Are Reserves of the Largest US Coal Field Overstated by 50%?

Posted by Rembrandt on February 24, 2009 - 10:10am

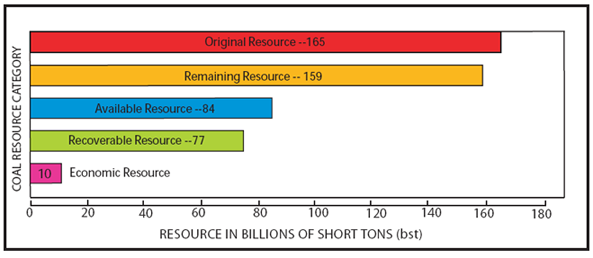

United States coal reserves are taking a beating in a new examination by the USGS of recoverable reserves of Gilette in Wyoming, the largest field in the US with 37% of total coal production in 2006. Its present reserves have been downgraded by half thanks to an improved methodology which incorporates a new dataset with ten times as many datapoints as used in the previous assessment. Of 182 billion metric tonnes of resource in place, 9.16 billion (6% of original resource total) were found to be recoverable under "current technological and economic circumstances". This compares to an earlier assessment from 2002 by the USGS in which 20.87 billion metric tons were estimated to be recoverable.

The one catch is that the term "present economic circumstances" depends very much on the price of coal. If the price of coal increases significantly, the newly estimated reserve level of 9.16 billion metric tons can be expected to increase, perhaps several-fold. Although the USGS takes a shot at determining the price-sensitivity of reserves by discussing its effect, there still are a lot of open ends. Nonetheless the economic aspect of coal recoverability should be taken seriously; hence the question mark in the title.

The new USGS assessment does show that the statement made by the US National Academy of Science two years ago, that US coal reserves are likely overstated, should be taken seriously. The National Academy of Science concluded at that time that coal recoverability estimates are based on outdated assessment methods--these methods have not been reviewed or revised since 1974 and primarily reflect input data from the early 1970s.

More information on the USGS study, including estimates by the US of the effect of changing economic conditions on coal availability in Gillette, can be found below the fold. The study itself is available through this weblink (Beware! 92 megabyte, 123 pages)

The USGS study approach

Mining in the Gillette coal field has so far only taken place in two out of eleven coal beds identified in the Gillette coal field, namely Anderson and Canyon. These are the thickest and most contiguous beds with average thickness of 45 and 26 feet respectively. To assess the resources and reserves in all the coal beds, a dataset was made with old and new drill hole data totaling 10,210 data points. This is ten times as many data points as in the 2002 study.

"In addition, prior to this study the distance between data drill holes used in the correlation process was sometimes large, thus creating uncertainty in correctly correlating individual coal beds from one drill hole to the next. Previous reports relied on drill hole data that were up to ten or more miles apart. However, with the recent drilling and development of CBM in the PRB, data from over 10,000 new drill holes in the Gillette coalfield alone are now available. Utilizing the more closely spaced coalbed methane drill holes, it was possible to more confidently define coal bed correlations, determine split lines, and outline paleo-channels (USGS 2008, pp. 6-7)."

For each coal bed, a geological grid model was made including coal thickness, parting thickness, coal height (coal plus parting), and roof and floor structures, with the aid of PC/Cores, a multi-bed modeling program. By using these models it was found that in 6 out of 11 coal beds, mining could take place in the future thanks to suitable geological characteristics. The six coal beds are the Roland, Smith, Dietz and Anderson Rider coal beds as well as Anderson and Canyon beds where mining already takes place. This assessment was based on coal bed thickness and the stripping ratio. This latter factor shows the amount of waste rock to coal. A stripping ratio of 4:1 implies that four tons of rock have to be moved to get one ton of coal. The larger the stripping ratio, the greater the technical difficulties and cost will be to get the coal out of the ground. Specifically, the USGS used the following criteria:

The basic assumptions used to qualify coal beds for potential reserve evaluation were to include: (1) coal beds above the Anderson or Canyon 5 ft or greater with significant areal extent and (2) coal beds below the Anderson or Canyon 5 ft or greater with significant areal extent and an incremental stripping ratio of 4:1 or less. The minimum thickness of at least 5 ft and the maximum incremental stripping ratio of 4:1 criteria for beds below the Anderson or Canyon were selected on the basis of current mining practices at existing mines in the Gillette coalfield (USGS 2008, p.10).".... "This stripping ratio criterion eliminated all beds below the Canyon. Six beds with significant areal extent and exceeding 5 ft thick were evaluated for potential recovery and reserves. In addition to the Anderson and Canyon beds, the Roland, Smith, Anderson Rider, and Dietz coal beds were included in the mine models (USGS 2008, pp. 22-23)."

As a result of the new dataset, a considerable number of insights were gained on the detailed geology of the Gillette coal field. An example is the Anderson coal bed which was found to be less continuous and thick at the eastern margin of the north-south traverse. At this side also the Smith bed previously thought to be quite thick appears to be much thinner at 20 ft or less. Hence the stripping ratio there is much larger, and this creates an economic barrier to mining.

