World Oil Exports; US Oil Imports; and a Few Thoughts on Canada

Posted by Gail the Actuary on August 13, 2009 - 10:15am

Matt Mushalik from Australia was good enough to send me this graph of world oil exports, calculated from new oil data provided by the EIA.

This inspired me to put together a few other somewhat related graphs, relating to oil exports and US imports. Since Canada is such a tiny piece of world exports, but seems to be mentioned as a possible major source of future US imports, I have looked at it separately as well.

The likelihood of a huge ramp up in imports from Canada seems remote. Canadian exports to the US require continued imports to the East Coast of Canada. If imports of oil to Canada decline as world exports decline, US oil imports from Canada may also decline, because ramped up production from oil sands may not be enough to offset declines in production and imports elsewhere.

The major thing we note from Figure 1 is that the peak in oil exports seems to be in 2005, with recent exports down less than two percent. If oil production in 2009 is down, it is likely there will be a bigger drop off exports than in prior years. The two major exporting countries are Saudi Arabia and Russia. The graph seems to indicate that at least thorough 2008, exports are relatively level for the two large exporters.

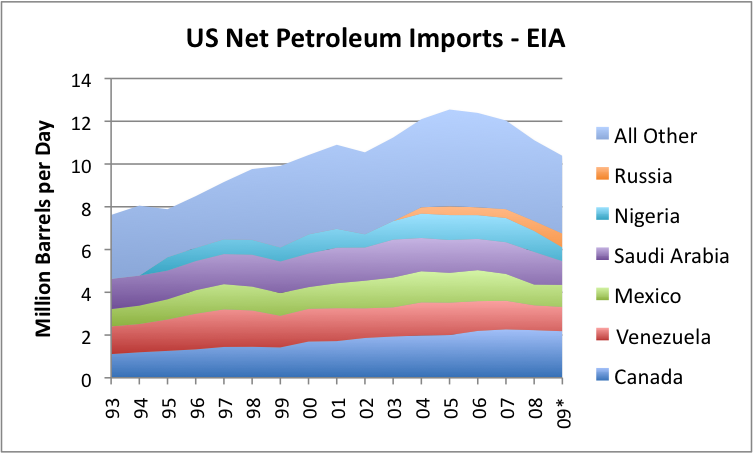

In the US graph, the peak in imports is also in 2005, with a much steeper downward slope than in the world export graph. This would suggest that the US is being outbid elsewhere on imports.

On Figure 2, I have shown US imports separately for the largest US sources. The most consistent of the exporters over the period (up until 2009) was Saudi Arabia. Mexico's exports have been declining, as have those of Venezuela. The only country whose exports to the US have been increasing is Canada.

But if a person looks back at Figure 1, Canada is only a thin light green line near the top of the graph, with relatively little net exports. How can it be ramping up exports to the United States?

I decided to look at this a bit further.

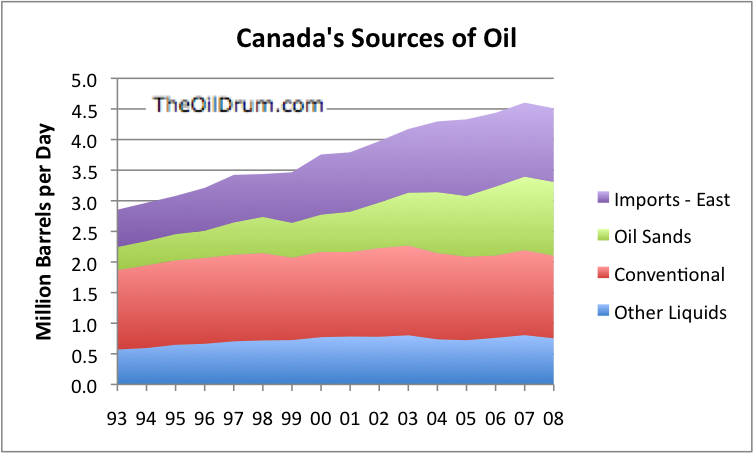

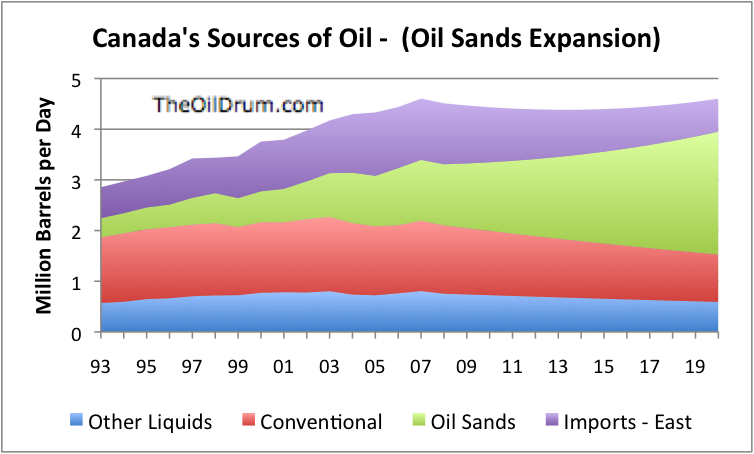

If one looks at Canadian data, using a combination of EIA and CAPP data, one discovers that Canada's sources of oil look like this:

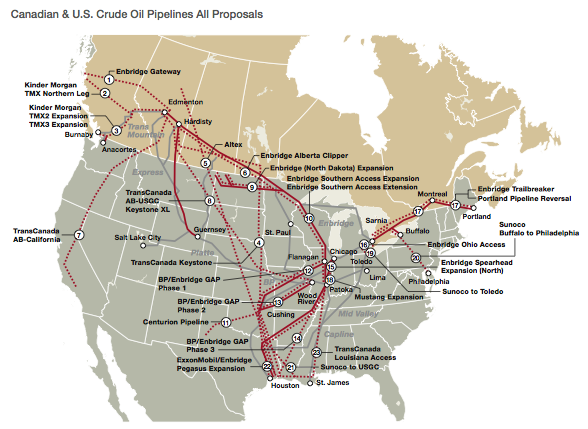

The way that Canada can be a major exporter to the US, even though it doesn't produce a whole lot more than it consumes, is by importing oil on Canada's east coast. I haven't seen any exhibits showing where this is from, but various comments usually seem to suggest that this is mostly oil from the Middle-East. Because of geography, it works out that Canada ends up consuming most (or all) of the imported oil itself. The oil it exports to the US it exports in pipelines from Canada's west, that come down the middle of the US, as shown in Figure 4.

The way the current pipelines are configured, the US is almost a captive market for oil exports from Canada (although it is possible to get oil back up to Montreal, for example). Proposed pipelines would take oil to the West Coast of Canada, for export to China and the Far East.

