What Peaked at the Same Time as Oil Prices? Lots of things.

Posted by Gail the Actuary on October 9, 2009 - 10:40am

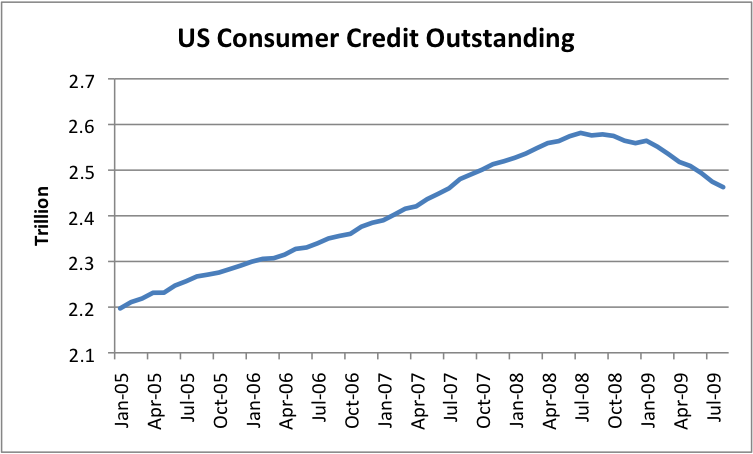

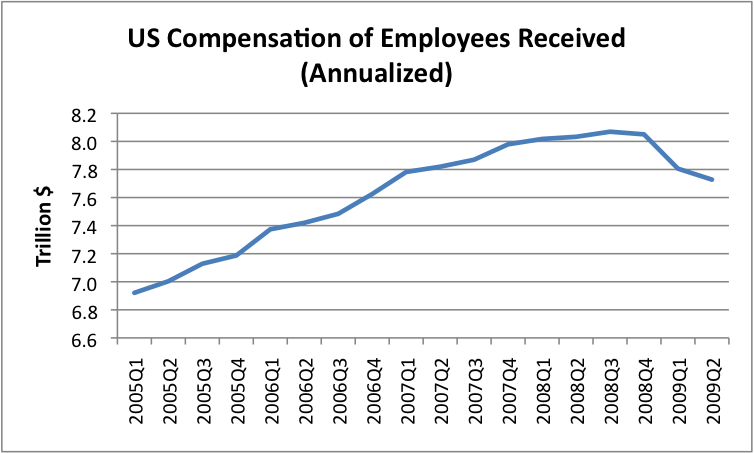

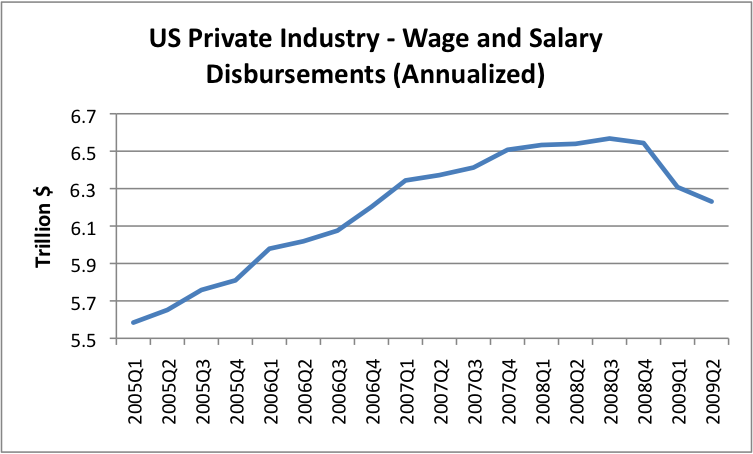

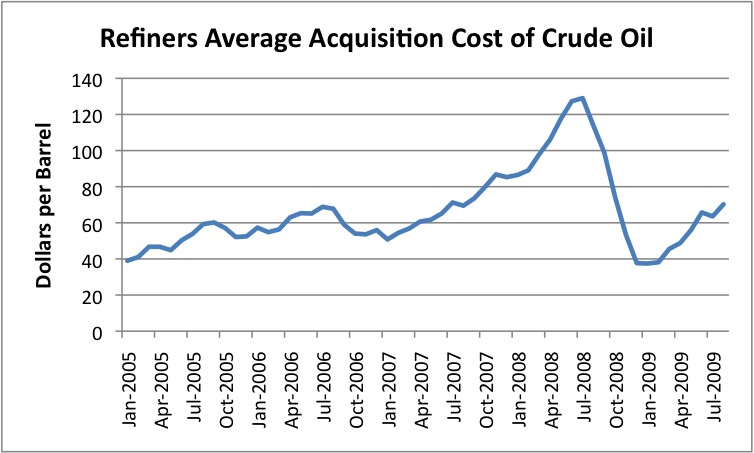

We know oil prices peaked in the third quarter of 2008--in fact in July 2008. But what else peaked about the same time? It turns out when you look at the data, lots of things:

It seems to me that the current crisis is credit driven, which is why it is so widespread. I had expected a credit crisis to result from the rising price of oil, because the rising price of price would choke back growth, and this would likely lead to debt defaults. But as I look at the data, I discover other relationships I didn't really expect.

It turns out that total US employee compensation peaked in the third quarter of 2008 (I don't have the data by month), so it peaked at the same time as peak oil. As I look at the breakdown of this, I find the government employee compensation has continued to rise since the peak.

What has really fallen since the peak is private industry wages. The above data also peaks in the third quarter of 2008. The amounts shown are annualized quarterly amounts (seasonally adjusted). In some sense, private industry wages drive everything, since without these, people would have difficulty buying anything, or paying taxes, or paying back debt. The fact that these are as small as these are-- only $6.6 trillion a year at their peak; now down to $6.2 trillion in the second quarter of 2009 is concerning.

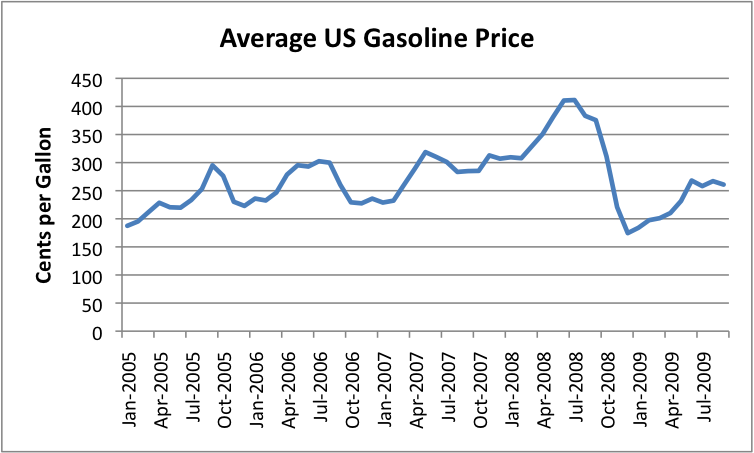

We know that oil prices peaked. This is how the prices refiners paid for oil (including US produced and imports were affected). Prices dropped a lot, but it turns out they only dropped to about the price that was being paid at the beginning of 2005.

Gasoline prices rose, but they didn't rise nearly as much as did the price of oil. This is to be expected, because part of the price of gasoline is people's wages, and fixed expenses, and these did not rise nearly as much as the price of oil.

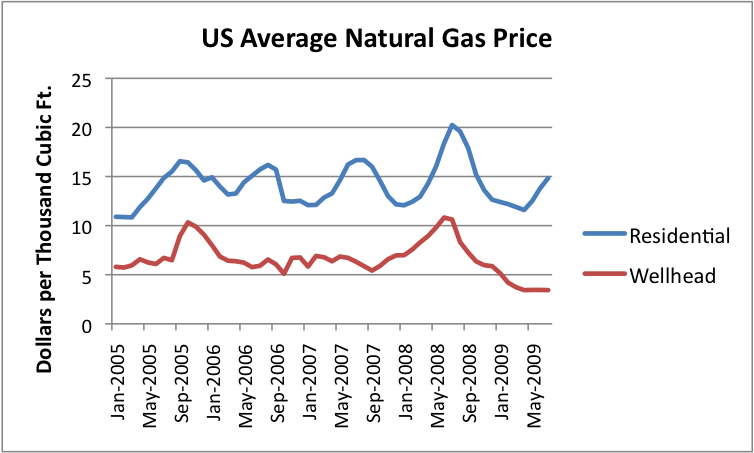

Natural gas prices hit their peak at about the same time. What is striking to me is the huge difference between what producers are paid at the well head and what residential customers pay. The peak gas price, from a residential point of view was about $20 per 1000 cubic feet. It is now down to $15 per 1000 cubic feet. But the price at the wellhead reached a peak of $11 per 1000 cubic feet, and dropped to something in the $3 to $4 range.

We hear that natural gas is selling at a low price per Btu relative to oil, and it is, at the wellhead. But for a residential customer, the price still isn't very low. There are a lot of costs in the production of natural gas, beyond wellhead costs. It seems to me that at least some of these costs are thanks to "deregulation".