"One of the most important findings of this assessment was the influence of the major north south distributary channel on long-term, deeper surface mining in the Gillette coalfield. From the 2002 assessment of this area (Ellis and others, 2002), it appeared that the thick Anderson coal bed was continuous throughout the coalfield. The comparison of the Upper Wyodak (Anderson) coal bed isopach map from the 2002 study and the current Anderson isopach (fig. 52), as well as the comparison of the significant changes in coal bed correlations (figs. 7 and 8), illustrate the important interpretational revisions of this assessment. The Anderson and Canyon beds pinch out along the eastern margin of the major north-south channel complex. The Smith bed extends over the major channel and thickens rapidly to over 60 ft to the west, but east of the channel, where the Anderson and Canyon beds are thinning and pinching out, the Smith bed is only 20 ft or less thick. Thus, there are areas along the eastern margin of the major channel where no thick coal beds are present, causing a rapid increase in the cumulative stripping ratio and thus effectively creating an economic barrier to down-dip surface mining (USGS 2008, p.16)."

After the geological model, a mining model was made to evaluate coal reserves based on a program named CoalVal developed by the USGS. This program is used to calculate recoverable coal resources, operating costs and a discounted cash flow at a given rate of return for the recoverable coal. The portion of recoverable coal that is economically minable at or below the current sales price of coal is designated as reserves. The mining model focused on new technology which uses large draglines in concert with truck-shovel pre-stripping operations. This approach is stated by the USGS to be a more cost effective overburden removal system. The 2002 study on the other hand anticipated mainly truck-shovel mining. According to the USGS, CoalVal will be made available to the public in 2009 so that it can be used by others.

Results of the study based on current technological and economical circumstances

The estimated effects of changes in the price of coal

The reserve estimate at a coal price of 10.47 dollars per ton appears to be rather limited, which is also confirmed by the USGS. They give the example of a price increase to 14 dollar per ton, which occurred in March of 2008. Incorporating this price would lead to nearly a doubling in the reserve figure to 16.8 billion metric tons as shown in figure 2 below, under the assumptions in the economic model.

"Because a coal reserve estimate is based on a single reference point in time, the use of cost curves is particularly useful. From the cost curve, the relationship between sales price and estimated reserves can readily be demonstrated. As of March, 2008, the sales price for the Gillette coalfield had increased to $14.00 per ton (Platts, 2008). If it is assumed that operating costs remained essentially unchanged over the past year since the reserve study was completed, there would be approximately 18.5 billion short tons of reserves (USGS 2008, p.30)."

However, as stated in the quote above, the economic model operates under the condition that operating costs do not change essentially over time. This is one of the open ends to the USGS study. Market conditions and technological change can lead to a significant alteration of operating costs. There is no quantification nor extensive discussion on changing operating costs over time. Only the following quote is given by the USGS.

"With continued favorable sales prices as well as productivity and technological advances in mining that positively affect economics, resources once considered to be subeconomic may be elevated to the status of reserves. Therefore, reserve studies should be considered a cyclic process and models should be adjusted periodically using the most recent data and reassessed utilizing the most current recovery technology and economics (USGS 2008, p.31)."

If reserves are being downgraded 50%, then they were overstated by 100%.

I wonder how sensitive coal mining costs are to oil and electricity costs?

@SF

That perception is correct if you look at it from the 'new' reserve figure. But when you look at the original figure one can perceive it as 50%. Half of a random number is 50% of that number. Is the glass half full or half empty?

When we talk about - overstatement - it becomes logical to reason from the new number I guess, I am not a native speaker so this is a bit confusing to me.

I notice this EIA graph of weekly spot coal prices. Powder Basin River coal, which is the type that we are looking at here, has been relatively constant in price over the long term, while others have varied a lot. PBR coal is lower in energy value than most of the other kinds shown (8,800 Btu vs 11,700Btu to 13,000 Btu), but based solely on heating value, it looks like the price could easily go higher, if it were in short supply.

If I remember correctly, when coal is used for electric power plants, the big cost involved is the diesel for transporting the coal. This cost is far higher than the cost of the coal itself. Thus, it seems like if there were a coal shortage, the coal price could quite easily increase, without having a huge impact on electricity prices. If this should happen, the study would seem to indicate that coal reserves could be higher.

Image source

Neat graph, Gail. I'm in West Virginia, and I didn't realize that the coal here was more "energetic." Looking at the prices, I can see why diesel is the biggest expense. Lots of trucks full of the black rocks, and I often have to stop at railroad crossings for trains laden with 100 or more coal-filled cars. Of course, the coal doesn't have far to travel for our electric needs, thus our electricity is relatively cheap and the state is able to export a lot of it.

Interesting sidenote...coal severance taxes are one of the big reasons West Virginia is one of those 4 out of 50 states that do not project a budget deficit over the next year or two. That could change with the recent price falls, though.

Coal is such a fascinating issue. I used to live in coal country (Indiana) and worked with the Indiana Geological Survey on the Indiana Energy Report. I had many discussions with other geologists there about the future of coal in Indiana and nationwide, and the consensus (on their side) was that it was inconceivable that there could ever be a limitation on coal extraction in the US provided strong coal prices. When we wrote the report, we were not permitted to speak ill of coal, nor were we allowed to even mention the words "climate change".