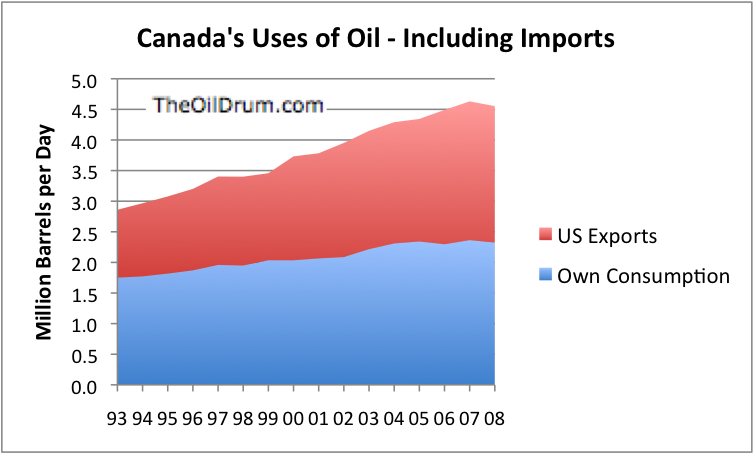

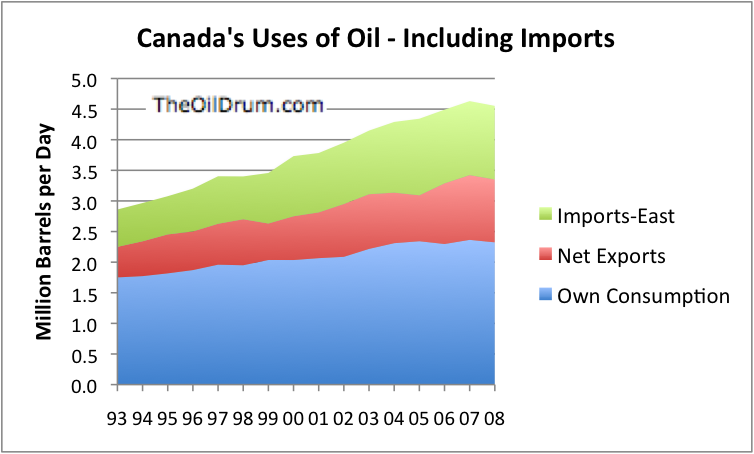

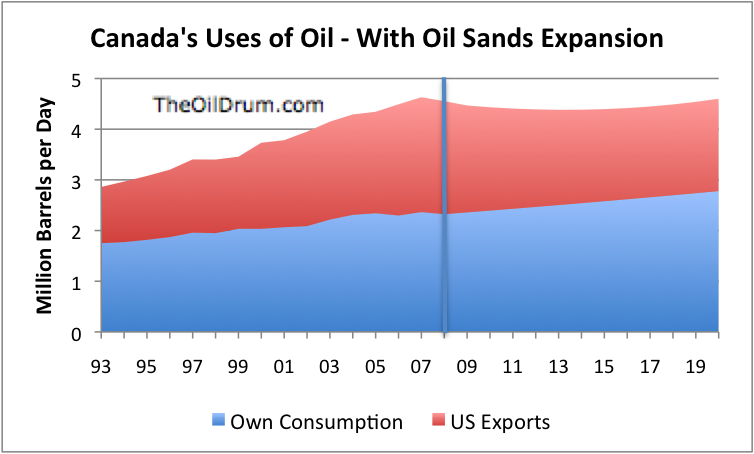

The above graph takes the total oil available to Canada, including imports from the East Coast and divides it between Canadian consumption and net US exports. It is clear that US exports have been growing more rapidly than Canadian consumption.

We can also break Figure 5 out to show how Canada's imports affect what is available. Figure 6 splits exports to the US (from Figure 5) into two pieces--those that are indirectly supported by Imports on the East Coast of Canada, and those corresponding to Canada's net exports.

From Figure 6 we can see that more than half of US imports are available because of Canada's East Coast imports. Both Canada's East Coast imports and its net exports have been increasing in recent years.

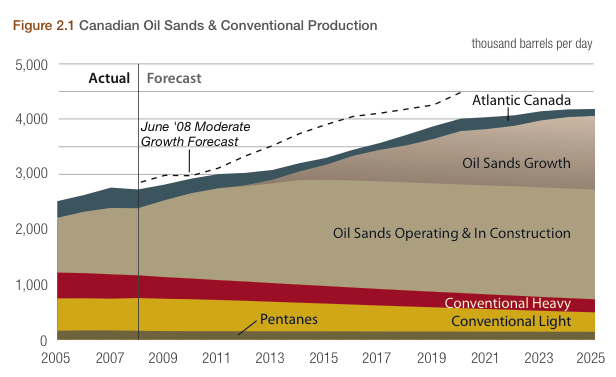

So what is likely to happen in the future to Canada's oil production and exports? The Canadian Association of Oil Producers (CAPP) puts out some quite high estimates of future oil sands production. Other types of Canadian petroleum production are expected to decline, partially offsetting the increase.

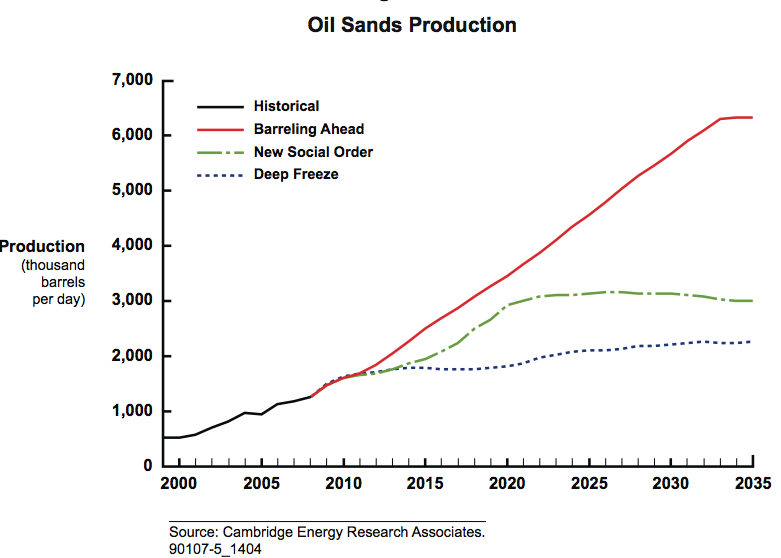

Cambridge Energy Research Associates (CERA) recently made forecasts of Oil Sands production. (Their report is available free with registration at this link!)

CERA's two lower forecasts are below the one made by CAPP. The "Barreling Ahead" forecast seems to be somewhat above the CAPP forecast.

My own view is that is technology and price will be the biggest determinants of the extent to which oil sands production is expanded. Necessary price to expand production will depend on whether a carbon tax is imposed, and also on whether royalties remain at the current level or increase. Both of these suggest that necessary price is likely to be quite high-likely $80 to $100 barrel or more, in the absence of technology improvements. If the necessary price for expansion is quite high, I would expect that one of the two lower CERA projections would be most likely. If there are big improvements in technology, production costs might be lower, and output might be higher.

Assuming production is in the range of CERA's two lower projections, I put together a very rough forecast of what Canada's sources of oil in the future might look like.

In this forecast, I show East Coast imports decreasing by 5% a year; conventional production decreasing by 3% a year; and other liquids decreasing by 2% a year. Oil sands production is assumed to increase by 6% a year, so that by 2020, it is 2.4 million barrels a day. In this scenario, the total oil available to Canada stays more or less flat, dipping somewhat between now and 2020.

If Canadian consumption continues to rise, the amount available for US exports will decline. In Figure 10, I show what US exports might look like, if Canadian consumption increases by 1.5% per year, and the US gets the balance as exports.

Figure 10 shows that even with Oil Sands expansion, there is a significant that chance that imports of oil from Canada will decline between now and 2020.

One thing I should point out is that as I read Canadian commentary about Canadian oil, there seems to be growing unhappiness about NAFTA and the United States having almost a monopoly on oil produced in Western Canada. Some of the comments I have read include the following. (See for example Tar Sands by Andrew Nikiforuk).

• Why should Canada run the risk of a sudden decline in imports, and the US get secure oil?

• The price the US pays is artificially low, because of the pipeline structure. China would probably pay more.

• Oil sands producers should pay more in royalties than they are (even with the recent increase).

• The US takes the oil Canada exports, and sells gasoline for $2.50 a gallon. Canadians now pay $1.00 a liter at the same time US citizens pay $2.50 a gallon. It isn't fair that Canadians are taxed to keep consumption down, but the US isn't.

• When Canadians export oil to the US, the Americans get all of the refining jobs. If Canada kept the oil in Canada, it could keep the refining jobs for itself.

• Why should Canada get hit with a charge in our carbon emission calculations for oil it sends to the US? If Canada is going to be charged for the emissions, it should at least be using it itself.

I expect these beliefs will become more widespread, as Canadians begin to understand the peak oil situation. Even now, there is a fair amount of writing indicating that if Canadians had their way, they would keep the oil they are producing for themselves, or sell it elsewhere.

If the US decides because of greenhouse gasses that it doesn't want Canadian oil, it seems to me that that decision would have little bearing on whether Canada produces oil from the oil sands. Many Canadians would be more than happy to get rid of us as competitors for their oil. The result would be that we would get less oil piped to us in the mid-section of our country. Canada might import less oil from abroad, and we theoretically would be able to buy that oil directly ourselves.

One issue might be logistics, though. Pipelines from Canada serve the Midwest. A shortfall in oil would likely hit the ends of the pipelines (and trucked supply lines) in the Midwest. I would expect that the ones hit disproportionately would be Midwestern farmers. It is not clear that it would be easy to get alternative petroleum supply to the farmers. It seems like oil piped up from the Gulf Coast would likely be inadequate as a substitute for a shortfall. This would especially be the case if an overall shortfall occurred because of a hurricane.

It seems to me that we are likely looking at a reduction of imports from Canada in the next ten years, even under the best of circumstance (unless a huge improvement in technology allows a big ramp up of production from the oil sands, and we decide we can live with the CO2 emissions). If a reduction in Canadian imports in likely, we should probably be thinking now about rationing schemes that would protect the farmers from loss of diesel fuel, if there is an overall shortfall in supply.

