Financial Collapse and Energy - Something Other than a NINJA Problem

Posted by Gail the Actuary on May 27, 2009 - 10:26am

This is a guest post by Pedro Prieto from Madrid, Spain. He is the head of ASPO-Spain and organized the ASPO 7 conference in Barcelona last year. See also follow up post, regarding inflation adjustment to parameters.

When the economy started to fade last year, many attributed the cause to subprime lending.

Others put together very successful, hilarious stories, explaining that the ultimate reason for this financial crisis was the NINJA policies of banks (credits granted to people with No Jobs, No Income and No Assets). Many of these stories were uploaded to Youtube.

Neither subprime lending, nor NINJA policies, nor any financial media is able to explain why banks around the world, which had been for decades very cautious in granting a credit without solid collateral, suddenly started to grant loans to insolvent people; or why the strict financial regulatory and supervisory entities started to look the other way.

This is an attempt to offer a different perspective.

Barter/Countertrade

In the beginning, the world used barter or countertrade. Countertrade was based on equivalent human effort (labor), which, in fact, corresponded to easily measurable equivalent energy expenses.

For example, if a chair maker needed six working hours to make one chair and a farmer, producing eggs to fill a basket, also needed six hours of work, then a chair could be reasonably be exchanged for a basket of of eggs. This approach was immediate, rational, and simple. But the procedure limited the exchange in goods and measurable services, especially those involving large volumes, complex transactions or distant operations.

Gold as a Mediation Device

Gold was introduced to solve the problems of the earlier systems. Its natural scarcity represented many hours of human equivalent effort in piece that was small in weight and volume.

It was ductile and malleable; it could be coined; it was difficult to alter, easily divisible and transportable. Gold very much eased the paths of commerce.

However, gold still represented, in principle, a measurable form of condensed human equivalent effort (energy) in the commercial exchanges.

Paper Money

Marco Polo took paper money from China, where it was invented, to Europe and then to the world.

It represented, with an authoritative signature, a given amount of gold deposited by a bearer, in a well known and secure deposit, that the faithful depositary was obliged to immediately return to the bearer upon presentation of the paper money.

And this gold, in its turn, continued to represent goods or measurable services, in human equivalent effort (embedded energy, in a sense). And it proved for many centuries to be more effective than gold.

Despite the early existence of paper money, the physical and monetary world still had a close relationship. This was the case in spite of specific abuses and partial system bankruptcies due to regional wars or collapses.

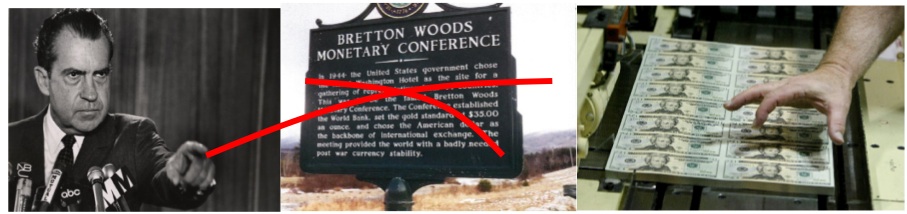

Nixon unilaterally broke the Bretton Woods agreement in 1971.

Bretton Woods was the last global attempt to fix gold as the standard for exchange of goods and of measurable services. The agreement was reached late in 1944, after some developed countries had abused the printing of money without the necessary physical backing or equivalent reserves.

In 1971, the US$ became the world reference for valuing all human activities.

It was at this point that a real growing divorce between the physical world, represented by equivalent human effort (energy, in the final analysis), concentrated in gold in the reserves of each country. It gave way to a new form of paper money, where the authoritative signature committing an amount did not necessarily correspond to equivalent real goods or measurable services.

We should ask ourselves why this growing drift between the physical goods and measurable services has been working until now.

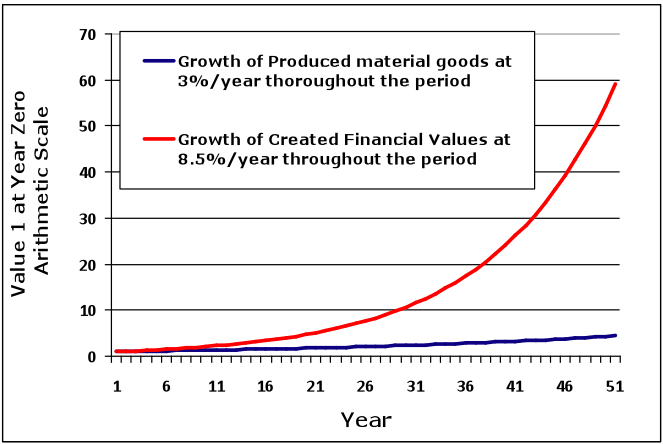

Professor Albert Bartlett summarized the reason very well: “The greatest shortcoming of the human race is our inability to understand the exponential function."

A Mathematical Model

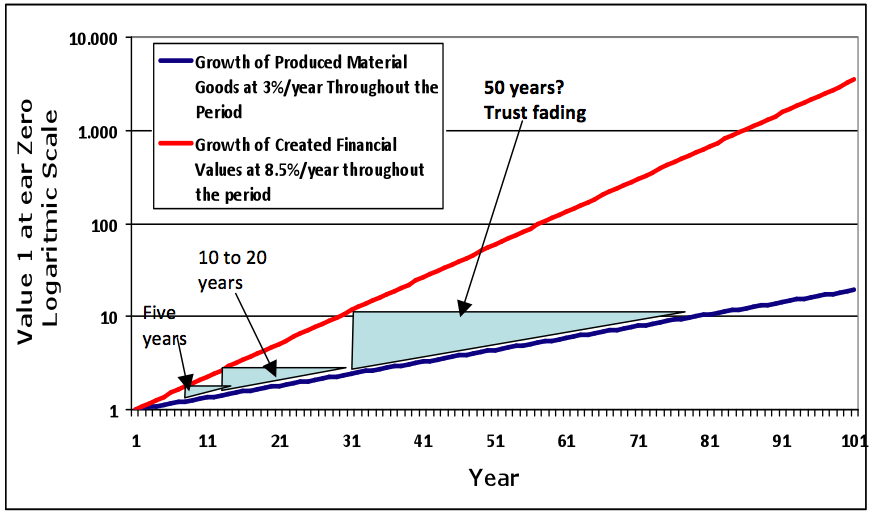

Let us represent mathematically two different types of growth. If we assume, for instance, that goods and measurable, physical-related services grow at 3% per year through a given period of time (i.e. 50 years) and financial services grow at 8.5% per year, we have the following graph:

Interest Paid by Banks: a Religious Touch

The so-called “religions of the Book” originally were opposed to lending money with interest. This opposition represented clear recognition that interest based on credit is the main agent forcing the world toward continuous growth, faster than natural trends.

The official position of the Catholic Church until end of the 18th century could be summarized in the phrase enunciated by Thomas Aquinas: Pecunia pecuniam parere non potest.-–Money cannot give birth to money. One of the sins severely punished by the Inquisition was usury--and in those days, they considered usury what today would be considered a very low interest rate.

About 800,000 Jews were expelled from Spain in 1492. Inasmuch as they could not become owners of property, they specialized in trade and banking services. Some of them were in control of lending and were therefore tolerated-–after all, they were not Christians, and sometimes having somebody to ask for money to advance a payment for a given enterprise was initially useful. According to the Torah, Jews can lend money with interest to gentiles, but without interest to other Jews. They also understood the impact of the debtor of having to pay interest.

For Muslims, bank interest is theoretically forbidden by the Koran, although some of them-–especially those called by the Western countries “conservative Muslims” and clearly not the “radical” or “fundamentalist” Muslims--have also managed, in the new globalized world, to evade from the norm with artful financial devices.

However, even the Catholics finally managed to get away from this doctrine and even dared to make subtle changes in the 2,000 years old prayer, so that they moved from the traditional Our Father, asking Him to forgive their own debts and those of others, by praying:

Pater noster, qui es in caelis:

….

et dimitte nobis debita nostra,

Sicut et nos dimittimus debitoribus nostris;

..

Instead of that wording, there was much more flexibility for operating in the financial markets without remorse with the following wording:

Our Father, Who art in heaven,

…

And forgive us our trespasses,

as we forgive those who trespass against us.

