US Energy Tax: How Level Is the Playing Field?

Posted by Gail the Actuary on January 16, 2009 - 10:57am

A new study has been issued by the Manhattan Institute, called TAXING ENERGY IN THE UNITED STATES: Which Fuels Does the Tax Code Favor? The study was written by Gilbert Metcalf of Tufts University. I also participated in a conference call with Metcalf regarding the report. A couple of Metcalf's findings:

• The tax code is not at all generous with respect to investments in the electric grid. The effective tax rate on these investments is very close to the unadjusted statutory tax rate of about 39%. If investment is to be encouraged in the electric grid, Dr. Metcalf believes that this tax rate must be lowered.

• The current tax code, especially since enactment of the Energy Policy Act of 2005, strongly encourages investment in nuclear, wind, and solar power, which enjoy tax subsidies ranging from nearly 100 percent, for nuclear, to more than 200 percent, for solar. In other words, tax subsidies for these forms of energy generation are sufficiently generous that investors may use them to offset tax liabilities for capital gains and income derived from non-energy investments. The telephone discussion indicated that these provisions are not currently working as intended for wind and solar, because of lack of "tax appetite".

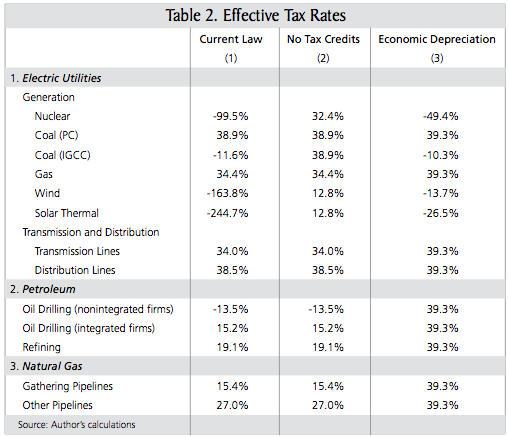

In order to compare tax rates for different energy products, Metcalf calculates the effective tax rate for new energy investments, using provisions from the tax code as he interprets them. This effective tax rate is a combination of the federal tax rate and an average state tax rate. With no favorable offsets, Metcalf estimates the combined rate to amount to 39.3%. The primary table Metcalf shows in his report with respect to effective tax rates is this one:

The first column shows the amounts as Metcalf calculates them under the current law. A rate of 39.3% would indicate that there are no provisions giving any sort of tax benefit. Rates lower than 39.3% would indicate some type of tax benefit. To illustrate whether the benefit results from a favorable depreciation schedule or a tax credit, he shows two additional columns, the first showing the effective tax rate excluding any tax credit, and the other showing the effective tax rate using economic depreciation, instead of the accelerated depreciation, if accelerated depreciation is permitted under the tax code.

It is clear from this table that nuclear, wind, and solar thermal are all taxed very favorably. (A negative tax rate is a very favorable tax treatment.) There are different tax treatments for pulverized coal (PC) electric power plants and integrated gasification combined cycle (IGCC) power plants. IGCC power plants are theoretically more adaptable to CO2 sequestration than PC power plants, so are taxed more favorably.

Electrical transmission and distribution lines receive practically no tax benefit. Metcalf believes this needs to be changed, if utilities are to be encouraged to upgrade their infrastructure both to handle congestion and to handle new production from wind and solar.

Tax rates are different for integrated companies and non-integrated (independent) oil and gas companies, with the non-integrated taxed more favorably. As an alternative to cost depletion, independent oil and gas companies are allowed to take percentage depletion, which is more favorable, up to 1,000 barrels a day.

In the telephone call discussing the paper, Metcalf mentioned several things not discussed in the paper.

In any investment decision, profitability is an issue as well as effective tax rates. IGCC power plants are expensive, even with the lower tax rates. With the current lower energy prices, many investments many not be profitable, regardless of tax rates. This is likely part of the problem for wind and solar.

Another issue is "tax appetite" for tax credits. Wind and solar have big tax credits, and in the past, this has helped encourage investment. The wind and solar companies have not been able to use the tax credits directly themselves, but instead have partnered with banks, who could use the credits. The problem now is that banks doing the financing have little appetite for these tax credits, either because they themselves are not profitable and have no use for the tax credit, or because tax laws have changed, and they can now buy another bank, and offset their taxes through this approach instead.

One question raised was what changes stimulus legislation could make, if there is little tax appetite for refunds. Metcalf said he thought that "refund ability is off the table" with the Obama administration, where refund ability is defined as allowing full benefit, whether or not any profit is actually earned (and taxes paid). In the absence of refund ability, the possible stimulus approaches Metcalf suggested for upgrading the electric grid were

1. US direct investment - Metcalf thought this was unlikely for the grid.

2. Remove obstacles to grid investment - Many types, including siting new lines.

3. Carbon price - Back door approach - If price for coal-fired generation is higher, this will make investment to benefit wind more attractive.

4. Accelerated depreciation - Perhaps write off smart meters over 10 years instead of 20 (but still needs taxable income to work)

In the final section of his paper on Implications for investment, Metcalf makes the following remarks:

The effective rate measures help explain several facts about recent trends in energy capital investment. First, the recent boom in wind and solar renewable investment, especially in wind, is consistent with the large negative rates for wind and solar. . .

Second, the production tax credit for new nuclear-power plants is driving the large negative effective tax rate on new nuclear-power construction and is likely contributing to the resurgent interest in nuclear construction. . .

Third, domestic oil and gas drilling increased markedly with the run-up in oil prices. . .The effective-tax-rate estimates in Table 2 suggest that a strong incentive exists for capital to flow to independent firms that can take advantage of the benefits of percentage depletion and the expensing of intangible drilling costs. . .