Economics are important, and I think it's very useful to view coal reserves through an economic lens. I wish we did the same for oil and gas, as it might prevent the likes of Colin Campbell et al. from prematurely forecasting near term world oil peaks over and over and over again and creating an opportunity for skeptics to turn Hubbert's depletion theories into a joke.

But, if the economics of extraction matter to the extractive process, then of course they matter to us as well. If it takes skyrocketing coal prices to keep US coal extraction rates (i.e. supply) rising, then what good is domestic coal as a source of "energy security"?

Beyond issues of how many years we'll be extracting coal, it seems to me that not all of those years will be on the upslope of coal's depletion cycle. We'll be able to grow coal supply for a certain number of years (maybe many, many not), then we'll see a plateau for a certain number of years, then a decline. We'll certainly be extracting coal 250 years from now, but will it offer a substantial enough and cheap enough supply of energy to matter?

Just thinking out loud...

It may be that coal at $14 dollars is so cheap, and such a small part of the total cost of electricity, that it doesn't matter. Multiplying the price by 2, 3, or 4 may not be a big issue. The bigger issue may be the availability of diesel for its entire role in the supply chain.

Another issue will be the financial picture. If some of the intermediaries in the wider system (from extraction to delivery) go bankrupt because of debt problems, how will this affect supply? If people are unable to pay their electric bills because they are out of work, what impact will this have? If we have hyperinflation or deflation, what will this do to our current system?

This is a quantitative question, so it's easy enough to get a rough answer by doing a little simple math. The answer boils down to "unlikely to be a problem".

Electricity in the US is roughly $0.10/kWh, and US coal generates about 2,000kWh/ton. Multiplying those tells us that the retail cost of electricity is $200 per ton of coal consumed, so a minemouth cost of $10/ton for coal represents only 5% of the overall retail price.

If the minemouth cost of coal rose to $30/ton, the retail cost of coal-fired electricity would increase only 10%, but economically-recoverable coal reserve would increase six times.

Based on this report, any reasonable discussion of ultimately-recoverable US coal reserves should use a figure of somewhere around 60bst. The headline figure of 10bst is useful for economic planning in the coal industry, but is not a reasonable estimate of long-term coal availability.

Most likely not.

Rail transportation is about 440 ton-miles/gal, and low-sulfur coal in the US travels roughly 1,000 miles before being used. Dividing these tells us that transporting US coal requires roughly 2.3 gal/ton.

Accordingly, each $100/bbl increase in the cost of oil will increase the cost of transporting a ton of coal by $100/bbl * 1bbl/42 gal * 2.3gal/ton = $5.50/ton, or about 3% of the retail price.

Coal transportation is much less sensitive to the price of oil than many other areas (particularly air and personal-vehicle travel), and can be converted in a relatively straightforward manner to use electricity instead of diesel, meaning that reduced oil supplies are highly unlikely to have a significant direct impact on the ability of the US to transport coal.

At certain point, the coal can be used as the fuel for transportation or be converted for diesel.

Does anyone know the EROI of Fischer-Tropsch diesel?

The efficiency of converting coal gas or natural gas into diesel via F-T is apparently about 66%. I'm not sure if "coal gas" refers to gasified coal, but I would imagine CTL efficiency is in roughly the same ballpark.

For comparison, refining oil into gasoline is roughly 80% efficient, so the difference is actually not that huge. (From the first link, the pollution created is about the same.)

This is an average for all rail transportation. Coal trains are probably even more fuel efficient, because the ratio of load to tare weight is greater than most other rail freight (particularly intermodal). 600 gtm/g might be a good guess.

And your right, of course, that rail can transition to electricity with existing proven technology. And thus be powered by coal. Indeed, if it really comes down to it, we can go back to coal-powered steam engines.

None of this is good news for those concerned about carbon emissions, of course.

Pitt, the EIA conversion table only calculates the (thermal) energy content of coal but does not consider conversion losses in the power plant. A conventional coal power plant only converts about a third of the thermal energy into electricity. So you should get only about 667 kWh of electricity per ton of coal.

Sorry..er..this is wrong.

A ton of coal has ~21000000 Btus or 6150 kwh of primary energy in it.

1/3 of that is 2000 kwh per ton of electricity. Most experts use 2000 kwh(electricity) per ton.

Coal is about 60 % carbon so you multiply .6 x 3.66=2.2 tons of CO2 per ton of coal--the EPA uses 2.1-2.3tCO2 and they use .712 tCO2 per Mwh of grid electricity(which is 70% fossil): .7 x 2.1 tCO2/x 2 Mwh ton=7.35 t CO2 per 10000 kwh.

Okay, you win. Thanks.

Gail,

It's easy to get carried away with the thesis that since oil is presently used for every aspect of industrial production, as we start to run out of oil, all industry will stop.

In the case of coal mining, transport, burning in power plants and distribution of electricity oil use is very small and can be easily replaced. Probably the largest use presently is for rail transport of coal.

