Fractal Adaptive Cycles in Natural and Human Systems

Posted by nate hagens on January 7, 2010 - 9:46am

The following is a guest post from Stoneleigh, former editor of The Oil Drum Canada, who now writes at The Automatic Earth. The essay explores the natural patterns that occur in human systems.

Adaptive cycles are the foundation of both natural ecological and human socio-economic systems, and have been investigated independently from very different perspectives by ecologists and financial analysts who have almost certainly never heard of each others' work. It is interesting then to look at the strong correspondence of the self-similar hierarchical patterns, best described as fractals, which emerge from both fields. This form of organization seems to be a fundamental dynamic in many areas.

The bewildering, entrancing, unpredictable nature of nature and people, the richness, diversity and changeability of life come from that evolutionary dance generated by cycles of growth, collapse, reorganization, renewal and re-establishment. We call that the adaptive cycle.

Holling, 2009

Holling, Panarchy and Resilience

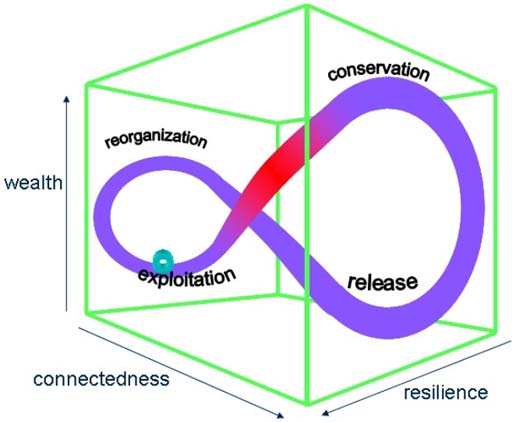

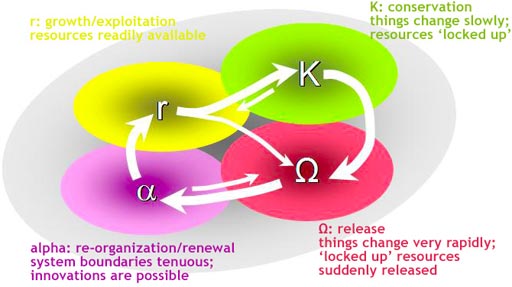

Arguably the most significant thinker in the field of ecological cycles has been Buzz Holling, who refers to the conceptual model he derived from the study of forest ecosystems as Panarchy. Holling observed that ecosystems developed in adaptive cycles of exploitation, conservation, release and reorganization which could be described in three dimensions - ecological 'wealth', connectedness and resilience. These cycles provide a framework for the opposing forces of growth and stability versus change and variety.

In an adaptive cycle, early growth is rapid as individuals of many species arrive in a newly opened space and seek to exploit a plethora of vacant ecological niches. Genetic diversity and biomass, both living and dead, increase quickly in this expansion phase. Ecological connections are initially simple and sparse, but over time many interconnections and mutual dependencies develop. The system therefore increases in both 'wealth' and connectedness, as flows of energy and materials become larger and more complex. Biological 'wealth' confers the potential for novelty, allowing the system to adapt in disparate directions as circumstances warrant. Connectedness permits increasing stability, through the development of negative feedback loops, which help to regulate conditions conducive to life.

As time passes, rapid growth gives way to conservation. Inter-dependencies become highly specialized and self-regulation becomes fine-tuned and sophisticated. Efficiency is maximized as niches are fully occupied, and flows of energy and nutrients are tightly controlled by the existing biota. This represents the end of the growth phase. Relatively few opportunities are left for newcomers or novel strategies, hence diversity stabilizes or declines. The system is 'rich', but becomes more rigid, and therefore less resilient in the face of potential shocks, which can propagate rapidly through a highly inter-connected system with smaller margins for error than it had in its generalist phase. An increasingly brittle ecosystem becomes, in Holling's words, "an accident waiting to happen".

When something does push the ecosystem outside of the boundaries it can tolerate, the long growth phase can morph into a rapid and chaotic release and reorganization phase, where nutrients and energy stores previously tied up can suddenly be liberated. This can be associated with a considerable loss of complexity, but also with much greater potential for generalist strategies and for novelty.

- During the growth phase the system finds an abundance of resources available. Expansion and exploration of new opportunities are key concepts within this stage. “When new ecological spaces open up – due, for instance, to forest fires, or retreating glaciers, or many other things- resources needed for other species to grow are made available. There’s more light reaching the soil surface when large trees are toppled, or burned to the ground, for example.”

- “The "r" phase is transitory, and as the system matures, it is replaced by the K phase. Eventually slower growing, long lived species or entities enter the system. Resources become less widely available as they become “locked up”… The K phase is sometimes called the conservation phase, because energy acquired goes into maintaining or conserving existing structure, rather than building new structure. In this phase, a few dominant species or companies or countries … have acquired many of the resources and are controlling the way they can be used.”

- “Often systems rapidly pass into a phase called omega. This is also referred to as the release (or creative destruction) phase because structure, relationships, capital or complexity accumulated during the r and K phases is released (often in a dramatic or abrupt fashion). … Plants may die … or a company may go bankrupt, releasing workers and decommissioning factories or offices.”

- “The fourth, or alpha phase, is a period of reorganization, in which some of the entities previously released begin to re-structure but not necessarily as they were before. This phase can mark the beginning of another trip through an adaptive cycle … Many new entities may enter the system, and innovation becomes more probable.” Project Shrink

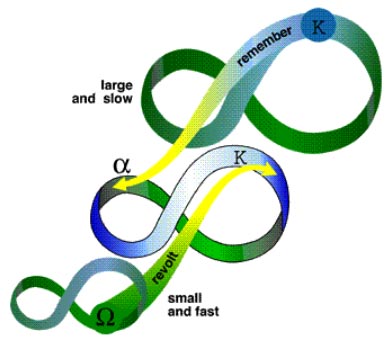

However, such adaptive cycles do not exist in isolation. Local ecosystem cycles are embedded in larger and slower-moving regional cycles operating over years and decades, which are in turn part of global climate and elemental cycles (carbon, nitrogen, phosphorus etc) that may unfold over centuries or millennia. These larger cycles can act as stabilizing factors by adding a 'memory effect', or wealth reservoir, enabling rapid regeneration following a localized setback, but only if the larger cycle is not in its own contraction and reorganization phase. In addition to being part of larger cycles, dynamic ecosystems are also composed of smaller and faster-moving cycles of growth and decay, operating on much shorter time horizons. This nested set of self-similar structures allows for both persistence and innovation.

Where higher and lower order cycles are very tightly coupled, they may synchronize, becoming trapped in a extended growth phase at many scales at once, thereby risking synchronous collapse. This need not be triggered at a large-scale level, but can begin anywhere in a set of nested adaptive cycles and proceed both upwards and downwards. A destabilizing event arising from below, for instance a disease outbreak leading to widespread morbidity and further adverse consequences, is called a 'revolt'. A synchronous collapse, which can take the form of a "pancaking implosion", to use Holling's term, can lead to a poverty trap, or persistent maladaptive state characterized by low 'wealth' and connectivity, which is very much more difficult to recover from than a localized reversal would have been.

By way of illustration, the Canadian province of British Columbia is currently facing a confluence of circumstances that pose a significant large-scale ecological threat. A long-standing policy of fire-suppression, in a hitherto naturally fire-controlled ecosystem, has led to a thick understory of growth, which has in turn caused significant stress to trees forced to compete for water and nutrients in an area becoming warmer and drier. Trees under stress have much lower resistance to pine beetle infestation, with the result that a pine beetle population explosion is killing huge tracts of forest despite all efforts to contain the outbreak. This adds to the combustible material on the forest floor and greatly increases the risk of widespread conflagration. The much smaller self-limiting fires typical of the province would have opened up areas for new growth, killed insect pests and released nutrients for regeneration, and in fact are required by some tree species in order to open up seed pods for reproduction. In contrast, very large and intense fires, fueled by a tremendous excess of flammable detritus, can comprehensively denude enormous tracts of land. This can remove the biological reservoir of potential repopulating species as well as lead to enough soil erosion to inhibit regrowth of the forest ecosystem. An interlocking series of adaptive cycles has been synchronized through being locked into an extended growth phase and is therefore much more vulnerable to a catastrophic event that could become a lasting poverty trap.

