Reflections from ASPO: Contradiction, EROI, and Future Energy Supplies

Posted by David Murphy on October 28, 2009 - 10:26am

One feature of this year’s ASPO conference that I most enjoyed was the contradiction amongst presentations. Marcio Mello gave an animated talk on Sunday night about the pre-salt formations off the coast of Brazil quoting that there are upwards of 500 billion barrels of oil available, an extravagant estimate that peak oilers are unused to hearing. Monday morning two talks on natural gas were juxtaposed in tone and content, one claiming that natural gas is the “American Treasure” and the other claiming that shale gas is marginally profitable, let alone a “treasure.”

Contradiction in this kind of academic setting magnifies the awareness of all involved by broadening the scope of the discussion.

I have been to every ASPO-USA conference (save the first ever in Denver) and this is the first time that contradiction was so evident—though not for a lack of invitations from ASPO to potential contrarians like Cambridge Energy Resource Associates (CERA) and Mr. Yergin himself. All in the peak oil world are guilty of preaching to the choir to some degree. Places like The Oil Drum, The Post Carbon Institute, and ASPO have done an impressive job of educating people and getting the word out, but we never should feel fully satisfied with our outreach, as there will always be more populations—academic, professional, and otherwise—to educate. Paraphrasing from Al Bartlett at this year’s ASPO conference: for every PhD gained, there is one of equal and opposite magnitude.

Serendipitously, the New York Times published an article on unconventional natural gas production in the U.S only one day ahead of this year’s ASPO conference. They state:

"CERA caculated that the recoverable shale gas outside of North America could turn out to be equivalent to 211 years worth of natural gas consumption in the United States at the present level of demand, and maybe as much as 690 years” (NY Times, Oct. 10 2009)

When I read quotes like the above I think only one thing: we—the peak oil community at large—have much work to do. To that end, it’s important to simplify and condense our message to make it as clear and accessible to the general public as possible—without sacrificing the nuances of the argument for peak oil. I am inclined to borrow a methodology from a book I am currently reading. The Canon by Natalie Angier is a summation of what scientists within the “hard” sciences (biology, astronomy, physics, chemistry, mathematics, etc) identify as the most significant ideas within their fields. I will share what I believe to be the most important concept to emerge from Energy Return on Investment (EROI) literature. So, here goes:

The quantity of oil, gas, coal, or any other energy bearing resource that is left in the Earth is not the question, all that matters is that portion that can be exploited at a significant energy profit.

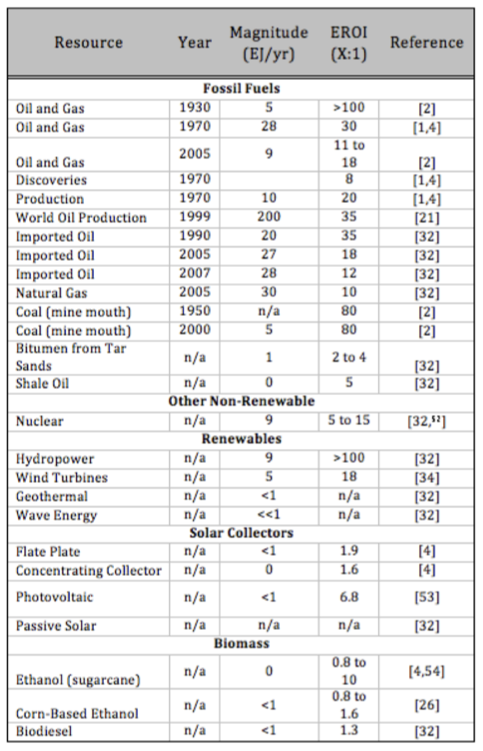

EROI is a method by which we determine how much energy can be gained at a significant energy profit. And note the deliberate use of the word “significant,” because what may be an insignificant net energy gain to an advancing industrial economy may be a significant net energy gain for a subsistence agricultural economy. Below is a table of what we believe to be the EROI of most major sources of energy. This data was accepted and will be published by the New York Annals of Science in January, as part of a special report on Ecological Economics. There are limitations to the estimates provided in this table, however. The numbers quoted in the table are averages, and as technology advances and companies look for oil and gas in remote places using techniques that are far from conventional, the averages grow increasingly inaccurate. Thus whenever there is an announcement of a new discovery, such as those at the top of this post, one needs to ask: “How much will be recovered at a significant energy profit?”

In summation, this year’s ASPO conference offered a broad scope of argumentation from individuals who do not necessarily subscribe to Peak Oil pedagogy. But this is a positive thing; for me, it confirmed that I still have much work to do, as most people still do not understand the importance of Energy Return on Investment. Take for example the claims made by Marcio Mello, who reported that there are 500 billion barrels of oil located in ultra-deep, pre-salt geologic formations off the coast of Brazil. To him I ask: how many 2.7 billion dollar Tahiti platforms are needed to extract that oil? How much will this cost in both energy and dollar terms? Ultimately, what is the energy return on investment for extracting these resources? Without answers to these questions, reporting the discovery of oil or gas is somewhat misleading because it may take more energy to access those barrels than chemical energy contained within them.

Without Mello’s provocative talk, though, we would not be forced to question our own methodologies. It is essential to keep the scope of argumentation at conferences, as well as individual departments or business, broad and open to contradiction. Otherwise, we peak oilers will find ourselves isolated from the possibility of enlightening others, and will self-reinforce to a point of immobility.

This is precisely why we need to engage the brain trusts at the USGS and places like the Colorado School of Mines, especially when the ASPO circus comes to town. These people are our acedemic leaders, movers and shakers.

This is "economic geology". Anyone wonder what "economic geology" really is? What flavor of economics? Isn't "economic geology" a contradiction? A word salad?

Why not engage top geologists in their field - how about top "economic" geologists? Get one of them to explain the "economics" perhaps?

http://www.mines.edu/GeologyprofessortodebateatAmericanMuseumofNaturalHi...

Try flipping through a copy of "Economic Geology". Lots of good geology (science) but wheres the "economics"?

Um! First off there are other schools than Colorado School of Mines that some of us might suggest are at least as good, if not, by some measures better. Secondly economic geology is largely what the title suggests. It teaches how to assess how much of the valuable ore is there and, depending on who is teaching it, it may get into some geostatistics, which helps predict based on current known locations and grades of ore, where to look for more.

I'm thinking that, since the Denver ASPO was in Denver, then some of the local stars could have shown up.

Here is a list of officers and editors at "Economic GEology"

http://www.segweb.org/EG/PubcoOfficers.htm

Some of these folks are local to any Denver event. Lets task them.

As to CSM, not only are the extremely local to any Denver event, they make this claim:

I think if such an influential institution is going to make such extrordinary claims, they have to back it up.

Try walking onto the CSM campus, even into the brand new petroleum building and asking where the M. King Hubbert Center for Petroleum Studies is.

A few years back I spent a Sunday afternoon in the CSM library and found that they had no hard copies of the Hubbert Center Newsletter. I did leave notes suggesting that it be added to their collection.

I think PDV and Robert have a point here. The field does seem to be more about exploitation of resources rather than stewardship. If somebody in the research area had actually wanted to or had the charter to, they could have done an impartial study of resource depletion based on some rather simple models. The fact that a branch of this field is called "geostatistics" makes one think that somebody must be doing original research.

But then you find that a web-site exists called http://www.geostatscam.com/ .

The guy who runs the site says the specialty of geostatistics consists of "voodoo statistics" and "scientific fraud". Granted, it looks like this is mainly in the context of mineral mining and perhaps petroleum extraction is not really a part of this field, but it makes you wonder what exactly constitutes research.