All rail transport uses less than 1% of oil, and this can be replaced by electric trail, gas turbine trains or direct injection of coal in existing(modified) diesel engines. Before 1930, all coal was moved by coal-burning steam engines, but it seems simpler to use existing diesels with coal-powder/water fuels. This report is a good up to date summary of direct injection of coal in diesel engines.

http://www.ccsd.biz/publications/files/TA/TA%2074%20Efficient%20use%20of...

I think flexibility will be key going forward. If there is more than one option, it is likely that something will work.

PO should cause a diesel shortage and make Powder River Basin coal an inaccessible luxury to to exorbitant transport costs or completely unavailability of diesel fuel for eh mile long trains to the midwest USA. Also the costs to dig out ever thinner seams with higher stripping ratios will become a big factor when human and animal muslce power is forced to replace machinery. The machinery is electric(coal based) and diesel based. If the excavation costs can be completely coal based then the question becomes EROEI, i.e. how much of the coal do you have to burn to get the coal out and to transport in electric trains. This presuming no more diesel. When muscle power is left out of the equation and all energy to remove and transport coal is taken from the coal itself then the question is not anymore about dollar costs but when does it take more coal to get the coal out and transport it to midwest than you end up with.

If 37% of US coal comes from PRB in Wyoming and 450 million tonnes x 20 years = 9 billion tonnes is completely played out in 20 years then according to our Peaking resource theory peak happens earlier and dcline last longer, i.e. depletion means in X years supply from PRD willbe only X% of current supply and will decline X% p.a. putting a slowly tightening noose around US electrical supply as NG, etc. which supplies rest of US electrical supply will also be in decline.

The situation looks like with PO, lots of overoptimistic estimates were made based on demand and infinite growth models.

If you take the reserves of PRB as 60 billion tons, not 9 billion tons.

60 billion / assuming 450 million per year = 133 years. At $30 per ton

the price per kwh might double in price but it's so cheap now that probably won't matter. Price of electricity from natural twice as high as from coal.

As far as trains full of coal goes, this option is cheaper

on an operating basis than minemouth coal plants sending the power thru the grid. The disadvantages like congestion and not being able to sequester CO2 are as usual not factored in; because I support CCS, we should go for grid delivered electricity from wind farms or minemouth/CCS site coal generating plants, but there are only a couple decades before petroleum becomes effectively exhausted, IMO. Also the rail infrastructure appears to be seriously failing.

http://www.aep.com/newsroom/resources/docs/Meeting_Americas_Future_Elect...

That's an overstatement at best. At least until the financial crash last year, US railroads were expanding capacity and hauling more freight than ever before. Contrary to the out of context/out of date figures in the link you provided, UP and BNSF both loaded record amounts of PRB coal in 2008.

I'm against coal, but in favor of arguing from facts. And I'm in favor of railroads, as we all should be. It's the transportation system we will still have when oil is gone.

One of the things I noticed about the EIA coal data was that the there has been a huge drop in net coal exports, on a BTU basis, but on a tonnage basis the trend is far less obvious. In any case, here are the net coal export data on a BTU basis. Note that we are very close to being a net importer, on a BTU basis.

I assume that this reflects an overall decline in the BTU content per ton of US coal.

Does anybody know what type of coal power plants use, lignite, bituminous, sub-bituminous, etc? Can they use any kind?

A few US powerplants can use lignite (brown coal) but not many and these are hopefully being phased out.

With operating and some mechanical adjustments, most power plants can burn bituminous or sub-bituminous coal. Lower BTU, higher fly ash, etc. issues to deal with.

Alan

Power plants will buy what is cheapest on a delivered basis, and meets their needs with respect to environmental regulations. Utilities need to limit sulphur pollution. This can be done either by pollution control equipment or by low sulphur fuel or a combination. What is cheapest, and meets the needs of the power plant will depend on where the power plant is located and what kind of pollution control equipment the power plant has installed.

There is so much coal used by power plants, it would seem like each of the types of coal listed is used by some power plant somewhere. I don't know how much adaptation is required for a particular power plant to switch from one type of fuel to another, but I would expect that there would be at least some adaptation required.I have heard about coal fired-plants being adapted to take wood chips as in input, so with adaptation, a range of inputs seems possible.

My guess is that it would be easy to burn higher grade coal than a boiler was designed for, but using lower grades would probably limit capacity. Also, the sulfur content is a factor. There are probably differences in how well scrubbers handle differnt grades.

I lived in the Shreveport, LA area 20 years ago and some power plants were using lignite there and in TX. Many of the plants were built near the lignite beds. The lignite was surface or strip mined.

Lignite is difficult to use because it has a very high ash content. Lignite and the ash is full of a lot of environmentally damaging trace elements.

Power plants can burn all this stuff (and even peat or wood). But plants using lower btu matter like lignite has to be built right next to the mine, as the eroei would be too low for transporting. This may limit for example the use of low btu coals of Alaska.

Part of Texas uses lignite, the PRB coal is sub-bituminous, Appalachain coal is bituminous, some of which is high enough quality to be used in coking for steel or other metal forging. There was some anthracite, but most of it was mined out, from the Pittsburg coal seam. Some steel making processes may substitute powdered coal, or natural gas.

