Chinese Transportation Growth

Posted by Gail the Actuary on January 15, 2010 - 10:14am

This is a guest post by Stuart Staniford. It was originally posted in Stuart's blog Early Warning.

The Chinese National Bureau of Statistics has a lot of interesting data. The web site is hard to use, at least in my browser, but after poking around in the html source of the pages, I've managed to figure out how to get to all the annual data, which let me make some graphs. I don't know how accurate these numbers are, but here, at any rate, is the official story.

As usual, when reviewing Chinese economic statistics, I strongly recommend that you first arrange for ample clearance below your lower jaw to avoid any risk of accidental injury...

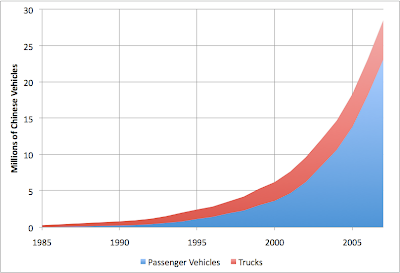

First up, we have the data on total passenger-kilometers by major mode. (One caveat to bear in mind. These are annual data from 1990 to 2007. Prior to 1990, there are data points for 1978, 1980, and 1985. I have made annual plots from 1978-2007, and just used linear interpolation for the data gaps before 1990.)

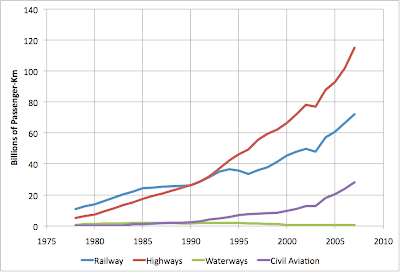

To get a better sense of the growth rates in that data, here's the five year compound annual growth rate (CAGR) for the three major modes:

As you can see, growth rates of railway and highway usage are both very high (the 7% growth corresponds to about a ten year doubling time). However, it's the airline usage that's really electrifying with over 15% growth over the last decade. Note also that highway passenger travel will include both buses and personal vehicles, and this combined data likely conceals a significant transition from the one to the other.

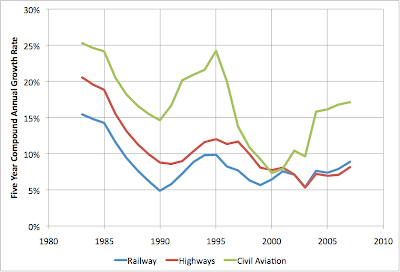

Next, there are some data on total length of transportation routes. (Here the only missing data point is 1979 which I interpolated). In this next graph, I show the length of railways versus expressways (not all highways, which is a much larger number, just the freeway-equivalent roads):

Clearly, China is becoming increasingly car-centric, versus rail-centric. For kicks, I also put in the level of the US Interstate Highway System in 2008. As you can see, the Chinese Expressway system is reaching the size of that system and will likely far surpass it soon. According to the wiki entry:

Design standards for China's National Trunk Highway System are derived from the standards used on the American Interstate Highway System, with Chinese expressway cross-sections, interchange profiles, and bridge designs closely reflecting their counterparts in the United States

The Wikipedia even has a nice map, with blue being expressways in existence, and red under construction or planned.

Looks like they can keep stimulating their economy with shovel-ready projects for quite a while to come...

Also, from the same dataset, here is the breakdown of electrified and non-electrified railroad:

The electrified railroad is increasing very rapidly, but right now, between the rapid growth of private passenger transportation, and the remaining diesel powered railroads, Chinese transportation is probably almost as oil dependent as US transportation (they have pretty much phased out the steam trains now).

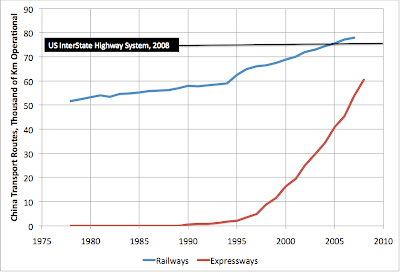

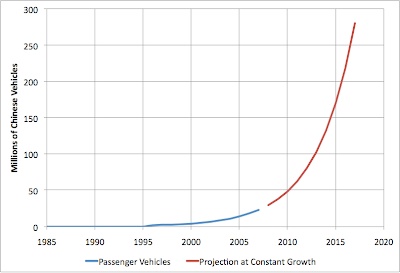

Next up, ownership of private vehicles:

Holy Batmobile! That's quite a growth curve!

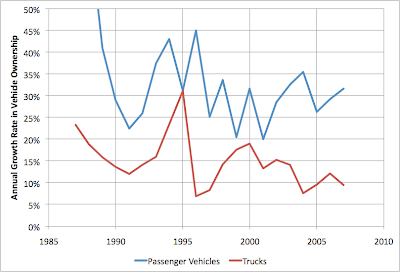

Still a ways to go to reach US levels of 250m or so. But with growth rates like these:

it won't take long! Over the twenty years 1987 to 2007, the compound annual growth rate was 30.8% in the private passenger vehicle ownership rate. That's the average growth rate. And it's not like there's a sharp slowdown - 2006-2007 was over that twenty year average. In fact, if you take the decade 1997 to 2007 CAGR of 28.3% (!!), and project it forward then the Chinese vehicle fleet will surpass the US fleet by 2017 or so.

Admittedly it's hard to see such astronomical growth rates continuing for long. Maybe they won't. But then, it's hard to imagine them having continued for the last 25 years, and apparently they did. If you'd said in 2000 that growth was slowing down and certain to slow down more, you'd have been wrong. And they'd still be a long way from US per capita car ownership at that level, since the population is four times larger.

The world has never seen anything like this Chinese industrial machine.

In summary, if present trends continue, the Chinese expressway system will likely grow larger than the US interstate highway system within the next couple of years, and Chinese car ownership will exceed US car ownership by somewhere in the neighborhood of 2017. So while the al-Shahristani plan for Iraqi oil production seems like it aims for an extraordinary increase in oil production in a hurry, it's not at all hard to see where all that oil can go. Oversimplifying greatly, it's as though the US borrowed a pile of money from China in order to fight a war to free up oil supply in Iraq in order that China could become the greatest industrial power the world has ever seen.

Oh, and you can see why China wasn't too keen to strike a deal in Copenhagen.

Dave Cohen, at the ASPO 2008 conference, likened the US to space shuttle Columbia, which disintegrated in flight while descending to the earth, while China was likened to space shuttle Challenger, which disintegrated while taking off.

Both China and the US are disasters waiting to happen. The Chinese and Indian disasters will be the worst by far because of their large populations. The road to greater industrialization with oil and coal ends at the edge of a cliff.

That may be true Shox. But how many US folks do you imagine would swap their lifestyles as they improved over the last century thanks to the expanded use of FF? The end of the road for China might be a cliff. But those wishing a ride down that nice comfy road the US had for the last 80 years or so might be just fine with some future generation falling off that cliff. So far our current population doesn't seem to have a problem with that inevitability.

I'd rather practice mental hygiene than condone sociopathic behavior - Individuals make choices differently than societies. It's obvious that there are individuals desiring a better future. When the calvery came the tribal leaders made agreements for things like taking care of the future generations, health care which according to the constitution is the supreme law of the land.

second the presumption of improvement in quality of live has been correlated with income up to around $10,000 -

from a study the UN did and some NPR Author's interview.

Consumption above that is just meaningless material consumption which perhaps people do feel bad about, or if not that then are levels of of self reported satisfaction with life as high as they were back in post WWII days ?

The diseased of affluence they are called. Things like teenage suicide, morbid obesity and 3,000 st ft homes with 2 master bed rooms don't account for an improvement in lifestyles just increases in consumption. More correctly the results of trading in real substantive quality of life.