I am curious what HO thinks about these charges. Here is a sample:

Wht,

Whoever wrote the quote "degrees ...investors" must be an idiot.There is no way that aggregation of words can be read in any way that makes any sense at all.

I don't know about the idiot part. Yet, it indeed does kind of read like William Faulkner if Faulkner had an engineering degree.

Actually the guy writes in a mix of very active voice and some passive constructions. See the language E'prime: http://www.rawilson.com/quantum.shtml

I usually can spot E'Prime writers and to me they make perfect sense because every subject has an action and the writer leaves no ambiguity as to who said what. This guy doesn't quite make the grade -- he appears to try, yet it comes out too flowery.

I wrote more here on the junk science: http://mobjectivist.blogspot.com/2009/10/geostatistics-fraud.html

I leave you with more of this guy's genius takedown:

"valuable ore"

How do you define "valuable"? one ounce of crystaline Au vs one ounce of crystaline H20 vs one ounce of phosphorous. Which one is more "valuble"? in terms of "money" or ..? What brand of economics will you rely on to asses the value of your ore, Hobbsian? Keynsian? Miltonian? Malthusian? Hall? Will you adhere to zero-sum or will you hoard? I think "economic geology" is a word salad. "Economics" has become "politics". That is why there is no "economics" IN "Economic Geology", outside perhaps some politics.

We need to work on our "system" of "valuation"; our "priorities" if you will.

We've covered this point before but it might bear repeating for those that missed the discussion.

Emphatic truth: there are hundreds of TCF of NG in the shale gas plays in the US. First, my model estimates we can recover, with existing technology, over 120 TCF of NG from these plays. Second, my model estimates we can recover, with existing technology, 10 TCF of NG from these plays. Both of these statements are undeniably true. No one deny the accuracy of my model. It is a proven methodology.

Of course, both model results are based on a set of assumptions. All the assumptions in both models are identical. Except one: the anticipated price of NG. The first model assumes $25/mcf. The second assumes $5/mcf. No geologist or engineer can argue against my model. One can choose different price structures but this is an assumptive factor and you cannot argue its validity. It is an assumption...not a prediction.

As been said before: any projection of the recovery of any commodity that does not include the associated price assumptions is a meaningless value and does not merit discussion IMHO. Mr. Mello may be right about there being 500 billion bbls of oil in the various DW trends. I see no point in debating its validity. Just accept such numbers because they are meaningless to a degree. The question is: how much of that oil is recoverable? Easy to answer actually (if you first assume that oil is actually out there). Just run an economic model using the appropriate cost estimates. And then vary the assumptive price of that future oil. At $300/bbl the recoverable reserves from these plays could be hundreds of billions of bbls (again, if they actually exist). And at $50/bbl the number could be a couple of billion bbls. And both model outcomes are correct and undeniable because they are models with price assumptions...not price predictions.

My analysis has no bearing on Mr. Mello's model predicting the existence of this oil. That's another model I assume he's generated. This analysis has no bearing on anyone's model for predicting the future price of oil either. The conversation gets very messy when we try to discuss validity when the different models are lumped together to extract a prediction. We tend to lose sight of the trees for the forest IMO. I haven't been able to review all the presentations at the conference. But from what others have posted I see no obvious contradictions in as much I haven't seen the underlying assumptions.

ROCKMAN, I really appreciate your no nonsense clear explanations.

A few years ago I had the opportunity to work with a software company that marketed a high end scientific graphics application with advanced capabilities including GIS, CGM, Seismic data analysis (PIP), to both major and minor players in the Petroleum Industry, I had many geologists and Landsmen as customers. I often had to trouble shoot their data files so I saw a lot of proprietary information. I wish many more of them had had your grasp of the bigger picture. It might have saved them a lot of headaches.

You're welcome FM. I'm not so sure it's a better grasp of the "big picture" as it is a different perspective. I tease westexas about being a crazy wildcatter. But you have to give those guys a lot of credit: stand up in front of someone and recommend they spend $10 million to drill a well that will probably be a dry hole. And then drill a dry hole and go back and ask for another $10 million to drill another prospect. Got to have nerves of steel (and complete lack of shame genes) to play that game. Explorationist have to have unbridle optimism to take on Mother Earth every day. I work on the development geology/engineering side of the fence and thus deal with more concrete data. Thus I have a much clearer picture of what is real and what's not...unlike westexas.

Interesting you bring this up. I'm starting to realize that there is such a thing as a EROEI for money.

Often this wall is viewed as inflation. For example flooding the US with cheap credit over the last decade primarily drove up housing prices. Perfectly good homes and decent shelter became a multiples of its former value. Very little real increase in wealth was created while the notational debt ballooned.

Deep down underlying all of this there seems to be a sort of law of economics and energy.

You cannot expand using lower value more expensive resources without going into debt.

As usual for me asserted without proof but think about it.

If NG was at 25 vs 5 and we wanted to keep the precentage costs devoted to energy constant then in the 25 dollar case the economy would have to be five times larger than in the five dollar case. How do you do that ?

The only way to do this if resources are getting more scarce and expensive is to expand the amount of debt in the system to allow it to grow.

The hope of course is that this new larger economy will create new ways to create wealth (computers) and this new wealth will offset the decline in resource quality. In general however it also creates bubbles which make this sort of growth very inefficient requiring even more debt.

Nate Hagens explains this as chaining many low EROEI sources together i.e instead of one 100:1 source you have several say 10:1 sources. As long as the resource base is large the decline in EROEI does not look all that bad. However you still have to grow to keep the magnitude of the extra effort constant. Exploiting a larger base of lower value resources requires growth !

There is a saying that came out of the .com era that we will sell at a loss and make it up in volume.

Thats exactly the game you have to play as you use the infrastructure developed with high EROEI resources to exploit lower value EROEI resources. However no matter what you do the debt side continues to grow.

Assuming you start with no debt or even a significant pile of wealth and that some of the growth does capture real value i.e the expanding economy esp with technical advance does indeed innovate then the expansion of debt can be done for a long long time as resources become depleted and more expensive.

But it turns out your simply delaying the end. The only real answer or way out is to develop viable alternatives as it becomes obvious that debt expansion is taking place. Literally the moment that its clear growth is impossible without expanding the debt you have to stop and pour resources into bootstrapping other energy sources.

We actually did this but only partially with our expansion into coal and NG and it helped for a while but these are also finite and eventually started slipping down their own EROEI curve. And the rate at which debt increased increased.

Well it turns out that money actually is not infinite it can't pretend to create wealth via expanding the debt forever eventually you have a run on the bank as it dawns on people that very very very few will ever get repaid. Expanding debt is a confidence game and when it fails the system fails.

This is important because it means our economic system has not been viable for decades. Trying to use our economic model to predict the reserves available from low quality resources is useless.

Instead we will extract what we can as long as we can expand debt without a run on the bank but our real resource base capable of creating real wealth was used up decades ago we have been out of true resources for a very long time.

Not only is there nothing left we exhausted the resource base useful for real expansion without debt expansion decades ago. All thats left now is to see how long we can go before the debt bubble implodes on itself.

Once this happens then the actual resource base is minute so much lower than our current assumptions as to be treated as zero. Although small what can be exploited it may or may not be valuable but it will if extracted at all be extracted under a completely different economic system that has no bearing with the current one.

Of course we managed to live in a dreamworld for so long that its now practically impossible for people to wake up and realize what we have done. For many of us this means the world we grew up in was already toast back when we where children or teenagers. Its all we know and for most they simply can't accept that its been a lie the entire time.

