Looking Back at Peak Global Production of...Gold

Posted by Heading Out on November 14, 2009 - 10:16am

Yesterday the President of the largest gold mining and production company, Barrick Gold, noted that after ten years of declining production it is time to recognize that the world has seen the peak in gold production. To maintain production ore is being mined with increasingly less gold in it. (The grade of the ore, or metal content, defines whether it is profitable to mine.)

Ore grades have fallen from around 12 grams per tonne in 1950 to nearer 3 grams in the US, Canada, and Australia. South Africa's output has halved since peaking in 1970.

The supply crunch has helped push gold to an all-time high, reaching $1,118 an ounce at one stage yesterday.

Gold serves two purposes. Firstly, it has provided down through history a form of currency, though it is not clear whether it was Croesus or the Egyptians who used it in trade. Both date back to around 5-600 B.C., and gold coins have flourished since that time. (Before then gold was mined around Mestia, in what is now Georgia, back at the time of Jason and the Golden Fleece (before 1300 B.C.) and used for ornamental wear and art objects.) But gold also has a useful function as a metal.

Gold conducts electricity, does not tarnish, is very easy to work, can be drawn into wire, can be hammered into thin sheets, alloys with many other metals, can be melted and cast into highly detailed shapes, has a wonderful color and a brilliant luster. Gold is a memorable metal that occupies a special place in the human mind.

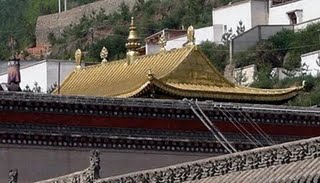

It is even, on occasion, used as a roofing material.

As with peak oil, the fact that global production has peaked does not mean that there is no gold left to mine. Rather it means that less gold will be mined each year into the future. It will likely, in time, bring back into debate the environmental costs of mining.

For there are deposits of gold still in the ground that are being not mined, in part because of the environmental cost. If you go, for example, to the Malakoff Diggins in California (a state park north of American Hill), you will find tall sandstone cliffs that used to be mined using streams of water from large monitors. However, in excavating the rock it was also disintegrated, and the clay particles were carried down into the Sacramento River, gradually filling the river bed, to the point that in heavy rains the river flooded the surrounding communities. Thus, back in 1886 Judge Sawyer restricted the practice, which largely fell into abeyance. But the gold is still “in them thar hills.” Similarly if one goes up to the valleys outside Fairbanks in Alaska, there is gold in the gravel beds – but is has been largely too expensive, both commercially and environmentally, to recover to this point. One of the more recent discoveries in Alaska has become known as the Pebble Mine Project. While there may be up to 3 million ounces of gold in the region, there has been strong opposition to development--even though that development continues.

Gold has been a valuable mineral for a long time and for nations all around the world. All the good and easy places to find it, therefore, have been sought after and largely found. The gold deposits that are worked have become smaller of lower value and found in places that are harder to get to. With lower availability, greater demand and higher price, it became more practical to mine and process lower grade deposits and to go deeper into the Earth for the higher grades. Mines in South Africa and in South Dakota have been worked down to more than 2 miles below the surface, to recover the ore. And techniques have been developed that recover it in even very small quantities – 3 gm per tonne is an ore that contains very little gold (3 divided by 1000 = 0.003 kg divided by 1000 = 0.000003 tonnes or 3 parts per million). So, while miners can still find the odd nugget when they pan for gold in streams around the country (and there are lots of maps available to tell you where to look), for the large scale levels of production that make a significant impact on the market, you need large deposits of gold with the potential for greater yields, and those places are getting harder and harder to find. And even as one goes deeper, the grade of the gold doesn’t necessarily continue.

Harmony Gold said yesterday that it may close two more mines over coming months due to poor ore grades.

Gold production in South Africa had fallen 9.3% year-on-year last September--this in the country that once led the world in gold production.

We haven’t run out of gold yet

Barrick produced 1.9 m ounces of gold last quarter, down from 1.95 m a year earlier. Costs have been "trending down" to $456 an ounce, though rising energy prices pose a fresh threat. Total reserves are 139 m ounces, far ahead of rival Newmont Mining at 86 m.

But production will continue to fall as the reserves become even harder to extract. Beyond a certain point there is not a lot that technology can do, except perhaps to fund ways of getting gold out of veins that are too small and costly to mine at present. But that won’t yield the millions of ounces that are needed to maintain supply. And the industry was not one, in recent years, to invest in that future. When gold can be recovered by soaking crushed rock in a solvent at relatively low cost, there is not a lot of incentive for new ideas. The days of the industrial innovations that used to come from the research labs in South Africa are likely now over.

So, as the oil industry starts its travels down a similar path past peak and into decline, there are a couple of thoughts I would offer.

Firstly it could be pointed out that the gold industry has been able to see the declining production and lack of available prospects for some time. But it is only now, some 9 – 10 years after the decline started, that the industry is publically recognizing the problem.

Secondly one might ask whether there should not be an agency of the government that can independently warn the government and the nation of this before it happens, so that either better mining methods, access to restricted reserves, or the development of alternate materials could be hastened. Well actually there was--it was called the U.S. Bureau of Mines, and all those tasks were in its charter. But the mining community is a small one, and has not nearly the clout or popularity in Washington that it is thought to have. Thus, in 1996 the agency was closed.

Thirdly, even though the story is out there it is unlikely, for a while, to get much media attention, and the vast majority of the world’s population will not either know of the predicament that is now approaching, nor understand why it is going to be something that will impact many aspects of their lives. Until, of course, it does.

And of course gold is only a pre-cursor of other minerals that will soon run short. Few folk realize the role that metals and minerals play in providing their lifestyle, and do not recognize that the value of many metals comes, in part, because there is nothing that can substitute as well for that particular metal in doing a particular job. Unfortunately, doing something about it requires vision for an industry that is not favorably viewed by much of the population. It will be interesting to see if that perception changes, or if the industry becomes the target of blame as shortages lead to even further cost increases.

And then, of course, will come oil . . . . .

Nothing to worry about, gold is almost as useless as diamonds.

Diamond mines is one of the worst wastes of resources there is.

Most essential use of diamonds that I have heard about can be

met with synthetisised materials including synthetic diamonds.

And most of the gold need can be met with other materials, there

has even been one developed at my local university i Linköping

that is better then gold for protecting electrical contact surfaces.

Gold is perceived as a tangible method of storing wealth and has survived as such for over three thousand years. Somehow I don't think you're going to be able to change that. But you might see folk moving to purchase more of it as a physical item with more long-term sustainable value than the paper money that they buy it with.

Its a lot better for society if we store wealth as durable capital goods or infrastructure investments. Or even to use ut all on educaton and gathering knowledge.

I would rather have metal cutting bits as the base for coinage then useless gold.

Metal cutting bits would work just fine -if there was some way of being sure nobody would ever be able to - in effect - counterfiet them by developing a way to lower thier production costs.

Apparently ( I may be wrong ) the supply of gold has never increased fast enough to significantly lower it's price over the middle or long term.

But I agree with the concept of storing wealth in the form of concrete, physically durable, useful forms.

But if you are going to take this approach you must be reasonably sure your chosen medium will not be substituted or replaced by a better material or product.