The Wicks report on Energy Security recently published in Britain gives a very different impression about oil sands exports. The Wicks report paragraph 2.27 says

It is expected that over half of all the oil consumed in the world in 2030 will be traded across national borders. . . In contrast North America becomes much less dependent on imports, dropping by almost a half, as production from Canadian oil sands increases.

If the authors would sit down and look at all of the pieces, I doubt that they would come to any such conclusion, in the absence of a dramatic change in technology. CERA's two lower forecasts are showing 2030 oil sands production to be similar to 2020 production. If oil sands production is similar, and other pieces in Figure 9 are lower, Canada's total oil available will drop by further by 2030. If its consumption continues to rise, as in Figure 10, the amount available for export in 2030 will be lower yet than I am forecasting for 2020 (which in turn is lower than now).

In 2008, oil sands production was 1,213,000 barrels a day, according to CAPP. I am forecasting it to approximately double by 2020. Production would have to ramp up a whole lot more than this to make a meaningful difference to North American oil use.

The three key characteristics of Net Oil Export (NOE) declines are as follows: (1) NOE’s tend to decline at a rate faster than production declines; (2) The NOE decline rate tends to accelerate with time and (3) NOE declines tend to be front-end loaded, with the bulk of post-peak Cumulative NOE’s (CNOE’s) being shipped early in the decline phase, e.g., two years after hitting its final production peak in 1996, Indonesia had already shipped 44% of their post-peak CNOE’s, even though their 1998 NOE’s were only 9% below their 1996 rate.

The difference between production and post-peak CNOE’s for Indonesia is even more striking. If we round off to the nearest 0.1 mbpd, Indonesia’s production was approximately flat from 1996 to 1998, inclusive, at about 1.6 mbpd, but as noted above by the end of 1998 their post-1996 CNOE’s were 44% depleted--almost half gone in only two years, despite virtually flat production, on their way to net importer status six years later, in 2004. You can see the obvious implications for world oil production versus world NOE’s.

I suspect that a rough rule of thumb is that about 50% of post-peak CNOE’s are shipped in the first third of a NOE decline phase, with the other 50% being shipped in the final two-thirds of the decline phase. This is roughly what Sam’s modeling shows for the top five net oil exporters (Saudi Arabia, Russia, Norway, Iran & the UAE).

Regarding our three closest sources of imported oil--Canada, Mexico & Venezuela--their combined NOE’s fell from 5.0 mbpd in 2004 to 4.0 mbpd in 2008 (EIA), and all three showed year over year NOE declines in 2008, with Mexico and Venezuela showing multiyear, and accelerating, NOE declines.

Looks like by 2015, the US will only be able to import 6 mbpd versus 12 mbpd back in 2006.

If this comes true, then the US will have a lot of adjustments to make very quickly.

Such as:

- Increase average gas mileage for cars (by at least 20 mpg)

- Less Airline travel (50%)

- More Local foods

Nowhere,

There will soon be a lot LESS food ;( in total but you are correct in that there will be a larger PERCENTAGE of local food;).

I believe we need to get started letting the world know that the airline industry pays no fuel tax,which is a highly regressive tax IN EFFECT for the non flying public-and most of us don't fly all that often,if at all.

The fewer the road warriors crisscrossing the world selling junk and mergers,the faster we adapt.

The people making thier living as a result of cheap air travel are screwed any way you look at it,and the faster they get started looking for a new meal ticket the better.

westexas, the graph above shows NOE from these 3 countries is about level from 2004-2007 and then falling to about 4 mbd in 2008.

Here is what I came up with for combined NOE's from CMV by year (EIA), and the year over year exponential rate of change:

2004: 5.0 mbpd

2005: 4.7 (-6.2%/year)

2006: 4.8 (+2.1%/year)

2007: 4.4 (-8.7%/year)

2008: 4.0 (-9.1%/year)

If all three countries were just conventional oil producers, we could extrapolate out the decline, which would suggest that they would collectively probably be approaching zero net oil exports around 2029 or so. For the sake of argument if that were the case (approaching zero around 2029), in the 2005 to 2008 time period, inclusive, they would have shipped about 30% of their post-2004 CNOE's. Of course the unconventional stuff makes the projections much more complicated.

In any case, the three countries provide yet another example of the crucial difference between production and NOE's. Their combined total liquids production fell by only 6% from 2004 to 2008 (from 9.8 mbpd to 9.2 mbpd), but this 6% decline in production, plus some increase in consumption, resulted in a 20% decline in NOE's (from 5. 0 mbpd to 4.0 mbpd).

Incidentally, their combined consumption as a percentage of production in 2004 was high, almost 50%, and consumption as a percentage of production is the biggest factor driving the NOE decline rate (assuming that falling production and/or rising consumption are causing NOE's to fall). The observed 2004 to 2008 production decline rate was -1.1%/year, with a +2.0%/year rate of increase in consumption, from 4.8 mbpd to 5.2 mbpd. If we extrapolated this out for 10 years, their combined net exports 10 years hence would be 2.5 mbpd (production of 8.9 mbpd and consumption of 6.4 mbpd). Of course, as noted, the unconventional factor is a wild card.

Also, as I pointed out in the post, Canada is really depending on imports from the East to support its exports to the US. It is because of these imports that the US can import a whole lot more oil from Canada than Canada exports on a net basis.

This dependence on Canadian imports puts us more at risk than we would otherwise be. We can assume that NAFTA will protect us, and Canadian citizen will bear any shortfall in imports, if there is one, but as a practical matter this can't continue for long.

Of course, the key problem for the Canadians regarding domestic production is that there are very few pipelines running west to east within the country, so at present they don't have a choice; they have to export from the west and to import into the east.

In any case, the -1.1%/year combined production decline rate was the net result of some increase in Canadian production partially, but not fully, offsetting the 2004 to 2008 declines in production in Mexico & Venezuela. I would expect to see this pattern continuing for a while. If their combined production was down to 8.9 mbpd in 2018, a drop of only 9.2% from 2004, their combined net exports would be down by 50% from their 2004 rate, assuming a continued +2%/year rate of increase in consumption.

There's much misunderstanding about what NAFTA says about oil movements between Canada and the USA. NAFTA says that Canada can't reduce its exports to the USA faster than it makes reductions to domestic customers.

Does Canada regulate the actual volume exported? I don't know. If not, and the market controls what is exported, do the NAFTA restrictions apply? It's a viper's nest and Mexico was wise to opt out of this provision.

Yes, there is a misunderstanding about what NAFTA says about oil exports. It is true that the Canadian government agreed that it would not cut back sales to the U.S. more than sales in Canada. The misunderstanding is that the Canadian government does not control the oil in Canada. The Canadian constitution assigns control of natural resources to the provincial governments, and as a result, the government of Alberta owns and controls most of the oil in Canada.

The government of Alberta never signed NAFTA, so this renders the NAFTA provisions somewhat moot. Alberta, as owner of the resource, can sell it to whoever it feels like, the government of Canada need never become involved, and the NAFTA provisions would never kick in. The Canadian negotiators probably realized this and signed NAFTA with a clear conscience and a straight face, knowing it was largely irrelevant.

Gail

where is the "new data" ?

the EIA link gives 2006 and forecast for 2007

If you click on specific countries, they have the 2008 data posted.

There is a spreadsheet you can download for each country.

Here's the reddit links for this post (we appreciate your helping us spread our work around, both in this post and any of our other work--if you want to submit something yourself to another site, etc., that isn't already here--feel free, just leave it as a reply to this comment, please so folks can find it.):

http://www.reddit.com/r/reddit.com/comments/9abw8/world_oil_exports_us_o...

http://www.reddit.com/r/energy/comments/9abw4/world_oil_exports_us_oil_i...

http://www.reddit.com/r/environment/comments/9abw5/world_oil_exports_us_...

http://www.reddit.com/r/collapse/comments/9abw7/world_oil_exports_us_oil...

Find us on twitter:

http://twitter.com/theoildrum

http://friendfeed.com/theoildrum

Find us on facebook and linkedin as well:

http://www.facebook.com/group.php?gid=14778313964

http://www.linkedin.com/groups?gid=138274&trk=hb_side_g

Thanks again. Feel free to submit things yourself using the share this button on our articles as well to places like stumbleupon, metafilter, or other link farms yourself--we appreciate it!

