

THIS IS WHY WE NEED A 8/29 COMMISSION

The US Army Corps of Engineers id using it's considerable power and influence (and cold hard cash) to cover up their myriad failures.

Alan

Be glad to, its actually on the video I mentioned to you at the last ASPO. The pilings all along the center of the breach were flat on the ground, and a fair distance from their starting point along the wall, but still connected. I took a fair number of shots up around the bend in the wall where it started (at the opposite end to where the barge ended up). You also have to look at the building damage around the point where the barge ended up. The school bus is a little bit of a puzzle (or maybe corroborative evidence). Sucking the barge into an existing hole is not consistent with where the barge ended up! As I remember, but need to go back and look, there was not a whole lot of damage to the pilings (apart from their being peeled out and over) up by where the barge ended up, and from the point where they were dragged out of original alignment. The barge had to strike one part of the wall with considerable forward momentum along the wall direction and continue pushing the wall over as it moved up what became the breach, knocking the wall loose, and freeing the wall of water to move into the gap, pushing the steel further out as the barge continued to be carried by the wall of water out beyond the original wall. As the barge moved out from the center of the breach and the water flowing through it, it began to run out of water to ride on, and thus came to ground where it did. But that position relative to the breach allows one to define the barge path and give some idea of the momentum it had.

Will you be in Sacramento? Oh, and before I forget, delighted (and relieved) to see you made it through.

Best

This shot shows the barge (the school bus gives the scale) and while the breach is being filled you can see the position of the piles where they were carried. Note that all the concrete along the top is gone.

And now Tropical Depression Nine is coming in... This map looks unpleasant:

http://www.nhc.noaa.gov/gtwo_atl.shtml

What's the L with the x area it look like might have a spin already !

The "L with the x" is TD9, that I mentioned above. Go to the NHC website and click on it to see the forecast track.

Each post from NHC ends with:

"ELSEWHERE...TROPICAL CYCLONE FORMATION IS NOT EXPECTED DURING THE NEXT 48 HOURS."

But their fast changing data seems to contradict this.

Oh Come ON! this ain't funny.

It's way too early to tell what this year's hurricane season is going to rank overall but there's a couple of possibilities as to what could cause this seemingly increased intensity. One is that the La Niña/El Niño is over this year. This phenomenon may have contributed to the weak hurricane seasons in the last two years. So we might just be getting back to "normal".

Second is the global climate change. There is a controversial paper that came out a few months before Katrina hit that showed an increase in hurricane intensity in the later part of the twentieth century and early 21st. NOAA decided this wasn't real, or any effect was too minor to be significant. However, I don't necessarily trust NOAA on this because they are governed by political appointees who are appointed by an administration who in the past has shown no qualms about hiring people who lie about important things when it is politically expedient, or who are incompetent but loyal to the administration. It is possible though that the increase in powerful hurricanes we're seeing is just a natural cycle, but you'd expect that increased sea surface temperatures would contribute to hurricane intensity. It's hard to tell.

Looks like the British are controlling the weather if thats not a proper English queue then I don't know what it is. Obviously they won't let depression 3 develop unless he gets lined up a tad better.

Heh, they always look like that. The lower pressure zone that ultimately becomes the hurricane forms as a series of ripples in the atmosphere above the Sahara, essentially a standing wave that gives them their nice periodicity. After they get over ocean they get spun off and move westward following the warm water. Their later track in general I think is governed by a combination of the Hadley cells and the Coriolis effect, but the precise track is affected by other weather patterns and ocean circulation/temp., etc.

I dunno...they aren't quite that close together. If you stand at a polite distance in the UK, people cut in front of you, assuming you aren't in line. While Brits tend to stand so close Americans assume they are some kind of perverts. :)

The Weather Channel is covering Ike. They think he could be a problem as soon as this weekend. With another storm (Josephine?) hot on his heels.

Yes, the models say that 40% of GOM oil will be offline for 30 days, and 30% of GOM NG for will be offline for 30 days.

If that's true how you explain that the news are in jubilation that the price is sliding because Gustav is underperforming.

That's the word they used: underperforming, the media is disappointed by the Mother Gaia.

Quelle bêtise!