When collapse occurs it can be a natural part of the pattern of adaptation and learning. That is what happens in forests when they burn or are attacked by natural enemies. Recovery typically replaces the old with a similar but new pattern that is similar because of the memory reserved in seeds and vegetation of the understory.

But when the collapse occurs as a consequence of long effort to freeze the system into one paradigm of development and management, then it might involve collapse of a level of the panarchy, which in turn threatens other levels. The collapse of ancient societies has this character- the top religious and political controls can collapse, triggering the gradual collapse of institutions till the family is left as the sole source of survival. It leads to a "poverty trap." Holling, 2009

Much of Holling's work has focused on the crucial role of resilience in both natural and human systems, and the Resilience Alliance has been the result:

We define resilience, formally, as the capacity of a system to absorb disturbance and reorganize while undergoing change so as to still retain essentially the same function, structure and feedbacks - and therefore the same identity.

Resilience arises from a redundancy that has the appearance of inefficiency and a lack of critical structural dependency on specialized hierarchy, neither of which conditions are likely to be met at the peak of the growth phase of an adaptive cycle. For these to be achieved from this point at least a partial, or localized, collapse to a simpler level of organization would have to occur. There can potentially be a fine line between a retreat from rigidity to this level of resilience and a 'poverty trap', where a collapse has proceeded so far and so fast that the system has been stripped of the wealth (biological or otherwise) that it would need to rebuild. Where adaptive cycles have become synchronized, so that the likelihood of deep collapse is increased, striking a balance of resilience would be far more difficult.

- A resilient world would promote biological, landscape, social and economic diversity. Diversity is a major source of future options and of a system's capacity to respond to change.

- A resilient world would embrace and work with natural ecological cycles. A forest that is never allowed to burn loses its fire-resistant species and becomes very vulnerable to fire.

- A resilient world consists of modular components. When over-connected, shocks are rapidly transmitted through the system - as a forest connected by logging roads can allow a wild fire to spread wider than it would otherwise.

- A resilient world possesses tight feedbacks. Feedbacks allow us to detect thresholds before we cross them. Globalization is leading to delayed feedbacks that were once tighter. For example, people of the developed world receive weak feedback signals about the consequences of their consumption.

- A resilient world promotes trust, well developed social networks and leadership. Individually, these attributes contribute to what is generally termed "social capital," but they need to act in concert to effect adaptability - the capacity to respond to change and disturbance.

- A resilient world places an emphasis on learning, experimentation, locally developed rules, and embracing change. When rigid connections and behaviors are broken, new opportunities open up and new resources are made available for growth.

- A resilient world has institutions that include "redundancy" in their governance structures and a mix of common and private property with overlapping access rights. Redundancy in institutions increases the diversity of responses and the flexibility of a system. Because access and property rights lie at the heart of many resource-use tragedies, overlapping rights and a mix of common and private property rights can enhance the resilience of linked social-ecological systems.

- A resilient world would consider all nature's un-priced services – such as carbon storage, water filtration and so on - in development proposals and assessments. These services are often the ones that change in a regime shift – and are often only recognized and appreciated when they are lost. Walker, 2008

This will be a very tall order in a panarchic future.

Prechter, Elliottwaves and Socionomics

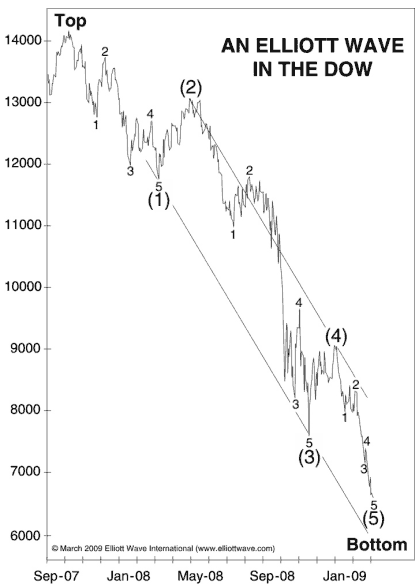

Bob Prechter has also spent decades studying the structure of nested cycles, but in his case in financial markets, carrying on the work of RN Elliott, who established the field in the 1930s. Elliott painstakingly documented motive (impulse) and corrective patterns which unfold at all degrees of trend simultaneously - from small moves completing in minutes to larger cycles playing out over months, years, decades and longer. Elliott noted that motive waves in the direction of the one larger trend occur in fives, while corrective waves counter to the one larger trend form threes or multiples thereof.

Prechter explains that this is the minimum requirement for an adaptive cycle capable of both fluctuation and progress, and therefore the most efficient form. Each move itself is composed of the same patterns, while each also forms a component part of larger structures. (Motive waves are labeled with numbers, while corrective waves are labeled with letters.)

As opposed to self-identical fractals, whose parts are precisely the same as the whole, and indefinite fractals, which are self-similar only in that they are similarly irregular at all scales, a robust fractal is one of intermediate specificity. Though variable, its component forms, within a certain defined latitude, are replicas of the larger forms. Prechter, 1999, p17

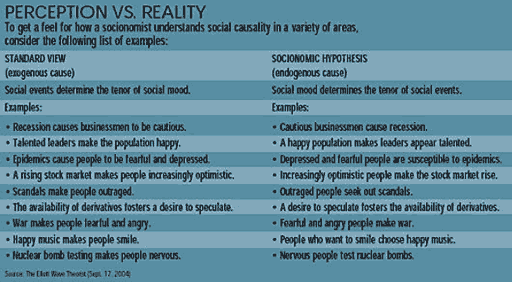

Bob Prechter's socionomics model combines Elliott's observed fractal patterns with an understanding of human herding behaviour, comprising a comprehensive challenge to prevailing notions such as the Efficient Market Hypothesis by reversing causation and recognizing the role of emotional/irrational behaviour as the prime market driver. While the real economy demonstrates negative feedback loops, finance is thoroughly grounded in positive feedback.

Socionomics provides a model of collective mood swings which permits collective human behaviour prediction in finance, the real economy and beyond. Consensus takes time to build, so that the more extreme the sentiment, the closer one is to a trend change. Collectively optimistic people engage in one range of behaviours over different timescales - typically buy stocks, borrow funds to build businesses, employ others in the expectation of profit, vote for incumbents whom they credit with stability, engage in cheerful expressions of popular culture and behave in an increasingly inclusive manner in recognition of common humanity. Collectively pessimistic people become increasingly risk averse and suspicious of others, in whom they look for differences rather than similarities. Both optimistic and pessimistic behaviours, particularly in their extreme forms, can create self-fulfilling prophecies for varying periods of time, until perception substantially overshoots reality and the trends it creates can no longer be sustained. The manic trend of recent years has led to an unsustainable debt burden of unprecedented scope and complexity. It also led to an unprecedented degree of global economic and financial integration dependent on hierarchical specialization, comparative advantage and just-in-time delivery that are clear examples of rigidity creating a brittle system.

Like Holling's panarchy, Prechter's nested socionomic cycles either reinforce or counter each other depending on the direction of cycles larger and smaller than the one under consideration. Where cycles at several degrees of trend are moving in the same direction, the move will be extreme - either a mania to the upside or a crash to the downside. The largest mania ever known topped in the year 2000, and we have been in bear market territory since then (more obviously in real terms). We are now approaching a synchronized move in the opposite direction as the rally of recent months peters out in the face of the larger downtrend. The consequences of this will be considerable, but we are still quite near the beginning of the large-scale and complex downward pattern the model predicts will unfold over the next several decades. We can expect many deleveraging cascades and many intervening rallies, some larger than we have seen so far.