From now on out given we seem to be in the end stage of the debt bubble declining resources will only hasten the speed at which we collapse further attempts to grow to utilize more expensive resources will do the same.

Checkmate.

Good explanation.

How does price volatility play into your recoverability through barrel price model?

This includes the assumption will be seeing a lot more volatility in the future as well - at least after a real economic recovery starts.

With my limited experience, project financing managers hate volatility more than anything, because it throws their payback calculations around like a dead rat in a washing machine.

What's your take on this?

Good question. I'd argue the volatility is itself the signal the system is already in collapse mode.

The whale oil papers show this.

http://europe.theoildrum.com/node/3960

However be careful about assumptions using the past to predict the future. The only certain thing you can take away is that volatility is a key signal to the start of collapse past that the evolution of the system is really really hard to guess.

I guess other people guess one of the guesses will be right but the truth cannot be known until after the fact.

One could argue the Roman Empire was doomed the day the republic ended but the longest measure has it ending after Constantinople fell. Even then a fair amount of absorption took place into the new Moslem Empire and back into the older Barbarian empires of the west.

Or it can crash fast like the Soviet Union with a fair number of people actually born before and living after its existence. So and empire rose and fell in the span of a human lifetime or Franco's Spain or Mao's China.

If you notice the pace has quickened then it stands to reason a Roman like centuries long fall is probably not going to happen.

Price and money itself are going to be wrapped up in a mix of volatility and the rate of actual collapse.

As far as I can tell I expect intervals of low prices where collapse itself has ensured supply meets demand will be short. Obviously we managed to have one such event happen although it already seems to be starting to end.

Its not clear at all that the circumstances will result in another such event. Maybe but again depending on how you model maybe not.

Obviously my model is pretty simple we enter a period of stronger and stronger price increases for oil and NG and the system tries to keep from collapsing via ever more rapid expansion of debt but implodes. I don't see us making it through the next one and I also feel that from here on out attempts to keep the system together will generally only cause it to deteriorate even faster. Way way to many bombs or landmines or what have you are now armed with hair triggers littering the ground and also pressure triggers ready to go if anything goes.

So what I see is volatility on a rising trend then as some point maybe in the very near future a rapid surge in oil prices and a bit later on NG and then a new event not yet seen where the fiat currencies begin to collapse sending prices even higher in addition to whatever changes in production rate are causing. From that point on who knows the system is in a death spiral. If I'm right both about the price spike and it initiating a fiat money collapse then its one and done.

Theoretically the US could avert such a event by rapidly increasing interest rates and rapidly reducing the money supply and hopefully not collapse because of the resulting defaults. This should moderate energy prices if not initiate another price collapse and we could potentially sort of slide along the bottom for quite sometime in a deep depression. However given the quick way prices rebounded after our last collapse its note even clear if this will really work. There may be no bottom to the whole even going this way.

Or of course my assumptions are wrong we have more rope left but this simply means we will continue BAU undulating between those two extreme outcomes for a bit longer before finally picking one of the paths. I'd argue that outside of my extreme view its really really hard to guess what happens as some fairly slight difference can lead to longer term changes. This of course signals that if we are not yet at the point of collapse right now then the system is chaotic effectively tumbling between the extremes without falling into them on a very unpredictable path.

By chaotic what I mean is that the problems we face may not cause collapse but they may cause the system to change course fairly dramatically over a fairly short period of time as its in a sense trying to dodge between the two certain collapse scenarios. This almost certainly means extreme volatility with prices. Think of a ship sinking with the passengers running back and forth from one side to another rocking the boat. Which way it finally rolls depends on a very subtle change in sink rate and where the passengers are but the boat rocking game is not changing the outcome.

Of course volatility on this scale is itself very stressful so its tough to believe that even this won't fail fast probably with only a short delay.

Hopefully you can see the role volatility plays once the system becomes unstable and volatile its really hard to come up with a way to dampen it in such a way that you don't end up in collapse.

As and example the great homebuyer tax credit simply created another foreclosure bomb thats literally going off even as its working.

Here it is

http://waysandmeans.house.gov/media/pdf/111/gao1022.pdf

Given median home prices and base cost of living issues and the fact we are now in a weak to declining economy this is simply creating a bomb that in my opinion will start going off before the ink dries on the last credit request.

I suspect a significant number of these loans are already delinquent with many buyers losing their jobs shortly after purchase others quickly hitting the wall as they are in over there heads. Expect credit card defaults to rise sharply with this program.

So not only do I not think this program helped in my opinion it actually accelerated the collapse process esp given its pulled forward demand from people that might have been able to purchase a house in a few years or months if they got their personal financial houses in order.

Also it certainly accelerated the fall in rents as these people where renters. Moving them to vacant houses they cannot afford not only did not solve anything it made matters worse the moment it had enough of a effect to cause macro economic changes.

And this is just one of a long long list of things happening now that not only lead to larger longer term problems but cause and almost immediate short term problems to accelerate.

Heck the 0% interest rate for example has ignited a carry trade on the US dollar.

http://www.financialsense.com/fsu/editorials/willie/2009/0923.html

Pension funds, Commercial real estate ??? The list is endless.

Given this and even assuming I'm remotely close or even just Westexas's export land then one in done seems obvious.

If I'm closer to correct it just means we have a 50 megaton nuclear explosion going off instead of a 10.

Given most of us are at ground zero I'm not sure the difference matters.

Oh I forget Pruis's and plugin EV's windmills and NG powered diesel trucks are going to save the day nothing to worry about. All I can figure is they must work just as well driving over radioactive glass as they do on asphalt.

Sam -- Excellent point. In the basic economic model the industry follows you enter a price deck. A starting price with, perhaps, some inflation built in. The starting point is always close to current pricing. If we're in a high price period we'll tend to use a lower number. But seldom use a higher number in a low price period. The economic model uses the recoverable reserve model to supply an asset volume. It's not uncommon to give this volume a "hair cut" to allow a more conservative out come. So such a model might yield a ROR of 7 to 1. Now this is where it can be a little confusing to outsiders. We then consider the probability of success of the project. Two projects can have identical ROR but one has a PS of 80% and the other a PS of 20%. Yes...some risk adjustment within the ecomodel but that's just a "shading effort". Obviously one would chose the higher PS project if these are your only two choices. What you seldom see (on paper, anyway) is the price volatility risk you mention. I've seen as many companies fail as a result of price volatility as drilling too many dry holes. As you imply, a project might be a technical success but the company fails because it doesn't receive the anticipated price. The recent shale gas play is a great example. My client was one of the most successful players. But that success turned into an anchor that nearly sunk them when NG prices collapsed. In fact, their exploration model exceeded expectations a little. In 34 years I've seen many different efforts to risk a project. I have never once seen a price collapse used in any evaluation. Make sense though: would you climb out of bed this morning if your model showed you getting hit by a bus today. And why would you put all of your 401k into the stock market if you anticipated a market crash? Oh...yeah...that greed motivation thing.

This gets to the root of the point I was trying to make elsewhere. The reserve recovery models are not predictions of how much oil/NG WILL be found or IF the effort will be profitable. They are just geological models based upon a set of assumptions. The ecomodel doesn't predict how much oil/Ng will be found or if there will be a profit. It just offers a ROR based upon the assumptions made. Now there is a whole different world of models one can construct to PREDICT the future price of oil/NG. And models to PREDICT how much oil/NG might exist in a region. I know these sound like subtle differences but to the oil industry they are easily separated. Dr. Mello may have a geologic model indicating 500 billion bbls of oil. And it may be a very sound model. But such models typically don't include the probability factor. Dr. Mello might characterize the PS of his 500 billion bbl model as 10% or 90%. But that won't change the model...it's still 500 billion bbls of oil. And this is where I see us often debating apples and oranges. I might have no problem accepting the validity of Dr. Mello's 500 billion bbls model if I saw the details. But I can offer that there's not a freaking chance those bbls will ever be produced. Two different questions... two different answers... apples and oranges.