…

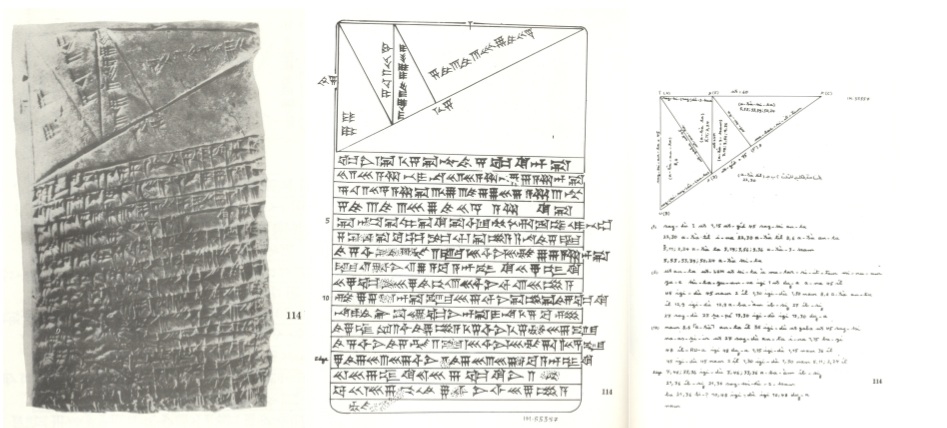

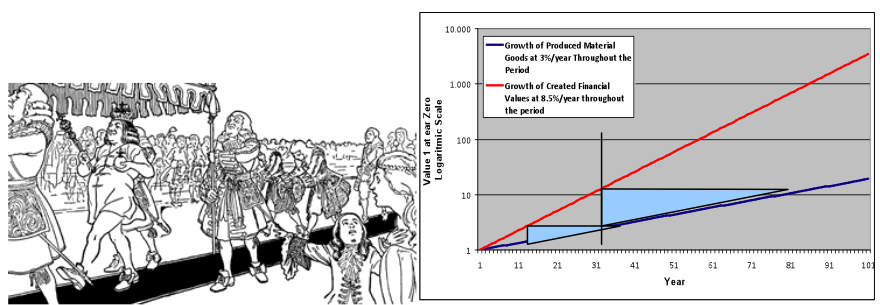

A Euclidean Model for Diverging Worlds

Equivalences between rectangle triangles have been understood for thousands of years. A clay cuneiform tablet found at Tell Harmal, close to Baghdad (Iraq), from the Old Babylonian period (1,800 BCE) depicted a theorem, similar to one of Euclid, but 1,500 years earlier, on rectangle triangles equivalences.

Therefore, if credit is the amount of money, or equivalent, that somebody takes from and owes to a physical person or legal entity, the creditor has the right to get it back (with interest-–more money--) in a given period. And if interest is the obligation, deferred in time, to return more money-–i.e. equivalent goods and/or measurable services--that is human equivalent effort--than those originally taken, the Euclidean model suggests that financial money needs more time, every time, in order for the financial model to match the physical reality that it should theoretically correspond to.

Therefore, amortization periods necessarily need to get longer over time, starting from a given base. As the physical world is finite, the financial representation of money or monetary values cannot, at a given moment, match physical goods--nor even at a reasonable future moment, deferring the relationship in time. Neither can they match reasonable human effort, or energy efforts translated into equivalent physical goods at the disposal of the holder of the paper money.

Myopic Visions of the World

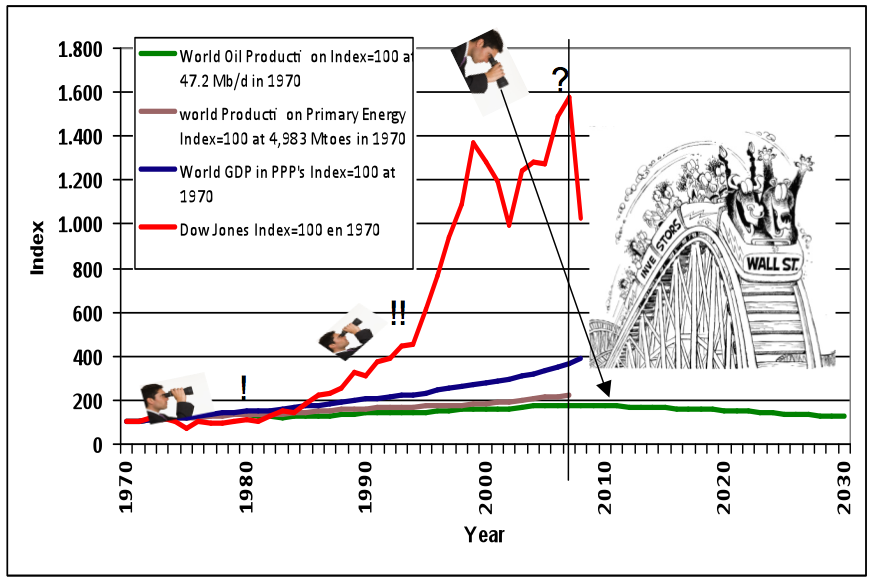

Even if GDP is an inaccurate measure of the goods which have been produced and services which have been rendered (the bomb business or an increase in traffic accidents is good for GDP, for example), it is still a tool of neoclassic economists that is theoretically an index related to the production of tangible goods and measurable services. And it shows that the divergence between physical and financial growth is becoming more and more evident over time.

I cannot accurately quote Noam Chomsky here, but I recall him saying something like, "Probably nine out of each ten circulating $ in financial markets does not correspond to the physical exchange of goods or the measurable trade of services."

In the next chart, we can see the effects of the diverging financial and physical worlds over time.

Sources: http://images.google.es/imgres?imgurl=http://photos.mongabay.com/07/SPM0...

for the world GDP growth and http://www.nyse.tv/dow-jones-industrial-average-history-djia.htm for the Dow _Jones Index

Now, let us add some other variables starting in 1970, such as the world oil production and trends in total primary energy production, and trends in wold GDP in Purchasing Power Parity, setting 1970 production equal to a base value of 100:

So, everyone was happy believing in the spiral of infinite growth. However, if money is to represent an equivalence to physical reality, we have been lying to ourselves for quite a number of years.

Then, why has the growing gap between the monetary world and the physical world apparently worked so well during the last several decades of robust growth? There are probably several reasons: Faith in infinite growth; the progressive lengthening of amortization periods for principal and interest; and the charging of the future to the wasteful present.

Therefore, the system works as long as owners of paper money (courtesans and gregarious people in the kingdom) are made to believe by the swindler tailors of the Emperor’s New Clothes of Hans Christian Andersen, that the looking-glass clothes, light as a cobweb, were magnificent; they are made to believe that their accumulated financial wealth as per the red line of the above graphs may be exchanged any time by the blue line of physical goods or services.

The system also works when the owners of financial assets see financial models indicating that they will recover physical world equivalent assets some years later, as long as material goods also keep growing, even if the material goods are growing at a lower rate and the recovery periods keep extending.

And it also works well, if all the community bearing financial or monetary values, as per the red line do not SIMULTANEOUSLY attempt to “materialize” all this money, at a given moment, into physical goods or measurable services, resulting in a need for goods and services beyond the level that actually exists as per the blue line at a given point in time.

Gregarious Behaviour

But the system may collapse if somebody, spontaneously, shouts for the first time, as the child did with the Emperor: "But he has nothing on!“, and then all run at the same time to “materialize” the red line financial values with the blue line physical goods and measurable services at a given moment, as we have recently seen in our world.

That is why the swindler tailors, most of the leaders and financial advisors, specialists and experts, working for the real financial powers, keep asking for the people to trust and believe in the system. Perhaps there is only a need to make some small adjustments in re-weaving the clothes, but the fabric is as beautiful as the ever-growing free market is not negotiable.

That is why these courtesans always address the herd and tell them the same thing that Don Vito Corleone said to his protégées: this perfect market system works based on trust and belief.

But the child has already shouted. And we know that the king and his whole court will walk, anyway, with still greater dignity in the middle of the financial and industrial production chaos, until they end the procession, as if the king were properly dressed.

And they leave us diving head first for a hard landing, from the heights of the red financial line, to the bumpy slope, slide or cliff blue landing strip, paved by and always directly linked to declining energy production.

Many thanks to Pedro for offering a very helpful analogy. For me, this helps fill in a missing piece of the puzzle. We know the growth in financial assets couldn't continue, but it was hard to measure the extent of the overshoot. Now, as oil production decreases in the future, the blue line is likely to head downward, further reducing true assets.

Pedro,

Excellent article! While the space here is limited for long discourses, you managed to compress it into a coherent "digest".

