Drilling deviated wells and a couple of legal terms

Posted by Heading Out on October 25, 2009 - 10:44am

This is part of the ongoing series of tech talk posts I make on Sundays about the technology behind some aspects of getting oil, natural gas and coal out of the ground. At the moment, as I noted recently, there are places where it costs more to get the fuel out of the ground than folk are being paid for it, yet they are still pumping it out. There are a number of reasons for this, but I wanted to tie in a comment that goes back to the early days of oil production, when one could find pictures of oil derricks, built one right next to another. That density has been reproduced at Kilgore, TX where at one time they had 1,100 wells producing oil from the Great East Texas Oil field.

Reproduction of well density (from TexasEscapes )

When times got tough each well owner would still produce all the oil possible, why? (Apart, that is from paying the interest on all the money borrowed to drill the well in the first place).

When times got tough each well owner would still produce all the oil possible, why? (Apart, that is from paying the interest on all the money borrowed to drill the well in the first place).

Early photos of the oilwells when the first boom first began, showed that they were drilled almost on top of one another and in some difficult country.

There was an interesting ruling that came about at that time, and which has persisted since. It is called "The rule of capture" (which also pertains to water rights, and essentially it says that whatever flows into your oilwell, regardless of where it came from, is yours. (`cos you "captured" it).

So let's say that you live in a nice neighborhood in downtown San Diego, for instance. And under your neighborhood someone discovers there is a rich pool of oil. Well if your next door neighbor is a fast mover, he might drill his well and suck all the oil out of your particular bit of that pool, before you can blink, and yup! It's his (or hers).

So what do you do to counter this and get what's yours before it is half-inched? The obvious answer is to drill your own well, and (rather like two siblings drinking a soda through straws into the same glass) whoever sucks hardest gets the most. Which does all sorts of nasty things to the idea of holding a resource until it's value goes up - but then, that's the oil and gas business.

Well over the last century that obsessive attitude has ameliorated a tad, and now when wells are drilled (particularly since they are a bit more expensive) we try and space them at intervals so that each gets to drain out to the point where it naturally runs out of ability to drain further. There are intricate mathematical equations for this (which I long ago deliberately forgot) but as a first rule of thumb the industry uses a baseline of 40 acres per well. Which means that if you were looking to drill a second well you might step out and drill the next well some 440 yds away from the first. (A quarter of a mile, for those of us who think that way).

Which way would you go? Well that depends very much on the information that you managed to get from the well that you just put in. And this will rely on logs that you ran after drilling, and the map that you were given of the underground geology before you drilled the first well. Some of that information will relate to the permeability of the rock, and the quality of the oil. The lighter the oil and the higher the permeability then the further apart you may want to space the wells (given that they are becoming just a tad expensive these days). Generally in more favorable fields you may space at greater intervals (gas wells tend to be about a mile apart for example).

On the other hand, in some cases, having drilled a very well spaced set of wells you may discover that the permeability isn't quite as good as you had thought, and then you might go in and put wells at closer intervals than originally drilled, infilling the well pattern.

But there are places where this is not an easy option. One such, of course, is the current spate of discoveries and development in Deep Water. But one of the earlier places where this came about was in Western Siberia. After all, here you are, finally established on a man-made island in the marsh, and producing oil, and to drill the next well you have to drive another road through the swamp, build an island, move the equipment, recreate the drill site, before you can start drilling. As Ivan Ivanovich might have said, "why don't you be a good Comrade and let me drill over to my patch, from your site?"

And thus we get into directional drilling (and the entirely "accidental" occasional happening of "subsurface trespass"). Directional drilling as a term is quite often used now to refer to techniques for putting pipes under rivers.

Historically wells were drilled, to as great a degree as possible, vertically downwards. There was the occasional meander, and this had to be corrected, after running a borehole survey, to make sure that the drill eventually arrived at the intended target. But in making those corrections, so a technology evolved that allowed wells to be steered at deliberate angles, and then the light dawned, and deviated wells could be steered away, at designated angles from the initial well, and out to some additional nearby possible sources.

