USA Gulf of Mexico Oil Production Forecast Update

Posted by ace on February 9, 2009 - 4:49pm

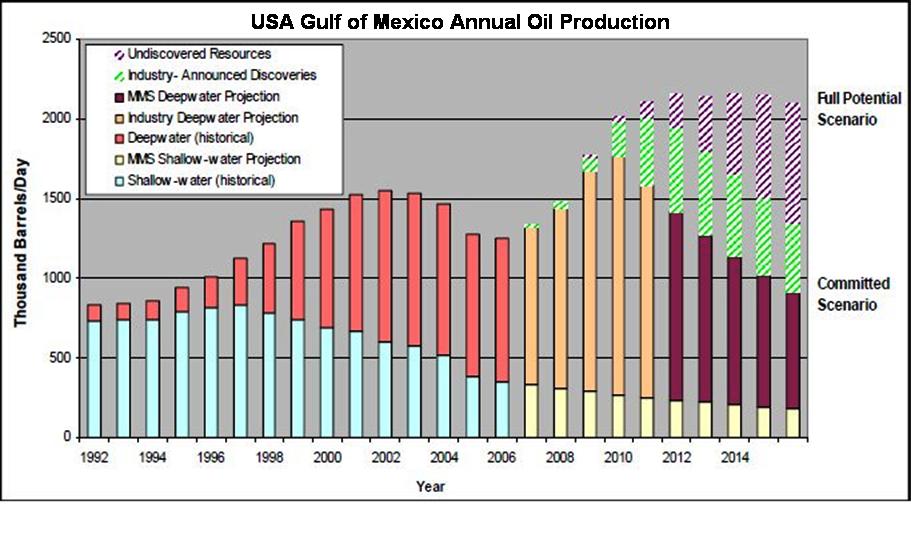

For comparison this 2007 forecast from the US Dept of the Interior, Minerals Management Service, showed GoM oil production increasing from 2006. Unfortunately, the opposite occurred.

click to enlarge

Although the USA GoM is only producing about 1.3 mbd, it remains the region of the biggest future capacity additions for the entire USA. The 250 kbd capacity Thunder Horse project started oil production in mid 2008 and BP claims that it is producing 200 kbd now, but it has not stopped the overall declining trend in GoM production. Blind Faith and Neptune also started in 2008, adding almost 100 kbd capacity, but they have not helped to reverse the declining GoM production trend.

2009 GoM projects include Shenzi, 85 kbd; Tahiti, 125 kbd; and Thunder Hawk, 60 kbd. Will these projects combined with the 2008 projects reverse the declining GoM production trend?

Deepwater GoM projects face numerous production constraints. These include hurricanes, planned and unplanned maintenance, and production ramp up delays due to engineering challenges. In addition, current low oil prices and credit constraints may delay some projects. Production decline rates for mature GoM fields are about 20% per year according to the IEA.

If it's assumed that a 20% decline rate is applied to 1 mbd of GoM production, then additional production additions of 200 kbd are required every year just to keep GoM production constant. 2008 total GoM capacity additions might be as high as 360 kbd. However, 2008 production additions are probably closer to 250 kbd, on an annual basis. Similarly, 2009 GoM capacity additions might be 270 kbd of which about 200 kbd will probably be production additions for 2009.

There is some hope that recent GoM discoveries could increase GoM production. In 2006, Chevron made a large oil discovery at the Jack well in the lower tertiary trend thought to hold as much as 15 billion barrels. This month, Chevron announced another oil discovery also in the lower tertiary trend, called Buckskin. Anadarko announced two GoM discoveries this month, Shenandoah and Heidelberg. Unfortunately, it appears unlikely that these discoveries will reverse the declining production trend as it could be at least five years until first oil is produced from these discoveries. For example, Chevron's CEO Dave O'Reilly recently stated that he hoped production from Jack would start before 2015.