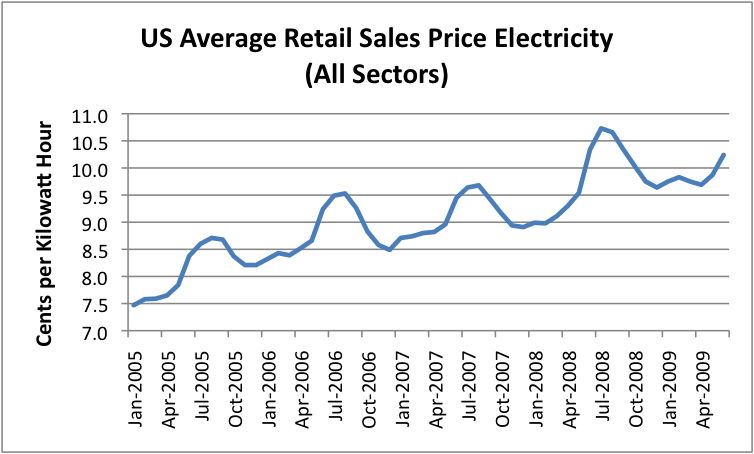

One thing I had not expected was the extent to which electricity prices have been rising over time, and the fact that their prices, too, peaked in the summer of 2008. Electricity prices tend to be higher in the summer each year, because more natural gas is used in summer, and it tends to be more expensive than coal.

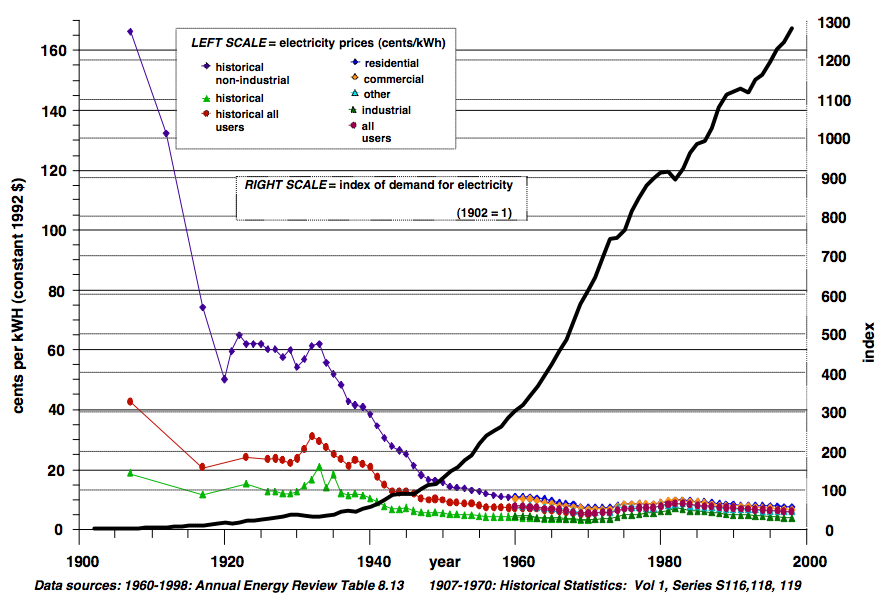

One of the things that is concerning to me is the rise of electricity prices over time that the above graph shows. In the paper Accounting for Growth, the Role of Physical Work by Robert U. Ayres and Benjamin Warr, Structural Change and Economic Dynamics, February, 2004), Ayres and Warr show a model that indicates that growing energy efficiency, together with greater energy inputs, explain most of the rise in GDP between 1900 and 1998.

In the same paper, they indicate that the declining real cost of energy, particularly electricity, and the rising use of the much cheaper electricity, fed economic growth in the 1900 to 1998 period. The problem we have now is that we are getting to precisely the opposite of this situation--electricity prices are now rising, and use falling. This is not normally a formula for economic growth.

There are no doubt several reasons for the rise in electrical prices:

• Deregulation. With many more players, each trying to make a profit, prices didn't go down, as many had thought they would.

• Rise in oil prices. Oil is used to transport coal, so as oil prices rise, electricity from coal can be expected to increase in price.

• Law changes to reduce coal pollution In order to reduce sulphur emissions, electricity producers bought lower quality coal that needed to be shipped longer distances. This reduced the efficiency of the electrical plants and increased transportation costs.

• Shift in mix. The shift in mix of electrical production has shifted to more natural gas and to more wind. These tend to be higher cost, and thus raise costs.

Going forward, there may be additional reasons for cost rises as well:

• Cap and trade laws. These will add costs and shift toward higher cost sources of generation.

• Cost of grid improvements These are badly needed, especially if wind is added.

• Declining demand. There are still huge overhead costs to cover, even as demand declines, as it has recently.

While the rise in electrical price may be inevitable, it can be expected to have a negative impact on economic growth, just as a rise in oil prices above a certain level stifles economic growth.

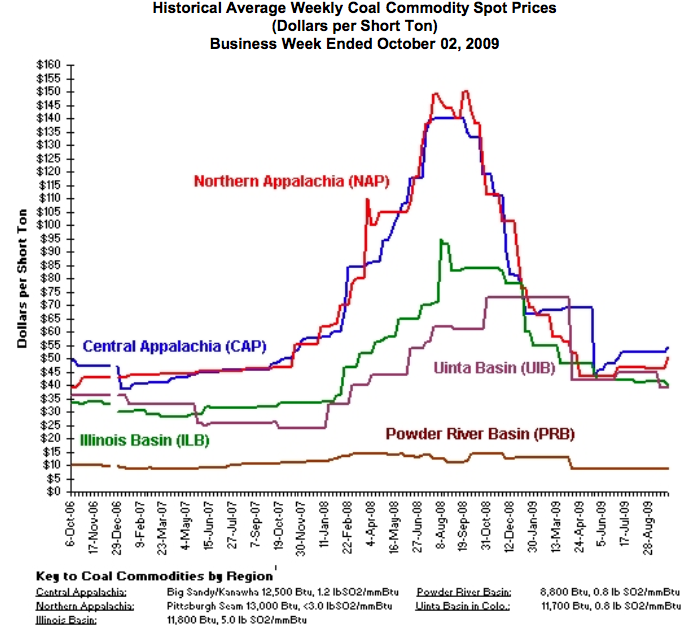

I might also note that coal prices (used in electricity production) peaked during the same period. On an annual basis, using actual sales prices (including contract prices), the EIA indicates the following average prices:

• 2005 $23.59

• 2006 $25.16

• 2007 $26.20

• 2008 $32.59

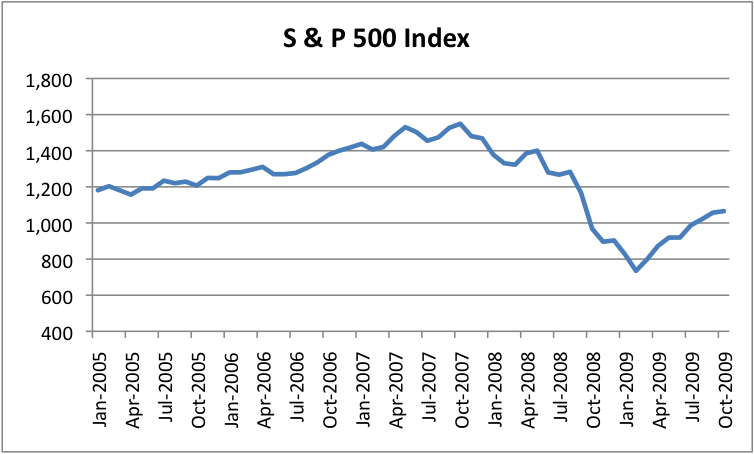

As everyone knows, stock market prices also declined in the same period, but their peak came earlier--back in 2007.

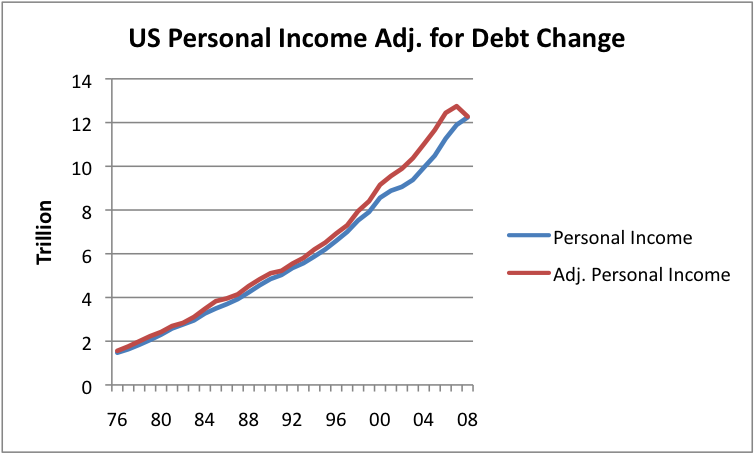

I haven't figured out a way to look at how people's incomes were affected by the many changes affecting them--falling stock markets, falling housing prices, declining debt availability, and declining wages. I did figure out a way to look at a couple of these things simultaneously--debt and income.

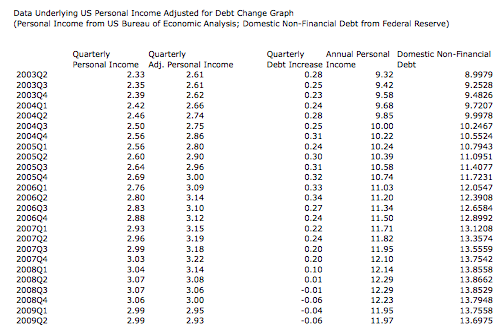

The Federal Reserve shows information on US domestic non-financial debt. This would seem to include mortgage debt, credit card debt, auto debt, and most other individual debt, but not debt used for, say, purchasing stocks and bonds, or debt of businesses or governments. It seems to me the increase in domestic non-financial debt gives a sense of how well off people feel they are. As the amount of debt increases, people can buy more and more "stuff". If we add the change in this debt to the amount of personal income, it gives a rough measure of how much a person had to spend in a year. (Of course, the number of workers was going up slightly during this period, so the per capita changes are a little lower.)

Looking over the long term, the growth in debt tended to increase funds available to the US population. The amount of debt added got larger and larger during the early 2000s, but then decreased in 2008.