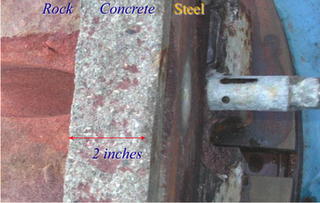

When directional drilling first was developed, the process occurred in a series of steps. Remember that the wells are usually cased with a steel liner. So the first thing that had to be done was to cut a window in that casing. There are several ways to do this, one of the more efficient of which is to use a high-pressure stream of mud from a jet nozzle, that has had a certain amount of sand added to the mud. This abrasive jet can eat through the steel and cut out a segment or window so that the drill bit can reach and attack the rock.

Now we have to make the drill deflect, and the easy way to do this was to slide a wedge into the hole right at the point where the window had been cut. This wedge, known as a whipstock was very carefully aligned and set into the borehole with the inclined side set so that as a new drilling bit slid down the hole it would be kicked off into the window, and began to drill and penetrate the rock in the required direction.

The hole could be started with a smaller bit until the hole is well established (maybe several feet into the new well) and then this pilot bit was removed and a full-scale bit put on the bit to allow the drill to continue creating a new hole moving out from, and down from, the new start to reach the new target either by a straight shot, or by drilling over to the vicinity of the new end point, and then kicking back over to the vertical to drill down into the new oil reservoir. The process is not that complicated, and with practice one could then drill a number of different wells out in different directions from that original hole. And from one location, or platform, one can then collectively extract the oil from an increasingly large surrounding area of the reservoir.

More recently there are services available such as the Autotrak system where, just behind the drill bit (which is rotating – as are the main pipe segments – yellow in the picture below) a non-rotating piece of equipment is located (blue) that has three small rams that can push out against the well bore and direct the drilling head over in the direction required.

And thus it is now possible, through computer sensing of the position of the head, and control of the rams, to steer the drilling head to where you want it to go.

I said "historically" just before talking about Autotrak because when they tried the older system in Western Siberia they ran into a problem. The quality of Soviet steel was not, at that time, that good at keeping the bit turning down and through the bend it had to follow to deviate the well. And so they had to come up with a different approach. And that I’ll leave perhaps for next week's chapter.

This is a series of highly informal posts that are aimed at giving some background to what goes into drilling and production from oilwells. To keep them simple and short I have sometimes simplified a little more than I should to make the description clear, so if it isn’t, please ask.

Are deviated wells generally drilled from the same borehole as a vertical well or another deviated well or are they different boreholes and just use the same pad site? For instance if you were looking at two API#'s; one named the Heading Out #1 (vertical) and the other named the Heading Out #1D (deviated), would they be from the same borehole or same pad site?

Steve -- Obviously all wells start out vertical. At some point the directional portion begins. An example: drill vertically to 10,000' and discover your map was wrong. But now you know better where to drill. You set a cement plug at 6000' and can then usea whipstock to turn the well to the north. The well angle builds and you eventually reach your new target X' north of the original hole. Depending on what state you're in (or if you're in federal waters) the new well bore may require a new permit (and thus a new name) and would get a different API number. If the deviated hole is on the same lease it could be called the Heading Out #1 S/T (S/T = side track). If the new bottom hole location ends up on my lease it would be the Rockman #1. As far as drilling from the same pad it can be done but the surface location doesn't determine the well name. It's typically based upon the lease name which is penetrated.

You apparently understand API numbers. Was there a more specific question?

Would two API#'s produce at the same wellhead on the surface? Onshore US, no offshore

Steve -- It is possible. There are splitter systems which allow multiple wells to be drilled from the same well head. These are used offshore when there are not enought slots left on the platform. Not a common situation but can happen. From a a practical stand point it's the bottom home location which is actually assigned an API number whether it's multiple wells from the same bore hole or same platform or same drilling pad.

Steve C.

I can't speak for other states but here in California the Department of Oil and Gas (affectionately known as the D.O.G.) regards multiple side tracks as the same well (I don't know if that applies to MRC wells). So for instance a well drilled in the field where I work that has had seven side tracks still has had the same API number throughout its' life span.

hope that helps.

Thanks for the input.