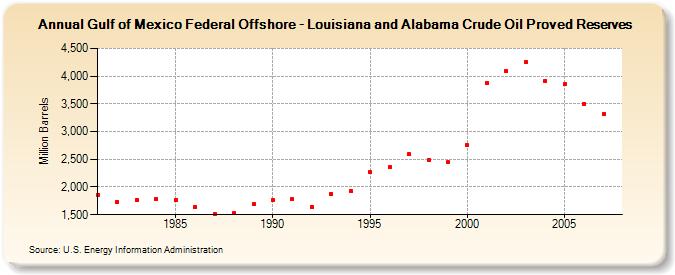

Since 2003, oil discoveries have not been sufficient to replace reserves lost to production. About 95% of GoM crude oil proved reserves are located in Federal Offshore Louisiana and Alabama. These reserves have been in a declining trend from the peak of 4.25 Gb in 2003 down to 3.32 Gb in 2007 shown below in the chart from the EIA.

click to enlarge

It is possible that GoM production will stay constant over the short term from 2008 to 2010. However, long term GoM production will probably continue its decline from the 2002 peak because sanctioned capacity additions beyond 2010 are less than 100 kbd per year which are not enough to offset production declines from existing fields. This indicates that USA crude and condensate (C&C) production will also continue its long term decline from its peak in 1970. According to the EIA, USA C&C production in 2004 was 5.42 mbd; 2005, 5.18 mbd; 2006, 5.10 mbd; 2007, 5.06 mbd; and 2008 YTD November, 4.94 mbd.

Ace,

First thank you for all your hard work in putting this together. Your forecast shows a 3 ½% decline rate going forward. My question is in your opinion will the adverse conditions in the credit markets have the effect of cancelling any major projects & therefore make for a far steeper decline rate?

Tremain,

The 3.5% pa decline rate is the observed decline rate from the peak in June 2002 to now. As many of the large capacity additions from projects scheduled for 2009 and 2010 are already under construction, the adverse credit markets should not affect those additions. Consequently, the decline rate from 2008 to 2010 might be very small.

Beyond 2010, the decline rate will probably be greater than 3.5% per year as sanctioned additions are small - 2011, Droshky, Ozona, Liberty, 60 kbd; 2012, Caesar, Tonga, 50 kbd; and 2014, Puma, Tubular Bells, 80 kbd.

http://en.wikipedia.org/wiki/Oil_megaprojects

Some smaller field developments will probably be suspended at these low prices. For example, Callon Petroleum suspended its Entrada field development late last year.

http://news.moneycentral.msn.com/ticker/article.aspx?Feed=BW&Date=200811...

Entrada's 2P reserves are only 57 mboe of oil and gas and located in 4,650 feet of water so oil prices needs to be at least $70/barrel for economic viability.

http://www.reuters.com/article/pressRelease/idUS145755+12-Feb-2008+BW200...

Very nice update!

Is there any new production expected for 2010 or 2011, or is it just whatever additional can be pumped from the 2008 and 2009 additions? I remember hearing about Shell's Perdido project, which might be in that timeframe.

Gail,

There is production beyond 2010 as outlined above in my response to Tremain. However, the sanctioned additions are small and will probably not offset production declines from existing fields.

Additions in 2010 are Chinook, Cascade at 80 kbd; Perdido, 100 kbd; and Phoenix, 25 kbd.

http://en.wikipedia.org/wiki/Oil_megaprojects_(2010)

This gives a total capacity addition of 205 kbd. Given the production constraints of hurricanes and maintenance, the 2010 production addition might be about 150 kbd which is probably not enough to offset production decline of about 200 kbd from existing fields.

Why do deep water fields seem to have a mean output of about 100 kbd?

Is there a technical reason for this limitation involving pipes, pumps, and tiebacks?

It seems like the shallow water platforms with multiple holes had higher outputs.

Does your analysis assume that no new acreage will be opened to leasing in the offshore areas of the Gulf of Mexico west of Florida that have been completely closed to exploration and development for decades? It seems premature to assume that this very large area will never be explored and developed in the future.

Plantagenet,

My analysis excludes Gulf of Mexico, west of Florida. If this acreage is opened up and discoveries made then first oil might happen in five to ten years which will help production.

I do include some additional oil yet to be found in the GoM in my analysis as the total ultimate recoverable reserves (URR) number used is 23 billion barrels (Gb). This means that remaining URR as at October 2008 is 6.6 Gb which is greater than the EIA's proved reserve number of 3.5 Gb as at December 2007. This difference of about 3 Gb gives some allowance for future oil discoveries.