While I don't agree with it I can explain it. Human's have many cognitive foibles - we are domain specific not domain general - i.e. everyone looks at oil last week vs today and looks at LOOP and infrastructure last week vs today, and says 'why isn't oil rocketing?!!', forgetting there are 20+ other variables impacting the price of oil, first and foremost the short term existing positions of nervous short term speculators. When I worked in this business, I developed models that would capitalize on short term (small) moves that mean reverted but would stay with larger moves that tended to persist much further than people expected. In other words, most events were noise but some larger trends would consistently be underreacted to.

We won't have a rational 'explanation' of why oil continues to sell off from $140+ until months after the fact, just like we didn't have an explanation why it went from $90 to $140+ earlier this year.

The markets are always right, even though they're not.

Do you think that some (big) traders are trying to keep as low as possible the price of oil until US elections in November? Can be that someone or some group have the means to do that ?

karl Rove, having concluded that high oil prices on balance threaten the permanent repugnant majority, is only driving his SUV on alternate days and has motivated those on his mailing list to do the same.

Regarding petroleum, because of the SPR I thought that Gustav would be a product problem, not a crude problem. Of course, I think that the long term problem for crude is declining net oil exports worldwide.

and the long term problem for declining net oil exports is declining net energy.

You're right if the refineries are in a standstill then what's the point to import crude, probably US will increase its import in the refined product. Why then the gasoline and diesel price doesn't jump or it's a matter of weeks?

Trading is speculative...nobody is there now at the LOOP or Port Fourchon to see how bad things really are. So I wouldn't place too many stocks into the good good news.

This Monster of a storm hit the LOOP head on and lingerered around Port Fourchon causing damage...esp flooding!

This storm hit both places as a powerful hurricane CAT 3! That is something to be reckoned with.. I can tell you I waited out a CAT 1 in FL before and it felt like the end of the world...it was a horrifying experience!

This SOB has hit the main energy terminal of the USA! A main artery per say! It won't go unnoticed!!

Looks like Port Fourchon got about 5 feet of water.

http://tidesonline.nos.noaa.gov/geographic.html

This is a graph that was posted by ace on thread 2, showing historical oil US oil production in the Gulf of Mexico, and his forecast of future oil production in the Gulf of Mexico. The US total crude oil production is about 5 million barrels a day, so production from the Gulf is about 28% of that total. Some production was offline for several months after Hurricane Katrina.

This is a graph Gail made of federal offshore natural gas production in the Gulf of Mexico. State offshore natural gas production is not available monthly, but it isn't very much. Adding Texas and Louisiana state offshore natural gas would only increase the total by about 5%. Gulf of Mexico natural gas (federal plus Louisiana and Texas state) currently amounts to about 13% of US natural gas production. When Katrina hit, we lost the equivalent of about one month's natural gas production.

Generic SLOSH forecast for a Cat 4 Hurricane

Here's a link to some maps from Rigzone: http://www.rigzone.com/news/hurricanes/gustav_map.asp?m=All

Some maximum wind readings, as of 1000 CDT:

Grand Isle (GISL1): ENE 58 kt (67 mph, 107 km/h) gusting 75 kt (86 mph, 139 km/h) at 0548 CDT

Pilot's Station East (PISL1): E 79 kt (91 mph, 146 km/h) gusting 100 kt (115 mph, 185 km/h) at 0418 CDT

Power outages seem to have shut down communications from two of the New Orleans-based ASOS stations early in the storm's arrival to the city, and the highest wind speeds in the area are likely missing from the data. Last wind report from New Orleans International (KMSY) showed a maximum gust of 55 kt (63 mph, 101 km/h) out of 040º at 0608 CDT. Highest wind report from the Lakefront Airport (KNEW) showed a max gust of 47 kt (54 mph, 87 km/h) out of 040º at 0349 CDT. Alvin Callender Field (KNBG) continues to send communications: Peak gust there 63 kt (72 mph, 117 km/h) out of 060º at 0800 CDT. About 0.87" of rain has fallen at the NAS as of 0952 CDT.

Looks like Cat-1 winds on the coast (possibly near low Cat-2 in places) at these official stations, and TS-force inland, around New Orleans.

-best,

Wolf

Was anyone else aware of the "special" energy trading day on Sunday?

yes. that was posted here both saturday and yesterday. There are precedents for altering trading times based on exogenous events. (Katrina -9/11 etc)

Reader Paul e-mailed about the special, early opening of the NYMEX to permit pre-Gustav trading. As he correctly noted:

I have NEVER heard of a US market opening early due to macro events; the usual move is to CLOSE during exceptional circumstances.