Thanks! I think I get the gist your argument about how hard it is to value Dr Mello's assessment. I'd also take a wild guess that he couldn't reveal his cost estimation and profitability calculations even if he wanted. And I don't think he wants.

Coming back to your point about volatility assessment. In the energy utility trade price volatility is of course part of the daily bread and butter - not that they necessarily do it great either (most of them use Black-Scholes formula derivations for their options hedging strategies - not the most robust approach out there as last yeas have shown, but allows one to fall back on the 'gold standard' excuse if things fail). Regardless, they do make an attempt to factor it in - especially since 2007.

Now, why don't the upstream players use volatility hedging cost estimation as part of their projected costs? Would it be too prohibitive? Would it result in the 'why get out of bed' outcome in too many cases? Or is it because historically it has been such a small factor compared to the PS you refer to? If the latter, I think people ought to start re-evaluating their historical position on that. Then again, who am I to tell them that.

And yes, in the end, recoverability is what we are all interested in. My second wild guess would be that one way or the other, we'll end up pumping oil through genuinely loss making activities for quite some time in the future. Price externalities are a useful invention in that regard. But that's another topic, for another time.

sam -- I suppose the short answer is that you can't hedge what you haven't found yet. Most companies hedge,to some degree, on the existing production. I've never seen an operator work hedging into the drilling economics. And, as we both know, hedging can hurt your revenue stream as well as help.

No..I think price shocks (especially on the order of a Black Swan) are one of the biggest unconsidered risks in the economic evaluation in some type of plays. In a conventional play a dry hole loses money regardless of the price of oil/NG. I've seen many operators talk themselves into drilling poor prospects because of high price expectations. Doesn't matter if oil is selling for $120/bbl if you're plugging a $148 million dry hole (something I watched first hand last year in the DW GOM).OTOH, in plays like the shale gas where you have a high probability of making a well operators used high NG price expectations to justify those high lease/drilling/completion costs. Thus even when they found the NG they were drilling for, the eventual low prices broke their backs.

Given that NG seems to have bottomed out it looks like we will actually find out what happens next.

My own experience is investors hate volatility. They don't mind risk so much if the risk and rewards can be understood if inflated. They are used to everyone inflating the upside. This is in software which is a very volatile business esp for smaller startups. Always has been one reason investors got wiped out in the .com crash is they walked into a very volatile business they did not understand and thought it was always going up. They found out later.

Also and a lot of people don't realize a lot of the money lost was with established companies telecoms software companies etc. The actual amount lost at the start ups was substantially lower. However after the boom investment dries up in the startup area and from experience in a matter of days if not hours. Investors try to extract their money and generally kill the companies. The only thing worse than a company run by a incompetent management team is one run by a incompetent management team and incompetent investors. Generally the turn around artists are really people who managed to kill companies that had strong business's but short term cash flow issues and extract money in the process.

In the whole process the concept of actually making a product people want and selling it and making money seldom if every enters the picture.

After this you get the big shake out but more important you never ever get capitol input at near the level it was during the big boom. Maybe if you wait decades it might come again but don't hold your breath. Thats not to say you can't raise money but its what I call cautious capitol and it takes a long time to strike a balance as the new risk factors or realistic risk factors are determined via experiment for the most part. For the software industry most of the investment capitol for startups is now coming from successful .com's and venture capitol firms in the last boom.

They of course think they are smart realistically for the most part they just got lucky. Regardless they put the money in.

I don't see any reason why the shale plays won't follow this same model it seems to be a basic one for boom/bust business cycles. This means of course that your in a bit of a catch 22 since investors will be slow to invest in general and want to see handsome profits before expanding their investment which means shale development will probably slow down substantially.

Now of course at this point what happens next depends on the product. In software we have a sort of analog to shale its the bazillion social networking sites some make it some don't most of the time they get big fast then fall off just as fast as something new comes along. In a sense the group of people willing to support the next cool thing is finite so they effectively steal each others customers the actual customer base grows slowly. The twitter guys are not using facebook as much any more etc.

I don't know the shale business well enough but my guess is its more about investors the investors willing to invest are a finite group now and the shale players will compete for them.

Next these investors are not just seeking profit they are seeking maximum profit to justify the current investment. In general further investment will come for the profits of the current round. Pretty much just like software where the investment money is driven by the few profitable companies the survived the .com era.

And its smart and scared money a whiff of volatility and its gone.

I think the overall investment side is probably going to be pretty close to what I've seen and it will certainly be interesting to see how it interacts with the shale plays.

I've said for a long time that I think that they will provide a slow and steady stream of NG once both the business model matures and the development of shale itself matures.

For shale at least given that conventional NG plays are declining the issue becomes LNG imports obviously if LNG imports under price shale then no shale development. This is similar to the relationship between North American oil production and imports. Its expensive today to produce oil in North America and development is pretty much controlled by the global price. This obviously slows things down. And the big oil bust is a reminder of that.

My opinion is not a lot really happens until our NG prices stabilize with global NG prices. Enough LNG is being exported today to ensure that the NA market is not longer isolated its just a matter of when prices reach the point you have liquidity. The software industry has an analog in the form of outsourcing.

This suggest that longer term NA shale won't really expand until its competitive with LNG from other sources.

However given the nature of the plays one has to wonder what the world is like when shale is one of the better plays to expand. Of course there are some large discounts that change matters but still.

So overall assuming the business and financial model follows what happened in software you simply can expect much from shale for the foreseeable future. It will be developed as it makes sense but the bulk probably won't really be exploited until global LNG supplies become a issue.

We have another example and that the Venezuela heavy oil deposits and the Canadian tar sands at some point in both cases they are or will eventually be exploited at some steady but relatively low rate vs the resource base and they probably will remain there until they are closer to the only choice and all other choices are reaching exhaustion.

Given that as NG prices go up LNG is likely to expand steadily increasing the liquidity of the NG markets and globalizing them shale ..

And of course this means the global economy will eventually have to absorb higher NG prices until the market becomes very fungible if you will and my opinion on that happening at the global level is its questionable and I'll leave it at that.

I agree memmel. It's difficult to be optimistic about SG activity regaining anywhere near its former level anytime soon...maybe never (never being in 10 years or so). As far as private investors sources for SG I'm not sure they played a big role. The big SG players were big public companies. Their investors, per se, were the bankers extending them credit. I suspect that source will return very slowly to the mix.

We won't get anywhere close to SG. In fact, we won't even drill for lower quality conventional NG reservoirs. Fortunately for us there are viable NG plays with high quality/high flow rate reservoirs. And even more fortunately there is little competition for such prospects. If NG were selling for $10/mcf right now we probably could buy just 10% of the deals we've taken. And they would have cost more to acquire and drill.

As the man said...it's good to be King.

If you have the money then I see no reason for it not to be a lucrative area for a long time.

Even in end of the world type scenarios you have to have X amount of NG if you don't want to end in the stone age.

The difference between maintaining BAU and keeping things from collapse is huge. All kinds of intermediate possibilities exist.