If you want some wishful optimism you can refer to this 2006 report done by the same Department of the Interior that made the optimistic GoM forecast in my second chart.

http://www.mms.gov/revaldiv/PDFs/2006NationalAssessmentBrochure.pdf

The 2006 report states that total endowment of recoverable oil from the GoM including Florida is 71.91 Gb which is three times my estimate. The table below shows that future reserves appreciation and future discoveries are a huge 51.8 Gb of the total endowment. Since 2003, reserves appreciation and discoveries have not been enough to replace production losses as shown by my last chart above from the EIA.

Part of the justification of my estimate of URR 23 Gb for the GoM is the prediction by the Hubbert Linearization technique as shown below.

http://en.wikipedia.org/wiki/Hubbert_Linearization

click to enlarge

I also use this older and probably more realistic 1999 report (186 pages) from the Dept of the Interior, Minerals Management Service.

http://www.gomr.mms.gov/homepg/offshore/gulfocs/assessment/MMS990034-a.PDF

It says that the GoM total endowment, including Florida, is 23.34 Gb as on page 128:

If discoveries are made in the Florida part of GoM then I sincerely hope that the GoM URR will increase beyond 23 Gb.

HI Ace,

One of the reasons the MMS estimates for GOM oil are so high is that they've increased the UUR to 60%, which you can see at

http://www.mms.gov/offshore/

This is completely unrealistic by a factor of 2 or 3. I've got a question about the 1999 assessment you list above. In it, they talk about 4,658 pools (pg 148 of the PDF) of oil in about 50 plays and 876 to 924 fields. I've been trying to get a map of where the pools and field are supposed to be to estimate the number of rigs that would be required (cost and timescale) to recover the oil. Have you any idea about their distribution and how many rigs and wells it would take to tap into the supposed reserves? I’ve filed a FOIR because they have been unresponsive.

I don't think we have a good answer as to why MMS has produced what seem to be such unrealistic production estimates. It seems like the likely reason was that this was the politically desired outcome. It was in 1998 that the IEA (the international organization) made its projection of world oil supply that took into account peak oil considerations. When the USA came up with its optimistic estimates of remaining reserves (not just in the Gulf of Mexico, but in the world as a whole), the IEA dropped its comments about peak oil in its forecasts, and made forecasts based solely on demand. The US EIA has produced optimistic forecasts as long as one can remember, and the high reserve numbers may have helped support these forecasts.

The most recent information I got about Jack (Chevron) was that they have an estimated 500 million barrels of oil there, and there are an estimated 15 billion barrels in the Lower Tertiary trend.

There are new deep water drilling rigs being built, however the cost of oil is as low as to inhibit activity in the deepwater GOM. Production is also inhibited by increased taxation (the Federal govt. reneging on leasing agreements initially in place to stimulate interest in very expensive deep water projects, claiming they gave the corporations unfair advantage), credit crisis (more people need to borrow than there are available lenders), drilling rig shortages, and the aforementioned hurricanes.

Rainy -- Lots of optimism about the Lower Tertiary especially moving westward. But, as usual, I'll throw in the qualification that those are exploration estimates. Which means possible reserves...not proven...not even probable. Could be even more but all trends eventually come to an end. As far as rig shortages the future there depends greatly on Petobras' access to future capital IMO. They currently have a lot of floating rigs tied up (including 80% of the rigs capable of drilling in 3000 m water depth or greater). I think most now have a good feel for the oil patch cycles (highs/lows in crude prices/drilling costs, etc) and the associated lag times so we don't need to throw that around much anymore. Normally activity cycles in Deep Water are much longer then the onshore plays but I'm starting to see that differential close up some especially in the GOM (and sending me back to the house or over seas by this summer). It's difficult to change DW time lines too quickly but I've recently seen some fairly quick responses in the GOM.

An aside: PEMEX has 2 or 3 new drill ships scheduled for delivery in the next 12 months or so. They are at least a decade behind the US in exploring their section of the DW GOM. They haven't yet offered any indication of where they plan to deploy them but some folks speculate it may be towards the far western potential edge of the Lower Tertiary. If true this could go a long way towards either tempering or expanding expectations about the play in the next several years.