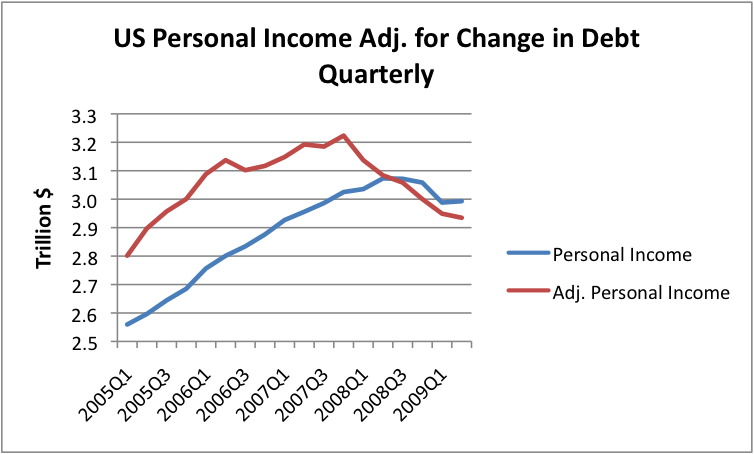

If we look at recent quarterly data, one can see how the decline in personal income has combined with the reduction in debt to provide a "double whammy" to the individual. While personal income hit a peak in the summer of 2008, personal income adjusted for debt reached a peak earlier--back in the fourth quarter of 2007. As mortgage debt started to contract (lead partly by falling housing prices), this started to affect homeowners even before the drop in consumer credit (auto loans and credit card debt). So this graph helps show why people started feeling poor, even earlier. Of course, the drop in the S&P 500 didn't help either.

Current weak US energy demand is really part of a multiyear trend, in response to annual oil prices rising at 20%/year from 1998 to 2008 ($14 to $100). In response, our total oil consumption in 2008 was down to the same level as 1999, 19.5 mbpd. However, many non-OECD countries showed huge double digit increases in total oil consumption in 2008, versus 1998. Two examples from Asia are China & India, and two examples from Africa are Morocco & Kenya.

I've compared our focus on US energy data to the old joke about a drunk looking for his keys under a streetlight late at night. He lost his keys down the street, but the light was better under the streetlight. We have great energy data in the US and other OECD countries, but that is not where the growth in energy consumption has been in recent years.

In any case, I think that the US is very poorly equipped to bid for declining net oil exports worldwide, given our recent 10 year track record versus developing countries. Absent the actual or threatened use of force, I think that we can look forward to the US headed toward freedom from foreign sources of imported oil, but perhaps not in the way that many people anticipated.

I'm wondering this morning after hearing that President Obama has been awarded the Nobel Peace prize if the people on the committee that awarded the prize saw it as an opportunity to push for world peace by making it more difficult for him to wage wars. Sort of a preemptive strike against his ability to so easily use his power to wage war thereby giving diplomacy a better chance at the tables where negotiations so desperately need to occur.

Best hopes for a more rational approach to world peace.

Pretty ironical if the guy who "wins" the Nobel Peace Prize turns around & authorizes a strike on Iranian nuclear facilities. Or tacitly allows the Israelis to do it. You may have a point. Maybe a canny choice by the Committee, after all.

Very prestigious award and Committee-after all, Kissinger was a past recipient and who has done more to advance world peace than good old Henry.

Kissinger getting the prize probably made Kafka blush in his grave.

I have two competing conspiracy theories about Obama's prize.

(1) This is part of a conspiracy to pretend that there really is a difference between the Dems and the Reps (as part of the wider international pretence of choice in "democratic" countries). As soon as O came to office, prominent changes were heavily publicised. Once the attention had turned away, O reverted to much the same agenda as Bush, even appointing many of the same chief officials. The "peace" prize would add to the spun falsehood?

(2) It's well known that in order to qualify for the peace prize you normally have to have been responsible for a large number of deaths first. Maybe the Nobel committee did indeed act in anticipation, knowing something....

I'll see your Kissinger and raise you an Arafat.

I saw Obama's speech @ 11 and he made a point to remind the world that there's a war going on and nuclear energy must be peacefull. He probably felt the committee's challenge as he didn't look completely happy about it.

Or maybe these days Obama's moves are as peaceful as one can hope for, creating a new floor for violent behavior? Appropos for a new era of diminishing expectations?

I was as cynical as anyone upon hearing of the award.

But really, I think it was given to the American people who elected him.

After a decade of being told that we were in a cultural war of the Enlightened Christian West against benighted terroristic Islamic culture, the American people elected someone named Barack Hussein Obama.

I think we in the US underestimate how much this impressed many in the larger world.

I had many of the same thoughts as those outlined in comments above. Particularly, the putting Obi-man on watch..

Then I remembered that the deadline for submission of names for the Nobel Peace prize is ... February. (Checked it on their site, it is so.)

Obama had been president for all of the blink of an eye. So dohboi's comment seems apt.

Of course the final decision is taken somewhat later, but one can see this nomination as dependent on the momemtum of Hopiness and Changiness, which didn't have time to sag or peter out.

I bet some of the 'judges' are unhappy with this choice today.

Gone are the days when america was capable of starting wars.

The more problems a powerful country has ,the more likely it is to start a war.

If you had any real understanding of international politics and history you would be thanking Allah this very minute that it is the US that is a super power and has armies on the ground in your part of the world.

If the Germans or the Japanese or the English of a century ago were there with modern day weapons you would all be in Paradise already.

If we weren't there you would be occupied right now by the Russians or the Chinese and they would not be building many schools or repairing many water and sewer lines.

The Russians didn't leave because you drove them out-they could haver killed all of you as easy as swatting a fly-Stalin killed over twenty million of his own people.

The Russians did not want the rest of the world -meaning the great satan America mostly-to see just how rotten and brutal communism is/was.Your lives were spared because Russia wanted trade with the west more than she wanted your country and feared not only the loss of trade but war with us.

You have remarked before that you "make software".If you are a programmer you must have some technical education.You should add to it by reading some western history.

While your best and brightest young men are studying religious texts , our mern and women are createing and discovering new knowledge such as the internet which enables me to communicate with you.

My country men are mostly "people of the book"-in a broader sense-not Jewish but Protestants, followers of a religion with Jewish roots that holds Abraham to be next to God second only to Jesus.They believe in Heaven just as you believe in Paradise.

If we fight to the finish they also will fight believing God is on thier side-just as you do.

Maybe we can still avoid a true war -one that kills by the thousands every single day, day after day for months or years.If it happens our men will die by the dozen.Yours will die by the tens of thousands until none are left to fight.

Our own newspapers and television call the conflict war- but really it is not -no more than a six year old boy is a man.

Oil is a curse-things would be better if there was no oil in your part of the world.You will have no peace until it is gone.

It is very ironic and quite sad.Though these religions claim that they follow the Bible i.e. Judaism, Christianity, and Islam - none of them actually do as God commanded and share the same ideology.

Why?

People who are not familiar with the Bible will often ask the proverbial question - What is God really like?What are His characteristics?The Bible states unequivocally that Jesus was the Son of God - God manifested in the flesh.Therefore, the lineaments that pertain to God would be seen in Jesus.What He taught is how He actually lived out His life to the point of death.His life is an example for those who would follow Him in truth.

First and foremost He said judge not least you be judged.Do unto others as you would have them do unto you - if someone strikes you upon the cheek turn to him the other, bless those who curse you and pray for those who despitefully use you.

These teachings were absolutely astonishing for their time, for the Jewish people were acquainted with the Torah which predicated an 'eye for an eye'.

It became axiomatic, however, that no man actually carried the righteousness and the understanding of right and wrong to pass judgment with equity and follow the Torah.

This is why God revealed Himself in this manner.

When Jesus was arrested and brought to the unfair kangaroo-court that He was subjected to He did not accuse or revile back at His accusers.He did not lift a hand against those who were striking him, infact, in the historiographical account of His life He never lifted a finger to hurt anyone.

This is why it is so ironic and the greatest oximoron of history that those who claim to follow Him and respect His teachings i.e. Catholics, Protestants, Muslims are some of the most violent people in recorded history.They were no more 'civilised' than the so called 'barbarians' they were trying to convert.

No...God is not concerned with our own religious theological points or our erudition of what we consider to be true - He is only concerned with real equity and tuth.

Remember, one mans terrorist is another mans freedom fighter.

We as Americans cannot pontificate and say that we were 'different' than the Japanese or the Germans.Imagine if Hitler had dropped a fission weapon on a city populated with women children and the elderly!?Would we perhaps look upon him as being infinitely more egregious than we already do?

Can we not see past ourselves and admit that we are just as inclined to share the very same Manichean tendencies that the Germans succumbed to? Maybe we also should be looking at history differently.

The Bible predicates clearly Jesus would not commit himself to any man (and by extension any religion) because He knew what was in the heart of man;He gives a good example to the term existentialism, and those who would follow what He actually taught would be wise to do the same.

Sampson,

We have not been put to the test in the way The japanese and the Germans have in the last century or so , but our imperialism is of a different stripe than that practiced by other countries-it's much milder, to say the least possible thing about it-for instance we actually pay for oil, and at the going rate, no less.

And insofar as the atom bombs dropped on Japan are concerned , that has been blown entirely out of proportion by people looking for an opportunity to bash either America or nuclear technology in general.

Any one who has trouble understanding this is invited to read any legit book on the history of the air war with Germany-we sent over whole fleets of planes and burned entire cities to the ground as a matter of day to day policy.

Nobody was interested in invading Japan and it is perfectly obvious that they would never have surrendered without a lot of further bloodshed if the atom bombs had not been used-most credible observers of the time put the "otherwise" deaths several times higher, which would have of course included many thousands of our own men.