Neither have I. This looks pretty suspicious. Did some influential parties need to rearrange their positions, or did some hope to use a probably-thin market to their advantage? How many were aware of this session when it opened? How much advance notice was there, and how was this disseminated? It is almost certain no questions will be raised. Any reactions from informed readers very much appreciated.

As for the substance, Bloomberg notes that the market reaction is subdued compared to the supposed severity of the storm, although as of this writing it was a Category 3, not the feared Category 5 it seemed likely to become.

From Bloomberg:

``It's a huge storm, and it's got the potential to cause all kinds of problems,'' said Peter Beutel, president of energy consultant Cameron Hanover Inc. in New Canaan, Connecticut. ``There's a lot of concern that this is something that could really, really damage infrastructure badly, and this could be another instance of Katria-Rita or worse.''

Crude oil for October delivery rose $1.67, or 1.5 percent, to $117.13 a barrel at 5 p.m. on the New York Mercantile Exchange. Prices are up 22 percent this year.

Gasoline for October delivery gained 6.58 cents, or 2.3 percent, to $2.92 a gallon on the exchange.

To see oil ``up two and a half dollars is a muted reaction to what they're calling the mother of all storms,'' Beutel said....

``We're more prepared for this storm than we ever have been for any hurricane that I remember,'' said Phil Flynn, senior trader at Alaron Trading Corp. in Chicago. ``We're better prepared, and demand isn't that strong anyway, so I'm about as optimistic as I can be in this type of disastrous situation.''.....

``You get a couple of rigs shut down, keeled over from this hurricane, and this is going go take days or weeks to fix,'' said Brad Samples, a commodity analyst for Summit Energy Inc. in Louisville, Kentucky. ``The bigger problem is on the refining side and the potential impact on all the refineries that string along the Gulf Coast.''

Almost half of U.S. refining capacity is centered along the Gulf Coast, and refineries have been operating at less than 90 percent of capacity all year, according to the Energy Department.

http://www.nakedcapitalism.com/2008/08/why-no-questions-about-special-ny...

CNN are reporting that floodwaters are overtopping the industrial levees in NO.

Overtopping is not necessarily a problem.

Yes, a further report says the levees are holding and no flooding of houses. Doesn't seem to be a problem.

It is my understanding that a large earthen dam will almost invariable fail if it is overtopped.

Matt

It's not an earthen dam. See this footage here to see the overtopping of the industrial canal floodwall for yourself.

http://www.wwltv.com/video/news-index.html?nvid=278017

The earthen levees will slowly erode under continuous flow when they are overtopped, and I expect that when this is over and folk go back down the delta that you will find spots where they are severely eroded, and perhaps cut through. However that takes some time and the short, splash-over type waves that you are seeing on the Industrial Canal does not have enough power or time to do much damage. The walls are deliberately made thick so that it takes time to cut a breach, and thus they resist short term overtopping, as most of the levees did in 2005. The worry comes with the concrete and piling walls where there is no concrete base on the landward side, and the overtopping waves quickly start to eat down through the soil and undercut the piling foundation holding the wall up. The walls along the Industrial Canal now have that concrete protection as you can see on the transmissions - they did not on the Lower Ninth side in 2005.

Watching CNN live video, it is very good news (at the moment) that this storm is only a cat 2, miles from NO and moving away. With another foot of water it would be pouring over this levee. Thankfully it is not.

Here is the latest chart of Gustav's history, as of the latest 1500 UTC statements by the NHC:

Perhaps some minor strengthening occurred post-landfall on Cuba, as evidenced by a modest central pressure drop. Looks like a Cat-2 hurricane at landfall. Interesting downward blip in central pressure as of the latest report.

Here's Gustav's movement speed:

Looks like some slowdown has occurred, but as of the latest NHC report, Gustav is still moving northwest at a fairly quick clip.

Latest Doppler radar image from New Orleans, as of 1530 UTC:

Shows the eye just about completely ashore with the southern eyewall now touching the coastline. Notice a fairly well-formed and complete eyewall: the storm's organized. Looks like Houma is in the eye. As Gustav moves further inland, over more solid ground, the NHC forecasters expect more rapid weakening to occur.

-best,

Wolf

So what are the odds that we will see actual, widespread shortages sometime this year, if the LOOP and Port Fourchon turn out to have sustained significant damage?

Pretty close to zero, provided there are no long term problems accessing the oil from the SPR; however, I think that the long term trend is for an accelerating decline in net oil exports worldwide.