In the short term I am storing some wealth in the form of diesel fuel and fertilizer, which are not really well suited to long term storage but seem likely to appreciate fast over the next year or two.So I guess I'm one those petroluem speculators that are responsible for eighty dollar oil!

Items that seem likely to hold thier value well and store or last indefinitely as well as being useful in the meantime ( earning the equivalent of interest income )include any tools or machinery or household furnishings made to last indefinitely.

Some that we have are heavy stainless steel cookware, a cast iron hand pump, nylon rope, scythes with heavy duty blades, wood stoves made out of heavy steel plate at least one quarter inch thick,

a hand operated grinder for sharpening tools,etc.

Some items, such as the rope and grinder , do wear out in a few years if used comercially, but for homestead use they are essentially lifetime investments.

I also have stored a comsiderable amount of angle iron , pipe, channels , and I beams which are useless until put into service but which will doubtless appreciate sharply in value in coming years-steel is one of the most energy intensive of products.

If I had money to invest I might buy into a mining company with good prospects for the metals such as chromium , molybedium, etc. used in maling specialty steels.

"But I agree with the concept of storing wealth in the form of concrete, physically durable, useful forms. "

Gold fits that description perfectly. While other metals degrade and corrode, gold is DURABLE. It does not have to be useful for other purposes.

I am using 11 year old diesel fuel that i keep treated, and it runs fine. I've wondered about fertilizer as I have a farm, maybe i'll experiment with

a bag of urea, see how long it takes to dissipate.

The recommended ratio...

Could come in handy WTSHTF...

;-)

Super insulating your house, shop, barn etc.. (minimum of R-50 walls and roofs) is one of the best long term investments you can make. It will continue to pay increasing long term dividends (as long as energy prices continue to rise) for as long as you own and use the structure.

That followed by investing in a geothermal heat pump to heat/cool the structure. Do NOT look at payback, but at return on investment in the heat pump vs what you can get in other investments. [Stocks don't look "safe" to me and Cd's are paying under 1%]

the supply of gold has never increased fast enough to significantly lower it's price over the middle or long term.

However, with the influx of gold from his campaign in Gaul, Caesar may have inadvertently caused the [silver] price of gold to plunge by as much as 25%.

The influx of gold (and later silver) from the New World created such inflation that Spanish industry & crafts were severely reduced. Coins were traded for goods from abroad instead.

Likewise, gold in California after 1849 bought FAR fewer goods than it did in 1848.

Alan

Hi Alan,

I'm not a gold bug-pointed that out-but after that gold had time to shall we say "disperse " out of California and Spain , where it was concentrated, what happened next?

Of course by the time of the California gold rush there was a different kind of economy-industry was on a roll with trains, more efficient steel manufacture, etc.

I have never felt good about any money comparision from one time period to another as to how values compared because wages as well as prices change.

Spain took many decades, perhaps centuries, to recover from their gold version of the resource curse.

A little like what the US has done with it's reserve currency.

A good insight !

Our reserve currency has had the same effect as having "too many" resources to export.

Alan

Thanks.

Once thought of, it seems both fairly obvious and pretty important.

I wonder why this gets no attention? It seems closely linked to the US Strong Dollar policy, which has done so much harm to US manufacturing.

For over a century in the USA, good farm labor (except during harvest) went for about $1/day. In Reconstruction in the South it dropped to $0.25 to 0.60/day but stayed near $1 in the North. Also lower during Panics.

In good times it was $1 plus room & board (up to $1.50 if you roomed and boarded yourself) and in harder times it could be $0.60 plus room & board or $1 to $0.80 for labor alone.

But there was tradition behind the $1/day.

Such is my reading of economic history over time.

Alan

In his book: Beyond Oil, Kenneth S. Deffeyes thinks that once the global economy is shrinking severily, gold will be

almost worthless. Very few people will be interested in buying jewelry or any luxury items.

For a better future we have to manufacture very durable tools and products.

One of my grandmothers had a refrigerator [Brand = Frigidaire] that lasted more than 40 years, it worked fine!!

I have an electric shaver [Braun] made in Germany that has worked fine for more than 12 years.

Nowadays there are juice extractors and other appliances which are almost rubbish (made in China).

In a growing economy, it makes sense that gold and jewelry can hold or increase their value, whereas in a contracting

economy it doesn't make sense.

...once the global economy is shrinking severily, gold will be almost worthless. Very few people will be interested in buying jewelry or any luxury items.

Thing is, the fundamental demand for jewelry and other luxury items has little to do with the current price of gold (~$1100/oz). Gold is being universally hoarded as the perceived "hard money" safe haven from fiat currency debasement, while the world's central banks pump money (in the form of bank bailouts and ZIRP) like crazy.

It's all about preserving the purchasing power of one's "money", not about the bling.

Willem Buiter has a good article on gold in the Financial Times - Gold - A six thousand year old bubble.You can link to this through the current issue of The Automatic Earth.

"I would rather have metal cutting bits as the base for coinage then useless gold."

No, that is a bad idea. Metal can be used for other purposes and it is quite common. Also easy to counterfeit.

Gold has unique advantages:

- very hard to counterfeit

- it is pretty much USELESS for anything else than money

- it is rare

It is not a coincidence that gold has been (and still is) money for thousands of years.

In Zimbabwe people started to sell rings and jewlerey as things got bad. The dealers buying them and selling them on abroad could only give fixed prices for the weight of gold because they had no way of gauging its purity. In this case you were better off selling a poor quality gold ring than good.

Too bad they can't afford a balance and some water...

I belive they are offering a fixed amount, but that is more likely a way of taking advanje of people than a consequence of lack of means.

Economics Professor posts a blog at The Financial Times castigating gold ... then people post comment below his blog, crushing his argument. Priceless.

http://blogs.ft.com/maverecon/2009/11/gold-a-six-thousand-year-old-bubble/

Very interesting THREAD after I wrote PEAK SILVER and PEAK MINING due to a falling EROI, Which can be found here:

http://www.marketoracle.co.uk/Article14756.html

First, as HEADING OUT states, GOLD is real money as it has a STORE of VALUE. When Gold and silver were mined by physical labor in years past, it was this amount of physical labor and time investment that was stored in the value of the coin. If you wanted to trade a pair of boots you made for eggs as an example, the labor in making a boot compared to picking an egg would be much higher. The market in barter would figure this out to compare LABOR RATES between different goods and services. GOLD and SILVER were money that had STORED LABOR in them to use in this market.

FIAT MONEY never lasts and the last record for a fiat currency was 18 years. The US DOLLAR has broken that last record, and is now 38 years old. I would be surprised if it went to 40 years. The reason why it has lasted so long, was due to the US Military, Strong arm policies for those countries who would not trade oil in US dollars, Hook and Crook, and of course if all else failed, murder and execution.

To say GOLD is as worthless as Diamonds, comes from an ignorant commodity view of GOLD. Many present day analysts see gold as a mere commodity, similar to refering to the past trade of humans as slaves. When the energy crisis gets into full gear, electronic money, trade and etc will become increasingly difficult due to the breakdown in infrastructure. If people want to put faith in fiat money or electronic digits...do so at ones own peril.

The Peaking of GOLD in 2001, was a very important event. But, the Peaking of Silver will be even more critical, as it will signify the peaking of the Global Mining Industry in general. 72% of all silver production comes from by-product mining of base metals. I stated in the article that I believe the PEAK of SILVER will have occured in 2008. We will see if this pans out.