Finally, despite the urgent need to upgrade and expand the electricity transmission network, there is a lack of investment incentives that would encourage the flow of financial capital to this asset. This is particularly worrisome given the need to move electricity from remote sites that are well suited to renewable electricity generation to high-demand areas. Generous production and investment tax incentives for renewable energy are undermined to the extent that the domestic electricity transmission network cannot move this new power over the grid.

The concept of adjusting the income tax code to guide energy investments is flawed. As you point out the companies actually investing in new projects often have very little income at least at the beginning when investments are made. A feed in tariff for renewables such as wind and solar as in Europe would be far more direct and effective.

Does the government provide the money to fund the feed in tariff, or does the electric utility?

If it is the government (which it seems like it should), I suspect that is the problem with enacting it here.

There is essentially NO government monies needed for Feed-In Laws. That is one of the beauties of these. The other is that the electric tariffs are customized for each renewable energy technology, as well as their location sometimes (different PV rates for deserts and temperate climate areas based on average insolation of regions). Furthermore, rates are essentially locked in for 20 years (constant or slightly declining), so future electricity prices are predictable.

Feed-In Laws are very well designed for capital intensive investments, where the cost of energy production has minimal or no fuel inputs, little maintenance costs and huge loan repayment/interest on loans/return on equity requirements. The predictable price lowers but does not eliminate the financial risk, which lowers the interest rate on loans/debts and capital return (unless the owners are really greedy). This lowers the cost of production.

In general, the Feed-In tariffs on competitive technologies (wind, run-of-river, tidal, geothermal) are still higher than for electricity made at today's natural gas, coal and fully depreciated nuke plants (especially since there are essentially zip for CO2 or rad-waste pollution costs, or proliferation of nuke "firecracker" costs). When gas prices were $10 to $15/MBtu, Ngas derived electricity was more expensive than wind. And who thinks that Ngas will stay at $6/MBtu for that long, let alone 20 years. What would normally happen is that, without a steady and rapid buildup of renewables, we will depend on Ngas and coal, until those prices spike, again and again. The high prices will cause recessions and depressions, ad infinitum, until the Ngas is gone. When Ngas prices are high, renewable investments will increase, followed by the hangover of low Ngas/electricity prices in the following recession, when the after-effects of demand destruction work on the demand for Ngas. And also the supply of Ngas...as the low prices cause supply destruction. Repeat cycle, and rinse.....

Perhaps a nuke fails or is sabotaged, or perhaps the Greenland ice-sheets break up a bit earlier than expected, and coastal towns like NYC and Miami and Houston strt turning into fish farms. The consequences of reliance on depleting and moderately polluting Ngas, depleting and highly polluting coal, on nukes....those get accentuated when no renewables are allowed in the picture.

Renewables are significantly encouraged with Feed-In Laws. So is conservation. Feed-In Laws also minimize the casino like gambling on future electricity prices, as they put on ceiling on electricity prices. Why pay 20 or 30 c/kw-hr for expensive Ngas based electricity when Ngas is pricey, when wind is available at 10 c/kw-hr...? Feed-In Laws do not result in the cheapest possible electricity when fossil fuel prices are cheap, but so what - electricity prices will be reasonable with wind. If electricity prices are based on unrestricted use of Wyoming coal at $15/ton...how is that going to provide any motivation for energy efficiency?

In other words, customers pay known prices that are predictable for a generation. These allow massive deployment of renewables, especially in countries with significant renewab;le resources, such as the U.S. and Canada. Just think what would happen if the Feed-In Laws in Germany (which, in general, has pretty crappy wind, especially crappy solar, and modest biomass resources) were available in the U.S? What energy crisis? What massive unemployment problem...? would be the result. After all, we have several times the wind capacity versus our current electricity demand. And the wind derived electricity capacity of this country and of Canada is more a function of what the allowable price for that electricity is than anything else. Close to zip at 3 c/kw-hr, several times the current 450 GW at 10 c/kw-hr. Places like the southwest could start getting populated with solar thermal generation systems. And the tidal potential of San Francisco Bay, Puget Sound and especially the Bay of Fundy could finally get tapped with "underwater turbines" without having to "compete" with fully depreciated fossil fuel plants that pay squat for the ability of using our atmosphere as a collective CO2 garbage dump.

Besides, Feed-In Laws have a proven track record of providing more renewables at lower cost and at gretaer installation rates than subsidies and quotas and other ways of "bribing really rich people" into investing in renewable energy, and a better world. That way, they get a chance to pretty much own most of this important future technology, even if the installation rate is painfully slow compared to what is required.

For more info, try here:

http://www.wind-energie.de/en/news/article/amendment-of-the-renewable-en...

Nb

Thanks. That does seem a much more efficient system. Does a feed-in tariff address the transmission issues? What about time-of-use?

I really hope that NioBium41 is Steven Chu's username.

Consumer,

No such luck, just another unemployed and over-educated engineer. Still available for hire by Dr. Chu, in case the U.S. DOE wants a renewable energy system with some cojones. I'm no fan of wimped out when it comes to renewable development.

As to transmission issues, we really don't have to worry given the 1.5% wind penetration of the US grid - that is a concern, in general, once you get above 20%. Denmark and parts of Northern Germany range between 25% to 100% (depends on how windy it is).

Access to the grid is much easier administratively with a Feed-In Law - renewable generation gets preference. And connecting more grids together makes for a more robust arrangement, where wind tends towards baseline power production - lack of wind in one spot gets made up for by a lot of wind somewhere else.