Even without LOOP damage we have diesel and heating oil shortages coming. Stocks are too low even before Gustav - as reflected in +$20 heat cracks.

After Katrina, refineries came back up without much damage. We'll see something similar with Gustav.

As noted up the thread, I think that Gustav is a product problem, not a crude problem.

I've seen a few comments pointing out that some marginally producing wells were not restarted after Katrina, thus permanently shutting that flow out, and that "recovery" was really about new fields/wells coming on line. Does someone have some very specific data that shows the loss (by well or field?)?

-d

Deep water wells now provide 70% of GOM production for the most part these are basically new production having come in over the last five years or so.

You would need a bit more detail to figure out what was not rebuilt after Katrina but overall shallow water production has been in steep decline for some time and will continue to decline.

http://www.gomr.mms.gov/homepg/whatsnew/techann/000022.html

I really liked this link its a good overview.

http://www.actuaries.org.uk/__data/assets/pdf_file/0016/31057/Jowett.pdf

Insurance data if public might be the best answer.

Remember that the major oil operators are going to wait 10 days+ before saying anything conclusive about damages in order to avert constant revisions (like Citigroup or Morgan Stanley...)

I.e. Methaz' damage estimates above are about the best guess we can make at moment - they use a model which was very accurate after Katrina - but we just don't know. In a world when data crosses the planet in less than a second, we are all used to immediate answers, but not gonna happen in events like this

You mean they might wait until the wind, rain, and tornadoes stop to make an accurate assessment? That's blasphemy! We wanted it yesterday.

It is also "good" for business to delay admitting bad news to the last possible moment and to "spin" the bad news to limit its impact on profit. I know because I've seen it many times in my own company. It can be many months later to find out the real affect on the company's bottom dollar.

Another factor we saw after Katrina was that since the storm hit the oil/gas industry where it lives, crews aren't available as fast since they are trying to recover themselves, so it's a two part process for the offshore stuff: 1) recover the land assets and stage crews; 2) see in detail what happened offshore. Also, Rita came in on the heels of Katrina, and everybody evacuated before the damage was evaluated. We didn't have good numbers on impacts until December.

But this year will be different - it's not like there are any more storms out there. Right?

Possible gasoline shortages esp in the New England States.

Also natural gas may pose a problem this early winter in the USA.

This storm effected allot of the refined products "about 7% US ave" that is allot with razor tight supplies already and the SRP will not help with refined products...Likely the USA will get help from the EU.

Hannah has been promoted :)

I just talked with a friend who lives in New Orleans but is holed up in Mississipi - he is a natural gas trader sans internet or anything - he told me to look at possible damage to the Venice,LA gas processing plant as well as Yscloskey - I got this info from Chuck Watson:

I have a google earth image but too large to post here..there is going to be a LONG delay in info coming out on damage and shut-in production, IMO. I can assure you it is greater than 0 (and as we have pointed out all weekend, this could have been much much worse)

Three cheers for dry air!

Venice is almost in the very foot of the Delta: Google Maps Link. Kinda crazy place for a GOSP, or anything else for that matter. IMO.

Is there anyone on this blog that is a pilot who could rent a plane and fly over the area and do their own recon? With photos on this web site, the oil guys here could help us all with dammage assesment.

Generally the oil companies will be flying their helos down here as soon as anyone and that info should get out fairly quickly. (It did last time).

The eyewall (what's left of it) is scraping through Baton Rouge now. At 1245 CDT, a wind gust of 61 kt (70 mph, 113 km/h) out of 050º was reported at Ryan Field (KBTR). Pressure down to 987.3 mb (29.16") at 1253 CDT, dropping fast (nearly 4 mb/hr).

Among the official stations at New Orleans, one of the highest readings occurred at the New Canal station (NWCL1): 51 kt gusting 68 at 0818 CDT. That's 60 gusting 78 in mph. Alvin Callender NAS recently reported a gust to 60 kt (69 mph, 111 km/h) out of 120º at 1132 CDT. Gusts were a bit higher at this station earlier in the day.

Edit:

The 1353 CDT report from Baton Rouge shows ENE winds 41 kt gusting 64 (47 mph gusting 74), with 0.58" rain in the past hour, and the barometer down 5.0 mb over the last hour to 982.3 mb (29.01"). The center of Gustav is very close to this site.

Now, 1412 CDT, 79 kt (91 mph) gust out of 060º at Baton Rouge.