Rockman,

I presume you also know that you can start out the well at an angle? www.glossary.oilfield.slb.com/DisplayImage.cfm?ID=650

Offshore Congo, Agip had a field which utilised slant drilling technology, so all the wellheads were lying over at an angle of around 45 deg. Really looked weird, but that was the nature of the reservoir, very shallow.

Cheers

Chris

Interesting Chris...hadn't seen those pics before. Thanks. I've driven drive pipe at an angle in the GOM to help build angle fast enough. Long ago someone told me that the roots of hz drilling began with equipment designed to drill pipeline crossing under rivers and such. Basicly a drill rig laid over on its side as you've described.

how long a pipe can a rig like that control?

Luke -- If you're asking about river cross drilling I don't know. But if you're talking about an oil/NG well they are drilling horizontal legs over 26,000' in the ME.

Luke/Rockman,

I was involved in renting fishing tools to a company that was drilling utility boreholes in Hong Kong for the new airport as well as connecting some of the internal islands to the major utilities such as power, water as well as communications. Some of those crossings were up to 3 km. They used a fixed slanted drilling system that only used 3m sections of pipe.

As Rockman mentioned, ERD wells are now heading out past the 15Km range, with horizontal sections being longer and longer. That in itself brings new problems if the reservoir section has to be sand controlled. The longest drilling string I was involved in was 9500m of 5 7/8" XT 57 drill pipe with 3 1/2" XT 38 for the horizontal section out to 12000m. All at Sakahalin Island for the Phase II production project.

They are even now working on ERD wells of 25 KM step out.

Chris

"It is called "The rule of capture" (which also pertains to water rights, and essentially it says that whatever flows into your oilwell, regardless of where it came from, is yours."

In Alberta, this is often done by compulsory pooling where several different wells share and share alike. Most of my wells are under these orders. The idea is to prevent everyone from madly pumping as fast as possible and ruining the oil field.

The rule of capture is used in Alberta. It derives from game laws, believe it or not, where a landowner can shoot a deer that strayed onto his land from a neighbour, or harvest apples from a neighbour's tree leaning over the fence.

CPO are rare when the parties can't agree to combine interests in a pool or dDrill Spacing Unit. Maximum Rate Limitations, spacing and target areas are setup to deal with equity and 'rule of capture'.

Standard spacing for oil wells in Alberta is 160 acres.

I had a situation a few years ago where the mineral rights were split between several parties on a quarter-section, one of whom had a 1% share by inheritance of the freehold (cousins and siblings had the rest) and also still owned the land and was thus the go-to guy for the surface rights. He tried to hold us up for ransom and asked for way more than what he would have gotten with just his 1% freehold and surface rights. The rest of the family and the lease operator (the partnership unit I am in) got a compulsory pooling order. Problem solved.

It seems like it isn't just the rule of capture that produced the close spacing. It seems like there must have been a lot of small individual owners (or leasees) of different pieces of lands. If one company had rights to a large area, it doesn't seem like there would be the motivation for drilling wells too closely.

Gail -- spacing rules do have a foundation in efficient reservoir management but to avoid prolonged technical/legal battles field rules are established in Texas. The spacing, be it 40 acs or 640 acs, is determined by regulators with input from the operators. Two reservoirs at the same depth may have greatly different drainage capabilities. That might lead to 10 ac units in one case 160 ac units in another case. Unit size determines spacing rules. Spacing regs are not static either. After a number of years of production an operator may show evidence that spacing should be reduced and propose cutting unit size in half. Should that happen the unit holders have the option to double the number of producing wells. The option but not the requirement. But La. is a whole different ball game. No right off capture. You drill a good well on your lease at a legal location and I own the offset mineral lease: I can call a hearing of the state regulators and make a technical argument that half of your production is coming from my lease. If the state agrees with me I have to pay you half the well costs but I get half the production. So you risk $4 million to drill the well but I end up with half of the $80 million of oil you find and all I have to do is pay you $2 million. Needless to say operators in La. try to lease enough acreage to protect themselves.