As higher levels of grid penetration occur, more use of HVDC, and pumped hydro systems will be needed. More jobs, more infrastructure, more economic development. And costs gets paid by all customers of the grid(s).

Nb41

I recognize that link ...

OK, this post you used the abbreviated handle I was trying to trace:

http://www.strandedwind.org/node/4119

Nice to see you 8D

Production based subsidies (PTC in the US, FIT in Europe) are very effective, there's no doubt about it. Still, I also support mandatory renewable energy targets per state or region, since that will supply an additional incentive for co-operating and investing in transmission (especially for regions with lower renewable resources, since importing renewable electricity will be economically optimal, promoting increased grid interconnections with other areas).

It seems to me that one of the obstacles to feed in tariffs in the US is probably concern that the grid cannot really accommodate very much in the way of renewables. Our interconnection between locations is pretty poor, and strained already, particularly in the Northeast and California. A major upgrade would have a lot of other impacts as well (make it easier to ship cheap electricity generated from coal in Wyoming elsewhere, for example). A major upgrade would be very difficult, because we have a huge number of players, and assigning costs and benefits is problematic. This analysis is looking at the tax issues with respect to encouraging grid upgrades, but there are a lot of other issues as well.

Does Germany have provisions for assisting low income households with the higher rates that would inevitably come from a Feed-in Tariff? With the very cold weather we have had in Iowa recently has led to greater use of electric heaters to supplement our propane use.

As I mentioned elsewhere, the mandatory renewable energy targets that are being devised/implemented in many US states will provide a decent incentive for more interconnected transmission grids, with the lower renewable resource states having to import renewable electricity from other states. Because the tax credits will pay for renewables in higher resource areas (in particular wind right now) this extra instrument will typically not incur much extra costs.

Depending on how it is implemented there could be some adverse effects. Assuming transmission capacity is sufficient and PV supply capability fixed, we would want PV to be installed only in the highest insolation sites. Giving a greater incentive for someone in a cloudy location decreases the net power produced. Of course if the objective is to incubate a nascent industry which is expected to grow exponentially, then supporting the fastest possible growth rate for that industry should take precedence.

That's why per kWh electric feed in rate for PV systems should be as equal between areas as possible. And also as equal as possible between different system sizes; the benefits of scale vs distributed should be decided by the market, not distorted by large feed in tariff differences (my biggest issue with most feed in tariff structures today).

Nukes (plural) are redundant. Further, they are far easier to defend and less vulnerable to sabotage than thousand-mile transmission lines. The US's worst commercial nuclear accident had little negative effect on either the grid or public health, and improvements since then make it very unlikely to be repeated [1].

You put non-GHG-emitting nuclear with coal and gas, instead of with non-GHG-emitting (maybe, depending on the specifics) renewables?

You have a mental blind spot, sir.

[1] Projections indicate that public health was probably harmed quite a bit by the coal-fired power used to replace the output of TMI Unit 2.

Manhattan Institute. Yup. The basic premise is that a) taxes are always too much, b) private is better than public, and c) growth is good.

But skip the first question - are we too big or too small right now? Scale. I'd argue that our scale is too big and there is no justification for incentivizing a *bigger* grid.

"This hasn't worked for us. This hasn't worked for the planet. It's time to go on to the next age."

Fudging this stuff through tax code is nothing but subsidy. Better to pay up front, to pay it forward, to own it. Munis and local energy co-ops. At least in US, all of this is going to run head on into Commerce Clause, WTO and GATTS. Get used to it.

cfm in Gray, ME

Interesting study; thank you for reporting on this. One finding in the table that jumps out at me is that coal gets effectively no subsidy. Abundant supply means it can keep on keepin' on despite many efforts to favor other technology, or otherwise 'kill coal'. Put another way, our coal addiction may be even tougher to break than our oil addiction.

The grid investment angle may be important as well. It seems to me we need to take these fossil-intensive sources on in stages, something like this: 1) invest in the grid and battery/electric transportation, allowing electric load to grow while oil usage shrinks, and 2) investing in renewable/zero emission generation, allowing coal to be eased out.

My estimates indicate that switching from gasoline to electricity reduces carbon dioxide emissions per mile by roughly 10%, if all the electricity is from coal (to the extent zero emission sources and natural gas get into the mix, the reduction is much better).

This seems like a plausible way forward. The only question is timing, i.e., do we have enough time in reducing carbon emissions before we devote more total energy to climate emergencies.

There actually was a subsidy for coal which expired in 2007, namely a subsidy of coal-to-liquids. It is not in the effective tax rate calculations I show, since it is not part of the current cost structure.

Coal to liquids seems like a particularly bad way of using coal. If I understand a table from the report correctly, the coal to liquids subsidy accounted for $2.4 billion out of the $10.4 billion in total energy-related subsidies spent in 2007. Renewables (which I understood is mostly ethanol, but would probably also include wind) accounted for about $4.0 billion out of the $10.4 billion spent in 2007. End use and conservation amounted to $0.8 billion in 2007.

I agree on coal-to-liquids. The more I look at it the more it seems like a non-starter. My thought was if we go to electric vehicles we can keep our existing coal generation a bit longer, start reducing co2, and bridge over the renewables (also open to nuclear if we can reduce the cost).

Yeah. Long term might be better perspectives, with coal methanization and direct carbon fuel cells. However, alternatives are developing quickly (cost-wise) so the market for advanced coal in the future may not be big anyway.

http://www.dpi.nsw.gov.au/__data/assets/pdf_file/0019/223831/CSIRO-NSW-c...

Its technically possible to micronise coal and use it as a fuel in compression ignition engines at around 50% thermal efficiency. If coal is going to be limited on run hours (such as the European Large Combustion Plant Directive) or emissions, it makes sense to use it at maximum thermal efficiency and only for peak times. The link above shows possible units sized from 10-500MW ideally suited to providing peak power or powering district heating.