And insofar as bloody religions are concerned, man is a bloody species, period-there are no noble savages, now, and there never have been any in the past-once we get to be fairly numerous, we start fighting for the space and resources we need to reproduce.

If there had never been a Jewish people to serve as the foundation stock of the "people of the book" some other dominant religion or philosophy would have occupied the void thus created and been just as bloody.

Give me an effing break. If we don't have a Kipling shooting elephants it's only because 1) our soldiers are number than hakes and 2) there are next to no elephants left. Our colonialism is in no way milder; it is total.

cfm, the growlery, gray, me

Just to tweak your tail ;) -

I was reading recently about the Nicene creed was changed in 381 AD, to include a definition of jesus as being goad and the son of god, or something like that.

The previous version (nicene creed version 0.9) had jesus as a seperate person... the eastern churches (including the russian orthodox) kept the old version.

One of the main innovations in christianity was that one could convert, rather than have to be born into it, unlike the preceding judaism, which was - and still is, more-or-less - restricted to an ethnic group.

I could also suggest that the notion of making reference to a text as the authority, as opposed to making reference to a cleric as authority, was actually an innovation of the middle-east around 630 AD.

In the western world, the cleric had final authority - until, beginning around 1400 AD there began movements to replace the ultimate authority of the ecclesiastical heirarchy, with the ultimate authority of the conscience of the reader of the holy text.

This was of course the appearance of protestantism, helped enormously by the spread of printing technology around about the same place and time.

You got it all wrong. Read about Ecumenical councils and don't mistake Eastern Orthodox for Oriental Orthodox. Also, Filioque clause was introduced much later than 381 AD.

I guess if I lived next to Afghanistan's Taliban and insurgents plus US troops, 1B Indians who are historic enemies, 1B Chinese who might need more space, and the Iranians who are finding themselves cornered between a rock and hard place, I might hope for the best too.

I think that we can look forward to the US headed toward freedom from foreign sources of imported oil, but perhaps not in the way that many people anticipated.

You Yankees allatime gotta be some sort of hot shot leaders don'tcha.

And hey that is a great idea they gave Obama the Nobel peace prize so quickly. Something learned via Kissinger?

In strange all this has me thinking of a poem, of Empire lost, that might be brushed and tidied to swagger again in our days.

In any case, I think that the US is very poorly equipped to bid for declining net oil exports worldwide, given our recent 10 year track record versus developing countries.

There's a more benign interpretation: the US has freer market pricing, so it uses less when prices rise. Countries that freeze energy prices (China, India, oil exporters, etc) are hurting themselves with excessive spending on energy that could be used better elsewhere. OTOH, it's only to be expected that developing countries' energy consumption will rise, while developed economies will reduce their energy (especially oil) consumption by improving efficiency.

Europe has already priced in the real cost of externalities with steep fuel taxes, so it's to be expected that the biggest declines would happen in the US, where prices are free to adjust and the biggest efficiency improvements are still very, very easily (and cheaply) available.

"Europe has already priced in the real cost of externalities with steep fuel taxes"

Not everywhere in Europe, Ukraine still imports gas at a higher price than it sells it domestically. Something to do with a dodgy political scene where no politician is prepared to make the hard decision, where have i heard that before?

That's too bad. You're talking about gasoline, not natural gas, right?

How much are prices below market?

Absolutely right, WT.

I love the comparison with the joke about the drunk. Indeed, we can only see what's happening where we have good data. But even the little data we have for the developing world shows, as you keep reminding folks, that consumption there is up and showing no signs of retreating, recession or no.

-- Jon

We can of course argue why, but the data are very compelling, a sustained increase in oil consumption in non-OECD countries, versus flat to declining oil consumption in OECD countries--as oil prices rose at 20%/year. I can't see how this is anything but a negative for the US in future years, at least in regard to the auto-centric suburban way of life in the US that we know and love.

This is why I usually finish my presentations with a "Desire Named Streetcars," i.e., a strong push for Alan Drake's recommendations.

I can't see how this is anything but a negative for the US in future years, at least in regard to the auto-centric suburban way of life in the US that we know and love.

Isn't that funny? I see it as only a positive for the US, as we wean ourselves off of dependence on oil.

A I noted elsewhere, personal transportation is about 50% of US oil consumption. If we raised the average MPG from 22 to 50 (just replace current vehicles with hybrids like the Prius, which costs less than the average US new vehicle) we could reduce overall US oil consumption by very roughly 30%.

That's before going to vehicles like the Volt, which would reduce fuel consumption by 90% over the current average.

Or...carpooling, which can be done in a matter of days.

Or better yet, largely abandon the auto-centric lifestyle. As someone said, "The American love affair with cars is a lot like Stockholm Syndrome."

I say we abandon the ICE powered auto-centric lifestyle and move to a human powered mode of individual transport. Well maybe an electric assist for the little old ladies that might need a boost to power up the hills.

http://velomobiles.ca/Borealis%20gallery.html

Sure, if you want to. I have - I drive about 1,500 miles per year. I enjoy urban living (my walkscore is 92%), and I like trains quite a bit more than driving.

Of course, I pay a large premium in living costs to do so, something most people can't do.

But, I don't see any reason why people will be forced to give up their personal transportation, if they don't want to or can't afford to. Driving will continue to be affordable, and can be made sustainable.

Have you read "$20 per Gallon?"

It's at least a little refreshing to read something positive for a change, from someone who accepts Peak Oil.

Thanks for the thought. I haven't, though I've read pretty good reviews.

I do work under the assumption that oil has plateaued, and will decline in 3-5 years. I guess you could say that I'm relatively optimistic, compared to many of those who accept Peak Oil.

I'll add "$20 per Gallon" to my list...

I've been focused on net export graphs in my spare time for the past two weeks, and they are not pretty pictures. Sam's best case is that the top five net oil exporters will have shipped more than half of their post-2005 cumulative net oil exports by the end of 2013.

Well, have you looked at the rate at which the top importers are reducing their imports? I'd be curious to see a comparison of the two. The US has reduced imports by what, 20% from their peak? Japan's imports are plummeting, and Germany's reducing them as well.

That's hopeful for the long-term trade deficits of the oil importers.

If I were a oil exporter, I'd be happily stocking up on all the t-bills I could, against the day when exports run out.

Nick, you are something else.

Are you claiming that exporters are increasing their consumption at the expense of their exports because importers are reducing their imports?

WT has identified a pretty clear cause and effect you here you are trying to turn that 180 degrees around.

Are you claiming that exporters are increasing their consumption at the expense of their exports because importers are reducing their imports?

Not at all. I'd say that increased oil prices caused importers to reduce their imports.

What I'm saying here is that the pace of import reduction is important. To focus only on net exports doesn't give us a realistic picture: we need to also look at the production and consumption in importing countries.

It's certainly true that OECD consumption and oil imports fell in response to oil prices increasing at 20%/year from 1998 to 2008, but it's also true that non-OECD consumption and oil imports increased in response to oil prices increasing at 20%/year from 1998 to 2008.

Again, that makes sense. It's only to be expected that developing countries' energy consumption will rise, while developed economies will reduce their energy (especially oil) consumption by improving efficiency.

The US has freer market pricing, so it uses less when prices rise. Countries that freeze energy prices (China, India, oil exporters, etc) are hurting themselves with excessive spending to buy energy - money that they could use better elsewhere.

Europe has already priced in the real cost of externalities with steep fuel taxes, so it's to be expected that the biggest declines would happen in the US, where prices are free to adjust and the biggest efficiency improvements are still very, very easily (and cheaply) available.

So, I guess we are in agreement that the developing countries will probably import a growing portion of a declining supply of exported oil.

Yes, indeed.

Some of them, like China, recognize the danger of this growing addiction, and some, like India, not so much.

I read $20 per gallon. I thought it was a crock! It pretended that as gas prices rise, all that happens is simple changes to the way we transport ourselves. It completely failed to recognize or address what would happen to the overall economy by way of fuel that was rising in price 2 dollars at a time. It took a cornucopian viewpoint of the positives of higher priced fuel as it pertained to health, from getting more exercise. If you are someone that is angled in a cornucopian direction, you'll love it, but if you are a discerning individual with a good understanding of Pead oil and how it will impact the economy, don't bother picking up this rag.

And that's coming from someone who has read Simmons, Defeyyes, Kunstler, Catton and the rest.

As a follow up to my reaming of $20 per gallon: If gas really did sell for that much a gallon, how much would a barrel of oil sell for? Well, if the average now is $3 a gallon and a barrel is $70, then every dollar of price per gallon of fuel is equal to 23.33 a barrel. So 20 dollars a gallon would mean a barrel costs 466.60

But as we remember from oil reaching 147, the economy collapsed and the price dropped to 30. Also, recent articles have supported the premise that historically above 4% GDP spent on fuel has caused recessions. So how are we going to get to 466.60? By the same token, even if fuel sells for $10 a gallon, that translates to approx. 233.30 per barrel. How is the economy going to support that price level?

So as we can readily see, this book is cornucopian - it does not take a responsible position on explaining how the economy will support such a high fuel or oil price. Ipso facto, the book is DOA.

Sounds like pre-2008 thinking IMO.

Recessions will now come more quickly as the oil price ratchets back up to "kill level" more and more quickly until we enter a period where the only thing that buys us a little more time is efficiency. The most efficient countries -or those still with oil to export or cheaper internal energy sources (China:coal, Norway:Hydro)- will probably be less affected. Those with greater imports or more leveraged to cheap energy -Poster child: USA- will be more affected.

Nick.

It pretended that as gas prices rise, all that happens is simple changes to the way we transport ourselves.

It's not clear to me how prices could rise that high. First, most uses of oil have substitutes at much lower prices (e.g., an EV is cheaper than an ICE, at $4 gas). 2nd, oil importing countries would see their economies slow down at oil prices over $100/bbl.