Another approach is to form a unit prior to drilling. And if a mineral owner has 10% of that unit they get 10% of the production even if they don't lease to you. But at least you know this going in. There has always been a potential for abuse of the ROC laws. But there is also a long history of forced unitization laws in La. The folks making those decisions are typically political appointees. The abuse potential is thus obvious. But they also cannot prevent you from drilling even though you haven't leased to them. The effort to prevent one operator from drilling a well by an offset lease owner is the general reason for ROC and unitization laws. Actually the basis for most of these rules is to protect the interests of the landowners and not the oil companies. There are variations to the outline I put forth above. The realities are often much more complicated. As a result working out those details has produced an entire class of law firms and consulting engineering companies that solely handle such matters.

i am wondering if you or anyone else knows the reservoir dip, reservoir temperature, and solution gas oil ratio for the east texas oil field ?

Rockman,

Can you and the other gus in the biz say a little bit about the law(or lack thereof?) that will control drilling or mining(shale, etc) for petroleum products in states where the industry is not yet active?

My guess is that in most states there will be a lot of regulation put into effect right up front-but not necessarily the right regulations-ones that will get the product out w/o too much environmental overhead.Some examples from places you guys have worked could throw some light on this.

Thanks in advance!

mac -- I'll give you one shocking discovery I made a few years ago when I drilled some wells in Kentucky. It was jumping back in TX 90 years. Most shocking: an operator could drill and produce an oil/NG well in the state and wasn't required to report how much they produced...to anyone: the state, the mineral owner, etc. Our play was the new Albany Shale Gas play (BTW...we failed big time...ran our butts back to TX as fast as possible.) I could take a lease offsetting a NG well that had been producing 10 years and had no way of finding out what it had produced. Other then asking that operator...and they seldom had anything to say. The state didn't even regulate the environmental impact of drilling. They dumped that on the EPA, and their closest office was Atlanta. The little I've heard about NY state they were also very unprepared for the Marcellus boom.

Not difficult for states to develop goods regs: just copy Texas. In the old days it wasn't too pretty. Today it's a very tight game here.

HeadingOut.

A lot of the worlds oil is produced from infield drilling in known fields. And of course a lot of reserve growth is from this activity but thats a different issue.

What I've never really got a good handle on is once you develop a field using best practices is there any sort of rate at which you reach the point that further infield drilling is no longer useful in maintaining production rates. You go into decline.

It seems to me that as your field matures and you infield drill at a certain rate the time at which this becomes ineffective is trivial to figure out i.e you have a very good idea when the field will begin to show declining production as the last reasonable set of infield wells is put in.

However I've never read any info on this. To me it seems clear that if you know the production level and the status of infield drilling you have a good handle on the fields productive future yet there does not seem to be any sort of industry standard number for this.

The original well spacing as you point out seems well defined and adjusted for the type of field and well style i.e everyone seem to start out producing a field using the best practices for that particular type of field. However soon after that you get into this murky world of infield drilling reworking new horizontals etc that is to my knowledge never clearly explained in the literature. Just one day out of the blue a field goes into decline.

I of course have a huge amount of interest in infield drilling programs yet to date I've been left effectively guessing at how they progress since it seems to seldom be documented.

A simple answer is of course you simply double the number of wells extracting and potentially turn off some of the worst older wells. Using simple geometric arguments it seems you can do this in general maybe twice

i.e you well density seems to maximize at three and and most four times the original number of production wells then its basically over. If your original wells had a lifetime of 10 years then the absolute longest you could keep a fantastic field on plateau production is about 40 years or so give or take.

You can see that a good understanding of infield drilling tends to give you a natural field lifetime for it peak production phase. Thats sort of a maximum in general it would be less sometimes a lot less.

A minimum thats financially viable seems to be 2-3 years for a well with a field top production line similar but a bit longer say 5 years. Under that it it seems the resource becomes very questionable.

These are all hopefully educated guess on my part but if you look at normal production i.e not discovery you seem to come up with some very natural numbers based on how infield drilling is performed.

Certainly it various by field conditions such as permeability etc but these either speed up or slow down the drilling i.e they tend to vary randomly around the mean so the average is "strong" with deviations canceling.