I don't know if this picture turned out. Don't know how to post pictures in this blog, but that graph of Australian production rates, is most certainly exponential. Silver has the most exponential graph of them all.

You can make bullets out of gold, and that is an advantage.

I would be collecting antibiotics and fish hooks over gold.

Glue and matches would also be on the list.

aren't silver bullets better?

;-)

Only for Wall Street Werewolves.

Would be?

I have already collected the items you mentioned and also a pretty good collection of hand tools.

Don't forget gold is an excellent conductor, which means it's essential for complex electronics like computers and photovoltaics.

Not "essential", merely helpful, other things will do.

regarding buying gold as protector of value, after the romans started retreat from Britain the wealthy sometimes left a pots with golden coins, convinced they would return soon, even now you can find one. i wonder how many of those gold bullion in deep vaults of present day banks will share the destiny.

there is 200 000 tons of gold in the world (already mined) and one tone contains 30 000 ounces so you get 6 billion, if we got to use gold for something useful other than a superstitious "wealth" preserver we wont have a problem for a long time.

and if we take in account a fact of end of cheap oil and energy are we not near the end of feasible extraction methods? in other words gold has run out?

You got that right.

You cannot eat gold - so what good is it in the long run.I really feel sorry for those individuals who are trying to calculate why the world economy is tanking right now without the knowledge or acceptance of PO.Currencies backed by precious metals are a thing of the past: approximately 37 years for the world at large and 76 years for the good ol' USA.

That sort of stability is a thing of the past; we are rapidly headed for a digital technocratic socialistic economy and there is nothing that can stop it.

Feeling free lately?

If not just turn on your boobtube and escape reality indefinitely - if you can't handle reality.

Better to face reality...

Has anyone charted production of gold vs price? It would be interesting to see if chart has the same shape as whale oil. Unlike lead or mercury, the demand for gold is clearly high, as indicated by the price.

If this is the all time peak in human energy production, then perhaps gold in decline is a good choice for a currency! Lol.

Which curancy would you like the chart?

In Euros it has been dropping. Dollars it has been raising. Euro @ USD ~1.49 while 2 years ago the ratio was much less.

"Hit Print!"

Gold is rising in price in all currencies not just dollars. We have record prices in euros about now.

The difference between gold and oil is that gold is imperishable and tends to last for a very long time. Oil, however, once combusted, is gone forever...

another difference is that oil has real economic worth commensurate with it's price. gold has very little intrinsic economic worth. (of course there is a market for it, but i'm speaking of intrinsic worth) while i don't expect to change the opinion of the market, i would never buy gold because it is built on an antiquated premise.

Yup the atavistic notion of gold being money will never leave the hairless apes collective psyche.

The ultimate base for any money would be renewable energy. We would want it counterfeited and it also links human activity to the real world.

The only thing we would have to worry about is misapplying it and over doing it.

Porge,

I agree with you on most things-but not this one.

People need a way to save and store up value-we need something in the nature of currency that can be niether counterfieted nor inflated.

Let us suppose your old age money is in wind farm electricity shares-and somebody invents a way to do solar so cheap that your wind farm goes broke?

I'm open to suggestions as to how savings can be managed-I have never yet heard of a fool proof system.

I didn't say as a store of value but as the base for currency.

Gold is just a confidence game and the items of embedded energy will lose value if someone invents a cheap energy producing machine as well.

As far as saving or investing for the long term there is always unforeseen risk.

And why would the wind farm go broke unless it was financed and servicing the debt.

Let's face it if the magical free energy source is introduced the entire game is changed anyway and the game should change for the better.

There are a lot of things to consider.

edit:

I see your logic on investing in rare elements after all, all the energy in the world won't be able to mine something that just isn't there anymore.

Maybe elements with intrinsic value is a possible Quasi "fool proof".

Or this could all be academic and we are screwed either way.

One other point I just have to make is that if energy IS the currency then as long as a positive EROEI can be maintained you are in the black.

You are thinking in terms of dollars and I am thinking in terms of BTUs or Joules or Calories............etc.

What is a "storage of wealth" today vs. yesterday vs. tomorrow?

When agrarian cultures ruled the world the store of wealth was in the granaries. When a harvest failed (pretty common in the early days) those that had access to stored wealth in the granaries survived.

Presently industrialized societies have morphed wealth into status symbols. You don't need ownership of actual wealth. A big bank account is an allele for raising your reproductive potential. Gold plated bathroom fixtures anyone?

The question is: What will the "storage of wealth" be in collapsing industrial societies?

Joe

Grain in granaries maybe?

Have you read Greer's piece this week.

You could have quoted him.

Gold doesn't taste good and it won't burn so it needs something else that is useful to give it value.

I'd say something which produces/releases energy. Oil for example. It doesn't go bad and the embedded energy never changes....

Rgds

WeekendPeak

oldfarmermac gets it.

Thank you Harm,

Even out here out on the farm I can't expect to store enough of anything-not even firewood -to last thru old age.At some point I need something compact, non perishable, and easy to store that I can acquire by exchanging whatever I have in excess TODAY which I can exchange LATER for food, electricity,and taxes when I am no longer able to work.

Barter is not a very good option except in a village level society and hopefully we won't sink that far.

And people who have money to lend or who wish to borrow need a non counterfietable, non inflatable currency in order to make more rational decisions; otherwise they must guess at the effects of "common man's inflation". (By this I mean the man on the street uses a different definition than bankers and economists.

My personal guess is that while gold is intrinsically worthless except foe a few industrial applications such as the very finest quality electrical contacts it has such a hold on the imagination that it will be extremely valuable in the event of a collapse.

But if by some miracle the economy stabilizes people will get tired of holding it because it pays no interest and the price will probably collapse to maybe half of whatever the historical high has been.

Personally I think that many other goods are currently better investments as long term stores of value.

A good many of my acquaintances are of the opinion that a well chosen tool collection, a small tract of farmland, a masonry house with a metal roof and a chimney, and firearms are better investment bets in terms of concrete goods

But none of them are opposed to holding a little gold either-on the principle that someone who has something you may want to buy may be overloaded with guns, tools and firearms.Houses and farm land are extremely illiquid and may be nearly worthless in a situation where you really need to sell-nobody may have anything with which to pay for them.

Nobody has ever had enough gold to flood even a local market so far as I know.

But on a desert island a man with a pound of gold would gladly trade it for a bushel of wheat if there is nothing else on the island edible.

You're assuming we will never be able to manufacture gold, after all, it's just protons and nuetrons in the proper proportions. I gues we're probably safe for about 50 years at least, but never is a much bigger proposition.

If nano tech develops to that level then who cares?

Nanotech can not do that... Femtotech, here we come!

Femtotech=the new alchemy

I had never heard of this before. thanks for mentioning it.

Now I have one more arcane word to throw around in conversation!

Grains and bread are also antiquated, please stop eating them. You are a modern man after all.

Gold is about the only thing that is a store of wealth on LONG term basis and easily transportable. If you store your wealth in land or tools or animals or anything else, that is also a liability if for some reason you have flee (war, bandits, famine, flood, etc). Better to flee with gold in your pocket than with 10 sacks of grain.

uh no. grains and bread provide sustenance and therefore have instrinsic value. gold has marginal instrinsic value and is not comparable at all. it will certainly continue to be a valuable investment strategy because of group think but i just refuse to put my money in such a worthless metal.

give me a nation of people and land with a trillion dollars worth of gold and no oil vs a trillion dollars worth of oil and no gold and I can tell you with reasonable certainty which nation will have the advantage. Scrooge McDuck vs. Superman..