Markets for natural gas and oil will exist as long as they can be supplied once you give up on "cheap" NG for the mass market use cases we have today plenty of demand remains which means supply. There is reasonable demand for NG well out the price curve. Bottled propane for cooking is sold at a nice profit all over the world for example.

In economics you have the velocity of money which is the number of transactions occurring. What I see going forward is decent low "velocity" demand for NG well into the future barring complete economic collapse. Its not going to build to offset falling oil supplies simply because we cannot afford it. BAU is dead but multiple niche markets less price insensitive can and probably will drive a more sedate but stable NG market or likely markets. One has to think that a return to vertical integration may become important with NG developed buy unified utilities that also balance with say wind or other alternative energy sources or coal or nuclear. Or fertilizer manufactures will move to directly control NG production etc.

What I saw in the third world was that companies tended to be vertically integrated or horizontally split on intrinsic market divides what one would call natural markets. I.e your typical village market. Loss of a fairly open market for bulk sale of NG does not mean you won't have vertical customers and direct sale markets. I consider both natural markets in the absence of open exchanges and the ability to mesh NG sales across countries and even the world via LNG.

The end of BAU suggest we would probably see the end of these national and international meshed markets however "natural markets" remain and price supply demand all work like they always have.

There won't be a price for NG like we have today just like there was no global price for salt back in the old days or any other commodity price will vary and the ability to transport enough product between markets to level prices will be limited but this means of course just as the salt caravans of old made steady profits century after century the NG industry should as long as the demand remains and supply is reasonably there.

So if you think about it as a fundamental change in how NG is marketed and sold then the strange situation of high prices not resulting in rapid expansion of production makes sense. The markets are localized and these more local markets constrain the situation. Lacking a large growing market there is simply no reason for supply and demand to not find its equilibrium at some price point and it does not have to be a infinite growth solution others are viable and work.

So to be clear when I suggest like I did in a previous post that there is no market for 25 dollar NG I mean there is no meshed NG market like what we have now. Instead there are fragmented markets some working on 2 dollar NG some on 50 or 100 NG many on none. The volume of NG produced is significantly lower than today but its simply different and works under different rules and its hard to even guess how things will play out.

And I suspect ROCKMAN will profit handsomely off of this :)

Investors well eventually some will win but probably many lose in the process but thats what happens with investment.

memmel -- I had not thought about vertical integration for a while. Back in the late 70's that became all the rage for the utility/pipeline companies. They bought into NG drilling programs as a working interest partner and, in some cases, actually started their own prospect generator shops. With very few exceptions they were slaughtered. Combination of two simple factors: NG exploration wasn't their specialty and, more importantly, they couldn't tell good operators from the wolves who were more than ready and willing to exploit their ignorance and slaughter them on the spot. I worked with Transco P/L back in those days. Poster child for what I'm describing. In one joint venture they bought into 18 NG drilling projects from an independent operator. Result: 18 dry holes and the principal players for the operator retired millionaires. It's easy to imagine these events repeating themselves when the end users once again see the "benefit" of vertical integration. Like any good idea it all hangs on the execution and not the validity of the plan.

My $25/mcf value was obviously a gross over statement of where prices could go. Just part of the absurdity, IMO, of undue expectations of the SG plays being the great PO solution. As you say, big variance from local market to market. What I'm focused on right now is how to deal/benefit from the absurdly short cycles should they persist. When I started 34 years ago the boom/bust cycles were on the order of 10 to 15 years. Just look at the last 2 years: oil -- $50 - $147 - $38 - $75. We stared our program thinking in terms of hitting the liquidation phase in 4 or 5 years. Now I'm thinking in terms of 18 to 24 months. And then would require us to drill even faster. And that also means ramping up exposure that much quicker. And that often leads to failure. My cohorts and I will benefit handsomely if we get it right. And we will be dumped in a heartbeat if we don't perform adequately. That's the deal and we were all happy to let our abilities determine our outcome.

Pretty much every analysis I've seen recently indicates that short term there is about a $5 cap on North American gas and a low end around $3 - $4 that LNG still can't displace simply because there are competing markets and not really enough regas facilities in the US. The shale gas players have been responding by lower costs....the breakeven for Haynesville is now around $2.50 for Marcellus around $3 as compared to an average for North American conventional gas of around $7/Mcf. Continued low prices will cause greater efficiencies but certainly you will see additions only from the best or Tier 1 acreage of the various shale plays. Gas will get shutin as the hedges roll off (a lot of companies are still well hedged) and eventually the price will rise again towards the marginal cost of conventional gas at which point the shale gas plays will ramp up once again. The company I work for is projecting $6/mcf long term, consistent from what I've seen from CERA. A lot of companies can make hay at this price in shale gas plays, specifically those that have learned the manufacturing approach.

Rock, after all the knobs are turned, what you really have is some sort of curve, ulimate recoverable reserves versus (inflation adjusted) price. But of course both geologic and technical assumptions went into making that curve.

So we have multiple sources of uncertainty: What is really under the ground? How much will the market pay to extract it? How tough (expensive) will extraction of X percent cost?

enemy -- So true. I could never document the number but, based upon my personal experience over 34 years, there has been more money invested in oil/NG then has ever been recovered. Thanks to optimism/greed I've had a career.

Maybe I'm missing something but I'll ask anyway:

You say 'with current technology we can recover' but does that mean we can recover that much with a positive EROI or just that we can get the gas out the rock if we want too but with a negative EROI for the last bit?

We know there is still a lot of FF in the earths crust, as is e.g. uranium. But if we use these resources mainly for burning it to get energy, then recovering it has only any use if the EROI is (at least) several times larger then 1. Can we still get the 120 TCF of shale gas out? Same with the 500 billion barrels of oil between S. America and Africa?

Also, the EROI only applies to the situation where we burn the resource. For other uses like production of plastics and other products it's only the monetary ROI that counts right?

Styno -- I can't answer you in terms of EROI. The oil industry never has and will never base drilling decisions on EROI. Not that there isn't a relationship. But we just deal in $'s. The NG is there in the SG plays. Whether it's 100 or 80 or 120 TCF I don't really know. But there is a huge amount PROVEN IN PLACE NG. And current technology can recover all of it. The big IF, of course, is IF the price is high enough. And it might well reach a point when the profit to do so is there but you might actually have a negative EROI. But I don't think such a time, if it ever did occur, would persist very long.

The 500 billion bbls in the Atlantic is a whole different story. I still haven't seen Dr. Mello's complete presentation but I'll stick my neck out and say he doesn't have specific data showing that amount of oil exists out there. I take it his number comes from a model. IOW, what could be out there. That number may be right or off by 300 billion bbls...time will tell. And, again, not knowing the details, even if that's his estimate of the amount of oil out there that could be produced his number is totally bogus if he doesn't include a pricing assumption. Just like shale gas, the 100 TCF recoverable number is only valid at a certain price assumption. But to be practical I see no potential for NG prices to reach $25/mcf (2009 $'s) and stay at that price long enough to cause a sufficient number of wells to be drilled to recover anywhere near that volume of NG. The economic feedback loop is just way too efficient these days.

Thank you for your insight and time.

So what is the likely EROEI of Mr Mello's 500 BBL secret? I watched his presentation on video, and I have to say, high marks for showmanship. For the sake of the peak oil crowd, he made a big deal about being conservative in his estimates.

Jeremy Gilbert said the very next morning that we would be lucky to get 10 billion barrels out. As for the EROI, I am not sure, but we might be working on that in the not to distant future...

David -- As per my thoughts above did Mr.Gilbert offer a price assumption for his 10 billion bbl of oil prediction?