Using coal to assist solar thermal power plants could also be an option increasing the capacity factor of the project and making use of the same plant equipment.

Of course the best option is to leave the stuff in the ground but I don't think thats going to happen, but if we are going to burn the stuff it would be good to get 50% more useful electricity per ton of CO2 released (50% thermal efficiency vs 35% in older coal plants with lower transmission losses) and make use of the massive amounts of 'waste' heat which goes up cooling towers globally.

You could probably get almost 50% net effiency in a state of the art pulverized coal plant as well. Still increasing ~1%/year. Smaller size of the compression ignition engine could be an advantage though (easier transmission, CHP).

No.

A Chevy Volt gets 40 miles from its 16 kwh battery or .4 kwh/mile.

Coal fired electricity produces 1.05 tons of carbon dioxide per 1000 kwh.

So a Chevy Volt produces .42 tons per 1000 miles.

The US electricity grid with nuclear and gas,etc. averages .712 tons of CO2 per 1000 kwh, so for average electricity a Volt would produce .284 tons of CO2 per 1000 miles.

A Toyota Prius hybrid gets 45 miles per gallon. Petroleum produces 9.08 tons of CO2 per 1000 gallons.

So a Toyota Prius produces .227 tons of CO2 per 1000 miles.The Prius is 20% greener than the plug-in.

In fact, a Chevy Volt running on coal electricity would be equal in carbon emissions to an ordinary car getting 21.7 miles per gallon while the national auto average is around 22 mpg.

9.08t CO2 per 1000 gal /1.05t CO2 per 1000 kwh x .4 kwh/mi= 21.7 miles per gallon car.

Plug-in are simply not greener and at the lower gas prices are almost as expensive to feed.

With gas prices at $2 per gallon, it would cost a Prius owner $44.44 to go 1000 miles. A Volt owner could take (25) 40 mile daily trips for $40 if electricity is 10 cents per kwh.

We need to look at electric plug-ins more skeptically IMO.

Natural gas hybrids look much more do-able.

Also, need to look at this state by state. PG&E of California estimates that they generate .524 pounds per kwh or 524 pounds per 1000 kwh which is .262 tons per 1000 kwh.

So, in California, the equivalent miles per gallon of a Volt would be 9.08/.262 times .4 = 86.64 mpg.

In California, at least, which is a big state obviously, the Volt appears to make sense from a CO2 standpoint. As other states reduce their carbon emissions then electric or part electric may begin to make sense.

This, of course, doesn't consider embodied energy and possible reductions in maintenance like oil changes.

I am waiting to see if Honda decide to create and IMA natural gas engine, use that to power the front wheels then stick a small electric motor on the rear axle with a battery pack to cover a short all electric range.

Make the rest of the car from aluminium with hemp composites and you have a winner.

Majorian,

You have made a (common)mistake in calculating Chevy Volt electricity consumption. The 16 kWh battery is only half discharged to give 40 miles range, works out at 0.13 kWh/km. When using gasoline is expected to be 45mpg.

In fact only half the electricity in US is from coal, so carbon use is considerably less than 1 tonne/kWh.

"A Chevy Volt gets 40 miles from its 16 kwh battery or .4 kwh/mile"

I believe this is an error and is off by a factor of 2. Although the Volt comes with a 16kwh battery the 40 miles electric range is on a draw of only 8kwh. The battery is kept in a range of 30 - 80% charged so as to increase its lifespan.

Okay, they define a 40 mile 'full charge' as between 85% and 30% of the 16 kwh which is 8.8 kwh or .22 kwh per mi.

http://en.wikipedia.org/wiki/Chevrolet_Volt

This is rather vague and I would suspect that Volt's real world performance will be worse just like with the idealized EPA mpg ratings. Hard driving is bound to drive down the battery quickly.

1.05 t of CO2 per 1000 kwh(coal electricity) x .22 kwh/mi

becomes .231 ton per 1000 miles so the coal powered Volt still makes more CO2 per 1000 miles than a Prius hybrid at .227 t CO2 per 1000 miles.

Then again, if electricity is 100% from nuclear or wind energy you have 0.3-1Kg CO2/1000 miles( based on carbon intensity of wind and nuclear generated electricity), and more importantly have a way to travel post-peak oil. Without gasoline the Prius will still be in the driveway.

Nah, they'll just make it "flex-fuel," like the Volt.

Your premises are wildly delusional.

Non-fossil fuel amount to just 29% of our electricity.

We have 100 aging nuclear power plants most of which are approaching the end of their useful lives.

There are 2500000 tons of proven uranium in the entire world for LWR reactors assume that the US somehow gets control of 25% of that.

How long would that last if we got 50% of US electricity from LWR nukes--just 72 years!

OTH, how long that power would last if it were burnt in our current nuke plants?

162 years.

We have hydroelectric dams in every place where it makes sense.

We get 1% of US electricity from wind.

There is no unified national grid.

It's all a pipe dream.

OTH, using carbon capture and sequestration, the domestic proven reserves of coal alone could provide 50% electric power this country for at least 150 years at the current rates of power consumption.

We get 0% of our electricity from coal with CCS. Ain't no infrastructure for it either on any scale that matters. Talking about pipedreams in a more literall sense of the word...

You were saying something about being delusional? Are you familiar with the saying "the pot calls the kettle black..."?

It's time for some self-evaluation, Majorian. Getting rid of some of your biases might actually do your analysis good.

If you think that coal CCS is any good, then giving it the same tax breaks as wind and electric infrastructure would be all that's required, no?