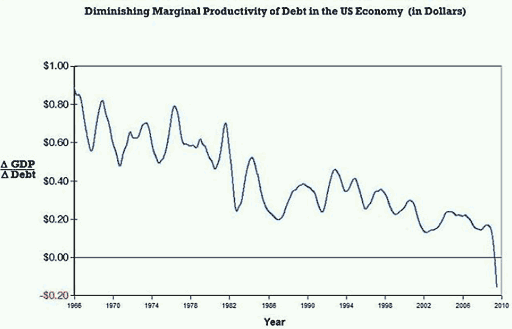

It is inevitable that the complex web of debt instruments and inter-dependencies that humanity invented to prolong its growth phase (to use Holling's terminology) by stealing from the future will be a prime focus for a sharp reversal, as we have already reached the point where additional debt provides less than no benefit. Socionomics tells us that the trust and complacency as to systemic risk that allowed this debt structure to develop will be primary casualties of a synchronized move to the downside, being both cause and effect in a powerful positive feedback loop.

Tainter, Complexity and Peer Polities

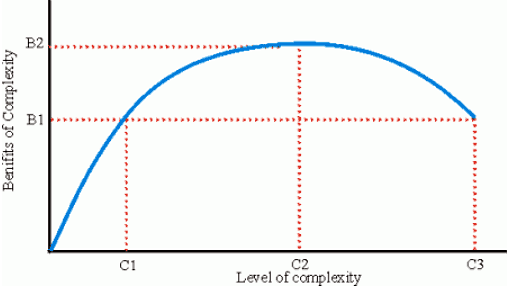

Joseph Tainter's work complements that of Holling and Prechter, providing a framework of diminishing marginal returns to complexity which encompasses ecosystems, individual societies and competitive peer polities. As complexity increases, it eventually becomes a liability, as we can see with Holling's description of rigidity reducing the resilience of ecosystems and Prechter's many writings on the debt complexity of manias and the systemic risk it engenders.

As with diminishing marginal productivity of debt, past a certain point further investments in complex solutions to increasingly complex problems has a negative return. Tainter explains, however, that where there is not a single political structure, but instead competitive peer polities, these entities become trapped in a competitive spiral where investment in organizational complexity must be maintained regardless of cost, as the alternative is domination by another member of the cluster at the same level of complexity, rather than collapse to a simpler system. The counter-productive actions of states are legitimized to the citizenry by the fact that each member of the cluster is engaging in the same behaviour. Collapse, which requires a power vacuum, is not possible unless the whole cluster collapses at once at the point of economic exhaustion.

Peer polity systems tend to evolve toward greater complexity in lockstep fashion as, driven by competition, each partner imitates new organizational, technological, and military features developed by its competitors. The marginal return on such developments declines, as each new military breakthrough is met by some counter-measure, and so brings no increased advantage or security on a lasting basis.. A society trapped in a competitive peer polity system must invest more and more for no increased return, and is thereby economically weakened. And yet the option of withdrawal or collapse does not exist.....Peer polity competition drives increased complexity and resource consumption regardless of cost, human or ecological. Tainter, 1988, p214

Tainter observes that the peer polity nature of the modern world creates a more apt comparison with the rapid collapse of the ancient Maya than with the slow decline of Rome. To use Holling's terminology, we have seen a panarchy of nested cycles synchronize, with the effect of artificially extending the growth phase for all simultaneously. The evidence for this is abundantly available in terms of the many limits to growth we are approaching or have reached, most notably the high EROEI energy required to maintain complexity. The significant risk is therefore of deep collapse over a relatively short period of time (although this would still likely be decades at least).

Collapse, if and when it comes again, will this time be global. No longer can any individual nation collapse. World civilization will disintegrate as a whole. Competitors who evolve as peers collapse in like manner. Tainter, 1988, p214

References

- LH Gunderson and CS Holling (2001). Panarchy: Understanding Transformations in Human and Natural Systems.

- RR Prechter (1999). The Wave Principle of Human Social Behaviour and the New Science of Socionomics.

- RR Prechter (2002). Conquer the Crash.

- RR Prechter (2003). Pioneering Studies in Socionomics.

- JA Tainter (1988). The Collapse of Complex Societies.

Postscript:

There are about three kinds of scientists - the consolidator, the technical expert, and the artist. Consolidators accumulate and solidify advances and are deeply skeptical of ill formed and initial, hesitant steps. That can have a great value at stages in a scientific cycle when rigorous efforts to establish the strength and value of an idea is central. Technical experts assess the methods of investigation. Both assume they search for the certainty of understanding.

In contrast, I love the initial hesitant steps of the "artist scientist" and like to see clusters of them. That is the kind of thing needed at the beginning of a cycle of scientific enquiry or even just before that. Such nascent, partially stumbling ideas, are the largely hidden source for the engine that eventually generates change in science. I love the nascent ideas, the sudden explosion of a new idea, the connections of the new idea with others. I love the development and testing of the idea till it gets to the point it is convincing, or is rejected. That needs persistence to the level of stubbornness and I eagerly invest in that persistence. Holling, 2009

(Original here).

There aren't too many songs about mathematics but this is one of my favorites!

Nice summary of fractal geometry here http://library.thinkquest.org/3493/frames/fractal.html

I read this post on Illargi's site, and am glad to read it again.

Other than the notion of interlocking cycles with different time scales that produce a sort of "memory effect" in development of ecosystems, and therefore, I guess, a tendency for recurrence of similar development after local collapses, I don't see much relation to "fractals" in ecosystems.

The basic plan of life is set by the physical dimensions and properties of carbon bonds to oxygen, hydrogen, carbon, nitrogen, etc. So far as I can understand, as long as these elements exist, and a source of energy exists outside the system of those elements, then life will recur in more or less the same way after any kind of collapse.

Even human imagination is probably not unique, and is likely determined at a molecular level. If we collapse and disappear as a species -- to be replaced eventually by another "intelligent" species, it seems quite likely that all the same mistakes will be made again, as perception of reality is determined by carbon bond length and strength.

So on a geological time scale, nothing matters to an individual. On the individual's time scale, the only thing that matters is personal relationships with people (and other living things) that you care about, and that matters a great deal.

My personal New Year's resolution is to be less gloomy about the future, over which I have no control, and more joyful about personal relationships which potentially modifiable -- or at least negotiable.

Granted, that on earth, carbon based life forms are quite likely the only viable forms.

Even though it is a long shot, at least in theory, there is nothing in physics and chemistry that precludes a non carbon based life form from coming into existence. What our current understanding of the universe shows is that the universe is large enough and has been around long enough to have allowed for extremely unlikely events to happen quite frequently. Including the formation and the evolution of an intelligent (well, somewhat debatable) carbon based life form here on our pale blue dot.

True enough. There may be other life based on other combinations than carbon -- we just haven't either seen it or recognized it, and certainly it doesn't fit with our notion of physics and chemistry.

Just last night I watched an ancient (1976) Dr Who series

which is based on the notion of "silicon based life forms"

I guess we are not only carbon based, we are also carbon biased ;-)

"we are also carbon biased"

nice one...

I really enjoy (err.. maybe there is no word that describes how I feel) TOD, as it has allowed me to jump inside the brains of engineers, chemists. mathematicians ect. and get a better understanding of the thinking of the thinkers who got us to this predicament.(preemptively, I said to this predicament not into this predicament) It's a wonderful thing for a dyslexic intuitive thinker like myself.

As i have tried to point out here before, thru our human history there have been uncountable ways with which to interpret any current situation. I imagine trying to relate Stoneliegh's piece a hunter-gatherer 30,000 years ago and after finding the relevant words, the guy looking at me and saying "well no $h!t"

Above LNG states "The basic plan of life is set by the physical dimensions and properties of carbon bonds to oxygen, hydrogen, carbon, nitrogen, etc."

Well, this is not arguable by any reasonable, semi-educated human. Unfortunately, 30,000 years ago it was an unarguable fact that, say, the basic plan was set in motion based on the migration of animals. If you argued this you were laughed out of the troop and left to die or find converts.

Well converts were found and it became inarguable that the whole thing was set in motion by some really pissed off guy, of which only a handful of people have ever seen, who sits on a cloud and moves folks around at his pleasing, and if you don't like it we're going to kill you. hey, made sense at the time.