I really think many people are omitting the potential for dollar collapse/inflation.

A few years ago, I read a compelling argument that the massive US external debt could only be dealt with in one of two ways:

It became clear in 2006 that the inflatory path was preferred by TPTB, despite some hopes to the contrary, once bernanke realised what a mess the banks had gotten themselves into.

Assuming the Fed inflates it's way out of the debt, e.g. by halving it's value, oil would then go to $140/bbl, gold to $2000/ozt, and euros from $1.40 to $2.80.

In that scenario, US buyers would be handing over $140 for a barrel that would cost the europeans/chinese/etc the same amount as before..

How does reducing the exchange value of the dollar inflate it?

Who are TPTB?

TPTB=the powers that be; MSM=mainstream media; WTSHTF=when the sh*t hits the fan, BAU=business-as-usual, etc etc

monetary inflation is increase in money supply (M1,M2,M3 etc).

price inflation is increase in prices, through either increasing costs and/or increasing demand and/or reduced supply.

When bernanke speaks of 'dropping money from helicopters', he refers to anti-deflationary measures, =inflation.

'Printing money', i.e. increasing the supply, i.e. increasing the number of dollars (not yen or euros) in circulation, results in a situation where more dollars are available to swap for some import. therefore the import's price-in-dollars will rise - but not necessarily the product's price in euros, yen, rupees.

Therefore the number of dollars needed to buy some foreign currency would also be higher.

The British are also printing money ('quantitative easing') so thier currency is also increasingly worth less.

see here for more currency value comparisons.

I agree that money supply increase can affect exchange rates, assuming the additional money doesn't go into reserves (or get used to handle normal economic growth). It's not clear to me that the Fed is succeeding in increasing the money supply, given the recent problems with money velocity (i.e., banks not lending it, people not spending it).

You seemed to be suggesting that changing exchange rates would somehow reduce US debt. Unlike most countries, US debt is in it's domestic currency (the dollar), so this isn't clear to me why this would be so.

You seemed to be suggesting that changing exchange rates would be a form of inflation in itself (which I consider to be primarily price inflation).

It wasn't clear to me who you felt TPTB were.

There ya go again Nick, stupid and meaningless statements "if we", "we could", "which would", "which can"...................wouda, couda, shouda. You must be a politician because you obviously think we are all idiots.

"just replace current vehicles with hybrids like the Prius"......no need to read further than that, everyone knows by then that you are full of it.

Go and stand on a freeway overpass for half a day. Then come back and tell us "we can" replace "current vehicles" with hybrids.

Make yourself known to The Dallas Cowboys, they could use a good interference runner.

You're getting a little emotional and personal, there. Ad hominem attacks really don't convince anyone.

Yes, we have a lot of conventional vehicles on the road. OTOH, 50% of vehicle miles driven come from vehicles less than 6 years old, so it doesn't take as long to replace vehicles as you might think.

Don't forget, I was responding to the following:"I can't see how this is anything but a negative for the US in future years, at least in regard to the auto-centric suburban way of life in the US".

So, is there a solution for suburbanites? Yes, buy a Prius (or Honda Insight, or Ford Fusion). Of course, when gas prices rise those might get back-ordered. So, put in your order, and carpool. Carpooling will instantly reduce your fuel consumption by 75%. No investment needed, just a little bit of scheduling.

Now you flippantly declare that the "solution" for suburbanites is to buy a hybrid or carpool.........you make me sick.

Nick there is absolutely no reasoning with you so I wouldn't bother. You evoke all the characteristics of an evangelist, with faith alone as the guiding hope, like "I say mountain be moved"...............

Faith and hope won't pay for the cars people drive now let alone finance a changeover to hybrids. All, all your assumptions are apparently based on assumptions of BAU. You should acknowledge, clarify or allow for the possibility that, debt is a problem, that consumerism is falling precipitously, economic growth and taxation revenue is on the verge of collapse......resource depletion, unemployment, aged care, homelessness, pensions, health care, law enforcement and incarceration, climate change and so on are real, they are events and problems happening now and of course continue to be exacerbated not alleviated by a teetering financial system and peak oil.

And your beloved Prius

Toyota......

Financial information

Toyota is publicly traded on the Tokyo, Osaka, Nagoya, Fukuoka, and Sapporo exchanges under company code TYO: 7203. In addition, Toyota is foreign-listed on the New York Stock Exchange under NYSE: TM and on the London Stock Exchange under LSE: TYT. Toyota has been publicly traded in Japan since 1949 and internationally since 1999.

As reported on its consolidated financial statements, Toyota has 540 consolidated subsidiaries and 226 affiliates.

Toyota Motor North America (100% - 2004)

Toyota Canada Inc. owned via Toyota Motor North America

Toyota Tsusho - Trading company for the Toyota Group

Daihatsu Motor Company (51.2% - March 31, 2006)

Lexus 100% (1989)

Scion 100% (2003)

DENSO (24.74% - September 30, 2006)

Toyota Industries (23.51% - March 31, 2006)

Aisin Seiki Co. (23.0% - September 30, 2006)

Fuji Heavy Industries (16.66% - June 28, 2008)

Isuzu Motors (5,9% - November 10, 2006)

PT Toyota Astra Motor (49% - 2003)

PT Toyota Motor Manufacturing Indonesia (95% - 2003)

Government bailouts

Toyota's financial unit has asked for an emergency loan from a state-backed lender on March 16, 2009, with reports putting the figure at more than $3 billion. It says the international financial situation is squeezing its business, forcing it to ask for an emergency loan from the Japan Bank for International Cooperation. It is the first time the state-backed bank has been asked to lend to a Japanese car manufacturer.

you flippantly declare that the "solution" for suburbanites is to buy a hybrid or carpool

Well, the original question was whether suburbanites would have to move out of the suburbs - I would suggest that if suburbanites can't afford a Prius, they can't afford to move. Further, carpooling is mighty cheap - if you carpool with 3 other people, you reduce your costs by 75% - who can't afford that?

Faith and hope won't pay for the cars people drive now let alone finance a changeover to hybrids.

And yet, hybrid sales are staying pretty strong. It's conventional vehicle sales that have dropped by 40%.

Yes, we have other problems - see my post just now to ccpo. It certainly looks like we're recovering from our current bank panic. Of course, we'll have another eventually - we always have.

That's interesting about Toyota's financial unit. As you note, Toyota has a lot of separate units - the overall company is doing just fine, though of course it's profits have disappeared for a few quarters.

You, and all those with a similar position, are in for a rude shock. You will find that weaning ourselves off oil will be a lot like weaning ourselves off food.

Ron P.

Not really. Reducing oil consumption is quite easy, once you decide to do it. As Nate Hagens has noted recently, the barriers aren't technical or economic (exactly), they're due to entrenched institutions who are fighting change.

See http://energyfaq.blogspot.com/2008/09/can-everything-be-electrified.html

I agree with you Ron. Everything is so inter-connected, that it weaning us off of oil wouldn't work. It would be a little like learning to live without blood in our physical bodies.

Gail, think of it this way: oil is used in a lot of little interconnected ways in our economy, but the majority of oil is used in a few, large ways. Reducing those is simple.

For instance, 25% of US oil consumption is commuting. Reducing that is really easy: just carpool in the short term (if needed for crises), and in the longer-term shift to hybrids, then PHEVs, and then to EVs.

Another 25% is passenger car travel, most of which is optional. In the short-term most can be foregone (if needed for crises), and in the longer-term we can shift to hybrids, then PHEVs, and then to EVs.

Not complex, really.

Huh. Tell that to the ice caps. And all the other resources that are depleting... like fish.

Simple is as simple does. Do some math on 7 billion people all living even a lower-middle class American existence and see how many Liebig's you come up against. (Let alone the 9 billion or so we're almost guaranteed to end up with in even the best of circumstances.)

Cheers

Tell that to the ice caps. And all the other resources that are depleting... like fish.

No, I agree that climate change is a big problem, and that fish stocks are being depleted. But those aren't what we're talking about here, and reducing oil consumption will only help climate change, right?

Do some math on 7 billion people all living even a lower-middle class American existence and see how many Liebig's you come up against.

Well, I see per-capita wild fish, meat eating and CO2 emissions as needing to be reduced - I don't see these as essential to "our way of life". What do you see?

No. 1) because we will burn coal, 2) because the push to "renewables" will trash every other form of concentrated emergy, and 3) because it is already too late.

Wild fish aren't essential to "our way of life" perhaps, only to the greater web of life itself. There's a lot of stuff our 8 year old children know that we adults seem to forget.

cfm, the growlery, gray, me

No. 1) because we will burn coal

I don't think the US will do CTL in any serious way. Coal to power EVs is better than oil in ICE's, CO2-wise.

the push to "renewables" will trash every other form of concentrated emergy

Could you elaborate on that? Wind in the US is cheap, overall.

because it is already too late.

Probably, but not because of any defects in wind power. No, it's just social resistance to change.

Wild fish aren't essential to "our way of life" perhaps, only to the greater web of life itself.

I meant that eating wild fish wasn't essential to "our way of life".

Just as every human roughly needs to inhale the same amount of oxygen, MPP says that eventually we will all get to use the same amount of daily exosomatic energy, except for those who can convince others that they are truly more deserving of a luxury-energy lifestyle.

Duncan's Olduvai Re-Equalizing rough scenario equalizes everyone about the Third Decade at approx 4 BOE/C [unless the planet's vast quantity of humans learns to hold hands and sing Kumbaya, thus moving ahead smartly with Non-BAU better ideas for long-term sustainability]:

http://www.theoildrum.com/files/DuncanFigure5.png

Oil and the USD...and our military machine...

http://www.informationclearinghouse.info/article23680.htm

Still Puzzling: Is money the real problem and can efficiëncy gaines (EG) save the day?