How many, I presume millions to varying degrees - whom wouldn't want a substantively better live vs a materially full one ?

I would also add, for the Chinese, cars are a convenience. Their cities are still built around cars, bikes and mass transit. Most of our cities are not built that way. We like urban sprawl and freeways.

China can feed one plus billion people because of geography, climate and proximity to the ocean. I doubt the U.S. could support as many people as the western part of China.

When the price of gas becomes unaffordable, the Chinese can more easily switch back to riding bikes, then us. I live in a residential area in a suburb of L.A. If I need to go to the nearest store, right now, I have to walk over a mile. If I have to walk to the nearest hospital, well, for me, that might be a 10 or 15 mile walk.

When tshtf, I’d rather be in Europe.

I don't see how China is headed for the level of disaster that we are. Put the numbers in perspective. 30 million autos is one per 50 people. We have more than one auto per capita. 120 billion hwy passenger-kms per year is 90 km each. That's my daily commute!

Sure, they will reach our level of consumption quickly if exponential growth continues, but it never does. There will be an S-curve, and the asymptote will still be a fraction of what we consume.

I agree. I think the cultural shift we have had over the last 60 years or so has been very much towards helpless dependence; we have a long long way to fall. The Chinese are on their way there too, but I can't see them ever getting near our level of "development". I'm prone to think that much of the world is also closer to their base-state or petroleum-free state, and will also have an easier time of it.

I think thats a mistake. I used to to think that till I realized that petroleum uses in the poor nations was much closer to the minimum level before they would have to give up on oil. However the productivity drop going back to donkeys vs trucks is huge and the population has grown in most places that its well beyond the old donkey mule base one. In many countries ten times higher. The US could cut a lot before it actually reached the mule/donkey level and it has a lot lower population.

Plus we are still a large oil producer I'd argue we could readily run our country on 5mbd even without a return to rail/street cars if you include that then we would not have a problem.

Our problem is then not oil per-se but the financial structure we have created based on endless growth.

And of course surviving as the over populated third world collapses. Although we could have shortages I don't see the US itself collapsing because of lack of oil. Japan and Europe are a different matter and obviously the collapse of either would have enormous repercussions in the US.

I was talking with a friend about Haiti I said I'm afraid once the emergency is over the world will leave giving only token assistance to help rebuild their infrastructure. I figure its at least 10-50 billion to actually put in a replacement infrastructure on the island. This of course means that over the coming years the Haitians will get desperate and try and leave. We will nave a new crisis on our hands. I could be wrong but I don't think so. The US already turned its back on Katrina victims over the long term once the public had moved on to other news the aid dried up and these are US citizens.

The world has not really dealt with large numbers of desperate people since the Vietnam refugee crisis.

It looks to me like Haiti will be the first of many. The problem is people look at the oil situation figure out way that it can be mitigated in the US and assume the problem is solved.

Well its not the US is not isolated from its neighbors and desperation can and will drive people to do whatever they have to to survive.

Moving to China on average Chinese are much better off than Haitians but its probably the worst country in the world to try and use averages on they are almost meaningless. The disparity in wealth rivals third world countries with some regions strait out of the 18th century and others modern. As with the America's its the differences which eventually becomes the unsolvable problem not the minority that are wealthy. The problem is not actually the rich people but the huge masses of poor that have not benefited. Eventually this is what will do in China just as sure as it will do in the US. At some point the poor will get desperate enough that they won't stay hidden behind national or internal checkpoints.

The worst border crossings in the world are internal Chinese crossing esp between the mainland and Hong Kong they make national borders look like a picnic.

Looking at the top 10% completely misses the fact that peak oil is really a deadly problem for the bottom 90% of the worlds population. What the top 10% do and don't do now does not really matter its the decades of doing nothing for the bottom 90% that will haunt us.

Another example many people are very comfortable believing that since shipping is very efficient world trade won't be a problem post peak well now it should be obvious that piracy not lack of fuel will be the problem as countries crumble into chaos. Its not oil its the desperation caused as oil based infrastructure crumbles. Our world cannot last as it gets filled with millions of desperate immigrants and pirates. Not to mention the almost certain war. You never even come close to addressing the problem of keeping suburbia going with plugin EV's instead of gasoline powered cars.

For the wealthy countries the financial situation dominates and for the poor food. Declining oil supplies simply serve as tinder feeding the fuel of overpopulation and and decades of greed and arrogance.

We literally never even reach the problems that are often debated and the underlying population/wealth monster devours everything.

That's exactly it memmel. A lot of people think strictly in terms of whether or not we can get by with dramatically less usage of oil, when in fact our finacial system is based on growth via lots of cheap oil. Loans are made with the anticipation of growth to pay off those loans with profit, and then parlay the profits forward and outward with more loans. It's like Michael Rupert said in Collapse, "It wasn't just Madoff that was running a ponzi scheme, the whole damn thing is a ponzi scheme"! Meaning, growth is mandatory for it to continue to be viable.

People need to forget about whether they can bicycle to work, or if the price of a gallon of gas is just fine with them, it's about how the overall economic system responds to higher priced oil as it affects all aspects of commerce. So much oil is used all along the way to produce and transport goods and food to the marketplace. High priced oil acts like a headwind to slow progress and maintain this long recession we don't seem to be able to get out of, and it threatens the master ponzi scheme.

Thats the top loaded side i.e the rich are not rich but have a lot of credit.

Coming up for the bottom are immense numbers of people just trying to live.

Backing off for a moment what people don't understand is what happens when the ponzi scheme collapses ?

The actual process of the collapse of a scheme is seldom told in its gory details. For the rich its waking up to find out you used to be rich for the poor its waking up and finding out you used to have a job.

The period between when the scheme is going and everyone is happy and when its obviously crashed is seldom looked at. Who made it out who did not ? Equals become unequals in a day.

Thats where we are right now in the twilight zone between when the beginning of the end starts and the end of the end is obvious.

Hi memmel,

I agree with you, but 99% of the good folks in the US don't seem to. In other threads, I've posted comments (with my intentions often misunderstood) that are typical from public radio programs that attempt give us a "realistic" look at the potential future scenarios for the US and the planet in general. Although warnings are typically set forth, the general impression created by these "expert analysis" is that technology can clearly solve all of our problems.

The experts point to our great history of adaptation, our entrepreneurial spirit, the wonders of free enterprise. So, now we have new forms of nuclear energy around the corner, nanotechnology to make oil from algae, etc, etc. And, BTW, centuries of collapse predictions have never come true.

It seems to me that the underlying drivers of our global predicament come from the thirst for power as it manifests itself in the major organized religions, global banks/corporations, and entrenched political factions. How these entities can be converted to think about the common good is beyond me. And, I really doubt that individual acts of conservation and efficiency will make much of a difference.

I think this is an error. Why via cheap oil? That isn't a precursor. I don't care where my growth comes from. That it has been cheap oil doesn't mean it has to be cheap oil. Especially given that most oil goes to personal transport.

So you then say, but we need growth in our industries, especially the car industry. Maybe. But why can't there be a reset level? If we blew up every car in the US today, there would be huge chaos, great financial loses, whole industries gone. Then tomorrow, the rest of us would go to work and car sales people would look for work. We'd all say, "Hell, our 50K 401Ks are now worth 5K.... so how do I grow it to 6K?" I think the death of the auto will be similar to this, albeit slower and far messier than sudden extinction.

Also, I am not 100% convinced investment will go away even in a negative growth world. You have to put your "wealth" somewhere. Investing in tools and dried beans might work for an individual, but not for a corporation with large holdings. Do you really think CEOs are going to trade in the company for dried food? That's a lot of cans of beans! You have to put money somewhere and an investment in a solid business (even as it declines in sales) is probably better than paper wealth. Maybe longterm this strategy is a dead end, but who thinks longterm? Not many. No one when they're desperate.