Rockman,

No, he did not. He was acknowledging the fact that Mr. Mello was reporting resources in existence, not proved reserves, to which Mr. Gilbert said might be about 10 billion.

But I think the situation is more complicated than you discuss. I agree that in the "net present value" sense that the price of oil will determine what is recoverable and what is not - economically speaking. However, you are assuming that all of the resources, financial and otherwise, are available to these firms as long as the price signal says that they will make a profit.

I get your point David. But my economic model makes no assumptions "that all of the resources, financial and otherwise, are available". That's the point I was trying to make. This is where we can get lost in our conversation. My model isn't dependent upon the factors you mention because my model isn't a prediction of what will or won't happen. It's just a model...not reality. Your factors are critical, of course. But they would be projected based upon other models: future capital availability model, future political model, future consumption model, etc. All such models could be used to predict future conditions. But, by in large, each model is independent of each other. My hypothetical model is valid whether there is every another $ to spend drilling wells. As I said, it's just a model...not a prediction of the future.

As I was trying to imply we have a tendency to debate models when we're really debating what appears to be predictions used in these models. That's why I struggle to make the distinction in our conversations between assumptions and predictions. You cannot argue that someone's model assumptions are wrong. But we can vigorously debate whether one prediction or another is correct. In Dr. Mello's case if he has a model that shows 500 billion bbls of oil then it's 500 billion bbls of oil. We can discuss if he's staying within the realm of geologic reality or not. But if he predicts that we will prove up 500 billion bbls then that's a completely different matter. Perhaps I come to the subject with a very prejudiced view. I look at proposed drilling projects daily and it's very easy for me to judge a project's model as being valid but the reject the deal because it doesn't have a chance of working. For me models and predictions exist in two different worlds. I hope that makes sense.

Rockman,

I understand the difference between assumptions and predictions and I agree with your general opinion, i.e. assumptions should not be argued over. But we are fundamentally asking different questions, though. You are answering the question in your model: "how much of a resource can we get, based on assumptions of X price for natural gas?" I am asking how much of that gas will be gained at a significant energy profit? That is a much different question.

Also, models are defined as a simplification of a real system (Hall and Day 1977). Your model is a simplified version of some system that makes predictions based on a set of assumptions. You predict that 120 TCF of natural gas are recoverable from shale plays given your assumptions. Until you can validate empirically your model, than your predictions remain predictions, and are not "truth" of any sort.

No David. My model is not a prediction and is quit valid. I have no idea if we'll every produce that much NG from the shale plays. Thus I would never make a fool of myself with such a prediction. I can recover 120 TCF of NG today if my pricing assumptions existed today. That's not a prediction...it's a fact. I spent last year doing just that. Unfortunately the price support went away. I know the reservoir characteristics, the cost to drill and complete and the economic requirements of the operators. I run my economic model daily on drilling prospects. It's about as standard as it gets. Again, I'm not predicting I can get 120 TCF...I'm saying I can do it today. All I need is the price support. I can also recover 100 million ounces of gold out of sea water today. That's not a prediction. It's a fact based on a recovery model of gold from sea water. All I need is the price support of gold to be suffciently high enough to make it profitable. Again, I have no idea if gold would ever reach the price needed to make the process work. But, once again, I'm not predicting we'll ever see that price. My model just says that it's possible to recover all that gold with existing technology.

Rockman,

How do you know you can get 120 TCF. How do you know it isn't 110 TCF or 130 TCF? I realize that it is "technically" possible to get gas (or gold or whatever) if you have the proper price support, but how are you getting 120 TCF as the exact amount of recoverable reserves? Is there ANY uncertainty in your model? If so, then it is not "truth" or "fact", but a probability, and much like any other model it needs to be validated (i.e. tested). I understand that you have probably been using this model for years, and if so it has been "validated" numerous times before and there is no reason to suspect it would be wrong now. However, models are models, they are not "truth" or "fact". It is a semantic argument, but an important one.

When NG was over $10.00 mcf, shale gas was much more feasible. If NG goes to $1.50 you might not see the drilling boom that $10.00 mcf gas will bring. Much depends on the price of a lease in the Haynesville or the Marcellus. Some people looked at operating costs, but did not include fixed costs, employee benefit plans, health insurance, pipeline tarrifs etc. in the price of gas. Some companies hedged their production and had cash flow to continue drilling to keep their leases that they spent many dollars to attain. There is a potential problem if a financial institution hedges wrong like Enron did. It could take down a company. Naked derivatives are yet a potential problem as we saw with the 100 billion dollar collapse of AIG. To make it in the oil/natural gas patch you might need to known the bottom line, the odds, and the rocks.

Oops, that is substantiating Rockman. If you are questioning delta errors below and above the estimate, Rockman has provided a very good model with no bias, and unstated variance. Apart from the missing variance, that is a great model in my book. Rockman is basically stating the most probable estimate. With the variance included, this is the value that will occur most frequently if you could run the experiment many times.

In other words, if the number was 110, so what? If the number was 130, so what? Unless this was some over/under sports gambling enterprise, does it really matter?

This is the only good way to look at a model result. If someone presents you with a model that aggregates lots of information, immediately assume that the result is the most probable estimate, and most errors will be symmetric above and below this value. This is in accordance with the central limit theorem. If, on the other hand, you know that the model is a fundamental measure of some physical process governed by entropic considerations, assume the variance is equal to the mean squared, and take your chances.

David -- Is it 110 TCF or 110.1 TCF? Don't split hairs with me son...I'm a geologist. Old joke: question -- what's 2+2 equal? Engineer: 4.0000. Lawyer: what do you want it to be. Prostitute: depends on how much you're willing to pay (not to unlike the lawyer's answer). Geologist: somewhere between 3 and 5.

No..there is no uncertainty in my model. That's because there are no predictions in my model. There are only assumptions. And I can change those assumptions and generate 100 different models. I actually don't think our thought processes are that far apart. Semantics perhaps. I consider that models are facts. Whether they represent the "truth" is of no concern at this level of analysis. But truth(probability of success or being correct) is critical in the risk analysis phase. And that's my point: Dr. Mello's 500 billion bbl model may well be valid. The fact that I might think there's not 1 chance in 100 that this oil will ever be produced doesn't stop me from accepting his model.

I suspect my analysis may be a little too anal for TOD. My apologies if that's so.

Rock,

Apparently what I call a model is what you call fact. Ok. done.

And I believe Mr. Gilbert talked about a three letter word beginning with "L."

@David Murphy

That means a recovery factor of 2% !!!??? Why is the recovery factor so low for this particular oil? To the best of my knowledge, it's currently between 15-50% for most wells, using primary and secondary techniques. I'm guessing secondary techniques would be a serious challenge that deep under-water, so even if that is out of the question, the recovery factor is still between 15-30% isn't it?

Is it not conceivable that with the world facing collapse, enhanced-recovery technology will flourish? Can we not have at least a little faith in new technology? Mr Mello also mentioned that the layer of rock has good porosity, which should be a good help.

I acknowledge that it won't change peak oil, but if 100-200 BBL can come to our rescue, we can have a nice big bump in the decline part of the curve.

Shox,

I am not a geologist or petroleum engineer, so I cannot speak to recovery factors at length. However, it seems that the recovery factor is the % of the original {what - EUR?} that is actually recovered in the end, right? Mr. Mello was speaking about oil that he has found, many miles beneath the surface of earth, so my guess is that Jeremy Gilbert, a petroleum engineer, was speaking from many years of experience. In fact, he spoke the disconnect between what geologist would find and what engineers were able to get out. Sorry I can't answer is detail...