The US isn't being "outbid for exports," otherwise with level demand we'd have reached MOL in stocks long ago and peak oil would be screaming from every headline. Imports have been curbed by three factors:

1) ethanol, which accounted for 669 kb/d production in May and an estimated 600 kb/d of imports in 2008 (RFA - The Industry - Statistics);

2) demand destruction, which can be seen in this chart of VMT and finished motor gasoline supplied:

As VMT declines less gasoline is necessary for motorists, thus refineries have that much less of a need to import oil in the first place; indeed US exports are on the rise, with refiners arbitraging diesel especially, as it is in great demand elsewhere in the world and they can obtain a premium by shipping it to countries such as the Netherlands and Mexico, the latter of which imported a great quantity of product last year, coasting on the wave of revenue brought by the price run up in crude.

3) Increased refining complexity. This is an area I have little familiarity with, and would very much like to see an expert analysis of. But, in (pun alert) crude terms, as refineries in the US invest in coking units, they are able to refine the bottom grade of crude inputs into middle and light products such as diesel and gasoline, whereas before they were resigned to producing road oil and asphalt. The data is on this EIA page: U.S. Downstream Charge Capacity of Operable Petroleum Refineries; note the 7.7% increase in thermal cracking capacity (which is mostly coking) from 2004 to 2008. Thus they are able to produce more valuable output while importing less, at the expense of the aforementioned bottom grade products, which are declining in availability and becoming more expensive - there have even been occasional asphalt shortages in recent years.

The EIA also published this excellent report on the refining situation in May: Refinery Investments and Future Market Incentives. It would be great if Robert would crank out a paper on this aspect of supply.

"2) demand destruction, which can be seen in this chart of VMT and finished motor gasoline supplied:"

Isn't demand destruction due to high oil prices -- i.e. being out-bidded. Dollar's been on a long trending slide down that is part of the losing bid too.

Not really, because prices have dropped since a year ago but the demand hasn't picked up. The VMT decline is a reflection of the economic downturn, influenced both by the decline in highway truck traffic and in lower consumer activity. Gasoline consumption is also being reduced, at last, by the entry of more fuel efficient vehicles into the in-use fleet.

Outbid on the personal level - you can think of it that way, if you consider life an auction. But cutting out consumption equates to just walking away from the bidding; or not taking part in further auctions, does this metaphor really hold? We hold a new auction every day, as well.

Also the ethanol is tantamount to having...let's say friends of yours in the auction who will do your bidding for you. At any rate these lessen the need for the US (and other countries) to purchase the oil in the first place, placing them outside of the bounds of the oil market per se - a bit akin to the net oil exports phenomenon, where the oil that is shipped is in a different class than total production.

CAFE only really goes on an upward trajectory in 2011, I want to build some simple growth forecasts on the US auto fleet to see what gains will be made from the new goals. We'll not be purchasing cars in the volumes we have recently, that's for sure.

The refineries for syncrude are in the US midwest.

Western Canada has .6 mbpd of refining capacity.

Eastern Canada has 1.2 mbpd of refining capacity,isolated from

syncrude.

Why would Canadians build pipelines or upgrade most of their refineries?

Nationalism?

Nonsense.

About as sensible as Hugo Chavez trying to sell his oil to China.

50% of Venezuela's production still goes to the US even after almost a decade of oil the most strident anti-Americanism on earth.

http://www.csmonitor.com/2008/0103/p06s01-woam.html

Venezuela's existing fields(2 mbpd) are depleting fast(25% say some) and extraheavy production is rising slowly(.6 mbpd). Also domestic consumption is getting significant(worthy of exportland analysis).

http://www.eia.doe.gov/cabs/Venezuela/Oil.html

http://www.canadainternational.gc.ca/washington/bilat_can/energy-energie...

And if you think unraveling a close energy relationship is easy consider the natural gas situation between Ukraine and Russia.

You make a good point about the close tie between Russia and the Ukraine, and the parallels to the US / Canada situation. One can understand why friction would result, especially if Canada finds imports from the East lest available, and is increasingly criticized for CO2 emissions that really don't benefit Canada directly.

I think jobs are becoming more of an issue. This is why there is more thought about Canada refining the oil themselves, especially related to any increase in production. But this would require a big investment in facilities. In the states, there are oil refineries that can be refurbished at less cost, to do the same thing, I would expect.

The ties are obviously much closer than just oil. Something like 79% of Canadian exports go to the US. A bad American economy, almost by definition, translates into a bad Canadian economy. This is one of the reasons that they would like to find some other customers. However, intentionally squeezing oil exports (or gas, or electricity) to the US would potentially have substantial economic consequences for both economies. Diversifying the customer base isn't that easy, especially in the age of increasing, and increasingly volatile, oil prices. Most of their potential replacement customers are a long way away (high and increasingly unpredictable transportation costs, etc.) So, while they would like to diversify their customer base, it will certainly not be all that easy.

Brian

There are several reasons for wanting to build your own refineries -economic and national security.

As Gail mentioned -one is economic, job creation and the Government of Alberta is very aware of this this. Their clout is to request that future royalty payments be taken in kind for whoever builds a refinery in the province.

Refinery profits will undoudtedly increase as peak oil takes a firm grip. Refining the oil locally will ensure that these profits are taxes in Canada. In addition Canada will not become dependent on the US for its allocation of refined products. Just look at other crude oil exporting countries who do not have sufficient refinery capacity to see how they can be squeezed.Saudi Arabia is very aware that they must control part of the refining infrastructure for their own long term good.

There is also the perception that being entirely dependent on the US places you in an unenviable position -just look at the Canada-US history of commercial disputes and you need go no further than the softwood lumber dispute. There is the thinking that the price for oil being sold to the US is below fair market -exchanges are easily manipulated when governments turn a blind eye. That the only way you will obtain fair market prices is by being in a position to sell on the world market.

The proposed US carbon tax is viewed by many as beneficial for the US at the expense of producing countries. Why not simply have a carbon tax on the refined products (some Canadian provinces have such a tax in effect) rather than creating another market which will be ripe for manipulation and beneficial for Wall Street.

Gail, a very though provoking article. Something I knew but you provided numbers which gives the problem a more important dimension.

Refinery profit will plummet due to Peak Oil. Many refineries will shut down due to lack of oil to process. The refineries that survive the longest will have the lowest costs.

For Canada to build new refineries does not make economic sense when the number of refineries needed will decline.

Some refineries have shut down due to lack of oil to process. Many U.S. refineries have been modified to handle Canadian bitumen because of a lack of domestic U.S. oil supplies.

The thing about bitumen is that it is difficult to transport, and there is a looming shortage of condensate to dilute it for pipelining to distant markets. The rational for building new refineries in Alberta is that it is possible to transport oil as far as the big refinery complexes in the Edmonton area by using heated pipelines, eliminating the need for diluent.

An even better argument can be made for building bitumen refineries in the oil sands themselves, because then there is no need for diluent or heating. Oil sands go in the front end and gasoline and diesel fuel go out the back. The main problem with this is that it is expensive to build things that far north, and there aren't enough people up there to build or operate them.

Another problem is that it would obsolete the refineries in Eastern Canada, since the whole country could be supplied by product pipelines from Northern Alberta. This would go over badly in the East. Eventually, however, after Peak Oil cuts off their supply of imports, this may be exactly what happens. Those Eastern Canadian refineries are just not economically sustainable in the long term.

Gail --

Thanks for this post, which goes into a little more detail than high-level discussions of oil sands I've seen previously.

Not that I'm a big fan of oil sands to begin with, but this paints a pretty dark picture for this supply. If oil sands economics essentially rely on an arbitrage between its production cost and Arab Heavy + tanker, oil sands will remain in a precarious position. The U.S. can get whatever international supplies Canada gets, at roughly the same price, with more ability to store. Oil Sands will essentially fluctuate as the swing supplier based on U.S. demand. Oil producers can scarcely hope to make this work as their core business.

It is my understanding that the upgraded oil produced by Syncrude trades at about the same price as West Texas Intermediate. The bitumen has to be mixed with Syncrude oil or with another dilutant, and the resulting mixture trades at a discount to WTI. I believe the Syncrude - Bitumen blend (about 50% - 50%) trades as Western Canadian Select blend.

I understand that at this point, there is a shortage of heavy oil, because OPEC has disproportionately cut back in their production. See this article:

Heavy Oil Prices Defy Logic

You can find a readable description of the different grades produced in the Western Canadian Sedimentary Basin here.

Steve ,If the projected annual rates of world wide depletion are even in the ball park,it seems to me that prices will be high enoug and supplies tight enough that in just a short while they will be in the catbird seat.

Prices "should" be constantly well above their costs within five years (?)or so,assuming any recovery in demand.