One could also note the role that derivatives played in the drive to squeeze even higher 'profits' our of the doomed financial system.

I am currently reading a book published this month, Fool's Gold by Gillian Tett, a prize winning British writer. It is a detailed history of recent events in the financial markets. From the back cover: "The J.P. Morgan derivatives team was engaged in the banking equivalent of space travel. Computing power and high-order mathematics were taking finance far from its traditional bounds, and this small group of brilliant minds was charting the outer reaches of cyberfinance." Companies other than J.P Morgan later took these techniques to riskier heights. This 291 page book includes notes, a glossary and an index. Other than the fact that it is more than I wanted to know, I recommend it highly.

http://www.amazon.com/Fools-Gold-Corrupted-Unleashed-Catastrophe/dp/1416...

Why is it that every explanation for the current predicament centers on some group of genius financiers that created these brilliantly arcane arrangements that were intended to improve the human condition?

All they are is typical swindlers just like all the others that came before them.

Let's just admit that all of the institutions in the world are run by criminals and call a spade a spade.

I think that maybe the main problem is that we glorified the wrong behavior.

Why is Warren Buffet a hero? He never created anything in his life and he certainly didn't benefit man kind.

We need an entirely new ethos that is eco-centric (is that a word?) and we also need to reward different behavior and punish what used to be regarded as noble.

I'm in total agreement with you Sir. Until this system the greedy people of the world have built (I blame their parents for not drumming this basic fault out of them when they were very young) colapses or is pulled down by the people below them who, at some point in the near future, begin to suffer real hardship, then the show goes on.

Nice one Pedro. Any relation to the Canned Heat drummer, Pedro de la Cote? Porge, there is a word 'ecocentric'. Describes a person who drinks the bland, de-caffeinated, bean based beverage, Ecco.

Does this article imply that I should covert my paper money into hard assets before everyone tries to convert theirs (red line to blue).

Logically, you should buy physical assets and sell financial assets now, while everyone else thinks are recovery is underway.

There are several risks, however:

1. You may have to move (no water, no jobs, lack of locally grown food) and you won't be able to take the assets with you, or sell them.

2. The assets won't last over time. Food spoils; termites get into wood; fresh water is hard to keep clean in adequate quantity.

3. Having more assets makes you a target for those without assets, possibly increasing risk to your physical person.

I think it is probably worthwhile to change your attitude as much as possible that toward "Not having all these assets is OK, I can do without."

I am pretty much in deflation camp, but I acknowledge that TPTB probably can delay/prevent it if so they choose (before lowering interest rates, now QE, etc..).

Of course, they are cautious not to overheat the system, as they too know that oil has peaked and life $200 oil would kill the economy again.

The article itself is good, one just has to bear in mind that it is prety much impossible to defend against TPTB. Our JIT economic system will function until it won't and when it fails it is likely that no hard assets will be of any help, farming land included.

I agree with that, I live in the UK, we have a saying "as safe as the Bank of England" which is meant to imply 'as safe as you can get'.

The Bank of England issues our currency, the 'Pound Sterling' - the pound it refers to is one pound in weight of Sterling Silver (an alloy of 92.5% Silver and other metals).

Our paper currency is a receipt for this silver, so a twenty pound note is a receipt for twenty pounds of silver that was once deposited with the bank (in those days it maybe represented twenty years wages). Today, twenty pounds of silver is worth somewhere in the region of £3000 (about two months wages, such inflation!), but a twenty pound note will only get you around two OUNCES of silver, not twenty pounds.

Somebody has stolen 318 ounces ( >99%) of the original silver that was deposited, as it was deposited in the Bank of England it must be somebody in there! Does the Bank of England sound safe to you? Have faith in our Banking system!

"Our JIT economic system will function until it won't and when it fails it is likely that no hard assets will be of any help, farming land included."

This would seem to go against the thinking of many Peak Oilers who believe that a piece of farmland, the Doomstead, is going to save them. Why dont you think farming land will be of help?

Gail,these comments could have been written by a farmer as a cautionary tale for those who want to believe that getting back to the land is a realistic goal-ESPECIALLY those who get thier info from pollyanna websites and think that we can produce like Chinese and Korean peasants ,evidently,just because we are Yankees.

We lost our peaches and nearly all of our apples to a late frost this year.We lost our cherries over the last three days due to unusually heavy rains.They just kept swelling up until they burst,less than two weeks before the harvest would have started.

And we live in an area long noted as exceptionally well suited to these crops.We are fortunately diversified in a way not possible on a very small acreage,and we will not lose everything-at least we never have.

Buying a farm now could easily turn into a disaster, especially for those of use who have little idea what would be needed to actually produce food in adequate quantity to feed a family and store if for winter months. The more I think about the problems, the more I admire our ancestors and their ability to get along without fossil fuels.

I have always been of the opinion that the minds of the past were better than of the present..............they had to be.

Not buying a farm is higher risk. If food is short, any additional food is a direct benefit. In addition, I have not materially impacted my fitness. Productive land is a hedge. My venture may fail, but my odds increase.

Gail, don't take this personally, but your logic sounds to me like an excuse. Inaction is a valid option if the benefits outweigh the liabilities. In your case this may be true, but bashing farming is illogical. How is your food supply more secure in a city full of strangers?

My guess is that you judge the marginal increased fitness of farming as insufficient. I agree, but all other options I can find are worse.

Cold Camel

It is interesting for me to find this debate here since I've gone over this territory with my husband now for a few years (with me arguing for a farm and he, a person who really dislikes dirt, arguing against).

I think it's worth examining his point. My husband argues that you don't need to run to a farm for cover. What you want to do is always have what other people will pay for. Maybe you have some doctoring skills or maybe you can sell things or maybe you can write or teach or design or sing......whatever. The point is to spot where you can compete using your talents and then throw yourself into this wholeheartedly. If the market changes you have to be quick to adapt, but if you are good then you may be able to compete well.

There will always be an elite (non-producers) and my husband's idea is to be included among them as they "circulate" (Pareto's term) since he hates anything that involves lifting a shovel. I think he'd rather be a really starving used book dealer than a well-fed farmer.

The governments of the world are trying to slow down the collapse process as much as they can in order to 1) avoid chaos and panic and 2) give the elites a chance to "circulate" naturally in a new lower energy based society. When I say elites I mean all non-producers, that is shopkeepers, librarians, teachers, office workers, etc. Almost all of us are elites these days.

I personally can understand both positions: the escape to the farm or the desire to stay and fight for ones position.

If you love working the land and love animals then the farm is for you!

But if you really hate that life, it might be a bad choice.

BTW: To read more about medieval Spain and moneylending try a great novel CATHEDRAL OF THE SEA by Ildefonso Falcones. The author is a lawyer who uses his vast knowledge of legal (and other) history to portray Barcelona and its surrounding area in the 1300s. For those who are PO aware (I think Falcones may be) this novel is a special TREAT because these old laws are so often concerned with food (energy) through the use of land for grazing etc. There is so much intricate knowledge of money, foreign currency trading, land use, grain markets, etc displayed (but in a fun way) that I promise you will be vastly entertained. Also of course there is a lot of horror--the prejudice against Jews and the Spanish Inquistion (does local have to mean narrow-minded? Isn't there another way?) the cruelty of the feudal lord (must they be so nasty or did being nice mean being weak?)...

The whole novel is a picture of what it means to compete in a city (where you obviously can't be a farmer for lack of land). The hero, Arnau, manages to succeed but there is a lot of luck involved so I don't know how realistic this is.

Forget your PO worries and get totally into this novel where someone else's PRE-OIL worries will provide great vicarious thrills and food for thought!

I too am currently reading a book about cathedrals and medieval times. It's called Pillars of the Earth. At each turn in the book it becomes painfully obvious how oil has dramatically changed our way of life.

I think you are married to my brother.

My perspective, that if I can't sell it, I can eat it, comes from my grandfather, but your (husband's) arguements are certainly valid, as is your conclusion that if you don't like dirt, don't become a farmer.

The challenge for all of us is to be quick on our toes, farmer or not. Market conditions can render the best plans invalid. I recommend "Farmer Boy" from the "Little House on the Prairie" series as an example of the random nature of profits. That book paints a positive picture of farming, the rest of the series portrays a more realistic and negative view. The key is never to be left redundant.

I have lots of potential routes to take with my land, none of which are currently economically viable. The same is true for your husband's plan, his out of the mainstream lifestyle isn't economically viable, so really, we're both full of it. Ah, well, back to the grindstone.