That's not a bad answer David. Except I might qualify it a little: what Dr, Mello THINKS will be found and not what he has found (I think that's his position). Also, I would tend to say "what the geologist THINKS he has found" and what the "engineer THINKS he will recover". Even when you have all the facts in front of you there's still a potential for significant variance.

Agreed...this year's conference (my second) truly was put together well for exactly the reason you mention: opposing points of view make the discussion much richer!

I would add two more fundamental concepts to EROEI (net energy) that we need people to understand.

First, the net export problem, which is so basic it's hard to see how so many people are completely missing it. As producer country consumption goes up and their top line production goes down, there is less oil for oil importing countries to purchase.

The right-half of the age of oil, when viewed from an oil-importing country's point of view, is going to look much more like this:

The curve would be even steeper if declining EROEI were added to it. Thanks to Jeffrey Brown and Sam Foucher for waking me up to this issue.

The second concept deals with the mess we've gotten ourselves into with our monetary system. Although economists (and the population in general) relate to accumulated paper currencies as wealth, because they are a claim on future planetary resources they are actually a liability to the planet. Of course the planet, which last time I checked was finite, cannot have infinite liability put against it. However, the monetary system, being virtual, can increase forever until something stops it from doing so.

This disconnect between what we think is wealth and what the planet can actually provide is growing by the day and has only one way to end (in my view) and that is collapse of paper currencies. There won't be an event to point to that will demonstrate that this weakening relationship was one of the fundamental problems that caused the collapse. It will simply be like sand washing away from under a building foundation until the foundation fails.

Thanks to Chris Martenson for pointing out this doozy of an Achilles heel to me.

I like the way Charlie Hall puts it, it's a race between technology and depletion and depletion is winning.

Actually, it isn't even a race. Fossil fuel resources are limited. Depletion is always going to win, hands down.

Only a switch to using renewable resources can give technology the winning hand.

I completely agree but would the add the following tweak to the sentence below:

It is not that paper currencies will collapse, it is that the belief that they will go on representing a claim on the future resources of the planet and future sweat of humans which will collapse. And ultimately it will be the specialised economic ecology which will disappear as without abundant net energy, and without the ability to pay for it early in the day (ie, cheap) then all other labour and sweat during that day will not be enough to satisfy the interest on the debt holding the currency up.

Once one's eyes are open to these basic truths, one never views the world quite the same again!

Hi, HACland.

Fair enough, the belief collapses first then the currencies. But since the currencies are not real (they aren't anything physical), isn't it ultimately the same thing?

HACland wrote:

Indeed. This speaks to an important distinction between fiat currencies on the one hand and debt-based currency creation on the other - particularly fractional reserve systems.

aangel wrote:

No, because you can have a fiat currency that isn't a debt-created currency and vice versa. (Some local currencies are fiat without being debt-based, for example.) The fact that we don't see a fiat currency not created via debt doesn't mean they can't exist; we just live in a world where all state currencies are based on the fractional-reserve system.

Even when a currency is backed by something "real", like gold, if it uses a fractional reserve system then debt can still expand beyond what the economy can support (i.e. claims on future wealth can expand beyond what real growth in production will support). This is the financial system the world had until most countries left the gold standard around ~1919-1939. There was never enough gold to cover all the paper currency because the fractional reserve system ensured that gold reserves would always be some "fraction" of them. This worked basically because only a fraction of the paper was ever asked to be converted into gold at any time. That also meant it only worked until lots of people asked for their gold deposits back at the same time. This was the cause of bank runs and the original argument for central banks: financial stability - which also happens to come at the cost of moral hazards on the part of lenders (oops!).

If the issuance of debt is instead coupled with someone actually lending pre-existing currency (e.g. when you make a term deposit, buy a bond, etc.) - where the debt-note isn't also usable as a medium of exchange, as the gold-backed bank notes were - then claims on future wealth would exist independently of growth in the money supply. (Those instruments of debt, if usable as a medium of exchange, would otherwise act to increase the supply of "money-equivalents.") Modern banks end up "creating money" because whenever they receive a new deposit, the fractional reserve system generates new loans up to {(the deposit) divided by (the target reserve ratio)}, typically a very large multiple of the original deposit - i.e. in Canadian banks with a target of ~0.5%, it's something like 200 times the original deposit amount.

Bank loans that create money act not just as a claim on future wealth - because they must be paid back from future income - but also on existing wealth - because they are used to make immediate purchases with money that would not otherwise exist, thereby competing with existing currency. On the other hand, a fiat currency need not be created via debt; it could be created by e.g. government expenditures - say, on infrastructure or a progressive tax rebate. This would only act as an increased claim on existing wealth; it would still generate inflation if the economy wasn't also growing at an equal or greater pace, or deflation if it wasn't growing as fast as the economy. However, that's just an argument for why it should be limited to the rate of economic growth.

Coupled with a lending system that depended on banks to act only as mediators between people looking to lend money and those looking to borrow - and not creating money out of nothing - it's unlikely you would see lending so out of touch with reality. If banks wanted to make so many loans they would have to raise interest rates to attract the money, but that would also undermine people's willingness to borrow. On the other hand, if people wanted to lend lots of money, interest rates would decline and fewer people would want to lend.

Adrynian,

all that is true but my question still points to the fact that our currencies happen to be both fiat and debt-based. So for our situation, losing confidence in the currency amounts to the same thing...a distinction without a difference.

Fair enough. I was partly reacting to the sentiment you appeared to be displaying - one that I see many people express, most frequently on other sites but also on TOD at times - that simultaneously denigrates all fiat systems, conflates them with fractional reserve systems, and pines for the return of "the good old days" of gold-backed currency.

Going back to gold - or any other physical/non-fiat/commodity-backed medium of exchange - won't prevent the problems we're currently facing so long as we retain the fractional reserve system. That is the real problem with our financial system.

I apologize for reading into your post, and for using it as a launching pad for this topic, but I felt it was important to explicitly differentiate fiat and fractional reserve systems, particularly since you seemed confused about the difference.

It's not that the "currencies are not real" (i.e. they're fiat) that makes them problematic; they're problematic because they exist via debt-creation which cannot be supported if our economy experiences sustained economic decline. It's grow or implode; no middle ground is possible.

Excellent. Two thumbs up.

Nice graphs.

However see my post above it was game over once debt started expanding and EROEI declining.

Shift everything to the right and add in 30 years of the surreal twilight-zone dreamland period and you got it.

Its a bit interesting that the last decades after WWII have been labeled as the American Dream period of suburbia etc.

Turns out to be a 100% perfect label.

Thanks.

They are animated if you watch version 2.0 of my video:

www.postpeakliving.com/preparing-post-peak-life

I think it's possible to go much further than that. This game was over before it even began simply because the fiat currencies were never tied to energy. Of course population growth was still a background pressure, but that's a separate (equally important) issue.

I think the relationship we created between our currencies and real wealth is fundamentally flawed by design. There is/was no way to prevent collapse with this system. Eventually the disconnect catches up to you for whatever reason (dropping EROEI or exponential debt or population pressure) and there is no way to avoid that unless there is some constraint on the increase in money supply.

It might be possible to have designed a poorer system, but it escapes me exactly how.

Note: Link fixed.

Aangel -

www.postpeakliving.com/preparing-post-peak-life

! Post Pea is something completely different!!

Whoops, must have been typing quickly, thanks. (Reminder to self: always check links!)

http://www.postpeakliving.com/preparing-post-peak-life

I concur there are other game changers involved i.e oil/debt was not the only one.