Maybe sooner?

The reason eastern Canada is dependent on foreign imports of oil is the 1979 National Energy Policy (http://en.wikipedia.org/wiki/National_Energy_Policy). The NEP was imposed by the Liberals so that they could buy votes in Ontario and Quebec by stealing oil money from Alberta, about $50 billion. Alberta retaliated by cutting off exports to the easterners, as a result of which they had to depend more on foreign imports.

One reason why westerners supported NAFTA was because it ensured that oil exports anywhere would be at world prices. It doesn't matter to us whether Ontario or the USA buys our exports as long as we get fair market value. A glance at the map shows the obvious market for our surplus oil is the USA, as it is easy to run pipelines across the flat prairies. Exporting to the Pacific coast requires crossing several mountain ranges, and beating off the environmentalists with one hand while attempting to drive the trenching machine with the other.

Interesting! It seems like with enough electric pumps, it would be possible (but perhaps expensive) to get oil to run uphill over the mountains to the West coast.

What kinds of things do you hear in Calgary about oil sands? Do you hear as much of the environmental concerns there as here?

Gail - the Kinder Morgan Trans Mountain pipeline runs across the Rockies/Cascades to the refineries in Washington state already; expansion plans are underway already: Kinder Morgan Canada Completes Jasper Section of the Trans Mountain Pipeline's Anchor Loop Project. Your CAPP map shows this, along with a truly out there plan to ship oil sands crude direct to California. Also Enbridge plan to build a line to the deepwater port at Kitimat BC, to export oil sands crude and import dilutient to enable said crude to be shipped in pipelines: Northern Gateway at a Glance - Project Info.

PADD 5 demand sank back to 2004 levels last year, though, so how much additional supply we'll need is up to question. The price study conducted by Washington state last year showed relatively flat demand there; you can check this for individual states using the EIA's U.S. Prime Supplier Sales Volumes of Petroleum Products data. For my locality (Oregon) demand has been contracting the last few years, but if oil sands production dried up too much we'd likely be in a bind, as our other suppliers for the WA state refineries are Alaska and California, both regions in the depths of long term decline, making us fall back on more expensive imported crude, which has additional bottlenecks - Puget Sound has no deepwater port, and a regulation forbids anything above Panamax size tankers as well.

Interesting. I hadn't run across the Prime Supplier sales volume data before--or for that matter, the other things.

Last fall I gathered together a fair amount of data concerning how we obtain fuel in the Pacific Northwest, in the wake of Ike and Simmons talking about imminent fuel shortages; the system out here is isolated to an extent from the rest of the country, and it was noteworthy that the shutdown of the Colonial pipeline remained largely a local event - which was being investigated by the North Carolina state government, I posted a piece about that in Drumbeat in the spring, and I wonder if any progress was made there. California and, as I mentioned, Washington state have investigated price shocks and published reports.

Anyway familiarizing myself with the pipeline systems was part of the research I did. Some of those lines have been in place since the 50s; one document from the 60s listed the output of the Washington refineries, in their original configuration all <50 kb/d I think; in the meantime they've all expanded about fivefold. I came across a book about the building of the Trans Mountain pipeline early this year, too, should go back and snap that up. It was quite the undertaking, if you couldn't guess.

The Trans Mountain Pipeline has been expanded to deliver about 300,000 bpd of crude oil and products to Vancouver, but the Vancouver area has only one old refinery, which can only handle about 50,000 bpd (It's nearly impossible to build a new refinery or expand an old one in British Columbia). So where do you think the rest is going? To export, of course.

Most of it goes by pipeline to the Pacific Northwest, since Alaska and California oil production is falling, but the rest can go by tanker to anywhere in the world. China and Japan leap to mind as possible recipients. There are plans afoot to expand the pipeline to as much as 1.1 million bpd.

I was talking about the Washington state refineries such as BP's Cherry Point. PADD 5 imports from Canada were 151 kb/d on average for 2008, I assume none of this is by tanker and the main entrepont is Blaine, where the BP facility is located.

NEB approves trans mountain Anchor Loop project. | Asia from AllBusiness.com

Dale is quite correct. Much of the west has gas & oil supplies including the North. When supplies become tight in the East, the government of the day will approach the west for access the supplies. Canada is a nation of regions and depending on the party in power and the methodology of how they do this..could cause the country to literally break into pieces. Western Canada has long suffered through "Western Alienation". Many of the decisions made by the government of the day benefit Central Canada but completely ignore the needs of Western Canada. The recent auto bailout is an example. The auto industry is located in Ontario, a province with the largest number of federal ridings. The government of the day was very fast to bailout the auto industry, but people in the farming, meat, forestry and mining industry were essentially left to fend for themselves or received scraps.

In the future, I can see a showdown happening in Canada. The West versus East..and I suspect the outcome will be a nation that literally self destructs. It's common to see the provincial flag in Alberta which represents a sort of independent streak in Alberta. You can find the same thing in Newfoundland, an Island province in the East which also has oil. The Premier of that province has gone head to head with the government of the day..going so far as asking the citizens to NOT vote for the party in power..thought the man running that province is part of the same party.

A person wonders what alliances will look like going forward. If there is a financial crisis, country boundaries could get redrawn. It seems like there is at least a vague possibility of some groupings that would take some US states and combine them with some Canadian provinces--perhaps along the pipeline supply route.

A combination including oil and food production might work out pretty well. Not sure what would happen with groups of states/provinces without such a good mix of resources, though.

When push comes to shove, this world will find energy by all means necessary. When your back is to the wall and your livelihood is at stake, well the gloves are off. The province of Alberta has, in theory, up to 2 trillion barrels of crude in the tar sands. If you're the USA and you're in "need" of an oil fix..you're willing to do a lot of things. You'll send up water to increase production. You'll send money. You'll petition the government of Eastern Canada. And if things really get tough..you'll be willing to "protect" your supply. Eastern Canada may come knocking and find itself staring into the eyes of the American Eagle in need of it's oil fix. Western Canada also has substantial reserves of coal.

I guess the best way to describe it is like this. For a long time, Central Canada was the "husband" and Western Canada was the "wife". The husband had control, had the money, had the power. And the husband disregarded the wife, often ridiculing who she was, making fun of her. But now the "wife" now has the money and the energy..and believe me, she's not really happy about sharing it with that husband that had no regard for her.

the wife this summer and last summer broke the gas refinery and rendered herself destitute again for her Western driver friends in Alberta, while the East was wholly unaffected since most of his oil comes from the Middle East.

Now what will happen when her Athabasca water starts running out or her natural gas keeps declining? The wife attitude of living off the avails of Toronto the husband will have to end, (The creditcard of $1.6 Billion subsidy to tarsands from Ottawa will be cut at some point) and then what hobbies will the wife have left?

Hello Gail,

Your Quote: "A person wonders what alliances will look like going forward. If there is a financial crisis, country boundaries could get redrawn. It seems like there is at least a vague possibility of some groupings that would take some US states and combine them with some Canadian provinces--perhaps along the pipeline supply route."

In response, please consider "The Dictatorship of the Detritovores":

I covered this about three years ago in my analysis of the Hirsch Report in my 'Fifteen Favored Detritovore States' posting series. An speculative excerpt reposted below for your convenience:

http://www.theoildrum.com/comments/2006/9/25/111015/301/86

---------------------

September 27, 2006 6:33 pm

It all depends on how the continental topdogs wish to play this out. Do they wish to continue the infinite growth paradigm or jumpstart a wholesale shift to true, shared biosolar sustainability at a vastly reduced level of everything? I speculate that they will go for a mixture across the North American geography. Detritus MPP for them, and rapid, but forced postPeak biosolar MPP livestyles for the rest.

Consider the latest Hirsch update of 15 favored detritovore states and the continuing topdog push for SuperNafta. Since the human harnessing of fire so long ago: an eventual global "Dictatorship of the Detritovores" is the paramount result. Never forget that at this advanced state of Global Overshoot: Detritus means Life.

How might this play out? I think it is highly plausible to have 'National Sacrifice Zones' of massive ecosystem destruction for continued detritus extraction, and 'National Sacrifice Zones' of massive human destruction for biosolar living at the same time...

---------------------------

EDIT: My 'Rogue Wave Theory' colliding head-on into Pipeline MOL might be a key determinant of this trend, but alas, I don't have the expertise to further flesh out this analysis. Asimov's Foundations would be handy here, IMO.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

My Thxs to SuperGoose[?] for the restoration of node 5482, thus I can now relink my 'Rogue Wave Theory':

http://www.theoildrum.com/node/5482/512259

For future discussions, I would hope that TODers recognize that the term ‘oil’ sands is propaganda – propaganda no different than what is utilized by the apparatchiks of the ‘clean’ coal lobby.