What makes sense now? Ions. Ever seen one? Me neither, but it sure is convenient to just accept it as fact and keep moving.

Ions and chemical bonds are an impressive step away from theism (no I can't argue we've stepped away from theism) and if we can make it thru the up coming bottle neck(s) with this knowledge intact it's gonna be a great time. Diltthium crystals and replicators. But, I think Holling's etal. work is free to the intuitive/indigenous thinker, it's a real "no $h!t" argument, and if we have to go thru such exhaustive measures to make it understood by folks we're doomed. Put it this way, if we don't reincorporate some indigenous thought into our modern thinking, soon all that will be left is indigenous thought

thanks for bearing with me, the written word is my personal bottle neck

"human imagination" actually is unique, but imagination itself is certainly not. I've had some very creative dolphin acquaintances.

There is, of course, no "preferred direction" to evolution and thus no reason to think that sentience will evolve again. It is a rarely-visited location on the fitness landscape.

However, the "same mistakes" would not necessarily be made again. It was not simply intelligence but a confluence of factors which enabled us to get ourselves into this existential pickle. For instance, if it had been an effectively impossible threshold for us to discover fire and store resources, and impossible to store information exosomatically, as it is for the dolphins, no amount of native intelligence would have managed to mess things up this badly. We would have remained aboriginals, although perhaps thinking quite deep and sophisticated thoughts for quite a long time.

Moreover, without the random happenstance of accessible fossil fuels, we could not have gone nearly as far into overshoot, even as fire symbiotes. Without the sequestration of methane in previous history, global warming would be less of a danger. Etc. Context is all. If there are any humans or dolphins left, or if something else pushes past self-awareness into sentience and beyond, the odds are it will have no opportunity to f*ck up as badly. The concentrations of accessible fossil fuels, and pretty much everything else, will have been scattered to entropy by our brief orgasm of ape overshoot and dieoff.

To any "human imagination" worth the description, it should matter deeply. Our fixation with short-term novelty-seeking at the cost of a beautifully balanced natural world is nothing less than sociopathic. The future is as real as the physically distant.

We are kin to the inhabitants of the far future, our probabilistic descendants, and are at merciless war with them. To a good first approximation, our civilization exists by pillaging future options.

The longer we artificially sustain this cycle by leveraging off all others, the worse it is for life on earth, which may be a lot rarer in the universe than we suppose.

The idea of cycles within cycles that can move into and out of synchonicity either at random or in recognizable patterns appeals stronglty to me and is intuitively comfortable.

I think most of us here are probably already acquainted with the concepts on an informal basis, perhaps in piecemeal fashion.Odd bits pop up as in rare confluences of circumstances being described as perfect storms , the ever changing and yet ever the same astronomical cycles (days are predictable on a very simple level , the phases of the moon on s little more complicated level , eclipses on a higher level, the Milankovich cycles on a higher level yet-but all repeapt in a predictable but ever changing tapestry of interactions as you explore the higher levels of interaction.Or we say that the only constant is change but also that there is nothing new under the sun.

My guess is that in the world of business the ground rules and the arbitrary distribution of resources among other random factors along with fast changing circumstances taken together mean that these concepts can't be reliably used as the basis of short term decision making.

But in the same sense that climate is more easily predicted than weather, these concepts are probably useful in scoping out the upper and lower limits as to what is possible in terms of economic activity, and in terms of environmental stabilty.Knowing where the edge of the cliff is , especially on a dark night, is priceless information.

Greenish is onto something critical when he speaks of "effectively impossible threshholds."

We have a natural experiment to this effect in the Australian Bushmen, who are as intelligent as anybody but have lived for forty thousand years without making much material progress and may have actually lost some technologies they brought with them to Australia due to a lack of raw materials suitable for those technologies.

But if there were nobody around to bother them , they would probably still be doing just fine forty thousand years from now, whereas we most likely will still be around too in my opinion but we will have passed thru all sorts of crises that knocked our numbers down to almost nothing in many areas many times over.We might just wipe ourselves out someday .

The aborigines don't have the power to destroy themselves or thier environment.

What a brilliant piece of synthesis! For big-picture addicts like me, stuff like this is utterly irresistible. I've been learning each of these threads on their own over the last few years, but to see them all drawn together like this is an illuminating treat.

Thanks, Stoneleigh!

I second the Thanks!

Great read.

Some fine synthesis some hocus pocus.

Two of the adjacent Walker bullets do make one scratch the head

Kind of looks like the in concert development in the latter bullet gives you the globalization in the former.

The Holling stuff was just beautifully presented though.

You're welcome :) There will be a sequel when I get the time to write it - on sociopolitical cycles and food chain complexity. It will also be a sequel to Entropy and Empire (TOD Canada March 2007).

Again, Wonderful Job Stoneleigh. It's nice you are getting some recognition.

These phrases.

Tainter observes that the peer polity nature of the modern world creates a more apt comparison with the rapid collapse of the ancient Maya than with the slow decline of Rome

and

...we have seen a panarchy of nested cycles synchronize..,

It is the multi-level and interdependantness of the problems we face is the thing.

Stoneleigh,

However your theory about explosive break out into each newly-exploitable domain (basically finding a passage way into a newly exploitable paradise) got me thinking about finite brain energy and its consequences.

It is well known to students of neurobiology that the human brain has power limits.

The brain has available to it only a finite and relatively small amount of usable processing power (power in the sense of energy consumed per unit time). If one area of the brain demands more energy for mission critical processing (e.g., staying alive) then energy delivery is cut off to less important regions so that the more important brain region can be serviced by oxygen and nutrient delivery. --Basically this is what you see in some of those fMRI pictures where certain parts of the brain light up and others go dormant.

With that notion in mind, imagine what happens when an exciting new paradise is discovered!

All the energy in the brain floods towards exploiting the new found frontier and alternate model-supporting regions are shut down.

In each case, parts of the brain that might worry about Peak Oil, or Limits to Growth, or Global Warming shut down as the mad rush is made towards the new apparent paradise (the newly discovered and explosively exploitable domain).

This may explain why the main stream of the herd (MSM and friends) never gets it about PO or LTG or AGW, etc. They are too busy rushing into the next apparent paradise. No time or energy to step back and concern oneself about slow Black Swans and other possibilities.

Stoneleigh,

I very much look forward to your take on sociopolitcal cycles and food chain complexity. As an academic working with local food system issues I've come to believe that there is a strong instinctual/biological underpinning in the local foods movement. We've become "uneasy" as a species with the lack of control over our food. Having given the reins of creating food to large and complex systems and corporations, we now feel compelled to gain back some of that control. Hence the local foods movement.

I so appreciate all the work that you and Ilargi do at TAE.

Regarding the Elliot Wave and the Dow chart above:

I first found out about Elliot Wave in the early 1980's. I was into the stock market at the time and it seemed to be an exciting concept. But as many others and I found out, one can never be sure what the wave count is until after the fact.

The Elliot Wave count is a Rorschach test for sure. It is the same old problem. Wave counts can change at any time and can only be determined in hindsight. Even then they are extremely arbitrary.

The main evidence of Elliot Wave's uselessness is that Prechter and others who use it do not come to own the world and make most of their money talking and writing about the concept. It's a good racket though and there is money to be made selling lies.

People want to believe that they have insight that others have missed and that they are special. It's human nature.

But it is people like Warren Buffett or Bill Gates who amass fortunes through a fundamental understanding of the businesses they run that make the big bucks.

Prechter has been wrong big time in the past. If I recall correctly I think at one time he predicted Dow 36,000. The Dow itself is a flawed, fallacious construct where stocks that collapse are replaced with the best stock keepers of the Dow can find at that time.

So over a long period of time, the components of the Dow change and it no longer reflects the reality of the collapse of its internal components one by one. I think GE is the only component of the original Dow that is still in it.

The Dow morfs into something completely different from what it originally was little by little hiding the underlying collapse of company after company for various reasons and the destruction of capital that took place.