Cold Camel

You are right, oldfarmer, and your comments appreciated. But we don't have any other options that are more appealing. A little food is better than no food. I'd rather be puttering around on dirt than rioting on the streets because the stores were empty.

Cold Camel

I remember watching a program some time back about a town in the US where they had a plaque dedicated to a local farmer who was long dead. The reason he got the plaque was one year all the crops failed in the local area except on his farm (something to do with his elevation above sea level was mentioned) and what he produced was enough to keep the town from starving till the next spring.

The next Hero might be the past hero.

Well said oldfarmermac.

I do not live in USA but exhausted soils was fairly typical for US up to middle of 20thC until farming found the industrial alternatives. Jackman and Long, 1964, in The Oregon Desert, give a sympathetic and entertaining account of the brief 'homesteading' boom in that part of the country during the first years of the last century. Teachers, clerks, fit young folk, found, alongside some personal tragedies, some good romance and socializing and played some good baseball apparently, and I guess the kids had memorable childhoods, but there is hardly a trace left in the ground.

I guess the Chinese and Korean peasants will still be around. Even they are not self-sufficient and need these days some industrial N fertilizer and sufficient regional/system 'insurance' against inevitable local failures. March larger regional system adjustment is required to deal with issues of water or other long term declines.

Having said that, maximising suburban or urban gardening can ensure some healthy nutrition and an attractive environment.

Hi Phil. I wouldn't underestimate the Chinese. They have a command and control society, a largely rural population, and a history of cultivation that goes back before the Europeans were plundering and pillaging each other,

Gail,

point 1.

No water! I am not capable of surviving without modern medicine, if the water goes then I am long dead because other things are gone.

point 2.

Ok, I am growing my own food and have chickens, but, nowhere near enough land to feed myself. Should I convert money into more land?

Point 3.

When things get this bad, see point 1.

I don't want all these assets. Everytime someone tells me to save more for old age I answer "what old age" and "I need less in old age". As you have pointed out in previous posts, I just want to "store" for old age so I can eat without doing the "hunting".

To be honest, it is pointless preparing for WTSHTF because I am only alive because TSH not HTF - figure that one out :-)

Sometimes people here do not realise how dependent they are on modern conveniences.

I'm gone in very short order without not only modern medicine, but relatively intensive healthcare as can be had (in the US) only with sufficient health insurance. Society need not break down for me to go; I need only lose my job.

Hi Gail;

Sound advice. I have no assets or debt. As soon as my partner pays off her small debt we are off to the farm upcountry in N.E Thailand.

Another thing. What do you make of the recent rally in oil prices? What price do you think the battered world economy can entertain before it sets off another downward spiral?

I saw a chart here on TOD a while back showing the world economy topping out and plateauing at $60/bbl, but not starting to drop until about $90/bbl. We're at $65/bbl this morning.

That's been exactly my take on the situation for the past several years now.

Hence, got out of stock funds (liquidated retirement accounts) and put money into things like home insulation, solar panels, good bike, tools for growing food, etc.

Most everyone thought I was nuts and when I tried to explain why (see article above), they thought I was nutter. Not so much anymore.

Great article Pedro.

Good article indeed, and spot on with respect to what's coming. I am a former equities trader (pro) now still trading, but in countdown to the day it becomes pointless. I left the field, left the country and while not having "gone native," exactly, have made great changes in my life. Anyone interested in homesteading in Argentina in a strawbale house, please have a look at www.fromthecatacombs.info

I believe the snowball of financial destrution has come too far down the hill to be stopped now.

Insulation, done that!

Solar panels, 6.84 KwP thanks to FIT in Germany

Bike, of course with trailer.

Growing food, already eating home grown stuff and have chickens.

Electic tools, perfect for the solar panels.

No medicine, I die.

Are you 100% sure. My mother in law had diabetes and was dependant on meducation. I treated her homoeopathically for it, she had a heart attack and when she got out of hospital - no need for diabetes medication, that was 4 years ago. A lot of stuff that doctor's tell you is spin, just like the "fast money" morons.

One of my signatures is: If you want to remain healthy, solvent, and alive, stay away from doctors, pharmacies, and hospitals. Now, of course, I may have a massive collapse a few seconds from now, but this motto has worked for me for over 30 years (and near three score and ten years, I take no pharmaceuticals, I use herbs and natural "medicines" when necessary, and haven't taken so much as an aspirin for many years).

I rather think that many Americans are almost totally neurotic, whimper and run to the doctor for many mostly imaginary ills, load themselves down with prescriptions, and think of the health disaster system as their mother.

You're living in a cocoon of youth and hubris. Just wait a few more years.

Well Speedy I'm a chemist dunno what medicine your taking but if patent enforcement weakens a lot of medicines will be readily available.

Of course if you think we are going to have total collapse its a no go.

But depending on the details many can be synthesized in any well equipped lab.

Obviously its something else I've thought about post peak.

Does not mean that medical research will advance but there is no intrinsic reason to lose most of our drugs as long as things stay reasonably stable somewhere in the world.

Obviously one of the big exports from these stable regions will be drugs.

I'm so thankful I got a chemistry degree even though I've not really used it all that much its always been something thats been really nice to have.

In a normal economy it gives me the option of becoming a lab tech of some sort with reasonable pay and basically 9-5 type working condition to focus on other aspects of life. If things get interesting a chemist becomes a fairly valuable guy to have around.

Give me some sulfur and I can rule the world :)

There is a famous character here in Toronto, now in jail, who stocked up on bicycles. They were stolen. He likely did not steal them him all himself but he was the market for stolen bikes in Toronto. When he was finally caught he was found to have teens of repositories containing hundreds of bikes. It was reported that he was hoarding bike for the eventual peak oil future.

I was think of investing in a sizable shipment of Brook "Imperial" leather bicycle saddles.

Thanks Pedro (and Gail).

I am working on a similar post. In past recessions we had a)time, b)lower population and c)alot more of the cheap energy left underground (nearly instant 'energy gain'), as well as low levels of overall (paper) debt. If you denominate US Debt (private, household, corporate, govt), it works out to over $60 trillion, which does not include off balance sheet derivatives, nor underfunded social security or medicare). If we had to pay back this debt in barrels of oil, it would be 1.3 trillion barrels of oil at $50 per barrel. (not that we would ever do this, but it gives a perspective on what our debt is in remaining oil left on planet - arguably it is greater than remaining URR - this was NOT the case in 1970s or 1930s).

The decoupling between financial/marker and real assets is extreme. This is the real story.

Nate, would you say that looks like a clear way of showing that the world is already bankrupt (subject to my homeopathic home fusion never receiving the funding it deserves)? And what I would then be wondering is how, and how much longer, can the world go on imagining it is not broke (when it is). And what bursts the bubble and what then?

Robin

I think the industrialized world is in Chapter 11, but not terminal. For the interest we get every year plus the remaining bank account is still large enough to support this population for some time, but only on dramatically lower natural capital spending habits, (which will only change if we change how we measure 'success'). It is not likely but possible to reduce consumption of resources by 80-90% over next couple decades and still lead meaningful enjoyable lives. The problem is the sunk cost - all the infrastructure built during last 30-40 years that requires high amounts of energy dense fuels and global transport needs to be addressed/changed as soon as possible to something less transportation oriented, at least for basic needs.

Personal mobility gives the people the illusion of freedom, so TPTB will be very cautious to forcefully impose any regulation (apart from possibly lowering max speed).

IMHO it is precisely this "freedom" thing that prevents people to sink in that we actually live in resource constrained world. Had enough people embraced the truth, the economy changes profoundly immediately and the reality is that at the moment that is still not needed as the oil supply is plentiful. TPTB chose gradual transition, so that as little people as possible actually notice anything.

This Saturdays Campfire will be part 3 of the book recommendations, but next week I am going to write a post on this exact topic - the fact that we like CONTROL. There are many examples of human experiences that only differ in the amount of control we have - the rest of experience is identical - those that we can control exhibit a lower stress hormone (cortisol) to norepinephrine ratio in our blood etc. Basically freedom to choose actually is healthier for us (to a point).

The papers I will discuss are:

"Biological Basis of the Stress Response" by James P. Henry, Integrative Physiological and Behavioral Science, January-March, 1992, volume 27, Number 1, pages 66-83.

"Pituitary-adrenal and sympathetic-adrenal correlates of distress and effort" Lundberg and Frankenhaeuser (1980) Journal of Psychosomatic Research volume 24, pages 125-130.

IMO this will shed insight into what future systems are workable...