It is delusional to think that nuclear wind and hydro will provide a low carbon electric grid. We are dependent coal for 50% of our electricity. So people who think plugin electric cars or electric trains (or any other electron base 'fix')are clean are deluding themselves.

The truth is fossil fuels are going provide most of our electricity for at least 50 years so the goal needs to be reducing our dependence on electricity.

Fancy gadgets like plug-in cars just make the problem worse.

I agree that CCS coal is starting from zero but there are marginal benefits in the form of EOR oil and recovered coalbed methane. Most importantly, coal can be gasified to methane with the process carbon dioxide being sequestered as at Weyburn. Natural gas produces 57% of the CO2 for the same amount energy in bituminous coal.

IGCC is a way to make electricity but also natural gas, methanol or hydrogen in the same plant and all these fuels can be stored as backup fuel for electric peaker plants to compensate for variable renewables like wind and solar. Another use for natural gas in particular is in cogeneration. Central station electric plants can't be used for that.

An Ultra supercrit. pulverized coal plan can only make baseload electricity and the low pressure carbon capture process is even more energy intensive than IGCC.

All fossil fuels will eventually decline. Electricity generations at 33% efficiency is the most wasteful use of fossil fuels or uranium and it needs to minimized.

It is delusional to pick specific technology winners and expect that to be an optimal solution. If you think clean enough IGCC CCS is really that good and more proven than wind, then giving it the same subsidies as wind (mostly PTC, ITC and some RD&D) will sort out that IGCC CCS will have a big market share.

THIS brings water usage at an ethanol plant down to about Zero.

Didn't I read something about TVA having a few problems with their Coal Slurries, or something?

If I take the headline rates from column one, the priorities (excepting transmission) seem to be reasonably in line with what I would think make sense. I would prefer natural gas get a bigger subsidy than oil, but mild subsidies for both are not unreasonable, given the likely future scarcity of them. IGCC is supposedly a less pollution, technology, and supposedly would be a lot easier to do carbon capture with, so I don't mind it receiving some benefits. Of course if in practice the favorable rates cannot be realized by the businesses in question, as is discussed here, things may not be as rosy as (1) would imply.

There is an assumption being made, that an improved grid will help renewables. That may not be true. Even with a price on carbon it is possible that lower cost coal power would be more economically viable, because of the capability to sell to distant markets. We need to be careful how things develop in practice.

I think that an upgraded grid will have very many effects. One of them will be that it will be easier to ship cheap coal generated electricity around the country. Another is that it will be easier to use off peak power across time zones. If the grid is at all smart, it is likely to reduce peak demand for electricity. All of these effects are likely to reduce the need for additional power of any sort.

Also costs will be evened out across the country. Any type of generation that is at a cost disadvantage now will probably be at a greater cost disadvantage later. This will make coal more attractive.

I doubt that much more than a minor grid enhancement will in fact be done, because of the costs involved, lack of capital, and all of the players who will be hurt by major grid enhancement. We may see some upgrading to a smart grid, and a few long distance high voltage transmission lines, but I doubt much more.

Gail, if the grid is at all smart, it will concentrate and increase profits to the owners. That it will be easier to ship cheap power around, that it will exacerbate cost disadvantages, sure. But it is not within the scope of "the grid" to reduce peak demand - only to deny that demand. Code will replace legitimacy - to use Larry Lessig's terms.

cfm in Gray, ME

You don't think that consumers will react to buy "on sale" and use less at full retail? You have a very dim view of things.

"Consumers" have a role. To consume. We're way past the time where that is relevant. Yes, peak pricing will time shift use. Consumers will respond to yet another commercial dictum - in "code" - and shift around the load like rats following the food. But that fails to address the "scale of use" which is too much. People have to put on their "citizen" hat to deal with that. Citizen-of-the-planet or citizen-of-the-nation or citizen-of-the-locale will all give different responses, too. Burying that necessary responsibility under "smart grid" abdicates to "the machine". Big honking carbon taxes on energy beyond a certain baseline would do just fine for a start.

cfm in Gray, ME

This is silly, the politicians are just asking for transmission bottlenecks. All power grid investments should be near zero tax rate, and a reasonable loan guarantee for all power grid investments will help a lot too (the loan guarantee percentage should be the same for all power grid investments, eg 50% for all projects). This will help getting the financing completed while still allowing investors to decide what the best/most economical power grid investments will be (no picking technology winners).

I don't like the IGCC tech winner policy. It's only cleaner theoretically (pulverized coal with best available control technology is just as clean in practice) and there is no efficiency gain over ultracritical pulverized coal. Ultracritical cycles appear to be getting similar efficiency gains over time as do IGCC plants. Coal to liquids are a likely spin off from IGCC tech (yikes!). Increasing complexity and materials issues is not a good way to start when developing superiour technology. Expensive gasifcation, expensive combined cycle plant. What genius invented IGCC? If we want to improve coal tech for the future, we need more RD&D on direct carbon fuel cells, and maybe poor coal grades to natural gas conversion (perhaps bacterial underground methanation).

What is the cost difference between an IGCC plant and a "best of breed" ultracritical pulverized coal?

Depends on where you are. For today's US, this graph I find most comprehensive (except for geothermal, which differs eg low temperature geothermal from Raser was 5000/kWe):

Ultra supercritical cycles are actually just incrementally improved conventional coal, typically costing a few percent more. The IGCC combined cycle efficiency advantage is negated by the gasifier losses. Coal's carbon bonds are very strong, the best systems still lose about 20% of the initial energy in the coal in converting the coal to syngas.

Supposedly, IGCC is more capture ready than traditional pulverized coal combustion plants, and theoretically the syngas can be pre-cleaned which should allow lower pollution, but I'm not impressed so far.