-best,

Wolf

This is cool (and to my very untrained eye they don't look that different):

Comparing Gus and Katrina. (from Jeff Master's blog, click to go there)

Okay, yes they do look that different. The colors didn't come through the first time :)

And -- Hello, Ike.

This thread is awfully quiet, is it the whole "dodged a bullet" thing?

Maybe just waiting for damage reports from the LOOP and Port Fourchon. Companies will mainly wait until tomorrow to inspect, right? Today's conditions still seem likely to be too gnarly.

You're probably right.

I saw a comment over at the Wunderblog this morning (around 9 or 10 AM) about "might as well move on to Hannah" or something like that. Once the storm hit land, the storm trackers started losing interest :)

Oil market has opined that Gustav missed.

http://www.bloomberg.com/apps/news?pid=20670001&refer=home&sid=axqf_0wRE_C4

``The reason that the energy markets are so soft today is because where the hurricane came ashore basically misses everything,'' said Michael Rose, trading director at Angus Jackson Inc. in Fort Lauderdale, Florida. ``There are a couple of rigs out there, but not many. The market is just basically resuming its trend, which was lower.''

A Predator drone was deployed this afternoon, before human flights were allowed, to survey the situation.

Alan

How often do you have human flights in NO?

Flights of Fancy are extraordinarily common :-)

Alan

I think it's more that it's a holiday (Labor Day, for non-USans). And a beautiful day in much of the country. People are out with their families, celebrating the last holiday of summer.

Ben, thanks for posting the graphs. They are quite informative. Katrina was definitely a stronger storm at the time of landfall than Gustav. However, I suspect that Gustav was a very close call for New Orleans.

If the storm center had ended up closer to New Orleans, say in a similar position to either Baton Rouge or Lafayette, in other words about 20-40 miles east of the actual track, the outcome could have been quite a bit more catastrophic.

I say this primarily because atmospheric surface pressure would have be significantly lower, especially if the center went over New Orleans. Low pressure reached 968.5 mb (28.60") at Lafayette, and 982.1 mb (29.00") at Baton Rouge. The low at the New Orleans NAS was 989.5 mb (29.22"). Likely, lower pressure would have translated an even higher surge at New Orleans.

Apparently that the heaviest rains also missed New Orleans. Before communications at the Lafayette Regional Airport met station largely ceased (most likely due to power outage around 1600 CDT), hourly rain totals reached 1.22" at 1453 CDT and 1.18" at 1553 CDT. Such heavy precipitation could have compounded the hydrological load in the New Orleans area.

And, as best as I can ascertain from available official data, wind loads would have been higher with the center closer to New Orleans, too. This is evidenced by two to three hours of gusts in the range of 60 to 80 knots at Baton Rouge and at least 60 to 70 at Lafayette (some of Lafayette's wind record is missing). This is roughly 10 to 15 kt higher than what happened in New Orleans, an additional force that could have added pressure to the levees.

Anyway, just pointing out some details to think about.

Hmmm... Looks like some levees are still in danger of failure according to recent CNN reports...

-best,

Wolf

Here's the lake gauge and it's still going up.

Latest image at time of posting. Click image for real time data.

Perhaps I've spoken too soon in the sense of New Orleans being in the clear...

These storms, and their surges tend to have quite a bit of momentum/inertia.

Great graph, BTW. Thanks for adding this.

-best,

Wolf

From Chuck's company's press release:

Storm damage of $35 to $40 billion is a lot. I'm sure only a small portion of this is insured damage. Someone will have to fix the damage, whether insured or not (unless the property / infrastructure is left un-repaired).

According to this article,

Even $6 to $10 billion is a chunk for the insurance industry.

The Times comes up with similar estimates:

http://www.timesonline.co.uk/tol/money/insurance/article4656675.ece

On top of just under $10bn for residential and so on, they put oil industry damage at at least $2bn.

Another interesting comment is that zinc prices may rise as vast amounts are held in NO warehouses.

New Orleans is also one of three major copper warehouse locations worldwide. Stored copper is at low levels ATM.

Alan

Folks are usually shocked by our storm total numbers, but we include a lot of stuff the other estimates don't, like evacuation costs, flood damages, government infrastructure, agriculture losses, etc. Insured losses only include "covered" perils, mainly wind in this case (recall that there is no private flood insurance - it's all the Federal FIP). Even though it's a holiday weekend, think about lost business revenue, what it cost folks to evacuate, how much it cost to mobilze the state and federal response, etc. Billion here, Billion, there, pretty soon you're talking real money!