The advantage will go to the better steward. Nigeria and Japan come to mind, though both could have neither gold or oil within a century.

Certainly anything from fishhooks to woodpecker scalps to solar collectors can be used as money, relative scarcity being the common denominator. Gold is just the worldwide standard, and is in fact more fungible than either currency or oil.

If you have oil, the US will invade you for sure. Or install a puppet government.

If you have nothing but gold you won't be invading anyone.

Here's an important quote that I stumbled on from an old-timer miner wrt mining metals:

Having been a fan of 'Supreme Commander' for years I know exactly what he means! :o)

Now it stands to reason that given an ever increasing supply of Energy, mining operations can continue to expand even as ore grades reduce. At an extreme if we had unlimited energy to apply we could extract minerals from sources of very low grade -I've read a cubic mile of seawater contains around 20 tons of Gold...

BUT! We are witnessing/living through the end of the age of Energy Expansion -in fact if you graph the price of oil 'Peak Cheapness' for it was in 1999.

So it stands to reason IMO that given the statement above those commodities that will be in continous demand even given a downturn will experiance dramatic increases in price as Energy costs rise / availability declines...

Now, some commodities will experiance a decline in demand as well, these are not the ones to cherry pick if you want your Pension to increase. An example would be diamonds.

IMO the commodities that will fly -amongst others- are those involved in the production of oil (as it is indentified that the oil supply is dwindling there will be a rush to maintain supply 'at all costs'.

One commodity that nicely fits this bill is Molybdenum. Molybdenum is used in significant quantities in the Energy sector -both as a strengthening agent for pipes and steelwork and as a catalyst to crack heavy-sulphur content oils, which will be increasingly the ones supplied to the market once the light sweet stuff has dried up...

In addition Moly is used to strengthen Nuke plants and building steel -with a thousand Chinese cities being built out over the next few decades Moly will be in big demand even without an oil crunch.

You want a renewable angle? Neodynium is used in windmills and other Rare Earths have had a good run recently too being used in many 'Green' areas with a supply pretty much 'sewn up' by the Chinese ('Economy' may be one of our best bets to combat oil decline in the coming decades).

...and so back to Gold , where does that fit on this scale of 1 to Useless?

I would like to see more analysis of the increase in Gold price wrt. Dollar decline and Energy Cost to producers but given its historic status as store of value over time I expect it will rise as fiat currencies increasingly become divorced from any underlying real asset value.

For more on my views in this area Google "Peak Oil Joining The Dots" and have a look at the section 'Commodities and Food Costs will rise'...

Nick.

http://en.wikiquote.org/wiki/The_Treasure_of_the_Sierra_Madre#Dialogue

That's the real issue, because between hydrocarbons and metals you're talking about the decline and eventual end of industrialism on anything like its current scale.

As a side light, this also means that at some point gold too will have much less of role to play, because the volume of globally traded commodities will decline, and the non-diminishing existing supply of gold will be more than adequate to mediate their exchange. This is not investment advice -- near term gold may well continue rising.

In general, we are accustomed to thinking only as investors, and not as citizens concerned about collective survival. So gold receives a lot interest in these parlous times. But it will be a lot less valuable than the ability to act collectively to find a road to survival for all of us as the walls come tumbling down.

It's not just gold. All metals are approaching extraction limits.

Silver is at or near the top of the list.

http://news.silverseek.com/SilverSeek/1257346165.php

http://mineweb.co.za/mineweb/view/mineweb/en/page34?oid=93062&sn=Detail

"SA gold miners on final deathwatch as scientist finds gold reserves more than 90% less than claimed"

Perhaps the fact that Barrick is buying back its hedged production should tell us something??

In addition to increasing scarcity, we would be remiss not to point out the exponential increase in both wastes produced and energy consumed as the grade drops for metal ores:

From "Limits to Growth: The 30 Year Update" by Meadows et. al.

Cheers,

Jerry

The increasing energy requirements are a key part of the argument in the link on silver I provided.

Hi,

nice diagrams!

one should apply them to uranium extraction energy costs!

For those who bother!

would be nice to copy/paste them into the

nuclear energy chapter IV discussion!

michael

A couple of points to consider:

Gold is closer to a renewable than oil. It can be "remined" from existing quantities.

Minerals have a much more gradual ore gradation than crude oil. The difference between the way that crude aggregates versus the way that minerals aggregate means that the depletion transitions are much more subtle. Look at the USA, production truly ebbed and flowed depending on the extraction technology.

Not that it will make a difference, but recently I have started to look at the way that mineral engineers use the discipline of geostatistics to find new deposits. One consultant has said the entire approach is rather suspect and I tend to agree (he actually calls it a fraud). It is a fascinating topic that I intend to look at some more, since I have used the exact same math on a completely different topic. http://mobjectivist.blogspot.com/2009/10/geostatistics-fraud.html

Geostatistics is not used as much for fossil fuel exploration, perhaps because of the controversial aspects. It is controversial enough that the criticisms are described in the wikipedia page http://en.wikipedia.org/wiki/Geostatistics (also see the topic of kriging). I bet HeadingOut knows all about this topic.

There are difficulties in reclaiming metals, too.

Silver, for instance, has been difficult to reclaim and much of the metal used in industrial applications is probably largely gone for good. Another problem metal is copper. It is very energy intensive to refine as this is done through electrolysis. For this reason, the large amounts of copper that have been used for making piping are very difficult to reclaim for use in electrical applications as the scrap stock needs to be re-processed as virgin ore in order to achieve the necessary fineness for electrical use.

We can cut our use of copper in construction and motor vehicles in half simply by doublimng our operating voltages-of course that will be very hard to do , given the difficulty of changing over.

Reducing the operating wattage/amperage required can also dramatically help. Scaling down tonnage, replacing steel with polymers or aluminum, reducing design complexity, more efficient circuitry, etc.

My reading in EE Times has been sporadic of late but I remember a few years ago there was a push in the auto industry to convert from 12 volts to 48 volts for just this reason. This was also to be part of a general industry shift to electrification of the control systems, e.g. "drive by wire" electric steering etc. to reduce weight. Anyone more up on this than I am? I'm wondering if a lot of this hasn't been shelved due to the general upheaval in the industry today.

The last I heard of this voltage switch in motor vehicles it was stalled because the industry could not agree on a standard for all the switches and plugs which are manufactured by electrical suppliers for the industry.

That was four or five yrars ago probably.

Maybe the engineers thought at the time that they would be wasting thier time at forty eight volts and wanted to wait until a hundred or more volts becomes practical.

I'm no engineer nor even an electrician but I do know that higher voltages and dc current are real problems when it comes to manufacturing cheap plug connections and switches and this was supposed to be the crux of the problem.

This issue got some coverage in the automobile industry press which I used to read regularly.

WHT,

Can you point me to the source of the data for this graph. I'd love to play around with it.

-- Jon

From Encyclopedia of Earth

http://www.eoearth.org/article/Gold_mining_and_sustainability%3A_A_criti...