Nice graph -thanks for posting it. I see it was put together by FERC (Federal Regulatory Energy Commission) staff.

I like it too - the sensitivity bars seem just about right with a lot of estimates I've seen (there are a few rare cases that are higher or lower but it hardly matters for any arguments' sake).

Too bad it doesn't include distributed and centralized PV estimates.

The energy isn't "lost", it's converted to heat. This heat is used to make steam; a substantial part of the Wabash River plant's steam input to its (1950's Westinghouse) steam turbine comes from the gasifier's syngas cooler.

It's that "increment" that's too small. The TVA ash-pond flood shows that there are serious problems which cannot be addressed by merely increasing thermal efficiency. There are other factors to consider:

The real question is if it pays enough to build gasifiers and carbon-capture gear just to keep burning coal, or if it makes more sense to switch to nuclear.

Thanks, I hadn't considered that yet. I've been wondering what the learning curve is for IGCC (not necessarily CCS since olivine sequestration is a feasible alternative).

What is MORE interesting is if you convert the graph to KW HOURS and not just name-plate capacity. What do the figures look like if you want, say, 1,000 MW hours producing over a 24 hour period based on actual capacity. How much solar and wind would one need to achieve this and then multiply the numbers on the graph above by that factor. Then you get *true* costs.

David

That is a good point. For 2007, nuclear averaged 87% of capacity; coal 69% of capacity, and gas 23% of capacity based on comparing this chart with this chart. The EIA seems to go out of its way not to give numbers for wind.

Nuclear is clearly run full time. The others probably have a fair amount of variability in them. There may be some very old coal plants that are only run when it is unusually hot or cold. I would expect typical plants are higher than the average of 69%. Maybe someone from the industry knows more about this.

I know that gas has quite a bit of variability as well. I would bet some of the peaking plants are operating at less than 10%, while some of the intermediate plants operate at over 40%, producing the 23% average.

If one is looking at production costs, as in the graph upthread, It would seem like one would like to look at plant costs, relative to actual use. If it is necessary to build a gas plant, just to balance out wind generation, that should be considered also (also, extra transmission wires for the wind).

In the past, increasing capacity factor has kept increases in cost moderate. Now, with this effect nearly exhausted (can't get beyond 100% and some maintenance will always be needed) nuclear technology will have to find different ways of reducing the levelised cost, lest it become uncompetitive altogether. The MIT donut shaped fuel elements are promising, but we need gen4 ASAP to change the game.

How do these super-mega pulverized coal plants compare with IGCC for heavy metal and other toxic pollutants? I always thought that was the big advantage of the IGCC plants, limited mercury, etc (I don't buy the fact that CCS will ever happen in any meaningful quantity).

ultra supercritical cycles?

Yeah, a tad higher steam temps and - pressures, and maybe another reheat line.

Ultra giga mega super duper coal plants.

Emphatically not. Not just no, but hell, no!

This is the same mistake made by the "drill here, drill now" proponents; they want to subsidize production while ignoring the consumption end. If it costs less to save oil than to drill it, subsidy of drilling makes us poorer; the same is true of subsidy of grid investments alone. Ideally we'd just have a tax on what costs us (fossil carbon in general and petroleum in particular for its security issues) and let investments flow according to whatever works best.

Feed-in tariffs might be worthwhile but transmission needs to get part of the take for remote supplies. Does anyone know how that would affect the incentives?

I'm definately not suggesting subsidizing (by low or negative tax rates) electric grids alone. If you knew me better, you'd know I'd actually focus mostly on the demand side, and I care about equity between technologies. For example, in this instance I would propose a labelling scheme for pretty much everything that uses energy, combined with fiscal incentives (the better the energy label, the lower the tax rate). European experience shows that bonus-malus systems work well, and I don't see how a tax on carbon is mutually exclusive with such systems, especially considering it is politically very difficult to tax carbon according to its social and environmental cost. In the absence of a full Pigovian tax regime, further price signals are necessary, and I will support fiscal regulation that works.

It does not matter whether it costs more to produce with low carbon technologies or to reduce consumption - as long as both are given the same benefits, the market will not be distorted, but enhanced.

You give an oil production analogy, but how do you translate that to power grid investments? Reducing consumption is great, but if you have a crappy electric grid that fails in the double digit percentage, it doesn't matter whether you use 10 Watts or 100 Watts, your power is out xx percent of the time and that sucks. We're stuck with an ageing grid.

There are political dimensions that you're forgetting as well. A Pigovian tax is ideal according to mainstream environmental accounting theory, but is not always politically achievable. I can't see a full cost accounting on carbon (taxes) happening in the short term so fiscal measures are a useful tool.

Another omission you make is that production tax credits for wind work very well to jumpstart the industry - a strategical rather than tactical policy. And without subsidies (direct, indirect and through lower taxes) we would probably have no wind and nuclear power at all.

The choice of instruments and in particular instrument mixes is rarely of what's ideal.

Ironically you're starting to sound to me like Amory Lovins with his lowest cost only approach. It's unstrategical. Now is not the time for static viewpoints, we need to consider the dynamic effect of policy instruments (such as creating and jumpstarting an industry - with important benefits in the long run as evidenced by nuclear power). Generalized ideology is not very helpful.

(to tell you the truth, I have no idea why you'd even want to compare new oil production capacity with new grid upgrades in terms of societal usefulness, dynamic-strategical effects, political feasibility, equity in todays markets and environmental outcome)

A low-capacity grid isn't the same as a crappy grid. Any grid will "fail" if you try to cram too much power through it. The real issue we've got with sources like wind and CSP is that the best supplies are a long way from the "load centers", and the cost of the lines to move that power has to be allocated properly and the effort rewarded properly.