What are efficiëncy gaines?

Most of our industrialised time, it was just common sense to keep big stockpiles (let's say one month) all across the production line. If one machine broke down, nothing else was effected, until that machine's stockpile run out. Nobody panicked because you had one month to repair it.

In the 70's alot of things happened and the need to do more with less arised.

A new way of thinking entered the workforce and we just called it managing. These guys just sold the stockpiles which created a quick buck and a bonus for them. They kept trimming (bonus) the proces until the machines were sold (quick buck) to some undeveloped country, and we build new more automated machines.

At some point, these so called "undeveloped" countries could produce cheaper with our old machines than we could with our new machines. So the managers again made a quick buck by selling the new machines.

From a money perspective EG are a real money maker.

What would you rather have?

1 high tech 3MW windturbine (very efficiënt?) or 15 low tech windmills with 4 rotating shafts at the bottom.(thanks Gail for this eyeopening idea)

So EG can save the day! But what about tomorrow?

(If the TOD mods think this isn't the right place for stuff like this, please delete it.)

Efficiency gains in the past led to lower prices. What we are seeing now is higher electrcity prices, so the efficiency gains aren't in the production of electricity.

One place we might theoretically make efficiency gains is in manufacturing, but we aren't manufacturing much now. It seems like we would need changes in equipment for efficiency, so this won't be cheap.

Another place there would be room for efficiency is appliances and light bulbs. This requires new ones, so is cheap for light bulbs; not so cheap for appliances. (Having recently cleaned up a mess from a broken florescent light bulb in a carpeted bedroom, and read the directions about possibly replacing carpeting and bed clothes, I am not convinced this approach is as cheap as it is claimed to be, however.)

Another place for efficiency is in tighter buildings and better insulation, for heating and cooling with electricity.

Not too many years ago, we got an efficiency improvement of about 1% a year. With the recent rise of electricity costs, it looks like we will need a lot bigger improvement than that to keep electricity costs flat or decreasing.

Hi Gail

I wonder if you have seen this lecture, Elizabeth Warren covers a broad spectrum of issues such as inflation adjusted wages, costs of living, health insurance, housing etc.

http://www.youtube.com/watch?v=akVL7QY0S8A&feature=channel

Due to family income being so overstreached, energy price increases will have a serious effect, but I feel that this will drive house prices down to historical median levels. This could actually help mitigate some of the worse effects of oil prices. For a time at least.

Yes, I have seen Elizabeth Warren's lecture. It is very good.

I agree that housing prices will drop more. The catch is that interest rates are very low now, and it is doubtful that they can really be kept this low long-term. With rising interest rates, there still will be pressure on homeowners (especially those who do not have low interest rates locked in).

They've been making this electricity thingy for more than a hundred years so i doubt huge efficiency gains are possible:-(

..

Why have you left out transportation?

With the normal US transport mode being single driver, and the average US car weighing 2 tons, and lots around 3 tons (or more!), and the average person weighing maybe 150 lbs (okay, maybe hopeful in the McDonalds age... but stil), we are carting around 25 to 40 times the mass we need moved for commuting, much of it dead weight.

Huge gains possible there.

So the goal should be to reduce the mass of the car and increase the mass of the driver, to maximize efficiency? :)

Palecon,

Sarcasm doesn't go over too well here even with the smiley face-but I did get a good and much needed laugh.

There is one bright spot as far as the car fleet is concerned that I think has been overlooked-just judging from my personal observations.

This is that older and larger cars are going to be scrapped much faster than expected-the cost of repairing these old dinosaurs has jumped beyond belief in the last year or two and now when one needs a serious repair it seldom gets it unless it's a classic or collectible.

I find it hard to understand why auto parts prices have climbed so fast but lots of commonly needed parts have doubled in two years and almost anything I 've bought is up fifty percent or more.

Working guys and girls are catching on fast to the fact that a set of tires for an old Escort cost only a little more than half as much as a set for a Crown Vic,and that the Escort has only four spark plugs to the Crown Vic's eight.

You can buy a serviceable middle aged Cavalier in pretty decent running order (maybe a little shabby from normal wear and tear) for about the same money as it costs for a transmission overhaul if you're driving a full size Chevy or Ford car or truck.

That will save you fifty or a hundred bucks on your insurance every six months,and cut your gas bill by at least a third, probably more.

Even folks who live only four or five miles from work are getting rid of thier old dinosaurs once they have a problem,even though they don't buy a lot of gasoline.

Here's some irony: My 4-cycliner car developed some fuel supply problems last year, and so, due to a growing rust problem (fixable) and a water leak (also fixable), I parked it, reasoning that I could get along just fine without a car of my own.

And I did. I walked wherever I wanted to go, or borrowed a car, or got a lift with someone. Eventually, family pressure effectivly forced me to get a car on the road (irrational fear of me being assaulted while walking etc). I reasoned that a cheap station wagon that was sitting in the yard (we were 'storing' it for a friend) was a better option that fixing the old car, so I got it up to registirable condition, and started driving it. It never idled properly, drinks fuel like a 18yo girl drinks Vodka Shots at Spring Break, and most of the under-bonnet cabling and hoses are either not there, or are just skew-iff. Just last week, it developed it's own problems with fuel, by stalling at the traffic lights and not starting again.

On a whim, I charged the battery in the old car, connected it up, and turned it over. Despite being left, unloved, for 8 months or so, it started first time...

What we are seeing now is higher electrcity prices, so the efficiency gains aren't in the production of electricity.

U.S. nuclear plants have been paid off for a long time. They make electricity at a cost of 2 cents per kWh.

http://www.eia.doe.gov/cneaf/electricity/epa/epat8p2.html

Vermont gets 80% of its electricity from nuclear, yet customers pay 13 cents per kWh, so why do they charge so much?

Connecticut gets half its electricity from nuclear, yet customers pay 17 cents per kWh, so why do they charge so much?

Saudi Arabia pumps oil out of the ground for $8 a barrel, yet last year they charged $150, so why do they charge so much?

The answer is the same in each case, because they could. Low cost energy sources do not produce cheap energy unless the capacity to supply energy exceeds demand.

The U.S. completed about 5 reactors per year for 20 years at a time when fossil fuel was cheap and global warming was relatively unknown. Had we continued to build reactors at that rate we would have clean abundant cheap electricity. We would be more competitive in the world marketplace and more Americans could have high paying jobs and a lower cost of living.

Windmills and solar cells cannot do that because their kWh’s are very expensive when storage, transmission, backup power and frequency and voltage regulation are factored into the cost.

The U.S. spends $1,000 billion per year on energy. We should spend 10% of that amount to develop technology that can be mass produced that will produce energy that is cheaper AND more abundant than fossil fuel.

Massive feed in payments to reproduce large numbers of inefficient machines that produce limited expensive energy is a waste of money, raw material and human resources.

Windmills... cannot do that because their kWh’s are very expensive when storage, transmission, backup power and frequency and voltage regulation are factored into the cost.

Have you seen good calculations for that? As far as I can tell, that's not the case. The current grid doesn't need storage or backup to deal with wind up to about 15% KWH market share; geographical dispersion together with a modest amount of long-distance transmission, and Demand Side Management (especially with EVs and PHEVs) will allow rather more than 15%.

Denmark has pushed wind harder than any country for over 30 years. They have the most expensive electricity in the world, they export about half their wind power because of its intermittency, and they still burn a lot of fossil fuel.

Yes, all that is true, but it doesn't really matter.

Denmark is tiny; has a poor wind resource; chose coop-based decentralized generation (which is much more expensive); and wants to reduce oil imports but doesn't care how much coal it burns. So, those problems are to be expected.

Wind is much cheaper in the US.

Wrong. A single branch falling in Ohio proves that. By your logic, a generating system that did not work at all and cost $0 would be the best.

Good thought.

But, that's not why Denmark decentralized - they did it for social reasons, not for system reliability. It may have been the right choice, but it had a cost.

Wind power does need a complex grid, and bigger installations do work much better.

If a 1 GW nuclear plant received the 2.1 cent PTC wind gets it would make an additional $166 million per year. Add in the cost of tax breaks, renewable mandates, accelerated depreciation rates, storage, transmission lines, backup power and frequency and voltage regulation, and we see that wind is very expensive.

More importantly, wind cannot provide reliable capacity that exceeds demand, a necessary condition to actually drive prices down below those of fossil fuel.

The next 6 nuclear plants will get the credit.

OTOH, don't forget that the PTC is only for the first 10 years, so you really have to discount it by about 50% for lifecycle costing.

Add in the cost of tax breaks,

What are you thinking of?

renewable mandates

Those don't create hidden costs, just additional demand

accelerated depreciation rates,

Yes, that's a subsidy. Not an unusual one, or all that large, but it's real.

storage, transmission lines, backup power and frequency and voltage regulation,

Those mostly aren't real. Nobody's building storage for wind, yet. Transmission lines are perhaps $.25/Wp, which isn't that large. Backup? What backup? Other sources of generation get paid for availability - if wind can't, it doesn't get paid for capacity credits.

wind cannot provide reliable capacity that exceeds demand, a necessary condition to actually drive prices down below those of fossil fuel.

Not really. First, you have to separate KWH and capacity credit payments in your mind. They're separate things, and get reimbursed separately. 2nd, wind can indeed provide some reliable capacity - it just takes some size and geographical dispersion.

Fully loaded wind KWHs are often less expensive than FF, and of course, they're always the cheapest in the hourly market.