The proper term is tar sands. Bitumen tar; extracted from sand; upgraded to a synthetic oil product.

That said, Gail’s analysis is first rate. Especially as it concerns future tar sands development – the lower production profile of 2MM bbl/d (boe/d?) by 2020 I am in concurrence with.

Nothing has changed to offset the present and future externalities of sands production namely:

- lack of support infrastructure at Fort Mac;

- water usage and rights issues;

- NatGas usage and supply;

- diluent supply;

- permit acquisition; and

- the environmental argument... one that producers and pro-sands decision makers are forever playing a pathetic defence of.

Note to producers: When 500 ducks die in your tailings pond, immediately put the number into perspective with the millions of migratory birds that pass overhead twice yearly. And for Pete’s sake, don’t lie to the public about it!

I know there is an argument on what to call the product. I would call it bitumen sands if I had my way. Tar is a product made from coal, so it is not really right either. Oil sands is what the producers call it, so I decided to go with that.

As we go forward, almost everything "new" available is either very deep in the ocean or very heavy. In general, I would expect the environmental footprint of oil to be closely associated with its cost of production--the more expensive the oil is to produce, the more problematic it is from a CO2 and other emission point of view.

I don't see Canada's bitumen sands in a class by themselves. I expect if we could look at the environmental impact of Brazil's Tupi oil closely, it would be just as bad (assuming we can get it out). The emissions are not as obvious when we are dealing with deep water. Certainly other heavy oil production is not too different from Canada's bitumen sands in terms of emission. (This is all closely related to Jeff Vail's post a few days ago, talking about EROEI being closely related to price. Low EROEI tends to be high CO2.)

I think the other question is--what are our alternatives? If people decide to go after oil shale instead of Canada's bitumen sands, this would be a big mistake. It is necessary to heat oil shale to a much higher temperature, so the environmental impact would likely be much greater. Colorado is water-deficient, so that would make the situation even worse.

Another option some might prefer is coal to liquids. That would be really bad, from a CO2 point of view.

Oil shale is worse environmentally than tar sands? It uses more water than tar sands?

Pah-lease!

First it depends on how shale oil is developed--Taciuk or Shell Mahagony In-situ and it depends on how much is developed.

The fact that the Colorado is 'water-deficit' is largely due to the

demands of the environmental Never-never Lands of Arizona, Nevada and Socal.

The energy density of Colorado oil shale at 15-30 gallons of shale oil per ton beats Alberta tar sands at 10-15 gallons of

ton of bitumen soaked sand.

Therefore there would be less mining associated with oil shale than with Alberta tar sands mining.

The Shell Mahagony Insitu process is considered the most environmentally benign so lets look at the 'inferior' Taciuk

retort.

It is true that oil shale requires heating to 800 degrees, however it is also true that heating the shale drives off enough 'oil shale gas' to fuel the heating process.

http://en.wikipedia.org/wiki/Alberta_Taciuk_Process

Whereas with tar sands, natural gas must be piped in or hydrogen must be produced by water-shifting tar in a F+T type process.

F+T produces 90 gallons per ton of coal, which is worth 13000 Btu/ pound. The efficiency is (90 x 120000)/(13000 x 2000) = 42%

OTH, oil shale is net energy positive(EROEI>3).

Oil shale contains 15-30 gallons(22.5 gallons) of shale oil ore, which has a value of less than 6500 Btus per pound. That means 8 times more ore would have to be mined than would be mined for CTL(still less than tar sands).

OTH, Colorado oil shale contains 1 trillion tons of oil shale. This is a larger energy resource(80% greater) than the proven coal reserves of the US(at 275 billion tons): 6500 x 1000Gt > 13000 x 275Gt. The whole world has 1 trillion tons of coal.

Sasol's Secunda CTL project uses 1.7 million tons of coal per year to produce 0.1 mbpd.

A 500 MW power plant uses about 1.7 million tons of coal per year.

Taciuk retorts mining 1.7 million tons of Colorado oil shale per year would produce a tiny .0125 mbpd. This is the biggest problem with oil shale and tar sands (except CO2).

The tar sand works mine about 1 billion tons of tar sands per year for 1.2 mbpd. With oil shale you'd need about 400 million tons of oil shale to get the same 1.2 mbpd.

If you think you can't live without less than 50% of the oil you use now, you'd better reconsider oil shale (though it is imperative than CO2 emissions be minimized).

IMO, oil shale easily beats both F+T and tar sands on an energy basis.

The biggest 'unspoken' objection is the mining issue(a pseudo-EROEI issue), which underestimates the efficiency of current mining technology.

Just remember that there is 80% more raw energy in Colorado shale than in all the coal in the USA, the 'Saudi Arabia of coal'.

Having read some of R Rapier's replies to your glowing assessments of ethanol's potential, I'll recommend people peruse Argonne Labs' pdf Potential Ground Water and Surface Water Impacts from Oil Shale and Tar Sands Energy-Production Operations before buying your call hook line and sinker. Industry insiders like Robert and Morgan Downey are quite dismissive of there ever being a chance of oil shale being processed on any meaningful scale, for one thing the politics involved in the water needs of those other states whose priorities you dismiss so cavalierly.

Other points you don't bring up are the massive electrical demands called for with Shell's process, the need to bring NG to the site to get said power plants up and running before associated gas can be extracted to run them (or will you start them on fuel oil for 2 years before fuel switching?), the heavy parrafin content and malodorous smell of the kerogen, the fact that Shell's 1/10 water demand is just a figure they've thrown out without any real world demonstration to date, etc.

The Argonne study you recommend gives a list of the water requirements of a .1 mbpd oil shale operation as about 15000 acre feet per year; therefore a 1 mbpd operation would require 150000 acre feet per year(?). Lake Powell which powers the 451 MW Glen Canyon Dam loses on average 860000 acre feet per year due to evaporation and seepage.

Lake Powell Reservoir: A Failed Solution

http://www.glencanyon.org/library/water.php

The Shell process uses 3 barrels of water per barrel of oil so a 1 mbpd operation would use 141,000 acre feet per year;

42 x 3 x 1E6 x 365/(43560 x 7.5)

while a BLM study says 244,000 AF for a 1 mpd operation(probably surface retort? (5 barrels of water per barrel oil?).

http://coloradoindependent.com/24758/shell-official-confirms-thirsty-nat...

And I didn't bring them up because I am trying to deceive everyone, right? Muahhhhhh! :->

I agree that Shell's process requires lots of electricity, probably coal or nuclear or even wind, not NG, however as with ethanol, oil shale is net energy positive, i.e. the energy you put in isn't destroyed but is multiplied.

Shell's process to me seems less energy efficient than Taciuk as it uses electricity. A 1 mbpd oil shale operation would require

12 GW years of electricity (52 million tons of coal/yr or 867 bcf/yr).

Now consider that 867 bcf/yr in CNG cars would be equivalent to 6.9 billion GGE, whereas 365 mbpy of shale oil would make 12.3 billion gallons of gasoline. Even low EROEI processes like NG fired ethanol makes more sense on a pure energy basis than simple extraction or F+T operations.

This talk about horribly high sulfur shale oil comes from Kenneth S. Deffeyes and is nonsense. Half the oil produced is sour( contains more than 0.5% sulfur).

http://www1.platts.com/Oil/Resources/News%20Features/crudeanalysis/index...

The average amount of sulfur in Colorado oil shale is 0.76% compared to 4.8% in tar sands bitumen.

http://en.wikipedia.org/wiki/Oil_shale

Oil shale is being developed in China( which doesn't have local political obstructions).

So this isn't really about energy then?

I find a LOT of energy 'experts' hiding behind enviro-wackos,

anti-nukes, tree-huggers, local yokels, Congress, etc.

If ONLY this ...if ONLY that...!

(If only you would give ME carte-blanc, is what the would-be Energy Czars mean)

If people don't want oil, that's fine with me. But factually, oil shale is a huge and practical energy source, IMHO.

Thanks for your newspaper link, which links to the Western Resource Advocates study. They have a whole page of shale links as well - handy stuff.

What you're getting at with the Glen Canyon Dam I'm not sure; are you advocating demolishing it and building something better, or having the citizenry manage without it? Bringing up how the PRC government manages environmental issues isn't applicable to the US or the rest of the OECD, either, unless you want to hypothesize about what could be done in a crisis.