The old Soviet system rewarded managers based on tons of machines produced; this system created some of the heaviest engines and other devices in their class, but far from the best. Bad reward structures for new energy can be just as counterproductive.

That's a good point but a rubbish comparison. We are not in such a completely planned economy; giving near zero taxes to transmission investments will still not happen if investors think they can't get a decent ROI. Which is why I say near zero tax, not a strong negative tax. Strong negative taxes might incur such risks, although they can be useful for jumpstarting an industry or new technology.

Giving large tax breaks to generation (wind, solar, nuclear) but not to transmission is asking for trouble. Sure, if we had a reasonable carbon tax, we wouldn't need strong fiscal measures. But until we do have such a tax (it could take a while) fiscal measures are a useful instrument.

Lower taxes on transmission is also something most will agree on. Coal and nuclear interest groups won't mind since it will benefit them too.

As for the crappy grid, we have it. An ageing grid that will need very large new investments. Granted, many issues arent strictly financial (NIMBY transmission lines, regulatory hurdles and inertia, too little cooperation between states etc) and need attention as well.

So, Reality finally sets in; and it comes down to this:

Coal + Batteries, or

Switchgrass, Corn, and Sugar Cane.

And, of course, the Oil Drum champions the coal.

Sheesh.

Who is this Oil Drum person?

There is no Oil Drum policy. Each writer has his/her own view.

I don't thing we are championing the coal. At this point, my view is that long-term the gird won't be kept up. Electricity will need to be local, with the fuel varying by the area. Water most often. A little wood, but without oil for transportation, you don't transport wood very far. Mostly, there may not be much electricity.

Whether or not lack of grid is an issue in the short term depends on whether the current financial crisis pulls the oil and electric industries down. If this happens, the discussion about building more grid is academic.

We don't know for certain how bad the financial crisis impacts will be, so we look at a number of possibilities.

We might be able to upgrade the grid, if them politicians had decided to go for low tax levels on grid infrastructure and - equipment (which this thread is about).

Some realities of plugin hybrids--they're not affordable.

http://finance.yahoo.com/news/Electric-cars-will-need-lots-cnnm-14067576...

How affordable they are depends on what oil costs; if (rather, when) we get back over $100/bbl, they'll look a lot better.

Maybe a LOT higher.

Let's say gasoline goes to $7(!) per gallon. To go 22000 miles Prius($30k) getting 45 mpg would cost $3422 per year. A Chevy Volt($50k) going 11000 miles on the 50 hp engine and 11000 miles on the battery would cost $1782 per year.

The Prius would be cheaper to own for

the first 12 years (264000 miles).

It is more likely that the world will run out of money than that Volts will be more economical than normal hybrids.

A lot of the people at this site think that in the next 20 years we may have shortages, rationing or even periods when No gasoline will be available. Under these conditions, having at least one vehicle that can travel 40 miles without using any gasoline, and that could be re-charged at home, may be worth the extra cost.

Where did you get the 50k estimate for the Volt?

"Commercial Scale" syngas to ethanol/methanol plant starts operation. Looks like about 95 gallons/ton.

http://ethanolproducer.com/article.jsp?article_id=5277

Coal? We don't need no stinkin "Coal."

I just took a drive down to Gulfport. I was reminded of the Enormous amount of forestry "waste" in Mississippi, alone. Pine trees on the left of me; pine trees on the right of me, for hundreds of miles. And, every where you looked, Dead Pine Trees. Dead from "Winter Freeze," dead from disease, dead from "old age." Still standing. Fallen over. Dead trees everywhere.

Process the trees; put the Ash back into the soil; plant a new tree. It's "Carbon Negative." (if you believe in that particular theory - that CO2 is not a good thing)

Go downtown. Every eleven, or twelve cars is powered by ethanol. We accomplished that in just a couple of years using excess corn. It must have been excess, corn is only up about $0.02/lb, and we're going to "Carryover" about 1.8 Billion Bushels this year - A year that saw Monstrous floods in the Midwest, and farmers cutting back on corn acreage due to "gouging" by the fertilizer companies.

I know that, for various, and sundry reasons, this is going to ruin the day for some folks, here; but we will replace gasoline like it never existed. Between more efficient engines, and biofuels gasoline will be about as important as the dinosaurs we once said it was made from.

There could be no better investment in America than to invest in America becoming energy independent! We need to utilize everything in out power to reduce our dependence on foreign oil including using our own natural resources. Create cheap clean energy, new badly needed green jobs, and reduce our dependence on foreign oil. OPEC will continue to cut production until they achieve their desired 80-100. per barrel. The high cost of fuel this past year seriously damaged our economy and society. Oil is finite. We are using oil globally at the rate of 2X faster than new oil is being discovered. We need to take some of these billions in bail out bucks and bail ourselves out of our dependence on foreign oil. Jeff Wilson has a really good new book out called The Manhattan Project of 2009 Energy Independence Now. He explores our uses of oil besides gasoline, our depletion, out reserves and stores as well as viable options to replace oil.Oil is finite, it will run out in the not too distant future. WE need to take some of these billions in bail out bucks and bail America out of it's dependence on foreign oil. The historic high price of gas this past year did serious damage to our economy and society. WE should never allow others to have that much power over our economy again. I wish every member of congress would read this book too.

www.themanhattanprojectof2009.com

Apples and oranges. No *operating* nuclear power plant gets this subsidy. This is only for NEW nuclear power plants and only for the first 6 or so (out to 8 GWs). If they build 5 EPRs then it's 5 reactors (not 'plants' which might be more than one reactor).