All money/commerce regimes have rigidities; debts that must be serviced in fixed amounts, for instance. The amounts are liabilities and assets at the same time, the finance universe as we contemplate it cannot exist or function without them. Financial instabilities exist when rigidities are challenged. This is the 'problem' with the large debt overhangs that exist in all countries (Brazil, China, Japan, US, India, Dubai ...) if these cannot be serviced indefinitely the entire idea of debt itself is called into question.

This is where we are now.

Oil is more than a precursor; it is a platform. It cannot exist as a useful item without an elaborate infrastructure that has an energy cost (translated into credit/money) that must show a profit somewhere ... outside of those that fall to the producer. As input costs rise, the infrastructure costs are stranded; utilizing the infrastructure to use (waste) the oil costs more than it returns. Businesses and other entities dependent on these returns fail as a consequence of this stranding process.

Look around and see what fails today, tomorrow, next week/month/year; governments at local/state/municipal levels, oil refining, international shipping, house building, commercial real estate, auto makers, retailers, rail freight and truck transport, hotel chains; all dependent on continuing sprawl and development and oil use. This is the 'Road to Stupid', the same road SS points out that China has put itself on.

China's temporary advantages are cheap labor and cheap coal. These advantages allow it to bid up petroleum prices for its massively expanding auto fleet. They are nonetheless transitory. To increase domestic purchases so that commerce can gain returns in excess of its energy waste, Chinese need to earn more money at increasing nominal amounts. Up until recently, relatively wealthy US consumers have been buying Chinese goods. Increasing nominal wages is inflationary. Increasing wages or adding wage subsidies erodes the China 'cheap labor advantage'. The outcome is identical to an increase in the value of China's currency. Already, Chinese wages are higher than in many neighboring countries and rising fast. As China seeks to become more middle- class, its primary export trade advantage evaporates.

Energy depletion raises real fuel costs (measured against labor costs) to where Chinese infrastructure is stranded. It is likely that some of the Chinese 'see- through' buildings that litter the countryside are too energy expensive to operate at a profit without subsidies or slave- labor wage rates. The rigidity that undoes capitalism is the need for a positive return on expenditures. Whether the lack of return is mediated by credit or ordered not to exist by a politburo, at some point, someone has to make some money or the system fails.

'Waste First' industrialization efficiently consumes the capital basis upon which industrialization itself absolutely depends.

Considering memmel's point that rigidities will break down Western finance while the 3d world will simply starve; before that point is reached the fragmented remains of governments in these nations will continue to subsidize fuel prices in an attempt to mimic Western- style GDP growth and keep discontent in check. This inserts finance and its macro- economic rigidities into non- industrial countries in unexpected and unpredictable ways.

That was the best post I've read on this problem in a while - wood for the trees and all that! Nice one.

-that China could become the greatest industrial power the world has ever seen.

China is merely the last great industrial power, and not survivable. China is a ecological disaster, and right on the edge of chaos at the turn of corner.

My brother was just there, and the sky was green the whole trip. Bureaucrats are in charge of things they have no understanding or education in, feudalism still is ingrained and interferes with responsibility, and left over Confucianism makes control of the population easy.

Interested by the total length of transportation highways and railways. The addition of the US Interstate system length provides great perspective. It's very interesting to me that China already has more railway than we have interstate highway.

Do you have a similar number for US railways?

From the American Association of Railroads "Class I

railroads operated in 2006 a total of 94,801 miles of the 140,490 mile network in the United States."

The "classes" of railroads are defined by the size of the companies, with the seven largest being the Class 1, which dominate the maket.

This definition of mileage is the "aggregate length of roadway, excluding yard tracks and sidings, and does not reflect the fact

that a mile of road may include two, three, or more parallel tracks."

So, to be more accurate, we would need mile-tracks of railroad, and also mile-lanes of highway, but Gieb that the Chinese data says "transport routes", it is likely not counting lanes, either.

It is certainly more expensive to build 8 lane than four lane highways (though not double), but when you look at the interchanges required when they meet, such as the Houston "high five", the cost is increasing exponentially with the lane count.

Anyway, the railroad figures have to be taken with a bit of caution, I would suggest using the Class 1 mileage as "mainline", much of the other mileage would be little used branch lines in rural areas for seasonal grain hauling - though the same may also apply to the Chinese railroads.

By this measure, at 94,000 miles compared to 60,000 for China, they have a way to go. But they may not need as much either. Since most of their industry is export oriented, more of it is located near the coasts than is the case in the US. Combine this with the fact that do do not have to move stuff from east coast to west coast and back, they just move it inland and then back again, and it begins to look like their economy may be less "transport intensive" than the US. Would be interesting to compare the "railroad ton-miles per GDP" and total freight ton-miles of both.

Good data mining Gail, the results do raise the eyebrows.

Sorry, I should acknowledge Stuart Saniford, who is the writer of the post. And a typo, I meant to say " but given the Chinese data..."

DoD classified 34,xxx miles of railroad as "strategic" (Stracnet). With minor adjustments, I inferred that the USA has 36,000 miles of mainline railroads.

China has gone through a series of speed upgrades on it's main mainlines. From memory, regular track can have 150 kph operations.

Roads have a negative cost elasticity of supply and rail has a positive cost elasticity of supply. The marginal cost for additional roads is typically higher than the average cost of the installed base. The opposite is true of rail.

The more you use rail, the cheaper it gets/unit.

Double tracking rail expands capacity by 300% to 400% and does not double costs. Likewise for improved signals, rail over rail bridges, grade separation, etc.

China is in the process of creating three intersecting standard gauge rail links to the EU. This may shift traffic patterns within China as well (one goal is to move more industry inland and create more even development).

Best Hopes for Chinese Rail,

Alan

Thanks Alan, interesting observation re the relative marginal costs. To be strictly fair, a "road" is normally assumed to be a two lane one already, but when you go from one to two lanes, it's productivity also increases 3-400%

But certainly rail is a big part of their future, one of the benefits of the all controlling government there is that they can pursue this on their schedule, rather than waiting for railroad companies to do so, and likely end up with a more efficient and integrated system - i.e. more ton miles moved for the same amount of track.

Rail usage is not primarily driven by the export sector of the economy. If you look at the tonnage carried on China's rail system in 2008, the breakdown is as follows:

Total rail turnover: 2.34 trillion tonne-km of which:

Coal and coke: 39.5%

Steel, iron & non-ferrous metals: 10.2%

Grain: 8.5%

Metal ore: 8.3%

Petroleum: 5%

In all these top five categories account for 71% of the freight carried on the rail system (with fertilizers being the next largest cargo). The rail system has had to refuse additional carriage of much freight (up to 60% in some years)--it is this current lack of rail capacity compared to demand that has driven highway freight growth (and on which the export sector relies much more.)

To be strictly accurate, the United States only has 5 class I railroads, not 7.

US: Union Pacifc, BNSF, Norfolk Southern, CSX Transportation, Kansas City Southern

Canada adds another 2: Canadian Pacific and Canadian National. Consolidation has greatly increased the size of the remaining railroad companies, and greatly reduced both their number and the length of trackage.

Great article, stellar work.

CN and CP also major US railroads. CN bought the former Illinois Central Railroad with a line from Chicago to New Orleans and CP recently bought DME and their plans to become the third railroad out of the Wyoming coal fields. Both CN and CP also have lines in the northern USA feeding their Canadian lines.

KCS is the major railroad in Mexico and the smallest Class 1 in the USA and Canada.

Alan

Bring back the Pensy, the NYC, the Milwaukee Road, and the Rio Grande! /sighs wistfully

If Gov Schwarzenegger has his way, Californians will soon have to do with much less mass transit.

But on the plus side, we'll save five cents in gas.