Generally, storm total losses are 4-5 times insured, so our numbers are in the same ball park as EQE's.

Most of that portion of the gulf coast lost out on tourism dollars for Labor Day Weekend. Folks started cancelling long before Gustav made it past Cuba ("what if..."). I'm sure that's hard to measure.

Make sure to check out JoulesBurn's Gustav and the Louisana Offshore Oil Platform -- What do we need to know?, it's the post right below this one on the front page.

cnn is reporting that Plac. parish east levy is about to collapse.

There are reports that levees in St. Bernard Parish are failing as well.

Plaquemines Parish levee overtopped, subdivision threatened

I would guess the problem is it's high tide now? Water levels in Lake Ponchartrain are higher now than during the height of the storm.

Um.... Guys?

I'm no hurricane expert, but looking at the relative development of Gustav and Hanna can someone reassure me that TS Ike is not really, really scary?

If someone can tell me how to embed jpegs, I'll show you what I mean.

The allowed HTML tags are listed below the text entry window for your post. Use the "img" tag, with the greater/lesser signs around it. In the following example, brackets are being substituted for the greater/lesser signs:

(img src = "URL of image")

That said, here's the latest water vapor satellite photo of Ike, taken at 2145 UTC:

Yes, indeed, the storm is looking quite impressive.

-best,

Wolf

It's html. For example, the following line

<img src="http://icons-pe.wunderground.com/data/images/at200809_5day.gif">

Produces this.

Thanks, but I'm not sure I understand. If I reference a URL on my hard drive, is it automatically pulled up during the comment post?

In the mean time, I'll try this:

http://www.wunderground.com/wundermap/?lat=29.57346&lon=-85.73730&zoom=6...

If you scroll over, you'll see that Ike is developing quickly into a Cat 1 hundreds of miles before Gus or Hanna became Tropical Storms, without the warm coastal waters to drive it. The track doesn't look too cheery either.

Cheers

No. You cannot upload images here.

You must upload the image somewhere else, and link to it.

Thanks, I have much to learn.

There are many sites.

http://www.imageshack.us is one of the simplest. Just follow the instructions and it will even provide you with the html to paste on TOD

It seems to me you posted the bookmark, not the image itself. So here goes my advice:

1) Click bookmark (on the other site)

2) Wait for original (large) image to download

3) Right click image

4) Copy the image link (below)

5) Come back to TOD

6) Type: (img src="paste link here"/) [note: use the smaller than-greater than signs)

7) Enjoy result

Cheers.

Thank you all !!!

I realized I pasted the thumbnail code but by the time I got the syntax right, my edit privileges timed out. (gotta get of this learning curve) :-)

Sorry if I've hijacked the thread.

That said, it does show show Ike to be quite the precocious boy, doesn't it?

Thanks again.

Editing privileges do not time out here. Instead, you can edit your post until someone replies to it. Once there is a reply, the "edit" option disappears.

No, he did the right thing. Thumbnailing is the best thing to do. The image he posted is bloody huge. There is no way it would be visible for most people if he did what you suggest.

point taken and noted

TVM

You are right, I wasn't paying attention to the size in both pixels and kbytes. Let alone my English: I wanted to type thumbnail so I can't figure out why I said bookmark instead. Twice.

Enough is enough, I probably need some sleep.

This is quite a large image so posting a thumblink was probably a reasonable thing to do in this case. In the case of imageshack it also offers you the choice to post the image full size (just click "thumbnail mode no" so you don't need to use the manual method above.

Before I was able to upload images to TOD, I used blogger.com. I set up an account and made each post equal to one image. The site makes it easy to upload images. Once I uploaded the image and saved it, I right clicked on the image, and chose "copy image address". The image address I copied is what then I pasted between the quote marks in the img src= "image_address" with pointy quote marks around it.

Be careful with Blogger. IME, they don't allow hot-linking. Or they only allow it sometimes. You think your image is visible to everyone, but often, it's not. You can see it, but others can't.

Go with wordpress on your own server---

Almost anything is possible.

The learning curve is not that steep, and you have control of your own destiny.

Easy software instal, and open source,

nevermind

ImageShack right - click for Firefox simplifies the process even more.

Thank you, Like I don't have enough problems, Hanna has stalled out 263 miles southeast of me here in George Town Bahamas, we already are having 20-25mph winds and rain. After it moves on we now find out we will only be have a day or two before we have to deal with Ike.