Deffeyes didn't say the kerogen was excessively sour, he said it was waxy and stinky, owing to its genesis from freshwater sedimentation. From the Wiki:

How much of an impediment to commercial production this would be I don't know. Note that CERA deign to even include an estimate on this chart:

Lake Powell WASTES almost a billion acre feet per year in evaporation and seepage!

Citizenry? Have you been to Lake Powell?

We can have afford to have a 250 square mile lake in the middle of a deserted wilderness but we can't afford several mpd of petroleum?

It is in the most remotest spot in the entire continental US?

Enviromentalists think it's INSANE.

The electricity goes to Las Vegas and loonies in Pace, Arizona.

Las Vegas has no right to exist (in its present form), the rest of the folks need to adapt to the desert they live in.

Leave it to the Dude to defend the right of unsustainability.

As far as the PRC goes, I mention that only to show that technical constraints are not holding up oil shale.

Shale oil from Mahogany produces light 36 API, not waxy sticky gunk.

http://www.vailsymposium.org/Images/Forecast/presentations/Boyd.ppt#268,... (In-situ Conversion Process)

As for CERA, I don't consider them to be experts on anything and

at present shale oil is not being produced except in China.

Dude, if you're reduced to quoting CERA...well...(say no more!)

Rather contentious by nature, aren't ya? I agree that monster reservoirs in desert areas are wasteful, that people will need to adapt as climate change draws down these watersheds over time. By no means will they agree to do in advance of the problem except in very minor measure, which certainly doesn't include abandoning whole cities as you suggest.

Wax content in crude oil is a characteristic separate from API, indeed light oils can be very waxy: Gulf Coast Midwest Energy, LLC

Your .ppt from Shell doesn't cover this issue.

???? Estonia, Brazil, pilot projects in Australia, another of same planned in Jordan using Taciuk.

Petrobras - Petrosix ®

This is all there to see in the Wiki article - you have an odd idea of what constitutes being an "expert" if you're forgetting basic material like this. Or do you not consider 4600 kb/d like Petrobras obtains from their operations worthy of notice?

Not according to wikipedia

Light crude oil is crude oil with a low wax content. The clear cut definition of 'light' and 'heavy' crude is hard to find, simply because the classification so made is based more on practical grounds than theoretical. Since crudes with high viscosities are more difficult to transport/pump, those with apparently lighter wax content are referred to as 'light crude' and the ones with substantially more wax are classified as 'heavy crude'.

http://en.wikipedia.org/wiki/Light_crude_oil

The Shell brochure stated that their shale oil had an API of 36(light).

Crude oil is classified as light, medium or heavy, according to its measured API gravity.Light crude oil is defined as having an API gravity higher than 31.1 °API.

http://en.wikipedia.org/wiki/API_gravity

Ouch...Again with the personal comments?

I don't think Brazil's investment in shale oil is serious. It was from before ethanol and before they found their deep water oil. Oil shale only appeals to people who don't have oil. The Chinese main deposit at Fushun was started by the Japanese in the 1920s. Before the discovery of oil at Daqing in 1960 it supplied most of Red China's tiny petroleum demand after which shale oil production dropped like a rock.

So why is oil shale production so low?

You might as well ask why tar sands production is happening only in one place, Canada. There are bitumen deposits all over the world used for producing road asphalt--about 600 million barrels per year worldwide. The commitment of resources is gigantic.

A billion tons of tar sands are mined every year. The US mines a billion tons of coal per year. Similar quantities would be required for a profitable shale oil industry. Only when the oil supply greatly reduces I expect oil shale will become a serious

alternative.

The main reason is that the Canadian and Alberta governments have committed billions in research funds and incentives over the years, and the American government has committed diddly-squat. Oil sands are a lot easier to extract and refine than oil shale but it's been a long, hard struggle to perfect the methods.

If the U.S. wanted to produce its oil shales, it should have started about 40 years ago, and put in an effort somewhat on the scale of landing a man on the moon.

The Canadian government developed the current separation method in the 1920s. Suncor started the first large-scale commercial mine 40 years ago, and didn't make any money at all for the first 12 years.

Today Suncor is the biggest oil company in Canada and the fifth biggest in North America (since it took over Petro-Canada earlier this month). It produces 710,000 bpd, about 300,000 bpd of it from its oil sands mine. Syncrude started its mine in 1973 and produces 350,000 bpd. Shell started its mine in 2003. Everyone else is playing catch-up.

One of the good things about an oil sands mine is that, once you have gone through the immense cost of starting up a mine and getting it working, you can expand it endlessly with no fear of running out anytime during your lifetime or that of your children. The only bad thing is that after a while it starts to frighten people looking at it on Google Earth.

The bitumen is attached rather loosely on the outside of the sand in Canada. There is a layer of water in between. All it takes is water heated to 40 C, plus a solvent to separate the bitumen from the sand, according to Syncrude. The water is recycled among batches, so 85% of it is reused. The primary fuel for the heat is gasses that are separated out when synthetic oil is made by Syncrude. About 1/3 of the fuel is natural gas.

In comparison, according to Wikipedia, oil shale would need to be heated to 450 to 500 C. The primary fuel would be electricity, generated from coal. Water would probably be needed to cool the coal-fired electricity plant.

The Shell process would heat the ore to 650 to 700 F (340 C to 370 C), over a period of years. It is hard to see how that could be more energy efficient.

We get a lot of "information" about the tar sands, but I think we need to be asking how much of that information is up-to-date. It might have been true when operations were first started 40 years ago, but is not longer true.

I also wonder if various hostilities against the tar sands, perhaps by Canadians who feel that the operations have been subsidized too long, are coming out in the kinds of environmental information we are seeing. The authors are not going to go out of their way to make sure they have current information, if it would render their point invalid.

For low water regions, new power stations have air cooled condensers which use 10% of the water that cooling towers do like this one by Siemens in Australia.

http://tiny.cc/Vf7MR

As far as efficiency goes, both Shell and tar sands processes are net energy positive. Of the energy recovered at Mahogany,

1/3 is natural gas, therefore a 1 mbpd shale oil operation would produce

1/2 mboe per day of natural gas which over 3 years would be about

3 Tcf. 3 Tcf is enough energy to produce 363 Twh of electricity.

Twelve 1 GW power stations( so says Shell) running for 3 years 24-7 would produce 315 Twh of electricity--so Mahogany, once put into motion, would be self-sustaining in energy.

http://tiny.cc/jBc3c

Can this be said for tar sands using the separated natural gas which would require 2/3 externally supplied gas (by your numbers)?

I want to talk to Shell people about their operations. They were supposed to call me this week, but so far it hasn't happened. Your points are useful, since it gives me some things to check on.

With respect to my Syncrude numbers, you have them reversed. It is 2/3 internally supplied gas, and 1/3 externally supplied. I want that verified in writing though. I heard it from someone who works there, but want to make certain I have the amounts correct. Syncude is claiming a 6:1 energy return, taking oil all the way from mining through crude oil production.

I have a very hard time that believing that shale oil operations will be able to be equivalently energy positive, because of the much larger energy inputs that seem to be required.

Not worried about Co2 in the least Gail. In fact, the whole catastrophic AGW paradigm is crumbling before our eyes because the Co2/atmosphere - causality/effect relationship is not panning out the way the IPCC's computer models said it would.

In other words... empirical observations have falsified the AGW hypothesis.

And it's going to get really ugly out there. Watch as the vested interests grasp at straws, beginning with Moon's panicky, apoplectic, "we're all going to die in 4 months" nonsense.

Combat Climate Change... seriously?!?

Why not combat the moon while we're at it. http://www.youtube.com/watch?v=7W33HRc1A6c

I still have yet to see any "vested interest" that stands to gain significantly from saying AGW is real if it isn't.

What's the business plan for that one?

The opposite side is pretty well established, as coal miners and oil companies definitely stand to lose big if they get shutdown in the name of stopping CO2 emissions.

Who do you believe?

Actually, I think there is a vested interest in pointing out AGW. If China wanted the bitumen from the Oil Sands, the best way to assure their getting it would be if the US would say the US didn't want it. The way to assure that is to agitate as much about oil sands being associated with AGW as possible--and of course reiterate that AGW is true.

This might also work for coal exports. The way it seems to work now, is that a country is only charged for the emissions they themselves generate--not the emissions on what is exported. So reduced coal use may mean more coal for export--thus more for China and other countries who have no intention of following any treaty. (Australia is a big coal exporter now, but is not penalized for it an CO2 calculations).