Practical question on the politics: is "Californians will soon have to do with much less mass transit" a sociopolitically meaningful statement? Or does "Californians" denote nothing more here than a politically insignificant minority centered in San Francisco (a place we all know to be an outlier) along with a handful more who happen to live and work in precisely the right spots in Los Angeles? In other words, will those of us watching from flyover country see any broad resistance to the Governator on this matter, or will we just hear raucous noise from a vocal few, signifying absolutely nothing?

Sacramento has a decent and useful light rail system. BART serves most of the Bay Area and Caltrain serves a wide swath. San Jose has the worst designed light rail system in the USA.

This plan ends any hope of expansion.

Alan

Don't forget the San Diego Trolley, the first modern light rail transit system in the US and the second in North America.

However, California is well on its way to becoming a failed state, a poster child for self-inflicted injuries.

Their first big mistake was abandoning the interurban electric railway system in Southern California, once the biggest in the world, and building freeways to replace it. After that, all their subsequent decisions just got worse and worse.

If they still had the electric interurbans, they would be much better positioned to survive the post-oil era. I wouldn't be surprised if 20 years from now, Los Angeles looks much like Detroit does now - vast stretches of abandoned buildings and vacant lots. Unfortunately they won't be able to grow anything on the vacant lots without water.

Round Tripper - the total length of transportation highways is much larger than just the expressways. Don't have time to graph it right now, but you can see the data table here

Actually, let me see if TOD let's me do an iframe:

Guess not :-(

great post

What I find interesting - and sad - is thatChina is doing exactly what every major country has done in the industrialization process, and is going through the same stages. they are late to the party but the are determined to "catch up"

First the UK then US then eurpoe then Japan etc

What surprises me is that we all give China credit for being smart, deep & long term thinkers.

But their actions belie that. They are rushing down the same road that the west did (i understand why - there is a huge amount of resentment of the west, and grievances like the Opium wars etc, and envy)

but I expected China to look ahead, not behind

Also, their actions and priorities seem to indicate that the concepts of "peak oil" or "peak commodities" have not sunk in there, beyond the belief that prices are going up, so they better stockpile, and lock in supplies.

I can understand that the west is confused and disorganized, but China has a central govt with the luxury of being able to take a long term view

oh well - we'll all go over the edge together

I stand corrected - the Chinese get it - they seem to be doing both - both standard industrialization as well as preparing for the future

The following is a quote from a Stephen Leeb interview:

...."And really far behind the Chinese, for that matter -- way, way, way behind in switching to green technology. In 2010 they're already the leading producer of hydroelectric and solar power and by 2011 will be the leading producer of wind power. They are literally outspending us on their smart grid by 200 to one. They have allocated $670 billion to their smart grid expenditures, their electric grid. We're spending about $3.5 billion."

I think I also read that the Chinese have plans for 3X the rest of the world for nuclear power over the next 20 years

China isn't doing this all by themselves. There are countless American, European and even Japanese companies sending production and related technology to China as fast as they can. This enables part of the fast growth.

And American, European and Japanese citizens oblige by buying the production of these and Chinese only enterprises. Just about every manufactured product I buy, even American brands, is made in China.

So it is really no wonder what is going on.

The mirror image of this phenomenon is high and rising unemployment in the U.S., Europe and Japan. But due to the fast rising standard of living of the Chinese and their huge numbers, Chinese demand for resources trump the declines in the West and Japan.

Look in the mirror to see who is helping achieve fast Chinese growth

in oil consumption.

Maybe it's all part of the Chinese plan to bring down the west.

Ditch the bikes and use cars.

The U.S. wanted our friends to flood the world with cheap oil to Bring down the U.S.S.R......

As the USSR was bogged down in Afghanistan, so are we

As the USSR political elite had no touch with reality so does a large part of the US political system

As the USSR was dependent upon oil sales we are dependent upon owed debt

They are ditching bikes to buy electric bikes - some 20 million a year.

Do consider that it is possible that the highways are being built for a number of different reasons, one of which might be to facilitate the rapid movement of troops around the country. After all, our own system is actually called "The National Interstate and Defense Highways". It was Ike's memories about what a nightmare it was to move a convoy across the country that moved him to build these highways once he was in office. I suspect that the Chinese leadership are equally concerned about being able to move troops around quickly to anywhere in the country, not just to the borders but especially to the cities. They might be quite content to build them and have them sit only very lightly used.

The reason why British Empire built railways wherever they went is precisely this - to move troops.

More important was enabling the trade of British goods for local raw materials.

British capital built a lot of railroads in Argentina. It was not to move troops.

Alan

People have been wondering how we are going to repay the money we owe to the Chinese. We are - with the limbs and lives of our young people. Securing oil supplies in Iraq and copper supplies in Afghanistan for the Chinese, that's the repayment.

Somehow, I rather doubt that the families of these brave young patriots would draw much comfort or pride from this thought.

That's a really bizarre way of interpreting it. Are they literally going to write off American debt in exchange for the lives sacrificed?

My interpretation of the war is that it was necessary to take control of Iraq to prevent it from becoming a dangerous hotbed for WMD's and terrorists after 9/11, and to guarantee order in that oil-rich region; NOT to divert its oil to the US, China or anywhere in particular.

The US is still playing by the rules of the free-market, as is evident from the number of contracts awarded to the highest bidders for oilfield development in Iraq, most of them non-US companies.

I suspect that the Chinese leadership knows that they are never going to be able to collect on 100% of what we owe them. They will be glad to get what they can in terms of compensation, whether that compensation is directly monetary or not. I suspect that they would see the secure access they are getting to Iraqi oil and Afghan copper as a pretty good down payment.

Well, that was the official line taken by the previous administration. Need I say, that line was not universally accepted as being the truth, the whole truth, and nothing but the truth? I, for one, happen to think that Iraq was not just "all about oil", there were in fact several different factors involved. I am more inclined to think, though, that a lot of it was a matter of imperialist geopolitical game playing, with a rather large dose of hubris and downright stupidity thrown into the mix. I am sure it didn't start out intentionally being about securing the oil fields for China. However, that is what it ended up being about - the main accomplishment paid for by the limbs and lives of thousands of young Americans.

Yes, knowing full well that the US is no longer in a position to out-compete the Chinese under such circumstances. Nor are we really in a position to just throw our weight around and shut out the Chinese, like we used to do. We owe them too much and have become too dependent upon them to be able to get away with treating them that way any longer.

LOL - you beleive that !

I believe it despite having gone through the conspiracy theory nonsense. The US IS in Iraq for oil, but not to steal it, just to keep stability in that oil rich region.

Hi shox,

My guess is that the above statement is essentially correct - but mostly just to keep the oil flowing. Whether we get it or someone else does is less important - more global oil means lower global oil prices.

I really can't believe that you are serious about that bit of blatant propaganda.

I supported (not for the stated reasons, and with serious reservations) what I call "Phase II of Operation Desert Storm", but not even I believe this.

Obviously, the short term solution to our Peak Oil problems is to somehow force the Chinese to abandon their new cars and go back to riding bikes.

Actually duck I believe that's the current position of the Chinese with regards to the US. Except I think they see us going back to horses and not bikes. And yes....they'll sell us all the tack we'll need when we do.

Obviously, the short term solution to our Peak Oil problems is to somehow force the

ChineseU.S. to abandon their new cars and go back to riding bikes.I'm sure that's what the Chinese want.

Hi SaturnV,

Excellent Plan!

Fantastic dataset Stuart!

This focus on the stories told by looking at the data is why I keep coming back to the Oil Drum.

I agree with WNC above that the Chinese are probably building this network to address multiple needs, not just personal mobility. Keeping that in mind, this post would be more appropriately titled Chinese Transportation Capacity Growth. In that same vein, a lot of Chinese may be buying cars for status and the freedom of personal mobility. I can imagine a strong craving for this sense of freedom given that nation's recent history. However, the Chinese do not yet have the Geography of Nowhere that makes using cars and trucks mandatory for a large percentage of the population.