The 8pm update has Hanna stalled and we are right on the edge it's windfield, from the 5pm Discussion Number 20

I've moved the boat twice in the last two days, I may have to move it again in the morning, we shell see?

Ed

My guess is Hard Hearted Hanna is going home to Savannah, GA.

Think she'll be pouring water on a drowning man?

Ike is still at least a week away. It is worthy of concern, yes, but I'd wait a few days before ratcheting things up. That said, this hurricane season has turned quite worrisome really quickly.

Here is a listing of the current infrastructure outage due to Gustav, from Reuters:

General Honore was just on CNN. He estimated it would be three weeks before power is restored to New Orleans. Not sure what that means for refineries, etc.

The refineries are all in "warm shut-down" and will restart in a day (absent labor force issues).

Minimal damage to electrical grid except on the coast (downed power lines @ Port Sulphur (hint Bob) and one HV AC line AFAIK.

Alan

My 6:15 AM post

My post that was cut-off by power failure @ 6:15 AM, computer saved it when repowered

----------------------

Bob Breck at 5 AM (obvious lack of sleep, last broadcast @ 11PM plus "extended conversation with NHC", quite likely since he contradicted conventional wisdom and computer models with human judgment)

Maximum wind gust speeds inside the city of 70 to 80 mph. Earlier I said 5 to 10" of wind, now I think it will be 5" despite what the computer models say (30+"). AREA of low Cat 3 wind speeds is very small, with reduces the impact of storm surge and high winds. A point he made earlier, noting that Gustav was just half of a Cat 3.

He congratulated NHC on their track and explained why they had the intensity too high. I learned for the first time that one of their forecasters had worked for him as an intern. Talked with him and a senior guy that had been there as long as Bob Breck had been at Channel 8.

then power went off

Alan

Great to hear from you, Alan. Hope you're coping well and that your city is back on its feet again soon.

Cheers,

Paul

Typo in 6:15 AM post

Bob Breck predicted 5 to 10 inches of rain, not wind.

I marvel at his willingness to go against the "consensus" and computer models for his own excellent reasons. I listened to his in depth logic and agreed that is was compelling.

Fox 8 is the only locally owned station and they give him *ALL* the toys we wants (and a new hire, a bright young female African-American meteorologist that operates the new tech for him).

He showed in the 3D/4D (time lapse) model of cloud heights how the dry air was cutting one side (but not the other) of Gustav into a "hundred squalls. He discussed, in quite some detail, the risks of reforming into a full hurricane. Plus much more. In some respects a college level seminar.

Best Hopes for Bob Breck,

Alan

Glad you ducked the bullet! ;-)

Bob Breck was Right !!

A triumph of human judgment (and moral courage !) over computer models and group speak.

A nearby Weatherbug station had a maximum gust for the day of 67 mph, and another a max of 75 mph. Well within Bob Breck's prediction of a max of 80 mph.

Both Weather bug stations failed to measure rain, but other sources show 3 to 6 inches of rain within New Orleans.

Power off at 6:15 AM this morning, back at precisely 4:45 PM (I think a preventative blackout).

Land line out at 10:33 AM (I was on the phone), back around 6:45 PM.

I am bewildered by the prevention of re-entry. Literally no need if people are willing to deal with power outages in SOME areas (reportedly 80%). This will create MASSIVE traffic jams when they do allow re-entry and multiple days of hotel rooms will make many reluctant to evac again.

Best Hopes for Bob Breck resisting any pressure to conform,

Alan

Hi Alan,

If you haven't already done so, I would crank your refrigerator dial to "max" and start making additional ice; you can safely assume the power system is highly fragile and that you will lose service at anytime. Do you have plenty of potable water on hand? If not, start filling those containers now and monitor the local media for boil water advisories.

You're also under a tornado watch so exercise due caution.

Best regards,

Paul

Good advice.

However, I am on the same substations as the Convention Center, a priority (National Guard bivouac) . City demand is minimal (little a/c, few people, most of city w/o power).

Water is unlikely to be disrupted. No major rain, few users (except post-K leaks), they have their own power (which they switched to before Gustav as a precaution).

Best Hopes,

Alan

Hi Alan

I presume that you are the "Alan Drake" who was interviewed on Radio New Zealand this morning (our time).

Hope you have enough beer to last until life returns to normal.

Cheers

Merv

That was me.