The same is true of the S&P, Nasdaq and other indexes only worse. Keepers of these indexes justify it by saying "What are we to do when companies go bankrupt, merge or simply go out of business?".

I say "Why not write the stock down to zero and reduce the number of stocks in the index to give an accurate picture of what is going on?".

Perhaps Elliot Wave might then have some validity as the supposedly new highs would likely disappear and all that would now be left is Dow component GE bumping along near the bottom. That would reflect the real world and the ability of people to see the future.

Anyone who looks at charts and does not discount what is going behind the scenes in the chart's construction will be led to false conclusions.

The "big picture" is always an illusion. It is the stories we tell to make sense of the world outside of our personal control.

Of course the DJA is an illusion, an ever-changing, shimmering story to explain certain complex dynamics of human interaction on one level, but a cynically manipulated tool for herding the sheeple on another.

I personally didn't understand this until year 2000 or so, but now I have a new metaphor for myself -- life is a coral reef, and all is illusion on any level but the most direct predator-eat-prey level.

Reality bites.

Prechter did not predict Dow 36,000. In fact he ridiculed the prediction, calling it symptomatic of manic psychology.

Elliottwaves are probabilistic. Prechter's timing has indeed been off before, mostly due to underestimating the scale of the mania we have lived through. However, he was the only one I know of who predicted the mania in the first place, back in the late 1970s/early 1980s when almost everyone else was bearish (as a long correction from 1966/67 was coming to an end, and people are always at their most bearish just before a major bull market).

His take on markets has more depth to it than any other I've come across because he understands the vital role of human nature. Markets are not machines. They do not obey rules of negative feedback and are not efficient resource allocation mechanisms.

Watch what happens to collective psychology coincident with the market turn that is rapidly approaching. As confidence evaporates, so will liquidity, no matter what governments may try to do to sustain it. The rally has been kind to governments, as it has created the appearance that their strategies are working. The coming decline, in contrast, will make them look completely incompetent, as nothing they do will work. Collective psychology is more powerful than governments.

Prechter did not predict Dow 36,000. In fact he ridiculed the prediction, calling it symptomatic of manic psychology.

I agree. Prechter is in the "grand super cycle" deflationary depression camp.

Elliottwaves are probabilistic. Prechter's timing has indeed been off before, mostly due to underestimating the scale of the mania we have lived through.

Sounds like you are willing to cut him a lot of slack. If his timing has been off by several years, then his predictions are completely useless to investors. In the world of investments timing is everything (ask the people who shorted NASDAQ in 1998).

However, he was the only one I know of who predicted the mania in the first place, back in the late 1970s/early 1980s when almost everyone else was bearish

If you remain a contrarian for a long time you are going to be right eventually. You can then shout from the roof tops about how you were right when everyone else was wrong. In the meantime people who followed your investment advice probably end up living in a cardboard box. It is interesting that you have to go that far back in time to find evidence of his predictive ability.

Prechter accurately predicted the stock market crash in October 1987. That was the last time he was successful in market timing.

Wrong. Prechter is the highest rated newsletter based on predictions for the past 2 years. He called the crash right before it happened and got long in March 2009.

http://www.marketwatch.com/story/elliott-wave-adviser-now-aggressively-b...

He still is the lowest rated in that sample over the long term, but I just wanted to get your facts straightened.

He called the crash right before it happened and got long in March 2009.

Since Prechter has been calling for a big stock market crash for several years now, it is not surprising that he finally got it right in 2008. A proverb about broken clock comes to mind. When you are in the business of making price predictions, you are going to get it right once in a while by sheer chance.

He still is the lowest rated in that sample over the long term

For an investor, long term record is what matters. The fact that he is the lowest rated shows that Elliot Waves cannot be used to make useful price predictions and his "Socionomics" hypothesis is hokum.

Bill Gates who amass fortunes through a fundamental understanding of the businesses they run that make the big bucks.

Mr. Gates, as the offspring of lawyers, understood the value of law.

How the BASIC language became his was due to another party not understanding child labor laws, and MS-DOS was due to cutting off the cash flow of Seattle Computing so that the rights transfered to Microsoft.

At one time Mr. Gates did not understand the value of greasing the palms of government. That oversight has now been corrected.

Stoneleigh knocks one out of the park again. I've been recommending this post to people since it ran at TAE, glad to see it here.

Thanks :)

I enjoyed reading this. I like diagrams with recycling built into them. I also enjoy all the old photos from the Shorpy site that preface the Automatic Earth.

One element of social resilience is to have lots of inventive ideas that might be recycled.

A lot of the Shorpy photos are from the 'pre-oil' age of circa 1900. Electricity is on the way up and there are lots of electric lights, tramcars and trains, but almost no oil-based transport. I ask myself 'how would I feel living in that society'. And how would I feel if I had to live then, but with today's advances in electrical and electronic technology?

What price a wind-up LED torch in 1900?

What price a wind-up LED torch in 1900?

What price *NOT*?

Imagine the lack of indoor lighting if you could instead put on a 'miner hat' attached to a clockwork generator like the http://www.design-technology.org/Baylis.htm ? That little 1 watt LED would be far brighter than a candle in the dark.

A small clockwork generator like that can run computers like the Newton 2100 or I'd bet a computer like the Android.

Imagine a world where the biggest electric motor is 1 HP.....electric bikes would be the norm.

An "elliot wave" in the Dow?

"Fractal Adaptive Cycles?"

This reminds me of a class I took on "Chaos Theory."

The professor went on and on about Chaos theory and eventually settled on this example of chaos theory:

If you place 3 magnets in the same position, close together where they repel each other equally, you can't predict which direction they go.

I ask - "how do you know it's simply not a question of not understand the system?"

He says Chaos.

I say - but how do you know that the magnetic fields are understood down to the correct level? Or that the position of the magnets in exactly duplicated each time? If you place them in pico-meter distances, why not femto meters?

He says Chaos.

So I conclude, - we call things "Chaos" theory when we don't understand them. It's the modern equivalent of spontaneous generation.

Also reminds me of a law class I took with some wordy title.

The 50 page papers typically assigned always were chock full of argot-specific words.

So anytime I start seeing a lot of "exclusive" language I start thinking - Chaos Theory.

If a thing can't be explained using plain language, generally a thing can't be explained.

Andrew, there really is a qualitative difference between systems-not-sufficiently-understood and those which are, in principle, not deterministic. And no, I'm not referring to quantum mechanical systems - even on purely classical scales, interconnectedness, bifurcating phase diagrams and sensitivity render the natural world complex and unpredictable beyond all deterministic models, even given arbitrary initial knowledge.

Nothing is not deterministic.

Any system that is currently believed to be non-deterministic is simply not sufficiently understood.

The non-deterministic systems of today are the spirits that caused the plague of yesteryear.

That of course is not true - quantum mechanics shows this clearly!

Our brains are simply to small to understand systems from a certain point of complexity - even within the constraints of the Heisenbergs uncertainty principle.

The mathematician ET Jaynes suggested that the probabilities associated with quantum theory are the result of theoretical physicists 'giving up' on the problem. In other words, he thinks they don't quite understand the situation and applying probabilities acts as a convenient crutch to get the solution 'close enough'. I don't necessarily buy that premise, but it is a facinating idea. So according to Jaynes, everything may be deterministic, but in ways we don't understand.

( I use the crutch myself, and so does Jaynes, in applying his entropy and logic principles )

Exactly. Probability theory is, itself, flawed. For example, the flip of a fair coin is not random, it is instead unpredictable. And there is a world of difference between random (which always seems to be an ex-nihilo observation) and unpredictable.

That is a fair criticism even though the word "unpredictable" is perhaps a stretch.

What you mean to say is that from a point of practicality, we cannot gather enough information fast enough to timely predict how many times the coin will spin, how high it will fly and how it will bounce and roll once it hits the ground. But if we had all the necessary information about all the system inputs, we could predict.

On the other hand, in the realm of quantum mechanics, measurement of inputs becomes a problem when we run into the uncertainty principle.