Oil consumption is way up in China but does not match the crazy exponential growth rates in car ownership and expressway construction seen in Stuart's graphs. In fact, it looks a lot like the rate of increase experienced in the US between 1990 and 2000. Here's a plot from the Energy Export Databrowser with US consumption overlaid for comparison:

I don't mean to downplay Stuart's excellent post in any way. I just want to caution that highway construction and car ownership are not the same as oil consumption. The Chinese capacity to consume oil is undoubtedly skyrocketing and we may see oil consumption follow. But it's also possible that they see benefits to expressways and cars that go beyond the joys of an hour commute twice a day.

It may be that oil consumption is more discretionary in China than it is in the US.

-- Jon

In many ways, oil consumption is less discretionary than in the US. As you can see in the chart below (for 2007), only a small percent of current oil use goes to personal cars (that is, privately owned cars whose use is discretionary by the owner). Much of China's road and rail capacity is used for the transport of freight as opposed to the transport of people. In other sectors, oil is already being used for its highest value in that sector (such as providing water pumping for agriculture; petrochemical feedstock in industry, etc). In some sense, this may actually make China more vulnerable to peak oil and high oil prices since they do have such little discretion for substitution in the short term.

(Source: China Energy End-Use Model, LBNL)

My personal observation when I lived in Shanghai was that China was using its coal reserves to build an incredible number of buildings. Your breakout fits well with what I saw. I don't see that there has been any big change in their economy. The government and related business's but tons and tons of buildings with many remaining empty for years before finally having anyone in them.

Given how the Chinese economy works they can build till they run out of coal.

As far as I can tell it still works the same way with the only notable difference is the cars are now new models not the old communist ones. Basically they build a empty skyscraper right next to another empty one and book it all as GDP growth based on the amount of money spent. Heck they probably book the growth the day the resources are allocated and then the day the building is complete so the loan shows as growth one year and the completed building a few years later.

This would suggest their inflated growth numbers are double what they should be with simply over accounted. Thus 15% fake growth is really 7%. I'd argue that building is not fully occupied until several years after that thus they probably have a 3-5% real economic growth rate excluding excess construction. Real growth in private transportation would be even lower like 1-2% growth rates.

Fuel usage would then grow even slower as the people that can afford cars where also the same ones that used private taxi's extensively so the overall mileage change is even lower. They are making the same trips just in their own cars instead of taxi's.

The actual growth in consumption is actually in the number of people that can afford to take a taxi more often instead of public transport. This would probably be a fraction of real growth i.e in the 1-2% range thus as former taxi users get private cars they are replaced by new taxi users finally resulting in total overall increases in fuel usage.

Offsetting this is the old Chinese cars where not particularly fuel efficient and the newer ones probably almost double the fleet fuel efficiency.

http://www.chinacartimes.com/2007/12/04/old-jetta-meet-new-jetta/

http://www.greencarcongress.com/2004/11/chinese_fuel_ec.html

Some of the old models

http://digilander.libero.it/cuoccimix/ENGLISH-automotorusse-chinesecars.htm

I don't know the fuel economy but regardless they where almost always out of tune.

I'd guess 30 mpg at best so say the new cars do 38 then they get a 7% increase in fuel efficiency for the fleet as it moves to newer cars.

This all fits well with the China I lived in. Its hard to express the the mind blowing amount of construction you just have to see it for yourself. But underneath the facades not a lot of real growth or endemic growth.

With 1 billion people you can build like crazy for a long time so in a sense its not wasted even though it takes a long time for people to actually afford to move in and occupy the buildings. There are more than enough people to fill every building built now and for years to come.

Anyway thats the China I know from first hand experience somehow I don't think its really changed.

Outside of the pollution its doing ok not the magnificent economy portrayed but one that steadily growing despite the crazy government building not because of it.

http://underthejacaranda.wordpress.com/2009/12/06/empty-buildings-china-...

http://www.chinasnippets.com/2005/10/30/shanghai-real-estate-empty-build...

http://www.csmonitor.com/World/Asia-Pacific/2008/1208/p07s03-woap.html

http://shanghaiscrap.com/?p=855

http://chinesetalberts.blogspot.com/

Hopefully those links give you a feel for China as far as I can tell everyone that spends any amount of time there comes back saying basically what I'm saying. Underneath the mirage of the building boom you have a steadily growing economy not fantastic and not exploding but moving along at a nice clip.

If you wonder why the Chinese refuse to allow the Yuan to increase in value well its because it will be decades before the real Chinese economy catches up to the hype. I don't see why it won't just outside of the crazy building bubble its really just your typical fiat/inflation/growth economy ala US 1980-2000 or so with a crazy Government driven building campaign tacked on top.

Memmel - on the one hand, there's a lot of evidence for your view that there's overbuilding, (eg see this amazing al-Jazeera report on an entire newly built city that is empty). On the the other hand, there are folks seriously concerned about an asset price bubble, particularly in housing. That would imply there was a lack of housing supply in order to get the house price inflation started. Furtheremore, there are statistics indicating a high fraction of the urban population living in slums, also implying the formal housing sector is unable to house everyone. How do we put these contrasting trends into a coherent picture, based on your first-hand experience?

Very interesting graph. But China will get stuck in peak oil just like everyone else.

World needs to save at least 3 mb/d by 2020 for China to grow. Any volunteers?

http://www.crudeoilpeak.com/?p=525

I'm not 100% sure about that Matt. Those who will get "stuck in peak oil" will be the ones without access to oil. It's difficult to quantify just how much oil reserves the Chinese have tied up and is it significant enough to change the playing field. Then to leap one step further should the Chinese have a dominant position in energy supplies they may become the dominant economy which will generate sufficient income to dominate the oil market to an even greater degree. Sounds familiar: look at the US growth post WWII. For decades we gobbled up a huge disproportionate share of energy thanks to our economic strength. Why wouldn't the same dynamics work for China. Same old story: he with the gold rules.

Or perhaps just perhaps the Chinese figures for roads and cars are inflated.

Its actually a safe bet that there is some inflation.

Next I've not been able to find any info on the scrapping rate in China.

Without knowing the scrapping rate its tough to say for sure what the net is.

I'd argue that its probably fairly high as old design chinese built cars are replaced with modern

internal brands and imports. Same for that matter for trucks. All the pics I've seen lately

suggest that the old vw based taxies are simply gone.

Next one has to imagine that communist party members that used to have one car now have 3-4

of various types and that autos as perks have penetrated to much lower levels. Similar for

wealthy business men. So you would have a fairly large set of people that own several cars but

can only drive one at a time.

Others could very well only drive on the weekends simply because of lack of parking.

Hired drivers are pretty common and cheap in Asia so parking is not as big a issue as you would think.

I'd have to think parking structures are going up as fast as the buildings so overall the concept of someone buying a car then only driving it on weekends or special events is tough to believe but not improbable.

One link but it suggests that Chinese are not buying cars to park at home all week.

http://wilsoncenter.org/index.cfm?topic_id=1421&fuseaction=topics.docume...

Thus you return to being suspicious about the numbers given these are imported cars makes you wonder about the manufactures also obviously they are booking these sales are at least acting like it from what I've read.

http://online.wsj.com/article/SB124151240258886783.html

Next of course being the suspicious sort I question internal Chinese production given the state of their oil fields.

http://www.eia.doe.gov/cabs/China/Oil.html

Given its China and that

http://www.chinadaily.com.cn/en/doc/2004-01/06/content_296195.htm

One has to wonder if the steep declines are in the future or in the past.

Indeed and increasing decline in internal production given the nature of their field of 4-6% readily accounts for most of the increase in oil imports.