A much longer and more interesting conversation before on-air.

How did I come across ?

Best Hopes for my 3 minutes of fame with the Kiwis,

Alan

We are proceeding with our plans to have Alan speak on October 24th in Dallas. We had hoped to have Boone Pickens give a luncheon speech, but given the six figure sum his agent asked for, we had to pass (I offered to do a speech for half of Boone's price, but the conference chairman declined my generous offer).

Here is a link to the NZ interview with Alan: http://www.radionz.co.nz/audio/national/mnr/2008/09/02/huricane_gustav_b...

war of Yankee agression, eh?

A bit of local color I thought New Zealanders might appreciate :-)

Alan

I am bewildered by the prevention of re-entry...

Oh, c'mon now. This is America the litigious and entitlement-minded, where by law everything revolves around the most feeble-minded and otherwise incapable. So as long as some sorry specimen might so much as conceivably snag his or her sorry self on the smallest windblown twig, and then sue for and possibly win $50 million in class-action "damages" from the mean nasty officials who let him or her back in, what bureaucrat in his or her right mind is going to sign off on re-entry?

And think, too, of all those power lines that just conceivably might be down. Remember, it's a city, and city governments are almost invariably in cahoots with all manner of grifters and grafters, which is far more interesting and lucrative than, say, just governing well. So you'll probably be needing crews who possess just exactly the right list of state and local licenses and certificates to walk every inch of every street. Since only a few people will have precisely the right paperwork with current date stamps, which after all, is almost the whole reason the licenses and certificates exist, the process could take days. Or weeks.

One of the disadvantages of living in any sizable city anywhere in the world is that you will have plenty of people helping themselves to generous vigorish, eating up your time and money in return for piously - mind you, with no thought to anything other than your welfare, cross their hearts and hope to die - keeping you "safe". It just goes with urban territory.

The comment I heard (I think it was on the BBC) was that although they were probably OK, the levees needed checking.

That seems reasonable. as once you let people in of course they might go anywhere, and if they were near one of the levees and it had been undermined more than was apparent, then it could suddenly break, and a fair number of people drowning from that cause would be.....embarrassing.

Quite frankly. poppycock.

Not one levee in the core of New Orleans is under stress as I write this (5:30 AM). The water is receding rapidly.

Last night lake levels approached 4 feet above sea level, but water is now flowing rapidly back into the Gulf of Mexico. Design is over a dozen feet over sea level (forgot exact #) so Gustav was hardly a "test".

I could see restricting I-10 East bridge traffic to cars and SUVs (not even pick-ups with travel trailers much less 18 wheelers) until comprehensive inspections are made.

But I-10 East is only one of 5 roads back in (I-10 West/I-55, Causeway (world's longest bridge), Airline Highway and US 90).

Alan

Not to deter from the conversation, Alan, but have you slept at all in the last 48 hours? Ever wonder why coffee is a top priority in your life? :-)

Get some rest. We need your wit and wisdom.

Cheers!

And they continued rising after the mayor's statement - risng about another foot. They now do seem to have peaked though.

Gustav loses stranglehold on energy prices

The article also mentions the LOOP.

So...so far, so good.

Gustav Rides Louisana's Energy Highway

I wonder how full the Clovelly Dome Storage Terminal (45 million barrel capacity) is at the moment.

I think we may be seeing the usual day after response of "everything is fine" which we also saw after Katrina and Andrew. It usually takes several days for government and the media to discover the hardest hit locations.

As far as energy infrastructure goes, there are a lot of ways this storm can cause disruption:

1/ Offshore platform damage.

2/Subsea pipeline disruption due to underwater landslides.

3/Damage to natural gas processing plants. There appear to be quite a few of these in the area where the storm hit.

4/Damage to pipelines and their compressor stations. Loss of electrical power can also shut pipelines down.

5/Damage to the support infrastructure and to things like supply boats. The direct hit on Port Fourchon is a big concern here.

6/Damage to wells in the swamps of South Louisiana. This is listed as onshore production.

7/Employee evacuations could delay the inspection and restart of many facilities.

I should think we will lose at least a couple hundred Bcf of natural gas production from a storm like this, and maybe much more.

There are also a few things that reduce gas demand, such as power outages and damage to petrochemical plants and refineries.

On the oil side, any disruption to supplies can be made up for by SPR releases as long as refineries are still usable. LOOP and the offshore platforms and pipelines are all areas where supply disruption could occur.