You can tell what side of the fence someone's on by their terminology. Those against the exploitation of the whatever sands want to tar its image, so that's the word they use. Oil sands is the term used by most others.

I disagree. Tar sand is more correct as bitumen is what you dig out of tar pits. Here's picture of La Brea on Trinidad.It is mined for asphalt.

In Alberta you have sand mixed with bitumen.

http://www.richard-seaman.com/Travel/TrinidadAndTobago/Trinidad/PitchLak...

http://en.wikipedia.org/wiki/Pitch_Lake

Former US vice president Dick Cheney was once stuck in a tar pit.

http://en.wikipedia.org/wiki/Tar_pit

In March 2009 Syncrude revealed that 1,600 ducks died and not 500 that was initially reported.

http://tinyurl.com/qjl3q4

Rare cancers:

http://media.knet.ca/node/3168

http://www.cbc.ca/canada/edmonton/story/2007/11/08/water-study.html

Deformed Fish:

http://www.cbc.ca/canada/edmonton/story/2008/08/18/chip-fish.html

Fort McMurray ranks number one in the province for drug abuse : http://oilsandstruth.org/sex-drugs-and-alcohol-stalk-streets-fort-mcmurray

Farmers might lose their livelihoods because the ground water table is contaminated.

http://oilsandstruth.org/they-can039t-just-walk-all-over-us-farmers-resi...

"""February 2007, the Wisconsin pipeline spilled 126,000 gallons of tar sand oil and diluting agent, contaminating

the water table.

"The way the geology is here, most wells are not that deep," says Turner. "We're worried our water supply will be ruined. And the stuff they have to use to dilute the oil is highly flammable-if that gets into the ground, a whole cornfield could go up in flames.""""

But hey, we don't live there so it's all good right? I can't believe you actually mean what you say. Justifying nonsense only makes it worse. Please ask yourself how long these inequities can go on until people decide to stop them?

Of course, you do have a point.

Utilitarianism says do what will produce the greatest good for the greatest number.

I don't know how many people benefit how much from our 'advanced' lifestyle to compensate for the squallor and degradation of northern Alberta.

And has an oil dependent world really improved things for everyone?

Our lives are hectic, aimless, empty and revolve around wealth and not need. Our environment away from Alberta is being degraded by pollution and climate change.

We could probably live/survive on 10% of the energy we waste now.

But the system cannot be easily avoided and will resist change.

Maybe the best we can hope for is compromise.

A few interesting factoids to throw into the mix:

1. Canada has NO Strategic Petroleum Reserve. Zero. Zilch. Nada. So, if there's a crisis causing a massive short term lack of oil, Canada will get smacked. Hard.

2. Notice that none of the oil lines go to eastern Canada (ON/QC/NB/NS etc.) This is what we call "a problem", and the solution is not something the USA is bound to like.

3. NAFTA screws Canada in a number of ways, and while Canadians are happy to trade easily with the states, many of the terms are seen as rather onerous and one sided favouring the USA.

4. IIRC, Canada imports most of its imported oil from Nigeria and Angola.

5. The political climate in Alberta is very different from the rest of the country.

Thanks for your comments. I take it you live in Canada.

It is pretty clear that the current pipeline system was set up by someone who never heard of peak oil, and assumed that imports would continue to be available in unlimited quantity. Once the world changed, the current system doesn't look so good.

If we are concerned about environmental issues, I expect oil imported from Nigeria and Angola rank pretty low in terms of environmental regulations and enforcement of those regulations. There is little agitation in this country (or in Canada) about this issue, though, so oil from Nigeria and Angola may be perceived to be OK environmentally.

Gail, detailed statistics on Canadian oil supply can be found at Statistics Canada on this page Supply and Disposition of Refined Petroleum Products in Canada.

Top OPEC suppliers as of April 2009 were Algeria, Angola,Saudi Arabia and Iraq. Top non-OPEC suppliers were the UK and Norway. Algeria was the largest single supplier. Details can be viewed here.

For information on the politics of oil supply in Canada see the Parkland Institute publications:

Thanks, those are helpful.

I see that both Eastern and Western canadian production are down in 2009 YTD, as are imports.

The Parkland Institute doesn't sound too happy about current practices.

The pipeline system in Canada is the way it is because Canada managed to put most of its population and industry at the opposite end of the country from most of its energy resources, and the terrain in between is largely hard granite rock interspersed with bottomless peat bogs.

Eastern Canadian refiners have never been willing to pay the transportation charges to move oil Alberta oil all the way to the other side of the country, nor have they been willing to spend the money to upgrade their processes to handle heavy oil, because they assumed they could always import as much cheap, high quality foreign oil as they needed. The concept of Peak Oil never occurred to them. If you look at the list of countries Canada imports oil from, they all produce sweet, light oil. That's because Eastern Canadian refineries can't handle anything else. They can't even handle Newfoundland's waxy oil so it too goes to export. Western Canadian refineries are more sophisticated and designed to handle whatever oil is available in the oil fields near them, but they don't supply as large a population.

On the other hand, as U.S. oil production declined, the Midwestern U.S. refineries found themselves without a source of domestic feedstock, and their distance from seaports made offshore imports expensive. However they are close to Alberta and Saskatchewan, so they modified their processes to handle the increasingly heavy Western Canadian feedstock and built pipelines to move the growing volumes of it. Then, as the Gulf Coast refineries ran short of feedstock, they too modified their processes to handle heavy oil from Mexico and Venezuela, and reversed the pipelines that used to take Texas oil north to bring Canadian heavy oil south. That's how the pipeline system got the way it is.

Now, this doesn't do much for Eastern Canadian energy security, but Eastern Canadians are generally unaware of the issues involved in Peak Oil. Western Canadians are more aware, but they have their own oil supplies well secured and don't really care what happens to the East, since Easterners have never shown much interest in the concerns of the West (until an oil crisis hits).

Thanks for your insights. That fits in pretty well with what I have heard.

At this point, it would be pretty hard to ship Western oil east, expect possibly by going through the United States. Trying to remedy the situation at this late date would be hard to do.

It's actually easier than you might think. There are currently two pipelines delivering Canadian oil from Alberta to Ontario via the U.S. One runs from Superior, Wisconsin south of the Great Lakes through northern Michigan. The other runs from Chicago through southern Michigan. Both cross the Detroit River and deliver oil to the big refinery complex at Sarnia, Ontario.

The real problem is the pipeline from Sarnia to Montreal. It was built to carry Canadian oil to Montreal, but in the late 1990s (remember $10 oil?) it was reversed to bring imported oil into Sarnia since Western Canadian production was becoming increasingly heavy and Arab oil was cheap. Global prices have risen since 1999 and Western Canadian production has been increasing (but going to the U.S.), so the oil companies would like to reverse it again and move Canadian oil to Montreal, and then reverse the pipeline from Montreal to Portland, Maine to carry Canadian crude to Portland for export to the world market.

This idea horrifies the environmental defenders of Eastern Canada because in their somewhat myopic world view, they consider the oil from the oil sands to be "dirty oil" (i.e. extremely heavy), and the oil they import from the Arabs is "clean oil" (i.e. sweet light crude oil). And the latter is the only thing the Eastern refineries can handle, so their refiners are onside with this agenda.

The point they missed is that Algeria, Angola, Saudi Arabia and Iraq are not the most reliable oil suppliers in the world, and if somebody starts a large-scale Islamic Jihad (or even if Peak Oil happens) they may suddenly find themselves freezing in the dark. The situation at that point would be hard to rectify quickly (it certainly was the last few times it happened), since pipelines are hard to reverse on the spur of the moment and their refineries would have to be upgraded to handle heavy oil - not the easiest of conversions. Also, the government did sign NAFTA documents which would prevent them from diverting oil from U.S. refineries on short notice, even if they could.

By the way, if Canada wanted to build a Strategic Oil Reserve, the obvious place to put it would be at Sarnia because of the huge salt caverns there. In fact, there is already a lot of oil and products in storage at Sarnia.

Thanks RockyMtnGuy... I was wondering where we should build our SPR.

RE: 3) above - NAFTA can abrogated if necessary with 6 months notice.

E-T Energy, of Alberta, has developed a new method for oil sands production that claims to be much more energy efficient than mining or SAGD. It also claims to be able to produce from deposits too deep to mine and too shallow for SAGD.

http://www.e-tenergy.com

The January 2009 presentation has more technical info:

http://www.e-tenergy.com/inthenews.php

Thanks for the links. The method looks very interesting. Perhaps it will work as well as hoped.