The uncertainty principle, according to Jaynes, is also a crutch. But a practical crutch.

Yes. However, we know right now what the six* outcomes of a coin flip can be, there is no longer any need to try to predict which one of those outcomes it will be next time. Knowing the outcomes in advance allows us to prepare for any and all of them when they happen. Statistical prediction is moot.

* Heads, tails, edge, and let's see who can come up with the other three.

Or initial velocity >> escape velocity and it goes beyond Earth orbit?

Or initial velocity >>> escape velocity and it melts going through atmosphere?

Or initial velocity > speed of light in which case coin turns into a black hole and swallows up planet Earth?

We can also have rotational speed of coin exceeds tensile strength and then it rips itself apart.

Excellent, two out of the remaining three. The fourth case is the coin does not find a steady state (does not land, does not stop spinning). The fifth case is the coin ceases to exist as a coin (destroyed, incinerated, ripped apart).

Step back from the problem one more time, and you'll probably see the sixth case.

Ha, all the folks gathered round for the coin toss could be toasted by a terrorist or some such miserable fate, so there is nobody left to see about the coin.

Or an asteroid could land and finish off the coin, the coin flippers, and everything else in the vicinity.

Or what if the coin flip is happening someplace like an orbiting space ship. Maybe the space ship is spinning to produce artificial gravity. But the coin might come to rest right in the middle of the ship, spinning on axis at just the same speed as the ship. So it is stationary WRT the ship frame of reference. However, on the spin axis there is no local gravitational field, i.e. no up or down. The observers will all disagree about the final orientation - is it up or down or sideways or what?

How about a coin with strange pictures on both sides. Maybe different subcultures have different conventions about which is called "heads" and which "tails". So the coin lands but there are disagreements about the interpretation.

In the old days in England there was an octagonal coin - I think it was a thrupence. So really that made eight different edges to land on.

Really, a cylindrical coin can come to rest at an infinite number of orientations, anywhere along the edge.

And really, even when it lands on one or the other face, that face could have any of an infinite orientations. We just conventionally lump them together.

I am reading Poundstone's Prisoner's Dilemma. He tells the story of folks at RAND making a fat cylindrical coin with probability 1/3 of landing on edge.

6a) Coin does not move but instead "tunnels" quantum mechanically into tosser's finger or into other coin tossing mechanism and becomes embedded and stuck there.

6b) The Universe (as we know it) ends before the coin enters into steady state and we never find out because we cease to exist also.

Or, if there was a hole drilled through the center of the earth, and one dropped the coin down that hole, the coin would come to rest at the earth's center. That's another place where "up" and "down" lose their meaning. Which side of the coin is facing up? No way to say!

Thanks, JimK, you got the sixth case, the observer ceases to exist as the observer. The other great examples mentioned fall under the fourth case, the coin does not "land" or find a steady state, continues spinning, or the fifth case, the coin goes bye-bye.

The examples from you and step back could further be made in perhaps a 4 1/2th case which hold non-trivial, repeating, or chaotic steady states. I actually envision a mechanized coin flip experiment where orientation is tracked continuously, with forces and initial conditions tightly analyzed and tested. We would be able to see a strange attractor that forms within the data.

Quantum tunneling at the macroscopic scale? It could happen. Maybe case 7.

Great job thinking outside the box. Keep it up, carry on.

JimK,

Sorry, hole to the center of the Earth can't happen.

As we all know, the roughly center poetion of the Earth is occupied by a creamy nogut abiotic generator of new hydrocarbons. Obviously the longest chain and most massive CnHm molecules will collect at the point of maximum gravitational attraction (not the center --but that is a riddle for another day).

As the coin falls towards the center, it will become stuck in the high density goo and never make to the center. Besides, the center is empty. Nothing falls exactly to the center.

710, thanks for a good riddle.

though it is likely the exact center (at any given moment) is empty it is not necessarily so at all given moments, actually the latter is extremely unlikely, though possible.

So what level of system simulation will be needed to make the Powerball bouncing ball number picker work right?

Here's how I understand the mathematical definition of a chaotic system...

In classical mechanics, if one knows precisely the present state of a system, then one can predict the precise trajectory as far as one likes. Unfortunately though, there is no way one can measure the state of a system with infinite precision. The interesting question is then - if the error in one's measurement is quite small, how does that error turn into uncertainty about the future evolution of the state of the system? If I need more certainty about the future, how much do I need to improve my measurement precision?

With a chaotic system, every time one cuts in half one's measurement error (i.e. doubles one's measurement precision), one only adds some constant time interval into the future for which one can predict the evolution of the system with bounded error.

With a non-chaotic system, halving the measurement error would *multiply* the time interval over which the trajectory could be predicted with bounded error.

Chaos theory comes out of differential equations. This is mathematics, i.e. at some level what is being studied is understood with infinite precision - there is no mystery or obscurity at all. Look at some small bundle of close-by states of the system, then watch the trajectories followed from those states as time passes. If trajectories that are very close at one point in time continue to stay decently close to each other as time passes, that is not a chaotic system. If, however, trajectories that are close at one point then quickly diverge, the system is chaotic. An approximate measurement of the system at one time is of very limited use in predicting where it will be at any even moderately distant time in the future.

Thanks, that's quite helpful.

Yes, that is a good summation. I would only add that a range of these outcomes may occur all at the same time so that the result smears over the various states. So it doesn't pay to focus on a single outcome, but to look at the ensemble result. The ensemble can often be predicted while the single chaotic result not.

A great example is looking at the popping of a single kernel ;f popcorn. You can't predict a single kernel popping time yet the collective is quite predictable.

I don't think the Elliot wave proponents understand any of these fundamental principles, unfotunately.

Of course if you have 100,000 uneven sized bags of popcorn popping at any given time, in a continuous cycle with bags of unpopped kernels entering the system continuously but at changing (possibly random) intervals, all the pops being monitored from a single remote speaker, the boundaries between individual or groups of active bags could become indiscernible or at least would be very subjectively defined unless the monitoring equipment deciphering the signals from the speaker was extremely sophisticated and a great deal of information from the original signal transmission had been passed on by the single remote speaker. EW is trying to manage such trick with an awfully blunt sensing instrument array monitoring a rather poor quality speaker and is claiming to have discerned a very regular and recognizable pattern.

"Deterministic" is best reserved to mean that future behavior of a system is determined by its current state and the external forces that act on it now and in the future. This definition does not require that we understand such a system sufficiently well to be able to compute its future.

But, counterintuitively, neither does it require us not to understand it completely in order for its behavior to be unpredictable in principle. There are ridiculously simple mechanical systems of which we understand completely the rules that govern their dynamic behavior, and whose behavior cannot be predicted in principle -- no improvement in measurement or computing technology will make the details of their behavior predictable. Some such systems involve very simple configurations of permanent magnets, but even simpler systems consisting of a single asteroid display the apparently random motion that signifies sensitivity to initial conditions -- chaos. (The shape of the asteroid produces a chaotic portion of the state space of its equations of motion, so that infinitesimal differences in the forces acting on the asteroid produce huge differences in subsequent motion.)

It has become widely recognized in the past few decades that simple deterministic chaotic systems are common in nature.

"Simple" means, e.g., that we can write down differential equations that completely characterize the evolving behavior of the system.

"Chaotic" means that the future behavior of the system depends sensitively on the state of the system now. In other words, arbitrarily small differences in the state of the system, differences of, say, one part in 10 to 100, can make gross differences in the imminent future of the system. Such systems are unpredictable for two reasons, in spite of a complete and accurate mathematical understanding of their physics.

1) We cannot measure the state of the system accurately in order to enter it in the computer. Any limitation of the accuracy of measurement is inadequate in principle.

2) We cannot have a sufficiently accurate computer. A computer that could represent the state variables of even a ridiculously simple chaotic mechanical system would have an enormous mass. In fact, you could not predict the required mass sufficiently well to bound it -- you need infinite mass. (Those who think God can predict anything should think about where it would get the computational resources required.)

Our mistake is believing that something as limited as calculus can be used to describe something as complex as . . . molecular motion.