Now that leads to a real quandary is using older data from China before oil became expensive freely admits to falling oil production that easily result in oil imports they have today just to maintain the status quo i.e about the same number of cars over the last five years. Perhaps newer more efficent models but no massive boom.

Of course this fairly reasonable train of though as usual puts me way out in tin foil hat region vs official numbers but that seems to be norm for me these days.

Of course this puts me firmly in the nut case camp but its surprisingly easy to do using published data.

I think that's a good way to verify the numbers - looking at transportation's portion of the petroleum used. There should be a nearly exponential growth if there's that kind of increase in vehicles, in roads, and presumably in drivers putting the miles in.

I think if you look at the old communist manner of government, there is a long tradition of cooking the books at all levels and no real reason for anything to have changed.

Jon:

You raise an excellent issue that had also occurred to me. One idea, which I haven't had a chance to confirm yet, is that the oil consumption data represent a sum of a previously larger-but-slower-growing component of non-car usage, and a smaller but faster growing car usage. If that were true, we might expect Chinese oil demand growth to accelerate in future (until it hit the price shock level, anyway). I will work further on trying to confirm or disconfirm this story in the future.

Sparaxis' comment upthread seems to confirm your suspicion.

I'm always a bit bemused at the levels of awe and appreciation Oil Drum users have for China. Usually it's framed in the "look at how great China is and how bad the West is" narrative that suggests we are headed for doom while our Chinese neighbors ascend to superpower status. I am not of course absolving the West or picking on China. I'm saying it's nuanced and that neither side can claim any superiority in sustainability.

I really don't get it, it's a cognitive dissonance to equate China as a "green leader" just because they lead in "green power produced", (or any other incomplete measure) when in fact most of the worst environmental mistakes of the West are being duplicated and scaled on a much more horrific level than what occurred in the US or Soviet Union during their industrial rises. Of course China leads the US in "green power", they have almost 5 times the population! They also lead in greenhouse emissions and horror show pictures from some of their industrial areas.

Putting aside the purely environmental issues, there is of course the question of what happens when the Chinese left behind by the great expansion (the urban poor) begin to gain a class consciousness and demand living wages and higher work standards.

China has problems folks, different problems than the West, but problems none the less. Just as there is no hocus pocus "American exceptionalism" there is no "China exceptionalism". Once people get a taste of class consciousness and free speech there is no going back. China is on that path, as hard as they try to control their society it will not work, it never has, not once in history. I am not a historicist, (if I am, it's in an extremely limited and specific context) but I cannot see how China will be immune from the same labor and political strife that the US and Eastern Europe respectively endured during the last century of modernization.

And finally, the US and China's futures are intertwined. It will be a rare and completely unforseeable occurance if one should collapse and the other thrive. China needs the US's currency to stay high, it needs US investment and technical expertise, and the US needs China's emerging markets and cheap goods.

Frankly I feel the discussions on China and foreign policy WRT to the West are among the weakest on TOD, and often times devolve into a "it's different: it must be better" argument for China and against the West. (This isn't even mentioning the ham-handed and oversimplified "monolithic" assumptions that assume everyone and everything in the west is moving in the same direction and everything and everyone in China is moving in the same direction, it's immensely more complex).

I hope I've contributed a bit to improving the dialogue.

Flame on folks!

I don't claim to know more than anybody else about what's in store for China over the next few decades. I'm not even sure what's in store for the US. There are too many currents pulling in different directions; I can't sort out which is dominant or predict how the competing trends will balance out. I can, however, share a bit of anecdotal information about China that I find significant.

I recently visited with a second cousin I hadn't met before. He is an entrepreneur and a truly brilliant individual. He has grown a quite successful company working from personal savings, no outside investment money to date. He has two factories and a research lab in China contracted to him, and recently opened a company office in Beijing for closer contact with key government agencies. He learned to speak Mandarin when he was in graduate school, maybe 10 - 15 years ago. He travels to China frequently, and just recently married his Chinese girlfriend. I'd say he knows the country about as well as it's possible for any American to know it.

He told me that he chose to learn Chinese because he "could see the handwriting on the wall", and felt that China would soon become the place to be for the sort of leading-edge applied technology that he was into. But he isn't doing business there just on the basis of a hunch. One of the things he's developing is a new technology for early detection and treatment of breast cancer. He has friends and contacts in the medical research community. He told me that they were unanimous in advising him against trying to develop his technology in the US. It is too innovative and too different from anything that FDA officials understand. Without the funding and pull of big pharma or a big name medical university behind him, it was guaranteed he would go bankrupt just trying to get it approved for trials.

There was also a pretty solid concensus as to where he might go to develop it: China or Brazil. Those were the two places where there was a happy combination of technical resources and a regulatory environment in which innovative approaches might be given a chance to prove themselves.

We also talked a little about the comparative outlooks in China and the US. It's always risky to generalize, but his experience was that in China, when you broach a new idea to an engineer-businessperson or a government official, the likely reaction is excitement leading to discussions about how to make it happen. In the US, by contrast, the mood is mostly negative. The Silicon Valley area is still an exception, but in most of the country, the reaction to a new idea will be to dig up reasons why it isn't practical. Most Americans seem stuck in their past successes, and just want to keep doing what has worked for them before.

I think you are way off base here Madvillain. No peak oiler in his or her right mind would claim that China is headed for superpower status. Did you read the very first post posted on this thread up top? Let me quote from it if you will:

I could not agree more. China is definitely NOT headed for superpower status. And reading the comments on China on TOD since the beginning of this Great Recession, I think the general conesus is that China is headed for a crash, likely as great as or greater than the crash the US is headed for. At any rate it will be a global crash, no country will be exempt.

I agree with you on the point that the US and China's futures are intertwined. I have often, on this list, referred to the two as "Chimerica".

Also you would probably agree with me that this painting America as the world's worst villain is way off base. It is just stupid to refer to the US as bloodthirsty villains. The government in any democracy is nothing more than a reflection of the wishes of the people. When we invaded Iraq our government had the support of a majority of the American people. (Most all of the Bush supporters anyway.) However, having said that I must also say that the Iraqi invasion pales in comparison to what most Middle Eastern Islamic peoples would wish upon America.

Ron P.

I do agree in a way that nowadays it has became somewhat fashionable for the Western academics or businesses leaders in praising the Chinese (Communist Party) model of fast growth and China's glamorous "growth stories" and symptoms on the surface.

Perhaps we should have given more attention to voices from the normal Chinese people within whom are more critical of their own government and social / environmental woes, where they have firsthand experiences.

China has a lot of problems, and some of them are getting worse.

Land grabs, wide-scale corruptions, growing volume and ferocity of mass incidents, an ever widening of the rich-poor divide, a property bubble, a ridgid and backward political system (that stifle individual intellectual developments), shrinking arable land, rivers and lakes heavily polluted, a disadvantaged demographic with ageing population, etc.

China has a future that is not out-right rosy nor without any major risks and hurdles ahead.

Ask any mainland Chinese especially the young ones, I think most would have grab the opportunity to migrate to live in the West if there is one. Many communist bureaucrats, despite their often anti-Western rhetoric, have their families settled well in Western countries. To them, China is only a place for them to make tons of money. Any signs of the ship (China) sinking, they will bid farewell and spend the rest of their luxurious lives in the West.

Won't they be surprised when the West goes down too!!!

If two assumptions hold, then a large majority of Chinese rail freight moves over electrified lines.

One, China electrified the most heavily used rail lines. Since electrification has specific advantages in mountains/steep grades and in tunnels, some medium density lines may have been electrified for those reasons. But a reasonable assumption none the less.

Two, freight density follows the Pareto Principle (also known as the 80-20 rule). 20% of the rail lines carry 80% of the tonne-km. Specifically true for BNSF railroad. No authoritative study has been made for China or rail lines world-wide that I know of.