In any case throw a discovery curve on top of this natural field life and you get a sort of main sequence time period of 30-50 years as a very rough estimate of how long oil production can remain high with infield drilling practice actually the critical number for figuring this out.

If this looks like a topic for one of your posts then your on track :)

memmel -- There are always exceptions, of course, but historically the development wells following a discovery are drilled rather quickly...say a year or so. Thus there isn't a very slow period of infield drilling as you appear to envision. I've seen development programs where 30 or 40 wells are drilled within 18 months of discovery…or less. The unconventional NG fields, such as shale gas, don't follow such patterns as they don't really have a defined boundary such as a conventional oil/NG trap. Perhaps those recent events have prejudiced your thoughts on the subject. There are poorer quality fields that might undergo a later drilling phase if a price spikes justifies these efforts.

I'm only describing US field development over the last 40 years or so. Large overseas fields could have a slower time line for a variety of reasons. WRT horizontal drilling, redevelopment of old fields can happen but it's relatively rare in conventional reservoirs...especially the better quality rocks. In all phases of the life of a field the justification for drilling any well is always based upon individual well economics. While drilling a closer spaced pattern might increase field ult recovery if those additional wells (which would have lower per well recoveries) won't make an acceptable profit they won't be drilled.

As far as a 30 – 40 year field life at high flow rates such fields are almost unheard of in the US. More common overseas perhaps but still not universal. I’ ve seen good Texas fields produce at a constant high rate for 5 to 8 years (strong water drive reservoirs) but rare for the flush end of production to last much longer. Development drilling is the profit end of the biz so when they make a discovery it’s typically all out to drill the development wells as fast as possible. In a big field (say ult recovery of 150 million bo) it might take 60 to 90 wells. But in such cases there might be 10 or more rigs in the field drilling at the same time.

But that’s old history. Today it’s very rare for a new conventional field discovery to require more then a handful of development wells. That’s why the NG players jumped so hard into the shale gas plays: cookie cutter development drilling. In the last 25 years I don’t think I’ve seen one conventional discovery in the US which required more then 5 or so development wells in a single reservoir. Many of the deep conventional NG discoveries have been one-well fields. The US, with the exception of DW GOM, is very picked over to say the least.

Thanks Rockman I was trying to be global and also sort of consider a maximum.

Although I did not say it with this approach Ghawar is the best you can get i.e Ghawars production lifetime literally spans basically all the remaining oil production from the time it was discovered till the time it declines. All other production effectively fits within this envelop if you will as it has the longest development or infield drilling campaign.

Obviously some places well within it.

However with what your saying infield drilling if it occurs is probably a last ditch effort to keep production rates up and probably will be ineffective and not as substantial as I would assume. I.e the place it even makes sense to drill are few and far between. So the actual pattern is a surge to get the field into production followed by effectively panic drilling as the field declines. This fits Cantarell and Purdhoe Bay actually.

Sure I'm ignoring recent discoveries but the focus is on how oil fields age once peak discovery is well in the past not the additional oil from the tail end of discovery.

If so I'll be as bold as to say the uptick in rigs in a region with very mature fields aka Saudi Arabia is not a good sign..

What we have discovered from the fantastic satellite posts is probably more serious then most people realize.

Obviously I had a lot more faith in infield drilling then seems justified and I'm not exactly known for my optimistic viewpoint :)

memmel --Yes...not to useful to use US production history to model global. It's easy to believe gleeful sounding press releases about infield drilling successes because they can be very profitable. But collectively they might not be more then a pimple on the field production chart. This is where some folks get mad about optimistic reports from companies about great new production. They can be truly great...for the operators bottom line. But at the same time be totally unimportant w/respect to PO. This is why some CEO's can be justifed by issuing glowing press releases: truly great advances for the company but irrelevant with regards to PO. No inconsistancies....just a scalability variance.

I'm figuring that out :)

Next question and its related somewhat to this post and the last post.

As near as I can tell whats happened in oil extraction is that overtime we managed create and maintain and incredible amount of conectivity between the well and the reservoir. This post illustrates the scale.

You drill a hole in the ground that have a few feet of interaction with the reservoir but it drains and area on the scale of 40 acres. Impressive ! And this is assuming a simple vertical well. Horizontal drilling of course adds more contact area but the real important part seems to be the completion of the well.