Where coal was close to a shipping port it was of higher value for exports. Coal deposits near the coasts of Norfolk, Columbia, South Africa, China, and Australia have been used for export. Much of the world signed the Kyoto treaty and they are trying to switch from coal to less carbon intensive energy. Not sure how long the treaty will bind them as some were already suffering economic problems due to the treaty requirements.

wt

Part of the drop may be due to the fact that the US has superior coking coal used for making steel. Asian steel producers very much want our metalurgical coal. If steel production is down, drop the high BTU (~12,500 BTU/lb, as received (i.e., ~6% moisture))coking coal out and you would see a large drop in BTUs with a much smaller drop in total tonnage.

What is 'the cost of coal'?

Last June I posted a piece A Little History of the Affordability of Domestic Energy

http://www.theoildrum.com/node/4134

This chart (click to expand):

shows that the earnings deflated cost of coal in Great Britain was almost constant between 1914 and about 1985. I suggested that this is because the coal was labour intensive. The main cost of coal was that of a miner to dig it up (even in mechanised pits). As average real wages rose (i.e relative to the cost of food), so did miners's wages and the cost of coal.

Subsequently coal prices fell slightly as cheaper surface machine-mined coal was imported from places like Australia.

Most of the world's remaining coal reserves are deep mined, and are likely be labour intensive, particularly the thin seams.

So, maybe, the future price of coal, and the 'economically extractable reserves' will depend on how much miners get paid. Will they be 'worker heroes' paid a decent wage for a nasty dirty dangerous job? Or, will they be surplus labour drafted into the mines to work for a pittance?

Will the future be one of uniform affluence, with consumers being able to afford the 'expensive' coal produced by properly paid miners? Or will 'cheap' coal be produced by a mining underclass, underpaid and resentful and forever going on strike?

Will the 'Road to the Olduvai Gorge' go back through the 19th century?

Thoughts please

BobE

If China is anything to go by, with 3000 miners dying every year, then the answer is yes.

China is the (second ?) largest coal producer/consumer (?) in the world. They have dreadful working conditions, and dreadful pollution and CO2 emissions. They are making some token efforts to improve or close down the worst mines, but until the credit crunch they could not dig/import coal fast enough to meet local demand.

Given the economic collapse it is hard to see them (or us) upgrading their industry to meet pollution or safety standards, or real wages. They will burn anything with a positive EROEI.

There seems to be a bit of 'peak productivity' in the US coal industry.

Approximately twice as much coal is surface mined as comes from underground mines.

In 2000 average productivity in short tons per miner-hour for surface mining was 11.01 tons and 4.15 tons for underground mines (roughly 5 times the productivity of 1949).

But by 2007 this had fallen to 10.23 and 3.36 tons respectively.

See

http://www.eia.doe.gov/emeu/aer/pdf/pages/sec7_15.pdf

Doesn't bode well.

BobE

The USGS 2008-1202 report is an important step in understanding our coal supplies, but it is not the end. A true analysis requires looking at the life span of existing coal mines--especially those in the Powder River Basin. The new report discussed below does that and also analyzes the USGSW 2008-1202 report discussed above in great detail.

There is a new detailed report on coal supply constraints at http://www.cleanenergyaction.org. The report is entitled "Coal: Cheap and Abundant–Or Is It? Why Americans Should Stop Assuming they Have a 200 Year Supply of Coal."

It discusses the life span of existing mines and the USGS reports that point out that less than 20% of the coal in this country is likely to be economically recoverable because it is buried too deeply to be reasonably accessible.

For alternatives, we can use the solar resource of the southwest and Concentrating Solar Power (just Google it–there is lots of information on new BIG CSP projects) and then ship electricity instead of shipping coal around our country at 20 mph on our antiquated railroad system.

Assuming coal will continue to show up on mile long trains every week for the next century doesn't appear to be a great assumption if we want to keep our country powered in the coming decades.

Check out the report on coal supplies. It is a lot different than everyone has assumed! Find the report at www.cleanenergyaction.org

If my math is correct, and if we extrapolate the above net export trend out for 10 years, in 2016 we would be (net) importing coal with the energy equivalent of about 5 BCF per day.

It seems unlikely.

The US imports cheap coal from Colombia 27 Mt, Indonesia 3.7Mt, Venezuela 3.6 Mt and 2 Mt from western Canada(though eastern Canada imports 40 Mt) and some coking coal from China.

The US mines 1.1 billion tons of coal per year.

http://www.csmonitor.com/2006/0710/p02s01-usec.html

http://www.eia.doe.gov/cneaf/coal/page/special/feature.html

I am continually stunned to find people on this board trying to wish away the US coal 'bounty' and simultaneously contend that we'll will run out of fossil fuels so we don't have to address GW.

Frankly, it's weird.

There'll be plenty of coal after the oil runs out.

We need to incorporate CCS into our energy system because coal reserves (with more than twice the energy in all remaining world conventional oil and natural gas reserves combined) WILL and SHOULD be used.