Here is another one, from Macquarie Research, depicting world gold production 1850-2008.

http://goldnews.bullionvault.com/gold_mine_production_072020092

Decline for gold will differ from crude decline no doubt.

Here is the extracted average gold grade over time:

I would say that the equivalent chart for crude oil does not exist. In general terms, either you have refinable crude or you don't. There is then a discontinuous step function to the alternatives such as shale and tar sands.

Yes, I've been amused to see the denigration of geostatistics on Wikipedia, and almost tempted to comment on it. Because geostatistics uses co-variants in the same way that climate scientists use proxies as ways of making better use of data and improving predictive ability those of us who know one can follow the arguments in the other, and see and perhaps point out where there are statistical weaknesses. Thus there may be a move by those defending the AGW position to attack the geostatistics side, in this way seeking to weaken the credibility of those critically reviewing their work.

That being said, when geostatistics first showed up it provided a new way of looking at data and, as with many innovations, was criticized by those more familiar with the old way of doing things. The mining industry tends to be very conservative in these things. I have taught it as a part of some of my classes - there is a change from "factor of safety" analysis to statistical designation of risk and being able to incorporate more statistical aspects into the analysis helps with that transition.

I would not say that we don't use it for fossil fuel exploration because of its controversial nature, rather it is that it is better suited for use in predicting where the vein might have gone in a metal mine. Coal tends to be very predictable, from the nature of its genesis, metals much less so, hence the need for ways of predicting where to put the exploratory coring hole to find where the blankety blank mineral went to now! It isn't the easiest thing in the world to understand and apply, and by its nature and the nature of the subject does not always provide the "right" answer, it is just another useful tool, when properly applied.

(Oh, and in my lecture notes I also include phrases by well known consultants about current widely accepted practices, that were made, denigrating them, when they first came out. Getting industry to accept innovation has not been the easiest thing in the world).

The general idea of kriging in geostatistics is intuitive. However the practitioners seem to do badly at figuring out the variance in their estimates (in the critics opinion). There is an entire field known as non-parametric statistics and modeling where you can use the data itself to start to understand correlations. That is what geostatistics is about to a large degree, though there are some parametric models as well. However, without a lot of data the correlations and and statistical dependence can become spurious and the estimates for predicting whether a deposit exists turns out way too optimistic (i.e. a smaller variance than if you did it correctly). The usual way around this is to just drill more holes, but this is expensive and it kind of defeats the purpose of doing the elaborate statistics on a small set of points.

The overall criticism is that there have been what are called "spectacular" failures using the approach in that the kriging results said finding untold riches was a certainty.

The difference beween a success and a failure is binary, and whether the variance is off by a factor of 2 is I believe all the critics are complaining about. I guess it makes a huge difference between when you say that you are 75% certain versus that you are 50% certain when an investor is supplying the mining equipment and money.

Hi,

I'm looking at the major dips in the Graph -they all seem associated with periods of War:

1900: Boer War

1914-1922ish: 1st WW

1940-1943: 2nd WW

which could be explained by rel-allocation of Energy to Warfare or the 1970 period which was the dramatic increase in price of Energy during that period.

So war and energy price increase reduces supply.

I would be interesting to see superimposed a graph of relative price and see if rises corrolate with these periods. If the answer is yes then fill yer boots' cus here we go again...!!

Nick.

Thanks HO for a superbly written article on my favorite metal. It's just the right length with both historical and technical information, some of which is new to me.

Given humanity's three thousand year fascination with gold and its recent, meteoric rise I would expect this story to gain traction sooner rather than later.

And it may be just the sort of incontrovertable example of natural limits we need to convince people that natural limits do indeed exist.

-- Jon

I would hope that you are right, but in reality I wouldn't be quite so fast in jumping to that conclusion. The fine folks over at the MasterResource blog would surely be quick to sneer in your general direction, call you a "nitwitter", and with much rolling of the eyes re-state what to them is the painfully obvious fact that human ingenuity will overcome all limits.

I see that one or two regulars at TOD have commented on a few of the honorable Michael Lynch's posts at that blog, although I'm a bit disappointed that WHT has not risen to the challenge despite Mr. Lynch practically calling him out by name. From Lynch's bio on the 'about' page:

Gosh, I guess all that work on the shock/dispersive discovery model has been for nothing...

Cheers,

Jerry

Good catch, wrong conclusion. Saying that it will all amount to nothing, is like saying that running a few laps around the lake amounts to nothing. It at least gives a person a chance to exercise the mind.

Even granting this, Lynch has long touted the unscientific nature of oil depletion analysis, well before I discovered him saying this, definitely pre-year 2000. That has been the constant theme of his work.

So this gives me a chance to offer up a suggestion. How many TOD readers would support me if I started to modify the Wiki pages for say the Hubbert Curve (http://en.wikipedia.org/wiki/Hubbert_curve), Hubbert peak theory (http://en.wikipedia.org/wiki/Hubbert_peak_theory), Peak oil (http://en.wikipedia.org/wiki/Peak_oil), or Oil depletion (http://en.wikipedia.org/wiki/Oil_depletion)? So far there is little model theorizing on these pages, only empirical evidence or heuristics such as HL exist on the wiki. I can certainly add entries or descriptions to the oil shock model or dispersive discovery but they will only stick if there is sufficient support among people that maintain the wiki. Otherwise any thing I add there will likely be removed by some home-schooler. Science only truly progresses if a consensus exists. Often its a long painful process.

I think that is the single most frustrating thing about Wikipedia: the churn never stops. Anything you contribute on an article that has any topical interest whatsoever is guaranteed to either be altered beyond recognition or completely deleted within weeks, if not days.

That being said, I do think your model deserves a more organized presentation and greater exposure, despite my sarcasm above.

Cheers,

Jerry

The Peak Oil Secret is Revealed!

by Michael Lynch

November 11, 2009

Peak oil took place in 1998. Don’t believe me, look at any price chart. Since 1999, prices have risen over 600%.

Don’t blame this rise on speculators, speculators arbitrage between markets, they do not destroy them.

Forget geology, follow the money. Oil has never been as available as it was in December, 1998. Since then, the world’s economy has been unwinding. Some businesses can thrive on oil priced higher than $35, most US businesses cannot.

The macro- strategy for coping with uncertain availability and increasing prices has been to inflate asset bubbles to hedge against the higher (oil) prices. Unfortunately, support for the asset prices depended more on low input costs than the architects of the hedges assumed.

Oil is not simply a commodity. It is a platform which includes all the infrastructure that is required to consume it. The productivity of the entire platform cannot generate returns at high prices as it is designed and built for and around oil inputs at pre- 1999 price levels.

The costs of the platform are stranded as a result. Additional platform costs are stranded as oil prices increase. Unproductive infrastructure and stranded costs are why businesses are failing and have been failing all across the country. The economy is being eroded from the bottom up.

For the same reason reason, consumers in 3d world countries are able to outbid the US and other developed countries for for oil. Developing countries do not have to support the costs of massive consumption infrastructure that does not exist.

As more countries develop further and add platform infrastructure, their costs rise and more of their platform becomes stranded, too. This is beginning to happen in China, which is building consumption infrastructure – roads, bridges, shopping centers, suburbs – as fast as possible.