Here is where propoants, fracturing and acide washes come into play. It seems as far as I can tell even the simplest vertical well properly treated is actually has a fractal connection to the reservoir via the fracture network that we now know how to keep open.

At the end of the day this seems to be the key to our success in maintaining extraction rates and the underlying reason why I could even possibly be correct about a fast decline.

In the good old days the oil column was so deep and the field pressure high enough that realistically the oil pretty much flowed if you did even a half decent job of completing the well. However it seems as times got leaner we advanced a lot more than most people realize at completing the wells.

So on to my question ok the wells are drilled completed and pumping oil. From what you said above its rare to drill more wells after the initial ones are put into place. However no matter how well you complete a well it seems problems later are not uncommon.

So now how often are well reentered for clean up after they are drilled. Are most subject to some sort of rework once in their lifetime. As with this post it seems doing a lateral later as the oil column thins and say blocking the lower end thats watered out would be a very common approach for old wells and old fields.

I know all kinds or remedial actions are possible but again it seems difficult to find an sort of average or total for how often wells are reworked during their productive life.

Obviously the conclusion is if its common then what you may be doing is effectively creating a new optimized well as the fields properties change and this gives you a chance to apply the right technology that could have been developed years after the well was initially drilled.

My opinion given the range of methods used to rejuvenate old wells is that production can be kept high in many fields using these methods right up to the point its watered out and becomes a rock washing exercise.

The literature seems to indicate to me that anytime a well begins to suffer flow problems rework is almost always attempted before say higher water cuts are accepted but thats again just a guess on my part.

Your thoughts ?

Certainly horizontal drilling is very important but this more mundane and probably overlooked aspect of oil extraction might actually account for a very significant amount of our production volume. Once new fields become hard to find it seems like we did spend a lot of time keeping production optimized in existing fields.

Maybe not drilling a new well but effectively the same result via reworking of older wells. And also explains to some extent why the oil industry itself may have overlooked a huge issue. In the good old days you would simply abandon the well or cap it and go on to greener pastures.

Regardless it seems my scary collapse scenario is related to this plus horizontal drilling you need both to achieve the extraction profile required to cause collapse horizontals alone is not enough and this seems to be my needed second smoking gun I just attributed to much of it to new infield drilling instead of remedial actions in existing wells.

There is a post in the near future on workovers of existing oil wells - but I have to work through drilling horizontal wells and coiled tubing first.

Ok lets stop this then for the right thread.

Obviously I'd love to see how often wells are worked over on average global and the change in production for every single well on the planet before and after workover and how long the well produced at its new level.

I don't think thats asking to much :)

memmel -- I'll run down your questions in order but first I'll make a point about two different types of hz wells. My own classification but it's generally accepted. In a conventional reservoir a hz well does aid with increased contact that does as much or more for the sweep efficiency as it does for flow rate. When we say we're draining 40 acs the truth is that you're not draining it equally. Close to the well bore you might be recovering 70% or more of the oil. At the edges of the 40 acs it might be more like 20%. The average might be 40% or so. The reach of a hz improves that sweep. But when you get to a fractured reservoir (shale or limestone) you basic win/lose based on the how many fractures you cut and how extensive they are. A hz well has a much greater probability of hitting those natural fractures. The subclass of hz wells would be the shale gas plays where there may be few effective natural fractures and thus we have to frac the wells. In this case a multi-stage frac (say 10 separate fracs spaced 400' apart) would mimic 10 vert frac'd wells spaced 400' apart.

Rework frequency? -- varies a good bit. Some wells, especially with big water cuts, plug off slowly with mineralization. Can pump acid to clean up. Also, down hole pumps wear out and thus lead to work overs. A zone depleting will lead to a workover in which another behind pipe zone is completed. And again, some wells have produced 15 years without a single w/o. But, just to hang a number on it, most w/o's occur during the last 10 or 15% of a well's life. A broad statement: w/o's of old wells is the world of the small and micro-operators. The net income goes into someone's personal checking account they write checks on at the grocery. Larger companies generally can't afford the manpower requirements of such operations unless it's a very large field.