Of course, who can compete with old dirty coal plants, or old nuclear plants that have been fully amortized and now just have $.02/KWH operating costs?

More importantly, what about the opportunity cost of money spend on nuclear, that could be building wind and solar, with it's zero risk of weapons creation? How much would we have saved (and save in the future) if the Shah of Iran had invested in the 70's in a domestic wind & solar industry, instead of nuclear?

The next 6 nuclear plants will get the credit… don't forget that the PTC is only for the first 10 years, so you really have to discount it by about 50% for lifecycle costing.

Was the PTC cut off after the first 6 wind farms, why not? $166 million for 10 years is $1.66 billion, a lot of money.

But the nuclear PTC is not as good as it is for wind mills.

The production tax credit (PTC) for new nuclear generation allows 6,000 megawatts of new nuclear capacity to earn $18 per megawatt-hour for the first eight years of operation. The maximum tax credit for any one plant is capped at $125 million per year. In 2005, $18 per megawatt-hour was comparable to the PTC for renewable resources. However, unlike the renewable PTC, which increases annually with inflation, the nuclear PTC does not escalate.

New plants will average well over 1 GW, so the credit per kWh is much lower than for wind.

I recommend a totally level field.

renewable mandates, Those don't create hidden costs, just additional demand

Mandates for some percentage of “renewable” energy force utilities to pay whatever cost developers charge to avoid violation. Nothing hidden, it is a naked extortion of money that is passed on to the rate payers and spread over all kWh’s to hide the true size of the subsidy to wind.

storage, transmission lines, backup power and frequency and voltage regulation, Those mostly aren't real. Nobody's building storage for wind, yet. Transmission lines are perhaps $.25/Wp, which isn't that large.

No way. For how many miles? Grand renewable plans always call for thousands of miles of new supergrid, paid for by others, to subsidize wind and solar.

Show us some recent power line completions in the U.S. for the cost you claim.

Backup? What backup? Other sources of generation get paid for availability - if wind can't, it doesn't get paid for capacity credits.

Show us some examples of utilities paying independent producers to standby while wind is up.

wind cannot provide reliable capacity that exceeds demand, a necessary condition to actually drive prices down below those of fossil fuel… wind can indeed provide some reliable capacity - it just takes some size and geographical dispersion.

Evidence that wind can reliably and consistently exceed demand?

Fully loaded wind KWHs are often less expensive than FF, and of course, they're always the cheapest in the hourly market.

Why do the countries with the most wind have very expensive electricity and high carbon emissions?

“More importantly, what about the opportunity cost of money spend on nuclear, that could be building wind and solar

If the U.S. had built wind and solar in the 70’s-80’s instead of nuclear they would have failed miserably and filled landfills long ago, as the few wind farms of that era did. We would have hundreds more coal plants.

with it's zero risk of weapons creation?

Which countries developed a real commercial nuclear power industry and than used it to make nuclear weapons disregarding the far easier faster and cheaper paths to nuclear weapons?

the nuclear PTC is not as good as it is for wind mills.

Interesting - thanks for the info.

I recommend a totally level field.

Sure, but to do that we'd have to eliminate Price-Anderson for nuclear, and tax carbon heavily for fossil fuels. That doesn't seem likely any time soon.

Nothing hidden, it is a naked extortion of money that is passed on to the rate payers and spread over all kWh’s to hide the true size of the subsidy to wind.

Well, if it's not hidden, it's not hidden, right?

Grand renewable plans always call for thousands of miles of new supergrid, paid for by others, to subsidize wind and solar.

Sure, some people talk about that, but it's not necessary or likely.

Show us some recent power line completions in the U.S. for the cost you claim.

There have been two recent projects, in S CA and W TX, and the cost was about $.25/W.

Show us some examples of utilities paying independent producers to standby while wind is up.

I'm not sure what you mean. The basic structure of the industry is that KWHs and reliable capacity are paid for separately. If wind doesn't provide reliable capacity, it doesn't get paid for it. OTOH, some nat gas generators run about 100 hours per year, but make a profit with the capacity payments.

Evidence that wind can reliably and consistently exceed demand?

Again, I'm really not sure what you're talking about. I don't think anyone is suggesting a grid composed only of wind.

Why do the countries with the most wind have very expensive electricity and high carbon emissions?

You're mostly talking about just Denmark, and I explained that before. Germany also has a poor wind resource (average capacity factor is 50-60% of the US), very unlike the US.

If the U.S. had built wind and solar in the 70’s-80’s instead of nuclear they would have failed miserably and filled landfills long ago, as the few wind farms of that era did. We would have hundreds more coal plants.

Sure, wind wasn't really ready back then, but you're missing my point about Iran.

Which countries developed a real commercial nuclear power industry and than used it to make nuclear weapons disregarding the far easier faster and cheaper paths to nuclear weapons?

That's not what I said: it's pretty clear that Iran is using their plans to develop a commercial nuclear power industry to cover up development of weapons. You really can't ignore that.

Sure, but to do that we'd have to eliminate Price-Anderson

Price Anderson is not a subsidy, it is a handicap no other industry has to carry, it should be eliminated.

http://www.theoildrum.com/node/3877#comment-335609

There have been two recent projects, in S CA and W TX, and the cost was about $.25/W.

How many miles, what cost, does it account for the lower capacity factors transmitting intermittent power?

Links please.

Why do the countries with the most wind have very expensive electricity and high carbon emissions?

You're mostly talking about just Denmark, and I explained that before.

So what countries are success stories? 50-80% renewable with low cost low emission energy, comparable to Switzerland or France?

it's pretty clear that Iran is using their plans to develop a commercial nuclear power industry to cover up development of weapons. You really can't ignore that.

I have no problem with Iran having commercial nuclear power.

Enrichment and reprocessing are the two easy paths to weapons, and that is true with or without commercial nuclear power. Those two functions should be limited to large stable countries and be under full oversight by IAEA. Enrichment is a tiny fraction of the cost of nuclear power.

Irans nuclear weapons program hides behind a transparent fig leaf. Using that to oppose commercial applications of fission is like being opposed to fire because it enables napalm bombs.

Price Anderson is not a subsidy, it is a handicap no other industry has to carry, it should be eliminated.

Wow. Do you feel that's a view that's widely shared in the nuclear industry? Has there been an official initiative to eliminate it?

How many miles, what cost, does it account for the lower capacity factors transmitting intermittent power?

They're long - designed to move things maybe 1,000 miles, IIRC.

Links please.

I'll look. You know, you brought that point up - it would be reasonable of you to do a little research.

So what countries are success stories? 50-80% renewable with low cost low emission energy, comparable to Switzerland or France?

Now you're just being difficult - you know that wind is too new as an industry for that.

Enrichment and reprocessing ... should be limited to large stable countries and be under full oversight by IAEA.

Do you see any prospect of the world moving to that kind've program?

Irans nuclear weapons program hides behind a transparent fig leaf.

Well, I've kind've thought so - I wondered what I was missing. Why do you think they're getting away with it?

Using that to oppose commercial applications of fission is like being opposed to fire because it enables napalm bombs.

I know what you mean...yet....nuclear weapons are a whole level beyond napalm bombs. They're the one thing that humankind truly could use to take us back to cockroaches being the dominant species with the weapons that we have now, 30 minutes away from being used. That's a threat that's even worse than climate change, even though everyone seems to have forgotten about it lately.

Wow. Do you feel that's a view that's widely shared in the nuclear industry? Has there been an official initiative to eliminate it?

Most knowledgeable people exposed to my view agree with it. The nuclear industry puts up with a lot of c**p resulting from fear and ignorance. It does not see Price Anderson as an issue worth fighting.

You know, you brought that point up - it would be reasonable of you to do a little research.

I have. Transmission costs for renewables will be much greater for proposed massive renewable grids due to much longer average travel distance for renewable kWhs, and resulting low capacity factor for new renewable transmission lines. I am on travel now, so away from links.

Pro wind folks compare existing grids as they are now against existing grids with windmills added and show that it saves fuel cost and emissions. But the real comparison is existing grids with the same investment in new nuclear power analyzed over the next 60 years.

Now you're just being difficult - you know that wind is too new as an industry for that.

Wind has been around for over 300 years and has evolved much more than primitive reactor technology. Windmill efficiency is near theoretical max 60% while steroidal submarine reactors split only 0.6% of mined uranium. There is far more room for improvement in fission than in wind.

Enrichment and reprocessing ... should be limited to large stable countries and be under full oversight by IAEA.

Do you see any prospect of the world moving to that kind've program?

Not overtly, but the percentage of enrichment capacity in large stable countries under IAEA oversight is very high, much higher than during the cold war. Obama wants to eliminate nuclear weapons, as do I. Strict controls on enrichment and reprocessing should be part of that.

Why do you think they're [Iran] getting away with it?

So far nobody has the guts to stop them, that may change.

nuclear weapons are a whole level beyond napalm bombs. They're the one thing that humankind truly could use to take us back to cockroaches

Under the light of serious research nuclear winter became nuclear fall. The southern hemisphere would be habitable, especially with smaller arsenals today. But this issue is not applicable to nuclear power except to say that a world with abundant energy would be less likely to go to war over energy.

Many solutions are proposed to solve our energy problems, at best only one of them is best. My recommendation is to push every technology as hard as possible and pick the best technology

http://www.theoildrum.com/node/5144#comment-476522

This is the only strategy that guarantees the best solution will result. I urge you to adopt this recommendation.

Re: Price-Anderson - do you feel that the industry could now get the liability insurance that was unavailable in the 50's? Have you seen any evidence of this you could pass along?

Transmission costs for renewables will be much greater for proposed massive renewable grids due to much longer average travel distance for renewable kWhs, and resulting low capacity factor for new renewable transmission lines.