Nate, can I get in a comment on your control topic in advance (so you can modify your article beforehand if seems appropriate).

Thing is that most uni psychologists have long been shy of mentioning individual differences, due to p.c. concerns. As a result they do all sorts of studies which lead to false generalisations --an error folk-psychologists also fall into-- when the variability is much more to the point.

In the present case a swift look at your choice of papers raises the thought of substantial differences in handling of stress (or definition of stress) related to the level of N - neuroticism, and P - psychoticism, and also I would expect time-dependencies related to the E -extraversion factor.

On the other hand we all have adrenal glands, even though in my case they've been hanging on by a thread for many years and only kept going by learned magic. Note for instance the ridiculous recent uk govt recommendation that everyone should take bloodpressure lowering thingys when my own constant struggle is to keep the pressure high enough anyway.

And more directly related to the topic of control, I'd be amazed if there were not huge individual differences in this arena too. Some people are overwhelmed by too much choice and gladly go to a McDumbo's diner where they are idiotically restricted to a choice of #6 or #4 or so on.

Some people just want to be told what to do, while others go out of their way to become judges so they can engage in nasty criminal abuse of others' lives as happened to myself.

I've also read findings that lack of choice makes people happier with their lot. You were warned! (You still have the choice of chickening out...)

Eric Fromm ¨Escape from Freedom¨

I was watching the History Channel film "Life after People" on DVD the other night and when ever they were talking about the time it takes for infrastructure to degrade, I kept wondering how the decline of energy (oil particularly) would affect the rate of decline of infrastructure.

I am wondering what others think:

Would infrastructure degrade faster without people; With people still using the infrastructure but not maintaining it; Or doesn't it make any difference?

My guess is that infrastructure will degrade faster with use but no maintainence.

One word.

Fire :)

Jon, The answer depends heavily on the type and location of the infrastructure. Here in Santa Barbara the place would burn up rapidly during a drought period without fire fighters. In other areas damage could come rapidly from flooding. In other areas damage would come very slowly.

So you have to ask in each case what are the physical and biological threats to the structure and what is the type of structure.

Nate I am encouraged that you think we are only in chapter 11 and can avoid the collapse so many see as inevitable.You must be pretty smart(wink) since I think you are right.

I find these new economic models intrigueing,but also a little cryptic-like somebody elses borrowed lecture notes.They raise as many or more questions in my mind as they answer,although I do get the aha! moment from them here and there.

If you or anyone here knows of a good book that gathers them together and examines each one,using plenty of examples,I am ready to buy in hardcover if necessary.It must be accessible to the non professional, not many of us are trained economists.

I rather tend to agree that we could "lose" 90% of our financial system and still manage a good life, if you accept learning, enjoyment, creativity and so on as "goods."

While I really liked the explanation given here, particularly as it relates to the disconnect between physical value and money, I'm still puzzled. I'm puzzled because even if you took away all money, had it all evaporate, people are still left with shelter, tables, bed, chairs, and so on, and can do without aircon, can get more blankets for the cold, can sleep when it gets dark, which leaves, really, just water and food (and cooking) as the really critical needs. Food supply is not going to be really affected if JIT goes down the drain; fewer deliveries can be managed. City folk may have problems, but small towns, like where I am, you can walk to the farms, if necessary. Water comes out of taps now, but if you really need it, you can just go collect some from the almost daily rains, take a "bath" in the rain. If there is no energy for cooking, solar cookers, which can be made in a couple of hours or less, can be used. There are many, many, many ways in which we could manage, so I really don't see any direct connection between a failed financial system and being able to bathe, eat, drink, and so on.

Interesting you mentioned solar cookers.

My 10 year old and I just made a homemade solar cooker from a pizza box aluminum foil black paper and clear plastic last night for a school project.

It seems a high odd bet that the school is trying to create awareness in these young people at an early age.

In addition they are learning about conserving and the environment. This is very encouraging but I am afraid it may be late in the game.

I have even noticed that some of the mainstream programing for children centering on the theme of saving the palnet and conserving etc.

My personal opinion says if we end up operating on 80%-90% of what we need at present the the world will be F###ed place to live in, especially if you are not a part of the elite. Simple as that.

There are too many people.

Imagine how poor the poor will be if the middle class are making do with 90% less than now.

I don't know if it's naivety or wishful thinking to expect an even collapse to mediocrity, where all exist in a communist society of common good.

No more hip operation for grandma or triple bypasses for granddad. Governments will struggle to fund schooling let alone infant vaccines with 90% less taxes.

Just an opinion though, the last time I was wrong it was a mistake.

Dayahka. I second that. I look around me and see megatons of junk and stuff that could be used if we needed to. It takes only a little bit of trying to make what we need- I mean need-out of all that.

People in the US ought to go to places like Bangladesh and see what people do when they need to.

Then I think of myself. The best thing I did was marry the right woman, who loves to grow our own food in return for my fixing the hardware that needs it- and I still have the 50-80 year old tools I inherited from my good old father in law. He got the best tools and kept them in shape. And no batteries anywhere.

What is the connection between Cleopatra, Jesus, Julius Caesar, Shakespeare, and Moses? None of them used any electricity at all.

I have to tell you that in Shakespeare's era Londoners burned coal for heat. Coal was one reason that London became such a big powerful and complex city.

Shakespeare's parents couldn't read and his father was only a middle-class glover but (as energy availability was increasing) bright kids could get an education and luckily for us, Shakespeare got one.

Before any elites acknowledge bankruptcy they will resort to the military. That's always the last resort.

TJ,

(1) Quite what will the military be deployed to do to stave off the effects of bankruptcy/whatevercy?

(2) How will their bosses pay their military if they are bankrupt?

TJ interesting you should say that. I am an expat in Thailand. and watch Australia Network (with the self effacing slogan 'A different view'). I watch the sport-the news is too hilarious. Anyway, there is an emergence of programs featuring the paternal police state (The Force and Rescue). Shorts of blockheads with no necks sporting the latest fashion sunglasses gearing people up to obedience, or they will kick your head in. The elite will squeeze the population for all their worth.

Nate, Neat way to look at the issue. Just the three largest banks in the US today, have over $150 Trillion dollars of derivative "assets" on the books. Due to recent rule changes they are carried at face value rather than market value. Talk about no clothes. These would add about $135 Trillion in needed oil extraction. Good luck.

Most people think that 90% of those derivatives are currency swaps, which have very little risk beyond a few hundred basis points. But WHAT if a counter party goes under with an exaggerated currency move? Then the only way to halt the domino effect is adding fuel to fire (more easy credit, more quant easing etc.)

100% reserve requirements, tethering to real assets, reducing debt, reducing leverage, reducing consumption, etc. How to accomplish it all at a pace that doesnt upset the applecart is beyond me...

Nate, (apologies for the idiot faction intruding in here again, but...)

I suspect I'm not the only reader who's out of his financials depth with your first paragraph there. But it appears that you are describing some scenario that is perhaps sure to arise and then cause an abrupt collapse of some systems to some extent.

And then your second paragraph appears to be in line with the concept of having to convert an airplane (current system) into a helicopter (steady state system) while keeping airborne throughout. Again a seemingly inevitable abrupt collapse in the making.

If you (or someone else less busy) could elaborate these points into an econo-dumbo's guide then at least one reader would be most grateful. I think also it could be useful to incorporate these ideas into the "Will there be an abrupt collapse" article I have been working on. Not that there's a shortage of impossible problems already. More the merrier (insanity permitting)!

I wish to raise a query about the use of the word "collapse" in the title here. Not least because I'm preparing an article to send to TOD about whether or not there will be any collapse.

If this word is used to mean total collapse (where not qualified as "partial collapse"), then surely we have not yet seen a financial collapse. If a financial collapse had already taken place it would mean we are now reduced to bartering with money no longer holding value. We've had a financial downturn, sure.

Secondly, not only is fiat currency a delusion, the entire concept of wealth and ownership is merely a belief in people's minds.

Thirdly, has the child shouted yet? Some people now see the scam of unbacked money. But most continue to be naive and trusting in the genuine value of their cash. Most wealthy people have too much invested in the delusion to wish it to be undone.

The question is when will be the time when a critical mass of people do not find it convenient to believe in wealth/ownership and then things would/will really become "interesting".

I wouldn't read collapse as past tense.

At this point, I think the child has only whispered, and the financial authorities have shut him up. The word is that recovery is just around the corner. I read that 90% of economists surveyed see recovery in 2009, and most of them see recovery in the third quarter. Amazing group-think, based on next to nothing.