The 500,000+ US highway bridges – one quarter of which are dilapidated – can be supported by $20 oil but not $50 oil. @ $80 the entire economy begins to collapse. At less than this price the entire economy collapses more slowly.

Don’t believe me, walk outside.

What is happening is the free market in action. Establishment efforts to maintain oil price hedges in real estate and finance derivatives simply add to consumption pressures increasing price. The actions of the Establishment are eloquent testimony to the fact of peak oil, even as they deny it with words.

Price movements and the lack of effect on production – less production @ increasing investment inputs – also indicates peak oil has taken place. In fact a definition of peak oil is the period when production becomes unresponsive to investment stimulus.

Peak oil can also be described when market equilibrium shifts from a balance between consumers and producers ... to favoring producers. This shift took place with the decline in North Sea production beginning in 1999. Since then, price- setting power has fallen to OPEC, away from independent producers (and consumers).

Another indicator of peak oil is when the aggregate value of the oil commodity is greater to the producer than the value to the producer of the commerce derived from oil use. This reflects the shift from industrialized countries adding value by trade and manufacture toward non- industrial producers who do not engage in commerce and consequently cannot receive value from it.

The solution to this permanent oil shortage and its effects on the current iteration of socialized crony capitalism is a free- market one. However, you will not like this free market solution one bit! Your oil use will be rationed by price and availability; it will be effectively zero. All US production not slated for agricultural- and emergency services use will be sold overseas to developing countries for hard currency.

My market call is to invest in some comfortable shoes. Welcome to walking.

well written!

michael

ps.. i bought shoes yesterday

Peak Oil (in 1998?) caused peak pricing in 2007-2008 followed by a crash in 2008-2009 and the amount of oil production in 2008 at 73.78 mbpd higher than 73.01 mbpd in 2007(this number includes unconventional oil).

http://www.eia.doe.gov/aer/txt/ptb1105.html

A Peak in Gold ten years ago lead to $1100 prices today?

Try making a sensible argument instead of appealing to 'signs and wonders'.

Follow the trend, not the noise. When asked about the stock market, JP Morgan said; "It will fluctuate." The trend has been up since 1998. $12 vs. $78. That's not a sign, it's the record of market activity. It's certainly not my opinion.

Trends take time to manifest themselves.

I don't care about physical production, it's irrelevant. What matters is price. Price measures production against demand to ration consumption. The rationing part matters, nothing else.

The only way production would matter if new production could drive prices to $20 a barrel and keep them there. I'm waiting ...

I don't pay attention to gold, hopefully if I ignore it gold will go away.

Steve in Virginia squawked:

What happened to your head, Mamba?

JP Morgan might have tried to explain to you that the US dollar is not a constant value.

MLynch replied:

Hmmm ... I didn't make a depletion argument.

I didn't mention Colin Campbell or exponential growth or Cantarell, they are all irrelevant to my argument which is strictly about oil price and effects of price on the economy. Your discussion about Cantarell is not relevant to my observation.

I have never seen or read any claim by any other analyst that peak oil took place in 1998. It's hard to replay a concept - anecdotal or otherwise - that isn't in circulation, The conventional peak oil argument is built around the period of peak physical production. Your depletion counter- argument belongs with these peak oil analysts, not with me..

At issue is whereabouts of the $15 - 20 oil? Much of our nation's infrastructure was financed and built assuming sub- $20 oil cost to operate, ad- infinitum.. As oil prices rise, both the fuel itself and associated infrastructure becomes increasingly unaffordable. Our infrastructure is designed to leverage expanding oil consumption. Investment returns on this consumption are meager, returns derive from the direct sales of the infrastructure components themselves; cars, houses, roads, bridges, schools, waste and water treatment plants and grids, utilities, state- and municipal government services, various consumer goods, transports, etc.

Whatever returns derive from the development of new supply. This appears to be diminishing relative to the rate of investment. This trend is well documented and includes all forms of energy return on oil- investment.

Because there is little investment return, small increases in component prices tend to strand proportionately larger amounts of consumption infrastructure expenditures. If the average price of a car were to rise to $100,000, the number of cars would diminish and the roads would become underutilized. The trillions spent on the roads would be unrecoverable through use/returns. Funds would nevertheless be required to repair the roads otherwise large sections would become unusable. At the same time fewer persons could afford $100,000 cars and the manufacturers would have problems staying in business.

At low oil prices, money returns of commerce are distributed to increasing numbers of market participants - including those that do not directly trade in oil or oil products. Market participants 'play the spread' between the low input cost of oil and the profits/returns gained by their trade. Oil producers gain new customers with the expansion of markets. Here, the value of commerce is greater than the commodity value of the oil.

Currently, consumption has become too expensive. Diamonds will burn in the presence of air as they are carbon. You can heat your house for a little while by burning your wife's wedding ring. The return on burning the diamond is insignificant. Diamonds are too valuable to burn because the investment in time, money and effort required to bring them to market is greater than any possible gain in heat. Oil since 1998 has fallen within the same dynamic. Oil has become too valuable to simply consume, it represents the increased investment in time, money and effort required to bring it to the market! The returns of oil- enabled commerce are shrinking relative to the intrinsic value of oil traded as a commodity.

The power of this dynamic is illustrated by the observation that oil that is still cheap to produce is sold for a high price. The returns offered by commerce have little value to producers which do not manufacture or trade in goods other than oil. The marginal producer in this environment sets the price for all other producers; Saudi oil costs $5 a barrel to produce, there is no incentive for them to sell for less than $75; a price deemed necessary by higher- cost producers but acceptable to buyers as well as providential to the Saudis.

The Saudis could dump some of their 'spare capacity' and drive prices to $25 a barrel. They would stand to lose $50 on each barrel in the commodity markets. This amount could not be gained elsewhere by commerce as the value of commerce is set by the returns 'baked into' the consumption infrastructure. The intrinsic worth competes against the consumption 'worth' of each barrel of oil.

Consumption must now to provide a return greater than $78 a barrel. It cannot because all returns now flow to the producers marooning the many business participants who would generate profits/returns at lower prices. This failure is reflected in the erosion of the businesses that depends on consumption. Anecdotal or not, the trials of retailers, commercial real estate, home builders, and the rest of the list are well documented. Consumption makes up a large part of the developed world's economy, by extension that part of the world's economy is now going out of business.

As it goes out of business, more infrastructure costs are stranded. Commerce's ability to generate returns diminishes. Consumers are locked into a strong feedback cycle. The only means to make consumption competitive long- term is for commercial nations to bring sufficient oil to the markets to drive prices lower. That these nations have failed to do so over a ten year period of mostly high oil prices is noteworthy.

Ironically, consumers have no choice but to bid prices higher, raising commodity values at the same time. Refusing to bid means nothing is available for the non- bidder to consume.

Currently, cheap oil can only be provided by destroying demand by a credit malfunction or money panic.

Would an alternative to 'cheap oil by demand destruction' be available it certainly would be made use of.

Whether this dynamic is a result of above- ground or geologic or otherwise causes is immaterial. The 'cheap oil' peaked ten years ago, this is the kind of oil that our economy needs to show profits. The fact of this dynamic is far more important than its cause. It is likely the cause is the lack of returns against the scale of consumption 'investment'.