However if your willing to tackle the population issue its addressable even at fairly high population levels not easy by any means but addressable to a point. Where that point is is unknown but in the end the key constraint on population is generally water and aquifer depletion. However if allowed migration could actually help even in that regard. Even now our population could be redistributed move to renewable use of our agricultural system and wind itself down without tragedy. I think significant shifts are needed crossing many borders but its even at this late date doable.

Given there are graceful failure modes for population I continue to maintain hope against all odds that we will eventually adopt a wind down thats what I call dignified. In general it means a heck of a lot of intensive organic agriculture at the subsistence level for many but given the alternative its not bad. The natural cycle of agriculture ensures some time is available at points in the years to both enjoy yourself and create something besides food to increase your standard of living although slow it does not have to be a zero/negative lifestyle. And as population pressure reduced then the overall system improves.

However all the solutions I seem to be able to come up with involve low tech innovative use of local resources and corrected population patterns with a fairly small amount of high tech to enhance the quality of life.

And even here its clear we have not even scratched the surface of providing "high tech" to subsistence farmers.

Right now the monetary system effectively precludes this but once its the only game in town then I think the situation can change rapidly.

Hopefully you can see that even now at this late date if your willing to give up on the old system and forget about it and focus on how to build a new system focusing on reducing the population with dignity we can still change.

Of course its not so late that its impossible to transition the "old" its toast but the right answer has never changed its just a bit harder to execute now than it was 40 years ago. But the basic things that need to be done are the same and the solution is the same. Rebalance the distribution of the worlds population to achieve sustainability and wind down growth and use technology to increase the quality of life for everyone. It does not matter if its 1,2,4,?? billion people however your obviously getting into the danger zone as you pass four not impossible but exponentially more difficult to pull off.

Surprisingly given I often come off as a super doomer I think the way out will remain open even as our current economic system crashes I think that the opportunity to change exists and the door if you will to make that change will remain open regardless of what happens to the existing system. Maybe its not wide open now but its still not closed and won't be no matter what.

Funnily enough the rapid concentration of wealth at the top which is the intrinsic reason we crash "early" also means our other options are still open.

So by being too greedy we have left a window or door or escape route open if we choose to take it.

Its sort of like someone harvesting trees clear cutting as fast as they can and leaving the ones in ravines and steepest mountain side that are too difficult to get when the clear cutting is done and the business collapses you still have the trees in the ravines and you can responsibly use them to restore a balanced forest. Right now we see these last trees as resources available to the clear cutting civilization they are not however maybe just maybe its enough to create a new civilization if your careful.

I will always agree that it is theoretically possible to sort ourselves out. It would require:

So, yes, it's theoretically possible that all this could happen before collapse arrives.

You should get right to work on that, Mike ;-).

Seriously, I once believed this could be done, but no longer. Here is an email I sent to Chris Nelder, Jeff Jelten and Jason Bradford about a month ago that explains my view now:

Well I'm dabbling in alternative energy. Finally putting my chem degree to use.

This is based on liquified gas as a energy storage preferably liquid nitrogen if I can get it to work.

Not because its the "best" but because I think it can be done cheaply and has a number of benefits.

Cold is good stuff.

Polishing off my alternative software platform designed to provide a rich experience on cheap devices.

Sort of a uber next next gen webbrowser.

And I joined the local currency group in Portland. The end of the national/international fiat money regimes does

not have to be that painful simple credit clearing is more than enough to support a robust local economy.

They may not take off until after the system collapses but it turns out that done correctly local currencies seem

sound and if abused fail rapidly. Money turns out to be and almost trivial problem if your trying to live within your means. I think that only the larger number of bank failures that occurred during the depression prevented a return to local currencies people where hurt so bad they where simply mentally unable to trust the creation of local currencies.

This time around although I think people will be burned we have lived with credit long enough to understand its both good and bad and won't react quite the same way. Thats my hope at least.

Certainly I continue to watch as things unfold but its more as a sort of voyeur almost :)

At some point you just have to treat it as what it is a sad historical event playing out in real time.

The "real world" or what happens next has already started to grow and form it does not take much to find a way to turn your back on the last of the historical melodrama and focus on the future. I'll admit I still watch out of morbid interest but mentally and even physically I've already moved on to look past todays events as best I can.

Plenty of places to find your niche in the transition town movement.

http://www.transitiontowns.org/

I'd say about the only reason I still write is in vain hope that perhaps Obama might go on national TV and explain to all Americans how badly we have screwed up and give us a chance of taking our lumps and getting through to something real and sustainable or crashing. Crazily enough I have this small hope that he will default on the dollar stop all the insanity dismantle the Fed and help America refocus on itself and its closet neighbors. In the end the only solution is for US to follow in the footsteps of Japan and effectively seal ourselves off from the world and let our absence both give us a chance to heal and the world a chance to succeed or fail with out either our help or meddling.

Sure it means we default on our current obligations and it will hurt like hell but its not deadly we and the world would survive and eventually once the wounds heal prosper again.

But thats just the nation doing what the transition town movement is doing so why not start early and hope that the nation will follow ?

Bwaha. Cold is bad because efficiency is related to differences in temperatures. When the phase transition occurs, the area gets cold and efficiency plummets. Compressed nitrogen is loads better than condensed. Majorian can explain it to you.

I suggest you straddle a LN2 cannister and take a sledgehammer to the nozzle. If you have it pointed in the right direction and hold on tight, you have a remote chance of making it to the moon. Good luck.

Bwaha squared.

LOL

That would get you the worlds fastest ice rink. I've poured LN2 over the floor many times. It cool as hell of the top of my head I forget the effect but you get a gas barrier forming and it literally dances over the floor.

It not cheap so I never dumped a full container but you should get a killer ice rink. Need to resurface just dump some more.

Dang can't remember the name of the effect you can get it with water and a hot griddle also arghhh google is not helping.

And generally there is no nozzle just a foam cork and that is generally open to allow boil off.

And of course this highlights things that modern engineers miss cold is very very useful as much as energy itself.

All kinds of processes use cold not to mention storing food. Getting energy out the other in is really a freebie.

And forget about electricity why ?

Use air powered motors. 200 psi is more than enough to power tons of other uses say a full machine shop.

http://www.isegoria.net/2009/02/amish-hackers.htm

The machine shop itself can make everything locally for the entire system given the right alloys even bearings if you had to.

Your actual electrical usage is down to your telecomunications gear and a few lights.

And compressed air can make heat ..

http://www.iprocessmart.com/itw/vortex_tubes.htm

Hot enough to boil water.

Obviously you can condense all the clean water you want so theres your water supply no contamination no disease.

I just outlined a way a community could live a very nice lifstyle with all the amenities of our modern homes with practically no electricity only if you want light bulbs and computers. If you don't want those then none is needed and except for a few air powered motors readily created except for a few bearing by any machine shop your done.

And the shop itself can avoid large castings for its tools using concrete or even stone or synthetic stone for the beds leaving just the fixtures for a single lath and mill and the required tools as input.

Certainly lots of knowledge needs to be transmitted and skills acquired but with some fairly small inputs a farming village in India could dramatically increase its standard of living on its own rivaling if not better combined with other concepts the "American Dream".

Obviously I don't see a lot of reason for using much electricity outside of lights if you want them and things like computers and televisions which can be made very energy efficient.

I'm not aware of a good non electrical source of lighting but certainly its doable just I think no one has really looked. Obviously good old fire works. But once your down to your computer and lights as all that requires electricity then I'd say who cares. PV and some air power are more than enough to power these use cases esp with some more work on efficiency.