My own thought exactly. Such pathetic bahh-bahhing!

A wonderfully ironic leading headline in a recent FT said

"King warns of slow recovery". [where King=BoE chief]

http://www.ft.com/cms/s/0/0e03fa68-3f9e-11de-9ced-00144feabdc0.html

Characteristic propaganda trick of leaving the key point implied, and disguising a reassurance as a "warning".

As for media suppression the following three links speak for themselves:

http://www.timesonline.co.uk/tol/comment/columnists/jeremy_clarkson/arti...

http://www.timesonline.co.uk/tol/driving/jeremy_clarkson/article5292547.ece

http://news.bbc.co.uk/1/hi/business/7766057.stm

Classic pump and dump scam :)

(Glad to see we've double-crossed memmel into shorting the market.)

"The entire concept of wealth and ownership is merely a belief in people's minds."

The concept of ownership and possession is shared by most if not all mammals.

Correction and apology for sloppy language and underlying conceptualisation! A concept is a concept, and never a belief. My sentence might better have read:

"Wealth and ownership are merely beliefs in people's minds."

Meanwhile, non-humans may also have these concepts, but they do not share the same beliefs relating to them. Rather they tend to believe that your honey belongs in their hive or your arm rightfully belongs in their mouth.

Never underestimate the power of the people to believe.

As an atheist I am always amazed by the stuff people accept as true even though the evidence clearly shows the opposite.

If a lie is repeated often enough in somber tones, accompanied with threats, and from a person seen to be of high authority it will be believed by the majority. It also helps to have back up literature from an even higher authority that supposedly can not be questioned.

Religion has had all of these for centuries. Economics and free market ideology now has an extensive literature to back up its lies. Anyone who questions it all is deemed an illiterate buffoon or worse.

Amazingly it all seems to work in the end. The people of faith succeed because they all accept the lies and the system continues on its merry way after periodic bouts with reality. These collapses and calamities are treated by the believers as punishment for questioning and lack of faith. Or perhaps they were brought on by the evil atheist doubters in their midst.

Saying the emperor doesn't have any clothes on is no more welcome than saying god does not exist. It will be rejected as blasphemy.

It is only in fairy tales that all the people recognize that the emperor is naked after the child points it out.

Someone has said all children are atheists and faith is learned. I think it is true.

"Someone has said all children are atheists and faith is learned."

I would argue with this assertion. Given that humans evolved in male dominated groups, it would be instinctive for people to form such groups. Religions have simply elevated the dominant male notion to a higher level for better control. Kids take to religion naturally. It takes a lot of education to convince them otherwise when they grow up. I think religions had to evolve when humans developed self consciousness and realized that the "big monkey" wasn't any better then they, themselves. With advent of religion, the Big Monkey became invisible and perfect and all powerful.

Agree as concern the unobserved but there is a kind of faith that the sun will always rise in the east derived from observation.

Kids take to nearly any human endeavor naturally.

And any system of learning or information can become a religion if you teach it children, punish them for questioning it, and cork it off with fear.

You sound like you where raised a Old School Catholic.

I was as well.

Porge you guys are right about religion and kids.Old Scholl Catholicism seems to be remarkably similar to Baptist fundamentalism in more respects than not. Been there,and had that done to me.

Catholic means universal in Latin and was the "official" version of Christianity sanctioned by the Romans. I have a theory that it was there last ditch attempt to continue the Empire through the control of the already rapidly growing Religious movement of Christianity. If you think of the tenets of Christianity in general and Catholicism in particular it basically says you should suffer here on earth to get a better deal later. It also says that if you are rich here you get the shaft in the next go round.......how convenient for the Romans.

I may be wrong but;

Wasn't the Catholic Church set up by Paul, who never even met Jesus but was struck by lightning instead. Spin doctors have been around a long time.

That's another theory I guess. I like mine better.

They are equivalent hypothesies actually.

"Thou [the apostle Simon] art Peter [=petrus as in petroleum!], and upon this rock I will build my church"-- words attributed to Christ in the Gospels.

WOW, now that is a unique interpretation of the bible and the only one that makes sense!

Lightning? Gimme a break. You're making the same logical error fundamentalists do when they read the Bible: you're reading it literally, and trying to find some natural phenomenon to explain in concrete terms what is metaphorical language describing an intense spiritual experience/awakening. Stop reading 'miracles' literally, rather one should see them as signs (Gospel of John's preferred term). Even the earliest Church Fathers were well aware of these things, and focused on a more 'spiritual reading' of the texts.

Actually, I think there were hundreds of different sects competing for several hundred years in the so-called AD years until Constantine realized that the only way to unify the empire was to unify its belief system, and the only way to do that was to convene a council of all the leading sects and have them come up with the one true religion.

When they couldn't do that after a couple years, Constantine told them that first we need a God, OK, take Hesu from the old Celtic religion and Krishna from the East, OK new god: Hesu Krishna (which some 1000 later evolved into the form we know it now). OK, now that we have a god, we need a story, go develop a "bible," which they did, drawing on all existing sects, pagan and non-pagan, which is why Christianity is really a pagan polytheistic religion masking itself as monotheism. OK, now that we have a bible, burn all the other bibles from the other sects. A few hundred years later, they again convened and "edited" these texts.

Point: Christianity is an invention with fictional characters and a fictional god, and many are the people who believe, have believed, and will believe these fictions, and if you don't, burn them at the stake, or whatever.

Capitalism is our latest "religion." You don't "believe" in Capitalism, then you're a no-good evil socialist, liberal, unAmerican, and so on.

Only when faith in this religion--the Capitalist religion of money as god--collapses will you have any real collapse.

What a load of mythology from Dayahka! The early Christian texts are very authentic apart from the magical bits. Most crucially Christ WAS seen "risen again" alive by witnesses because he'd never actually died; someone else had been arrested and crucified by mistake, and Christ cleared off along the road to Emmaus before he could be captured.

And that's why Judas was so remorseful that he had brought about the death of an innocent man and killed himself.

The main thing that Constantine did to Christianity was turn it from a pacifist dissident sect into an arm of a military establishment.

And the names jesus and christ are nothing to do with hesu and krishna.

http://en.wikipedia.org/wiki/Jesus

Cite?

Nothing in your link supports this interpretation, not even after following the "Historical Jesus" and "Resurrection appearances of Jesus" links. Indeed, your link tells us that most historical scholars disagree with your claim:

"Though the reconstructions vary, they generally include these basic points: Jesus was a Jewish teacher[2] who attracted a small following of Galileans and, after a period of preaching, was crucified by the Romans in Iudaea Province during the governorship of Pontius Pilate."

It's fine to have your own opinion, but it's patronizing to dismiss someone else's post as "a load of mythology" and then proceed to assert highly controversial claims without a shred of supporting evidence.

Wow. Simply stunning. Part gross oversimplification + part fabulation + a pinch of delusion = mindless drivel. Your understanding of history (ancient, Roman and Christian), philology and the evolution of religions is so twisted, I don't know where to start. Just on a purely etymological level, you've got it all wrong. Start with a dictionary; how about a Hebrew or Greek Lexicon? Jesus is a Greek word, derived from a common and universally recognized SEMITIC name (Joshua/Yeshua), that was common in 1st c. Palestine. As for Christ, well I'll let you read and discover the rest yourself. Clue: it bears no resemblance and has no connection, linguistic or otherwise, to the Hebrew.

Concerning the content of your statement, what are your sources? H.P. Blavatsky (Isis Unveiled)? J.M. Roberts (Antiquity Unveiled)? Hardly authoritative.

The Hesu Krishna claim you make here is oddly reminiscent and typical of the work of notable 19th quacks, new-agers, theosophists and spiritists. Or perhaps is it the work of self-proclaimed scholars and deluded lunatics like Godfrey Higgins, Gerald Massey, Alvin Boyd Kuhn? Or have you just recently read Tom Harpur's equally preposterous 'The Pagan Christ' and made his views your own? Or did you get this off the Internet? Maybe you watched Zeitgeist and accepted it all as truth (whose claims concerning religion, incidentally, are largely based on the aforementioned authors). I will very be surprised if you cite anything other than the authors mentioned here. If you do, they're likely to be authors whose references will cite them profusely. 20th c. archaeology, linguistics, etc. have thoroughly disproved these theories, and it is most unfortunate uncritical and prejudiced minds today are ignoring 100 years of scholarship and exhuming archaic bogus notions whose falsities are evident to even only the slightly critical and diligent mind.