The fact remains that if we believe the EIA, net coal exports, on a BTU basis, have dropped at the rate of about -20%/year for 10 years.

We've got to face the fact that we are running out of low entropy carbon. Our carbon source's entropy is rising at an alarming rate, whether it is oil or coal. Our society survives as any living organism, does, it coverts carbon from a low state of entropy to a higher state of entropy and lives on the heat produced by the reaction. There may be oceans of coal under the ground, but if it is not at a usable entropy level, it is totally worthless.

No doubt US use of coal is slowly inching up but competition for cheaper coal from South Africa, Australia and South America(Colombian child miners) has probably something to do with it.

What may be more interesting is looking at entire the world trade in coal(US is currently more or less self-sufficient). According to Exportland theory(if I may be so bold) domestic consumption will choke off world trade. I heard the Chinese are buying up Australia(the world's largest exporter).

So when will the export system for coal collapse?

I think that it actually got pretty tight early in 2008.

We need to incorporate CCS into our energy systemThis is much easier said than done. In Germany the electricity price from coal plants using CSS is expected to be at the same level as wind energy, which is some 7 ct/kWh - supposing coal prices at the current level.

So it is quite probable that as soon as any climate change measures are taken seriously coal will turn out to be economically noncompetitive compared to renewables. No matter how much there is left in the ground.

I understand Rembrandt is looking at that report also. I don't know whether he will agree with its findings or not.

@Pelican

I also took a look at that report when writing the post above. To my opinion it too easily lays aside issues such as the economic assessment made by the USGS on the PRB. Based on the argument that even though coal prices increases significantly since 2002, reserves were downgraded since in the PRB (comparing the 2002 to the 2008 assessment). This is shoddy argumentation as 1) the coal price in the PRB didn't change much, 2) Leslie Nielstrom/Clean Energy Action in their report do not give any sound reasoning as to why coal reserves would not increase significantly with higher coal prices.

I also find the reasoning that current coal mines will be depleted in 20-30 years, and so coal will 'run out' very far stretched. Probably there is currently no need by the Federal authorities to issue licenses to open new coal mines. And it has little to do with coal being buried too deep or being reasonably accesible (as the USGS report outlined above shows). This can of course be done in time when the need comes.

In any case there will be a post about the leslie Nielstrom report somewhere in the future where we can discuss it in more detail, don't yet know when as I first want to work on a coal import-export post.

There is also underground IGCC to consider - underground coal gasification. From what I understand, it makes burial depth and seam thickness almost irrelevant and even allows offshore coal beds to be exploited.

Assuming (big assume..) that it works, then it would drastically expand the coal supply. Only problem would then be the huge GHG problem from such a huge supply.

Hi Rembrandt--A few things:

1) Contrary to what you've said, "The Coal Cheap and Abundant--Or Is It?" report at www.cleanenergyaction.org goes into extensive discussion about the USGS cost curve and the likelihood that the coal at increasing stripping ratios (and therefore higher production costs)will be mined. The discussion is on pages 50-54 of the report.

2) The price of PRB coal has gone up significantly since 2002. Spot prices more than doubled from about $6 per ton in 2002 to about $14 a ton in August 2008 when the USGS 2008-1202 report was published. You can see the historical spot prices on pages 20-22 of the report.

3)Again, contrary to what you've suggested, there is indeed a "need" to expand the Powder River Basin mines because they are coming to the end of their life spans and many of the mines have requested lease expansions. The EISs governing these expansions are referenced in the footnotes to Table 14 which shows the expected life span of the 13 Powder River Basin mines.

4) Coal has to be mined. It can't be manufactured like "widgets" where when the price goes up you just make more. Essentially all western coal is owned by the Federal government and mine expansions will have to comply with a lot of laws--including the need to reclaim the PRB surface mines which have only reclaimed a small percentage of the area they've disturbed

5) The report never says coal will "run out" as you stated. Rather, it is a question of how expensive it will become, who will finance coal mine expansions in the 2020s and beyond and whether the coal mines will be able to comply with the laws governing coal mining.

6) The author's name is Leslie Glustrom, not Leslie Nielstrom as you stated. It doesn't seem like you've read the report very carefully.

We'll look forward to your post after you've read the report more carefully.

Moderate CO2 emission penalties could cause a large increase in the cost of coal. It has been claimed that burning a tonne of bituminous coal generates 2.4 tonnes of CO2, though that figure seems low to me. For example a per-tonne carbon tax could be say $25 or that could be the floor spot price under a cap-and-trade scheme. Then $25 X 2.4 = $60 and the $14 ton of coal goes to $74. I'd guess that would more than double some wholesale electricity prices.

My guess is that a year from now Obama won't have done anything about CO2 penalties, which in my opinion fails to keep election promises.

Is the 2.4 multiplier intended to account for the relative mass rations of carbon and oxygen in CO2? If so, I don't think it should be applied.

The 2.4 multiplier is used by the Australian Bureau of Agricultural and Resource Economics (ABARE) whose former director was a GW denier. I've looked unsuccessfully at a couple of pdf's to find how 2.4 was derived. It seems to imply a lot of impurities and I presume it applies to pulverised bituminous coal used in traditional plant.