More evidence for the intransigence of this dynamic is illustrated by the tactics of the Establishment to counter it. In general, businesses' expensive labor component has been exported to low wage countries. Lower wages plus higher transport costs (with capital and management costs remaining the same) allows a 'brand' to offset higher energy costs and salvage a profit for a short period. Unfortunately, the businesses' high- paying customers are exported along with the jobs. A second and enduring tactic has seen the inflation of asset price bubbles created as hedges against higher costs and uncertain energy availability. Participants would see increased 'wealth' and collateral values that could be loaned against to fund both fuel and stranded infrastructure costs. Unfortunately, the costs of inflating the asset bubbles turned out to excessive. Post- 2008 crash, the government and Wall Street have sought to maintain the hedges intact, the fact of the hedges themselves is eloquent. Outside of offsetting energy costs, there are few other reasons to maintain them.

I have 'invested' in gold because of the value that *others* see in it, not because of the value that I see in it.

thats it in a nutshell...

Unless gold actually physically changes hands as money it has almost no real value.

I guess everyone will be using scales and touch stones and clipping pieces off one ounce gold coins.

It seems that there is no where enough of the metal at large to be taken seriously as everyday money.

Barter will be more prevalent.

The means and the ability to produce food is the best bet and then store that in the heads of some trustworthy younger people and hope they throw you some of the food they produce in your stead as you age.

I will know this crisis is at an end when status equals what a person can do rather than what a person owns.

Otherwise, gold is just another consumer product.

(Anti- gold- bug- ism rant deleted)

"I guess everyone will be using scales and touch stones and clipping pieces off one ounce gold coins"

I'll use silver coins for change.

Sliver has always been used much more prevalently than gold as everyday money.

Curious, that Peak Oil in the US and Peak Gold in South Africa, then both the biggest producers of the respective commodities both occurred in 1970. I don't suppose there is any connection, though historians may in future conflate the period into a Peak Commodities period of 100 years from 1950 to 2050.

FWIW, I thought it was interesting that H. T. Odum and co. calculated that gold has a very high material value both in terms of eMergy per mass ratio and in terms of eMdollar per weight ratio. He offered this as a possible explanation why scarce materials like gold have long had such a high value in human culture.

From "Environment, Power, and Society for The Twenty First Century: The Hierarchy of Energy" by Howard T. Odum

Cheers,

Jerry

Interesting post Jerry.

I believe gold will have significant value in future for the same reasons it always has. Relative rarity, durability and in the eyes of many - beauty. It was valued by early man because it was one of the very few metals that could be found in native state (along with copper, platinum and silver). Thus it could be obtained without difficult extraction and reduction technology. It was an obvious first metal.

Its color was likened to the sun and thus entered into early religious mythology (for example Egyptian, Mayan and Inca societies). It was easily worked and quite early it was found it could be melted and poured into molds. It was early adapted for fabrication of fertility symbols as well as items of art.

It became a symbol of wealth in poor subsistence societies as well as more affluent societies. Because of its very high density a small volume of the metal could represent significant wealth.

Even today it is one of the major means of showing and storing wealth in very poor countries. This is not likely to change. One of the biggest buyers of gold is India where it is considered a necessary part of a dowry. Most of the families wealth is stored in gold jewelery often worn on a daily basis. It is valued for the same reasons in much of North Africa and other parts of the world.

Throughout history, large numbers of people have managed to escape tyranny and likely death by carrying quantities of gold and jewels sewn into clothing. It is nearly always possible to bribe ones way out of a very bad situation with such valuables.

In poor countries, it is common to sell gold jewelery when there are crop failures as a means of survival and starting over.

These uses of the "useless" metal will continue and eventually probably increase as the world becomes further impoverished due to strife and decreasing resources (besides gold, of course).

Image below - "Portable Family Wealth" - Click to enlarge.

Many people here are totally mistaken and consider gold an "investment". Gold is NOT an investment. Gold is pure money.

- transportable

- does not corrode

- useless for other tasks

- universally accepted and recognized throughout history

- it is rare

- counterfeiting is next to impossible

- easily hidden

If you believe you are better off with tools, weapons, land and food - you may be right. But if you have to move, you cannot carry those things - except maybe the guns. But any authority will look for your guns. Gold is an insurance policy in these times: if you have to flee where you live, gold gives you a chance to start over. Or what if the government /warlord decides to take away your land? Or your food? And your weapons? Those things are very hard to hide. Gold you can hide and keep more easily.

In the 1950s most of my family's property was nationalized by the government. If it weren't for a hidden gold stash they would have starved.

Ignore gold and you may regret it a lot later. At least 10% of your savings should be in gold as an insurance against unforeseen events.

What comes next is not a Mad Max world but an Argentina type economic collapse, where most of the middle class falls into poverty. Gold will shine brightly. As it did in Argentina during the crisis. As it did in any economic turmoil throughout history.

Read about Argentina here, to get a glimpse into the future.

http://ferfal.blogspot.com/

Having a homestead in a remote location (what many plan as Peak Oil preparation) is just about the WORST thing you can do. You will be robbed. If you are lucky. Even if you are at a place that is very hard to find, time will work against you, sooner or later someone with bad intentions will stumble to your place. Public safety will fall into the abyss around the periphery. And noone will care.

If you have guns you will soon have all the gold.

If it gets to that, it is a Mad Max world and gold will be worthless. Even if it happens, it will take a while yet.

Make it risky and difficult for the thieves and you will be OK.

If anyone out there thinks that they will not have to resort to force to defend themselves then they need to start imagining.

its well know the govenment can change the law to confiscate your gold, certainly over here in the UK .

so those theives could well be the government and its army

Forbin,

and I still assert that gold is just another fiat currency - I can't prove its gold so I have to believe it is gold , have faith in it, ergo "fiat".

"its well know the govenment can change the law to confiscate your gold, certainly over here in the UK."

That can happen anywhere, but who cares? You just hide your gold better. Do you think in the 1950s gold was not outlawed here? It was. Yet my grandfather held onto it. As Orlov has put it: you have to ignore the freakin government.

when I purchased gold here in the UK I was put on the company records, how much I'd purchased, because I might be involved in "terrorist" activities.

So they do know who I am and what I have , yes I might be able to hide a coin or two but nothing much more.

Jewelry purchased with cash could be the answer then , and its probably more tradable with the average main in the street

Forbin

Not necessary. Have you watched any TV in the UK recently? There are a frightening number of adverts for companies offereing to buy your 'scrap' gold jewelry. Somebody is desperate to buy up gold right now. It seems awfully similar to the gold seizures of the '30s to me, just with less arm-twisting.

You can come reasonably close to proving it is real by using a touch stone and also weighing it and do a water displacement volume measurement to determine the density.

yes but I don't see the average man in the street who reads the Sun and watches soaps doing that kind of thing. perhaps biting it to make sure its not lead is the quickest way.hmmm.

Trading gold would be easier with hallmarked jewelry, its value being in its art as well as its gold content.

but difficulties in testing in day to day transactions is a problem - looking at google - Black Lydian slate is not going to be easy for most to use and its sale will be noted and also you so need those gold alloy needles.

which brings it back to me trusting the assayer or the accuracy of someone elses touch stone or other methods.

I have to trust the bank for forgeries of paper bank notes and all the other methods used to make sure my money is "real"

thus I still see that gold in everyday use as coins or jewelry will rely on "faith" that it is real.

Forbin.