A little advice, stop reading Dan Brown, blogs/books by new-age nut-jobs, conspiracy theorists and the like. If you want a real understanding of Biblical Monotheism, before even dealing with the 'Jesus Event', I suggest anything by Mark S. Smith, particularly:

- The Early History of God: Yahweh and the Other Deities in Ancient Israel' (1990)

- The Origins of Biblical Monotheism: Israel's Polytheistic Background and the Ugaritic Texts (2000)

- Rainer Albertz, whose numerous writings on the origins of Israel, monotheism and Judaism are illuminating

- The Triumph of Elohim: From Yahwisms to Judaisms, Diana Vikander Edelman, Ed. (more purely archaeological in perspective)

On the origin of Christianity to the emergence of Christendom and it's interaction with the Roman Empire, read Peter Brown, especially:

- The Rise of Western Christendom: Triumph and Diversity, A.D. 200-1000.

- Power and Persuasion in Late Antiquity: Towards a Christian Empire

- Authority and the Sacred: Aspects of the Christianisation of the Roman World

On Jesus, the Gospels, etc. I don't know what to suggest, but from what I understand, Raymond E. Brown is a recognized authority on the subject, appreciated by both Catholics and non-Catholics. At the very least, I'm sure his bibliography will come in handy.

I realize this is way off topic of the thread, but I couldn't let this pass. Sorry.

So my guess was correct.

My parents tried, but then they made the mistake of sending me to a Jesuit high school. I had four years of religion classes where we discussed:

While at various times in science class we were learning about acids and bases, combustion, or, don't tell your parents, evolution.

I weren't no practicing Old School Catholic after that. Thank God I'm finally an atheist now.

Interesting comment.

When it comes to any one specific religion (i.e. Christianity, Judaism, Islam, etc.), certainly it must be "learned" and the adherents make sure that religious schools (madrassahs, etc.) are established and fully funded to perpetuate the belief in that one specific religion.

When it comes to religion in general, there may be a biological imperative.

It certainly "feels" like there is some other being listening to each of your prayers, watching and judging your every move, rooting for "you" to live long and prosper.

And who do "you" think this other being is?

That's right. It's the other parts of your brain. Call it God. Call it "spirituality". Call it what you want. It's there and it's real. Which is why some form of religion will always persist and thrive. Because it's part of our biology. Because it "feels" right.

_______________________

p.s. Some more additional links on the same topic:

Talking to yourself

Talking to Yourself is Good

Cartoon

Try not to Fall

I call it self-awareness.

Humans are the only living creatures that possess this faculty..........as far as I know anyway.

Very unlikely.

Pretty much every social mammal has to "model" in its own brain, the expected behaviors of others in its social group. Each member of a pod of killer whales, for example, needs to understand what the others are doing during a coordinated hunting maneuver.

It is not much of stretch to imagine that the ability to model the behavior of others extends to modeling one's self as well, hence, self awareness.

___________________

The family dog knows full well which family member is most likely to drop food under the table during dinner and understands full well that it should position its self near that other member of the social pack. That behavior implies the ability to model others (of another species) and the ability to model one's self. The latter is self-awareness.

When taking my first (and last) economic course about 30 years ago it struck me that all the work of economics had forgotten a basic premise. If it takes one person to feed one person via hunting or agriculture (or one family to feed one family) there is no economy. If that person or family has some time to spare they might create a few goods to trade (arrow heads, baskets, eggs). I have lost the links but I think it was USDA that provided me with the information that in the 1700's in the Americas it took 10 farmers to feed 11 people. Thus one person was freed for a different job out of every 11. Now the ratio goes the other way and in the US 1 farmer feeds about 80 people.

The basis for any economy is how many people can one person feed. All else flows from that basic. This concept which is obscure to most now may become painfully clear in the (possibly quite near) future.

Most of what we call our economy is that excess we can produce because we don't all have to feed ourselves.

I think the 10 farmers in the 1700's were "farming" fewer hours (on the average) than we work. They spent time building their own houses (repairing neighbors' etc...), splitting wood, making their own furniture or having very little, making their own clothes and bedcovers. Appalachian women had to make 8-10 quilts for each family member in the 1800's (!!!). And they also hung quilts on walls for insulation. The saving grace was the quilting bees and barn raising, which made all the work a lot more fun. The downside was that any mishap (say an adult died of pneumonia) would plunge the whole family into economic despair - there was no buffer.

In "The Story of Stuff" the claim is made that 90% of what we buy ends up in the landfill or otherwise consumed within 6 months. That sort of oversupply must be fossil fuels. We are trading "gold" someone has been pumping out of the ground, and our overwork results in making some people at the top insanely rich while we drown in revolving doo-dads. So far, everyone I've mentioned the 6 month statistic to has replied that it can't be true for them. It sure isn't true for me but then again my house is awfully cluttered... .. ;o)

Capitalism : A marvelous mechanism for turning natural resources and slave labor into air pollution and landfills.

How insane is this Rube Goldberg machine called capitalism?

We take the stuff out of the ground bust our assess transforming into some other form and then put it back in the ground!

I remember the comment about needing fewer farmers freeing up others to work in other occupations from economics class as well.

I think we have about reached the minimum on the number of farmers.

If I had to produce my own food without fossil fuels, though, I would do pretty badly, just producing enough for one person. For one thing I don't have the knowledge. For another, I don't live in an area well adapted to agriculture (soil is clay with rocks mixed in - trees grow well, not much else). In addition, I would need seeds of the right type, adapted for the area. I am not sure how I would deal with deer, birds, and insects who want to eat what I am growing. And assuming I could get things to grow, I would need to keep the fertility up.

Eat 'em. That'll learn 'em.

In like manner it was the discovery of a novel goat grass hybrid -- I think anthropologists call it by the hypothetical name "Emma" -- that for the first time in human history allowed proto-farmers to easily collect and process more food than they could eat, which in turn allowed them to settle in fertile valleys and create proto-cities containing artisans, soldiers, teachers and merchants who could be fed from the surplus. The rest is (literally) history. The importance of being able to reliably create more food than you can expect to consume is perhaps the most important foundation stone of civilization ever laid. At the end of the day it may turn out to be the ONLY foundation. It may be that civilization simply cannot endure in the absence of a reliable surplus of food, and the greater the relative surplus (and the longer you can sustain it against adversity and invasions) the more "civilized" you get to be.

Well that and a steady supply of wood or other cooking approaches :)

I think you hit on one really key point. It should become the ONLY foundation.

I guess a really good way to look at it is to design like you would anything else a society built on reasonable agricultural excess that is designed to have minimal impact.

Obviously farming will always have some impact but I think we could determine what we can do without seriously impacting biodiversity then back down even a bit further that that.

That would be our base case we would work from. I suspect with some work we could even introduce a lot of forest style gardening that would lower the impact even more.

That would form your base society if you will then you start working through all the requirements for a comfortable life and minimizing the impact of those.

I see no reason that a pleasant equilibrium condition is not possible we achieved it in the past with far less knowledge and just sometimes only for a few etc but still.

And yes there are social aspects and they will need to evolve. A flower child like innocence approach is probably not the answer any more than some sort of tyrannical solution. I have to think that as we work on the problem of physical balance that we would also discover that we solved the problem of social balance in the process.

Not sounding like my typical doomer self today but I'm not a doomer I just believe we have to make fundamental changes and without recognizing this we can't succeed.

It isn't a matter of "it should be". It is obviously the difference between the number of people-hours needed to produce food+clothing+shelter and the number of people-hours available in total that can go into arts, finance, politics and the other trappings of civilization.

The elites are those that have figured out how to tap into this excess, in modern capitalist societies this is done by giving as many people as possible "sub-elite" status and siphoning off as much of their excess hours as one can get away with.

Unless you know exactly how this trick works and are taking advantage of it, you are not one of the elite. At best, you are one of the sub-elites that is managing to preserve a greater fraction than average of your surplus hours from being siphoned off to someone else's benefit.

Lest I sound overly cynical, this is not the worst possible system out there, but it is a bit demoralizing when you first figure out the rules and find out that you've been playing the wrong game for most of your life.

Once I was asked the Question:

"How do you get rich?"

My reply:

"Position yourself to take advantage of the efforts of others."

You are not cynical you are correct.

Now I am older and I see the the wrong in this system of exploitation.

I think that the people that produce are so busy and occupied with producing that they don't recognize the fact that they are yoked beasts of burden until something causes them to examine the situation.

Right now the situation is being examined and exposed and it seems we are on the cusp of a paradigm shift.