Lines below a certain density are abandoned, which reduces the tail of the Pareto distribution and may distort the rule somewhat.

Currently, about 30% of Chinese rail lines have been electrified. This is very close to the 35% that I advocate for the USA (lets electrify the main lines, where the case is solid, and then evaluate the rest in the future). This implies close to 90% of the tonne-km under the Pareto Principle, even with a shortened tail for the reason above.

Best Hopes for more Rail Investments,

Alan

The Chinese have only one real goal; to overtake and replace the US as the world's leading economy. Their top-down leadership has made this their number one goal. OTOH, our leadership is fractured and absorbed by politics.

Peak Oil and Climate Change will destroy the 21st century world power dinosaurs.

Either way, we aren't fit to survive.

maj -- I don't hold quite as strong a position as you. OTOH I wouldn't bet much money against you either.

Look at Chinese actions lately, they sense a power vacuum. They are aggressively applying 'soft-power', letting the US take the lumps for military action. They are economically taking over Pakistan and Burma. Where ever western 'scrupples' restrain western greed, the Chinese are already in control.

Our 'friends' in East Asia, Japan Korea and Taiwan are exporting to China(where we are imports thanks to mf Walmart) and thus become Chinese 'clients' and our billions spent over decades in military obligations is spurned.

The passing of a great power as told by Plutarch. BTW, Pompey then gave way to Julius Caesar.

There's some old Asian saying that I can't quite remember, along the lines of "Soft plants are hard destroyers", pointing out that even a fragile plant can destroy the most solid building (or rocks), given enough time.

I don't have much experience dealing with Chinese government statistics (some, but not much). On the other hand, I have worked quite a bit with Former Soviet Union data. I assume the communist bureaucracy works in much the same way in both places.

There are two conflicting tendencies:

In the first case, the quota called for in the five-year plan is booked, although the actual amount produced is lower.

In the second case, the quota called for in the five-year plan is booked, and the actual amount produced is higher, with the difference being diverted to the blackmarket, and the profits diverted to the pockets of the loyal party members in charge.

In any case, the official statistics reflect the five-year plan, regardless of whether the production is higher or lower. It is quite difficult to determine from published data whether these figures are too high or too low.

Of course, this kind of thing would never happen in a capitalist economy. Would it, Mr. Madoff? Mr. Gould? Mr. Fisk? Mr. Fall? Mr. Skilling?

Well for me at least when I suspect a public number is political I always look at naturally associated economic indicators that I have more faith in.

These may be government numbers but collected for different reasons.

For example in the US I have a lot of faith in our VMT numbers because they are used for lots of different reasons. Collection is automatic often its results don't agree with stats that are questionable etc. For example falling VMT indicates the real US economy has been in a deep recession for a long time only the credit bubble kept things looking good.

If the suspect stat does not align with one I have more faith in then I assume its wrong.

China's claims about a massive surge in car ownership is not reflected in what I consider more

believable total stats.

In general for China overall what seems to be happening is its importing and generally stockpiling more

raw materials while they are relatively cheap and their dollar holding have value. Now they are also claiming their economy is booming but as far as I can tell its doing ok but not fantastic.

This is pretty much across the board. I'd suspect this claim is related to trying to play off the fact that they are hoarding like crazy while they can unload dollars that still have some value.

As far as oil imports go for example I suspect Chinese oil production is at the minimum close to peak and may well be a lot worse. Regardless if they are now in hoarding mode they could very well be resting their internal fields and importing even more oil than they actually have to while its cheap and dollar have value.

No telling for sure but it fits with their current pattern of aggressively importing raw materials while reducing pressure on internal raw material producers.

Certainly other economic moves are in play.

http://www.commodityonline.com/news/Brazil-China-steel-exports-rise-2168...

You can see they are also increasing exports of finished industrial products. Of course all this exported steel is not going into making cars but :)

Internally they do whatever it takes to keep the home economy growing enough to not contract.

The actual growth rate is open to question but significantly less than reported esp organic growth.

Thats not to say they don't have some serious bubbles forming aka with property etc but thats a different issue.

For now I'd argue the focus is on reducing the extraction rate of internal resources. Using dollars to buy commodities for import and also at the same time aggressively expanding exports to take market share. So hoarding of raw materials is a net process not a static one.

What they are not doing is investing capitol in the western financial markets outside of what they need to do to maintain their currency peg.

Looking further down the road past where most Western economist think one can see that the Chinese will have made significant and steady progress on expanding exports and also have large stores of raw materials.

At this point they do what the US has been claiming it wants all along they allow their currency to start increasing in value.

What this does when the time is right is lower their import costs for raw materials and offsets the need to effectively lower prices for exported goods.

I think it will be a even bigger play than that as they position to actually become a reserve currency competing with the US dollar and Euro. These guys are not thinking small. Call it the PetroYuan.

They can readily offer recycling of Yuan for oil as a wide range of real goods and services to the ME as these countries get very serious about trying to diversify from falling oil production.

Food of course is a issue but thats what Africa is for if you read the Chinese and ME are interested in Africa becoming the bread basket so to speak for both countries.

http://www.groundreport.com/Business/China-s-innovative-agricultural-inv...

http://www.guardian.co.uk/environment/2009/jul/03/africa-land-grab

Obviously at some point this sort of three way trade will occur. And of course India will have to do its best to fit in.

If you read your history you will realize that as the Moslem Empire reached its height this tight trading relation ship between the ME, India, China and Africa lay at the heart of the system.

This has been a very natural trade arrangement for thousands of years and strengthens periodically.

So the really really big picture is a resurgence of this trade and its not really oil based i.e it worked before we had oil and it will work afterwards no matter how economies change structurally.

I'd guess that nuclear and NG will play a much larger role. Later perhaps wind and solar.

In any case this regional trading network will in my opinion steadily grow in the future and China is in my opinion focusing on this. Also I think South America but that at the moment is a second front.

Obviously its a system that works even if you get a sort of return to the dark ages in the Western world which is now North America and Europe. Its a self contained decoupled and natural/ancient trade network. The only thing new would be the addition of South America into the network at some point.

That would be a bad assumption. There are few points of similarity between the old Soviet Union and modern China, and the Chinese always disagreed with the Russians about most things anyway. The Chinese pay only lip service to communist principles, and their economic system is nothing that Karl Marx would recognize as communism.

These days, China is actually more capitalistic than the capitalist countries. It's not a democracy, and the bureaucrats are firmly in charge, but the Chinese have their own ideas on how to run a bureaucracy. I would describe it as really being a technocracy. China is really run by the technocrats.

If I was to compare China and the US, I would say China is more capitalistic and does more sophisticated economic planning. Their planning techniques are more 21st century Chicago School of Business than old school Soviet Union.

Does anyone read Chinese? It looks like there's some potentially very interesting car production stats at the Chinese Association of Automobile Manufacturors, but it will take a Chinese reader to sort out what they mean.

I know this guy called Nate Hagens who speaks Cantonese - don't know if that helps.

Euan, I speak Mandarin, and can only swear in Cantonese. The writing (characters) in both is the same however. At my Peak Chinese moment I could get the gist of a newspaper but only learned 3000 characters out of some 40,000+ so was never a fluent reader. The brain is a funny thing. Certain long term knowledge (chinese) is stored but most of the other stuff goes through a revolving door with like a 3-6 month window. I think I've forgotten the details of all theoildrum posts I wrote back in 05-06...;-)

There are many online translators available.

That was about how far I got when I stopped studying. The thing that was funny was that once I got good at classification of characters (radical, phonetic component, etc), I could take something I didn't recognize and "sound it out"..

I speak some, but I am pretty rusty. You can try this however:

http://translate.google.com/translate?js=y&prev=_t&hl=en&ie=UTF-8&layout...

as it will give you a good idea what most of the pieces have to do with. There are legends on some of the pictures that aren't translated, of course..