Everything can be determined. It is the apogee of hubris to believe that something is indeterminable simply because we cannot determine it.

Quantum physics, chaos theories, string theories, women's mentation.

These things all seem unpredictable and based on randomness.

They are not.

We just don't understand the system.

Saying "you can never know the location and direction of a particle at any time t" is just a deceitful way of saying "WE can't know the location and direction of a particle at any time t."

Like I wrote - Every scientist who ever supported a theory that was later proven wrong was dead sure - before it was later disproved (and sometimes even after) - that the theory was correct.

It's really very funny to see so many who are so sure that quantum physics is the REAL physics.

Even classical Newtonian physics is not "determinable". It's equations of motion can be sensitive to initial conditions -- they commonly are. The ubiquity of chaos says that it is extremely likely to be a feature of any more refined way of understanding, e.g., motion.

Never mind Heisenberg and quantum mechanics. The inaccuracy of measurement necessary to preventing prediction is much more mundane, relating to the fact that accuracy up to a few decimal points is all that is ever available in practice, while the requirement for accuracy of representation of the state variables whose equations have a chaotic region is essentially unlimited.

Perhaps "indeterminable" just means: "we cannot determine it".

In general, any sort of argument for the indeterminacy of something ought to specify what sorts of methods are available for determining that thing. At any time, a piece of paper might fall from heaven, telling us the answer. Obviously, any notion of indeterminacy must exclude such possibilities!

The fundamental "indeterminacy" theorem in my line of work, computer science, is Turing's Halting Theorem. The methods it specifies for possibly solving the Halting Problem are any methods implementable as a computer program. It's a funny thing. Suppose we want to determine whether or not a particular program A will halt when presented with particular data B. There certainly exists a program that can give us the answer, and indeed a very short one will do the job: either one like "print(yes);" or one like "print(no);". But suppose we want to write a program that will print out the correct answer for every different possible program and data. That's impossible!

But the Halting Theorem certainly doesn't prove that it is impossible to determine, given an arbitrary program and data, whether the program will halt eventually given that data as its initial input. It just says there is no computer program that can do the job.

Similarly with quantum mechanics. The Heisenberg Uncertainty Principle is about wave functions and measurement operators. If the state of a particle is described by a wave function, and our measurements of position and momentum correspond to the usual Hilbert Space operators, then there is just no wave function, no vector in the Hilbert Space, for which the operator spectra can simultaneously be given arbitrarily tight bounds. But maybe you have some tricks up your sleeve that go beyond anything that can be squeezed into the theory of quantum mechanics! Nobody can prove that it's impossible!

How about that for a sort of ultimate theory of indeterminacy: whatever theory one might propose about the nature of reality, there is no way to determine with utter certitude whether or not that theory is correct! Actually I would tend to go a bit further. I would hypothesize (though I can pretty much prove that it cannot be proved) that: given any theory about the way things really are, one can always find a flaw if one looks hard enough.

More likely you need to use a more specialized language, namely mathematics to write the relevant equations, and then plot them out using graphs so you can actually visualize the phenomenon you wish to understand. Plain language will simply not cut it!

Here is a mathematical explanation of how to create a "Barnsley's Fern", a chaotic fractal.

http://mathforum.org/mathimages/index.php/Blue_Fern#A_More_Mathematical_...

The problem is not the explanation, the problem is the language and the relative audience.

What is "plain language" is different if you're 4 years old and an orphan, 16 and in high school, or 31 and a post-doctoral candidate.

This a warning: it is easy to get sucked into such time-consuming and, as FarmerMac said, comforting paths of thought. It is certainly far better than watching TV, or porn, or any other mindless activity.

However, the article is not science as defined by Karl Popper as it contains no falsifiable hypothesis. I suggest a more productive activity would be to form and test your own hypothesis rather than blindly following the untested ideas of these people.

How would my mate react to the suggestion of starting an allotment?

Would I be capable of starting a "Transition Town" in my area?

What would happen if I offered to try to fix broken bikes?

Life is to short to get caught up by every obscure abstraction, however comforting it may. This article is at best an inspiration to act in the world, at worst another obscure abstraction to avoid action. I highly recommend Holling and his work. I recommend getting off your lazy arse doing something practical even more.

Thinking is among the hardest work my lazy ass can do.

The falsifiable hypothesis is that the world is disconnected and linear. The historical evidence is that we have approached our dealings with the physical world in a linear and disconnected manner, to arrive at our current predicaments.

And how, exactly, do you intend to test this hypothesis?

The history of results of our dealing with the world around us. This would not qualify as "scientific", but that doesn't mean it can't be valid.

If the null hypothesis were something like "actions by any agents or members of a system will not affect each other or the system", it can be mirrored by the long-held idea, "we humans are too small to have an effect on the environment". Or even the idea, "there's plenty of oil!", as though the oil we have already taken didn't matter.

I'm having trouble finding the words for this. Feel free to challenge me on this notion in the future, I'll try to come up with a better explanation.

And 710, I didn't mean you personally when I said "your lazy ass", I meant people in general.

Realize on re-reading it could have come across that way.

Robin

I do have a lazy ass, so no offense was taken. :)

Wonderful! This is paralleling my own research on the patterns of growth and development (in everything). My own approach has been to use a binary diagram to help clarify the different dimensions. I tend to call them physical (self-focused), emotional (ethno-centric), intellectual (world-centric), and spiritual (life-centric). The first three there correspond to Holling's physical wealth, connectedness, and resiliency, in that order. Using the binary approach, you can add as many factors/dimensions as you like.

Here are some diagrams, if you're interested:

http://www.thewiseturtle.com/images/formativestages.gif (detail)

http://www.thewiseturtle.com/images/5Dstages.gif (big picture)

Also, the biologist Elizabet Sahtouris has her own similar version of the cycle of life that you might be interested in looking at. And Maslow's hierarchy of needs reflects this cycle, too. (I've got a modern version here: http://www.thewiseturtle.com/hierarchyofneeds.html .)

Anyway, thanks for posting this! I'd never seen these folks' work before, and it's very useful. (I found this through Reddit, by the way.)

Turil, Have you read any Ken Wilbur?

Indeed. He's where I started. I took a look at his quadrants and said "there's a pattern here" which you can put the levels into. Self-internal, self-external, other internal, other external. (There's a nice spiral image describing this on my site.) Then I asked "Who's figuring out what we need to move through these levels?" and when the response was silence, I figured I'd have to do the work myself! :-)

I can't believe you are taking Prechter seriously; in my opinion he is a quack. I subscribed to Elliot Wave theory newsletter in 2002 and 2003.

Elliot waves are useless for making predictions about financial markets. There are so many possible Elliot wave patterns that regardless of what the market does you can claim it is following Elliot waves. Another problem is that the labeling of waves is subjective. Two people can look at the same pattern and label it differently giving rise to completely different forecasts.

Here is a guy who has been wrong about just about everything since he correctly called the stock market crash in 1987. Why is he being given publicity here?

Here is a partial list of Prechter predictions (date of prediction):

1. Grand super cycle depression will take Dow Jones to 1000 (since at least 2002)

2. Gold will crash to $110/oz (since at least 2002)

3. The US $ will stage a large counter trend rally that will take it to 120 (since 2005 or 2006)

4. Real estate will collapse by 90% (since at least 2002)

5. Michael Jordan's career is correlated with the stock market; hence his retirement portends a market crash (he said this when MJ retired).

6. Donald Trump's book publishing is correlated with a top in the real estate; since Trump has published a book, real estate will crash (he said this in 2002 or 2003).

7. Stock market is correlated with sun spots (2002 or 2003).

8. Stock market crashes when slasher films become popular. Since the slasher movie "Kill Bill" is popular, the market will crash (2002 or 2003).

9. Oil will top at $60 (since 2005?)

Prechter ridicules peak oil theory and claims that the price of oil is determined by "social mood". Last year when oil crashed he was crowing that the peak oil crowd can keep themselves warm by burning peak oil books.

In my opinion, if you follow Prechter, be prepared to lose all or most of your money.