Wind and solar get the subsidies more or less permanently under the PTC and EPA (based on renewability o the Act).

It is true as someone noted that the higher percentage of the electrical grid is nuclear, the less CO2 there is.

David

You are right. The paper talks about there being 15 nuclear reactors on the drawing board, but the money allocated is only enough for the first 8GW. That is the reason all of the utilities considering nuclear are running to see if they can get part of the money. I am pretty sure the calculations assume the plants get the subsidy--too bad for those who don't clear the hurdles fast enough.

With all of today's financial problems, it is hard to see this subsidy extended to, say, 20 new nuclear power plants.

It's complex. The current nuclear fleet of 105 reactors has a large "historical" subsidy that evolved all the way back to the Manhattan Project. I would say "so what". All major civil engineering projects in the US are gov't run, funded or subsidized. It is an irrelevant equation. It's what we do now that counts and how power is produced, it's cost, future developments (wind, solar, nuclear III and IV). Nuclear now, is very cheap to run. But that's now. Newer plants?

I should put to rest this idea expressed further up the comment thread that US plants are nearing the end of their life expectancy. Who came up with that? EVERY 20 year renewal has been granted so far (all for plants that are *paid off*, I might add). The original "20 and 40" year license period was established by the old AEC by simply *copying* hydro license agreements! The "life span" has zero to do with the licenses. Most plants will last at least 60 years. The new plants are designated for 60 to 80 years (that is how US AP1000s are talked about. Interestingly the very successful Russian VVER1000 has a stated life span of only 50 years.

David

I think you are right about 50-60 year fleet life, but would like to caution that the longest running plant in the US (Oyster Creek) has only run for 42 years IIRC and most are much younger.

In terms of financing, the levelised capital cost is only reduced perhaps 10% or so with going from 40 year to 60 year contracts. An investor may not weigh that 10% up to the risk of not meeting the contract lifetime - nuclear plants in the US tend to be most of different design and quite a few reactors were disconinued with the claim of extension not being feasible/economic. I suspect this is one of the main reasons why the new nuclear contracts are 40 year PPA rather than 60 year PPA.

Like you say, it's complex.

Oyster Creek is (if a quick search can be trusted) 619 megawatts. That's big enough to be worth operating over the long term. Older plants now decomissioned, like Big Rock Point and Shippingport, were much smaller and less economical.

Do you have a reference to support that this was the reason for closing the plants?

It shouldn't be necessary either. The subsidy is a good way to help the first plants over the teething pains of updated designs and an inexperienced workforce. After the first few plants, those should no longer be a problem.

First you oppose subsidies on the production side, and now you advocate them.

What's that, like poetic freedom?

No, just advocating a new government policy that offsets the damage that old policies inflicted on the industry. The added risk created by the old policies tapers off after the first few units, so it's appropriate that the incentives do too.

The Manhattan Institute?

This is like asking a member of the flat earth society to work on a mission to the Moon.

For reference:

http://www.sourcewatch.org/index.php?title=Manhattan_Institute_for_Polic...

It is a sucker's game to try to discuss the "findings" of this report when their is such a long history of the place using ideology as a way to distort findings.

I would look carefully at who has paid for this study and who is currently funding the MI. It seems to me this is an attempt to promote whatever energy sector is behind them. I would guess coal or oil.

One of my favorite projects of theirs has to do with linguistics and grammar. Trying to make it so people can't even think of certain concepts. I wish I'd kept the sources for that - grrrrr. Fascinating stuff. Not quite the same as the promotion of terms like "education reform", but close. One cannot discuss something like that now without getting into a clusterf**k of conflicting definitions. That is the intent of players like MI.

cfm in Gray, ME

People are going to be looking at this stuff, whether we agree with it or not. Also, one would hope that some of the calculations are more or less straightforward, showing how differently various forms of energy are taxed now. The policy implications given in the report are only true, if you agree with their underlying beliefs (expand the grid, expand solar and wind, lots of free enterprise, etc.) I have not tried to discuss where I agree / disagree with these, but if you have read some of my other posts, you will get the idea that there are fairly big differences between what the Manhattan Institute advocates and my position.

I suspect the Obama administration will try to adjust taxation to reach the ends they are seeking, and I think it is helpful to know what they numbers they may be looking at.

Perhaps I am overly dense, but the whole idea of pouring immense amounts of money into the transmission systems and alternative energy, replete with massive “bailouts” (aka tax subsidies), appears to be nothing more than a raid on the consumer’s nearly empty wallet. Several underlying assumptions driving this shakedown of the consumer are highly suspect:

1. Need to move “cheap power” to regions of the country with expensive energy. If you are unwilling to build your own power plants, then perhaps you should be willing to accept the consequences – as in your power will cost a lot.

2. Alternative energy can solve our energy problems. We are colliding headlong with the laws of physics and Mother Nature. Wind and solar energy are intermittent and erratic sources of energy and can not be relied upon for sustained energy production. As a direct result, they are generally poor investments that markedly increase the consumer’s bill, absent being heavily subsidized.

3.Subsidizes are “free”. While there seems to be this peculiar notion that the government can simply print the money, ultimately we (or our children) have to pay the bill.

How about we apply a few simple concepts:

a) If an investment is not prudent, sound and able to stand on its own two feet, then do not spend the money.

b) Let the consumer decide how he wants to spend his money.

c) Take responsibility for our actions.

As far as the environment is concerned, concentrate heavily on prudent (i.e. good paybacks) efficiency improvements and cost effective processes. This will inherently reduce greenhouse gas emissions. Fully deploy developing technologies when the economics become sound. Ultimate, technology will solve the climate issues.