It makes sense that wind transmission costs would be higher due to longer distance and lower capacit factor, but the other important part is how large transmission costs are as a % of the overall project - IOW, is this a really significant difference? It doesn't look like it, to me.

Ah, here's estimates for transmission costs in Texas of $.26/nameplate W: http://www.cnbc.com/id/25708335

Wind has been around for over 300 years and has evolved much more than primitive reactor technology. Windmill efficiency is near theoretical max 60% while steroidal submarine reactors split only 0.6% of mined uranium. There is far more room for improvement in fission than in wind.

But conversion efficiency matters very, very little, as the fuel is so cheap, in both cases. What matters is the capital & operating cost per KWH output, and both wind and nuclear are good enough. It doesn't matter that much if one is slightly better on cost - other things that are harder to quantify (such as weapons proliferation) begin to matter more.

the percentage of enrichment capacity in large stable countries under IAEA oversight is very high, much higher than during the cold war

I'm not especially doubting you, but I'd love to see a link on that for future reference.

So far nobody has the guts to stop them, that may change...Under the light of serious research nuclear winter became nuclear fall. The southern hemisphere would be habitable, especially with smaller arsenals today.

I have to say, neither of those reassures me. No one is willing to stop weapons proliferation, and only half the planet would uninhabitable...!

Those countries that import everything one day have to import their govt too.

Is money the real problem and can efficiency gaines (EG) save the day?

Ayres-Warr's papers show that thermodynamic eficiency has increased by a factor of 10 since the early steam engines. Electrical generation today is 35% efficient for coal, with best practice being 45%. Comined cycle natural gas is 60% efficient. Thermodynamic efficiencies cannot even equal 100% because thay have to use real cycles, not "ideal" ones. Also, they have to use real materials, as in boiler tubes and turbine blades.

This implies that economic growth will be lower in the future. At some point declining resource quality will overtake economic growth and the economy will turn down.

The highest growth in the US economy occurred from about 1880 to 1910, due to Bessemer steel making, railroads lowering the distribution cost of goods and to electrification.

China has all the driving force of going from a pre pre-industrial to a 21st Century economy, allowing 12% growth. China will continue to drive down wage rates and put upward pressure on raw material prices until the developed world economies collapse.

This implies that economic growth will be lower in the future.

Not really. There are many cheap, effective ways to increase efficiency or "work done" without worrying about thermodynamic heat-engine efficiency.

For instance, I can go from a 15MPG SUV to a 50MPG Prius, and be 3x as efficient at solo commuting (at a lower purchase price!). The Prius engine is maybe 30% more efficient, but that's by far not the most important thing: more important are better aerodynamics, regenerative kinetic energy recovery, and a host of details.

I added laminate panes to my existing windows, and don't have to use heat until it gets below freezing. The most efficient energy is the energy you don't need.

We can convert from heat engines to wind turbines, and then the efficiency of conversion is irrelevant, because the "fuel" is free and abundant.

Not to mention that knowledge work doesn't really need much physical "work" done.

Or you could move closer to work and walk your ass there. I don't know why this is so hard to understand. Most of the energy we produce, no matter how efficiently, is USED inefficiently.

There is a minimum level of energy use we need to run an advanced society. It's no where near what we use in the US... or anywhere in the West.

This isn't to say that resource problems are no big deal... adjustments like that are hard, which is why they aren't done, and rich people will try to do each other to stay in their SUV and suburban home... but that doesn't mean change is impossible because we have nearly maxed out thermodynamic efficiency of the ICE.

Or you could move closer to work and walk your ass there. I don't know why this is so hard to understand.

Because it's much, much cheaper for most people to buy (or rent) something cheaper, and commute farther.

Which is makes more sense: paying $3k more for a hybrid, or paying $100K more for your home?

Heck, just the process of moving costs more than $3k!

Up until recently, most people would have answered "paying $100K more for your home! Duh!" Maybe most people still would say that.

Just sayin' ...

Which is makes more sense: paying $3k more for a hybrid, or paying $100K more for your home?

Heck, just the process of moving costs more than $3k!

Precisely! One thing I just don't get about New Urbanists and suburb-haters (including Kunstler) is how they think the Newly Impoverished class can somehow afford to abandon their already built (and still perfectly servicable) homes and all just move to the city. And pay 3-4X current rents or mortgage payments. Coming up with almost *any* type of more efficient transport, whether it takes the form of hybrids, all-electrics, light rail, or human powered trikes is FAR less expensive than abandoning all suburbs/exurbs wholesale and cramming into the cities. Not to mention, if everyone did that, the already high cost of living in cities would skyrocket as demand would far outstrip supply... thus leading to an urban building boom, more consumption of scarce resources, etc.

Precisely. I am a present suburb hater, but when it gets down to it, I have no choice but to accept that I made a bad decision some fifteen years ago to buy in the Sacramento suburbs. A bad decision on a number of levels, levels that I was ignorant of for a great many years, but most certainly not a bad decision based on the cost of living. It will be far, far, far less expensive to continue to bus and to bicycle and to drive the 15 miles to work, no matter how expensive energy becomes. Call it mis-investment, OK...but I am constrained to live in suburbia in my [almost] paid for housal unit.

There are pre-WWII developments in the Sacramento core, yes. There are quite a few places in the core where basic services are close enough to walk to, or to transit to with relative ease. They are also twice as expensive. On a property tax basis alone, it would cost me an addition $85,000 over the rest of my life if I moved to such an area...to live in a community whose design I now recognize the value of.

Moving to any existing TOD neighborhood would be financially unwise. I live less than a mile from Calthorpe's Laguna West, the supposed TOD neighborhood that Kunstler praised in Geography Of Nowhere but recognized its failure in Home From Nowhere. We aren't anywhere close to following through with old TOD designs here in my region, let alone capable of building any new TODs.

At this point I am stuck in suburbia, and I have found ways to [mostly] eliminate my exposure to energy volatility. I cannot say what depleting energy will do to suburbia in general; perhaps it will force us to build correctly. But I most certainly understand the issues that are raised here on TOD, and I believe my future efforts will be much better spent learning to persevere through future energy calamities rather than absorbing the extreme cost of living in a better, correctly built, less energy intensive neighborhood.

There are many cheap, effective ways to increase efficiency or "work done" without worrying about thermodynamic heat-engine efficiency.

Of course there are other ways to increase "work done" efficiency besides thermodynamics. We made a serious effort to do those after the 1973 oil price shock and have decreased our $GDP/BTU by about half by thermodynamic and other means since then.

Hybrid and PIEV's will cost a lot more than IC engines, reducing consumers' expenditures on other items. Same with wind and solar energy. Wind "fuel" may be free, but wind turbines, transmission lines and storage are not.

Hybrid and PIEV's will cost a lot more than IC engines

A Prius costs less than the average new vehicle.

Same with wind and solar energy.

New coal generation is as or more expensive as wind.

Wind transmission is about 12% of overall project costs - not a really big deal. Storage isn't needed yet, and likely never will be - Demand Side Management, esp with PHEV/EVs will fill the need.

I meant to say BTU/$GDP

As oil is the lifeblood of the economy, all credit is essentially based on future oil production. You take out a loan, you're borrowing against the future oil production. When oil production no longer can pay the interest on all those loans taken out against it, everyone goes into default, credit dries up, and the economy goes into a tailspin.

Here we are.

~wildeyes

Wildeyes-not bad for a down and dirty summary-

and as for what peaked with oil prices?

Our current way of life, in a nutshell.

oil is the lifeblood of the economy

Not really. Oil is only about 40% of US energy, and declining (see my note to Westexas).

Eventually oil will be obsolete, just as it is for lighting. In the 1880's, kerosene for lighting was the main use for oil, and electrification made that obsolete - if gasoline for vehicles hadn't come along, oil exporters (like Pennsylvania) would have been in real trouble.

Too bad electrical costs seem to be on almost the same trajectory as oil prices--with not as much drop as oil after the peak.

Well, I don't think it's a cause for concern.

1) US electricity is still dirt cheap - compare to most other places in the world, like Germany and Japan, who've been thriving for decades with much more expensive electricity.

2) It's only risen about 15% in 3 years (after adjusting for inflation), which isn't much.

3) It's domestically produced, so it doesn't create trade deficit and credit problems, like oil.

4) much of the increase was due to the spike in nat gas pricing, which has since mostly reversed itself - do we know 2009 electricity prices?

It's really a very tiny problem.

Electricity prices are not a cause for concern if you have a little discretionary income that can be diverted to pay more for your juice.

About half of all the people I know have hardly any discretionary income at all.

I agree that electricity is still a bargain.

From the Energy Export Databrowser:

If oil prices continue to rise (talking about yearly averages here) while natural gas prices remain subdued I expect that oil and natural gas will switch places on this chart over the next decade.

It seems that we could reduce oil consumption by 1/3 over a decade by driving less, driving smaller cars and replacing much of that mobility with electrically powered transit. Assuming that we can produce natural gas in sufficient quantities over the next decade, we can get close to living within our nation's ability to produce fossil fuels while retaining a modicum of personal mobility and a fully Western lifestyle.

And all of this is predicated on an abundance of natural gas being produced in North America. It seems possible based on some of the recent claims but the jury is still out.

Happy exploring!

-- Jon

I agree.

It's worth noting that personal transportation is about 50% of US oil consumption. If we raised the average MPG from 22 to 50 (just replace current vehicles with hybrids like the Prius, which costs less than the average US new vehicle) we could reduce overall US oil consumption by very roughly 30%.

That's before going to vehicles like the Volt, which would reduce fuel consumption by 90% over the current average.

Or...carpooling, which can be done in a matter of days.

Are you forgetting about water, lithium, metals, minerals...?