I suppose another name for this is numerology. For some reason people often become more entranced by the fractal shapes than by the mechanisms underlying them. Unless at least some math is added one can't make any sense of the overall picture. And unfortunately if math was added, a real scientist would rip it to shreds in any case -- the gaping hole that I see is randomness is not added to the mix to maximize entropy. Chaos is often disguised as randomness maximizing entropy.

Wht, I think I follow your agrument and partly agree with it.Even with numbers I agree that this system cannot be used for making short term predictions becase we can never know all the variables.

Are you saying that it cannot be refined to make any generalized predictions?

It is pseudoscientific.

I have a problem with fields like astrology since I can't derive them from first principles. I guess it is just a mental defect that I suffer from.

First principles are key - but the bigger issue is that we will not have time nor resources to mathematically conjugate a good % (not all) of the issues facing humanity. Estimates and heuristics will be all we have time for. Doesn't mean we shouldn't try to disprove all the hokiness out there, it just means that we don't have unlimited time and will probably have to deal with a certain % of astrology-like-noise at every juncture. As I've said for 5 years here, the most interesting and relevant puzzles facing the Limits to Growth era won't be 'solved'. We'd need 30 more years to parse many of the principles involved (and discussed on TOD) into holistic equations you would feel were near iron clad.

And it's not a defect - more like a religion....;-)

I have got all the time in the world. If you look at some of the simple stuff, like popcorn popping behavior (a chaotic system), and look at how few people even deign to look at that from a fundamental perspective, you begin to realize that you don't have to punt and fall-back on heuristics. Too many lazy SOB's in the world as it is.

Laziness is the religion.

Humans at the beginning of civilization figured out how to bake limestone into plaster, with no numbers, no science, no error bars on the predictions, no differential equations.

Astrology makes sense when you consider the times in which it was born.

The first principle to all the problems at hand, all of them, are that people feel pain and that they are mortal. Solve how to deal with that one, and the rest will be easy. Yes, billions of people could die in a very short time due to collapse. But if it weren't for peak oil, climate change, overpopulation, were we going to otherwise be immortal?

Incorrect. The solution is freakin' simple, it's people thinking too much or not enough that is the problem.

I see where Nate is coming from, yet I agree with you as well. From the standpoint of human limitations which we all have, we need things to hold on to, and science (in competent hands) is one of the most resilient and robust thought systems we have come up with.

However, the remainder of living things on this planet for the last few billion years managed to survive for long periods of time with no holistic systems of differential equations modeled in phase space.

WHT,

I'm not altogether sure in this case what you mean by first principles-if you are saying there are no discernable data to quantify , or if there are too many unknowns, too many unique disruptors in any given situation, no long term baseline to work from, or something else.

These ideas appear to stand up so far as I can see in qualitative form at least when applied to biological systems.But it is true that a tree crashing in a forest is an event that occurs against a reasonably stable background-things don't ordinarily change in a forest radically and almost at random-the negative feedbacks in a forest keep it fairly stable.

Even a raging fire that wipes out a forest -temporarily- is just another (albeit less common )negative feedback if you expand the time of observation window adequately.

If you expand the time window enough you could arguably say the movement of a forest or a forest type up and dowm the sides of a mountian or north and south is a normal process,cyclical and predictable qualitatively in principle.

I expect climatologists may some day be able to to apply a time scale to this phenomenon athough the scale may have only coarse graduations of say a thousand years or five thousand years.

A probabilistic event such as a forest fire can clearly be linked to other events that clearly occur in cycles-droughts that occur over multiple years, or periods of yeras with exceptionally heavy rain.

Now it may be that multi year droughts are partly the result of ordinary chance, the rolling of the dice by nature so to speak, but there is accumulating and credible evidence that known cyclical cycles such as El Nino ,etc, play a predictable role in thier occurence.

It would seem that the cycles of forest fires, which are in and of themselves reasonably cyclical, are therefore in some sense nested within the cycles of wet and dry weather.

I strongly suspect that many more such links, of which there are many known already, will be established as research into climate and ecology proceeds.

But I'm not a mathematician and sometimes I can't follow your arguments .

Yet most biological cycles as you describe are at least weakly tied to seasons, whch are deterministically cyclic.

Yes.In principle I don't see why some deterministic cycles such as the seasons should not be considered in evaluating the overall model.These would add just add more variability to the overall process -in the case of the seasons the variations would be close to 100 percent predictable, but we do have the odd year without a summer or winter from Nordic hell.

The effects of a drought which is only moderately predictable would be different depending on the season in which it occurs.So the seasons would reduce the predictability of drought effects-unless it is possible to predict which seasons droughts are likely to occur.

I'm not trying to say that this hypothesis can be developed to make specific predictions that it will for instance rain the first week of July in the southeast but that perhaps it might enable forecasters to say with greater certainty that it will be dry or wet in the southeast in July, once more cycles are discovered and integratedint the model.

I think things change too fast on the business front for it to have any predictive qualities in that respect.Nature changes slower than culture and is less variable , mor stable.

Thank you all for not genuflecting at this altar. This very issue causes me to take The Automatic Earth with a huge grain of salt now.

This video, often touted at TAE, pretty much flaunts the fallacious reasoning behind Prechter and technical analysis. It's all post hoc fallacy, observational selection, and confirmation bias.

Then he proceeds to pick and choose the music that supports his pre-conceived belief. It's really quite hilarious.

Finally, there's things like this:

Oh, dear. What's a lay person to do when reading stuff like this? Being a former English major, I'm familiar with such language--it's what made me flee graduate study in "Theory," which might be defined as the art of bamboozling people with abstract language. Some call it "fashionable nonsense."

My own personal metric is the "Big Daddy Test," which the above passage fails:

Economic forecasting, debunked.

While I'm not sufficiently versed in the field to comment on criticisms of Prechter, I will say that the quote about resilience was utterly perspicuous to me.

The notion that resilience and efficiency (or perhaps more correctly, "optimization") are inversely related isn't exactly rocket science, nor is the idea that resilience is diminished if a system depends on a specialized hierarchy. The concept of a "poverty trap" has much in common with the general idea that overshoot erodes the underlying resource base, which is a basic ecological understanding.

The language isn't even all that abstract. I have no formal training in ecology, but the meaning still seemed obvious. Perhaps you have a "square peg, round hole" problem?

The problem is not with the explanation, it's with your understanding of the language involved. Similarly, there would be complaints if an explanation were posted in Latin or Swahili.

Having studied chaos theory, the resilience explanation makes perfect sense.

Also, instead of declaring it nonsense, you could ask for a better explanation. Or maybe I don't understand the point of your post, and thus can also declare it nonsense?

I wouldn't look to Bob Prechter for information on peak oil. The nature of energy as master resource is his major blindspot. That doesn't mean his work is not useful as far as it goes though, even in the energy field when it comes to price. Not many people were predicting a coming spike in oil prices back in 2001. Prices are not determined by the fundamentals, but by perception of them. Prices spike on perception of scarcity and crash on the perception of glut. Peak oil is no less true than it was when oil was $147/barrel, but perception changed. Now we are at a time of perceived scarcity again, not just in relation to oil, but many other commodities as well. IMO commodity prices are peaking again. We have already seen turns in gold and the dollar in this rolling top. I am expecting a top in the markets soon, and with it a resumption of financial crisis. This is very likely to drop the price of all commodities by a very large amount, even in the face of a global production peak the which is very unlikely ever to be exceeded.

IMO you misrepresent Prechter's predictions over the last decade, and greatly distort socionomics. Prechter does not say that social trend drive markets, he says that collective mood swings drive both markets and social trends, and that one may therefore look to both for evidence of developing swings of optimism and pessimism.

Elliottwaves are probabilistic. There are rules and there are guidelines. The interpretation that violates no rules and satisfies the highest number of guidelines is assigned the highest probability. There will always be other possible interpretations of lower probability. What Elliottwaves do is to offer evidence as to times of higher and lower risk, and point to coming trend changes, which is immensely useful. They are based on an understanding of human nature that is completely lacking in other market models.