With gold coins it really is nigh impossible to counterfeit them effectively. Most anything having the density of gold it too valuable to use. Making a coin the same weight makes it too big and making it the same size makes it too light. A set of calipers and a decent scale is all you need or

this device .

Edit Feeling fairly comfortable til I found these.

http://www.youtube.com/watch?v=xvRqEXWRRD8

http://www.tungsten-alloy.com/en/alloy11.htm

Tungsten 19.25 g cm3 gold 19.32 g cm3

Fisch says none have ever surfaced but boy oh boy when they do...

Mr Void, I'll add another reason why gold has been valued across cultures and centuries: it facilitates reproduction, the bottom-line motivator of all human behavior.

As it turns out, gold is just about the very best thing for signalling status in a public manner. It is very ductile and malleable and can be fashioned into elaborate decorative chains, earings, and such with low-tech methods. And here's the final fillip: it stays shiny and doesn't turn your skin green! It makes the ideal gift for that high-value female: it's warm color looks great against her brown skin, it won't turn her skin green if she perspires, and it drives the other women crazy with jealousy. For the guys, well, nothing says 'status' like a nice gold crown and chain of office...

Humans think they're all that, but they're really just Bowerbirds. They love shiny objects. You want a high-status female? You better have a fancy bower (err...McMansion), clear the area in front of it (a nice, green, close-cropped yard) and decorate it with a few shiny SUVs and jetskis.

Those who think these aspects of human mating ritual are soon going away, won't bother to have any gold. The rest of us will have some if we have the earning power to have it.

Errol in Miami

Neutron and black hole grams would trump the lot but are hardly portable.

We could probably include anti-matter on the scale -CERN regularly makes small quantities of the stuff. It would probably be as far again to the right as the river water from Gold.

Nick.

Not sure about that, the cost of storing it may be at least the same as it's "value", whatever that would be given that it's useless really.

Gold is the least of our problems. Virtually all the gold ever produced still exists in highly purified form, available to meet all our practical needs for many years.

Contrast this with a much more mundane material, zinc, which is far more crucial to running our industrial society, but which has been highly dispersed in its use(think galvanized steel wire). Once used, it's mostly gone forever. Zinc, and a number of other seemingly common metals, are actually quite rare in the earth's crust, and are only available to us because they exist in ores. When those ores are gone, we're done. This will clobber us long before gold does.

My understanding is that Copper has been a much better investment lately.

what to trade dollars for, other than precious metals ??

Tools,Solar Panels and Guns ??

wheelbarrows, or ...

http://sunelec.com/

or .... http://www.gunblast.com/GSG5.htm

This question of which metals might be valuable in the future is a very interesting one. It all depends upon how far into the future you want to look.

Take tantalum for example. It's mined in only a few places in the world, currently very valuable, and ubiquitously found in the capacitors in every small electronic device you own. Though 99% of people have never even heard of it, it's crital to life as we currently know it. However, it would only take a minor unravelling of the industrial infrastructure to make the production of tantalum impossible (say, for examples, that hydrofluoric acid or methyl ethyl ketone, which are critical to its production, were no longer available). In this event, its value would be zero. Likewise metals such as titanium, zirconium, tungsten, etc, etc.

Things like iron, copper, tin, zinc, and lead will remain valuable far longer, as they can be converted into valuable functional objects even in a very low-tech, low-energy society (remember the Bronze Age?)

"Things like iron, copper, tin, zinc" -- there is a great abundance of these metals in cars and buildings. They will not be very valuable. Try for something that is RARE. Ah, gold.

It takes years for a major gold mine to open. The response to a surge in gold prices has not yet been satisfied by increased mine openings. There is gold in many different places and reserves of millions of ounces might be scooped out of the ground for those who cannot find more beneficial investments than storing heavy metal in vaults. A good biotech patent may yield more than a placer operation on a malarial jungle river. A well cared for orange tree might yield 600 lbs of fruit in a year while a mining company drilling holes in barren rock might yield nothing but worthless mining penny stocks.

Gold is not an investment, it is MONEY.

Mr Void, again you are quite correct.

As it turns out, barter is very inefficient and breaks down completely if someone has trade goods I desire but isn't interested in what I have to trade. Here's a contemporary example: when Federal prisons outlawed smoking, the previous medium of exchange, the cigarette, was no longer available. So they settled on aseptic packages of mackeral :) I'm not making this up! The current currency is the 'Mac Pac'. The prisoners really don't like to eat it, but it is in limited supply, portable, and reasonably imperishable as a store of value.

The take-home point here: humans will seek out a medium of exchange and store of value; across the oceans and across the centuries, the consensus has been that gold is the best combination of the features that make a functional money.

Errol in Miami

HO,

Wouldn't it be useful to overlay a chart of gold prices for the last 50 years, adjusted for inflation and currency exchange values, over a production chart? Gold prices have been sliding for 40 years; started rising only about 3-4 years ago; and are up only perhaps 2x even now in inflation-adjusted Euros.

Put that together with the fact that gold production has increased dramatically since the 50's, and that the decline since the peak is small, and it seems premature to call a genuine peak.

If a peak happened 10 years ago, we would expect prices to rise at that point. Instead, they kept falling for another 6 years, and even since that point the price rise has been relatively small.

I'd say this is driven by the current economic uncertainty, not by gold supply problems.

Gold has proved its worth as a store of value since the earliest recorded history, so I see no reason for that changing, come oil shortage or other crisis.

One thing I learned as an investor is that markets are irrational. Look at the prices people paid for tech stocks in 2000, a large number of which are not worthless. In the 2008-09 crash when some resource stocks (TCK, TC, and FCX to name a tiny fraction) lost 80-90% of their value, only to rebound 300% or more. Who is to say that gold won't go to $5000 per ounce? I doubt that it will be headed down much because people are becoming skeptical of fiat currencies.

techniques have been developed that recover it in even very small quantities – 3 gm per tonne is an ore that contains very little gold (3 divided by 1000 = 0.003 kg divided by 1000 = 0.000003 tonnes or 3 parts per million).

Well - that makes me think of the old, old idea of gold from seawater. Estimates of concentration of gold in seawater vary enormously, from 5-50 PPT. It would be interesting to know the upper bound of gold prices.

A quick google on the topic suggests that there are a lot of things to be extracted from seawater: manganese (1 part per thousand), copper (150 PPM), silver, etc, etc. I should think that co-extraction of all of the metals would pretty close to cost-feasibility....

AFAIK, water from deep in the Red Sea has the highest metal concentrations. Something Saudi Arabia may look into. The Dead Sea, Great Salt Lake and others have high concentrations of other minerals.

http://www.britannica.com/EBchecked/topic/229724/geology/14204/Mineral-d...

Alan

I wonder about this:

"One estimate puts the value of sea floor mineral deposits in our exclusive economic zone (EEZ) at ... somewhere around $700 billion.

...Where there are underwater hot springs, you can also expect to find minerals, called massive sulphide deposits, containing lots of copper and zinc, but also gold and silver.

...Underwater mining is untested but, in principle, should be less environmentally destructive than mining on land.

The mineral deposits, extending over an area the size of a couple of football fields, lie on or just below the sea floor, to a depth of perhaps 30m. "

http://www.nzherald.co.nz/technology/news/article.cfm?c_id=5&objectid=10...