The European cap-and-trade scheme works on mass of CO2 equivalent. Thus if the CO2 spot price is $25 then unburned methane could be $500 a tonne. An advantage of c&t over carbon tax is that the CO2 price will reduce in tough economic times while still achieving the emissions target.

My point was your use of the term "carbon tax" to dscribe what you now say is apparently a "carbon dioxide tax". Precision matters. IMHO, far smarter than any trading scheme designed so that bankers can skim off 25%, is a source tax on carbon content of fuels of all types.

That's not a feature, it's a bug. The cost advantage of lower-carbon energy sources should not be reduced just because the economy is slow; that's a recipe for making the cleanest (and newest) things go bankrupt first.

The impact of a ton of CO2 doesn't change with the state of the economy, and the price shouldn't either.

This is high school chemistry. Since the molecular weight of carbon is 12, and that of oxygen is 16, every unit of weight of pure carbon accounts for (12+16+16)/12, or 3.67, units of weight of CO2. Since (according to Wikipedia) bituminous coal is 60-80 percent carbon (by weight), you'd expect the CO2 emissions from a ton of bituminous coal to be on the low end of 60-80 percent of 3.67 tonnes, which is between 2.2 and 3.0 tons. (It's on the low end because not every last bit of carbon ends up in C02 in any combustion process. Perhaps bituminous coal averages on the low end of the given range as well.)

IOW, it's a sensible figure and whatever error is present is not enough to affect your point about prices, which seems to be off anyway in light of Pitt the Elders calculation that only %5 of the retail prices of electricity is the cost of coal. (see his comment above). I should add, his and your figures bolster the argument for a carbon tax, at least on coal, since it could be introduced and ramped up without affecting electricity costs by huge percentages that would hurt consumers. A carbon tax of the level you describe should only increase electricity prices (from coal) by about %25, which if ramped up gradually is not outrageous.

I fear you are right about Obama, I hope you're wrong.

Here are some interesting visualizations of some of the issues that have come up here. Below is the Energy Information Agency's version of coal reserves, apparently from self-reported mine data.

(http://show.mappingworlds.com/usa/?subject=COALRES)

Also coal production for 2007 from the Office of Surface Mining, and estimated state budget deficits and electric power generation (all fuels).

BTW: There is a similar posting at Grist.

Perhaps one could make a calculation for EROEI for any particular type of coal(lignite, bituminous,etc.) and depending on stripping ratio and the availability in a mine(seam width),etc. in comparison to what energy is required to get it out and transport it. So take a certain isolated mine with X tonnes at certain depth. We mine and transport all of those tonnes with a certain technique (diesel motor and train, steam shovel and steam train, human muscle power at good union wages or slave labour, or perhaps a power plant on location with long electric lines to midwest,etc.) So depending on the efficiency of the method of excavation and transport of coal(or electricity directly) and the amount of energy needed (in tonnes of coal for steam shovel) to get out a tonne of (very deep thin seamed) low energy coal.

Soemwhere we will cross a line where it is not worth it to mine unless you allow for slave labour, enormous pollution, etc.

When % of coal used to run the equipment is 100% what you can get out the line will be crossed but I would guess that would be some deep mines with very thin seams of low energy coal. It will take some time yet to reach that point. Perhaps however as that % icreases year for year the profitability to finance the venture will be so low as to make it impossible to keep up the mining venture.

What is the interplay between the various types of energy? If oil becomes too expensive to transport and dig out the coal(it becoming a luxury article for military planes, ambulances,etc.) then coal becomes much less affordable. If export land model is right this could happen sooner than we think. If NG production dips quickly then coal demand could rise as people would pay any price to remain warm in winter. The same logic in last case could be valid for heating oil. The case of diesel vs. gasoline is important as diesel is used in trains and mining equipment. When electricity in general becomes very expensive the forests could be stripped bare so that before all that distant expensive coal gets out of the ground every last tree in the midwest and norhteast could be burnt plus all the topsoil used up for corn cobs to be burnt in ovens and for ethanol. At any rate a complete energy picture emerges of less EROEI per USD per capita per surface area of land over time and makes things more dangerous. What now seems like the land of plenty becomes quickly in energy terms an overcrowded place with not enough enrgy to heat, feed, pump water from far away, make precious non-natural fertilizers(NG or coal use for nitrogen production), etc. I know the Chinese manage on much less land with much more people but the whole system has to be looked at in a country. Presuming zero energy/food imports/exports, i.e. autarchic system with X people and X amount of land and X amount of native coal, NG, oil of certain quality)low or high EROEI) what kind of standard of living can Americans expect to lead at what point in time with Peak oil, Peak coal, Peak NG, Peak soil, Peak trees being at point X on any particular Hubbert curve for a particular resource in the country? You could perhaps make a hubbert total energy curve for all FFs in North America or USA and compare to population and guess when the people start starving or freezing en masse determined by amount of energy needed per person for minimal survival.