A broad statement but generally true: with respect to conventional reservoirs there is seldom a reason for additional drilling late in a field's life. In poor quality reservoirs we might discover such poor sweep that infield wells could be drilled. But this potential is often minimal since some sweep has occurred and new well economics don't look too good. Your "rock washing exercise" is probably the most meaningful term I've seen that a layman could appreciate. That's exactly what it amounts to.. Imagine hosing an oil drip off of your driveway. The flowing water does dislodge the oil but the ratio of water to oil is huge.

Water cut vs. w/o timing: essentially an economic factor. By the time high water cuts (and thus low net oil volumes) develop the income from a well, including post w/o income, usually cannot justify an expensive remedial operation. In general there really are few opportunities to do hz wells in old fields. Ghawar et al are exceptions due to their size. perhaps folks see all the press on hz redevelopment in such fields and assume there some potential application in many, if not most, other old fields. I can attest to the presence of billions of bbls of stranded oil reserves in Texas Gulf Coast fields which no one has any plans to redevelop horizontally. Except for me, of course, but that's only because I'm stubborn. I tried for years to talk operators into the effort. Though hz work is relatively common offshore the small onshore operators lack that experience and I've never been able to overcome that knowledge gap. If my new company is successful over the next year and we establish ourselves I think I might be able to talk my owner into giving it a try. I think we could economically recover 100 million bbls of oil with a $60/bbl price support. Time will tell. There might be a place to discuss the details in HO's tech thread next Sunday.

Scary collapse scenario: I honestly don't see any technology/new plays that can alter such a possibility. IMO consumption factors will be THE controlling issue in how hard PO hits the world.

parshall field, mountrail co. nd bakken

sales data:

date oil wells

'8-09 1524024 157

'7-09 1438618 140

'6-09 1292497 127

production data:*

date oil water gas wells

8-2009 1028977 73353 525870 117 0 0 0

7-2009 1052465 77036 412408 116 0 0 0

6-2009 1114881 97601 427494 117 0 0 0

5-2009 1106708 100892 432888 116 0 0 0

4-2009 954110 75559 379859 113 0 0 0

3-2009 1055492 101624 497495 112 0 0 0

2-2009 956003 71878 376913 110 0 0 0

1-2009 1148648 77984 430755 109 0 0 0

12-2008 1420317 121521 587013 108 0 0 0

11-2008 1477215 177486 572263 101 0 0 0

10-2008 1385906 187449 520846 88 0 0 0

9-2008 1201283 139214 474419 80 0 0 0

8-2008 1097173 174227 473326 74 0 0 0

7-2008 962542 143862 402363 66 0 0 0

6-2008 875464 146922 370718 59 0 0 0

5-2008 749837 125157 429653 51 0 0 0

4-2008 609492 114377 256064 44 0 0 0

3-2008 487983 87444 206494 36 0 0 0

2-2008 357101 54391 144044 29 0 0 0

1-2008 374367 57710 153190 27 0 0 0

12-2007 342372 3198 138681 24 0 0 0

11-2007 296066 2506 112102 21 0 0 0

10-2007 258830 71 98834 19 0 0 0

9-2007 188422 79 66920 16 0 0 0

8-2007 191300 92 70451 14 0 0 0

7-2007 175271 88 60694 11 0 0 0

6-2007 121457 51 42362 9 0 0 0

5-2007 108063 87 40541 7 0 0 0

4-2007 55775 91 19223 6 0 0 0

3-2007 47715 50 17015 5 0 0 0

2-2007 40797 90 13910 4 0 0 0

1-2007 39226 94 14718 4 0 0 0

12-2006 28596 23 10382 3 0 0 0

11-2006 31855 30 9836 3 0 0 0

10-2006 17812 19 4433 2 0 0 0

9-2006 6551 26 1680 2 0 0 0

8-2006 5022 6 1852 1 0 0 0

7-2006 6207 7 2069 1 0 0 0

6-2006 7271 20 1917 1 0 0 0

5-2006 1883 1 0 1 0 0 0

* the difference is from "confidential" wells

It might be easier to read if I tabulate these:

and

So the big play in Dakota is working its way toward 2,000,000 barrel a month while the fading North Slope still produces that about every three days (used to do more than that a day)...but when you read articles on Dakota they glowingly speak of the the total resevoir size, with little reference to the ultimate percetage that can be recovered or the the highest feasible production rates...no great wonder the average joe doesn't see a crunch coming. Takes a dozen Parshall Fields just to match today's slope production, that is not a difficult thing to grasp or explain,

parshall may be at or near or past it's peak. this field is defined by a geographic area, not necessarily a geological boundary.