As far as the eastern GOM that's the real wild card IMO. Though there had been a good bit of unsuccessful drilling in the Destine Dome area some 25+ years ago exploration techniques have improved significantly. Also, most of this area is on trend with the very significant (but very mature) oil plays of Miss and Al. This would be a carbonate (reef+) reservoir play as compared to the sandstone reservoir plays of the Lower Tertiary and central and western shelf areas. This is both good news and bad: difficult to explore but billion barrel fields are certainly possible. For the last 10 years operators have been developing the far western edge of this play just to the east of the Mississippi River delta. It would be very easy (and legitimate) for the explorationists to speculate about 10’s of billions of BO out there. But, again, that only offers a reason to spend some $’s poking around there and not numbers to apply to future production rates estimates IMO.

And another Hubbert reminder. In 1956, Hubbert found that a one-third increase in projected Lower 48 URR, from 150 Gb to 200 Gb, an increase of 50 Gb, only postponed the projected Lower 48 peak by five years.

Hello Ace,

Thxs for the GoM chart. Interesting to examine the lost production downward spikes from the hurricanes. They seem to be getting deeper and slightly wider over time. This seems to make sense if one considers that rigs & platforms are moving ever more miles offshore and requiring ever more infrastructure to get the oil and/or natgas back to land.

Then, when a Caribbean and/or GoM hurricane forms: you need to shutdown production that much earlier so that the crews have sufficient evac time for the long helo-flight or boatride back to shore, plus the multiplier factor of that many more rigs & platforms scattered all over the ocean. Especially since it is so damn hard to precisely predict where the 'Cane will go; you can't take the chance of having a far offshore rigcrew trying to topride out a CAT 5.

Then, after the 'Cane passes, it now takes longer to re-crew, repair, and restart production. Makes one think that having some submarines may be safer and cheaper than helicopters, as it would allow the crew to work longer before locking down the rig, then safely ride out the storm 200ft down, then quickly getting back to work once the all clear signal is given. If their drill-rig sinks: they still have a safe and comfortable sub ride back to shore vs a pitching boat on the high seas.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

toto,

Hmmmm...sub rides. You think they might cut some portholes in them subs so my fellow Cajuns can fish on the way back in?

Actually, on any given days there are around 20,000 hands working offshore. I suspect it would take the entire US Navy sub fleet and then some to get the job done. But I do like the idea though....get one up the bayou and it would make one hell of a bass boat.

According to the today's EIA Short Term Energy Outlook, the EIA is forecasting US crude to increase in 2009 and 2010 due to new Gulf of Mexico projects. I don't believe it.

http://www.eia.doe.gov/emeu/steo/pub/contents.html

click to enlarge

source http://www.eia.doe.gov/emeu/steo/pub/gifs/Fig12.gif

Given the high decline rates and hurricanes in the Gulf of Mexico, I project that US crude oil production in 2009 will be 4.94 mbd which is almost the same as in 2008. For 2010, I am projecting 4.73 mbd. I think that the EIA is overoptimistic.

As Russia is now in decline in addition to declining production from Mexico, the North Sea, Argentina, Australia, Colombia, Egypt, Indonesia, Oman, Syria and Yemen, there are not enough other non OPEC countries to cause crude oil, lease condensate and oil sands production (C&C) to increase in 2009 over 2008. I project that non OPEC C&C will fall by 0.3 mbd to 41.0 mbd in 2009 followed by a further fall of 1.3 mbd to 39.7 mbd in 2010 as shown below.

click to enlarge

The comparable forecast from the US EIA Annual Energy Outlook 2009 Early Release also shows a 2004 peak but with an optimistic smaller post-peak decline rate.

http://www.eia.doe.gov/oiaf/aeo/index.html

click to enlarge

Thanks! It's amazing to see how the EIA can keep coming up with these forecast increases.

I do notice that their latest actual numbers are actually showing increases. Oil production for the week ended February 6 was 5,327,000 barrels a day--a level not seen since early 2007, and there is supposedly still some oil off-line in the GOM. Any thoughts on what this is? Thunder Horse?