Id like to understand how fractional reserve ratios could be inserted into this article.

Much mention is made of the religious objection to charging interest. But it would seem to me that interest by itself wouldnt be nearly so destructive if Banks were only allowed to lend money that they actually have. The concept of interest is simple and merely takes into account the value of time. Its when banks can loan up to 10 times the amount of money they actually have that they "create money from money".

I tend to think that its that leverage that really makes the financial world divorce itself so quickly from reality. If we stuck with a physical backing behind EVERY paper note then I think we would have been safe even with interest rates. But with fractional reserve banking came reserve currency.

Also what interests me is what other currency exsisted aside from gold. For regular folks gold and silver might have been a bit "rich". What other materials were folks using for trade? Candles? whale oil? Olive oil? Something non-perishable, that had value and energy but wasnt as dense in value as gold?

There is a publication put out by the Chicago Federal Reserve that explains Fractional Reserve Lending.

According to this pamphlet the Banks are not allowed to lend out 10 times the deposits they have but 90% of the deposits and must retain 10% for withdrawals.

The problems, if you will, are created when that lent out 90% is deposited in another bank and considered a deposit and 90% is lent out again.

This theoretically could go on to infinity but converges on approximately 10-1. For example; If I deposit 1000.00, 900.00 can be lent out and deposited in another bank then 810.00 can be lent out by that bank etc.....

Google Modern Money Mechanics.

Now I believe that there is rampant fraud throughout the banking system and the interpretation of this fraction is probably the way you understand it.

I believe that even if the banks are audited that it is fraudulent and the auditor is being compensated by the bank to give them a clean bill of health.

Why wouldn't it be this way? That is exactly what is happening at the highest level of the system right before our very eyes.

After all, the tone is set at the top.

Criminals are running the country and all the institutions both public and private.

It is time for a overhaul.

Inflation is known for centuries. In Roman times it was with metal (cheaper - like iron or copper...) coins. It is not that our TPTB invented their policies out of their asses.

Inflation tax is the best tax ever - very slow and hard to notice.

Salt was one and is the origin of the word Salary.

Rome paid the military this way.

Porge

There is a very good book Salt A world History by Marl Kurlansky pertinent to this discussion.It's a very good read,about one evenings worth,chock full of interesting historical info.I reccomend it highly,and you can get it at Amazon for five bucks.

Thanks, I need something to read right now.

Ugh. I hated that book. I picked it up with high hopes. It turned out to be a rather boring collection of ancient recipes for salting foods.

I was very disappointed with it.

Hi,

This is my first post here.

What about Salt as the basis for currency?

Salt will always have value - it takes some energy and effort to obtain it,

and

Salt can't be hoarded - if I try to corner the Salt market, you go to the Sea and evaporate some more.

Not a likely basis for currency today, but later?

(Thanks to Lisa S. for the idea.)

It is too abundant and also it dissolves in water. The reason it was so valuable in the past was probably it's food preserving qualities.

Maybe it will be more valuable in a post refrigeration future but I doubt it will be currency.

Salt is a nutrition essential and lack of it will cause death; however, the daily amount of sodium required is only about 300 milligrams. Where I live in the humid southeastern US the some early Native Americans were known to have died from salt deficiency. We routinely eat many times that amount from things like ham and other cured meats and cheese. Which brings to mind my favorite way of getting enough salt, namely, a ham and cheese sandwich and some tortilla chips.

When people list the things most necessary for survival they have a serious blindspot about salt. Without salt you can be dead within hours, and a great many have indeed thus died. Unless you eat enough meat it is very hard to find it other than from the sea or from (rare) salt mines. For these reasons it is one of the most crucial assets. The Romans built huge long roads to salt mines with good reason. www.droitwichspa.com/history/ironage.htm

Thanks for the eye opener..I am starting to hoard salt now while it is still almost free.

This is getting silly.

Did you ever hear of the Licks of Ky? Rivers that contain salt. Or springs that contain a degree of salt?

So D. Boone went to Blue Licks or perhaps the Licking to boil down the water for salt. He was supposed to have traded in salt. Captured by the Shawnees, I belive the Shawnees, he was made a blood brother.

Anyway my understanding is that the cherokee and others using wood ashes as lye to create their 'samp' or porridge of corn( I call grits) and thereby partook of a degree of salt. Yet they also knew how to obtain it.

If the Native Americans had to rely on salt mines or the oceans then just how the hell do you think they survived? Really!

And did you NEVER hear of a SALT LICK???????????????????????????Jeez.

Dead within hours? What a load of garbage. I can easily go without salt for a long time and do so. I do NOT live solely on store brought foodstuffs!! and unless I put salt on it or its there naturally then I do not eat salt and that can be for more than one day , easily.

Where does these urban legends or whatever come from? Who makes this stuff up?

I was going to not post anymore today but this sheer stupidity was a tad too much. You get a F for todays grade.'

Airdale

PS. I used to live right beside the Salt River in cental Ky. I wonder why they called it that???? Check it on a map.

See http://en.wikipedia.org/wiki/Bullitt%27s_Lick

I hope you didn't include my sarcastic hoarding statement in your rebuttal.

I stand by the ancient value being in it's preservative qualities and not because it was a necessary to survival as water.

My reply was to the comment above yours. RobinPC's.

Suprised no one else called him on it. And way Off Topic I might add.

I was recently chastised for being Off Topic so I won't add to it any further. The whole thread was in fact. But bullshit it still bullshit,salted or otherwise.

Airdale

Fractional Reserve Lending magnifies the problem (and the risk), but the interest still has to come from somewhere (otherwise, the non-lending part of the economy runs out of money). Money has a time value because of the notion that it can be put to work to make even more money.

JB

That is true while the economy is growing. Since the economy actually started to shrank, TPTB have to deploy bigger guns. In the process a lot of money is lost, but that's nothing to be surprised about.

I would call it "doubling down". Go for broke.

I think that a lot could be corrected by linking the profit of the financier to the success or failure of the entrepreneur. Equity share if you will.

If you can keep the lenders skin in the game than he wants the venture to succeed and is not merely trying to confiscate the assets of the borrower.

The later is the SOP of the banking industry.

They put up fictitious value and hope to steal real wealth for there privilege of creating phony buying power.

So I agree no or less leverage but mainly the creditor and debtor sink or swim together...that will align the interests of both parties.

Our banking system is nothing but a swindle game in it's current incarnation.

Interest continues to be problematic though when this is a steady-state (no growth) game as any given investment is just as likely to succeed as it is to fail. In the world we are accustomed to, more enterprises succeed, which is why people are willing to borrow. If we focus on designing sustainable systems, that return to nature as much as they extract, then there is no profit in the system overall, and lending only makes sense in an "exchange" sort of way (I got surplus this year, and will lend to you, but I may need your help next year - I can't expect to get more back than I put in, even if some time has gone by!!).

What about improvements in efficiency as a way to "gain"?

That is, less waste, more product.

I agree that growth is over but doing more with less will always be a possibility and has basically been the story of technology.

Really the mess is so far gone at this point that most of these comments are nothing but an academic exercise.

Why?

Consider this investment:

This is entirely supportable in a steady-state environment, as it just represents a transfer of money from one's most productive years (mid-life) to lower-earning years (retirement/start of career). The retired couple made the transfer by saving; the young couple makes the transfer by borrowing. There's no need for increasingly large amounts of money; advance two generations, and the young couple is now the retired couple, and the grandchildren of the original retired couple are now forming their own young couples.

Interest is just rent on money; it no more requires growth than rent on a house does.

I think that your example does not imply what you think it implies. Of course it is true that the people who are still working provide income (in the literal sense of the output of goods and services) for the people who are retired, since no other physical possibility exists. However, your example ignores the fate of the principle. If the retired couple does not spend down their principle then their heirs will. If the interest represents anything other than inflation, then the excess purchasing power must correspond to excess production. Deferring consumption is not the same thing as earning interest.

The principal only grows if someone is willing to take on additional debt. Simple exercise: I buy a bond that matures in one year and pays 5% interest. In a year's time, I'm paid $1.05. If I can't find someone to borrow the full amount at the same interest rate, the process doesn't continuously replicate itself. Some of the posters here are like little kids that just discovered compounding. Just because you can do an exercise on a calculator doesn't make it meaningful analysis.

That's a fundamental misunderstanding on your part. Compound interest doesn't magically create money; it's nothing more than a way of calculating how much something costs.

If it helps you understand, think of it this way: the retired couple loans $100,000 and the young couple pay them back $110,000 over the next 10 years.