My impression is that coal EROEI is quite high, when measured at the coal mine mouth. The problem is that to use it, you generally have to transport it somewhere, and the transport costs multiply the cost of coal. Even when these costs are built in, coal's cost is relatively low, and its EROEI relatively high. Because of CO2 issues, people want to put in a cap and trade system, or a tax on CO2, to level the playing field.

If we had a high voltage long distance grid backbone, we could burn the coal where it is produced, and ship the electricity around the US at much less cost. If the cost of the upgraded grid is buried (thinking it is subsidizing wind), the cost may not be transferred back. Electricity produced from coal at the mine mouth with a "free" upgraded grid will likely look very cheap, even with a cap and trade system, or a tax on CO2.

As a practical matter, though, I don't think that the high voltage long distance grid backbone is going to get built. Too expensive; too many potential losers; too many funding issues.

Regarding interplay among the systems, I think Liebig's Law of the Minimum is going to be important, as is the built infrastructure, and what it is designed to use. A third thing that will be important is the financial system, and the inability to obtain long-term debt (arising indirectly out of peak oil). The pull downward of the financial system could be more important than physical depletion--if no company is in financial position to extract an energy fuel, it won't get extracted. Natural gas and uranium seem most at risk from the credit crisis, since the companies involved are often highly leveraged

It is clearly true that extra transmission facilitates the uptake of the cheapest coal power. This was shown by the underwater Basslink HVDC cable intended to export continuous hydro power. Instead it exports small amounts of peak high priced hydro and import large amounts of cheap lignite power.

Thus if they built such a cable from Morocco to Europe to export solar thermal the Moroccans would end up using European lignite power since it's cheaper.

The cost and NIMBY resistance to new transmission increasingly makes rooftop solar PV look less expensive. If PV costs truly do come down local microgeneration could boom.

"to use it, you generally have to transport it somewhere, and the transport costs multiply the cost of coal...Electricity produced from coal at the mine mouth with a "free" upgraded grid will likely look very cheap, even with a cap and trade system, or a tax on CO2."

As Pitt said above, rail transportation is about 440 ton-miles/gallon on average, and coal is likely higher than 500 tm/gallon. Low-sulfur coal in the US travels roughly 1,000 miles before being used. Dividing these tells us that transporting US coal requires roughly 2 gal/ton.

2 gallons of diesel have a lot less carbon than a ton of coal, so the transportation mode doesn't make much difference to the CO2 emissions of coal.

Gail - I am probably mistaken, but I seem to recall reading that since most coal is converted to electricity, that when you look at the energy value of the electricity produced (after line loss), it is only 35% -40% of the energy from the coal used. Do you have a figure?

It is the thermal efficiency of a coal power plant that accounts for the major loss. Search Wikipedia for coal power plant. This is due to fundamental physical factors and can't be much improved upon (although the waste heat from the plant can be made useful in other ways, which you could say is more "energy efficient" than simply wasting it).

Energy losses from electrical transmission in the US electrical system are only around 8 percent. That's only 8 percent of the %30-40 converted to electricity, or around 3% of the original coal energy that might be lost to line losses.

You're right. An intuitive measure of this is that for quite some time, in this country and elsewhere, it was quite economical to haul coal with steam locomotives that were themselves coal powered. I doubt that the coal required by the locomotives ever amounted to more than a couple carloads in trains with several dozens of cars. And steam locomotives are several times less energy efficient than diesels or electric locomotives.

I would mention that this means that if one is concerned about coal emissions and global warming, one needs to seek a political solution, such as a carbon tax, and not rely on markets.

I'm a bit afraid to say it, but I think this is probably wrong.

See Pitt the Elder's comment above for the fuel requirement of transporting coal: 2.5 gals diesel for 1000 miles. At current roadside prices, less than $6. (We know it won't stay that cheap, but...) Incidentally this produces 56 lbs of CO2.

Now consider the comparable "fuel requirement" from transporting electricity via high voltage lines; this is equivalent to whatever line losses are incurred over 1000 miles to deliver the electricity produced by one ton of coal, which is 2000 kwh (see Pitt's comment again). According to Wikipedia, HVDC losses are about 3% per 1000km, which comes out to 4.8% per 1000 miles. (I don't think you specified HVDC, but I understand it's more efficient than AC, so giving the grid the benefit here.) It works out that to deliver 2000kwh 1000 miles away you need to produce 2100kwh at the plant. The extra 100kwh comes out to $10 at retail rates (Pitt's comment), about equal to what 2.5 gallons of diesel cost last year, but certainly not representing "much less cost" up to this point in time. And incidentally, this produces 205 lbs C02, if the coal is bituminous, which is the kind that produces the least CO2. And I'm not certain, but I believe a true comparison would also include additional losses in DC to AC inverters once the electricity arrives at it's destination.

Relevant figures to the calculations taken from here and here. (How many adults need to read that "Kids Page"!?)

Have any studies been made on coal recoverable using Underground Coal Gasification?.

Here's a public company dabbling in UCG

http://www.lincenergy.com.au/release-04.php

I read a report IIR in Green Car Congress by Chinese academics. Apparently suitable coal seams with the right porosity, depth, thickness and moisture content aren't that common. Therefore underground partial combustion won't 'set the world on fire', pun intended.