Stuart:

Thanks for all of this...classic "J-curve." And although I take these numbers with a very large, single crystal (defects and all) od sodium chloride, they at least give some sense of the magnitude of numbers we are looking at here. For example, I was just asked to do a short presentation on electrical demand issues. On of the subtopics is the comparison of the growth of the US grid to the Chinese. Some of their units are difficult to work with (e.g., SCE or Standard Coal Equivalent) but as long as the basic data is there we can get a sense of things.

Seems an appropriate place to use the phrase "Boom goes the dynamite!"

I did a quick check against the IEA data for electricity. Pretty close for the totals. The China dat provides some breakdown and here is a quick plot of the data from China and the US for electricity.

Fascinating dataset.

They are where we were in the early 1990's and unless there is a sudden halt to their growth (nearly 12% per year currently, nearly 8% p.a. since 1980), they are just about to surpass the US in electrical generation (this data only goes up through 2007).

Nice!

Eyeballing suggest the slope of the US curve is about 8% and we generally have GDP growth around 4-5% or so this suggests that the real China GDP is about 7.5%

If we assume 50% is related to the insane housing bubble in China then you get a non-bubble growth rate of 3.75% which is what I've argued the real Chinese growth rate is.

This seems to be a sort of basic number large economies seem to be unable to grow much faster than this.

This makes some sense since the rate at which people can achieve growth is limited by how people work.

It simply takes X amount of time to build a building or bridge or a factory etc. You can only train X numbers of engineers a year the ones with experience are limited in the number of projects they can perform. As the system ages replacement becomes a factor. A lot of infrastructure is still old and needs to be replaced which adds only a incremental growth vs brand new cities and factories.

Looks to me like that are booking the rate they expand their electrical generation capacity as the rate the economy is increasing or as the GDP. Perhaps not directly but indirectly as the rate of electrical expansion is closely related to how they are running their command economy. Intrinsic growth is market driven and much slower. Increasing the electricity generation capacity esp in the poorer regions does not cause immediate growth.

It would be interesting if we had the numbers for the US from back in the 1920's which are probably a better fit with China.

That's an interesting observation. I'd like to make the points that

1) China has four times the population of the US, so nothing stops them from graduating four times as many engineers. More likely they're going to graduate ten times as many engineers.

2) Ageing systems that need replacement aren't a factor in China. They don't have any. This is the advantage of starting from square zero.

The US school system is pretty lightweight compared to the Chinese one, and it's very weak in mathematics. Most Americans think the US has a good school system, but they're wrong. US high school students don't get enough math to even get into a university engineering program. US kids are playing football when they should be studying calculus. The Chinese students are more focused.

I think overall that it is unlikely that Chinese oil consumption will ever reach American levels on a per-capita basis. There just isn't enough oil in the world to do that. However, it is possible for Chinese electricity consumption to reach American levels. They have about 100 nuclear reactors on order from western companies a the moment, and once they steal the technology (which they will), they can build as many as they want themselves. Australia and Canada can supply enough uranium to get the original batch going, and once the Chinese develop their own fast breeder reactors (wait for it), fuel won't be a problem.

They will also have their high-speed trains running by that time. They are currently accepting bids for high-speed trains, and once they steal the technology (which they will, but the bidders have factored that into their bids), they will have ultra-high-speed trains running everywhere in the country. Cars will only be used for occasional trips on weekends.

At the end of it, American drivers will be wondering why they can't afford gas to commute to work, and American kids will be wondering why they can't get a job with a high school education spent playing football. We're well down that garden path already.

I think a lot of this is true. I think in China the competition is intense for the top engineering schools. Those that do get in have all kinds of opportunities - those that don't have far fewer.

In the U.S., a lot of kids have soured on engineering. In some fields, many jobs have gone overseas where the salaries are lower. In others there is a boom/bust cycle that makes it really hard to have anything like a stable career. So kids for the most part choose to go off in other directions. Without science or engineering, nobody needs calculus.

Even the R&D that goes on in the country has been dumbed down. The focus is on making new consumer crap (iPods, phones, video games, etc) and marketing (i.e. "develop" a new flavor of junk food).

But the blame for the mess isn't entirely with the job market. A lot of our kids waste their spare time playing video games or watching TV. They wouldn't know a rigorous curriculum if it bit them in the nose. Math is "hard", and nobody pushes the kids to take hard courses. So the schools have dumbed down the courses to match the level of the students.

Many people don't understand my hostility towards football in particular. We have colleges and universities that sign multi-million dollar contracts for coaches, and some of the student athletes are functionally illiterate. Yet to the schools a winning team can lead to a huge payout - the media will pay to televise games, a good chunk of which goes back to the schools. But the school doesn't get to spend it any way it wants - the money goes back to the athletics programs. All the school gets out of the deal is bragging rights. And the student athletes are used and for the most part discarded when the schools are done with them.

The alumni are also at blame here. If the school needs to build another library, the alumni are nowhere to be found. But if the school wants to build a new stadium the alumni open their wallets and fork over the cash..

Oh, well - that's enough of a rant for now...

I don't know about that. I always found it useful for doing economic analyses, although it does tend to upset the less mathematically sophisticated accountants in an organization. Which is most of them.

After which they outsource the actual production to China. And you realize that the Chinese are learning to do this sort of R&D, too. Which leaves open the question, "What part of the manufacturing industry is left for the US to do?"

I'm not particularly hostile to football, but it's not a good idea to let it cut into the time students spend learning calculus. There's no future in being an unemployed ex-high school football player. Some of my former classmates discovered this the hard way, and for some reason it was a surprise for them.

It's a very competitive world out there, but I know people who are making a living doing stuff for Chinese companies that the Chinese are not able to do yet, and they are making a lot of money at it. However, you have to realize that this involves a considerably higher level of technological skills than students are going to learn in a typical US school.

Hi ericy,

Just to support your statement, I can offer a bit of personal history. And, I guess I should admit right off that I'm one of those people who contributed to sending jobs to India - although I truly wish this had not been the case.

In the mid 90's I was responsible for development for a high end supplier of computer software in the logistics field - our product relied on fairly technical programming skills ("C" for you geeks). Our head salesman announced he had sold a couple of huge contracts that had to be honored or the company would go out of business. I needed 50 programmers to honor those contracts - I had about 10 available.

I had lots of contacts in the contracting world - no way I could get that many programmers in a short time frame (and the prices were out of the question). I had lots of contacts in the college/university world - I was told that classes in this type of technical programming were being eliminated because potential students "were not interested in this type of discipline" - the type of programming I needed involved really hard work.

Then I was directed to an Indian contractor - he could have 50 programmers of the type I needed in a couple of weeks. I just needed to go over there and provide the specifics of what I needed. My subsequent work paved the way for millions of dollars of wages paid to Indian programmers for work that easily could have been done here if US students had been willing to perform this kind of hard work.

I can assure you that this arrangement was not a bed of roses for me or our company - but it did allow us to stay in business.

It was kind of interesting watching the growth of the Indian outsourcing industry, although the development was highly predictable.

Originally, US companies brought over large numbers of Indian computer science grads (Indian actually has some very good university computer science programs) because there were not enough American grads to fill the demand. When the economy collapsed (as it does after every boom), they terminated these employees and sent them back to India.

There were now large numbers of extremely smart, well trained computer experts sitting around India wondering, "Now, what do I do to make a living?" Being extremely smart, they realize the answer was, "Set up my own IT company, hire local Indian computer science graduates, and start bidding on contracts".

When the next US boom occurred, and the next programmer shortage occurred, there were large numbers of IT outsourcing companies in India with large numbers of extremely smart, well trained computer experts willing to work relatively cheap. And of course they can outbid anybody for contracts.