the parhall field is the largest of many being developed(not necessarily economically) in nd.

some nd oil production statistics can be found here:

https://www.dmr.nd.gov/oilgas/stats/statisticsvw.asp

there was a lesser peak in parshall in nov -08 and thereafter, operators stopped frac'ing because of the difficulty and expense of conducting such operations in winter. completions accelerated starting in april -09.

and thank you for formatting that for me, ho.

Thanks. For how long is it expected the ND will be able to maintain around 200,000 barrel per day (or more)? North Slope production is expected to fall by between 400,000 and 500,000 barrels per day in the next decade (possibly suddenly dropping to nothing before falling to that level as TAPS hits minimum flow needed to operate). With zero exploration even allowed in ANWR currently and Beaufort offshore exploratory drilling by Shell not even started yet...just trying to get my head around the short term prospects for merely maintaining U.S. production somewhere close to the current levels. Sounds like the GOM may be all there is...natural gas price volatility isn't exactly herding projects online.

Where is the sense of urgency showing up in MSM? Chu you got these numbers? What is your plan? Saudi I guess, that is so reassuring. Just being a little rhetorical. Curbing demand is the only real option, prices high enough to do that are the only real mechanism that will work, shrinking the economy by taking the actions needed to make the price mechanism curb oil demand causes certain political death. The future sure looks rosy.

Like a lot of ideas surrounding oil production, this doesn't sound too hard to understand at an abstract level. The premise is that we have a certain amount of oil underground for a collection of reservoirs. We can either develop many rigs and get less oil per rig, or do fewer and get more per rig. In other words, N*Size=Constant, which is the hyperbolic "cutting the pie" law, y=C/x.

The following figure confirms this to a great extent, but also indicates that the overall volume is shrinking over the years

http://www.ellipticalresearch.com/drillingandoilproduction.html

The result of infilling fits right into this law, as they slice the pie thinner, they get less out per additional.

Nothing too exciting, just something that should be reiterated whenever this topic gets discussed. From a greedy perspective, the "pigs at the trough" theory at work.

Or ever bigger slices of a much smaller pie.

Not sure you can tell the difference. I'm arguing its larger slices of a much smaller pie.

Thus technology improvements allowed you to take a lot more out even though the pie itself was getting smaller more rapidly.

I'd argue that your result is only correct if technological advancement was constant.

However a single horizontal well produces at least 5X more oil. So one rig produces wells that are five times more productive yet the overall production level per rig still fell.

Probably not a lot of pie left to slice these days.

How can one argue this? It is not "my result" that is correct, it is what the data says for a relatively short period of time. Better tech cancels out diminishing returns, which is what dispersive discovery states as well. Please come up with a chart that does not show this result.

I appreciate this is a technical seminar and not an open Drumbeat, but 'stuff' ultimately does have its own consequences. How did Kilgore, Tx. use it vast inheritance, bequeathed by a generous Earth?

What did Kilgore do with it oil wealth? Where are the world-class museums or even post-modern architectural atrocities? How has the Kilgore economy transitioned into its own post-peak? What does it say about our future?

It has often been the case that those who make the money aren't the roustabouts and roughnecks that live in town, or the miners who mine the coal or gold, but those that own the mines or wells, and they often live in places such as Dallas or Houston - which, as I recall, have some of the things that you ask about.

There is often not a lot to keep folk in the small towns that sprang up when the fields were active, now that they are largely depleted, and just as with the old mining communities of the West, (or the pit villages of Europe) without jobs folk leave, and without folk there is no call for a world-class museum.